AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

29 October 2018

AT 6:00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

29 October 2018

AT 6:00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 29 October 2018 at 6:00pm.

Council live streams video and audio of Council meetings. Members of the public are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

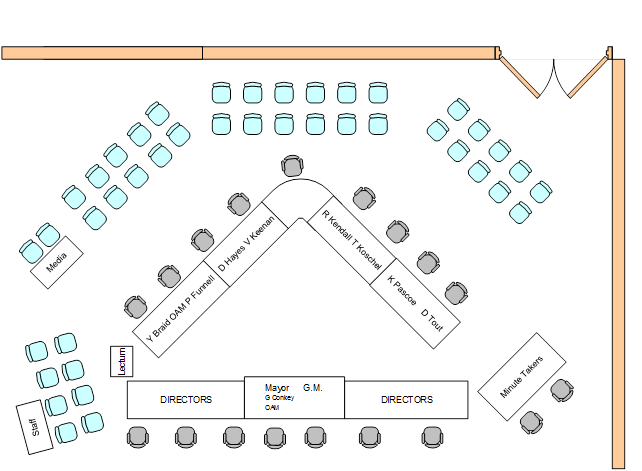

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 29 October 2018.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 29 October 2018

CLAUSE PRECIS PAGE

PRAYER 3

ACKNOWLEDGEMENT OF COUNTRY 3

APOLOGIES 3

CONFIRMATIONS OF MINUTES

CM-1 Ordinary Council Meeting - 8 October 2018 3

DECLARATIONS OF INTEREST 3

Reports from Staff

RP-1 ANNUAL FINANCIAL STATEMENTS 4

RP-2 Financial Performance Report as at 30 September 2018 11

RP-3 DISCLOSURE OF PECUNIARY INTEREST RETURNS - COUNCILLORS AND DESIGNATED STAFF 2018 35

RP-4 Proposed Voluntary Planning Agreement for environmental land associated with DA 17/0572 - Lot 39 Genista Place 37

RP-5 Lake Albert Blue Green Algae Remediation 64

RP-6 Gregadoo Waste Management Centre - Biosolid Processing 72

RP-7 Gregadoo Waste Management Centre - Gas Capture Network Extension and Gas Powered Evaporator 75

RP-8 Gregadoo Waste Management Centre - Aceess Road and Fence Construction 78

RP-9 Gregadoo Waste Management Centre - Community Recycling Centre Funding Grant 81

Committee Minutes

M-1 Audit, Risk and Improvement Committee Minutes - 11 October 2018 84

QUESTIONS/BUSINESS WITH NOTICE 91

Confidential Reports

CONF-1 RFT2019-11 LANDSCAPE DESIGNS RIVERSIDE STAGE II 92

CONF-2 Proposed Easement for Transmission Line - East Bomen Road and Trahairs Road 93

CONF-3 RFT2018-34 MAIN WAGGA LEVEE UPGRADE STAGE 2 94

CONF-4 RFT2019-10 SUPPLY READY MIX CONCRETE & ASSOCIATED PRODUCTS 95

CONF-5 POTENTIAL EVENT OPPORTUNITY 96

CONF-6 RFT2019-07 MUSEUM REDEVELOPMENT DETAILED DESIGN 97

CONF-7 RFT2018-14 FOOD AND GARDEN ORGANICS ACCEPTANCE PROCESSING SERVICE 98

PRAYER

Confirmation of Minutes

CM-1 Ordinary Council Meeting - 8 October 2018

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 8 October 2018 be confirmed as a true and accurate record.

|

|

1⇩. |

Ordinary Council Meeting - Minutes - 8 October 2018 |

99 |

RP-1 ANNUAL FINANCIAL STATEMENTS

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Analysis: |

The 2017/18 Financial Statements have been completed by Council staff, and have recently been audited by the NSW Audit Office. |

|

That Council: a note the comments from the Audit, Risk & Improvement Committee regarding the 2017/18 Financial Statements b approve the signing of the 2017/18 Financial Statements pursuant to Section 413 (2)(c) of the Local Government Act 1993 c approve the closing balances of the Restricted Assets (Reserves) as at 30 June 2018 as detailed in Note 6 (c) - Cash & Investments d receive a presentation from the NSW Audit Office on the audited financial reports and auditors report at the 26 November 2018 Council Meeting, pursuant to Section 418 (1) and provide public notice accordingly |

Report

The 2017/18 Annual Financial Statements have been prepared and Council’s external auditors, NSW Audit Office have completed their audit. It is a requirement of the Local Government Act 1993 that Council prepare a statement on the General Purpose and Special Purpose Financial Reports prior to sign off by the auditor. These statements must be signed by the Mayor, one Councillor, the General Manager and the Responsible Accounting Officer. The Financial Statements will remain in a draft form until the audit is completed.

This statement is required to be signed and included in the Financial Statements prior to the auditor providing the final reports. The Financial Statements together with the auditors’ reports must be forwarded to the Office of Local Government by 31 October 2018.

The 2017/18 financial statements were presented to the Audit, Risk & Improvement Committee (ARIC) at its meeting on 11 October 2018. The report from the Chairperson is included in the Committee meetings minutes in a separate report – M-1, with an extract provided below for Councillor’s information:

Extract from the Report from the ARIC Chairperson:

The Committee considered in detail the draft financial statements for 2017-18 and directed a range of questions to the Manager Finance, the Director Finance and representatives of the external auditor, Audit Office NSW.

Members commended the Finance Team on the quality and readability of the reports.

The Committee recommends to Council that the reports be accepted and that they be approved for signing on behalf of Council.

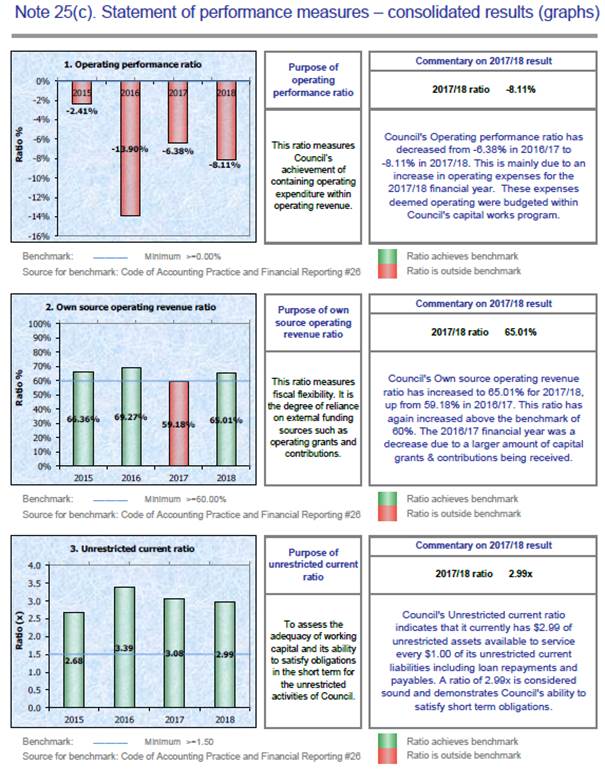

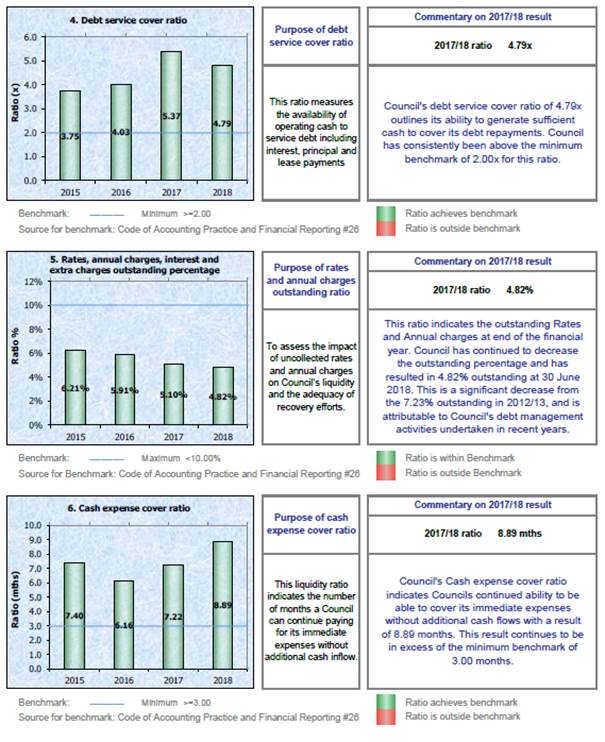

2017/18 Financial Overview

The 2017/18 draft financial statements show total income from continuing operations of $146.8M, total expenses from continuing operations of $124.7M, resulting in a preliminary net operating surplus of $22.1M (including capital grants and contributions). The 2016/17 financial year resulted in a net operating surplus of $32.6M. The main difference in the reduced net result is attributable to a reduction in grants and contributions received for 2017/18.

Extract from the 2017/18 Draft Financial Statements

As of 30 June 2018 Council held $36.8M in internal reserves, an increase of $1.1M on the previous year. The major internally restricted reserves Council holds are:

|

Reserve Name |

30 June 2018 Balance |

30 June 2017 Balance |

Increase/ (Decrease) from prior year* |

|

Plant and Vehicle Replacement |

$3.935M |

$5.894M |

($1.959M) |

|

Employees Leave Entitlements |

$3.323M |

$3.185M |

$138K |

|

Fit for the Future |

$5.340M |

$3.033M |

$2.307M |

|

Grant Commission |

$5.199M |

$4.957M |

$242K |

*Notes on Increases/(Decreases)

· Plant and Vehicle Replacement Reserve – Council experienced delays in fulfilling their plant replacement program during the 2016/17 financial year, and were able to catch up some of the backlog in replacement during the 2017/18 financial year.

· Fit for the Future Reserve – an additional $2.3M has been transferred to this reserve, bringing the balance up to $5.340M. Council’s Fit for the Future submission notes an annual target of identifying efficiencies of $800K to be spent on asset renewals. A detailed program of priority works will be established during the 2018/19 financial year.

· Grant Commission Reserve – $5.199M received in 2017/18 for the prepayment of the Financial Assistance Grant relating to the 2018/19 financial year. This prepayment occurred in the 2016/17 financial year also, for 2017/18.

Extract from the draft 2017/18 Financial Statements:

A copy of the Draft Financial Statements is attached to this report.

Financial Implications

Whilst this report and associated attachments show Council’s financial performance and position for the 2017/18 financial year, the adoption of this report by the Council has no financial implications.

Policy and Legislation

Local Government Act 1993

Sections: 413 - Preparation of Financial Reports

418 - Public notice to be given of presentation of financial reports

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

The NSW Audit Office will provide Council with a final Management Letter by 30 November 2018, with the Interim Management Letter previously discussed at the 10 August 2018 Audit, Risk & Improvement Meeting. The Interim Management Letter identified five issues with two rating as Moderate and three rated as Low. Council officers will undertake the actions that will be identified in the Final Management Responses.

Internal / External Consultation

The Council’s Community Engagement Strategy and IAP2 considers the community to be “any individual or group of individuals, organisation or political entity with an interest in the outcome of a decision….”

Council’s external auditors, NSW Audit Office have liaised with Council’s Finance division. The NSW Audit Office will be providing the Committee members with the Client Service Report and the Conduct on the Audit Report prior to the meeting date.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

|

X |

|

|

|

|

|

|

|

|

|||||

|

Involve |

|

|

|

|

|

|

|

|

|||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

2017/18 Draft General Purpose Financial Statements - Provided under separate cover |

|

|

2. |

2017/18 Draft Special Purpose Financial Statements - Provided under separate cover |

|

|

3. |

2017/18 Draft Special Schedules - Provided under separate cover |

|

|

4. |

2017/18 GPFS Councillor Statement - Provided under separate cover |

|

|

5. |

2017/18 SPFS Councillor Statement - Provided under separate cover |

|

RP-2 Financial Performance Report as at 30 September 2018

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Analysis: |

This report is for Council to consider and approve the proposed 2018/19 budget variations required to manage the 2018/19 budget and Long Term Financial Plan, and details Council’s external investments and performance as at 30 September 2018. |

|

That Council: a approve the proposed 2018/19 budget variations for the month ended 30 September 2018 and note the balanced budget position as presented in this report b approve the future year adjustments to the Long Term Financial Plan for loan repayments as detailed in this report c approve the future year adjustment to the Long Term Financial Plan for an ArtsNSW event as detailed in this report d provide financial assistance of the following amounts in accordance with Section 356 of the Local Government Act 1993: i) The Women’s Domestic Violence Court Advocacy Service $1,298 ii) Riverina Pregnancy and Baby Loss Support group (Bloss) $ 85 e note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above f note details of the external investments as at 30 September 2018 in accordance with section 625 of the Local Government Act 1993 g in accordance with Regulation 212(1)(ii) of the Local Government (General) Regulation 2005, receive the report on council investments in the second Council meeting of each month |

Report

Wagga Wagga City Council (Council) forecasts a balanced budget position as at 30 September 2018. Proposed budget variations are detailed in this report for Council’s consideration and adoption.

Council has experienced a positive monthly investment performance for the month of September, when compared to budget. This is a result of a larger than expected portfolio balance as well as better than expected interest rates.

Key Performance Indicators

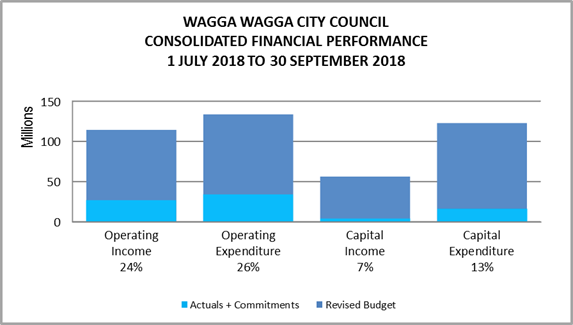

OPERATING INCOME

Total operating income is 24% of approved budget, which is tracking only slightly below budget for the end of September (this percentage excludes capital grants and contributions). An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 66%.

OPERATING EXPENSES

Total operating expenditure is 26% of approved budget and is tracking only slightly over budget for the full financial year.

CAPITAL INCOME

Total capital income is 7% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions relating to projects. This income also includes the sale of property, plant and equipment.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 13% of approved budget.

|

WAGGA WAGGA

CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2018/19 |

COMMT'S 2018/19 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|||||||

|

Rates & Annual Charges |

(65,998,971) |

0 |

(65,998,971) |

(17,542,298) |

0 |

(17,542,298) |

27% |

|

User Charges & Fees |

(26,844,544) |

150,317 |

(26,694,227) |

(5,404,473) |

0 |

(5,404,473) |

20% |

|

Interest & Investment Revenue |

(2,917,452) |

(205,000) |

(3,122,452) |

(1,119,638) |

0 |

(1,119,638) |

36% |

|

Other Revenues |

(2,983,104) |

(308,552) |

(3,291,656) |

(1,021,934) |

0 |

(1,021,934) |

31% |

|

Operating Grants & Contributions |

(13,894,989) |

(1,273,816) |

(15,168,805) |

(1,901,692) |

0 |

(1,901,692) |

13% |

|

Capital Grants & Contributions |

(36,517,290) |

(16,724,481) |

(53,241,771) |

(3,835,041) |

0 |

(3,835,041) |

7% |

|

Total Revenue |

(149,156,350) |

(18,361,532) |

(167,517,882) |

(30,825,076) |

0 |

(30,825,076) |

18% |

|

|

|||||||

|

Expenses

|

|||||||

|

Employee Benefits & On-Costs |

44,786,608 |

(40,278) |

44,746,330 |

11,048,980 |

40,649 |

11,089,629 |

25% |

|

Borrowing Costs |

3,752,580 |

0 |

3,752,580 |

819,115 |

0 |

819,115 |

22% |

|

Materials & Contracts |

32,384,231 |

5,331,911 |

37,716,142 |

7,491,054 |

3,394,132 |

10,885,186 |

29% |

|

Depreciation & Amortisation |

35,418,997 |

0 |

35,418,997 |

8,854,749 |

0 |

8,854,749 |

25% |

|

Other Expenses |

12,125,204 |

(156,252) |

11,968,952 |

2,406,710 |

95,789 |

2,502,499 |

21% |

|

Total Expenses |

128,467,621 |

5,135,380 |

133,603,001 |

30,620,609 |

3,530,570 |

34,151,179 |

26% |

|

|

|

||||||

|

Net Operating (Profit)/Loss |

(20,688,729) |

(13,226,152) |

(33,914,881) |

(204,467) |

3,530,570 |

3,326,102 |

|

|

|

|||||||

|

Net Operating (Profit)/Loss before Capital Grants & Contributions |

15,828,561 |

3,498,329 |

19,326,890 |

3,630,574 |

3,530,570 |

7,161,143 |

|

|

|

|||||||

|

Capital / Reserve Movements |

|||||||

|

Capital Exp - Renewals |

33,260,752 |

13,008,380 |

46,269,132 |

2,971,773 |

4,463,358 |

7,435,131 |

16% |

|

Capital Exp - New Projects |

31,336,485 |

16,649,895 |

47,986,381 |

3,491,533 |

4,550,502 |

8,042,035 |

17% |

|

Capital Exp - Project Concepts |

25,044,335 |

369,459 |

25,413,794 |

11,796 |

47,421 |

59,217 |

0% |

|

Loan Repayments |

3,129,777 |

0 |

3,129,777 |

782,444 |

0 |

782,444 |

25% |

|

New Loan Borrowings |

(6,108,672) |

(608,380) |

(6,717,052) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(952,795) |

(2,095,732) |

(3,048,527) |

(290,235) |

0 |

(290,235) |

10% |

|

Net Movements Reserves |

(29,602,157) |

(14,097,470) |

(43,699,627) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

56,107,727 |

13,226,152 |

69,333,878 |

6,967,310 |

9,061,281 |

16,028,591 |

|

|

|

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED

BUDGET |

YTD ACTUAL EXCL COMMT'S 2018/19 |

COMMT'S 2018/19 |

YTD ACTUAL +

COMMT'S |

YTD % OF BUD |

|

Net Result after Depreciation |

35,418,997 |

0 |

35,418,997 |

6,762,843 |

12,591,850 |

19,354,693 |

|

|

|

|||||||

|

Add back Depreciation Expense |

35,418,997 |

0 |

35,418,997 |

8,854,749 |

0 |

8,854,749 |

25% |

|

|

|||||||

|

Cash Budget (Surplus)/Deficit |

0 |

0 |

0 |

(2,091,906) |

12,591,850 |

10,499,944 |

|

Revised Budget Result - Surplus/(Deficit) |

$’000s |

|

Original 2018/19 Budget Result as adopted by Council Total Budget Variations approved to date Budget variations for September 2018 |

$0 $0 $0 |

|

Proposed revised budget result for 30 September 2018 |

$0 |

The proposed Budget Variations to 30 September 2018 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact Fav/ (Unfav) |

||

|

1 – Community Leadership and Collaboration |

|||||

|

External & Internal Loan Repayments |

$348K |

Airport Reserve ($279K) Event Attraction Reserve ($69K) |

Nil |

||

|

Due to the carryover of capital works projects from 2017/18 to 2018/19, the total amount of loan borrowings budgeted for 2017/18 was not required. This has the effect of delaying loan borrowings and subsequent repayments in future years. In addition to this, the subsequent borrowing rate for 2017/18 was less than budgeted. This review has resulted in savings of $348K in 2018/19, with $279K attributed to the Airport Reserve and $69K in GPR savings. The $69K in GPR savings has been set aside in a new Event Attraction Reserve pending future reports to Council. Creation of this reserve should enable Council to continue attracting and delivering events into the city, which has both a community and an economic benefit for Wagga Wagga, along with enhancing liveability. It is intended that additional funds are considered to be set aside in the reserve during the budget process. The future year budget adjustments from the review of loan borrowings have been detailed below in a separate table. |

|

||||

|

2 – Safe and Healthy Community |

|||||

|

PCYC Contribution |

$2,364K |

External Borrowings ($2,364K) |

Nil |

||

|

Due to delays in construction of the new PCYC facility, it has been determined that the contribution from Council will not be required in 2018/19 and is to be deferred to 2019/20. This has resulted in the deferral of external loan borrowings and loan repayments, which are reflected separately in the table below. |

|

||||

|

Strategic Fire Breaks |

$68K |

Rural Fire Service ($68K) |

Nil |

||

|

Council has been successful with their grant application to the Rural Fire Service (RFS) for Rural Fire Fighting grant funds. These funds will be utilised to carry out hazard reduction works, through the chemical and mechanical treatment of strategic fire breaks at 14 locations. |

|

||||

|

Lights 4 Lake Maintenance |

$18K |

Street Lighting Reserve ($18K) |

Nil |

||

|

Significant damage on a number of lights at the lake from ant infestation has resulted in the replacement of some of these lights not repairable under warranty. Additional works have also included the installation of ant bait stations, further cleaning and diagnostics. It is proposed to fund these works from the Street Lighting Reserve. |

|

||||

|

4 – Community Place and Identity |

|||||

|

Sector Support Program |

$192K |

Department of Health Grant Funding ($192K) |

Nil |

||

|

Council has been successful in securing a further two years of grant funding from the Commonwealth Department of Health to continue the auspice of the sector development service in ageing and disability. The program will operate over the two financial years 2018/19 and 2019/20 with grant funding of $192K to be received each financial year. |

|

||||

|

FUSION Festival |

$25K |

Riverina Water Sponsorship ($25K) |

Nil |

||

|

Riverina Water has agreed to be a major sponsor of the FUSION Festival over a 3 year period 2018/19 – 2020/21 contributing $25K each financial year. These additional funds will be used towards the running of the event including the commissioning of creative works and musical acts for the festival. |

|

||||

|

5 – The Environment |

|||

|

Pine Gully Roundabout |

$200K |

Section 94 Reserve ($200K) |

Nil |

|

It is proposed to bring forward the design budget allocated in 2019/20 for the Pine Gully Road Roundabout into this financial year to allow the design for the project to occur. The project is currently allocated to ‘Potential Projects’ and has $1.3M allocated for construction in 2020/21. This will tie in with the proposed structure plan for the northern growth area, which will be presented to Councillors early in the new calendar year. The project is funded from the Section 94 Reserve. |

|

||

|

SURPLUS/(DEFICIT) |

Nil |

||

Future Year External Loan Repayment Budget Adjustments

A review was conducted on the borrowing schedule and assumptions given the rates that were achieved for 2017/18 borrowings (3.26% compared to a 3.55% assumption). Based on this rate as a guide, a further review was undertaken on future year borrowing rates, which resulted in savings as these have been reduced by 0.5% (the 4% assumption in 2018/19 has been reduced to 3.5% for example). Furthermore, it was also determined that the PCYC contribution of $2.4M which is funded from loan borrowings would not be required in 2018/19 and could be deferred to 2019/20 resulting in a significant saving of $220K to loan repayments in 2019/20. Additional borrowings that were not required in 2017/18 for particular capital projects have also been adjusted resulting in repayment savings, particularly for the airport.

This review has resulted in future year surplus budget adjustments as presented in the table below, which will reduce the bottom line deficits in the adopted 2018/19 Long Term Financial Plan.

|

Financial Year |

Airport Reserve |

Cemetery Reserve |

GPR |

Total Budget Saving |

|

2018/19 |

$278,507 |

$0 |

$69,421* |

$347,928 |

|

2019/20 |

$281,836 |

$0 |

$242,689 |

$524,525 |

|

2020/21 |

$160,906 |

$0 |

$33,874 |

$194,780 |

|

2021/22 |

$162,109 |

$0 |

$33,874 |

$195,983 |

|

2022/23 |

$162,109 |

$7,117 |

$33,874 |

$203,100 |

|

2023/24 |

$162,109 |

$7,117 |

$33,874 |

$203,100 |

|

2024/25 |

$164,527 |

$7,117 |

$41,453 |

$213,097 |

|

2025/26 |

$164,527 |

$7,117 |

$41,453 |

$213,097 |

|

2026/27 |

$164,527 |

$7,117 |

$41,453 |

$213,097 |

|

2027/28 |

$164,527 |

$7,117 |

$41,453 |

$213,097 |

|

TOTAL |

$1,865,684 |

$42,702 |

$613,418 |

$2,521,804 |

* A further report will be presented to Council allocating these funds.

Regional Arts NSW (RANSW) Event

As per the CONF- 2 ‘Additional Event Funding Requests’ report presented to Council on 28 May 2018 Resolution 18/191, funds are required in 2020/21 for Council to host this event. It is proposed to fund the variation from the external loan repayment savings in 2019/20 and restrict these funds until required in 2020/21.

Proposed Long Term Financial Plan Bottom Line

|

Financial Year |

Adopted 2018/19 LTFP Bottom Line (Surplus)/ Deficit |

Budget Variations Approved to date (Relationships Australia lease) |

External Loan Repayment Budget Adjustments |

ArtsNSW~ |

Revised LTFP Bottom Line (Surplus)/ Deficit |

|

2019/20 |

$995,043 |

($16,046) |

($242,689) |

$40,000 |

$776,308 |

|

2020/21 |

$398,372 |

($16,448) |

($33,874) |

$0 |

$348,050 |

|

2021/22 |

$307,404 |

($16,859) |

($33,874) |

$0 |

$256,671 |

|

2022/23 |

$703,257 |

($17,280) |

($33,874) |

$0 |

$652,103 |

|

2023/24 |

$355,147 |

($17,712) |

($33,874) |

$0 |

$303,561 |

|

2024/25 |

$467,639 |

($18,155) |

($41,453) |

$0 |

$408,031 |

|

2025/26 |

($90,555) |

($18,609) |

($41,453) |

$0 |

($150,617) |

|

2026/27 |

($402,280) |

($19,074) |

($41,453) |

$0 |

($462,807) |

|

2027/28 |

($1,567,767) |

($19,551) |

($41,453) |

$0 |

($1,628,771) |

~$40K restricted into Reserve for 2019/20 and allocated into the 2020/21 financial year budget.

Current Restrictions

|

RESERVES SUMMARY |

|||||

|

30 SEPTEMBER 2018 |

|||||

|

|

CLOSING BALANCE 2017/18 |

ADOPTED RESERVE TRANSFERS 2018/19 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 8.10.18 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

|

|

|

|

|

|

|

Externally Restricted |

|

|

|

|

|

|

Developer Contributions |

(25,903,320) |

8,264,183 |

2,009,310 |

200,000 |

(15,429,827) |

|

Sewer Fund |

(26,204,212) |

4,267,364 |

2,638,508 |

0 |

(19,298,341) |

|

Solid Waste |

(20,184,154) |

9,600,364 |

955,359 |

0 |

(9,628,430) |

|

Specific Purpose Grants |

(3,519,384) |

0 |

3,519,384 |

0 |

0 |

|

SRV Levee |

(2,847,382) |

1,807,667 |

892,802 |

0 |

(146,914) |

|

Stormwater Levy |

(3,167,296) |

162,032 |

102,841 |

0 |

(2,902,423) |

|

Total Externally Restricted |

(81,825,747) |

24,101,610 |

10,118,202 |

200,000 |

(47,405,934) |

|

|

|

||||

|

Internally Restricted |

|

||||

|

Airport |

(63,685) |

(158,452) |

(52,270) |

(278,507) |

(552,914) |

|

Art Gallery |

(49,209) |

13,262 |

0 |

0 |

(35,947) |

|

Ashmont Community Facility |

(6,000) |

(1,500) |

0 |

0 |

(7,500) |

|

Bridge Replacement |

(201,972) |

(100,000) |

0 |

0 |

(301,972) |

|

CBD Carparking Facilities |

(863,695) |

160,302 |

50,801 |

0 |

(652,592) |

|

CCTV |

(74,476) |

(10,000) |

0 |

0 |

(84,476) |

|

Cemetery Perpetual |

(65,479) |

(129,379) |

51,958 |

0 |

(142,900) |

|

Cemetery |

(452,507) |

420 |

139,581 |

0 |

(312,506) |

|

Civic Theatre Operating |

0 |

(55,000) |

55,000 |

0 |

0 |

|

Civic Theatre Technical Infrastructure |

(92,585) |

(50,000) |

4,911 |

0 |

(137,675) |

|

Civil Projects |

(155,883) |

0 |

0 |

0 |

(155,883) |

|

Community Amenities |

(76,763) |

0 |

0 |

0 |

(76,763) |

|

Community Works |

(61,888) |

(59,720) |

0 |

0 |

(121,608) |

|

Council Election |

(255,952) |

(76,333) |

5,000 |

0 |

(327,285) |

|

Emergency Events |

(220,160) |

0 |

29,000 |

0 |

(191,160) |

|

Employee Leave Entitlements |

(3,322,780) |

0 |

0 |

0 |

(3,322,780) |

|

Environmental Conservation |

(131,351) |

20,295 |

0 |

0 |

(111,056) |

|

Estella Community Centre |

(230,992) |

178,519 |

0 |

0 |

(52,473) |

|

Family Day Care |

(320,364) |

75,366 |

(1,556) |

0 |

(246,555) |

|

Fit for the Future |

(5,340,222) |

4,444,014 |

661,863 |

0 |

(234,345) |

|

Generic Projects Saving |

(1,056,917) |

150,000 |

115,306 |

0 |

(791,611) |

|

Glenfield Community Centre |

(19,704) |

(2,000) |

0 |

0 |

(21,704) |

|

Grants Commission |

(5,199,163) |

0 |

0 |

0 |

(5,199,163) |

|

Grassroots Cricket |

(70,992) |

0 |

0 |

0 |

(70,992) |

|

Gravel Pit Restoration |

(767,509) |

0 |

0 |

0 |

(767,509) |

RESERVES SUMMARY

|

|||||

|

30 SEPTEMBER 2018 |

|||||

|

|

CLOSING BALANCE 2017/18 |

ADOPTED RESERVE TRANSFERS 2018/19 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 8.10.18 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

Gurwood Street Property |

(50,454) |

0 |

0 |

0 |

(50,454) |

|

Information Services |

(369,113) |

77,858 |

285,000 |

0 |

(6,256) |

|

Infrastructure Replacement |

(193,634) |

(68,109) |

15,000 |

0 |

(246,743) |

|

Insurance Variations |

(28,644) |

0 |

(71,603) |

0 |

(100,246) |

|

Internal Loans |

(518,505) |

(631,470) |

680,054 |

0 |

(469,921) |

|

Lake Albert Improvements |

(62,349) |

(21,563) |

5,859 |

0 |

(78,053) |

|

LEP Preparation |

(3,895) |

0 |

1,350 |

0 |

(2,545) |

|

Livestock Marketing Centre |

(5,724,767) |

(1,146,762) |

1,098,260 |

0 |

(5,773,270) |

|

Museum Acquisitions |

(39,378) |

0 |

0 |

0 |

(39,378) |

|

Oasis Building Renewal |

(209,851) |

(85,379) |

0 |

0 |

(295,230) |

|

Oasis Plant |

(1,140,543) |

390,000 |

100,000 |

0 |

(650,543) |

|

Parks & Recreation Projects |

(79,648) |

49,500 |

0 |

0 |

(30,148) |

|

Pedestrian River Crossing |

(10,775) |

|

10,775 |

0 |

0 |

|

Plant Replacement |

(3,935,062) |

253,958 |

1,043,434 |

0 |

(2,637,671) |

|

Playground Equipment Replacement |

(164,784) |

69,494 |

0 |

0 |

(95,290) |

|

Project Carryovers |

(2,006,338) |

402,808 |

1,585,155 |

0 |

(18,376) |

|

Public Art |

(208,754) |

30,300 |

64,997 |

0 |

(113,457) |

|

Robertson Oval Redevelopment |

(92,151) |

0 |

0 |

0 |

(92,151) |

|

Senior Citizens Centre |

(15,627) |

(2,000) |

0 |

0 |

(17,627) |

|

Sister Cities |

(36,328) |

(10,000) |

0 |

0 |

(46,328) |

|

Stormwater Drainage |

(180,242) |

0 |

22,000 |

0 |

(158,242) |

|

Strategic Real Property |

(475,000) |

401,305 |

(395,655) |

0 |

(469,350) |

|

Street Lighting Replacement |

(74,755) |

0 |

0 |

18,206 |

(56,549) |

|

Subdivision Tree Planting |

(582,108) |

40,000 |

0 |

0 |

(542,108) |

|

Sustainable Energy |

(588,983) |

95,000 |

259,414 |

0 |

(234,569) |

|

Traffic Committee |

(21,930) |

0 |

20,138 |

0 |

(1,792) |

|

Unexpended External Loans |

(841,521) |

0 |

841,521 |

0 |

0 |

|

Workers Compensation |

(40,000) |

0 |

(53,251) |

0 |

(93,251) |

|

Total Internally Restricted |

(36,795,390) |

4,244,732 |

6,572,040 |

(260,301) |

(26,238,919) |

|

|

|

|

|

|

|

|

Total Restricted |

(118,621,137) |

28,346,342 |

16,690,242 |

(60,301) |

(73,644,853) |

Section 356 Financial Assistance Requests

Two Section 356 financial assistance requests have been received for consideration at the 29 October 2018 Ordinary Council meeting.

It is noted that the Riverina Pregnancy and Baby Loss Support Group who have requested financial assistance in this report received $3,000 financial assistance via Council’s 2018/19 Annual Grant Program (Council Meeting 23 July 2018) to provide a support service and network for parents and families, point of referral, local reference, information and linkages.

Details of the financial assistance requests are shown below:

· The Women’s Domestic Violence Court Advocacy Service $1,298

The Women’s Domestic Violence Court Advocacy Service has requested financial assistance to hold a book launch “The Skinny Girl” by S.S.Mathews on the 22 November 2018 outside Council and in the library. The request outlines the following:

“Wagga Family Support Services and The Women’s Domestic Violence Court Advocacy Service would like to request that the council support this great cause and provide a venue and assistance in promoting this book launch as it could truly make a difference and raise awareness in our community, by raising funds for women and children experiencing and escaping domestic violence from the book sales. The funds we raised on the day will be going into WWFS brokerage account, to help support women & children who are experiencing domestic violence, to remain living where they choose and have the violent person leave.

We are confident that the local media and local services will support such a project and with the council’s assistance, it could be a huge event.

We propose a date of Thursday the 22nd of November between 12 noon and 2pm as this is within the 16 days of activism, although we happy to change this date and time if the council requires. “

The financial assistance has been costed as below:

· Room hire waiver costs of $ 198

· Event costs –catering $ 800

· Library Staff costs $ 300

Total Costs $1,298

The above request aligns with Council’s Strategic Plan “Safe and Healthy Community – Outcome: We are safe”.

· Riverina Pregnancy and Baby Loss Support Group (Bloss) $85

The Riverina Pregnancy and Baby Loss Support Group (Bloss) in their attached letter have requested Council’s consideration for financial assistance to waive the hire fees of $85, for staging a Remembrance Walk at the Victory Memorial Gardens. The event was held on the 14 October 2018.

The support group provides comfort, acknowledgement, information, empowerment and guide families during their time of loss.

The above request aligns with Council’s Strategic Plan “Safe and Healthy Community – Outcome: We have access to health and support services that cater for all our needs”.

The Section 356 financial assistance budget for the 2018/19 financial year is $50,255.50, of which $41,689 is already committed in the adopted Delivery and Operational Plan 2018/19.

A balance of $4,567.50 is currently available for additional financial assistance requests received for the reminder of the year following financial assistance approved at the 8 October 2018 Council meeting.

|

Unallocated balance of S356 fee waiver financial assistance budget 2018/19 |

$4,567.50 |

|

The Women’s Domestic Violence Court Advocacy Service |

($1,298.00) |

|

The Riverina Pregnancy and Baby Loss Support Group (Bloss) |

($ 85.00) |

|

Total Section 356 Financial Assistance Requests – 29 October 2018 Council Meeting |

($1,383.00) |

|

Balance of Section 356 fee waiver financial assistance budget for the remainder of the 2018/19 Financial Year |

$3,184.50 |

Investment Summary as at 30 September 2018

In accordance with Regulation 212 of the Local Government (General) Regulation 2005, details of Wagga Wagga City Council’s external investments are outlined below:

|

Institution |

Rating |

Closing Balance |

Closing Balance |

September |

September |

Investment |

Maturity |

Term |

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

AMP |

A |

2,000,000 |

2,000,000 |

2.95% |

1.42% |

1/06/2018 |

31/05/2019 |

12 |

|

NAB |

AA- |

2,000,000 |

0 |

0.00% |

0.00% |

8/09/2017 |

7/09/2018 |

12 |

|

AMP |

A |

1,000,000 |

1,000,000 |

2.95% |

0.71% |

5/06/2018 |

2/01/2019 |

7 |

|

NAB |

AA- |

2,000,000 |

0 |

0.00% |

0.00% |

28/09/2017 |

28/09/2018 |

12 |

|

Auswide |

BBB- |

2,000,000 |

2,000,000 |

2.67% |

1.42% |

5/10/2017 |

5/10/2018 |

12 |

|

Auswide |

BBB- |

1,000,000 |

1,000,000 |

2.67% |

0.71% |

16/10/2017 |

16/10/2018 |

12 |

|

Auswide |

BBB- |

2,000,000 |

2,000,000 |

2.70% |

1.42% |

5/12/2017 |

5/12/2018 |

12 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

2.70% |

1.42% |

28/02/2018 |

29/10/2018 |

8 |

|

AMP |

A |

2,000,000 |

2,000,000 |

2.95% |

1.42% |

17/05/2018 |

13/11/2018 |

6 |

|

AMP |

A |

1,000,000 |

1,000,000 |

2.95% |

0.71% |

17/05/2018 |

17/05/2019 |

12 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

2.86% |

1.42% |

28/05/2018 |

28/05/2019 |

12 |

|

AMP |

A |

2,000,000 |

2,000,000 |

2.95% |

1.42% |

29/05/2018 |

24/01/2019 |

8 |

|

Westpac |

AA- |

1,000,000 |

1,000,000 |

2.80% |

0.71% |

28/06/2018 |

28/06/2019 |

12 |

|

Australian Military Bank |

NR |

1,000,000 |

1,000,000 |

3.01% |

0.71% |

16/07/2018 |

16/07/2019 |

12 |

|

Suncorp-Metway |

A+ |

2,000,000 |

2,000,000 |

2.65% |

1.42% |

31/08/2018 |

30/11/2018 |

3 |

|

Bankwest |

AA- |

2,000,000 |

2,000,000 |

2.76% |

1.42% |

31/08/2018 |

23/04/2019 |

8 |

|

NAB |

AA- |

0 |

1,000,000 |

2.65% |

0.71% |

7/09/2018 |

7/12/2018 |

3 |

|

Australian Military Bank |

NR |

0 |

1,000,000 |

2.86% |

0.71% |

7/09/2018 |

8/07/2019 |

10 |

|

Total Short Term Deposits |

|

27,000,000 |

25,000,000 |

2.81% |

17.75% |

|

|

|

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

2,995,159 |

1,003,176 |

1.50% |

0.71% |

N/A |

N/A |

N/A |

|

NAB |

AA- |

16,686,568 |

16,715,321 |

2.19% |

11.87% |

N/A |

N/A |

N/A |

|

AMP |

A |

345 |

346 |

2.30% |

0.00% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

107 |

63 |

1.35% |

0.00% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

19,682,179 |

17,718,906 |

2.15% |

12.58% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

RaboBank |

A+ |

1,000,000 |

1,000,000 |

3.16% |

0.71% |

5/06/2017 |

6/06/2022 |

60 |

|

ING Bank |

A |

3,000,000 |

3,000,000 |

2.75% |

2.13% |

24/08/2017 |

26/08/2019 |

24 |

|

ME Bank |

BBB |

2,000,000 |

2,000,000 |

4.28% |

1.42% |

2/09/2014 |

2/09/2019 |

60 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

4.10% |

0.71% |

5/12/2014 |

5/12/2019 |

60 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.10% |

1.42% |

7/07/2017 |

7/07/2020 |

36 |

|

AMP |

A |

2,000,000 |

2,000,000 |

3.00% |

1.42% |

2/08/2018 |

3/02/2020 |

18 |

|

Newcastle Permanent |

BBB |

1,000,000 |

1,000,000 |

3.00% |

0.71% |

12/08/2016 |

12/08/2019 |

36 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

3.20% |

0.71% |

25/08/2016 |

25/08/2021 |

60 |

|

Newcastle Permanent |

BBB |

1,000,000 |

1,000,000 |

3.00% |

0.71% |

31/08/2016 |

30/08/2019 |

36 |

|

Police Credit Union |

NR |

1,000,000 |

0 |

0.00% |

0.00% |

8/09/2016 |

10/09/2018 |

24 |

|

Newcastle Permanent |

BBB |

2,000,000 |

2,000,000 |

3.00% |

1.42% |

10/02/2017 |

11/02/2019 |

24 |

|

Westpac |

AA- |

3,000,000 |

3,000,000 |

3.10% |

2.13% |

10/03/2017 |

10/03/2022 |

60 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

2.92% |

0.71% |

16/10/2017 |

16/10/2019 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

2.92% |

1.42% |

6/11/2017 |

6/11/2019 |

24 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.35% |

1.42% |

3/01/2018 |

4/01/2022 |

48 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

2.80% |

0.71% |

5/01/2018 |

6/01/2020 |

24 |

|

Institution |

Rating |

Closing Balance |

Closing Balance |

September |

September |

Investment |

Maturity |

Term |

|

Australian Military Bank |

NR |

1,000,000 |

1,000,000 |

2.95% |

0.71% |

29/05/2018 |

29/05/2020 |

24 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

3.50% |

0.71% |

1/06/2018 |

1/06/2022 |

48 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

3.02% |

1.42% |

28/06/2018 |

28/06/2021 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

2.88% |

1.42% |

28/06/2018 |

29/06/2020 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

2.86% |

1.42% |

16/08/2018 |

17/08/2020 |

24 |

|

BOQ |

BBB+ |

3,000,000 |

3,000,000 |

3.25% |

2.13% |

28/08/2018 |

29/08/2022 |

48 |

|

ING Bank |

A |

3,000,000 |

3,000,000 |

2.85% |

2.13% |

30/08/2018 |

14/09/2020 |

24 |

|

Total Medium Term Deposits |

|

40,000,000 |

39,000,000 |

3.11% |

27.70% |

|

|

|

|

Floating Rate Notes - Senior Debt |

|

|

|

|

|

|

|

|

|

BOQ |

BBB+ |

2,019,400 |

2,009,400 |

BBSW + 110 |

1.43% |

5/08/2014 |

24/06/2019 |

58 |

|

Bendigo-Adelaide |

BBB+ |

1,006,485 |

1,008,743 |

BBSW + 110 |

0.72% |

18/08/2015 |

18/08/2020 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,006,485 |

1,008,743 |

BBSW + 110 |

0.72% |

28/09/2015 |

18/08/2020 |

59 |

|

Suncorp-Metway |

A+ |

1,016,153 |

1,018,351 |

BBSW + 125 |

0.72% |

20/10/2015 |

20/10/2020 |

60 |

|

Rabobank |

A+ |

2,055,562 |

2,041,840 |

BBSW + 150 |

1.45% |

4/03/2016 |

4/03/2021 |

60 |

|

Newcastle Permanent |

BBB |

1,011,294 |

1,004,034 |

BBSW + 160 |

0.71% |

22/03/2016 |

22/03/2019 |

36 |

|

CUA |

BBB |

2,021,668 |

2,026,100 |

BBSW + 160 |

1.44% |

1/04/2016 |

1/04/2019 |

36 |

|

ANZ |

AA- |

1,018,373 |

1,012,362 |

BBSW + 118 |

0.72% |

7/04/2016 |

7/04/2021 |

60 |

|

Suncorp-Metway |

A+ |

1,021,242 |

1,023,280 |

BBSW + 138 |

0.73% |

21/04/2016 |

12/04/2021 |

60 |

|

AMP |

A |

1,010,964 |

1,012,232 |

BBSW + 135 |

0.72% |

24/05/2016 |

24/05/2021 |

60 |

|

Westpac |

AA- |

1,020,948 |

1,014,761 |

BBSW + 117 |

0.72% |

3/06/2016 |

3/06/2021 |

60 |

|

CBA |

AA- |

1,018,942 |

1,020,930 |

BBSW + 121 |

0.72% |

12/07/2016 |

12/07/2021 |

60 |

|

ANZ |

AA- |

2,027,746 |

2,031,342 |

BBSW + 113 |

1.44% |

16/08/2016 |

16/08/2021 |

60 |

|

BOQ |

BBB+ |

1,514,436 |

1,517,613 |

BBSW + 117 |

1.08% |

26/10/2016 |

26/10/2020 |

48 |

|

NAB |

AA- |

1,013,333 |

1,015,031 |

BBSW + 105 |

0.72% |

21/10/2016 |

21/10/2021 |

60 |

|

Teachers Mutual |

BBB |

1,509,473 |

1,513,535 |

BBSW + 140 |

1.07% |

28/10/2016 |

28/10/2019 |

36 |

|

Bendigo-Adelaide |

BBB+ |

1,005,585 |

1,007,853 |

BBSW + 110 |

0.72% |

21/11/2016 |

21/02/2020 |

39 |

|

Westpac |

AA- |

1,013,793 |

1,016,071 |

BBSW + 111 |

0.72% |

7/02/2017 |

7/02/2022 |

60 |

|

ANZ |

AA- |

1,007,944 |

1,009,623 |

BBSW + 100 |

0.72% |

7/03/2017 |

7/03/2022 |

60 |

|

CUA |

BBB |

758,531 |

753,782 |

BBSW + 130 |

0.54% |

20/03/2017 |

20/03/2020 |

36 |

|

Heritage Bank |

BBB+ |

603,309 |

604,976 |

BBSW + 130 |

0.43% |

4/05/2017 |

4/05/2020 |

36 |

|

Teachers Mutual |

BBB |

1,011,624 |

1,005,493 |

BBSW + 142 |

0.71% |

29/06/2017 |

29/06/2020 |

36 |

|

NAB |

AA- |

3,029,352 |

3,011,202 |

BBSW + 90 |

2.14% |

5/07/2017 |

5/07/2022 |

60 |

|

Suncorp-Metway |

A+ |

1,005,445 |

1,007,273 |

BBSW + 97 |

0.72% |

16/08/2017 |

16/08/2022 |

60 |

|

Westpac |

AA- |

2,005,250 |

2,010,686 |

BBSW + 81 |

1.43% |

30/10/2017 |

27/10/2022 |

60 |

|

ME Bank |

BBB |

1,504,793 |

1,509,245 |

BBSW + 125 |

1.07% |

9/11/2017 |

9/11/2020 |

36 |

|

NAB |

AA- |

2,000,552 |

2,004,488 |

BBSW + 80 |

1.42% |

10/11/2017 |

10/02/2023 |

63 |

|

ANZ |

AA- |

1,502,258 |

1,505,556 |

BBSW + 77 |

1.07% |

18/01/2018 |

18/01/2023 |

60 |

|

Bendigo-Adelaide |

BBB+ |

500,398 |

501,602 |

BBSW + 105 |

0.36% |

25/01/2018 |

25/01/2023 |

60 |

|

Newcastle Permanent |

BBB |

1,499,364 |

1,504,266 |

BBSW + 140 |

1.07% |

6/02/2018 |

6/02/2023 |

60 |

|

Westpac |

AA- |

1,998,992 |

2,001,968 |

BBSW + 83 |

1.42% |

6/03/2018 |

6/03/2023 |

60 |

|

UBS |

A+ |

2,000,512 |

2,005,088 |

BBSW + 90 |

1.42% |

8/03/2018 |

8/03/2023 |

60 |

|

Heritage Bank |

BBB+ |

1,408,855 |

1,400,874 |

BBSW + 123 |

0.99% |

29/03/2018 |

29/03/2021 |

36 |

|

ME Bank |

BBB |

1,607,912 |

1,612,373 |

BBSW + 127 |

1.14% |

17/04/2018 |

16/04/2021 |

36 |

|

ANZ |

AA- |

2,006,850 |

2,011,666 |

BBSW + 93 |

1.43% |

9/05/2018 |

9/05/2023 |

60 |

|

NAB |

AA- |

2,004,810 |

2,009,228 |

BBSW + 90 |

1.43% |

16/05/2018 |

16/05/2023 |

60 |

|

CBA |

AA- |

2,005,870 |

2,010,306 |

BBSW + 93 |

1.43% |

16/08/2018 |

16/08/2023 |

60 |

|

Bank Australia |

BBB |

750,185 |

753,123 |

BBSW + 130 |

0.53% |

30/08/2018 |

30/08/2021 |

36 |

|

CUA |

BBB |

0 |

601,432 |

BBSW + 125 |

0.43% |

6/09/2018 |

6/09/2021 |

36 |

|

AMP |

A |

0 |

1,502,436 |

BBSW + 108 |

1.07% |

10/09/2018 |

10/09/2021 |

36 |

|

Institution |

Rating |

Closing Balance |

Closing Balance |

September |

September |

Investment |

Maturity |

Term |

|

NAB |

AA- |

0 |

2,003,808 |

BBSW + 93 |

1.42% |

26/09/2018 |

26/09/2023 |

60 |

|

Total Floating Rate Notes - Senior Debt |

|

53,524,685 |

57,642,714 |

|

40.93% |

|

|

|

|

Managed Funds |

|

|

|

|

|

|

|

|

|

NSW Tcorp |

NR |

1,459,169 |

1,457,599 |

-0.11% |

1.04% |

17/03/2014 |

1/09/2023 |

113 |

|

Total Managed Funds |

|

1,459,169 |

1,457,599 |

-0.11% |

1.04% |

|

|

|

|

TOTAL

CASH ASSETS, CASH |

|

141,666,033 |

140,819,219 |

|

100.00% |

|

|

|

|

LESS: RIVERINA REGIONAL LIBRARY (RRL) CASH AT BANK |

|

3,736,257 |

3,383,040 |

|

|

|

|

|

|

TOTAL

WWCC CASH ASSETS, CASH |

|

137,929,776 |

137,436,179 |

|

|

|

|

|

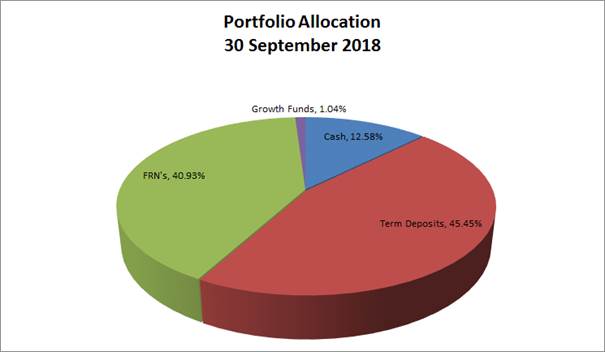

Council’s investment portfolio is now dominated by Term Deposits, equating to approximately 45% of the portfolio across a broad range of counterparties. Cash equates to 13% of the portfolio with Floating Rate Notes (FRNs) around 41% and growth funds around 1% of the portfolio.

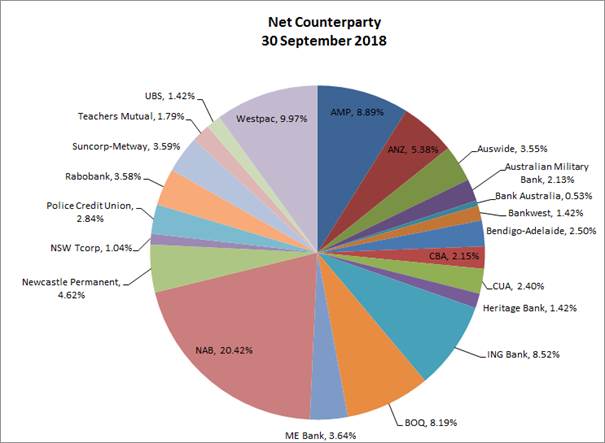

Council’s investment portfolio is well diversified in complying assets across the entire credit spectrum. It is also well diversified from a rating perspective. Credit quality is diversified and is predominately invested amongst the investment grade Authorised Deposit-Taking Institutions (ADIs) (being BBB- or higher), with a smaller allocation to unrated ADIs.

All investments are within the defined Policy limits, as outlined in the Rating Allocation chart below:

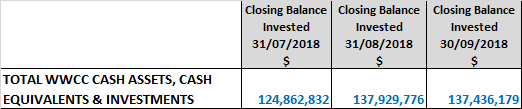

Investment Portfolio Balance

Council’s investment portfolio balance has decreased slightly from the previous month’s balance, down from $137.9M to $137.4M.

MONTHLY INVESTMENT MOVEMENTS

Redemptions/Sales – Council redeemed the following investment security during September 2018:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

NAB Term Deposit |

$2M |

12 months |

2.60% |

This term deposit was redeemed on maturity and funds were reinvested in 2 x $1M term deposits with NAB and Australian Military Bank (see below). |

|

NAB Term Deposit |

$2M |

12 months |

2.62% |

This term deposit was redeemed on maturity and funds were used for the new NAB 5-yr FRN (see below). |

|

Police Credit Union Term Deposit |

$1M |

2 years |

2.90% |

This term deposit was redeemed on maturity due to poor reinvestment rates and funds were used for cashflow purposes. |

New Investments – Council purchased the following investment security during September 2018:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

NAB Term Deposit |

$1M |

3 months |

2.65% |

The NAB rate of 2.65% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

|

Australian Military Bank Term Deposit |

$1M |

10 months |

2.86% |

The Australian Military Bank rate of 2.86% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

|

Credit Union Australia (CUA) Floating Rate Note |

$600K |

3 years |

BBSW + 125 |

Council’s independent Financial Advisor advised this Floating Rate Note represented fair value. |

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

AMP Floating Rate Note |

$1.5M |

3 years |

BBSW + 108 |

Council’s independent Financial Advisor advised this Floating Rate Note represented fair value with a highly rated institution. |

|

NAB Floating Rate Note |

$2M |

5 years |

BBSW + 93 |

Council’s independent Financial Advisor advised this Floating Rate Note represented good value with a highly rated institution. |

Rollovers – Council did not roll over any investment securities during September 2018.

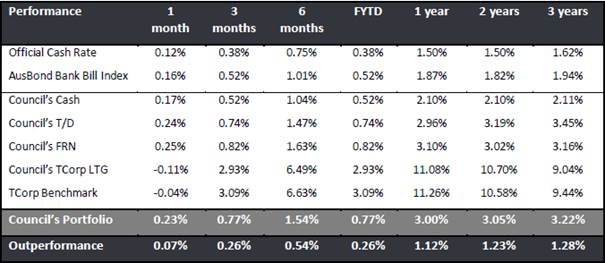

MONTHLY PERFORMANCE

Interest/growth/capital gains for the month totaled $324,140, which compares favourably with the budget for the period of $244,709, outperforming budget for the month of September by $79,431. This is mainly due to a larger than expected portfolio balance as well as better than expected interest rates.

It should be noted that a majority of Councils FRNs continue to trade at a premium. The capital market value of these investments will fluctuate from month to month and Council continues to receive the coupon payments and the face value of the investment security when sold or at maturity.

It is important to note Council’s investment portfolio balance is tracking well above what was originally predicted. This is mainly due to the timing of some of the major projects that are either not yet commenced or not as advanced as originally predicted. It is anticipated that over the 2018/19 financial year the portfolio balance will reduce in line with the completion of major projects. This will result in Councils investment portfolio continuing to maintain a higher balance until these projects commence or advance further.

The longer-dated deposits in the portfolio, particularly those locked in above 4% yields, have previously anchored Council’s portfolio performance. It should be noted that the portfolio now only includes two investments yielding above 4% and Council will inevitably see a fall in investment income over the coming months compared with previous periods. Council staff and Council’s Independent Financial Advisor will continue to identify opportunities to lock in higher yielding investments as they become available.

In comparison to the AusBond Bank Bill Index* (+1.87%pa), Council’s investment portfolio returned 2.76% (annualised) for September. Cash and At-Call accounts returned 2.15% (annualised) for this period. These funds are utilised for daily cash flow management and need to be available to meet operating and contractual payments as they come due.

* The AusBond Bank Bill Index is the leading benchmark for the Australian fixed income market. It is interpolated from the RBA Cash rate, 1 month and 3 month Bank Bill Swap rates.

Report by Responsible Accounting Officer

I hereby certify that all of the above investments have been made in accordance with the provision of Section 625 of the Local Government Act 1993 and the regulations there under, and in accordance with the Investments Policy adopted by Council on 26 February 2018.

Carolyn Rodney

Responsible Accounting Officer

Policy and Legislation

Budget variations are reported in accordance with Council’s POL 052 Budget Policy.

Investments are reported in accordance with Council’s POL 075 Investment Policy.

Local Government Act 1993

Section 625 - How may councils invest?

Local Government (General) Regulation 2005

Section 212 - Reports on council investments

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

This report is a control mechanism that assists in addressing the following potential risks to Council:

· Loss of investment income or capital resulting from ongoing management of investments, especially during difficult economic times

· Failure to demonstrate to the community that its funds are being expended in an efficient and effective manner

Internal / External Consultation

Council’s Community Engagement Strategy and IAP2 considers the community to be “any individual or group of individuals, organisation or political entity with an interest in the outcome of a decision….”

All relevant areas within the Council have consulted with the Finance Division in regards to the budget variations listed in this report.

The Finance Division has consulted with relevant external parties to confirm Council’s investment portfolio balances.

|

1⇩. |

Section 356 Finanical Assistance Request - The Women's Domestic Violence Advocacy Service |

|

|

2⇩. |

Section 356 Finanical Assistance Request - The Riverina Pregnancy and Baby Loss Support Group (Bloss) |

|

Report submitted to the Ordinary Meeting of Council on Monday 29 October 2018. RP-3

RP-3 DISCLOSURE OF PECUNIARY INTEREST RETURNS - COUNCILLORS AND DESIGNATED STAFF 2018

Author: Nicole Johnson

General Manager: Peter Thompson

|

Analysis: |

Section 449 of the Local Government Act 1993 requires all Councillors and Designated Staff to complete an annual Disclosure if Pecuniary Interest Return. |

|

That the Register of Pecuniary Interest Returns, containing current returns for the period 1 July 2017 to 30 June 2018 be tabled in accordance with Section 449 of the Local Government Act. |

Report

Each year, Councillors and Designated Staff are required under Section 449 of the Local Government Act 1993 (the Act) to complete an annual Disclosure of Pecuniary Interest Return.

A Pecuniary Interest is described in Section 442 of the Act as “an interest that a person has in a matter because of a reasonable likelihood or expectation of appreciable financial gain or loss to the person”.

Section 449 of the Act states, that:

(1) A councillor or designated person must complete and lodge with the general manager, within three months after becoming a councillor or designated person, a return in the form prescribed by the regulations.

(1A) A person must not lodge a return that the person knows or ought reasonably to know is false or misleading in a material particular.

(2) A person need not lodge a return within the 3-month period after becoming a councillor or designated person if the person lodged a return in that year or the previous year or if the person ceases to be a councillor or designated person within the 3-month period.

(3) A councillor or designated person holding that position at 30 June in any year must complete and lodge with the general manager within three months after that date a return in the form prescribed by the regulations.

(4) A person need not lodge a return within the 3-month period after 30 June in a year if the person lodged a return under subsection (1) within 3 months of 30 June in that year.

Lodgement of Declarations of Pecuniary Interest Returns was required by 30 September 2018.

All returns have been received from Councillors and Designated Persons (staff and committee members).

Council’s register of Pecuniary Interest Returns 2018 is submitted to this meeting of Council, as required under the Act.

Section 450A(1) of the Act requires the general manager to keep a register of returns required to be lodged with the general manager under section 449. The Register of Pecuniary Interest Returns is available for inspection at Council’s Civic Centre offices during ordinary business hours.

Financial Implications

N/A

Policy and Legislation

Section 449 of the Local Government Act 1993

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

Report submitted to the Ordinary Meeting of Council on Monday 29 October 2018. RP-4

RP-4 Proposed Voluntary Planning Agreement for environmental land associated with DA 17/0572 - Lot 39 Genista Place

Author: Belinda Maclure

Director: Natalie Te Pohe

|

Analysis: |

Council received an offer from Esler and Associates on behalf of Watsons Hill requesting a Voluntary Planning Agreement for the land defined as Lot 39 DP1085747, Genista Place Springvale. This land is associated with the DA17/0572, involving a 9 lot subdivision which is currently being assessed. The proposal is to dedicate 8.33 hectares of the land in E2 Zone to Council. A reduction of the Section 94 developer contributions is requested in return for the land, which is currently valued considerably higher than the contributions due. |

|

That Council: a support the draft Voluntary Planning Agreement including the Explanatory Note relating to Lot 39 DP1085747 and associated with DA17/0572 b place the draft Voluntary Planning Agreement including the Explanatory Note on public exhibition for a period of 28 days from 3 November 2018 until 1 December 2018, and invite public submissions on the Voluntary Planning Agreement until 15 December 2018 c receive a further report following the exhibition and submission period: i addressing any submission made in respect of the draft Voluntary Planning Agreement ii proposing to enter into the Voluntary Planning Agreement unless there are any recommended amendments deemed to be substantial and require a further public exhibition period |

Report

An offer has been made to dedicate 8.33 hectares of E2 land to Council in lieu of paying the Section 94 developer contributions associated with the development (DA17/0572) required under the current City of Wagga Wagga Section 94 Contributions Plan 2006‑2019.

The land to be dedicated to Council includes two sections of the Wiradjuri walking track, which is identified as an important pedestrian infrastructure asset in the draft Activation Strategy and the Recreation Open Space and Community Strategy.

The developer has agreed to donate the land in exchange for the Section 94 developer contributions to be waived, which is a net asset value increase for Council of $51,045. The value of the land is $125,000 and the contributions due are approximately $73,955 (this amount will vary depending due to the timing of the finalisation of the agreement and the indexing of the contributions).

A draft Voluntary Planning Agreement has been developed by Council’s legal representative. As required by the Environmental Planning and Assessment Act 1979 the agreement cannot be entered into unless public notice is given of the proposed agreement being available for inspection by the public for at least 28 days.

Financial Implications

The financial implications of the Voluntary Planning Agreement will have an impact on the Contributions Reserve to the value of the Section 94 developer contributions due for DA17/0572. This will see a reduction in revenue of approximately $73,955. As the current balance of the Reserve is $19.961M (as per the draft Financial Statements 2018) the decrease in revenue is not considered significant on the Reserve and will not effect the delivery of project in the contributions plan. The value of Council’s land assets will increase by $125,000.

Policy and Legislation

Environmental Planning and Assessment Act 1979, Sections 7.4 and 7.11 (formerly Sections 93F and 94)

City of Wagga Wagga Section 94 Contributions Plan 2006-2019

Link to Strategic Plan

The Environment

Objective: Create and maintain a functional, attractive and health promoting built environment

Outcome: We create an attractive City

Risk Management Issues for Council

If Council does not own this land, the landholders may fence the Wiradjuri walking track making it inaccessible to the public.

Internal / External Consultation

The draft Voluntary Planning Agreement will be placed on public exhibition for 28 days from 3 November 2018 until 1 December 2018, with submissions being accepted to 15 December 2018, utilising the consultation processes outlined in the table below.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

|

x |

|

|

x |

|

|

|

|

x |

x |

|

|||

|

1⇩. |

Draft Deed and Explanatory Note for the Planning Agreement Related to Genista Place |

|

RP-5 Lake Albert Blue Green Algae Remediation

Author: Rupesh Shah

Director: Caroline Angel

|

Analysis: |

The purpose of this report is to recommend that Council carry out a pilot (trial) of the Envirosonic ultrasound technology for controlling cyanobacteria bloom in Lake Albert. Following the trial period, a further report will be presented to Council which depending on the results of the trial, may recommend the purchasing of a system. Some financial information relating to the proposal is commercial in confidence and therefore cannot be presented in Open Council. This information is presented to Councillors under confidential separate cover. |

|

That Council: a endorse the pilot/trial of ultrasound technology for controlling cyanobacteria bloom in Lake Albert b authorise the General Manager or their delegate to enter into a contract with Masonry Management Services Pty Ltd (ABN 67072 316477) trading as Envirosonic for provision of a 12 month trial of ultrasound technology as detailed in the body report c receive a subsequent report in 12 months on the performance of the pilot/trial including recommendations on whether or not to purchase the installed system d approve the budget variations as detailed in the confidential separate cover attachment |

Report

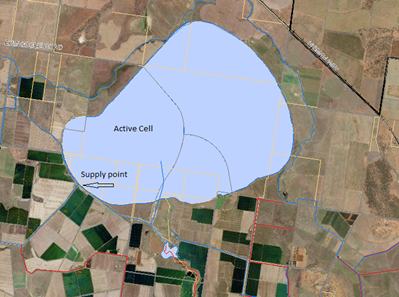

Lake Albert is one of Wagga's popular recreational destinations and an important asset for the City. The Lake precinct offers a range of facilities for all boating and recreational users.

Without regular rainfall, Lake Albert receives a high dose of nutrients from the stormwater when it does rain, such as from fertiliser and animal faeces, and is thus experiencing a significantly high growth of cyanobacteria (blue green algae) during summer for the last few years. This has resulted in the council and health authorities issuing a ‘Red Level Alert’, to warn the public that the water body is considered to be unsuitable for water contact activities, such as swimming, bathing, sailing, skiing or other direct water-contact sports.

Blue-green algae are actually a type of bacteria known as Cyanobacteria. Despite being called algae, they only have some things in common — they photosynthesise using light to produce oxygen and they need sunlight to grow. Blue-green algae are a natural part of the freshwater environment. Two species, Dolichospermum and Microcystis, are the most common types in Lake Albert.

Algal blooms generally occur in waters rich in nutrients and thrives in dry, warm conditions.

Council has been investigating a range of options to manage water quality at Lake Albert.

The long-term management of algae should involve reducing nutrient inflow into the water body. However, long-term nutrient reduction requires extensive changes in policies and activities that may take many years before significant improvement in water quality can be seen. There are some short-term treatment options available for managing algae problems such as chemical, aeration, biological additives or ultrasound technology.

· Chemicals

Chemical intervention involves treating the water with a variety of additives, such as alum, lanthanum, or any other products that precipitate or sequester the ionized orthophosphates. Aquatic herbicides used to treat algae are called algaecides and are often copper-based compounds, such as copper sulfate, copper chelate communes or the chemical Endothall.

Disadvantages - Care must be taken in the use of algaecides because they can cause algal cell rupture, which can result in intracellular toxins being released into the water reservoir. A rapid decay of an algal bloom may result in the release of high concentrations of algal toxins into the water. In addition, the potential long-term effect of chemicals on the ecological balance of the entire lake is a serious factor that needs to be considered.

· Aeration

Aeration is used to increase the level of oxygen in the water. Aeration is an environmentally friendly technique to maintain and rejuvenate water bodies. It is important to maintain healthy levels of dissolved oxygen in the lake because the oxygen aids in the breakdown of decaying vegetation and other nutrients that find their way into the water.

Disadvantages - The disadvantages of this technology are the high costs for maintenance (labour costs) and energy use. Since aeration does not kill the algae directly, the efficiency of this technology against algae is not always certain.

· Mixing

The main function of mixers in a reservoir is de-stratification, which is a process in which the water is mixed to eliminate stratified layers and make it less favourable for algae growth in certain layers.

Disadvantages - The disadvantage of the mixing or circulation of water is often the high maintenance required to the systems regarding wear and tear, and the fluctuating results the systems can have on algae blooms.

· Ultrasound Algal Control Technology

Controlling algae with ultrasound is an environmentally-friendly technology that is harmless to fish and plants. Ultrasound are sound waves with frequencies higher than the upper audible limit of human hearing (22 kHz). At specific frequencies, these sound waves can be used to control algae growth.

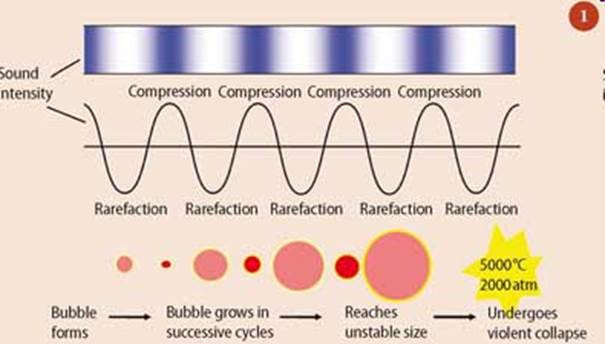

The Envirosonic Ultrasound units (ES300) are solar powered and will be installed on pontoons anchored to the bottom of the lake. The transducer is the pulsating mechanism for the EnviroSonic unit, made of stainless steel, with a titanium head, and using a series of internal ceramic disks, emits ultrasound in one third of a second bursts, every second, in a range of 20KHZ to 60 KHZ. Each unit has an influence range of about 300m and the transducers generate ultrasonic sound waves which create bubbles in the water, which grows and undergoes a violent collapse resulting in cellular cavitation of the cell boundary of the algae which are super saturated with dissolved gases.

Many types of algae have an internal buoyancy chamber that allows them to float. These chambers can be broken with ultrasonic frequencies in a similar way that a crystal glass can be shattered by the right sound wave. With the buoyancy chamber gone, the algae sinks to the bottom.