Ordinary Meeting of

Council

Ordinary Meeting of

Council

To be held on

Monday

27 June 2016

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

Ordinary Meeting of

Council

Ordinary Meeting of

Council

To be held on

Monday

27 June 2016

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 27 June 2016 at 6.00pm.

Mr Alan Eldridge

General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Rod Kendall |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Alan Brown |

|

Councillor Greg Conkey OAM |

Councillor Paul Funnell |

Councillor Gary Hiscock |

Councillor Julian McLaren |

|

Councillor Kerry Pascoe |

Councillor Kevin Poynter |

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

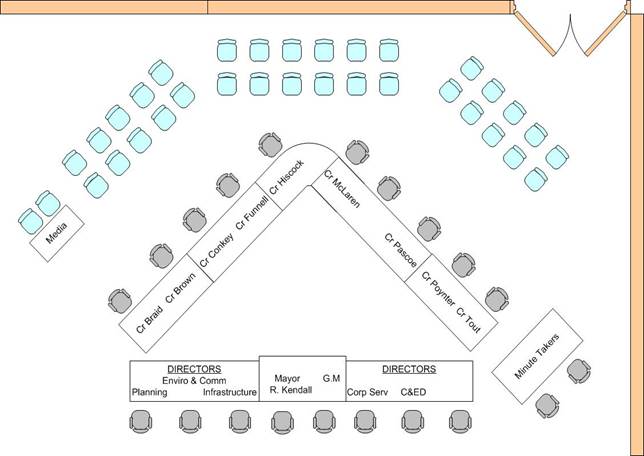

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 27 June 2016.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 27 June 2016

ORDER OF BUSINESS:

CLAUSE PRECIS PAGE

PRAYER 2

ACKNOWLEDGEMENT OF COUNTRY 2

APOLOGIES 2

CONFIRMATIONS OF MINUTES

CM-1 SUPPLEMENTARY COUNCIL MEETING - 14 JUNE 2016 2

DECLARATIONS OF INTEREST 2

Reports from Policy and Strategy Committee

PS-1 POLICY AND STRATEGY COMMITTEE MEETING - 14 June 2016 3

Reports from Staff

RP-1 2016 CARETAKER PERIOD 31

RP-2 INTEGRATED PLANNING AND REPORTING - ADOPTION OF DOCUMENTS 33

RP-3 EMERGENCY SERVICES PRECINCT 45

RP-4 REQUEST FOR LEGAL ASSISTANCE - LOCAL GOVERNMENT NSW 54

RP-5 FINANCIAL PERFORMANCE REPORT MAY 2016 58

RP-6 POL 029 - ASBESTOS POLICY 69

RP-7 SOLID WASTE - WASTE SUBSIDY FOR CHARITABLE ORGANISATIONS 71

RP-8 MULTI PURPOSE STADIUM BOLTON PARK 74

RP-9 PROPOSED CREATION OF AN ESSENTIAL ENERGY EASEMENT OVER LOT 1 DP 535470 AT WAGGA WAGGA 77

Committee Minutes

M-1 AUDIT AND RISK COMMITTEE MINUTES - 12 MAY 2016 80

Confidential Reports

CONF-1 RFT2016-011 SUPPLY OF LEGAL SERVICES 99

CONF-2 DEVELOPMENT SERVICING CHARGES MODIFICATION REQUEST 100

QUESTIONS/BUSINESS WITH NOTICE 101

Confirmation of Minutes

CM-1 SUPPLEMENTARY COUNCIL MEETING - 14 JUNE 2016

|

That the Minutes of the proceedings of the Supplementary Council Meeting held on 14 June 2016 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - 14 June 2016 |

110 |

Report submitted to the Ordinary Meeting of Council on Monday 27 June 2016. PS-1

Reports from Policy and Strategy Committee

PS-1 POLICY AND STRATEGY COMMITTEE MEETING - 14 June 2016

|

That the Minutes of the Policy And Strategy Committee Meeting held on 14 June 2016 be confirmed and recommendations numbered PSCM-1, PSRP-1 to PSRP-19 and PSM-1 contained therein be adopted.

|

|

1⇩. |

Minutes - Policy and Strategy Committee Meeting - 14 June 2016 |

|

RP-1 2016 CARETAKER PERIOD

Author: Priest, Christine

Director: Richardson, Craig

|

That Council: a note Section 393B of the Local Government (General) Regulation 2005 limiting the exercise of functions by Council in the four (4) week period leading up to ordinary elections b delegate the necessary authority to the Mayor, Councillor Kendall and the General Manager, Mr Alan Eldridge to co-jointly deal with any matters for which a decision of the Council would be required, other than those which cannot be delegated under Section 377 of the Local Government Act 1993, from 10 September 2016 until the declaration of the poll |

Report

Caretaker Period

Section 393B of the Local Government (General) Regulation 2005 outlines the Exercise of Council functions during the caretaker period http://www.austlii.edu.au/au/legis/nsw/consol_reg/lgr2005328/s393b.html

It is expected that the OLG will distribute a Circular in relation to the Caretaker period within the next month and as soon as Council receives this it will be made available to Councillors.

The “caretaker period” will commence on Friday, 12 August 2016 until Saturday, 10 September 2016.

Delegation to Mayor and General Manager until the declaration of the poll

In accordance with Section 230 of the Local Government Act 1993 (the Act), Councillor Rod Kendall will continue to be the Mayor of the City of Wagga Wagga until such time as a mayoral election is undertaken by the incoming, new Council. Section 290 of the Act states that this election must take place within three (3) weeks of the ordinary election which, subject to declaration of the election result, will occur at the 26 September 2016 Ordinary Council meeting.

Given the uncertainty of the date of the declaration of poll, it would be prudent for authority to be co-jointly delegated to the Mayor and General Manager, to deal with matters which might arise for which a decision of the Council would normally be required, other than those which cannot be delegated in accordance with Section 377 of the Act. This delegation of authority would be for the period immediately following the dissolution of the current Council (midnight 9 September 2016) and the declaration of the incoming Council.

Budget

N/A

Policy

N/A

Impact on Public Utilities

N/A

Link to Strategic Plan

1. We are an engaged and involved community

1.1 We are a community that is informed and involved in decisions impacting us

QBL Analysis

|

|

Positive |

Negative |

|

Social |

N/A |

N/A |

|

Environmental |

N/A |

N/A |

|

Economic |

N/A |

N/A |

|

Governance |

Ensures the provision of a framework for decision making which is effective, transparent and accountable to the community. |

N/A |

Risk Management and Work Health and Safety Issues for Council

No specific issues identified

Internal / External Consultation

N/A

Report submitted to the Ordinary Meeting of Council on Monday 27 June 2016. RP-2

RP-2 INTEGRATED PLANNING AND REPORTING - ADOPTION OF DOCUMENTS

Author: Priest, Christine

Director: Richardson, Craig

|

That Council, having considered all submissions received relating to the exhibited documents by the closing date of 26 May 2016: a adopt the Combined Draft Delivery Program and Operational Plan for the Financial Year 2016/2017 including the Draft Revenue and Pricing Policy 2016/2017, and the Draft Long Term Financial Plan 2016/2026 with the modifications as outlined in the body of this report b set the interest on overdue rates and charges for 2016/2017, in accordance with Section 566(3) of the Local Government Act 1993, at 8.00 % per annum calculated on a daily simple interest basis (set in accordance with the limit advised by the NSW Office of Local Government) c make and levy the following Rates and Annual Charges for 2016/2017 under the relevant sections of the Local Government Act 1993: i Residential - City and Suburbs rate of 0.8371 cents in the dollar in terms of Sections 516 and 529 of the Local Government Act 1993, calculated on the land value in respect of all rateable lands situated in the centres of population defined by Council Resolution 12/176 as the City of Wagga Wagga and the Village of Forest Hill, excluding Business - City and Suburbs land, rated in accordance with the provisions of Section 518 of the Local Government Act 1993, Residential (Other) land as defined, and also Farmland, rated in accordance with the provisions of Section 515 of the Local Government Act, within such centres of population A minimum rate of $656.00 for each parcel of land as prescribed under Section 548 of the Local Government Act 1993 shall apply to this rate ii Residential - Other rate of 0.65490 cents in the dollar calculated on the land value in respect of all rateable land within the Council’s area, which, in the Council’s opinion, is land which:- (a) is not less than two (2) hectares and not more than 40 hectares in area (b) is either: (i) not zoned or otherwise designated for use under an environmental planning instrument (ii) zoned or otherwise designated for use under such an environmental planning instrument for non urban purposes (c) does not have a significant and substantial commercial purpose or character Excludes Business - City and Suburbs land, rated in accordance with the provisions of Section 518 of the Local Government Act 1993, and also Farmland, rated in accordance with the provisions of Section 515 of the Local Government Act, within such centres of population A minimum rate of $295.00 for each parcel of land as prescribed under Section 548 of the Local Government Act 1993 shall apply to this rate. iii Residential – Villages rate of 0.56570 cents in the dollar in terms of Sections 516 and 529 of the Local Government Act, 1993, calculated on the land value of all rateable lands situated in the centres of population defined by Council Resolution 12/176 as the villages of San Isidore, Gumly Gumly, Tarcutta, Humula, Uranquinty, Mangoplah, Oura, Currawarna, Ladysmith, Galore, Collingullie and North Wagga excluding Business - Villages and Rural land, rated in accordance with the provisions of Section 518 of the Local Government Act 1993, Residential (Other) land as defined, and also Farmland, rated in accordance with the provisions of Section 515 of the Local Government Act, within such centres of population A minimum rate of $248.00 for each parcel of land as prescribed under section 548 of the Local Government Act 1993 shall apply to this rate. iv Business - City and Suburbs rate of 1.44310 cents in the dollar calculated on the land value of all rateable non residential land, which cannot be classified as residential, or farmland land in the centres of population defined by Council Resolution 12/176 as the City of Wagga Wagga and the village of Forest Hill, in terms of Sections 518 and 529 of the Local Government Act 1993 A minimum rate of $629.00 for each parcel of land as prescribed under Section 548 of the Local Government Act 1993 shall apply to this rate. v Business - Villages and Rural rate of 0.71280 cents in the dollar calculated on the land value of all rateable land in the Council’s area, in terms of Sections 518 and 529 of the Local Government Act, 1993, defined by Council Resolution 12/176, excluding lands defined as Business - City and Suburbs, Residential, and Farmland A minimum rate of $106.00 for each parcel of land as prescribed under Section 548 of the Local Government Act 1993 shall apply to this rate. vi Farmland rate of 0.38750 cents in the dollar, calculated on the land value of all rateable land, which, in Council’s opinion, qualifies as farmland as defined in Section 515 of the Local Government Act, 1993 A minimum rate of $285.00 for each parcel of land as prescribed under Section 548 of the Local Government Act 1993 shall apply to this rate. Special Rate - Levee Upgrade vii Residential - City and Suburbs Special Rate - Levee upgrade rate of 0.0337 cents in the dollar in terms of Sections 516 and 529 of the Local Government Act 1993, calculated on the land value in respect of all rateable lands situated in the centres of population defined by Council Resolution 12/176 as the City of Wagga Wagga and the Village of Forest Hill, excluding Business - City and Suburbs land, rated in accordance with the provisions of Section 518 of the Local Government Act 1993, Residential (Other) land as defined, and also Farmland, rated in accordance with the provisions of Section 515 of the Local Government Act, within such centres of population

viii Residential – Other Special Rate - Levee upgrade rate of 0.0264 cents in the dollar calculated on the land value in respect of all rateable land within the Council’s area, which, in the Council’s opinion, is land which:- (a) is not less than two (2) hectares and not more than 40 hectares in area (b) is either: (i) not zoned or otherwise designated for use under an environmental planning instrument (ii) zoned or otherwise designated for use under such an environmental planning instrument for non urban purposes (c) does not have a significant and substantial commercial purpose or character Excludes Business - City and Suburbs land, rated in accordance with the provisions of Section 518 of the Local Government Act 1993, and also Farmland, rated in accordance with the provisions of Section 515 of the Local Government Act, within such centres of population viiii Residential – Villages Special Rate - Levee upgrade rate of 0.0228 cents in the dollar in terms of Sections 516 and 529 of the Local Government Act, 1993, calculated on the land value of all rateable lands situated in the centres of population defined by Council Resolution 12/176 as the villages of San Isidore, Gumly Gumly, Tarcutta, Humula, Uranquinty, Mangoplah, Oura, Currawarna, Ladysmith, Galore, Collingullie and North Wagga excluding Business - Villages and Rural land, rated in accordance with the provisions of Section 518 of the Local Government Act 1993, Residential (Other) land as defined, and also Farmland, rated in accordance with the provisions of Section 515 of the Local Government Act, within such centres of population x Business - City and Suburbs Special Rate - Levee upgrade rate of 0.0581 cents in the dollar calculated on the land value of all rateable non-residential land, which cannot be classified as residential, or farmland land in the centres of population defined by Council Resolution 12/176 as the City of Wagga Wagga and the village of Forest Hill, in terms of Sections 518 and 529 of the Local Government Act 1993 xi Business - Villages and Rural Special Rate - Levee upgrade rate of 0.0287 cents in the dollar calculated on the land value of all rateable land in the Council’s area, in terms of Sections 518 and 529 of the Local Government Act, 1993, defined by Council Resolution 12/176, excluding lands defined as Business - City and Suburbs, Residential, and Farmland

xii Farmland - Special Rate - Levee upgrade rate of 0.00729 cents in the dollar, calculated on the land value of all rateable land, which, in Council’s opinion, qualifies as farmland as defined in Section 515 of the Local Government Act, 1993 xiii Sewerage Services Annual Charge of $474.00 per dwelling unit. Multiple residence properties are charged at $474.00 per residence, for all residences, and non-strata title residential premises on a single allotment (flats/units) situated within the Council’s centres of population, capable of being connected to the sewerage service scheme except when excluded by specific council policy, such charge being made in terms of Section 501 of the Local Government Act 1993 xiiii Non Residential Sewer Charges Access charge based on each and every meter connection per non-residential allotment for all non-residential premises and non-residential allotments situated within the Council’s centres of population, capable of being connected to the sewerage service scheme except when excluded by specific council policy, such charge being made in terms of Section 501 of the Local Government Act 1993. Access charge based on Meter size for 2016/2017 is as follows:

Non Residential includes : (a) Non residential strata (b) Small community property (c) land owned by the Crown, not being land held under a lease for private purposes (d) land that belongs to a religious body and is occupied and used in connection with: (i) a church or other building used or occupied for public worship (ii) a building used or occupied for the purpose of religious teaching or training (e) land that belongs to and is occupied and used in connection with a school (being a government school or non-government school within the meaning of the Education Reform Act 1990 or a school in respect of which a certificate of exemption under section 78 of that Act is in force), including: (i) a playground that belongs to and is used in connection with the school; and (ii) land that belongs to a public benevolent institution or public charity and is used or occupied by the institution or charity for the purposes of the institution or charity (f) land that belongs to a public hospital (g) land that is vested in the Minister for Health, the Health Administration Corporation or the New South Wales Health Foundation (h) land that is vested in a university, or a university college, and is used or occupied by the university or college solely for its purposes Usage charge Per kl usage charge of $2.00 per kl will apply to all Non Residential Sewer customers except excluded by specific Council Policy, such charge being made in accordance with Section 501 of the Local Government Act 1993. xv Pressure Sewer Scheme – Annual pump maintenance charge (rural residential and villages). An additional sewerage service charge of $148.00 per pump for all premises connected to the sewerage system via a pressure service for the maintenance and replacement of the pump unit as necessary xvi Domestic Waste Management Service Charge of $303.00 per service on a per occupancy basis per annum for a once weekly service rendered in the centres of population and within the scavenging areas defined as the City of Wagga Wagga and the villages of Ladysmith, Forest Hill, Tarcutta, Oura, Mangoplah, North Wagga and Gumly Gumly, charged in accordance with the provisions of Section 496 of the Local Government Act 1993 xvii Domestic Waste Management Service Charge Rural Residential of $303.00 per service to be applied to all properties utilising a waste collection service managed by Council, but outside Council’s defined waste collection service areas charged in accordance with the provisions of Section 496 of the Local Government Act 1993 xviii Commercial Waste Management Service Charge of $303.00 per occupancy per annum, for a once weekly service rendered in the centre of population and within the scavenging areas defined as the City of Wagga Wagga, and the villages of Ladysmith, Forest Hill, Tarcutta, Oura, Mangoplah, North Wagga and Gumly Gumly, charged in accordance with the provisions of Section 501 of the Local Government Act 1993 xviiii Domestic Waste Management Service Charge of $31.00 for each parcel of rateable undeveloped land not receiving a service within the scavenging areas of the City of Wagga Wagga, and the villages of Ladysmith, Forest Hill, Tarcutta, Oura, Mangoplah, and Gumly Gumly, such charge being levied in accordance with the provisions of Sections 496 of the Local Government Act 1993 xx Domestic Waste Management Service Charge of $31.00 for each parcel of rateable residential land in the waste collection service areas including Lake Albert and Springvale where Council’s Waste Management collection service is not utilized. This only applies those properties that have been previously charged this rate on their notices prior to June 2012. Such charge being levied in accordance with the provisions of Sections 496 of the Local Government Act 1993 xxi Domestic Waste Management Service Charge of $101.00 for each additional domestic bin, being an additional domestic bin provided over and above the three (3) bins already provided by the service, rendered in the centres of population, and within the scavenging areas defined as the City of Wagga Wagga, and the villages of Ladysmith, Forest Hill, Tarcutta, Oura, Mangoplah, North Wagga and Gumly Gumly, charged in accordance with the provisions of Section 496 of the Local Government Act 1993 xxii Commercial Waste Management Service Charge of $194.00 for each additional commercial bin, being an additional bin provided over and above the bin already provided by the service, rendered in the centres of population and within the scavenging areas defined as the City of Wagga Wagga, and the villages of Forest Hill, Ladysmith, Mangoplah, Tarcutta, Oura, North Wagga and Gumly Gumly, charged in accordance with the provisions of Section 501 of the Local Government Act 1993 xxiii Commercial Waste Management Charge – Small Commercial Strata Properties to be applied to all commercial strata properties with a parcel area of less than 70 square metres not utilising a Council commercial waste service, and capable of using waste service funded by the body corporate - $101.00 xxiiii Multi Unit Developments (Non Strata) Domestic Waste Management Service Charge of $303.00 for each rateable property with an additional bin charge of $101.00 to apply for each additional bin charged in accordance with the provisions of Section 496 of the Local Government Act 1993. For the purposes of the revenue and pricing policy the definition of Multi-Unit developments (Non Strata) involves the development of twenty or more residential units on a site at a higher density than general housing development. xxv Stormwater Management Service Charges Stormwater Management Service charges will be applicable for all urban properties (i.e. residential and business) as referenced below with the following exceptions in accordance with the Division of Local Government (DLG) Stormwater Management Service Charge Guidelines dated July 2006: · Non rateable land · Crown Land · Council Owned Land · Land held under lease for private purposes granted under the Housing Act 2001 or the Aboriginal Housing Act 1998 · Vacant Land · Rural Residential or Rural Business land not located in a village, town or city · Land belonging to a charity and public benevolent institutions (a) Residential Stormwater Management Service Charge of $25.00 per residential property levied in accordance with the provisions of Section 496A of the Local Government Act 1993 (b) Residential Medium/High Density Stormwater Management Service Charge of $12.50 per occupancy: Residential Strata, Community Title, Multiple Occupancy properties (flats and units), and Retirement Village style developments. Subject to a maximum charge of $250.00 per rateable assessment levied in accordance with the provisions of Section 496A of the Local Government Act 1993 (c) Business Stormwater Management Service Charge of $25.00 per business property. Properties are charged on a basis of $25.00 per 350 square metres of land area. Subject to a maximum charge of $250.00 per rateable assessment levied in accordance with the provisions of Section 496A of the Local Government Act 1993 (d) Business Medium/High Density Stormwater Management Service Charge of $5.00 per occupancy - Business Strata and Multiple Occupancy Business properties. Subject to a maximum charge of $250.00 per rateable assessment levied in accordance with the provisions of Section 496A of the Local Government Act 1993 d note that the amount of the Special Rate to fund Council’s one-third share of the cost of the levee upgrade may be reduced on a pro-rata basis in future years if the project can be delivered at a lower cost than the current estimate of $23.3 million |

Executive Summary

This report addresses the following:

- Overview of the Integrated Planning and Reporting framework at Council

- Recommendation to adopt the exhibited documents, which include; Combined Delivery Program and Operational Plan (DP/OP) 2016-17, Long Term Financial Plan 2016-26 and the Pricing and Revenue Policy 2016-17

- Detail of minor corrections to the exhibited Pricing and Revenue Policy 2016/17

After having considered the submissions received during the public exhibition period it is now appropriate for Council to adopt the various plans and approve the levy of the rates and annual charges and various fees for the 2016/17 financial year.

Report

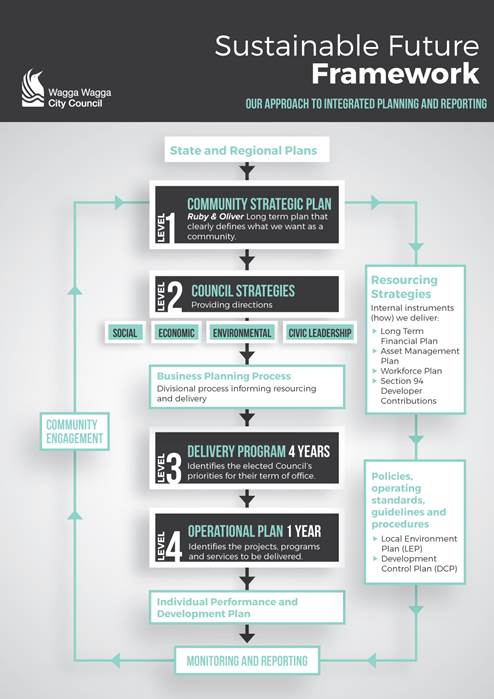

Sustainable Future Framework – our approach to IP&R

Integrated Planning and Reporting (IP&R) is a requirement under NSW State legislation which requires Council’s to prepare a number of plans which provide details on how Council intends to deliver works and services in the short and long term. Council is committed to IP&R and has tailored the legislated approach to create the Sustainable Future Framework (as shown below) which demonstrates Council’s commitment to achieving integration and long term sustainability.

Public Exhibition and Submissions Received

Note that all submissions were tabled in a separate report that was presented to the Policy and Strategy Committee meeting on Monday 14 June 2016 and included the following:

|

Submission |

Number |

|

Family day care parent administration fee |

1 |

|

Proposed reduction in fees and charges for chairs on footpaths and concerns regarding lack of “no smoking” regulation |

2 |

|

Committee 4 Wagga response to Long Term Financial Plan, Delivery Program and Operational Plan |

Committee |

|

Quinty Skate Park Committee submission for funding and petition |

Committee |

|

Request for funding for a Botanic Gardens Museum Master Plan |

Historical Society |

|

Capital Works and Roundabouts (late submission) |

1 |

http://www.wagga.nsw.gov.au/__data/assets/pdf_file/0016/44341/PS_14062016_AGN_AT-Final-reduced.pdf

Revenue and Pricing Policy 2016/17

Immediately after the Revenue and Pricing Policy was placed on public exhibition a correction was identified that related to the fee in the Crematorium and Cemeteries section, specifically the “Crematorium Cremation Fee – 13yr to adult” which was a reduction in the printed fee. An updated version of the document was placed on the “Your Say” website along with a message to communicate this amendment.

|

Crematorium Cremation Fee - 13 yrs to adult |

C |

Each |

$1,262.00 |

$890.91 |

$89.09 |

$980.00 |

In addition to this fee a number of minor administrative errors required correction in the Pricing and Revenue Policy document were identified with the most significant being a change required to the waste charge listed below which should have shown a 10% increase in-line with a previous Council resolution.

|

Gregadoo Waste Disposal - general putrescible waste per tonne |

C |

Tonne |

$112.50 |

$112.50 |

$11.25 |

$123.75 |

|

Gregadoo Waste Disposal - green waste per tonne |

C |

Tonne |

N/A |

$112.50 |

$11.25 |

$123.75 |

These corrections have been made and the final version of the 2016/17 Revenue and Pricing Policy is attached for adoption.

The draft Revenue and Pricing Policy includes a proposed reduction in fees in relation to the Footpaths Policy POL041. The details of the proposed reduction were included in the exhibited documents and the community were invited to provide feedback. This feedback was considered at the Policy and Strategy Committee Meeting on Tuesday 14 June 2016.

Special Rate Variation – Levee Upgrade

The amount of the Special Rate Variation has been calculated at one-third of the estimated cost of the levee upgrades. The estimated cost of the upgrades is $23.3M which is based on a delivery period of five years subject to the timing of funding being provided by the NSW and Commonwealth governments.

In the lead up to the federal election, the coalition government has announced a pledge of $10 million towards the levee bank project if it wins the election. The NSW Government through the local member has also announced a pledge of a further $2 million.

In the event that the coalition government does win the election and the pledges are confirmed through funding agreements, it is Council’s intention to complete the works over a shorter timeframe (3 years instead of 5 years) which will result in a more efficient project delivery and potential for cost savings. If these circumstances come to fruition, Council will adjust downward the amount of the special variation in subsequent years to reflect the recovery of one third of the actual delivery cost.

Budget

· 2016/17 Proposed total operating expenditure budget - $119 million, plus

· Capital renewals $32 million

· New Capital $33 million.

Draft budgets for the first four (4) years (2016/17 to 2019/20), of the 10 year LTFP are balanced. This position has been achieved with significant changes (both removing and delaying) to both operational and capital budgets over the 10 year period. These adjustments have helped Council to overcome unfavourable adjustments to Council’s revenue sources including the three (3) year freeze on indexation of the Federal Government’s Financial Assistance Grant ($9.4M) and an estimated reduction in investment income over the 10 year period due to the downturn in the market.

Policy

N/A

Impact on Public Utilities

N/A

Link to Strategic Plan

1. We are an engaged and involved community

1.1 We are a community that is informed and involved in decisions impacting us

QBL Analysis

|

|

Positive |

Negative |

|

Social |

A number of initiatives have been identified through the CSP and translated into the Combined DP/OP to benefit the community in this area. |

N/A |

|

Environmental |

Council has engaged with the community in defining the priorities for the coming years and a number of these have been addressed through this report and projects listed in the DP/OP. |

N/A |

|

Economic |

Economic considerations have included opportunities to maximise revenue generation opportunities for Council whilst providing fundamental services to the community. |

N/A |

|

Governance |

In developing and publicly exhibiting the Integrated Planning and Reporting suite of documents Council has ensured compliance with the Local Government Act and other requirements as published by the Office of Local Government. |

N/A |

Risk Management and Work Health and Safety Issues for Council

Potential lack of resources to deliver planned activities detailed in the Combined DP/OP and potential for delay/interruption to planned works due to external variables.

Internal / External Consultation

Comprehensive internal and external consultation has taken place in the review and development of these plans.

A thorough communication plan was undertaken to ensure the community was advised of the exhibition period and to encourage submissions, including promotion of the exhibition period through Council News and Social Media.

A ‘Your Say’ website was also set up and there were 366 visitors to the website during the exhibition period, 81.7% of which looked at content on the site.

About 44% of visitors downloaded a document, while a similar percentage of people visited multiple pages.

Link to the Your Say Page http://yoursaywagga.com.au/ipr1

|

1⇩. |

Draft Combined Delivery Program and Operational Plan 2016/17 - Provided under separate cover |

|

|

2⇩. |

Draft Revenue and Pricing Policy 2016/17 - Provided under separate cover |

|

|

3⇩. |

Draft Long Term Financial Plan 2016/26 - Provided under separate cover |

|

Report submitted to the Ordinary Meeting of Council on Monday 27 June 2016. RP-3

RP-3 EMERGENCY SERVICES PRECINCT

Director: Richardson, Craig

|

That Council: a receive and note the Business Case for the City of Wagga Wagga Emergency Services Precinct b provide in-principle support for establishing a co-located site with the various agencies for the coordination and management of emergency events c set aside Lot 2 DP702230 as the preferred site for an Emergency Services Precinct d receive a further report, once the full scope, resourcing requirements and costs, and the funding model for the proposed Emergency Services Precinct are further developed |

Executive Summary

The emergency service organisations identified in this report have stand-alone separate facilities that they consider are coming to the end of its lifespan due to outgrowing these facilities, the age of the facility and the operational maintenance costs associated with duplicated buildings and equipment. The agencies are now seeking that Council agree to concept of developing an Emergency Services Precinct on a suitable greenfield site.

The NSW Rural Fire Service (RFS) has prepared a comprehensive business case which proposes to establish a new combined precinct on Council owned land on the corner of Olympic Highway and Coolamon Road. The Business Case has been prepared with the support and input from Fire and Rescue NSW, NSW SES and the Volunteer Rescue Association.

The proposed new precinct aims to service the future collective needs for all of these agencies and achieve enhanced coordination and cooperation during multi-agency emergency events through co-location.

The proposal requires Council’s support as the land owner and ultimately the owner of all buildings and improvements. The project is also contingent on obtaining funding support from the NSW Government and therefore it would not be appropriate at this time for Council to make any further commitment beyond the recommendations detailed above until there is a clear picture of the overall project costs and the funding model.

If Council supports the recommendation, the plans can be further developed and a funding model developed to enable further consideration by Council at a later time.

Council is expected to play a significant role in the implementation of the project in the capacity as Project Sponsor and a member of the Project Steering Committee. The Business Case envisages the employment of a specific project manager.

Background

Council staff have held a number of discussions and meetings with local and regional staff from the RFS in the two year period leading up to this report. Initially the proposal centred around an expanded local base for the RFS, however the RFS were encouraged to develop a concept around a facility which incorporates the future needs of the various emergency services agencies in the City as a collective with the aim of achieving a more coordinated and integrated approach to emergency management for this City and the surrounding region.

A number of potential sites have been assessed by the four agencies and a summary of the assessment is attached. The site recommended has the full support of all agencies.

Report

The reasons supporting the recommendation are as follows:

1. The current facilities do not meet the current and future operational requirements and have exhausted the capacity of these facilities. A new precinct would provide a state of the art facility where all agencies could be located.

2. Council is expected and required to play a lead role in ensuring that the community is protected and educated as to the prevalent dangers and has the required support from the various Emergency Services Organisations.

3. Whilst cooperation between the various agencies is very good, co-location will further strengthen the coordination and cooperation that currently exists and achieve efficiencies through the sharing of resources and facilities.

4. The concept and site selection is supported by the RFS, Fire & Rescue NSW, NSW SES and the Volunteer Rescue Association. This is evidenced by the Business Plan which was jointly prepared by the agencies.

5. The project requires Councils support to enable progression of the concept and preparation of a funding model.

Budget

The RFS has seed funding of $100K to assist in advancing the project from the concept phase to the development phase including the creation of a detailed master plan for the site and costing of facilities and site development.

A further report detailing the cost estimates and funding model is required before any additional funds are allocated to this project. This will include contributions from the NSW State agencies.

|

Project Name & Component |

Existing Budget |

Expenditure to Date |

Proposed Budget Variation |

Effect on LTFP

|

|

Emergency Services Precinct – Seed Funding |

$100,000 |

$4,155 |

Nil |

No |

A new district budget process is being implemented by NSW RFS effective from 1 July 2016. This is likely to lessen the immediate impact on Council of a major capital project such as the one proposed in this report. A copy of the flyer prepared by the RFS is attached which contains further detail.

Policy

Council has a requirement under the Local Government Act to provide suitable accommodation for the NSW RFS. Council makes annual statutory contributions to all three NSW Emergency Services Organisations.

Impact on Public Utilities

N/A

Link to Strategic Plan

2. We are a safe and healthy community

2.1 We live in a safe community

QBL Analysis

|

|

Positive |

Negative |

|

Social |

A combined emergency services precinct demonstrates a coordinated and cohesive approach to emergency management in the City. |

N/A |

|

Environmental |

The proposed site is suitable for the intended use and has the capacity to meet all environmental requirements. |

N/A |

|

Economic |

N/A |

N/A |

|

Governance |

The Business Case outlines a robust governance model for the project. |

N/A |

Risk Management and Work Health and Safety Issues for Council

The Business Case attached identifies and makes an assessment of 14 key risks and the mitigation actions against each risk.

Internal / External Consultation

There has been extensive consultation with the emergency services agencies and the volunteer network. Internal consultation across all directorates of Council has occurred.

|

1⇩. |

New District Budget Factsheet |

|

|

2⇩. |

Map - 11 Farrer Road, Brucedale |

|

|

3⇩. |

Emergency Services Precinct - Summary of Site Analysis |

|

|

4. |

Business Case Wagga Wagga City Emergency Services Precinct – Provided under separate cover |

|

RP-4 REQUEST FOR LEGAL ASSISTANCE - LOCAL GOVERNMENT NSW

Director: Richardson, Craig

|

That Council make a contribution of $1,071.24 (exclusive of GST) to Local Government NSW for legal costs associated with an appeal to the Supreme Court of NSW for Bathurst Regional Council. |

Report

From time to time, councils in NSW receive requests for assistance from Local Government NSW (LGNSW) to undertake legal appeals which it considers may have broad ranging implications for Local Government.

Council has received such a request related to Bathurst Regional Council and the contribution sought is $1,071.24 exclusive of GST. A copy of the letter of request is attached.

The circumstances of the matter are that Bathurst Regional Council entered into a long term contract with a private company for a negotiated fee. The company later challenged the Council’s legal ability to apply the fee without first having advertised the fee and sought public submissions as required under Part 10 of Chapter 15 of the Local Government Act. Bathurst Regional Council defended the matter before the NSW Court of Appeal but were unsuccessful.

Whilst it is normal practice for Councils to publicly advertise the fees and charges applied to the various services performed, it is not the common practice for Councils to publicly advertise commercial negotiated fees that are incorporated in a contract.

LGNSW note in their letter that they are “…considering the implications of this decision for NSW Councils and are likely to seek feedback from councils in the future to enable the issue to be adequately addressed in the next phase of the review of the Local Government Act 1993.”

Whilst there is no compulsion on Council, it is recommended that Council financially contribute to this matter given the potential broad ranging implications for contractual matters that involve the payment of a fee.

Budget

This cost can be accommodated within the existing budget for the subscription to Local Government NSW

|

Project Name & Component |

Existing Budget |

Expenditure to Date |

Proposed Budget Variation |

Effect on LTFP

|

|

Subscription to LGNSW |

46,000 |

$44,164 |

Nil |

No |

Policy

N/A

Impact on Public Utilities

N/A

Link to Strategic Plan

1. We are an engaged and involved community

1.1 We are a community that is informed and involved in decisions impacting us

QBL Analysis

|

|

Positive |

Negative |

|

Social |

N/A |

N/A |

|

Environmental |

N/A |

N/A |

|

Economic |

N/A |

N/A |

|

Governance |

Council may at some time in the future require assistance from Local Government NSW in dealing with legal matters that have broader implications for the Local Government sector. |

It could be argued that the Wagga Wagga community should not be contributing to legal costs for a matter related to another Council. |

Risk Management and Work Health and Safety Issues for Council

There are no issues identified.

Internal / External Consultation

Internal discussions only.

|

1⇩. |

Local Govt NSW - Legal Costs - Bathurst Regional Council |

|

RP-5 FINANCIAL PERFORMANCE REPORT MAY 2016

Author: Rodney, Carolyn

Director: Richardson, Craig

|

That Council: a approve the variations to the 2015/16 original budget for the month ended 31 May 2016 and note the forecast balanced budget as presented in this report b note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above c note Council’s external investments as at 31 May 2016 |

Executive Summary

· Council forecasts an overall balanced budget for the month ended 31 May 2016

· Three (3) budget variations are presented to Council, which have a nil bottom line effect on Council’s overall budget

· Council experienced a positive monthly investment performance for the month of May and is currently tracking on budget for the full financial year

Report

Actual Capital Income does not yet reflect the budgeted transfers from reserve funds.

These reserve movements will be effected at 30 June 2016.

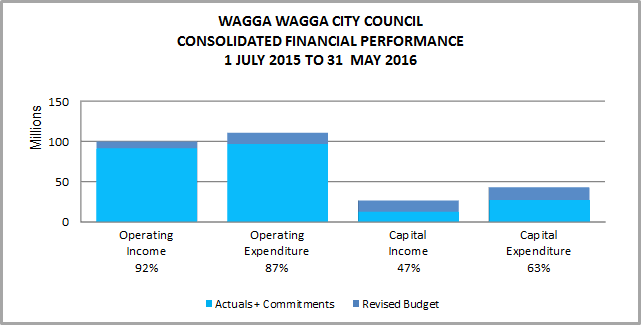

OPERATING INCOME

Total operating income is 92% of approved budget. An adjustment has been made to reflect the levy or rates which occurred at the start of the financial year. Excluding this adjustment, operating income received is 96%.

OPERATING EXPENSES

Total operating expenditure is 87% of approved budget and is overall tracking to budget for the full financial year.

CAPITAL INCOME

Total capital income is 47% of approved budget. Please note that the actual income from capital is influenced by the timing of payment of capital grants and contributions. Transfers from reserves are not processed until the end of financial year.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 63% of approved budget. This figure has been adjusted due to the timing of the Riverina Intermodal Freight and Logistics (RIFL) Hub major project. Including this project in the percentage calculation, actual capital expenditure would be 45% of budget.

Revised budget result - Surplus/(Deficit) |

$’000s |

|

Original funded budget result as adopted by Council Budget variations approved to date Net Revised Budget Result |

$0 $0 $0 |

|

April 2016 net budget variations – Council meeting May 2016 |

$0 |

|

Proposed revised budget result as at 31 May 2016 |

Nil |

The proposed Budget Variations to 31 May 2016 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact Fav/ (Unfav) |

|

|

3 – We have a growing economy |

||||

|

Energise Enterprise Grant Program |

$12K |

Energise Enterprise Grant Income ($12K) |

Nil |

|

|

Council has been successful with an application for the Energise Enterprise Fund Grant facilitated by TAFE NSW. The course assists small businesses to improve their online profile with the aim of increased online sales. The grant will be received in two (2) instalments with $12K to be received in June 2016 and the final $12K to be received upon completion of the report in December 2016. |

|

|||

|

4 – We have a sustainable natural and built environment |

||||

|

Tony Ireland Park Fencing $11K Morgan/Docker St Drain Fencing $20K |

$31K |

Maintain Stormwater Assets ($31K) |

Nil |

|

|

Due to Work Health and Safety risks to the general public, fencing works were required at both Tony Ireland Park and the Morgan/Docker Street drain. The urgent works are proposed to be funded from the Stormwater assets maintenance budget. |

|

|||

|

Norton Street Stormwater Drainage |

$40K |

Maintain Stormwater Assets ($40K) |

Nil |

|

|

It has been identified that the initial project budget for the Norton Street Stormwater Drainage project was costed via conceptual prices without being market tested. The original budget was developed on the construction works only and did not include any project management or design costs. |

||||

|

SURPLUS/(DEFICIT) |

Nil |

|||

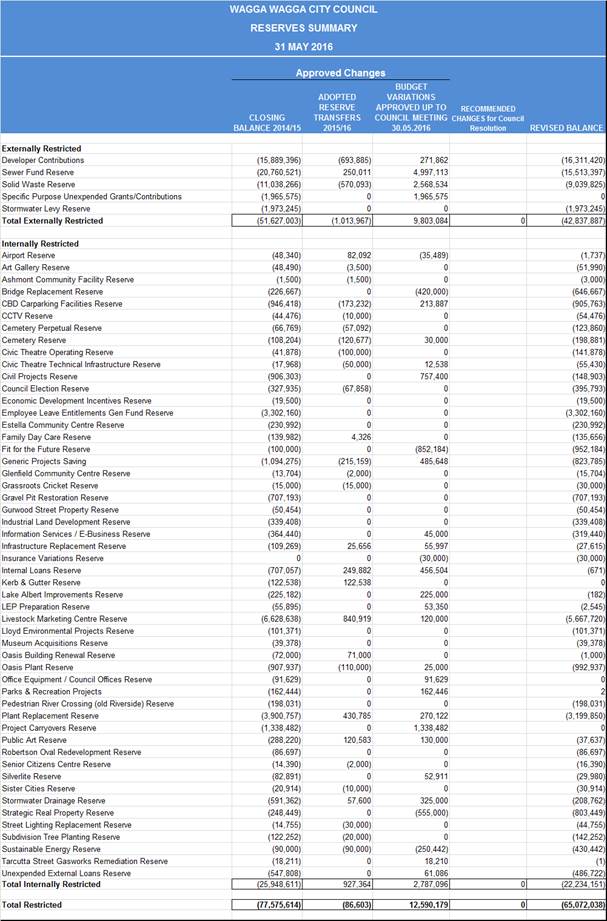

Current Restrictions

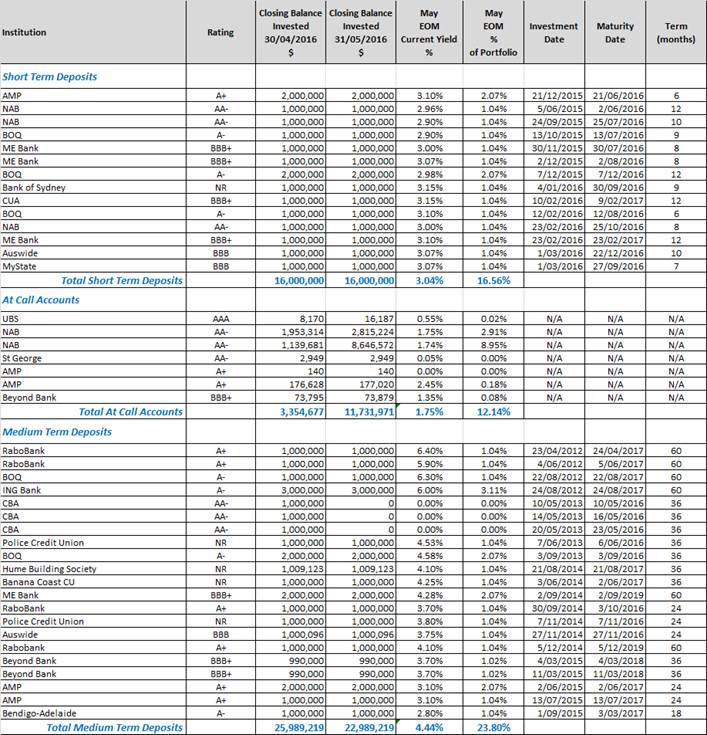

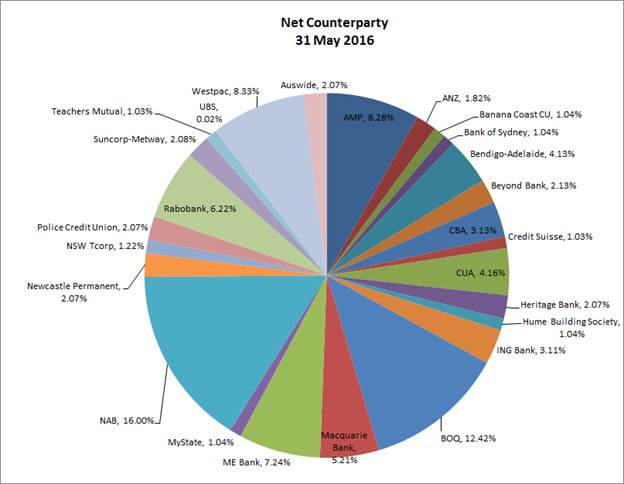

Investment Summary as at 31 May 2016

In accordance with Clause 212 of the Local Government (General) Regulation 2005, details of Wagga Wagga City Council’s external investments are detailed below:

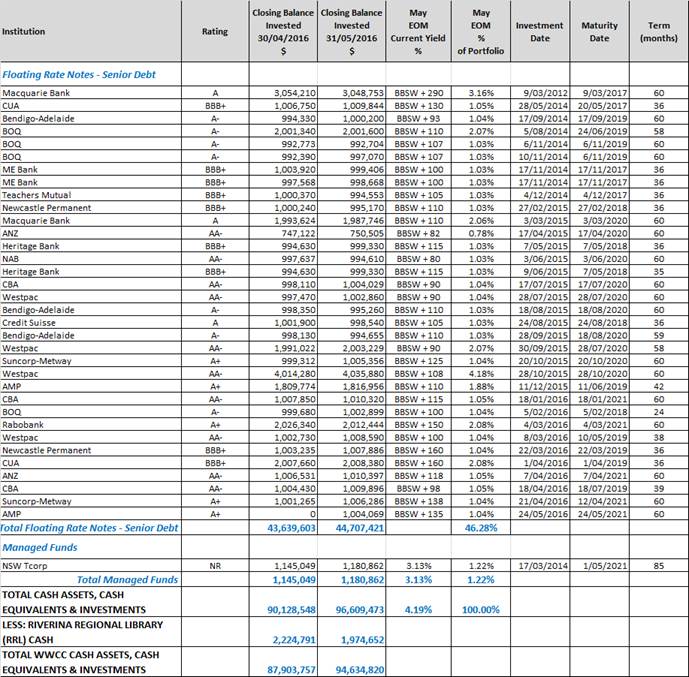

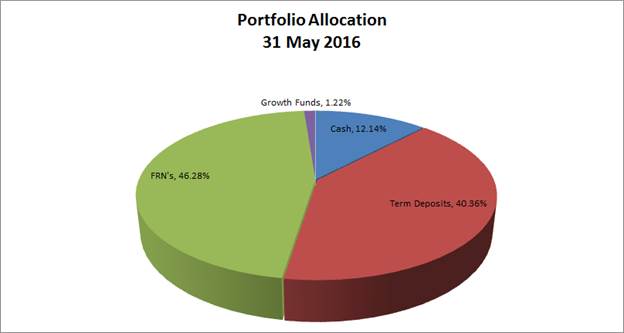

Council’s portfolio is dominated by Floating Rate Notes (FRN’s) at approximately 46% across a broad range of counterparties. Cash equates to 12% of Council’s portfolio with Term Deposits around 41% and growth funds around 1% of the portfolio.

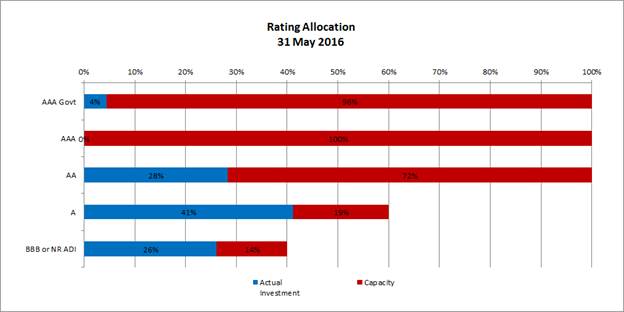

Council’s investment portfolio is well diversified in complying assets across the entire credit spectrum. It is also well diversified from a rating perspective. Credit quality is diversified and is predominately invested amongst the investment grade ADIs (BBB- or higher), with a smaller allocation to unrated ADIs.

All investments are well within the defined Policy limits, as outlined in the Rating Allocation chart below:

Investment Portfolio Balance

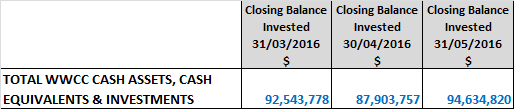

Council’s investment portfolio balance has increased from the previous month’s balance, up from $87.9M to $94.6M. This is reflective of the final 2015/16 rates installment being due at the end of May.

MONTHLY INVESTMENT MOVEMENTS

Redemptions/Sales - Council redeemed the following investment securities during May 2016:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

CBA Term Deposit |

$1M |

3 years |

4.55% |

This term deposit was redeemed for cash flow purposes. |

|

CBA Term Deposit |

$1M |

3 years |

4.55% |

This term deposit was redeemed for cash flow purposes. |

|

CBA Term Deposit |

$1M |

3 years |

4.55% |

This term deposit was redeemed and reinvested in the $1M AMP Bank FRN security. |

New Investments - Council purchased the following investment securities during May 2016:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

AMP Bank Floating Rate Note |

$1M |

5 years |

BBSW + 135 |

Council’s independent Financial Advisor CPG, advised that this Floating Rate Note represented good value over the medium term. |

Rollovers – Council did not roll over any investment securities during May 2016.

MONTHLY PERFORMANCE

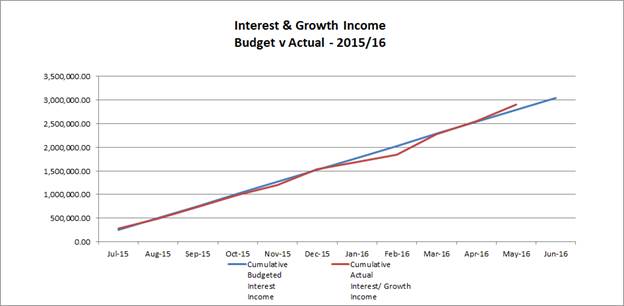

Interest/growth/capital gains for the month totaled $344,030 which compares favourably with the budget for the period of $253,554 – out performing budget for the May month by $90,476. This is attributable to the positive growth experienced for Council’s NSW T-Corp managed funds of $35,812 as well as continued strong growth of Council’s Floating Rate Note portfolio. This continues a strong three (3) month period from March to May for Council’s portfolio, out performing budget for the period by $303,263. This follows a period of lower than budgeted investment returns for January and February 2016.

It should be noted that the capital market value of these investments will fluctuate from month to month and that Council continues to receive the coupon payments and the face value of the investment security when sold or at maturity.

Council’s portfolio performance continues to be anchored by the longer-dated deposits in the portfolio, particularly those locked in above 4% yields. It is to be noted however that the average deposit yield will inevitably fall as some of the longer-dated deposits mature within the next year.

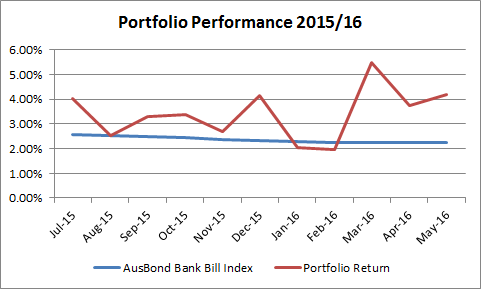

In comparison to the AusBond Bank Bill Index* (+2.25%pa), Council’s investment portfolio in total returned 4.19% for May. Short term deposits returned 3.04%. These funds are utilised for daily cash flow management and need to be available to meet operating and contractual payments as they come due.

* The AusBond Bank Bill Index is the leading benchmark for the Australian fixed income market. It is interpolated from the RBA Cash rate, 1 month and 3 month Bank Bill Swap rates.

Certificate: I hereby certify that all of the above investments have been made in accordance with the provision of Section 625 of the Local Government Act 1993 and the regulations there under, and in accordance with the WWCC Investments Policy adopted by Council on 26 August 2013.

C Rodney

Responsible Accounting Officer

Budget

The forecast full year budget result to 31 May 2016 is a balanced budget.

Policy

Investments are reported in accordance with POL 075 Investment Policy.

Budget Variations are reported in accordance with POL 052 Budget Policy.

Impact on Public Utilities

N/A

Link to Strategic Plan

1. We are an engaged and involved community

1.1 We are a community that is informed and involved in decisions impacting us

QBL Analysis

|

|

Positive |

Negative |

|

Social |

N/A |

N/A |

|

Environmental |

N/A |

N/A |

|

Economic |

N/A |

N/A |

|

Governance |

The preparation of the monthly financial report provides for the timely reporting on investments and budget performance year-to-date. |

N/A |

Risk Management and Work Health and Safety Issues for Council

No specific issues identified.

Internal / External Consultation

All relevant areas within Council have consulted with the Finance Division in regards to the budget variations listed in this report.

The Finance Division has consulted with relevant external parties to confirm Council’s investment portfolio balances.

Report submitted to the Ordinary Meeting of Council on Monday 27 June 2016. RP-6

RP-6 POL 029 - ASBESTOS POLICY

Author: Veneris, Geoff

General Manager: Eldridge, Alan

|

That Council: a note that no submissions were received during the exhibition period for Draft Policy 029 Asbestos Policy b adopt POL 029 Asbestos Policy |

Report

Council at its meeting of March 2016, resolved:

That Council:

a endorse the draft POL 029 Asbestos Policy and place on public exhibition for a period of 28 days and invite public submissions on the draft policy

b receive a further report following the public exhibition period:

(i) addressing any submissions made in respect of the proposed policy

(ii) proposing adoption of the policy unless there are any recommended amendments deemed to be substantial and requiring a further public exhibition period

POL 029 - Asbestos Policy, has been developed in response to Division of Local Government (DLG) requirements:

In 2010 the NSW Ombudsman issued a report, ‘Responding to the Asbestos Problem: The need for significant reform in NSW’. The NSW Government responded to the Ombudsman's Report (in August 2011) committing to:

· Communication strategies for public awareness and education particularly for local communities and councils, and

· Issue a model asbestos policy to all councils from the Division of Local Government for adoption. The Policy is to assist NSW councils to formulate an asbestos policy and to promote a consistent approach to asbestos management which will provide important information and guidance to local communities.

The policy was placed on public exhibition from 15 April 2016 through to 13 May 2016. No submissions were received during the exhibition period and no amendments have been proposed.

Council officers recommend the adoption of POL 029 Asbestos Policy as was exhibited.

Budget

NA

Policy

POL 029 Asbestos Policy

Impact on Public Utilities

N/A

Link to Strategic Plan

1. We are an engaged and involved community

1.1 We are a community that is informed and involved in decisions impacting us

QBL Analysis

|

|

Positive |

Negative |

|

Social |

Clear direction to the community regarding roles and responsibilities of handling asbestos materials. |

N/A |

|

Environmental |

Clear direction to the community regarding roles and responsibilities of handling asbestos materials. |

N/A |

|

Economic |

N/A |

N/A |

|

Governance |

Clear direction to the community regarding roles and responsibilities of handling asbestos materials. |

N/A |

Risk Management and Work Health and Safety Issues for Council

The introduction of a new policy regarding asbestos was thought to strengthen Council’s compliance with requirements set out in the Work Health and Safety Act 2011.

Internal / External Consultation

The draft policy was exhibited for a period of 28 days, commencing on 15 April 2016 to 13 May 2016. No submissions were received during the exhibition period.

Internal and external consultation was required to develop to be undertaken in order to identify key roles and responsibilities of asbestos materials.

|

1⇩. |

POL 029 - Draft Asbestos Policy - provided under separate cover |

|

Report submitted to the Ordinary Meeting of Council on Monday 27 June 2016. RP-7

RP-7 SOLID WASTE - WASTE SUBSIDY FOR CHARITABLE ORGANISATIONS

Author: Veneris, Geoff

General Manager: Eldridge, Alan

|

That Council: a in accordance with POL 093 Subsidy for Waste Disposal by Charitable Organisations, endorse the annual waste disposal subsidies for the amount of $7150 for the organisations as referred to in this report b authorise the General Manager or his delegate to approve further applications from charitable organisations and community groups for subsidised waste disposal fees for the 2016/17 financial year up to an amount of $5149 as budgeted |

Report

In response to approaches made to Council by local charitable organisations and community groups seeking relief from fees for the disposal of waste at Council’s Gregadoo Waste Management Centre (GWMC), Council adopted the Policy POL 093 Subsidy for Waste Disposal by Charitable Organisations at its December 2007 Council meeting. POL 093 has since been reviewed and was again confirmed by Council at its August 2013 Council meeting.

In summary, the Policy allows charitable organisations, community groups and individuals for specific projects to apply for donations under Section 356 of the Local Government Act by way of subsidised disposal fees for the disposal of waste material at the GWMC.

An annual budget of $12,299 is allocated for subsidising waste disposal fees for not-for-profit charitable organisations and community groups in the Solid Waste budget for 2016/17.

In accordance with the Policy, an advertisement was placed in regional newspapers and on Council’s website during May 2016 inviting relevant organisations and groups to apply for subsidised waste disposal fees. Twelve applications were received by the advertised closing date of the 1 June 2016.

Assessment

The following table shows the applicants name and the amount of subsidy requested

|

No. |

Name of Applicant |

Requested Subsidy $ |

|

1 |

Wagga Wagga Inter Church Christian Education Team |

250 |

|

2 |

Sisters Housing Enterprises Inc |

1000 |

|

3 |

Family Link |

1000 |

|

4 |

Anglican Opportunity Shop |

1000 |

|

5 |

Chris Long (individual) |

500 |

|

6 |

St Vincent de Paul |

1000 |

|

7 |

The Salvation Army |

1000 |

|

8 |

Wagga Men’s Shed |

250 |

|

9 |

Peter Dolden (individual) |

100 |

|

10 |

St Paul’s Anglican Church Chain Gang |

300 |

|

11 |

Rotary Club of Wollundry |

250 |

|

12 |

Lions Club of Wagga Wagga South Inc |

500 |

|

|

Total |

$7150 |

The ten organisations/community groups and two individuals that submitted applications for subsidised waste disposal fees are well known to Council for providing valuable charitable and social services that benefit the community of Wagga Wagga.

As described in the Policy, charitable organisations and community groups are able to apply for subsidised disposal fees to a maximum limit of $1000 per financial year.

The Policy also allows for charitable organisations and community groups to apply for subsidised disposal fees for specified projects which include the disposal of waste originating from the Wagga Wagga Local Government Area (WWLGA) for advertised events such as Clean-Up Australia Day or the Adopt - A - Road Program.

Given that there are over 150 registered charities listed in the WWLGA and only eleven applications were received, it is proposed that the remaining budget amount of $5,149 be retained to fund any further applications for subsidised fees that may be received during the 2016/17 financial year. Any unspent monies will be retained by the solid waste reserve.

Budget

An allowance of $12,299 for subsidised waste disposal has been made in the Solid Waste budget for 2016/17, funded from the Solid Waste Reserve.

|

Project Name & Component |

Existing Budget |

Expenditure to Date |

Proposed Budget Variation |

Effect on LTFP

|

|

Waste subsidy |

$12,299 |

$0 |

0 |

Nil |

|

TOTALS |

$12,299 |

$0 |

0 |

Nil |

Policy

POL – 093 Subsidy for Waste Disposal by Charitable Organisations and Community Groups Policy.

Impact on Public Utilities

N/A

Link to Strategic Plan

1. We are an engaged and involved community

1.1 We are a community that is informed and involved in decisions impacting us

QBL Analysis

|

|

Positive |

Negative |

|

Social |

Assist registered charitable organisations and identified community groups though the provision subsidised waste disposal fees in responding to the needs of the wider community. |

N/A |

|

Environmental |

N/A |

N/A |

|

Economic |

N/A |

N/A |

|

Governance |

Implementing initiatives in accordance with Council’s Management Plan, legislative requirements, policies and procedures. |

N/A |

Risk Management and Work Health and Safety Issues for Council

No risk management issues were identified in respect to the provision of subsidised waste disposal fees provided they are applied as per the Policy.

Internal / External Consultation

Internal consultation with the relevant sections within Council will be undertaken to ensure the operators of the landfill and finance staff is advised of the subsidy to ensure it is applied correctly.

The charitable organisations and community groups will be advised of the resolution of Council regarding their application for subsidised disposal fees, how the subsidy will be applied and the conditions of entry into the landfill

Report submitted to the Ordinary Meeting of Council on Monday 27 June 2016. RP-8

RP-8 MULTI PURPOSE STADIUM BOLTON PARK

Author: Gardiner, Mark

Director: Summerhayes, Janice

|

That Council: a receive and note the report b proceed with developing a revised master plan for the Bolton Park precinct including a business case for the Multi-Purpose Stadium Bolton Park Project c not make a determination regarding providing financial support towards the PCYC Youth Hub to be located at the former South Wagga Bowling Club site until a detailed business case and design has been received from PCYC d receive a further report once a detailed proposal is received from PCYC |

Background

Council resolved to proceed with a Multi-Purpose Stadium (MPS) project at its March 2013 meeting. The project included the redevelopment of the existing Indoor Stadium at Bolton Park to facilitate the relocation of the Police and Community Youth Clubs NSW (PCYC) to this facility.

Agreement was reached on preferred design layout for the Bolton Park redevelopment with PCYC on 30 October 2013 and Council endorsed the Bolton Park concept design option at its November 2013 meeting, based on it being supported by a majority of stakeholders.

Council progressed the MPS development to the point of tender for construction and included detailed designs and development application. The project was placed on hold at the May 2015 Supplementary Council meeting following advice from PCYC that they had a new vision for a Youth Hub involving an estimated $12 - $13 million development on the former South Wagga Bowling Club site.

Report

Staff have been liaising with PCYC over the past 12 months whilst they further evaluated the Youth Hub option on the former South Wagga Bowling Club land. They have recently confirmed they have taken over the perpetual lease of the former South Wagga Bowling Club site and are progressing with community consultation to finalise the design to progress submitting a development application.

A workshop was held with Councillors on 6 June 2016 to provide an update on the PCYC development. As outlined in the workshop the proposed development is estimated to be $13 - $15 million and includes:

· three (3) basketball courts and change rooms

· youth hub and cafe

· after school care facilities

· boxing facilities

· meeting rooms and offices

· underground carparking

Although Council is yet to receive a formal request from PCYC for a contribution towards the proposed development on the former South Wagga Bowling Club site, it is understood such a request may be forthcoming and be around $4 - $5 million.

Given PCYC is no longer partnering with Council on the redevelopment of the Bolton Park Stadium Council will need to reconsider the future use of this facility. Within the 2016/17 Budget $150,000 has been allocated for the integrated master planning of the Bolton Park precinct inclusive of:

– Bolton Park Stadium

– Oasis Aquatic Centre

– Bolton Park sports fields

– Robertson Oval

This planning will look at developing, maintaining and operating facilities that meet community expectations in the most cost effective method.

Budget

Within the 2016/17 Budget $150,000 has been allocated for the integrated master planning of the Bolton Park precinct.

Policy

Recreation and Open Space Strategy 2005-2015.

Bolton Park/Robertson Oval & Wagga Wagga Exhibition Centre Master Plans.

Impact on Public Utilities

N/A

Link to Strategic Plan

1. We are an engaged and involved community

1.1 We are a community that is informed and involved in decisions impacting us

QBL Analysis

|

|

Positive |

Negative |

|

Social |

Meeting community wellbeing outcomes as per Council’s strategic plans, particularly the Recreation and Open Space, Social and Cultural Plans. |

N/A |

|

Environmental |

N/A |

N/A |

|

Economic |

Meeting community outcomes as per Council’s strategic plans and fostering local economic activity. |

N/A |

|

Governance |

N/A |

N/A |

Risk Management and Work Health and Safety Issues for Council

Any risk management and work health and safety matters will be addressed as part of the day to day operations.

Internal / External Consultation

Extensive consultation has been undertaken within Council, with the broader community, PCYC and user groups.

Report submitted to the Ordinary Meeting of Council on Monday 27 June 2016. RP-9

RP-9 PROPOSED CREATION OF AN ESSENTIAL ENERGY EASEMENT OVER LOT 1 DP 535470 AT WAGGA WAGGA

Author: Walker, David

Project Management Officer: Angel, Caroline

Director: Summerhayes, Janice

|

That Council: a create an easement in favour of Essential Energy for electricity purposes over Lot 1 DP 535470 at the Wagga Wagga Lawn Cemetery b note that Crown Lands consent is required for creation of the easement c authorise execution of all necessary documents under Council’s common seal as necessary |

Report

The Wagga Wagga Lawn Cemetery Stage 2A Master Plan project includes the establishment of a new Section 12A for additional burial sites. The project is listed in Council’s 2015/16 Capital Works Program. The creation of an electricity easement is necessary to facilitate these works. The project also includes the construction of sealed internal roads and a car park.

The Lawn Cemetery is situated on Crown Reserve No. 87534 being Lot 1 DP 535470, Brunskill Road Wagga Wagga and is owned by the State of New South Wales (Crown Lands) and managed by Council.

In order to proceed with the development, the creation of an easement is required for electricity supply as the existing overhead electricity power lines need to be relocated underground. Consultation is currently underway with Crown Lands who have agreed in principal to the creation of the easement.

It is proposed that an easement be created for electricity purposes approximately 247.43 metres in length and two (2) metres wide (subject to final survey) in favour of Essential Energy over Lot 1 DP 535470 (as per the attached map). The electricity infrastructure will comprise replacement of a 63kVA substation with a 100kVA substation, replacement of a substation pole and conversion of the overhead high voltage 11kV line to an underground system.

Costs associated with the creation of the easement are to be borne by Council and are estimated to be $8,000 (excluding GST). This amount comprises legal and survey costs.

It is therefore recommended that Council proceed with the creation of the easement in favour of Essential Energy over Lot 1 DP 535470 for the purpose of electricity supply at an estimated cost of $8,000 (excluding GST).

Budget

|

Project Name & Component |

Existing Budget |

Expenditure to Date |

Proposed Budget Variation |

Effect on LTFP

|

|

Lawn Cemetery Master Plan Stage 2A |

292,165 |

77,421 |

N/A |

No |

|

TOTALS |

292,165 |

77,421 |

|

|

Budget Summary

The creation of the easement for the purpose of electricity supply at an estimated cost of $8,000 (excluding GST).

Policy

Wagga Wagga Lawn Cemetery Master Plan

Impact on Public Utilities

The creation of a new electricity easement as per this report.

Link to Strategic Plan

3. We have a growing economy

3.2 Our community grows

QBL Analysis

|

|

Positive |

Negative |

|

Social |

Meeting community wellbeing outcomes as per Council’s strategic plans, particularly the Recreation and Open Space, Social and Cultural Plans. |

N/A |

|

Environmental |

Meeting community outcomes as per Council’s strategic plans, particularly the Environmental Sustainability Strategy. |

N/A |

|

Economic |

N/A |

N/A |

|

Governance |

Implementing initiatives against Council’s Management Plan, legislative requirements, policies and procedures. |

N/A |

Risk Management and Work Health and Safety Issues for Council

No specific issues identified.

Internal / External Consultation

· Crown Lands

· Commercial & Economic Development Directorate

· Project Management Office

|

1⇩. |

Location Map - Lot 1 DP 535470 - Cemetery |

|

Report submitted to the Ordinary Meeting of Council on Monday 27 June 2016. M-1

M-1 AUDIT AND RISK COMMITTEE MINUTES - 12 MAY 2016

Author: Priest, Christine

Director: Richardson, Craig

|

That the Council receive and note the minutes of the Audit and Risk Committee Meeting held on 12 May 2016 and endorse the recommendations contained therein with the change to RP-1 as detailed in the report below. |

Report

The Audit and Risk Committee Meeting was held on 12 May 2016. Minutes of the meeting are attached.

Council has granted certain authorities to the Audit and Risk Committee within the scope of its role and responsibilities, as defined within its Charter. As an advisory committee to Council, the Audit and Risk Committee has no authority to action items that may have a budget and/or resource implication outside of this authority unless Council resolves to adopt the recommendations.

At this meeting the Committee made the following recommendation for item RP1 following the General Manager’s update:

That the Audit and Risk Committee recommends that:

a The General Manager develops a procedure, effective not later than 1 July 2016, for the prompt and comprehensive reporting of related party matters on a confidential basis to an appropriate Council Committee

b The General Manager consider to which of Council’s key management personnel (as defined in AASB 124 Related Party Disclosures) such reporting should be extended

c The elected members be briefed on the effects of AASB 124 and consider advancing the review of POL112 Conflicts of Interest Policy

The reporting of related party matters is a new requirement for Local Government across Australia and this will occur through the Audited Financial Statements commencing from the 2016/17 Financial Year.

The reporting through a separate note in the financial statements will include all transactions with related parties including the nature and amount of the transaction. This will include key management personnel (including Councillors) and other related entities.

The NSW Office of Local Government have released draft guidance notes around the capture and reporting of related party transactions and further communication to each party including a notice of intention to collect information on transactions between Council and related parties will take place prior to 30 June 2016. A copy of the draft guidance notes are attached to this report.

The reporting of related party transactions through the Audited Financial Statements is an open and transparent process and it is not appropriate that this occur on a confidential basis through a Council committee. The Audit and Risk Committee members will have the opportunity to review the content of the financial statements in the period leading up to Council’s formal consideration of the statements in September each year.

For this reason it is recommended that the Audit and Risk Committee recommendation for RP1 be adopted with the deletion of the words underlined in the Committee recommendation above. The alternate recommendation from staff is as follows.

a The General Manager develops a procedure, effective not later than 1 July 2016, for the prompt and comprehensive reporting of related party matters

b The General Manager consider to which of Council’s key management personnel (as defined in AASB 124 Related Party Disclosures) such reporting should be extended

c The elected members be briefed on the effects of AASB 124 and consider advancing the review of POL112 Conflicts of Interest Policy

Budget

There are no budgetary implications associated with the minutes of the 12 May 2016 Audit and Risk Committee meeting.

Policy

POL 098 Internal Audit Policy.

Impact on Public Utilities

N/A

Link to Strategic Plan

1. We are an engaged and involved community

1.1 We are a community that is informed and involved in decisions impacting us

QBL Analysis

|

|

Positive |

Negative |

|

Social |

N/A |

N/A |

|

Environmental |

N/A |

N/A |

|

Economic |

N/A |

N/A |

|

Governance |

The Audit and Risk Committee is an essential part of a Good Governance framework to provide independent oversight of Council’s operations. |

N/A |

Risk Management and Work Health and Safety Issues for Council

The Audit and Risk Committee assists Council by monitoring its risk exposure and determining if management systems have appropriate risk management processes in place.

Internal / External Consultation

N/A

|

1⇩. |

Significant changes to 2016/17 Code due to accounting standards changes - Appendix J |

|

|

2⇩. |

Audit and Risk Committee Meeting - Minutes - 12 May 2016 |

|

Report submitted to the Confidential Meeting of Council on Monday 27 June 2016. CONF-1

CONF-1 RFT2016-011 SUPPLY OF LEGAL SERVICES

Author: Priest, Christine

Director: Richardson, Craig

This report is CONFIDENTIAL in accordance with Section 10A(2) of the Local Government Act 1993, which permits the meeting to be closed to the public for business relating to the following: -

(d) (i) commercial information of a confidential nature that would, if disclosed, prejudice the commercial position of the person who supplied it.

Report submitted to the Confidential Meeting of Council on Monday 27 June 2016. CONF-2

CONF-2 DEVELOPMENT SERVICING CHARGES MODIFICATION REQUEST

Author: Bolton, James

General Manager: Eldridge, Alan

This report is CONFIDENTIAL in accordance with Section 10A(2) of the Local Government Act 1993, which permits the meeting to be closed to the public for business relating to the following: -

(c) information that would, if disclosed, confer a commercial advantage on a person with whom the Council is conducting (or proposes to conduct) business.

Report submitted to the Ordinary Meeting of Council on Monday 27 June 2016.

QUESTIONS/BUSINESS WITH NOTICE

Reports submitted to the Ordinary Meeting of Council to be held on Monday 27 June 2016.

Minutes of the SUPPLEMENTARY Meeting of Council held on Tuesday 14 June 2016.

Present

The Mayor, Councillor Rod Kendall

Councillor Yvonne Braid

Councillor Alan Brown

Councillor Paul Funnell

Councillor Garry Hiscock

Councillor Julian McLaren

Councillor Kerry Pascoe

Councillor Kevin Poynter

Councillor Dallas Tout

In Attendance

Director Corporate Services (Mr C Richardson)

Acting Director Commercial & Economic Development (Mr J Bolton)

Director Environmental & Community Services (Mrs J Summerhayes)

Manager Events (Ms S Nolan)

Manager Strategic CED (Mr J Bolton)

Manager Corporate Strategy, Communications &

Governance (Mrs C Priest)

Manager Finance (Mrs C Rodney)

Manager Environmental & Recreation Services (Mr M Gardiner)

Manager Engineering (Mr A Fenwick)

Manager Executive Support (Mr S Gray)

Strategic Partner – Strategy & Communications (Mr B Koschel)

Governance Officer (Miss B King)

The Supplementary Council meeting commenced at 9.24pm.

Prayer

Almighty God,

Help protect our Mayor, elected Councillors and staff.

Help Councillors to govern with justice, integrity, and respect for equality, to preserve rights and liberties, to be guided by wisdom when making decisions and settling priorities, and not least of all to preserve harmony.

Amen.

Acknowledgement Of Country

I would like to acknowledge the Wiradjuri people who are the Traditional Custodians of this Land. I would also like to pay respect to the Elders both past and present of the Wiradjuri Nation and extend that respect to other Community members present.

APOLOGIES

An Apology for non-attendance was received and accepted for The General Manager, Mr Alan Eldridge on the Motion of Councillors Brown and K Pascoe.

CARRIED

LEAVE OF ABSENCE

|

16/142 RESOLVED: On the Motion of Councillors A Brown and K Pascoe RESOLVED That Council grant a leave of absence to Councillor G Conkey OAM for the 14 June 2016 Policy and Strategy Committee and Supplementary Council meetings. CARRIED |

CONFIRMATION OF MINUTES

|

CM-1 ORDINARY COUNCIL MEETING - 30 MAY 2016 |

|

|

|

16/143 RESOLVED: On the Motion of Councillors A Brown and K Pascoe That the Minutes of the proceedings of the Ordinary Council Meeting held on 30 May 2016 be confirmed as a true and accurate record.

CARRIED |

Declarations Of Interest