Ordinary Meeting of

Council

Ordinary Meeting of

Council

To be held on

Monday

29 January 2018

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

Ordinary Meeting of

Council

Ordinary Meeting of

Council

To be held on

Monday

29 January 2018

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 29 January 2018 at 6.00pm.

Council live streams video and audio of Council meetings. Members of the public are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

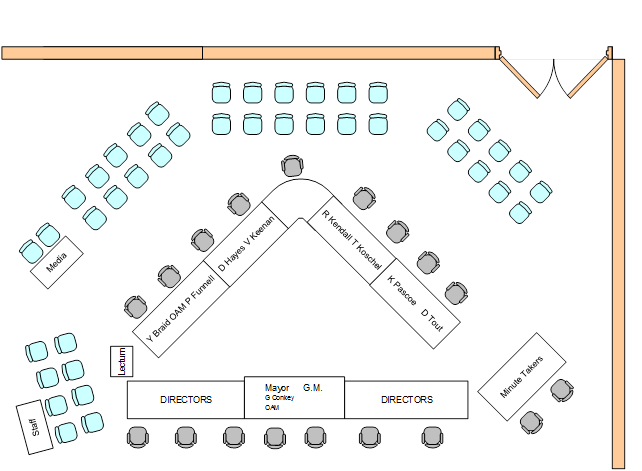

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 29 January 2018.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 29 January 2018

ORDER OF BUSINESS:

CLAUSE PRECIS PAGE

PRAYER 2

ACKNOWLEDGEMENT OF COUNTRY 2

APOLOGIES 2

CONFIRMATIONS OF MINUTES

CM-1 Ordinary Council Meeting - 18 December 2017 2

DECLARATIONS OF INTEREST 2

Reports from Staff

RP-1 DA17/0595 DEMOLITION OF EXISTING DWELLING, CONSTRUCTION OF MULTI DWELLING HOUSING AND COMMUNITY TITLE SUBDIVISION, 19 COCHRANE STREET KOORINGAL, LOT 134 DP 38519 2

RP-2 Anomalies Planning Proposal (PP2017/1) to Amend Wagga Wagga Local Environmental Plan 2010 2

RP-3 Financial Performance Report as at 31 December 2017 2

RP-4 2018 Australian Local Government Women's Association Annual Conference 2

RP-5 Youth Engagement Consultation Report 2

RP-6 RESPONSE TO NOTICE OF MOTION - LIVESTOCK MARKETING CENTRE AND HEAVY VEHICLE ACCESS 2

RP-7 POLICY 029 - ASBESTOS POLICY 2

RP-8 POL 053 Corporate Purchase Card Policy 2

RP-9 Reinstatement of Airport Fees and Charges 2

RP-10 AIRPORT BAY 4 EMERGENCY REPAIRS 2

RP-11 RENEWAL OF COMMUNITY, CULTURAL AND SPORTING AGREEMENTS 2

RP-12 Audit, Risk and Improvement Committee Charter 2

RP-13 Responses to Questions/Business with Notice 2

Committee Minutes

M-1 Riverina Regional Library Advisory Committee Meeting - 8 November 2017 2

M-2 Floodplain Risk Management Advisory Committee Minutes - 12 December 2017 2

M-3 Audit, Risk and Improvement Committee Minutes - 14 December 2017 2

QUESTIONS/BUSINESS WITH NOTICE 2

Confidential Reports

CONF-1 CODE OF CONDUCT - CONDUCT REVIEW PANEL 2

CONF-2 Major Events, Festivals and Films Sponsorship Applications 2

CONF-3 RFT2018/13 FOOTPATH CONSTRUCTION CONNECTIVITY 2

CONF-4 RFT2018/02 CONSTRUCTION OF A CAR PARK AND AMENITIES FACILITY LIVESTOCK MARKETING CENTRE (LMC) 2

CONF-5 RFT2018/15 OASIS TILE REMEDIATION 2

CONF-6 RFQ2018/516 Supply of Two 4WD Tractors with Loader and 4-in1 Bucket 2

CONF-7 RFQ2018/517 Supply of Three 4WD Tractors 2

Confirmation of Minutes

CM-1 Ordinary Council Meeting - 18 December 2017

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 18 December 2017 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - 18 December 2017 |

2 |

RP-1 DA17/0595 DEMOLITION OF EXISTING DWELLING, CONSTRUCTION OF MULTI DWELLING HOUSING AND COMMUNITY TITLE SUBDIVISION, 19 COCHRANE STREET KOORINGAL, LOT 134 DP 38519

Author: Camilla Rocks

General Manager: Peter Thompson

|

Analysis: |

The report is for a development application and is presented to Council for determination. The application has been referred to Council under 2 provisions of the Wagga Wagga Development Control Plan 2010: 1. The application is development for multi dwelling housing, where a variation to a numeric control by greater than 10% is proposed. It is proposed to vary the front setback requirement under Clause 9.3.6 from 7.5 metres to 5 metres, which would require a variation of between 3.4% up to 33.3% of the numeric control 2. Under the provisions of Council Policy POL 046 Processing Development Applications Lodged by Councillors, Staff and Individuals of Which A Conflict of Interest may Arise, or on Council Owned Land Policy, Council must determine the application because the applicant is acting on behalf of a member of the Wagga Wagga City Council staff, the owner is a staff member, the development does not comply with the provisions of the Wagga Wagga Development Control Plan 2010 and the development has a development cost greater than $250,000 and is not any of the developments exempted from this policy. |

|

That Council approve DA17/0595 for Demolition of Existing Dwelling, Construction of Multi Dwelling Housing and Community Title Subdivision at 19 Cochrane Street, KOORINGAL NSW 2650 subject to the conditions outlined in the Section 79C Assessment Report for DA17/0595.

|

Development Application Details

|

Applicant |

Troy Lucas |

|

Owner |

Troy Lucas, Shay Lucas, Brett Lucas and Tracey Dawes-Lucas |

|

Development Cost |

$690,000 |

|

Development Description |

The development seeks consent to demolish the existing dwelling and outbuilding, as well as the removal of 4 trees, then construction of three dwellings. Each dwelling is proposed to comprise of 2 bedrooms, study and open plan living and kitchen area. Dwellings 1 and 2 are proposed to have a single garage each, whilst Dwelling 3 to the rear of the allotment is provided with a double garage. An accessway is proposed to be constructed along the southern boundary to provide vehicular access to the dwellings. An additional car space is proposed in the accessway for visitor parking.

The three units are proposed to be subdivided under Community Title, with the common accessway being the community parcel.

|

Report

Key Issues

1. Variation of front setback sought

2. Sewer main across the site with assumed easement

3. Removal of 4 trees

Assessment

· The proposal is defined under the standard definitions contained in the Wagga Wagga Local Environmental Plan 2010 (LEP) as Multi Dwelling Housing (3 or more dwellings (whether attached or detached) on one lot of land, each with access at ground level but does not include a residential flat building.

· Under the provisions of the LEP, the subject site is within the R1 General Residential zone.

· The proposal is generally consistent with the R1 objectives because it provides for the housing needs of the community and provides for a variety of housing types and densities.

· Demolition of the existing dwelling is proposed. The dwelling is not considered to have any heritage significance.

· According to Council records, the subject site is not contaminated and staff are satisfied the land is suitable for its future purpose, with regard to State Environmental Planning Policy No. 55 Remediation of Land

· A valid BASIX Certificate was submitted with the application

· The application was advertised and notified and no submissions were received.

· Vehicle access and movement areas are satisfactory and sufficient on-site parking is proposed to satisfy DCP requirements.

· An adequate landscape plan was submitted to satisfy DCP requirements.

· 4 trees are proposed to be removed and no objection was raised from Council’s Parks section.

· Community title subdivision of the lot is proposed, with 3 residential lots and 1 community lot. A Management Statement was not submitted with the development application but will form part of the subsequent Subdivision Application.

· The proposal complies with DCP requirements for site area and site cover.

· Solar access within the development and private open space are assessed as being adequate.

· The application seeks a variation to front setback for the proposed development. Typical setback in the area is 7.5 metres and the proposed setback varies from 5 metres to 7.2 metres, due to the shape of the lot. The application provided adequate justification for the variation.

Reasons for Approval

1. The proposed development is consistent with the provisions of Wagga Wagga Local Environmental Plan 2010;

2. The objectives of Sections 2, 7 and 9 of the Wagga Wagga Development Control Plan 2010 (the DCP) are satisfied by the proposed development;

3. The proposed variation of the front setback, pursuant to Clause 9.3.6 of the DCP, has been justified by the application;

4. For the abovementioned reasons it is considered to be in the public interest to approve this development application.

Site Location

The subject site, Lot 134 DP 38519, known as 19 Cochrane Street, Kooringal is an allotment of approximately 1007m2 in area. The lot is irregular in shape, with a 14.2m frontage to Cochrane Street, splaying to a 34.4m rear boundary. The lot is generally flat with a slight fall north to south.

The site is located on the eastern side of Cochrane Street, approximately 50 metres north of its intersection with Kooringal Road.

The surrounding area comprises of residential allotments, with a mix of single dwellings and multi dwelling housing.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have housing that suits our needs

Risk Management Issues for Council

Refusal of the application may result in an appeal process in the Land and Environment Court which will have to be defended by Council. The reasons for refusal will have to be justified and withstand scrutiny and cross examination in Court.

Approval of the application is not considered to raise risk management issues for Council as the proposed development is generally consistent with LEP and DCP controls and the one proposed variation of a control is minor.

Internal / External Consultation

See attached s79C report for details of all consultation.

|

1. |

DA17/0595 Section 79C Report - Provided under separate cover |

|

|

2. |

DA17/0595 Plans - Provided under separate cover |

|

|

3. |

DA17/0595 Statement of Environmental Effects - Provided under separate cover |

|

Report submitted to the Ordinary Meeting of Council on Monday 29 January 2018. RP-2

RP-2 Anomalies Planning Proposal (PP2017/1) to Amend Wagga Wagga Local Environmental Plan 2010

Author: Tristan Kell

Director: Natalie Te Pohe

|

Analysis: |

This report provides a summary on the outcome of the exhibition of the Anomalies Planning Proposal (PP2017/1), and seeks support for minor amendments to the Planning Proposal. The revised Planning Proposal will be resubmitted to the Department of Planning and Environment for a revised Gateway Determination. |

|

That Council: a receive and note the submissions made during the exhibition of the Planning Proposal b support minor amendments to the original Planning Proposal as a result of the submissions received and as outlined in the report c re-submit the Planning Proposal to the Department of Planning and Environment for Gateway Determination d adopt the Planning Proposal to amend the Wagga Wagga Local Environmental Plan 2010 if no submissions are received during the second round of public consultation and use Council’s delegated authority to gazette the plan and notify the Department of Planning and Environment accordingly e receive a further report if any new submissions are received during the second round of public consultation |

Report

This report provides a summary of the submissions received in relation to the Anomalies Planning Proposal (PP2017/1) to amend the Wagga Wagga Local Environmental Plan 2010.

Council at its meeting held on Monday 26 June 2017 resolved:

That Council:

a support the planning proposal to amend the Wagga Wagga Local Environmental Plan 2010

b submit the planning proposal to the Department of Planning and Environment for Gateway Determination

c adopt the planning proposal to amend the Wagga Wagga Local Environmental Plan 2010 if no submissions are received

d receive a further report if submissions are received during the exhibition and submission period:

i addressing any submission made in respect of the planning proposal

ii proposing adoption of the planning proposal unless there are any recommended amendments deemed to be substantial and requiring a further public exhibition period

The Planning Proposal

The purpose of the Anomalies Planning Proposal is to:

· Amend inconsistency in the land use table.

· Rectify minor errors in the zoning, minimum lot size, maximum height of building and floor space ratio maps.

· Correct an omission in the heritage map

· Revise an item in Schedule 5 Environmental Heritage.

Prior to exhibition, the Planning Proposal was amended as per the Gateway Determination to:

· Include a minimum lot size map amendment for lots on the Sturt Highway, Gumly Gumly proposed to be rezoned from RE1 Public Recreation to RU1 Primary Production.

· Identify that lots on the Sturt Highway, Gumly Gumly are privately owned.

Public Consultation

The Anomalies Planning Proposal was placed on public exhibition from 16 September 2017 to 14 October 2017.

Twelve submissions (provided under separate cover) have been received. The issues raised in the submissions are summarised below together with Council officer comments. The majority of submissions received include matters that are not relevant to the current proposal and / or suggestions that may be considered as part of a separate Planning Proposal.

|

Submission |

Summary |

Officer Comments |

|

1. |

This submission is requesting a rezoning for residential purposes and or amendment to minimum lot size in the Gregadoo Road precinct. The submission provides the following reasons for the request: · Public services are available in the area. · Revitalises the Gregadoo Road Precinct. · Population density is low in the area. · Supports future growth and diversity. |

The proposed rezoning and reduction in the minimum lot size is not an anomaly and a separate application for rezoning and or reduction in minimum lot size requirement will be required and considered on its own merits. |

|

2 & 3 |

Both submissions are requesting a rezoning in Cartwrights Hill from RU6 Transition to either IN1 General Industry, IN2 Light Industry or R5 Large Lot Residential with a one hectare minimum lot size. The submissions provide the following reasons for the request: · RU6 Transition zone restricts development. · There are no major noise and odour impacts. · The property has a sealed road frontage. · LEP1985 / DCP 1986 zoned the property Residential 2a. · A R5 Large Lot Residential zone for six, one hectare residential lots will have minimal impact on the local environment. |

The submission is noted, but cannot be processed as part of the current Anomalies Planning Proposal. A separate application for rezoning and / or reduction in minimum lot size will be required and will be assessed on its own merits. It should also be noted that the RU6 Transition zone minimises the potential for conflict between residential properties and the Bomen Industrial Sewerage Treatment Facility (BISTF) and industrial activities. The transition zone provides a buffer that reduces potential impacts from noise, odour, dust or pollution. Support of a rezoning and/or will result in the removal of a buffer area is unlikely to be supported. |

|

4. |

The submission indicates no objection to amending the minimum lot size in Copland Street under Item 11 of the anomalies planning proposal.

The submission also requests the rezoning of part of a property in Copland Street from RE1 Public Recreation zone to IN2 Light Industrial and provides the following reasons for the request: · This will align the IN2 Light Industrial zone with the rear property boundary. · The IN2 Light Industrial zone aligns with the rear boundary of most properties along Copland Street. |

Noted.

The current zoning alignment reflects flooding constraints and land acquisition mapping. The proposed rezoning is not an anomaly and requires a separate application for rezoning that will be considered on its own merits.

|

|

5. |

This submission supports Land Zoning Map Amendment – Item 12, but requests that the boundary follow the shape of the public easement.

The following reason is provided for the suggested change: · The boundary is inconsistent with the boundary of Council’s easement. · The RE1 zone impacts on the privacy of common areas. · The RE1 Public Recreation zone should not extend further than the easement for public access. |

This submission is supported because: · The revised boundary line is consistent with the angle of the boundary of adjoining properties. · The boundary line cannot include a public easement. · Buildings should not be encouraged within a transmission line easement.

The boundary of the R3 Medium Density Residential zone in Land Zoning Map Amendments – Item 12 has been revised accordingly. The boundary now follows the western boundary of the transmission line easement.

The Department of Planning and Environment has advised that the amendment is minor and that an altered Gateway Determination is not required for this item on the basis that adequate justification is provided. |

|

6. |

This submission requests the rezoning of 103 Gurwood Street from Special Use to R1 General Residential and provides the following reasons for the request: · The site is vacant. · Residential uses are more appropriate. |

The submission is noted, but cannot be processed as part of the current Anomalies Planning Proposal. A separate application for rezoning will be required and will be assessed on its own merits. |

|

7. |

This submission is requesting a rezoning of a property in the Holbrook area from E2 Environmental Zone to R5 Large Lot Residential and a reduced minimum lot size. The following reasons are put forward in support of the request. · Consistent with adjoining zoning. · Correct inappropriate zoning and minimum lot size. · R5 Large Lot Residential zone with a two hectare minimum lot size is consistent with other land in Glenoak. · Integration with expanding Glenoak. · Existing minimum lot size restricts subdivision into three two hectare residential allotments. DCP 2005 provided for three two hectare lots.

|

The proposed rezoning cannot be processed as part of the current Anomalies Planning Proposal. A separate application for rezoning and / or reduction in minimum lot size will be required and will be assessed on its own merits. It should also be noted that the site contains an Endangered Ecological Community. This is a significant consideration and will need to be addressed as part of any future planning proposal to rezone the site. |

|

8. |

This submission is requesting the subdivision of a large rural lifestyle block in Springvale and provides the following reasons for the request: · Land shortage in Wagga Wagga. · Demand for larger residential blocks. · Better utilisation of land. |

The submission is noted, but cannot be processed as part of the current Anomalies Planning Proposal. A separate application to reduce the minimum lot size will be required and will be assessed on its own merits. |

|

9. |

This submission is opposed to the minimum lot size proposed for a property in Copland Street under Item 11. The proposal is not supported for the following reasons: · Rezoning flood prone land transfers flooding to other properties, minimising the land use of these properties. · Development increases runoff and flood waters back up Marshalls Creek. · Rezoning is anticipated if the minimum lot size is changed from 200 hectares to nil.

The submission also does not support Lot Size Map Amendment - Item 10 in Governors Hill because it creates further residential development.

The submission is also opposed to the proposal under Item 25 to rezone a property in Lavender Place and Maple Road as this land could provide access to the property.

|

The proposal under Item 11 is not to rezone any properties. The Planning Proposal seeks to amend the minimum lot size from 200 hectares to nil. This is consistent with all other land zoned IN2 Light Industrial.

Lot Size Map Amendment – Item 10 amends the 200 hectare minimum lot size to 0.4 hectares to be consistent with the existing R5 Large Lot Residential zone and existing subdivision approvals. The proposed amendment does not create additional development opportunities.

The intention of the proposal under Item 25 is to rezone part of 4, 5 and 6 Lavender Place from RE1 Public Recreation to R1 General Residential to acknowledge the existing use of the lots.

The proposed amendment does not affect the existing access way.

|

|

10. |

This submission has no objection to Land Zoning Map Amendment – Item 16.

The submission requests the rezoning of a property in Sunset Lane, Kapooka from RU1 Primary Production to R5 Large Lot Residential and provides the following reasons for the request: · The E2 Environmental Protection zone needs to be realigned because most of the land is not heavily vegetated. · A R5 Large Lot Residential zone is consistent with plans to incorporate the corridor within the City and provides serviced rural residential allotments. |

Noted.

The proposed rezoning cannot be processed as part of the current Anomalies Planning Proposal. A separate application for rezoning will be required and will be assessed on its own merits.

|

|

11. |

This submission relates to Item 18 that aims to rezone part of the Birramal Reserve from RE1 Public Recreation to E2 Environmental Protection and and requests that access to the Widradjuri Walking track be retained.

This submission has no objection to Land Zoning Map amendment - Item 19 to rezone the Ashmont Service Station from E2 Environmental Protection to R1 General Residential. |

The proposed rezoning from E2 Environmental Protection to R1 General Residential will not change the existing access arrangement to the Wiradjuri Walking Track.

Noted. |

|

12. |

This submission is to include an additional lot as part of the current planning proposal under Item 3 to rezone part of 103 Travers Street from SP2 Infrastructure to RU1 Primary Production. The submission requests that Lot 5 DP848787 be included in the anomalies proposal. The following reasons are put forward in support of the request: · Part of the privately owned site is zoned SP2 Infrastructure. The correct zone for the whole site is RU1 Primary Production. |

This submission is supported and can be included as part of the current Anomalies Planning Proposal. The Planning Proposal has been revised and now includes this site.

The Department of Planning and Environment supports including the additional lot in the anomalies proposal, but requires an altered Gateway Determination. The revised proposal will also require re-exhibition to adjoining neighbours for 14 days after the Gateway Determination. |

A copy of the revised Planning Proposal is provided under separate cover.

Financial Implications

N/A

Policy and Legislation

Environmental Planning and Assessment Act 1979

Wagga Wagga Local Environmental Plan 2010

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

Internal consultation occurred with Council Officers and the anomalies proposal with the suggested changes are supported.

A second round of public exhibition will occur in accordance with the Environmental Planning and Assessment Act 1979 and per the advice of the Department of Planning and Environment.

|

1. |

Planning Proposal PP2017/1 Revised Planning Proposal - Provided under separate cover |

|

|

2. |

Planning Proposal PP2017/1 Submissions - Provided under separate cover |

|

Report submitted to the Ordinary Meeting of Council on Monday 29 January 2018. RP-3

RP-3 Financial Performance Report as at 31 December 2017

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Analysis: |

This report is for Council to consider and approve the proposed 2017/18 budget variations required to manage the 2017/18 budget and Long Term Financial Plan, and details Council’s external investments and performance as at 31 December 2017. |

|

That Council: a approve the proposed 2017/18 budget variations for the month ended 30 December 2017 and note the surplus budget position as presented in this report b note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above c note details of the external investments as at 31 December 2017 in accordance with section 625 of the Local Government Act |

Report

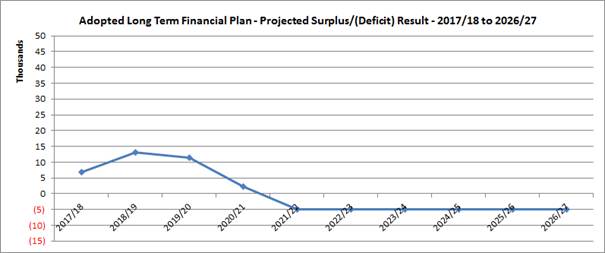

Wagga Wagga City Council (Council) forecasts a surplus budget position as at 31 December 2017. Proposed funded budget variations are detailed in this report for Council’s consideration and adoption.

Council has experienced a positive monthly investment performance for the month of December that is mainly attributable to the higher than anticipated portfolio balance.

Key Performance Indicators

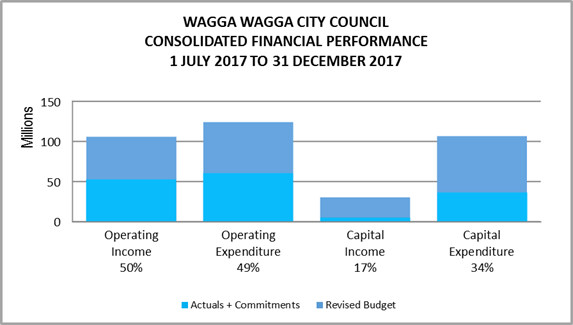

OPERATING INCOME

Total operating income is 50% of approved budget, which is tracking to budget for the end of December (this percentage excludes capital grants and contributions). An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 79%.

OPERATING EXPENSES

Total operating expenditure is 49% of approved budget and is tracking to budget for the full financial year.

CAPITAL INCOME

Total capital income is 17% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions relating to projects.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 34% of approved budget.

|

WAGGA WAGGA CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2017/18 |

COMMT'S 2017/18 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue

|

|||||||

|

Rates & Annual Charges |

(63,090,002) |

0 |

(63,090,002) |

(32,238,999) |

0 |

(32,238,999) |

51% |

|

User Charges & Fees |

(25,947,798) |

(14,531) |

(25,962,329) |

(11,568,667) |

0 |

(11,568,667) |

45% |

|

Interest & Investment Revenue |

(3,154,163) |

0 |

(3,154,163) |

(2,038,158) |

0 |

(2,038,158) |

65% |

|

Other Revenues |

(2,984,954) |

(58,151) |

(3,043,105) |

(1,237,584) |

0 |

(1,237,584) |

41% |

|

Operating Grants & Contributions |

(13,910,429) |

3,394,386 |

(10,516,043) |

(5,691,546) |

0 |

(5,691,546) |

54% |

|

Capital Grants & Contributions |

(13,704,984) |

(22,667,872) |

(36,372,857) |

(5,527,597) |

0 |

(5,527,597) |

15% |

|

Total Revenue |

(122,792,330) |

(19,346,167) |

(142,138,498) |

(58,302,552) |

0 |

(58,302,552) |

41% |

|

|

|||||||

|

Expenses

|

|||||||

|

Employee Benefits & On-Costs |

42,458,491 |

175,003 |

42,633,494 |

19,931,922 |

30,537 |

19,962,459 |

47% |

|

Borrowing Costs |

3,591,092 |

0 |

3,591,092 |

1,704,114 |

0 |

1,704,114 |

47% |

|

Materials & Contracts |

29,833,841 |

3,916,996 |

33,750,838 |

14,090,878 |

2,686,854 |

16,777,732 |

50% |

|

Depreciation & Amortisation |

34,477,729 |

0 |

34,477,729 |

17,238,864 |

0 |

17,238,864 |

50% |

|

Other Expenses |

9,453,285 |

160,986 |

9,614,271 |

4,774,353 |

74,141 |

4,848,494 |

50% |

|

Total Expenses |

119,814,437 |

4,252,985 |

124,067,423 |

57,740,131 |

2,791,532 |

60,531,663 |

49% |

|

|

|

||||||

|

Net Operating (Profit)/Loss |

(2,977,893) |

(15,093,182) |

(18,071,075) |

(562,421) |

2,791,532 |

2,229,111 |

|

|

|

|||||||

|

Net Operating (Profit)/Loss before Capital Grants & Contributions |

10,727,091 |

7,574,690 |

18,301,781 |

4,965,176 |

2,791,532 |

7,756,708 |

|

|

|

|||||||

|

Cap/Reserve Movements |

|||||||

|

Capital Exp - Renewals |

25,035,121 |

26,852,461 |

51,887,583 |

6,422,135 |

16,150,986 |

22,573,122 |

44% |

|

Capital Exp - New Projects |

16,498,302 |

16,652,308 |

33,550,610 |

10,219,907 |

2,299,691 |

12,519,598 |

37% |

|

Capital Exp - Project Concepts |

11,800,337 |

7,266,800 |

18,667,137 |

48,891 |

57,521 |

106,412 |

1% |

|

Loan Repayments |

2,474,343 |

0 |

2,474,343 |

1,237,172 |

0 |

1,237,172 |

50% |

|

New Loan Borrowings |

(7,215,980) |

(3,903,710) |

(11,119,690) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(4,678,401) |

(1,371,761) |

(6,050,162) |

(403,491) |

0 |

(403,491) |

7% |

|

Net Movements Reserves |

(6,458,101) |

(30,409,731) |

(36,867,832) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

37,455,621 |

15,086,367 |

52,541,988 |

17,524,615 |

18,508,198 |

36,032,813 |

69% |

|

|

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2017/18 |

COMMT'S 2017/18 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Net Result after Depreciation |

34,477,728 |

(6,815) |

34,470,913 |

16,962,194 |

21,299,730 |

38,261,924 |

|

|

|

|||||||

|

Add back Depreciation Expense |

34,477,729 |

0 |

34,477,729 |

17,238,864 |

0 |

17,238,864 |

50% |

|

|

|||||||

|

Cash Budget (Surplus)/Deficit |

0 |

(6,815) |

(6,815) |

(276,670) |

21,299,730 |

21,023,059 |

|

Revised Budget Result - Surplus/(Deficit) |

$’000s |

|

Original 2017/18 Budget Result as adopted by Council Total Budget Variations approved to date Council report variations not included above – 27 November 2017 Council Meeting: - CONF-7 Grazing Licence EOI at GWMC - CONF-8 Grazing Licence Agreement – Surplus Sewer Land Budget variations for December 2017 |

$0 $0 $0

$2K $0 |

|

Proposed revised budget result for 31 December 2017 |

$7K |

The proposed Budget Variations to 31 December 2017 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact Fav/ (Unfav) |

|

5 – The Environment |

|||

|

Lake Albert Hall Accessible Ramp |

$14K |

Fit for the Future Reserve ($14K) |

Nil |

|

The Lake Albert Hall Accessible Ramp was identified in the Disability Inclusion Action Plan and included in this year’s Long Term Financial Plan. The project was originally proposed to be funded 50:50 grant and general purpose revenue. Additional Council funding is now required due to the Northcott Society being unsuccessful with their grant funding application through the Community Building Partnership grant program. It is proposed to fund the unsuccessful grant allocation of $14K from the Fit for the Future Reserve.

|

|||

|

Kooringal Public School Bus Shelter Refurbishment |

$50K |

Fit for the Future Reserve ($50K) |

Nil |

|

The Kooringal Public School Bus Shelter has been identified as a high priority safety risk, as the platform and the seated area where children wait and enter/exit the buses is narrow and is in close proximity to the road. It is proposed to refurbish and install an existing spare bus shelter structure, and undertake site preparation, which includes tree removal, and installation of handrails and tactiles. It is proposed to fund the works from the Fit for the Future Reserve. |

|||

|

SURPLUS/(DEFICIT) |

Nil |

||

Current Restrictions

|

RESERVES SUMMARY |

|||||

|

31 DECEMBER 2017 |

|||||

|

|

Approved Changes |

|

|

||

|

|

CLOSING BALANCE 2016/17 |

ADOPTED RESERVE TRANSFERS 2017/18 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 18.12.17 |

RECOMMENDED CHANGES for Council Resolution |

REVISED BALANCE |

|

|

|

||||

|

Externally Restricted |

|

||||

|

Developer Contributions |

(21,947,807) |

3,374,249 |

4,733,577 |

(13,839,982) |

|

|

Sewer Fund Reserve |

(24,045,646) |

1,229,992 |

4,609,319 |

(18,206,335) |

|

|

Solid Waste Reserve |

(15,824,723) |

4,878,008 |

1,361,377 |

(9,585,338) |

|

|

Specific Purpose Unexpended Grants/Contributions |

(4,956,776) |

0 |

4,956,776 |

0 |

|

|

SRV Levee Reserve |

(1,167,316) |

0 |

1,167,316 |

0 |

|

|

Stormwater Levy Reserve |

(2,940,246) |

(587,206) |

451,268 |

(3,076,184) |

|

|

Total Externally Restricted |

(70,882,514) |

8,895,043 |

17,279,633 |

0 |

(44,707,838) |

|

|

|

||||

|

Internally Restricted |

|

||||

|

Airport Reserve |

(371,610) |

(386,660) |

101,914 |

(656,355) |

|

|

Art Gallery Reserve |

(30,990) |

(21,000) |

0 |

(51,990) |

|

|

Ashmont Community Facility Reserve |

(4,500) |

(1,500) |

0 |

(6,000) |

|

|

Bridge Replacement Reserve |

(240,240) |

(100,000) |

153,573 |

(186,667) |

|

|

CBD Carparking Facilities Reserve |

(891,982) |

0 |

129,191 |

(762,792) |

|

|

CCTV Reserve |

(64,476) |

(10,000) |

0 |

(74,476) |

|

|

Cemetery Perpetual Reserve |

(157,605) |

(125,146) |

144,084 |

(138,667) |

|

|

Cemetery Reserve |

(193,116) |

(161,330) |

100,000 |

(254,446) |

|

|

Civic Theatre Operating Reserve |

0 |

(50,000) |

0 |

(50,000) |

|

|

Civic Theatre Technical Infra Reserve |

(105,450) |

(50,000) |

57,100 |

(98,350) |

|

|

Civil Projects Reserve |

(155,883) |

0 |

0 |

(155,883) |

|

|

Community Amenities Reserve |

(5,685) |

0 |

0 |

(5,685) |

|

|

Community Works Reserve |

0 |

0 |

(62,869) |

|

(62,869) |

|

Council Election Reserve |

(166,776) |

(73,095) |

0 |

(239,871) |

|

|

Emergency Events Reserve |

(133,829) |

(86,331) |

(220,160) |

||

|

Employee Leave Entitlements Gen Fund Reserve |

(3,184,451) |

0 |

0 |

(3,184,451) |

|

|

Environmental Conservation Reserve |

(131,351) |

0 |

0 |

(131,351) |

|

|

Estella Community Centre Reserve |

(230,992) |

0 |

0 |

(230,992) |

|

|

Family Day Care Reserve |

(169,356) |

(123,944) |

0 |

(293,300) |

|

|

Fit for the Future Reserve |

(3,033,479) |

(2,265,725) |

542,464 |

63,610 |

(4,693,130) |

|

Generic Projects Saving |

(1,040,610) |

20,000 |

93,727 |

(926,883) |

|

|

Glenfield Community Centre Reserve |

(17,704) |

(2,000) |

0 |

(19,704) |

|

|

Grants Commission Reserve |

(4,956,776) |

0 |

4,956,776 |

0 |

|

|

Grassroots Cricket Reserve |

(70,992) |

0 |

0 |

(70,992) |

|

|

Gravel Pit Restoration Reserve |

(761,422) |

0 |

25,000 |

(736,422) |

|

|

Gurwood Street Property Reserve |

(50,454) |

0 |

0 |

(50,454) |

|

|

Information Services |

(378,713) |

250,000 |

8,000 |

(120,713) |

|

|

Infrastructure Replacement Reserve |

(136,098) |

(48,071) |

954 |

(183,215) |

|

|

Insurance Variations Reserve |

(28,644) |

0 |

0 |

(28,644) |

|

|

Internal Loans Reserve |

(674,661) |

(851,794) |

850,468 |

(675,986) |

|

|

Lake Albert Improvements Reserve |

(53,867) |

(50,000) |

56,078 |

(47,789) |

|

|

LEP Preparation Reserve |

(28,301) |

14,636 |

11,120 |

(2,545) |

|

|

Livestock Marketing Centre Reserve |

(7,267,731) |

(1,180,017) |

4,053,725 |

(4,394,024) |

|

|

Museum Acquisitions Reserve |

(39,378) |

0 |

0 |

(39,378) |

|

|

Oasis Building Renewal Reserve |

(172,000) |

(32,147) |

121,000 |

(83,147) |

|

|

Oasis Plant Reserve |

(1,115,347) |

90,000 |

85,770 |

(939,577) |

|

|

Parks & Recreation Projects |

(79,648) |

0 |

74,360 |

(5,288) |

|

|

Pedestrian River Crossing (old Riverside) Reserve |

(198,031) |

48,031 |

150,000 |

0 |

|

|

Plant Replacement Reserve |

(5,893,831) |

1,804,934 |

1,059,675 |

(3,029,223) |

|

|

Playground Equip Replacement Reserve |

(59,181) |

(105,679) |

0 |

(164,860) |

|

|

Project Carryovers Reserve |

(1,276,882) |

0 |

1,276,882 |

0 |

|

|

Public Art Reserve |

(173,283) |

(23,669) |

53,969 |

(142,983) |

|

|

Robertson Oval Redevelopment Reserve |

(86,697) |

0 |

0 |

(86,697) |

|

|

Senior Citizens Centre Reserve |

(13,627) |

(2,000) |

0 |

(15,627) |

|

|

Sister Cities Reserve |

(36,527) |

(10,000) |

0 |

(46,527) |

|

|

Stormwater Drainage Reserve |

(183,420) |

0 |

3,177 |

(180,242) |

|

|

Strategic Real Property Reserve |

(702,792) |

0 |

(380,000) |

(1,082,792) |

|

|

Street Lighting Replacement Reserve |

(74,755) |

(30,000) |

0 |

(104,755) |

|

|

Subdivision Tree Planting Reserve |

(272,621) |

(20,000) |

0 |

(292,621) |

|

|

Sustainable Energy Reserve |

(520,442) |

35,000 |

60,000 |

(425,442) |

|

|

Traffic Committee Reserve |

(50,000) |

(50,000) |

0 |

(100,000) |

|

|

Total Internally Restricted |

(35,686,205) |

(3,511,177) |

13,639,806 |

63,610 |

(25,493,966) |

|

|

|

||||

|

Total Restricted |

(106,568,720) |

5,383,866 |

30,919,439 |

63,610 |

(70,201,805) |

|

|

|

|

|

|

|

|

CONSULTANCY & LEGAL EXPENSES BUDGET REVIEW STATEMENT |

|||||||

|

31 DECEMBER 2017 |

|||||||

|

|

|

Approved Changes |

|

|

|

|

|

|

|

BUDGET 2017/18 |

SEPTEMBER QTR BUDGET VARIATIONS APPROVED TO DATE |

DECEMBER QTR BUDGET VARIATIONS APPROVED TO DATE |

REVISED BUDGET |

PROJECTED YEAR END RESULT |

ACTUAL |

|

|

|

|

||||||

|

Consultancy Expenses |

74,092 |

326,978 |

98,800 |

499,870 |

499,870 |

224,686 |

|

|

|

|

||||||

|

Legal Expenses |

314,522 |

111,129 |

(5,942) |

419,709 |

419,709 |

283,778 |

|

|

|

|

|

|

|

|

|

|

|

CITY OF WAGGA WAGGA |

||||||

|

CONTRACTS REVIEW STATEMENT |

||||||

|

31 DECEMBER 2017 |

||||||

|

Contract Number |

Contractor |

Contract |

Contract |

Start |

Duration of |

Budgeted |

|

2018/512 |

CTECS Pty Ltd |

Natural Asset Management Roadside Reserves |

65,040.00 |

23/11/2017 |

7 months |

Y |

|

2018/25 |

Fulton Hogan Industries Pty Ltd |

Supply of specialist asphaltic concrete products for trial |

100,000.00 |

13/11/2017 |

4 weeks |

Y |

|

2018/526 |

Xylem Water Solutions Aust. Ltd |

Supply of packaged pump station |

119,529.95 |

13/11/2017 |

9 weeks |

Y |

|

PC98322 |

WSP Australia Pty Ltd |

RIFL Enabling Infrastructure |

120,552.50 |

1/09/2017 |

8 weeks |

Y |

|

PC98321 |

Pacific National (NSW) Pty Ltd |

Shunting services during underpass construction |

139,377.70 |

1/06/2017 |

12 weeks |

Y |

|

|

|

|||||

|

Notes: |

||||||

|

1. Minimum reporting level is 1% of estimated income from continuing operations or $50,000, whichever is the lesser. |

||||||

|

2. Contracts to be listed are those entered into during the quarter and have yet to be fully performed, excluding contractors that are on Council's Preferred Supplier list. |

||||||

|

3. Contracts for employment are not required to be included. |

||||||

|

4. Where a contract for services etc was not included in the budget, an explanation is to be given (or reference made to an explanation in another Budget Review Statement). |

||||||

Section 356 Financial Assistance Requests

No Section 356 financial assistance requests are submitted for consideration at the 29 January 2018 Ordinary Council meeting.

Investment Summary as at 31 December 2017

In accordance with Regulation 212 of the Local Government (General) Regulation 2005, details of Wagga Wagga City Council’s external investments are detailed below:

|

Institution |

Rating |

Closing Balance |

Closing Balance |

December |

December |

Investment |

Maturity |

Term |

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

Police Credit Union |

NR |

1,000,000 |

0 |

0.00% |

0.00% |

6/12/2016 |

6/12/2017 |

12 |

|

Banana Coast CU |

NR |

1,000,000 |

1,000,000 |

2.80% |

0.85% |

2/06/2017 |

1/06/2018 |

12 |

|

AMP |

A |

2,000,000 |

2,000,000 |

2.80% |

1.70% |

2/06/2017 |

1/06/2018 |

12 |

|

CUA |

BBB |

1,000,000 |

1,000,000 |

2.80% |

0.85% |

9/02/2017 |

5/01/2018 |

11 |

|

AMP |

A |

2,000,000 |

2,000,000 |

2.60% |

1.70% |

2/08/2017 |

2/08/2018 |

12 |

|

CUA |

BBB |

1,000,000 |

1,000,000 |

2.75% |

0.85% |

3/03/2017 |

2/03/2018 |

12 |

|

Suncorp-Metway |

A+ |

2,000,000 |

2,000,000 |

2.60% |

1.70% |

7/06/2017 |

3/01/2018 |

7 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

2.60% |

1.70% |

8/09/2017 |

7/09/2018 |

12 |

|

ME Bank |

BBB |

2,000,000 |

2,000,000 |

2.60% |

1.70% |

22/08/2017 |

19/04/2018 |

8 |

|

AMP |

A |

1,000,000 |

1,000,000 |

2.80% |

0.85% |

8/09/2017 |

5/06/2018 |

9 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

2.62% |

1.70% |

28/09/2017 |

28/09/2018 |

12 |

|

Auswide |

BBB- |

2,000,000 |

2,000,000 |

2.67% |

1.70% |

5/10/2017 |

5/10/2018 |

12 |

|

Auswide |

BBB- |

1,000,000 |

1,000,000 |

2.67% |

0.85% |

16/10/2017 |

16/10/2018 |

12 |

|

Auswide |

BBB- |

0 |

2,000,000 |

2.70% |

1.70% |

5/12/2017 |

5/12/2018 |

12 |

|

Auswide |

BBB- |

0 |

1,000,000 |

2.67% |

0.85% |

15/12/2017 |

16/07/2018 |

7 |

|

Total Short Term Deposits |

|

20,000,000 |

22,000,000 |

2.68% |

18.71% |

|

|

|

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

3,572,711 |

860,901 |

1.50% |

0.73% |

N/A |

N/A |

N/A |

|

NAB |

AA- |

17,103,457 |

14,632,467 |

2.19% |

12.45% |

N/A |

N/A |

N/A |

|

AMP |

A |

183,154 |

183,478 |

2.15% |

0.16% |

N/A |

N/A |

N/A |

|

Beyond Bank |

BBB+ |

148,997 |

149,149 |

1.00% |

0.13% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

58,359 |

58,321 |

1.35% |

0.05% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

21,066,677 |

15,884,315 |

2.14% |

13.51% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

RaboBank |

A+ |

1,000,000 |

1,000,000 |

3.16% |

0.85% |

5/06/2017 |

6/06/2022 |

60 |

|

ING Bank |

A |

3,000,000 |

3,000,000 |

2.75% |

2.55% |

24/08/2017 |

26/08/2019 |

24 |

|

ME Bank |

BBB |

2,000,000 |

2,000,000 |

4.28% |

1.70% |

2/09/2014 |

2/09/2019 |

60 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

4.10% |

0.85% |

5/12/2014 |

5/12/2019 |

60 |

|

Beyond Bank |

BBB+ |

990,000 |

990,000 |

3.70% |

0.84% |

4/03/2015 |

4/03/2018 |

36 |

|

Beyond Bank |

BBB+ |

990,000 |

990,000 |

3.70% |

0.84% |

11/03/2015 |

11/03/2018 |

36 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.10% |

1.70% |

7/07/2017 |

7/07/2020 |

36 |

|

Newcastle Permanent |

BBB |

1,000,000 |

1,000,000 |

3.00% |

0.85% |

12/08/2016 |

12/08/2019 |

36 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

3.20% |

0.85% |

25/08/2016 |

25/08/2021 |

60 |

|

Newcastle Permanent |

BBB |

1,000,000 |

1,000,000 |

3.00% |

0.85% |

31/08/2016 |

30/08/2019 |

36 |

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

2.90% |

0.85% |

8/09/2016 |

10/09/2018 |

24 |

|

Newcastle Permanent |

BBB |

2,000,000 |

2,000,000 |

3.00% |

1.70% |

10/02/2017 |

11/02/2019 |

24 |

|

Westpac |

AA- |

3,000,000 |

3,000,000 |

3.10% |

2.55% |

10/03/2017 |

10/03/2022 |

60 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

2.92% |

0.85% |

16/10/2017 |

16/10/2019 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

2.92% |

1.70% |

6/11/2017 |

6/11/2019 |

24 |

|

Total Medium Term Deposits |

|

22,980,000 |

22,980,000 |

3.21% |

19.54% |

|

|

|

|

Institution |

Rating |

Closing Balance |

Closing Balance |

December |

December |

Investment |

Maturity |

Term |

|

Floating Rate Notes - Senior Debt |

|

|

|

|

|

|

|

|

|

Bendigo-Adelaide |

BBB+ |

1,009,267 |

1,004,654 |

BBSW + 93 |

0.85% |

17/09/2014 |

17/09/2019 |

60 |

|

BOQ |

BBB+ |

2,023,800 |

2,015,400 |

BBSW + 110 |

1.71% |

5/08/2014 |

24/06/2019 |

58 |

|

BOQ |

BBB+ |

1,007,927 |

1,009,952 |

BBSW + 107 |

0.86% |

6/11/2014 |

6/11/2019 |

60 |

|

BOQ |

BBB+ |

1,007,927 |

1,009,952 |

BBSW + 107 |

0.86% |

10/11/2014 |

6/11/2019 |

60 |

|

Teachers Mutual |

BBB |

1,006,700 |

0 |

0.00% |

0.00% |

4/12/2014 |

4/12/2017 |

36 |

|

Newcastle Permanent |

BBB |

1,001,178 |

1,003,184 |

BBSW + 110 |

0.85% |

27/02/2015 |

27/02/2018 |

36 |

|

Macquarie Bank |

A |

2,016,000 |

2,025,484 |

BBSW + 110 |

1.72% |

3/03/2015 |

3/03/2020 |

60 |

|

Heritage Bank |

BBB+ |

1,003,787 |

1,005,973 |

BBSW + 115 |

0.86% |

7/05/2015 |

7/05/2018 |

36 |

|

Heritage Bank |

BBB+ |

1,003,787 |

1,005,973 |

BBSW + 115 |

0.86% |

9/06/2015 |

7/05/2018 |

35 |

|

CBA |

AA- |

1,012,407 |

1,014,182 |

BBSW + 90 |

0.86% |

17/07/2015 |

17/07/2020 |

60 |

|

Westpac |

AA- |

1,011,817 |

1,013,772 |

BBSW + 90 |

0.86% |

28/07/2015 |

28/07/2020 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,007,817 |

1,009,902 |

BBSW + 110 |

0.86% |

18/08/2015 |

18/08/2020 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,007,817 |

1,009,902 |

BBSW + 110 |

0.86% |

28/09/2015 |

18/08/2020 |

59 |

|

Westpac |

AA- |

2,023,634 |

2,027,544 |

BBSW + 90 |

1.72% |

30/09/2015 |

28/07/2020 |

58 |

|

Suncorp-Metway |

A+ |

1,019,286 |

1,021,430 |

BBSW + 125 |

0.87% |

20/10/2015 |

20/10/2020 |

60 |

|

Westpac |

AA- |

4,067,624 |

4,075,644 |

BBSW + 108 |

3.47% |

28/10/2015 |

28/10/2020 |

60 |

|

AMP |

A |

1,826,455 |

1,816,997 |

BBSW + 110 |

1.55% |

11/12/2015 |

11/06/2019 |

42 |

|

CBA |

AA- |

1,019,296 |

1,021,120 |

BBSW + 115 |

0.87% |

18/01/2016 |

18/01/2021 |

60 |

|

Rabobank |

A+ |

2,052,012 |

2,056,158 |

BBSW + 150 |

1.75% |

4/03/2016 |

4/03/2021 |

60 |

|

Newcastle Permanent |

BBB |

1,013,397 |

1,008,003 |

BBSW + 160 |

0.86% |

22/03/2016 |

22/03/2019 |

36 |

|

CUA |

BBB |

2,025,414 |

2,030,600 |

BBSW + 160 |

1.73% |

1/04/2016 |

1/04/2019 |

36 |

|

ANZ |

AA- |

1,021,716 |

1,016,371 |

BBSW + 118 |

0.86% |

7/04/2016 |

7/04/2021 |

60 |

|

Suncorp-Metway |

A+ |

1,024,866 |

1,026,939 |

BBSW + 138 |

0.87% |

21/04/2016 |

12/04/2021 |

60 |

|

AMP |

A |

1,019,876 |

1,022,060 |

BBSW + 135 |

0.87% |

24/05/2016 |

24/05/2021 |

60 |

|

Westpac |

AA- |

1,017,256 |

1,019,001 |

BBSW + 117 |

0.87% |

3/06/2016 |

3/06/2021 |

60 |

|

CBA |

AA- |

1,022,506 |

1,024,679 |

BBSW + 121 |

0.87% |

12/07/2016 |

12/07/2021 |

60 |

|

ANZ |

AA- |

2,035,352 |

2,039,200 |

BBSW + 113 |

1.73% |

16/08/2016 |

16/08/2021 |

60 |

|

BOQ |

BBB+ |

1,515,986 |

1,519,023 |

BBSW + 117 |

1.29% |

26/10/2016 |

26/10/2020 |

48 |

|

NAB |

AA- |

1,016,516 |

1,018,511 |

BBSW + 105 |

0.87% |

21/10/2016 |

21/10/2021 |

60 |

|

Teachers Mutual |

BBB |

1,505,591 |

1,510,235 |

BBSW + 140 |

1.28% |

28/10/2016 |

28/10/2019 |

36 |

|

Bendigo-Adelaide |

BBB+ |

1,007,037 |

1,009,103 |

BBSW + 110 |

0.86% |

21/11/2016 |

21/02/2020 |

39 |

|

Westpac |

AA- |

1,018,166 |

1,019,930 |

BBSW + 111 |

0.87% |

7/02/2017 |

7/02/2022 |

60 |

|

ANZ |

AA- |

1,011,757 |

1,013,512 |

BBSW + 100 |

0.86% |

7/03/2017 |

7/03/2022 |

60 |

|

CUA |

BBB |

754,875 |

753,902 |

BBSW + 130 |

0.64% |

20/03/2017 |

20/03/2020 |

36 |

|

Heritage Bank |

BBB+ |

601,500 |

603,000 |

BBSW + 130 |

0.51% |

4/05/2017 |

4/05/2020 |

36 |

|

Teachers Mutual |

BBB |

1,005,837 |

1,000,664 |

BBSW + 142 |

0.85% |

29/06/2017 |

29/06/2020 |

36 |

|

NAB |

AA- |

3,035,271 |

3,021,699 |

BBSW + 90 |

2.57% |

5/07/2017 |

5/07/2022 |

60 |

|

Suncorp-Metway |

A+ |

1,005,867 |

1,008,193 |

BBSW + 97 |

0.86% |

16/08/2017 |

16/08/2022 |

60 |

|

Westpac |

AA- |

2,009,254 |

2,013,306 |

BBSW + 81 |

1.71% |

30/10/2017 |

27/10/2022 |

60 |

|

ME Bank |

BBB |

1,503,597 |

1,507,685 |

BBSW + 125 |

1.28% |

9/11/2017 |

9/11/2020 |

36 |

|

NAB |

AA- |

2,004,656 |

2,008,268 |

BBSW + 80 |

1.71% |

10/11/2017 |

10/02/2023 |

63 |

|

Total Floating Rate Notes - Senior Debt |

|

56,304,830 |

55,341,107 |

|

47.07% |

|

|

|

|

Managed Funds |

|

|

|

|

|

|

|

|

|

NSW Tcorp |

NR |

1,369,496 |

1,370,117 |

0.05% |

1.17% |

17/03/2014 |

1/11/2022 |

103 |

|

Total Managed Funds |

|

1,369,496 |

1,370,117 |

0.05% |

1.17% |

|

|

|

|

Institution |

Rating |

Closing Balance |

Closing Balance |

December |

December |

Investment |

Maturity |

Term |

|

TOTAL

CASH ASSETS, CASH |

|

121,721,002 |

117,575,539 |

2.87% |

100.00% |

|

|

|

|

LESS: RIVERINA REGIONAL LIBRARY (RRL) CASH AT BANK |

|

2,596,959 |

2,414,728 |

|

|

|

|

|

|

TOTAL

WWCC CASH ASSETS, CASH |

|

119,124,044 |

115,160,812 |

|

|

|

|

|

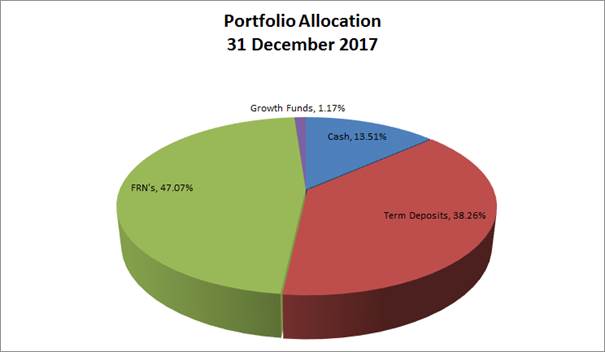

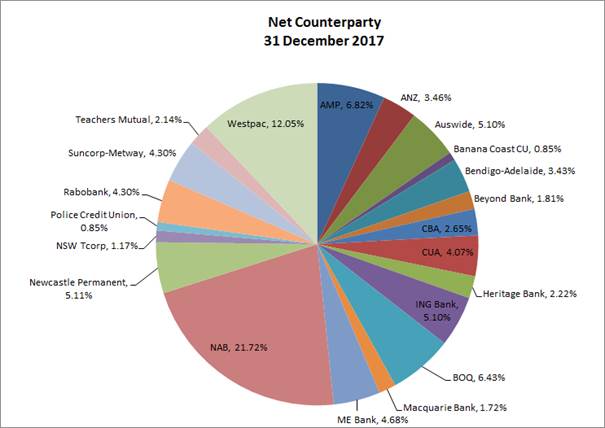

Council’s portfolio is dominated by Floating Rate Notes (FRN’s) at approximately 47% across a broad range of counterparties. Cash equates to 14% of Council’s portfolio with Term Deposits around 38% and growth funds around 1% of the portfolio.

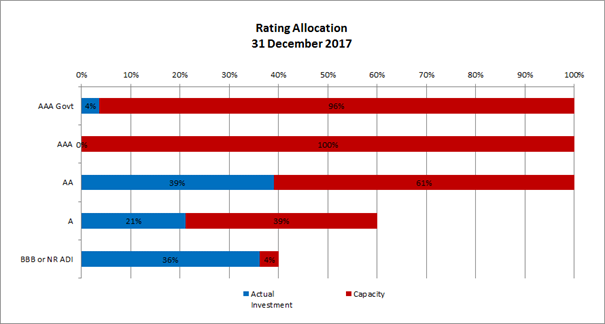

Council’s investment portfolio is well diversified in complying assets across the entire credit spectrum. It is also well diversified from a rating perspective. Credit quality is diversified and is predominately invested amongst the investment grade Authorised Deposit-Taking Institutions (ADIs) (being BBB- or higher), with a smaller allocation to unrated ADIs.

All investments are within the defined Policy limits, as outlined in the Rating Allocation chart below:

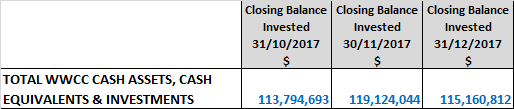

Investment Portfolio Balance

Council’s investment portfolio balance has decreased from the previous month’s balance, down from $119.1M to $115.2M. This is reflective of a number of larger contractor payments made during the December period.

MONTHLY INVESTMENT MOVEMENTS

Redemptions/Sales – Council redeemed/sold the following investment securities during December 2017:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

Police Credit Union Term Deposit |

$1M |

12 months |

2.87% |

This term deposit was redeemed due to poor reinvestment rates available with Police Credit Union. These funds were reinvested with Auswide Bank (see below). |

|

Teachers Mutual Bank Floating Rate Note |

$1M |

3 years |

BBSW + 105bps |

This floating rate note was redeemed at maturity. These funds were reinvested in a new Auswide Bank Term Deposit (see below). |

New Investments – Council purchased the following investment securities during December 2017:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

Auswide Bank Term Deposit |

$2M |

12 months |

2.70% |

The Auswide Bank rate of 2.70% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

|

Auswide Bank Term Deposit |

$1M |

7 months |

2.67% |

The Auswide Bank rate of 2.67% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

Rollovers – Council did not roll over any investment securities during December 2017.

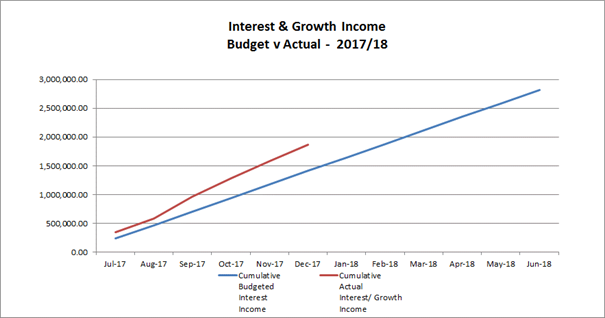

MONTHLY PERFORMANCE

Interest/growth/capital gains for the month totalled $287,089, which compares favourably with the budget for the period of $235,087, outperforming budget for December by $52,002. This is mainly attributable to the higher than anticipated portfolio balance.

It should be noted that many of Councils FRNs continue to trade at a premium. The capital market value of these FRN investments will fluctuate from month to month and Council continues to receive the coupon payments and the face value of the investment security when sold or at maturity.

It is also important to note Council’s investment portfolio balance has consistently been over $100M recently, which is tracking well above what was originally predicted. This is mainly due to the timing of some of the major projects that are either not yet commenced or not as advanced as originally predicted. It is anticipated that over the remainder of the 2017/18 financial year the portfolio balance will reduce in line with the completion of major projects.

The longer-dated deposits in the portfolio, particularly those locked in above 4% yields, have previously anchored Council’s portfolio performance. It should be noted that the portfolio now only includes two investments yielding above 4% and Council will inevitably see a fall in investment income over the coming months compared with previous periods. Council staff and Council’s Independent Financial Advisor will continue to identify opportunities to lock in higher yielding investments as they become available.

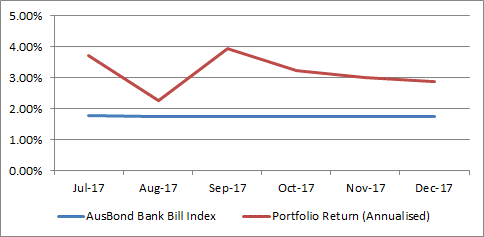

In comparison to the AusBond Bank Bill Index* (+1.75%pa), Council’s investment portfolio in total returned 2.87% for December. Short-term deposits returned 2.68%. These funds are utilised for daily cash flow management and need to be available to meet operating and contractual payments as they come due.

* The AusBond Bank Bill Index is the leading benchmark for the Australian fixed income market. It is interpolated from the RBA Cash rate, 1 month and 3 month Bank Bill Swap rates.

Report by Responsible Accounting Officer

I hereby certify that all of the above investments have been made in accordance with the provision of Section 625 of the Local Government Act 1993 and the regulations there under, and in accordance with the Investments Policy adopted by Council on 26 August 2013.

Carolyn Rodney

Responsible Accounting Officer

Policy and Legislation

Budget variations are reported in accordance with Council’s POL 052 Budget Policy.

Investments are reported in accordance with Council’s POL 075 Investment Policy.

Local Government Act 1993

625 How may councils invest?

(1) A council may invest money that is not, for the time being, required by the council for any other purpose.

(2) Money may be invested only in a form of investment notified by order of the Minister published in the Gazette.

(3) An order of the Minister notifying a form of investment for the purposes of this section must not be made without the approval of the Treasurer.

(4) The acquisition, in accordance with section 358, of a controlling interest in a corporation or an entity within the meaning of that section is not an investment for the purposes of this section.

Local Government (General) Regulation 2005

212 Reports on council investments

(1) The responsible accounting officer of a council:

(a) must provide the council with a written report (setting out details of all money that the council has invested under section 625 of the Act) to be presented:

(i) if only one ordinary meeting of the council is held in a month, at that meeting, or

(ii) if more than one such meeting is held in a month, at whichever of those meetings the council by resolution determines, and

(b) must include in the report a certificate as to whether or not the investment has been made in accordance with the Act, the regulations and the council’s investment policies.

(2) The report must be made up to the last day of the month immediately preceding the meeting.

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

This report is a control mechanism that assists in addressing the following potential risks to Council:

· Loss of investment income or capital resulting from ongoing management of investments, especially during difficult economic times

· Failure to demonstrate to the community that its funds are being expended in an efficient and effective manner

Internal / External Consultation

Council’s Community Engagement Strategy and IAP2 considers the community to be “any individual or group of individuals, organisation or political entity with an interest in the outcome of a decision….”

All relevant areas within the Council have consulted with the Finance Division in regards to the budget variations listed in this report.

The Finance Division has consulted with relevant external parties to confirm Council’s investment portfolio balances.

Report submitted to the Ordinary Meeting of Council on Monday 29 January 2018. RP-4

RP-4 2018 Australian Local Government Women's Association Annual Conference

Author: Nicole Johnson

General Manager: Peter Thompson

|

Analysis: |

Endorse representation and appointment of a Councillor to attend the ALGWA Conference in Gundagai from Thursday 15 to Saturday 17 March 2018. |

|

That Council: a consider Council representation at the 2018 Annual Australian Local Government Women’s Association (ALGWA) Conference to be held from Thursday 15 March to Saturday 17 March 2018 in Gundagai b appoint one Councillor as Council’s delegate to attend the ALGWA Conference |

Key Reasons

· Australian Local Government Women’s Association (ALGWA) NSW, is the State's peak representative body for women who are in any way involved or interested in local government. The group aims to promote gender equality within Councils for both elected representatives and staff and encourages women to embrace challenges and be the best version of themselves. Council has participated in the ALGWA Annual Conference since 2008.

· The theme of the 2018 ALGWA Annual Conference is ‘Celebrating Rural Women’.

· The 2018 Conference is scheduled to be held in Gundagai from Thursday 15 March to Saturday 17 March 2018. The draft outline of the program is attached to this Report.

Financial Implications

The registration cost per delegate is $870.00. Transport, accommodation and incidentals additional to the registration costs are estimated at $450 per delegate.

The Conference will be funded from the Councillors’ Conference budget which has a budget allocation of $25,000 for 2017/18 with $5,436 currently expended as at 31 December 2017.

Policy

POL 025 Payment of Expenses and Provision of Facilities to Councillors.

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

N/A

|

1⇩. |

ALGWA Registration form |

|

|

2⇩. |

ALGWA Draft Conference Program |

|

RP-5 Youth Engagement Consultation Report

Author: Madeleine Scully

Director: Janice Summerhayes

|

Analysis: |

This report is in response to the resolution of Council made on 26 June 2017 to determine the best methods for youth engagement. The timing of this report has come back to the January Ordinary Council meeting in order to include feedback received at the 28 November 2017 Mayoral school leader’s breakfast meeting. This report presents the findings and recommendations out of the consultation process held with young people between June and November 2017.

Taking into account the substantial feedback received during this consultation process, staff are recommending that Council establish and resource a suite of youth specific social media platforms, a youth database along with a youth portal on Council’s website. These initiatives will strengthen the promotion of opportunities for young people to participate in events, services and programs across the city, increase avenues for young people to provide feedback, and initiate and lead projects for young people. To complement the above staff also recommend the continuation of the Mayoral school leadership breakfast meetings and the establishment of a new category in the Annual Grants Program to the amount of $15,000, which will support youth led initiated projects.

Increases in operational costs associated with this report’s recommendations will be included in the 2018/19 business planning budget process and long-term financial plan for Council’s final consideration. This will also allow for public exhibition of the inclusion of these costs as part of Council’s business planning process. |

|

That Council: a note the findings and recommendations of the youth engagement consultation b support in principle the establishment of a consultative framework with young people through the development of a suite of social media and digital youth platforms as referenced in the body of this report and subject to the 2018/19 business planning process c Consider the implementation costs of b above as part of the 2018/19 business planning and LTFP budget process d Support in principle the establishment of a new category in the annual grants program of $15,000 for youth run initiatives across the city and consider this new funding category as part of the 2018/19 business planning and LTFP budget process e continue the Mayoral school leaders breakfast meetings twice per calendar year |

Report

The youth consultation process occurred from June to November 2017, with 396 young people participating over this period. Consultation included an online survey, face to face working groups and/or workshops, a youth forum and a Mayoral student leaders breakfast meeting. Qualitative and quantitative data was gathered as part of this consultation process and is included in the attachment to this report.

The online survey questions, face to face working groups and/or workshops, youth forum and Mayoral student leaders breakfast meeting were devised to assist in answering the following questions;

· How should Council engage with young people to hear their voice?

· What platforms should Council use to communicate with youth?

· What attracts young people to take part in forums, events and activities?

· What areas of leadership interest young people?

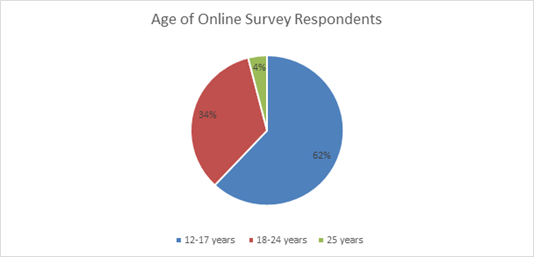

A total of 254 young people completed the online survey with 62% aged between 12–17 years, 34% aged between 18–24 years and 4% aged 25 years.

Based on the Australian Bureau of Statistics 2016 census data within profile ID the population of Wagga Wagga was recorded as 62,383 of which 18.9% (11,800) were young people. Based on this data the following sample size represented in this youth consultation process can be read as follows:

· The percentage of online survey participants (254) of the city’s total youth population (11,800 as stated above) was 2%

· The percentage overall of youth participants consulted (396) of the total youth population of the city (11,800 as stated above) was 3.5%

· The percentage of online survey participants (254) of overall consultation participants (396) was 64%

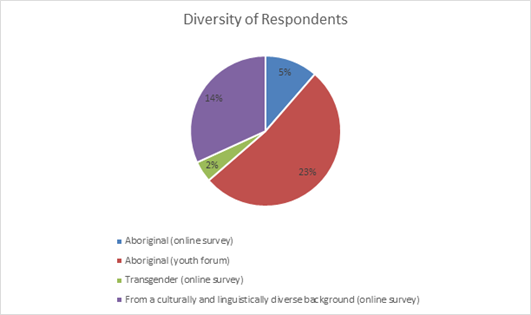

The diversity of online respondents included 14% culturally and linguistically diverse backgrounds, 5% Aboriginal and 2% transgender. Of the 18 years + attending, the youth forum held at Charles Sturt University, Wagga campus there were 23% Aboriginal young people.

Key findings out of the consultation process overall indicated that young people want to be engaged online, namely through social media (for example Facebook, snapchat and Instagram), email or a youth specific portal on Council’s website and not through regular face-to-face meetings. Although a response of 42% was received indicating likely and 11% for highly likely to join a traditional face to face Youth Council model, it is important to note that when young people then prioritised their preferred method of engagement with Council, there was only 17% of youth who selected the Youth Council option. The remaining 83% of youth selected online platforms as their preferred method of engagement. Considering these responses, staff are able to design an option for an on-line youth forum/council to be established as part of the suite of youth specific social media platforms. For example, the online group option is able to be established through private groups on Facebook and through a member’s only environment. As part of the above it is proposed to establish and actively maintain a youth database providing increased information exchange with young people.

To complement the above offerings staff are also recommending to continue with the twice a year Mayoral School Leaders breakfast meetings. Positive feedback was received from both high school student respondents and their respective teachers and Principals that the inaugural 2017 Mayoral School Leaders breakfast meetings were beneficial. Feedback received indicated that this breakfast meeting format strengthened the connection and rapport between student leaders and Council along with complimenting existing school based leadership programs. Feedback also indicated that these meetings provided much needed contact for students with the Mayor and Councillors, providing the students with new insights into Council business processes, a greater understanding of what role Council plays in the community, along with civic leadership experience.

In order to reach further into the school communities across the City, the Mayor has already communicated to all high schools in the Local Government Area, his willingness along with other Councillors to be invited to speak at school assemblies or class room presentations. This initiative will increase opportunities to interact with students and provide another platform for young people to provide feedback directly to the Mayor and Councillors on matters that interest them.

Of the online survey respondents 84% indicated they would like to contribute their ideas to the development of Council run events, services and programs, as well as to other non-Council run community events, health and youth services organised across the city. Online survey respondents identified specific interest in the Civic Theatre and the Oasis. Overall young people prioritised festivals such as the annual FUSION multicultural festival and participation in sport and recreation as important areas of interest for them.

Providing leadership opportunities through volunteering and fundraising activities that have a direct impact on social and community issues, was identified overall as the way young people want to participate in the community.

Overall priority issues to young people included mental health particularly youth suicide prevention, lesbian, gay, transgender, queer and intersex (LGBTQI) community issues notably safety and inclusion, public transport, employment, increasing youth run initiated projects across the City and increasing access to diverse recreational/leisure and cultural opportunities for young people.

The main methods of communication young people identified they use to find out about community issues, youth events and Council run services and programs include social media, followed by word-of-mouth (through friends) and at school.

Report Recommendations: