Ordinary Meeting of

Council

Ordinary Meeting of

Council

To be held on

Monday

27 March 2017

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

Ordinary Meeting of

Council

Ordinary Meeting of

Council

To be held on

Monday

27 March 2017

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 27 March 2017 at 6.00pm.

Mr Robert Knight

Acting General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

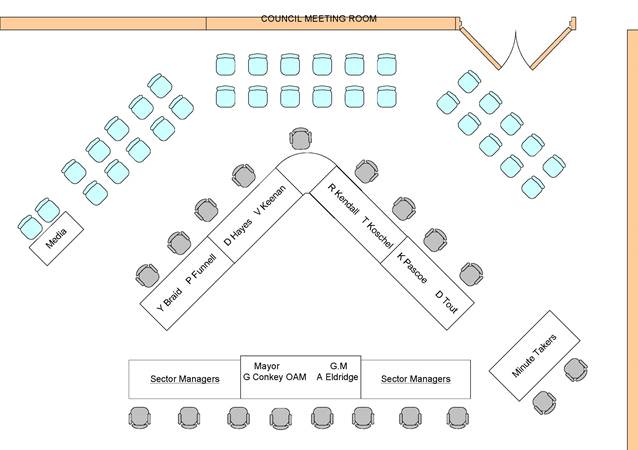

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 27 March 2017.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 27 March 2017

ORDER OF BUSINESS:

CLAUSE PRECIS PAGE

PRAYER 3

ACKNOWLEDGEMENT OF COUNTRY 3

APOLOGIES 3

CONFIRMATIONS OF MINUTES

CM-1 Ordinary Council Meeting - 27 February 2017 3

DECLARATIONS OF INTEREST 3

Motions Of Which Due Notice Has Been Given

NOM-1 Notice of Motion - Planning Taskforce 4

Reports from Staff

RP-1 DA16/0728 - Development Application for Four Dwellings with attached Secondary Dwellings and Torrens Title Subdivision 6

RP-2 Code of Meeting Practice 10

RP-3 2017 Australian Local Government Women's Association Annual Conference 13

RP-4 National General Assembly - Call for Motions 18

RP-5 Audit and Risk Committee - Independent Member Remuneration 30

RP-6 POL 100 Fraud and Corruption Prevention Policy 32

RP-7 City of Wagga Wagga Cultural Protocols 43

RP-8 Suspension of Alcohol Free and Prohibited Alcohol Consumption Zones for Events 45

RP-9 Membership of Riverina Regional Tourism 48

RP-10 Airport Advisory Committee - Terms of Reference 62

RP-11 Financial Performance Report as at 28 February 2017 74

RP-12 Sale of Land for Unpaid Rates 88

RP-13 Consultation with State and Federal Government 91

RP-14 Hampden Bridge - Final Report 93

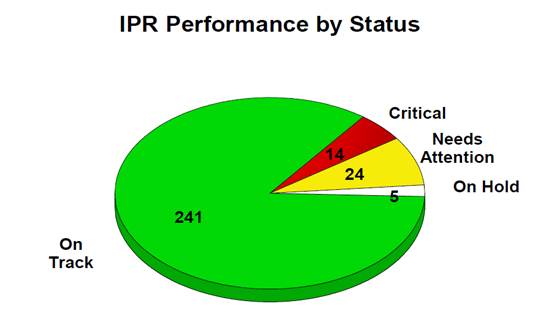

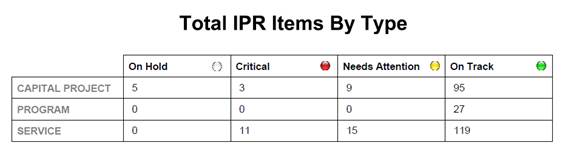

RP-15 Integrated Planning and Reporting Performance Report for the Quarter Ended 31 December 2016 95

RP-16 Planning Proposal to amend the Wagga Wagga Local Environmental Plan 2010 - Land at Old Bomen Road & East Street, Cartwrights Hill 122

RP-17 Section 356 Donation - Henwood Park Football Club Inc - Request to waive Sewer Charges 140

RP-18 Section 356 Donation Request - Uranqunity Junior Cricket Club 143

RP-19 Venue Naming Sponsorship Proposal 148

RP-20 Economic Development Grants Program 2016/2017 - Recommendations of assessment panel 151

QUESTIONS/BUSINESS WITH NOTICE 160

Confidential Reports

CONF-1 Proposed Sale of Council Property - 34 Johnston Street, Wagga Wagga 161

CONF-2 RFT2017/18 Tree Maintenance Services 162

CONF-3 RFT2017-20 Supply of Passenger & Baggage Screening Services 163

CONF-4 EOI 2017/601 - Energy Performance Contract 164

CONF-5 Appointment of Sister City Community Committee Members 165

CONF-6 Audit and Risk Committee Minutes - 16 February 2017 166

CONF-7 Oasis Aquatic Centre - Natural Gas Supply Agreement 167

CONF-8 Riverina Intermodal Freight and Logistics (RIFL) Hub and Genesee & Wyoming Australia Framework Agreement 168

CONF-9 Solid Waste - Kerbside Waste Contract 169

Confirmation of Minutes

CM-1 Ordinary Council Meeting - 27 February 2017

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 27 February 2017 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - Ordinary Council Meeting - 27 February 2016 |

185 |

Motions Of Which Due Notice Has Been Given

NOM-1 Notice of Motion - Planning Taskforce

Author: Councillor Kerry Pascoe

|

Analysis: |

Notice of Motion brought to Council from Councillor Kerry Pascoe. |

|

That Council receive a report at the 24 April 2017 Ordinary Council, giving an update on the progress of the Planning Taskforce.

|

Key Reasons

In the previous term of Council the Planning Advisory Committee was abolished and replaced by the Planning Taskforce.

The Planning Advisory committee was made up of a group of community stakeholders that conducted regular meetings that were open, transparent and were recorded. Planning staff and Councillors attended the meetings and the minutes of each meeting were formally adopted in Council Meetings.

The Planning Taskforce does not report back to Councillor’s.

In the report back to Councillor’s we request the following details;

1. The composition of the Planning taskforce;

2. Any minutes that are recorded for the meeting of the taskforce members;

3. An update on the progress of the following stated aims of the taskforce;

i. Develop a residential strategy which would look at population forecasts and demand for housing stock and develop growth scenarios based on this analysis

ii. Undertake a Rural Lands Strategy which would look at the sustainability of villages within the local government area and the potential for villages to accommodate growth

iii. Undertake a review of the Local Environmental Plan (LEP)

iv. Undertake a review of Development Control Plan (DCP)

v. Undertake the review of the Development Contribution Plans including Section 94, Section 94A and Section 64

Financial Implications

N/A

Policy

Code of Meeting Practice

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We plan long term

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

N/A

Report submitted to the Ordinary Meeting of Council on Monday 27 March 2017. RP-1

RP-1 DA16/0728 - Development Application for Four Dwellings with attached Secondary Dwellings and Torrens Title Subdivision

Author: Stander, Adriaan

Sector Manager: Somerville, Paul

|

Analysis: |

The report is for a development application and is presented to Council for decision. The application has been referred to Council as: · the application seeks to vary one numeric control of the Wagga Wagga Development Control Plan 2010 (DCP) by greater than 10%; and · The application is also presented to Council for determination in accordance with Policy ‘Processing development applications lodged by councillors, staff and individuals of which a conflict of interest may arise, or on council owned land policy.’ as the applicant and the landowner is Councillor Pascoe. |

|

That Council approve DA16/0728 for four dwellings with attached secondary dwellings and Torrens Title subdivision at 12-14 Kellerman Crescent, Boorooma subject to the conditions outlined in the Section 79C Assessment Report for DA16/0728. |

Development Application Details

|

Applicant |

Pascoe Constructions |

|

Owner |

Davtil Pty Ltd |

|

Development Cost |

$1,235,870.00 |

|

Development Description |

The application is for: 1. The subdivision of Lot 801 and 802 DP 1191265 into four lots, namely Lot 31, Lot 32, Lot 2 and Lot 3. The proposed lots are between 648sqm and 851sqm in size. A reciprocal access easement will be created over Lot 2 and 3 in favour of both lots. A service easement will also be provided over Lot 2 and 3 to accommodate existing services that traverse the site; this includes an electricity easement for overhead power lines that located within the adjacent property to the south (Lot 46 DP 1179795). 2. Four dwellings on the newly created lots. Each dwelling will consist of 3 bedrooms, 2 bathrooms and an open plan living, dining and kitchen area that leads out onto a covered outdoor area. Each dwelling is provided with a double garage. 3. Secondary dwellings are attached to the principal dwellings on each lot. The secondary dwellings will gain access through the main foyer of the principal dwellings and will each consist of 2 bedrooms, a bathroom and open plan living, dining and kitchen area. |

Key Issues

· Overall the site design is considered acceptable and is in accordance with the adopted master plan for Boorooma.

· The proposed setback requires a variation of the DCP controls. The proposed variation and its justification are supported as the proposed setback will still be able to comply with the overall objectives of the setback controls including complimenting the established built pattern.

Assessment

The proposed subdivision will create an additional 2 lots which would increase the density but still maintaining the minimum lot size requirement of 600sqm generally in accordance with the master plan for Boorooma.

The proposed development is compatible with the existing form and nature of development in the locality. The majority of surrounding development is low density in character and even though the development will result in an increased density the density is still considered appropriate given the context and setting of the site.

With the exception of the front setbacks, the proposed development complies with the LEP and DCP provisions.

The DCP requires a 6m setback on Kellerman Crescent. The dwellings on proposed Lot 31 and Lot 32 are provided with 5.035m and 4.95m setbacks to accommodate the front porches for both dwellings. The remainder of the dwellings are set behind the 6m setback. The proposed setback represents a variation of 17% which is required under the provisions of clause 1.11 of the DCP to be considered by Council.

The proposed setback is supported as it is compatible with the 3m setback of the adjoining house to the north of the development site.

Reasons for Approval

· The proposed development is considered to satisfy the outcomes sought for the R1 – General Residential Zone, particularly by satisfying the two main objectives of the zone which is to provide housing and to add to the variety of housing and density types.

· The variation of the setback control is supported as the proposed setback will still be able to comply with the overall objectives of the setback controls including complimenting the established built pattern.

· The proposed development will contribute to the housing choice in the area while respecting the setting, layout and form of adjoining developments.

Site Location

The subject land is located on the eastern side of Kellerman Crescent, Boorooma and currently consists of two vacant lots of 2,882sqm in total. The land is zoned R1- General Residential and is within a new residential area characterised by a mixture of residential uses and styles.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010 (LEP)

Wagga Wagga Development Control Plan 2010 (DCP)

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have housing that suits our needs

Risk Management Issues for Council

An approval of the application raises no risk management issue and will not create an undesirable precedent. Refusal of the application may result in an appeal process in the Land and Environment Court which will have to be defended by Council. The reasons for refusal will have to be justified and withstand scrutiny and cross examination in Court.

Internal / External Consultation

See attached s79C report for details of all consultation.

|

1⇩. |

DA17/0728 - S79C Assessment - Provided under separate cover. |

|

|

2⇩. |

DA16/0728 - Plans - Provided under separate cover. |

|

Report submitted to the Ordinary Meeting of Council on Monday 27 March 2017. RP-2

Author: Hensley, Ingrid

Acting General Manager: Knight, Robert

|

Analysis: |

Endorse amended Code of Meeting Practice and place on public exhibition. |

|

That Council: a alter resolution 16/305 adopted at the Ordinary Council Meeting held 21 November 2016 being: “That Council alter part (a) of resolution 16/276 – COUNCIL MEETING AND COMMITTEE STRUCTURE from 31 October 2016 to read as follows: a endorse Council Meetings to be held monthly b endorse the Draft Code of Meeting Practice and place on public exhibition for a period of 28 days from 28 March 2017 to 24 April 2017 and invite public submissions c receive a further report following the public exhibition period: i addressing any submissions made in respect of the Draft Code of Meeting Practice ii proposing adoption of the Code unless there are any recommended amendments deemed to be substantial and requiring a further public exhibition period |

Key Reasons

At the Ordinary Council Meeting held 31 October 2016, Council was presented with draft amendments to the Code of Meeting Practice and resolved (Res 16/277):

“That Council:

a endorse the following amendments to Council’s Code of Meeting Practice as outlined in this report:

· record a division for every resolution, excluding procedural motions

· amend the Order of Business for Ordinary Council Meetings to include Questions/Business with Notice prior to Closed Council

· amend public address sessions to be held at Ordinary Council Meetings

b receive a further report following the Office of Local Government’s release of the Model Code of Meeting Practice in early 2017”

The Code of Meeting Practice was updated in accordance with the above endorsed amendments and is the current Code in place.

At the Ordinary Council Meeting held 21 November 2016, Council resolved (Res 16/305):

“That Council alter part (a) of resolution 16/276 – COUNCIL MEETING AND COMMITTEE STRUCTURE from 31 October 2016 to read as follows:

a endorse a schedule of a monthly Council Meeting and the establishment of a monthly Planning Standing Committee for this term of Council

i amend the Code of Meeting Practice to allow Public Addresses at both Council and Standing Committee Meetings

ii receive a further report outlining the Terms of Reference of the Planning Standing Committee”

In line with Council’s resolution, draft amendments were made to the Code of Meeting Practice and presented to the Ordinary Council Meeting held 12 December 2016 that would allow Public Addresses at both Council and Standing Committee Meetings. Consideration of these changes was deferred to the January 2017 meeting.

Consideration of this matter was further deferred to the 27 February 2017, Ordinary Council Meeting, to allow further consultation with Councillors in establishing a Public Forum for Development Application before Council, in place of the adopted Planning Standing Committee.

At the Ordinary Council Meeting held 27 February 2017, Council resolved in part to (Res: 17/033):

a endorse the introduction of the following forums, in addition to the existing public address forum at Council meetings, as methods for the public to address Councillors on matters of interest:

(i) Public Forum – Development Assessment and Policy, and

(ii) Public Access Session

f receive a report at March 2017 Ordinary Council meeting proposing updates to the Code of Meeting Practice as may be required

As a result of the resolution above and the establishment of the Public Forum - Development Assessment and Policy, resolution 16/305 will no longer be enacted. Therefore it is recommended that resolution 16/305 be altered to remove the establishment of a monthly Planning Standing Committee for this term of Council and the additional associated items as below:

i amend the Code of Meeting Practice to allow Public Addresses at both Council and Standing Committee Meetings

ii receive a further report outlining the Terms of Reference of the Planning Standing Committee”

Attached is the draft Code of Meeting Practice for consideration by Council to amend the following:

· Reference to the Public Forum - Development Assessment and Policy. Although this session is not a formal meeting of Council, the Forum has a direct link to Development Applications scheduled for the next available Ordinary Council Meeting and Council Policies or Plans on Public Exhibition as at the date of the Meeting.

· Clarification of process of Service and Operational requests in Section 20 (d) Questions with Notice in accordance with Council’s Provision of Information to and Interaction between Councillors and Staff Policy.

It should also be noted that the purpose of the Public Access Session is to allow a member of the community to address Councillors on matters not included in the agenda of a Council Meeting. Therefore this session is not required to be referenced in the Code of Meeting Practice.

The Office of Local Government is developing a Model Code of Meeting Practice, which is expected for release in 2017. A full review of Council’s Code of Meeting Practice will take place following the release of the Model Code of Meeting Practice.

Financial Implications

N/A

Policy

Code of Meeting Practice

POL 089 - Provision of Information to and Interaction Between Councillors and Staff Policy

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

Office of Local Government

|

1⇩. |

Draft Code of Meeting Practice - Provided under separate cover |

|

Report submitted to the Ordinary Meeting of Council on Monday 27 March 2017. RP-3

RP-3 2017 Australian Local Government Women's Association Annual Conference

Author: Hensley, Ingrid

Acting General Manager: Knight, Robert

|

Analysis: |

Endorse representation and appointment of a Councillor to attend the ALGWA Conference in May 2017. |

|

That Council: a consider Council representation at the 2017 Annual Australian Local Government Women’s Association (ALGWA) Conference to be held from 4 to 6 May 2017 in Penrith b appoint one Councillor as Council’s delegate to attend the ALGWA Conference |

Key Reasons

· Australian Local Government Women’s Association (ALGWA) NSW, is the state's peak representative body for women who are in any way involved or interested in local government. Council has participated in the ALGWA Annual Conference since 2008.

· The theme of the 2017 ALGWA Annual Conference is “Your Adventure Starts Now”.

· The 2017 Conference is scheduled to be held in Penrith from Thursday, 4 May to Saturday, 6 May 2017. The program outline is attached for your information.

Financial Implications

The registration cost per delegate is $1,177.00. Transport and accommodation and incidentals additional to the registration are estimated at $800.00 per delegate.

The conference will be funded from the Councillors’ Conference budget which has an allocation of $30,000 for 2016/17 with $ 20,708 currently available.

Policy

POL 025 – Payment of Expenses and Provision of Facilities to Councillors.

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We have leaders that represent us

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

N/A

|

1⇩. |

2017 ALGWA NSW Annual Conference - Program |

|

RP-4 National General Assembly - Call for Motions

Author: Hensley, Ingrid

Acting General Manager: Knight, Robert

|

Analysis: |

Endorsement of the Mayor’s attendance at the 2017 National General Assembly of Local Government Annual Conference as outlined in the report.

Consideration and endorsement of Motion’s to be submitted to the Australian Local Government Association for the 2017 National General Assembly of the Local Government under this year’s theme, “Building Tomorrow’s Communities’. |

|

That Council: a endorse submitting a motion/s to the National General Assembly of Local Government Annual Conference on 18 to 21 June 2017 b endorse the Mayor’s attendance at the conference |

Key Reasons

The National General Assembly (NGA) will be held at the National Convention Centre in Canberra from 18 to 21 June 2017.

The Australian Local Government Association (ALGA) Board is calling for motions for the 2017 NGA under this year’s theme, “Building Tomorrow’s Communities’.

This report provides an opportunity for Councillors to consider any motions for submission the ALGA. To be eligible for inclusion in the ALGA business papers, motions must follow the following criteria:

1. be relevant to the work of local government nationally

2. be consistent with the themes of the NGA

3. complement or build on the policy objectives of your state and territory local government association

4. be from a council which is a financial member of their state or territory local government association

5. propose a clear action and outcome

6. bot be advanced on behalf of external third parties that may seek to use the NGA to apply pressure to Board members to gain national political exposure for positions that are not directly relevant to the work of, or in the national interests of, local government

To assist Council in preparing motions, a discussion paper has been prepared by the ALGA. This paper provides background information on the theme and is designed to assist Councils in developing motions.

Motions must be received by the ALGA by 11.59pm on Friday 21 April 2017 via the online form on the NGA website.

Councillors may wish to consider submitting additional motions which align the conference themes.

Council is provided with one vote. Therefore it recommended that the Mayor represent Council at the 2017 National General Assembly.

Financial Implications

The estimated cost of the conference is $2,700 including conference registration, two conference dinners, three nights’ accommodation and associated out of pocket expenses. The conference will be funded from the Councillors’ Conference budget which has an allocation of $30,000 for 2016/17 with $ 20,708 currently available.

Policy

POL 025 Payment of Expenses and Provision of Facilities to Councillors Policy.

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We have leaders that represent us

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

N/A

|

1⇩. |

Discussion Paper - "Building Tomorrow’s Communities" |

|

RP-5 Audit and Risk Committee - Independent Member Remuneration

Author: Hensley, Ingrid

Acting General Manager: Knight, Robert

|

Analysis: |

It is recommended that Council confirm the remuneration fee rate for independent members of the Audit and Risk Committee. |

|

That Council endorse that remuneration fees for independent external members of Council’s Audit and Risk Committee remain unaltered. |

Key Reasons

At the Ordinary Council Meeting held 23 February 2015, Council resolved (Res 15/039):

That Council endorse that remuneration fees for independent external members of Councils (sic) Audit and Risk Committee remain unaltered for the term of this Council.

The term of the Council at the time of resolution ended upon the local government elections held September 2016. As a result, it is proposed that this Council reconfirm remuneration payable to independent members of Council’s Audit and risk Committee.

In March 2011, Council resolved the fee structure for the external members of the Audit and Risk Committee, based on qualifications, skills and time commitment required with the fees being:

|

Role |

Payment per meeting attended |

|

Chairperson |

$500 |

|

Independent Committee Member |

$400 |

This fee structure has remained unchanged since.

Whilst a review of the Committee’s remuneration is expected over the current term of Council, it is proposed that Council endorse the continuation of the current level of remuneration in the short term.

Financial Implications

The 2016/17 budget for the Audit and Risk Committee is $18,000. There is sufficient budget to allow for the 27 February 2017 appointment for four independent Committee members at the current remuneration fee rates. The future year budgets included in the Long Term Financial Plan are also sufficient to fund these ongoing appointments.

Policy

N/A

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We have leaders that represent us

Risk Management Issues for Council

The Audit and Risk Committee assists Council by monitoring its risk exposure and determining if management systems have appropriate risk management processes in place.

Internal / External Consultation

N/A

Report submitted to the Ordinary Meeting of Council on Monday 27 March 2017. RP-6

RP-6 POL 100 Fraud and Corruption Prevention Policy

Author: Hensley, Ingrid

Acting General Manager: Knight, Robert

|

Analysis: |

Amendments to Council’s Fraud and Corruption Prevention Policy POL 100 are presented to Council for endorsement and placement on public exhibition. |

|

That Council: a receive the draft POL 100 Fraud and Corruption Prevention Policy b endorse the draft POL 100 Fraud and Corruption Prevention Policy and place on public exhibition for a period of 28 days and invite public submissions on the draft policy c receive a further report following the public exhibition period: (i) addressing any submissions made in respect of the proposed policy (ii) proposing adoption of the policy unless there are any recommended amendments deemed to be substantial and requiring a further public exhibition period |

Key Reasons

A review of Council’s Fraud and Corruption Prevention Policy POL 100 has been undertaken in line with a review of Council’s underlying fraud management framework and recent changes within the organisation.

Council’s fraud management arrangements were assessed against the Fraud Control Improvement Kit developed by the Audit Office of NSW and Australian Standard AS8001-2008 Fraud and Corruption Control. This has resulted in amendments to the Fraud and Corruption Policy, Fraud and Corruption Prevention Framework and development of a Fraud Action Plan for the 2017 calendar year.

The Policy’s objectives below have been amended in line with Council’s risk appetite that there is no appetite for internal fraud, corruption, collusion or theft:

· To promote an organisational culture that will not tolerate any action of fraud or corruption

· To ensure high standards of ethical and accountable conduct

· To protect public funds and assets

· To protect the integrity, security and reputation of Council and its staff

Other changes within the document include high level details of the process for Councillors, staff and members of the public to report any suspicions of wrongdoing.

The attached draft POL 100 Fraud and Corruption Prevention Policy, together with the draft Fraud and Corruption Prevention Framework and Fraud Action Plan, were considered by the Audit and Risk Committee at its meeting of 16 February 2017.

To allow community feedback on the Policy, it is recommended that the Policy be placed on public exhibition for a period of 28 days.

Financial Implications

N/A

Policy

POL 100 Fraud and Corruption Prevention Policy

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

Council is committed to the formal, systematic and proactive management of risks, including the risk of fraud. The Fraud and Corruption Prevention Policy establishes council’s approach to managing fraud risks and establishes clear objectives to ensure that Council Officials and those that do business with Council are aware of and understand their responsibility for managing that risk.

Internal / External Consultation

Consultation has occurred with the Executive Team and Council’s Audit and Risk Committee.

|

1⇩. |

Draft POL 100 Fraud and Corruption Policy |

|

RP-7 City of Wagga Wagga Cultural Protocols

Author: Scully, Madeleine

Sector Manager: Summerhayes, Janice

|

Analysis: |

Council’s Aboriginal and Torres Strait Islander Cultural Protocols provide a comprehensive resource for Councillors and Council staff to use when liaising, consulting and engaging with the Aboriginal and Torres Strait Islander community. The protocols have been significantly revised and updated to align with national best practice. |

|

That Council: a endorse the revised Aboriginal and Torres Strait Islander Cultural Protocols: A guide for Councillors and Council staff b place on public exhibition for a period of 28 days from 28 March 2017 to 24 April 2017 and invite public submissions on the document c receive a further report following the public exhibition period: i addressing any submissions made in respect of the revised protocols |

Key Reasons

Contemporary Best Practice

Council’s current Aboriginal and Torres Strait Islander Cultural Protocols were adopted in 2010. During the period since this adoption, community expectations and best practice standards for Local, State and Federal Government in relation to cultural protocols have undergone significant changes. These changes are reflected in the revised protocols and include clear guidance for Councillors and Council staff when liaising, consulting and engaging with the Aboriginal and Torres Strait Islander community.

Financial Implications

N/A

Policy

N/A

Link to Strategic Plan

Community Place and Identity

Objective: We are proud of where we live and our identity

Outcome: We have a strong sense of place

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

External consultation with local Aboriginal and Torres Strait Islander community members including Aunty Isobel Reid on behalf of the Mawang Gaway Aboriginal Consultative Group to ensure content is correct, culturally appropriate and in alignment with the Community Protocols document developed by Mawang Gaway.

External review with other Local Government areas for bench marking on the development of cultural protocols for Local Government and adherence to National best practice.

During the public exhibition period staff will engage with the community by:

· placing the document on Council’s website

· seeking comment from our registered Your Say users

· utilise social media advertising

· create a Council News story

· issue media releases

· undertake further individual and small group engagement with Aboriginal and Torres Strait Islander community members

|

1⇩. |

City of Wagga Wagga Aboriginal Torres Strait Cultural Protocols - Provided under separate cover. |

|

Report submitted to the Ordinary Meeting of Council on Monday 27 March 2017. RP-8

RP-8 Suspension of Alcohol Free and Prohibited Alcohol Consumption Zones for Events

Author: Hamilton, Fiona

Sector Manager: Summerhayes, Janice

|

Analysis: |

This report is to request that Council suspend the alcohol free and prohibited alcohol consumption zones for specific 2017 events. |

|

That Council endorse the suspension of the alcohol free and prohibited alcohol consumption zones in the area detailed in the attached map for the following two events: · Gears and Beers – 30 September and 1 October 2017 · Wagga Live – 31 December 2017 |

Key Reasons

This report has been raised by the Events Team in an effort to reduce last minute reports to Council requesting the suspension of alcohol free and prohibited alcohol consumption zones for events where alcohol is being served. Two events have been identified requiring suspension of the alcohol free and prohibited alcohol consumption zones in 2017 as detailed below:

· Gears and Beers is a community event held in the Victory Memorial Gardens. The event will commence on Saturday 30 September 2017 with the arrival of a large number of riders to the City and registrations from 4pm-10:30pm with the main event held on Sunday 1 October 2017 from 11am to 5pm.

· Wagga Live is also a community event which is held within the Civic Precinct to celebrate the commencement of the New Year. This event is held on 31 December 2017.

The public roads surrounding the area where these events are to be held fall within the existing alcohol free and prohibited alcohol consumption zones. Section 645 of Local Government Act 1993 provides Council with the power to cancel or suspend the alcohol free and prohibited alcohol consumption zones during its period of operation, so that Council may respond to a situation which may occur within the zones. Council must pass resolution to suspend or cancel a particular zone.

The recommendation is to suspend the existing alcohol free and prohibited alcohol consumption zones in the area bound by Tarcutta Street, Morrow Street, Fitzmaurice Street, Johnston Street and Ivan Jack Drive (refer to attached map) on the following dates:

· Gears and Beers from 4pm-10:30pm Saturday 31 September and 10am to 9pm Sunday 1 October 2017.

· Wagga Live from 12 noon 31 December 2017 to 1am 1 January 2018.

The Wagga Local Area Licencing Constable (NSW Police) has been advised and further consultation will occur with NSW Police after the Council resolution. Council must publish a public notice of the suspension. There is no requirement to remove the alcohol free signs for the period of the suspension.

Financial Implications

N/A

Policy

Part 4 Section 645 of Local Government Act 1993.

Link to Strategic Plan

Safe and Healthy Community

Objective: We are safe

Outcome: We create safe spaces and places

Risk Management Issues for Council

1. Collection of glass and debris after the event

2. Risk of injury due to broken glass

Internal / External Consultation

1. Internal – Finance and City Compliance

2. External – Respective Event Organisers/NSW Police

|

1⇩. |

Alcohol Free Zone Map |

|

RP-9 Membership of Riverina Regional Tourism

Author: Hamilton, Fiona

Sector Manager: Summerhayes, Janice

|

Analysis: |

In mid-2016 Destination NSW announced a restructure of regional tourism to ensure the effectiveness of regional marketing, funding and governance of regional tourism entities over the next four years and beyond. This included the establishment of six (6) Destination Networks, funded through the state government with the key mandate of doubling visitation rates across NSW. City of Wagga Wagga falls under the Riverina Murray Destination Network (RMDN).

Riverina Regional Tourism (RRT), the existing regional tourism organisation, is seeking membership funds from all Local Government Area (LGA) members for the 2017/18 financial year with a $27,927 contribution from City of Wagga Wagga to continue its operations under a new entity to be formed by 30 June 2017, despite Destination NSW forming the new Destination Networks to replace existing local tourism boards.

RRT plans to wind up its existing operation and replace with a new entity comprising the same membership base and fee structure, to commence 1 July 1017.

Taste Riverina is a key flagship event for the RMDN region and will continue to be supported this year. Destination NSW has provided $20,000 in funding for that event this year and the RMDN operational staff will provide other marketing and promotional support for the event as well. RRT has requested $5,000 of our membership fee go towards Taste Riverina 2017.

The proposal from RRT is deemed to be a direct duplication of the new Riverina Murray Destination Network’s resources and activities and there are concerns around governance and transparency of process. RRT have requested confirmation of City of Wagga Wagga’s membership intentions by 4 April 2017.

|

|

That Council: a discontinue with the paid financial membership of RRT (or any proposed new entity) b continue to work collaboratively with LGA’s in the region and RMDN on projects including the support of Taste Riverina 2017 with a $5,000 financial contribution from City of Wagga Wagga in 2017/18 c utilise remaining membership/product development funds for investment in tourism initiatives supported by both our City and the new RMDN, a range of matched funding is available including DNSW event funding, DNSW Tourism Product Development, ARTN Funding and Department of Industry Tourism funding d put forward an Expression of Interest to host the RMDN staff in suitable and available City of Wagga Wagga office space |

Key Reasons

· Duplication of activity and resources – The retention of the existing local tourism board will result in duplication of resources and effort as the new established state network RMDN, which fully funds three full time staff based within the region, their role is to increase visitation through regional campaigns, develop the Destination Management Plan, work with LGAs to improve product and be the conduit through to DNSW. The RMDN does not require any membership fees from Council’s. The proposed function of the new local tourism board will duplicate many of these activities.

· New Entity - RRT are winding up as recommended by the State but have discussed with its members to effectively form an entity operating under the same model, focusing on promoting the Riverina. The entity is yet to be formed and RRT are requesting a membership fee with a determination by Councils by April 4th 2017. Given there is no clear difference to the newly formed Destination Riverina Murray Network we are unable to make a recommendation to invest in a model that is fee paying and appears to duplicated key functions of the Destination Riverina Murray Network.

· Sound governance processes – there is concern over the transparency of how the proposed operating budget of $200,000 would be administered and put in place for the proposal by RRT in establishing a new entity. This is based on the dollar value of the operating budget and requirements on all Councils to undertake open, robust, and transparent procurement processes that ensures accountability to the community.

· State Government Investment - The State Government is demonstrating strong support for the State’s regional tourism industry with unprecedented levels of investment and our efforts should be focussed on the opportunities presented through this avenue rather than expending effort supporting past tourism models that have been ineffective due to a significant proportion of their funding going towards administration rather than core tourism activity.

Financial Implications

The Visitor Economy Product Development budget for the 2017/18 financial year is $27,000. It is proposed for $5,000 to be committed to Taste Riverina 2017 during the 2017/18 financial year, with the remaining $22,000 to be invested in tourism initiatives aligned to the new Destination Management Plan to be undertaken by RDMN in consultation with City of Wagga Wagga.

Policy

N/A

Link to Strategic Plan

Growing Economy

Objective: We are a tourist destination

Outcome: We promote our city and villages

Risk Management Issues for Council

Financial Risk – investment in RRT does not align to the current state government tourism framework and drive, so there is risk that funds invested will not add value.

Negative Perception Risk – risk of negative perception by RMDN and State Government if continue to support out dated/unsupported local tourism board model.

Regulatory/Compliance Risk – obligation to operate in a transparent manner, RRT’s proposal does not demonstrate an open and transparent process in relation to proposed operations.

Internal / External Consultation

· Destination New South Wales

· Riverina Murray Destination Network Chair

· Riverina Regional Tourism

|

1⇩. |

RRT Proposed Operations 2017/18 |

|

|

2⇩. |

Destination Network Overview - Provided under separate cover. |

|

|

3⇩. |

Destination Riverina Murray - Review of RRT Proposal sent to General Managers 13 March 2017 |

|

RP-10 Airport Advisory Committee - Terms of Reference

Sector Manager: Somerville, Paul

|

Analysis: |

This report presents the outcomes of consultation on the draft Terms of Reference (TOR) with the proposed members of the Airport Advisory Committee (Committee). The report is seeking endorsement of the representation on the Committee and the Terms of Reference for the Committee to enable the Committee to be formed and commence to function. |

|

That Council: a endorse the attached Terms of Reference (TOR) for the Airport Advisory Committee (Committee) b appoint two Councillors as voting members of the Committee c invite the following organisations to nominate a representative as a voting member of the Committee: · Qantas Airlines · Regional Express Airlines (Rex) · JetGo · Wagga Wagga Business Chamber d invite the Department of Defence to nominate a representative as a non-voting member of the Committee e invite expressions of interest for two aviation industry representatives as non-voting members of the Committee |

Key Reasons

Consultation Process and Feedback

Council has invited feedback on the draft TOR from:

· Qantas

· Rex

· JetGo

· Department of Defence

· Wagga Wagga Business Chamber

The feedback obtained has been as follows:

Qantas

· Confirmed their intent to be represented on the Committee.

· No further feedback relating to the draft Terms of Reference.

· Noted that they would also like to reserve the right to alter their representative for future meetings if there is a more appropriately skilled person based on the objectives of the committee to attend on behalf of Qantas.

Regional Express

· Confirmed their intent to be represented on the Committee

· Increase the scope of the Committee to:

o review the financial performance of each financial year and propose the annual budget of the airport for Council adoption.

o review the operational and financial efficiencies of the airport regarding headcount as well as the operational management structure of the airport.

· There are too many voting members. The bulk (99%) of the budget is provided by Qantas and Rex so we should restrict the voting rights to Qantas, Rex, Councillor representatives and the Business Chamber.

· The minutes of each meeting need to be approved by all voting members.

Jetgo

· Confirmed their intent to be represented on the Committee.

· JetGo has a long history in Regional aviation and look forward to contributing to the future of Wagga Wagga Airport and the broader community.

· Noted that from a procedural nature, it may not be possible for all members to attend every meeting in person but should still have the opportunity to provide agenda items for discussion and review the minutes.

Department of Defence

· Confirmed their intent to be represented on the Committee.

· RAAF Commandant advised that they do not think it would appropriate for the Defence representative to be voting member of the Committee. As part of the federal government they would not be comfortable voting on proposals.

· What they would like to be able to do is participate in the process and provide Defence advice, as the landlord, a major neighbour and a user of the airfield. They would also appreciate the opportunity to provide formal feedback on proposals, limited of course to any Defence-related implications.

Wagga Wagga Business Chamber

· Confirmed their intent to be represented on the Committee

· No further feedback relating to the draft Terms of Reference.

Proposed Changes

A marked up version of the TOR is attached to the report which details the amended draft for Council endorsement.

In summary, taking into consideration the feedback received, the changes are as follows:

Section 3 – Purpose and Objectives, an additional purpose is added:

Provide oversight on the financial performance, annual budget (including fees) and the ten year financial plan for the airport

Section 5 – Function and Role, two additional functions are added:

1. To consider the draft budget and proposed fees for the forthcoming financial year and recommend to Council for public exhibition and adoption.

2. To review the financial performance of the airport and provide recommendations on improving financial performance through increasing passenger numbers and gaining operational efficiencies

Section 6 – Membership

The Department of Defence and Aviation Industry Participants are moved from ‘voting’ members to ‘non-voting’ members.

Financial Implications

N/A

Policy

POL 117 – Appointment of Organisation, Community and Individual Citizen Members to Council Committees.

Link to Strategic Plan

Growing Economy

Objective: We are a Regional Capital

Outcome: We have complete and accessible transport networks, building infrastructure, improving road travel reliability, ensure on-time running for public transport

Risk Management Issues for Council

The Committee is established under S355 of the Local Government Act and the authority of the Committee is limited to an advisory capacity only.

Internal / External Consultation

As detailed above.

|

1⇩. |

Airport Advisory Committee - Terms of Reference (FINAL DRAFT) March 2017 |

|

RP-11 Financial Performance Report as at 28 February 2017

Author: Rodney, Carolyn

Sector Manager: Te Pohe, Natalie

|

Analysis: |

This report is for Council to consider and approve the proposed 2016/17 budget variations required to manage the 2016/17 budget and Long Term Financial Plan, and details Council’s external investments and performance as at 28 February 2017. |

|

That Council: a approve the proposed 2016/17 budget variations for the month ended 28 February 2017 and note the deficit budget of ($14K) as presented in this report b note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above c note details of the external investments as at 28 February 2017 in accordance with section 625 of the Local Government Act 1993 |

Key Reasons

An overall budget deficit of ($14K) is forecast for February 2017 which has resulted in no change to the reported January 2017 deficit.

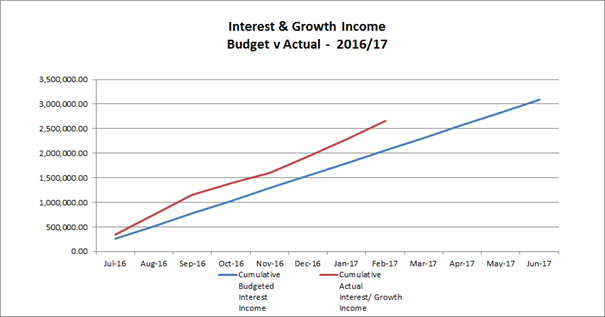

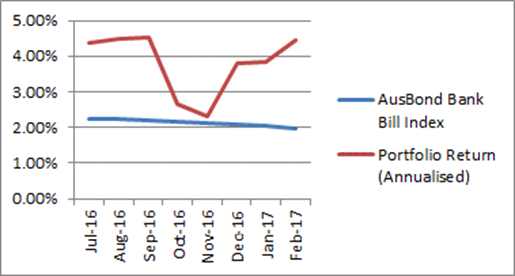

Council has experienced a positive monthly investment performance for the month of February which is mainly attributable to the continued strong growth period for Council’s Floating Rate Note (FRN) portfolio, with many of these investments trading at a premium.

Financial Implications

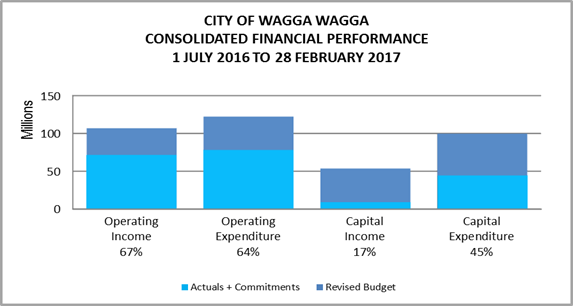

OPERATING INCOME

Total operating income is 67% of approved budget which is tracking to budget for the end of February (this percentage excludes capital grants and contributions). An adjustment has been made to reflect the levy of rates which occurred at the start of the financial year. Excluding this adjustment, operating income received is 85%.

OPERATING EXPENSES

Total operating expenditure is 64% of approved budget and is tracking to budget for the full financial year.

CAPITAL INCOME

Total capital income is 17% of approved budget. It should be noted that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions relating to projects.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 45% of approved budget. The RIFL Stage 1 contract commitment has been raised for $21M. Excluding this amount the total capital expenditure is 24% of approved budget.

|

CITY OF WAGGA WAGGA |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2016/17 |

COMMT'S 2016/17 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|

||||||

|

Rates & Annual Charges |

(60,642,286) |

0 |

(60,642,286) |

(40,757,497) |

0 |

(40,757,497) |

67% |

|

User Charges & Fees |

(23,631,263) |

57,916 |

(23,573,347) |

(14,574,307) |

0 |

(14,574,307) |

62% |

|

Interest & Investment Revenue |

(3,406,597) |

0 |

(3,406,597) |

(2,855,506) |

0 |

(2,855,506) |

84% |

|

Other Revenues |

(3,123,096) |

(32,284) |

(3,155,380) |

(2,086,747) |

0 |

(2,086,747) |

66% |

|

Operating Grants & Contributions |

(14,779,516) |

(1,377,582) |

(16,157,098) |

(11,419,937) |

85 |

(11,419,852) |

71% |

|

Capital Grants & Contributions |

(34,768,294) |

(20,776,047) |

(55,544,341) |

(11,756,941) |

0 |

(11,756,941) |

21% |

|

Total Revenue |

(140,351,052) |

(22,127,997) |

(162,479,049) |

(83,450,935) |

85 |

(83,450,850) |

51% |

|

|

|

||||||

|

Expenses |

|

||||||

|

Employee Benefits & On-Costs |

42,105,886 |

94,622 |

42,200,508 |

26,692,415 |

17,239 |

26,709,654 |

63% |

|

Borrowing Costs |

3,953,083 |

(157,682) |

3,795,402 |

1,867,992 |

0 |

1,867,992 |

49% |

|

Materials & Contracts |

2,722,383 |

3,430 |

2,725,813 |

7,070,128 |

1,015,677 |

8,085,805 |

297% |

|

Depreciation & Amortisation |

32,405,375 |

0 |

32,405,375 |

21,603,583 |

0 |

21,603,583 |

67% |

|

Other Expenses |

37,493,005 |

3,519,381 |

41,012,387 |

18,083,731 |

1,861,086 |

19,944,817 |

49% |

|

Total Expenses |

118,679,732 |

3,459,752 |

122,139,484 |

75,317,850 |

2,894,002 |

78,211,852 |

64% |

|

|

|

||||||

|

Net Operating (Profit)/Loss |

(21,671,319) |

(18,668,245) |

(40,339,565) |

(8,133,085) |

2,894,087 |

(5,238,998) |

|

|

|

|

|

|

|

|

|

|

|

Net Operating (Profit)/Loss before Capital Grants & Contributions

|

13,096,975 |

2,107,802 |

15,204,776 |

3,623,856 |

2,894,087 |

6,517,943 |

|

|

|

|

||||||

|

Cap/Reserve Movements |

|||||||

|

Capital Exp - Renewals |

24,265,446 |

9,066,396 |

33,331,842 |

7,837,919 |

5,146,820 |

12,984,740 |

39% |

|

Capital Exp - New Projects |

45,730,456 |

9,288,223 |

55,018,679 |

8,190,665 |

21,648,083 |

29,838,748 |

54% |

|

Capital Exp - Project Concepts |

8,264,763 |

590,044 |

8,854,807 |

23,251 |

0 |

23,251 |

0% |

|

Loan Repayments |

2,603,821 |

(173,623) |

2,430,198 |

1,620,131 |

0 |

1,620,131 |

67% |

|

New Loan Borrowings |

(13,859,917) |

7,992,810 |

(5,867,108) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(4,982,151) |

2,968,619 |

(2,013,532) |

(2,701,434) |

0 |

(2,701,434) |

134% |

|

Net Movements Reserves |

(7,945,724) |

(11,050,578) |

(18,996,301) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

54,076,694 |

18,681,890 |

72,758,584 |

14,970,532 |

26,794,903 |

41,765,435 |

57% |

|

|

|

||||||

|

Net Result after Depreciation |

32,405,375 |

13,645 |

32,419,020 |

6,837,446 |

29,688,991 |

36,526,437 |

|

|

|

|

||||||

|

Add back Depreciation Expense |

32,405,375 |

0 |

32,405,375 |

21,603,583 |

0 |

21,603,583 |

|

|

|

|

||||||

|

Cash Budget (Surplus)/Deficit |

(0) |

13,645 |

13,645 |

(14,766,137) |

29,688,991 |

14,922,854 |

|

Revised Budget Result - Surplus/(Deficit) |

$’000s |

|

Original 2016/17 Budget Result as adopted by Council Total Budget Variations approved as reported to 27 February 2017 Council Meeting Budget variations for February 2017 |

$0 ($14K)

$0 |

|

Proposed revised budget result for 28 February 2017 |

($14K) |

The proposed Budget Variations to 28 February 2017 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact Fav/ (Unfav) |

|

|

1 – We are an engaged and involved community |

||||

|

Alan Turner Depot Security Gate Upgrade |

$21K |

Maintain and Clean Culverts ($7K) Road Reserve Maintenance ($7K) Sewer Mains Plant Hire ($7K) |

Nil

|

|

|

The Alan Turner Depot requires the supply and installation of electric motors to the existing front entry gates and connection to the access control system. It is proposed to fund the works from existing culvert, road reserve and sewer plant hire budgets. |

||||

|

Mater Dei Primary School Pedestrian Safety |

$20K |

RMS Grant Funding ($20K) |

Nil

|

|

|

Council has been successful with RMS Grants for three (3) pedestrian safety projects that were resolved at the Traffic Committee Meeting held on 10 March 2016 and subsequent Council Meetings. The three (3) projects are Mater Dei Primary School ($20K in 2016/17), Kooringal High School ($40K in 2017/18) and Wagga Wagga High School ($50K in 2017/18). The 2017/18 grant funds will be incorporated into the Long Term Financial Plan along with the expenditure programs accordingly. |

||||

|

SURPLUS/(DEFICIT) |

|

|

($14K) |

|

Current Restrictions

|

CITY OF WAGGA WAGGA |

|||||

|

RESERVES SUMMARY |

|||||

|

28 FEBRUARY 2017 |

|||||

|

|

Approved Changes |

|

|

||

|

|

CLOSING BALANCE 2015/16 |

ADOPTED RESERVE TRANSFERS 2016/17 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 27.02.2017 |

RECOMM CHANGES for Council Resolution |

REVISED BALANCE |

|

|

|

||||

|

Externally Restricted |

|

||||

|

Developer Contributions |

(19,387,519) |

1,683,496 |

2,804,552 |

(14,899,470) |

|

|

Sewer Fund Reserves |

(21,286,523) |

2,385,453 |

3,526,563 |

(15,374,507) |

|

|

Solid Waste Reserves |

(12,803,085) |

751,764 |

271,273 |

(11,780,049) |

|

|

Specific Purpose Unexpended Grants/Cont |

(3,473,810) |

0 |

3,473,810 |

0 |

|

|

Stormwater Levy Reserves |

(2,537,418) |

(228,466) |

164,020 |

(2,601,864) |

|

|

Total Externally Restricted |

(59,488,355) |

4,592,247 |

10,240,218 |

0 |

(44,655,889) |

|

|

|

||||

|

Internally Restricted |

|

||||

|

Airport Reserve |

(202,674) |

(65,492) |

(31,851) |

(300,017) |

|

|

Art Gallery Reserve |

(48,490) |

(3,500) |

17,500 |

(34,490) |

|

|

Ashmont Community Facility Reserve |

(3,000) |

(1,500) |

0 |

(4,500) |

|

|

Bridge Replacement Reserve |

(646,667) |

140,000 |

420,000 |

(86,667) |

|

|

CBD Carparking Facilities Reserve |

(936,300) |

(94,195) |

60,537 |

(969,958) |

|

|

CCTV Reserve |

(54,476) |

(10,000) |

0 |

(64,476) |

|

|

Cemetery Perpetual Reserve |

(123,860) |

(89,661) |

200,000 |

(13,521) |

|

|

Cemetery Reserve |

(308,649) |

(136,637) |

271,552 |

(173,734) |

|

|

Civic Theatre Operating Reserve |

0 |

(100,000) |

0 |

(100,000) |

|

|

Civic Theatre Technical Infrastructure Reserve |

(55,450) |

(50,000) |

0 |

(105,450) |

|

|

Civil Projects Reserve |

(155,883) |

0 |

0 |

(155,883) |

|

|

Community Amenities Reserve |

(5,685) |

0 |

0 |

(5,685) |

|

|

Council Election Reserve |

(417,616) |

236,558 |

0 |

(181,058) |

|

|

Economic Development Incentives Reserve |

(19,500) |

0 |

0 |

(19,500) |

|

|

Employee Leave Entitlements Gen Fund Reserve |

(3,352,639) |

0 |

0 |

(3,352,639) |

|

|

Estella Community Centre Reserve |

(230,992) |

0 |

0 |

(230,992) |

|

|

Family Day Care Reserve |

(135,608) |

14,606 |

0 |

(121,002) |

|

|

Fit for the Future Reserve |

(952,184) |

388,225 |

(1,945,335) |

(2,509,294) |

|

|

Generic Projects Saving |

(927,180) |

(116,966) |

103,039 |

(941,106) |

|

|

Glenfield Community Centre Reserve |

(15,704) |

(2,000) |

0 |

(17,704) |

|

|

Grassroots Cricket Reserve |

(45,942) |

(15,000) |

0 |

(60,942) |

|

|

Gravel Pit Restoration Reserve |

(738,010) |

0 |

0 |

(738,010) |

|

|

Gurwood Street Property Reserve |

(50,454) |

0 |

0 |

(50,454) |

|

|

Industrial Land Development Reserve |

(328,851) |

0 |

0 |

(328,851) |

|

|

Information Services / E-Business Reserve |

(378,713) |

0 |

0 |

(378,713) |

|

|

Infrastructure Replacement Reserve |

(77,488) |

(887) |

28,233 |

(50,142) |

|

|

Insurance Variations Reserve |

(28,644) |

0 |

0 |

(28,644) |

|

|

Internal Loans Reserve |

(1,289,806) |

(629,241) |

444,842 |

(1,474,205) |

|

|

Lake Albert Improvements Reserve |

(113,972) |

0 |

113,789 |

(182) |

|

|

LEP Preparation Reserve |

(38,665) |

0 |

36,120 |

(2,545) |

|

|

Livestock Marketing Centre Reserve |

(8,095,560) |

3,215,056 |

1,675,773 |

(3,204,732) |

|

|

Lloyd Environmental Projects Reserve |

(101,371) |

0 |

0 |

(101,371) |

|

|

Museum Acquisitions Reserve |

(39,378) |

0 |

0 |

(39,378) |

|

|

Oasis Building Renewal Reserve |

(122,000) |

(50,000) |

121,000 |

(51,000) |

|

|

Oasis Plant Reserve |

(1,005,347) |

(110,000) |

0 |

(1,115,347) |

|

|

Parks & Recreation Projects |

(91,288) |

0 |

86,000 |

(5,288) |

|

|

Pedestrian River Crossing (old Riverside) Reserve |

(198,031) |

150,000 |

0 |

(48,031) |

|

|

Plant Replacement Reserve |

(5,145,588) |

(151,353) |

158,636 |

(5,138,305) |

|

|

Playground Equipment Replacement Reserve |

0 |

(51,230) |

0 |

(51,230) |

|

|

Project Carryovers Reserve |

(1,841,669) |

0 |

1,841,669 |

(0) |

|

|

Public Art Reserve |

(199,713) |

137,579 |

51,424 |

(10,711) |

|

|

Robertson Oval Redevelopment Reserve |

(86,697) |

0 |

0 |

(86,697) |

|

|

Senior Citizens Centre Reserve |

(11,627) |

(2,000) |

0 |

(13,627) |

|

|

Silverlite Reserve |

(29,980) |

0 |

0 |

(29,980) |

|

|

Sister Cities Reserve |

(30,914) |

(10,000) |

5,000 |

(35,914) |

|

|

Stormwater Drainage Reserve |

(473,996) |

0 |

290,378 |

(183,618) |

|

|

Strategic Real Property Reserve |

(5,136) |

0 |

(314,073) |

(319,209) |

|

|

Street Lighting Replacement Reserve |

(44,755) |

(30,000) |

0 |

(74,755) |

|

|

Subdivision Tree Planting Reserve |

(195,795) |

40,000 |

0 |

(155,795) |

|

|

Sustainable Energy Reserve |

(430,442) |

(90,000) |

0 |

(520,442) |

|

|

Traffic Committee Reserve |

0 |

(50,000) |

0 |

(50,000) |

|

|

Unexpended External Loans Reserve |

(163,087) |

0 |

0 |

(163,087) |

|

|

Total Internally Restricted |

(29,995,474) |

2,462,361 |

3,634,233 |

0 |

(23,898,879) |

|

|

|

||||

|

Total Restricted |

(89,483,829) |

7,054,608 |

13,874,452 |

0 |

(68,554,769) |

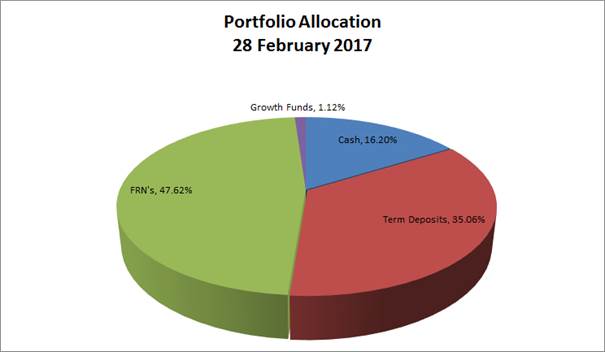

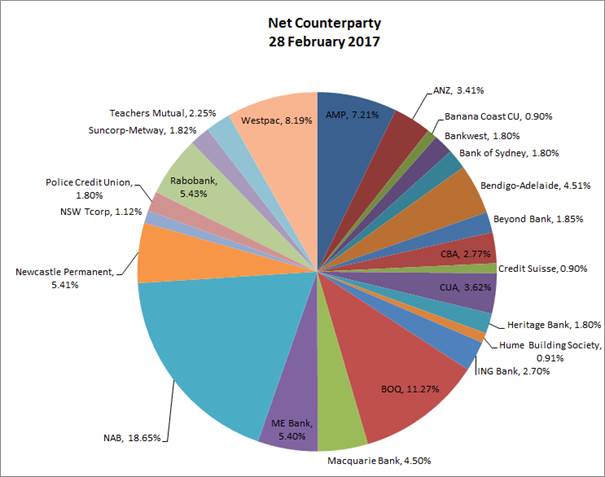

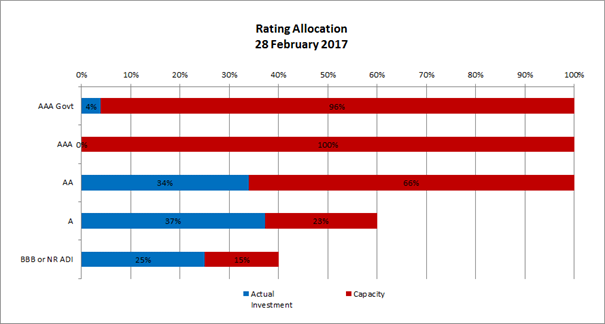

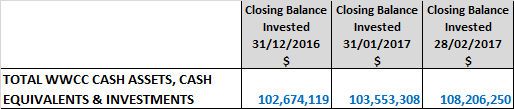

Investment Summary as at 28 February 2017

In accordance with Clause 212 of the Local Government (General) Regulation 2005, details of Council’s external investments are detailed below:

|

Institution |

Rating |

Closing Balance |

Closing Balance |

February |

February |

Investment |

Maturity |

Term |

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

2.87% |

0.90% |

6/12/2016 |

6/12/2017 |

12 |

|

BOQ |

A- |

2,000,000 |

2,000,000 |

2.75% |

1.80% |

2/09/2016 |

4/04/2017 |

7 |

|

BOQ |

A- |

2,000,000 |

2,000,000 |

2.80% |

1.80% |

7/12/2016 |

7/07/2017 |

12 |

|

Bank of Sydney |

NR |

2,000,000 |

2,000,000 |

2.75% |

1.80% |

30/09/2016 |

29/09/2017 |

12 |

|

CUA |

BBB+ |

1,000,000 |

1,000,000 |

2.80% |

0.90% |

9/02/2017 |

5/01/2018 |

11 |

|

NAB |

AA- |

1,000,000 |

1,000,000 |

2.74% |

0.90% |

25/10/2016 |

25/05/2017 |

7 |

|

ME Bank |

BBB+ |

1,000,000 |

0 |

0.00% |

0.00% |

23/02/2016 |

22/02/2017 |

12 |

|

AMP |

A+ |

2,000,000 |

2,000,000 |

3.00% |

1.80% |

2/08/2016 |

2/08/2017 |

12 |

|

BOQ |

A- |

1,000,000 |

1,000,000 |

2.80% |

0.90% |

7/11/2016 |

8/05/2017 |

6 |

|

Bankwest |

AA- |

2,000,000 |

2,000,000 |

2.50% |

1.80% |

3/02/2017 |

4/04/2017 |

2 |

|

ME Bank |

BBB+ |

2,000,000 |

2,000,000 |

2.80% |

1.80% |

16/12/2016 |

16/10/2017 |

10 |

|

Total Short Term Deposits |

|

17,000,000 |

16,000,000 |

2.78% |

14.39% |

|

|

|

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

2,228,318 |

2,829,235 |

1.50% |

2.54% |

N/A |

N/A |

N/A |

|

NAB |

AA- |

13,176,106 |

14,898,632 |

2.19% |

13.40% |

N/A |

N/A |

N/A |

|

AMP |

A+ |

0 |

0 |

0.00% |

0.00% |

N/A |

N/A |

N/A |

|

AMP |

A+ |

179,894 |

180,231 |

2.15% |

0.16% |

N/A |

N/A |

N/A |

|

Beyond Bank |

BBB+ |

74,386 |

74,443 |

1.00% |

0.07% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

30,781 |

37,774 |

0.00% |

0.03% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

15,689,485 |

18,020,315 |

2.07% |

16.20% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

RaboBank |

A+ |

1,000,000 |

1,000,000 |

6.40% |

0.90% |

23/04/2012 |

24/04/2017 |

60 |

|

RaboBank |

A+ |

1,000,000 |

1,000,000 |

5.90% |

0.90% |

4/06/2012 |

5/06/2017 |

60 |

|

BOQ |

A- |

1,000,000 |

1,000,000 |

6.30% |

0.90% |

22/08/2012 |

22/08/2017 |

60 |

|

ING Bank |

A- |

3,000,000 |

3,000,000 |

6.00% |

2.70% |

24/08/2012 |

24/08/2017 |

60 |

|

Hume Building Society |

NR |

1,009,123 |

1,009,123 |

4.10% |

0.91% |

21/08/2014 |

21/08/2017 |

36 |

|

Banana Coast CU |

NR |

1,000,000 |

1,000,000 |

4.25% |

0.90% |

3/06/2014 |

2/06/2017 |

36 |

|

ME Bank |

BBB+ |

2,000,000 |

2,000,000 |

4.28% |

1.80% |

2/09/2014 |

2/09/2019 |

60 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

4.10% |

0.90% |

5/12/2014 |

5/12/2019 |

60 |

|

Beyond Bank |

BBB+ |

990,000 |

990,000 |

3.70% |

0.89% |

4/03/2015 |

4/03/2018 |

36 |

|

Beyond Bank |

BBB+ |

990,000 |

990,000 |

3.70% |

0.89% |

11/03/2015 |

11/03/2018 |

36 |

|

AMP |

A+ |

2,000,000 |

2,000,000 |

3.10% |

1.80% |

2/06/2015 |

2/06/2017 |

24 |

|

AMP |

A+ |

1,000,000 |

1,000,000 |

3.10% |

0.90% |

13/07/2015 |

13/07/2017 |

24 |

|

Bendigo-Adelaide |

A- |

1,000,000 |

1,000,000 |

2.80% |

0.90% |

1/09/2015 |

3/03/2017 |

18 |

|

Newcastle Permanent |

BBB+ |

1,000,000 |

1,000,000 |

3.00% |

0.90% |

12/08/2016 |

12/08/2019 |

36 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

3.20% |

0.90% |

25/08/2016 |

25/08/2021 |

60 |

|

Newcastle Permanent |

BBB+ |

1,000,000 |

1,000,000 |

3.00% |

0.90% |

31/08/2016 |

30/08/2019 |

36 |

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

2.90% |

0.90% |

8/09/2016 |

10/09/2018 |

24 |

|

Newcastle Permanent |

BBB+ |

0 |

2,000,000 |

3.00% |

1.80% |

10/02/2017 |

11/02/2019 |

24 |

|

Total Medium Term Deposits |

|

20,989,123 |

22,989,123 |

4.14% |

20.67% |

|

|

|

|

Institution |

Rating |

Closing Balance |

Closing Balance |

February |

February |

Investment |

Maturity |

Term |

|

Floating Rate Notes - Senior Debt |

|

|

|

|

|

|

|

|

|

Macquarie Bank |

A |

3,007,389 |

3,002,181 |

BBSW + 290 |

2.70% |

9/03/2012 |

9/03/2017 |

60 |

|

CUA |

BBB+ |

1,004,742 |

1,006,540 |

BBSW + 130 |

0.91% |

28/05/2014 |

20/03/2017 |

34 |

|

Bendigo-Adelaide |

A- |

1,002,475 |

1,006,493 |

BBSW + 93 |

0.91% |

17/09/2014 |

17/09/2019 |

60 |

|

BOQ |

A- |

2,005,480 |

2,013,760 |

BBSW + 110 |

1.81% |

5/08/2014 |

24/06/2019 |

58 |

|

BOQ |

A- |

1,000,039 |

1,002,655 |

BBSW + 107 |

0.90% |

6/11/2014 |

6/11/2019 |

60 |

|

BOQ |

A- |

1,006,249 |

1,004,813 |

BBSW + 107 |

0.90% |

10/11/2014 |

6/11/2019 |

60 |

|

ME Bank |

BBB+ |

1,005,587 |

1,000,884 |

BBSW + 100 |

0.90% |

17/11/2014 |

17/11/2017 |

36 |

|

ME Bank |

BBB+ |

1,000,269 |

1,000,464 |

BBSW + 100 |

0.90% |

17/11/2014 |

17/11/2017 |

36 |

|

Teachers Mutual |

BBB+ |

1,004,669 |

999,719 |

BBSW + 105 |

0.90% |

4/12/2014 |

4/12/2017 |

36 |

|

Newcastle Permanent |

BBB+ |

1,006,160 |

1,001,380 |

BBSW + 110 |

0.90% |

27/02/2015 |

27/02/2018 |

36 |

|

Macquarie Bank |

A |

2,008,181 |

2,007,185 |

BBSW + 110 |

1.80% |

3/03/2015 |

3/03/2020 |

60 |

|

ANZ |

AA- |

750,110 |

754,344 |

BBSW + 82 |

0.68% |

17/04/2015 |

17/04/2020 |

60 |

|

Heritage Bank |

BBB+ |

998,220 |

1,000,680 |

BBSW + 115 |

0.90% |

7/05/2015 |

7/05/2018 |

36 |

|

NAB |

AA- |

1,001,674 |

1,000,809 |

BBSW + 80 |

0.90% |

3/06/2015 |

3/06/2020 |

60 |

|

Heritage Bank |

BBB+ |

998,220 |

1,000,680 |

BBSW + 115 |

0.90% |

9/06/2015 |

7/05/2018 |

35 |

|

CBA |

AA- |

1,002,884 |

1,009,125 |

BBSW + 90 |

0.91% |

17/07/2015 |

17/07/2020 |

60 |

|

Westpac |

AA- |

1,001,700 |

1,007,990 |

BBSW + 90 |

0.91% |

28/07/2015 |

28/07/2020 |

60 |

|

Bendigo-Adelaide |

A- |

1,006,200 |

1,003,950 |

BBSW + 110 |

0.90% |

18/08/2015 |

18/08/2020 |

60 |

|

Credit Suisse |

A |

1,006,690 |

1,002,670 |

BBSW + 105 |

0.90% |

24/08/2015 |

24/08/2018 |

36 |

|

Bendigo-Adelaide |

A- |

1,006,025 |

1,004,104 |

BBSW + 110 |

0.90% |

28/09/2015 |

18/08/2020 |

59 |

|

Westpac |

AA- |

2,000,983 |

2,013,091 |

BBSW + 90 |

1.81% |

30/09/2015 |

28/07/2020 |

58 |

|

Suncorp-Metway |

A+ |

1,006,976 |

1,011,971 |

BBSW + 125 |

0.91% |

20/10/2015 |

20/10/2020 |

60 |

|

Westpac |

AA- |

4,027,000 |

4,054,160 |

BBSW + 108 |

3.65% |

28/10/2015 |

28/10/2020 |

60 |

|

AMP |

A+ |

1,813,500 |

1,818,558 |

BBSW + 110 |

1.64% |

11/12/2015 |

11/06/2019 |

42 |

|

CBA |

AA- |

1,009,813 |

1,016,339 |

BBSW + 115 |

0.91% |

18/01/2016 |

18/01/2021 |

60 |

|

BOQ |

A- |

1,001,653 |

1,004,276 |

BBSW + 100 |

0.90% |

5/02/2016 |

5/02/2018 |

24 |

|

Rabobank |

A+ |

2,043,588 |

2,039,086 |

BBSW + 150 |

1.83% |

4/03/2016 |

4/03/2021 |

60 |

|

Newcastle Permanent |

BBB+ |

1,008,074 |

1,010,498 |

BBSW + 160 |

0.91% |

22/03/2016 |

22/03/2019 |

36 |

|

CUA |

BBB+ |

2,012,088 |

2,017,092 |

BBSW + 160 |

1.81% |

1/04/2016 |

1/04/2019 |

36 |

|

ANZ |

AA- |

1,011,234 |

1,018,385 |

BBSW + 118 |

0.92% |

7/04/2016 |

7/04/2021 |

60 |

|

Suncorp-Metway |

A+ |

1,010,361 |

1,016,116 |

BBSW + 138 |

0.91% |

21/04/2016 |

12/04/2021 |

60 |

|

AMP |

A+ |

1,016,045 |

1,014,327 |

BBSW + 135 |

0.91% |

24/05/2016 |

24/05/2021 |

60 |

|

Westpac |

AA- |

1,013,660 |

1,019,820 |

BBSW + 117 |

0.92% |

3/06/2016 |

3/06/2021 |

60 |

|

CBA |

AA- |

1,010,877 |

1,017,539 |

BBSW + 121 |

0.91% |

12/07/2016 |

12/07/2021 |

60 |

|

ANZ |

AA- |

2,022,255 |

2,020,213 |

BBSW + 113 |

1.82% |

16/08/2016 |

16/08/2021 |

60 |

|

BOQ |

A- |

1,502,613 |

1,512,746 |

BBSW + 117 |

1.36% |

26/10/2016 |

26/10/2020 |

48 |

|

NAB |

AA- |

1,001,188 |

1,008,109 |

BBSW + 105 |

0.91% |

21/10/2016 |

21/10/2021 |

60 |

|

Teachers Mutual |

BBB+ |

1,500,416 |

1,504,143 |

BBSW + 140 |

1.35% |

28/10/2016 |

28/10/2019 |

36 |

|

Bendigo-Adelaide |

A- |

1,005,432 |

1,002,921 |

BBSW + 110 |

0.90% |

21/11/2016 |

21/02/2020 |

39 |

|

Westpac |

AA- |

0 |

1,009,340 |

BBSW + 111 |

0.91% |

7/02/2017 |

7/02/2022 |

60 |

|

Total Floating Rate Notes - Senior Debt |

|

51,840,719 |

52,959,155 |

|

47.62% |

|

|

|

|

Managed Funds |

|

|

|

|

|

|

|

|

|

NSW Tcorp |

NR |

1,228,958 |

1,244,899 |

1.30% |

1.12% |

17/03/2014 |

1/02/2022 |

94 |

|

Total Managed Funds |

|

1,228,958 |

1,244,899 |

1.30% |

1.12% |

|

|

|

|

TOTAL

CASH ASSETS, CASH |

|

106,748,285 |

111,213,493 |

4.45% |

100.00% |

|

|

|

|

LESS: RIVERINA REGIONAL LIBRARY (RRL) CASH |

|

3,194,978 |

3,007,242 |

|

|

|

|

|

|

TOTAL

WWCC CASH ASSETS, CASH |

|

103,553,308 |

108,206,250 |

|

|

|

|

|