AGENDA AND BUSINESS

PAPER

Ordinary

Meeting of Council

To be held on

Monday 25 June 2018

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

In pursuance of the provisions of the Local Government Act, 1993 and

the Regulations there under, notice is hereby given that an Ordinary Meeting of

the Council of the City of Wagga Wagga will be held in the Council Chamber,

Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday

25 June 2018 at 6.00pm.

Council live streams video and audio of Council meetings. Members of

the public are advised that their voice and/or image may form part of the

webcast.

Mr Peter

Thompson

General Manager

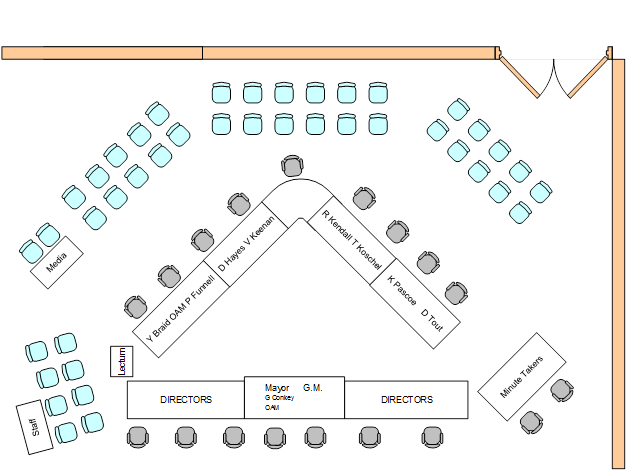

WAGGA WAGGA CITY COUNCILLORS

|

Mayor

Councillor Greg

Conkey OAM

|

Deputy Mayor

Councillor Dallas

Tout

|

Councillor Yvonne Braid

|

Councillor Paul Funnell

|

|

Councillor Dan Hayes

|

Councillor Vanessa Keenan

|

Councillor Rod Kendall

|

Councillor Tim Koschel

|

|

Councillor Kerry

Pascoe

|

|

|

|

QUORUM

The quorum for a meeting of the

Council is a majority of the Councillors of the Council who hold office for the

time being who are eligible to vote at the meeting.

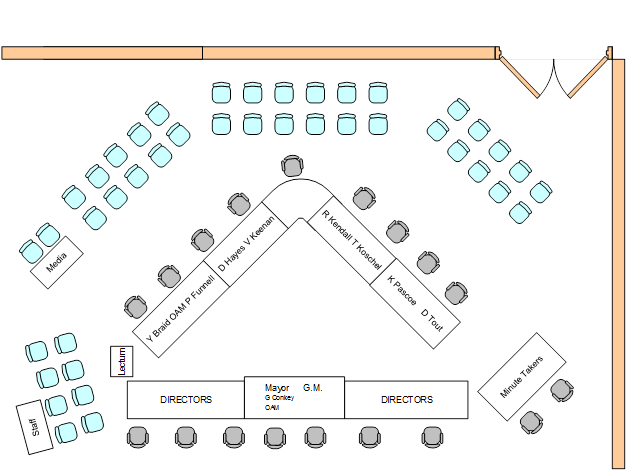

COUNCIL MEETING

ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 25 June 2018.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 25 June 2018

ORDER

OF BUSINESS:

CLAUSE PRECIS PAGE

PRAYER 2

ACKNOWLEDGEMENT

OF COUNTRY 2

APOLOGIES 2

CONFIRMATIONS

OF MINUTES

CM-1 Ordinary Council

Meeting - 12 June 2018 2

DECLARATIONS

OF INTEREST 2

Reports from Staff

RP-1 Financial

Performance Report as at 31 May 2018 3

RP-2 Outstanding

Debtors Deemed Unrecoverable - Proposed Write Off List 20

RP-3 NSW

Department of Planning & Environment - Low Cost Loans Initiative 23

RP-4 Integrated

Planning and Reporting - Adoption of Documents 42

RP-5 STATE

GOVERNMENT FUNDING - LIST OF PRIORITY PROJECTS 82

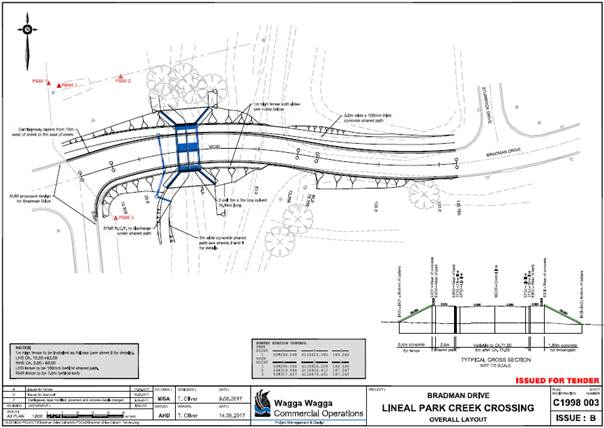

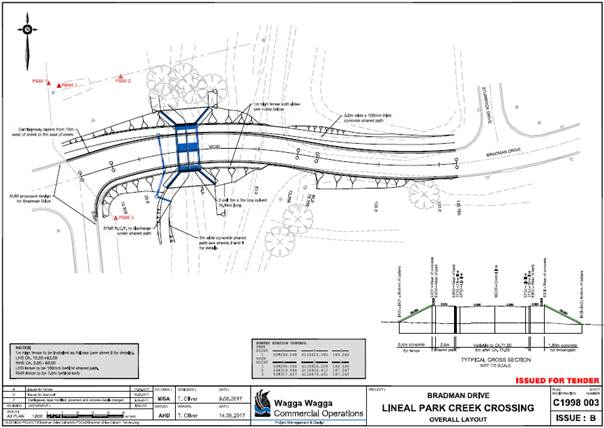

RP-6 Bradman

Drive Lineal Creek Crossing 86

RP-7 Management

of Derelict houses and buildings 91

RP-8 Response

to Questions/Business with Notice 94

Committee Minutes

M-1 AIRPORT

ADVISORY COMMITTEE MEETING - 1 MAY 2018 96

QUESTIONS/BUSINESS

WITH NOTICE 104

Confidential Reports

CONF-1 RFT2018-28

FOOTPATH CONNECTIVITY STAGE II 105

CONF-2 EOI2018-604

STRENGTHENING AND WIDENING OF EUNONY BRIDGE 106

CONF-3 RFQ2018-540

Supply of One Street Sweeper 107

CONF-4 PROPOSED

GRAZING LICENCE RENEWAL TO JA AND CH RODHAM 108

CONF-5 DA17/0211

- 199 Gurwood Street Wagga Wagga - Council ats Debgar Holdings Pty Limited 109

PRAYER

ACKNOWLEDGEMENT

OF COUNTRY

APOLOGIES

Confirmation

of Minutes

CM-1 Ordinary Council Meeting - 12 June

2018

|

Recommendation

That the

Minutes of the proceedings of the Ordinary Council Meeting held on 12 June

2018 be confirmed as a true and accurate record.

|

Attachments

|

1⇩.

|

Council Meeting -

Minutes - 12 June 2018

|

110

|

DECLARATIONS

OF INTEREST

Report submitted to the Ordinary Meeting of Council

on Monday 25 June 2018. RP-1

Reports

from Staff

RP-1 Financial Performance Report as at

31 May 2018

Author: Carolyn

Rodney

Director: Natalie Te Pohe

|

Analysis:

|

This report is for Council to consider and approve the proposed

2017/18 budget variations required to manage the 2017/18 budget and Long Term

Financial Plan, and details Council’s external investments and

performance as at 31 May 2018.

|

|

That Council:

a approve

the proposed 2017/18 budget variations for the month ended 31 May 2018 and

note the balanced budget position as presented in this report

b note

the Responsible Accounting Officer’s reports, in accordance with the

Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203)

that the financial position of Council is satisfactory having regard to the

original estimates of income and expenditure and the recommendations made

above

c note

details of the external investments as at 31 May 2018 in accordance with

section 625 of the Local Government Act 1993

|

Wagga Wagga City Council (Council) forecasts a balanced budget

position as at 31 May 2018. Proposed funded budget variations are detailed in

this report for Council’s consideration and adoption.

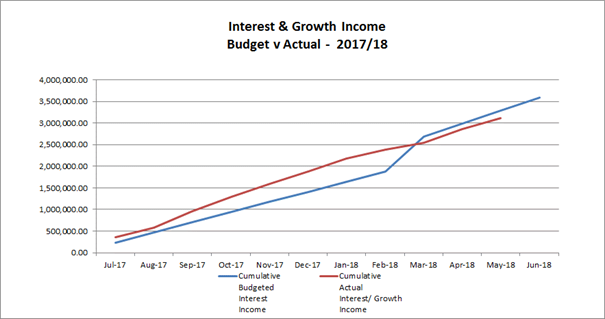

Council has experienced a negative monthly investment performance for

the month of May, when compared to budget. This is a result of

a negative movement in the value of Council’s Floating Rate Note portfolio

during the month.

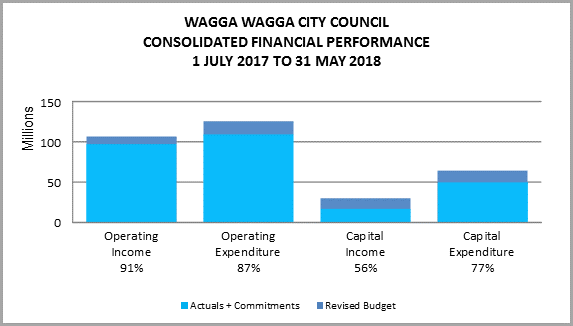

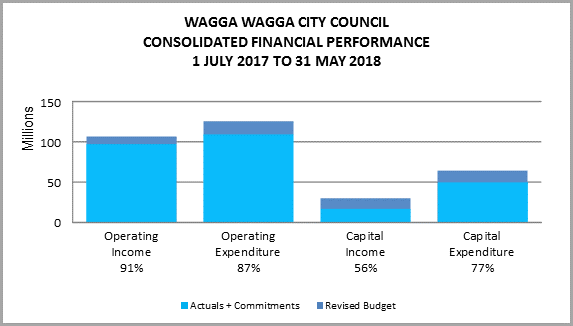

Key Performance Indicators

OPERATING INCOME

Total operating income is 91% of approved budget, which is tracking to

budget for the end of May (this percentage excludes capital grants and contributions).

An adjustment has been made to reflect the levy of rates that occurred at the

start of the financial year. Excluding this adjustment, operating income

received is 96%.

OPERATING EXPENSES

Total operating expenditure is 87% of approved budget and is tracking

close to budget for the full financial year.

CAPITAL INCOME

Total capital income is 56% of approved budget. It is important to

note that the actual income from capital is influenced by the timing of the

receipt of capital grants and contributions relating to projects. This income

also includes the sale of property, plant and equipment.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 77% of approved

budget.

|

WAGGA WAGGA

CITY COUNCIL

STATEMENT OF FINANCIAL PERFORMANCE

1 JULY 2017 TO 31 MAY 2018

|

|

CONSOLIDATED

STATEMENT

|

|

|

ORIGINAL

BUDGET

2017/18

|

BUDGET ADJ

2017/18

|

APPROVED BUDGET

2017/18

|

YTD ACTUAL

EXCL COMMT'S 2017/18

|

COMMT'S 2017/18

|

YTD ACTUAL + COMMT'S

2017/18

|

YTD % OF BUD

|

|

Revenue

|

|

Rates & Annual Charges

|

(63,090,002)

|

0

|

(63,090,002)

|

(58,122,459)

|

0

|

(58,122,459)

|

92%

|

|

User Charges & Fees

|

(25,947,798)

|

(24,531)

|

(25,972,329)

|

(22,934,713)

|

0

|

(22,934,713)

|

88%

|

|

Interest & Investment Revenue

|

(3,154,163)

|

(606,544)

|

(3,760,707)

|

(3,272,207)

|

0

|

(3,272,207)

|

87%

|

|

Other Revenues

|

(2,984,954)

|

83,065

|

(2,901,889)

|

(2,497,903)

|

0

|

(2,497,903)

|

86%

|

|

Operating Grants & Contributions

|

(13,910,429)

|

3,108,305

|

(10,802,124)

|

(10,407,520)

|

0

|

(10,407,520)

|

96%

|

|

Capital Grants & Contributions

|

(13,704,984)

|

(11,322,186)

|

(25,027,171)

|

(14,839,477)

|

0

|

(14,839,477)

|

59%

|

|

Total Revenue

|

(122,792,330)

|

(8,761,891)

|

(131,554,222)

|

(112,074,280)

|

0

|

(112,074,280)

|

85%

|

|

|

|

Expenses

|

|

Employee Benefits & On-Costs

|

42,458,491

|

175,003

|

42,633,494

|

36,376,203

|

27,058

|

36,403,260

|

85%

|

|

Borrowing Costs

|

3,591,092

|

0

|

3,591,092

|

2,666,816

|

0

|

2,666,816

|

74%

|

|

Materials & Contracts

|

29,833,841

|

5,279,469

|

35,113,310

|

26,375,055

|

3,290,079

|

29,665,134

|

84%

|

|

Depreciation & Amortisation

|

34,477,729

|

0

|

34,477,729

|

31,604,584

|

0

|

31,604,584

|

92%

|

|

Other Expenses

|

9,453,285

|

177,801

|

9,631,086

|

8,720,083

|

110,485

|

8,830,568

|

92%

|

|

Total Expenses

|

119,814,437

|

5,632,274

|

125,446,711

|

105,742,741

|

3,427,622

|

109,170,363

|

87%

|

|

|

|

|

|

|

|

|

|

|

Net Operating (Profit)/Loss

|

(2,977,893)

|

(3,129,618)

|

(6,107,511)

|

(6,331,539)

|

3,427,622

|

(2,903,917)

|

|

|

|

|

Net Operating (Profit)/Loss before Capital Grants

& Contributions

|

10,727,091

|

8,192,569

|

18,919,660

|

8,507,939

|

3,427,622

|

11,935,561

|

|

|

|

|

Capital / Reserve Movements

|

|

Capital Exp - Renewals

|

25,035,121

|

11,453,300

|

36,488,422

|

18,005,700

|

5,851,796

|

23,857,496

|

65%

|

|

Capital Exp - New Projects

|

16,898,302

|

7,759,144

|

24,657,446

|

14,871,252

|

8,416,442

|

23,287,694

|

94%

|

|

Capital Exp - Project Concepts

|

11,400,337

|

(10,776,866)

|

623,471

|

144,250

|

95,657

|

239,907

|

38%

|

|

Loan Repayments

|

2,474,343

|

0

|

2,474,343

|

2,267,238

|

0

|

2,267,238

|

92%

|

|

New Loan Borrowings

|

(7,215,980)

|

(652,930)

|

(7,868,910)

|

0

|

0

|

0

|

0%

|

|

Sale of Assets

|

(4,678,401)

|

(280,351)

|

(4,958,752)

|

(2,012,774)

|

0

|

(2,012,774)

|

41%

|

|

Net Movements Reserves

|

(6,458,101)

|

(4,372,680)

|

(10,830,781)

|

0

|

0

|

0

|

0%

|

|

Total Cap/Res Movements

|

37,455,621

|

3,129,618

|

40,585,239

|

33,275,666

|

14,363,895

|

47,639,562

|

|

|

|

|

|

ORIGINAL

BUDGET

2017/18

|

BUDGET ADJ

2017/18

|

APPROVED

BUDGET

2017/18

|

YTD

ACTUAL EXCL COMMT'S 2017/18

|

COMMT'S

2017/18

|

YTD ACTUAL +

COMMT'S

2017/18

|

YTD % OF BUD

|

|

Net Result after Depreciation

|

34,477,728

|

0

|

34,477,728

|

26,944,128

|

17,791,517

|

44,735,645

|

|

|

|

|

Add back Depreciation Expense

|

34,477,729

|

0

|

34,477,729

|

31,604,584

|

0

|

31,604,584

|

92%

|

|

|

|

Cash Budget (Surplus)/Deficit

|

0

|

0

|

0

|

(4,660,457)

|

17,791,517

|

13,131,060

|

|

Revised Budget Result - Surplus/(Deficit)

|

$’000s

|

|

Original 2017/18 Budget Result as adopted by

Council

Total Budget Variations approved to date

Budget variations for May 2018

|

$0

$0

$0

|

|

Proposed revised budget result for 31 May 2018

|

$0

|

The proposed Budget Variations to 31 May 2018 are listed below:

|

Budget

Variation

|

Amount

|

Funding Source

|

Net Impact

Fav/ (Unfav)

|

|

|

1 – Community Leadership and Collaboration

|

|

|

Section 94 Additional Income

|

($1,500K)

|

Section 94 Reserve $1,500K

|

Nil

|

|

|

Strong

subdivision activity and funds being received earlier than anticipated for

growth in the suburbs of Lake Albert, Estella, Boorooma, Gobbagombalin and

Gumly Gumly has resulted in additional income for Section 94 Contributions

for 2017/18. These funds are to be transferred to the Section 94 Developer

Contribution Reserve for future capital projects.

|

|

|

Stormwater Development Servicing Plan

(DSP) & Sewer Development Servicing Plan (DSP)

|

$200K

|

Section 64 Reserve ($100K) Stormwater

Section 64 Reserve ($100K) Sewer

|

Nil

|

|

|

Funds are

required for the 2018/19 financial year for the revision and updating

of Council’s Stormwater Development Servicing Plan 2007 and

Sewer Development Servicing Plan 2013 for the future growth and needs of the

city. These strategic documents are a priority for the following reasons:

· The

City of Wagga Wagga Development Servicing Plan -Stormwater was last updated

in 2007. The City of Wagga Wagga Development Servicing Plan No 1: Sewer

Services was last updated in 2013. There has been significant subdivision

development in recent years and substantial future subdivision development is

forecast for future years.

· plan

for the future stormwater and sewer infrastructure requirements of the city

due to its future growth

· to

inform future budgets and section 64 reviews.

It is

proposed to fund the project in 2018/19 from the Section 64 Reserve

Stormwater Delivery Service Plan and Sewer Reserve.

Completion Date: 2018/19

|

|

|

|

Lewis Drive and Yabtree

Street Pedestrian Safety

|

$25K

|

RMS

Grant ($25K)

|

Nil

|

|

|

Urgent

works were required by RMS to improve pedestrian safety on Lewis Drive and

Yabtree Street near the hospital. The works included the installation of

speed cushions and additional signage that are to be funded by RMS

contributions.

Completion Date: 31 May 2018

|

|

|

|

4 – Community Place and Identity

|

|

|

Cultural Strategy

|

$100K

|

Internal Loans Reserve ($100K)

|

Nil

|

|

|

Funds are required for the revision

and updating of Council’s Cultural Plan for the future growth and needs

of the city. This strategic document is a priority for the following reasons:

· identified

priority in ROCS

· the

State Government Cultural Infrastructure Program fund is only available for

another 3 years, so it’s essential to identify future projects

· plan

for the cultural requirements of the city due to its future growth

· to

inform future cultural budgets and section 94 reviews.

The Cultural Plan is identified in the new contributions plan but

it is proposed to fund the project in 2018/19 from an internal loan until the

plan is adopted.

Completion

Date: 2018/19

|

|

|

|

5 – The Environment

|

|

|

Emergency Hot Water Upgrade Connolly Park

|

$11K

|

Internal Loans Reserve ($11K)

|

Nil

|

|

|

Emergency funding was required at

Connolly Park for the upgrade of hot water units with the replacement of a

new instantaneous system, as the existing units were no longer working. It is

proposed to forward fund this project from the annual programmed building

maintenance budget in 2018/19.

Completion

Date: 31 May 2018

|

|

|

|

SURPLUS/(DEFICIT)

|

$0

|

|

Nil

|

|

|

|

|

|

|

|

|

|

|

Current

Restrictions

|

RESERVES

SUMMARY

|

|

31 MAY 2018

|

|

|

CLOSING

BALANCE 2016/17

|

ADOPTED

RESERVE TRANSFERS 2017/18

|

BUDGET

VARIATIONS APPROVED UP TO COUNCIL MEETING 28.05.18

|

PROPOSED

CHANGES for Council Resolution

|

REVISED

BALANCE

|

|

|

|

|

|

|

Externally Restricted

|

|

|

|

|

|

|

Developer Contributions

|

(21,947,807)

|

3,374,249

|

(3,287,096)

|

(1,500,000)

|

(23,360,654)

|

|

Sewer Fund

|

(24,045,646)

|

1,229,992

|

(3,389,245)

|

|

(26,204,899)

|

|

Solid Waste

|

(15,824,723)

|

4,878,008

|

(5,830,838)

|

|

(16,777,553)

|

|

Specific Purpose Unexpended

Grants/Contributions

|

(4,956,776)

|

0

|

4,956,776

|

|

0

|

|

SRV Levee

|

(1,167,316)

|

0

|

(640,350)

|

|

(1,807,666)

|

|

Stormwater Levy

|

(2,940,246)

|

(587,206)

|

451,268

|

|

(3,076,184)

|

|

Total Externally Restricted

|

(70,882,514)

|

8,895,043

|

(7,739,486)

|

(1,500,000)

|

(71,226,957)

|

|

|

|

|

|

|

|

|

Internally Restricted

|

|

|

|

|

|

|

Airport

|

(371,610)

|

(386,660)

|

242,472

|

|

(515,798)

|

|

Art Gallery

|

(30,990)

|

(21,000)

|

0

|

|

(51,990)

|

|

Ashmont Community Facility

|

(4,500)

|

(1,500)

|

0

|

|

(6,000)

|

|

Bridge Replacement

|

(240,240)

|

(100,000)

|

153,573

|

|

(186,667)

|

|

CBD Carparking Facilities

|

(891,982)

|

0

|

18,889

|

|

(873,094)

|

|

CCTV

|

(64,476)

|

(10,000)

|

0

|

|

(74,476)

|

|

Cemetery Perpetual

|

(157,605)

|

(125,146)

|

144,084

|

|

(138,667)

|

|

Cemetery

|

(193,116)

|

(161,330)

|

100,000

|

|

(254,446)

|

|

Civic Theatre Operating

|

0

|

(50,000)

|

0

|

|

(50,000)

|

|

Civic Theatre Technical

Infrastructure

|

(105,450)

|

(50,000)

|

65,800

|

|

(89,650)

|

|

Civil Projects

|

(155,883)

|

0

|

0

|

|

(155,883)

|

|

Community Amenities

|

(5,685)

|

0

|

0

|

|

(5,685)

|

|

Community Works

|

0

|

0

|

(62,869)

|

|

(62,869)

|

|

Council Election

|

(166,776)

|

(73,095)

|

0

|

|

(239,871)

|

|

Emergency Events

|

(133,829)

|

|

(57,331)

|

|

(191,160)

|

|

Employee Leave Entitlements

|

(3,184,451)

|

0

|

0

|

|

(3,184,451)

|

|

Environmental Conservation

|

(131,351)

|

0

|

0

|

|

(131,351)

|

|

Estella Community Centre

|

(230,992)

|

0

|

0

|

|

(230,992)

|

|

Family Day Care

|

(169,356)

|

(123,944)

|

0

|

|

(293,300)

|

|

Fit for the Future

|

(3,033,479)

|

(2,265,725)

|

810,178

|

|

(4,489,026)

|

|

Generic Projects Saving

|

(1,040,610)

|

20,000

|

106,499

|

|

(914,111)

|

|

Glenfield Community Centre

|

(17,704)

|

(2,000)

|

0

|

|

(19,704)

|

|

Grants Commission

|

(4,956,776)

|

0

|

4,956,776

|

|

0

|

|

Grassroots Cricket

|

(70,992)

|

0

|

0

|

|

(70,992)

|

|

Gravel Pit Restoration

|

(761,422)

|

0

|

25,000

|

|

(736,422)

|

|

Gurwood Street Property

|

(50,454)

|

0

|

0

|

|

(50,454)

|

|

Information Services

|

(378,713)

|

250,000

|

8,000

|

|

(120,713)

|

|

Infrastructure Replacement

|

(136,098)

|

(48,071)

|

954

|

|

(183,215)

|

|

Insurance Variations

|

(28,644)

|

0

|

0

|

|

(28,644)

|

|

Internal Loans

|

(674,661)

|

(851,794)

|

620,468

|

|

(905,986)

|

|

Lake Albert Improvements

|

(53,867)

|

(50,000)

|

56,078

|

|

(47,789)

|

|

RESERVES

SUMMARY

|

|

31 MAY 2018

|

|

|

CLOSING

BALANCE 2016/17

|

ADOPTED

RESERVE TRANSFERS 2017/18

|

BUDGET

VARIATIONS APPROVED UP TO COUNCIL MEETING 28.05.18

|

PROPOSED

CHANGES for Council Resolution

|

REVISED

BALANCE

|

|

LEP Preparation

|

(28,301)

|

14,636

|

11,120

|

|

(2,545)

|

|

Livestock Marketing Centre

|

(7,267,731)

|

(1,180,017)

|

4,053,725

|

|

(4,394,024)

|

|

Museum Acquisitions

|

(39,378)

|

0

|

0

|

|

(39,378)

|

|

Oasis Building Renewal

|

(172,000)

|

(32,147)

|

0

|

|

(204,147)

|

|

Oasis Plant

|

(1,115,347)

|

90,000

|

(114,230)

|

|

(1,139,577)

|

|

Parks & Recreation Projects

|

(79,648)

|

0

|

24,860

|

|

(54,788)

|

|

Pedestrian River Crossing

|

(198,031)

|

48,031

|

150,000

|

|

0

|

|

Plant Replacement

|

(5,893,831)

|

1,804,934

|

1,084,675

|

|

(3,004,223)

|

|

Playground Equipment Replacement

|

(59,181)

|

(105,679)

|

0

|

|

(164,860)

|

|

Project Carryovers

|

(1,276,882)

|

0

|

874,074

|

|

(402,808)

|

|

Public Art

|

(173,283)

|

(23,669)

|

53,969

|

|

(142,983)

|

|

Robertson Oval Redevelopment

|

(86,697)

|

0

|

0

|

|

(86,697)

|

|

Senior Citizens Centre

|

(13,627)

|

(2,000)

|

0

|

|

(15,627)

|

|

Sister Cities

|

(36,527)

|

(10,000)

|

0

|

|

(46,527)

|

|

Stormwater Drainage

|

(183,420)

|

0

|

25,177

|

|

(158,242)

|

|

Strategic Real Property

|

(702,792)

|

0

|

(380,000)

|

|

(1,082,792)

|

|

Street Lighting Replacement

|

(74,755)

|

(30,000)

|

0

|

|

(104,755)

|

|

Subdivision Tree Planting

|

(272,621)

|

(20,000)

|

0

|

|

(292,621)

|

|

Sustainable Energy

|

(520,442)

|

35,000

|

(65,000)

|

|

(550,442)

|

|

Traffic Committee

|

(50,000)

|

(50,000)

|

60,000

|

|

(40,000)

|

|

Workers Compensation

|

0

|

0

|

(40,000)

|

|

(40,000)

|

|

Total Internally Restricted

|

(35,686,205)

|

(3,511,177)

|

12,926,941

|

0

|

(26,270,441)

|

|

|

|

|

|

|

|

|

Total Restricted

|

(106,568,720)

|

5,383,866

|

5,187,455

|

(1,500,000)

|

(97,497,399)

|

Investment

Summary as at 31 May 2018

In accordance with Regulation 212 of the Local Government (General)

Regulation 2005, details of Wagga Wagga City Council’s external

investments are detailed below:

|

Institution

|

Rating

|

Closing Balance

Invested

30/04/2018

$

|

Closing Balance

Invested

31/05/2018

$

|

May

EOM

Current Yield

%

|

May

EOM

%

of Portfolio

|

Investment

Date

|

Maturity

Date

|

Term

(mths)

|

|

Short

Term Deposits

|

|

|

|

|

|

|

|

|

|

Banana

Coast CU

|

NR

|

1,000,000

|

1,000,000

|

2.80%

|

0.79%

|

2/06/2017

|

1/06/2018

|

12

|

|

AMP

|

A

|

2,000,000

|

2,000,000

|

2.80%

|

1.58%

|

2/06/2017

|

1/06/2018

|

12

|

|

AMP

|

A

|

2,000,000

|

2,000,000

|

2.60%

|

1.58%

|

2/08/2017

|

2/08/2018

|

12

|

|

NAB

|

AA-

|

2,000,000

|

2,000,000

|

2.60%

|

1.58%

|

8/09/2017

|

7/09/2018

|

12

|

|

AMP

|

A

|

1,000,000

|

1,000,000

|

2.80%

|

0.79%

|

8/09/2017

|

5/06/2018

|

9

|

|

NAB

|

AA-

|

2,000,000

|

2,000,000

|

2.62%

|

1.58%

|

28/09/2017

|

28/09/2018

|

12

|

|

Auswide

|

BBB-

|

2,000,000

|

2,000,000

|

2.67%

|

1.58%

|

5/10/2017

|

5/10/2018

|

12

|

|

Auswide

|

BBB-

|

1,000,000

|

1,000,000

|

2.67%

|

0.79%

|

16/10/2017

|

16/10/2018

|

12

|

|

Auswide

|

BBB-

|

2,000,000

|

2,000,000

|

2.70%

|

1.58%

|

5/12/2017

|

5/12/2018

|

12

|

|

Auswide

|

BBB-

|

1,000,000

|

1,000,000

|

2.67%

|

0.79%

|

15/12/2017

|

16/07/2018

|

7

|

|

NAB

|

AA-

|

2,000,000

|

0

|

0.00%

|

0.00%

|

28/02/2018

|

28/05/2018

|

3

|

|

Police

Credit Union

|

NR

|

2,000,000

|

2,000,000

|

2.70%

|

1.58%

|

28/02/2018

|

29/10/2018

|

8

|

|

AMP

|

A

|

0

|

2,000,000

|

2.95%

|

1.58%

|

17/05/2018

|

13/11/2018

|

6

|

|

AMP

|

A

|

0

|

1,000,000

|

2.95%

|

0.79%

|

17/05/2018

|

17/05/2019

|

12

|

|

Police

Credit Union

|

NR

|

0

|

2,000,000

|

2.86%

|

1.58%

|

28/05/2018

|

28/05/2019

|

12

|

|

AMP

|

A

|

0

|

2,000,000

|

2.95%

|

1.58%

|

29/05/2018

|

24/01/2019

|

8

|

|

Total Short Term Deposits

|

|

20,000,000

|

25,000,000

|

2.75%

|

19.79%

|

|

|

|

|

At

Call Accounts

|

|

|

|

|

|

|

|

|

|

NAB

|

AA-

|

978,100

|

2,451,509

|

1.50%

|

1.94%

|

N/A

|

N/A

|

N/A

|

|

NAB

|

AA-

|

13,281,887

|

14,405,319

|

2.19%

|

11.40%

|

N/A

|

N/A

|

N/A

|

|

AMP

|

A

|

184,789

|

185,116

|

2.30%

|

0.15%

|

N/A

|

N/A

|

N/A

|

|

Beyond

Bank

|

BBB+

|

149,740

|

148

|

1.00%

|

0.00%

|

N/A

|

N/A

|

N/A

|

|

CBA

|

AA-

|

65,154

|

72,123

|

1.35%

|

0.06%

|

N/A

|

N/A

|

N/A

|

|

Total At Call Accounts

|

|

14,659,670

|

17,114,215

|

2.09%

|

13.55%

|

|

|

|

|

Medium

Term Deposits

|

|

|

|

|

|

|

|

|

|

RaboBank

|

A+

|

1,000,000

|

1,000,000

|

3.16%

|

0.79%

|

5/06/2017

|

6/06/2022

|

60

|

|

ING

Bank

|

A

|

3,000,000

|

3,000,000

|

2.75%

|

2.38%

|

24/08/2017

|

26/08/2019

|

24

|

|

ME Bank

|

BBB

|

2,000,000

|

2,000,000

|

4.28%

|

1.58%

|

2/09/2014

|

2/09/2019

|

60

|

|

Rabobank

|

A+

|

1,000,000

|

1,000,000

|

4.10%

|

0.79%

|

5/12/2014

|

5/12/2019

|

60

|

|

BOQ

|

BBB+

|

2,000,000

|

2,000,000

|

3.10%

|

1.58%

|

7/07/2017

|

7/07/2020

|

36

|

|

Newcastle

Permanent

|

BBB

|

1,000,000

|

1,000,000

|

3.00%

|

0.79%

|

12/08/2016

|

12/08/2019

|

36

|

|

Rabobank

|

A+

|

1,000,000

|

1,000,000

|

3.20%

|

0.79%

|

25/08/2016

|

25/08/2021

|

60

|

|

Newcastle

Permanent

|

BBB

|

1,000,000

|

1,000,000

|

3.00%

|

0.79%

|

31/08/2016

|

30/08/2019

|

36

|

|

Police

Credit Union

|

NR

|

1,000,000

|

1,000,000

|

2.90%

|

0.79%

|

8/09/2016

|

10/09/2018

|

24

|

|

Newcastle

Permanent

|

BBB

|

2,000,000

|

2,000,000

|

3.00%

|

1.58%

|

10/02/2017

|

11/02/2019

|

24

|

|

Westpac

|

AA-

|

3,000,000

|

3,000,000

|

3.10%

|

2.38%

|

10/03/2017

|

10/03/2022

|

60

|

|

ING

Bank

|

A

|

1,000,000

|

1,000,000

|

2.92%

|

0.79%

|

16/10/2017

|

16/10/2019

|

24

|

|

ING

Bank

|

A

|

2,000,000

|

2,000,000

|

2.92%

|

1.58%

|

6/11/2017

|

6/11/2019

|

24

|

|

BOQ

|

BBB+

|

2,000,000

|

2,000,000

|

3.35%

|

1.58%

|

3/01/2018

|

4/01/2022

|

48

|

|

ING

Bank

|

A

|

1,000,000

|

1,000,000

|

2.80%

|

0.79%

|

5/01/2018

|

6/01/2020

|

24

|

|

Australian

Military Bank

|

NR

|

0

|

1,000,000

|

2.95%

|

0.79%

|

29/05/2018

|

29/05/2020

|

24

|

|

Institution

|

Rating

|

Closing Balance

Invested

30/04/2018

$

|

Closing Balance

Invested

31/05/2018

$

|

May

EOM

Current Yield

%

|

May

EOM

%

of Portfolio

|

Investment

Date

|

Maturity

Date

|

Term

(mths)

|

|

Total Medium Term Deposits

|

|

24,000,000

|

25,000,000

|

3.16%

|

19.79%

|

|

|

|

|

Floating

Rate Notes - Senior Debt

|

|

|

|

|

|

|

|

|

|

BOQ

|

BBB+

|

2,018,000

|

2,020,600

|

BBSW + 110

|

1.60%

|

5/08/2014

|

24/06/2019

|

58

|

|

BOQ

|

BBB+

|

1,003,987

|

1,006,175

|

BBSW + 107

|

0.80%

|

6/11/2014

|

6/11/2019

|

60

|

|

BOQ

|

BBB+

|

1,003,987

|

1,006,175

|

BBSW + 107

|

0.80%

|

10/11/2014

|

6/11/2019

|

60

|

|

Macquarie

Bank

|

A

|

2,026,954

|

0

|

0.00%

|

0.00%

|

3/03/2015

|

3/03/2020

|

60

|

|

Westpac

|

AA-

|

1,007,747

|

0

|

0.00%

|

0.00%

|

28/07/2015

|

28/07/2020

|

60

|

|

Bendigo-Adelaide

|

BBB+

|

1,011,767

|

1,006,884

|

BBSW + 110

|

0.80%

|

18/08/2015

|

18/08/2020

|

60

|

|

Bendigo-Adelaide

|

BBB+

|

1,011,767

|

1,006,884

|

BBSW + 110

|

0.80%

|

28/09/2015

|

18/08/2020

|

59

|

|

Westpac

|

AA-

|

2,015,494

|

0

|

0.00%

|

0.00%

|

30/09/2015

|

28/07/2020

|

58

|

|

Suncorp-Metway

|

A+

|

1,014,887

|

1,016,693

|

BBSW + 125

|

0.80%

|

20/10/2015

|

20/10/2020

|

60

|

|

Westpac

|

AA-

|

4,047,828

|

4,056,212

|

BBSW + 108

|

3.21%

|

28/10/2015

|

28/10/2020

|

60

|

|

CBA

|

AA-

|

1,014,287

|

1,016,383

|

BBSW + 115

|

0.80%

|

18/01/2016

|

18/01/2021

|

60

|

|

Rabobank

|

A+

|

2,054,252

|

2,055,000

|

BBSW + 150

|

1.63%

|

4/03/2016

|

4/03/2021

|

60

|

|

Newcastle

Permanent

|

BBB

|

1,009,917

|

1,012,514

|

BBSW + 160

|

0.80%

|

22/03/2016

|

22/03/2019

|

36

|

|

CUA

|

BBB

|

2,018,214

|

2,023,388

|

BBSW + 160

|

1.60%

|

1/04/2016

|

1/04/2019

|

36

|

|

ANZ

|

AA-

|

1,016,886

|

1,018,932

|

BBSW + 118

|

0.81%

|

7/04/2016

|

7/04/2021

|

60

|

|

Suncorp-Metway

|

A+

|

1,019,746

|

1,021,622

|

BBSW + 138

|

0.81%

|

21/04/2016

|

12/04/2021

|

60

|

|

AMP

|

A

|

1,021,356

|

1,012,744

|

BBSW + 135

|

0.80%

|

24/05/2016

|

24/05/2021

|

60

|

|

Westpac

|

AA-

|

1,018,566

|

1,020,100

|

BBSW + 117

|

0.81%

|

3/06/2016

|

3/06/2021

|

60

|

|

CBA

|

AA-

|

1,017,146

|

1,019,072

|

BBSW + 121

|

0.81%

|

12/07/2016

|

12/07/2021

|

60

|

|

ANZ

|

AA-

|

2,038,692

|

2,028,106

|

BBSW + 113

|

1.61%

|

16/08/2016

|

16/08/2021

|

60

|

|

BOQ

|

BBB+

|

1,510,931

|

1,513,926

|

BBSW + 117

|

1.20%

|

26/10/2016

|

26/10/2020

|

48

|

|

NAB

|

AA-

|

1,011,617

|

1,012,873

|

BBSW + 105

|

0.80%

|

21/10/2016

|

21/10/2021

|

60

|

|

Teachers

Mutual

|

BBB

|

1,503,162

|

1,507,283

|

BBSW + 140

|

1.19%

|

28/10/2016

|

28/10/2019

|

36

|

|

Bendigo-Adelaide

|

BBB+

|

1,010,837

|

1,005,975

|

BBSW + 110

|

0.80%

|

21/11/2016

|

21/02/2020

|

39

|

|

Westpac

|

AA-

|

1,011,997

|

1,013,193

|

BBSW + 111

|

0.80%

|

7/02/2017

|

7/02/2022

|

60

|

|

ANZ

|

AA-

|

1,013,297

|

1,006,884

|

BBSW + 100

|

0.80%

|

7/03/2017

|

7/03/2022

|

60

|

|

CUA

|

BBB

|

756,500

|

758,283

|

BBSW + 130

|

0.60%

|

20/03/2017

|

20/03/2020

|

36

|

|

Heritage

Bank

|

BBB+

|

602,129

|

603,525

|

BBSW + 130

|

0.48%

|

4/05/2017

|

4/05/2020

|

36

|

|

Teachers

Mutual

|

BBB

|

1,004,417

|

1,007,034

|

BBSW + 142

|

0.80%

|

29/06/2017

|

29/06/2020

|

36

|

|

NAB

|

AA-

|

3,015,801

|

3,021,162

|

BBSW + 90

|

2.39%

|

5/07/2017

|

5/07/2022

|

60

|

|

Suncorp-Metway

|

A+

|

1,009,747

|

1,003,905

|

BBSW + 97

|

0.79%

|

16/08/2017

|

16/08/2022

|

60

|

|

Westpac

|

AA-

|

1,998,536

|

2,000,912

|

BBSW + 81

|

1.58%

|

30/10/2017

|

27/10/2022

|

60

|

|

ME Bank

|

BBB

|

1,500,312

|

1,503,443

|

BBSW + 125

|

1.19%

|

9/11/2017

|

9/11/2020

|

36

|

|

NAB

|

AA-

|

2,006,116

|

1,995,012

|

BBSW + 80

|

1.58%

|

10/11/2017

|

10/02/2023

|

63

|

|

ANZ

|

AA-

|

1,496,067

|

1,498,044

|

BBSW + 77

|

1.19%

|

18/01/2018

|

18/01/2023

|

60

|

|

Bendigo-Adelaide

|

BBB+

|

498,054

|

499,068

|

BBSW + 105

|

0.40%

|

25/01/2018

|

25/01/2023

|

60

|

|

Newcastle

Permanent

|

BBB

|

1,495,017

|

1,496,319

|

BBSW + 140

|

1.18%

|

6/02/2018

|

6/02/2023

|

60

|

|

Westpac

|

AA-

|

2,004,416

|

1,992,792

|

BBSW + 83

|

1.58%

|

6/03/2018

|

6/03/2023

|

60

|

|

UBS

|

A+

|

2,007,176

|

1,996,032

|

BBSW + 90

|

1.58%

|

8/03/2018

|

8/03/2023

|

60

|

|

Heritage

Bank

|

BBB+

|

1,405,163

|

1,407,861

|

BBSW + 123

|

1.11%

|

29/03/2018

|

29/03/2021

|

36

|

|

ME Bank

|

BBB

|

1,602,605

|

1,606,728

|

BBSW + 127

|

1.27%

|

17/04/2018

|

16/04/2021

|

36

|

|

ANZ

|

AA-

|

0

|

2,002,730

|

BBSW + 93

|

1.59%

|

9/05/2018

|

9/05/2023

|

60

|

|

NAB

|

AA-

|

0

|

2,001,330

|

BBSW + 90

|

1.58%

|

16/05/2018

|

16/05/2023

|

60

|

|

Total Floating Rate Notes - Senior Debt

|

|

58,855,377

|

57,801,797

|

|

42.59%

|

|

|

|

|

Managed

Funds

|

|

|

|

|

|

|

|

|

|

Institution

|

Rating

|

Closing Balance

Invested

30/04/2018

$

|

Closing Balance

Invested

31/05/2018

$

|

May

EOM

Current Yield

%

|

May

EOM

%

of Portfolio

|

Investment

Date

|

Maturity

Date

|

Term

(mths)

|

|

NSW

TCorp

|

NR

|

1,394,045

|

1,396,766

|

0.20%

|

1.11%

|

17/03/2014

|

1/05/2023

|

109

|

|

Total Managed Funds

|

|

1,394,045

|

1,396,766

|

0.20%

|

1.11%

|

|

|

|

|

TOTAL

CASH ASSETS, CASH

EQUIVALENTS & INVESTMENTS

|

|

118,909,091

|

126,312,778

|

|

100.00%

|

|

|

|

|

LESS:

RIVERINA REGIONAL LIBRARY (RRL) CASH AT BANK

|

|

3,140,356

|

2,962,777

|

|

|

|

|

|

|

TOTAL

WWCC CASH ASSETS, CASH

EQUIVALENTS & INVESTMENTS

|

|

115,768,736

|

123,350,001

|

|

|

|

|

|

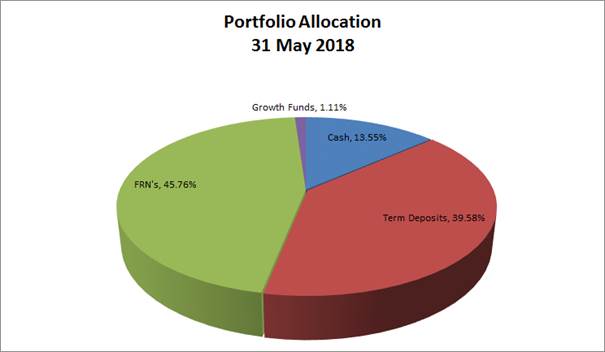

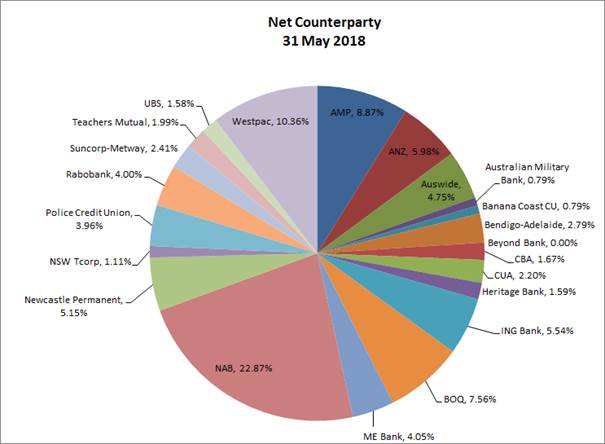

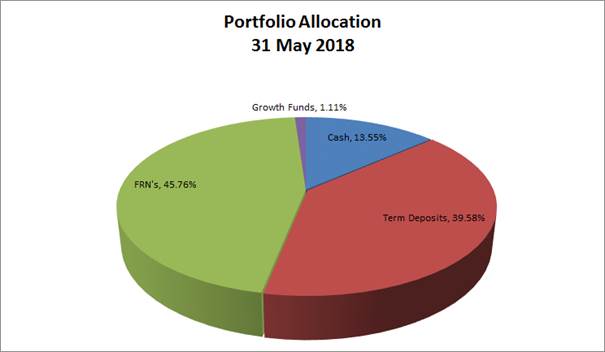

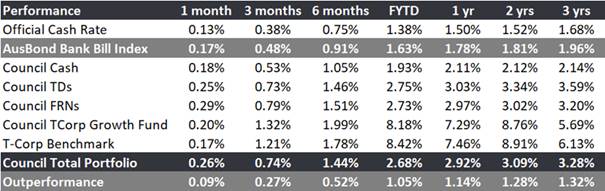

Council’s investment portfolio is dominated by

Floating Rate Notes (FRNs) equating to approximately 46% across a broad range

of counterparties. Cash equates to 14% of Council’s portfolio with Term

Deposits around 39% and growth funds around 1% of the portfolio.

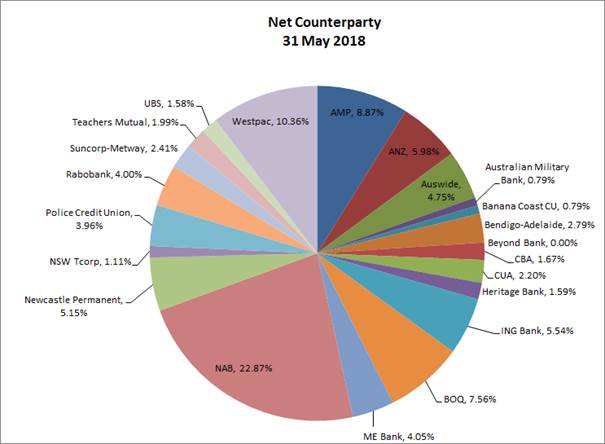

Council’s investment portfolio is well diversified

in complying assets across the entire credit spectrum. It is also well

diversified from a rating perspective. Credit quality is diversified and is

predominately invested amongst the investment grade Authorised Deposit-Taking

Institutions (ADIs) (being BBB- or higher), with a smaller allocation to

unrated ADIs.

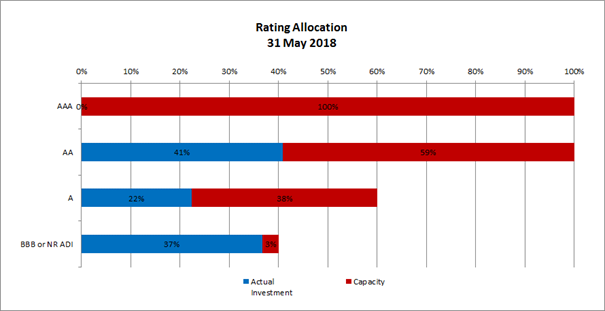

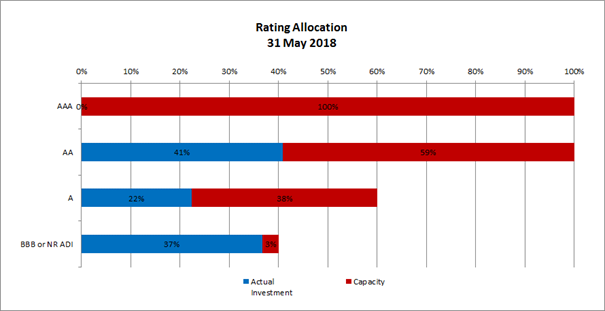

All investments are within the defined Policy limits,

as outlined in the Rating Allocation chart below:

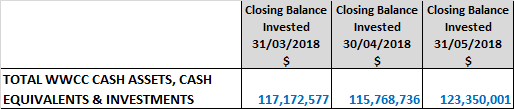

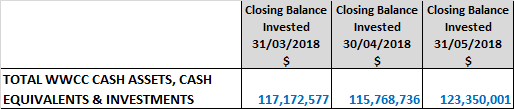

Investment

Portfolio Balance

Council’s investment portfolio balance has

increased from the previous month’s balance, up from $115.8M to $123.4M,

which is reflective of the final rates instalment for 2017/18 being due.

MONTHLY

INVESTMENT MOVEMENTS

Redemptions/Sales – Council

redeemed/sold the following investment securities during May 2018:

|

Institution and Type

|

Amount

|

Investment

Term

|

Interest

Rate

|

Comments

|

|

Macquarie Bank Floating Rate Note

|

$2M

|

5 years

|

BBSW + 110bps

|

This floating rate note was sold prior to maturity and funds were

reinvested in the new 5 year ANZ Bank FRN (see below). Council recognised a

capital gain of $16,660.

|

|

Westpac Bank Floating Rate Note

|

$1M

|

5 years

|

BBSW + 90bps

|

This floating rate note was sold prior to maturity and funds were

reinvested in a 12 month AMP term deposit (see below). Council recognised a

capital gain of $7,210.

|

|

Westpac Bank Floating Rate Note

|

$2M

|

5 years

|

BBSW + 90bps

|

This floating rate note was sold prior to maturity and funds were

reinvested in the new 5 year NAB FRN (see below). Council recognised a

capital gain of $18,980.

|

|

NAB Term Deposit

|

$2M

|

3 months

|

2.47%

|

This term deposit was redeemed on maturity due to poor

reinvestment rates. These funds were reinvested in a 12 month Police Credit

Union term deposit (see below).

|

New Investments – Council

purchased the following investment securities during May 2018:

|

Institution and Type

|

Amount

|

Investment

Term

|

Interest

Rate

|

Comments

|

|

ANZ Bank Floating Rate Note

|

$2M

|

5 years

|

BBSW + 93bps

|

Council’s independent Financial Advisor advised this

Floating Rate Note represented good value.

|

|

NAB Floating Rate Note

|

$2M

|

5 years

|

BBSW + 90bps

|

Council’s independent Financial Advisor advised this

Floating Rate Note represented fair value.

|

|

AMP Term Deposit

|

$2M

|

6 months

|

2.95%

|

The AMP rate of 2.95% compared favourably to the rest of the

market for this investment term. This term was chosen to fill a maturity gap

within Council’s investment portfolio.

|

|

AMP Term Deposit

|

$1M

|

12 months

|

2.95%

|

The AMP rate of 2.95% compared favourably to the rest of the

market for this investment term. This term was chosen to fill a maturity gap

within Council’s investment portfolio.

|

|

AMP Term Deposit

|

$2M

|

8 months

|

2.95%

|

The AMP rate of 2.95% compared favourably to the rest of the

market for this investment term. This term was chosen to fill a maturity gap

within Council’s investment portfolio.

|

|

Police Credit Union (PCU)

|

$2M

|

12 months

|

2.86%

|

The PCU rate of 2.86% compared favourably to the rest of the

market for this investment term. This term was chosen to fill a maturity gap

within Council’s investment portfolio.

|

|

Australian Military Bank (AMB)

|

$1M

|

2 years

|

2.95%

|

The AMB rate of 2.95% compared favourably to the rest of the

market for this investment term. This term was chosen to fill a maturity gap

within Council’s investment portfolio.

|

Rollovers – Council did not roll

over any investment securities during May 2018.

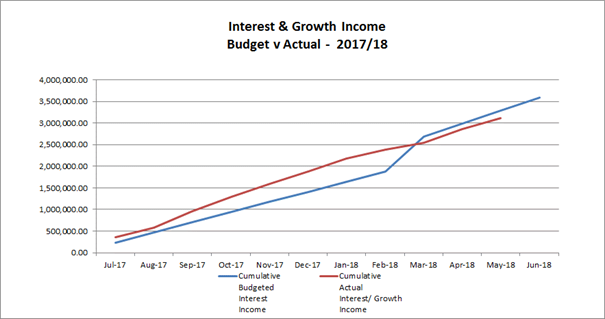

MONTHLY

PERFORMANCE

Interest/growth/capital gains for the month totalled

$252,270, which compares unfavourably with the budget for the period of

$298,465, underperforming budget for the month of May by $46,195. This is due

to a negative movement for Councils Floating Rate Note portfolio during May.

It should be noted that a majority of Councils FRNs

continue to trade at a premium. The capital market value of these investments

will fluctuate from month to month and Council continues to receive the coupon

payments and the face value of the investment security when sold or at

maturity.

It is important to note Council’s investment

portfolio balance has consistently been over $100M, which is tracking well

above what was originally predicted. This is mainly due to the timing of some

of the major projects that are either not yet commenced or not as advanced as

originally predicted. It was originally anticipated that over the remainder of

the 2017/18 financial year the portfolio balance would reduce in line with the

completion of major projects. Further analysis of the capital works program and

revised timing has been completed and has resulted in a number of these

projects being scheduled for a future financial year. This will result in Councils

investment portfolio continuing to maintain a higher balance until these

projects commence.

The longer-dated deposits in the portfolio,

particularly those locked in above 4% yields, have previously anchored

Council’s portfolio performance. It should be noted that the portfolio

now only includes two investments yielding above 4% and Council will inevitably

see a fall in investment income over the coming months compared with previous

periods. Council staff and Council’s Independent Financial Advisor will

continue to identify opportunities to lock in higher yielding investments as

they become available.

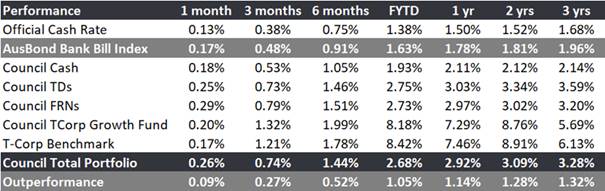

In comparison to the AusBond Bank Bill Index*

(+1.78%pa), Council’s investment portfolio in total returned 3.12% for

May. Short-term deposits returned 2.75%. These funds are utilised for daily

cash flow management and need to be available to meet operating and contractual

payments as they come due.

*

The AusBond Bank Bill Index is the leading benchmark for the Australian fixed

income market. It is interpolated from the RBA Cash rate, 1 month and 3 month

Bank Bill Swap rates.

Report by Responsible

Accounting Officer

I hereby certify that all of the above

investments have been made in accordance with the provision of Section 625 of

the Local Government Act 1993 and the regulations there under, and in

accordance with the Investments Policy adopted by Council on 26 February 2018.

Carolyn Rodney

Responsible Accounting Officer

Budget

variations are reported in accordance with Council’s POL 052 Budget

Policy.

Investments are reported in accordance with Council’s POL 075

Investment Policy.

Local Government Act 1993

625 How may councils invest?

(1) A council may invest money that is not, for the time being,

required by the council for any other purpose.

(2) Money may be invested only in a form of investment notified

by order of the Minister published in the Gazette.

(3) An order of the Minister notifying a form of investment for

the purposes of this section must not be made without the approval of the

Treasurer.

(4) The acquisition, in accordance with section 358, of a

controlling interest in a corporation or an entity within the meaning of that

section is not an investment for the purposes of this section.

Local Government (General) Regulation 2005

212 Reports on

council investments

(1) The responsible accounting officer of a council:

(a) must provide the council with a

written report (setting out details of all money that the council has invested

under section 625 of the Act) to be presented:

(i) if only one ordinary meeting of the

council is held in a month, at that meeting, or

(ii) if more than one such meeting is

held in a month, at whichever of those meetings the council by resolution

determines, and

(b) must include in the report a

certificate as to whether or not the investment has been made in accordance

with the Act, the regulations and the council’s investment policies.

(2) The report must be made up to the last

day of the month immediately preceding the meeting.

Community Leadership and Collaboration

Objective:

We have strong leadership

Outcome:

We are accountable and transparent

Risk Management Issues for

Council

This report

is a control mechanism that assists in addressing the following potential risks

to Council:

· Loss

of investment income or capital resulting from ongoing management of

investments, especially during difficult economic times

· Failure

to demonstrate to the community that its funds are being expended in an

efficient and effective manner

Internal / External

Consultation

Council’s Community Engagement Strategy and IAP2 considers the

community to be “any individual or group of individuals, organisation or

political entity with an interest in the outcome of a decision….”

All relevant areas within the Council have consulted with the Finance

Division in regards to the budget variations listed in this report.

The Finance Division has consulted with relevant external parties to

confirm Council’s investment portfolio balances.

Report submitted to the Ordinary Meeting of Council on Monday 25 June 2018. RP-2

RP-2 Outstanding Debtors Deemed

Unrecoverable - Proposed Write Off List

Author: Carolyn

Rodney

Director: Natalie Te Pohe

|

Analysis:

|

This report lists the outstanding debtor accounts whereby Council

officers have undertaken all available debt recovery methods, and are now

deeming them unrecoverable. Council officers are now recommending for these

accounts to be written off.

|

|

That

Council:

a authorise,

in accordance with Clause 131 of the Local Government (General) Regulation

2005, the write-off of outstanding debtor accounts totalling $9,619.50

against the existing Provisions for Doubtful Debts as outlined in the report

b note

the $14,553.69 total for outstanding accounts under $1,000 which is also to

be written off under the General Manager’s delegation

|

Council raises in excess of $20 million in user charges and fees each

financial year.

The below table illustrates the user charges and fees raised, the

amount outstanding at financial year end, and also the percentage outstanding.

|

|

2012/13

|

2013/14

|

2014/15

|

2015/16

|

2016/17

|

|

User Charges and Fees Collectible -

$’000

|

20,021

|

21,114

|

23,432

|

24,195

|

23,698

|

|

User Charges and Fees Outstanding -

$’000*

|

2,534

|

2,612

|

1,440

|

1,206

|

1,062

|

|

User Charges and Fees Percentage Outstanding*

|

13.62%

|

13.53%

|

6.80%

|

5.52%

|

5.03%

|

*NB: The User Charges and Fees

Outstanding shown in Council’s annual financial statements have been

adjusted to exclude user charges and fees raised during the June month that

were not yet due.

As can be seen from the above table, and also mentioned in the Sale of

Land for Unpaid Rates Council report RP-4 presented to the 12 June 2018 Council

meeting, Council has been proactive in managing debt levels using a variety of

debt recovery methods. Unlike the rates and charges outstanding where the last

avenue for recovery is the sale of property, for user charges and fee debts,

when all available debt recovery methods have been exhausted, at times the only

practical option in certain cases is to write the debt off.

Pursuant to

Clause 131 (4) of the Local Government (General) Regulation 2005:

An amount of rates or charges can be written off under

this clause only:

(a) if there is an error in the

assessment, or

(b) if the amount is not lawfully

recoverable, or

(c) as a result of a decision of

a court, or

(d) if

the council or the general manager believes on reasonable grounds that an

attempt to recover the amount would not be cost effective.

The following outstanding amounts appear in Council’s general

debtors ledger and as mentioned earlier, all normal avenues of debt recovery

have been exhausted in respect to these accounts.

Outstanding accounts over $1,000 each – Council resolution

required for write-off

|

Debtor Type

|

Invoice Date

|

Amount

|

Reason for Write Off

|

|

Cemetery Fees

|

04/01/2016

|

$4,014.04

|

This amount refers to outstanding burial

fees at the Cemetery ($3,012.00) along with debt recovery fees ($1,002.04).

Recent attempts from Council's Debt Recovery Agency have been unable to

locate the person who was responsible for this account.

|

|

Food Inspection Charges

|

2010 - 2015

|

$2,009.18

|

This amount refers to Food Inspection

charges over a four (4) year period for a business that is no longer trading.

|

|

Food Inspection Charge

|

2015

|

$1,022.40

|

This amount refers to Food Inspection

charges for a business that has new owners since these inspection charges

were incurred.

|

|

Sewer Non-Domestic Charges

|

2012

|

$1,102.42

|

Change in ownership of property, and debt

not automatically transferred to new property.

|

|

Sewer Non-Domestic Charges

|

2004

|

$1,471.46

|

Sewer usage charges that were not

originally invoiced.

|

|

Total Amount to be Written Off - Accounts greater than

$1,000

|

$9,619.50

|

|

Outstanding amounts under $1,000 each – authority for General

Manager to write-off

The General Manager, under Delegation 1.56 has authority to write-off

individual amounts under $1,000. A review of outstanding accounts under $1,000

that Council is unlikely to recover totals $14,553.69. A summary by charge type

is provided below:

|

Charge Type

|

Number

|

Total Amount

|

|

Development related fees

|

8

|

$1,769.00

|

|

Inspection Charges

|

22

|

$7,821.03

|

|

Trade Waste Charges

|

14

|

$1,234.05

|

|

Sewer Non-Domestic Charges

|

5

|

$2,679.61

|

|

Airport Parking Fees

|

1

|

$60.00

|

|

Cemetery Fee

|

1

|

$100.00

|

|

Booking Fee

|

1

|

$90.00

|

|

Clean Up Notice

|

1

|

$506.00

|

|

Stores issue

|

1

|

$70.00

|

|

Swimming Fees

|

1

|

$224.00

|

|

Total Amount to be Written Off to Provisions - Accounts

less than $1,000

|

55

|

$14,553.69

|

Proposed

accounts over $1,000 each to be written off $

9,619.50

Accounts

under $1,000 each to be written off $

14,553.69

Total

write off $

24,173.19

The amounts recommended to be written off are to be funded from

existing General Fund and Sewer provisions for doubtful debts allowed for at

the end of 2016/17.

Of the total $24,173.19 to be written off, $17,685.65 relates to

General Fund income, and $6,487.54 relates to Sewer income (Sewer and Trade

Waste Fees).

Clause 131

of the Local Government (General) Regulation 2005.

Community Leadership and Collaboration

Objective:

We have strong leadership

Outcome:

We are accountable and transparent

Risk Management Issues for

Council

N/A

Internal / External

Consultation

Council’s Community Engagement Strategy and IAP2 considers the

community to be “any individual or group of individuals, organisation or

political entity with an interest in the outcome of a decision….”

The Finance Division has consulted with the appropriate areas of the

organisation, where required, in determining those amounts to write-off.

Report submitted to the Ordinary Meeting of Council on Monday 25 June 2018. RP-3

RP-3 NSW Department of Planning &

Environment - Low Cost Loans Initiative

Author: Carolyn

Rodney

Director: Natalie Te Pohe

|

Analysis:

|

NSW Planning & Environment have announced a new Low Cost Loans

Initiative that provides a 50% interest subsidy on projects that meet the

criteria under their program.

Council officers are requesting Council endorsement to make an

application for the projects listed in this report, totalling $24.27 million

and to vote in the potential projects listed in the report.

|

|

That

Council:

a endorse

the General Manager or their delegate to submit an application to the Low

Cost Loans Initiative (LCLI) program, for the projects listed in this report

b approve

the inclusion of the Potential Projects outlined in this report to be

included in Council’s Delivery Program

c note

that a subsequent report will be provided to Council once a determination has

been made by NSW Planning & Environment which will outline any budget

variations required

|

NSW Planning & Environment announced the $500 million Low Cost

Loans Initiative (LCLI) in late April 2018. As mentioned in the attached

guidelines:

The key aim of

the LCLI is to enable new housing supply. The essential elements are:

· the

NSW Government will refund 50% of the costs of council’s interest

payments on loans for eligible infrastructure

· the

council is responsible for repaying the loan which is funded by TCorp, or

another financial institution or the council’s choice, on their standard

terms and prudential requirements

Loans taken out

must be for a minimum of $1 million and have a fixed interest rate.

The duration of

loans subsidised under the LCLI must be no longer than 10 years. Councils

showing that planned infrastructure will be substantially completed by 30 June

2021 will be preferred for LCLI support.

During the 2018/19 Budget process, numerous infrastructure works were

identified that would effectively exhaust the Contributions Reserve and the Fit

for the Future Reserve in particular, within a relatively short timeframe.

While additional contributions will be received and assist in supplementing the

cash reserves over this time, there is the risk of depleting these funds at the

expense of additional infrastructure requirements. In order to assist in the

Council’s cashflow for the large infrastructure program that is

associated with growth across the city, it was determined that the LCLI would

be a beneficial source of income that could then be repaid over 10 years,

resulting in cash being available for future growth and infrastructure requirements.

Council officers have had numerous conversations with the NSW Planning

& Environment team in relation to the application process, the timing of

the drawdown of funds, and in particular, whether or not the interest that

would be charged on the borrowings could be applied to the Contributions

Reserve without a separate line item being incorporated in the Contributions

Plan. If this was not allowable, there would be a GPR impact which Council

could not afford given the balanced budget position for 2018/19.

In trying to determine whether the application of interest to the

Contributions Reserve was allowable, contact was also made with other Councils,

however officers from NSW Planning & Environment clarified this matter on 6

June allowing officers to progress. Confirmation has also been received that

while the application would need to be for the total funding required, the

funds can be drawn down based on the project completion timeframes, therefore

ensuring that interest is not paid until the funds are required.

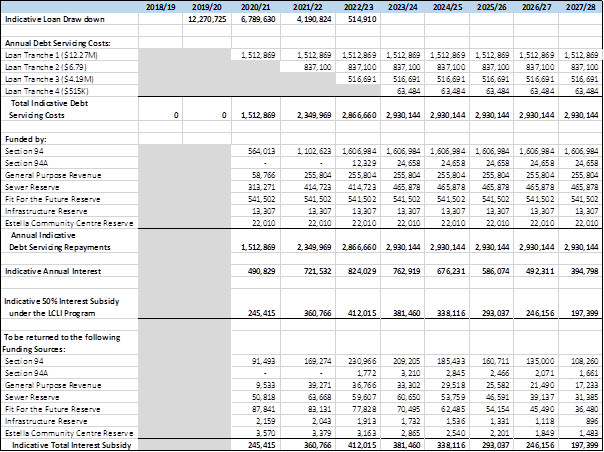

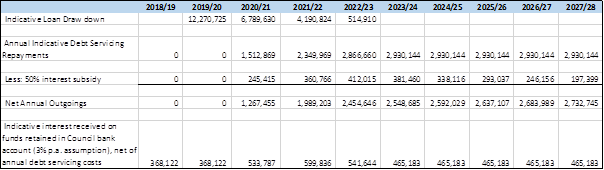

If approved by the State, the 50% interest subsidy will be returned to

the original funding source incurring the debt repayments that is outlined in

Table 4 below.

Council officers have reviewed the current draft 2018/28 Long Term

Financial Plan Capital works program due for adoption at this Council meeting.

Officers have determined that the projects identified in Table 1 meet the

eligibility requirements and criteria of the program, and will submit the

application based on a precinct approach associated with the Northern, Lloyd

and City Wide Growth Precincts. This approach is supported by Direction 22 of

the Riverina Murray Regional Plan that refers to significant housing release

areas requiring the support of infrastructure delivery in Estella, Lloyd and

Boorooma in Wagga Wagga.

The approach is also supported through the Spatial Plan 2013 (pg. 45)

which highlights the following housing and population numbers that are provided

for in the urban release areas:

· 3,208

potential lots in Northern Urban Release Area

· 1,461

potential lots in Lloyd Urban Release Area

· 8,020

people in Northern Urban Release Area – based on average of 2.5 occupancy

rate per potential lot

· 3,652

people in Lloyd Urban Release Area – based on average of 2.5 occupancy

rate per potential lot

The application itself will further demonstrate the growth of Wagga

Wagga in utilising the Australian Bureau of Statistics recent population data

that shows Wagga Wagga has a strong growth rate of 1.2 per cent, and the

city’s northern suburbs have the second fastest growth rate in regional

NSW at 5.1 per cent.

Table 1: Proposed projects included in Council’s LCLI

application

|

Project – linked to enabling new housing supply

|

Total Project Budget

|

Current LTFP Funding Source comments

|

Current year(s) for completion, as listed in current

2018/28 LTFP

|

|

NORTHERN GROWTH

|

|

Estella -

Neighbourhood Open Space Works - Walking Path

|

$31,816

|

Section 94

|

2018/19

|

|

Sewer -

Pump Station - SPS 08 Boorooma - Increase Pump Capacity

|

$76,689

|

Sewer Reserve

|

2018/19

|

|

Northern

Sporting Precinct - Sports grounds and play equipment*

|

$6,579,000

|

S94 Plan

$5,979,000 (New Plan still to be adopted) + GPR $199,643 + S94 (Old Plan)

$121,838 + Estella Community Centre Reserve $178,519 + Borrowings $100,000

|

2018/19 - $1,800,000

2019/20 - $3,200,000

2020/21 - $1,579,000

|

|

Old

Narrandera Road - Second Carriageway for 600m*

|

$827,428

|

2018/19 -

S94 $90,000 + 2020/21 - S94 $637,428 + 2021/22 - S94A $100,000

|

2018/19 – Design ($90,000)

2020/21 ($637,428) + 2021/22 ($100,000) – Construct

|

|

Old Narrandera Road/Olympic Highway Roundabout*

|

$667,886

|

2018/19 -

S94 $90,000 + 2020/21 - S94A $100,000 + S94 $477,886

|

2018/19 – Design ($90,000) 2020/21 ($577,886) - Construct

|

|

Pine Gully Road Roundabout*

|

$1,500,000

|

Section 94

|

2019/20 – Design ($200,000) 2020/21 ($1,300,000) - Construct

|

|

Pine Gully Road - Bike Track*

|

$126,510

|

Section 94

|

2018/19 – Design ($30,000)

2020/21 ($96,510) - Construct

|

|

Pine Gully

Road/Old Narrandera Road - Intersection Upgrade*

|

$1,057,439

|

Section 94

|

2018/19 – Design ($180,000)

2019/20 – Construct ($877,439)

|

|

Harris

Road/Pine Gully Road - Dual Lane Roundabout*

|

$1,201,000

|

Section 94

|

2018/19

|

|

Farrer

Road Improvements*

|

$6,120,000

|

Fit for

the Future Reserve $4,392,066 + S94 $1,620,000 + Infrastructure Reserve

$107,934

|

2018/19

|

|

TOTAL NORTHERN GROWTH

|

$18,187,768

|

|

|

LLOYD GROWTH

|

|

Sewer -

Pump Station - SPS23 Ashmont - New Assets - New pump station and rising main

|

$2,093,413

|

Sewer Reserve

|

2018/19 ($1,270,543) + 2019/20 ($822,870)

|

|

Red Hill

Road and Hudson Drive – Intersection improvements*

|

$101,164

|

Section 94

|

2018/19 – Design ($10,000)

2019/20 – Construct ($91,164)

|

|

TOTAL LLOYD GROWTH

|

$2,194,577

|

|

|

CITY WIDE GROWTH

|

|

|

|

|

Exhibition

Centre - Kooringal Road Exit

|

$1,775,157

|

Loan Borrowings

|

2018/19 – Design ($177,000)

2019/20 – Construct ($1,598,157)

|

|

Sewer -

Pump Station - SPS39 Copland Street - New Assets - New pump station

|

$414,910

|

Sewer Reserve

|

2022/23

|

|

Sewer

Treatment Works - Forest Hill Plant - New Assets

|

$1,193,677

|

Sewer Reserve

|

2018/19

|

|

TOTAL

CITY WIDE GROWTH

|

$3,383,744

|

|

|

TOTAL PROJECTS

|

$23,766,089

|

|

* Currently included in Council’s

Potential Projects list. Funding sources have been restricted and require

Council resolution to be voted into the delivery program.

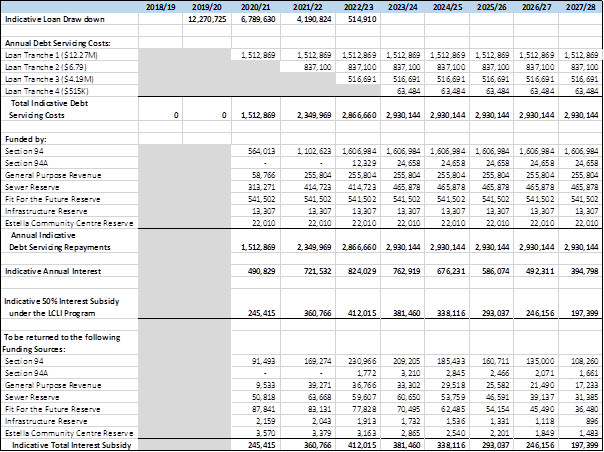

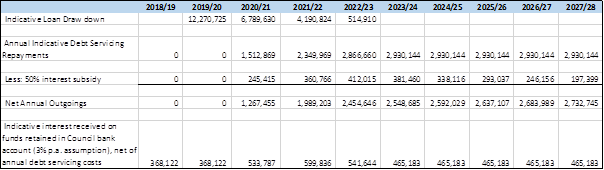

The loan repayments will be based on the total current identified

funding sources for the projects as shown in Table 2 below. Also included in

the table is the estimated interest subsidy.

The total estimated interest on a $23,766,089 loan (assuming a 4%

interest rate over a 10 year term) is $5,535,346. Under the LCLI, 50% of the

total interest would be paid to Council as a subsidy - $2,767,673.

Table 2: Loan Repayments for each Funding Source

|

Funding Source

|

Amount

$

|

Total Loan Interest^

$

|

Interest Subsidy^

$

|

Loan Repayments (Principal + Interest) net of interest

subsidy^

$

|

|

Section 94

|

13,034,081

|

3,035,760

|

1,517,880

|

14,551,961

|

|