Agenda

and

Business Paper

To be held on

Monday 23

June 2025

at 6:00 PM

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

Agenda

and

Business Paper

To be held on

Monday 23

June 2025

at 6:00 PM

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

NOTICE OF MEETING

The proceedings of all Council meetings in open session, including all debate and addresses by the public, are recorded (audio visual) and livestreamed on Council’s website including for the purpose of facilitating community access to meetings and accuracy of the Minutes.

In addition to webcasting council meetings, audio recordings of confidential sessions of Ordinary Meetings of Council are also recorded, but do not form part of the webcast.

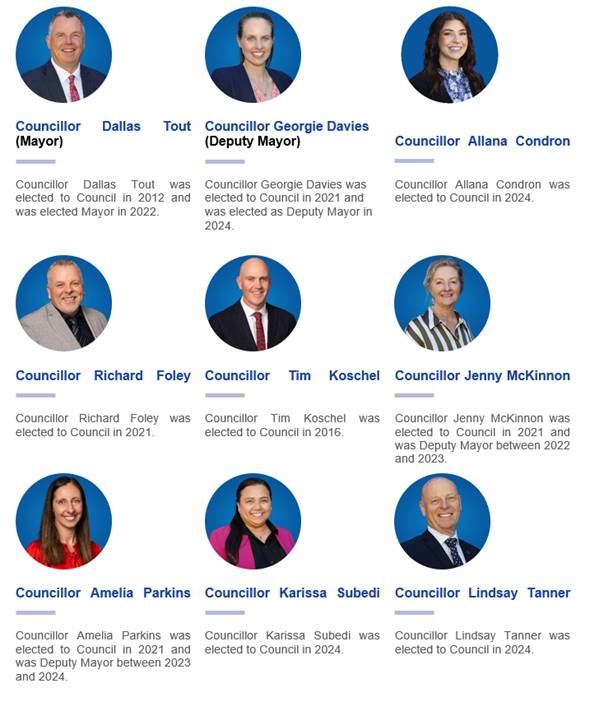

WAGGA WAGGA CITY COUNCILLORS

STATEMENT OF ETHICAL OBLIGATIONS

Councillors are reminded of their Oath or Affirmation of Office made under Section 233A of the Local Government Act 1993 and their obligation under Council’s Code of Conduct to disclose and appropriately manage Conflicts of Interest.

QUORUM

The quorum for a meeting of the Council, is a majority of the Councillors of the Council, who hold office for the time being, who are eligible to vote at the meeting.

Reports submitted to the Ordinary Meeting of Council to be held on Monday 23 June 2025.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 23 June 2025

CLAUSE PRECIS PAGE

ACKNOWLEDGEMENT OF COUNTRY 3

REFLECTION 3

APOLOGIES 3

Confirmation of Minutes

CM-1 ORDINARY COUNCIL MEETING - 10 JUNE 2025 3

DECLARATIONS OF INTEREST 3

Councillor Report

CR-1 COUNCILLOR REPORT - 2025 FLOODPLAIN MANAGEMENT CONFERENCE - MELBOURNE 4

Reports from Staff

RP-1 PROPOSED PLANNING PROPOSAL TO FACILITATE AN AMENDMENT TO WAGGA WAGGA LOCAL ENVIRONMENTAL PLAN 2010 CLAUSE 5.4 (9) SECONDARY DWELLINGS ON LAND OTHER THAN LAND IN A RURAL ZONE AND CLAUSE 5.5 CONTROLS RELATING TO SECONDARY DWELLINGS ON LAND IN A RURAL ZONE 7

RP-2 INTEGRATED PLANNING AND REPORTING (IP&R) - ADOPTION OF DOCUMENTS 17

RP-3 Draft Wagga Wagga Local Housing Strategy 53

RP-4 PROPOSED ASSIGNMENT OF SUBLEASE - LIGHT AIRCRAFT PRECINT HANGAR 7, WAGGA WAGGA AIRPORT 60

RP-5 INITIAL CLASSIFICATION OF LAND - LOT 2 IN DEPOSITED PLAN 1143881, BEING 232 ASHFORDS ROAD, GREGADOO 62

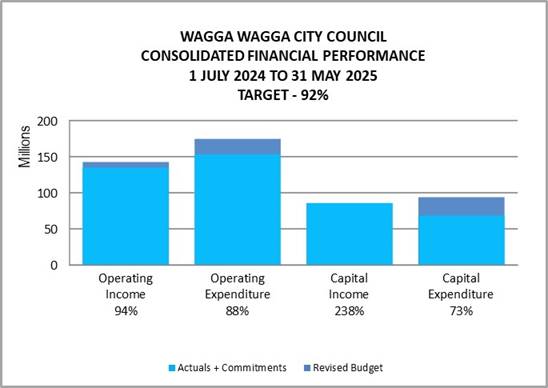

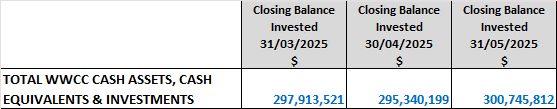

RP-6 FINANCIAL PERFORMANCE REPORT AS AT 31 MAY 2025 65

RP-7 Proposed New Fees and Charges for 2025/26 96

RP-8 OUTSTANDING DEBTS DEEMED UNRECOVERABLE - PROPOSED WRITE OFF LIST 100

RP-9 APPLICATIONS FOR SUBSIDY FOR WASTE DISPOSAL FOR CHARITY ORGANISATIONS 103

RP-10 QUESTIONS WITH NOTICE 106

Committee Minutes

M-1 LOCAL TRAFFIC COMMIITTEE MEETING - CONFIRMATION OF MINUTES - 8 MAY 2025 110

M-2 CONFIRMATION OF MINUTES - FLOODPLAIN RISK MANAGEMENT ADVISORY COMMITTEE - 17 APRIL 2025 115

Confidential Reports

CONF-1 UPDATE

REPORT - LMC CANTEEN & AIRPORT CAFE 128

Wagga Wagga City Council acknowledges the traditional custodians of the land, the Wiradjuri people, and pays respect to Elders past, present and future and extends our respect to all First Nations Peoples in Wagga Wagga.

We recognise and respect their cultural heritage, beliefs and continuing connection with the land and rivers. We also recognise the resilience, strength and pride of the Wiradjuri and First Nations communities

REFLECTION

Councillors, let us in silence reflect upon our responsibilities to the community which we represent, and to all future generations and faithfully, and impartially, carry out the functions, powers, authorities and discretions vested in us, to the best of our skill and judgement.

CM-1 ORDINARY COUNCIL MEETING - 10 JUNE 2025

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 10 June 2025 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - Ordinary Council - 10 June 2025 |

129 |

|

Report submitted to the Ordinary Meeting of Council on Monday 23 June 2025 |

CR-1 |

Councillor Report

CR-1 COUNCILLOR REPORT - 2025 FLOODPLAIN MANAGEMENT CONFERENCE - MELBOURNE

Author: Councillor Jenny McKinnon

That Council receive and note the report.

Report

This is the third time I have attended the floodplain management Australia Conference and as always this was an excellent event. There were opportunities to learn about flood management from researchers and practitioners and to network with Councillors and staff from other councils.

Speakers included:

Mr. Andrew Mannekin for the national emergency management agency on the topic of flooding and the convergence of hazards. This was a keynote address, focusing on the practices of NEMA and their plans for building resilience into the disaster management system.

Mr. Mannekin addressed issues of:

- levels of funding for disaster management and the grants available to communities for replacing housing in flood prone areas.

- weather alert systems that are used by NEMA, and the level of awareness they have of impending weather events

Rob Swan and Carolyn Tsloulos from HARC presented a session on risk based decision-making for non-stationary flood behaviour in planning decisions. They concluded that risk based assessments need to replace hazard based assessments, but hazard assessments will always inform risk based assessments.

Tegan McKenzie from Latrobe City Council presented a session on implementing flood studies; learnings from amendment C131 to the Latrobe planning scheme. This was an honest appraisal of a process that did not go according to plan. Lessons from this process included that there must be excellent communication with the community about flood risk, as with all the stakeholders in the process.

Liz Frazer from VicSES presented a session on engaging for community action and behaviour change. She concluded that conversations with trained practitioners cannot be replaced by simply handing out pamphlets about flood risk. The conversations need to be had.

Sue Sheldrick from VicSES presented a session titled ‘Ground roots: really connecting with vulnerable communities in flood prone areas’. The title ‘ground roots’ comes from the idea that relationships with community need to go much deeper than just a grass roots approach. This applies particularly in dealing with members of vulnerable communities such as those with English as a second language and First Nations communities.

Paul Hackney of City of Parramatta Council presented a paper entitled ‘So you have adopted a new flood study? Great! But what now?’. He emphasised that flood studies are very expensive and need to be used as much as possible to get good value. They can be made more worthwhile by informing all the appropriate authorities of the results of the study and compiling all relevant statistics, including items such as numbers of Aged Care facilities and any information on any other vulnerable communities.

Jessica Hillier and Nikki Granik of Melbourne Water presented a session on Managing Flood and Climate in Melbourne: the need for integrated urban planning. They asked how can the current planning system address the challenge of climate change and the other risk factors affecting flood management issues included the foundation of better climate-informed flood information, enhanced spatial understanding of impacts, hazard based approaches to applying current flood controls, collaboration across stakeholders to manage planning activities beyond flood controls, and innovative and risk based decision-making.

Mahnaz Sedigh of City of Gold Coast presented a session entitled ‘Riverine Flash Flooding: Overland flow modelling, where should we draw the line?’. This paper examined the trade-offs between model complexity, computational feasibility, and prediction timelines, with insights into where and how to draw the line for real time modelling to ensure effective flood forecasting and response.

One outstanding moment at the conference was the presentation by primary school students from St Joseph’s School in Eugowra. As a result of their experience in the catastrophic flood in their town in 2022, a group of six year 5 and 6 students invented a flood warning system, for which they won an award at the STEM MAD competition in 2024.

A copy of the program and abstracts can be provided to any Councillor or staff member.

I highly recommend this conference as a learning experience for Councillors.

Financial Implications

N/A

Policy and Legislation

Code of Conduct

Code of Meeting Practice

Councillor Expenses and Facilities Policy POL 025

Councillor induction and Professional Development Policy POL 113

Link to Strategic Plan

Regional Leadership

Ethical Leadership

Provide strategic direction and leadership for our region to deliver key community priorities.

Risk Management Issues for Council

N/A

Internal / External Consultation

Council endorsed and nominated Councillor J McKinnon to attend at its Ordinary Council Meeting 10 March 2025, Resolution number: 25/062.

|

Report submitted to the Ordinary Meeting of Council on Monday 23 June 2025 |

RP-1 |

Reports from Staff

RP-1 PROPOSED PLANNING PROPOSAL TO FACILITATE AN AMENDMENT TO WAGGA WAGGA LOCAL ENVIRONMENTAL PLAN 2010 CLAUSE 5.4 (9) SECONDARY DWELLINGS ON LAND OTHER THAN LAND IN A RURAL ZONE AND CLAUSE 5.5 CONTROLS RELATING TO SECONDARY DWELLINGS ON LAND IN A RURAL ZONE

Author: Fiona Hamilton

General Manager: Peter Thompson

|

Summary: |

This report recommends the preparation of a Planning Proposal, as detailed in this report, which will expand the options currently available to landowners in permissible zones for the development of secondary dwellings and may stimulate the development of a more affordable and diversified housing supply, whilst encouraging efficient growth patterns through infill development where the majority of infrastructure services are already in place. The Planning Proposal will seek to facilitate an amendment to Clause 5.4(9)(b) and Clause 5.5(a)(ii) of the Wagga Wagga Local Environmental Plan 2010 to increase the maximum floor space area of secondary dwellings from 33% of the size of the principal dwelling to 65% of the size of the principal dwelling on both rural and non-rural land where secondary dwellings are a permissible land use. |

That Council:

a endorses the preparation of a Planning Proposal, as detailed in this report; and

i forwards it to the Minister for Planning seeking an Amendment to the Wagga Wagga Local Environmental Plan 2010 and requests that a Gateway Determination be issued, including the delegation of Plan making powers, so as to enable the public exhibition of the Planning Proposal pursuant to the EP&A Act 1979; and

ii upon receipt of a Gateway Determination under Section 3.34 of the EP&A Act 1979, Council places the Planning Proposal and any supporting material on public exhibition pursuant to any requirements of the Gateway Determination and Schedule 1, clause 4 of the EP&A Act 1979; and

iii should no objections be received, furnishes a copy of this report and other relevant information to the NSW Department of Planning, Industry and Environment and/or NSW Parliamentary Counsels Office, in accordance with the EP&A Act 1979, and requests the Minister for Planning (or a delegate on their behalf) undertake the appropriate actions to secure the making of the amendment to the WLEP 2010.

Report

This report proposes preparation of a Proposed Planning Proposal that will request an amendment to the Wagga Wagga Local Environmental Plan 2010 (WWLEP2010).

The overall intent of the secondary dwelling provisions is to add to the range of residential housing opportunities reflective of the future demographic profile of the city and allow for a relative/s or an unrelated person(s) to live in their own home adjacent to and within the curtilage of a main dwelling on a block of land.

Under the current provisions of the WWLEP2010 secondary dwellings are a permissible land use in the following land use zones:

|

• R1 General Residential • R3 Medium Density Residential • R5 large Lot Residential • MU1 Mixed Use • C4 Environmental Living |

Land other than land in a rural zone |

|

• RU1 Primary Production • RU2 Rural Landscape • RU4 Primary Production Small Lots • RU5 Villages |

Rural zones |

Definitions:

Secondary dwelling means a self-contained dwelling that:

(a) is established in conjunction with another dwelling (the principal dwelling), and

(b) is on the same lot of land as the principal dwelling, and

(c) is located within, or is attached to, or is separate from, the principal dwelling.

Note - clauses 5.4 and 5.5 of WWLEP2010 provide controls relating to the total floor area of secondary dwellings.

Principal dwelling means the largest dwelling house on a lot, measured by gross floor area.

Rural worker’s dwelling means a building or place that is additional to a dwelling house on the same lot and that is used predominantly as a place of residence by persons employed, whether on a long-term or short-term basis, for the purpose of agriculture or a rural industry on that land.

A lot on which a secondary dwelling is constructed cannot be subdivided so as to separate the secondary dwelling from the principal dwelling.

The development of a secondary dwelling can only result in there being one principal dwelling and one secondary dwelling on the site, meaning approval of a secondary dwelling cannot result in there being on the land any dwelling other than the principal dwelling and the secondary dwelling. This means that there can only be one other dwelling on the land with the secondary dwelling. A secondary dwelling may not be on land where a dual occupancy, residential flat building, or rural workers dwelling exists.

Current controls:

The clauses within the WWLEP 2010 which provide controls for secondary dwellings are described below.

The controls currently adopted in the WWLEP2010 for secondary dwellings in residential zones are as follows:

WWLEP2010 Clause 5.4(9) Secondary dwellings on land other than land in a rural zone

If development for the purposes of a secondary dwelling is permitted under this Plan on land other than land in a rural zone, the total floor area of the dwelling, excluding any area used for parking, must not exceed whichever of the following is the greater:

(a) 60 square metres,

(b) 33% of the total floor area of the principal dwelling.

Clause 5.4(9) is a compulsory clause of the LEP. However, whilst Part (a) is stipulated by the Standard Instrument and cannot be amended, part (b) is an optional percentage that can be individually selected by councils.

The controls currently adopted in the WWLEP2010 for secondary dwellings in rural zones are as follows:

WWLEP2010 Clause 5.5 Controls relating to secondary dwellings on land in a rural zone

If development for the purposes of a secondary dwelling is permitted under this Plan on land in a rural zone

(a) the total floor area of the dwelling, excluding any area used for parking, must not exceed whichever of the following is the greater:

(i) 60 square metres,

(ii) 33% of the total floor area of the principal dwelling, and

(b) [Not adopted]

Clause 5.5 is an optional clause of the WWLEP2010, Council opted to adopt part of the clause only. Section (b) relates to the distance between the principal dwelling and the secondary dwelling and was not adopted by Council.

As Clause 5.5(b) is not currently adopted, the location of dwellings, including secondary dwellings, in rural zones is currently controlled under the provisions of the WWDCP2010, section 8.3 Rural Dwellings as included below:

C9 Rural workers dwellings and secondary dwellings should:

• be situated on the same legal title as the principal farm dwelling

• share the same road access, power and communication infrastructure as the principal farm dwelling (as should secondary dwellings)

• be located within reasonable proximity to other farm buildings (e.g. within 300 m), and,

• be appropriately separated from farm boundaries and potentially conflicting land uses (e.g. intensive livestock operations, livestock yards, dairies and the like)

Background Analysis:

In Wagga Wagga 107 secondary dwellings were approved over the 14 years from 2010-2024 (approximately 8 per annum), this is compared to 220 dual occupancies over the same period.

Interviews conducted with urban planners at five regional local governments in NSW highlighted that Bathurst, Dubbo and Orange are approving a significantly higher number of secondary dwellings each year.

|

|

Albury |

Armidale* |

Bathurst |

Dubbo |

Tamworth |

Orange |

Wagga Wagga |

|

Typical number of secondary dwellings per annum |

10 |

10 |

25 |

30 |

Not available |

34 |

8 |

|

Max Floor Area sqm

|

60sqm |

60sqm |

60sqm |

60sqm |

60sqm |

60sqm |

60sqm |

|

Max Floor Area % of principal |

25% |

30% |

20% |

65% |

25% |

50% |

33% |

|

Rural Max Floor Area |

100sqm |

NA |

60sqm |

60sqm |

130sqm |

60sqm |

60sqm |

|

Rural Max Floor Area % of principal |

30% |

NA |

20% |

65% |

25% |

50% |

33% |

|

Rural Max Separation Distance from principal |

NA |

NA |

50m |

100m |

100m |

60m |

NA |

*Secondary dwellings not permissible in rural zones in Armidale.

Further analysis of existing approved secondary dwellings and their principal dwellings revealed the following:

|

Zone |

R1/R3 |

R5/RU1 |

|

Lot Sizes |

550-800 sqm |

2000-14000 sqm |

|

Principal dwelling size |

120-250 sqm |

100-450 sqm |

|

Secondary dwelling size |

<60 sqm |

60-140 sqm |

The analysis also determined that in Wagga Wagga we are typically seeing two styles of secondary dwelling, being single storey and 2-storey construction, with the secondary dwelling above a garage. Approximately 65% of secondary dwelling approvals have been 1-bedroom and 35% 2-bedroom.

Justification:

The Planning Proposal will seek to facilitate an amendment to Clause 5.4(9)(b) and Clause 5.5(a)(ii) of the Wagga Wagga Local Environmental Plan 2010 to increase the maximum floor space area of secondary dwellings from 33% of the size of the principal dwelling to 65% of the size of the principal dwelling on both rural and non-rural land where secondary dwellings are a permissible land use.

With principle dwelling sizes averaging between 100 – 450 sq m, the 33% restriction in 5.4(9)(b) and 5.5(a(ii) allows secondary dwellings of a maximum of 60 sq m for all principal dwellings below 181.81 sq m.

The blue cells in the table below highlight instances where secondary dwelling size can increase beyond 60m2 under the current controls compared to the proposed 65% floor area ratio control.

Under the current floor area controls landowners with smaller, more modest, established homes (up to 181.81m2) are limited to a maximum secondary dwelling size of 60m2.

|

Principal Dwelling Floor Area |

Current Control for Secondary Dwelling (33%) |

Amended Control for Secondary Dwelling (65%) |

|

90m2 |

60m2 |

60m2 |

|

95m2 |

60m2 |

61.75m2 |

|

100m2 |

60m2 |

65m2 |

|

120m2 |

60m2 |

78m2 |

|

150m2 |

60m2 |

97.5m2 |

|

180m2 |

60m2 |

117m2 |

|

200m2 |

66m2 |

130m2 |

|

300m2 |

99m2 |

195m2 |

|

450m2 |

148.5m2 |

292.5m2 |

By way of comparison the Low-Rise Housing Diversity Design Guide provides the minimum sizes for dual occupancies and terrace houses and requires the following minimum internal area sizes, all being above 60m2 with the exception of a studio:

|

Apartment Type |

Minimum internal area |

|

Studio |

Not defined |

|

1 bedroom |

65sqm |

|

2 bedroom |

90sqm |

|

3 bedroom |

115sqm |

For larger principal dwellings this would allow greater flexibility in design for the secondary dwelling.

Should Council adopt the proposed 65% floor area ratio, there is flexibility for landowners to develop secondary dwellings that will cater to a broader range of uses of living beyond that of a studio style accommodation.

Example secondary dwelling floor plans are depicted below:

|

|

|

|

|

|

In addition to the floor area ratio controls, the size of the secondary dwelling is also regulated through site cover controls.

Site cover controls within the WWDCP2010 restrict the proportion of land which

may be built upon.

· Site cover is the proportion of a site that is occupied by buildings, garages and other structures.

· Site cover does not include basements, area under eaves, unenclosed decks, balconies, swimming pools, tennis courts or the like.

The floor area ratio ensues an appropriate relationship between the principal and the secondary dwelling is maintained and the lot size and site cover controls ensure that excessively large dwellings are prevented, and amenity is also maintained.

Development Control Plan - Rural Zones:

In rural zones, secondary dwellings may be built to accommodate a second generation of the same farming family, farm retirees or for farm workers and they may also play a role in housing other rural or regional workers not working on the farm such as agribusiness professionals and also provide an option for affordable rental for lower-moderate income earners in these communities.

Staff will bring a report to a future meeting of Council recommending changes to the Development Control Plan 2010, namely amending Section 8.3, Control 9 to remove suggested distances of secondary dwellings to principal dwellings in permissible rural zones.

The removal of the recommended distance of the principal dwelling to other farm buildings will provide landowners with greater flexibility to locate secondary dwellings in areas on their land to suit operational or family needs.

Given the development of a secondary dwelling can only result in there being one principal dwelling and one secondary dwelling on the site and the secondary dwelling cannot be subdivided this will mitigate the risk of further land fragmentation in rural zones.

Current control:

C9 Rural workers dwellings and secondary dwellings should:

• be situated on the same legal title as the principal farm dwelling

• share the same road access, power and communication infrastructure as the principal farm dwelling (as should secondary dwellings)

• be located within reasonable proximity to other farm buildings (e.g. within 300 m), and,

• be appropriately separated from farm boundaries and potentially conflicting land uses (e.g. intensive livestock operations, livestock yards, dairies and the like)

Suggested Future Amendment:

C9 Rural workers dwellings and secondary dwellings should:

• be situated on the same legal title as the principal farm dwelling

• share the same road access, power and communication infrastructure as the principal farm dwelling (as should secondary dwellings), and;

• be appropriately separated from farm boundaries and potentially conflicting land uses (e.g. intensive livestock operations, livestock yards, dairies and the like).

Additionally, the WWLEP2010 contains objectives for each zone, which must be addressed in consideration of any proposed development.

Conclusion:

A Planning Proposal facilitating the proposed amendments to the Wagga Wagga Local Environmental Plan 2010 will expand the options currently available to landowners in permissible zones for the development of secondary dwellings which may stimulate the development of a more affordable and diversified housing supply, whilst encouraging efficient growth patterns through infill development where the majority of infrastructure services are already in place.

In rural zones where secondary dwellings are a permissible land use, the Planning Proposal may provide for larger secondary dwellings that may be more suitable to accommodate a second generation of the same farming family or provide further opportunities for rental income.

It is therefore recommended that Council endorses the preparation of a Planning Proposal which:

· Amends Clause 5.4(9)(b) to increase the maximum floor area of a secondary dwelling on land other than land in a rural zone from 33% of the floor area of the principal dwelling to 65% of the size of the principal dwelling.

· Amends Clause 5.5(a)(ii) to increase the maximum floor area of a secondary dwelling on land other than land in a rural zone from 33% of the floor area of the principal dwelling to 65% of the size of the principal dwelling.

Financial Implications

As this is a Council led planning proposal, the preparation of this planning proposal will be funded from within existing operational budgets.

Policy and Legislation

Environmental Planning and Assessment Act 1979

Wagga Wagga Local Strategic Planning Statement – Wagga Wagga 2040

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

Growing Economy

Objective: Wagga Wagga is an attractive location for people to live, work and invest

Attract and support local businesses, industry, and employment opportunities

Risk Management Issues for Council

Stimulating the development of a more affordable and diversified housing supply, whilst encouraging efficient growth patterns through infill development while maintaining liveability, sense of community and local identity.

Internal / External Consultation

Relevant internal and external consultation will be completed as part of the preparation of the proposed planning proposal and it’s assessment.

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Have your Say |

Email newsletter |

Social media |

Website |

|

|

Consult |

|

x |

|

x |

|

|

|

|

|

|

|

x |

|

|||

|

|

|

Report submitted to the Ordinary Meeting of Council on Monday 23 June 2025 |

RP-2 |

RP-2 INTEGRATED PLANNING AND REPORTING (IP&R) - ADOPTION OF DOCUMENTS

Author: Scott Gray

|

Summary: |

This report addresses Council’s obligations in ensuring legislative compliance and meeting the requirements of the Office of Local Government in adopting and implementing the Integrated Planning and Reporting Framework. |

|

That Council: a adopt the Delivery Program 2025/2029 and Operational Plan 2025/26 b adopt the Fees and Charges for the financial year 2025/26 c adopt the Long Term Financial Plan 2025/26 d adopt the Asset Management Strategy and Asset Management Plans e adopt the Workforce Resourcing Strategy f sets the interest on overdue rates and charges for 2025/26, in accordance with Section 566(3) of the Local Government Act 1993 at 10.5% per annum calculated on a daily simple interest basis. g makes and levy the following Rates and Annual Charges for 2025/26: i Residential – City and Suburbs rate of 0.666133 cents in the dollar in terms of Sections 516 and 529 of the Local Government Act 1993, calculated on the land value in respect of all rateable lands situated in the centres of population defined as the City of Wagga Wagga and the Village of Forest Hill, excluding Business - City and Suburbs land, rated in accordance with the provisions of Section 518 of the Local Government Act 1993, Residential (Other) land as defined, and also Farmland, rated in accordance with the provisions of Section 515 of the Local Government Act, within such centres of population A minimum rate of $841.00 for each parcel of land as prescribed under Section 548 of the Local Government Act 1993 shall apply to this rate ii Residential – Other rate of 0.371356 cents in the dollar calculated on the land value in respect of all rateable land within the Council’s area, which, in the Council’s opinion, is land which: (a) is not less than two (2) hectares and not more than 40 hectares in area (b) is either: (i) not zoned or otherwise designated for use under an environmental planning instrument (ii) zoned or otherwise designated for use under such an environmental planning instrument for non-urban purposes (c) does not have a significant and substantial commercial purpose or character Excludes Business - City and Suburbs land, rated in accordance with the provisions of Section 518 of the Local Government Act 1993, and also Farmland, rated in accordance with the provisions of Section 515 of the Local Government Act, within such centres of population A minimum rate of $376.00 for each parcel of land as prescribed under Section 548 of the Local Government Act 1993 shall apply to this rate. iii Residential – Villages rate of 0.382762 cents in the dollar in terms of Sections 516 and 529 of the Local Government Act 1993, calculated on the land value of all rateable land situated in the centres of population defined as the villages of San Isidore, Gumly Gumly, Tarcutta, Humula, Uranquinty, Mangoplah, Oura, Currawarna, Ladysmith, Galore, Collingullie, Belfrayden and North Wagga excluding Business - Villages and Rural land, rated in accordance with the provisions of Section 518 of the Local Government Act 1993, Residential (Other) land as defined, and also Farmland, rated in accordance with the provisions of Section 515 of the Local Government Act, within such centres of population A minimum rate of $313.00 for each parcel of land as prescribed under section 548 of the Local Government Act 1993 shall apply to this rate. iv Business - City and Suburbs rate of 1.366905 cents in the dollar calculated on the land value of all rateable non-residential land, which cannot be classified as residential, or farmland land in the centres of population defined as the City of Wagga Wagga and the Village of Forest Hill, in terms of Sections 518 and 529 of the Local Government Act 1993 A minimum rate of $804.00 for each parcel of land as prescribed under Section 548 of the Local Government Act 1993 shall apply to this rate. v Business - Villages and Rural rate of 0.334717 cents in the dollar calculated on the land value of all rateable land in the Council’s area, in terms of Sections 518 and 529 of the Local Government Act 1993, excluding lands defined as Business - City and Suburbs, Residential, and Farmland A minimum rate of $132.00 for each parcel of land as prescribed under Section 548 of the Local Government Act 1993 shall apply to this rate. vi Farmland rate of 0.127279 cents in the dollar, calculated on the land value of all rateable land, which, in Council’s opinion, qualifies as farmland as defined in Section 515 of the Local Government Act 1993 A minimum rate of $362.00 for each parcel of land as prescribed under Section 548 of the Local Government Act 1993 shall apply to this rate. vii Sewerage Services Annual Charge of $664.00 per dwelling unit. Multiple residence properties are charged at $664.00 per residence, for all residences, and non-strata title residential premises on a single allotment (flats/units) situated within the Council’s centres of population, capable of being connected to the sewerage service scheme except when excluded by specific council policy, such charge being made in terms of Section 501 of the Local Government Act 1993 viii Non Residential Sewer Charges Access charge based on each and every meter connection per non-residential allotment for all non-residential premises and non-residential allotments situated within the Council’s centres of population, capable of being connected to the sewerage service scheme except when excluded by specific council policy, such charge being made in terms of Section 501 of the Local Government Act 1993. Access charge based on Meter size for 2025/26 is as follows:

Non Residential includes: (a) Non-residential strata (b) Small community property (c) land owned by the Crown, not being land held under a lease for private purposes (d) land that belongs to a religious body and is occupied and used in connection with: (i) a church or other building used or occupied for public worship (ii) a building used or occupied for the purpose of religious teaching or training (e) land that belongs to and is occupied and used in connection with a school (being a government school or non-government school within the meaning of the Education Reform Act 1990 or a school in respect of which a certificate of exemption under section 78 of that Act is in force), including: (i) a playground that belongs to and is used in connection with the school; and (ii) land that belongs to a public benevolent institution or public charity and is used or occupied by the institution or charity for the purposes of the institution or charity (f) land that belongs to a public hospital (g) land that is vested in the Minister for Health, the Health Administration Corporation or the New South Wales Health Foundation (h) land that is vested in a university, or a university college, and is used or occupied by the university or college solely for its purposes Usage charge Per kl usage charge of $2.72 per kl will apply to all Non Residential Sewer customers except excluded by specific Council Policy, such charge being made in accordance with Section 501 of the Local Government Act 1993. ix Pressure Sewer Scheme – Annual pump maintenance charge (rural residential and villages). An additional sewerage service charge of $205.00 per pump for all premises connected to the sewerage system via a pressure service for the maintenance and replacement of the pump unit as necessary x Domestic Waste Management Service Charge of $447.00 per service on a per occupancy basis per annum for a service rendered in the centres of population and within the scavenging areas defined as the City of Wagga Wagga and the villages of North Wagga Wagga, Gumly Gumly, Forest Hill, Kapooka, Tarcutta, Mangoplah, Oura, Ladysmith, Brucedale, Uranquinty, Bomen and Cartwrights Hill, charged in accordance with the provisions of Section 496 of the Local Government Act 1993 xi Domestic Waste Management Service Charge Rural Residential of $447.00 per service to be applied to all properties utilising a waste collection service managed by Council, but outside Council’s defined waste collection service areas charged in accordance with the provisions of Section 496 of the Local Government Act 1993 xii Domestic Waste Management Annual Charge of $72.00 per service to be applied to all properties utilising an upgraded general waste bin in accordance with the provisions of Section 496 of the Local Government Act 1993 xiii Domestic Waste Management Annual Charge of $79.00 per service to be applied to all properties utilising an upgraded recycling bin in accordance with the provisions of Section 496 of the Local Government Act 1993 xiv Domestic Waste Management Service Charge of $47.00 for each parcel of rateable undeveloped land not receiving a service within the scavenging areas of the City of Wagga Wagga and the villages of North Wagga Wagga, Gumly Gumly, Forest Hill, Kapooka, Tarcutta, Mangoplah, Oura, Ladysmith, Brucedale, Uranquinty, Bomen and Cartwrights Hill, such charge being levied in accordance with the provisions of Sections 496 of the Local Government Act 1993 xv Domestic Waste Management Service Charge of $149.00 for each additional domestic bin, being an additional domestic bin provided over and above the three bins already provided by the service, rendered in the centres of population, and within the scavenging areas defined as the City of Wagga Wagga and the villages of North Wagga Wagga, Gumly Gumly, Forest Hill, Kapooka, Tarcutta, Mangoplah, Oura, Ladysmith, Brucedale, Uranquinty, Bomen and Cartwrights Hill, charged in accordance with the provisions of Section 496 of the Local Government Act 1993. On application, depending on individual circumstances, this fee may be waived. xvi Domestic Waste Scheduled Off Week Pickup Service Charge of $593.00 per general waste bin for each domestic service within the scavenging areas defined as the City of Wagga Wagga and the villages of North Wagga Wagga, Gumly Gumly, Forest Hill, Kapooka, Tarcutta, Mangoplah, Oura, Ladysmith, Brucedale, Uranquinty, Bomen and Cartwrights Hill, charged in addition to the Domestic Waste Management Service Charge in accordance with the provisions of Section 496 of the Local Government Act 1993. xvii Commercial Waste Management Service Charge of $447.00 per service per annum, for a two-bin commercial waste service rendered in the centre of population and within the scavenging areas defined as the City of Wagga Wagga and the villages of North Wagga Wagga, Gumly Gumly, Forest Hill, Kapooka, Tarcutta, Mangoplah, Oura, Ladysmith, Brucedale, Uranquinty, Bomen and Cartwrights Hill, charged in accordance with the provisions of Section 501 of the Local Government Act 1993 xviii Commercial Waste Management Service Charge of $224.00 per service per annum, for a one-bin commercial waste service rendered in the centre of population and within the scavenging areas defined as the City of Wagga Wagga and the villages of North Wagga Wagga, Gumly Gumly, Forest Hill, Kapooka, Tarcutta, Mangoplah, Oura, Ladysmith, Brucedale, Uranquinty, Bomen and Cartwrights Hill, charged in accordance with the provisions of Section 501 of the Local Government Act 1993 xix Commercial Waste Management Service Charge of $149.00 for each additional commercial bin, being an additional bin provided over and above the bin/s already provided by the service, rendered in the centres of population and within the scavenging areas defined as the City of Wagga Wagga and the villages of North Wagga Wagga, Gumly Gumly, Forest Hill, Kapooka, Tarcutta, Mangoplah, Oura, Ladysmith, Brucedale, Uranquinty, Bomen and Cartwrights Hill, charged in accordance with the provisions of Section 501 of the Local Government Act 1993 xx Commercial Waste Management Annual Charge of $81.00 per service to be applied to all commercial properties utilising an upgraded recycling bin in accordance with the provisions of Section 501 of the Local Government Act 1993 xxi Urban Area: Scheduled Off Week Commercial Pickup Service Charge of $587.00 per bin for each commercial service with 1-2 bins onsite, charged in addition to the Commercial Waste Management Service Charge in accordance with the provisions of Section 501 of the Local Government Act 1993 xxii Urban Area: Scheduled Off Week Commercial Pickup Service Charge of $317.00 per bin for each commercial service with 3-5 bins onsite, charged in addition to the Commercial Waste Management Service Charge in accordance with the provisions of Section 501 of the Local Government Act 1993 xxiii Urban Area: Scheduled Off Week Commercial Pickup Service Charge of $242.00 per bin for each commercial service with over 5 bins onsite, charged in addition to the Commercial Waste Management Service Charge in accordance with the provisions of Section 501 of the Local Government Act 1993 xxiv Rural Areas and Villages: Scheduled Off Week Commercial Pickup Service Charge of $587.00 per bin for each commercial service onsite, charged in addition to the Commercial Waste Management Service Charge in accordance with the provisions of Section 501 of the Local Government Act 1993 xxv Multi Unit Developments (Non-Strata) Domestic Waste Management Service Charge of $447.00 for each unit charged in accordance with the provisions of Section 496 of the Local Government Act 1993. For the purposes of Council’s Fees and Charges the definition of Multi-Unit developments (Non-Strata) involves the development of three or more residential units on a site at a higher density than general housing development. On application and approval by Council, In lieu of the standard charge for each unit, property owners can elect to vary the quantity and size of bins. Each premise must be supplied with a suite of bins to address general waste, recycling and food and garden waste which are applied to your rates on a pro-rata basis, charged in accordance with the provisions of Section 501 of the Local Government Act 1993 as per below: 660L Recycling Bin – Collected fortnightly - $739.00 660L General Waste Bin – Collected fortnightly - $827.00 1100L Recycling Bin – Collected fortnightly - $928.00 1100L General Waste Bin – Collected fortnightly - $1,016.00 240L FOGO Bin – Collected fortnightly - $149.00 240L Recycling Bin – Collected fortnightly - $149.00 240L General Waste Bin – Collected fortnightly - $149.00 360L Recycling Bin – Collected fortnightly - $228.00 xxvi Multi Unit Developments Wheel Out Wheel In (WOWI) Services Charge of $265.00 per occupancy. For the purposes of Council’s Fees and Charges the definition of Multi-Unit developments (Non-Strata) involves the development of three or more residential units, including Strata and Non-Strata properties, on a site at a higher density than general housing development. On application, this service may be available to individual properties. Depending on individual circumstances, this fee may be waived. xxvii Stormwater Management Service Charges Stormwater Management Service charges will be applicable for all urban properties (i.e. residential and business) as referenced below with the following exceptions in accordance with the Division of Local Government (DLG) Stormwater Management Service Charge Guidelines dated July 2006: · Non rateable land · Crown Land · Council Owned Land · Land held under lease for private purposes granted under the Housing Act 2001 or the Aboriginal Housing Act 1998 · Vacant Land · Rural Residential or Rural Business land not located in a village, town or city · Land belonging to a charity and public benevolent institutions (a) Residential Stormwater Management Service Charge of $25.00 per residential property levied in accordance with the provisions of Section 496A of the Local Government Act 1993 (b) Residential Medium/High Density Stormwater Management Service Charge of $12.50 per occupancy: Residential Strata, Community Title, Multiple Occupancy properties (flats and units), and Retirement Village style developments. Subject to a maximum charge of $250.00 per rateable assessment levied in accordance with the provisions of Section 496A of the Local Government Act 1993 (c) Business Stormwater Management Service Charge of $25.00 per business property. Properties are charged on a basis of $25.00 per 350 square metres of land area. Subject to a maximum charge of $250.00 per rateable assessment levied in accordance with the provisions of Section 496A of the Local Government Act 1993 (d) Business Medium/High Density Stormwater Management Service Charge of $5.00 per occupancy - Business Strata and Multiple Occupancy Business properties. Subject to a maximum charge of $250.00 per rateable assessment levied in accordance with the provisions of Section 496A of the Local Government Act 1993 |

Report

The Integrated Planning and Reporting (IP&R) framework includes the following plans that require adoption by 30 June in the year following an ordinary election of council.

|

Plan |

Completed Actions |

New Actions |

|

Community Strategic Plan |

Adopted 28 April 2025 |

No further action required. |

|

Delivery Program 2025-2029 and Operational Plan 2025/26 |

Reported to Council 12 May 2025. Placed on public exhibition 13 May 2025 – 10 June 2025. |

For adoption at 23 June 2025 meeting. |

|

Long Term Financial Plan 2025/26 |

||

|

Fees and Charges 2025/26 |

||

|

Asset Management Strategy |

New |

For adoption at 23 June 2025 meeting. |

|

Asset Management Plans |

New |

|

|

Workforce Resourcing Strategy |

New |

Public Exhibition Feedback

At the 12 May 2025 Council Meeting, Council resolved to place the following documents on public exhibition for 28 days commencing 13 May 2025 and concluding on 10 June 2025:

· draft Delivery Program and Operational Plan 2025/26 – 2028/29 (“DPOP”)

· draft Fees and Charges for the financial year 2025/26

· draft Long Term Financial Plan 2025 – 2026

A detailed listing of feedback and responses during the public exhibition period is contained within the section below on Internal / External Consultation. The public exhibition was promoted through social media, email to village contacts, the Multicultural Council of Wagga Wagga and to Wiradjuri Community Elders, published in Council News and Councils Have Your Say page. External consultation with the community involved 15 community pop-up engagements throughout Wagga Wagga and its surrounding villages.

Delivery Program and Operational Plan 2025/26 – 2028/29

At the 12 May 2025 Council meeting, the following two changes were requested by Councillors to the DPOP.

· Reflect funding constraints relating to plans and strategies.

· Add translation information for Hindi to the section “Need help understanding this document.

Plans and strategies include a mix of funded and unfunded actions. To clarify this, page 79 has been amended to include a statement “Implementation of specific actions within projects, plans and strategies may be subject to funding”. The addition of Hindi translation is being investigated by the Communications and Engagement team.

Amendments completed to the DPOP since placement on public exhibition have included:

· Typographical and formatting.

· Additional details for delivery and output measures.

· Inclusion of a table of contents in section three.

· Updating of leadership team and service areas.

· Addition of a Principal Activity to reflect Council’s priority regarding Inland Rail:

o Advocate to and collaborate with the Federal and State Governments to minimise the impacts of Inland Rail on Wagga Wagga, including grade separation of key crossings, installation of station lifts, and investigation of a bypass route.

· Inclusion of capital projects added to the Long Term Financial Plan following the initial development of the draft DPOP.

The final version of the DPOP is attached under separate cover.

Long Term Financial Plan (LTFP) 2025/26

No changes have been required to be made to the draft LTFP. A copy is attached under separate cover.

Fees and Charges

Below is a summary of changes to fees and charges placed on public exhibition as well as the introduction of a new fee.

Development Application Fees and Charges

During the public exhibition period, the NSW Department of Planning and Environment advised that those fees contained within Schedule 4 of the Environmental Planning and Assessment Regulation 2021 would be updated from 1 July 2025 to reflect the increased movement in the consumer price index (CPI). The fee unit for planning services will be increased from $111.32 to $113.90, and mainly impacts Development Application (DA) fees as well as some planning certificate fees. The below table provides an outline of the changes made as a result of this notification.

|

Item Number (Public Exhibition Item Number) |

Fee Name |

2025/26 Public Exhibition Fee |

2025/26 Final Proposed Fee |

|

0953 (0952) |

D.A. Fee for Advertisements |

$371.00 for 1st advertisement plus $93 for each additional advertisement (where fee exceeds that payable under item 2.1 of Schedule 4) |

$379.00 for 1st advertisement plus $93 for each additional advertisement (where fee exceeds that payable under item 2.1 of Schedule 4) |

|

0954 (0953) |

D.A. Fee (not involving erection of building, carrying out of work or subdivision of land) |

$371.00 |

$379.00 |

|

0955 (0954) |

D.A. Fee (Dwelling with estimated construction cost $100,000 or less) |

$592.00 |

$606.00 |

|

0956 (0955) |

D.A. Fee – Subdivisions not involving opening of public road |

$430.00 plus $53.00 for each additional lot created by the subdivision |

$440.00 plus $53.00 for each additional lot created by the subdivision |

|

0957 (0956) |

D.A. Fee – Subdivisions involving opening of public road |

$865.00 plus $65.00 for each additional lot created by the subdivision |

$885.00 plus $65.00 for each additional lot created by the subdivision |

|

0958 (0957) |

D.A. Fee – Strata Subdivision |

$430.00 plus $65.00 for each additional lot created by the subdivision |

$440.00 plus $65.00 for each additional lot created by the subdivision |

|

0959 (0958) |

D.A. Fee (estimated cost up to $5,000) |

$144.00 |

$147.00 |

|

0960 (0959) |

D.A. Fee (estimated cost $5,001 to $50,000) |

$220.00 plus an additional $3.00 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $5,000 |

$226.00 plus an additional $3.00 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $5,000 |

|

0961 (0960) |

D.A. Fee (estimated cost $50,001 – $250,000) |

$459.00 plus an additional $3.64 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $50,000 |

$469.00 plus an additional $3.64 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $50,000 |

|

0962 (0961) |

D.A. Fee (estimated cost $250,001 – $500,000) |

$1,509.00 plus an additional $2.34 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $250,000 |

$1,544.00 plus an additional $2.34 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $250,000 |

|

0963 (0962) |

D.A. Fee (estimated cost $500,001 – $1,000,000) |

$2,272.00 plus an additional $1.64 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $500,000 |

$2,325.00 plus an additional $1.64 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $500,000 |

|

0964 (0963) |

D.A. Fee (estimated cost $1,000,001 – $10,000,000) |

$3,404.00 plus an additional $1.44 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $1,000,000 |

$3,483.00 plus an additional $1.44 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $1,000,000 |

|

0965 (0964) |

D.A. Fee (estimated cost of more than $10,000,000) |

$20,667.00 plus an additional $1.19 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $10,000,000 |

$21,146.00 plus an additional $1.19 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $10,000,000 |

|

0968 (0967) |

Development requiring Concurrence – Council administrative processing fee |

$176.00 Council administration fee for each concurrence sought (plus $416.00 payable to each concurrence authority) |

$187.00 Council administration fee for each concurrence sought (plus $426.00 payable to each concurrence authority) |

|

0969 (0968) |

Integrated Development – Council administrative processing fee |

$176.00 Council administration fee for each integrated approval sought (plus $416.00 payable to each approval authority) |

$187.00 Council administration fee for each integrated approval sought (plus $426.00 payable to each approval authority) |

|

0970 (0969) |

Designated Development (in addition to D.A. fee) |

$1,198.00 |

$1,226.00 |

|

0971 (0970) |

Giving of Notice of Designated Development |

$2,890.00 |

$1,478.00 |

|

0973 (0972) |

D.A. Modification of consent: S.4.55(1) (minor error, misdescription or miscalculation) |

$92.00 |

$95.00 |

|

0975 (0974) |

D.A. Modification of consent: S.4.55(1A) or S.4.56(1) (minimal environmental impact) |

50% of original DA fee or $839 whichever is the lesser |

50% of original DA fee or $859 whichever is the lesser |

|

0978 (0977) |

D.A. Modification of consent: S.4.55(2) or S.4.56(1) (not of minimal environmental impact) Original DA fee $113.90 or greater and for the erection of a dwelling-house with an estimated cost of construction of $100,000 or less |

$247.00 |

$253.00 |

|

0979 (0978) |

D.A. Modification of consent: S.4.55(2) or S.4.56(1) (not of minimal environmental impact) (estimated cost up to $5,000) |

$71.00 |

$73.00 |

|

0980 (0979) |

D.A. Modification of consent: S.4.55(2) or S.4.56(1) (not of minimal environmental impact) (estimated cost $5,001 – $250,000) |

$110.00 plus an additional $1.50 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $5,000 |

$113.00 plus an additional $1.50 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $5,000 |

|

0981 (0980) |

D.A. Modification of consent: S.4.55(2) or S.4.56(1) (not of minimal environmental impact) (estimated cost $250,001–$500,000) |

$651.00 plus an additional $0.85 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $250,000 |

$666.00 plus an additional $0.85 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $250,000 |

|

0982 (0981) |

D.A. Modification of consent: S.4.55(2) or S.4.56(1) (not of minimal environmental impact) (estimated cost $500,001–$1,000,000) |

$927.00 plus an additional $0.50 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $500,000 |

$949.00 plus an additional $0.50 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $500,000 |

|

0983 (0982) |

D.A. Modification of consent: S.4.55(2) or S.4.56(1) (not of minimal environmental impact) (estimated cost $1,000,001– $10,000,000) |

$1,285.00 plus an additional $0.40 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $1,000,000 |

$1,314.00 plus an additional $0.40 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $1,000,000 |

|

0984 (0983) |

D.A. Modification of consent: S.4.55(2) or S.4.56(1) (not of minimal environmental impact) (estimated cost more than $10,000,000) |

$6,167.00 plus an additional $0.27 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $10,000,000 |

$6,310.00 plus an additional $0.27 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $10,000,000 |

|

0985 (0985) |

D.A. Review of determination: Division 8.2 Review for the erection of a dwelling-house with an estimated cost of construction of $100,000 or less |

$247.00 |

$253.00 |

|

0987 (0987) |

D.A. Review of determination: Division 8.2 Review (estimated cost up to $5,000) |

$71.00 |

$73.00 |

|

0988 (0988) |

D.A. Review of determination: Division 8.2 Review (estimated cost $5,001 – $250,000) |

$111.00 plus an additional $1.50 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $5,000 |

$114.00 plus an additional $1.50 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $5,000 |

|

0989 (0989) |

D.A. Review of determination: Division 8.2 Review (estimated cost $250,001 – $500,000) |

$651.00 plus an additional $0.85 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $250,000 |

$666.00 plus an additional $0.85 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $250,000 |

|

0990 (0990) |

D.A. Review of determination: Division 8.2 Review (estimated cost $500,001 – $1,000,000) |

$927.00 plus an additional $0.50 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $500,000 |

$949.00 plus an additional $0.50 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $500,000 |

|

0991 (0991) |

D.A. Review of determination: Division 8.2 Review (estimated cost $1,000,001– $10,000,000) |

$1,285.00 plus an additional $0.40 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $1,000,000 |

$1,314.00 plus an additional $0.40 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $1,000,000 |

|

0992 (0992) |

D.A. Review of determination: Division 8.2 Review (estimated cost more than $10,000,000) |

$6,167.00 plus an additional $0.27 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $10,000,00 |

$6,310.00 plus an additional $0.27 for each $1,000 (or part of $1,000) by which the estimated cost exceeds $10,000,000 |

|

0993 (0993) |

D.A. Review of Decision – to reject a Development Application (estimated cost of development less than $100,000) |

$71.00 |

$73.00 |

|

0994 (0994) |

D.A. Review of Decision – to reject a Development Application (estimated cost of development $100,000 – $1,000,000) |

$195.00 |

$199.00 |

|

0995 (0995) |

D.A. Review of Decision – to reject a Development Application (estimated cost of development greater than $1,000,000) |

$325.00 |

$333.00 |

|

1053 (1054) |

Section 10.7(2) Certificate Fee |

$69.00 |

$71.00 |

|

1054 (1055) |

Section 10.7(2) & (5) Certificate Fee |

$174.00 |

$178.00 |

|

1058 (1059) |

Certified copy of a document, map or plan (S.10.8(2)) |

$69.00 |

$71.00 |

It was also identified that the two fees below are no longer required to be included within the 2025/26 Fees and Charges:

|

Item Number (Public Exhibition Item Number) |

Fee Name |

2025/26 Public Exhibition Fee |

2025/26 Final Proposed Fee |

|

(0985) |

D.A Modification of Consent under S.4.55(2) or S.4.56(1) requiring notification (by advertising) under these Sections |

$400.00 |

Removed |

|

(0997) |

D.A. Review of determination: Division 8.2 Review requiring notification (by advertising) under these Sections |

$400.00 |

Removed |

Asset Management

Asset Management Strategy and Asset Management Plans

Council must prepare an Asset Management Strategy and Asset Management Plans for existing assets under its Asset Management Framework.

Asset Strategy

The Asset Management Strategy 2025 (the Strategy) outlines Council’s management of the infrastructure assets on behalf of the Community. The Strategy recognises that Council aims to improve the overall condition of the assets, within the limitation of the financial resources available. Through good asset management practices Council can prioritise its resources to obtain the best value for money.

Asset Management Plans

The aim of each Asset Management Plan (AMP) is to present the funding required to meet the levels of service for each asset type in comparison to the current funding levels in the Long Term Financial Plan (LTFP). The Customer levels of service identified within each AMP identify that Council will aim to renew asset currently in and expected to reach conditions 4 and 5 over the duration of the 10-year planning period.

AMPs have been developed for the following asset categories:

· Building assets – administration, recreational facilities, community facilities, halls and emergency services buildings.

· Recreation assets – fencing, irrigation, lighting, playgrounds, park accessories, public art, shade sails, shelters and sporting equipment.

· Sewer assets – sewer mains and manholes, pump stations and treatment plants.

· Stormwater assets – levee banks, stormwater pipes and pits, stormwater pumps, gross pollutant traps (GPT’s) and channels and detention basins.

· Transport assets – bridges, bus shelters, carparks, culverts, kerb and gutter, footpaths and shared paths, sealed roads and unsealed roads.

Workforce Resourcing Strategy

The Workforce Resourcing Strategy 2025-2029 outlines how Council will meet future workforce resourcing and capability needs. It provides an analysis of our current workforce while considering the impact of external factors, workforce trends, and anticipated demands.

This strategy sets out our strategic workforce priorities and actions for the next four years, ensuring we have the right people with the right skills to deliver on the goals outlined in the Community Strategic Plan: ‘Wagga Wagga 2050’, as well as the Delivery Program and Operational Plan.

Our six key workforce priorities include:

1. Transform Council into a Learning Organisation by investing in the development and wellbeing of our people.

2. Implement a continuous improvement approach to workforce planning and development.

3. Facilitate a culture that empowers our people to demonstrate positive leadership.

4. Establish an engaged, diverse and inclusive workforce that is connected to the vision and purpose of Council to deliver services to the community.

5. Develop and implement strategies and plans to strengthen our values-based organisational culture.

6. Ensure the safety, health and wellbeing of our people.

The Workforce Resourcing Strategy 2025-2029 also partners with various Council plans and programs that further drive workforce initiatives.

Financial Implications

The adoption of the IP&R suite of documents including the Long Term Financial Plan and Fees & Charges will inform the 2025/26 and 10 year adopted budget.

The Base Case budget detailed in this Long Term Financial Plan indicates Council will maintain a balanced budget for 2025/26. Arriving at this balanced position for Year 1 was a complex and challenging task.

External factors have placed significant pressure on Council’s long term sustainability. These factors include Council’s regulatory environment, continual lower than anticipated allowable rate peg increases which reduces Council’s ability to align rating revenues with the increased cost of providing services, cost shifting of services or functions by Federal and State government along with growth and urban development increasing the demands on existing infrastructure, facilities and services provided.

These factors result in an income gap with costs increasing at a greater rate than revenue and will continue to have a substantial impact on the delivery of projects and services, requiring Council to be highly innovative and efficient in delivering the Operational Plan and Delivery Plan items.

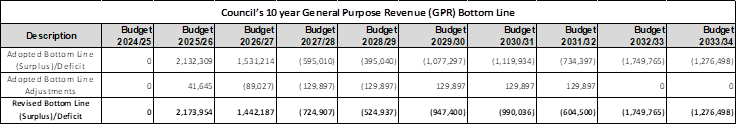

The budget for 2025/26 is balanced with the majority of the years for the LTFP projecting deficits (excluding 2027/28 and 2030/31 which are showing surpluses) for the 10-year rolling plan as shown in the table.

|

2025/26 |

2026/27 |

2027/28 |

2028/29 |

2029/30 |

2030/31 |

2031/32 |

2032/33 |

2033/34 |

2034/35 |

|

|

0 |

614,465 |

(125,802) |

323,574 |

1,570,849 |

(8,490) |

652,439 |

188,451 |

786,886 |

686,373 |

|

Council’s 10-year budgeted bottom lines – (surplus)/deficits

These figures will again be reviewed as part of the 2026/27 Long Term Financial Plan to ensure that a balanced budget for at least the initial financial year is achieved.

2025/26 Budget Snapshot

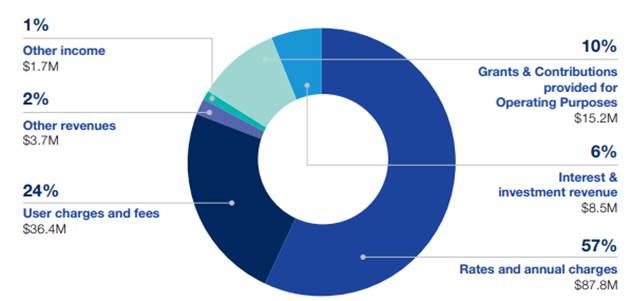

Total Operating Revenue - $153.4M

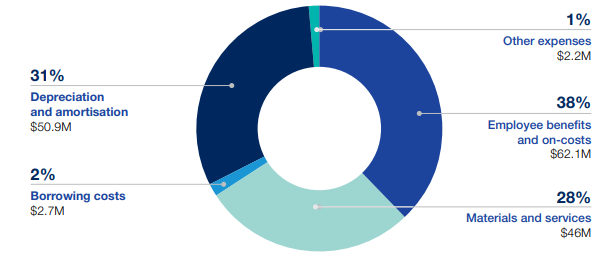

Total Operating Expenditure - $163.9M

2025/26 Capital Works

Capital works projects and programs account for over $113M of the planned activities for the 2025/26 financial year. There are two different categories of capital works:

· $26.1M – Recurrent Capital Program

· $87.1M – New Capital Projects – One-off

· $113.2M – Total 2025/26 Capital works included in Delivery Program

New Capital Projects refer to the new one-off projects Council will undertake during the year. Recurrent Capital Projects refer to the expenditure allocated on an annual basis for capital works programs. Both of these categories are included in the Delivery Program for the 2025/26 financial year.

For the 2025/26 financial year, included in the overall Capital Works project budgets of $113.2M there is a total allocation of $53.9M for roads, which includes one-off projects of ($40.4M) and recurrent programs of ($13.5M).

Policy and Legislation

The documents have been created to meet Council’s Integrated Planning and Reporting requirements under the Local Government Act 1993 and Local Government Regulations 2021.Link to Strategic Plan

Regional Leadership

Ethical Leadership

Provide strategic direction and leadership for our region to deliver key community priorities.

Risk Management Issues for Council

A number of risk management issues were identified and have been actively managed.

A summary of these risks are as follows:

- Lack of engagement from the community

- Inability to meet everyone’s expectations

- Inability to resource and deliver on plans

Internal / External Consultation

The draft documents were placed on public exhibition for a period of 28 days on Council’s Have Your Say page to enable users to review documents and submit feedback. A variety of communication methods were used (e.g. Council Website and Social Media platforms including Council Facebook), to not only promote the public exhibition period but also promote the purpose of the documents. During the consultation period Council directly engaged with 156 people face to face. Four submissions were received through Council’s Have Your Say website. The outputs of the community engagement activities are details in the following tables. Table 1 details the Public Engagement Schedule. Table 2 details feedback received and responses to this feedback. Further actions are required to conclude some matters which remain open.

Table 1: Public Engagement Schedule

|

Date |

Location |

Time |

Numbers |

Summary |

|

7/5 |

Business Roundtable |

16:00-17:00 |

10 |

Presentation recapped CSP feedback, review of CSP and overview of the DPOP. DPOP emailed to members for feedback with meeting minutes |

|

15/5 |

Turvey Park Shopping Centre |

8:30–10:00 |

0 |

Limited foot traffic with many in a hurry before school. Engagement limited to greetings. |

|

15/5 |

Forest Hill School |

15:00-15:30 |

4 |

Scheduling clash with school athletics carnival. Limited parent numbers due to children leaving direct from the carnival. Feedback received regarding community amenities and footpaths to improve safety. |

|

17/5 |

Tarcutta Village Markets |

8:00-13:00 |

15 |

Attended Tarcutta Village markets. It was noted that visitors were lower due to the Batlow Cider fest. Feedback focussed on Paddy Osborne Park, Mates Gully Road and Sydney Street. |

|

20/5 |

Ladysmith Public School |

15:00-15:30 |

Cancelled |

Cancelled due to School Swimming Carnival. Engagement details were emailed to the school for distribution via their newsletter. |

|

22/5 |

Botanic Gardens |

9:30-11:30 |

Cancelled |

Cancelled due to inclement weather. |

|

23/5 |

Kooringal Mall |

16:00-17:30 |

9 |

Consultation stand set up between Dominos and stairs. 8 feedback cards were handed out with four people providing specific feedback. |

|

24/5 |

Bolton Park Football |

8:30-10:00 |

4 |

Consultation stand set up between the canteen and walkway to toilets. High numbers present on the day but limited interest received. Feedback forms were provided and 3 specific enquiries received. |

|

24/5 |

Equex Netball Courts |

10:30-12:00 |

3 |

Consultation stand set up on the verandah at the opposite end to the canteen. Low foot traffic. 2 feedback cards were handed out. |

|

25/5 |

Lake Village Shopping Centre |

8:00-10:00 |

36 |

Consultation stand set up in front on Foodworks. High level of engagement with a genuine interest in Council services and the opportunity to provide feedback. |

|

27/5 |

Estella Shopping Centre |

15:00-17:00 |

9 |

Consultation stand set up out the front of Foodworks. Engagement enquiries were broad including council services, planning, and roads. |

|

28/5 |

Humula |

13:00-15:00 |

3 |

Consultation was coordinated with a visit by the Agile Library. In-depth discussion regarding the village and Council services with three community members. |

|

29/5 |

Riverina Producers Market |

14:30-16:30 |

5 |

Consultation held in conjunction with the Circular Economy Waste Strategy. |

|

30/5 |

South City Shopping Centre |

8:30-10:00 |

10 |

Consultation stand set up at the entrance to South City shopping centre. 2 specific enquiries received. |

|

31/5 |

Riverside: Wagga Beach |

9:00-10:30 |

22 |

Consultation stand set up just off the walking track towards the playground. High level of engagement with a genuine interest in Council services and were complementary of the facilities provides particularly in the riverside area. |

|

3/6 |

Collingullie Hall |

17:30-19:15 |

26 |

Extensive feedback received regarding communication, services and developments. A representative of the progress association provided an update on development of the petrol station. |

|

4/6 |

Bolton Park Stadium - Wheelchair AFL/Basketball |

17:00-17:45 |

0 |

A consultation stand was set up at the entrance to Bolton Park Stadium. The stadium hosted wheelchair sports, gymnastics and skating. Limited foot traffic with engagement limited to greetings. |

Table 2 - Feedback Details

|

Feedback |

Response Details |

|

Business Roundtable - 7 May 2025 |

|

|

Requested a section on managing / advocating / mitigating Inland Rail impact in the OP for 2025/26? |

The DPOP includes as a Council Priority advocacy for a bypass of the city as the best outcome for the community. “An additional principal activity has been added to DPOP for completion by City Engineering: Advocate to and collaborate with the Federal and State Governments to minimise the impacts of Inland Rail on Wagga Wagga, including grade separation of key crossings, installation of station lifts, and investigation of a bypass route.” |

|

Forest Hill School - 15 May 2025 |

|

|

Footpath construction leading to the school to ensure safety of kids walking along highway |

A customer service request has been submitted. |

|

Improved Park at the Forest Hill Oval |

Forest Hill oval playground is scheduled for replacement in 2025/26 in accordance with Council’s Playground Strategy 2024-2044. |

|

Community centre at the forest hill oval |

At the 10 February 2025 Council meeting, Council approved proceeding with the development of a concept plan for the proposed Forest Hill Community Hall and amenities building at the Forest Hill Oval, adjacent to Brunskill Avenue. |

|

Active travel link to Forest Hill from town |

A tender has been awarded for construction of the Mitchell Road to Forest Hill link. Scheduled to be completed by the end of 2025. |

|

Tarcutta Village Markets - 17 May 2025 |

|

|

Paddy Osborne Park - renewal · When is an upgrade scheduled for Paddy Osborne Park.

|

Paddy Osborne Park is scheduled to be replaced in the 2028/29 financial year. The playground was refurbished in 2018. Prior to the refurbishment community consultation was undertaken. Due to the available budget residents opted to refurbish the old playground and install the double flying fox, rather than have a smaller new playground. |

|

Paddy Osborne Park - equipment · Installation of exercise stations at Paddy Osborne Park. · Limited variety of activities within the park for children. |

To be investigated but not currently budgeted for.

There are standard park activities common throughout the LGA – large playground, large double flying fox, bbq area, BMX track, sealed bike/walking paths, picnic shelters. However, opportunities for adding new infrastructure are limited due to the availability of greenspace. |

|

Paddy Osborne Park - safety concerns: · Doesn’t meet soft-fall requirements due to height of slide. · Bridge in playground is slippery. · Installation of a fence to close off the park from the traffic on Sydney Street side road. |

Council staff inspected the playground on Wednesday, 11 June, and conducted softfall testing using impact assessment equipment. The large slide recorded a HIC value of 266 from a height of 1.63 metres. As readings below HIC 1000 are considered compliant, the softfall meets the relevant Australian Standard requirements.

The bridge in playground is slippery, the timber has been treated with a non-slip resin and will be monitored.

Council’s Playground Strategy recommends the installation of fencing at all regional and suburban playgrounds. However, while this is a strategic recommendation, the implementation of fencing is dependent on the availability of funding. At present, no funding has been allocated for this work. |

|

Installation of solar lights in Paddy Osborne Park to enable use during the early morning. |

Solar lighting can be considered; however, it is unlikely to be implemented in the short to medium term. Most parks within the LGA are not equipped with lighting for nighttime use. |

|

Cleaning schedule for public toilets during school holiday weekends. Requested that the schedule be adjusted to respond to increased usage during |

Facilities Management confirmed that additional cleaning was organised with Councils contractor for cleaning toilets on Sydney Street in Tarcutta during the last school holiday period from 17/4/25 to 22/4/25.

Additional cleaning of the toilets will be organised by Facilities Management for all future school holidays. The number of additional cleans and dates to be confirmed prior to each holiday period. |

|

Concern regarding industries that have left Wagga Wagga over the years and comparative growth to Albury. |

An Economic Development Strategy and priority implementation plan is being developed in 2025/26. The goal of this strategy is to improve standards of living and quality of life across Wagga Wagga by enabling strong, innovative and sustainable shared economic growth. |

|

Future of the village: · Lack of available land to purchase. · Concern regarding ability to keep school open. · Opportunity as an affordable housing location. |

Feedback has been noted for development of Village Plans scheduled to be completed in 2026. |

|

Line marking on Sydney Street at the crossing in front of the hall is hard to see and has resulted in cars being on the wrong side of the road. |

Customer service request placed. |

|

Rest area / toilets · Suggestion to provide power for camping at the sports ground and use of an existing building for public toilets. · Improve signage for rest area toilets (damaged by car hitting). |

Feedback has been provided to the Recreation Assets team. |

|

Ability to collect firewood from the roadside. |

s.629 Local Government Act 1993 prohibits the removal of plants, animals, rocks and soil from public places, including roadside reserves which result in a penalty. |

|

Cynthia Street Tarcutta does not have curb and guttering which leads to issues during rain running across the street. |

Customer request submitted to Civil Operations team. |

|

Visitors from Melbourne. Requested more EV charging stations. Currently four, have been previously fully utilised. |

Council has no plans to install any EV chargers at present. Council has an Electric Vehicle Charging Infrastructure on Public Land Policy. This policy allows interested service providers to lease appropriate Council land to develop their infrastructure and deliver their services to the public. |

|

Mates Gully Road condition including holes verge condition and road width. Safety concern with increased heavy vehicle traffic. |

A contribution of $3.684M has been received from Transgrid for the upgrade of Mates Gully Road. This is scheduled to be completed during 2025/26. |

|

Have Your Say Submission - 20 May 2025 |

|

|

Council should do whatever it takes to ensure it reduces the size of its staff, the provision of its services, and its overall impact on the community, which is very significant at present.

Council should ignore IPART's rate pegging recommendation and instead decrease rate contributions, and plan to continue decreasing them into the future.