Agenda

and

Business Paper

To be held on

Monday 22

July 2024

at 6.00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

Agenda

and

Business Paper

To be held on

Monday 22

July 2024

at 6.00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

NOTICE OF MEETING

The proceedings of all Council meetings in open session, including all debate and addresses by the public, are recorded (audio visual) and livestreamed on Council’s website including for the purpose of facilitating community access to meetings and accuracy of the Minutes.

In addition to webcasting council meetings, audio recordings of confidential sessions of Ordinary Meetings of Council are also recorded, but do not form part of the webcast.

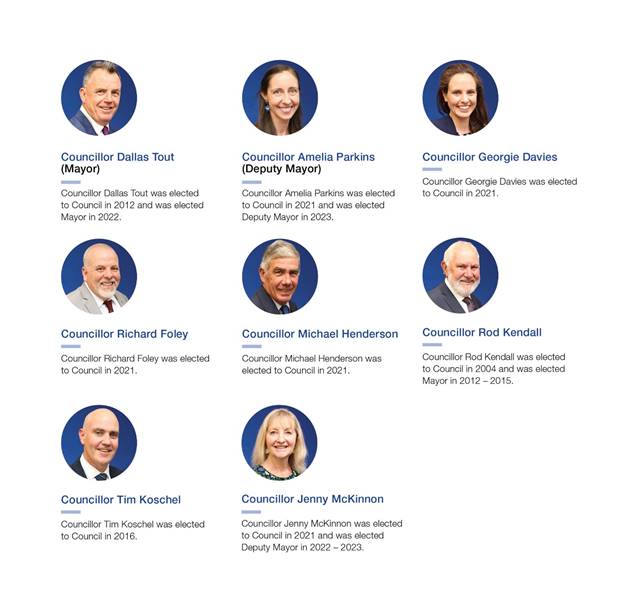

WAGGA WAGGA CITY COUNCILLORS

STATEMENT OF ETHICAL OBLIGATIONS

Councillors are reminded of their Oath or Affirmation of Office made under Section 233A of the Local Government Act 1993 and their obligation under Council’s Code of Conduct to disclose and appropriately manage Conflicts of Interest.

QUORUM

The quorum for a meeting of the Council, is a majority of the Councillors of the Council, who hold office for the time being, who are eligible to vote at the meeting.

Reports submitted to the Ordinary Meeting of Council to be held on Monday 22 July 2024.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 22 July 2024

CLAUSE PRECIS PAGE

ACKNOWLEDGEMENT OF COUNTRY 3

REFLECTION 3

APOLOGIES 3

Confirmation of Minutes

CM-1 ORDINARY COUNCIL MEETING - 24 JUNE 2024 3

DECLARATIONS OF INTEREST 3

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - REVIEW OF THE HERITAGE CONSERVATION AREA 4

Councillor Report

CR-1 COUNCILLOR REPORT - 2024 ROADS CONGRESS 6

Reports from Staff

RP-1 DA21/0604.01 MODIFICATION OF CONSENT FOR MULTI-LEVEL COMMERCIAL OFFICE & CAR PARK - AMENDMENTS TO APPROVED PLANS, 199-205 MORGAN STREET, WAGGA WAGGA 8

RP-2 DA24/0017 - ALTERATIONS AND ADDITIONS TO EXISTING DWELLING AND CONSTRUCTION OF TWO ADDITIONAL DWELLINGS CREATING MULTI DWELLING HOUSING, 11 THE BOULEVARDE, KOORINGAL 14

RP-3 DA24/0018 - ALTERATIONS AND ADDITIONS TO EXISTING LICENCED PREMISES (TURVEY PARK HOTEL) 18

RP-4 PROPOSED AMENDMENTS TO THE WAGGA WAGGA LOCAL ENVIRONMENTAL PLAN 2010 AND OPTIONS FOR SALE OF LAND - LOT 2, DP 7702230, BOOROOMA 23

RP-5 2024/25 BUDGET VARIATIONS AND 30 JUNE 2024 INVESTMENT REPORT 38

RP-6 REQUESTS FOR FINANCIAL ASSISTANCE 52

RP-7 2023/24 WORKS IN PROGRESS AND BUDGET REVOTES 64

RP-8 ANNUAL GRANTS PROGRAM 2024/25 - SMALL BUSINESS 75

RP-9 ANNUAL GRANTS PROGRAM 2024/25 - ARTS, CULTURE & CREATIVE INDUSTRIES 81

RP-10 ANNUAL GRANTS PROGRAM 2024/25 - YOUTH PROGRAMS & PROJECTS 87

RP-11 ANNUAL GRANTS PROGRAM 2024/25 - RECREATIONAL & COMMUNITY FACILITIES 91

RP-12 ANNUAL GRANTS PROGRAM 2024/25 - ENVIRONMENT 96

RP-13 ANNUAL GRANTS PROGRAM 2024/25 - EVENTS 102

RP-14 ANNUAL GRANTS PROGRAM 2024/25 - LOCAL HERITAGE 108

RP-15 ANNUAL GRANTS PROGRAM 2024/25 - RURAL HALLS 114

RP-16 ANNUAL GRANTS PROGRAM 2024/25 - NEIGHBOURHOOD & RURAL VILLAGES 119

RP-17 ANNUAL GRANTS PROGRAM 2024/25 - COMMUNITY PROGRAMS & PROJECTS 125

RP-18 PROPOSED AMENDMENTS - PUBLIC ART POLICY - POL 109 130

RP-19 APPLICATIONS FOR SUBSIDY FOR WASTE DISPOSAL FOR CHARITY ORGANISATIONS 154

RP-20 GET NSW ACTIVE 2024/25 FUNDING 157

RP-21 WAGGA WAGGA PLAYGROUND STRATEGY 2024-2044 164

RP-22 PROPOSED EXPRESSION OF INTEREST CAMPAIGN - COUNCIL MANAGED CROWN LAND - 8 BENT STREET, TARCUTTA (LOT 136 DP 757255) 167

RP-23 ASSIGNMENT OF LEASE - GRESHAM STREET, TARCUTTA (LOT 7009 DP 1028847 & PART LOT 16 DP 1189207) 170

RP-24 HOUSING SUPPORT PROGRAM FUNDING - STREAM 1 173

RP-25 DELEGATIONS DURING THE ELECTION PERIOD 176

RP-26 QUESTIONS WITH NOTICE 179

Confidential Reports

CONF-1 SPONSORSHIP OPPORTUNITY AT EXHIBITION CENTRE 181

CONF-2 LEASE AGREEMENT FOR STORAGE – CHARLES STURT UNIVERSITY 182

CONF-3 RFT 2024-27 PURCHASE OF ONE (1) TRUCK MOUNTED EWP BOOM LIFT 183

CONF-4 PROPOSED LEASES OF COUNCIL LAND TO INLAND RAIL - 204 URANA STREET, ASHMONT; PART 2 GLENFIELD ROAD, GLENFIELD PARK AND PART LOT 12, CASSIDY PARADE, TURVEY PARK 184

CONF-5 RFT2024-27 PURCHASE OF TWO (2) STREET SWEEPER UNITS 185

CONF-6 43 LIVINGSTONE STATE FORREST ROAD, BURRANDANA - PROPOSED FUTURE ACTIVITIES 186

CONF-7 RESPONSE TO NOTICE OF MOTION - HOUSING OPPORTUNITIES 187

Wagga Wagga City Council acknowledges the traditional custodians of the land, the Wiradjuri people, and pays respect to Elders past, present and future and extends our respect to all First Nations Peoples in Wagga Wagga.

We recognise and respect their cultural heritage, beliefs and continuing connection with the land and rivers. We also recognise the resilience, strength and pride of the Wiradjuri and First Nations communities

REFLECTION

Councillors, let us in silence reflect upon our responsibilities to the community which we represent, and to all future generations and faithfully, and impartially, carry out the functions, powers, authorities and discretions vested in us, to the best of our skill and judgement.

CM-1 ORDINARY COUNCIL MEETING - 24 JUNE 2024

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 24 June 2024 be confirmed as a true and accurate record.

|

|

1⇩. |

Ordinary Council Meeting - 24 June 2024 |

188 |

|

Report submitted to the Ordinary Meeting of Council on Monday 22 July 2024 |

NOM-1 |

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - REVIEW OF THE HERITAGE CONSERVATION AREA

Author: Councillor Amelia Parkins

|

Summary: |

Notice of Motion seeking a review into the Heritage Conservation Area to be prepared in advance of or concurrently with the CBD Masterplan. |

That Council receives a report that considers options to conduct a review of the Heritage Conservation Area to inform the CBD Masterplan. Such a review should include, but not be limited to:

a an assessment of the heritage significance of the existing heritage conservation area and the extent of the conservation area;

b consideration of new objectives and controls that retain and enhance the identified heritage significance of the conservation area while allowing appropriate new development to occur; and

c preparation of a Heritage Design Guide to facilitate sympathetic new development in a heritage precinct and appropriate conservation outcomes

Report

The current Wagga Wagga Heritage Conservation Area is being managed in an ad hoc and inconsistent way. The value of the conservation area is not clear, which has the potential to result in missed opportunities for development or inadvertent loss of heritage significance.

In 2013 the latest Wagga Wagga Heritage Study Review was prepared by NGH Environmental. This study provided a review of heritage items but excluded any assessment of the conservation area. The review recommended “that a separate study be undertaken by heritage consultants specific to the conservation area”, which 11 years later has not occurred.

Council is currently preparing a masterplan for the CBD, which includes part of the heritage conservation area. The significance of the conservation area should be assessed and in turn, inform how and where development occurs in this precinct. Appropriate controls that ensure a balance between contemporary design and development and retention of the identified heritage significance needs to be prepared.

The Heritage Council of NSW in collaboration with the NSW Government Architect have prepared a suite of publications including the Better Placed Design Guide for Heritage. These documents should be referenced in the review of the conservation area and inform the preparation of new controls and guidelines.

A review of our conservation area is overdue and with the preparation of a CBD masterplan now is the perfect time to carry out this project. As well as providing guidance to the CBD masterplan, appropriate controls will provide certainty for landowners, developers and the community about what can occur within the conservation areas. It would set clear expectations and allow Council staff to consistently implement controls that facilitate good design in heritage settings while protecting aspects of the conservation area that contribute to its significance.

Financial Implications

There is likely to be a cost associated with the preparation of this report, unless the scope can be captured within the work currently being undertaken for the CBD Masterplan.

Policy and Legislation

Code of Meeting Practice

Link to Strategic Plan

Community leadership and collaboration

Objective: Our community is informed and actively engaged in decision making and problem-solving to shape the future of Wagga Wagga

Ensure our community feels heard and understood

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 22 July 2024 |

CR-1 |

Councillor Report

CR-1 COUNCILLOR REPORT - 2024 ROADS CONGRESS

Author: Councillor Rod Kendall

That Council receive and notes the report from Councillor Rod Kendall in relation to the 2024 Local Roads Congress.

Report

I had the pleasure of attending the 2024 Local Roads Congress held in the NSW Parliament House on Monday, 3 June 2024. The congress jointly held by Local Government NSW and the NSW & ACT IPWEA (Institute of Public Works Engineering Australasia.

The theme of this year's congress was “Planning for the Future”.

The congress was addressed by Will Barton, Vice President, IPWEA NSW & ACT, Cr Darriea Turley AM, President of LG NSW, Mal Lanyon APM, Acting CEO, NSW Reconstruction Authority, The Hon John Graham MLC, Minister for Roads, The Hon Natalie Ward MLC, Shadow Minister for Transport and Roads, The Hon Jenny Aitchison MP, Minister for Regional Transport and Roads and David Layzell PM, Shadow Minister for Regional Transport and Roads.

Technical presentations were presented by Nabil Issa, CEO, Street Opening Coordination Council, Peter Shields, Chief Engineer City of Sydney, ‘Street as Shared Spaces’, Scott Greenow, A/Executive Director Freight, Transport for BSW, ‘Future Freight’, Joshua Devitt, Chief Engineer, IPWEA NSW & ACT, ‘Asset AI Project Update’, Dr Austin Morris, Dir Engineering & Enviromental Services Lockhart Shire Council, ‘Electric Vehicle Implementation’, Warren Sharp, Director, Warren Sharp Services P/L, ‘Integrated Network Planning’.

At the conclusion of the congress a ‘Congress Communique’ was agreed to and adopted.

All congress details, presentations and the communique can be found at

https://www.ipweansw.org/roadsdirectorate/local-roads-congress.

Financial Implications

N/A

Policy and Legislation

Code of Meeting Practice 2022

Code of Conduct

Councillor Expenses and Facilities Policy POL -025

Councillor Induction and Professional Development Policy - POL 113

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga has strong community leadership and a shared vision for the future

Our leaders represent our community

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 22 July 2024 |

RP-1 |

Reports from Staff

RP-1 DA21/0604.01 MODIFICATION OF CONSENT FOR MULTI-LEVEL COMMERCIAL OFFICE & CAR PARK - AMENDMENTS TO APPROVED PLANS, 199-205 MORGAN STREET, WAGGA WAGGA

Author: Steven Cook

General Manager: Peter Thompson

|

Summary: |

The report is for an application to modify a Development Consent and is presented to Council for determination.

DA21/0604 for a ‘multi-level commercial office & car park’ was approved by the full Council at its meeting on 11 April 2022. An application has now been received to modify the consent, pursuant to Section 4.55(2) of the Environmental Planning and Assessment Act 1979.

The modification proposes amendments to the approved plans including:

· Design variations to the façade and architecture of the building. · Increasing commercial leasable floor space from 6730m2 to 6860m2 across five levels. · Increasing gross floor area from 7595m2 to 7634m2. · Removal of two car parking levels (from six levels to four). · Reduction of car parking spaces from 483 to 316. · Reduction of motorcycle spaces from 20 to 12. · Increase of bicycle spaces from 10 to 18. · Overall reduction in building height by 725mm. · Relocation of sub-station; and · Other minor access and internal feature alterations.

Ten public submissions were received in relation to the modification application during its public exhibition period. Nine of these were by way of objection. One was in support. |

That Council approve DA21/0604.01 to modify Development Consent DA21/0604 for a Multi-level Commercial Officer and Car Park at 199-205 Morgan Street, Wagga Wagga (Lot 7 DP 203835, Lot 1 DP 375748, and Lot A DP 331461) subject to the conditions outlined in the Section 4.15/4.55 Assessment Report.

Modification Application Details

|

Applicant |

Manuel Donebus |

|

Owner |

Damasa Pty Ltd Directors: Daniel Donebus, Sandra Weston, Manuel Donebus |

|

Development Cost |

$25,500,000 |

|

Development Description |

Modification of Consent for Multi-level Commercial Office & Car Park - Amendments to Approved Plans including Facade Changes, Increase in Leasable Floor Area from 6730m2 to 6860m2, Removal of Two Car Parking Levels (with Reduction in Car Parking Spaces from 483 to 316), and Reduction in Building Height by 725mm |

Report

Key Issues

· Changes to parking numbers.

· Compliance with site masterplan.

· Changes to building façade.

· Submissions.

Site Location

The site, being Lot 7 DP 203835, Lot 1 DP 375748 and Lot A DP 331461, 199-205 Morgan Street, Wagga Wagga, is located on the north-eastern corner of Docker Street and Morgan Street, approximately 300m north of Edward Street. Works are also proposed in the Morgan Street road reserve adjacent to the site.

An open stormwater drain also crosses Lot A, taking water from the east, and directing this water to the north, towards the Wollundry Lagoon. Works have commenced under DA21/0604, with demolition of buildings on, and removal of vegetation from, the site.

All vehicular access to the land is currently from Morgan St.

The site is flat, and subject to inundation from overland flow from heavy rainfall events.

The locality is mixed in character. To the north, west and south of the site residential uses, including single dwellings and multi-unit developments prevail. To the southwest is an area of open space.

Land to the east and northeast is used for a range of commercial purposes, including retail, medical and office space. A four storey commercial building stands on land immediately to the east. This land has not historically been used for residential uses.

Assessment

· DA21/0604 for a ‘multi-level commercial office & car park’ was approved by the full Council at its meeting on 11 April 2022.

· An application has now been received to modify the consent, pursuant to Section 4.55(2) of the Environmental Planning and Assessment Act 1979.

· The site is zoned MU1 Mixed Use under the provisions of the WWLEP 2010. The adjacent road reserve is zoned R1 General Residential. The development is permitted with consent.

· As set out in the attached assessment report, Council can be satisfied of relevant matters under s4.55(2) of the Environmental Planning and Assessment Act 1979, including that the consent as modified will be substantially the same development as the as the development for which the consent was originally granted.

· The development, as proposed to be modified, does not result in any new non-compliances with the Wagga Wagga Local Environmental Plan (WWLEP) 2010, the Wagga Wagga Development Control Plan (WWDCP) 2010 and relevant State Environmental Planning Policies.

· The development remains non-complaint with one non-numerical control of the WWDCP 2010, being C1 of Section 2.1. This control states that “Access should be from an alternative secondary frontage or other non-arterial road where possible”. This is not a new non-compliance, with the non-compliance approved under the original consent. Access to the site is unaltered under this modification.

· The development continues to provide significantly more parking than is requried for the development under Section 2.2 of the WWDCP 2010. The development, as modified, requires 170 parking spaces. The modification reduces the number of spaces on the site from 483 to 316, and therefore a surplus of 146 spaces is maintained.

· The Development Application and subsequent modification have foreshadowed that the additional parking will be used to support future developments in the precinct.

· Future stages of the development of the site will need to demonstrate that adequate parking is available to accommodate those developments at the time they are carried out. There is no requirement for Council to grant consent to those developments in future if it is not satisfied in this regard.

· The details of those developments are not known at this time and will only be understood precisely when a Development Application for those future developments is lodged. The subject development still provides additional parking which allows for flexibility in the development of the site, but a definitive number for an additional parking requirement has never been established, either under the original Development Application nor under this modification, nor is it reasonable to expect that would be the case at this time.

· The masterplan for the precinct indicates that 300 parking spaces will be provided on the site. This is not a binding figure, because as noted above, each development must be assessed on its merits. Notwithstanding, the development provides 316 spaces.

· The proposed modifications are such that the impacts of the development will be no greater than previously assessed and the previous assessment remains valid. The changes to the approved plans are considered to be acceptable and unlikely to adversely impact on the character and amenity of the area.

· The site has been previously assessed as being suitable for the proposed development. Nothing in these proposed modifications is considered to alter this previous assessment.

· The application was referred to Transport for NSW who raised no objection to the proposed modification.

· Ten submissions were received in relation to the development. Nine by way of objection, and one in support. Objections raised matters both previously assessed with the Development Application, as well as matters relevant to the proposed modifications. Submissions relating to the modifications primarily related to:

o The reduction in parking, and the potential for this to increase impacts related to additional on-street parking now, and into the future.

o Ensuring that parking is available for employees, customers and visitors.

o That a reduction in parking would be inconsistent with the masterplan, and result in insufficient parking for future stages.

o Changes to the building façade and associated impacts on the amenity of the area.

· An amended condition (C.61) is proposed to clarify that parking spaces requried to meet the parking demands of the office space must not be used for the parking of plant or fleet, and must be available for employee, customer and visitor parking.

· The public interest was assessed under the original application and the development was found to be in the public interest. Nothing in these proposed modifications is considered to alter this previous assessment.

· The nature of the modification is such that consistency of the development against the provisions of the Biodiversity Conservation Act 2016 remains as per the previous assessment.

Having regard for the information contained in the attached Section 4.55/4.15 assessment report, it is considered that the development is acceptable for the following reasons and recommended for approval.

Reasons for Approval

1. The proposed development, as modified, is consistent with the strategic intent for the site, as previously supported by Council in the rezoning and DCP amendment process.

2. The proposed development, as modified, is consistent with the provisions of the Wagga Wagga Local Environmental Plan 2010.

3. The proposed development, as modified, is consistent with the controls and matters for consideration in relevant State Environmental Planning Policies.

4. The proposed development, as modified, is generally consistent with the objectives and controls of the Wagga Wagga Development Control Plan 2010. No new non-compliances are introduced.

5. Impacts of the proposed development, as modified, are acceptable and can be managed via the recommended conditions of consent.

6. Submissions have been considered and addressed and the development, as modified, is considered to be in the public interest.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: Future growth and development of Wagga Wagga is planned for in a sustainable manner

Ensure sustainable urban development

Risk Management Issues for Council

Approval of the application is not considered to raise risk management issues for Council as the proposed development is generally consistent with LEP and DCP controls.

Internal / External Consultation

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Have your Say |

Email newsletter |

Social media |

Website |

|

|

Inform |

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

x |

|

Consult |

|

x |

|

|

|

|

|

|

|

|

x |

|||||

|

Involve |

|

|

|

|

|

|

|

|

||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other methods (please list specific details below) |

|

Site notice placed on site during exhibition period. |

|

1. |

DA21/0604.01 - Section 4.55/4.15 Assessment Report - Provided under separate cover |

|

|

2. |

DA21/0604.01 - Modified Plans - Provided under separate cover |

|

|

3. |

DA21/0604.01 - Statement of Environmental Effects (Modification of Consent) - Provided under separate cover |

|

|

4. |

DA21/0604.01 - Redacted Submissions - Provided under separate cover |

|

|

5. |

DA21/0604.01 - Relevant Plans Approved under DA21/0604 to be Superseded - Provided under separate cover |

|

|

6. |

DA21/0604.01 - Site Masterplan Referenced in Section 10.8 of Wagga Wagga Development Control Plan 2010 - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 22 July 2024 |

RP-2 |

RP-2 DA24/0017 - ALTERATIONS AND ADDITIONS TO EXISTING DWELLING AND CONSTRUCTION OF TWO ADDITIONAL DWELLINGS CREATING MULTI DWELLING HOUSING, 11 THE BOULEVARDE, KOORINGAL

Author: Steven Cook

General Manager: Peter Thompson

|

Summary: |

This report is for a development application and is presented to Council for determination. The application has been referred to Council under Section 1.11 of the Wagga Wagga Development Control Plan 2010 as the development is for Multi Dwelling Housing and a variation to a numerical control of the DCP of greater than 10% is proposed.

The Development Application seeks consent to carry out alterations and additions to an existing dwelling and to construct two additional two-bedroom dwellings on the site, resulting in multi dwelling housing on the site (as defined under the Wagga Wagga Local Environmental Plan 2010). |

That Council approve DA24/0017 for alterations and additions to existing dwelling and construction of two additional dwellings, creating multi dwelling housing at 11 The Boulevarde, Kooringal NSW 2650 (Lot 56 DP 38519) subject to the conditions outlined in the Section 4.15 Assessment Report.

Development Application Details

|

Applicant |

Andrew Jones |

|

Owner |

Old Girl Pty Ltd Directors: Gordon Saggers, Ellen Saggers |

|

Development Cost |

$700,000 |

|

Development Description |

Alterations and additions to existing dwelling and construction of two additional dwellings, creating multi dwelling housing |

Report

Key Issues

· Variations proposed to following controls of the Wagga Wagga Development Control Plan (WWDCP) 2010:

o Control C2 of Section 9.2.2 of relating to the height of fences forward of the building line and

o Control C1 of Section 9.3.1 relating to minimum site area per dwelling in the R1 zone.

· The variations are greater than 10% (10.04% in the case of site area per dwelling, and 25% in the case of the fence). In the case of multi-dwelling housing, Council officers do not have delegation to approve variations to numerical standards of greater than 10%.

Assessment

· Under the Wagga Wagga Local Environmental Plan (WWLEP) 2010 the site is zoned R1 – General Residential. ‘Multi-dwelling housing’ is permitted with consent in the R1 zone.

· The proposed development is consistent with the provisions of the WWLEP 2010 and relevant State Environmental Planning Policies.

· Two variations to numerical standards in the WWDCP 2010 are proposed. Having regard to the objectives of the WWDCP 2010 in relation to these controls, and the overall impacts of the proposed development, it is recommended that these variations be supported.

· The development is otherwise generally consistent with the objectives and controls of the WWDCP 2010.

· The impacts of the development are assessed as being acceptable.

· The development was placed on public exhibition for 14 days. No public submissions in relation to the development were received.

· The site is considered suitable for the proposed development.

· The provision of a range of housing types in the city is considered to be in the public interest.

· A comprehensive assessment report completed in accordance with the provisions of Section 4.15(1) of the Environmental Planning and Assessment Act 1979 is provided as an attachment to this report. This assessment addresses all maters identified above in further detail and also considers all other relevant heads of consideration including the likely impacts of the development and the suitability of the site.

· Having regard to this assessment, the application is recommended for approval subject to the inclusion of recommended conditions of consent.

Reasons for Approval

1. The proposed development is consistent with the objectives and provisions of the Wagga Wagga Local Environmental Plan 2010.

2. The proposed variations to the numerical controls of the WWDCP 2010 set out in:

a. Control C2 of 9.2.2 relating to the height of fences forward of the building line, and

b. Control C1 of Section 9.3.1 relating to minimum site area per dwelling in the R1 zone,

are appropriate having regard to the assessment requirements under 1.11 of the DCP.

3. The proposed development is generally consistent with the remaining objectives and controls of the Wagga Wagga Development Control Plan 2010.

4. No public submissions were received in relation to the development.

5. The site is considered suitable for the proposed development and is in the public interest.

Site Location

The site, Lot 56 DP 38519, 11 The Boulevarde, Kooringal, is located on the northern side of The Boulevard, 50m east of its intersection with Tichborne Crescent.

The site is 1012m2 in size, and contains an existing dwelling, and outbuildings. A number of trees are on the site, including small fruit trees (such as plum, nectarine and lemon), and medium box elders which have possibly self-seeded.

The locality is residential in character, containing a mix of older single dwelling properties, with an older unit development nearby, as well as a range of sites that have been redeveloped for dual occupancy and multi-dwelling housing.

Opposite the site is Henwood Park.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: Future growth and development of Wagga Wagga is planned for in a sustainable manner

Provide for a diversity of housing that meets our needs

Risk Management Issues for Council

Approval of the application is not considered to raise risk management issues for Council as the proposed development is generally consistent with LEP and DCP controls, and variations are justified.

Internal / External Consultation

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Have your Say |

Email newsletter |

Social media |

Website |

|

|

Inform |

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

x |

|

Consult |

|

x |

|

|

|

|

|

|

|

|

x |

|||||

|

Involve |

|

|

|

|

|

|

|

|

||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other methods (please list specific details below) |

|

Site notice placed on site during exhibition period. |

|

1. |

DA24/0017 - Section 4.15 Assessment Report - Provided under separate cover |

|

|

2. |

DA24/0017 - Plan Set (Redacted) - Provided under separate cover |

|

|

3. |

DA24/0017 - Statement of Environmental Effects - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 22 July 2024 |

RP-3 |

RP-3 DA24/0018 - ALTERATIONS AND ADDITIONS TO EXISTING LICENCED PREMISES (TURVEY PARK HOTEL)

Author: Emma Molloy

General Manager: Peter Thompson

|

Summary: |

The report is for a development application and is presented to Council for determination. The application has been referred to Council under Section 1.10 of the Wagga Wagga Development Control Plan 2010 (DCP) as an objection has been received in relation to a numerical control that is being varied by more than 10%.

It is proposed to vary the onsite loading requirements and off-street parking requirements subject to C4 within Section 2.1 and C1 within Section 2.2 of the DCP.

The details of the submission are contained within the attached Section 4.15 Assessment Report. |

That Council approve DA24/0018 for Alterations and Additions to Existing Licenced Premises (Turvey Park Hotel) at 71 Bolger Avenue, Mount Austin NSW 2650 (Lot 1 DP 505153) subject to the conditions outlined in the Section 4.15 Assessment Report.

Development Application Details

|

Applicant |

Tav Holdings Pty Ltd |

|

Owner |

Tav Holdings Pty Ltd |

|

Development Cost |

$150,000 |

|

Development Description |

Alterations and Additions to Existing Licenced Premises (Turvey Park Hotel) |

Report

Site Location

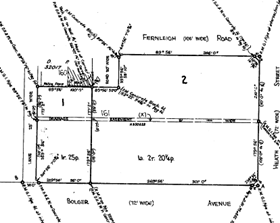

The subject site is legally known as Lot 1 DP 505153 located at 71 Bolger Avenue, Mount Austin. The site is located on the northern side of Bolger Avenue within the Turvey Tops Shopping Centre (as shown below). The lot measures 1644m² and contains an existing licensed premises known as the Turvey Park Hotel and Bottle Shop. There are public entrances from the shopping centre and from Bolger Avenue. The site is fully developed with no vegetation.

The surrounding locality is a local centre comprising of businesses and other services that serve the Turvey Park and Mount Austin communities. Residential properties and a playing oval are located around the centre.

Assessment

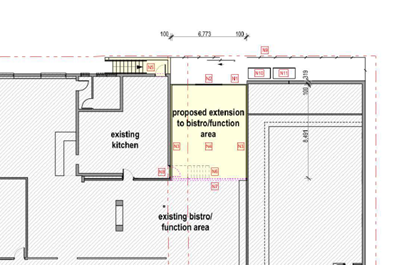

· The application seeks consent for the use of an extension that was built without consent. The extension comprises of 58m² in area and will be used for additional dining space for the bistro. The extension is not currently in use. As part of the works the stairs providing access to the kitchen were demolished. The kitchen is now accessed via stairs on the western side of the building off the laneway to the rear which were also constructed without approval (as shown below).

· No other changes to the hours or general operation of the premises are proposed.

· The development is generally consistent with the WWLEP and WWDCP with the exception of the below variations to DCP Controls.

· Variations are sought to C4 within Section 2.1 and C1 of Section 2.2 of the DCP in relation to loading and unloading areas and off-street parking. Written justification was received from the applicant which is addressed in the attached s4.15 report.

· In consideration of C4 within Section 2.1 of the DCP and the impacts of the development (as assessed in the attached s4.15 report). The variation requested with respect to unloading and loading areas within the development site be supported for these reasons:

o The location of the extension was previously the loading area and bin storage area, small additions over a long period of time have decreased the ability to use this area as it was originally intended to which has resulted in deliveries for the kitchen being from the laneway itself.

o Deliveries to the kitchen are typically between 9am and 12 pm which does not detrimentally impact the other users of the laneway.

· In consideration of C1 of Section 2.2 of the DCP and the impacts of the development (as assessed in the attached s4.15 report). The variation requested with respect to the provision of parking for this development be supported for these reasons:

o The site is within a busy local centre where parking is also generated by other uses within the centre which also impact on off-street parking.

o The addition results in the requirement for six car parking spaces. This is not considered to have noticeable impact on available off-street parking.

o There is on-street parking available around the site which accommodate an overflow of car parking depending on the day of the week which is considered reasonable.

o A courtesy bus service is provided by the Hotel which alleviate some of the dependence on car parking combined with Uber and taxi services does reduce patrons need for car parking.

· One submission was received during the notification period. The submission raised concerns in regard to off-street parking. The submission is addressed in the attached s4.15 report.

· Having regard for the information contained in the attached Section 4.15 assessment report, it is considered that the development is acceptable for the following reasons and recommended for approval.

Reasons for Approval

· The application is for the use of an existing extension to the rear of the Turvey Park Hotel within the E1 Local Centre zone which is permitted with consent.

· The development complies with the requirements of the Environmental Planning and Assessment Act 1979 and will not compromise the outcomes sought within the Wagga Wagga Local Environmental Plan 2010.

· An assessment of the application against the relevant provisions within the Wagga Wagga Development Control Plan 2010 demonstrates that the proposed development will not cause any significant adverse impacts on the surrounding natural environment, built environment, infrastructure, community facilities or local character and amenity. Variations to the controls have been justified and assessed.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: Future growth and development of Wagga Wagga is planned for in a sustainable manner

Ensure sustainable urban development

Risk Management Issues for Council

Approval of the application is not considered to raise risk management issues for Council as the proposed development is consistent with LEP and DCP controls.

Internal / External Consultation

Full details of the consultation that was carried out as part of the development application assessment is contained in the attached s4.15 Report.

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Have your Say |

Email newsletter |

Social media |

Website |

|

|

Inform |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consult |

|

x |

|

|

|

|

|

|

|

|

|

|||||

|

Involve |

|

|

|

|

|

|

|

|

||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other methods (please list specific details below) |

|

|

|

1. |

DA24_0018 - Statement of Environmental Effects - Provided under separate cover |

|

|

2. |

DA24_0018 - Plans - Provided under separate cover |

|

|

3. |

DA24_0018 - Structual Engineers Letter - Provided under separate cover |

|

|

4. |

DA24_0018 - Redacted Copy of Submission - Provided under separate cover |

|

|

5. |

DA24_0018 - Submission Unredacted This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: personnel matters concerning particular individuals. - Provided under separate cover |

|

|

6. |

DA24_0018 - s4.15 report - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 22 July 2024 |

RP-4 |

RP-4 PROPOSED AMENDMENTS TO THE WAGGA WAGGA LOCAL ENVIRONMENTAL PLAN 2010 AND OPTIONS FOR SALE OF LAND - LOT 2, DP 7702230, BOOROOMA

Author: Paul O'Brien

General Manager: Peter Thompson

|

Summary: |

Council, at its ordinary meeting of 16 December 2019 resolved (19/474) that council: a note the contents of this report b receive a further report on options for sale of the existing site, Lot 2, DP 702230, Farrer Rd, Boorooma c in consultation with Emergency Service Providers investigate options for an alternate site in the Bomen SAP area This report is presented to update council in relation to that resolution and for consideration of recommendations to progress the development of Lot 2, DP 702230, Farrer Rd, Boorooma. It is recommended that a Planning Proposal be prepared to rezone part of the subject site from R5 (Large Lot Residential) to R1 (General Residential) and remove the 2 Ha minimum lot size. This planning proposal is considered to be routine in nature and is consistent with the Wagga Wagga Local Strategic Planning Statement in ensuring that appropriate housing is available while maintaining liveability, sense of community and local identity. It is recommended that a EOI process for the sale of the land be undertaken to allow the development industry to put forward options for purchase and development of the land. This tender process will allow the industry to put forward options tailored to the best residential use of the land combined with the public interest. Discussions between RGDC, Council and RFS have been very constructive and an alternative precinct approach at a different site on the northern side of the city is being negotiated. |

That Council:

a endorses the preparation of a Planning Proposal, as detailed in the attached scoping report; and

i forwards it to the Minister for Planning seeking an Amendment to the WLEP 2010 and requests that a Gateway Determination be issued, including the delegation of Plan making powers, so as to enable the public exhibition of the Planning Proposal pursuant to the EP&A Act 1979; and

ii upon receipt of a Gateway Determination under Section 3.34 of the EP&A Act 1979, Council places the Planning Proposal and any supporting material on public exhibition pursuant to any requirements of the Gateway Determination and Schedule 1, clause 4 of the EP&A Act 1979; and

iii should no objections be received, furnishes a copy of this report and other relevant information to the NSW Department of Planning, Industry and Environment and/or NSW Parliamentary Counsels Office, in accordance with the EP&A Act 1979, and requests the Minister for Planning (or a delegate on their behalf) undertake the appropriate actions to secure the making of the amendment to the WLEP 2010.

b commence an expression of interest (EOI) process for the sale/lease of the land formulated to allow the development industry to put forward options for purchase/lease and development of the land to achieve the best residential use of the land combined with the public interest.

c continue negotiations with RGDC and emergency services agencies to facilitate an alternative precinct approach at a different site on the northern side of the city.

Report

Amendment to Wagga Wagga Local Environmental Plan 2010

This report proposes preparation of a Proposed Planning Proposal that will request an amendment to the Wagga Wagga Local Environmental Plan 2010 (WWLEP2010).

The Planning Proposal to rezone part of the subject site and remove the 2 Ha minimum lot size is considered to be routine in nature and is consistent with the Wagga Wagga Local Strategic Planning Statement in ensuring that appropriate housing is available while maintaining liveability, sense of community and local identity.

Should Council endorse the attached scoping report and provide in principle support for the lodgement of a planning proposal, any subsequent Planning Proposal will be prepared in accordance with Section 3.33 of the Environmental Planning and Assessment Act 1979 (EP&A Act) and the NSW Government’s A Guide to Preparing Planning Proposals and A Guide to Preparing Local Environmental Plans.

Figure 1 Aerial Image of the site and surrounds

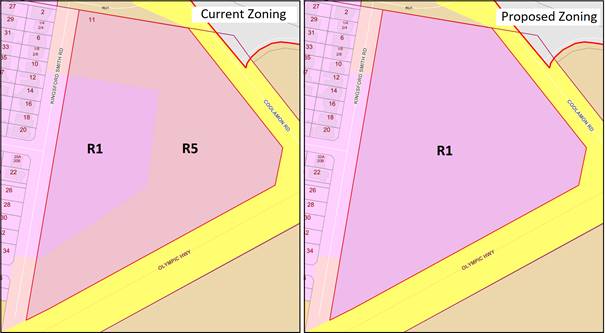

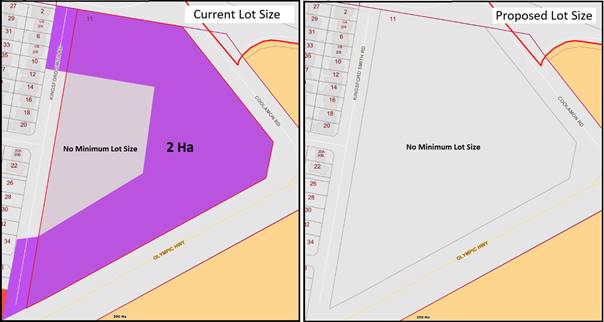

The intended outcomes are shown in figures 2 and 3 below.

Figure 2 Current and Proposed Zoning

Figure 3 Current and Proposed Minimum Lot Size

Site and Locality

The site is located approximately 9.5km north and west of the of the Wagga Wagga City Centre adjacent to the intersection of the Olympic Highway and Coolamon Road. Boorooma and Charles Sturt University are located to the west of the site and Cartwrights Hill is located to the east. The site has a total area of approximately 8.18 hectares.

Key Considerations

The objective of the Planning Proposal will be to enable the subject land to be rezoned and developed for general residential purposes. The Planning Proposal will allow the site to be developed in an orderly and economic manner and will facilitate future development that will be consistent with the adjacent residential land uses in the R1 (General Residential) zone, increasing the potential lot yield from 29 to 69.

1. Strategic Context and Strategic Planning

The Riverina Murray Regional Plan 2041 provides overarching strategic framework for the region, guiding each Council’s more detailed local planning. The vision for the region, as outlined within the plan, is ‘a diversified economy founded on Australia’s food bowl, iconic waterways and a network of vibrant connected communities’. The proposal is consistent with the relevant principles and objectives of this plan.

The proposed rezoning is consistent with council’s Local Strategic Planning Statement (LSPS), providing for a diversity of housing that meets our needs and ensuring that appropriate housing is available while maintaining liveability, sense of community and local identity. The site currently includes around 30% of its area already zoned R1 (General Residential), and its location adjacent to existing developed R1 zoned land to the west further demonstrates the potential for integration of the remaining 70% of the site into the residential character of the area.

2. Contamination

The site has previously been used for agricultural activities, such as cropping and grazing. The site is not listed on councils register of potential contaminated sites.

3. Biodiversity

The site consists of paddocks containing non-native vegetation which are not considered to offer any significant conservation values.

4. Infrastructure

The proposal will locate infill residential development in an existing urban area with existing services and infrastructure

Sale of land by expression of interest (EOI)

POL 038 – Acquisition, Disposal and Management of Land Policy, sets the requirements when disposing of council owned land.

POL 038 provides that all decisions and actions in relation to the acquisition, disposal and/or management of Land should have due regard to the following fundamental principles:

• Best value for money – achieving ‘best value’ for the whole of the community may include both direct and indirect benefits in relation to economic, financial, social and environmental outcomes.

• Transparency – processes should be open to scrutiny and provide full information and record the reasons behind decisions.

• Accountability – demonstrate the best use of public resources and the highest level of performance through appropriate record keeping and audit trails.

• Impartiality – address perceived and/or actual conflicts of interest.

POL 038 further provides that disposal of Land should occur by an open competitive process such as auction, tender or expression of interest (EOI) unless exceptional circumstances warrant disposal by means of direct negotiation with a single party.

This report recommends that council commence an expression of interest (EOI) process for the sale/lease of the land formulated to allow the development industry to put forward options for purchase/lease and development of the land to achieve the best residential use of the land combined with the public interest.

This would have the effect of locking the potential land purchaser/lessee into a fixed agreed development outcome, deemed by council to provide the best value for the Wagga Wagga local government area.

An expression of interest (EOI) process is preferable over a tender process as it allows greater flexibility for council in negotiation of the proposal achieving ‘best value’ for the whole of the community. Section 55(3)(d) of the Local Government Act specifically removes the requirement for a contract for the purchase or sale by a council of land to be facilitated by tender.

Emergency Services Precinct

That Council staff continue negotiations with RGDC and emergency services agencies to facilitate an alternative precinct approach at a different site on the northern side of the city.

Discussions between RGDC, Council and RFS have been very constructive and an alternative precinct approach at a different site on the northern side of the city is being negotiated.

Financial Implications

N/A

Policy and Legislation

Environmental Planning and Assessment Act 1979

Riverina Murray Regional Plan 2041

Wagga Wagga Local Strategic Planning Statement – Wagga Wagga 2040

Wagga Wagga Local Environmental Plan 2010

Link to Strategic Plan

Growing Economy

Objective: Wagga Wagga is an attractive location for people to live, work and invest

Attract and support local businesses, industry, and employment opportunities

Risk Management Issues for Council

Providing appropriate areas of residential zoned land within the Wagga Wagga local government area assists in ensuring housing options are available while maintaining liveability, sense of community and local identity.

Internal / External Consultation

Relevant internal and external consultation will be completed as part of the preparation of the proposed planning proposal and it’s assessment.

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Have your Say |

Email newsletter |

Social media |

Website |

|

|

Inform |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consult |

|

x |

|

x |

|

|

|

|

|

|

|

x |

|

|||

|

1⇩. |

11 Farrer Rd Boorooma R5 to R1 - Scoping-Proposal |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 22 July 2024 |

RP-5 |

RP-5 2024/25 BUDGET VARIATIONS AND 30 JUNE 2024 INVESTMENT REPORT

Author: Carolyn Rodney

|

Summary: |

This report is for Council to consider and approve the proposed budget variations required to manage the 2024/25 budget and Long-Term Financial Plan.

This report is also for Council to consider its external investments and performance as at 30 June 2024. |

|

That Council: a approve the proposed 2024/25 budget variations as presented in this report b note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2021 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above c note the details of the external investments as of 30 June 2024 in accordance with section 625 of the Local Government Act 1993 |

This report includes proposed 2024/25 budget variations for Council’s consideration and adoption. Council is forecasting a balanced budget position for the 2024/25 financial year as at 22 July 2024.

The usual monthly financial report is not included in the Business paper due to the commencement of the year-end process and preparation of the financial statements for auditing. The 2023/24 Financial Statements will be presented to Council in October 2024 which will highlight and provide analysis on Council’s overall financial performance and position for the 2023/24 financial year. Council’s Independent Auditor will present the 2023/24 Audit Report at the November 2024 Council meeting.

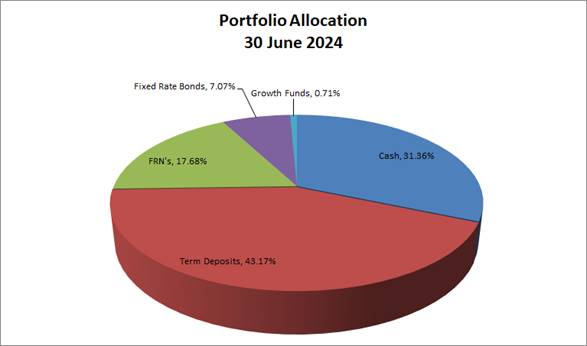

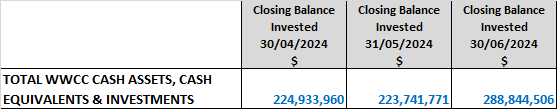

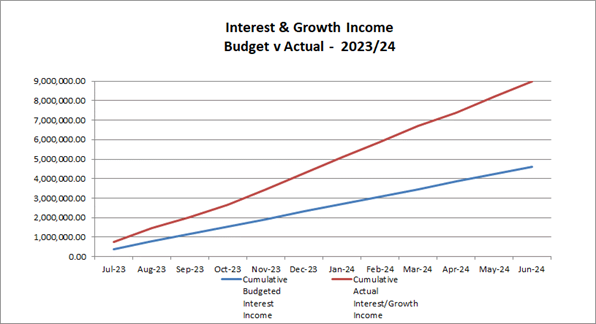

Council has experienced a positive monthly investment performance for the month of June when compared to budget ($411,048 up on the monthly budget). This is mainly due to better than budgeted returns on Council’s investment portfolio as a result of the recent movements in the interest rate environment, as well as higher than anticipated investment portfolio balances throughout the year.

Council’s investment portfolio continued to perform strongly throughout the 2023/24 financial year, with the portfolio returning 3.86% for the year.

2024/25 Revised Budget Result – (Surplus) / Deficit |

$’000s |

|

Original 2024/25 Budget Result as adopted by Council Total Budget Variations approved to date. Budget Variations for 2024/25 |

$0K $0K $0K |

|

Proposed Revised Budget result for 2024/25, as at

22 July 2024 – |

$0K |

The proposed Budget Variations to 22 July 2024 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact (Fav)/ Unfav |

||

|

1 – Community Leadership and Collaboration |

|

|

|||

|

Telco for GPS |

$50K |

Plant Replacement Reserve ($50K) |

Nil |

|

|

|

Funds are required for the additional ongoing software expenses for Geotab services. The Geotab services software will allow Council to migrate Fleet Telematics from the existing provider based on the 3G Network to 4G Network and will also allow Council to capture all 349 current assets which is a significant increase to the 188 assets that are captured with the existing 3G based system. It is proposed to fund the additional $50K required per year from the Plant Replacement Reserve for the 10 years of the Long Term Financial Plan (LTFP). Job Consolidation: 18114 |

|

|

|||

|

Artificial Intelligence Early Adopter Grant |

$170K |

Department of Planning, Housing & Infrastructure Grant Income ($170K) |

Nil |

|

|

|

Council has been successful in securing Department of Planning, Housing and Infrastructure grant funding under the Artificial Intelligence Early Adopter Grant Program for an AI assisted platform to improve and streamline our current DA processes. Council will utilise the platform to troubleshoot applications, eliminating issues quickly to accelerate the development application process. The platform will improve assessment timeframes to enable faster delivery of housing supply. Estimated Completion: 30 June 2025 Job Consolidation: 23140 |

|

|

|||

|

3 – Growing Economy |

|

|

|||

|

Regional Events Fund - Wagga Wagga Festival of W |

$20K |

Destination NSW ($20K) |

Nil |

|

|

|

Wagga Wagga’s Festival of W is a premiere destination event held across 16 days in winter. Council has been advised they have been awarded $20,000 through the Destination NSW’s Regional Events Fund. This additional grant funding will be used for out-of-region marketing of the 2024 festival, for example the Canberra/ACT market, to highlight the significance of the festival and encourage both day-trippers and overnight visitation to the city. Estimated Completion: 31 July 2024 Job Number: 23137 |

|

|

|||

|

$5K |

Parks & Recreation Reserve ($5K) |

|

|

||

|

A Councillor workshop was held on 20 May 2024 to consider lighting options to support community awareness raising campaigns. This workshop was requested in response to the Notice of Motion “Endometriosis Awareness – Endo Enlighten Program” presented to the 20 November 2023 Council meeting. Various options were considered with Councillor support confirmed for the lighting of the Wagga Wagga Coat of Arms located on the north side of forecourt area of the Civic Centre Building facing Baylis Street and the Victory Memorial Gardens, at a cost of $5K. It is proposed to fund these works from the Parks & Recreation Reserve, which has sufficient funding available. Estimated Completion: 30 December 2024 Job Number: 23129 |

|

|

|||

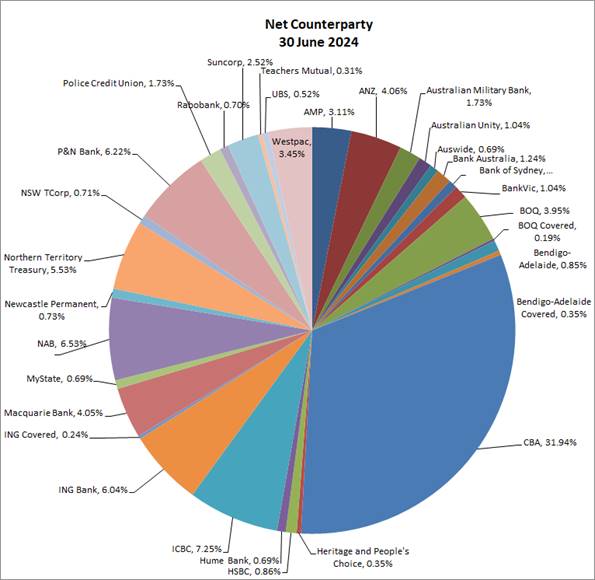

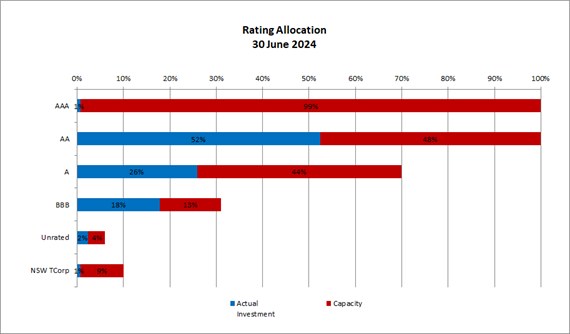

Investment Summary as at 30 June 2024

In accordance with Regulation 212 of the Local Government (General) Regulation 2021, details of Wagga Wagga City Council’s external investments are outlined below.

|

Institution |

Rating |

Closing

Balance |

Closing

Balance |

June |

June |

Investment |

Maturity |

Term |

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

817,189 |

211,553 |

4.35% |

0.07% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

6,598,321 |

73,244,111 |

4.35% |

25.30% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

7,616,834 |

7,645,298 |

4.40% |

2.64% |

N/A |

N/A |

N/A |

|

Macquarie Bank |

A+ |

9,681,954 |

9,713,458 |

4.15% |

3.35% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

24,714,298 |

90,814,421 |

4.33% |

31.36% |

|

|

|

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

AMP |

BBB+ |

1,000,000 |

1,000,000 |

5.40% |

0.35% |

15/11/2023 |

15/11/2024 |

12 |

|

Australian Unity |

BBB+ |

1,000,000 |

0 |

0.00% |

0.00% |

8/06/2023 |

11/06/2024 |

12 |

|

ING Bank |

A |

2,000,000 |

0 |

0.00% |

0.00% |

26/06/2023 |

26/06/2024 |

12 |

|

ING Bank |

A |

2,000,000 |

0 |

0.00% |

0.00% |

30/06/2023 |

28/06/2024 |

12 |

|

Heritage and People's Choice |

BBB+ |

1,000,000 |

1,000,000 |

5.80% |

0.35% |

10/07/2023 |

10/07/2024 |

12 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

5.27% |

0.69% |

31/08/2023 |

30/08/2024 |

12 |

|

Australian Unity |

BBB+ |

1,000,000 |

1,000,000 |

5.49% |

0.35% |

27/11/2023 |

27/11/2024 |

12 |

|

Suncorp |

A+ |

2,000,000 |

2,000,000 |

5.46% |

0.69% |

30/11/2023 |

29/11/2024 |

12 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

5.46% |

0.35% |

30/11/2023 |

29/11/2024 |

12 |

|

BankVic |

BBB+ |

1,000,000 |

1,000,000 |

5.45% |

0.35% |

4/12/2023 |

4/12/2024 |

12 |

|

AMP |

BBB+ |

2,000,000 |

2,000,000 |

5.35% |

0.69% |

14/12/2023 |

16/12/2024 |

12 |

|

Australian Unity |

BBB+ |

1,000,000 |

1,000,000 |

5.19% |

0.35% |

30/01/2024 |

30/01/2025 |

12 |

|

Suncorp |

A+ |

1,000,000 |

1,000,000 |

5.12% |

0.35% |

7/03/2024 |

7/03/2025 |

12 |

|

ING Bank |

A |

0 |

1,000,000 |

5.31% |

0.35% |

3/06/2024 |

3/06/2025 |

12 |

|

BankVic |

BBB+ |

0 |

2,000,000 |

5.34% |

0.69% |

26/06/2024 |

26/06/2025 |

12 |

|

Bank of Sydney |

NR |

0 |

2,000,000 |

5.47% |

0.69% |

28/06/2024 |

30/06/2025 |

12 |

|

Total Short Term Deposits |

|

18,000,000 |

18,000,000 |

5.39% |

6.22% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

BOQ |

A- |

1,000,000 |

0 |

0.00% |

0.00% |

1/06/2022 |

3/06/2024 |

24 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.32% |

0.69% |

28/06/2021 |

29/06/2026 |

60 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.80% |

0.69% |

15/11/2021 |

17/11/2025 |

48 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

2.03% |

0.69% |

6/11/2019 |

6/11/2024 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.83% |

0.69% |

28/11/2019 |

28/11/2024 |

60 |

|

BOQ |

A- |

1,000,000 |

1,000,000 |

2.00% |

0.35% |

28/02/2020 |

28/02/2025 |

60 |

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

2.20% |

0.35% |

1/04/2020 |

1/04/2025 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.85% |

0.35% |

29/05/2020 |

29/05/2025 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.86% |

0.35% |

1/06/2020 |

2/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.75% |

0.69% |

25/06/2020 |

25/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.75% |

0.69% |

25/06/2020 |

25/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

0 |

0.00% |

0.00% |

29/06/2020 |

28/06/2024 |

48 |

|

ICBC |

A |

3,000,000 |

3,000,000 |

5.07% |

1.04% |

30/06/2022 |

30/06/2027 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.42% |

0.69% |

7/07/2020 |

8/07/2024 |

48 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.50% |

0.69% |

17/08/2020 |

18/08/2025 |

60 |

|

BoQ |

A- |

1,000,000 |

1,000,000 |

1.25% |

0.35% |

7/09/2020 |

8/09/2025 |

60 |

|

BoQ |

A- |

2,000,000 |

2,000,000 |

1.25% |

0.69% |

14/09/2020 |

15/09/2025 |

60 |

|

NAB |

AA- |

1,000,000 |

1,000,000 |

5.23% |

0.35% |

14/09/2023 |

16/09/2024 |

12 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.20% |

0.35% |

7/12/2020 |

8/12/2025 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

0.95% |

0.69% |

29/01/2021 |

29/01/2026 |

60 |

|

NAB |

AA- |

1,000,000 |

1,000,000 |

1.08% |

0.35% |

22/02/2021 |

20/02/2026 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

1.25% |

0.69% |

3/03/2021 |

2/03/2026 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

1.40% |

0.69% |

21/06/2021 |

19/06/2026 |

60 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.32% |

0.69% |

25/06/2021 |

25/06/2026 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.32% |

0.35% |

25/08/2021 |

25/08/2026 |

60 |

|

AMP |

BBB+ |

2,000,000 |

2,000,000 |

1.00% |

0.69% |

18/10/2021 |

17/10/2024 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.56% |

0.69% |

30/11/2021 |

29/11/2024 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

2.00% |

0.69% |

8/02/2022 |

10/02/2025 |

36 |

|

P&N Bank |

BBB+ |

2,000,000 |

2,000,000 |

2.40% |

0.69% |

9/03/2022 |

10/03/2025 |

36 |

|

P&N Bank |

BBB+ |

2,000,000 |

2,000,000 |

4.90% |

0.69% |

11/03/2024 |

11/03/2026 |

24 |

|

MyState |

BBB |

2,000,000 |

2,000,000 |

2.20% |

0.69% |

2/03/2022 |

3/03/2025 |

36 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

3.99% |

0.69% |

4/05/2022 |

5/05/2025 |

36 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

5.11% |

0.35% |

23/05/2024 |

25/05/2026 |

24 |

|

ICBC |

A |

2,000,000 |

0 |

0.00% |

0.00% |

6/06/2022 |

6/06/2024 |

24 |

|

Australian Unity |

BBB+ |

2,000,000 |

0 |

0.00% |

0.00% |

8/06/2022 |

11/06/2024 |

24 |

|

MyState |

BBB |

2,000,000 |

0 |

0.00% |

0.00% |

29/06/2022 |

28/06/2024 |

24 |

|

BoQ |

A- |

1,000,000 |

1,000,000 |

4.50% |

0.35% |

7/07/2022 |

7/07/2025 |

36 |

|

CBA |

AA- |

1,000,000 |

1,000,000 |

4.25% |

0.35% |

12/08/2022 |

12/08/2025 |

36 |

|

P&N Bank |

BBB+ |

3,000,000 |

3,000,000 |

4.55% |

1.04% |

29/08/2022 |

29/08/2025 |

36 |

|

Australian Military Bank |

BBB+ |

2,000,000 |

2,000,000 |

4.55% |

0.69% |

2/09/2022 |

2/09/2025 |

36 |

|

P&N Bank |

BBB+ |

1,000,000 |

1,000,000 |

4.40% |

0.35% |

9/09/2022 |

9/09/2025 |

36 |

|

BoQ |

A- |

1,000,000 |

1,000,000 |

4.70% |

0.35% |

4/10/2022 |

4/10/2024 |

24 |

|

AMP |

BBB+ |

2,000,000 |

2,000,000 |

4.95% |

0.69% |

21/10/2022 |

21/10/2024 |

24 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

5.20% |

0.69% |

21/10/2022 |

21/10/2025 |

36 |

|

AMP |

BBB+ |

1,000,000 |

1,000,000 |

4.75% |

0.35% |

15/11/2022 |

14/11/2024 |

24 |

|

AMP |

BBB+ |

1,000,000 |

1,000,000 |

4.80% |

0.35% |

21/11/2022 |

20/11/2025 |

36 |

|

P&N Bank |

BBB+ |

2,000,000 |

2,000,000 |

4.75% |

0.69% |

16/12/2022 |

16/12/2024 |

24 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

5.04% |

0.69% |

15/02/2023 |

17/02/2025 |

24 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

4.94% |

0.69% |

14/03/2023 |

14/03/2025 |

24 |

|

P&N Bank |

BBB+ |

2,000,000 |

2,000,000 |

5.00% |

0.69% |

14/03/2023 |

15/03/2027 |

48 |

|

Hume Bank |

BBB+ |

2,000,000 |

2,000,000 |

4.75% |

0.69% |

31/03/2023 |

31/03/2025 |

24 |

|

Auswide |

BBB |

2,000,000 |

2,000,000 |

4.95% |

0.69% |

13/04/2023 |

13/04/2026 |

36 |

|

P&N Bank |

BBB+ |

2,000,000 |

2,000,000 |

5.20% |

0.69% |

20/04/2023 |

20/04/2027 |

48 |

|

P&N Bank |

BBB+ |

1,000,000 |

1,000,000 |

5.20% |

0.35% |

26/05/2023 |

26/05/2026 |

36 |

|

ING Bank |

A |

0 |

2,000,000 |

5.38% |

0.69% |

28/06/2024 |

28/06/2029 |

60 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

5.37% |

0.69% |

21/08/2023 |

21/08/2025 |

24 |

|

P&N Bank |

BBB+ |

1,000,000 |

1,000,000 |

5.45% |

0.35% |

30/11/2023 |

28/11/2025 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

5.20% |

0.69% |

14/12/2023 |

15/12/2025 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

5.14% |

0.69% |

3/01/2024 |

5/01/2026 |

24 |

|

P&N Bank |

BBB+ |

2,000,000 |

2,000,000 |

5.10% |

0.69% |

4/01/2024 |

4/01/2027 |

36 |

|

Suncorp |

A+ |

1,000,000 |

1,000,000 |

5.08% |

0.35% |

8/01/2024 |

8/01/2026 |

24 |

|

Australian Unity |

BBB+ |

1,000,000 |

1,000,000 |

4.93% |

0.35% |

7/03/2024 |

9/03/2026 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

5.10% |

0.69% |

23/04/2024 |

24/04/2028 |

48 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

5.10% |

0.69% |

6/05/2024 |

6/05/2026 |

24 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

5.12% |

0.35% |

24/05/2024 |

24/05/2027 |

36 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

5.26% |

0.35% |

31/05/2024 |

31/05/2028 |

48 |

|

ING Bank |

A |

0 |

2,000,000 |

5.26% |

0.69% |

6/06/2024 |

6/06/2028 |

48 |

|

Australian Military Bank |

BBB+ |

0 |

1,000,000 |

5.20% |

0.35% |

11/06/2024 |

11/06/2026 |

24 |

|

Australian Military Bank |

BBB+ |

0 |

2,000,000 |

5.20% |

0.69% |

11/06/2024 |

11/06/2026 |

24 |

|

Total Medium Term Deposits |

|

109,000,000 |

107,000,000 |

3.58% |

36.95% |

|

|

|

|

Floating Rate Notes - Senior Debt |

|

|

|

|

|

|

|

|

|

Suncorp |

A+ |

1,256,102 |

1,260,926 |

BBSW + 78 |

0.44% |

30/07/2019 |

30/07/2024 |

60 |

|

HSBC |

AA- |

2,525,933 |

2,503,419 |

BBSW + 83 |

0.86% |

27/09/2019 |

27/09/2024 |

60 |

|

ANZ |

AA- |

1,513,110 |

0 |

0.00% |

0.00% |

16/01/2020 |

16/01/2025 |

60 |

|

NAB |

AA- |

2,016,155 |

2,023,701 |

BBSW + 77 |

0.70% |

21/01/2020 |

21/01/2025 |

60 |

|

Newcastle Permanent |

BBB+ |

1,105,221 |

1,109,887 |

BBSW + 112 |

0.38% |

4/02/2020 |

4/02/2025 |

60 |

|

Macquarie Bank |

A+ |

2,010,313 |

2,018,028 |

BBSW + 84 |

0.70% |

12/02/2020 |

12/02/2025 |

60 |

|

BOQ Covered |

AAA |

553,956 |

556,187 |

BBSW + 107 |

0.19% |

14/05/2020 |

14/05/2025 |

60 |

|

UBS |

A+ |

1,510,891 |

1,516,972 |

BBSW + 87 |

0.52% |

30/07/2020 |

30/07/2025 |

60 |

|

CBA |

AA- |

2,014,855 |

2,023,636 |

BBSW + 70 |

0.70% |

14/01/2022 |

14/01/2027 |

60 |

|

Rabobank |

A+ |

2,008,594 |

2,016,397 |

BBSW + 73 |

0.70% |

27/01/2022 |

27/01/2027 |

60 |

|

Newcastle Permanent |

BBB+ |

996,317 |

1,001,124 |

BBSW + 100 |

0.35% |

10/02/2022 |

10/02/2027 |

60 |

|

NAB |

AA- |

2,404,720 |

2,414,343 |

BBSW + 72 |

0.83% |

25/02/2022 |

25/02/2027 |

60 |

|

Bendigo-Adelaide |

A- |

1,672,409 |

1,657,210 |

BBSW + 98 |

0.57% |

17/03/2022 |

17/03/2025 |

36 |

|

ANZ |

AA- |

2,020,526 |

2,029,105 |

BBSW + 97 |

0.70% |

12/05/2022 |

12/05/2027 |

60 |

|

NAB |

AA- |

1,708,766 |

1,714,990 |

BBSW + 90 |

0.59% |

30/05/2022 |

30/05/2025 |

36 |

|

Suncorp |

A+ |

905,715 |

909,302 |

BBSW + 93 |

0.31% |

22/08/2022 |

22/08/2025 |

36 |

|

ANZ |

AA- |

2,545,808 |

2,557,747 |

BBSW + 120 |

0.88% |

4/11/2022 |

4/11/2027 |

60 |

|

NAB |

AA- |

2,537,841 |

2,548,236 |

BBSW + 120 |

0.88% |

25/11/2022 |

25/11/2027 |

60 |

|

Suncorp |

A+ |

1,127,896 |

1,117,201 |

BBSW + 125 |

0.39% |

14/12/2022 |

14/12/2027 |

60 |

|

CBA |

AA- |

2,040,258 |

2,049,420 |

BBSW + 115 |

0.71% |

13/01/2023 |

13/01/2028 |

60 |

|

Bank Australia |

BBB+ |

1,911,539 |

1,921,581 |

BBSW + 155 |

0.66% |

22/02/2023 |

22/02/2027 |

48 |

|

Bendigo-Adelaide Covered |

AAA |

1,019,270 |

1,010,032 |

BBSW + 115 |

0.35% |

16/06/2023 |

16/06/2028 |

60 |

|

CBA |

AA- |

2,520,638 |

2,530,535 |

BBSW + 95 |

0.87% |

17/08/2023 |

17/08/2028 |

60 |

|

ANZ |

AA- |

2,135,708 |

2,116,748 |

BBSW + 93 |

0.73% |

11/09/2023 |

11/09/2028 |

60 |

|

Bank Australia |

BBB+ |

1,663,621 |

1,671,045 |

BBSW + 150 |

0.58% |

30/10/2023 |

30/10/2026 |

36 |

|

ANZ |

AA- |

2,522,649 |

2,534,241 |

BBSW + 96 |

0.88% |

5/02/2024 |

5/02/2029 |

60 |

|

ANZ |

AA- |

1,012,723 |

1,004,261 |

BBSW + 98 |

0.35% |

19/03/2024 |

19/03/2029 |

60 |

|

ING Bank |

A |

506,398 |

501,822 |

BBSW + 95 |

0.17% |

22/03/2024 |

22/03/2027 |

36 |

|

BoQ |

A- |

1,665,581 |

1,672,676 |

BBSW + 128 |

0.58% |

30/04/2024 |

30/04/2029 |

60 |

|

Bendigo-Adelaide |

A- |

803,095 |

806,594 |

BBSW + 100 |

0.28% |

14/05/2024 |

14/05/2027 |

36 |

|

ANZ |

AA- |

0 |

1,502,541 |

BBSW + 86 |

0.52% |

18/06/2024 |

18/06/2029 |

60 |

|

Teachers Mutual |

BBB+ |

0 |

901,315 |

BBSW + 130 |

0.31% |

21/06/2024 |

21/06/2027 |

36 |

|

Total Floating Rate Notes - Senior Debt |

|

50,236,607 |

51,201,220 |

|

17.68% |

|

|

|

|

Fixed Rate Bonds |

|

|

|

|

|

|

|

|

|

ING Covered |

AAA |

692,171 |

694,111 |

1.10% |

0.24% |

19/08/2021 |

19/08/2026 |

60 |

|

Northern Territory Treasury |

AA- |

3,000,000 |

3,000,000 |

1.00% |

1.04% |

24/08/2021 |

16/12/2024 |

40 |

|

Northern Territory Treasury |

AA- |

3,000,000 |

3,000,000 |

1.50% |

1.04% |

24/08/2021 |

15/12/2026 |

64 |

|

BoQ |

A- |

1,764,229 |

1,768,954 |

2.10% |

0.61% |

27/10/2021 |

27/10/2026 |

60 |

|

BoQ |

A- |

1,994,217 |

2,004,277 |

5.30% |

0.69% |

30/04/2024 |

30/04/2029 |

60 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.50% |

0.69% |