AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

24 September 2018

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

24 September 2018

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 24 September 2018 at 6.00pm.

Council live streams video and audio of Council meetings. Members of the public are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

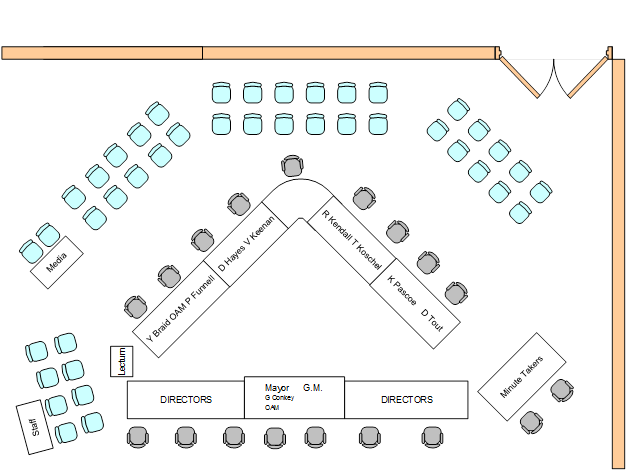

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 24 September 2018.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 24 September 2018

CLAUSE PRECIS PAGE

PRAYER 3

ACKNOWLEDGEMENT OF COUNTRY 3

APOLOGIES 3

CONFIRMATIONS OF MINUTES

CM-1 Ordinary Council Meeting - 10 September 2018 3

DECLARATIONS OF INTEREST 3

procedural motion

pM-1 ELECTION OF MAYOR AND DEPUTY MAYOR 4

Reports from Staff

RP-1 DELEGATION OF AUTHORITY TO THE MAYOR 12

RP-2 DA18/0317 - MULTI-DWELLING HOUSING - PARTIAL DEMOLITION, ALTERATIONS & ADDITIONS TO EXISTING 3 PROPERTIES, 2 x NEW TWO-STOREY UNITS TO REAR OF BLOCK, ASSOCIATED DRIVEWAYS, CAR-PORTS AND LANDSCAPING AND COMMUNITY TITLE SUBDIVISION OF THE 5 x MULTI-UNIT DEVELOPMENT AT 80-82 JOHNSTON STREET, WAGGA WAGGA. LOTS A & B DP 157777 14

RP-3 Financial Performance Report as at 31 August 2018 18

RP-4 Invitation to join Regional Cities New South Wales 35

RP-5 Toilet block at the Victory Memorial Gardens 59

RP-6 ROAD CLOSURE - DAMPIER STREET, BOMEN 77

RP-7 RENEWAL OF COMMUNITY, CULTURAL AND SPORTING AGREEMENTS UNTIL 30 JUNE 2019 81

RP-8 STRONGER COUNTRY COMMUNITES FUND - ROUND 2 86

RP-9 POMINGALARNA MULTISPORT CYCLING COMPLEX 93

RP-10 Response to Questions/Business with Notice 97

QUESTIONS/BUSINESS WITH NOTICE 99

Confidential Reports

CONF-1 ASHMONT PRESCHOOL EXPRESSION OF INTEREST FOR LEASE 100

CONF-2 ACQUISITION OF LAND FOR BOMEN ENABLING ROADS - BOUNDARY ADJUSTMENT 101

CONF-3 RFQ2018-558 Supply of One Wheel Loader 102

CONF-4 RFT2019-09 PROVISION OF SECURITY SERVICES 103

CONF-5 RFT2018-17 CATTLE DELIVERY SERVICES 104

CONF-6 RFT2018-31 TARCUTTA, LADYSMITH & URANQUINTY FLOODPLAIN RISK MANAGEMENT STUDIES AND PLANS 105

CONF-7 RFT2019-11 LANDSCAPE DESIGNS RIVERSIDE STAGE II 106

CONF-8 Major Events, Festivals and Films Sponsorship Applications 2018/19 107

CONF-9 SPORTING EVENT OPPORTUNITY 108

PRAYER

Confirmation of Minutes

CM-1 Ordinary Council Meeting - 10 September 2018

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 10 September 2018 be confirmed as a true and accurate record.

|

|

1⇩. |

Ordinary Council Meeting - Minutes - 10 September 2018 |

109 |

Report submitted to the Ordinary Meeting of Council on Monday 24 September 2018. PM-1

PM-1 ELECTION OF MAYOR AND DEPUTY MAYOR

|

Analysis: |

The purpose of this report is to facilitate the election of the Mayor and Deputy Mayor. In the case of the Council of the City of Wagga Wagga, the Mayor is to be elected by the Councillors from among the Councillors (Section 227). |

|

That Council conduct the election of the Mayor and Deputy Mayor by the voting method determined by Council for the two year period from September 2018 to September 2020. |

Report

Section 225 of the Local Government Act 1993 (the Act) requires Council to have a Mayor who is elected in accordance with the provisions of the Act.

The Councillor elected as Mayor at this meeting will hold that office for a period of two years, until the next Mayoral election in September 2020 (Section 230(1)) following the next ordinary local government election.

In accordance with the provisions of Section 231(2) of the Act, the Council may elect one of its members to act as Deputy Mayor either for the Mayoral term or for a shorter term as may be resolved by the Council. Further, the Deputy Mayor may exercise any function of the Mayor, at the request of the Mayor or if the Mayor is prevented by illness, absence or otherwise from exercising the function or if there is a casual vacancy in the office of the Mayor.

The election provisions of Part 11 of the Local Government (General) Regulation 2005 also relate to the Deputy Mayor.

Role of the Mayor

Section 226 of the Act prescribes that the role of the Mayor includes but is not limited to the following:

• to exercise, in cases of necessity, the policy-making functions of the governing body of the Council between meetings of the Council

• to exercise such other functions of the Council as the Council determines

• to preside at meetings of the Council

• to carry out the civic and ceremonial functions of the mayoral office

Election of Mayor – September 2018 to September 2020

The procedure to be followed for the election of Mayor is outlined in Schedule 7 of the Local Government (General) Regulation 2005, and is reproduced hereunder:

Part 1 – Preliminary

Returning Officer

1. Councillors are advised that in accordance with Schedule 7 Part 1 (1) of the Local Government (General) Regulations 2005, the General Manager, Mr Peter Thompson is the returning officer for the election of Mayor and Deputy Mayor.

Nomination

2. (1) A Councillor may be nominated without notice for election as Mayor or Deputy Mayor.

(2) The nomination is to be made in writing by two or more Councillors (one of whom may be the nominee). The nomination is not valid unless the nominee has indicated consent to the nomination in writing.

(3) The nomination is to be delivered or sent to the Returning Officer.

(4) The Returning Officer is to announce the names of the nominees at the council meeting at which the election is to be held.

Election

3. (1) If only one Councillor is nominated, that Councillor is elected.

(2) If more than one Councillor is nominated, the council is to resolve whether the election is to proceed by preferential ballot, by ordinary ballot or by open voting.

(3) The election is to be held at the council meeting at which the council resolves on the method of voting.

(4) In this clause:

"ballot" has its normal meaning of secret ballot.

"open voting" means voting by a show of hands or similar means.

Part 2 - Ordinary ballot or open voting

Application of Part

4. This Part applies if the election proceeds by ordinary ballot or by open voting.

Marking of ballot-papers

5. (1) If the election proceeds by ordinary ballot, the Returning Officer is to decide the manner in which votes are to be marked on the ballot-papers.

(2) The formality of a ballot-paper under this Part must be determined in accordance with clause 345 (1) (b) and (c) and (6) of this Regulation as if it were a ballot-paper referred to in that clause.

(3) An informal ballot-paper must be rejected at the count.

Count-2 candidates

6. (1) If there are only two candidates, the candidate with the higher number of votes is elected.

(2) If there are only two candidates and they are tied, the one elected is to be chosen by lot.

7. (1) If there are three or more candidates, the one with the lowest number of votes is to be excluded.

(2) If three or more candidates then remain, a further vote is to be taken of those candidates and the one with the lowest number of votes from that further vote is to be excluded.

(3) If, after that, three or more candidates still remain, the procedure set out in subclause is to be repeated until only two candidates remain.

(4) A further vote is to be taken of the two remaining candidates.

(5) Clause 6 of this Schedule then applies to the determination of the election as if the two remaining candidates had been the only candidates.

(6) If at any stage during a count, under subclause (1) or (2), two or more candidates are tied on the lowest number of votes, the one excluded is to be chosen by lot.

Part 3 - Preferential Ballot

Application of Part

8. This Part applies if the election proceeds by preferential ballot.

Ballot-papers and voting

9. (1) The ballot-papers are to contain the names of all the candidates. The councillors are to mark their votes by placing the numbers “1”, “2” and so on against the various names so as to indicate the order of their preference for all the candidates.

(2) The formality of a ballot-paper under this Part is to be determined in accordance with clause 345 (1) (b) and (c) and (5) of this Regulation as if it were a ballot-paper referred to in that clause.

(3) An informal ballot-paper must be rejected at the count.

Count

10. (1) If a candidate has an absolute majority of first preference votes, that candidate is elected.

(2) If not, the candidate with the lowest number of first preference votes is excluded and the votes on the unexhausted ballot-papers counted to him or her are transferred to the candidates with second preferences on those ballot-papers.

(3) A candidate who then has an absolute majority of votes is elected, but, if no candidate then has an absolute majority of votes, the process of excluding the candidate who has the lowest number of votes and counting each of his or her unexhausted ballot-papers to the candidates remaining in the election next in order of the voter’s preference is repeated until one candidate has received an absolute majority of votes. The latter is elected.

(4) In this clause, "absolute majority", in relation to votes, means a number that is more than one-half of the number of unexhausted formal ballot-papers.

11. (1) If, on any count of votes, there are two candidates in, or remaining in, the election and the numbers of votes cast for the two candidates are equal, the candidate whose name is first chosen by lot is taken to have received an absolute majority of votes and is therefore taken to be elected.

(2) If, on any count of votes, there are three or more candidates in or remaining in the election and the numbers of votes cast for two or more candidates are equal and those candidates are the ones with the lowest number of votes on the count of the votes the candidate whose name is first chosen by lot is taken to have the lowest number of votes and is therefore excluded.

Part 4 - General

Choosing by lot

12. To choose a candidate by lot, the names of the candidates who have equal numbers of votes are written on similar slips of paper by the Returning Officer, the slips are folded by the Returning Officer so as to prevent the names being seen, the slips are mixed and one is drawn at random by the Returning Officer and the candidate whose name is on the drawn slip is chosen.

Result

13. The result of the election (including the name of the candidate elected as Mayor or Deputy Mayor) is:

(a) to be declared to the Councillors at the council meeting at which the election is held by the Returning Officer, and

(b) to be delivered or sent to the Director-General and to the Secretary of the Local Government and Shires Association

Having regard to the above, Councillors are required to determine the method of voting for the election of the Mayor and Deputy Mayor. The method of voting options available to Councillors are the following of which one is to be chosen:

· Open Voting

· Ordinary Ballot

· Preferential Ballot

In addition, it is also recommended that the result of the counts for both the Mayoral and Deputy Mayoral elections be made known to the meeting by the Returning Officer at the completion of each of the elections.

Election of Deputy Mayor – September 2018 to September 2020

It has been Council’s normal practice to elect a Deputy Mayor for the same Mayoral term, immediately following the election of the Mayor.

Nomination papers for the Mayor and Deputy Mayor are attached and have previously been distributed to Councillors. Nomination papers are to be delivered or sent to the Returning Officer (Director Corporate Services) prior to the commencement of the Council Meeting to be held on Monday, 24 September 2018 at 6.00pm.

Financial Implications

N/A

Policy and Legislation

Section 225 of the Local Government Act 1993

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We have leaders that represent us

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

1⇩. |

Mayoral nomination form |

|

|

2⇩. |

Deputy Mayor nomination form |

|

RP-1 DELEGATION OF AUTHORITY TO THE MAYOR

Author: Nicole Johnson

General Manager: Peter Thompson

|

Analysis: |

Adopt accurate and contemporary Delegations of Authority to the Mayor. |

|

That Council delegate the following powers, authorities, duties or functions to the Mayor, as listed below: 1. Day-to-day oversight of the General Manager’s employment under the contract of employment between the Council and the General Manager as contemplated by Part D of Division of Local Government, Department of Premier & Cabinet in 2011 titled ‘Guidelines for the Appointment & Oversight of General Managers’ 2. Incurring expenditure on behalf of the Council in connection with the mayor’s day-to-day oversight of the General Manager’s employment in order to obtain independent expert advice on matters relating to the General Manager’s performance under the contract of employment between the Council and the General Manager 3. To expend money in an amount not exceeding $30,000.00 in any financial year in the proper exercise of the Council’s functions in circumstances where the Mayor reasonably considers that the expenditure is urgent and the expenditure is duly authorised by the Council under clause 211 of the Local Government (General) Regulation 2005 and subject to any conditions or limitations imposed by resolution of the Council from time to time specifically for the purpose of this delegation 5. To approve jointly with the General Manager, the attendance of Councillors at any seminar, conference, meeting or course, provided that: i. such delegation shall not be exercised if there is a prior Council meeting at which the attendance might be considered allowing sufficient time for registration, arrangements, etc ii. provision has been made for such expenditure in the Council’s budget iii. such seminar, conference etc is for one day or less and does not involve an overnight stay |

Report

Wagga Wagga City Council (Council) has, in the past, delegated authority to the Mayor for certain functions. This is considered to be both appropriate and necessary to ensure the position of Mayor has the relevant authority to undertake the role effectively and in the best interests of the community.

In accordance with Section 377 of the Local Government Act 1993 (the Act), a Council may delegate functions, other than those specified and exempted under that Section. A council may, by resolution, sub-delegate to the General Manager or any other person or body (not including another employee of the council) any function delegated to the Council by the Department’s Chief Executive except as provided by the instrument of delegation to the Council.

The delegations included in the recommendation reflect the current delegations of the Mayor and are in addition to the functions prescribed under Section 226 of the Act which states that the role of the Mayor relates to:

· Conferring Powers or Duties under the Act

· Powers or Duties under other legislation

· Preside at Meetings and Functions of Council

The Mayor does not need a delegation from Council to carry out the functions set out in section 226 as above, that section provides the functions as specified.

In accordance with the roles, previous delegations and consistent with legislation, it is recommended that the powers, authorities, duties and functions listed above be delegated to the Mayor.

Financial Implications

N/A

Policy and Legislation

Local Government Act 1993

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

RP-2 DA18/0317 - MULTI-DWELLING HOUSING - PARTIAL DEMOLITION, ALTERATIONS & ADDITIONS TO EXISTING 3 PROPERTIES, 2 x NEW TWO-STOREY UNITS TO REAR OF BLOCK, ASSOCIATED DRIVEWAYS, CAR-PORTS AND LANDSCAPING AND COMMUNITY TITLE SUBDIVISION OF THE 5 x MULTI-UNIT DEVELOPMENT AT 80-82 JOHNSTON STREET, WAGGA WAGGA. LOTS A & B DP 157777

Author: Amanda Gray

General Manager: Peter Thompson

|

Analysis: |

The report is for a development application and is presented to Council for determination. The application has been referred to Council under Section 1.11 of the Wagga Wagga Development Control Plan 2010 (DCP) as the application is development for multi dwelling housing, which includes a request to vary a numerical control by greater than 10%.

It is proposed to vary the off street car parking requirements under Clause 2.2. This control requires 9 car parking spaces and the layout identifies 7 car parking spaces. The reduced number of spaces is a variation of 22% of the numeric control. |

|

That Council approve DA18/0317 for Multi-Dwelling Housing - 5 x two bedroom dwellings with community title subdivision at 80-82 Johnston Street, Wagga Wagga NSW 2650 subject to the conditions outlined in the Section 4.15 Assessment Report. |

Development Application Details

|

Applicant |

Kenneth John Dwyer |

|

Owner |

Kenneth John Dwyer, Marguerite Ann Dwyer |

|

Development Cost |

$1,045,000.00 |

|

Development Description |

Multi-Dwelling Housing - 5 x two bedroom dwellings with community title subdivision; Three existing properties to be refurbished and two new units at the rear of block. |

Report

Key Issues

Impact on heritage conservation area

Variation to DCP standards

Assessment

· The proposal is defined under the standard definitions contained in the Wagga Wagga Local Environmental Plan 2010 (LEP) as Multi Dwelling Housing (3 or more dwellings (whether attached or detached) on one lot of land, each with access at ground level but does not include a residential flat building.

· Under the provisions of the LEP, the subject site is within the R3 Medium Density Residential zone.

· The proposal is generally consistent with the R3 objectives because it provides for housing within a medium density residential environment and adds to the variety of housing and density types.

· The development retains and restores the existing properties to the benefit of the existing streetscape and the character of the heritage conservation area within which the subject site is located.

· Vehicle access and manoeuvring, solar access within the development and private open space are assessed as being adequate and the layout complies with site area and site cover controls.

· The application seeks a variation to the off street car parking provision. A total of 7 spaces are provided whereas 9 are required using the criteria outlined in clause 2.2 of the DCP. The variation has been justified by the proximity of the site to the city and there being less reliance on private vehicles in such a location as well as the ability for two dwellings to benefit from a tandem parking arrangement.

· Tree removal is proposed within the site and protection zones will be established around trees to be retained adjacent to the lagoon.

· The application was advertised and notified, no submissions were received.

· Community title subdivision of the lot is proposed, with 5 residential lots and 1 community lot. A Management Statement was not submitted with the development application but will form part of the subsequent Subdivision Application.

Reasons for Approval

1. The proposed development is consistent with the provisions of the Wagga Wagga Local Environmental Plan 2010;

2. The applicable objectives of Sections 2, 3 and 9 of the DCP are satisfied by the proposed development;

3. The proposed variations of the car parking pursuant to Clause 2.2 of the DCP, has been justified by the application;

4. The impact on the significance of the heritage conservation area is positive and acceptable and no detrimental impacts are anticipated;

5. For the abovementioned reasons it is considered to be in the public interest to approve this development application.

Site Location

The site is located on the southern side of Johnston Street and consists of two long and narrow blocks extending to a total area of 1388.94sq.m. There are three existing units on site, two within No.80 and one at No.82, the rear area of the properties are overgrown.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have housing that suits our needs

Risk Management Issues for Council

Refusal of the application may result in an appeal process in the Land and Environment Court which will have to be defended by Council. The reasons for refusal will have to be justified and withstand scrutiny and cross examination in Court.

Approval of the application is not considered to raise risk management issues for Council as the proposed development is generally consistent with LEP and DCP controls and the one proposed variation of a control is minor.

Internal / External Consultation

Full details of the consultation that was carried out as part of the development application assessment is contained in the attached 4.15 Report.

|

1. |

DA18/0317 - Section 4.15 Report - Provided under separate cover |

|

|

2. |

DA18/0317 - Floor Plans and Elevations - Provided under separate cover |

|

|

3. |

DA18/0317 - Plan of Subdivision - Provided under separate cover |

|

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Analysis: |

This report is for Council to consider and approve the proposed 2018/19 budget variations required to manage the 2018/19 budget and Long Term Financial Plan, and details Council’s external investments and performance as at 31 August 2018. |

|

That Council: a approve the proposed 2018/19 budget variations for the month ended 31 August 2018 and note the balanced budget position as presented in this report b note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above c note details of the external investments as at 31 August 2018 in accordance with section 625 of the Local Government Act 1993 |

Report

Wagga Wagga City Council (Council) forecasts a balanced budget position as at 31 August 2018. Proposed funded budget variations are detailed in this report for Council’s consideration and adoption.

Council has experienced a positive monthly investment performance for the month of August, when compared to budget. This is a result of a positive movement in the value of Council’s Floating Rate Note portfolio during the month as well as a larger than expected investment portfolio.

Key Performance Indicators

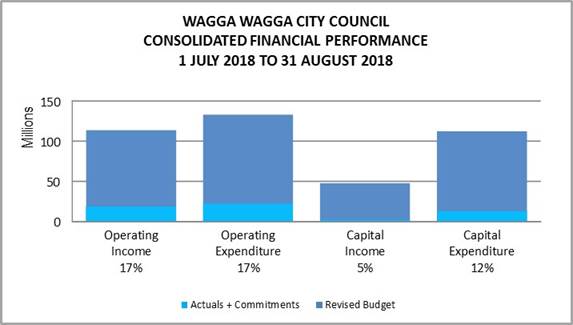

OPERATING INCOME

Total operating income is 17% of approved budget, which is tracking to budget for the end of August (this percentage excludes capital grants and contributions). An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 63%.

OPERATING EXPENSES

Total operating expenditure is 17% of approved budget and is tracking close to budget for the full financial year.

CAPITAL INCOME

Total capital income is 5% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions relating to projects. This income also includes the sale of property, plant and equipment.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 12% of approved budget.

|

WAGGA WAGGA

CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2018/19 |

COMMT'S 2018/19 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|||||||

|

Rates & Annual Charges |

(65,998,971) |

0 |

(65,998,971) |

(12,216,476) |

0 |

(12,216,476) |

19% |

|

User Charges & Fees |

(26,741,044) |

150,317 |

(26,694,227) |

(3,398,510) |

0 |

(3,398,510) |

13% |

|

Interest & Investment Revenue |

(2,917,452) |

(205,000) |

(3,122,452) |

(785,397) |

0 |

(785,397) |

25% |

|

Other Revenues |

(3,086,604) |

(308,552) |

(3,291,656) |

(699,889) |

0 |

(699,889) |

21% |

|

Operating Grants & Contributions |

(13,894,989) |

(660,117) |

(14,555,106) |

(1,761,695) |

0 |

(1,761,695) |

12% |

|

Capital Grants & Contributions |

(36,517,290) |

(8,232,261) |

(44,749,551) |

(2,012,231) |

0 |

(2,012,231) |

4% |

|

Total Revenue |

(149,156,350) |

(9,255,613) |

(158,411,963) |

(20,874,197) |

0 |

(20,874,197) |

13% |

|

|

|||||||

|

Expenses

|

|||||||

|

Employee Benefits & On-Costs |

44,780,608 |

(13,800) |

44,772,808 |

6,361,458 |

6,826 |

6,368,284 |

14% |

|

Borrowing Costs |

3,752,580 |

0 |

3,752,580 |

(18,670) |

0 |

(18,670) |

0% |

|

Materials & Contracts |

32,390,231 |

4,572,343 |

36,956,574 |

4,786,072 |

3,522,655 |

8,308,727 |

22% |

|

Depreciation & Amortisation |

35,418,997 |

0 |

35,418,997 |

5,903,166 |

0 |

5,903,166 |

17% |

|

Other Expenses |

12,125,204 |

(156,252) |

11,968,952 |

1,470,836 |

97,143 |

1,567,980 |

13% |

|

Total Expenses |

128,467,621 |

4,402,291 |

132,869,911 |

18,502,862 |

3,626,624 |

22,129,486 |

17% |

|

|

|

||||||

|

Net Operating (Profit)/Loss |

(20,688,729) |

(4,853,323) |

(25,542,052) |

(2,371,335) |

3,626,624 |

1,255,289 |

|

|

|

|||||||

|

Net Operating (Profit)/Loss before Capital Grants & Contributions |

15,828,561 |

3,378,938 |

19,207,499 |

(359,104) |

3,626,624 |

3,267,521 |

|

|

|

|||||||

|

Capital / Reserve Movements |

|||||||

|

Capital Exp - Renewals |

33,260,752 |

11,749,397 |

45,010,149 |

1,645,595 |

3,155,612 |

4,801,207 |

11% |

|

Capital Exp - New Projects |

30,936,485 |

7,395,209 |

38,331,695 |

1,602,539 |

5,986,651 |

7,589,191 |

20% |

|

Capital Exp - Project Concepts |

25,444,335 |

369,459 |

25,813,794 |

7,269 |

47,421 |

54,690 |

0% |

|

Loan Repayments |

3,129,777 |

0 |

3,129,777 |

521,630 |

0 |

521,630 |

17% |

|

New Loan Borrowings |

(6,108,672) |

(608,380) |

(6,717,052) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(952,795) |

(1,991,732) |

(2,944,527) |

(168,915) |

0 |

(168,915) |

6% |

|

Net Movements Reserves |

(29,602,157) |

(12,060,630) |

(41,662,787) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

56,107,727 |

4,853,323 |

60,961,049 |

3,608,117 |

9,189,684 |

12,797,802 |

|

|

|

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED

BUDGET |

YTD ACTUAL EXCL COMMT'S 2018/19 |

COMMT'S 2018/19 |

YTD ACTUAL +

COMMT'S |

YTD % OF BUD |

|

Net Result after Depreciation |

35,418,997 |

0 |

35,418,997 |

1,236,782 |

12,816,309 |

14,053,091 |

|

|

|

|||||||

|

Add back Depreciation Expense |

35,418,997 |

0 |

35,418,997 |

5,903,166 |

0 |

5,903,166 |

17% |

|

|

|||||||

|

Cash Budget (Surplus)/Deficit |

0 |

0 |

0 |

(4,666,384) |

12,816,309 |

8,149,925 |

|

Revised Budget Result - Surplus/(Deficit) |

$’000s |

|

Original 2018/19 Budget Result as adopted by Council Total Budget Variations approved to date Budget variations for August 2018 |

$0 $0 $0 |

|

Proposed revised budget result for 31 August 2018 |

$0 |

The proposed Budget Variations to 31 August 2018 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact Fav/ (Unfav) |

|||

|

1 – Community Leadership and Collaboration |

||||||

|

Unsealed Roads Maintenance |

$47K |

State Government – Financial Assistance Grant Income ($47K) |

Nil |

|||

|

Council has been advised by the State Government, that the 2018/19 Financial Assistance Grant will be higher than the budgeted amount. It is proposed to add these additional funds to the existing unsealed roads maintenance budget. |

|

|||||

|

2 – Safe and Healthy Community |

||||||

|

Fire Trail Maintenance |

$78K |

RFS Grant Income ($78K) |

Nil |

|||

|

Council has been successful in securing grant funding in Round 1 of the RFS 2018/19 Bush Fire Risk Mitigation and Resilience Program. The grant relates to fire trail maintenance on Clifton, Andrews, Casuarina and Tatton Trails.

|

|

|||||

|

3 – Growing Community |

||||||

|

Airport Compliance |

$18K |

Airport Reserve ($18K) |

Nil |

|||

|

A budget variation is required to fund annual regulatory airport compliance and audit activities such as technical and lighting inspections and other operational functional works. This budget line item was removed in error during the 2018/19 budget compilation. This budget will also be required as an annual allocation of $18K in the Long Term Financial Plan funded from the Airport Reserve. |

|

|||||

|

5 – The Environment |

||||||

|

Cadet Engineers x 2 |

$98K |

Subdivisions Salaries ($27K) Generic Projects Reserve ($71K) |

Nil |

|||

|

Funds are required to fund the WWCC commitment for a Memorandum of Understanding with Charles Sturt University for the placement of two cadet engineers. It is proposed to fund these placements from available funds in the Generic Projects Reserve and the vacant Subdivisions Engineer Role (3 months). |

|

|||||

|

Docker and Forsyth St Pedestrian Refuge |

$40K |

Traffic Committee Reserve (20K) RMS Grant ($20K) |

Nil |

|||

|

Council has been successful in gaining 50/50 grant funding from the Roads and Maritime Services as part of the 2018/19 Active Transport Program. The Docker and Forsyth St intersection has been identified as high use and requiring the installation of laybacks, refuges, linemarking and signage to improve pedestrian safety. It is proposed to fund Council’s portion from the Traffic Committee Reserve. |

|

|||||

|

144 Baylis Street Building Renovations |

$15K |

Infrastructure Replacement Reserve ($15K) |

Nil |

|||

|

Funds are required for renovations to the Council owned building at 144 Baylis Street, located across the road from the Sturt Mall. The building currently houses public amenities and is used as a walkway between the main street and the rear carpark. The renovations involve the construction of a lunchroom for the main street maintenance staff. It is proposed to fund these works from the Infrastructure Replacement Reserve. |

|

|||||

|

Kooringal Public School Bus Stop Upgrade |

$10K |

NSW Government Grant ($10K) |

Nil |

|||

|

Council has been successful in obtaining funding under the Country Passenger Transport Infrastructure Grants Scheme (CPTIGS) program from the NSW Government. This funding is to be utilised for the Kooringal Public School Bus Stop Upgrade which brings the total project budget up to $62K. |

|

|||||

|

SURPLUS/(DEFICIT) |

Nil |

|||||

Current Restrictions

|

RESERVES SUMMARY |

|

||||||||||

|

31 AUGUST 2018 |

|

||||||||||

|

|

CLOSING BALANCE 2017/18 |

ADOPTED RESERVE TRANSFERS 2018/19 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 31.08.18 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

|||||

|

|

|

|

|

|

|

|

|||||

|

Externally Restricted |

|

|

|

|

|

|

|||||

|

Developer Contributions |

(25,903,320) |

8,264,183 |

984,096 |

0 |

(16,655,040) |

|

|||||

|

Sewer Fund |

(25,564,064) |

4,267,364 |

2,638,508 |

0 |

(18,658,192) |

|

|||||

|

Solid Waste |

(20,184,154) |

9,600,364 |

955,359 |

0 |

(9,628,430) |

|

|||||

|

Specific Purpose Grants |

(4,159,532) |

0 |

4,159,532 |

0 |

0 |

|

|||||

|

SRV Levee |

(2,847,382) |

1,807,667 |

892,802 |

0 |

(146,914) |

|

|||||

|

Stormwater Levy |

(3,167,296) |

162,032 |

102,841 |

0 |

(2,902,423) |

|

|||||

|

Total Externally Restricted |

(81,825,747) |

24,101,610 |

9,733,137 |

0 |

(47,990,999) |

|

|||||

|

|

|

|

|||||||||

|

Internally Restricted |

|

|

|||||||||

|

Airport |

(63,685) |

(158,452) |

(70,270) |

18,000 |

(274,407) |

|

|||||

|

Art Gallery |

(49,209) |

13,262 |

0 |

0 |

(35,947) |

|

|||||

|

Ashmont Community Facility |

(6,000) |

(1,500) |

0 |

0 |

(7,500) |

|

|||||

|

Bridge Replacement |

(201,972) |

(100,000) |

0 |

0 |

(301,972) |

|

|||||

|

CBD Carparking Facilities |

(863,695) |

160,302 |

50,801 |

0 |

(652,592) |

|

|||||

|

CCTV |

(74,476) |

(10,000) |

0 |

0 |

(84,476) |

|

|||||

|

Cemetery Perpetual |

(65,479) |

(129,379) |

51,958 |

0 |

(142,900) |

|

|||||

|

Cemetery |

(452,507) |

420 |

139,581 |

0 |

(312,506) |

|

|||||

|

Civic Theatre Operating |

0 |

(55,000) |

0 |

0 |

(55,000) |

|

|||||

|

Civic Theatre Technical Infrastructure |

(92,585) |

(50,000) |

4,911 |

0 |

(137,675) |

|

|||||

|

Civil Projects |

(155,883) |

0 |

0 |

0 |

(155,883) |

|

|||||

|

Community Amenities |

(76,763) |

0 |

0 |

0 |

(76,763) |

|

|||||

|

Community Works |

(61,888) |

(59,720) |

0 |

0 |

(121,608) |

|

|||||

|

Council Election |

(255,952) |

(76,333) |

0 |

0 |

(332,285) |

|

|||||

|

Emergency Events |

(220,160) |

0 |

29,000 |

0 |

(191,160) |

|

|||||

|

Employee Leave Entitlements |

(3,322,780) |

0 |

0 |

0 |

(3,322,780) |

|

|||||

|

Environmental Conservation |

(131,351) |

20,295 |

0 |

0 |

(111,056) |

|

|||||

|

Estella Community Centre |

(230,992) |

178,519 |

0 |

0 |

(52,473) |

|

|||||

|

Family Day Care |

(320,364) |

75,366 |

(1,556) |

0 |

(246,555) |

|

|||||

|

Fit for the Future |

(5,340,222) |

4,444,014 |

661,863 |

0 |

(234,345) |

|

|||||

|

Generic Projects Saving |

(1,056,917) |

150,000 |

44,053 |

71,253 |

(791,611) |

|

|||||

|

Glenfield Community Centre |

(19,704) |

(2,000) |

0 |

0 |

(21,704) |

|

|||||

|

Grants Commission |

(5,199,163) |

0 |

0 |

0 |

(5,199,163) |

|

|||||

|

Grassroots Cricket |

(70,992) |

0 |

0 |

0 |

(70,992) |

|

|||||

|

Gravel Pit Restoration |

(767,509) |

0 |

0 |

0 |

(767,509) |

|

|||||

RESERVES SUMMARY

|

|||||||||||

|

31 AUGUST 2018 |

|||||||||||

|

|

CLOSING BALANCE 2017/18 |

ADOPTED RESERVE TRANSFERS 2018/19 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 31.08.18 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

||||||

|

Gurwood Street Property |

(50,454) |

0 |

0 |

0 |

(50,454) |

||||||

|

Information Services |

(369,113) |

77,858 |

285,000 |

0 |

(6,256) |

||||||

|

Infrastructure Replacement |

(193,634) |

(68,109) |

0 |

15,000 |

(246,743) |

||||||

|

Insurance Variations |

(28,644) |

0 |

(71,603) |

0 |

(100,246) |

||||||

|

Internal Loans |

(518,505) |

(631,470) |

129,917 |

0 |

(1,020,058) |

||||||

|

Lake Albert Improvements |

(62,349) |

(21,563) |

5,859 |

0 |

(78,053) |

||||||

|

LEP Preparation |

(3,895) |

0 |

1,350 |

0 |

(2,545) |

||||||

|

Livestock Marketing Centre |

(5,724,767) |

(1,146,762) |

1,010,602 |

0 |

(5,860,928) |

||||||

|

Museum Acquisitions |

(39,378) |

0 |

0 |

0 |

(39,378) |

||||||

|

Oasis Building Renewal |

(209,851) |

(85,379) |

0 |

0 |

(295,230) |

||||||

|

Oasis Plant |

(1,140,543) |

390,000 |

0 |

0 |

(750,543) |

||||||

|

Parks & Recreation Projects |

(79,648) |

49,500 |

0 |

0 |

(30,148) |

||||||

|

Pedestrian River Crossing |

(10,775) |

0 |

10,775 |

0 |

0 |

||||||

|

Plant Replacement |

(3,935,062) |

253,958 |

1,043,434 |

0 |

(2,637,671) |

||||||

|

Playground Equipment Replacement |

(164,784) |

69,494 |

0 |

0 |

(95,290) |

||||||

|

Project Carryovers |

(2,006,338) |

402,808 |

1,585,155 |

0 |

(18,376) |

||||||

|

Public Art |

(208,754) |

30,300 |

64,997 |

0 |

(113,457) |

||||||

|

Robertson Oval Redevelopment |

(92,151) |

0 |

0 |

0 |

(92,151) |

||||||

|

Senior Citizens Centre |

(15,627) |

(2,000) |

0 |

0 |

(17,627) |

||||||

|

Sister Cities |

(36,328) |

(10,000) |

0 |

0 |

(46,328) |

||||||

|

Stormwater Drainage |

(180,242) |

0 |

22,000 |

0 |

(158,242) |

||||||

|

Strategic Real Property |

(475,000) |

401,305 |

(395,655) |

0 |

(469,350) |

||||||

|

Street Lighting Replacement |

(74,755) |

0 |

0 |

0 |

(74,755) |

||||||

|

Subdivision Tree Planting |

(582,108) |

40,000 |

0 |

0 |

(542,108) |

||||||

|

Sustainable Energy |

(588,983) |

95,000 |

38,541 |

0 |

(455,442) |

||||||

|

Traffic Committee |

(21,930) |

0 |

0 |

20,138 |

(1,792) |

||||||

|

Unexpended External Loans |

(841,521) |

0 |

841,521 |

0 |

0 |

||||||

|

Workers Compensation |

(40,000) |

0 |

(53,251) |

0 |

(93,251) |

||||||

|

Total Internally Restricted |

(36,795,390) |

4,244,732 |

5,428,981 |

124,391 |

(26,997,286) |

||||||

|

|

|

|

|

|

|

||||||

|

Total Restricted |

(118,621,137) |

28,346,342 |

15,162,118 |

124,391 |

(74,988,285) |

||||||

Investment Summary as at 31 August 2018

In accordance with Regulation 212 of the Local Government (General) Regulation 2005, details of Wagga Wagga City Council’s external investments are detailed below:

|

Institution |

Rating |

Closing Balance |

Closing Balance |

August |

August |

Investment |

Maturity |

Term |

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

AMP |

A |

2,000,000 |

2,000,000 |

2.95% |

1.41% |

1/06/2018 |

31/05/2019 |

12 |

|

AMP |

A |

2,000,000 |

0 |

0.00% |

0.00% |

2/08/2017 |

2/08/2018 |

12 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

2.60% |

1.41% |

8/09/2017 |

7/09/2018 |

12 |

|

AMP |

A |

1,000,000 |

1,000,000 |

2.95% |

0.71% |

5/06/2018 |

2/01/2019 |

7 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

2.62% |

1.41% |

28/09/2017 |

28/09/2018 |

12 |

|

Auswide |

BBB- |

2,000,000 |

2,000,000 |

2.67% |

1.41% |

5/10/2017 |

5/10/2018 |

12 |

|

Auswide |

BBB- |

1,000,000 |

1,000,000 |

2.67% |

0.71% |

16/10/2017 |

16/10/2018 |

12 |

|

Auswide |

BBB- |

2,000,000 |

2,000,000 |

2.70% |

1.41% |

5/12/2017 |

5/12/2018 |

12 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

2.70% |

1.41% |

28/02/2018 |

29/10/2018 |

8 |

|

AMP |

A |

2,000,000 |

2,000,000 |

2.95% |

1.41% |

17/05/2018 |

13/11/2018 |

6 |

|

AMP |

A |

1,000,000 |

1,000,000 |

2.95% |

0.71% |

17/05/2018 |

17/05/2019 |

12 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

2.86% |

1.41% |

28/05/2018 |

28/05/2019 |

12 |

|

AMP |

A |

2,000,000 |

2,000,000 |

2.95% |

1.41% |

29/05/2018 |

24/01/2019 |

8 |

|

Westpac |

AA- |

1,000,000 |

1,000,000 |

2.80% |

0.71% |

28/06/2018 |

28/06/2019 |

12 |

|

Australian Military Bank |

NR |

1,000,000 |

1,000,000 |

3.01% |

0.71% |

16/07/2018 |

16/07/2019 |

12 |

|

Suncorp-Metway |

A+ |

0 |

2,000,000 |

2.65% |

1.41% |

31/08/2018 |

30/11/2018 |

3 |

|

Bankwest |

AA- |

0 |

2,000,000 |

2.76% |

1.41% |

31/08/2018 |

23/04/2019 |

8 |

|

Total Short Term Deposits |

|

25,000,000 |

27,000,000 |

2.79% |

19.06% |

|

|

|

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

1,368,311 |

2,995,159 |

1.50% |

2.11% |

N/A |

N/A |

N/A |

|

NAB |

AA- |

13,156,936 |

16,686,568 |

2.19% |

11.78% |

N/A |

N/A |

N/A |

|

AMP |

A |

345 |

345 |

2.30% |

0.00% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

72,055 |

107 |

1.35% |

0.00% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

14,597,647 |

19,682,179 |

2.08% |

13.89% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

RaboBank |

A+ |

1,000,000 |

1,000,000 |

3.16% |

0.71% |

5/06/2017 |

6/06/2022 |

60 |

|

ING Bank |

A |

3,000,000 |

3,000,000 |

2.75% |

2.12% |

24/08/2017 |

26/08/2019 |

24 |

|

ME Bank |

BBB |

2,000,000 |

2,000,000 |

4.28% |

1.41% |

2/09/2014 |

2/09/2019 |

60 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

4.10% |

0.71% |

5/12/2014 |

5/12/2019 |

60 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.10% |

1.41% |

7/07/2017 |

7/07/2020 |

36 |

|

AMP |

A |

0 |

2,000,000 |

3.00% |

1.41% |

2/08/2018 |

3/02/2020 |

18 |

|

Newcastle Permanent |

BBB |

1,000,000 |

1,000,000 |

3.00% |

0.71% |

12/08/2016 |

12/08/2019 |

36 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

3.20% |

0.71% |

25/08/2016 |

25/08/2021 |

60 |

|

Newcastle Permanent |

BBB |

1,000,000 |

1,000,000 |

3.00% |

0.71% |

31/08/2016 |

30/08/2019 |

36 |

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

2.90% |

0.71% |

8/09/2016 |

10/09/2018 |

24 |

|

Newcastle Permanent |

BBB |

2,000,000 |

2,000,000 |

3.00% |

1.41% |

10/02/2017 |

11/02/2019 |

24 |

|

Westpac |

AA- |

3,000,000 |

3,000,000 |

3.10% |

2.12% |

10/03/2017 |

10/03/2022 |

60 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

2.92% |

0.71% |

16/10/2017 |

16/10/2019 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

2.92% |

1.41% |

6/11/2017 |

6/11/2019 |

24 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.35% |

1.41% |

3/01/2018 |

4/01/2022 |

48 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

2.80% |

0.71% |

5/01/2018 |

6/01/2020 |

24 |

|

Australian Military Bank |

NR |

1,000,000 |

1,000,000 |

2.95% |

0.71% |

29/05/2018 |

29/05/2020 |

24 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

3.50% |

0.71% |

1/06/2018 |

1/06/2022 |

48 |

|

Institution |

Rating |

Closing Balance |

Closing Balance |

August |

August |

Investment |

Maturity |

Term |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

3.02% |

1.41% |

28/06/2018 |

28/06/2021 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

2.88% |

1.41% |

28/06/2018 |

29/06/2020 |

24 |

|

ING Bank |

A |

0 |

2,000,000 |

2.86% |

1.41% |

16/08/2018 |

17/08/2020 |

24 |

|

BOQ |

BBB+ |

0 |

3,000,000 |

3.25% |

2.12% |

28/08/2018 |

29/08/2022 |

48 |

|

ING Bank |

A |

0 |

3,000,000 |

2.85% |

2.12% |

30/08/2018 |

14/09/2020 |

24 |

|

Total Medium Term Deposits |

|

30,000,000 |

40,000,000 |

3.11% |

28.24% |

|

|

|

|

Floating Rate Notes - Senior Debt |

|

|

|

|

|

|

|

|

|

BOQ |

BBB+ |

2,016,400 |

2,019,400 |

BBSW + 110 |

1.43% |

5/08/2014 |

24/06/2019 |

58 |

|

BOQ |

BBB+ |

1,003,268 |

0 |

0.00% |

0.00% |

6/11/2014 |

6/11/2019 |

60 |

|

BOQ |

BBB+ |

1,003,268 |

0 |

0.00% |

0.00% |

10/11/2014 |

6/11/2019 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,011,267 |

1,006,485 |

BBSW + 110 |

0.71% |

18/08/2015 |

18/08/2020 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,011,267 |

1,006,485 |

BBSW + 110 |

0.71% |

28/09/2015 |

18/08/2020 |

59 |

|

Suncorp-Metway |

A+ |

1,013,247 |

1,016,153 |

BBSW + 125 |

0.72% |

20/10/2015 |

20/10/2020 |

60 |

|

Westpac |

AA- |

4,043,068 |

0 |

0.00% |

0.00% |

28/10/2015 |

28/10/2020 |

60 |

|

CBA |

AA- |

1,013,167 |

0 |

0.00% |

0.00% |

18/01/2016 |

18/01/2021 |

60 |

|

Rabobank |

A+ |

2,047,592 |

2,055,562 |

BBSW + 150 |

1.45% |

4/03/2016 |

4/03/2021 |

60 |

|

Newcastle Permanent |

BBB |

1,008,637 |

1,011,294 |

BBSW + 160 |

0.71% |

22/03/2016 |

22/03/2019 |

36 |

|

CUA |

BBB |

2,016,094 |

2,021,668 |

BBSW + 160 |

1.43% |

1/04/2016 |

1/04/2019 |

36 |

|

ANZ |

AA- |

1,015,377 |

1,018,373 |

BBSW + 118 |

0.72% |

7/04/2016 |

7/04/2021 |

60 |

|

Suncorp-Metway |

A+ |

1,017,756 |

1,021,242 |

BBSW + 138 |

0.72% |

21/04/2016 |

12/04/2021 |

60 |

|

AMP |

A |

1,015,687 |

1,010,964 |

BBSW + 135 |

0.71% |

24/05/2016 |

24/05/2021 |

60 |

|

Westpac |

AA- |

1,017,886 |

1,020,948 |

BBSW + 117 |

0.72% |

3/06/2016 |

3/06/2021 |

60 |

|

CBA |

AA- |

1,015,976 |

1,018,942 |

BBSW + 121 |

0.72% |

12/07/2016 |

12/07/2021 |

60 |

|

ANZ |

AA- |

2,037,312 |

2,027,746 |

BBSW + 113 |

1.43% |

16/08/2016 |

16/08/2021 |

60 |

|

BOQ |

BBB+ |

1,509,491 |

1,514,436 |

BBSW + 117 |

1.07% |

26/10/2016 |

26/10/2020 |

48 |

|

NAB |

AA- |

1,010,147 |

1,013,333 |

BBSW + 105 |

0.72% |

21/10/2016 |

21/10/2021 |

60 |

|

Teachers Mutual |

BBB |

1,503,882 |

1,509,473 |

BBSW + 140 |

1.07% |

28/10/2016 |

28/10/2019 |

36 |

|

Bendigo-Adelaide |

BBB+ |

1,010,537 |

1,005,585 |

BBSW + 110 |

0.71% |

21/11/2016 |

21/02/2020 |

39 |

|

Westpac |

AA- |

1,010,387 |

1,013,793 |

BBSW + 111 |

0.72% |

7/02/2017 |

7/02/2022 |

60 |

|

ANZ |

AA- |

1,011,697 |

1,007,944 |

BBSW + 100 |

0.71% |

7/03/2017 |

7/03/2022 |

60 |

|

CUA |

BBB |

756,065 |

758,531 |

BBSW + 130 |

0.54% |

20/03/2017 |

20/03/2020 |

36 |

|

Heritage Bank |

BBB+ |

601,349 |

603,309 |

BBSW + 130 |

0.43% |

4/05/2017 |

4/05/2020 |

36 |

|

Teachers Mutual |

BBB |

1,006,767 |

1,011,624 |

BBSW + 142 |

0.71% |

29/06/2017 |

29/06/2020 |

36 |

|

NAB |

AA- |

3,017,631 |

3,029,352 |

BBSW + 90 |

2.14% |

5/07/2017 |

5/07/2022 |

60 |

|

Suncorp-Metway |

A+ |

1,008,767 |

1,005,445 |

BBSW + 97 |

0.71% |

16/08/2017 |

16/08/2022 |

60 |

|

Westpac |

AA- |

1,997,936 |

2,005,250 |

BBSW + 81 |

1.42% |

30/10/2017 |

27/10/2022 |

60 |

|

ME Bank |

BBB |

1,500,027 |

1,504,793 |

BBSW + 125 |

1.06% |

9/11/2017 |

9/11/2020 |

36 |

|

NAB |

AA- |

2,004,996 |

2,000,552 |

BBSW + 80 |

1.41% |

10/11/2017 |

10/02/2023 |

63 |

|

ANZ |

AA- |

1,495,137 |

1,502,258 |

BBSW + 77 |

1.06% |

18/01/2018 |

18/01/2023 |

60 |

|

Bendigo-Adelaide |

BBB+ |

497,694 |

500,398 |

BBSW + 105 |

0.35% |

25/01/2018 |

25/01/2023 |

60 |

|

Newcastle Permanent |

BBB |

1,491,177 |

1,499,364 |

BBSW + 140 |

1.06% |

6/02/2018 |

6/02/2023 |

60 |

|

Westpac |

AA- |

2,004,316 |

1,998,992 |

BBSW + 83 |

1.41% |

6/03/2018 |

6/03/2023 |

60 |

|

UBS |

A+ |

2,007,734 |

2,000,512 |

BBSW + 90 |

1.41% |

8/03/2018 |

8/03/2023 |

60 |

|

Heritage Bank |

BBB+ |

1,403,343 |

1,408,855 |

BBSW + 123 |

0.99% |

29/03/2018 |

29/03/2021 |

36 |

|

ME Bank |

BBB |

1,602,301 |

1,607,912 |

BBSW + 127 |

1.14% |

17/04/2018 |

16/04/2021 |

36 |

|

ANZ |

AA- |

1,999,756 |

2,006,850 |

BBSW + 93 |

1.42% |

9/05/2018 |

9/05/2023 |

60 |

|

NAB |

AA- |

2,012,374 |

2,004,810 |

BBSW + 90 |

1.42% |

16/05/2018 |

16/05/2023 |

60 |

|

CBA |

AA- |

0 |

2,005,870 |

BBSW + 93 |

1.42% |

16/08/2018 |

16/08/2023 |

60 |

|

Bank Australia |

BBB |

0 |

750,185 |

BBSW + 130 |

0.53% |

30/08/2018 |

30/08/2021 |

36 |

|

Institution |

Rating |

Closing Balance |

Closing Balance |

August |

August |

Investment |

Maturity |

Term |

|

Total Floating Rate Notes - Senior Debt |

|

57,770,780 |

53,524,685 |

|

37.78% |

|

|

|

|

Managed Funds |

|

|

|

|

|

|

|

|

|

NSW Tcorp |

NR |

1,436,122 |

1,459,169 |

1.60% |

1.03% |

17/03/2014 |

1/08/2023 |

112 |

|

Total Managed Funds |

|

1,436,122 |

1,459,169 |

1.60% |

1.03% |

|

|

|

|

TOTAL

CASH ASSETS, CASH |

|

128,804,548 |

141,666,033 |

|

100.00% |

|

|

|

|

LESS: RIVERINA REGIONAL LIBRARY (RRL) CASH AT BANK |

|

3,941,717 |

3,736,257 |

|

|

|

|

|

|

TOTAL

WWCC CASH ASSETS, CASH |

|

124,862,832 |

137,929,776 |

|

|

|

|

|

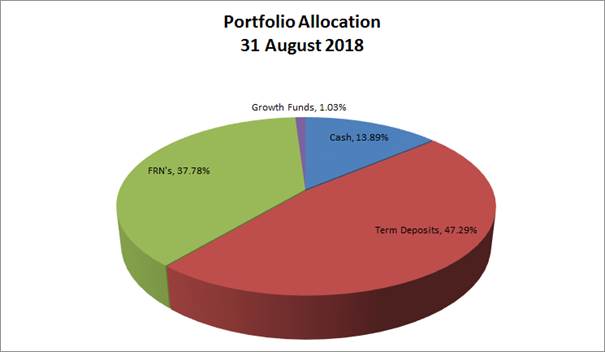

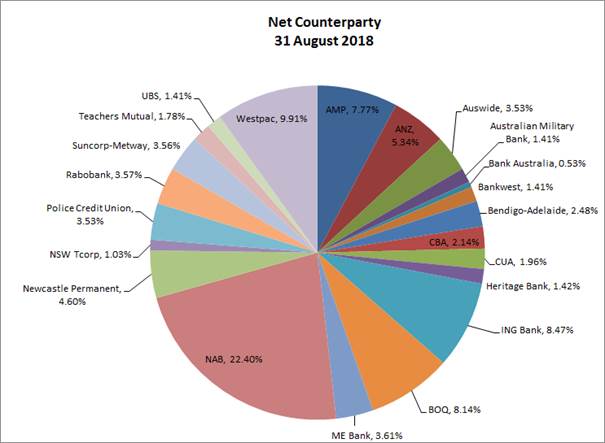

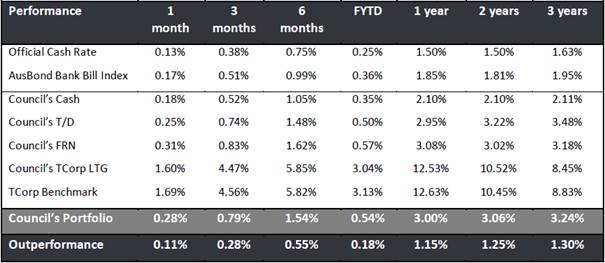

Council’s investment portfolio is now dominated by Term Deposits, equating to approximately 47% of the portfolio across a broad range of counterparties. Cash equates to 14% of the portfolio with Floating Rate Notes (FRNs) around 38% and growth funds around 1% of the portfolio.

Council’s investment portfolio is well diversified in complying assets across the entire credit spectrum. It is also well diversified from a rating perspective. Credit quality is diversified and is predominately invested amongst the investment grade Authorised Deposit-Taking Institutions (ADIs) (being BBB- or higher), with a smaller allocation to unrated ADIs.

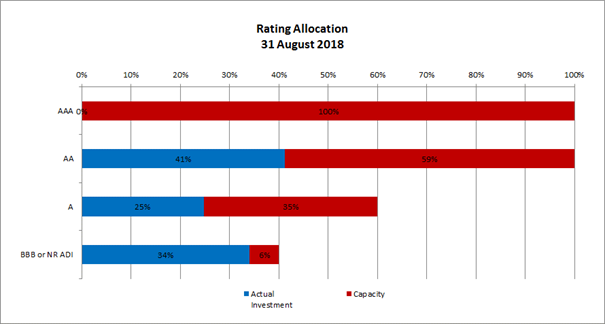

All investments are within the defined Policy limits, as outlined in the Rating Allocation chart below:

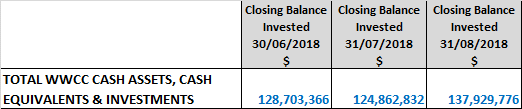

Investment Portfolio Balance

Council’s investment portfolio balance has increased from the previous month’s balance, up from $124.9M to $137.9M, which is reflective of the first quarter rates instalment being due at the end of August.

MONTHLY INVESTMENT MOVEMENTS

Redemptions/Sales – Council redeemed the following investment security during August 2018:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

Bank of Queensland Floating Rate Note |

$1M |

5 years |

BBSW + 107 |

This floating rate note was sold prior to maturity and funds were reinvested in the new 3 year Bank Australia FRN (see below). Council recognised a capital gain of $3,600. |

|

Bank of Queensland Floating Rate Note |

$1M |

5 years |

BBSW + 107 |

This floating rate note was sold prior to maturity and funds were used to invest in a number of new term deposits with ING, BoQ, Suncorp and Bankwest (see below). Council recognised a capital gain of $500. |

|

Westpac Floating Rate Note |

$4M |

5 years |

BBSW + 108 |

This floating rate note was sold prior to maturity and funds were reinvested in the new 5 year CBA FRN, with excess funds used to invest in a number of new term deposits with ING, BoQ, Suncorp and Bankwest (see below). Council recognised a capital gain of $41,920. |

|

CBA Floating Rate Note |

$1M |

5 years |

BBSW + 115 |

This floating rate note was sold prior to maturity and funds were used to invest in a number of new term deposits with ING, BoQ, Suncorp and Bankwest (see below). Council recognised a capital gain of $11,740. |

New Investments – Council purchased the following investment security during August 2018:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

Suncorp Bank Term Deposit |

$2M |

3 months |

2.65% |

The Suncorp Bank rate of 2.65% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

|

Bankwest Term Deposit |

$2M |

8 months |

2.76% |

The Bankwest rate of 2.76% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

|

ING Bank Term Deposit |

$2M |

2 years |

2.86% |

The ING Bank rate of 2.86% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

|

Bank of Queensland (BoQ) Term Deposit |

$3M |

4 years |

3.25% |

The BoQ rate of 3.25% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

|

ING Bank Term Deposit |

$3M |

2 years |

2.85% |

The ING Bank rate of 2.85% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

|

CBA Floating Rate Note |

$2M |

5 years |

BBSW + 93 |

Council’s independent Financial Advisor advised this Floating Rate Note represented good value with a highly rated institution. |

|

Bank Australia Floating Rate Note |

$750K |

3 years |

BBSW + 130 |

Council’s independent Financial Advisor advised this Floating Rate Note represented fair value. |

Rollovers – Council rolled the following investment securities during August 2018:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

AMP Term Deposit |

$2M |

12 months |

2.60% |

This term deposit was a 12 month investment at 2.60% and was rolled at maturity into a 18 month term deposit at 3.00%. |

MONTHLY PERFORMANCE

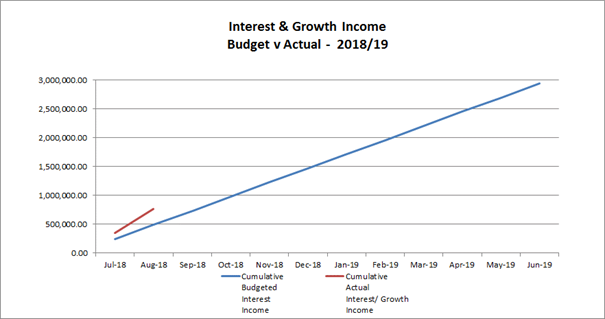

Interest/growth/capital gains for the month totaled $425,489, which compares favourably with the budget for the period of $244,709, outperforming budget for the month of August by $180,780. This is mainly due to a positive movement for Councils Floating Rate Note (FRN) portfolio during August as well as a larger than expected portfolio balance.

It should be noted that a majority of Councils FRNs continue to trade at a premium. The capital market value of these investments will fluctuate from month to month and Council continues to receive the coupon payments and the face value of the investment security when sold or at maturity.

It is important to note Council’s investment portfolio balance is tracking well above what was originally predicted. This is mainly due to the timing of some of the major projects that are either not yet commenced or not as advanced as originally predicted. It is anticipated that over the 2018/19 financial year the portfolio balance will reduce in line with the completion of major projects. This will result in Councils investment portfolio continuing to maintain a higher balance until these projects commence or advance further.

The longer-dated deposits in the portfolio, particularly those locked in above 4% yields, have previously anchored Council’s portfolio performance. It should be noted that the portfolio now only includes two investments yielding above 4% and Council will inevitably see a fall in investment income over the coming months compared with previous periods. Council staff and Council’s Independent Financial Advisor will continue to identify opportunities to lock in higher yielding investments as they become available.

In comparison to the AusBond Bank Bill Index* (+1.85%pa), Council’s investment portfolio returned 3.36% (annualised) for August. Cash and At-Call accounts returned 2.16% (annualized) for this period. These funds are utilised for daily cash flow management and need to be available to meet operating and contractual payments as they come due.

* The AusBond Bank Bill Index is the leading benchmark for the Australian fixed income market. It is interpolated from the RBA Cash rate, 1 month and 3 month Bank Bill Swap rates.

Report by Responsible Accounting Officer

I hereby certify that all of the above investments have been made in accordance with the provision of Section 625 of the Local Government Act 1993 and the regulations there under, and in accordance with the Investments Policy adopted by Council on 26 February 2018.

Carolyn Rodney

Responsible Accounting Officer

Policy and Legislation

Budget variations are reported in accordance with Council’s POL 052 Budget Policy.

Investments are reported in accordance with Council’s POL 075 Investment Policy.

Local Government Act 1993

625 How may councils invest?

(1) A council may invest money that is not, for the time being, required by the council for any other purpose.

(2) Money may be invested only in a form of investment notified by order of the Minister published in the Gazette.

(3) An order of the Minister notifying a form of investment for the purposes of this section must not be made without the approval of the Treasurer.

(4) The acquisition, in accordance with section 358, of a controlling interest in a corporation or an entity within the meaning of that section is not an investment for the purposes of this section.

Local Government (General) Regulation 2005

212 Reports on council investments

(1) The responsible accounting officer of a council:

(a) must provide the council with a written report (setting out details of all money that the council has invested under section 625 of the Act) to be presented:

(i) if only one ordinary meeting of the council is held in a month, at that meeting, or

(ii) if more than one such meeting is held in a month, at whichever of those meetings the council by resolution determines, and

(b) must include in the report a certificate as to whether or not the investment has been made in accordance with the Act, the regulations and the council’s investment policies.

(2) The report must be made up to the last day of the month immediately preceding the meeting.

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

This report is a control mechanism that assists in addressing the following potential risks to Council:

· Loss of investment income or capital resulting from ongoing management of investments, especially during difficult economic times

· Failure to demonstrate to the community that its funds are being expended in an efficient and effective manner

Internal / External Consultation

Council’s Community Engagement Strategy and IAP2 considers the community to be “any individual or group of individuals, organisation or political entity with an interest in the outcome of a decision….”

All relevant areas within the Council have consulted with the Finance Division in regards to the budget variations listed in this report.

The Finance Division has consulted with relevant external parties to confirm Council’s investment portfolio balances.

Report submitted to the Ordinary Meeting of Council on Monday 24 September 2018. RP-4

RP-4 Invitation to join Regional Cities New South Wales

General Manager: Peter Thompson

|

Analysis: |

This report is for Council’s consideration in joining a new regional alliance called Regional Cities NSW (RCNSW), to share opportunities and challenges for growth and investment with cities that expand outside of the metropolitan areas of Sydney, Newcastle and Wollongong. |

|

That Council: a note the information contained within this report b join Regional Cities NSW (RCNSW) provided at least nine of the cities identified in this report resolve to participate in forming the group c conduct a review of its membership within the first 24 months of the formal commencement of RCNSW, to ensure it is meeting its stated objectives d endorse the budget variation as outlined in the Financial Implications section of this report e note that any future requests for financial contributions over and above the annual membership fee to RCNSW will be reported to Council for further consideration |

Report

In early December 2017, Council received an invitation from the NSW Inland Forum to consider joining a new group called Regional Cities NSW (RCNSW).

The NSW Inland Forum is an existing group of seven Councils that have worked collaboratively for a number of years to achieve improved outcomes and opportunities for inland NSW. The current NSW Inland Forum member Councils are Albury, Armidale, Bathurst, Dubbo, Orange, Tamworth and Wagga Wagga. The membership of the NSW Inland Forum have agreed that there is great potential in expanding the membership of the group to create a new body to be known at RCNSW, hence the invitation received by Council.

According to the invitation, RCNSW is to be based on the successful model that has been implemented in Victoria, where the ten largest cities outside of Melbourne work cooperatively on issues and projects of mutual interest that affect regional cities in that State.

Following the invitation by the NSW Inland Forum to join RCNSW, the Mayor and General Manager attended a meeting in Sydney on 1 March 2018 to discuss the proposed new group with members of the NSW Inland Forum and other invited regional Councils.

This meeting was followed up by a planning day held in Sydney on 2 August 2018, attended by the Mayor and General Manager and other invited regional Councils, where further thinking around the establishment of RCNSW was workshopped and discussed. The report from this workshop is attached.

In summary, the original proposal received from the NSW Inland Forum was as follows:

· RCNSW will be comprised of Mayors and CEOs/General Managers of 16 large cities in regional New South Wales. These cities reside outside of the expanded metropolitan areas of Sydney, Newcastle and Wollongong, have distinct regional catchments, and share similar opportunities and challenges for growth and investment.

· RCNSW will be an alliance of regional cities dedicated to achieving real change in regional New South Wales though policy development and active implementation of those policies. Regional cities are the heart of regional New South Wales and by improving their infrastructure and liveability, regional cities can help to grow and support wide regional and rural communities.

For information, the Councils invites to participate in RCNSW are as follows:

|

Albury |

Coffs Harbour |

Maitland |

Tamworth |

|

Armidale |

Dubbo |

Orange |

Bathurst |

|

Griffith |

Tweed |

Cessnock |

Lismore |

|

Queanbeyan-Palerang |

Wagga Wagga |

Mid-Coast |

Port Macquarie-Hastings |

At the planning day held on 2 August 2018, participants agreed on the following indicators of overall success for RCNSW:

· State government and community have recognised the significance and benefits of regional cities

· A seat at the policy table to advise state government on the formation and implementation of policies

· The establishment of a population or settlement strategy that would prioritise population growth to regional cities

· The alliance is known as having a clear point of difference from the other alliances in the regional development space

· A strong network that offers collaboration, networking and collective benefit to all members

Further information relating to what success might look like for RCNSW, can be found on pages 7 and 8 of the attached workshop report.

It was agreed at the planning day that the overall success of RCNSW would be the creation of connected, thriving and sustainable regional cities. To this end, discussion took place on the establishment of a short-term agenda for RCNSW, to ensure that this new alliance was more than simply a talk-fest on regional issues, but had real actions and goals to work towards. The most supported ideas around this to come from the planning day were:

Memorandum of Understanding (MOU) with State Government - Establishing, through a formal agreement, a mechanism for the alliance to have a seat at the table and provide strategic influence on the State’s policy and investment agenda.

Snowy Hydro Funding - Providing a set of recommendations on how the government should invest the $4.2 Billion released in the NSW budget from the sale of Snowy Hydro project. The government has indicated that all of these funds will go to the regions and they will need guidance on how this money should be allocated. The group also anticipated that there would be streamlined funding mechanisms to enable regional cities to access this funding.

Population Strategy - Due to ongoing debate of metropolitan congestion and rapid population growth, the group saw a great opportunity to have influence in developing a framework for growing regional cities under the banner of a state population strategy, with the aim being to develop a settlement plan directing people, infrastructure and business to regional cities.

Regional Investment - Identifying a framework to identify how regional investment can be streamlined to be better facilitated in the regions.

One of the other key purposes of the 2 August 2018 planning day was to discuss the proposed governance and structure arrangements for RCNSW. Further details on this can be found on pages 10 to 14 of the attached workshop report, however in summary, the following was agreed:

|

Formation: |

The alliance to be known as Regional Cities New South Wales (RCNSW) be formed.

|

|

Membership: |

Councils representing regional cities that had a clear service centre role would be invited to be members.

|

|

Board Members: |

The forum should be a Mayor and CEO/General Manager forum with alternates offered in the case of inability to attend.

|

|

Board Structure: |

All member Councils (Mayor and CEO/General Manager) will sit on the board. Voting will be by consensus.

|

|

Meeting Schedule: |

Members agreed to meeting quarterly at a venue to be defined at a later date, noting that visits to each member city would be welcomed.

|

|

Working Group: |

It was agreed that a working group to further define and evolve the structure and agenda of the alliance be established, as well as to work through the development of the proposed MOU. Working Group members were nominated as:

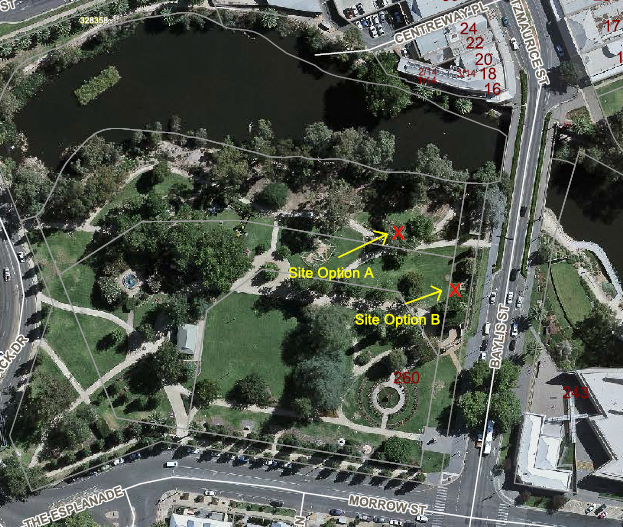

· Paul Bennett, GM, Tamworth Regional Council · Craig Swift-McNair, GM, Port Macquarie-Hastings · David Sherley, GM, Bathurst Regional Council · Peter Thompson, GM, Wagga Wagga City Council · Susan Law, CEO, Armidale Regional Council. |