Ordinary Meeting of

Council

Ordinary Meeting of

Council

To be held on

Monday 24 April 2017

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

Ordinary Meeting of

Council

Ordinary Meeting of

Council

To be held on

Monday 24 April 2017

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 24 April 2017 at 6.00pm.

Mr Robert Knight

Acting General Manager

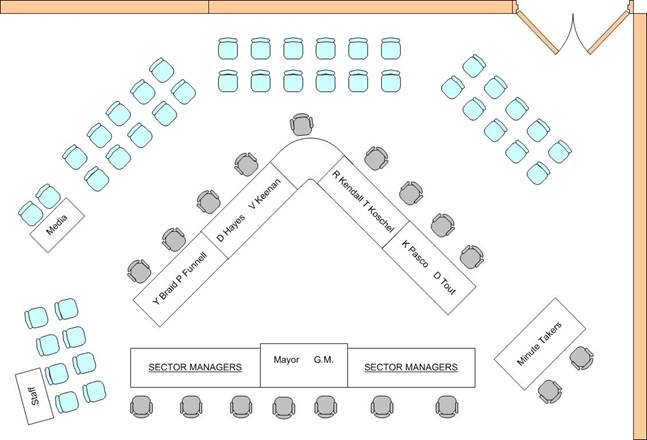

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 24 April 2017.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 24 April 2017

ORDER OF BUSINESS:

CLAUSE PRECIS PAGE

PRAYER 3

ACKNOWLEDGEMENT OF COUNTRY 3

APOLOGIES 3

CONFIRMATIONS OF MINUTES

CM-1 Ordinary Council Meeting - 27 March 2017 3

CM-2 Extraordinary Council Meeting - 3 April 2017 3

DECLARATIONS OF INTEREST 4

Mayoral Minutes

MM-1 Mayoral Minute - Group 9 Rugby League Sponsorship Request 5

MM-2 Mayoral Minute - Samoa vs NSW Country - Rugby League World Cup Practice Match 7

Motions Of Which Due Notice Has Been Given

NOM-1 Items on Display for Public Feedback 9

Reports from Staff

RP-1 Responses to Questions/Business With Notice 11

RP-2 Planning Proposal To Amend The Wagga Wagga Local Environmental Plan 2010 - Land At Old Bomen Road & East Street, Cartwrights Hill 14

RP-3 Response to Notice of Motion - Planning Task Force 30

RP-4 Slalom Water Skiing Proposal for Lake Albert 35

RP-5 Community Engagement Relating to the Proposed BMX Pump Track at Emblen Park 39

RP-6 Remote Control car track proposal 49

RP-7 Integrated Planning and Reporting - draft suite of documents 58

RP-8 Financial Performance Report and Quarterly Budget Review as at 31 March 2017 75

RP-9 Airport Advisory Committee - Terms of Reference 94

RP-10 POL 089 Provision of Information to and Interaction between Councillors and Staff Policy 106

RP-11 Audit, Risk and Improvement Committee Charter 111

RP-12 Engineering Guidelines for Subdivisions and Development Standards 126

RP-13 Sealing of Tooyal Road 127

RP-14 ACQUISITION OF CROWN LAND AT BOMEN 130

RP-15 Disability Inclusion Action Plan 2017-2021 133

RP-16 Section 356 Donation - Wagga Women's Health Centre 137

RP-17 Section 356 Donation Request - Estella Easter Family Event 141

Committee Minutes

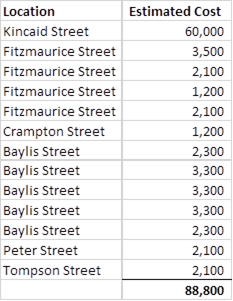

M-1 Traffic Committee Minutes and Summary - Meeting held 9 March 2017 147

M-2 Floodplain Risk Management Advisory Committee Minutes - 6 December 2016 and 22 February 2017 167

QUESTIONS/BUSINESS WITH NOTICE 178

Confidential Reports

CONF-1 RFT2017/16 Riverside Walking Track Construction Wiradjuri 179

CONF-2 RFT2017-516 Supply of One Wheel Loader 180

CONF-3 RFT2017/22 CLEANING OF COUNCIL BUILDINGS 181

CONF-4 RFQ2017/529 DENSELY GRADED ASPHALT SUPPLY & LAY 182

CONF-5 APPOINTMENT OF ADVISORY COMMITTEE MEMBERS 183

CONF-6 Extraordinary Audit and Risk Committee Minutes - 23 March 2017 184

Confirmation of Minutes

CM-1 Ordinary Council Meeting - 27 March 2017

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 27 March 2017 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - Ordinary Council Meeting - 27 March 2017 |

185 |

CM-2 Extraordinary Council Meeting - 3 April 2017

|

That the Minutes of the proceedings of the Extraordinary Council Meeting held on 3 April 2017 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - Extraordinary Council Meeting - 3 April 2017 |

217 |

Report submitted to the Ordinary Meeting of Council on Monday 24 April 2017. MM-1

MM-1 Mayoral Minute - Group 9 Rugby League Sponsorship Request

|

Analysis: |

Group 9 Rugby League requested Council extend its support as a sponsor of the Group 9 Rugby League Grand Final for a further three years. The previous sponsorship arrangement was provided between 2013 and 2016. |

|

That Council: a commit $1,000 for one year sponsorship (2017/2018) to Group 9 Rugby League b encourage Group 9 Rugby League to submit an application in the Annual Grants program for future years |

Key Reasons

· Council has been a sponsor of the Group 9 Rugby League Grand Final for the last three years (2013-2016)

· Council provided $1,000 per year which supported the official Grand Final program with a full page colour advertisement marketing the city as a city of sports as well as the inclusion of a mayoral message.

· In November 2016 Group 9 requested Council extend its support as a sponsor of the Group 9 Rugby League Grand Final for a further three years

· Staff are currently reviewing policies which will enable requests such as these to be determined based on a clear criteria

· Recommend that Council provide sponsorship for this year’s Grand Final while the policies are being reviewed

· Encourage Group 9 Rugby League to consider submitting an application through our annual grants program for future years as an option

Financial Implications

This proposed $1,000 sponsorship is suggested to be funded from within the Parks and Recreation operating budgets.

Policy

N/A

Link to Strategic Plan

Growing Economy

Objective: We are a Regional Capital

Outcome: We attract and support local businesses and industry

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

Consultation has occurred with staff, Councillors and Group 9 officials.

Report submitted to the Ordinary Meeting of Council on Monday 24 April 2017. MM-2

MM-2 Mayoral Minute - Samoa vs NSW Country - Rugby League World Cup Practice Match

|

Analysis: |

NSW Country Rugby League has recently made an approach regarding the hosting of a Ruby League game between Samoa and a NSW Country team. This game will be a practice match for the Samoan team prior to the 2017 Rugby League World Cup.

It is proposed that the game would be held either on 13 or 14 October 2017. Country Rugby League has requested financial support and assistance in the delivery of the event. The estimated cost of delivering the event is approximately $30,000 per team. |

|

That Council provide $14,415 support to the event that includes: i $2,500 contribution to assist in the covering of event costs ii $3,000 in additional infrastructure costs (toilets, fencing, etc) iii $4,000 in in-kind staff support (planning, setup, pack up and venue management) iv $2,675 of in-kind promotion through City of Wagga Wagga’s website and social media v $2,240 donation of the ground hire fee in accordance with the Section 356 of the Local Government Act 1993 |

Key Reasons

· This event would see the Samoan International Rugby League team (currently ranked 4th in the world) play in Wagga Wagga. This team will feature a number of current National Rugby League players.

· In addition to playing the game the Samoan team will complete other community engagement activities.

· It is expected the game will attract spectators from across the Riverina.

· Wagga Rugby League will be given the catering and beverage rights to the game as well as the opportunity to sell the grandstand seating. The funds generated from these activities will be invested into the development of local sporting facilities.

· The City of Wagga Wagga will receive recognition through the significant media coverage and live streaming of the event.

Financial Implications

It is proposed that the cash and in-kind contributions be funded from within the existing Parks and Recreation and Events operating budgets.

The ground hire donation would be funded from the 2017/18 S356 donation budget.

Policy

Recreation and Open Space Strategy

Link to Strategic Plan

Safe and Healthy Community

Objective: We promote a healthy lifestyle

Outcome: We promote participation across a variety of sports and recreation

Risk Management Issues for Council

No specific issues have been identified.

Internal / External Consultation

Internal consultation has occurred with staff, Country Rugby League, Group 9 Rugby League and Wagga Rugby League.

Motions Of Which Due Notice Has Been Given

NOM-1 Items on Display for Public Feedback

Author: Councillor Dan Hayes

|

Analysis: |

Council is committed to community consultation to ensure community members are part of Council’s decision-making process. Members of the public/community are encouraged to take the opportunity to read, examine or make comments on items that have been placed on public exhibition or which are open for public comment.

|

|

That Council receive a report at the May 2017 or June 2017 Ordinary Meeting of Council outlining how decisions are made on which documents are put on public display for comment, when they affect the provision of services to the community. The report to take into account other aspects of the decision-making and project management process, including key milestones, which influence the nature and extent of community consultation, including legislative and procurement requirements in addition to industry best practice. |

Public comment on Council projects and policies allows Council to consider community opinion into final documentations or decisions.

Community consultation in relation to a final draft is an important stage in increasing transparency and accountability for Councillors in the final decision-making process, in matters to be decided by Council.

Some items are placed on public exhibition or are part of a community consultation process, while others are not. An easily understandable process and/or policy which outlines how decisions are made in what goes out for public display, and what does not, will increase transparency.

A Report which takes into account a review by Council of its current process will assist a determination of whether this remains the best approach, including at what stage further consultation may be warranted.

To improve Councillor accountability and involvement, quarantining decisions on service changes from other elements of the process such as tender decisions may help achieve this.

Financial Implications

N/A

Policy

N/A

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We are informed and involved in decision making

Outcome: Everyone in our community feels they have been heard and understood

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

N/A

Report submitted to the Ordinary Meeting of Council on Monday 24 April 2017. RP-1

RP-1 Responses to Questions/Business With Notice

Author: Ingrid Hensley

Acting General Manager: Robert Knight

|

Analysis: |

The following are Responses to Questions/Business with Notice arising from the Ordinary Council meeting on 27 March 2017. |

|

That Council receive and note the report outlining responses to Questions/Business with Notice. |

Key Reasons

The Report below addresses the Questions/Business with Notice raised during the Ordinary Council Meeting held Monday, 27 March 2017.

1. Councillor D Hayes asked if staff are looking at the roadside reserves grants and requested further information?

Response provided by the Community Sector

Funding is being sought under the roadside reserves grant. The project brief submitted is to develop a comprehensive Roadside Management Framework for the Wagga Wagga Local Government Area for implementation by December 2018. As studies have documented, the value of well-managed roadside reserves can deliver varied benefits to council via:

· Cost savings: reduced maintenance costs by decreasing the need for mowing and weed control, stabilising banks and preventing road pavement waterlogging

· Safety: reducing road accidents by decreasing headlight glare, reducing driver monotony and highlighting road delineation

· Environment: seed source, wildlife habitat and habitat connectivity for threatened species and endangered ecological communities that are not represented in National Parks

· Community and commercial uses: scenic amenity, shelter, shade and privacy, horse riding, cycling and walking, activities such as bee keeping, travelling stock routes, rest stops and associated business opportunities

· Lower our risk exposure to legal or compliance action from inadequate management of our roadside vegetation, which encompasses large stretches of Endangered Ecological Communities.

If staff are successful in the funding a detailed project plan will be finalised to prepare and implement a Roadside Management Framework, which will allow staff to manage in an evidenced and more targeted way for roadside reserves. Without a Roadside Management Framework responses are in an adhoc way across our network.

2. Councillor D Hayes asked if staff are looking at Smart Cities and requested further information?

Response provided by the General Manager

City of Wagga Wagga staff have been holding internal discussions around the recently announced ‘Smart Cities Plan” which includes $50M of funding in the Smart Cities and Suburbs Program. An internal working group has been set-up to develop a “Smart Vision” and list of potential smart enabling projects for the regional city of Wagga Wagga which will use Smart Technology and Infrastructure to deliver high economic and social impacts to the city. The group have met and held initial brainstorming discussions with technology and communication providers to discuss which types of smart investments in new technology might have the highest economic and social impacts for the city.

The group is also examining the potential to develop a more ambitious proposal for the larger “City Deals” initiative and have completed desktop research on the recent successful examples of city deals such as Launceston / University of Tasmania, Townsville, Sunshine Coast and Manchester (UK). The City deal initiative might deliver a more holistic and higher impact for delivering future economic and employment growth for the city.

Councillors and other stakeholders will be heavily engaged in this process over the coming weeks.

3. Councillor D Hayes raised a query if any Council staff attended the PFOS contamination meeting, and if so, can Councillors receive an update on this in the Councillors bulletin?

Response provided by the Community Sector

The requested information was provided to Councillors through the bulletin on Friday, 31 March 2017. Information relating to the community walk-in sessions can be found through the following link:

Financial Implications

N/A

Policy

Code of Meeting Practice

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

N/A

Report submitted to the Ordinary Meeting of Council on Monday 24 April 2017. RP-2

RP-2 Planning Proposal To Amend The Wagga Wagga Local Environmental Plan 2010 - Land At Old Bomen Road & East Street, Cartwrights Hill

Author: Tristan Kell

Sector Manager: Natalie Te Pohe

|

Analysis: |

This report is for a Planning Proposal to amend the Wagga Wagga Local Environmental Plan 2010. Council at an Ordinary meeting held on 27 March 2071 resolved to defer considering the planning proposal to allow staff to engage with the proponent of an adjoining property. |

|

That Council: a receive and note the report on the proposed amendment to the Wagga Wagga Local Environmental Plan 2010 b adopt the planning proposal c use Council’s delegated authority to gazette the plan and notify the Department of Planning & Environment of the decision |

Key Reasons

Council at it’s Ordinary meeting held on Monday, 27 March 2017 resolved to defer consideration of the Planning Proposal until 24 April 2017. This was to allow City Officers to consult with the proponent of an adjoining property.

A copy of the Council report and the planning proposal is attached.

The planning proposal is to rezone Deferred Matter Area 1 to R5 Large Lot Residential with a one hectare minimum lot size and Deferred Matter Area 2 to RU1 Primary Production with a two-hundred (200) hectare minimum lot size. The Cartwrights Hill Precinct Map for noise and odour is to be extended to include Deferred Matter Area 1 & 2.

The Manager City Strategy subsequently held a meeting with Mr Kerry Christie and Mr Garry Salvestro from Salvestro Planning on Tuesday 28 March 2017. Mr Christie was advised that City Officers would not support incorporating his parcel of land within PP_2016_WAGGA_001_00. Mr Christie would need to lodge a separate Planning Proposal. Gateway Determination is specifically for Deferred Matter Areas 1 & 2.

A separate planning proposal would require:

i. Relevant Council fee

ii. Consistency with NSW A Guide to Preparing Planning Proposal

iii. Impact of Bomen Industry and Bomen Industrial Sewage Treatment Facility (BISTIF) on new residential dwellings odour and noise

iv. Strategic Merit

v. Impact on Industrial Activity

vi. Environmental Protection Agency Consultation

In advice received from the Department of Planning & Environment, Officers were advised that if Council were to consider altering the outcomes of the existing Gateway determination for the deferred land at Cartwrights Hill to include new development areas, it would require a revised Gateway determination.

Furthermore, the Department advised that any new or revised planning proposal for new residential areas in the vicinity of the deferred areas of Cartwrights Hill would need to be publicly exhibited.

The Department encouraged the Council to complete the planning process for the existing deferred areas in Cartwrights Hill. Any new proposed development area needs to be considered as a separate planning proposal.

If Council resolves to amend the existing planning proposal, the issuing of a revised Gateway determination and the subsequent need for re-exhibition of the planning proposal would significantly delay the completion of the proposed rezoning of deferred areas at Cartwrights Hill.

Mr Christie was formerly notified when his parcel of land was in the process of being re-zoned in 2013. Mr Christie indicated that he intended to subdivide his property. The Report to the Southern Joint Regional Planning Panel indicated that Mr Christie was informed that no further subdivision could take place once 62 Old Bomen Road, Cartwright’s Hill was zoned RU6, Rural Transition, which was gazetted in May 2015.

Mr Christie has provided Officers with information (attached) associated with LEC14/10415, which indicates the noise and odour impact on 62 Old Bomen Road. City Technical Experts have viewed the information provided by the consultant and are concerned that additional onus would be placed on industry in Bomen. Officers noted further information would be required prior to being in a position to assessing a planning proposal.

The letter of notification sent out to property owners (21 January 2017) in the vicinity, in accordance with the public exhibition requirements, included Teys Australia. Teys management have since informed City officers that the letter was not received by their head office and have subsequently provided a submission. It should be noted that in order to ensure all correspondence is received by head office, Teys have identified their Group Environmental Manager as the key contact for future correspondence via email.

While the submission is outside of the public exhibition period, it is still relevant to the current matter. The Teys submission opposes the re-zoning of land associated with the 23 lots and any further subdivision at Cartwrights Hill and is attached to this report.

Financial Implications

N/A

Policy

Environmental Planning and Assessment Act 1979

Wagga Wagga Local Environmental Plan 2010

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

Internal consultation has been undertaken with the LEP Working Group

Public exhibition occurred in accordance with the Environmental Planning and Assessment Act, 1979

A meeting was held between the Manager City Strategy, Mr Kerry Christie and Mr Garry Salvestro

|

1⇩. |

Odour Map |

|

|

2⇩. |

Planning Proposal - Provided under separate cover |

|

|

3⇩. |

Salvestro Submission |

|

|

4⇩. |

Noise Contour Map |

|

|

5⇩. |

Teys Submission |

|

|

6⇩. |

Council Report |

|

RP-3 Response to Notice of Motion - Planning Task Force

Author: Tristan Kell

Sector Manager: Natalie Te Pohe

|

Analysis: |

This report is provided in response to the Notice of Motion presented by Councillor Pascoe at the Ordinary Council Meeting on 27 March 2017. |

|

That Council: a note the approximate timeframes and update on Strategic Planning matters b in accordance with the Policy responses contained within the Wagga Wagga Spatial Plan 2013/2043, resolve to accept planning proposals for Greenfield subdivisions within the containment line identified within the Spatial Plan once the Activation Strategy has been adopted by the Council c continue to accept or prepare planning proposals for the following: i Planning Anomalies or inconsistencies within the Wagga Wagga LEP 2010 ii Amendments to the Wagga Wagga LEP 2010 that have positive economic or social impact pursuant to the consideration of the Policy and Strategy Committee on 12 August 2013 and subsequent Council Resolution on 26 August 2013 |

Key Reasons

At the Ordinary Council meeting on 30 May 2016 Councillors resolved:

That Council endorse the scope of work and timelines of the Planning Task Force as outlined in this report.

The scope within the report provided to Council on 30 May 2016 included the following:

· Conduct relevant strategic work (as outlined below)

· Review and amend the Local Environmental Plan 2010 (LEP)

· Review and amend / rewrite the Development Control Plan 2010 (DCP)

· Review and implement new Developer Contribution Plans (inclusive of Section 94, Section 94A and Section 64).

At the Ordinary Council meeting on 27 March 2017 Councillors resolved:

That Council receive a report at the 24 April 2017 Ordinary Council meeting, in relation to the purpose, constituency and deliverables of the Planning Task Force as outlined in the scope of works adopted in May 2016.

The following is provided in response to the resolution from the Ordinary Council meeting on 27 March 2017.

Purpose and Constituency of the Planning Task Force

In March 2016 the General Manager, Alan Eldridge committed to fast tracking an overhaul of the City of Wagga Wagga’s planning framework. The Planning Task Force was established to project manage this process in a timely manner to meet the needs of the community and to address previous commitments made.

The Planning Task Force was an internal temporary group of staff members formed to implement the specific project scope as identified in the report to Council on 30 May 2016. The Planning Task Force has recently dissolved as a result of the restructure and responsibility for the scope of works has transitioned to the City Strategy Division.

Update on Deliverables of the Planning Task Force

During the time the task force was in place a number of key actions were taken to progress the key projects identified to be completed as part of the planning task force. Progress included:

§ Development of Wagga View for the Community Strategic Plan.

§ Commencement of the logging of all development control plan and local environmental plan errors to be included in the review.

§ Preparation of a background document capturing relevant information that would inform the development of a Residential Strategy.

§ Preparation of a background document capturing relevant information that would inform the development of a Village Strategy.

§ Commencement of the draft Village Strategy.

§ Consultation with 9 villages and 3 rural communities to inform the Village Strategy.

Progress to date has seen the Wagga View: Community Strategic Plan 2040 endorsed by the Council in February 2017, along with assisting in the development of the Activation Strategy.

Update on Approximate Timeframes for Contribution Plans

Section 94 Plan

· Priorities are being determined in alignment with the draft Transport and Recreation, Open Space and Community Strategies. A draft works schedule has been developed

· A full reconciliation of the existing plan has been completed which details completed works, works to be carried over, works to be abandoned etc.

· A consultant has been selected to undertake the complex elements of the plan including the apportionment of cost between developer contributions and ratepayers

· Review of administrative clauses – there is a desire to simplify the language in the plan

· Legal advice obtained on reallocating funds from the existing plan into the priorities contained in a new Section 94 Plan

· Target date for Councillor Workshop – July 2017.

Section 94A Plan

· Review of administrative clauses – there is a desire to simplify the language in the plan

· Reduce the works schedule items to a few high profile items – Bomen enabling roads and the Riverside are the key priorities

· Target date for Councillor Workshop – July 2017.

Sewer Development Servicing Plan

· Immediate priority is to provide an addendum to the existing plan to capture the development areas in Bomen

· Key desire to increase flexibility around timing and splitting of payments at the subdivision stage to ensure the charge properly reflects the impact of new development on our sewer systems

· GHD have been engaged to prepare the addendum for Bomen and coordinate the master planning process for our sewer infrastructure

· New Sewer DSP to be prepared following the master planning process

· Review of administrative clauses – there is a desire to simplify the language in the plan

· Target date for completion of Bomen addendum is June 2017.

Stormwater DSP

· GHD have been engaged to coordinate the master planning process for our stormwater infrastructure

· New Stormwater DSP to be prepared following the master planning process

· Review of administrative clauses – there is a desire to simplify the language in the plan

· Target date for completion of draft Stormwater DSP is August 2017.

Update on Approximate Timeframes for Delivery for City Strategy

|

Planning Document |

Timeframe |

|

Community Strategic Plan |

Endorsed Feb 2017 |

|

Draft Integrated Transport Strategy and Plan |

August 2017 – Presented to Council for adoption |

|

Draft Recreation, Open Space and Community Strategy and Plan |

July 2017 – Council for public exhibition October 2017 – Council for adoption |

|

Draft Wagga Activation Strategy |

July 2017 – Council for public exhibition October 2017 – Council for adoption and subsequently accept planning proposals for Greenfield development sites if adopted. |

|

Wagga LEP Anomalies |

July 2017 – Presented to Council to commence gateway process |

|

Wagga DCP Review |

June 2018 – Present to Council for public consultation |

|

Comprehensive LEP |

Commence review June 2018 |

While it is suggested that planning proposals for Greenfield developments are only accepted after the adoption of the Activation Strategy, it is proposed that amendments to the Wagga Wagga LEP 2010 that have positive economic or social impact are considered moving forward.

This is consistent with consideration by the Policy and Strategy Committee on 12 August 2013 with RP-13: Process for Consideration and Submission of Planning Proposals to Amend the Wagga Wagga Local Environmental Plan 2010 which recommended the following:

That Council:

a endorse the process of submitting two Planning Proposals per year

b consider the submission of additional Planning Proposals under Section 73A of the Environmental Planning and Assessment Act 1979 or Planning Proposals that have significant positive economic or social impact as detailed in the body of the report

This recommendation was then adopted by the Council at the 26 August 2013 meeting whereby the Council resolved the following:

That the Minutes of the Policy and Strategy Committee Meeting held on 12 August 2013 be confirmed and recommendations numbered CM-1, RP-1 to RP-11, RP-13, M-1 to M-3 contained therein be adopted excluding RP-12, RP-14.

Financial Implications

There are no specific financial implications with the provision of this update.

Policy

Wagga View: Community Strategic Plan 2040

Development Contributions Plans (Section 94, 94A and 64)

Planning Agreements Policy 2006

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Wagga Wagga Spatial Plan 2013-2043

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We plan long term

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

The City Strategy Division has undertaken workshops with Councillors, Industry and State Government Agencies whereby positive feedback has been received.

Report submitted to the Ordinary Meeting of Council on Monday 24 April 2017. RP-4

RP-4 Slalom Water Skiing Proposal for Lake Albert

Author: Ben Creighton

Sector Manager: Natalie Te Pohe

|

Analysis: |

The City of Wagga Wagga has received a request from Wagga Wagga Watersports Inc. for land owner’s approval to lodge a development application for the development of a slalom water skiing course on the western side of Lake Albert (Attachment 1).

This proposal was initially reviewed by NSW Roads and Maritime Services before being referred to Council to determine the development approval process. City planning officers have since undertaken a review (inclusive of seeking legal advice) which has determined that the proposed facility will require development consent.

During discussions on this matter it was noted by Wagga Watersports officials that:

“The ideal scenario would be to have it set up semi-permanent for extended periods outside of the peak summer holiday period. If that is deemed not suitable then to leave the sunken course in place on the lake bed (does not obtrude off the lake floor) with necessary signage alerting users of the 'structure' location.

We are a club that will be maintaining the area and would be holding events such as the Malibu series that will attract national and even world level competitors and spectators.

Being the City of Good Sports, I am sure we can come up with a solution to develop another fantastic sporting facility, for the city to show off and lure even more tourism to the town.” |

|

That Council: a refuse the request to provide land owners approval for the construction of a permanent or sunken slalom water skiing course on Lake Albert b authorise land owners consent if Wagga Wagga Watersports Inc choose to lodge a development application for the temporary event usage of Lake Albert for a slalom water skiing course |

Key Reasons

Lake Albert is a popular community recreational asset where community access should be retained as much as possible.

If a permanent course is constructed it will be used exclusively by members of the Wagga Watersports Club and event competitors. This would be enforced by an exclusion zone identified by marker buoys to limit public access.

A sunken course has the potential to impact on other recreation activities such as fishing where lines and lures could easily become entangled on sunken cables.

Other organisations that hold events at Lake Albert use temporary courses that can be setup and pulled down at the end of an event. Slalom courses can also be managed in this manner however it is acknowledged that this creates significant additional work for officials and volunteers.

The ownership of the land under the proposed course location is split between the Wagga Wagga Country Club and Crown Land where Council is the trustee. In order for a development application to be lodged, land owners approval would be required from all parties.

Staff support the temporary closure and use of Lake Albert for Slalom skiing events in accordance with the process used by other user groups.

Financial Implications

N/A

Policy

Lake Albert Management Plan

Recreation and Open Space Strategy

Link to Strategic Plan

Safe and Healthy Community

Objective: We promote a healthy lifestyle

Outcome: We promote participation across a variety of sports and recreation

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

Internal consultation has been held with the City Strategy and City Development teams.

External consultation has been held with the Wagga Wagga Watersports Inc., Maritime Services and the Water for Lake Albert community group which is made up of stakeholders and residents.

|

1⇩. |

Proposed Slalom Course Location |

|

RP-5 Community Engagement Relating to the Proposed BMX Pump Track at Emblen Park

Author: Ben Creighton

Sector Manager: Natalie Te Pohe

|

Analysis: |

Council received a petition in response to a proposed Pump/BMX Bike Track planned for Emblen Park in Tolland. At the December 2016 Ordinary Meeting of Council it was resolved that Council receive a report on the matter following further community engagement. |

|

That Council: a note the outcomes of the further consultation and community engagement b approve the construction of a BMX pump track at Emblen Park in Tolland in a revised position |

Key Reasons

During mid-2016 City of Wagga Wagga staff (staff) submitted a grant application to build a BMX pump track at Emblen Park (Attachment 1). This facility was proposed following an inspection of an existing facility between Huthwaite and Maher Streets which found the facility to be in poor condition and in need of upgrade or replacement (Attachment 2). It was determined that Emblen Park was a better location for this facility when considering “Safer by Design” principles and site accessibility.

Staff were advised of the successful grant application during September 2016 with the budget variation approved at the October 2016 Ordinary Meeting of Council.

During November 2016, 300 flyers were delivered to the local residents informing them of the proposed plans and inviting them to provide feedback. Feedback was received via 11 phone calls and emails of which eight were negative, two were positive and one was neutral. In addition, a petition was received comprising of 57 signatures opposed to the plan which was presented to the Council at the December 2016 Ordinary Meeting.

A joint community consultation session with Housing NSW was held in March 2017 to allow residents to ask questions and provide further feedback on the project. This was promoted via a mail out to residents (720 letters sent), the City of Wagga Wagga’s social media and via Council News. A number of written responses were received at this session with mixed views on the merit of the project (Attachment 3). The City has subsequently received submissions from a number of stakeholders and service delivery organisations that operate within this area (Attachment 4-6).

Discussion points raised during the consultation against the proposal were:

· Increased traffic, noise and rubbish generated by users

· Possible increase in crime and anti-social behaviour in the area

· A lack of supervision of children using the track

· A preference to upgrade the existing track between Huthwaite and Maher Streets

· Possible effect on property values

· A preference for Emblen Park to be kept as a quiet park (walking with irrigation)

Discussion points raised during the consultation for the development were:

· The proposed track was a great way to engage the young people

· The visibility of the track means kids are safer than at the existing track

· The facility would provide added incentive for kids to play outside

· The facility would be a good activity to keep kids out of trouble

In exploring the concerns further with the residents it has been identified that most concerns relate to broader social issues and the perception this project will increase their impact on the surrounding areas.

Based on advice from the Local Area Command, the City will incorporate a cable fence around the perimeter of the track to prevent access from small motorcycles, and investigate the installation of sensor security lighting. However it should be noted that the sensor security lighting is not incorporated within the current budget and staff will explore the option of obtaining additional grant funding.

Whilst acknowledging the concerns raised by the residents the benefits the facility can provide the community are significant. To address some of the concerns raised staff propose to make an adjustment to the location of the facility to make it more central within the park. This will move the facility further from houses while still achieving the high visibility from Bruce Street.

The benefits of the Emblen Park development are:

· The area is a large open area with clearances from residents and roadways

· It has good passive surveillance by passing traffic and residents

· Parents could provide passive surveillance from the playground area

· It would enhance and improve an underutilised open space

· This area has high levels of disadvantaged youth

· It provides the community with a low cost activity for youth

· It will enhance opportunities for healthy lifestyles and community participation

Financial Implications

The total project budget, as reported to Council at the 31 October 2016 Council meeting is $81K, with a $50K grant from the State Government Social Housing Community Improvement fund and $31K from within the City’s operating budgets.

If this project does not proceed, staff will attempt to negotiate with the funding body to redirect the funds to alternative projects within the city’s social housing estates. If the negotiations are unsuccessful the funding agreement will have to be terminated.

Policy

N/A

Link to Strategic Plan

Safe and Healthy Community

Objective: We promote a healthy lifestyle

Outcome: Recreation is a part of everyday life

Risk Management Issues for Council

The risks associated with implementing this project relate to process, cost, environmental, WHS and contractor performance. These risks are addressed as part of the City of Wagga Wagga’s project management and contractor performance management systems.

Internal / External Consultation

Internal consultation has been undertaken with staff from the City’s Operations, Planning, Governance and City Strategy Divisions.

External Consultation has been undertaken with:

· Community and Residents

· Housing NSW

· NSW Police

· Australian Red Cross

|

1⇩. |

Proposed Emblen Park Pump Track Location |

|

|

2⇩. |

Existing Tolland Bike Track Location |

|

|

3. |

Community Consultation Feedback This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: personnel matters concerning particular individuals. |

|

|

4⇩. |

Tolland Community Centre - Letter of Support |

|

|

5⇩. |

Police Letter of Support |

|

|

6⇩. |

Clontarf Letter of Support |

|

RP-6 Remote Control car track proposal

Author: Ben Creighton

Sector Manager: Natalie Te Pohe

|

Analysis: |

Wagga Wagga Remote Control Car Club Inc. has approached staff with a proposal to license land for the construction of a remote control race track and associated facilities at Rawlings Park on Angel Street (Attachment One). |

|

That Council: a endorse Wagga Wagga Remote Control Cars Inc. to use part of Lots 8 & 9 Section F DP7231 in Angel Street, Lake Albert for the development of a remote control car race track b enter into a licence agreement with Wagga Wagga Remote Control Cars Inc. upon the following terms: i Property – part Lots 8 & 9 Section F DP7231 in Angel Street, Lake Albert ii Term – five (5) years on a commencement date to be agreed iii Rental – in accordance with Council’s minimum community rent as set out Council’s Revenue and Pricing Policy c note that some elements of the proposal may be subject to development consent d delegate authority to the General Manager or their delegate to execute all necessary documents on behalf of Council |

Key Reasons

Wagga Wagga Remote Control Cars Inc. formed in late 2016 with the purpose of conducting, promoting and administering remote control car racing in the local area (Attachment Two).

The proposed site in Angel Street has a RE1 zoning which is an appropriate zone for this activity. A site inspection by staff has also determined that this site is suitable (Attachment Three).

The request from Wagga Wagga Remote Control Cars Inc is for use of the land. There has been no request for a Council funding contribution as the club has access to funding which will allow for the facilities construction.

If this facility is developed there will be opportunities for the club to attract events to the city with up to 200 competitors.

This proposal will provide an additional recreational activity that is not currently catered for within the city.

Staff will continue to liaise with representatives of the club to ensure that all the required development approvals are obtained and that the development will not detract from surrounding facilities.

Financial Implications

N/A

Policy

Recreation and Open Space Strategy 2005-2015

Link to Strategic Plan

Safe and Healthy Community

Objective: We promote a healthy lifestyle

Outcome: We promote participation across a variety of sports and recreation

Risk Management Issues for Council

The risks associated with implementing this project relate to process, cost, environmental and Work Health and Safety. These risks are addressed as part of the City of Wagga Wagga’s project management and contractor performance management systems.

Internal / External Consultation

Internal Consultation has been undertaken with staff from Council’s Operations, Property and City Strategy Divisions.

|

1⇩. |

WWRCC Rawlings Park Proposal |

|

|

2⇩. |

WWRCC Statement of Purpose |

|

|

3⇩. |

WWRCC Proposed Licence Area |

|

Report submitted to the Ordinary Meeting of Council on Monday 24 April 2017. RP-6

![]()

RP-7 Integrated Planning and Reporting - draft suite of documents

Author: Tristan Kell

Sector Manager: Natalie Te Pohe

|

Analysis: |

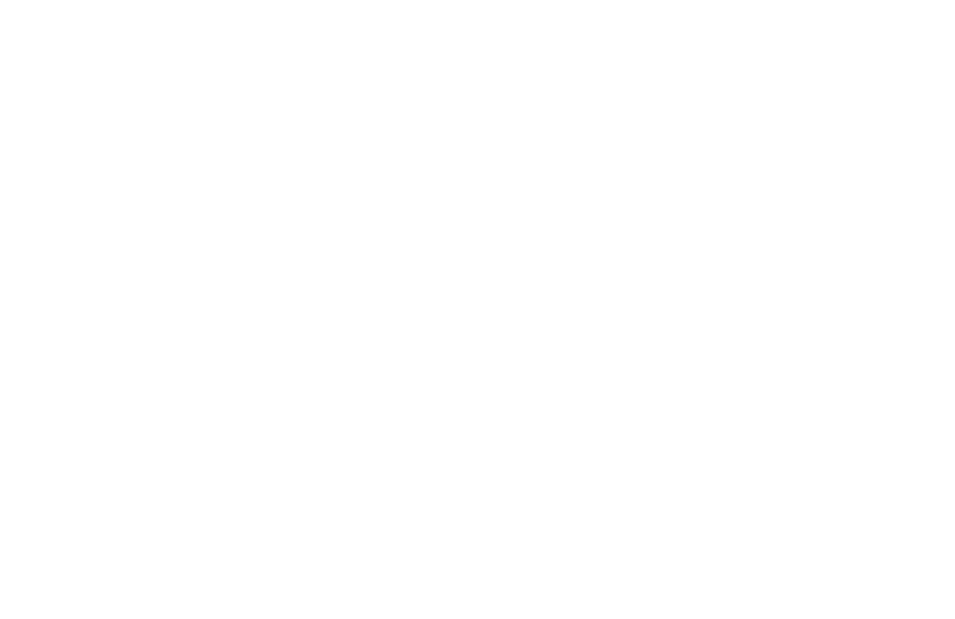

This report addresses the City of Wagga Wagga’s obligations in ensuring legislative compliance and meeting the requirements of the Office of Local Government in adopting and implementing the Integrated Planning and Reporting Framework. |

|

That Council: a place the following documents on public exhibition for 28 days commencing 27 April 2017 and concluding on 24 May 2017: i draft Workforce Plan 2017/21 ii draft Asset Management Plans: Buildings, Recreational Assets, Sewer, Stormwater and Transport Infrastructure Networks 2017/18 iii draft combined Delivery Program and Operational 2017/18 iv draft Fees and Charges for the financial year 2017/18 v draft Long Term Financial Plan 2017/27 b receive submissions from the community in relation to these documents throughout the exhibition period c consider a further report addressing the submissions received at the Council meeting on 26 June 2017 |

Key Reasons

Council’s suite of draft Integrated Planning and Reporting documents have been formulated with consideration to the Community Strategic Plan 2040 – Wagga View previously endorsed by Council as well as the draft Disability Inclusion Action Plan 2017/21. The integration of these documents has also been considered.

These documents together form a suite of plans focussed on Council’s sustainability into the future.

During the exhibition period the City will invite submissions from the community through the following engagement methods which will inform the final version of these plans to be presented to Council for adoption in June 2016:

· Public Notices

· Consultation via “Your Say”

· Media Release

· Social Media – Facebook and Twitter

· Public display at the Civic Centre

Workforce Plan

The Workforce Plan maximises the capacity of the City’s workforce resources to meet the outcomes of the Community Strategic Plan 2040: Wagga View. The Workforce Plan focuses on current and future staffing needs to ensure the City has the right people, in the right roles, at the right time to deliver services to our community. Council’s Workforce Plan 2017/21 has been developed to outline strategies and initiatives to attract and retain a capable, efficient and effective workforce with the capacity to deliver on Council’s Delivery Program and Operational Plans.

The Workforce Plan consists of:

· Introduction

o What is a workforce plan?

o How is the workforce plan developed?

· Workforce Snapshot

o Our organisation structure

o What we deliver

o Our people:

§ Total Workforce Summary

§ Permanent Workforce Summary

§ Age

§ Gender

§ Diversity

§ Flexible Work Arrangements

§ Length of service

· Trends

· Our achievements

· Challenges and future direction

· Action Plan

The new workforce plan was written in consideration of the City’s current workforce profile and future resourcing requirements. The process also included reviewing the existing workforce plan, analysing workforce trends and challenges, and further considering Council’s new organisation structure implemented in 2016.

Asset Management Plans

The City of Wagga Wagga adopted its first asset management plan in 2011. The 2017 review of the plan has resulted in significant change and improvements in the asset management plan documents.

The City now has five asset management plans: buildings, recreational assets and sewer, stormwater and transport infrastructure networks. Each plan sets out the level of service the City of Wagga Wagga provides the community in relation to the assets. They use financial information and technical asset data, compared to service levels to identify funding shortfalls in managing these assets.

The current budget data is based on the 2017/18 Long Term Financial Plan, and the asset data is from the City’s asset register where available. The asset data from the register includes the extent of the network, asset type, location, the condition rating of each individual asset, their current replacement cost, annual depreciation expense, written down value, and residual value.

The plans have been developed by the Strategic Asset Management Officer in partnership with subject matter experts from across the organisation. The project began in July 2016 with a review of the current asset data. Relevant managers were involved in the project development in 2016 and via a review of the draft plans in 2017. The plans were also reviewed by the Sustainable Futures Group during the month of March 2017.

The goal of the asset management plans and of managing the assets on behalf of the community is to meet the defined levels of service in a cost effective manner for present and future generations. The key elements of asset management are:

· providing a defined level of service and monitoring performance

· managing the impact of growth through demand management and infrastructure investment

· taking a whole of lifecycle approach to developing cost-effective management strategies for the long-term that meet the defined level of service

· identifying, assessing and appropriately controlling risks

· having a Long Term Financial Plan which identifies required, affordable expenditure and how it will be financed

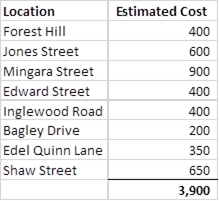

The following table shows the estimated projected costs to manage each asset category (based on current City of Wagga Wagga unit rates) over the next 10 years compared with the budget available as per the Long Term Financial Plan June 2017 to show the funding level.

The projected required budget includes the renewal, new and maintenance costs where available for each asset category. These are known as the first and second funding scenario. The first scenario (the projected required budget) is what we would like to do based on the asset register data. The second scenario (the current budget) is based on the Long Term Financial Plan (the existing budget). The plans include the level of service and risk consequences of this budget.

|

High Level Asset Category |

Project Required Budget to manage assets for 10 years |

Current Budget for 10 years |

Funding Level |

|

Buildings |

$38,413,023 |

$27,635,397 |

72% |

|

Recreational Assets (renewal only) |

$13,618,069 |

$5,113,290 |

38% |

|

Sewer |

$134,179,904 |

$133,151,748 |

99% |

|

Stormwater* |

$44,627,589 |

$39,247,276 |

88% |

|

Transport |

$298,230,715 |

$185,819,632 |

62% |

*Please note the stormwater figures do not include pipe renewal expected to be identified in the condition assessment.

The asset management plans will be reviewed annually to produce a rolling 10 year plan. They will undergo a full revision every 4 years in line with the Council election.

The effectiveness of the asset management plan will be measured in the following ways:

1. the gap between actual and targeted levels of service at any point in time

2. the degree of synchronisation between the asset management plan and the Long Term Financial Plan

3. the degree of integration between the asset management plan and the Delivery Program/Operational Plan

4. the level of execution of the identified actions in the plan, and

5. the degree the assessed level of risk to the City in each asset category reduces over time.

Therefore, following endorsement the next important step is for the City of Wagga Wagga to develop a third funding scenario, which provides a financially sustainable solution to the maintenance and renewal shortfalls for the assets which is budgeted for in the Long Term Financial Plan. This solution may see a change in target service levels included in the asset management plans. The community and Council will be invited to play an important role in the development of this option.

Combined Delivery Program and Operational Plan

The creation of the 2017/18 Combined Delivery Program and Operational Plan incorporates a new Delivery Program derived directly from the Community Strategic Plan 2040 – Wagga View and a complete review of the Operational Plan with the inclusion of relevant projects and activities for the coming 12 months.

The 2017/18 Combined Delivery Program and Operational Plan consist of:

· Mayor and GM Welcome

· Clear links to ‘Wagga View” the Community Strategic Plan 2040

· Clear links to the draft Disability Inclusion Action Plan 2017/21

· New Delivery Program and Operational Plan activities (including detailed operational descriptions and measures)

· Delivery Program four year budget

· Delivery Program Capital Works (New Projects and Recurrent)

· Contributions and Donations

Some key improvements to this year’s documents include the addition of the detailed activity descriptions and the increased number of operational items captured. A key focus of the business planning process was to capture a more comprehensive list of the services and projects we deliver as an organisation.

The combined Delivery Program and Operational Plan will be reviewed annually to produce a rolling 4 year plan. The Delivery Program will receive a full revision every 4 years in line with the Council election.

Fees and Charges

In accordance with Section 608 of the Local Government Act 1993, a council may charge and recover an approved fee for any service it provides.

The services for which an approved fee may be charged include the following provided under the Local Government Act or any other Act or the regulations by the council:

· supplying a service, product or commodity

· giving information

· providing a service in connection with the exercise of the council’s regulatory functions-including receiving an application for approval, granting an approval, making an inspection and issuing a certificate

· allowing admission to any building or enclosure.

Long Term Financial Plan

The Long Term Financial Plan is an essential element of the resourcing strategy which details how the strategic aspirations of the City which are outlined in the Community Strategic Plan can be achieved in terms of time, money, assets and people.

Council’s Long Term Financial Plan is a ten-year financial planning document with an emphasis on long-term financial sustainability. Financial sustainability is one of the key issues facing local government due to several contributing factors including growing demands for community services and facilities, constrained revenue growth and ageing infrastructure.

The Long Term Financial Plan is formulated by using a number of estimates and assumptions to project the future revenue and expenditure required of the City to deliver those services and projects expected by the community. In doing so it addresses the resources that impact on the City’s ability to fund its services and capital works whilst remaining financially sustainable.

The draft 2017/27 Long Term Financial Plan consists of:

· Executive Summary

· Fit for the Future Summary

· Special Rate Variation

· Financial Strategies

· Planning Assumptions

· Major Projects

· Financial Forecast Assumptions

· Sensitivity Analysis

· Financial Modelling Scenarios

· Budgeted Financial Statements:

o Budgeted Income Statement

o Budgeted Balance Sheet Forecasts

o Cash Flow Statement Forecasts

· Financial Sustainability Indicators

· External Reserve balances projections

· Internal Reserve balances projections

· External Loan Projects and Debt Servicing

· Total Capital Works Program, including one-off projects and recurrent programs

· “Concepts” Capital Projects

· Ten Year Financial Plans for “Council Businesses”:

o Wagga Wagga Regional Airport

o Livestock Marketing Centre

o Sewerage Services

o Solid Waste Services

· Stormwater Levy Function

· Budgeted Income Statement by Function

Financial Implications

The proposed adoption of these plans will form the basis of the City’s 2017/18 budget.

Policy

While not Policy specifically, it is worth highlighting that the suite of documents have been created to meet the requirements set in the Integrated Planning and Reporting Guidelines – March 2013.

The asset management plans have been formulated with consideration to POL 001 Asset Management Policy.

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We plan long term

Risk Management Issues for Council

A number of risk management issues were identified and have been actively managed. A summary of these risks are as follows:

- Lack of engagement from the community

- Inability to meet everyone’s expectations

- Inability to resource and deliver on plans

There are no implications for Work Health and Safety associated with this report.

Internal / External Consultation

Comprehensive internal consultation has taken place in the review and development of these plans including: business planning sessions across the organisation, internal review opportunities and three (3) workshops with Councillors.

|

1⇩. |

Draft Recreational Asset Management Plan 2017/18 - Provided under separate cover |

|

|

2⇩. |

Draft Transport Infrastructure Asset Management Plan 2017/18 - Provided under separate cover |

|

|

3⇩. |

Draft Sewer Asset Managment Plan 2017/18 - Provided under separate cover |

|

|

4⇩. |

Draft Buildings Asset Management Plan 2017/18 - Provided under separate cover |

|

|

5⇩. |

Draft Stormwater Asset Management Plan 2017/18 - Provided under separate cover

|

|

|

6⇩. |

Draft Combined Delivery Program and Operational Plan 2017/18 - Provided under separate cover |

|

|

7⇩. |

Draft Workforce Plan 2017/21 - Provided under separate cover |

|

|

8⇩. |

Draft 2017/18 Long Term Financial Plan Document - Provided under separate cover |

|

|

9⇩. |

Draft 2017/18 Fees & Charges - Provided under separate cover |

|

Report submitted to the Ordinary Meeting of Council on Monday 24 April 2017. RP-8

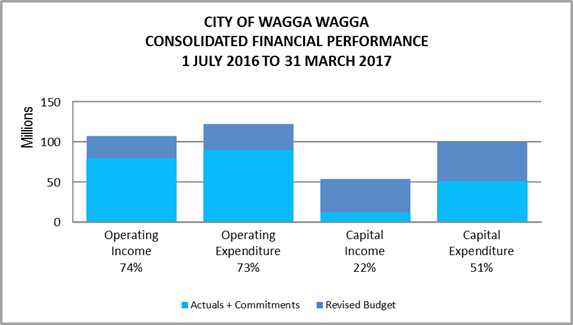

RP-8 Financial Performance Report and Quarterly Budget Review as at 31 March 2017

Author: Carolyn Rodney

Sector Manager: Natalie Te Pohe

|

Analysis: |

This report is for Council to consider and approve the proposed 2016/17 budget variations required to manage the 2016/17 budget and Long Term Financial Plan, and details Council’s external investments and performance as at 31 March 2017. |

|

That Council: a approve the proposed 2016/17 budget variations for the month ended 31 March 2017 and note the balanced budget as presented in this report b note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above c note details of the external investments as at 31 March 2017 in accordance with section 625 of the Local Government Act 1993 |

Key Reasons

The City of Wagga Wagga forecasts an overall balanced budget for the month ended March 2017, which is an improvement on the reported February 2017 deficit of ($14K).

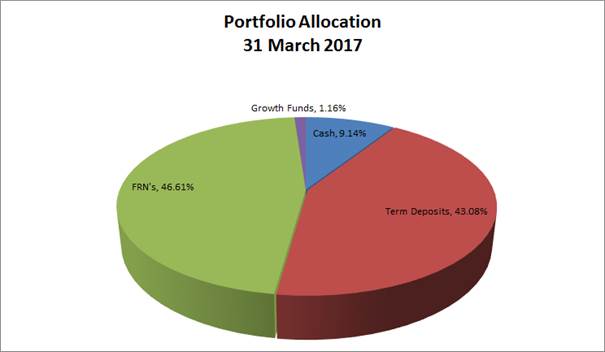

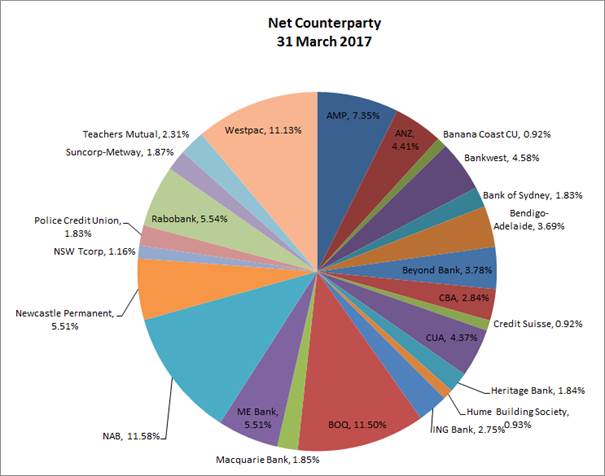

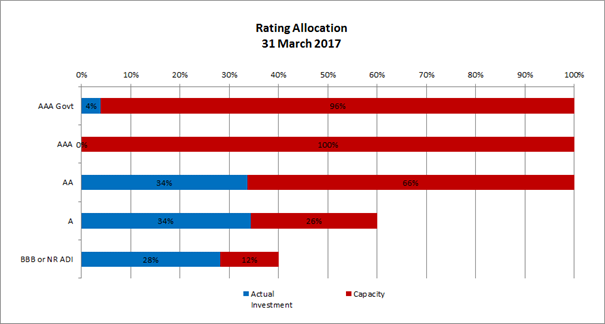

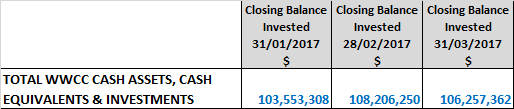

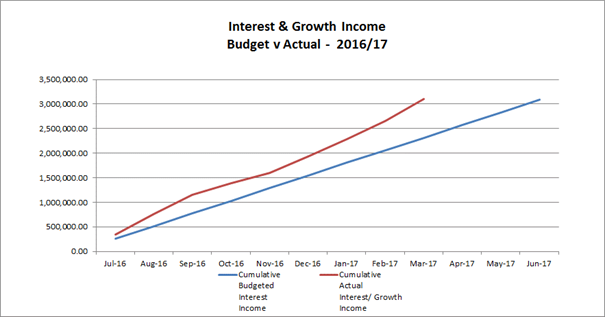

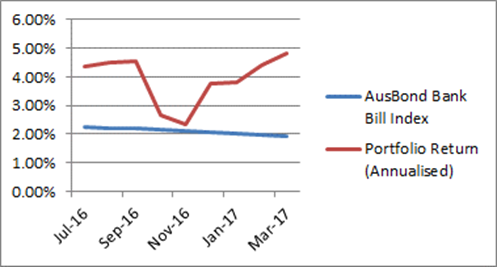

The City has experienced a positive monthly investment performance for the month of March that is mainly attributable to the continued strong growth period for the City’s Floating Rate Note (FRN) portfolio, with many of these investments trading at a premium.

Due to the continued higher than anticipated balance of the investment portfolio (mainly due to the timing of major projects), City of Wagga Wagga officers have reviewed the budget for interest on investments and revised upwards by $700,000. This figure is reflective of the anticipated amounts to be received for the remainder of the 2016/17 financial year.

Financial Implications

Key Performance Indicators

OPERATING INCOME

Total operating income is 74% of approved budget that is tracking to budget for the end of March (this percentage excludes capital grants and contributions). An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 88%.

OPERATING EXPENSES

Total operating expenditure is 73% of approved budget and is tracking to budget for the full financial year.

CAPITAL INCOME

Total capital income is 22% of approved budget. It should be noted that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions relating to projects.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 51% of approved budget. The RIFL Stage 1 contract commitment has been raised for $19M. Excluding this amount the total capital expenditure is 32% of approved budget.

|

CITY OF WAGGA WAGGA |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2016/17 |

COMMT'S 2016/17 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|

||||||

|

Rates & Annual Charges |

(60,642,286) |

0 |

(60,642,286) |

(45,669,895) |

0 |

(45,669,895) |

75% |

|

User Charges & Fees |

(23,631,263) |

57,916 |

(23,573,347) |

(16,555,088) |

0 |

(16,555,088) |

70% |

|

Interest & Investment Revenue |

(3,406,597) |

0 |

(3,406,597) |

(3,320,631) |

0 |

(3,320,631) |

97% |

|

Other Revenues |

(3,123,096) |

(72,284) |

(3,195,380) |

(2,317,494) |

0 |

(2,317,494) |

73% |

|

Operating Grants & Contributions |

(14,779,516) |

(1,397,582) |

(16,177,098) |

(11,973,826) |

0 |

(11,973,826) |

74% |

|

Capital Grants & Contributions |

(34,768,294) |

(20,776,047) |

(55,544,341) |

(14,617,010) |

0 |

(14,617,010) |

26% |

|

Total Revenue |

(140,351,052) |

(22,187,997) |

(162,539,049) |

(94,453,944) |

0 |

(94,453,942) |

58% |

|

|

|

||||||

|

Expenses |

|

||||||

|

Employee Benefits & On-Costs |

42,105,886 |

92,088 |

42,197,974 |

29,628,557 |

12,676 |

29,641,233 |

70% |

|

Borrowing Costs |

3,953,083 |

(157,682) |

3,795,402 |

2,753,527 |

0 |

2,753,527 |

73% |

|

Materials & Contracts |

2,722,383 |

(5,293) |

2,717,090 |

8,433,871 |

1,112,042 |

9,545,913 |

351% |

|

Depreciation & Amortisation |

32,405,375 |

0 |

32,405,375 |

24,304,031 |

0 |

24,304,031 |

75% |

|

Other Expenses |

37,493,005 |

3,492,536 |

40,985,542 |

20,774,033 |

2,203,119 |

22,977,152 |

56% |

|

Total Expenses |

118,679,732 |

3,421,650 |

122,101,382 |

85,894,018 |

3,327,838 |

89,221,856 |

73% |

|

|

|

||||||

|

Net Operating (Profit)/Loss |

(21,671,319) |

(18,766,347) |

(40,437,667) |

(8,559,926) |

3,327,838 |

(5,232,087) |

|

|

|

|

|

|

|

|

|

|

|

Net Operating (Profit)/Loss before Capital Grants & Contributions

|

13,096,975 |

2,009,700 |

15,106,674 |

6,057,084 |

3,327,838 |

9,384,923 |

|

|

|

|

||||||

|

Cap/Reserve Movements |

|||||||

|

Capital Exp - Renewals |

24,265,446 |

9,073,416 |

33,338,862 |

9,419,595 |

5,188,873 |

14,608,468 |

44% |

|

Capital Exp - New Projects |

45,730,456 |

10,385,256 |

56,115,712 |

10,665,876 |

23,681,026 |

34,346,902 |

61% |

|

Capital Exp - Project Concepts |

8,264,763 |

27,020 |

8,291,783 |

1,970 |

0 |

1,970 |

0% |

|

Loan Repayments |

2,603,821 |

(173,623) |

2,430,198 |

1,822,647 |

0 |

1,822,647 |

75% |

|

New Loan Borrowings |

(13,859,917) |

7,992,810 |

(5,867,108) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(4,982,151) |

2,968,619 |

(2,013,532) |

(2,711,729) |

0 |

(2,711,729) |

135% |

|

Net Movements Reserves |

(7,945,724) |

(11,493,504) |

(19,439,228) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

54,076,694 |

18,779,992 |

72,856,686 |

19,198,359 |

28,869,899 |

48,068,259 |

66% |

|

|

|

||||||

|

Net Result after Depreciation |

32,405,375 |

13,645 |

32,419,020 |

10,638,433 |

32,197,737 |

42,836,172 |

|

|

|

|

||||||

|

Add back Depreciation Expense |

32,405,375 |

0 |

32,405,375 |

24,304,031 |

0 |

24,304,031 |

|

|

|

|

||||||

|

Cash Budget (Surplus)/Deficit |

(0) |

13,645 |

13,645 |

(13,665,598) |

32,197,737 |

18,532,141 |

|

Revised Budget Result - Surplus/(Deficit) |

$’000s |

|

Original 2016/17 Budget Result as adopted by Council Total Budget Variations approved as reported to 27 March 2017 Council Meeting Budget variations for March 2017 |

$0 ($14K)

$14K |

|

Proposed revised budget result for 31 March 2017 |

Nil |

The proposed Budget Variations to 31 March 2017 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact Fav/ (Unfav) |

|

|

1 – We are an engaged and involved community |

||||

|

Customer Service Centre Postage |

$34K |

Information Management Legal ($1K) Digitising Records ($14K) |

($19K)

|

|

|

Additional funds are required for postage. The current postage budget is insufficient due to the continuing annual increases in postage prices from Australia Post, which have been significant. It should be noted that the budget has not been revised upwards to capture these increases for at least the last 3 years. This variation is proposed to be partly funded from Information Technology operational savings and additional income from interest on investments. |

||||

|

Cooinbil Crescent School Crossing |

$20K |

Cooinbil Crescent School Crossing Grant Income ($10K) |

($10K)

|

|

|

The Cooinbil Crescent School Crossing requires additional funding due to a change in the scope of works to include traffic control and stormwater pit modifications. The Roads and Maritime Authority as part of the 2016/17 Safety Around Schools Program is continuing to match the City of Wagga Wagga’s funding 50:50. This will increase the total project cost from $17K to $37K. |

||||

|

Developer Contributions Income |

($1,750K) |

Section 94 Reserve $1,500K Section 64 Stormwater Reserve $250K |

Nil |

|

|

Developer contributions income is significantly higher than budget for this financial year. This is a result of increased developer subdivision activity with contributions received for subdivision areas including Forest Hill, Gobbagombalin, Lloyd, Central Wagga and Boorooma. Income from these developer contributions is restricted and applied to the projects contained in the respective Developer Contribution Plans and budgeted in the Long Term Financial Plan. |

||||

|

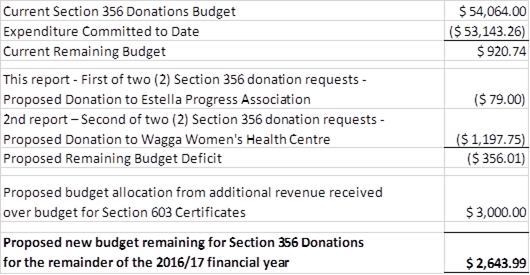

Section 356 Donations |

$3K |

Section 603 Certificate Income ($3K) |

Nil |

|

|

To facilitate the consideration of donation requests received for the remainder of this financial year it is proposed to seek a budget variation of $3,000 funded from additional revenue forecast from the issue of Section 603 Certificates. This budget variation is separately mentioned in the two April Council Reports relating to Section 356 donation requests. |

||||

|

Audit Fees |

$71K |

|

($71K) |

|

|

With the NSW Audit Office now being responsible for the auditing of all Councils in NSW, additional funds are required due to an increase in the cost of auditing. Compliance audits are still required from our previous auditor as they are not covered under the audit mandate. It is proposed to fund this variation from additional income from interest on investments. |

||||

|

Election Expenses |

$25K |

Council Election Reserve ($25K) |

Nil |

|

|

Funds of $25K are required in addition to the existing Election budget of $300K as advised by the NSW Electoral Commission for the conduct of the Local Government Elections held on 10 September 2016. The additional costs are to be funded from the Council Election Reserve. |

||||

|

Land Revaluation Sewer Revaluation |

$20K $25K |

Sewer Reserve ($25K) |

($20K) |

|

|

The City of Wagga Wagga is required to undertake asset revaluations on a rolling five-year schedule. This is a requirement of the Office of Local Government Code of Accounting Practice and needs to comply with the relevant Accounting Standards. For the 2016/17 financial year, the City is required to undertake valuations for its Land Portfolio and Sewerage Network. It is proposed to fund the Sewer Revaluation from the Sewer Reserve and the Land Portfolio Valuation from additional income from Interest on Investments. The City has allowed budget for future valuations as part of the proposed 2017/18 Long Term Financial Plan. |

||||

|

Interest on Investments |

($700K) |

S94 Reserves $24K Sewer Reserve $70K Solid Waste Reserve $19K Infrastructure Reserve $69K RRL $5K Emergency Events Reserve $134K |

$379K |

|

|

The City of Wagga Wagga’s interest on investments is on target to outperform budget for the 2016/17 financial year. This is due to the size of the investment portfolio maintaining a larger balance than expected. The larger balance is mainly a result of a number of large capital projects originally budgeted that are not as advanced as originally predicted. It is anticipated that the investment income will result in additional income above budget for the year of $700K. The General Purpose Revenue portion of this income is $513K and is being used to fund various budget variations included in this report. The remaining unallocated funds of $134K will be transferred to the Emergency Events Reserve. |

||||

|

2 – We are a safe and healthy community |

||||

|

Forest Hill Skate Park Asbestos Clean Up |

$50K |

|

($50K) |

|

|

A quantity of asbestos was uncovered whilst stripping the top soil for the construction of the Forest Hill Skate Park. A licenced asbestos removal contractor was engaged to remove and dispose of the material. Additional costs were also incurred for the backfilling of the area where the contaminated material was removed. It is proposed to fund this variation from additional income from interest on investments. |

||||

|

Traffic Parking Fine Income |

$550K |

CBD Car Parking Reserve ($205K) Traffic Parking Contractor Expenses ($100K) Development Penalty Notice Income ($30K) Impounded Trolleys Fine Income ($20K) |

($195K) |

|

|

The City Compliance team have operated with reduced staff numbers since the commencement of the financial year and this has affected the revenue generated from parking operations. It is proposed to fund the reduction in income from: - removal of the CBD Car Parking Reserve transfer - reduction of administration fees in processing fines - increasing income from infringements for development compliance and impounded shopping trolleys - additional income from interest on investments. |

||||

|

3 – We have a growing economy |

||||

|

Visitor Information Centre Income – Sale of Goods |

($49K) |

Visitor Information Centre Purchases $49K |

Nil |

|

|

The retail sales at the Visitor Information Centre have increased mainly due to the introduction of hamper sales, which has also increased the required stock on hand. This budget variation also aims to re-align the income and expense budgets for the sale of goods which better reflects the actual activity at the Visitor Information Centre. |

||||

|

Airport Maintenance & Ground Works |

$40K |

Airport Salaries ($40K) |

Nil |

|

|

Savings in Airport salaries due to staff vacancies are to be transferred to various Airport operational budgets due to changing requirements for 2016/17 as follows: - design for apron line marking and blast patterns for the introduction of Jet-Go services - $3K - car parking consumables - $15K - radio replacement - $12K - increased maintenance for landside grounds - $10K |

||||

|

Tourism Partner Program Income |

($50K) |

Partner Program Services $34K Printing Services $16K |

Nil

|

|

|

The Partner Program is an initiative to work together with tourism business operators to promote the city and boost visitation. The income received from partnership fees is to be used for the building of a new website, undertaking education with partners and the printing of the Wagga Visitor Guide. |

||||

|

4 – We have a sustainable natural and built environment |

||||

|

Lakehaven Rear Of Block Drainage |

$25K |

Maintain Stormwater Assets ($25K) |

Nil |

|

|

Funding of $25K is required to complete the Lakehaven rear of block drainage in addition to the existing $200K budget. This is due to a change in the scope of works to include a small section drainage line that will alleviate flooding at the top of the job. It is proposed to fund this variation from the existing stormwater drainage assets maintenance budget.

|

||||

|

Gregadoo Road Traffic Study |

$100K |

Fit For The Future Reserve ($100K) |

Nil |

|

|

A full review of Gregadoo Road and a design solution is required to address a number of traffic congestion issues experienced along this road. A recent Traffic Committee recommendation highlighted the need to undertake a full review. It is proposed to fund this variation from the Fit For The Future Reserve. |

||||

|

Elizabeth Avenue Sewer Pump Station |

$100K |

Sewer Reserve ($100K) |

Nil |

|

|

It is proposed to bring forward $100K of the 2017/18 budget of $1,033K for the Sewer Pump Station at Elizabeth Avenue. This will allow for detailed designs and preliminary works to be finalised for commencement and delivery of the project in 2017/18. It is proposed to fund the budget variation from the Sewer Reserve. |

||||

|

Development of Business Plan and Kerbside Contract |

$115K |

Solid Waste Reserve ($115K) |

Nil |

|

|

This project was previously reported to Council on 21 November 2016 but further costs have since been incurred. Additional funding of $115K is now required to finalise the kerbside collection tender documentation and formation of the new contract. The existing budget is $225K and it is proposed to fund this variation from the Solid Waste Reserve. |

||||

|

SURPLUS/(DEFICIT) |

|

|

$14K |

|

Current Restrictions

|

CITY OF WAGGA WAGGA |

|||||

|

RESERVES SUMMARY |

|||||

|

31 MARCH 2017 |

|||||

|

|

Approved Changes |

|

|

||

|

|

CLOSING BALANCE 2015/16 |

ADOPTED RESERVE TRANSFERS 2016/17 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 27.03.2017 |

RECOMM CHANGES for Council Resolution |

REVISED BALANCE |

|

|

|

||||

|