Ordinary Meeting of

Council

Ordinary Meeting of

Council

To be held on

Monday

27 November 2017

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

Ordinary Meeting of

Council

Ordinary Meeting of

Council

To be held on

Monday

27 November 2017

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 27 November 2017 at 6.00pm.

Council live streams video and audio of Council meetings. Members of the public are advised that their voice and/or image may form part of the webcast.

Mr James Bolton

General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

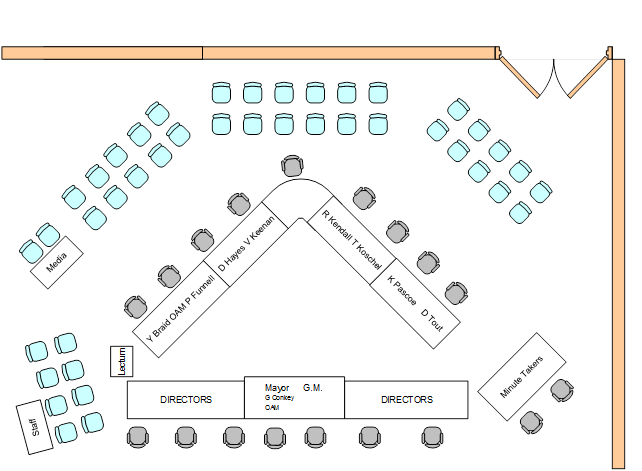

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 27 November 2017.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 27 November 2017

ORDER OF BUSINESS:

CLAUSE PRECIS PAGE

PRAYER 2

ACKNOWLEDGEMENT OF COUNTRY 2

APOLOGIES 2

CONFIRMATIONS OF MINUTES

CM-1 Extraordinary Council Meeting - 13 October 2017 2

CM-2 Ordinary Council Meeting - 23 October 2017

DECLARATIONS OF INTEREST 2

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - Disabled access to Waggas waterways 5

NOM-2 NOTICE OF MOTION - Change to Payment of Expenses and Provision of Facilities to Councillors Policy POL 025 7

Reports from Staff

RP-1 DA16/0104 INTENSIVE PLANT AGRICULTURE, RURAL INDUSTRY, EARTHWORKS ON FLOODPLAIN, FARM BUILDINGS, ROADSIDE STALL, FOOD & DRINK PREMISES, SIGNAGE AND NEW ACCESS, 103 TRAVERS STREET, WAGGA WAGGA, LOTS 4 -6 DP 7050 & LOT 5 DP 848787 9

RP-2 Planning Proposal LEP17/0002 to amend the Wagga Wagga Local Environmental Plan 2010 15

RP-3 2016/17 Financial Statements - Presentation from NSW Audit Office 24

RP-4 Financial Performance Report as at 31 October 2017 43

RP-5 COUNCIL MEETING DATES JANUARY 2018 to DECEMBER 2018 62

RP-6 Delegation of authority to the Mayor 64

RP-7 DELEGATION OF AUTHORITY TO THE GENERAL MANAGER 70

RP-8 Reinstatement of Airport Fees and Charges 74

RP-9 Strategic Planning Update 94

RP-10 APPLICATIONS FOR SUBSIDY FOR WASTE DISPOSAL FOR CHARITABLE ORGANISATIONS 101

RP-11 PROPOSED ASSIGNMENT OF LEASE - AUSTRALIAN LONG DISTANCE OWNER DRIVERS ASSOCIATION INCORPORATED TO THE TARCUTTA TRANSPORT AND FARMING MUSEUM INCORPORATED 104

RP-12 Submissions received for the Public Art Plan and Public Art Policy POL109 and Petition - Public Art 109

RP-13 New Policy - POL 048 Street Tree Policy 124

RP-14 LANDSCAPING COUNCIL MANAGED ROUNDABOUTS AND VERGES 132

RP-15 VILLAGE SEWER PROPOSAL - SAN ISIDORE 145

RP-16 RIVER SAFETY 153

RP-17 POL 033 - WEED MANAGEMENT POLICY 165

RP-18 POL 046 - PROCESSING DEVELOPMENT APPLICATIONS LODGED BY COUNCILLORS, STAFF AND INDIVIDUALS OF WHICH A CONFLICT OF INTEREST MAY ARISE, OR ON COUNCIL OWNED LAND POLICY 174

RP-19 POL 079 RISK MANAGEMENT POLICY 185

RP-20 Community Engagement for Public Exhibition of Council Documents 195

RP-21 Responses to Questions / Business with Notice 200

RP-22 Section 356 Donation - Australian Clay Target Association (ACTA) 202

RP-23 Section 356 Donation - Tiny Tykes 209

RP-24 PROPOSED EASEMENT FOR DRAINAGE OVER LOT 2 DP 702230 AT BOOROOMA 212

RP-25 SALE OF WIRADJURI CRESCENT PROPERTIES 216

RP-26 Mary Kidson Play Session Hall 218

RP-27 Update Regarding the 2017 Sale of Land for Unpaid Rates 222

QUESTIONS/BUSINESS WITH NOTICE 226

Confidential Reports

CONF-1 RFT2018/04 WINNING AND CRUSHING OF GRAVEL 227

CONF-2 RFT2017/05 Supply of One Garbage Landfill Compactor 228

CONF-3 RFT2018/07 BULK FUEL SUPPLY 229

CONF-4 RFT2018/08 DESIGN AND CONSTRUCT RURAL FIRE SERVICE SHED TARCUTTA 230

CONF-5 HOOK LIFT TRUCK - OPTIONS FOR CONTINUING SERVICE AT REGIONAL TRANSFER STATIONS 231

CONF-6 Major Events Advisory Panel 232

CONF-7 WAGGA WAGGA CITY COUNCIL EXPRESSIONS OF INTEREST FOR GRAZING LICENCE AT GREGADOO WASTE MANAGEMENT CENTRE 233

CONF-8 PROPOSED GRAZING LICENCE AGREEMENT - SURPLUS SEWER LAND 234

Confirmation of Minutes

CM-1 Extraordinary Council Meeting - 13 October 2017

|

That the Minutes of the proceedings of the Extraordinary Council Meeting held on 13 October 2017 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - Extrardinary Council Meeting - 13 October 2017 |

2 |

CM-2 Ordinary Council Meeting - 23 October 2017

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 23 October 2017 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - Ordinary Council Meeting - 23 October 2017 |

2 |

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - Disabled access to Wagga’s waterways

Author: Councillor Dan Hayes

|

Analysis: |

This Notice of Motion is being presented to Council to explore options and funding sources for improving access to our waterways for people with a disability.

|

|

That Council staff bring forward a report on options to improve and fund the accessibility to Wagga Wagga’s waterways to increase access and opportunity for sporting and recreation use.

|

Report

I present this Notice of Motion to:

· Improve access to Wagga Wagga’s significant attractions such as Lake Albert, Murrumbidgee River, and Wollundry Lagoon is important for residents with a disability so they can make more use of these attractions.

· Further improve upon Wagga's attractiveness for inclusive tourism, which is a considerable part of the travel and recreation market.

Financial Implications

N/A

Policy and Legislation

Disability Inclusion Action Plan (DIAP)

Recreation and Open Space and Community Strategy (ROSC)

Link to Strategic Plan

Safe and Healthy Community

Objective: We have access to health and support services that cater for all our needs

Outcome: Our health and support services meet the needs of our community

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

Report submitted to the Ordinary Meeting of Council on Monday 27 November 2017. NOM-2

NOM-2 NOTICE OF MOTION - Change to Payment of Expenses and Provision of Facilities to Councillors Policy POL 025

Author: Councillor Dan Hayes

|

Analysis: |

This Notice of Motion is being presented to Council to change the requirement for Councillor reports after attendance at a conference, seminar, training course or workshop. |

|

That Council: a bring forward a report on options to change Section 3.6.2.6 of the Payment of Expenses and Provision of Facilities to Councillors Policy (POL 025) which states that Councillors attendance at conferences, seminars, training courses or workshops “may be the subject of a report to Council” to a compulsory requirement to provide a report to Council b create a template for these reports c explore possibilities to ensure reports are presented to Council in an Ordinary Meeting |

Report

I present this Notice of Motion to:

· Ensure residents are aware of the outcomes and issues of attendance at conferences, seminars, training courses and workshops by Councillors.

· Improve the learning outcomes for all Councillors through sharing knowledge and information gained at these events.

Financial Implications

N/A

Policy and Legislation

Payment of Expenses and Provision of Facilities to Councillors Policy (POL 025)

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

N/A

Report submitted to the Ordinary Meeting of Council on Monday 27 November 2017. RP-1

RP-1 DA16/0104 INTENSIVE PLANT AGRICULTURE, RURAL INDUSTRY, EARTHWORKS ON FLOODPLAIN, FARM BUILDINGS, ROADSIDE STALL, FOOD & DRINK PREMISES, SIGNAGE AND NEW ACCESS, 103 TRAVERS STREET, WAGGA WAGGA, LOTS 4 -6 DP 7050 & LOT 5 DP 848787

Author: Camilla Rocks

Director: Adrian Butler

|

Analysis: |

The report is for a development application and is presented to Council for determination. The application has been referred to Council on request of the General Manager due to the potential impacts on Council’s sewer infrastructure, proximity to TOLL, the removal of the dwelling (due to flooding) and tourism initiative / proximity to Riverside. |

|

That Council approve DA16/0104 for Intensive Plant Agriculture, Rural Industry, Earthworks on Floodplain, Farm Buildings, Roadside Stall, Food & Drink Premises, Signage and New Access at 103 Travers Street WAGGAWAGGA NSW 2650 subject to the conditions outlined in the Section 79C Assessment Report for DA16/0104. |

Development Application Details

|

Applicant |

Michael Cashen |

|

Owner |

Michael Cashen, Kylie Cashen |

|

Development Cost |

$450,000 |

|

Development Description |

This proposal is for the development of an existing vacant rural allotment for the purpose of a “pick your own” strawberry farm and related ancillary development and infrastructure.

The proposal includes the following elements: · Use of the site for Intensive Plant Agriculture (hydroponic strawberries) · Use of the site for a Rural Industry and construction of a processing shed and ancillary staff facilities as well as ancillary farm buildings · Earthworks to create a building pad · Roadside stall for the sale of strawberries and related products · Cafe · Signage · Vehicle movement areas and car parking, landscaping and pathways |

Report

Key Issues

1. Flood prone land outside the levee bank:

2. Site is high to very high hazard floodprone land

3. Depth of flood up to 2m across the site, low velocity

4. Compatibility of the use with existing adjoining land uses (sewage treatment plant and transport depot)

5. Proximity to Sewage Treatment Plant –The Department of Urban Affairs and Planning’s Circular E3 — Guidelines for buffer areas around sewage treatment plants (STP) recommended buffer zones of at least 400 metres surrounding sewage treatment plants. A “Best Practice Odour Guideline” has since been drafted by the EPA which, although not legally enforceable, encourages the maintenance of existing separation distances. Main building is proposed at approx. 320m from plant

6. Risk to Council of allowing development within the separation distance with regard to odour incidents at the STP and complaints from café and farm patrons

7. Previous use of adjacent land for landfill may have led to contamination of the site

8. Visitor parking cannot enter and leave the site in a forward direction

9. Commercial premises are prohibited in the RU1 zone

Assessment

· The proposal is defined under the standard definitions contained in the Wagga Wagga Local Environmental Plan 2010 (LEP) as Intensive Plant Agriculture, Rural Industry, Earthworks, Farm Buildings, Roadside Stall, Food & Drink Premises

· Under the provisions of the LEP, the subject site is within the RU1 General Rural zone and SP2 (Sewage Treatment Plant) zone.

· The proposal is generally consistent with the RU1 objectives because the development will maintain and enhance the natural resource base, the various agricultural activities will encourage diversity in primary industry enterprises and systems appropriate for the area and will maintain the rural landscape character of the land. The lot is existing and no subdivision is proposed which would fragment or alienate resource lands.

· The proposal avoids the land that is subject to the SP2 zone and that area is intended to remain undeveloped as per existing.

· The application seeks approval under Clause 5.3 of the LEP – Development Near Zone Boundaries, for the use of part of the development for a cafe. Under the provisions, commercial premises are prohibited in the RU1 zone. The site is adjacent to land in the RE2 Private Recreation zone. Restaurants and cafes are permitted in the RE2 zone with consent. It is considered that the proposed cafe would generally be compatible with the objectives, as outlined in the 79C report attached under separate cover. Alternately, Council could request that the proponent make a Planning Proposal for a special provision over the site to address the prohibition.

· The site is outside the city levee bank system and in a high hazard flood prone area. The provisions allow for development on land that is compatible with the land’s flood hazard. The agricultural component is not likely to result in unsustainable social and economic costs to the community as a consequence of flooding. Access to the site is cut once the 20yr flood peak is reached.

· There is a groundwater bore existing on the property. The development proposal indicates that groundwater will be utilised for the property, in compliance with existing licencing. Due to the location adjacent to former landfill site, there is concern that the groundwater is contaminated therefore it is recommended that any consent be conditional on the groundwater being excluded from use on food products.

· The site investigation concluded that the soil on site is not contaminated and is suitable for residential use with limited consumption of fruit and vegetables grown in the soil but not suitable for the keeping of poultry.

· The proposed crop may be subject to contamination from STP aeration processes.

· Proposed signage has not been detailed however locations of signs as submitted is considered acceptable subject to further details being submitted prior to release of Construction Certificate.

· The Development Application was notified and advertised in accordance with the DCP provisions and no submissions were received.

· The development is consistent with relevant provisions of the Wagga Wagga Development Control Plan 2010.

· The proposed development may impact on the operation of the Sewage Treatment Plant (STP), owned by Wagga Wagga City Council, adjacent to the site if patrons make complaints about offensive odours or noise. An odour report commissioned by Council in 2010 states that the odour level in the vicinity of the main building and plantation are below acceptable limits.

· The proposed development may impact on the operation of the Transport Depot adjacent to the site if patrons make complaints about offensive noise. The Transport Depot operates 24hours a day/7 days a week.

· Whilst the proposed parking arrangement is technically non-compliant with DCP but given the nature of Billagha Street, considered appropriate.

· The site is a rural site that is not of sufficient size to support a dwelling or a traditional primary industry. It is located in a precinct that has been identified as a tourist destination due to the existing golf centre, wetlands and proximity to the Murrumbidgee River.

· The proposed “pick your own” strawberry farm is the only farm of its kind in the LGA and has recreational and social benefits for the population.

Reasons for Approval

1. The proposed development is consistent with the objectives of Clause 5.3 of the Wagga Wagga Local Environmental Plan 2010 and the consent authority is satisfied that the development is not inconsistent with the objectives for development in the RU1 and RE2 zones and the carrying out of the development is desirable due to compatible land use planning, infrastructure capacity and other planning principles relating to the efficient and timely development of land;

2. The proposed development is consistent with the objectives contained within Part 7 of the Wagga Wagga Local Environmental Plan 2010 relating to additional local provisions;

3. The objectives of Sections 2, 4 and 8 of the Wagga Wagga Development Control Plan 2010 (the DCP) are satisfied by the proposed development;

4. For the abovementioned reasons it is considered to be in the public interest to approve this development application.

Site Location

The site, being Lots 4, 5 and 6 in Deposited Plan 7050 and Lot 5 in Deposited Plan 848787, is known as 103 Travers Street, Wagga Wagga. The site is an irregular shape, with a narrow access handle to Travers Street. It is approximately 14.2 hectares in size. It is situated on the south-western corner of Narrung and Billagha Streets. Billagha Street is a rural type road, sealed but without kerb and guttering.

Access to the site is from Billagha Street. The site has an informal access to Travers Street however this access will not be formally utilised by the public as it does not meet Australian Standards for sightlines. The site is bordered by Billagha Street to the east, Council land to the west, Narrung Street to the north and the city levee bank to the south.

The site is relatively flat, with a slight rise to the north. The main flood levee bank is located along the southern boundary of the site.

The site has historically been in use as agricultural land. It is a remnant part of a 1912 subdivision. There is no dwelling on the land.

Land to the north and west of the site is Council owned and partly used for the city’s main sewerage treatment plant. The site opposite the subject site to the east is a former landfill site now in use as a recreation facility, also Council owned. Land to the south on the southern side of the levee bank is a transport depot. There are several small rural residential lots west of the Travers Street handle.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: Create and maintain a functional, attractive and health promoting built environment

Outcome: We look after and maintain our community assets

Risk Management Issues for Council

Refusal of the application may result in an appeal process in the Land and Environment Court which will have to be defended by Council. The reasons for refusal will have to be justified and withstand scrutiny and cross examination in Court.

Approval of the café (sensitive receptor) inside the recommended separation distance from the Sewage Treatment Plant (STP) may result in the NSW Environmental Protection Authority receiving complaints about odour from the STP, resulting in a fine and/or requirement for upgrade of the plant.

Internal / External Consultation

See attached s79C report for details of all consultation.

|

1. |

DA16/0104 - 79C Assessment Report - Provided under separate cover |

|

|

2. |

DA16/0104 - Plans - Provided under separate cover |

|

|

3. |

DA16/0104 - Statement of Environmental Effects - Provided under separate cover |

|

Report submitted to the Ordinary Meeting of Council on Monday 27 November 2017. RP-2

RP-2 Planning Proposal LEP17/0002 to amend the Wagga Wagga Local Environmental Plan 2010

Author: Crystal Golden

Director: Natalie Te Pohe

|

Analysis: |

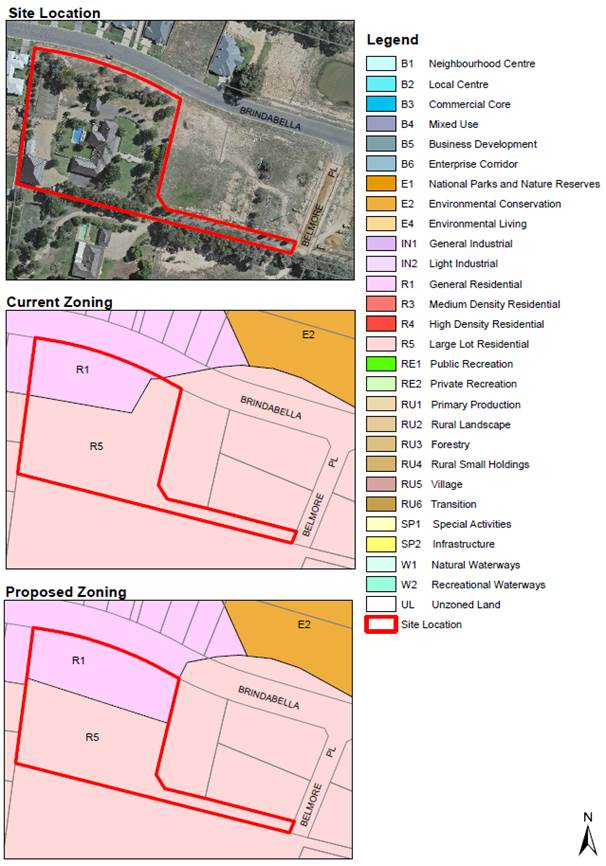

The purpose of this Planning Proposal is to rezone a portion of 6 Belmore Place, Tatton from R5 Large Lot Residential to R1 General Residential and to remove minimum lot size provisions to facilitate an additional R1 General Residential lot. |

|

That Council: a support the planning proposal to amend the Wagga Wagga Local Environmental Plan 2010 b submit the planning proposal to the Department of Planning and Environmental for Gateway Determination c adopt the planning proposal to amend the Wagga Wagga Local Environmental Plan 2010 if no submissions are received d receive a further report if submissions are received during the exhibition period i addressing any submissions made in respect of the planning proposal ii proposing adoption of the planning proposal unless there are any recommended amendments deemed to be substantial and requiring a further public exhibition period |

Report

An application and planning proposal has been received for 6 Belmore Place, Tatton as illustrated in Figure 1.

Figure 1, Site Location

The Planning Proposal has been prepared by Blueprint Planning and Development on behalf of the landowner to rezone land for R1 General Residential purposes and to remove the minimum lot size for part of 6 Belmore Place, Tatton. The amendment will provide a more conventional zone boundary for subdivision purposes and retain a rural lifestyle block containing the existing dwelling.

The proposal will result in amendments to the Wagga Wagga Local Environmental Plan 2010 land zoning map and minimum lot size map.

The proposal intends to:

· rezone a small portion of the lot fronting Brindabella Drive from R5 large lot residential land to R1 general residential

· rezone a small portion of the lot from R1 general residential to R5 large lot residential to align with the proposed rural lifestyle block boundary

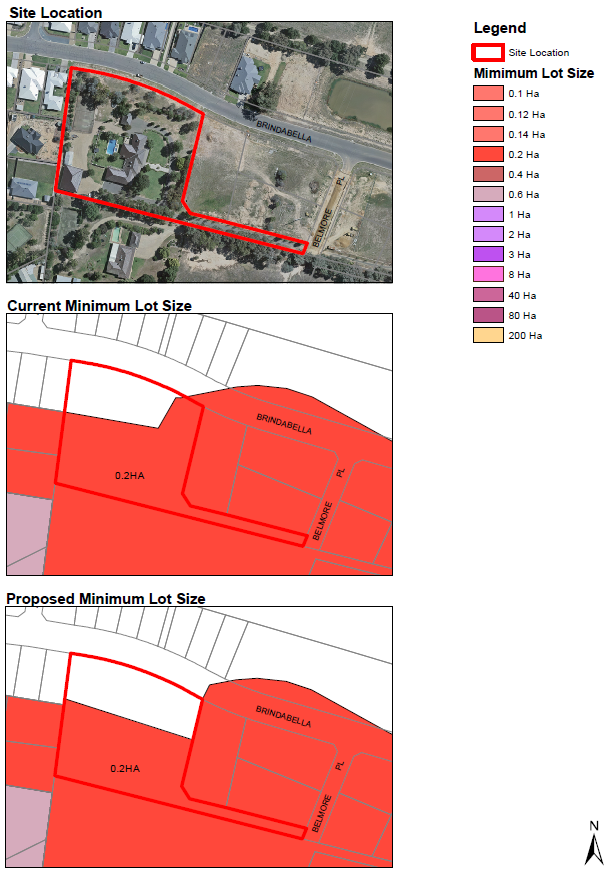

Amendments will also occur to the minimum lot size map with zero lot size provisions applying to land proposed to be rezoned to R1 general residential and 0.2 hectare lot size provisions applying to land proposed to be rezoned to R5 large lot residential.

A more detailed description of the proposal with supporting information is attached under separate cover.

The proposal will result in amendments to the Wagga Wagga Local Environmental Plan 2010 land zoning map and minimum lot size map. The land zoning and minimum lot size proposed is shown in the maps below:

Figure 2: Proposed Land Use Zone Changes

Figure 3: Proposed Minimum Lot Size Changes

The proposal is supported for the following reasons:

· The proposed amendment is a minor realignment of the existing zone and minimum lot size boundaries.

· The proposed amendment will be compatible with the existing land use pattern and urban fabric along Brindabella drive as illustrated on Figures 2 and 3.

· It is consistent with relevant Section 117 Directions.

· The investigation of the subject land provided with the application is sufficient to support the planning proposal with no further studies required.

· There is sufficient information to enable Council to support the planning proposal and forward it to the Department of Planning and Environment seeking a Gateway Determination.

To comply with the NSW Department of Planning and Environment guidelines and to support the planning proposal, council staff have prepared a proposed timeline and exhibition mapping.

Financial Implications

N/A

Policy and Legislation

· Environmental Planning and Assessment Act 1979

· Wagga Wagga Local Environmental Plan 2010

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

Consultation with Council’s Planning Section was undertaken via internal referral.

Community consultation will be undertaken as required by the Gateway Determination.

|

1. |

Planning Proposal - LEP2017/0002 - 6 Belmore Place, Tatton - Provided under separate cover |

|

|

⇩2. |

Planning Proposal - LEP2017/0002 - Proposed Minimum Lot Size |

|

|

Planning Proposal - LEP2017/0002 - Proposed Timeline |

|

Report submitted to the Ordinary Meeting of Council on Monday 27 November 2017. RP-3

RP-3 2016/17 Financial Statements - Presentation from NSW Audit Office

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Analysis: |

Council resolved to sign the 2016/17 Financial Statements at the 23 October 2017 Council Meeting, enabling Council officers to lodge the financial statements with the Office of Local Government (OLG) prior to the 31 October 2017 due date.

Council’s external auditors, NSW Audit Office have completed their Auditor’s Report, and have provided this to Council for their information. Representatives from NSW Audit Office will be presenting to Council at this meeting. |

|

That Council: a note that no public submissions were received regarding the draft Financial Statements for the year ended 30 June 2017 b receive the Audited Financial Statement, together with the Auditor’s Reports on the Financial Statements for the year ended 30 June 2017 c receive a presentation from Council’s external auditors, NSW Audit Office |

Report

The Audit Reports for the 2016/17 Financial Statements have now been received and are presented in accordance with section 419 (1) of the Local Government Act 1993.

Representatives from Council’s external auditors, NSW Audit Office will be making a presentation on the 2016/17 Financial Statements and will be available to answer any questions from Councillors.

Council has provided public notice that the Financial Statements and Auditor’s Reports will be presented at this meeting in accordance with section 418 (3) of the Local Government Act 1993 and has invited public submissions on the audited financial statements, of which no submissions were received.

Financial Implications

Council’s financial performance for the 2016/17 financial year has improved in comparison to the previous financial year’s result. The financial statements show a net operating surplus of $32.6M (including capital grants and contributions) which compares favourably to the 2015/16 result of $4.26M surplus which is mainly due to the $23.5M increase in grants and contributions ($5.9M additional for operating and $17.6M additional in capital). The main contributor to the increase in the capital grants was the $20.3M received for the Bomen Stage 1 Roadworks project.

As of 30 June 2017 Council held $35.7M in internal reserves, an increase of $4.6M on the previous year. The increase has been mainly due to the following:

· Grant Commission Reserve – $5M received for the prepayment of the Financial Assistance Grant relating to the 2017/18 financial year

· Fit for the Future Reserve – an additional $2.1M has been transferred to this reserve, bringing the balance up to $3.03M. Council’s Fit for the Future submission notes an annual target of identifying efficiencies of $800K and also additional operating income of $300K for asset renewals. A detailed program of priority works will be established during the 2017/18 financial year.

Policy

Local Government Act 1993

413 Preparation of Financial Reports

(1) A council must prepare financial reports for each year, and must refer them for audit as soon as practicable (having regard to the requirements of section 416 (1)) after the end of that year.

Note : Under section 416 (1), a council's financial reports for a year must be prepared and audited within 4 months after the end of the year concerned, and under section 428 (2) (a) the audited financial reports must be included in the council's annual report.

(2) A council's financial reports must include:

(a) a general purpose financial report, and

(b) any other matter prescribed by the regulations, and

(c) a statement in the approved form by the council as to its opinion on the general purpose financial report.

(3) The general purpose financial report must be prepared in accordance with this Act and the regulations and the requirements of:

(a) the publications issued by the Australian Accounting Standards Board, as in force for the time being, subject to the regulations, and

(b) such other standards as may be prescribed by the regulations.

418 Public notice to be given of presentation of financial reports

(1) As soon as practicable after a council receives a copy of the auditor’s reports:

(a) it must fix a date for the meeting at which it proposes to present its audited financial reports, together with the auditor’s reports, to the public, and

(b) it must give public notice of the date so fixed.

(2) The date fixed for the meeting must be at least 7 days after the date on which the notice is given, but not more than 5 weeks after the auditor’s reports are given to the council.

Note. Unless an extension is granted under section 416, the meeting must be held on or before 5 December after the end of the year to which the reports relate.

(3) The public notice must include:

(a) a statement that the business of the meeting will include the presentation of the audited financial reports and the auditor’s reports, and

(b) a summary, in the approved form, of the financial reports, and

(c) a statement to the effect that any person may, in accordance with section 420, make submissions (within the time provided by that section and specified in the statement) to the council with respect to the council’s audited financial reports or with respect to the auditor’s reports.

(4) Copies of the council’s audited financial reports, together with the auditor’s reports, must be kept available at the office of the council for inspection by members of the public on and from the date on which public notice of the holding of the meeting is given and until the day after the meeting (or any postponement of the meeting).

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

The NSW Audit Office will provide Council with a final Management Letter by 30 November 2017, with the Interim Management Letter previously discussed at the 10 August 2017 Audit, Risk and Improvement Committee Meeting. The Interim Management Letter identified six issues with five rating as Moderate and one rated as Low. Council officers will undertake the actions that will be identified in the Final Management Responses.

Internal / External Consultation

The Council’s Community Engagement Strategy and IAP2 considers the community to be “any individual or group of individuals, organisation or political entity with an interest in the outcome of a decision….”

Council’s external auditors, NSW Audit Office have liaised with Council’s Finance division and presented the draft Financial Statements in detail to the Audit, Risk and Improvement Committee at the 5 October 2017 Committee meeting.

|

1. |

WWCC - 2016/17 Financial Statements - Provided under separate cover |

|

|

2⇩. |

Report on the Conduct of the Audit - NSW Audit Office |

|

|

3⇩. |

Report on the General Purpose Financial Statements - NSW Audit Office |

|

|

4⇩. |

Report on the Special Purpose Financial Statements - NSW Audit Office |

|

|

5⇩. |

Report on Special Schedule No. 8 - NSW Audit Office |

|

RP-4 Financial Performance Report as at 31 October 2017

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Analysis: |

This report is for Council to consider and approve the proposed 2017/18 budget variations required to manage the 2017/18 budget and Long Term Financial Plan, and details Council’s external investments and performance as at 31 October 2017.

This report also includes Section 356 requests for financial assistance to be considered for approval. |

|

That Council: a approve the proposed 2017/18 budget variations for the month ended 31 October 2017 and note the balanced budget position as presented in this report b note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above c provide financial assistance of the following amounts in accordance with Section 356 of the Local Government Act 1993: i) Mayoress Concert $ 975.00 d note details of the external investments as at 31 October 2017 in accordance with section 625 of the Local Government Act 1993 |

Report

Wagga Wagga City Council (Council) forecasts an overall balanced budget position as at 31 October 2017. Proposed funded budget variations are detailed in this report for Council’s consideration and adoption.

Council has experienced a positive monthly investment performance for the month of October that is mainly attributable to Council’s Floating Rate Note (FRN) portfolio seeing a positive movement for the period. Councils managed funds investment also performed strongly during the October period. Council also continues to have a higher than anticipated investment portfolio balance and continued strong portfolio returns.

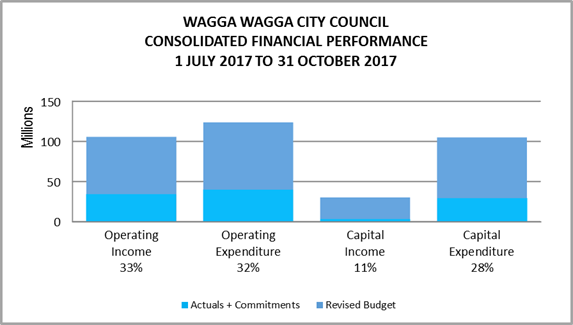

Key Performance Indicators

OPERATING INCOME

Total operating income is 33% of approved budget, which is tracking to budget for the end of October (this percentage excludes capital grants and contributions). An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 71%.

OPERATING EXPENSES

Total operating expenditure is 32% of approved budget and is tracking to budget for the full financial year.

CAPITAL INCOME

Total capital income is 11% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions relating to projects.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 28% of approved budget.

|

WAGGA WAGGA CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2017/18 |

COMMT'S 2017/18 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue

|

|||||||

|

Rates & Annual Charges |

(63,090,002) |

0 |

(63,090,002) |

(22,002,058) |

0 |

(22,002,058) |

35% |

|

User Charges & Fees |

(25,947,798) |

35,469 |

(25,912,329) |

(7,846,699) |

0 |

(7,846,699) |

30% |

|

Interest & Investment Revenue |

(3,154,163) |

0 |

(3,154,163) |

(1,408,175) |

0 |

(1,408,175) |

45% |

|

Other Revenues |

(2,984,954) |

(51,335) |

(3,036,289) |

(826,098) |

0 |

(826,098) |

27% |

|

Operating Grants & Contributions |

(13,910,429) |

3,432,786 |

(10,477,643) |

(2,650,668) |

0 |

(2,650,668) |

25% |

|

Capital Grants & Contributions |

(13,704,984) |

(22,547,734) |

(36,252,719) |

(3,705,997) |

0 |

(3,705,997) |

10% |

|

Total Revenue |

(122,792,330) |

(19,130,814) |

(141,923,144) |

(38,439,695) |

0 |

(38,439,695) |

27% |

|

|

|||||||

|

Expenses

|

|||||||

|

Employee Benefits & On-Costs |

42,458,491 |

178,503 |

42,636,994 |

12,368,876 |

38,620 |

12,407,496 |

29% |

|

Borrowing Costs |

3,591,092 |

0 |

3,591,092 |

828,779 |

0 |

828,779 |

23% |

|

Materials & Contracts |

6,580,594 |

503,084 |

7,083,678 |

3,277,855 |

895,206 |

4,173,060 |

59% |

|

Depreciation & Amortisation |

34,477,729 |

0 |

34,477,729 |

11,492,576 |

0 |

11,492,576 |

33% |

|

Other Expenses |

32,706,532 |

3,280,059 |

35,986,591 |

9,442,710 |

1,592,459 |

11,035,169 |

31% |

|

Total Expenses |

119,814,437 |

3,961,645 |

123,776,083 |

37,410,795 |

2,526,285 |

39,937,080 |

32% |

|

|

|

||||||

|

Net Operating (Profit)/Loss |

(2,977,893) |

(15,169,169) |

(18,147,062) |

(1,028,900) |

2,526,285 |

1,497,385 |

|

|

|

|||||||

|

Net Operating (Profit)/Loss before Capital Grants & Contributions |

10,727,091 |

7,378,566 |

18,105,657 |

2,677,097 |

2,526,285 |

5,203,382 |

|

|

|

|||||||

|

Cap/Reserve Movements |

|||||||

|

Capital Exp - Renewals |

25,035,121 |

26,703,189 |

51,738,311 |

3,097,464 |

13,717,267 |

16,814,731 |

32% |

|

Capital Exp - New Projects |

16,498,302 |

16,373,377 |

32,871,678 |

6,772,035 |

4,872,039 |

11,644,074 |

35% |

|

Capital Exp - Project Concepts |

11,800,337 |

6,097,816 |

17,898,153 |

34,540 |

65,708 |

100,248 |

1% |

|

Loan Repayments |

2,474,343 |

0 |

2,474,343 |

824,781 |

0 |

824,781 |

33% |

|

New Loan Borrowings |

(7,215,980) |

(4,059,170) |

(11,275,150) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(4,678,401) |

(1,371,761) |

(6,050,162) |

(305,621) |

0 |

(305,621) |

5% |

|

Net Movements Reserves |

(6,458,101) |

(28,574,282) |

(35,032,383) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

37,455,621 |

15,169,169 |

52,624,790 |

10,423,200 |

18,655,013 |

29,078,213 |

55% |

|

|

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2017/18 |

COMMT'S 2017/18 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Net Result after Depreciation |

34,477,728 |

0 |

34,477,728 |

9,394,300 |

21,181,298 |

30,575,598 |

|

|

|

|||||||

|

Add back Depreciation Expense |

34,477,729 |

0 |

34,477,729 |

11,492,576 |

0 |

11,492,576 |

|

|

|

|||||||

|

Cash Budget (Surplus)/Deficit |

0 |

0 |

0 |

(2,098,277) |

21,181,298 |

19,083,022 |

|

Revised Budget Result - Surplus/(Deficit) |

$’000s |

|

Original 2017/18 Budget Result as adopted by Council Total Budget Variations approved to date Budget variations for October 2017 |

$0 $0 $0 |

|

Proposed revised budget result for 31 October 2017 |

$0 |

The proposed Budget Variations to 31 October 2017 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact Fav/ (Unfav) |

|

2 – Safe and Healthy Community |

|||

|

Lawn Cemetery Irrigation and Pump Upgrade |

$154K |

Cemetery Reserve (100K) Cemetery Operating Budget Savings ($54K) |

Nil |

|

Funds are required for irrigation, turfing and a pump upgrade to allow for the completion of the Lawn Cemetery Master Plan Stage 2 project. The current pump system is operating at its maximum capacity with this upgrade required to cater for the additional irrigation requirements. It is proposed to fund these works from identified Cemetery operational budgets this financial year ($54K) and the Cemetery Operating Reserve ($100K). |

|||

|

Oasis Repairs & Maintenance |

$86K |

Oasis Plant Reserve ($86K) |

Nil |

|

Funds are required at the Oasis for the major upgrade of all five pool sand filters, the replacement of the chlorine storage room bunding and dosing pump control panel. In addition, Council officers have identified that the two evaporative air conditioners located at Workout Gym require replacing. Under the current lease agreement, Workout is responsible for the maintenance of the air conditioners, with Council responsible for the replacements. It is proposed to fund these required works from the Oasis Plant Reserve, which has a current balance of $1.1M and has capacity to fund these works. |

|||

|

4 – Community Place and Identity |

|||

|

Fitz Live Event |

$20K |

Fitz Live Grant Income ($20K) |

Nil |

|

Council has been successful in securing grant funding of $20K from the Live Music Office and Create NSW for Fitz Live. Fitz Live is a music event that will occur over two Saturdays in Autumn 2018 at Wagga Tourism Partner businesses in Fitzmaurice Street. |

|||

|

Civic Theatre Partnership Shows |

$50K |

Civic Theatre Partnership Shows Income ($50K) |

Nil |

|

It is proposed to create a new budget line for the Civic Theatre to be able to attract and present several high quality artists each year. The majority of these artists will only tour to regional areas as part of a partnership agreement. These shows are expected to operate on a cost neutral basis or return a small profit. Council are currently in partnership negotiations with a number of high quality artists. |

|||

|

Civic Theatre Lighting Upgrade |

$57K |

Civic Theatre Technical Reserve ($57K) |

|

|

Funds are required for the continuation of the Civic Theatre lighting upgrade with the replacement of analogue lights with LED lights. LED lighting is more flexible, energy efficient, cheaper and reliable. The lights selected are now industry standard and being used by the major theatre companies in Australia. It is proposed to fund these works from the Civic Theatre Technical Reserve which has a current balance of $105K and has capacity to fund these works. |

|||

|

Fusion Sustainability Strategy |

$18K |

Fusion Sustainability Grant Income ($18K) |

Nil |

|

Council has been successful in obtaining a Building Better Regions Grant for $18K to fund the Fusion Sustainability Strategy Project. This project aims to support local communities to prosper and grow and helps to boost economic growth in the region by continued support of the Fusion Festival. The Fusion Festival celebrates the 112 countries of origin that make up our community and attracts more than 10,000 people from across the region for the event. |

|||

|

5 – The Environment |

|||

|

Graham Park Embellishment

Wilga Park Embellishment |

$50K

$50K |

Graham Park Grant Income ($50K) Wilga Park Grant Income ($50K) |

Nil |

|

Council has been successful in obtaining $100K from Family & Community Services NSW under the Social Housing Community Fund to improve the liveability of social housing communities in Ashmont and Kooringal.

The Graham Park at Ashmont $50K grant will provide a new toilet block, bench seating and bubbler for the park. This grant will compliment the existing $100K allocated in 2017/18 for the upgrade of Graham Park.

The Wilga Park Kooringal grant of $50K will provide improvements to the park including landscaping, a basketball court and skate grinding rail. |

|||

|

VMG Christmas Lights |

$20K |

Events Management ($10K) Director of Commercial Operations - Operational Budget Savings ($10K) |

Nil |

|

Due to feedback received from community members last festive season, it is proposed to purchase and install quality Christmas lighting for the Victory Memorial Gardens (VMG). This involves providing lighting to the main tree at the VMG which will offer a new look and feel for Christmas 2017 in Wagga Wagga. Due to timing restraints, the lighting has been ordered to ensure that these lights will be installed by the end of November in time for Christmas. It is proposed to fund this variation from the existing Events Management budget and operational budget savings identified in the Director of Commercial Operations area. |

|||

|

SURPLUS/(DEFICIT) |

Nil |

||

Current Restrictions

|

RESERVES SUMMARY |

|||||

|

31 OCTOBER 2017 |

|||||

|

|

Approved Changes |

|

|

||

|

|

CLOSING BALANCE 2016/17 |

ADOPTED RESERVE TRANSFERS 2017/18 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 23.10.17 |

RECOMMENDED CHANGES for Council Resolution |

REVISED BALANCE |

|

|

|

||||

|

Externally Restricted |

|

||||

|

Developer Contributions |

(21,947,807) |

3,374,249 |

4,733,577 |

(13,839,982) |

|

|

Sewer Fund Reserve |

(24,045,646) |

1,229,992 |

3,325,465 |

(19,490,189) |

|

|

Solid Waste Reserve |

(15,824,723) |

4,878,008 |

1,207,212 |

(9,739,503) |

|

|

Specific Purpose Unexpended Grants/Contributions |

(3,378,959) |

0 |

3,378,959 |

0 |

|

|

SRV Levee Reserve |

(1,167,316) |

1,167,316 |

0 |

||

|

Stormwater Levy Reserve |

(2,940,246) |

(587,206) |

451,268 |

(3,076,184) |

|

|

Total Externally Restricted |

(69,304,697) |

8,895,043 |

14,263,797 |

0 |

(46,145,858) |

|

|

|

||||

|

Internally Restricted |

|

||||

|

Airport Reserve |

(371,610) |

(386,660) |

101,914 |

(656,355) |

|

|

Art Gallery Reserve |

(30,990) |

(21,000) |

0 |

(51,990) |

|

|

Ashmont Community Facility Reserve |

(4,500) |

(1,500) |

0 |

(6,000) |

|

|

Bridge Replacement Reserve |

(240,240) |

(100,000) |

153,573 |

(186,667) |

|

|

CBD Carparking Facilities Reserve |

(891,982) |

0 |

129,191 |

(762,792) |

|

|

CCTV Reserve |

(64,476) |

(10,000) |

0 |

(74,476) |

|

|

Cemetery Perpetual Reserve |

(157,605) |

(125,146) |

144,084 |

(138,667) |

|

|

Cemetery Reserve |

(193,116) |

(161,330) |

0 |

(354,446) |

|

|

Civic Theatre Operating Reserve |

0 |

(50,000) |

0 |

(50,000) |

|

|

Civic Theatre Technical Infra Reserve |

(105,450) |

(50,000) |

0 |

57,000 |

(98,450) |

|

Civil Projects Reserve |

(155,883) |

0 |

0 |

(155,883) |

|

|

Community Amenities Reserve |

(5,685) |

0 |

0 |

(5,685) |

|

|

Council Election Reserve |

(166,776) |

(73,095) |

0 |

(239,871) |

|

|

Emergency Events Reserve |

(133,829) |

(86,331) |

(220,160) |

||

|

Employee Leave Entitlements Gen Fund Reserve |

(3,184,451) |

0 |

0 |

(3,184,451) |

|

|

Environmental Conservation Reserve |

(131,351) |

0 |

0 |

(131,351) |

|

|

Estella Community Centre Reserve |

(230,992) |

0 |

0 |

(230,992) |

|

|

Family Day Care Reserve |

(169,356) |

(123,944) |

0 |

(293,300) |

|

|

Fit for the Future Reserve |

(3,033,479) |

(2,265,725) |

542,464 |

(4,756,740) |

|

|

Generic Projects Saving |

(1,040,610) |

20,000 |

93,727 |

(926,883) |

|

|

Glenfield Community Centre Reserve |

(17,704) |

(2,000) |

0 |

(19,704) |

|

|

Grants Commission Reserve |

(4,956,776) |

0 |

4,956,776 |

0 |

|

|

Grassroots Cricket Reserve |

(70,992) |

0 |

0 |

(70,992) |

|

|

Gravel Pit Restoration Reserve |

(761,422) |

0 |

25,000 |

(736,422) |

|

|

Gurwood Street Property Reserve |

(50,454) |

0 |

0 |

(50,454) |

|

|

Information Services |

(378,713) |

250,000 |

0 |

(128,713) |

|

|

Infrastructure Replacement Reserve |

(136,098) |

(48,071) |

954 |

(183,215) |

|

|

Insurance Variations Reserve |

(28,644) |

0 |

0 |

(28,644) |

|

|

Internal Loans Reserve |

(674,661) |

(851,794) |

695,008 |

(831,446) |

|

|

Lake Albert Improvements Reserve |

(53,867) |

(50,000) |

56,078 |

(47,789) |

|

|

LEP Preparation Reserve |

(28,301) |

14,636 |

11,120 |

(2,545) |

|

|

Livestock Marketing Centre Reserve |

(7,267,731) |

(1,180,017) |

4,053,725 |

(4,394,024) |

|

|

Museum Acquisitions Reserve |

(39,378) |

0 |

0 |

(39,378) |

|

|

Oasis Building Renewal Reserve |

(172,000) |

(32,147) |

121,000 |

(83,147) |

|

|

Oasis Plant Reserve |

(1,115,347) |

90,000 |

0 |

86,000 |

(939,347) |

|

Parks & Recreation Projects |

(79,648) |

0 |

74,360 |

(5,288) |

|

|

Pedestrian River Crossing (old Riverside) Reserve |

(198,031) |

48,031 |

150,000 |

0 |

|

|

Plant Replacement Reserve |

(5,893,831) |

1,804,934 |

1,059,675 |

(3,029,223) |

|

|

Playground Equip Replacement Reserve |

(59,181) |

(105,679) |

0 |

(164,860) |

|

|

Project Carryovers Reserve |

(1,276,882) |

0 |

1,276,882 |

0 |

|

|

Public Art Reserve |

(173,283) |

(23,669) |

0 |

(196,952) |

|

|

Robertson Oval Redevelopment Reserve |

(86,697) |

0 |

0 |

(86,697) |

|

|

Senior Citizens Centre Reserve |

(13,627) |

(2,000) |

0 |

(15,627) |

|

|

Sister Cities Reserve |

(36,527) |

(10,000) |

0 |

(46,527) |

|

|

Stormwater Drainage Reserve |

(183,420) |

0 |

3,177 |

(180,242) |

|

|

Strategic Real Property Reserve |

(702,792) |

0 |

(380,000) |

(1,082,792) |

|

|

Street Lighting Replacement Reserve |

(74,755) |

(30,000) |

0 |

(104,755) |

|

|

Subdivision Tree Planting Reserve |

(272,621) |

(20,000) |

0 |

(292,621) |

|

|

Sustainable Energy Reserve |

(520,442) |

35,000 |

60,000 |

(425,442) |

|

|

Traffic Committee Reserve |

(50,000) |

(50,000) |

0 |

(100,000) |

|

|

Total Internally Restricted |

(35,686,205) |

(3,511,177) |

13,242,376 |

143,000 |

(25,812,006) |

|

|

|

||||

|

Total Restricted |

(104,990,903) |

5,383,866 |

27,506,173 |

143,000 |

(71,957,864) |

|

|

|

|

|

|

|

Section 356 Financial Assistance Requests

Two Section 356 Donation requests has been received for consideration at the 27 November 2017 Ordinary Council meeting. A donation request of $90 to the Tiny Tykes Markets is the subject of a separate report.

The second donation request is noted below.

· Mayoress Concert 2018 - $975

The Mayoress – Mrs Jenny Conkey has requested the waiver of the hire fees for the Civic Theatre to stage a fund raising concert on the 28 July 2018.

Mayoress Conkey in her attached request notes:

“The concert would be a showcase of local musical talent with all profit used to fund youth programs in the local community “

|

Section 356 financial assistance available budget |

$8,010.64 |

|

Mayoress Concert |

($975.00) |

|

Tiny Tykes Market (Subject of separate 27 November Council Report) |

(90.00) |

|

Total Section 356 Financial Assistance Requests – 27 November 2017 Council Meeting

|

($ 1065.00) |

|

Proposed balance of Section 356 financial assistance budget – available for requests received for the remainder of this financial year

|

$6,945.64

|

Investment Summary as at 31 October 2017

In accordance with Regulation 212 of the Local Government (General) Regulation 2005, details of Wagga Wagga City Council’s external investments are detailed below:

|

Institution |

Rating |

Closing Balance |

Closing Balance |

October |

October |

Investment |

Maturity |

Term |

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

2.87% |

0.86% |

6/12/2016 |

6/12/2017 |

12 |

|

Banana Coast CU |

NR |

1,000,000 |

1,000,000 |

2.80% |

0.86% |

2/06/2017 |

1/06/2018 |

12 |

|

AMP |

A |

2,000,000 |

2,000,000 |

2.80% |

1.72% |

2/06/2017 |

1/06/2018 |

12 |

|

CUA |

BBB |

1,000,000 |

1,000,000 |

2.80% |

0.86% |

9/02/2017 |

5/01/2018 |

11 |

|

AMP |

A |

2,000,000 |

2,000,000 |

2.60% |

1.72% |

2/08/2017 |

2/08/2018 |

12 |

|

ME Bank |

BBB |

2,000,000 |

0 |

0.00% |

0.00% |

16/12/2016 |

16/10/2017 |

10 |

|

CUA |

BBB |

1,000,000 |

1,000,000 |

2.75% |

0.86% |

3/03/2017 |

2/03/2018 |

12 |

|

Suncorp-Metway |

A+ |

2,000,000 |

2,000,000 |

2.60% |

1.72% |

7/06/2017 |

3/01/2018 |

7 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

2.60% |

1.72% |

8/09/2017 |

7/09/2018 |

12 |

|

Suncorp-Metway |

A+ |

2,000,000 |

0 |

0.00% |

0.00% |

9/06/2017 |

9/10/2017 |

4 |

|

Suncorp-Metway |

A+ |

2,000,000 |

2,000,000 |

2.55% |

1.72% |

9/06/2017 |

6/11/2017 |

5 |

|

ME Bank |

BBB |

2,000,000 |

2,000,000 |

2.60% |

1.72% |

22/08/2017 |

19/04/2018 |

8 |

|

AMP |

A |

1,000,000 |

1,000,000 |

2.80% |

0.86% |

8/09/2017 |

5/06/2018 |

9 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

2.62% |

1.72% |

28/09/2017 |

28/09/2018 |

12 |

|

Auswide |

BBB- |

0 |

2,000,000 |

2.67% |

1.72% |

5/10/2017 |

5/10/2018 |

12 |

|

Auswide |

BBB- |

0 |

1,000,000 |

2.67% |

0.86% |

16/10/2017 |

16/10/2018 |

12 |

|

Total Short Term Deposits |

|

23,000,000 |

22,000,000 |

2.67% |

18.87% |

|

|

|

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

3,028,968 |

1,533,002 |

1.50% |

1.31% |

N/A |

N/A |

N/A |

|

NAB |

AA- |

14,049,701 |

15,577,967 |

2.19% |

13.36% |

N/A |

N/A |

N/A |

|

Institution |

Rating |

Closing Balance |

Closing Balance |

October |

October |

Investment |

Maturity |

Term |

|

AMP |

A |

182,498 |

182,821 |

2.15% |

0.16% |

N/A |

N/A |

N/A |

|

Beyond Bank |

BBB+ |

148,698 |

148,850 |

1.00% |

0.13% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

51,634 |

51,594 |

1.35% |

0.04% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

17,461,500 |

17,494,233 |

2.12% |

15.00% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

RaboBank |

A+ |

1,000,000 |

1,000,000 |

3.16% |

0.86% |

5/06/2017 |

6/06/2022 |

60 |

|

ING Bank |

A |

3,000,000 |

3,000,000 |

2.75% |

2.57% |

24/08/2017 |

26/08/2019 |

24 |

|

ME Bank |

BBB |

2,000,000 |

2,000,000 |

4.28% |

1.72% |

2/09/2014 |

2/09/2019 |

60 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

4.10% |

0.86% |

5/12/2014 |

5/12/2019 |

60 |

|

Beyond Bank |

BBB+ |

990,000 |

990,000 |

3.70% |

0.85% |

4/03/2015 |

4/03/2018 |

36 |

|

Beyond Bank |

BBB+ |

990,000 |

990,000 |

3.70% |

0.85% |

11/03/2015 |

11/03/2018 |

36 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.10% |

1.72% |

7/07/2017 |

7/07/2020 |

36 |

|

Newcastle Permanent |

BBB |

1,000,000 |

1,000,000 |

3.00% |

0.86% |

12/08/2016 |

12/08/2019 |

36 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

3.20% |

0.86% |

25/08/2016 |

25/08/2021 |

60 |

|

Newcastle Permanent |

BBB |

1,000,000 |

1,000,000 |

3.00% |

0.86% |

31/08/2016 |

30/08/2019 |

36 |

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

2.90% |

0.86% |

8/09/2016 |

10/09/2018 |

24 |

|

Newcastle Permanent |

BBB |

2,000,000 |

2,000,000 |

3.00% |

1.72% |

10/02/2017 |

11/02/2019 |

24 |

|

Westpac |

AA- |

3,000,000 |

3,000,000 |

3.10% |

2.57% |

10/03/2017 |

10/03/2022 |

60 |

|

ING Bank |

A |

0 |

1,000,000 |

2.92% |

0.86% |

16/10/2017 |

16/10/2019 |

24 |

|

Total Medium Term Deposits |

|

19,980,000 |

20,980,000 |

3.24% |

17.99% |

|

|

|

|

Floating Rate Notes - Senior Debt |

|

|

|

|

|

|

|

|

|

Bendigo-Adelaide |

BBB+ |

1,003,564 |

1,006,917 |

BBSW + 93 |

0.86% |

17/09/2014 |

17/09/2019 |

60 |

|

BOQ |

BBB+ |

2,015,000 |

2,021,800 |

BBSW + 110 |

1.73% |

5/08/2014 |

24/06/2019 |

58 |

|

BOQ |

BBB+ |

1,009,023 |

1,005,587 |

BBSW + 107 |

0.86% |

6/11/2014 |

6/11/2019 |

60 |

|

BOQ |

BBB+ |

1,009,023 |

1,005,587 |

BBSW + 107 |

0.86% |

10/11/2014 |

6/11/2019 |

60 |

|

ME Bank |

BBB |

1,003,714 |

1,005,777 |

BBSW + 100 |

0.86% |

17/11/2014 |

17/11/2017 |

36 |

|

ME Bank |

BBB |

1,003,714 |

1,005,777 |

BBSW + 100 |

0.86% |

17/11/2014 |

17/11/2017 |

36 |

|

Teachers Mutual |

BBB |

1,002,744 |

1,004,837 |

BBSW + 105 |

0.86% |

4/12/2014 |

4/12/2017 |

36 |

|

Newcastle Permanent |

BBB |

1,003,974 |

1,006,107 |

BBSW + 110 |

0.86% |

27/02/2015 |

27/02/2018 |

36 |

|

Macquarie Bank |

A |

2,008,000 |

2,012,400 |

BBSW + 110 |

1.73% |

3/03/2015 |

3/03/2020 |

60 |

|

ANZ |

AA- |

759,392 |

0 |

0.00% |

0.00% |

17/04/2015 |

17/04/2020 |

60 |

|

Heritage Bank |

BBB+ |

1,005,813 |

1,001,078 |

BBSW + 115 |

0.86% |

7/05/2015 |

7/05/2018 |

36 |

|

NAB |

AA- |

1,008,130 |

0 |

0.00% |

0.00% |

3/06/2015 |

3/06/2020 |

60 |

|

Heritage Bank |

BBB+ |

1,005,813 |

1,001,078 |

BBSW + 115 |

0.86% |

9/06/2015 |

7/05/2018 |

35 |

|

CBA |

AA- |

1,013,912 |

1,010,627 |

BBSW + 90 |

0.87% |

17/07/2015 |

17/07/2020 |

60 |

|

Westpac |

AA- |

1,013,752 |

1,009,907 |

BBSW + 90 |

0.87% |

28/07/2015 |

28/07/2020 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,008,643 |

1,012,347 |

BBSW + 110 |

0.87% |

18/08/2015 |

18/08/2020 |

60 |

|

Credit Suisse |

A |

1,008,233 |

0 |

0.00% |

0.00% |

24/08/2015 |

24/08/2018 |

36 |

|

Bendigo-Adelaide |

BBB+ |

1,008,643 |

1,012,347 |

BBSW + 110 |

0.87% |

28/09/2015 |

18/08/2020 |

59 |

|

Westpac |

AA- |

2,027,504 |

2,019,814 |

BBSW + 90 |

1.73% |

30/09/2015 |

28/07/2020 |

58 |

|

Suncorp-Metway |

A+ |

1,021,130 |

1,017,086 |

BBSW + 125 |

0.87% |

20/10/2015 |

20/10/2020 |

60 |

|

Westpac |

AA- |

4,075,884 |

4,059,188 |

BBSW + 108 |

3.48% |

28/10/2015 |

28/10/2020 |

60 |

|

AMP |

A |

1,817,501 |

1,822,729 |

BBSW + 110 |

1.56% |

11/12/2015 |

11/06/2019 |

42 |

|

CBA |

AA- |

1,020,510 |

1,016,806 |

BBSW + 115 |

0.87% |

18/01/2016 |

18/01/2021 |

60 |

|

Rabobank |

A+ |

2,057,038 |

2,063,050 |

BBSW + 150 |

1.77% |

4/03/2016 |

4/03/2021 |

60 |

|

Newcastle Permanent |

BBB |

1,007,043 |

1,009,597 |

BBSW + 160 |

0.87% |

22/03/2016 |

22/03/2019 |

36 |

|

CUA |

BBB |

2,045,000 |

2,018,874 |

BBSW + 160 |

1.73% |

1/04/2016 |

1/04/2019 |

36 |

|

Institution |

Rating |

Closing Balance |

Closing Balance |

October |

October |

Investment |

Maturity |

Term |

|

ANZ |

AA- |

1,016,251 |

1,019,506 |

BBSW + 118 |

0.87% |

7/04/2016 |

7/04/2021 |

60 |

|

Suncorp-Metway |

A+ |

1,026,779 |

1,022,386 |

BBSW + 138 |

0.88% |

21/04/2016 |

12/04/2021 |

60 |

|

AMP |

A |

1,021,530 |

1,025,136 |

BBSW + 135 |

0.88% |

24/05/2016 |

24/05/2021 |

60 |

|

Westpac |

AA- |

1,018,231 |

1,021,946 |

BBSW + 117 |

0.88% |

3/06/2016 |

3/06/2021 |

60 |

|

CBA |

AA- |

1,023,630 |

1,020,226 |

BBSW + 121 |

0.88% |

12/07/2016 |

12/07/2021 |

60 |

|

ANZ |

AA- |

2,037,182 |

2,044,672 |

BBSW + 113 |

1.75% |

16/08/2016 |

16/08/2021 |

60 |

|

BOQ |

BBB+ |

1,516,743 |

1,511,816 |

BBSW + 117 |

1.30% |

26/10/2016 |

26/10/2020 |

48 |

|

NAB |

AA- |

1,016,721 |

1,014,407 |

BBSW + 105 |

0.87% |

21/10/2016 |

21/10/2021 |

60 |

|

Teachers Mutual |

BBB |

1,510,205 |

1,501,842 |

BBSW + 140 |

1.29% |

28/10/2016 |

28/10/2019 |

36 |

|

Bendigo-Adelaide |

BBB+ |

1,007,673 |

1,011,347 |

BBSW + 110 |

0.87% |

21/11/2016 |

21/02/2020 |

39 |

|

Westpac |

AA- |

1,018,461 |

1,016,226 |

BBSW + 111 |

0.87% |

7/02/2017 |

7/02/2022 |

60 |

|

ANZ |

AA- |

1,011,832 |

1,016,486 |

BBSW + 100 |

0.87% |

7/03/2017 |

7/03/2022 |

60 |

|

CUA |

BBB |

750,825 |

752,925 |

BBSW + 130 |

0.65% |

20/03/2017 |

20/03/2020 |

36 |

|

Heritage Bank |

BBB+ |

602,984 |

600,413 |

BBSW + 130 |

0.51% |

4/05/2017 |

4/05/2020 |

36 |

|

Teachers Mutual |

BBB |

1,007,307 |

1,003,528 |

BBSW + 142 |

0.86% |

29/06/2017 |

29/06/2020 |

36 |

|

NAB |

AA- |

3,013,092 |

3,030,141 |

BBSW + 90 |

2.60% |

5/07/2017 |

5/07/2022 |

60 |

|

Suncorp-Metway |

A+ |

1,004,373 |

1,008,171 |

BBSW + 97 |

0.86% |

16/08/2017 |

16/08/2022 |

60 |

|

Westpac |

AA- |

0 |

2,000,200 |

BBSW + 81 |

1.72% |

30/10/2017 |

27/10/2022 |

60 |

|

Total Floating Rate Notes - Senior Debt |

|

55,566,515 |

54,770,690 |

|

46.98% |

|

|

|

|

Managed Funds |

|

|

|

|

|

|

|

|

|

NSW Tcorp |

NR |

1,312,222 |

1,347,006 |

2.65% |

1.16% |

17/03/2014 |

1/09/2022 |

101 |

|

Total Managed Funds |

|

1,312,222 |

1,347,006 |

2.65% |

1.16% |

|

|

|

|

TOTAL

CASH ASSETS, CASH |

|

117,320,236 |

116,591,928 |

3.22% |

100.00% |

|

|

|

|

LESS: RIVERINA REGIONAL LIBRARY (RRL) CASH AT BANK |

|

3,010,032 |

2,797,235 |

|

|

|

|

|

|

TOTAL

WWCC CASH ASSETS, CASH |

|

114,310,205 |

113,794,693 |

|

|

|

|

|

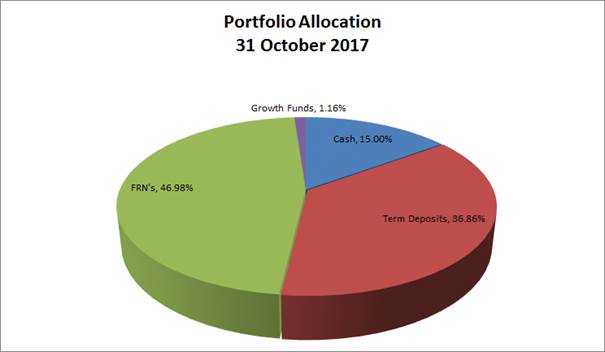

Council’s portfolio is dominated by Floating Rate Notes (FRN’s) at approximately 47% across a broad range of counterparties. Cash equates to 15% of Council’s portfolio with Term Deposits around 37% and growth funds around 1% of the portfolio.

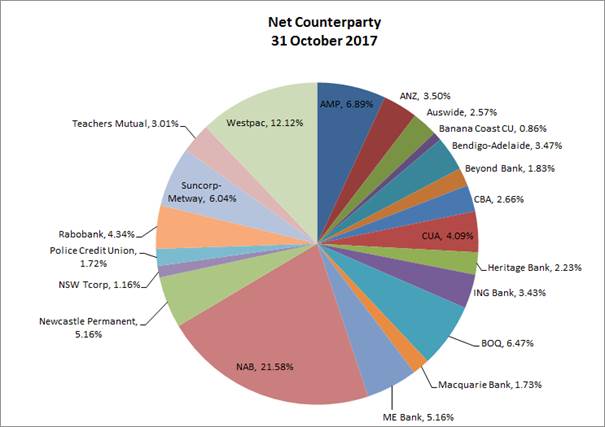

Council’s investment portfolio is well diversified in complying assets across the entire credit spectrum. It is also well diversified from a rating perspective. Credit quality is diversified and is predominately invested amongst the investment grade ADIs (BBB- or higher), with a smaller allocation to unrated ADIs.

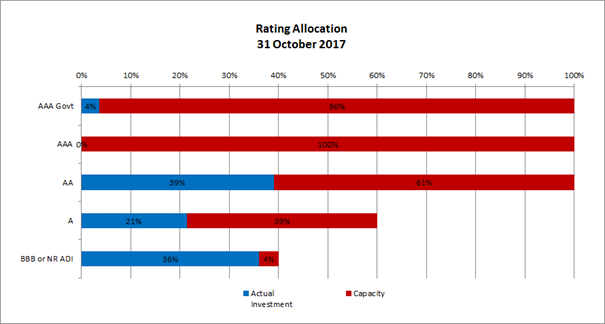

All investments are well within the defined Policy limits, as outlined in the Rating Allocation chart below:

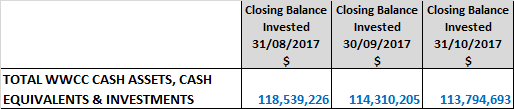

Investment Portfolio Balance

Council’s investment portfolio balance has remained relatively stable from the previous month’s balance, down from $114.3M to $113.8M.

MONTHLY INVESTMENT MOVEMENTS

Redemptions/Sales – Council redeemed/sold the following investment security during October 2017:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

ME Bank Term Deposit |

$2M |

10 months |

2.80% |

This term deposit was redeemed due to poor reinvestment rates available with ME Bank. These funds were reinvested with Auswide Bank and ING Bank (see below). |

|

Suncorp-Metway Term Deposit |

$2M |

4 months |

2.50% |

This term deposit was redeemed due to poor reinvestment rates available with Suncorp-Metway. These funds were reinvested with Auswide Bank (see below). |

|

ANZ Floating Rate Note |

$750K |

5 years |

BBSW + 82bps |

This floating rate note was sold for a Capital gain of $5,588. |

|

NAB Floating Rate Note |

$1M |

5 years |

BBSW + 80bps |

This floating rate note was sold for a Capital gain of $6,660 and the funds used to invest in a $2M parcel of Westpac Bank Floating Rate Note (see below). |

|

Credit Suisse Floating Rate Note |

$1M |

3 years |

BBSW + 105bps |

This floating rate note was sold for a Capital gain of $5,090 and the funds used to invest in a $2M parcel of Westpac Bank Floating Rate Note (see below). |

New Investments – Council purchased the following investment securities during October 2017:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

Auswide Bank Term Deposit |

$2M |

12 months |

2.67% |

The Auswide Bank rate of 2.67% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within the portfolio. |

|

Auswide Bank Term Deposit |

$1M |

12 months |

2.67% |

The Auswide Bank rate of 2.67% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within the portfolio. |

|

ING Bank Term Deposit |

$1M |

2 years |

2.92% |

The ING Bank rate of 2.92% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within the portfolio. |

|

Westpac Floating Rate Note |

$2M |

5 years |

BBSW + 81bps |

Council’s independent Financial Advisor advised this Floating Rate Note represented fair value with a major bank. |

Rollovers – Council did not roll over any investment securities during October 2017.

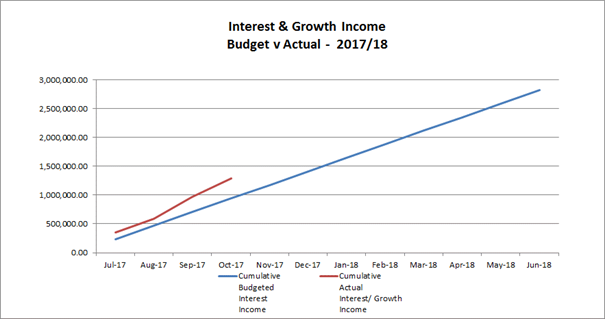

MONTHLY PERFORMANCE

Interest/growth/capital gains for the month totaled $318,894, which compares favourably with the budget for the period of $235,087, outperforming budget for October by $83,807. This is mainly attributable to Council’s Floating Rate Note (FRN) portfolio seeing a slight increase for the October period as well as a strong return from the NSW TCorp Managed Fund. It should be noted that many of Councils FRNs continue to trade at a premium.

The capital market value of these FRN investments will fluctuate from month to month and Council continues to receive the coupon payments and the face value of the investment security when sold or at maturity.

It is also important to note Council’s investment portfolio balance has consistently been over $100M recently, which is tracking well above what was originally predicted. This is mainly due to the timing of some of the major projects that are either not yet commenced or not as advanced as originally predicted. It is anticipated that over the 2017/18 financial year the portfolio balance will reduce with the construction of major projects.

The longer-dated deposits in the portfolio, particularly those locked in above 4% yields, have previously anchored Council’s portfolio performance. It should be noted that the portfolio now only includes two investments yielding above 4% and Council will inevitably see a fall in investment income over the coming months compared with previous periods. Council staff and Council’s Independent Financial Advisor will continue to identify opportunities to lock in higher yielding investments as they become available.

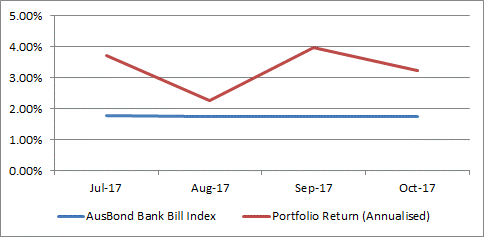

In comparison to the AusBond Bank Bill Index* (+1.74%pa), Council’s investment portfolio in total returned 3.22% for October. Short-term deposits returned 2.67%. These funds are utilised for daily cash flow management and need to be available to meet operating and contractual payments as they come due.

* The AusBond Bank Bill Index is the leading benchmark for the Australian fixed income market. It is interpolated from the RBA Cash rate, 1 month and 3 month Bank Bill Swap rates.

Report by Responsible Accounting Officer

I hereby certify that all of the above investments have been made in accordance with the provision of Section 625 of the Local Government Act 1993 and the regulations there under, and in accordance with the Investments Policy adopted by Council on 26 August 2013.

Carolyn Rodney

Responsible Accounting Officer

Policy and Legislation

Budget variations are reported in accordance with Council’s POL 052 Budget Policy.

Investments are reported in accordance with Council’s POL 075 Investment Policy.

Local Government Act 1993

625 How may councils invest?

(1) A council may invest money that is not, for the time being, required by the council for any other purpose.

(2) Money may be invested only in a form of investment notified by order of the Minister published in the Gazette.

(3) An order of the Minister notifying a form of investment for the purposes of this section must not be made without the approval of the Treasurer.

(4) The acquisition, in accordance with section 358, of a controlling interest in a corporation or an entity within the meaning of that section is not an investment for the purposes of this section.

Local Government (General) Regulation 2005

212 Reports on council investments

(1) The responsible accounting officer of a council:

(a) must provide the council with a written report (setting out details of all money that the council has invested under section 625 of the Act) to be presented:

(i) if only one ordinary meeting of the council is held in a month, at that meeting, or

(ii) if more than one such meeting is held in a month, at whichever of those meetings the council by resolution determines, and

(b) must include in the report a certificate as to whether or not the investment has been made in accordance with the Act, the regulations and the council’s investment policies.

(2) The report must be made up to the last day of the month immediately preceding the meeting.

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

This report is a control mechanism that assists in addressing the following potential risks to Council:

· Loss of investment income or capital resulting from ongoing management of investments, especially during difficult economic times

· Failure to demonstrate to the community that its funds are being expended in an efficient and effective manner

Internal / External Consultation

Council’s Community Engagement Strategy and IAP2 considers the community to be “any individual or group of individuals, organisation or political entity with an interest in the outcome of a decision….”

All relevant areas within the Council have consulted with the Finance Division in regards to the budget variations listed in this report.

The Finance Division has consulted with relevant external parties to confirm Council’s investment portfolio balances.

|

1⇩. |

Section 356 Donation Request - Mayoress Concert |

|

RP-5 COUNCIL MEETING DATES JANUARY 2018 to DECEMBER 2018

Author: Ingrid Hensley

General Manager: James Bolton

|

Analysis: |