Ordinary Meeting of

Council

Ordinary Meeting of

Council

To be held on

Monday

23 April 2018

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

Ordinary Meeting of

Council

Ordinary Meeting of

Council

To be held on

Monday

23 April 2018

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 23 April 2018 at 6.00pm.

Council live streams video and audio of Council meetings. Members of the public are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

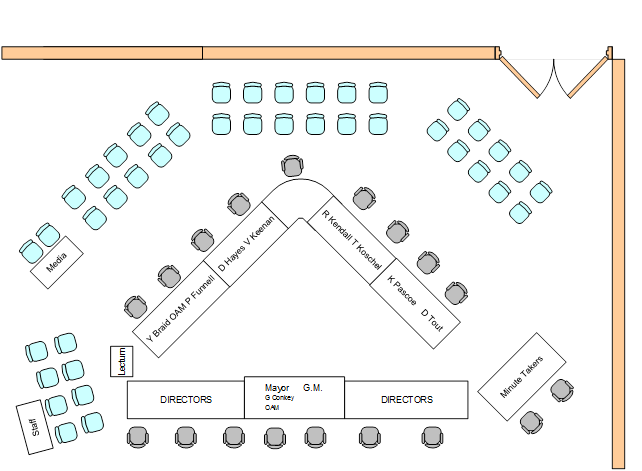

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 23 April 2018.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 23 April 2018

ORDER OF BUSINESS:

CLAUSE PRECIS PAGE

PRAYER 3

ACKNOWLEDGEMENT OF COUNTRY 3

APOLOGIES 3

CONFIRMATIONS OF MINUTES

CM-1 Council Meeting - 26 March 2018 3

DECLARATIONS OF INTEREST 3

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - UTILISING THE MAIN STREET AREA TO HOLD MARKETS/EVENTS 4

Reports from Staff

RP-1 DA18/0074 - DEMOLITION OF DWELLING AND CONSTRUCTION OF 8 x TWO STOREY THREE BEDROOM UNITS WITH COMMUNITY TITLE SUBDIVISION. 14-16 DAY STREET, WAGGA WAGGA. 5

RP-2 COUNCIL MEETING STRUCTURE - ADOPTION OF CODE OF MEETING PRACTICE 9

RP-3 Financial Performance Report as at 31 March 2018 13

RP-4 Integrated Planning and Reporting - Draft Long Term Financial Plan 2018/28 and Draft Combined Delivery Program and Operational Plan 2018/2019 36

RP-5 PROPOSED BIDGEE DRAGONS WAGGA WAGGA INCORPORATED BOATSHED 41

RP-6 CREATION OF SEWER EASEMENT WITHIN LOT 9 DP 1183084 AT LLOYD 51

RP-7 Eastern Riverina Arts Constitution and Membership 55

RP-8 SERVICE NSW - EASY TO DO BUSINESS 84

RP-9 RECREATION, OPEN SPACE AND COMMUNITY STRATEGY AND IMPLEMENTATION PLAN 2040 105

RP-10 Response to Questions/Business with Notice 110

Committee Minutes

M-1 TRAFFIC COMMITTEE MINUTES - 8 MARCH 2018 112

M-2 Floodplain Risk Management Advisory Committee Meeting - 13 February 2018 127

M-3 Airport Advisory Committee Meeting - 8 March 2018, 21 March 2018, 27 March 2018 131

QUESTIONS/BUSINESS WITH NOTICE 148

Confidential Reports

CONF-1 Appointment of Public Art Advisory Panel Community Member 149

CONF-2 NightLights Commission 2018 150

CONF-3 PROPOSED GRAZING LICENCE AGREEMENT - 95 BURILDA STREET, NORTH WAGGA 151

CONF-4 RFT 2018/06 SUPPLY STREET SWEEPER 152

CONF-5 RFQ 2018/517 Supply of Three 4WD Tractors 153

CONF-6 RFT2018-12 INSURANCE BROKERAGE SERVICES 154

CONF-7 RFT2018/20 LOADER MATERIAL HANDLER 155

CONF-8 Riverina Intermodal Freight and Logistics (RIFL) Hub Heads of Agreement 156

CONF-9 DA17/0211 - 199 GURWOOD SREET, WAGGA WAGGA - COURT PROCEEDINGS 157

CONF-10 Wagga Wagga Main City Levee Stage 1 - Stage 1 Update 158

Confirmation of Minutes

CM-1 Council Meeting - 26 March 2018

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 26 March 2018 be confirmed as a true and accurate record.

|

|

1⇩. |

Council Meeting - Minutes - 26 March 2018 |

159 |

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - UTILISING THE MAIN STREET AREA TO HOLD MARKETS/EVENTS

Author: Councillor Tim Koschel

|

Analysis: |

This Notice of Motion is being presented to Council to call for a report on options of utilising the main street area to hold markets/events. |

|

That council staff bring forward a report on options of utilising the main street area to hold markets/events. |

Report

I bring forward this Notice of Motion to:

· Explore the option of using our CBD / main street to hold markets and/or events

· Explore the impacts this would have on local traffic and insurance cover for event organisers

· Look at letting organisers / Charities using at low cost to encourage use

· Increase foot traffic to local retailers

· Show our support and understanding to local business who are struggling through a difficult time

Financial Implications

N/A

Policy and Legislation

Wagga Wagga City Council Code of Meeting Practice

Link to Strategic Plan

Growing Economy

Objective: We are a hub for activity

Outcome: We have vibrant precincts

Risk Management Issues for Council

No specific issues identified.

Internal / External Consultation

N/A

Report submitted to the Ordinary Meeting of Council on Monday 23 April 2018. RP-1

RP-1 DA18/0074 - DEMOLITION OF DWELLING AND CONSTRUCTION OF 8 x TWO STOREY THREE BEDROOM UNITS WITH COMMUNITY TITLE SUBDIVISION. 14-16 DAY STREET, WAGGA WAGGA.

Author: Amanda Gray

General Manager: Peter Thompson

|

Analysis: |

The report is for a development application and is presented to Council for determination. The application has been referred to Council under Section 1.11 of the Wagga Wagga Development Control Plan 2010 (DCP) as the application is development for multi dwelling housing, which includes a request to vary a numerical control by greater than 10%.

It is proposed to vary the front fence requirement under Clause 9.2.2. This control requires front fences to be no higher than 1.2m whereas the development proposes a front fence and gates of 1.8m in height. This requires a variation of 50% of the numeric control. |

|

That Council approve DA18/0074 for Demolition of Existing Dwelling, Multi Dwelling Housing consisting of 8 x two storey dwellings with community title subdivision at 14-16 Day Street, Wagga Wagga NSW 2650 subject to the conditions outlined in the Section 4.15 Assessment Report. |

Development Application Details

|

Applicant |

Matt Jenkins Builder Pty Ltd The ASIC company extract from February 2018 lists Matthew Jenkins as the Director. |

|

Owner |

Matt Jenkins Builder Pty Ltd The ASIC company extract from February 2018 lists Matthew Jenkins as the Director. |

|

Development Cost |

$2,280,000 |

|

Development Description |

Demolition of Existing Dwelling, Multi Dwelling Housing - 8 x Two Storey Dwellings & Community Title Subdivision |

Report

Key Issues

Variation to DCP control.

Neighbour submissions.

Assessment

· The proposal is defined under the standard definitions contained in the Wagga Wagga Local Environmental Plan 2010 (LEP) as Multi Dwelling Housing (3 or more dwellings (whether attached or detached) on one lot of land, each with access at ground level but does not include a residential flat building.

· Under the provisions of the LEP, the subject site is within the R3 Medium Density Residential zone.

· The proposal is generally consistent with the R3 objectives because it provides for housing within a medium density residential environment and adds to the variety of housing and density types.

· Vehicle access and manoeuvring, solar access within the development and private open space are assessed as being adequate and the layout complies with site area and site cover controls.

· The application seeks a variation to the front fence control. Clause 9.2.2 states a maximum height of 1.2m whereas the application proposes a front fence of 1.8m in height.

· The application was advertised and notified and four submissions in objection to the development were received. The submissions related generally to loss of privacy, loss of light, parking and impact on value of property.

· It is proposed to remove trees from the rear of the block as part of the development application.

· Community title subdivision of the lot is proposed, with 8 residential lots and 1 community lot.

Reasons for Approval

1. The proposed development is consistent with the provisions of the Wagga Wagga Local Environmental Plan 2010;

2. The applicable objectives of Sections 2 and 9 of the DCP are satisfied by the proposed development;

3. The proposed variation to the front fence height pursuant to Clause 9.2.2 of the DCP has been justified by the application;

4. For the abovementioned reasons it is considered to be in the public interest to approve this development application.

Site Location

The site is located on the northern side of Fitzmaurice Street. The site is long and narrow and extends to an area of 1834sq.m. One of the existing dwellings has approval to be demolished, the other demolition is included as part of the subject application.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

Refusal of the application may result in an appeal process in the Land and Environment Court which will have to be defended by Council. The reasons for refusal will have to be justified and withstand scrutiny and cross examination in Court.

Approval of the application is not considered to raise risk management issues for Council as the proposed development is generally consistent with LEP and DCP controls and the one proposed variation of a control is minor.

Internal / External Consultation

Full details of the consultation that was carried out as part of the development application assessment is contained in the attached s4.15 Report.

|

1. |

DA18/0074 - Section 4.15 Report - Provided under separate cover |

|

|

2. |

DA18/0074 - Site Plan - Provided under separate cover |

|

|

3. |

DA18/0074 - Floor Plans - Provided under separate cover |

|

|

4. |

DA18/0074 - Elevations - Provided under separate cover |

|

|

5. |

DA18/0074 - Landscape and Subdivision Plan - Provided under separate cover |

|

|

6. |

DA18/0074 - Shadow Diagrams - Provided under separate cover |

|

Report submitted to the Ordinary Meeting of Council on Monday 23 April 2018. RP-2

RP-2 COUNCIL MEETING STRUCTURE - ADOPTION OF CODE OF MEETING PRACTICE

General Manager: Peter Thompson

|

Analysis: |

Council resolved to place an amended Code of Meeting Practice on public exhibition at the February Council Meeting. The changes to the Code of Meeting Practice cater for two Ordinary Council Meetings per month. |

|

That Council: a note that there were no submissions received during the exhibition period for the draft Code of Meeting Practice b adopt the attached Code of Meeting Practice c endorse the meeting dates outlined in the body of this report d approve the budget variations as detailed in the Financial Implications section of the report e englobo confidential reports at the same time as open Council reports |

Report

Council, at its meeting of 26 February 2018, resolved:

That Council:

a endorse holding two Ordinary Council Meetings per month for the period May 2018 to December 2018

b endorse the attached Draft Code of Meeting Practice with the following addition to PART 2 – Section 6 – Call of the Council

(4) By operation of these rules Council grants a Leave of Absence (pursuant to LGA – S 234 (d)(ii)) to a Councillor who provides notice that they will be absent from an Ordinary Council Meeting, unless an alternative resolution is moved and passed at the Ordinary Council Meeting to the effect that a Leave of Absence is not granted. If an alternative resolution is moved and passed being that a Leave of Absence is not granted, the Councillor must be sent notice in writing within seven (7) days advising the Councillor that their absence from the meeting was not pursuant to a Leave of Absence.

c place the Draft Code of Meeting Practice on public exhibition for a period of 42 days from 27 February 2018 until 10 April 2018 and invite public submissions

d receive a further report following the public exhibition period if submissions are received:

i addressing any submissions made in respect of the proposed code

ii proposing adoption of the new code unless there are any recommended amendments deemed to be substantial and requiring a further public exhibition period

During its consideration at this meeting on 26 February 2018, it was suggested that Clause 8 (2) be amended to release the agenda and business paper to Councillors at least three business days prior to the meeting instead of three clear days as follows:

8. Notice of Meeting

(2) The

notice, agenda and business papers will be issued by authority of the General

Manager and will be posted to the Councillors’ secure Boardpad on each

Councillor’s iPad. Councillors will be notified of the business

paper(s) availability via email at least three (3) clear calendar business days before each meeting of the Council.

This Policy was placed on public exhibition for 42 days from 27 February 2018 until 10 April 2018 with no submissions received. Accordingly, it is recommended to Council that this Code of Meeting Practice be adopted as exhibited with the inclusion of the amendment to Clause 8 (2) above.

Meeting Dates

If Council resolve to adopt the amended Code of Meeting Practice the following dates will be scheduled until the end of this calendar year:

14 May 2018

28 May 2018

11 June 2018 (Meeting on Tuesday due to Queen’s Birthday holiday)

25 June 2018

9 July 2018

23 July 2018

13 August 2018

27 August 2018

10 September 2018

24 September 2018

8 October 2018

29 October 2018 (Meeting on the fifth week to cater for the financial statements)

12 November 2018

26 November 2018

17 December 2018 (amended to three weeks due to Christmas break)

Confidential Englobo

Council at its meeting held 28 August 2018 resolved to implement a six-month trial to englobo confidential items immediately after the englobo of open items. This process has been trialled since September 2017 and has caused disruption to the flow of the meeting by ceasing livestreaming and requiring the public gallery to leave.

After reviewing this process at the end of the trial period it is recommended that Council englobo confidential reports at the same time as open Council reports given englobo does not involve discussion of any confidential details in the report itself.

Financial Implications

The additional cost of $5,000 to livestream meetings for the remainder of this calendar year has been included in the draft 2018/19 budget for Council’s consideration and subsequent adoption at the 25 June 2018 Council meeting. Any further budget variations relating to ongoing livestreaming costs will need to be considered in subsequent reports adopting meeting dates at the conclusion of this calendar year.

Policy and Legislation

Wagga Wagga City Council Code of Meeting Practice

Local Government Act 1993

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

· Councillors may not have an appropriate amount of time to read and deliberate on complex matters.

· Councillors will have less opportunity to chair meetings and meet in an informal environment such as a Policy and Strategy meeting.

· Additional costs to livestream meetings

Internal / External Consultation

Consultation with Councillors

A number of workshops and discussions have taken place with the elected body since the inception of the current meeting structure. The feedback received by Councillors has varied and staff believe the proposed meeting structure is the most suitable solution to the current issues.

Community Consultation

The draft Code of Meeting Practice was placed on public exhibition for 42 days. During the public exhibition period staff utilised the Consult tier as per the engagement matrix below.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media releases |

Print advertising |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

|

x |

|

x |

|

|

|

|

|

|

|

x |

x |

x |

|

Below is a summary of engagement activities undertaken during the public exhibition period:

|

Engagement Activity |

Period |

|

Council News / Print Advertisement |

3 March and 7 March 2018. |

|

Website |

27 February 2018 until 10 April 2018 |

|

Email Newsletter (Your Say) |

2 March 2018 and 21 March 2018 |

|

Social Media |

Facebook post on 11 March 2018 and 1 April 2018 |

|

1. |

Draft Code of Meeting Practice - Provided under separate cover |

|

Report submitted to the Ordinary Meeting of Council on Monday 23 April 2018. RP-3

RP-3 Financial Performance Report as at 31 March 2018

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Analysis: |

This report is for Council to consider and approve the proposed 2017/18 budget variations required to manage the 2017/18 budget and Long Term Financial Plan, and details Council’s external investments and performance as at 31 March 2018. |

|

That Council: a approve the proposed 2017/18 budget variations for the month ended 31 March 2018 and note the balanced budget position as presented in this report b note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above c provide financial assistance of the following amounts in accordance with Section 356 of the Local Government Act 1993: i) Cantilena Singers $ 920.00 ii) South Wagga Apex Club $ 85.00 iii) Tarcutta Race Course Recreation Reserve Trust $ 6,470.00 d note details of the external investments as at 31 March 2018 in accordance with section 625 of the Local Government Act 1993 |

Report

Wagga Wagga City Council (Council) forecasts a balanced budget position as at 31 March 2018. Proposed funded budget variations are detailed in this report for Council’s consideration and adoption.

Council has experienced a negative monthly investment performance for the month of March, when compared to budget. This is a result of a negative movement in the value of Council’s Floating Rate Note portfolio during the month.

Key Performance Indicators

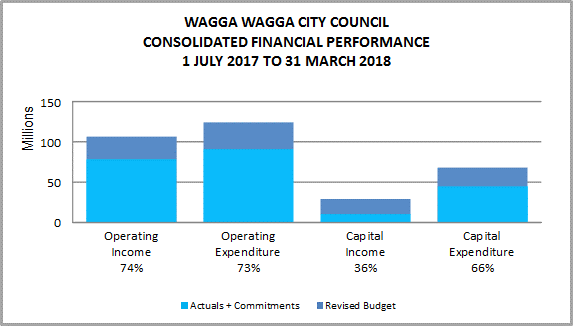

OPERATING INCOME

Total operating income is 74% of approved budget, which is tracking to budget for the end of March (this percentage excludes capital grants and contributions). An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 88%.

OPERATING EXPENSES

Total operating expenditure is 73% of approved budget and is tracking to budget for the full financial year.

CAPITAL INCOME

Total capital income is 36% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions relating to projects. This income also includes the sale of property, plant and equipment.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 66% of approved budget. The significant increase from what was reported in February’s Financial Performance Report of 38% is as a result of the adopted transfer of $42M of capital works budgets from 2017/18 to 2018/19.

|

WAGGA WAGGA

CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2017/18 |

COMMT'S 2017/18 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|||||||

|

Rates & Annual Charges |

(63,090,002) |

0 |

(63,090,002) |

(47,720,741) |

0 |

(47,720,741) |

76% |

|

User Charges & Fees |

(25,947,798) |

(24,531) |

(25,972,329) |

(17,961,774) |

0 |

(17,961,774) |

69% |

|

Interest & Investment Revenue |

(3,154,163) |

(755,144) |

(3,909,307) |

(2,785,959) |

0 |

(2,785,959) |

71% |

|

Other Revenues |

(2,984,954) |

231,665 |

(2,753,289) |

(1,884,177) |

0 |

(1,884,177) |

68% |

|

Operating Grants & Contributions |

(13,910,429) |

3,243,773 |

(10,666,656) |

(7,973,968) |

0 |

(7,973,968) |

75% |

|

Capital Grants & Contributions |

(13,704,984) |

(10,667,186) |

(24,372,171) |

(9,661,500) |

0 |

(9,661,500) |

40% |

|

Total Revenue |

(122,792,330) |

(7,971,423) |

(130,763,753) |

(87,988,119) |

0 |

(87,988,119) |

67% |

|

|

|||||||

|

Expenses

|

|||||||

|

Employee Benefits & On-Costs |

42,458,491 |

175,003 |

42,633,494 |

30,226,762 |

29,717 |

30,256,478 |

71% |

|

Borrowing Costs |

3,591,092 |

0 |

3,591,092 |

2,595,059 |

0 |

2,595,059 |

72% |

|

Materials & Contracts |

29,833,841 |

4,030,410 |

33,864,252 |

21,515,749 |

3,338,687 |

24,854,436 |

73% |

|

Depreciation & Amortisation |

34,477,729 |

0 |

34,477,729 |

25,858,296 |

0 |

25,858,296 |

75% |

|

Other Expenses |

9,453,285 |

160,986 |

9,614,271 |

7,211,573 |

126,860 |

7,338,432 |

76% |

|

Total Expenses |

119,814,437 |

4,366,399 |

124,180,837 |

87,407,439 |

3,495,263 |

90,902,702 |

73% |

|

|

|

||||||

|

Net Operating (Profit)/Loss |

(2,977,893) |

(3,605,023) |

(6,582,916) |

(580,680) |

3,495,263 |

2,914,583 |

|

|

|

|||||||

|

Net Operating (Profit)/Loss before Capital Grants & Contributions |

10,727,091 |

7,062,163 |

17,789,254 |

9,080,820 |

3,495,263 |

12,576,083 |

|

|

|

|||||||

|

Capital / Reserve Movements |

|||||||

|

Capital Exp - Renewals |

25,035,121 |

11,247,605 |

36,282,726 |

12,712,933 |

8,065,520 |

20,778,453 |

57% |

|

Capital Exp - New Projects |

16,898,302 |

7,679,289 |

24,577,591 |

12,832,769 |

9,184,790 |

22,017,559 |

90% |

|

Capital Exp - Project Concepts |

11,400,337 |

(6,836,754) |

4,563,583 |

100,830 |

47,421 |

148,250 |

3% |

|

Loan Repayments |

2,474,343 |

0 |

2,474,343 |

1,855,013 |

0 |

1,855,013 |

75% |

|

New Loan Borrowings |

(7,215,980) |

(652,930) |

(7,868,910) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(4,678,401) |

28,239 |

(4,650,162) |

(712,699) |

0 |

(712,699) |

15% |

|

Net Movements Reserves |

(6,458,101) |

(7,867,241) |

(14,325,342) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

37,455,621 |

3,598,208 |

41,053,829 |

26,788,846 |

17,297,731 |

44,086,577 |

|

|

|

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED

BUDGET |

YTD ACTUAL EXCL COMMT'S 2017/18 |

COMMT'S 2017/18 |

YTD ACTUAL +

COMMT'S |

YTD % OF BUD |

|

Net Result after Depreciation |

34,477,728 |

(6,815) |

34,470,913 |

26,208,166 |

20,792,994 |

47,001,160 |

|

|

|

|||||||

|

Add back Depreciation Expense |

34,477,729 |

0 |

34,477,729 |

25,858,296 |

0 |

25,858,296 |

|

|

|

|||||||

|

Cash Budget (Surplus)/Deficit |

0 |

(6,815) |

(6,815) |

349,870 |

20,792,994 |

21,142,864 |

|

Revised Budget Result - Surplus/(Deficit) |

$’000s |

|

Original 2017/18 Budget Result as adopted by Council Total Budget Variations approved to date Budget variations for March 2018 |

$0 $7K ($7K) |

|

Proposed revised budget result for 31 March 2018 |

$0K |

The proposed Budget Variations to 31 March 2018 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact Fav/ (Unfav) |

|

||||

|

1 – Community Leadership and Collaboration |

|

|||||||

|

Section 356 Donations |

$7K |

|

($7K) |

|

||||

|

To facilitate the consideration of Section 356 donation requests detailed in this report, it is proposed to process a budget variation of $7K funded from the current reported budget surplus. |

|

|||||||

|

Mount Austin High School Pedestrian Safety |

$21K |

RMS Grant ($21K) |

Nil |

|

||||

|

Urgent works were requested by RMS to improve pedestrian safety at Mount Austin High School on Bourke Street. The works included the installation of additional school zone signs, yellow patches and dragon’s teeth. The works are to be fully funded by RMS. Estimated Completion Date: 30 April 2018

|

|

|

||||||

|

Fuel Management Software and Hardware |

$25K |

Plant Replacement Reserve ($25K) |

Nil |

|

||||

|

Funds are required to replace the current fuel management system due to its recent failure and no longer being supported by the software provider. The reporting of the fuel usage for Council’s fleet is undertaken on a monthly basis. The replacement is budgeted in the draft 2018/19 financial year to be funded from the Plant Replacement Reserve so it is proposed to bring this project forward to 2017/18. |

|

|

||||||

|

StateCover Performance Rebate Distribution Income |

($162K) |

Health and Wellbeing Programs $41K Workers Compensation Reserve $93K WHS Position $28K |

Nil |

|

||||

|

Council has been notified by StateCover that Council will receive a total of $162K in 2 equal instalments of $81K over 2 financial years - 2017/18 and 2018/19 for a mutual performance rebate. The rebate is calculated at 8% of the actual base tariff premium. It is proposed to utilise these additional funds as follows:

· 2017/18 - Health and Wellbeing programs ($41K) · 2017/18 - Workers Compensation Reserve ($40K) · 2018/19 - WHS Operations Advocate Position ($28K) · 2018/19 - Workers Compensation Reserve ($53K)

|

|

||||||

|

4 – Community Place and Identity |

|||||||

|

Civic Theatre Technical Purchases |

$9K |

Civic Theatre Technical Reserve ($9K) |

Nil |

||||

|

Funds are required to replace technical and safety equipment at the Civic Theatre due to its age and safety concerns. These funds will be utilised for the purchase of a flat curtain, rigging rope upgrade, auditorium digital cable and piano microphones. It is proposed to fund these purchases from the Civic Theatre Technical Reserve. Estimated Completion Date: 30 June 2018

|

|

||||||

|

5 – The Environment |

|

|||||||

|

Floodplain Risk Management Study |

$32K |

Office of Environment and Heritage Grant ($21K) Flood Mitigation Maintenance ($11K) |

Nil |

|

||||

|

Council has received funding from the Office of Environment and Heritage (OEH) under the 2014-15 Floodplain Management Program for the finalisation of the recently adopted WWCC Revised Floodplain Risk Management Study Plan. These funds are to be matched 2:1 with Council’s portion to be funded from existing flood mitigations budgets. This brings the total project budget to $197K. Completion Date: 31 March 2018 |

|

||||||

|

Staying Active Program |

$8K |

Aquatic and Recreation Institute Grant ($8K) |

Nil |

|

||||

|

Council has been successful in obtaining funding under the Staying Active Program from the Aquatic and Recreation Institute (ARI). The program provides grants to establish and maintain aqua fitness and gentle exercise classes specifically for over 50’s. Estimated Completion Date: 31 October 2018 |

|

||||||

|

($7K) |

|

|||||||

Current Restrictions

|

RESERVES SUMMARY |

|||||

|

31 MARCH 2018 |

|||||

|

|

CLOSING BALANCE 2016/17 |

ADOPTED RESERVE TRANSFERS 2017/18 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 26.03.18 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

Externally Restricted |

|

||||

|

Developer Contributions |

(21,947,807) |

3,374,249 |

(2,208,443) |

(20,782,001) |

|

|

Sewer Fund |

(24,045,646) |

1,229,992 |

(800,898) |

(23,616,552) |

|

|

Solid Waste |

(15,824,723) |

4,878,008 |

(5,932,074) |

(16,878,789) |

|

|

Specific Purpose Unexpended Grants/Contributions |

(4,956,776) |

0 |

4,956,776 |

0 |

|

|

SRV Levee |

(1,167,316) |

0 |

(640,350) |

(1,807,666) |

|

|

Stormwater Levy |

(2,940,246) |

(587,206) |

451,268 |

(3,076,184) |

|

|

Total Externally Restricted |

(70,882,514) |

8,895,043 |

(4,173,721) |

0 |

(66,161,193) |

|

|

|

||||

|

Internally Restricted |

|

||||

|

Airport |

(371,610) |

(386,660) |

230,472 |

(527,798) |

|

|

Art Gallery |

(30,990) |

(21,000) |

0 |

(51,990) |

|

|

Ashmont Community Facility |

(4,500) |

(1,500) |

0 |

(6,000) |

|

|

Bridge Replacement |

(240,240) |

(100,000) |

153,573 |

(186,667) |

|

|

CBD Carparking Facilities |

(891,982) |

0 |

18,889 |

(873,094) |

|

|

CCTV |

(64,476) |

(10,000) |

0 |

(74,476) |

|

|

Cemetery Perpetual |

(157,605) |

(125,146) |

144,084 |

(138,667) |

|

|

Cemetery |

(193,116) |

(161,330) |

100,000 |

(254,446) |

|

|

Civic Theatre Operating |

0 |

(50,000) |

0 |

(50,000) |

|

|

Civic Theatre Technical Infrastructure |

(105,450) |

(50,000) |

57,100 |

8,700 |

(89,650) |

|

Civil Projects |

(155,883) |

0 |

0 |

(155,883) |

|

|

Community Amenities |

(5,685) |

0 |

0 |

(5,685) |

|

|

Community Works |

0 |

0 |

(62,869) |

|

(62,869) |

|

Council Election |

(166,776) |

(73,095) |

0 |

(239,871) |

|

|

Emergency Events |

(133,829) |

(57,331) |

(191,160) |

||

|

Employee Leave Entitlements |

(3,184,451) |

0 |

0 |

(3,184,451) |

|

|

Environmental Conservation |

(131,351) |

0 |

0 |

(131,351) |

|

|

Estella Community Centre |

(230,992) |

0 |

0 |

(230,992) |

|

|

Family Day Care |

(169,356) |

(123,944) |

0 |

(293,300) |

|

|

Fit for the Future |

(3,033,479) |

(2,265,725) |

757,447 |

(4,541,757) |

|

|

Generic Projects Saving |

(1,040,610) |

20,000 |

93,727 |

(926,883) |

|

|

Glenfield Community Centre |

(17,704) |

(2,000) |

0 |

(19,704) |

|

|

Grants Commission |

(4,956,776) |

0 |

4,956,776 |

0 |

|

|

Grassroots Cricket |

(70,992) |

0 |

0 |

(70,992) |

|

|

Gravel Pit Restoration |

(761,422) |

0 |

25,000 |

(736,422) |

|

|

Gurwood Street Property |

(50,454) |

0 |

0 |

(50,454) |

|

|

Information Services |

(378,713) |

250,000 |

8,000 |

(120,713) |

|

|

Infrastructure Replacement |

(136,098) |

(48,071) |

954 |

(183,215) |

|

|

Insurance Variations |

(28,644) |

0 |

0 |

(28,644) |

|

|

Internal Loans |

(674,661) |

(851,794) |

620,468 |

(905,986) |

|

|

Lake Albert Improvements |

(53,867) |

(50,000) |

56,078 |

(47,789) |

|

|

RESERVES SUMMARY

|

|||||

|

31 MARCH 2018 |

|||||

|

|

CLOSING BALANCE 2016/17 |

ADOPTED RESERVE TRANSFERS 2017/18 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 26.03.18 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

LEP Preparation |

(28,301) |

14,636 |

11,120 |

(2,545) |

|

|

Livestock Marketing Centre |

(7,267,731) |

(1,180,017) |

4,053,725 |

(4,394,024) |

|

|

Museum Acquisitions |

(39,378) |

0 |

0 |

(39,378) |

|

|

Oasis Building Renewal |

(172,000) |

(32,147) |

0 |

(204,147) |

|

|

Oasis Plant |

(1,115,347) |

90,000 |

(114,230) |

(1,139,577) |

|

|

Parks & Recreation Projects |

(79,648) |

0 |

24,860 |

(54,788) |

|

|

Pedestrian River Crossing |

(198,031) |

48,031 |

150,000 |

0 |

|

|

Plant Replacement |

(5,893,831) |

1,804,934 |

1,059,675 |

25,000 |

(3,004,223) |

|

Playground Equipment Replacement |

(59,181) |

(105,679) |

0 |

(164,860) |

|

|

Project Carryovers |

(1,276,882) |

0 |

874,074 |

(402,808) |

|

|

Public Art |

(173,283) |

(23,669) |

53,969 |

(142,983) |

|

|

Robertson Oval Redevelopment |

(86,697) |

0 |

0 |

(86,697) |

|

|

Senior Citizens Centre |

(13,627) |

(2,000) |

0 |

(15,627) |

|

|

Sister Cities |

(36,527) |

(10,000) |

0 |

(46,527) |

|

|

Stormwater Drainage |

(183,420) |

0 |

25,177 |

(158,242) |

|

|

Strategic Real Property |

(702,792) |

0 |

(380,000) |

(1,082,792) |

|

|

Street Lighting Replacement |

(74,755) |

(30,000) |

0 |

(104,755) |

|

|

Subdivision Tree Planting |

(272,621) |

(20,000) |

0 |

(292,621) |

|

|

Sustainable Energy |

(520,442) |

35,000 |

(65,000) |

(550,442) |

|

|

Traffic Committee |

(50,000) |

(50,000) |

60,000 |

|

(40,000) |

|

Workers Compensation |

0 |

0 |

(40,000) |

(40,000) |

|

|

Total Internally Restricted |

(35,686,205) |

(3,511,177) |

12,855,737 |

(6,300) |

(26,347,945) |

|

|

|

||||

|

Total Restricted |

(106,568,720) |

5,383,866 |

8,682,016 |

(6,300) |

(92,509,137) |

|

CONTRACTS REVIEW STATEMENT |

||||||

|

31 MARCH 2018 |

||||||

|

Contract Number |

Contractor |

Contract |

Contract |

Start |

Duration of |

Budget |

|

2018/541 |

Spacelab Studio Pty Ltd |

Northern Growth Area Structure Plan |

$ 114,615 |

21/03/2018 |

12 weeks |

Y |

|

2018/537 |

Xylem Water Solutions Australia Ltd |

Supply Packaged Pump Station |

$ 148,704 |

22/01/2018 |

8 weeks |

Y |

|

2018/536 |

Pavement Management Services P/L |

Visual condition assessment of footpaths, kerbs, medians and roundabouts |

$ 97,172 |

1/03/2018 |

8 weeks |

Y |

|

2018/535 |

VAC Operations T/a Earth Radar |

Laser condition assessment of sealed roads and car parks |

$ 115,877 |

28/02/2018 |

8 weeks |

Y |

|

2018/533 |

Cox Architecture Pty Ltd |

Bolton Park Master Plan |

$ 132,000 |

28/02/2018 |

6 weeks |

Y |

|

2018/527 |

Adaptive Interiors |

Civic Theatre rear of house lift, toilet and laundry |

$ 143,330 |

23/02/2018 |

5 weeks |

Y |

|

2018/524 |

Riverina Work Wear |

Supply of outdoor worker clothing |

$ 120,000 |

12/03/2018 |

2 years |

Y |

|

2018/522 |

SMEC Australia Pty Ltd |

Dunn's Road concepts and funding sources report |

$ 84,742 |

15/03/2018 |

26 weeks |

Y |

|

2018/544 |

Toro Waste Equipment Australia Pty Ltd |

Supply of hook lift bins to transfer stations |

$ 195,822 |

23/03/2018 |

16 weeks |

Y |

|

2018/538 |

Inland Truck Centres |

Supply hook lift truck |

$ 328,806 |

28/03/2018 |

14 weeks |

Y |

|

PE00451 |

Rodney's Transport |

Transport FOGO waste |

$ 88,000 |

2/04/2018 |

4 to12 weeks |

Y |

|

PE00455 |

Worm Tech Pty Ltd |

Process FOGO |

$ 115,500 |

2/04/2018 |

4 to 12 weeks |

Y |

|

CONSULTANCY & LEGAL EXPENSES BUDGET REVIEW STATEMENT |

||||||||

|

31 MARCH 2018 |

||||||||

|

|

|

Approved Changes |

|

|

|

|

||

|

|

BUDGET 2017/18 |

SEP QTR BUDGET VARIATIONS APPROVED TO DATE |

DEC QTR BUDGET VARIATIONS APPROVED TO DATE |

MAR QTR BUDGET VARIATIONS APPROVED TO DATE |

REVISED BUDGET |

PROJECTED YEAR END RESULT |

ACTUAL |

|

|

|

|

|||||||

|

Consultancy Expenses |

108,227 |

326,978 |

98,800 |

404,958 |

938,962 |

938,962 |

392,121 |

|

|

|

|

|||||||

|

Legal Expenses |

314,522 |

111,129 |

(5,942) |

8,240 |

427,949 |

427,949 |

356,619 |

|

|

|

|

|

|

|

|

|

|

|

Section 356 Financial Assistance Requests

Three Section 356 Donation requests have been received for consideration at the 23 April 2018 Ordinary Council meeting.

Details of the donation requests are shown below:

· Cantilena Singers $920

The Cantilena Singers Wagga’s longest established Choir has requested the donation of the hiring fees for the Wagga Wagga Art Gallery for the 19 and 20 May 2018 to perform two concerts. The hire fee is $960 per night.

Council’s 2017/18 Combined Delivery Program and Operational Plan already has included a Section 356 donation fee waiver allocation of $1,000 for the Cantelina Singers. The request for an overall donation in 2017/18 of $1,920 would require an additional allocation of $920 from the available Section 356 Fee Waiver Donation budget.

The Cantilena Singers provide a valuable community service by performing at numerous community events during the year.

The above request aligns with Council’s Strategic Plan “Community Place and Identity – Outcome: we have opportunities to connect with others”.

Given there is available funding to accommodate this request and having regard to the community benefits the request for additional funding of $920 is supported.

· South Wagga Apex Club $85

The South Wagga Apex Club has requested Council’s consideration to the waiving of the $85 hire fees for Apex Park to conduct a free outdoor community film night on the 7 April 2018.

The above request aligns with Council’s Strategic Plan “Community Place and Identity – Outcome: we have opportunities to connect with others”.

· Tarcutta Racecourse Recreation Reserve Trust $6,470

The Tarcutta Racecourse Recreation Reserve Trust has requested Council’s consideration to the donation of the development application fees associated with the construction of an updated Community facility at the Tarcutta Recreational Ground costing $320,000.

It is noted that Council donated $10,000 to the Tarcutta Racecourse Recreation Reserve Trust at its meeting of the 29 August 2016 to assist with the construction costs of the new community facilities.

The fees paid by the Trust to Council associated with the upgrade at the Reserve total $8055.80 (DA16/0309 & DA17/0341) as noted in the table below:

|

Fee

|

Amount |

Allowed to be considered under POL 078 |

Possible Donation |

Excluded under the POL 078 |

|

Development Applications |

$1,300 |

Yes |

$1,300 |

|

|

Construction Certifcate |

$863 |

Yes |

$863 |

|

|

Plumbling Certifcate/fees |

$1,427 |

Yes |

$1,427 |

|

|

Inspections |

$2,880 |

Yes |

$2,880 |

|

|

Long Service Leave (NSW Government) |

$581 |

No |

|

$581 |

|

S94A Developer Contribution |

$800 |

Yes but not recommended due to impact on other community projects |

0 |

$800 |

|

Planning NSW (NSW Government) |

$205 |

No |

0 |

$205 |

|

Total |

$8,056 |

|

$6,470 |

$1,586 |

Fees of $6,470 could be reasonably considered for donation under Council’s Financial Assistance Policy POL 078. The refund of S94A Developer contributions levies is not recommended as S94A funded projects are directly dependent on Council collecting this levy from development.

The Long Service Leave Levy & Planning NSW Levies are required to be remitted directly to the NSW Government.

Council’s budget result as reported to the 26 March 2018 Council Meeting was a $7K budget surplus. If Council granted the above donation request, the budget result would be amended to a balanced budget for 2017/18.

The above request aligns with Council’s Strategic Plan “Safe and Healthy Community – Outcome: Recreation is part of every day life”.

|

General Fund Section 356 financial assistance available budget |

$3,116.78 |

|

Proposed Additional Section 356 Budget Allocation |

$6,815.51 |

|

Cantilena Singers |

($ 920.00) |

|

South Wagga Apex Club |

($ 85.00) |

|

Tarcutta Racecourse Recreation Reserve Trust |

($6,470.00) |

|

Total Section 356 Financial Assistance Requests – 23 April 2018 Council Meeting

|

($7,475.00) |

|

Proposed balance of Section 356 financial assistance budget – available for requests received for the remainder of this financial year |

$ 2,457.29

|

Investment Summary as at 31 March 2018

In accordance with Regulation 212 of the Local Government (General) Regulation 2005, details of Wagga Wagga City Council’s external investments are detailed below:

|

Institution |

Rating |

Closing Balance |

Closing Balance |

March |

March |

Investment |

Maturity |

Term |

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

Banana Coast CU |

NR |

1,000,000 |

1,000,000 |

2.80% |

0.83% |

2/06/2017 |

1/06/2018 |

12 |

|

AMP |

A |

2,000,000 |

2,000,000 |

2.80% |

1.66% |

2/06/2017 |

1/06/2018 |

12 |

|

AMP |

A |

2,000,000 |

2,000,000 |

2.60% |

1.66% |

2/08/2017 |

2/08/2018 |

12 |

|

CUA |

BBB |

1,000,000 |

0 |

0.00% |

0.00% |

3/03/2017 |

2/03/2018 |

12 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

2.60% |

1.66% |

8/09/2017 |

7/09/2018 |

12 |

|

ME Bank |

BBB |

2,000,000 |

2,000,000 |

2.60% |

1.66% |

22/08/2017 |

19/04/2018 |

8 |

|

AMP |

A |

1,000,000 |

1,000,000 |

2.80% |

0.83% |

8/09/2017 |

5/06/2018 |

9 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

2.62% |

1.66% |

28/09/2017 |

28/09/2018 |

12 |

|

Auswide |

BBB- |

2,000,000 |

2,000,000 |

2.67% |

1.66% |

5/10/2017 |

5/10/2018 |

12 |

|

Auswide |

BBB- |

1,000,000 |

1,000,000 |

2.67% |

0.83% |

16/10/2017 |

16/10/2018 |

12 |

|

Auswide |

BBB- |

2,000,000 |

2,000,000 |

2.70% |

1.66% |

5/12/2017 |

5/12/2018 |

12 |

|

Auswide |

BBB- |

1,000,000 |

1,000,000 |

2.67% |

0.83% |

15/12/2017 |

16/07/2018 |

7 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

2.47% |

1.66% |

28/02/2018 |

28/05/2018 |

3 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

2.70% |

1.66% |

28/02/2018 |

29/10/2018 |

8 |

|

Total Short Term Deposits |

|

23,000,000 |

22,000,000 |

2.66% |

18.29% |

|

|

|

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

2,208,510 |

534,531 |

1.50% |

0.44% |

N/A |

N/A |

N/A |

|

NAB |

AA- |

17,380,012 |

12,908,003 |

2.19% |

10.73% |

N/A |

N/A |

N/A |

|

AMP |

A |

184,149 |

184,452 |

2.15% |

0.15% |

N/A |

N/A |

N/A |

|

Beyond Bank |

BBB+ |

149,438 |

149,593 |

1.00% |

0.12% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

65,223 |

65,192 |

1.35% |

0.05% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

19,987,332 |

13,841,771 |

2.15% |

11.50% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

RaboBank |

A+ |

1,000,000 |

1,000,000 |

3.16% |

0.83% |

5/06/2017 |

6/06/2022 |

60 |

|

ING Bank |

A |

3,000,000 |

3,000,000 |

2.75% |

2.49% |

24/08/2017 |

26/08/2019 |

24 |

|

ME Bank |

BBB |

2,000,000 |

2,000,000 |

4.28% |

1.66% |

2/09/2014 |

2/09/2019 |

60 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

4.10% |

0.83% |

5/12/2014 |

5/12/2019 |

60 |

|

Beyond Bank |

BBB+ |

990,000 |

0 |

0.00% |

0.00% |

4/03/2015 |

4/03/2018 |

36 |

|

Beyond Bank |

BBB+ |

990,000 |

0 |

0.00% |

0.00% |

11/03/2015 |

11/03/2018 |

36 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.10% |

1.66% |

7/07/2017 |

7/07/2020 |

36 |

|

Newcastle Permanent |

BBB |

1,000,000 |

1,000,000 |

3.00% |

0.83% |

12/08/2016 |

12/08/2019 |

36 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

3.20% |

0.83% |

25/08/2016 |

25/08/2021 |

60 |

|

Newcastle Permanent |

BBB |

1,000,000 |

1,000,000 |

3.00% |

0.83% |

31/08/2016 |

30/08/2019 |

36 |

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

2.90% |

0.83% |

8/09/2016 |

10/09/2018 |

24 |

|

Newcastle Permanent |

BBB |

2,000,000 |

2,000,000 |

3.00% |

1.66% |

10/02/2017 |

11/02/2019 |

24 |

|

Westpac |

AA- |

3,000,000 |

3,000,000 |

3.10% |

2.49% |

10/03/2017 |

10/03/2022 |

60 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

2.92% |

0.83% |

16/10/2017 |

16/10/2019 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

2.92% |

1.66% |

6/11/2017 |

6/11/2019 |

24 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.35% |

1.66% |

3/01/2018 |

4/01/2022 |

48 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

2.80% |

0.83% |

5/01/2018 |

6/01/2020 |

24 |

|

Total Medium Term Deposits |

|

25,980,000 |

24,000,000 |

3.16% |

19.95% |

|

|

|

|

Institution |

Rating |

Closing Balance |

Closing Balance |

March |

March |

Investment |

Maturity |

Term |

|

Floating Rate Notes - Senior Debt |

|

|

|

|

|

|

|

|

|

BOQ |

BBB+ |

2,022,200 |

2,013,400 |

BBSW + 110 |

1.67% |

5/08/2014 |

24/06/2019 |

58 |

|

BOQ |

BBB+ |

1,007,377 |

1,008,781 |

BBSW + 107 |

0.84% |

6/11/2014 |

6/11/2019 |

60 |

|

BOQ |

BBB+ |

1,007,377 |

1,008,781 |

BBSW + 107 |

0.84% |

10/11/2014 |

6/11/2019 |

60 |

|

Macquarie Bank |

A |

2,021,254 |

2,022,122 |

BBSW + 110 |

1.68% |

3/03/2015 |

3/03/2020 |

60 |

|

Westpac |

AA- |

1,011,397 |

1,012,170 |

BBSW + 90 |

0.84% |

28/07/2015 |

28/07/2020 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,008,357 |

1,009,381 |

BBSW + 110 |

0.84% |

18/08/2015 |

18/08/2020 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,008,357 |

1,009,381 |

BBSW + 110 |

0.84% |

28/09/2015 |

18/08/2020 |

59 |

|

Westpac |

AA- |

2,022,794 |

2,024,340 |

BBSW + 90 |

1.68% |

30/09/2015 |

28/07/2020 |

58 |

|

Suncorp-Metway |

A+ |

1,018,866 |

1,019,988 |

BBSW + 125 |

0.85% |

20/10/2015 |

20/10/2020 |

60 |

|

Westpac |

AA- |

4,064,224 |

4,066,556 |

BBSW + 108 |

3.38% |

28/10/2015 |

28/10/2020 |

60 |

|

AMP |

A |

1,825,105 |

1,814,654 |

BBSW + 110 |

1.51% |

11/12/2015 |

11/06/2019 |

42 |

|

CBA |

AA- |

1,019,126 |

1,019,199 |

BBSW + 115 |

0.85% |

18/01/2016 |

18/01/2021 |

60 |

|

Rabobank |

A+ |

2,049,172 |

2,050,454 |

BBSW + 150 |

1.70% |

4/03/2016 |

4/03/2021 |

60 |

|

Newcastle Permanent |

BBB |

1,013,897 |

1,007,332 |

BBSW + 160 |

0.84% |

22/03/2016 |

22/03/2019 |

36 |

|

CUA |

BBB |

2,025,554 |

2,030,200 |

BBSW + 160 |

1.69% |

1/04/2016 |

1/04/2019 |

36 |

|

ANZ |

AA- |

1,020,936 |

1,014,200 |

BBSW + 118 |

0.84% |

7/04/2016 |

7/04/2021 |

60 |

|

Suncorp-Metway |

A+ |

1,024,336 |

1,025,117 |

BBSW + 138 |

0.85% |

21/04/2016 |

12/04/2021 |

60 |

|

AMP |

A |

1,018,706 |

1,019,858 |

BBSW + 135 |

0.85% |

24/05/2016 |

24/05/2021 |

60 |

|

Westpac |

AA- |

1,015,847 |

1,015,340 |

BBSW + 117 |

0.84% |

3/06/2016 |

3/06/2021 |

60 |

|

CBA |

AA- |

1,021,806 |

1,021,338 |

BBSW + 121 |

0.85% |

12/07/2016 |

12/07/2021 |

60 |

|

ANZ |

AA- |

2,033,272 |

2,032,478 |

BBSW + 113 |

1.69% |

16/08/2016 |

16/08/2021 |

60 |

|

BOQ |

BBB+ |

1,516,436 |

1,518,510 |

BBSW + 117 |

1.26% |

26/10/2016 |

26/10/2020 |

48 |

|

NAB |

AA- |

1,015,617 |

1,014,760 |

BBSW + 105 |

0.84% |

21/10/2016 |

21/10/2021 |

60 |

|

Teachers Mutual |

BBB |

1,507,736 |

1,510,833 |

BBSW + 140 |

1.26% |

28/10/2016 |

28/10/2019 |

36 |

|

Bendigo-Adelaide |

BBB+ |

1,007,107 |

1,008,551 |

BBSW + 110 |

0.84% |

21/11/2016 |

21/02/2020 |

39 |

|

Westpac |

AA- |

1,016,786 |

1,016,369 |

BBSW + 111 |

0.84% |

7/02/2017 |

7/02/2022 |

60 |

|

ANZ |

AA- |

1,010,347 |

1,008,891 |

BBSW + 100 |

0.84% |

7/03/2017 |

7/03/2022 |

60 |

|

CUA |

BBB |

759,028 |

754,539 |

BBSW + 130 |

0.63% |

20/03/2017 |

20/03/2020 |

36 |

|

Heritage Bank |

BBB+ |

604,060 |

605,059 |

BBSW + 130 |

0.50% |

4/05/2017 |

4/05/2020 |

36 |

|

Teachers Mutual |

BBB |

1,007,187 |

1,001,523 |

BBSW + 142 |

0.83% |

29/06/2017 |

29/06/2020 |

36 |

|

NAB |

AA- |

3,031,311 |

3,004,419 |

BBSW + 90 |

2.50% |

5/07/2017 |

5/07/2022 |

60 |

|

Suncorp-Metway |

A+ |

1,008,227 |

1,007,951 |

BBSW + 97 |

0.84% |

16/08/2017 |

16/08/2022 |

60 |

|

Westpac |

AA- |

2,009,234 |

2,003,506 |

BBSW + 81 |

1.67% |

30/10/2017 |

27/10/2022 |

60 |

|

ME Bank |

BBB |

1,505,921 |

1,506,618 |

BBSW + 125 |

1.25% |

9/11/2017 |

9/11/2020 |

36 |

|

NAB |

AA- |

2,002,356 |

1,997,348 |

BBSW + 80 |

1.66% |

10/11/2017 |

10/02/2023 |

63 |

|

ANZ |

AA- |

1,503,867 |

1,499,360 |

BBSW + 77 |

1.25% |

18/01/2018 |

18/01/2023 |

60 |

|

Bendigo-Adelaide |

BBB+ |

502,284 |

500,317 |

BBSW + 105 |

0.42% |

25/01/2018 |

25/01/2023 |

60 |

|

Newcastle Permanent |

BBB |

1,504,362 |

1,503,185 |

BBSW + 140 |

1.25% |

6/02/2018 |

6/02/2023 |

60 |

|

Westpac |

AA- |

0 |

1,995,448 |

BBSW + 83 |

1.66% |

6/03/2018 |

6/03/2023 |

60 |

|

UBS |

A+ |

0 |

1,999,486 |

BBSW + 90 |

1.66% |

8/03/2018 |

8/03/2023 |

60 |

|

Heritage Bank |

BBB+ |

0 |

1,400,676 |

BBSW + 123 |

1.16% |

29/03/2018 |

29/03/2021 |

36 |

|

Total Floating Rate Notes - Senior Debt |

|

53,771,824 |

59,102,417 |

|

49.12% |

|

|

|

|

Managed Funds |

|

|

|

|

|

|

|

|

|

NSW Tcorp |

NR |

1,378,564 |

1,368,744 |

-0.71% |

1.14% |

17/03/2014 |

1/03/2023 |

107 |

|

Total Managed Funds |

|

1,378,564 |

1,368,744 |

-0.71% |

1.14% |

|

|

|

|

Institution |

Rating |

Closing Balance |

Closing Balance |

March |

March |

Investment |

Maturity |

Term |

|

TOTAL

CASH ASSETS, CASH |

|

124,117,719 |

120,312,933 |

100.00% |

|

|

|

|

|

LESS: RIVERINA REGIONAL LIBRARY (RRL) CASH AT BANK |

|

3,354,820 |

3,190,586 |

|

|

|

|

|

|

TOTAL

WWCC CASH ASSETS, CASH |

|

120,762,899 |

117,122,347 |

|

|

|

|

|

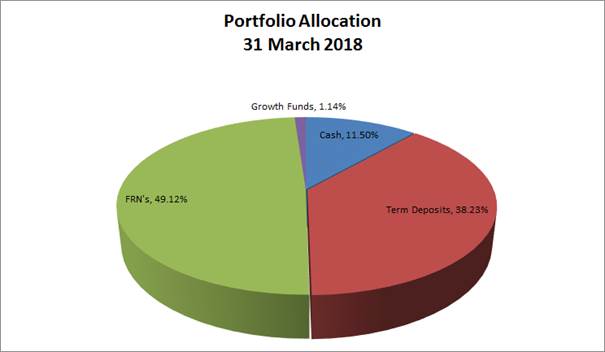

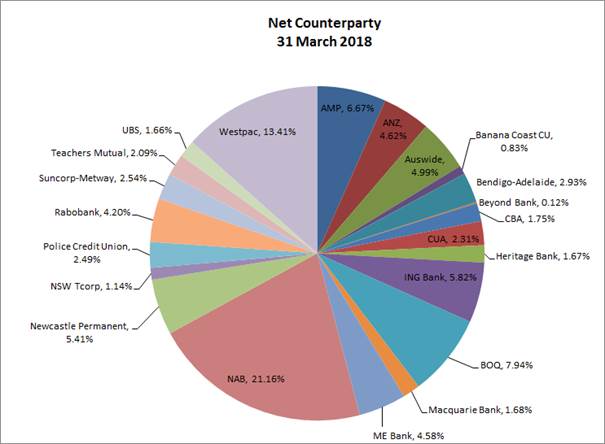

Council’s investment portfolio is dominated by Floating Rate Notes (FRNs) equating to approximately 49% across a broad range of counterparties. Cash equates to 12% of Council’s portfolio with Term Deposits around 38% and growth funds around 1% of the portfolio.

Council’s investment portfolio is well diversified in complying assets across the entire credit spectrum. It is also well diversified from a rating perspective. Credit quality is diversified and is predominately invested amongst the investment grade Authorised Deposit-Taking Institutions (ADIs) (being BBB- or higher), with a smaller allocation to unrated ADIs.

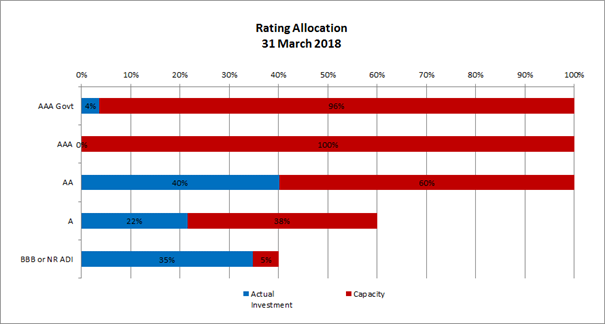

All investments are within the defined Policy limits, as outlined in the Rating Allocation chart below:

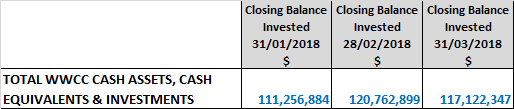

Investment Portfolio Balance

Council’s investment portfolio balance has increased from the previous month’s balance, down from $120.8M to $117.1M.

MONTHLY INVESTMENT MOVEMENTS

Redemptions/Sales – Council redeemed/sold the following investment securities during March 2018:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

Beyond Bank Term Deposit |

$990K |

3 years |

3.70% |

This term deposit was redeemed on maturity due to the poor reinvestment rates offered by Beyond Bank. |

|

Beyond Bank Term Deposit |

$990K |

3 years |

3.70% |

This term deposit was redeemed on maturity due to the poor reinvestment rates offered by Beyond Bank. |

|

Credit Union Australia (CUA) Term Deposit |

$1M |

12 months |

2.75% |

This term deposit was redeemed on maturity due to the poor reinvestment rates offered by CUA. |

New Investments – Council purchased the following investment securities during March 2018:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

Westpac Floating Rate Note |

$2M |

5 years |

BBSW + 83bps |

Council’s independent Financial Advisor advised this Floating Rate Note represented good value with a highly rated institution. |

|

UBS Floating Rate Note |

$2M |

5 years |

BBSW + 90bps |

Council’s independent Financial Advisor advised this Floating Rate Note represented good value. |

|

Heritage Bank Floating Rate Note |

$1.4M |

3 years |

BBSW + 123bps |

Council’s independent Financial Advisor advised this Floating Rate Note represented good value. |

Rollovers – Council did not roll over any investment securities during March 2018.

MONTHLY PERFORMANCE

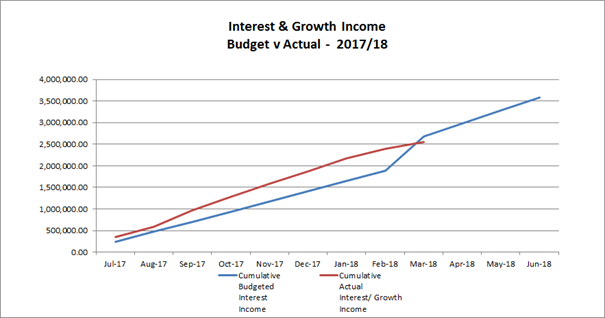

Interest/growth/capital gains for the month totalled $160,130, which compares unfavourably with the budget for the period of $298,465, underperforming budget for March by $138,335. This budget underperformance is due to a negative movement for Councils Floating Rate Note portfolio during March.

It should be noted that a majority of Councils FRNs continue to trade at a premium. The capital market value of these investments will fluctuate from month to month and Council continues to receive the coupon payments and the face value of the investment security when sold or at maturity.

It is important to note Council’s investment portfolio balance has consistently been over $100M, which is tracking well above what was originally predicted. This is mainly due to the timing of some of the major projects that are either not yet commenced or not as advanced as originally predicted. It was originally anticipated that over the remainder of the 2017/18 financial year the portfolio balance would reduce in line with the completion of major projects. Further analysis of the capital works program and revised timing has been completed and has resulted in a number of these projects being scheduled for a future financial year. This will result in Councils investment portfolio continuing to maintain a higher balance until these projects commence.

The longer-dated deposits in the portfolio, particularly those locked in above 4% yields, have previously anchored Council’s portfolio performance. It should be noted that the portfolio now only includes two investments yielding above 4% and Council will inevitably see a fall in investment income over the coming months compared with previous periods. Council staff and Council’s Independent Financial Advisor will continue to identify opportunities to lock in higher yielding investments as they become available.

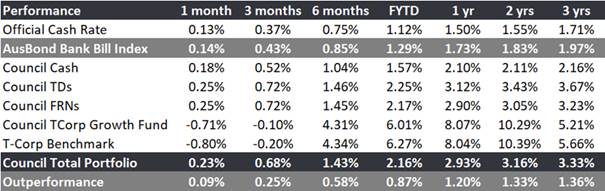

In comparison to the AusBond Bank Bill Index* (+1.73%pa), Council’s investment portfolio in total returned 2.76% for March. Short-term deposits returned 2.66%. These funds are utilised for daily cash flow management and need to be available to meet operating and contractual payments as they come due.

* The AusBond Bank Bill Index is the leading benchmark for the Australian fixed income market. It is interpolated from the RBA Cash rate, 1 month and 3 month Bank Bill Swap rates.

Report by Responsible Accounting Officer

I hereby certify that all of the above investments have been made in accordance with the provision of Section 625 of the Local Government Act 1993 and the regulations there under, and in accordance with the Investments Policy adopted by Council on 26 February 2018.

Carolyn Rodney

Responsible Accounting Officer

Policy and Legislation

Budget variations are reported in accordance with Council’s POL 052 Budget Policy.

Investments are reported in accordance with Council’s POL 075 Investment Policy.

Local Government Act 1993

625 How may councils invest?

(1) A council may invest money that is not, for the time being, required by the council for any other purpose.

(2) Money may be invested only in a form of investment notified by order of the Minister published in the Gazette.

(3) An order of the Minister notifying a form of investment for the purposes of this section must not be made without the approval of the Treasurer.

(4) The acquisition, in accordance with section 358, of a controlling interest in a corporation or an entity within the meaning of that section is not an investment for the purposes of this section.

Local Government (General) Regulation 2005

212 Reports on council investments

(1) The responsible accounting officer of a council:

(a) must provide the council with a written report (setting out details of all money that the council has invested under section 625 of the Act) to be presented:

(i) if only one ordinary meeting of the council is held in a month, at that meeting, or

(ii) if more than one such meeting is held in a month, at whichever of those meetings the council by resolution determines, and

(b) must include in the report a certificate as to whether or not the investment has been made in accordance with the Act, the regulations and the council’s investment policies.

(2) The report must be made up to the last day of the month immediately preceding the meeting.

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

This report is a control mechanism that assists in addressing the following potential risks to Council:

· Loss of investment income or capital resulting from ongoing management of investments, especially during difficult economic times

· Failure to demonstrate to the community that its funds are being expended in an efficient and effective manner

Internal / External Consultation

Council’s Community Engagement Strategy and IAP2 considers the community to be “any individual or group of individuals, organisation or political entity with an interest in the outcome of a decision….”

All relevant areas within the Council have consulted with the Finance Division in regards to the budget variations listed in this report.

The Finance Division has consulted with relevant external parties to confirm Council’s investment portfolio balances.

|

1⇩. |

Section 356 Donation request - Cantilena Singers |

|

|

2⇩. |

Section 356 Donation request - South Wagga Apex Club |

|

|

3⇩. |

Section 356 Donation request - Tarcutta Racecourse Recreation Reserve Trust |

|

RP-4 Integrated Planning and Reporting - Draft Long Term Financial Plan 2018/28 and Draft Combined Delivery Program and Operational Plan 2018/2019

Author: Serena Wallace

Director: Natalie Te Pohe

|

Analysis: |

Under Council’s Integrated Planning and reporting requirements, Council has drafted the Combined Delivery Program and Operational Plan 2018/2019, the Draft Fees and Charges 2018/2019 and the draft Long Term Financial Plan 2018/2028 for public exhibition. |

|

That Council: a place the following documents on public exhibition for 28 days commencing 24 April 2018 and concluding on 23 May 2018: i draft Combined Delivery Program and Operational Plan 2018/2019 ii draft Fees and Charges for the financial year 2018/2019 iii draft Long Term Financial Plan 2018/2028 b invite submissions from the community in relation to these documents throughout the exhibition period c receive a further report after the public exhibition period i addressing any submissions made in respect of the draft documents ii proposing adoption of the draft Combined Delivery Program and Operational Plan 2018/2019, draft Fees and Charges 2018/2019 and the draft Long Term Financial Plan 2018/2028 unless there are any recommended amendments deemed to be substantial and requiring a further public exhibition period |

Report

The Long Term Financial Plan 2018/28 and the Combined Delivery Program and Operational Plan 2018/19 have been formulated together with consideration to the Wagga View Community Strategic Plan 2040 previously endorsed by Council as well as the draft Disability Inclusion Action Plan 2017/21.

These documents have been created as part of Council’s Sustainable Future Framework, based on the local government requirements for Integrated Planning and reporting.

Combined Delivery Program and Operational Plan

The Draft Combined Delivery Program and Operational Plan 2018/19 has been designed to include Council’s commitment to the Wagga View Community Strategic Plan 2040 in the form of the Delivery Program and a Operational Plan inclusive of projects, programmes and services to be delivered over a 12 months.

The 2018/19 Combined Delivery Program and Operational Plan consist of:

· Mayor and GM Welcome

· Clear links to ‘Wagga View” the Community Strategic Plan 2040

· Clear links to the draft Disability Inclusion Action Plan 2017/21

· Continuation of the current Delivery Program and new Operational Plan activities

· Measures of performance

· Delivery Program four year budget

· Delivery Program Capital Works (New Projects and Recurrent)

· Contributions and Donations

Improvements to this year’s documents include:

· The presentation of the operational plan items for improved readability.

· Inclusion of an estimated budget per theme to demonstrate the resourcing required to deliver services against the Wagga View Community Strategic Plan objectives.

· Linking of the Delivery Program to the objectives and outcomes of the Wagga View Community Strategic Plan.

· Separated and referenced items from the Disability Inclusion Action Plan under the relevant Delivery Program items and included the relevant measures.

The combined Delivery Program and Operational Plan will be reviewed annually to produce a rolling 4 year plan. The Delivery Program will receive a full revision every 4 years in line with the Council election.

Fees and Charges

In accordance with Section 608 of the Local Government Act 1993, a council may charge and recover an approved fee for any service it provides.

The services for which an approved fee may be charged include the following provided under the Local Government Act or any other Act or the regulations by the council:

· supplying a service, product or commodity

· giving information

· providing a service in connection with the exercise of the council’s regulatory functions-including receiving an application for approval, granting an approval, making an inspection and issuing a certificate

· allowing admission to any building or enclosure.

Long Term Financial Plan

The Long Term Financial Plan is an essential element of the resourcing strategy which details how the strategic aspirations of Council which are outlined in the Community Strategic Plan can be achieved in terms of time, money, assets and people.

Council’s Long Term Financial Plan is a ten-year financial planning document with an emphasis on long-term financial sustainability. Financial sustainability is one of the key issues facing local government due to several contributing factors including growing demands for community services and facilities, constrained revenue growth and ageing infrastructure.

The Long Term Financial Plan is formulated by using a number of estimates and assumptions to project the future revenue and expenditure required by Council to deliver those services and projects expected by the community. In doing so, it addresses the resources that impact on the Council’s ability to fund its services and capital works whilst remaining financially sustainable.

The draft 2018/28 Long Term Financial Plan consists of:

· Executive Summary

· Fit for the Future Summary

· Special Rate Variation

· Financial Strategy

· Planning Assumptions

· Major Projects

· Family Day Care

· Contributions, Grants and Donations

· Financial Forecast Assumptions

· Sensitivity Analysis

· Financial Modelling Scenarios

· Budgeted Financial Statements:

o Budgeted Income Statement

o Balance Sheet Forecasts

o Cash Flow Statement Forecasts

· Financial Sustainability Indicators

· External Reserve balances projections

· Internal Reserve balances projections

· External Loan Projects and Debt Servicing

· Total Capital Works Program, including one-off projects and recurrent programs

· Potential Capital Projects List

· Ten Year Financial Plans for “Council Businesses”:

o Airport

o Livestock Marketing Centre

o Sewerage Services

o Solid Waste Services

· Ten Year Financial Plan for Council’s Stormwater Levy Function

· Budgeted Income Statement by Function

Financial Implications

The proposed adoption of these plans will form the basis of Council’s 2018/19 budget, along with the adoption of the full ten-year long term financial plan which is updated annually.

Policy and Legislation

These documents have been created to meet Council’s Integrated Planning and Reporting requirements under the Local Government Act 1993.

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We plan long term

Risk Management Issues for Council

A number of risk management issues were identified and have been actively managed. A summary of these risks are as follows:

- Lack of engagement from the community

- Inability to meet everyone’s expectations

- Inability to resource and deliver on plans

Internal / External Consultation

The documents will be placed on public exhibition from the for a 28 day period from the 24 April – 23 May 2018. As part of the exhibition period a variety of communication methods will be used, to not only promote the public exhibition period but also promote the purpose of the documents.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media releases |

Print advertising |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

|

x |

|

|

|

x |

|

|

|

|

x |

x |

x |

|

|

|

Involve |

|

|

|

|

|

|

|

|

|||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

2018/28 Draft Long Term Financial Plan - Provided under separate cover |

|

|

2. |

2018/19 Draft Fees and Charges - Provided under separate cover |

|