Agenda

and

Business Paper

To be held on

Monday 29

April 2024

at 6.00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

Agenda

and

Business Paper

To be held on

Monday 29

April 2024

at 6.00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

NOTICE OF MEETING

The proceedings of all Council meetings in open session, including all debate and addresses by the public, are recorded (audio visual) and livestreamed on Council’s website including for the purpose of facilitating community access to meetings and accuracy of the Minutes.

In addition to webcasting council meetings, audio recordings of confidential sessions of Ordinary Meetings of Council are also recorded, but do not form part of the webcast.

WAGGA WAGGA CITY COUNCILLORS

STATEMENT OF ETHICAL OBLIGATIONS

Councillors are reminded of their Oath or Affirmation of Office made under Secion 233A of the Local Government Act 1993 and their obligation under Council’s Code of Conduct to disclose and appropriately manage Conflicts of Interest.

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

Reports submitted to the Ordinary Meeting of Council to be held on Monday 29 April 2024.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 29 April 2024

CLAUSE PRECIS PAGE

ACKNOWLEDGEMENT OF COUNTRY 3

REFLECTION 3

APOLOGIES 3

Confirmation of Minutes

CM-1 ORDINARY COUNCIL MEETING - 8 APRIL 2024 3

DECLARATIONS OF INTEREST 3

Mayoral Minutes

MM-1 Mayoral Minute - Wagga Wagga Airport Lease Advocacy 4

Reports from Staff

RP-1 DA23/0264 - Demolition of existing building and construction of a 5 storey building containing 2 ground floor commercial tenancies and shop top housing consisting of 16 dwellings - 115 Fitzmaurice Street, Wagga Wagga 23

RP-2 FINANCIAL PERFORMANCE REPORT AS AT 31 MARCH 2024 30

RP-3 Procurement and Disposal Policy (POL 110) and Corporate Purchase Card Policy (POL 053) 64

RP-4 REQUESTS FOR FINANCIAL ASSISTANCE - SECTION 356 90

RP-5 PROPOSED LICENCE AGREEMENT FOR PART 344 BOURKE STREET, WAGGA WAGGA, BEING PART LOT 4 DP 790509 - UPDATE TO LICENSEE DETAILS 96

RP-6 Unreasonable Complainant Contact Policy (POL 056) 98

RP-7 RESOLUTIONS AND NOTICES OF MOTIONS REGISTERS 118

RP-8 QUESTIONS WITH NOTICE 120

Committee Minutes

M-1 Local Traffic Committee - Minutes - 11 April 2024 122

Confidential Reports

CONF-1 Wagga Wagga Airport Upgrade Business Case 136

CONF-2 PASSENGER & BAGGAGE SCREENING SERVICES WAGGA WAGGA AIRPORT CONTRACT EXTENSION (RFT2017-20) 137

CONF-3 PROPOSED COMMERCIAL LEASE - 84 TREATMENT WORKS ACCESS ROAD, FOREST HILL, BEING PART LOT2 DP 581941 138

CONF-4 RFT2024-24 SEWER MAINS REHABILITATION 139

Wagga Wagga City Council acknowledges the traditional custodians of the land, the Wiradjuri people, and pays respect to Elders past, present and future and extends our respect to all First Nations Peoples in Wagga Wagga.

We recognise and respect their cultural heritage, beliefs and continuing connection with the land and rivers. We also recognise the resilience, strength and pride of the Wiradjuri and First Nations communities

REFLECTION

Councillors, let us in silence reflect upon our responsibilities to the community which we represent, and to all future generations and faithfully, and impartially, carry out the functions, powers, authorities and discretions vested in us, to the best of our skill and judgement.

CM-1 ORDINARY COUNCIL MEETING - 8 APRIL 2024

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 8 April 2024 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - Ordinary Council - 8 April 2024 |

140 |

|

Report submitted to the Ordinary Meeting of Council on Monday 29 April 2024 |

MM-1 |

Mayoral Minute

MM-1 Mayoral Minute - Wagga Wagga Airport Lease Advocacy

|

Summary: |

This Mayoral Minute recommends Council commence an advocacy campaign for the Commonwealth Department of Defence (Defence) to enter into a new lease with Council to operate Wagga Wagga Airport. This will ensure that Council is able to continue to deliver this essential community service for our local community and the wider region. |

That Council:

a receive and note the Mayoral Minute

b write to stakeholders by the end of this week requesting letters of support for Council to retain the lease and operation of the Wagga Wagga Airport

c delegate the Mayor and General Manager to meet again with the Deputy Prime Minister, Minister for Defence and the Assistant Minister for Defence

d advocate and lobby all levels of government for Council to retain the lease of Wagga Wagga Airport

e receive a follow up report from staff outlining the actions taken in relation to this advocacy campaign and outcomes achieved

Report

Background:

Wagga Wagga Airport (Wagga Airport) is one of the most significant regional transport gateways in NSW, with it being pivotal infrastructure for Wagga Wagga and the Riverina Region. The Wagga Airport has a critical role in connecting the Riverina Region to the rest of Australia, which primarily occurs for health, education, commerce, and tourism.

Wagga Wagga is the largest urban centre in the Riverina supporting a highly diverse economy that services a catchment population of 297,000 people well beyond its local government area boundary.

Specifically, there is a reliance on Wagga Airport for:

· Business and private passengers - approximately 200,000 per year.

· Accessibility and medical services – the health sector relies on the Airport to access Wagga Wagga Base Hospital, with 6,000 RPT seats occupied by health professionals each year.

· Health patient transfers – on average there are between two to seven flights per day for medical evacuations, and 700-750 patient transfers a year at Wagga Airport.

· The Rural Fire Service (RFS) is increasingly using the Airport for firefighting.

· Aviation training – the airport is a hub for pilot training, with a 200 bed Australian Airline Pilot Academy, owned and operated by Regional Express Airlines (Rex) and through Wagga Air Centre, supplying trainee pilots that flow through to Australian and International airlines.

· Maintenance base – Rex has their heavy maintenance engineering facility at the Airport.

· General aviation – is a significant part of Wagga Airport and its aviation community. There are currently 60 members with 35 privately owned aircraft housed in private hangars on leased land at the Airport.

The Commonwealth Department of Defence, and the Royal Australian Air Force (RAAF) have a long history in Wagga with RAAF Forest Hill (now known as RAAF base Wagga) becoming operational in July 1940.

Lease:

Wagga Wagga City Council has operated the Wagga Airport under a 30-year lease from the Commonwealth Department of Defence, which is due to expire in June 2025. Council has been seeking a 49-year lease with a further 50-year option; however, Council will consider a shorter-term lease if that is offered by Defence.

Council bears the full cost of maintaining and upgrading all airport facilities, including runways, taxiways, and aviation infrastructure.

In addition, the conditions of the lease effectively penalises Council for any improvements or developments that are undertaken through linking lease value to investment.

Council has been actively advocating over the past three (3) years for a future lease beyond the current lease, which is due to expire in June 2025, however to date Council has not received an outcome and way forward from Defence.

Business Case:

Council received funding from Department of Regional NSW as part of the Business Case and Strategy Fund to develop a business case to consider an upgrade of Wagga Wagga Airport Terminal. The initial Business Case has now been finalised.

Obviously without any security over tenure Council is unable to apply for any future potential funding to support an upgrade to the currently run down and outdated Wagga Wagga Airport facility.

The need for advocacy:

Council has become extremely disappointed and frustrated that over a long period of time that our Federal member and successive governments have not resolved the lease issue to meet the needs of the community for the lease of the Wagga Wagga Airport to be retained by Council.

A local government managed airport ensures the community, through its elected members, has visibility and input into the airport’s operations and prioritises and optimises the broader economic and social needs that may not be considered under a private for-profit entity.

In my view, if Wagga Wagga Airport is leased to a private operator the risk is this arrangement will be profit driven and cost increases will be passed onto airlines and members of the public using the airport, resulting in significantly reduced accessibility to services for residents and businesses, creating disadvantage for our communities locally and regionally.

There are also flow-on concerns that the lack of access to an adequate and affordable community airport will result in the community seeking alternative airport facilities. Potentially Albury would become the hub which would have economic and social impacts to our community.

Council has made representations to the Commonwealth Department of Defence (Defence) and the Federal Member for Riverina over a long period of time in relation to the tenure issue of Wagga Wagga Airport. In March this year Council met with the Deputy Prime Minister and Minister for Defence the Hon Richard Marles MP, Assistant Minister for Defence the Hon Matt Thistlethwaite MP and the Federal Member for Riverina the Hon Michael McCormack MP. Council has still not received a resolution or positive outcome for our community.

Therefore, Council feels that we have no other option but to commence a public campaign to advocate to secure tenure of the Wagga Wagga Airport beyond June 2025 when the current lease expires.

Advocacy will include seeking current letters of support from key users of the Airport and regional stakeholders to articulate the impact to our local community if the lease is not extended and operation of the Airport is not retained by Council.

The advocacy information regarding the need for Council to retain the lease and operation of the Airport will be shared with all levels of government and all ministers to communicate the injustice that our community has been and is continuing to be subjected to by Defence.

Support from stakeholders:

Council has already received various letters of support from key stakeholders who rely on the Wagga Airport and who would be significantly impacted by a decision from Defence if they opt to privatise the Airport and don’t renew Councils lease of the Wagga Airport. In addition to this Council will be writing to those stakeholders again to reaffirm their position and also including additional new stakeholders to request their support.

These stakeholders include:

· Hon Michael McCormack – Federal Member for Riverina

· Dr Joe McGirr – Independent Member for Wagga Wagga

· Committee 4 Wagga

· Riverina Regional Development Australia

· Business NSW

· Wagga Wagga Business Chamber

· Murrumbidgee Local Health District

· Riverina Medical Specialist Recruitment and Retention Committee

· REROC

· All Riverina Regional Councils

· Wagga City Aero Club

· General Aviation at Wagga Wagga Airport

· Australian Airline Pilot Academy

· Qantas Airlines

· Regional Express Airlines

· Bonza Airlines

· Charles Sturt University

· Riverina Institute of TAFE

· Visy

Financial Implications

N/A

Policy and Legislation

Local Government Act 1993

Wagga Wagga Local Environmental Plan 2010

Airports Act 1996

Link to Strategic Plan

Growing Economy

Objective: Wagga Wagga is a thriving, innovative and connected regional capital city

Improve, maintain and renew transport networks and building infrastructure to provide safe, affordable, efficient, and reliable transport connections for our community

Risk Management Issues for Council

There are significant risk management issues for Council, our local community and the wider region if the lease of the Wagga Wagga Airport issue is not resolved.

Internal / External Consultation

Stakeholder engagement has occurred leading up to this Mayoral Minute and further engagement will occur as part of the proposed advocacy campaign.

|

1⇩. |

Letter of support - Dr Joe McGirr MP |

|

|

2⇩. |

Letter of support - Riverina Regional Development Australia |

|

|

3⇩. |

Letter of support - Committee 4 Wagga |

|

|

4⇩. |

Letter of support - Murrumbidgee Local Health District |

|

|

5⇩. |

Letter of support - Coolamon Shire Council |

|

|

6⇩. |

Letter of support - Lockhart Shire Council |

|

|

7⇩. |

Letter of support - Wagga Wagga Business Chamber |

|

|

8⇩. |

Letter of support - Wagga City Aeroclub |

|

|

9⇩. |

Letter of support - John Smith |

|

|

10⇩. |

Letter of support - Nick Leywood |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 29 April 2024 |

RP-1 |

Reports from Staff

RP-1 DA23/0264 - Demolition of existing building and construction of a 5 storey building containing 2 ground floor commercial tenancies and shop top housing consisting of 16 dwellings - 115 Fitzmaurice Street, Wagga Wagga

Author: Amanda Gray

General Manager: Peter Thompson

|

Summary: |

The report is for a development application and is presented to Council for determination. The application includes a request for variations of development standards under the provisions of clause 4.6 of the Wagga Wagga Local Environmental Plan (LEP) 2010.

The concurrence of the Planning Secretary (NSW Department of Planning and Environment) is required for variations to development standards under clause 4.6 of the LEP 2010. The Planning Secretary has issued deemed concurrence to Council by written notice dated 21 February 2018, to determine applications that include variations to development standards under clause 4.6. This deemed concurrence, however, is conditional that a delegate of the Council may not determine a development that departs from a numerical standard by more than 10%. As the subject proposal seeks variation to a development standard by more than 10%, the application must be determined by the elected Council.

Two public submissions were received during the notification period in objection.

A full assessment of the development application, including an assessment of the request for variation to development standards under Clause 4.6 of the LEP 2010, is provided as an attachment to this report. The assessment has considered and addressed all relevant matters raised in the submissions. |

That Council approve Development Application DA23/0264 for the demolition of existing building and construction of a 5 storey building containing 2 ground floor commercial tenancies and shop top housing consisting of 16 dwellings, Lot 12 DP 759031, Lot 2 DP 913838, Lot 1 DP 913839 and Lot 3 DP 913840, 115 Fitzmaurice Street, Wagga Wagga.

Development Application Details

|

Applicant |

Architects Ring & Associates Pty Ltd Director - Terrence Philip Ring |

|

Owner |

Anne and Garry Xuereb |

|

Development Cost |

$7,865,000.00 |

|

Development Description |

The development comprises the following components: · Demolition of the existing single storey commercial building. · Construction of a mixed use five storey building comprising:

o Ground Floor - two commercial tenancies and residential foyer fronting Fitzmaurice Street and car parking to the rear with access from Cadell Place.

o Floors 1 – 4 - each floor containing 4 dwellings (16 in total) with either open or enclosed balconies to Fitzmaurice Street and open balconies to Cadell Place. |

Report

Key Issues

· Requested variation to LEP development standards relating to building height and floor space ratio, including the potential impacts of these variations.

· Impact of the building demolition and proposed construction on heritage conservation area and Fitzmaurice Street precinct.

· Assessment against the provisions of State Environmental Planning Policy (Housing) 2021 (SEPP) including the design principles for residential apartment development and the Apartment Design Guideline.

Assessment

· Under the LEP the site is zoned E2 - Commercial Core. The development is characterised as “shop top housing” The development is permitted with consent within the E2 zone and is consistent with the objectives of the zone.

· The application seeks variations to 2 development standards contained within the LEP 2010. The variations have been assessed in accordance with the requirements of Clause 4.6 of the LEP. The variations are as follows:

o Clause 4.3 - Height of buildings – The maximum building height under this clause is 16 metres. Proposed building height is 17.2 metres.

o Clause 4.4 - Floor space ratio – The maximum floor space ratio under this clause is 2:1. Proposed floor space ratio is 2.58:1.

Having regard to the assessment against the provisions and objectives of both of the standards and the overall assessment contained in the 4.15 assessment report, it is satisfied that there are sufficient environmental planning grounds to justify the development contravening the 2 development standards and that strict compliance with the standards would be unreasonable in the circumstances. It is also satisfied that the development, incorporating the variations, will meet the public interest test required under the clause. An appropriate degree of flexibility has been applied to the standards and it is recommended that the variations be supported.

· The development is located within the heritage conservation area. The effect of the proposed development on the heritage significance of the conservation area has been considered as required under Clause 5.10. A full assessment as detailed under Section 3.3.1 of the DCP 2010 has demonstrated that the application will not result in a detrimental impact on the area.

· The proposed development is consistent with the remaining provisions of the LEP 2010.

· The development is subject to the provisions relating to residential apartment development under Chapter 4 of State Environmental Planning Policy (Housing) 2021 (SEPP). In accordance with the SEPP, the quality of the design of the development has been evaluated against the design principles for residential apartment development set out in Schedule 9 of the SEPP and also the relevant sections and objectives of the NSW Government Apartment Design Guideline. The development is deemed appropriate with regard to this evaluation.

· The proposed development has been assessed as generally consistent with the objectives and controls of the Wagga Wagga Development Control Plan 2010, including Sections 3.3.1, 10.1 and 12.8 identified below.

· A full assessment of the impact of the development has been undertaken against the provisions relating to the Fitzmaurice Street Precinct and the heritage conservation area under the provisions of sections 3.3.1 and 10.1 of the DCP 2010. This includes a review of the submitted Heritage Impact Assessment and various advice and comment received from Council’s Heritage Advisor. Having regard to this overall assessment, it is considered that the development will not have a detrimental impact on the heritage conservation area and is in keeping with the future desired character of the Fitzmaurice Street precinct.

· Section 12.8 of the DCP 2010 requires consideration against the Riverside Strategic Master Plan 2010. The development is consistent with the relevant objectives, strategies and design principles contained in the plan.

· Two public submissions were received during the notification period raising concerns summarised below. All matters raised in submissions have been considered in the assessment of the application and addressed in the 4.15 assessment report.

o Impact of requested variation to maximum height of building on:

- Heritage conservation area

- Shadow/solar impacts

o Insufficient car parking proposed.

o Requested variation to building height and floor space ratio is not justified and does not meet minimum standards as per NSW Planning guidelines for clause 4.6 variations.

o Need for careful interrogation of impacts on heritage conservation area.

o Potential impacts on adjoining properties caused by demolition and construction works.

· A comprehensive assessment report completed in accordance with the provisions of Section 4.15(1) of the Environmental Planning and Assessment Act 1979 is provided as an attachment to this report. This assessment addresses all maters identified above in further detail and also considers all other relevant heads of consideration including the likely impacts of the development and the suitability of the site.

· Having regard to this assessment, the application is recommended for approval subject to the inclusion of recommended conditions of consent.

Reasons for Approval

1. The proposed development is consistent with the objectives and provisions of the Wagga Wagga Local Environmental Plan 2010.

2. The requested variation to development standards contained in Clauses 4.3 and 4.4 of the Wagga Wagga Local Environmental Plan 2010, are appropriate having regard to the assessment requirements under Clause 4.6 of the plan.

3. The application is compliant with the provisions of State Environmental Planning Policy (Housing) 2021 including the requirement for consideration against the design principles set out in Schedule 9 of this policy and also the relevant sections and objectives of the Apartment Design Guideline.

4. The proposed development is generally consistent with the objectives and controls of the Wagga Wagga Development Control Plan 2010.

5. The impacts of the proposed development, including its impact on the heritage conservation area, are acceptable subject to the inclusion of recommended conditions of consent.

6. The site is considered suitable for the proposed development and is in the public interest.

Site Location

The site is identified as 115 Fitzmaurice Street. It is located on the eastern side of the street approximately 100 metres south of its intersection with Kincaid Street. The site also has frontage to Cadell Place to the rear.

The site is located within the heritage conservation area and is surrounded by commercial development to the north, south and west. The Murrumbidgee River and levee is located to the east of the site.

The site comprises 4 separated allotments with a combined area of 607.2 square metres. It is entirely occupied by an existing commercial building comprising 2 tenancies with shopfronts to Fitzmaurice Street and service access to Cadell Place.

Financial Implications

N/A

Policy

State Environmental Planning Policy (Housing) 2021

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: Future growth and development of Wagga Wagga is planned for in a sustainable manner

Ensure sustainable urban development

Risk Management Issues for Council

Approval of the application is not considered to raise risk management issues for Council as the proposed development is consistent with SEPP (Housing) 2021, LEP and DCP controls.

Internal / External Consultation

Full details of the consultation that was carried out as part of the development application assessment is contained in the attached s4.15 Report.

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Have your Say |

Email newsletter |

Social media |

Website |

|

|

Inform |

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

x |

|

Consult |

|

|

x |

|

|

|

|

|

|

|

x |

|||||

|

Involve |

|

|

|

|

|

|

|

|

||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other methods (please list specific details below) |

|

|

|

1. |

DA23/0264 - Section 4.15 Assessment Report - Provided under separate cover |

|

|

2. |

DA23/0264 - Plans - Provided under separate cover |

|

|

3. |

DA23/0264 - Statement of Environmental Effects - Provided under separate cover |

|

|

4. |

DA23/0264 - Heritage Impact Statement - Provided under separate cover |

|

|

5. |

DA23/0264 - Heritage Advisor Comments/Advice - Provided under separate cover |

|

|

6. |

DA23/0264 - Submissions (Redacted) - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 29 April 2024 |

RP-2 |

RP-2 FINANCIAL PERFORMANCE REPORT AS AT 31 MARCH 2024

Author: Carolyn Rodney

|

Summary: |

This report is for Council to consider information presented on the 2023/24 budget and Long-Term Financial Plan, and details Council’s external investments and performance as at 31 March 2024. |

|

That Council: a approve the proposed 2023/24 budget variations for the month ended 31 March 2024 and note the balanced budget position as presented in this report b approve the proposed budget variations to the 2023/24 Long Term Financial Plan Capital Works Program including new projects and future year timing adjustments c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2021 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above d note the details of the external investments as of 31 March 2024 in accordance with section 625 of the Local Government Act 1993 |

Wagga Wagga City Council (Council) forecasts a balanced budget position as of 31 March 2024.

Proposed budget variations including adjustments to the capital works program are detailed in this report for Council’s consideration and adoption.

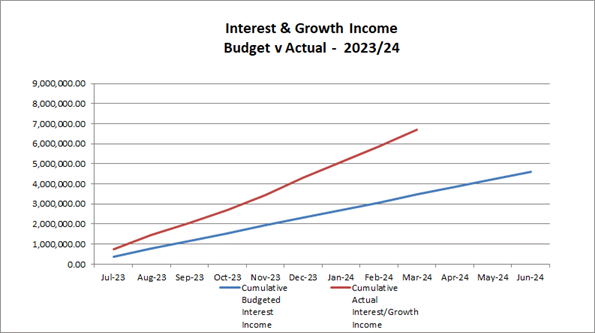

Council has experienced a positive monthly investment performance for the month of March when compared to budget ($440,925 up on the monthly budget). This is mainly due to better than budgeted returns on Council’s investment portfolio as a result of the ongoing movement in the interest rate environment, as well as a higher than anticipated investment portfolio balance.

Key Performance Indicators

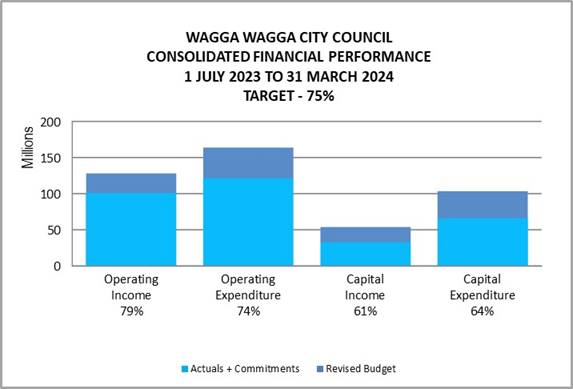

OPERATING INCOME

Total operating income is 79% of approved budget and is tracking ahead for the month of March 2024 mainly as a result of increased interest on investments income received this year.

An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 94% when compared to budget.

OPERATING EXPENSES

Total operating expenditure is 74% of approved budget and is tracking on budget at this stage of the financial year.

CAPITAL INCOME

Total capital income is 61% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions in relation to expenditure incurred on the projects.

CAPITAL EXPENDITURE

Total capital

expenditure including commitments is 64% of approved budget including pending

projects. Excluding commitments, the total expenditure is 38% when

compared to the approved budget.

|

WAGGA WAGGA CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2023/24 |

COMMT'S 2023/24 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|

||||||

|

Rates & Annual Charges |

(79,700,947) |

0 |

(79,700,947) |

(59,357,975) |

0 |

(59,357,975) |

74% |

|

User Charges & Fees |

(32,607,964) |

2,042,180 |

(30,565,784) |

(23,644,530) |

0 |

(23,644,530) |

77% |

|

Other Revenues |

(3,040,358) |

(89,000) |

(3,129,358) |

(4,471,363) |

0 |

(4,471,363) |

143% |

|

Grants & Contributions provided for Operating Purposes |

(13,891,687) |

5,725,583 |

(8,166,104) |

(4,944,786) |

0 |

(4,944,786) |

61% |

|

Grants & Contributions provided for Capital Purposes |

(43,630,578) |

(6,390,828) |

(50,021,405) |

(31,801,238) |

0 |

(31,801,238) |

64% |

|

Interest & Investment Revenue |

(4,873,916) |

0 |

(4,873,916) |

(6,951,961) |

0 |

(6,951,961) |

143% |

|

Other Income |

(1,564,445) |

(22,667) |

(1,587,112) |

(1,418,702) |

0 |

(1,418,702) |

89% |

|

Total Revenue |

(179,309,895) |

1,265,269 |

(178,044,626) |

(132,590,554) |

0 |

(132,590,554) |

74% |

|

|

|||||||

|

Expenses |

|||||||

|

Employee Benefits & On-Costs |

56,172,711 |

525,510 |

56,698,221 |

38,149,862 |

0 |

38,149,862 |

67% |

|

Borrowing Costs |

3,363,314 |

0 |

3,363,314 |

2,814,341 |

0 |

2,814,341 |

84% |

|

Materials & Services |

41,316,274 |

15,917,496 |

57,233,769 |

36,192,708 |

9,087,575 |

45,280,283 |

79% |

|

Depreciation & Amortisation |

44,291,577 |

0 |

44,291,577 |

33,218,683 |

0 |

33,218,683 |

75% |

|

Other Expenses |

1,954,429 |

233,560 |

2,187,989 |

1,673,073 |

183,084 |

1,856,156 |

85% |

|

Total Expenses |

147,098,304 |

16,676,566 |

163,774,870 |

112,048,666 |

9,270,659 |

121,319,325 |

74% |

|

|

|||||||

|

Net Operating (Profit)/Loss |

(32,211,591) |

17,941,834 |

(14,269,756) |

(20,541,888) |

9,270,659 |

(11,271,229) |

|

|

|

|||||||

|

Net Operating Result Before Capital (Profit)/Loss |

11,418,987 |

24,332,662 |

35,751,649 |

11,259,350 |

9,270,659 |

20,530,009 |

|

|

|

|||||||

|

Cap/Reserve Movements |

|||||||

|

Capital Expenditure - One Off Confirmed |

33,539,246 |

31,162,871 |

64,702,117 |

24,301,714 |

18,329,476 |

42,631,190 |

66% |

|

Capital Expenditure - Recurrent |

21,649,500 |

8,811,449 |

30,460,950 |

9,994,424 |

8,335,257 |

18,329,681 |

60% |

|

Capital Expenditure - Pending Projects |

38,732,266 |

(37,984,161) |

748,105 |

30,816 |

15,100 |

45,916 |

0% |

|

Loan Repayments |

7,523,436 |

0 |

7,523,436 |

4,892,577 |

0 |

4,892,577 |

65% |

|

New Loan Borrowings |

(10,609,635) |

7,043,364 |

(3,566,271) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(1,490,575) |

(2,317,180) |

(3,807,755) |

(854,626) |

0 |

(854,626) |

22% |

|

Net Movements Reserves |

(12,841,071) |

(24,658,178) |

(37,499,249) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

76,503,167 |

(17,941,834) |

58,561,333 |

38,364,905 |

26,679,833 |

65,044,738 |

|

|

|

|||||||

|

Net Result after Depreciation |

44,291,577 |

0 |

44,291,577 |

17,823,018 |

35,950,492 |

53,773,509 |

|

|

|

|||||||

|

Add back Depreciation Expense |

44,291,577 |

0 |

44,291,577 |

33,218,683 |

0 |

33,218,683 |

75% |

|

|

|||||||

|

Cash Budget (Surplus)/Deficit |

0 |

0 |

0 |

(15,395,665) |

35,950,492 |

20,554,827 |

|

Years 2-10 Current Adopted Long Term Financial Plan (Surplus) /Deficit*

|

Description |

Budget 2024/25 |

Budget 2025/26 |

Budget 2026/27 |

Budget 2027/28 |

Budget 2028/29 |

Budget 2029/30 |

Budget 2030/31 |

Budget 2031/32 |

Budget 2032/33 |

|

Adopted Bottom Line (Surplus) / Deficit |

706,102 |

2,769,193 |

2,225,767 |

0 |

0 |

0 |

0 |

0 |

(953,513) |

|

Adopted Bottom Line Adjustments |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Revised Bottom Line (Surplus) / Deficit |

706,102 |

2,769,193 |

2,225,767 |

0 |

0 |

0 |

0 |

0 |

(953,513) |

* Please note that Council is currently reviewing the 2024/25 Long Term Financial Plan, and will place the draft plan on public exhibition next month. The above table includes the current adopted position.

2023/24 Revised Budget Result – (Surplus) / Deficit |

$’000s |

|

Original 2023/24 Budget Result as adopted by Council Total Budget Variations approved to date. Budget Variations for March 2024 |

$0K $0K $0K |

|

Proposed Revised Budget result for 31 March 2024 - (Surplus) / Deficit |

$0K |

The proposed Operating and Capital Budget Variations for 31 March 2024 which affect the current 2023/24 financial year are listed below.

|

Budget Variation |

Amount |

Funding Source |

Net Impact (Fav)/ Unfav |

||

|

2 – Safe and Healthy Community |

|

|

|||

|

Fibre Connection to Bolton Park* |

$107K |

Section 7.11 Reserve ($87K) Existing IT Recurrent Capital Budgets ($20K) |

Nil |

|

|

|

The Oasis and Bolton Park precinct relies on a wireless network connection to Council’s Civic Centre building to access internal systems and the internet, which is currently over capacity. This affects the day-to-day operations of staff at several locations and security systems installed. The introduction of several CCTV cameras and the future planned growth of the precinct has led to the need to urgently upgrade the network connection back to the Civic Centre. The proposed solution is to install an underground fibre cable from Council’s existing fibre network on Baylis Street, through to the Oasis and the new tennis centre. This connection will provide capacity for the future planned growth of the precinct and is a long-term solution that is relatively maintenance free compared to alternatives. In addition, this will also reduce the load on Council’s wireless network at other remote sites, improving performance.

It is proposed to fund the variation by using a combination of existing 2023/24 IT recurrent capital budgets ($20K) and Bolton Park Precinct Upgrade funds ($87K) allocated in 2025/26 (funded from S7.11). Estimated Completion: 30 June 2024 Job Consolidation: 23091 |

|

|

|||

|

5 – The Environment |

|

|

|||

|

Destination Electric Vehicle (EV) Charger Installation |

$13K |

NSW Office of Energy and Climate Change Grant Round 2 ($8K) Net Zero Emissions (NZE) Reserve ($5K) |

Nil |

|

|

|

Council has been successful in securing NSW Office of Energy and Climate Change grant funds under the Drive Electric NSW EV Destination Charging Grants Round 2. This will allow for the installation of a Dual Port Electric Vehicle (EV) Charging Station at the Museum of Riverina Botanic Gardens Site. It is proposed to fund Councils contribution from the NZE Reserve. Estimated Completion: 30 June 2024 Job Consolidation: 23084 |

|

|

|||

|

Stormwater Quality from Residential Development Assessment |

$31K |

Section 64 Stormwater DSP Reserve ($31K) |

Nil |

|

|

|

Funds are required for an investigation of stormwater quality from residential development in comparison to predevelopment land use. This project will analyse stormwater quality at discharge points across the city and in lagoons to understand to what extent run-off from urban development affects the water quality in waterways downstream of the developments. The investigation will be based on data collected by Council from September 2022 to June 2023. The outcome of the assessment will inform the management of stormwater requirements associated with subdivision development in the future. It is proposed to fund the variation from the Section 64 Stormwater DSP Reserve. Estimated Completion: 30 June 2024 Job Consolidation: 23093 |

|

|

|||

|

Oasis Pool Filters* |

$153K |

Internal Loans Reserve ($153K) |

Nil |

|

|

|

Funds are required for the refurbishment of the Oasis Pool Filters. The works will include the isolation of the filters, removal of sand and patching and repairs to the fibreglass inside the filter. It will also entail the re-epoxying and coating with fibre matting of the top of the sand level of the centre section of the filter. The removal and replacement also includes the supply of the filter water collector arms, and the re-installation of sand from the existing filters and re-commissioning of the filters. It is proposed to fund the variation from the existing 2026/27 Oasis Pool Filters budget ($232K) through the Internal Loans Reserve with the remaining budget of $79K being reallocated to 2033/34. Estimated Completion: 30 June 2024 Job Consolidation: 23084 |

|

|

|||

|

Duke of Kent Community Building |

$70K |

Buildings Reserve ($70K) |

Nil |

|

|

|

Additional funds are required for the Duke of Kent Community Building to allow for a change in the scope of works to include the installation of an operable sound rated wall rather than a simple concertina style divider to separate the hall in the building and the installation of a hearing loop. The sound rated wall will allow for the hall to be used by two different user groups at once. The hearing loop is essential as it is anticipated that a lot of older residents will utilise the new facility and it brings the space in line with Councils All-Abilities Inclusion and Action Plan 2022-2026. This will bring the total project budget to $870K. Estimated Completion: 30 June 2024 Job Consolidation:21476 |

|

|

|||

* As the 2024/25 draft Long Term Financial Plan (LTFP) budget is currently being finalised any budget variations that impact the LTFP will not be processed until 1 July 2024.

The following projects were included in the 2024/25 LTFP Councillor Budget Workshops and are being included below for adoption and inclusion in the 10 year Capital Works Program.

|

Project Title |

2024/25 |

2025/26 |

2026/27 |

2027/28 |

2028/29 |

2029/30 |

2030/31 |

2031/32 |

2032/33 |

2033/34 |

|

Collingullie Augmentation of Sewer Treatment Ponds |

|

1,000,000 |

|

|

|

|

|

|

|

|

|

Forest Hill Sewer Augmentation & Upgrade of Plant |

|

|

10,000,000 |

|

|

|

|

|

|

|

|

Kooringal Sewer Treatment Plant Upgrade |

|

|

|

30,000,000 |

|

|

|

|

|

|

|

Sewer Telemetry Hardware Upgrades (some exp may be incurred in 23/24) |

1,000,000 |

|

|

|

|

|

|

|

|

|

|

Northern Sewer Rising Main Upgrade |

500,000 |

2,500,000 |

|

|

|

|

|

|

|

|

|

Narrung Sewer Treatment Plant Shed Cover |

100,000 |

|

|

|

|

|

|

|

|

|

|

Sewer Manhole Relining - Recurrent |

800,000 |

824,000 |

848,720 |

874,182 |

900,407 |

927,419 |

955,242 |

983,899 |

1,013,416 |

1,043,819 |

|

Art Gallery Cabinetry Work |

60,000 |

|

|

|

|

|

|

|

|

|

|

Regional Roads (replacement of grant funds from GPR) |

350,000 |

350,000 |

350,000 |

|

|

|

|

|

|

|

|

Culverts – Renew & Replace (additional budget) |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

50,000 |

|

Pavement Rehab Program (used for Geotechnical budget) |

(115,000) |

|

|

|

|

|

|

|

|

|

|

TOTAL |

2,745,000 |

4,724,000 |

11,248,720 |

30,924,182 |

950,407 |

977,419 |

1,005,242 |

1,033,899 |

1,063,416 |

1,093,819 |

2023/24 Capital Works Summary

|

Approved Budget |

Proposed Movement |

Proposed Budget |

|

|

One-off |

$64,702,117 |

$235,417 |

$64,937,534 |

|

Recurrent |

$30,460,950 |

($20,000) |

$30,440,950 |

|

Pending |

$748,105 |

$0 |

$748,105 |

|

Total Capital Works |

$95,911,172 |

$215,417 |

$96,126,589 |

Current Restrictions

|

RESERVES SUMMARY |

|||||

|

31 MARCH 2023 |

|||||

|

|

CLOSING BALANCE 2022/23 |

ADOPTED RESERVE TRANSFERS 2023/24 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 25.3.2024 |

PROPOSED CHANGES for Council Resolution* |

BALANCE AS AT 31 MARCH 2023 |

|

|

|

|

|

|

|

|

Externally Restricted |

|

|

|

|

|

|

Developer Contributions - Section 7.11 |

(33,518,693) |

5,650,317 |

(2,060,173) |

87,244 |

(29,841,305) |

|

Developer Contributions - Section 7.12 |

(427,766) |

(28,137) |

0 |

|

(455,903) |

|

Developer Contributions - Stormwater Section 64 |

(7,952,971) |

461,121 |

(1,003,403) |

31,000 |

(8,464,253) |

|

Sewer Fund |

(45,473,006) |

(486,810) |

(2,160,039) |

|

(48,119,854) |

|

Solid Waste |

(28,001,560) |

1,115,349 |

(935,606) |

|

(27,821,816) |

|

Specific Purpose Unexpended Grants & Contributions |

(13,419,243) |

0 |

13,419,243 |

|

0 |

|

SRV Levee Reserve |

(6,316,594) |

0 |

46,718 |

|

(6,269,877) |

|

Stormwater Levy |

(5,350,848) |

3,299,121 |

(2,906,312) |

|

(4,958,039) |

|

Total Externally Restricted |

(140,460,680) |

10,010,962 |

4,400,428 |

118,244 |

(125,931,047) |

|

|

|

|

|

|

|

|

Internally Restricted |

|

|

|||

|

Additional Special Variation (ASV) |

(630,214) |

(304,627) |

0 |

|

(934,841) |

|

Airport |

0 |

0 |

0 |

|

0 |

|

Art Gallery |

(3,804) |

0 |

0 |

|

(3,804) |

|

Bridge Replacement |

(277,544) |

0 |

40,739 |

|

(236,805) |

|

Buildings |

(1,816,155) |

222,330 |

255,413 |

70,000 |

(1,268,412) |

|

CCTV |

(47,471) |

12,476 |

0 |

|

(34,995) |

|

Cemetery |

(1,246,587) |

(240,585) |

30,437 |

|

(1,456,735) |

|

Civic Theatre |

(127) |

0 |

0 |

|

(127) |

|

Civil Infrastructure |

(8,750,164) |

1,975,590 |

623,233 |

|

(6,151,341) |

|

Council Election |

(305,964) |

(117,566) |

0 |

|

(423,531) |

|

Economic Development |

(407,131) |

0 |

388,773 |

|

(18,358) |

|

Emergency Events Reserve |

(245,427) |

(91,807) |

50,000 |

|

(287,235) |

|

Employee Leave Entitlements Gen Fund |

(3,604,926) |

0 |

0 |

|

(3,604,926) |

|

Environmental Conservation |

(116,578) |

0 |

0 |

|

(116,578) |

|

Event Attraction |

(969,436) |

0 |

728,755 |

|

(240,681) |

|

Financial Assistance Grants in Advance |

(12,361,442) |

0 |

12,361,442 |

|

0 |

|

Grant Co-Funding |

(500,000) |

0 |

0 |

|

(500,000) |

|

Gravel Pit Restoration |

(807,726) |

13,333 |

26,500 |

|

(767,892) |

|

Information Services |

(2,419,649) |

906,761 |

92,772 |

|

(1,420,116) |

|

Insurance Variations |

(50,000) |

0 |

0 |

|

(50,000) |

|

Internal Loans |

(6,215,667) |

(768,775) |

240,226 |

152,757 |

(6,591,460) |

|

Lake Albert Improvements |

(127,751) |

38,377 |

50,000 |

|

(39,374) |

|

Library |

(166,718) |

(155,915) |

0 |

|

(322,633) |

|

Livestock Marketing Centre |

(6,581,531) |

1,077,258 |

4,194,727 |

|

(1,309,546) |

|

Museum Acquisitions |

(54,612) |

10,000 |

10,000 |

|

(34,612) |

|

|

CLOSING BALANCE 2022/23 |

ADOPTED RESERVE TRANSFERS 2023/24 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 25.3.2024 |

PROPOSED CHANGES for Council Resolution* |

BALANCE AS AT 31 MARCH 2023 |

|

Net Zero Emissions |

(309,016) |

(44,492) |

226,196 |

4,916 |

(122,397) |

|

Oasis Reserve |

(1,324,304) |

172,650 |

222,748 |

|

(928,906) |

|

Parks & Recreation Projects |

(1,061,367) |

(137,862) |

706,268 |

|

(492,962) |

|

Parks Water |

(180,000) |

(150,000) |

0 |

|

(330,000) |

|

Planning Legals |

(100,000) |

(20,000) |

0 |

|

(120,000) |

|

Plant Replacement |

(4,023,265) |

128,993 |

2,370,501 |

|

(1,523,772) |

|

Project Carryovers |

(6,990,324) |

0 |

6,990,324 |

|

0 |

|

Public Art |

(238,510) |

30,000 |

159,177 |

|

(49,332) |

|

Service Reviews |

(100,000) |

0 |

0 |

|

(100,000) |

|

Sister Cities |

(30,590) |

0 |

0 |

|

(30,590) |

|

Stormwater Drainage |

(110,178) |

0 |

0 |

|

(110,178) |

|

Strategic Real Property |

(1,723,844) |

0 |

(1,806,417) |

|

(3,530,261) |

|

Subdivision Tree Planting |

(348,173) |

20,000 |

0 |

|

(328,173) |

|

Unexpended External Loans |

(1,870,017) |

136,612 |

1,541,428 |

|

(191,977) |

|

Workers Compensation |

(194,670) |

25,000 |

9,520 |

|

(160,149) |

|

Total Internally Restricted |

(66,310,882) |

2,737,751 |

29,512,760 |

227,673 |

(33,832,697) |

|

|

|

|

|

|

|

|

Total Restricted |

(206,771,562) |

12,748,713 |

33,913,188 |

345,917 |

(159,763,744) |

|

|

|

|

|

|

|

|

Total Unrestricted |

(11,502,000) |

0 |

0 |

0 |

(11,502,000) |

|

|

|

|

|

|

|

|

Total Cash, Cash Equivalents, and Investments |

(218,273,562) |

12,748,713 |

33,913,188 |

345,917 |

(171,265,744) |

Investment Summary as at 31 March 2024

In accordance with Regulation 212 of the Local Government (General) Regulation 2021, details of Wagga Wagga City Council’s external investments are outlined below.

|

Institution |

Rating |

Closing

Balance |

Closing

Balance |

March |

March |

Investment |

Maturity |

Term |

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

523,069 |

568,111 |

4.35% |

0.25% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

10,656,345 |

1,380,280 |

4.35% |

0.61% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

16,939,436 |

16,999,137 |

4.40% |

7.47% |

N/A |

N/A |

N/A |

|

Macquarie Bank |

A+ |

9,579,152 |

9,610,329 |

4.15% |

4.23% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

37,698,002 |

28,557,857 |

4.31% |

12.56% |

|

|

|

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

AMP |

BBB |

1,000,000 |

1,000,000 |

5.40% |

0.44% |

15/11/2023 |

15/11/2024 |

12 |

|

Australian Military Bank |

BBB+ |

1,000,000 |

1,000,000 |

5.06% |

0.44% |

24/05/2023 |

24/05/2024 |

12 |

|

Australian Unity |

BBB+ |

1,000,000 |

1,000,000 |

5.44% |

0.44% |

8/06/2023 |

11/06/2024 |

12 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

5.62% |

0.88% |

26/06/2023 |

26/06/2024 |

12 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

5.65% |

0.88% |

30/06/2023 |

28/06/2024 |

12 |

|

Heritage and People's Choice |

BBB+ |

1,000,000 |

1,000,000 |

5.80% |

0.44% |

10/07/2023 |

10/07/2024 |

12 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

5.27% |

0.88% |

31/08/2023 |

30/08/2024 |

12 |

|

Australian Unity |

BBB+ |

1,000,000 |

1,000,000 |

5.49% |

0.44% |

27/11/2023 |

27/11/2024 |

12 |

|

Suncorp |

A+ |

2,000,000 |

2,000,000 |

5.46% |

0.88% |

30/11/2023 |

29/11/2024 |

12 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

5.46% |

0.44% |

30/11/2023 |

29/11/2024 |

12 |

|

BankVic |

BBB+ |

1,000,000 |

1,000,000 |

5.45% |

0.44% |

4/12/2023 |

4/12/2024 |

12 |

|

AMP |

BBB |

2,000,000 |

2,000,000 |

5.35% |

0.88% |

14/12/2023 |

16/12/2024 |

12 |

|

Australian Unity |

BBB+ |

1,000,000 |

1,000,000 |

5.19% |

0.44% |

30/01/2024 |

30/01/2025 |

12 |

|

Suncorp |

A+ |

0 |

1,000,000 |

5.12% |

0.44% |

7/03/2024 |

7/03/2025 |

12 |

|

Total Short Term Deposits |

|

18,000,000 |

19,000,000 |

5.43% |

8.35% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

3.78% |

0.44% |

1/06/2022 |

3/06/2024 |

24 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.32% |

0.88% |

28/06/2021 |

29/06/2026 |

60 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.80% |

0.88% |

15/11/2021 |

17/11/2025 |

48 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

2.03% |

0.88% |

6/11/2019 |

6/11/2024 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.83% |

0.88% |

28/11/2019 |

28/11/2024 |

60 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

2.00% |

0.44% |

28/02/2020 |

28/02/2025 |

60 |

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

2.20% |

0.44% |

1/04/2020 |

1/04/2025 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.85% |

0.44% |

29/05/2020 |

29/05/2025 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.86% |

0.44% |

1/06/2020 |

2/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.75% |

0.88% |

25/06/2020 |

25/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.75% |

0.88% |

25/06/2020 |

25/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.60% |

0.88% |

29/06/2020 |

28/06/2024 |

48 |

|

ICBC |

A |

3,000,000 |

3,000,000 |

5.07% |

1.32% |

30/06/2022 |

30/06/2027 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.42% |

0.88% |

7/07/2020 |

8/07/2024 |

48 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.50% |

0.88% |

17/08/2020 |

18/08/2025 |

60 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

1.25% |

0.44% |

7/09/2020 |

8/09/2025 |

60 |

|

BoQ |

BBB+ |

2,000,000 |

2,000,000 |

1.25% |

0.88% |

14/09/2020 |

15/09/2025 |

60 |

|

NAB |

AA- |

1,000,000 |

1,000,000 |

5.23% |

0.44% |

14/09/2023 |

16/09/2024 |

12 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.20% |

0.44% |

7/12/2020 |

8/12/2025 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

0.95% |

0.88% |

29/01/2021 |

29/01/2026 |

60 |

|

NAB |

AA- |

1,000,000 |

1,000,000 |

1.08% |

0.44% |

22/02/2021 |

20/02/2026 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

1.25% |

0.88% |

3/03/2021 |

2/03/2026 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

1.40% |

0.88% |

21/06/2021 |

19/06/2026 |

60 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.32% |

0.88% |

25/06/2021 |

25/06/2026 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.32% |

0.44% |

25/08/2021 |

25/08/2026 |

60 |

|

AMP |

BBB |

2,000,000 |

2,000,000 |

1.00% |

0.88% |

18/10/2021 |

17/10/2024 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.56% |

0.88% |

30/11/2021 |

29/11/2024 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

2.00% |

0.88% |

8/02/2022 |

10/02/2025 |

36 |

|

P&N Bank |

BBB |

2,000,000 |

2,000,000 |

2.40% |

0.88% |

9/03/2022 |

10/03/2025 |

36 |

|

P&N Bank |

BBB |

2,000,000 |

2,000,000 |

4.90% |

0.88% |

11/03/2024 |

11/03/2026 |

24 |

|

MyState |

BBB |

2,000,000 |

2,000,000 |

2.20% |

0.88% |

2/03/2022 |

3/03/2025 |

36 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

3.28% |

0.88% |

26/04/2022 |

26/04/2024 |

24 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

3.78% |

0.88% |

4/05/2022 |

6/05/2024 |

24 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

3.99% |

0.88% |

4/05/2022 |

5/05/2025 |

36 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

3.76% |

0.44% |

23/05/2022 |

23/05/2024 |

24 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

3.95% |

0.88% |

6/06/2022 |

6/06/2024 |

24 |

|

Australian Unity |

BBB+ |

2,000,000 |

2,000,000 |

4.15% |

0.88% |

8/06/2022 |

11/06/2024 |

24 |

|

MyState |

BBB |

2,000,000 |

2,000,000 |

4.45% |

0.88% |

29/06/2022 |

28/06/2024 |

24 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

4.50% |

0.44% |

7/07/2022 |

7/07/2025 |

36 |

|

CBA |

AA- |

1,000,000 |

1,000,000 |

4.25% |

0.44% |

12/08/2022 |

12/08/2025 |

36 |

|

P&N Bank |

BBB |

3,000,000 |

3,000,000 |

4.55% |

1.32% |

29/08/2022 |

29/08/2025 |

36 |

|

Australian Military Bank |

BBB+ |

2,000,000 |

2,000,000 |

4.55% |

0.88% |

2/09/2022 |

2/09/2025 |

36 |

|

P&N Bank |

BBB |

1,000,000 |

1,000,000 |

4.40% |

0.44% |

9/09/2022 |

9/09/2025 |

36 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

4.70% |

0.44% |

4/10/2022 |

4/10/2024 |

24 |

|

AMP |

BBB |

2,000,000 |

2,000,000 |

4.95% |

0.88% |

21/10/2022 |

21/10/2024 |

24 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

5.20% |

0.88% |

21/10/2022 |

21/10/2025 |

36 |

|

AMP |

BBB |

1,000,000 |

1,000,000 |

4.75% |

0.44% |

15/11/2022 |

14/11/2024 |

24 |

|

AMP |

BBB |

1,000,000 |

1,000,000 |

4.80% |

0.44% |

21/11/2022 |

20/11/2025 |

36 |

|

P&N Bank |

BBB |

2,000,000 |

2,000,000 |

4.75% |

0.88% |

16/12/2022 |

16/12/2024 |

24 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

5.04% |

0.88% |

15/02/2023 |

17/02/2025 |

24 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

4.94% |

0.88% |

14/03/2023 |

14/03/2025 |

24 |

|

P&N Bank |

BBB |

2,000,000 |

2,000,000 |

5.00% |

0.88% |

14/03/2023 |

15/03/2027 |

48 |

|

Hume Bank |

BBB+ |

2,000,000 |

2,000,000 |

4.75% |

0.88% |

31/03/2023 |

31/03/2025 |

24 |

|

Auswide |

BBB |

2,000,000 |

2,000,000 |

4.95% |

0.88% |

13/04/2023 |

13/04/2026 |

36 |

|

P&N Bank |

BBB |

2,000,000 |

2,000,000 |

5.20% |

0.88% |

20/04/2023 |

20/04/2027 |

48 |

|

P&N Bank |

BBB |

1,000,000 |

1,000,000 |

5.20% |

0.44% |

26/05/2023 |

26/05/2026 |

36 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

5.37% |

0.88% |

21/08/2023 |

21/08/2025 |

24 |

|

P&N Bank |

BBB |

1,000,000 |

1,000,000 |

5.45% |

0.44% |

30/11/2023 |

28/11/2025 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

5.20% |

0.88% |

14/12/2023 |

15/12/2025 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

5.14% |

0.88% |

3/01/2024 |

5/01/2026 |

24 |

|

P&N Bank |

BBB |

2,000,000 |

2,000,000 |

5.10% |

0.88% |

4/01/2024 |

4/01/2027 |

36 |

|

Suncorp |

A+ |

1,000,000 |

1,000,000 |

5.08% |

0.44% |

8/01/2024 |

8/01/2026 |

24 |

|

Australian Unity |

BBB+ |

0 |

1,000,000 |

4.93% |

0.44% |

7/03/2024 |

9/03/2026 |

24 |

|

Total Medium Term Deposits |

|

106,000,000 |

107,000,000 |

3.37% |

47.05% |

|

|

|

|

Floating Rate Notes - Senior Debt |

|

|

|

|

|

|

|

|

|

Westpac |

AA- |

2,510,166 |

2,520,498 |

BBSW + 88 |

1.11% |

16/05/2019 |

16/08/2024 |

63 |

|

Suncorp |

A+ |

1,256,881 |

1,261,844 |

BBSW + 78 |

0.55% |

30/07/2019 |

30/07/2024 |

60 |

|

ANZ |

AA- |

2,003,782 |

2,011,387 |

BBSW + 77 |

0.88% |

29/08/2019 |

29/08/2024 |

60 |

|

HSBC |

AA- |

2,527,891 |

2,505,524 |

BBSW + 83 |

1.10% |

27/09/2019 |

27/09/2024 |

60 |

|

ANZ |

AA- |

1,513,693 |

1,520,229 |

BBSW + 76 |

0.67% |

16/01/2020 |

16/01/2025 |

60 |

|

NAB |

AA- |

2,016,949 |

2,025,732 |

BBSW + 77 |

0.89% |

21/01/2020 |

21/01/2025 |

60 |

|

Newcastle Permanent |

BBB |

1,104,626 |

1,109,679 |

BBSW + 112 |

0.49% |

4/02/2020 |

4/02/2025 |

60 |

|

Macquarie Bank |

A+ |

2,010,512 |

2,018,997 |

BBSW + 84 |

0.89% |

12/02/2020 |

12/02/2025 |

60 |

|

BOQ Covered |

AAA |

553,839 |

556,168 |

BBSW + 107 |

0.24% |

14/05/2020 |

14/05/2025 |

60 |

|

UBS |

A+ |

1,508,074 |

1,515,338 |

BBSW + 87 |

0.67% |

30/07/2020 |

30/07/2025 |

60 |

|

CBA |

AA- |

2,011,215 |

2,020,746 |

BBSW + 70 |

0.89% |

14/01/2022 |

14/01/2027 |

60 |

|

Rabobank |

A+ |

2,003,179 |

2,013,217 |

BBSW + 73 |

0.89% |

27/01/2022 |

27/01/2027 |

60 |

|

Newcastle Permanent |

BBB |

991,003 |

996,052 |

BBSW + 100 |

0.44% |

10/02/2022 |

10/02/2027 |

60 |

|

NAB |

AA- |

2,399,863 |

2,411,474 |

BBSW + 72 |

1.06% |

25/02/2022 |

25/02/2027 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,671,456 |

1,657,247 |

BBSW + 98 |

0.73% |

17/03/2022 |

17/03/2025 |

36 |

|

ANZ |

AA- |

2,017,084 |

2,028,374 |

BBSW + 97 |

0.89% |

12/05/2022 |

12/05/2027 |

60 |

|

NAB |

AA- |

1,708,882 |

1,715,104 |

BBSW + 90 |

0.75% |

30/05/2022 |

30/05/2025 |

36 |

|

Suncorp |

A+ |

905,110 |

909,401 |

BBSW + 93 |

0.40% |

22/08/2022 |

22/08/2025 |

36 |

|

ANZ |

AA- |

2,541,120 |

2,557,467 |

BBSW + 120 |

1.12% |

4/11/2022 |

4/11/2027 |

60 |

|

NAB |

AA- |

2,533,522 |

2,551,660 |

BBSW + 120 |

1.12% |

25/11/2022 |

25/11/2027 |

60 |

|

Suncorp |

A+ |

1,124,897 |

1,116,124 |

BBSW + 125 |

0.49% |

14/12/2022 |

14/12/2027 |

60 |

|

CBA |

AA- |

2,035,958 |

2,044,866 |

BBSW + 115 |

0.90% |

13/01/2023 |

13/01/2028 |

60 |

|

Bank Australia |

BBB |

1,909,915 |

1,918,849 |

BBSW + 155 |

0.84% |

22/02/2023 |

22/02/2027 |

48 |

|

Bendigo-Adelaide Covered |

AAA |

1,015,334 |

1,007,548 |

BBSW + 115 |

0.44% |

16/06/2023 |

16/06/2028 |

60 |

|

CBA |

AA- |

2,512,356 |

2,522,110 |

BBSW + 95 |

1.11% |

17/08/2023 |

17/08/2028 |

60 |

|

ANZ |

AA- |

2,129,778 |

2,111,313 |

BBSW + 93 |

0.93% |

11/09/2023 |

11/09/2028 |

60 |

|

Bank Australia |

BBB |

1,661,338 |

1,668,898 |

BBSW + 150 |

0.73% |

30/10/2023 |

30/10/2026 |

36 |

|

ANZ |

AA- |

2,514,641 |

2,522,292 |

BBSW + 96 |

1.11% |

5/02/2024 |

5/02/2029 |

60 |

|

ANZ |

AA- |

0 |

1,001,643 |

BBSW + 98 |

0.44% |

19/03/2024 |

19/03/2029 |

60 |

|

ING Bank |

A |

0 |

500,882 |

BBSW + 95 |

0.22% |

22/03/2024 |

22/03/2027 |

36 |

|

Total Floating Rate Notes - Senior Debt |

|

50,693,063 |

52,320,662 |

|

23.01% |

|

|

|

|

Fixed Rate Bonds |

|

|

|

|

|

|

|

|

|

ING Covered |

AAA |

686,703 |

691,613 |

1.10% |

0.30% |

19/08/2021 |

19/08/2026 |

60 |

|

Northern Territory Treasury |

AA- |

3,000,000 |

3,000,000 |

1.00% |

1.32% |

24/08/2021 |

16/12/2024 |

40 |

|

Northern Territory Treasury |

AA- |

3,000,000 |

3,000,000 |

1.50% |

1.32% |

24/08/2021 |

15/12/2026 |

64 |

|

BoQ |

BBB+ |

1,768,348 |

1,780,828 |

2.10% |

0.78% |

27/10/2021 |

27/10/2026 |

60 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.50% |

0.88% |

6/08/2021 |

15/12/2026 |

64 |

|

Northern Territory Treasury |

AA- |

1,000,000 |

1,000,000 |

1.50% |

0.44% |

14/07/2021 |

15/12/2026 |

65 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.30% |

0.88% |

29/04/2021 |

15/06/2026 |

61 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.00% |

0.88% |

30/11/2020 |

15/12/2025 |

60 |

|

Northern Territory Treasury |

AA- |

1,000,000 |

1,000,000 |

1.00% |

0.44% |

20/11/2020 |

15/12/2025 |

61 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.00% |

0.88% |

21/10/2020 |

15/12/2025 |

62 |

|

Total Fixed Rate Bonds |

|

18,455,051 |

18,472,441 |

1.30% |

8.12% |

|

|

|

|

Managed Funds |

|

|

|

|

|

|

|

|

|

NSW Tcorp |

NR |

2,030,650 |

2,073,713 |

2.12% |

0.91% |

17/03/2014 |

1/03/2029 |

179 |

|

Total Managed Funds |

|

2,030,650 |

2,073,713 |

2.12% |

0.91% |

|

|

|

|

TOTAL CASH ASSETS, CASH |

|

232,876,765 |

227,424,673 |

|

100.00% |

|

|

|

|

LESS: RIVERINA REGIONAL LIBRARY (RRL) CASH AT BANK |

|

2,495,075 |

2,490,713 |

|

|

|

|

|

|

TOTAL WWCC CASH ASSETS, CASH |

|

230,381,690 |

224,933,960 |

|

|

|

|

|

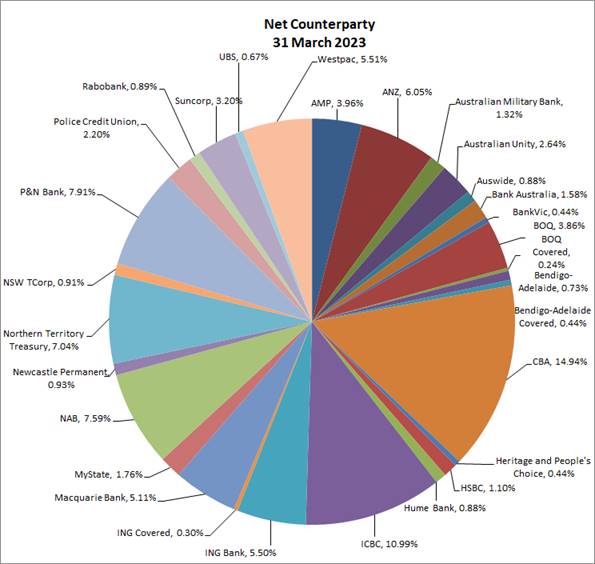

Council’s investment portfolio is dominated by Term Deposits, equating to approximately 55% of the portfolio across a broad range of counterparties. Cash equates to 13%, with Floating Rate Notes (FRNs) around 23%, fixed rate bonds around 8% and growth funds around 1% of the portfolio.

Council’s investment portfolio is well diversified in complying assets across the entire credit spectrum. It is also well diversified from a rating perspective. Credit quality is diversified and is predominately invested amongst the investment grade Authorised Deposit-Taking Institutions (ADIs) (being BBB- or higher), with a smaller allocation to unrated ADIs.

All investments are within the defined Policy limits, as outlined in the Rating Allocation chart below:

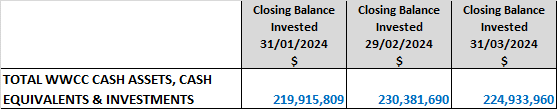

Investment Portfolio Balance

Council’s investment portfolio balance decreased over the past month, down from $230.38M to $224.93M.

Monthly Investment Movements

Redemptions/Sales – Council did not redeem any investment securities during March 2024.

New Investments – Council purchased the following investment securities during March 2024:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

Suncorp Bank (A+) Term Deposit |

$1M |

12 months |

5.12% |

The Suncorp Bank rate of 5.12% compared favourably to the rest of the market for this term. The next best rate for this term was 5.10%. |

|

Australian Unity Bank (BBB+) Term Deposit |

$1M |

2 years |

4.93% |

The Australian Unity rate of 4.93% compared favourably to the rest of the market for this term. The next best rate for this term was 4.85%. |

|

ANZ Bank (AA-) Floating Rate Note |

$1M |

5 years |

BBSW +98bps |

Council’s independent Investment Advisor advised this Floating Rate Note represented good value with a potential grossed-up value of +125-130bps after 2-2.5 years. |

|

ING Bank (A) Floating Rate Note |

$500K |

3 years |

BBSW +95bps |

Council’s independent Investment Advisor advised this Floating Rate Note represented good value with a potential grossed-up value of +115-120bps after 2 years. |

Rollovers – Council rolled over the following investment security during March 2024:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

P&N Bank (BBB) Term Deposit |

$2M |

2 years |

4.90% |

This term deposit was a 2-year investment earning 2.00% and was rolled at maturity into a new 2-year term deposit at 4.90%. |

Monthly Investment Performance

Interest/growth/capital gains/(losses) for the month totalled $825,790, which compares favourably with the budget for the period of $384,865 - outperforming budget for the month by $440,925.

Council’s outperformance to budget for March is mainly due to better than budgeted returns on Councils investment portfolio as well as a higher than anticipated investment portfolio balance. This is a result of the ongoing movements in the cash rate made by the Reserve Bank of Australia, with the latest increase in early November 2023 bringing the cash rate to 4.35% from a record low of 0.10% in April 2022.

Council experienced a positive return on its NSW T-Corp Managed Fund for the month of March, with the fund returning +2.12% (or +$43,063) as domestic (+3.27%) and international (+3.03%) shares continued to rally throughout the month.

Over the past year, Council’s investment portfolio has returned 3.73%, marginally underperforming the AusBond Bank Bill index by -0.46%. Councils investment portfolio has continued to outperform the AusBond Bank Bill Index* over the longer-term time period, returning 2.48% per annum over the past 3 years – outperforming the benchmark by 0.41% over this time.

* The AusBond Bank Bill Index is the leading benchmark for the Australian fixed income market. It is interpolated from the RBA Cash rate, 1 month and 3-month Bank Bill Swap rates.

Report by Responsible Accounting Officer

I hereby certify that all of the above investments have been made in accordance with the provision of Section 625 of the Local Government Act 1993 and the regulations there under, and in accordance with the Investment Policy adopted by Council on 11 December 2023.

Carolyn Rodney

Responsible Accounting Officer

Policy and Legislation

Budget variations are reported in accordance with Council’s POL 052 Budget Policy.

Investments are reported in accordance with Council’s POL 075 Investment Policy.

Local Government Act 1993

Section 625 - How may councils invest?

Local Government (General) Regulation 2021

Section 212 - Reports on council investments

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

This report is a control mechanism that assists in addressing the following potential risks to Council:

· Loss of investment income or capital resulting from ongoing management of investments, especially during difficult economic times

· Failure to demonstrate to the community that its funds are being expended in an efficient and effective manner

Internal / External Consultation

All relevant areas within Council have consulted with the Finance Division in relation to the budget variations listed in this report.

The Finance Division has consulted with relevant external parties to confirm Council’s investment portfolio balances.

|

1⇩. |

Capital Works Program 2023/24 to 2032/33 |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 29 April 2024 |

RP-3 |

RP-3 Procurement and Disposal Policy (POL 110) and Corporate Purchase Card Policy (POL 053)

Author: Carolyn Rodney

|

Summary: |