AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

26 November 2018

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

26 November 2018

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 26 November 2018 at 6.00pm.

Council live streams video and audio of Council meetings. Members of the public are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

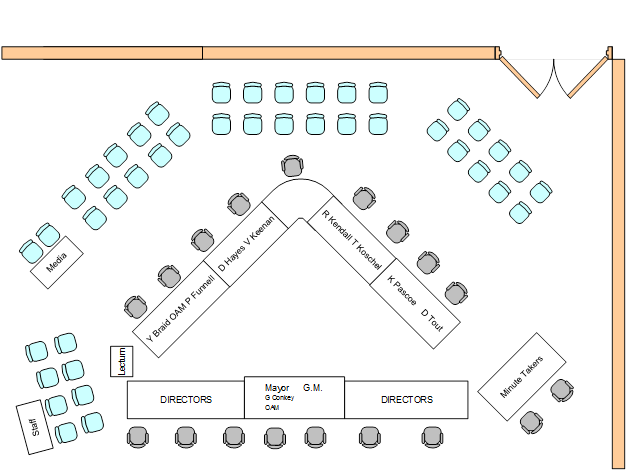

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 26 November 2018.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 26 November 2018

CLAUSE PRECIS PAGE

PRAYER 3

ACKNOWLEDGEMENT OF COUNTRY 3

APOLOGIES 3

CONFIRMATIONS OF MINUTES

CM-1 ORDINARY COUNCIL MEETING - 12 NOVEMBER 2018 3

DECLARATIONS OF INTEREST 3

PRESENTATIONS

TIDY TOWNS

NSW AUDIT OFFICE – AUDITED FINANCIAL STATEMENTS

MAYORAL MINUTES

MM-1 MAYORAL MINUTE - SAVE OUR RECYCLING CAMPAIGN 4

Councillor Report

CR-1 COUNCILLOR REPORT - DESTINATION NSW STAKEHOLDER FUNCTION 7

CR-2 LOCAL GOVERNMENT ASSOCIATION CONFERENCE REPORT 9

Reports from Staff

RP-1 Presentation from Council's external Auditors - NSW Audit Office on the 2017/18 Financial Statements 11

RP-2 Financial Performance Report as at 31 October 2018 22

RP-3 CANBERRA REGION JOINT ORGANISATION (CRJO) 42

RP-4 Council Meeting Schedule 2019 46

RP-5 COMPLAINT HANDLING 52

RP-6 Draft Planning Proposal LEP18/0008 with Council addendum - reduction to minimum lot size control to Lots 35 - 40 DP 1062621 and Lots 1 - 4, 6 DP 1127328 on Manuka Road and Dandaloo Road, Lake Albert 56

RP-7 PROPOSED APEX BIKE FACILITY AT APEX PARK - LAKE ALBERT 75

RP-8 Draft Wagga Wagga Local Infrastructure Contributions Plan 2018 80

RP-9 Disabled Access to Waterways 87

RP-10 WAGGA WAGGA INLAND WATER SAFETY MANAGEMENT PLAN 94

RP-11 Sporting Hall of Fame 98

RP-12 Parramore Park Car Park resurfacing 103

RP-13 PROPOSED UPDATE TO COUNCIL'S 2018/19 FEES AND CHARGES - WASTE SERVICES 105

RP-14 Proposed Mobile Food Vending Trial 116

Committee Minutes

M-1 RIVERINA REGIONAL LIBRARY ADVISORY COMMITTEE MEETING - 31 OCTOBER 2018 134

M-2 Audit, Risk and Improvement Committee Minutes - 9 November 2018 141

QUESTIONS/BUSINESS WITH NOTICE 153

Confidential Reports

CONF-1 Consideration of RFQ2018-556 Supply of One 4WD Tractor & RFQ2018-557 Supply of One Rotary Multi Deck Mower 154

CONF-2 RFT2018-25 EUNONY BRIDGE STRENGTHENING & WIDENING 155

CONF-3 Major Event Sponsorship Report 156

CONF-4 RFQ2017/529 - Densely Graded Asphalt Supply & Lay 157

Confirmation of Minutes

CM-1 ORDINARY COUNCIL MEETING - 12 NOVEMBER 2018

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 12 November 2018 be confirmed as a true and accurate record.

|

|

1⇩. |

Ordinary Council Meeting - Minutes - 12 November 2018 |

158 |

PRESENTATIONS

· Presentation to Wagga Wagga City Council - Tidy Towns Sustainable Communities Committee from the Tidy Towns Chairperson

· Presentation from NSW Audit Office regarding RP-1 - PRESENTATION FROM COUNCIL'S EXTERNAL AUDITORS - NSW AUDIT OFFICE ON THE 2017/18 FINANCIAL STATEMENTS

Report submitted to the Ordinary Meeting of Council on Monday 26 November 2018. MM-1

MM-1 MAYORAL MINUTE - SAVE OUR RECYCLING CAMPAIGN

|

Analysis: |

Certain licensed waste facilities in NSW are required to pay a contribution to the NSW Government for each tonne of waste received at the facility (referred to as the 'Waste Levy'). The purpose of this motion is to support the ‘Save Our Recycling’ campaign, which is advocating for 100% of the revenue collected from the levy to be reinvested into waste minimisation, recycling and resource recovery. |

|

That Council: a endorse the Local Government NSW (LGNSW) campaign, Save Our Recycling, to realise the reinvestment of a 100% of the Waste Levy collected each year by the NSW Government in waste minimisation, recycling and resource recovery b make representation to the local State Member, Dr Joe McGirr, in support of this campaign objective - for the NSW Government to commit to reinvest 100% of the Waste Levy in waste minimisation, recycling and resource recovery c make representation to all candidates leading up to the NSW State election scheduled for March 2019 seeking support for the Save Our Recycling campaign d write to the Premier, the Hon Gladys Berejiklian MP, the Opposition Leader, the Hon Michael Daley MP, the Minister for Local Government and the Minister for the Environment, the Hon Gabrielle Upton MP, and the Shadow Minister for the Environment and Heritage, Penny Sharpe MLC, seeking bipartisan support for the 100% reinvestment of the Waste Levy collected each year into waste minimisation, recycling and resource recovery e take a lead role in activating the LGNSW Save Our Recycling campaign locally f endorse the distribution and display of the LGNSW Save Our Recycling information on Council premises, as well as involvement in any actions arising from the initiative g formally advise LGNSW that Council has endorsed the Save Our Recycling advocacy initiative |

Report

I am calling on Councillors to support Local Government NSW (LGNSW) in its advocacy to all those contesting the State election to reinvest 100% of the Waste Levy collected each year into waste management, recycling and resource recovery in NSW.

The Protection of the Environment Operations Act 1997 (POEO Act) requires certain licensed waste facilities in NSW to pay a contribution to the NSW Government for each tonne of waste received at the facility. Referred to as the 'Waste Levy', the contribution aims to reduce the amount of waste being landfilled and promote recycling and resource recovery.

The Waste Levy applies in the regulated area of NSW which comprises the Sydney metropolitan area, the Illawarra and Hunter regions, the central and north coast local government areas to the Queensland border as well as the Blue Mountains, Wingecarribee and Wollondilly local government areas.

In 2016/17, the NSW Government collected $726 million from local government, community, businesses and industry via the Waste Levy, but only committed to use $72 million through its Waste Less Recycle More initiative – or 10% - on waste minimisation and recycling in 2017-18.

Overall the NSW Government’s Waste Less Recycle More initiative allocates $801 million over 8 years (2013-2021) to waste and recycling, however the Waste Levy collected over that same period will be over $4.62 billion.

At a local government level, just 18% of the $300 million collected from the local government sector each year is reinvested in recycling and waste management.

Regardless of how you look at it, the principle remains the same – very little of the Waste Levy is currently used to support waste minimisation, recycling and resource recovery. The remainder is returned to NSW Government’s consolidated revenue.

The reinvestment of the Waste Levy to support waste and resource recovery infrastructure, develop markets and innovative solutions, and undertake other initiatives to encourage reuse and recycling also offers wide-ranging benefits to our communities right across NSW. There is the potential for economic growth, new infrastructure, new technology and new jobs, particularly in our regional areas.

It should be noted that the following motion was unanimously endorsed at the LGNSW 2018 Conference:

That the NSW Government be called upon to ensure that 100% of the levy arising from Section 88 of the Protection of the Environment Operations Act 1997 be used for waste infrastructure and programs, predominantly by local government and the waste sector, for initiatives such as:

· Development of regional and region-specific solutions for sustainable waste management (e.g. soft plastic recycling facilities, green waste, waste to energy).

· Support innovative solutions to reduce waste and waste transport requirements.

· Protect existing and identify new waste management locations.

· Local community waste recovery and repair facilities.

· Funding a wider range of sustainability initiatives, such as marketing and strategies that promote and support a circular economy.

As previously noted, this is not a party-political issue: the advocacy initiative calls on all parties and candidates to commit to the 100% hypothecation of the Waste Levy to the purpose for which it is collected.

I am recommending that we support this campaign by the NSW local government sector and LGNSW and call on all political parties to commit to the reinvestment of 100% of the Waste Levy collected each year by the NSW Government into waste management, recycling and resource recovery.

Financial Implications

N/A

CR-1 COUNCILLOR REPORT - DESTINATION NSW STAKEHOLDER FUNCTION

Author: Councillor Dan Hayes

Councillor Vanessa Keenan

|

That Council receive and note the report. |

Report

On 25 October 2018, Councillors Keenan and Hayes attended a two-hour stakeholder function hosted by Destination NSW, the State Government’s Tourism and Major Events Agency.

This event brought together local government representatives, local business and tourism operators to meet the Destination NSW Board.

During the event John Warn, Chairman of Destination NSW spoke briefly about the increasing visitation to regional NSW destinations and the growth and development of tourism in the Riverina Murray region.

During smaller discussions, the board members raised the opportunities that exist with Canberra as it is Wagga’s closest capital city with our closest international airport. This is reflective of discussions that have taken place internally within Wagga Wagga City Council not just with tourism and events but in other areas too. The Destination NSW Chairman is planning on meeting with Canberra Government representatives for further discussions about these opportunities.

This function highlighted the importance of strong linkages with Canberra that Wagga Wagga City Council should continue to build upon via all options available as well as the establishment and fostering of networks within our region. These linkages should include relationships, transport connections and promotions.

The opportunity for business to business relationships to develop through value adding to each other’s product offerings was also evident in conversations with many of the operators in attendance.

Wagga Wagga City Council should continue to be acutely aware of the machinations of Destination NSW to embrace possible new opportunities and link in with future planning.

Financial Implications

N/A

Policy and Legislation

POL 025 Payment of Expenses and Provision of Facilities to Councillors

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We have leaders that represent us

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

Report submitted to the Ordinary Meeting of Council on Monday 26 November 2018. CR-2

CR-2 LOCAL GOVERNMENT ASSOCIATION CONFERENCE REPORT

Author: Councillor Greg Conkey OAM

|

That Council receive and note the report. |

Report

The LGNSW’s Annual Conference was held in Albury from October 21-23.

Wagga Wagga City Council was represented by the Mayor, Cr Greg Conkey OAM, Deputy Mayor, Cr Dallas Tout, Cr Rod Kendall (who is also on the Board of LGNSW) and Cr Vanessa Keenan while Cr Yvonne Braid attended as a member of the Riverina Water Board.

The official guests at the Conference included the Premier, Gladys Berejiklian (who attended the Welcome Ceremony on the Sunday night), the Minister for Local Government, Gabrielle Upton (who stayed and answered a few questions), the Federal Minister for Local Government, Bridget McKenzie, the Federal Shadow Minister for Local Government, Stephen Jones and the State Shadow Minister for Local Government, Peter Primrose (who stayed for the whole conference).

More than 100 motions were debated on the Monday of the conference.

Three motions put by Council were adopted.

They included urging the State Government to allocate some of the funding from the sale of Snowy Hydro to asset maintenance; urging the State Government to include lay down facilities for adults with disabilities along major highways; and calling on the State Government to review its decision to pass on the responsibility for payment of damages in addition to compensation where a native title claim is determined in favour of a native title interest. Another motion calling for a review of newspaper advertising was lost.

Some of the other motions passed included:

· Calling for additional drought policies and relief packages;

· Lobbying for increasing the number of slots for regional air services into Kingsford Smith International Airport;

· Encouraging the NSW Government to support and fund the Southern Lights Project;

· Calling on the State Government to ensure that 100% of all waste levy revenues be returned to councils to fund waste and recycling initiatives;

· Place the highest priority over the next 12 months to work with all governments to progress development of sustainable, long term solutions to the current recycling crisis;

· Calling on the NSW Government to deliver their climate change policy framework and develop programs with tangible outcomes to meet the aspirational long-term objectives of achieving net-zero emissions by 2050;

· Continue to lobby the NSW Government for a sustainable funding model for libraries;

· Review the remuneration paid to mayors and councillors in order to make the case for increased remuneration and conditions;

· Seeking ongoing funding for Jos.

Financial Implications

N/A

Policy and Legislation

POL 113 Councillor Training and Development Policy

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We have leaders that represent us

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

Report submitted to the Ordinary Meeting of Council on Monday 26 November 2018. RP-1

RP-1 Presentation from Council's external Auditors - NSW Audit Office on the 2017/18 Financial Statements

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Analysis: |

Council resolved to sign the 2017/18 Financial Statements at the 29 October 2018 Council Meeting, enabling Council officers to lodge the financial statements with the Office of Local Government (OLG) prior to the 31 October 2018 due date.

Council’s external auditors, NSW Audit Office have completed their Auditor’s Report, and have provided this to Council for their information. Representatives from NSW Audit Office will be presenting to Council at this meeting. |

|

That Council: a note that no public submissions were received regarding the draft Financial Statements for the year ended 30 June 2018 b receive the Audited Financial Statement, together with the Auditor’s Reports on the Financial Statements for the year ended 30 June 2018 c receive a presentation from Council’s external auditors, NSW Audit Office |

Report

The Audit Reports for the 2017/18 Financial Statements have now been received and are presented in accordance with section 419 (1) of the Local Government Act 1993.

Representatives from Council’s external auditors, NSW Audit Office will be making a presentation on the 2017/18 Financial Statements and will be available to answer any questions from Councillors.

Council has provided public notice that the Financial Statements and Auditor’s Reports will be presented at this meeting in accordance with section 418 (3) of the Local Government Act 1993 and has invited public submissions on the audited financial statements, of which no submissions were received.

Financial Implications

The 2017/18 financial statements show total income from continuing operations of $146.8M, total expenses from continuing operations of $124.7M, resulting in a preliminary net operating surplus of $22.1M (including capital grants and contributions). The 2016/17 financial year resulted in a net operating surplus of $32.6M, with the main difference in the reduced net result attributable to a reduction in grants and contributions.

As of 30 June 2018 Council held $36.8M in internal reserves, an increase of $1.1M on the previous year. The major internally restricted reserves Council holds are:

|

Reserve Name |

30 June 2018 Balance |

30 June 2017 Balance |

Increase/ (Decrease) from prior year* |

|

Plant and Vehicle Replacement |

$3.935M |

$5.894M |

($1.959M) |

|

Employees Leave Entitlements |

$3.323M |

$3.185M |

$138K |

|

Fit for the Future |

$5.340M |

$3.033M |

$2.307M |

|

Grant Commission |

$5.199M |

$4.957M |

$242K |

*Notes on Increases/(Decreases)

· Plant and Vehicle Replacement Reserve – Council experienced delays in fulfilling their plant replacement program during the 2016/17 financial year, and were able to catch up some of the backlog in replacement during the 2017/18 financial year.

· Fit for the Future Reserve – an additional $2.3M has been transferred to this reserve, bringing the balance up to $5.340M. Council’s Fit for the Future submission notes an annual target of identifying efficiencies of $800K to be spent on asset renewals. A detailed program of priority works will be established during the 2018/19 financial year.

Grant Commission Reserve – $5.199M received for the prepayment of the Financial Assistance Grant relating to the 2018/19 financial year. This prepayment occurred in the 2016/17 financial year also.

Policy and Legislation

Local Government Act 1993- Section 413 - Preparation of Financial Reports

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

The NSW Audit Office will provide Council with a final Management Letter by 30 November 2018, with the Interim Management Letter previously discussed at the 10 August 2018 Audit, Risk and Improvement Committee Meeting. The Interim Management Letter identified five issues with two rating as Moderate and three rated as Low. Council officers will undertake the actions that will be identified in the final Management responses.

Internal / External Consultation

The Council’s Community Engagement Strategy and IAP2 considers the community to be “any individual or group of individuals, organisation or political entity with an interest in the outcome of a decision….”

Council’s external auditors, NSW Audit Office have liaised with Council’s Finance division and presented the draft Financial Statements in detail to the Audit, Risk and Improvement Committee at the 11 October 2018 Committee meeting.

|

1. |

WWCC - 2017/18 Financial Statements - Provided under separate cover |

|

|

2⇩. |

Report on the Conduct of the Audit - NSW Audit Office |

|

RP-2 Financial Performance Report as at 31 October 2018

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Analysis: |

This report is for Council to consider and approve the proposed 2018/19 budget variations required to manage the 2018/19 budget and Long Term Financial Plan, and details Council’s external investments and performance as at 31 October 2018. |

|

That Council: a approve the proposed 2018/19 budget variations for the month ended 31 October 2018 and note the balanced budget position as presented in this report b provide financial assistance of the following amounts in accordance with Section 356 of the Local Government Act 1993: i) Toy Run (Combined Riders Wagga Wagga ) $ 327.00 ii) Ashmont Baptist Church $ 90.00 iii) Wagga Wagga Seventh Day Adventist Church $ 408.50 c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above d note details of the external investments as at 31 October 2018 in accordance with section 625 of the Local Government Act 1993 |

Report

Wagga Wagga City Council (Council) forecasts a balanced budget position as at 31 October 2018. Proposed budget variations are detailed in this report for Council’s consideration and adoption.

Council has experienced a positive monthly investment performance for the month of October, when compared to budget. This is a result of a larger than expected portfolio balance as well as better than expected interest rates.

Key Performance Indicators

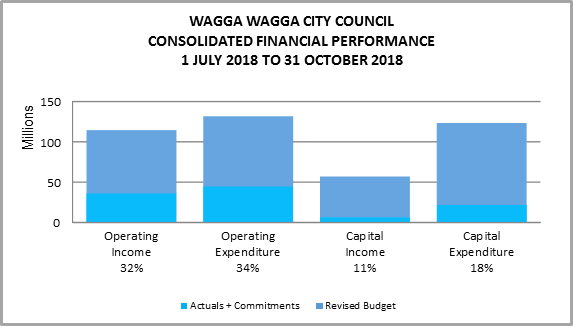

OPERATING INCOME

Total operating income is 32% of approved budget, which is tracking only slightly below budget for the end of October (this percentage excludes capital grants and contributions). An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 69%.

OPERATING EXPENSES

Total operating expenditure is 34% of approved budget and is tracking only slightly over budget for the full financial year.

CAPITAL INCOME

Total capital income is 11% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions relating to projects. This income also includes the sale of property, plant and equipment.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 18% of approved budget.

|

WAGGA WAGGA

CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2018/19 |

COMMT'S 2018/19 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|||||||

|

Rates & Annual Charges |

(65,998,971) |

0 |

(65,998,971) |

(22,909,962) |

0 |

(22,909,962) |

35% |

|

User Charges & Fees |

(26,844,544) |

150,317 |

(26,694,227) |

(8,245,864) |

0 |

(8,245,864) |

31% |

|

Interest & Investment Revenue |

(2,917,452) |

(205,000) |

(3,122,452) |

(1,408,697) |

0 |

(1,408,697) |

45% |

|

Other Revenues |

(2,983,104) |

(333,552) |

(3,316,656) |

(1,468,565) |

0 |

(1,468,565) |

44% |

|

Operating Grants & Contributions |

(13,894,989) |

(1,533,569) |

(15,428,557) |

(2,090,410) |

0 |

(2,090,410) |

14% |

|

Capital Grants & Contributions |

(36,517,290) |

(16,722,608) |

(53,239,899) |

(6,036,555) |

0 |

(6,036,555) |

11% |

|

Total Revenue |

(149,156,350) |

(18,644,412) |

(167,800,762) |

(42,160,053) |

0 |

(42,160,053) |

25% |

|

|

|||||||

|

Expenses

|

|||||||

|

Employee Benefits & On-Costs |

44,786,608 |

87,445 |

44,874,053 |

14,421,266 |

14,655 |

14,435,921 |

32% |

|

Borrowing Costs |

3,752,580 |

(121,277) |

3,631,304 |

872,863 |

0 |

872,863 |

24% |

|

Materials & Contracts |

32,384,231 |

5,838,613 |

38,222,844 |

9,538,639 |

3,494,491 |

13,033,130 |

34% |

|

Depreciation & Amortisation |

35,418,997 |

0 |

35,418,997 |

11,806,332 |

0 |

11,806,332 |

33% |

|

Other Expenses |

12,125,204 |

(2,517,999) |

9,607,205 |

4,396,313 |

110,808 |

4,507,121 |

47% |

|

Total Expenses |

128,467,621 |

3,286,782 |

131,754,403 |

41,035,413 |

3,619,954 |

44,655,367 |

34% |

|

|

|

||||||

|

Net Operating (Profit)/Loss |

(20,688,729) |

(15,357,630) |

(36,046,359) |

(1,124,640) |

3,619,954 |

2,495,315 |

|

|

|

|||||||

|

Net Operating (Profit)/Loss before Capital Grants & Contributions |

15,828,561 |

1,364,979 |

17,193,540 |

4,911,916 |

3,619,954 |

8,531,870 |

|

|

|

|||||||

|

Capital / Reserve Movements |

|||||||

|

Capital Exp - Renewals |

33,260,752 |

13,373,398 |

46,634,150 |

4,229,425 |

7,444,469 |

11,673,893 |

25% |

|

Capital Exp - New Projects |

31,336,485 |

17,374,328 |

50,000,415 |

4,680,812 |

4,214,708 |

8,895,520 |

18% |

|

Capital Exp - Project Concepts |

25,044,335 |

95,641 |

23,850,375 |

14,562 |

52,079 |

66,640 |

0% |

|

Loan Repayments |

3,129,777 |

(225,924) |

2,903,853 |

1,043,259 |

0 |

1,043,259 |

36% |

|

New Loan Borrowings |

(6,108,672) |

1,755,867 |

(4,352,805) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(952,795) |

(2,701,703) |

(3,654,498) |

(301,981) |

0 |

(301,981) |

8% |

|

Net Movements Reserves |

(29,602,157) |

(14,313,977) |

(43,916,134) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

56,107,727 |

15,357,630 |

71,465,356 |

9,666,076 |

11,711,256 |

21,377,332 |

|

|

|

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED

BUDGET |

YTD ACTUAL EXCL COMMT'S 2018/19 |

COMMT'S 2018/19 |

YTD ACTUAL +

COMMT'S |

YTD % OF BUD |

|

Net Result after Depreciation |

35,418,997 |

0 |

35,418,997 |

8,541,436 |

15,331,211 |

23,872,647 |

|

|

|

|||||||

|

Add back Depreciation Expense |

35,418,997 |

0 |

35,418,997 |

11,806,332 |

0 |

11,806,332 |

33% |

|

|

|||||||

|

Cash Budget (Surplus)/Deficit |

0 |

0 |

0 |

(3,264,896) |

15,331,211 |

12,066,315 |

|

Revised Budget Result - Surplus/(Deficit) |

$’000s |

|

Original 2018/19 Budget Result as adopted by Council Total Budget Variations approved to date Budget variations for October 2018 |

$0 $0 $0 |

|

Proposed revised budget result for 31 October 2018 |

$0 |

The proposed Budget Variations to 31 October 2018 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact Fav/ (Unfav) |

||

|

5 – The Environment |

|||||

|

Jubilee Park Stormwater Upgrade |

$50K |

Section 64 Stormwater DSP Reserve ($50K) |

Nil |

||

|

Funds are required for the design of the stormwater infrastructure upgrade at Jubilee Park as identified in the City of Wagga Wagga Development Servicing Plan (DSP) – Stormwater November 2007. This project is a priority due to the significant overland flow during relatively minor rain events (10 – 15mm) and the high usage of Jubilee Park. It is proposed to fund the design proportion of the project from the Section 64 Stormwater DSP Reserve. The project construction is budgeted in future years and will be refined once the detailed design is completed. Estimated Completion Date: 2018/19 |

|

||||

|

SURPLUS/(DEFICIT) |

Nil |

||||

Current Restrictions

|

RESERVES SUMMARY |

|||||

|

31 OCTOBER 2018 |

|||||

|

|

CLOSING BALANCE 2017/18 |

ADOPTED RESERVE TRANSFERS 2018/19 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 12.11.18 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

|

|

|

|

|

|

|

Externally Restricted |

|

|

|

|

|

|

Developer Contributions - Sect 7.11 |

(19,959,750) |

7,405,683 |

2,050,333 |

|

(10,503,733) |

|

Developer Contributions - Sect 7.12 |

(465,272) |

358,500 |

112,629 |

|

5,857 |

|

Developer Contributions – S/Water DSP S64 |

(5,478,298) |

500,000 |

46,347 |

50,000 |

(4,881,951) |

|

Sewer Fund |

(26,204,212) |

4,267,364 |

2,638,508 |

|

(19,298,341) |

|

Solid Waste |

(20,184,154) |

9,600,364 |

1,155,611 |

|

(9,428,179) |

|

Specific Purpose Grants |

(3,519,384) |

0 |

3,519,384 |

|

0 |

|

SRV Levee |

(2,847,382) |

1,807,667 |

892,802 |

|

(146,914) |

|

Stormwater Levy |

(3,167,296) |

162,032 |

102,841 |

|

(2,902,423) |

|

Total Externally Restricted |

(81,825,747) |

24,101,610 |

10,518,454 |

50,000 |

(47,155,683) |

|

|

|

||||

|

Internally Restricted |

|

||||

|

Airport |

(63,685) |

(158,452) |

(258,356) |

(552,913) |

|

|

Art Gallery |

(49,209) |

13,262 |

0 |

(35,947) |

|

|

Ashmont Community Facility |

(6,000) |

(1,500) |

0 |

(7,500) |

|

|

Bridge Replacement |

(201,972) |

(100,000) |

0 |

(301,972) |

|

|

CBD Carparking Facilities |

(863,695) |

160,302 |

31,400 |

(652,592) |

|

|

CCTV |

(74,476) |

(10,000) |

0 |

(84,476) |

|

|

Cemetery Perpetual |

(65,479) |

(129,379) |

0 |

(142,900) |

|

|

Cemetery |

(452,507) |

420 |

(1,191) |

(312,506) |

|

|

Civic Theatre Operating |

0 |

(55,000) |

55,000 |

0 |

|

|

Civic Theatre Technical Infrastructure |

(92,585) |

(50,000) |

0 |

(137,675) |

|

|

Civil Projects |

(155,883) |

0 |

0 |

(155,883) |

|

|

Community Amenities |

(76,763) |

0 |

0 |

(76,763) |

|

|

Community Works |

(61,888) |

(59,720) |

0 |

|

(121,608) |

|

Council Election |

(255,952) |

(76,333) |

5,000 |

(327,285) |

|

|

Emergency Events |

(220,160) |

0 |

0 |

(191,160) |

|

|

Employee Leave Entitlements |

(3,322,780) |

0 |

0 |

|

(3,322,780) |

|

Environmental Conservation |

(131,351) |

20,295 |

0 |

|

(111,056) |

|

Estella Community Centre |

(230,992) |

178,519 |

0 |

|

(52,473) |

|

Event Attraction Reserve |

0 |

0 |

(4,421) |

|

(4,421) |

|

Family Day Care |

(320,364) |

75,366 |

(1,556) |

|

(246,555) |

|

Fit for the Future |

(5,340,222) |

4,444,014 |

(200,000) |

|

(234,345) |

|

Generic Projects Saving |

(1,056,917) |

150,000 |

71,253 |

|

(791,611) |

|

Glenfield Community Centre |

(19,704) |

(2,000) |

0 |

|

(21,704) |

|

Grants Commission |

(5,199,163) |

0 |

0 |

|

(5,199,163) |

|

Grassroots Cricket |

(70,992) |

0 |

0 |

|

(70,992) |

|

Gravel Pit Restoration |

(767,509) |

0 |

0 |

|

(767,509) |

RESERVES SUMMARY

|

|||||

|

31 OCTOBER 2018 |

|||||

|

|

CLOSING BALANCE 2017/18 |

ADOPTED RESERVE TRANSFERS 2018/19 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 12.11.18 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

Gurwood Street Property |

(50,454) |

0 |

0 |

|

(50,454) |

|

Information Services |

(369,113) |

77,858 |

35,000 |

|

(6,256) |

|

Infrastructure Replacement |

(193,634) |

(68,109) |

15,000 |

|

(246,743) |

|

Insurance Variations |

(28,644) |

0 |

(71,603) |

|

(100,246) |

|

Internal Loans |

(518,505) |

(631,470) |

650,137 |

|

(469,921) |

|

Lake Albert Improvements |

(62,349) |

(21,563) |

58,195 |

|

(19,858) |

|

LEP Preparation |

(3,895) |

0 |

0 |

|

(2,545) |

|

Livestock Marketing Centre |

(5,724,767) |

(1,146,762) |

119,813 |

|

(5,773,270) |

|

Museum Acquisitions |

(39,378) |

0 |

0 |

|

(39,378) |

|

Oasis Building Renewal |

(209,851) |

(85,379) |

0 |

|

(295,230) |

|

Oasis Plant |

(1,140,543) |

390,000 |

100,000 |

|

(650,543) |

|

Parks & Recreation Projects |

(79,648) |

49,500 |

0 |

|

(30,148) |

|

Pedestrian River Crossing |

(10,775) |

|

0 |

|

0 |

|

Plant Replacement |

(3,935,062) |

253,958 |

13,000 |

|

(2,637,671) |

|

Playground Equipment Replacement |

(164,784) |

69,494 |

0 |

|

(95,290) |

|

Project Carryovers |

(2,006,338) |

402,808 |

0 |

|

(18,376) |

|

Public Art |

(208,754) |

30,300 |

0 |

|

(113,457) |

|

Robertson Oval Redevelopment |

(92,151) |

0 |

0 |

|

(92,151) |

|

Senior Citizens Centre |

(15,627) |

(2,000) |

0 |

|

(17,627) |

|

Sister Cities |

(36,328) |

(10,000) |

0 |

|

(46,328) |

|

Stormwater Drainage |

(180,242) |

0 |

0 |

|

(158,242) |

|

Strategic Real Property |

(475,000) |

401,305 |

(15,655) |

|

(469,350) |

|

Street Lighting Replacement |

(74,755) |

0 |

18,206 |

|

(56,549) |

|

Subdivision Tree Planting |

(582,108) |

40,000 |

0 |

|

(542,108) |

|

Sustainable Energy |

(588,983) |

95,000 |

220,873 |

|

(234,569) |

|

Traffic Committee |

(21,930) |

0 |

20,138 |

|

(1,792) |

|

Unexpended External Loans |

(841,521) |

0 |

0 |

|

0 |

|

Workers Compensation |

(40,000) |

0 |

(53,251) |

|

(93,251) |

|

Total Internally Restricted |

(36,795,390) |

4,244,732 |

806,981 |

0 |

(26,185,145) |

|

|

|

|

|

|

|

|

Total Restricted |

(118,621,137) |

28,346,342 |

11,325,435 |

50,000 |

(73,340,828) |

Section 356 Financial Assistance Requests

Three Section 356 financial assistance requests have been received for consideration at the 26 November 2018 Ordinary Council meeting.

It should be noted that in the last 12 months no grants or contributions have been provided to any of the three groups who have requested financial assistance in this current report.

Details of the current financial assistance requests are shown below:

· Toy Run (Combined Riders of Wagga Wagga) $327

Pat Combs the 2018 Coordinator Toy Run Committee in his attached letter (Attachment 1) on behalf of the Combined Riders of Wagga Wagga has requested Council’s consideration to the waiving of the hire fees for the staging of their annual Toy Run to be held on the 1 December 2018.

Council’s adopted 2018/19 Delivery Plan and Operational Plan includes a financial assistance contribution of $118 to the Combined Riders of Wagga towards their Toy Run event (contribution hire rate is based on the event finishing at Bolton Park). In 2018, the group has advised they will be using the Wollundry Lagoon Precinct and Civic Theatre external toilets.

The cost for the hire of Civic Precinct area is $245 i.e. $127 more than the Bolton Park hire costs budgeted for.

It has also been identified that the Toy Run Event is usually supported by Council staff who volunteer their time driving two Council Vehicles on the Toy Run day to help collect toys during the run.

The running costs for the use of the two vehicles has been estimated at no more than $200 for the event.

In total, Council’s requested contribution for the 2018 December event with facility hire and plant, use is approximately $445. Given $118 has been approved by Council, an additional contribution of $327 is required for the 2018 Toy Run.

The above request aligns with Council’s Strategic Plan: “Community Leadership and Collaboration – Outcome: We recognise we all have a role to play”.

· Ashmont Baptist Church $90

A member of the Ashmont Baptist Church has written to Council (Attachment 2) requesting Council’s consideration to the waiver of the fees of $90 for the use of Jack Mission Oval in Ashmont for Christmas Carols on the 14 December 2018.

The Christmas Carols are a free community event conducted by the church.

The above request aligns with Council’s Strategic Plan “Community Place and Identity – Outcome: Groups, programs and activities bring us together “.

· Wagga Wagga Seventh Day Adventist Church $408.50

A member of the Wagga Wagga Seventh Day Adventist Church has written to Council (Attachment 3) requesting Council’s consideration to the waiver of the fees of $408.50 for the use of the Glenfield Community Centre to conduct 19 mental health and education program for community members in response to the effect of the ongoing drought.

The above request aligns with Council’s Strategic Plan “Safe and Healthy Community – Outcome: We have access to health and support services that cater for all our needs.

Financial Implications

The Section 356 financial assistance budget for the 2018/19 financial year is $50,255.50, of which $41,689 is already committed in the adopted Delivery and Operational Plan 2018/19.

A balance of $3,184.50 is currently available for additional fee waiver requests received for the reminder of the year following financial assistance approved at the 29 October 2018 Council meeting.

|

Unallocated balance of S356 fee waiver financial assistance budget 2018/19 |

$3,184.50 |

|

Toy Run (Combined Riders of Wagga Wagga) $327 |

($327.00) |

|

Ashmont Baptist Church |

($90.00) |

|

· Wagga Wagga Seventh Day Adventist Church $408.50 |

($408.50) |

|

Total Section 356 Financial Assistance Requests – 29 October 2018 Council Meeting* |

($825.50) |

|

Balance of Section 356 fee waiver financial assistance budget for the remainder of the 2018/19 Financial Year |

$2,359.00 |

Investment Summary as at 31 October 2018

In accordance with Regulation 212 of the Local Government (General) Regulation 2005, details of Wagga Wagga City Council’s external investments are outlined below:

|

Institution |

Rating |

Closing Balance |

Closing Balance |

October |

October |

Investment |

Maturity |

Term |

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

AMP |

A |

2,000,000 |

2,000,000 |

2.95% |

1.45% |

1/06/2018 |

31/05/2019 |

12 |

|

AMP |

A |

1,000,000 |

1,000,000 |

2.95% |

0.73% |

5/06/2018 |

2/01/2019 |

7 |

|

Auswide |

BBB- |

2,000,000 |

0 |

0.00% |

0.00% |

5/10/2017 |

5/10/2018 |

12 |

|

Auswide |

BBB- |

1,000,000 |

0 |

0.00% |

0.00% |

16/10/2017 |

16/10/2018 |

12 |

|

Auswide |

BBB- |

2,000,000 |

2,000,000 |

2.70% |

1.45% |

5/12/2017 |

5/12/2018 |

12 |

|

Police Credit Union |

NR |

2,000,000 |

0 |

0.00% |

0.00% |

28/02/2018 |

29/10/2018 |

8 |

|

AMP |

A |

2,000,000 |

2,000,000 |

2.95% |

1.45% |

17/05/2018 |

13/11/2018 |

6 |

|

AMP |

A |

1,000,000 |

1,000,000 |

2.95% |

0.73% |

17/05/2018 |

17/05/2019 |

12 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

2.86% |

1.45% |

28/05/2018 |

28/05/2019 |

12 |

|

AMP |

A |

2,000,000 |

2,000,000 |

2.95% |

1.45% |

29/05/2018 |

24/01/2019 |

8 |

|

Westpac |

AA- |

1,000,000 |

1,000,000 |

2.80% |

0.73% |

28/06/2018 |

28/06/2019 |

12 |

|

Australian Military Bank |

NR |

1,000,000 |

1,000,000 |

3.01% |

0.73% |

16/07/2018 |

16/07/2019 |

12 |

|

Suncorp-Metway |

A+ |

2,000,000 |

2,000,000 |

2.65% |

1.45% |

31/08/2018 |

30/11/2018 |

3 |

|

Bankwest |

AA- |

2,000,000 |

2,000,000 |

2.76% |

1.45% |

31/08/2018 |

23/04/2019 |

8 |

|

NAB |

AA- |

1,000,000 |

1,000,000 |

2.65% |

0.73% |

7/09/2018 |

7/12/2018 |

3 |

|

Australian Military Bank |

NR |

1,000,000 |

1,000,000 |

2.86% |

0.73% |

7/09/2018 |

8/07/2019 |

10 |

|

Total Short Term Deposits |

|

25,000,000 |

20,000,000 |

2.84% |

14.52% |

|

|

|

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

1,003,176 |

1,001,924 |

1.50% |

0.73% |

N/A |

N/A |

N/A |

|

NAB |

AA- |

16,715,321 |

12,745,357 |

2.19% |

9.25% |

N/A |

N/A |

N/A |

|

AMP |

A |

346 |

347 |

2.30% |

0.00% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

63 |

0 |

0.00% |

0.00% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

17,718,906 |

13,747,628 |

2.14% |

9.98% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

RaboBank |

A+ |

1,000,000 |

1,000,000 |

3.16% |

0.73% |

5/06/2017 |

6/06/2022 |

60 |

|

ING Bank |

A |

3,000,000 |

3,000,000 |

2.75% |

2.18% |

24/08/2017 |

26/08/2019 |

24 |

|

ME Bank |

BBB |

2,000,000 |

2,000,000 |

4.28% |

1.45% |

2/09/2014 |

2/09/2019 |

60 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

4.10% |

0.73% |

5/12/2014 |

5/12/2019 |

60 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.10% |

1.45% |

7/07/2017 |

7/07/2020 |

36 |

|

AMP |

A |

2,000,000 |

2,000,000 |

3.00% |

1.45% |

2/08/2018 |

3/02/2020 |

18 |

|

Newcastle Permanent |

BBB |

1,000,000 |

1,000,000 |

3.00% |

0.73% |

12/08/2016 |

12/08/2019 |

36 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

3.20% |

0.73% |

25/08/2016 |

25/08/2021 |

60 |

|

Newcastle Permanent |

BBB |

1,000,000 |

1,000,000 |

3.00% |

0.73% |

31/08/2016 |

30/08/2019 |

36 |

|

Newcastle Permanent |

BBB |

2,000,000 |

2,000,000 |

3.00% |

1.45% |

10/02/2017 |

11/02/2019 |

24 |

|

Westpac |

AA- |

3,000,000 |

3,000,000 |

3.10% |

2.18% |

10/03/2017 |

10/03/2022 |

60 |

|

Auswide |

BBB- |

0 |

2,000,000 |

2.95% |

1.45% |

5/10/2018 |

6/10/2020 |

24 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

2.92% |

0.73% |

16/10/2017 |

16/10/2019 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

2.92% |

1.45% |

6/11/2017 |

6/11/2019 |

24 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.35% |

1.45% |

3/01/2018 |

4/01/2022 |

48 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

2.80% |

0.73% |

5/01/2018 |

6/01/2020 |

24 |

|

Institution |

Rating |

Closing Balance |

Closing Balance |

October |

October |

Investment |

Maturity |

Term |

|

Police Credit Union |

NR |

0 |

2,000,000 |

3.05% |

1.45% |

29/10/2018 |

29/10/2020 |

24 |

|

Australian Military Bank |

NR |

1,000,000 |

1,000,000 |

2.95% |

0.73% |

29/05/2018 |

29/05/2020 |

24 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

3.50% |

0.73% |

1/06/2018 |

1/06/2022 |

48 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

3.02% |

1.45% |

28/06/2018 |

28/06/2021 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

2.88% |

1.45% |

28/06/2018 |

29/06/2020 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

2.86% |

1.45% |

16/08/2018 |

17/08/2020 |

24 |

|

BOQ |

BBB+ |

3,000,000 |

3,000,000 |

3.25% |

2.18% |

28/08/2018 |

29/08/2022 |

48 |

|

ING Bank |

A |

3,000,000 |

3,000,000 |

2.85% |

2.18% |

30/08/2018 |

14/09/2020 |

24 |

|

P&N Bank |

BBB |

0 |

1,000,000 |

3.10% |

0.73% |

16/10/2018 |

18/10/2021 |

36 |

|

Total Medium Term Deposits |

|

39,000,000 |

44,000,000 |

3.10% |

31.94% |

|

|

|

|

Floating Rate Notes - Senior Debt |

|

|

|

|

|

|

|

|

|

BOQ |

BBB+ |

2,009,400 |

2,014,400 |

BBSW + 110 |

1.46% |

5/08/2014 |

24/06/2019 |

58 |

|

Bendigo-Adelaide |

BBB+ |

1,008,743 |

1,011,267 |

BBSW + 110 |

0.73% |

18/08/2015 |

18/08/2020 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,008,743 |

1,011,267 |

BBSW + 110 |

0.73% |

28/09/2015 |

18/08/2020 |

59 |

|

Suncorp-Metway |

A+ |

1,018,351 |

1,012,377 |

BBSW + 125 |

0.73% |

20/10/2015 |

20/10/2020 |

60 |

|

Rabobank |

A+ |

2,041,840 |

2,047,672 |

BBSW + 150 |

1.49% |

4/03/2016 |

4/03/2021 |

60 |

|

Newcastle Permanent |

BBB |

1,004,034 |

1,006,577 |

BBSW + 160 |

0.73% |

22/03/2016 |

22/03/2019 |

36 |

|

CUA |

BBB |

2,026,100 |

2,012,294 |

BBSW + 160 |

1.46% |

1/04/2016 |

1/04/2019 |

36 |

|

ANZ |

AA- |

1,012,362 |

1,014,407 |

BBSW + 118 |

0.74% |

7/04/2016 |

7/04/2021 |

60 |

|

Suncorp-Metway |

A+ |

1,023,280 |

1,017,076 |

BBSW + 138 |

0.74% |

21/04/2016 |

12/04/2021 |

60 |

|

AMP |

A |

1,012,232 |

1,014,427 |

BBSW + 135 |

0.74% |

24/05/2016 |

24/05/2021 |

60 |

|

Westpac |

AA- |

1,014,761 |

1,016,926 |

BBSW + 117 |

0.74% |

3/06/2016 |

3/06/2021 |

60 |

|

CBA |

AA- |

1,020,930 |

1,015,117 |

BBSW + 121 |

0.74% |

12/07/2016 |

12/07/2021 |

60 |

|

ANZ |

AA- |

2,031,342 |

2,035,952 |

BBSW + 113 |

1.48% |

16/08/2016 |

16/08/2021 |

60 |

|

BOQ |

BBB+ |

1,517,613 |

1,509,566 |

BBSW + 117 |

1.10% |

26/10/2016 |

26/10/2020 |

48 |

|

NAB |

AA- |

1,015,031 |

1,009,807 |

BBSW + 105 |

0.73% |

21/10/2016 |

21/10/2021 |

60 |

|

Teachers Mutual |

BBB |

1,513,535 |

1,505,427 |

BBSW + 140 |

1.09% |

28/10/2016 |

28/10/2019 |

36 |

|

Bendigo-Adelaide |

BBB+ |

1,007,853 |

1,010,597 |

BBSW + 110 |

0.73% |

21/11/2016 |

21/02/2020 |

39 |

|

Westpac |

AA- |

1,016,071 |

1,010,757 |

BBSW + 111 |

0.73% |

7/02/2017 |

7/02/2022 |

60 |

|

ANZ |

AA- |

1,009,623 |

1,012,257 |

BBSW + 100 |

0.73% |

7/03/2017 |

7/03/2022 |

60 |

|

CUA |

BBB |

753,782 |

755,840 |

BBSW + 130 |

0.55% |

20/03/2017 |

20/03/2020 |

36 |

|

Heritage Bank |

BBB+ |

604,976 |

601,925 |

BBSW + 130 |

0.44% |

4/05/2017 |

4/05/2020 |

36 |

|

Teachers Mutual |

BBB |

1,005,493 |

1,008,347 |

BBSW + 142 |

0.73% |

29/06/2017 |

29/06/2020 |

36 |

|

NAB |

AA- |

3,011,202 |

3,017,811 |

BBSW + 90 |

2.19% |

5/07/2017 |

5/07/2022 |

60 |

|

Suncorp-Metway |

A+ |

1,007,273 |

1,010,367 |

BBSW + 97 |

0.73% |

16/08/2017 |

16/08/2022 |

60 |

|

Westpac |

AA- |

2,010,686 |

2,000,796 |

BBSW + 81 |

1.45% |

30/10/2017 |

27/10/2022 |

60 |

|

ME Bank |

BBB |

1,509,245 |

1,501,692 |

BBSW + 125 |

1.09% |

9/11/2017 |

9/11/2020 |

36 |

|

NAB |

AA- |

2,004,488 |

2,009,894 |

BBSW + 80 |

1.46% |

10/11/2017 |

10/02/2023 |

63 |

|

ANZ |

AA- |

1,505,556 |

1,499,232 |

BBSW + 77 |

1.09% |

18/01/2018 |

18/01/2023 |

60 |

|

Bendigo-Adelaide |

BBB+ |

501,602 |

499,599 |

BBSW + 105 |

0.36% |

25/01/2018 |

25/01/2023 |

60 |

|

Newcastle Permanent |

BBB |

1,504,266 |

1,496,127 |

BBSW + 140 |

1.09% |

6/02/2018 |

6/02/2023 |

60 |

|

Westpac |

AA- |

2,001,968 |

2,007,814 |

BBSW + 83 |

1.46% |

6/03/2018 |

6/03/2023 |

60 |

|

UBS |

A+ |

2,005,088 |

2,011,394 |

BBSW + 90 |

1.46% |

8/03/2018 |

8/03/2023 |

60 |

|

Heritage Bank |

BBB+ |

1,400,874 |

1,405,498 |

BBSW + 123 |

1.02% |

29/03/2018 |

29/03/2021 |

36 |

|

ME Bank |

BBB |

1,612,373 |

1,603,453 |

BBSW + 127 |

1.16% |

17/04/2018 |

16/04/2021 |

36 |

|

ANZ |

AA- |

2,011,666 |

2,002,656 |

BBSW + 93 |

1.45% |

9/05/2018 |

9/05/2023 |

60 |

|

NAB |

AA- |

2,009,228 |

2,015,174 |

BBSW + 90 |

1.46% |

16/05/2018 |

16/05/2023 |

60 |

|

CBA |

AA- |

2,010,306 |

2,015,454 |

BBSW + 93 |

1.46% |

16/08/2018 |

16/08/2023 |

60 |

|

Institution |

Rating |

Closing Balance |

Closing Balance |

October |

October |

Investment |

Maturity |

Term |

|

Bank Australia |

BBB |

753,123 |

755,458 |

BBSW + 130 |

0.55% |

30/08/2018 |

30/08/2021 |

36 |

|

CUA |

BBB |

601,432 |

603,145 |

BBSW + 125 |

0.44% |

6/09/2018 |

6/09/2021 |

36 |

|

AMP |

A |

1,502,436 |

1,505,277 |

BBSW + 108 |

1.09% |

10/09/2018 |

10/09/2021 |

36 |

|

NAB |

AA- |

2,003,808 |

2,008,954 |

BBSW + 93 |

1.46% |

26/09/2018 |

26/09/2023 |

60 |

|

Bendigo-Adelaide |

BBB+ |

0 |

1,002,115 |

BBSW + 101 |

0.73% |

19/10/2018 |

19/01/2022 |

39 |

|

Total Floating Rate Notes - Senior Debt |

|

57,642,714 |

58,626,191 |

|

42.55% |

|

|

|

|

Managed Funds |

|

|

|

|

|

|

|

|

|

NSW Tcorp |

NR |

1,457,599 |

1,402,531 |

-3.78% |

1.02% |

17/03/2014 |

1/10/2023 |

114 |

|

Total Managed Funds |

|

1,457,599 |

1,402,531 |

-3.78% |

1.02% |

|

|

|

|

TOTAL

CASH ASSETS, CASH |

|

140,819,219 |

137,776,350 |

|

100.00% |

|

|

|

|

LESS: RIVERINA REGIONAL LIBRARY (RRL) CASH AT BANK |

|

3,374,250 |

4,435,355 |

|

|

|

|

|

|

TOTAL

WWCC CASH ASSETS, CASH |

|

137,444,969 |

133,340,994 |

|

|

|

|

|

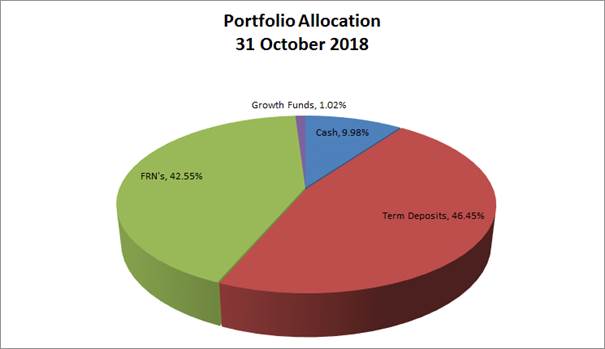

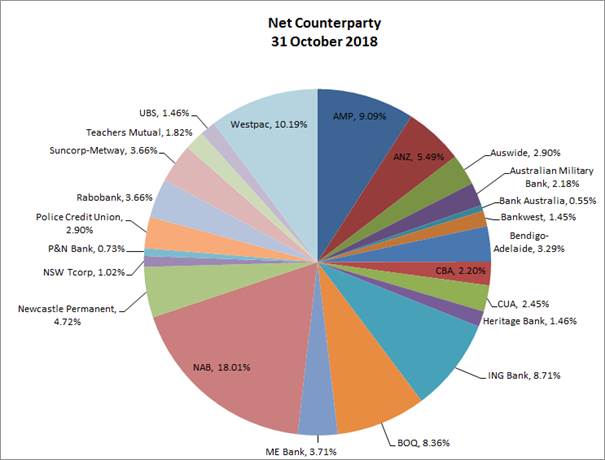

Council’s investment portfolio is now dominated by Term Deposits, equating to approximately 46% of the portfolio across a broad range of counterparties. Cash equates to 10% of the portfolio with Floating Rate Notes (FRNs) around 43% and growth funds around 1% of the portfolio.

Council’s investment portfolio is well diversified in complying assets across the entire credit spectrum. It is also well diversified from a rating perspective. Credit quality is diversified and is predominately invested amongst the investment grade Authorised Deposit-Taking Institutions (ADIs) (being BBB- or higher), with a smaller allocation to unrated ADIs.

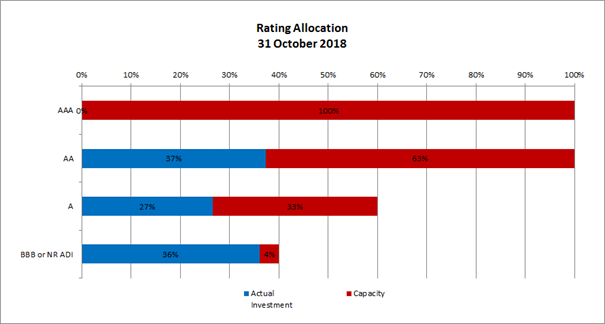

All investments are within the defined Policy limits, as outlined in the Rating Allocation chart below:

Investment Portfolio Balance

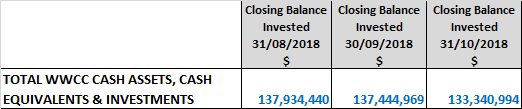

Council’s investment portfolio balance has decreased from the previous month’s balance, down from $137.4M to $133.3M.

MONTHLY INVESTMENT MOVEMENTS

Redemptions/Sales – Council redeemed the following investment security during October 2018:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

Auswide Bank Term Deposit |

$1M |

12 months |

2.67% |

This term deposit was redeemed on maturity and funds were reinvested in a 3‑year term deposit with P&N Bank (see below). |

New Investments – Council purchased the following investment security during October 2018:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

P&N Bank Term Deposit |

$1M |

3 years |

3.10% |

The P&N Bank rate of 3.10% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

|

Bendigo-Adelaide Bank Floating Rate Note |

$1M |

3.25 years |

BBSW + 101 |

Council’s independent Financial Advisor advised this Floating Rate Note represented fair value. |

Rollovers – Council rolled the following investment securities during October 2018:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

Auswide Bank Term Deposit |

$2M |

12 months |

2.67% |

This term deposit was a 12-month investment at 2.67% and was rolled at maturity into a 2-year term deposit at 2.95%. |

|

Police Credit Union Term Deposit |

$2M |

8 months |

2.70% |

This term deposit was an 8-month investment at 2.70% and was rolled at maturity into a 2-year term deposit at 3.05%. |

MONTHLY PERFORMANCE

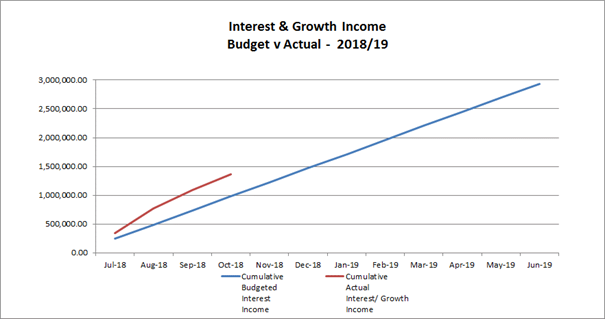

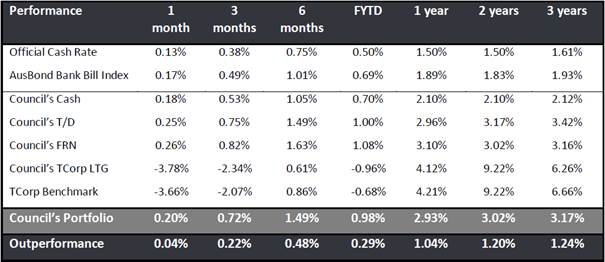

Interest/growth/capital gains for the month totaled $271,142, which compares favourably with the budget for the period of $244,709, outperforming budget for the month of October by $26,433. This is mainly due to a larger than expected portfolio balance as well as better than expected interest rates.

Council’s T-Corp Long Term Growth Fund detracted from the overall performance for the month of October following losses suffered in domestic and international markets. Even though the fund was down 3.78% for the month of October, the fund has returned 8.70% per annum since the original investment in March 2014. Overall, the Growth Fund remains Council’s best performing asset over 1-3 years by a considerable margin.

It is important to note Council’s investment portfolio balance is tracking well above what was originally predicted. This is mainly due to the timing of some of the major projects that are either not yet commenced or not as advanced as originally predicted. It is anticipated that over the 2018/19 financial year the portfolio balance will reduce in line with the completion of major projects. This will result in Councils investment portfolio continuing to maintain a higher balance until these projects commence or advance further.

The longer-dated deposits in the portfolio, particularly those locked in above 4% yields, have previously anchored Council’s portfolio performance. It should be noted that the portfolio now only includes two investments yielding above 4% and Council will inevitably see a fall in investment income over the coming months compared with previous periods. Council staff and Council’s Independent Financial Advisor will continue to identify opportunities to lock in higher yielding investments as they become available.

In comparison to the AusBond Bank Bill Index* (1.89%), Council’s investment portfolio returned 2.40% (annualised) for October. Cash and At-Call accounts returned 2.14% (annualised) for this period. These funds are utilised for daily cash flow management and need to be available to meet operating and contractual payments as they come due.

* The AusBond Bank Bill Index is the leading benchmark for the Australian fixed income market. It is interpolated from the RBA Cash rate, 1 month and 3 month Bank Bill Swap rates.

Report by Responsible Accounting Officer

I hereby certify that all of the above investments have been made in accordance with the provision of Section 625 of the Local Government Act 1993 and the regulations there under, and in accordance with the Investments Policy adopted by Council on 26 February 2018.

Carolyn Rodney

Responsible Accounting Officer

Policy and Legislation

Budget variations are reported in accordance with Council’s POL 052 Budget Policy.

Investments are reported in accordance with Council’s POL 075 Investment Policy.

Local Government Act 1993

Section 625 - How may councils invest?

Local Government (General) Regulation 2005

Section 212 - Reports on council investments

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

This report is a control mechanism that assists in addressing the following potential risks to Council:

· Loss of investment income or capital resulting from ongoing management of investments, especially during difficult economic times

· Failure to demonstrate to the community that its funds are being expended in an efficient and effective manner

Internal / External Consultation

Council’s Community Engagement Strategy and IAP2 considers the community to be “any individual or group of individuals, organisation or political entity with an interest in the outcome of a decision….”

All relevant areas within the Council have consulted with the Finance Division in regards to the budget variations listed in this report.

The Finance Division has consulted with relevant external parties to confirm Council’s investment portfolio balances.

|

1⇩. |

Section 356 Financial Assistance Request - Combined Riders of Wagga Wagga (Toy Run) |

|

|

2⇩. |

Section 356 Financial Assistance Request - Ashmont Baptist Church |

|

|

3⇩. |

Section 356 Financial Assistance Request - Wagga Wagga Seventh Day Adventist Church |

|

Report submitted to the Ordinary Meeting of Council on Monday 26 November 2018. RP-3

RP-3 CANBERRA REGION JOINT ORGANISATION (CRJO)

General Manager: Peter Thompson

|

Analysis: |

Council has been invited to join the Canberra Region Joint Organisation (CRJO) as an associate member. During the course of this calendar year, Wagga Wagga have actively participated in activities and meetings being coordinated by the CRJO as a non-member. The CRJO is professionally managed and Council has received substantial direct benefit through its short association with the organisation. |

|

That Council: a endorse becoming an associate member of the Canberra Region Joint Organisation b note the update regarding the Riverina Joint Organisation and REROC c approve the budget variation as detailed in the Financial Implications section of this report |

Report

Background

The Canberra region has strong strategic linkages for Wagga Wagga including commerce, transport (particularly airport), tourism and sport. The Canberra Region Joint Organisation (CRJO) provides a forum for Councils, State agencies and other stakeholders to work together at a regional level to identify shared priorities.

The CRJO provides advocacy for Councils and the NSW Government to work together to deliver things that matter the most to regional communities representing a strong commitment to collaborate in the long term to develop and support a shared vision for our regions. The member Councils involved in the CRJO include:

|

Bega Valley |

Hilltops |

Upper Lachlan |

Eurobodalla |

|

Queanbeyan-Palerang |

Goulburn Mulwaree |

Snowy Monaro |

Yass Valley |

|

ACT Government |

Snowy Valleys |

|

|

The CRJO has a vision to be a strong regional voice advocating strategic local government leadership and operates under following guiding principles:

· Cohesive - speaking with one voice on regional issues and valuing equal representation.

· Collaborative - by working transparently and in the spirit of trust across member councils, communities, governments, and with a wide range of partners.

· Aligned - with consistency between member Councils and NSW Government on regional strategies and policies.

· Efficient - by avoiding duplication and using resources within and available to member Councils wherever possible.

· Evidenced based - when introducing or transitioning programs and shared services.

· Educative - Challenging and improving as a sector and sharing information and opportunities between participating councils and the ACT.

· Flexible - Opportunities to operate at the sub-regional as well as regional level. Principles to opt in/opt out when deemed appropriate.

· Effective - Delivering real outcomes for the region through collaboration and shared delivery.

The CRJO operates under the following Governance structure:

· Board – Mayors (General Managers may attend; non-voting). Associate Members will attend at the invitation of the Board (non-voting)

· GMAC – General Managers of member and associate member Councils, provide recommendations to the Board through the Executive Officer

· Working Groups - Economic Development, Tourism (in collaboration with DSNSW), Waste Management, Infrastructure

The Canberra Region is a unique and diverse geographic region which stretches from the South-West Slopes, through the Sydney-Canberra Corridor across the Eurobodalla down to the Sapphire Coast and then up to the Snowy Mountains.

Benefits to Wagga Wagga

Wagga Wagga is ideally located and is only a two and a half hours drive from Canberra. The broader Canberra Region also offers a dynamic and diverse range of industries running from the Alpine, through the Tablelands and down to the Coast, contributing to an increasingly influential regional economy.

Wagga Wagga can leverage off the relationship with the CRJO to build a hub and spoke model with Australia’s Capital city and develop a coordinated approach with local government in the Canberra region to progress strategic issues such as freight, transport, tourism and economic development.

Since commencing with CRJO, Wagga Wagga has obtained the following benefits:

· Participation in joint organisation. Although we are not full members, we have nevertheless enjoyed the benefits of working through the JO to coordinate grant applications on a region wide basis.

· The CRJO played a significant role in our engagement with the Canberra Raiders, which led to the offer of a premiership match and the proposed establishment of Riverina Raiders.

· The CRJO has been instrumental in coordinating meetings with Ministers and senior State Government staff, both at CRJO meetings and on a one-on-one basis with the Wagga Wagga Mayor and General Manager.

· The ACT Government and the Canberra Airport are also active participants at CRJO meetings and both these entities offer beneficial links for Wagga Wagga City Council.

· The ability to gain the support of all the Canberra region Councils was a valuable feature of the Qantas Pilot Academy bid.

· The development of a Project Delivery Framework which provides linkages to the State Infrastructure Strategy 2018-2023. This framework is a template that has been populated into project Prospectus documents using a common language and specific project information for all levels of Government (confidential examples attached).

Wagga Wagga will play a key role in NSW freight and logistics in the future, and the CRJO provides a valuable forum to link our Riverina strategies with Canberra, Canberra Airport and the regional Councils surrounding Canberra. The lines of communication and trusting relationships which come from our membership will benefit all parties (both Wagga Wagga and Canberra regional Councils) as we move into the future.

The advantages which come from associate memberships need to be balanced with the additional cost of time commitment.

While we are not a member of a JO, the CRJO associate membership provides us with access to JO discussions and initiatives which are valuable. If we join a JO (other than CRJO) we can withdraw from the CRJO associate membership.

The CRJO have provided invaluable support and connections since our participation, including advocacy for priority projects and setting up meetings with Ministers and key staff.

REROC and the Riverina Joint Organisation

The REROC Board at its February Board meeting resolved to form a JO and adopted a model that allows for the continued operation of REROC, in its current structure side-by-side with the new JO.

Council’s preference was for a stand-alone JO and at the 26 February 2018 Ordinary council meeting resolved to establish a JO with Narrandera, Leeton, Snowy Valleys and any other Council where the Council also seeks to be part of a joint stand-alone organisation. This JO did not proceed with Snowy Valleys resolving to pursue full membership with the CRJO and Narrandera and Leeton have since resolved to join the RAMJO (Riverina and Murray Joint Organisation).

The Riverina Joint Organisation (RJO) was proclaimed in May 2018 with the following member Councils:

|

Bland |

Coolamon |

Cootamundra-Gundagai |

Greater Hume |

|

Junee |

Lockhart |

Temora |

|

At this stage, Council remains a member of REROC Inc, but not the RJO. The Mayor and General Manager recently addressed the RJO reaffirming Council’s desire to join a JO consisting of Councils that surround the city (ie REROC Councils), subject to further discussion and conditions. These discussions are continuing.

Council will remain a member of REROC for the remainder of this Financial Year. This membership will be reviewed prior to the renewal for the 2019/20 Financial Year.

Financial Implications

The 2018/19 CRJO associate membership fee is $39,045 (excluding GST).

It is proposed to fund the 2018/19 CRJO associate membership fee from the Council Election Reserve which is projected to exceed the amount required to conduct an election in 2020/21. The associate membership fee will be included in future budgets if Council support this recommendation.

The REROC Contribution fee for 2018/19 was $55,450 (excluding GST).

Policy and Legislation

Local Government Amendment (Regional Joint Organisations) Act 2017 No 65

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We plan long term

Risk Management Issues for Council

There is a risk that Council may not be included in key strategic planning discussions if it is not a member or an associate member of a JO.

Internal / External Consultation

Council has participated in numerous meetings with the CRJO and have held various discussions with REROC member councils and councils in the greater Riverina Murray Planning area.

Workshops have been held with Councillors on 20 August 2018 and 15 October 2018.

|

1. |

CRJO - Roads Projects Prospectus This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, prejudice the commercial position of the person who supplied it. - Provided under separate cover |

|

|

2. |

CRJO - Water and Waste Water Projects Prospectus This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, prejudice the commercial position of the person who supplied it. - Provided under separate cover |

|

Report submitted to the Ordinary Meeting of Council on Monday 26 November 2018. RP-4

RP-4 Council Meeting Schedule 2019

Author: Ingrid Hensley

General Manager: Peter Thompson

|

Analysis: |

The proposed Schedule of Ordinary Council Meetings for the calendar year 2019 has been prepared on the basis of two options being either monthly meetings or fortnightly meetings. Council has been trialling two meetings per month since May of this year. The report provides a schedule for either a return to monthly meetings or the continuation of two monthly meetings according to the preference of Council. |

|

That Council endorse the schedule of Ordinary Council meeting dates according to the preference of Council which make provision for ongoing two monthly meetings during January 2019 to December 2019, as outlined in the report. |

Report

At the Ordinary Meeting of Council held 26 February 2018, Council resolved to hold two Ordinary Council Meetings per month between May 2018 and December 2018 (inclusive). An amended Code of Meeting Practice was accordingly adopted on 23 April 2018, and fortnightly meetings were scheduled for the remainder of the 2018 calendar year. Prior to that time Ordinary Meetings of Council were held monthly.

It is proposed that Ordinary Meetings of Council continue to be held on the second and fourth Monday of each month (unless something influences scheduling), commencing at 6pm with public addresses to occur at the start of each meeting.

Proposed Ordinary Meeting of Council Schedule for 2019

The following dates are proposed:

|

Monthly Meetings |

Twice Monthly Meetings |

|

Tuesday 29 January 2019 (see notes below) |

Tuesday 29 January 2019 (see notes below) |

|

Monday, 25 February 2019 |

Monday, 11 February 2019 |

|

Monday, 25 March 2019 |

Monday, 25 February 2019 |

|

Monday, 29 April 2019 |

Monday, 11 March 2019 |

|

Monday, 27 May 2019 |

Monday, 25 March 2019 |

|

Monday, 24 June 2019 |

Monday, 8 April 2019 |

|

Monday, 22 July 2019 |

Monday, 29 April 2019 Monday, |

|

Monday, 26 August 2019 |

13 May 2019 |

|

Monday, 23 September 2019 |

Monday, 27 May 2019 |

|

Monday, 28 October 2019 |

Tuesday, 11 June 2019 (Meeting on Tuesday due to Queens Birthday Public Holiday) |

|

Monday, 25 November 2019 |

Monday, 24 June 2019 |

|

Monday, 16 December 2019 (Amended to three weeks due to Christmas break) |

Monday, 8 July 2019 |

|

|

Monday, 22 July 2019 |

|

|

Monday, 12 August 2019 |

|

|

Monday, 26 August 2019 |

|

|

Monday, 9 September 2019 |

|

|

Monday, 23 September 2019 |

|

|

Tuesday, 8 October 2019 (Meeting on Tuesday due to Labour Day Public Holiday. See also notes below) |

|

|

Monday, 28 October 2019 |

|

|

Monday, 11 November 2019 |

|

|

Monday, 25 November 2019 |

|

|

Monday, 16 December 2019 (Amended to three weeks due to Christmas break) |

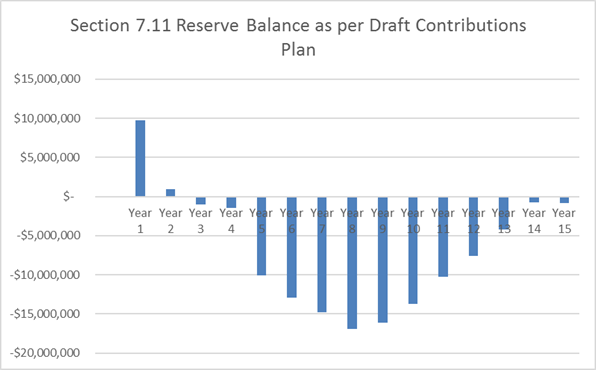

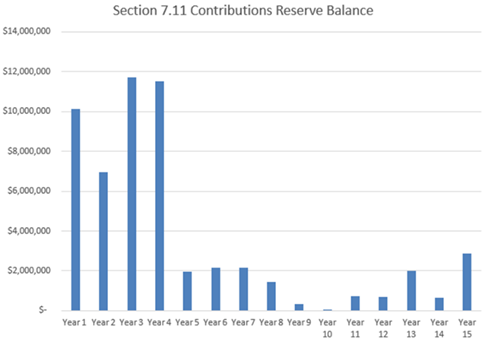

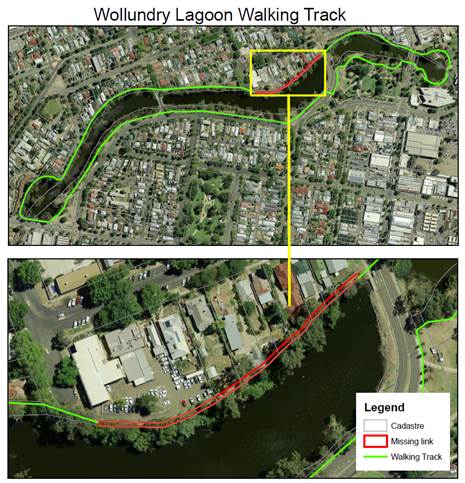

Notes: