Report submitted to the Extraordinary Meeting of Council on Monday 10 December 2018. RP-1

Reports

from Staff

RP-1 CONTAINER DEPOSIT SCHEME AND REFUND

SHARING ARRANGEMENT

Author: David

Butterfield

Director: Natalie Te Pohe

|

Summary:

|

The NSW Container Deposit Scheme (the Scheme) commenced on 1

December 2017, with a 10 cent refund claimable on eligible containers. Under

the Scheme, operators of Material Recovery Facilities (MRFs) can claim a

portion of the refund on containers collected from kerbside recycling using

the MRF Protocol.

MRFs could begin claiming a refund on containers they process for

councils on 1 December 2017, however, MRFs can only continue to claim the

refund after 1 December 2018 where:

· the MRF and

council have put a refund-sharing agreement in place if there is no existing

refund-sharing agreement; or

· the council

notifies the Environment Protection Authority (EPA) in writing that in the

circumstances it is fair and reasonable if there is an existing refund-sharing

agreement.

This report is recommending that Council enter into a short-term

refund-sharing agreement with Kurrajong for a 12-month period from the date

of execution of the Agreement, estimated to be 11 December 2018 to 10

December 2019 incorporating a retrospective payment for the period 1 December

2017 to 30 November 2018.

|

Ment

|

That

Council:

a authorise

the General Manager or their delegate to enter into a Refund Sharing

Agreement commencing 11 December 2018 to 10 December 2019 according to the

following refund sharing arrangement:

i 50%

Wagga Wagga City Council; and

ii 50%

Kurrajong

b authorise

the General Manager or their delegate to ensure that the Refund Sharing

Agreement includes the retrospective application for the period 1 December

2017 to 30 November 2018 according to the following refund sharing

arrangement:

i 50%

Wagga Wagga City Council; and

ii 50%

Kurrajong

c note

that a report commissioned by the Government indicated that the costs of

introducing the new Container Deposit Scheme, including the ongoing auditing

and reporting requirements are not more than 5% of revenue generated from the

Scheme

d note

that the recommended refund sharing arrangement with retrospective payments

is on a short term basis, allowing time to further review the ongoing

implications and costs of the Scheme

|

Background

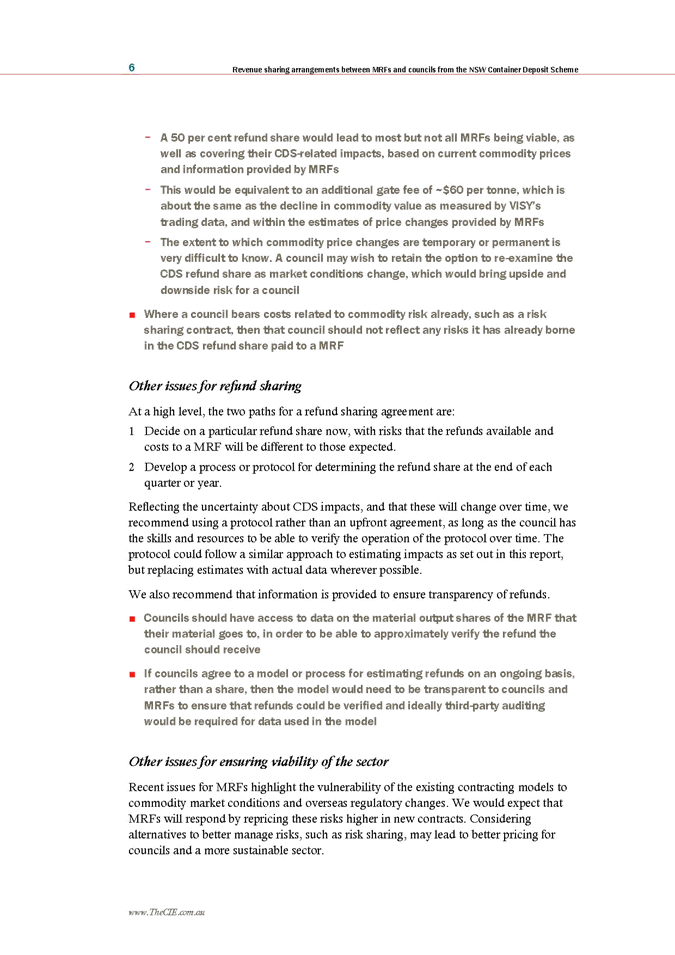

The NSW Container Deposit Scheme (the Scheme) commenced 1 December

2017, with a 10 cent refund claimable on eligible containers.

When members of the community dispose of containers to their yellow

recycling bins Council becomes the owner of the containers and can claim the

deposit. The Office of Local Government has the view that this income is to be

spent on reducing the cost of domestic waste management. In the future we hope

to lobby for this income to be available for other Community Projects.

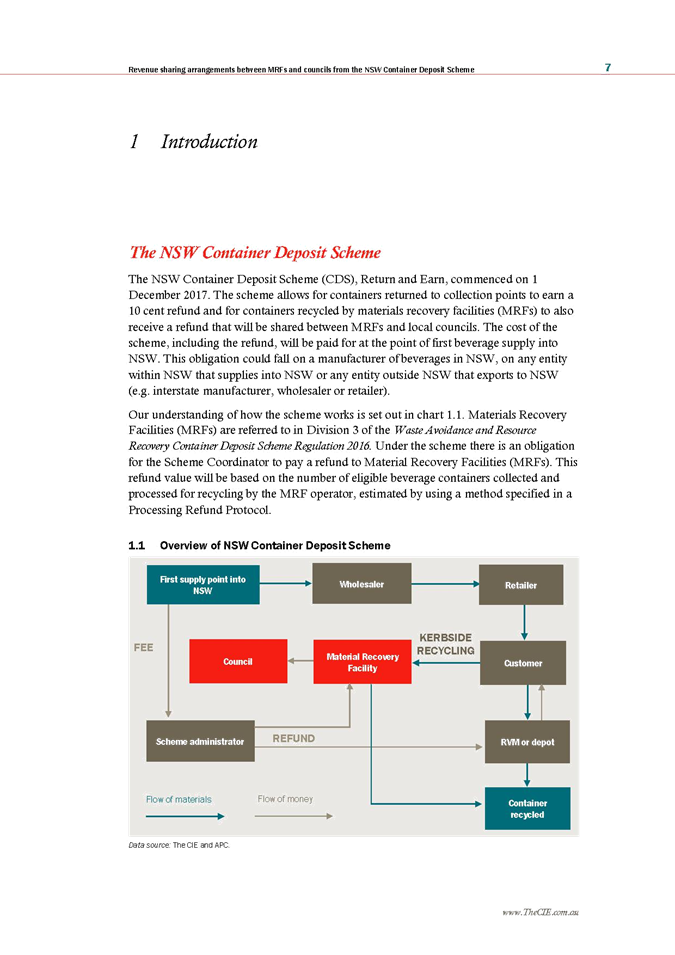

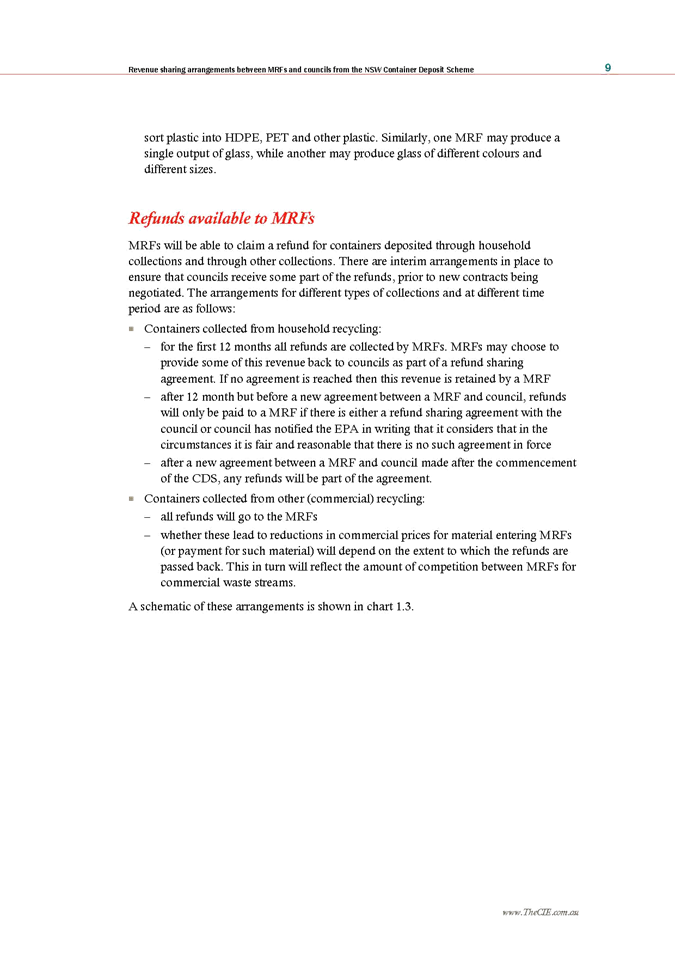

Under the Scheme operators of Material Recovery Facilities (MRFs)

claim the refund on containers collected from kerbside recycling using the MRF

Protocol. This is because in practical terms, the containers are delivered to

the MRF for sorting and processing.

MRFs could begin claiming a refund on containers they process for

councils on 1 December 2017. However MRFs can only continue to claim the

refund after 1 December 2018 where:

· the MRF and

council have put a refund-sharing agreement in place if there is no existing

refund-sharing agreement; or

· the council

notifies the Environment Protection Authority (EPA) in writing that in the

circumstances it is fair and reasonable if there is an existing refund-sharing

agreement.

As outlined above, if no agreement is reached prior to 1 December

2018, any refund sharing agreement that is entered into after this date, can

only be applied from the date the agreement is entered into, therefore

resulting in a significant loss of revenue for Council and therefore the

community.

It should be noted that under clause 18 of the Waste Avoidance and

Resource Recovery (Container Deposit Scheme) Regulation 2017, if a council

enters into a processing agreement with a MRF operator on or after 1 December

2017 that does not address the Scheme refund-sharing arrangements, the MRF

operator will continue to receive the entire Scheme revenue stream.

Accordingly, when Council entered into Contract 2017-26 for Recyclable

Waste Acceptance and Processing Services with Kurrajong commencing 2 April 2018,

clauses were inserted to ensure that Kurrajong were required to pay Council a

nominated percentage of any processing refund that the contractor received in

respect of containers collected under that Contract.

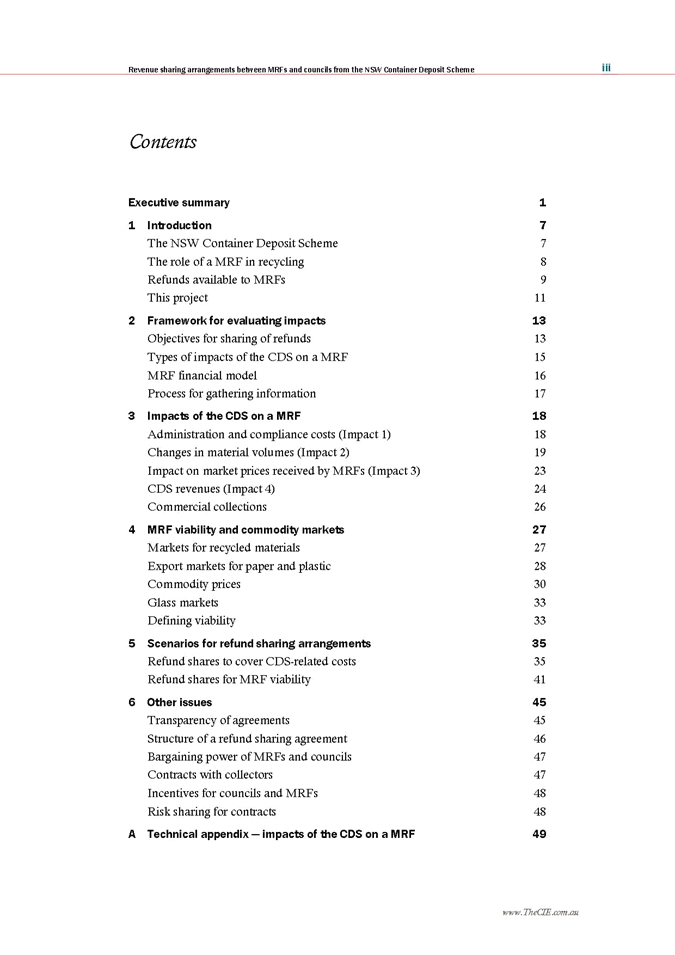

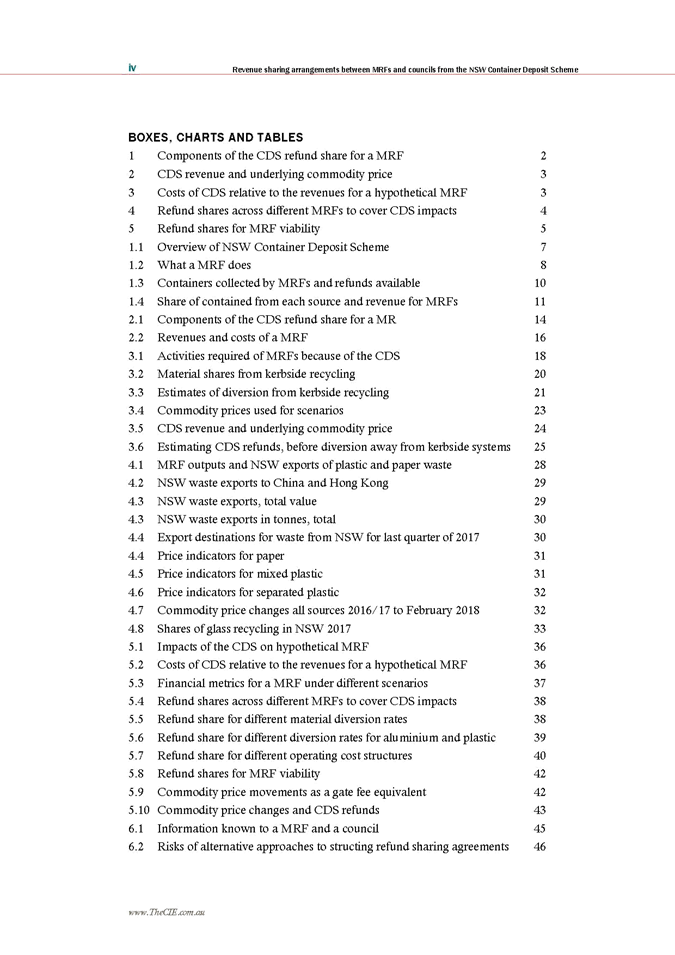

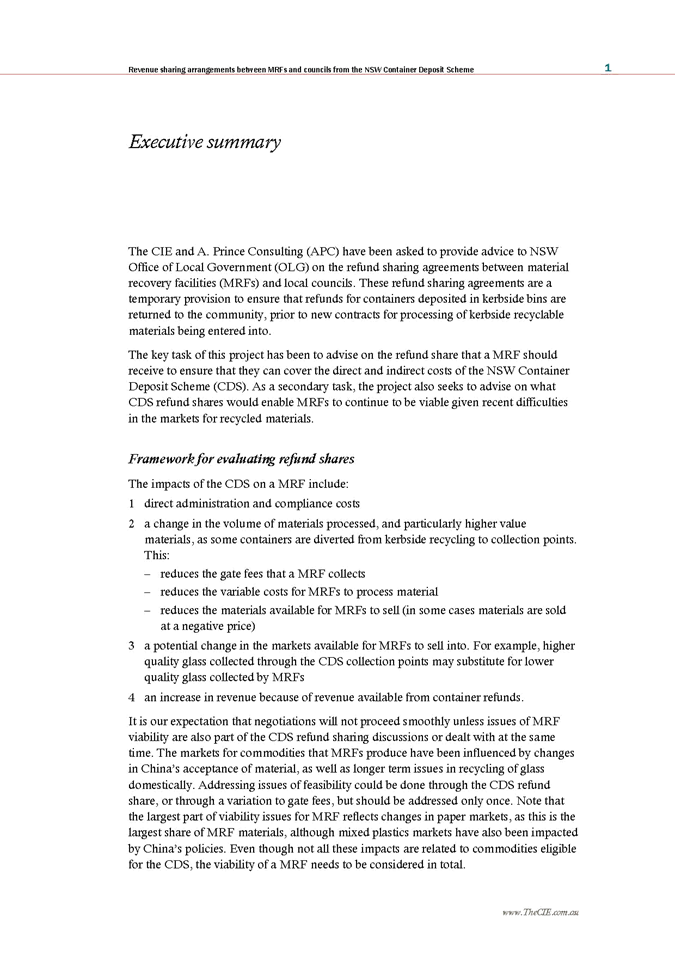

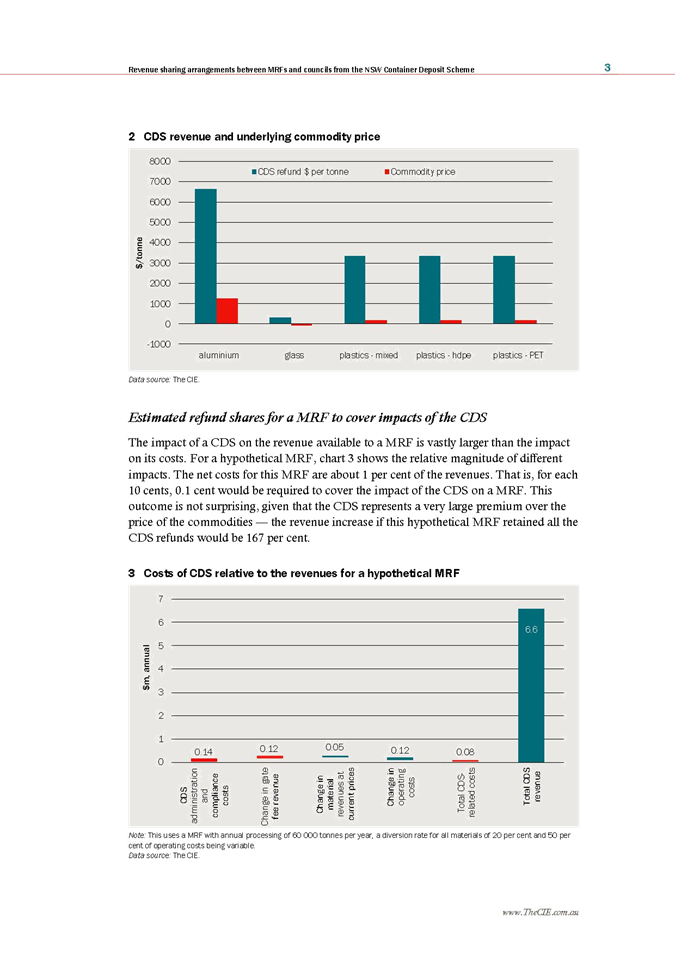

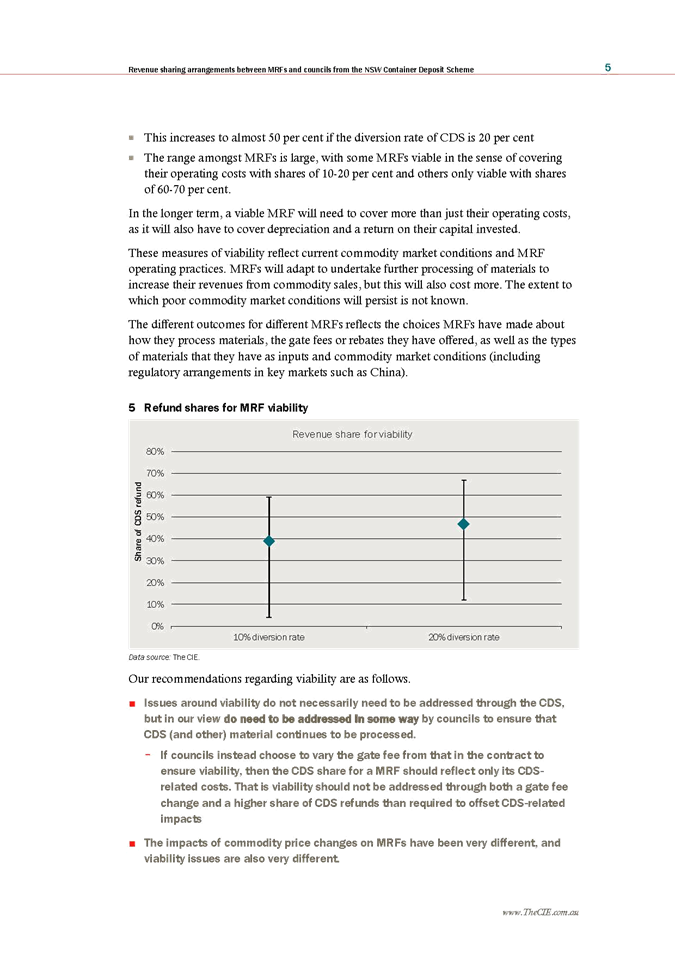

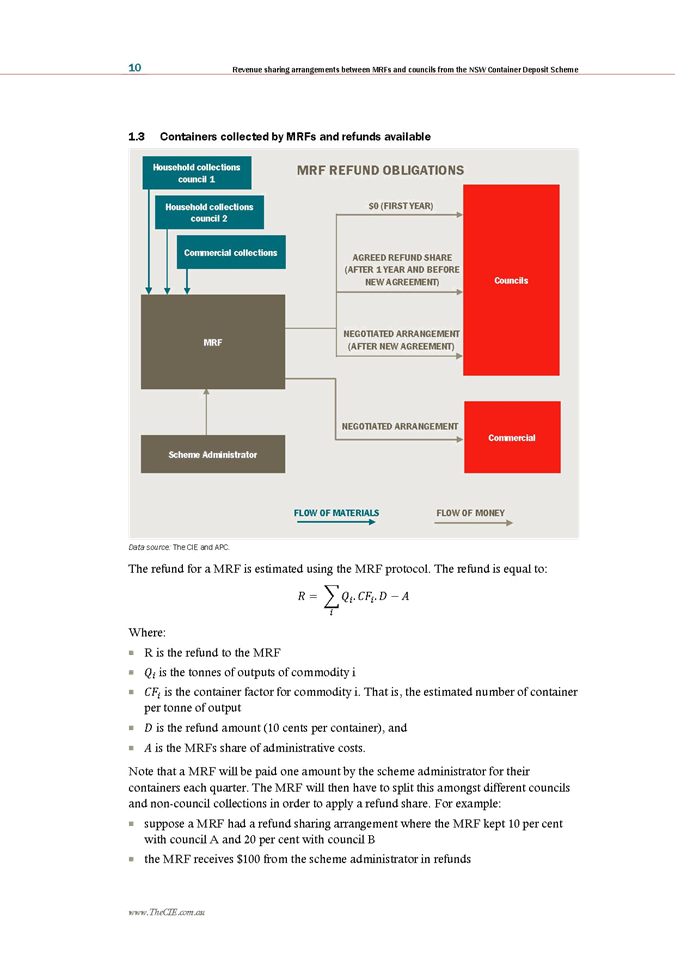

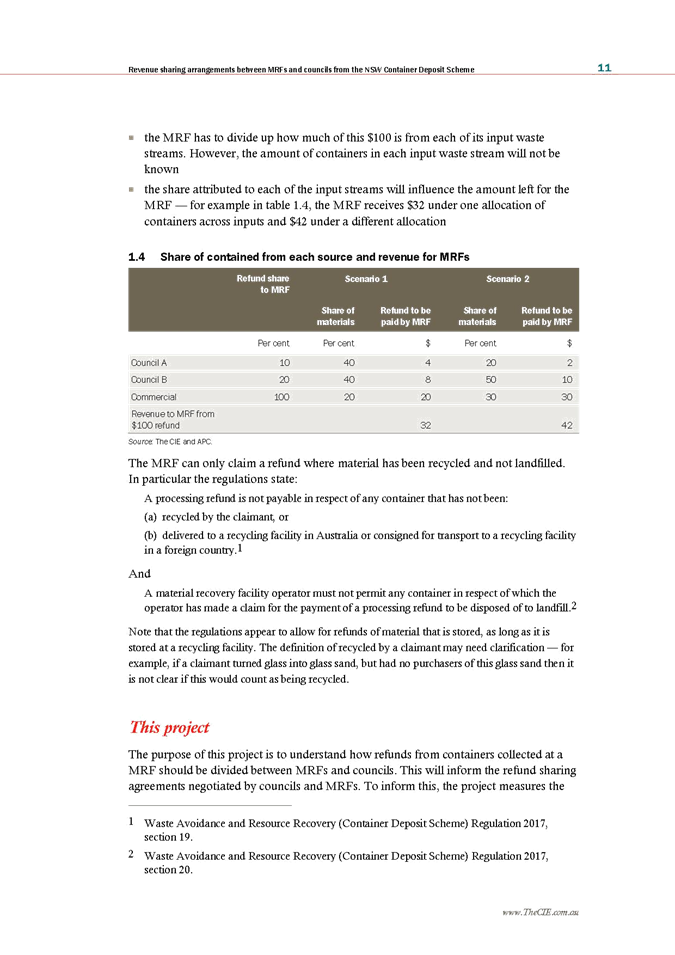

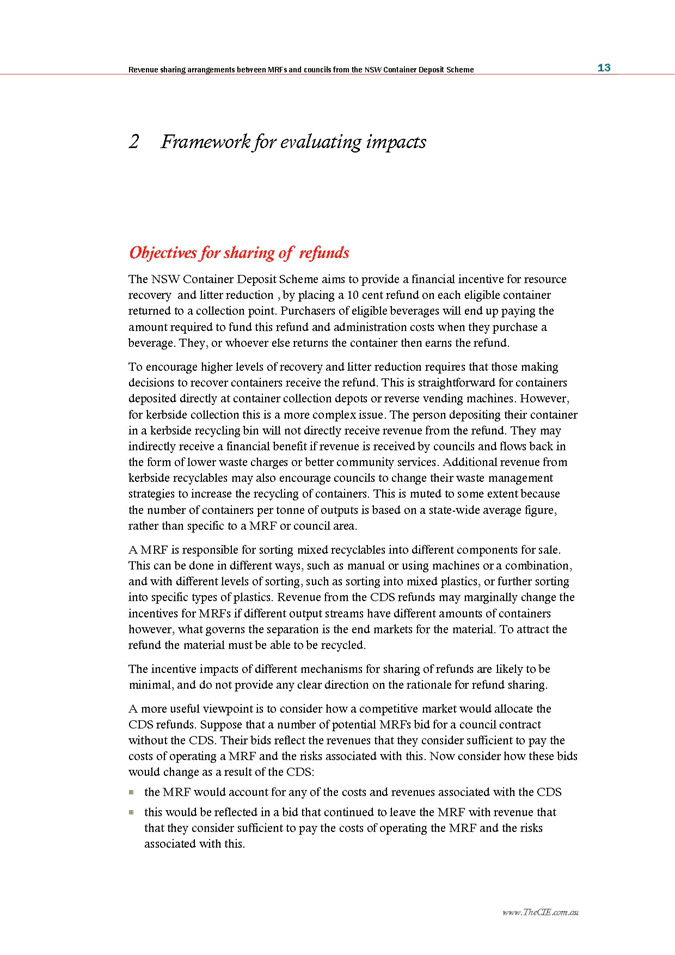

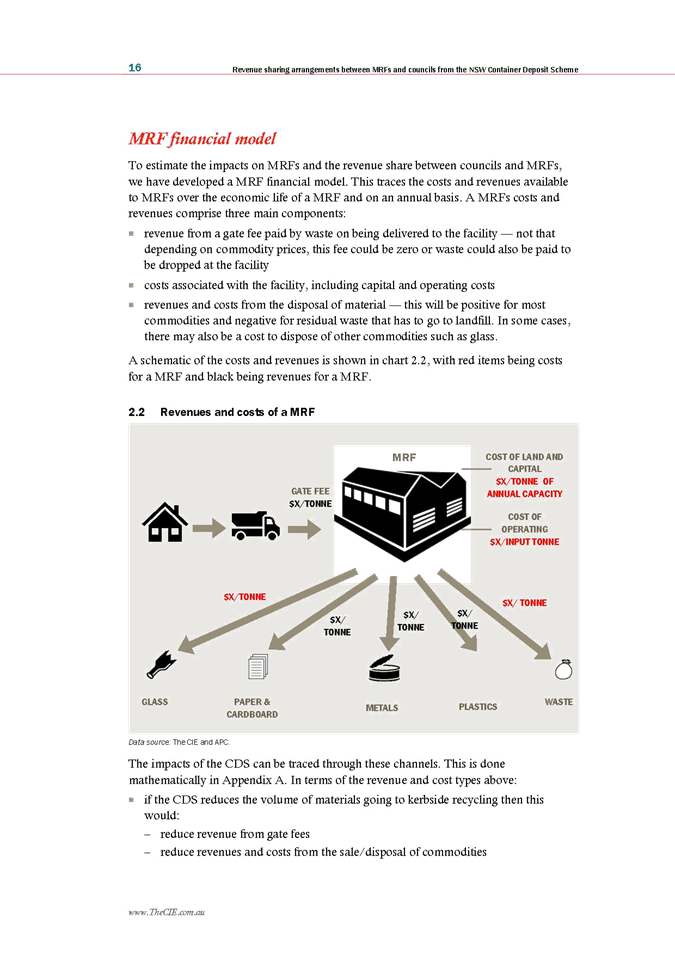

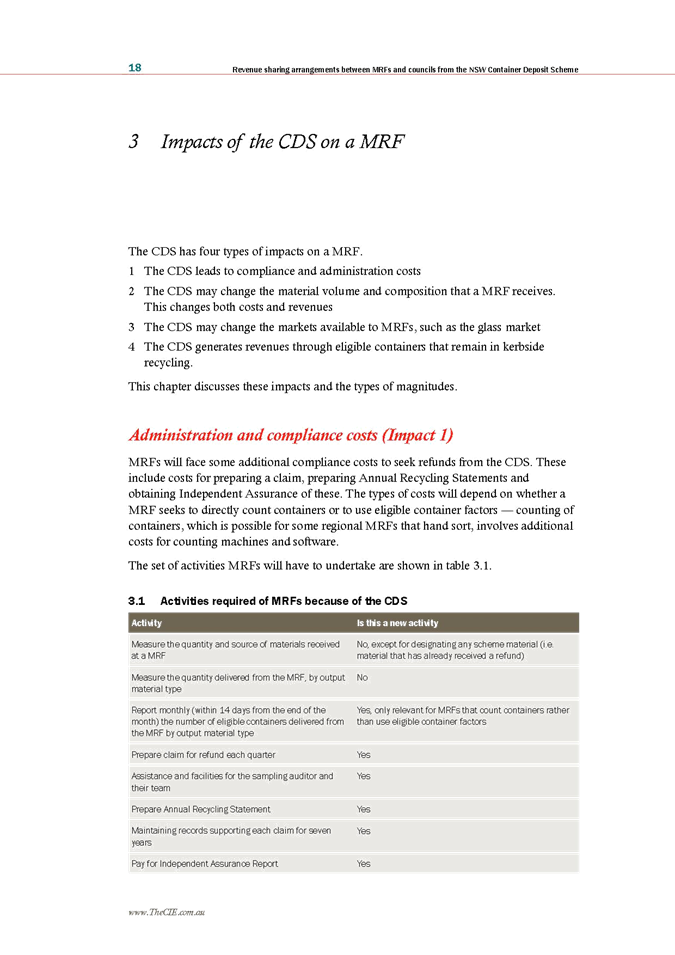

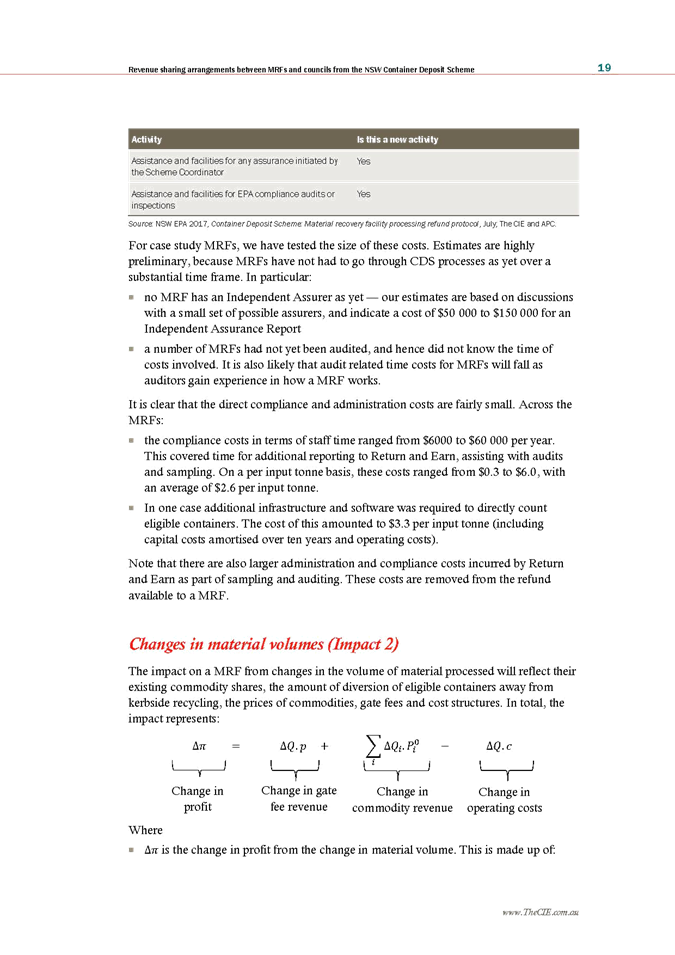

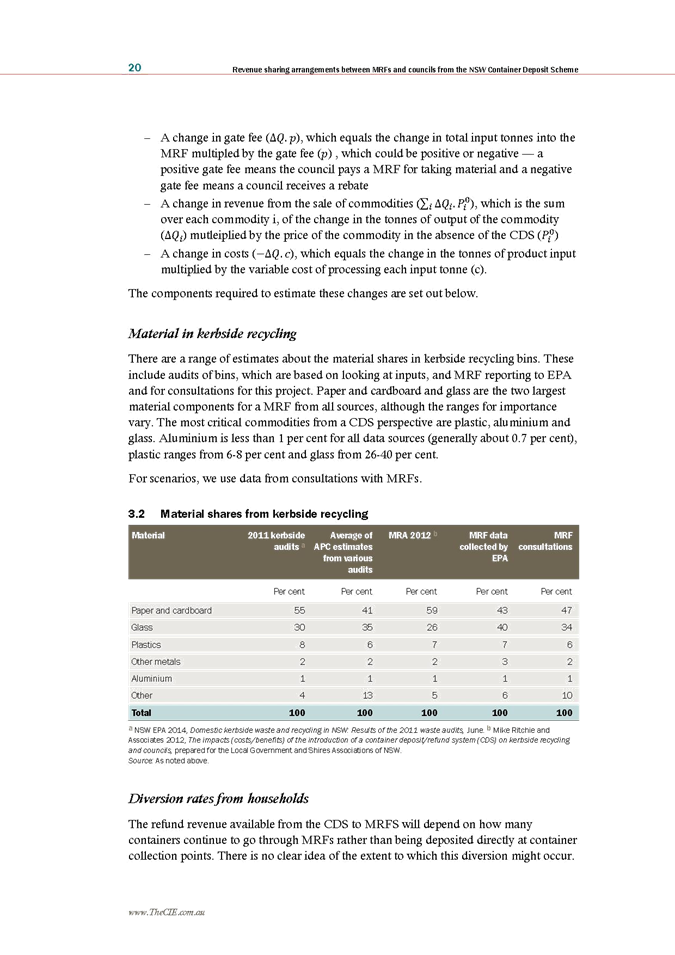

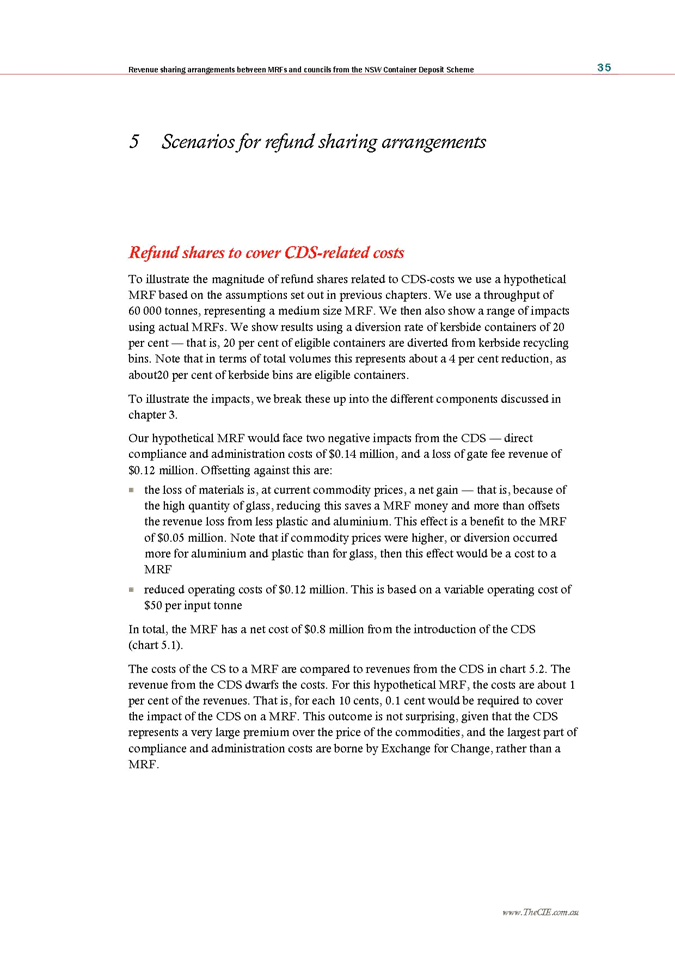

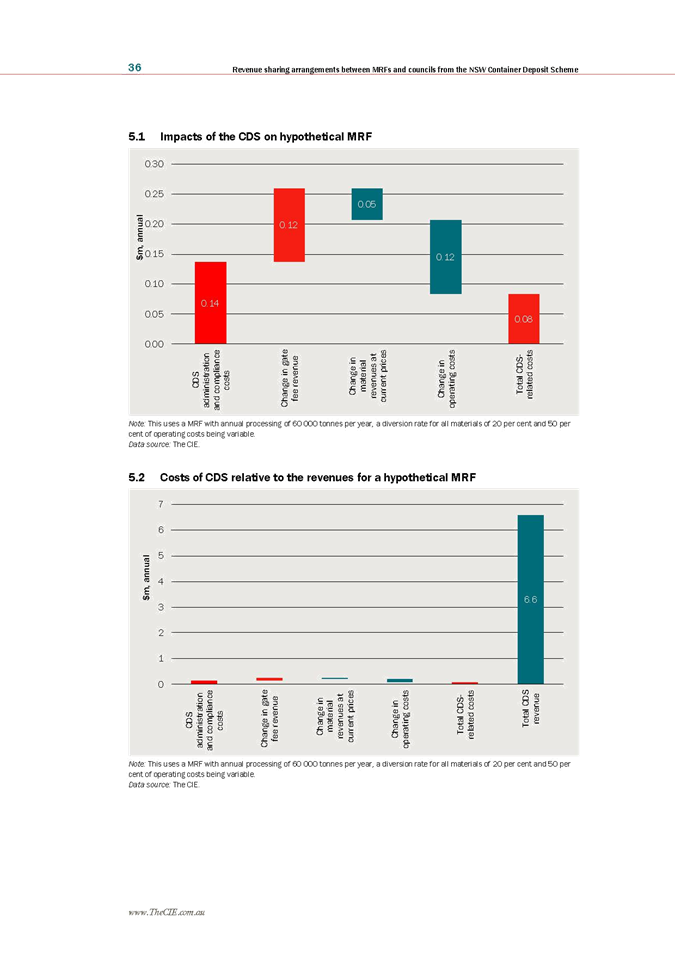

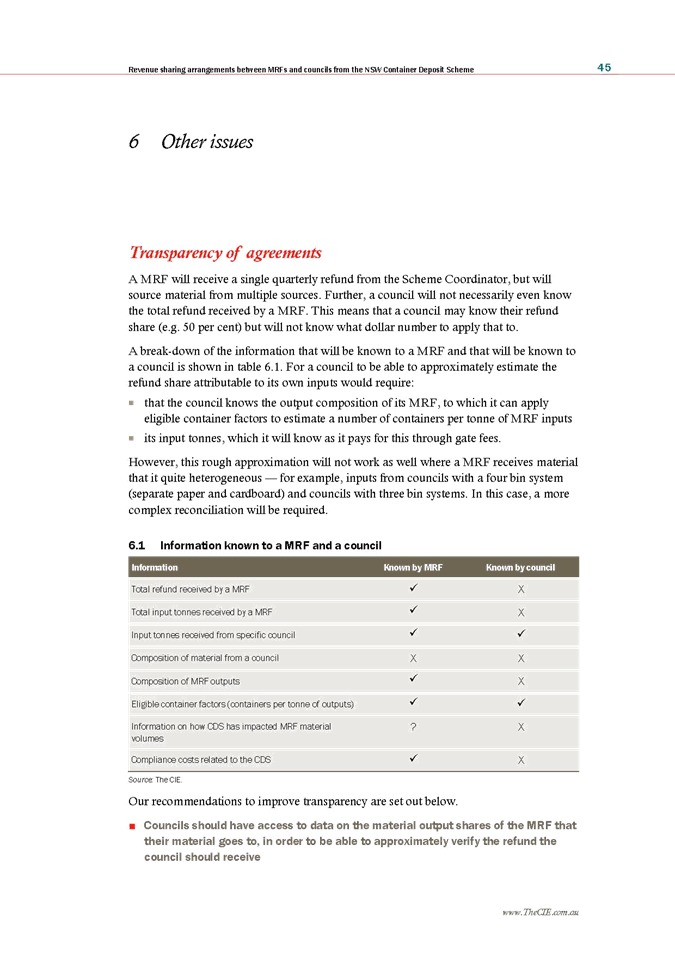

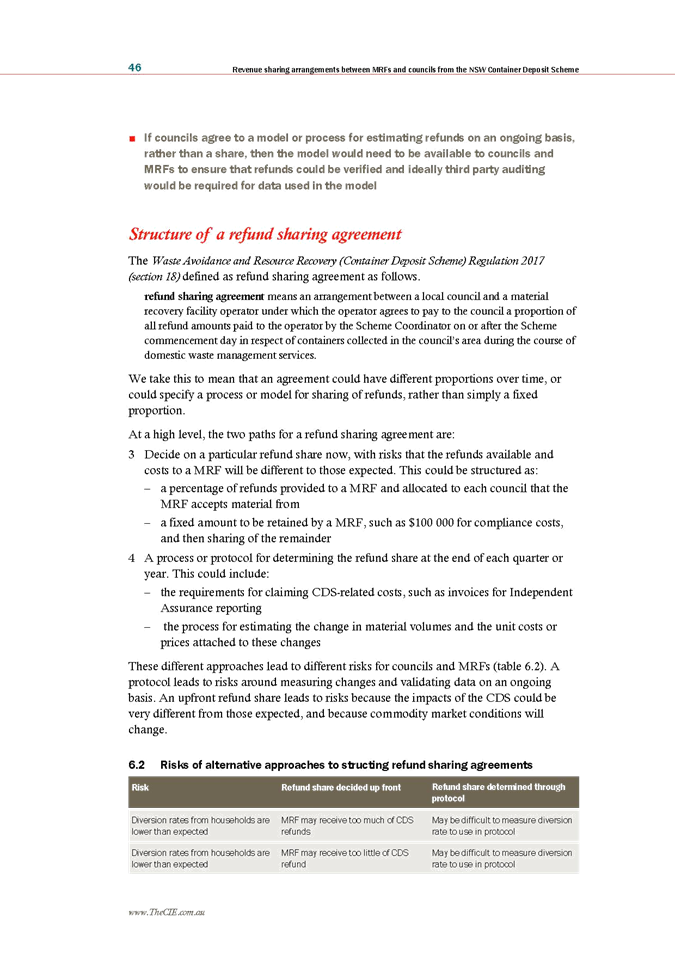

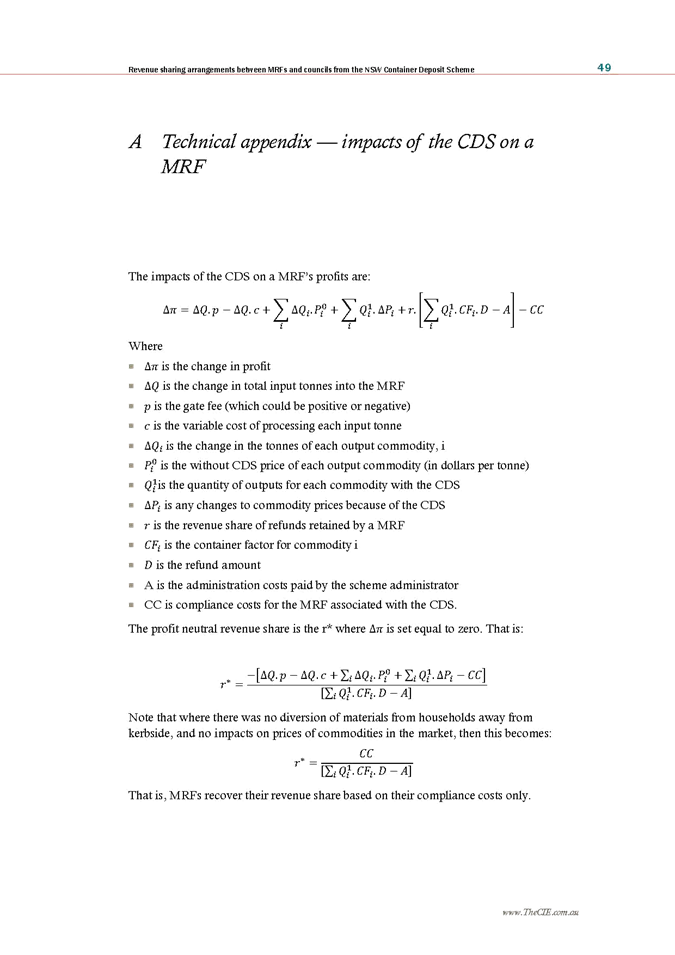

To support the introduction of the Scheme, the Government commissioned

the Centre for International Economics (CIE) and Anne Prince Consulting (APC)

to examine the impact of the Scheme on the business economics of MRFs. They

also assessed various revenue sharing arrangements along with wider viability

issues currently affecting the recycling industry. The final report is included

as Attachment 1.

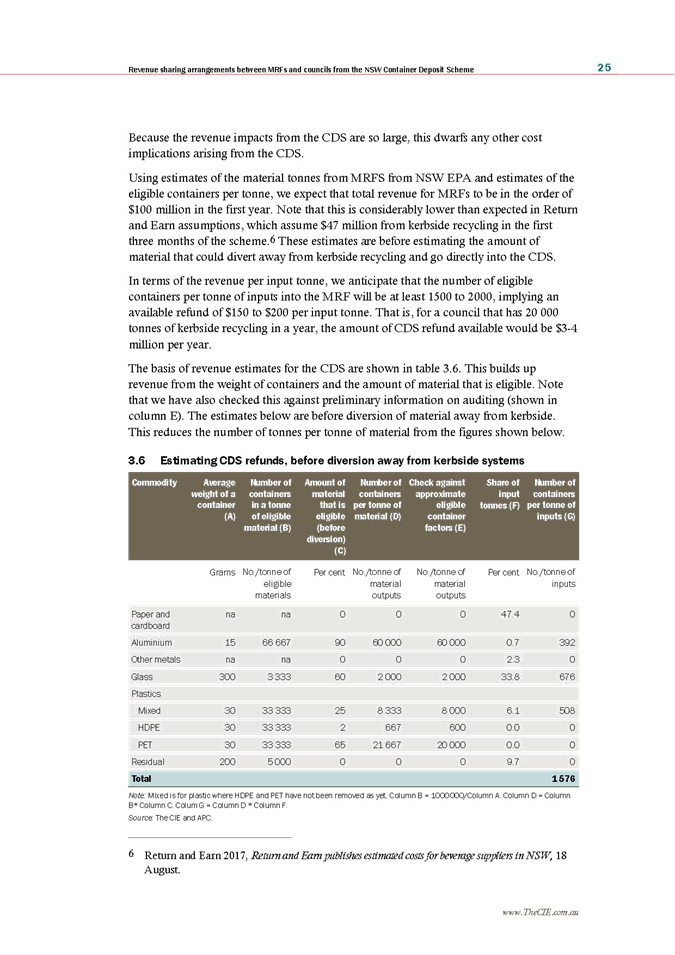

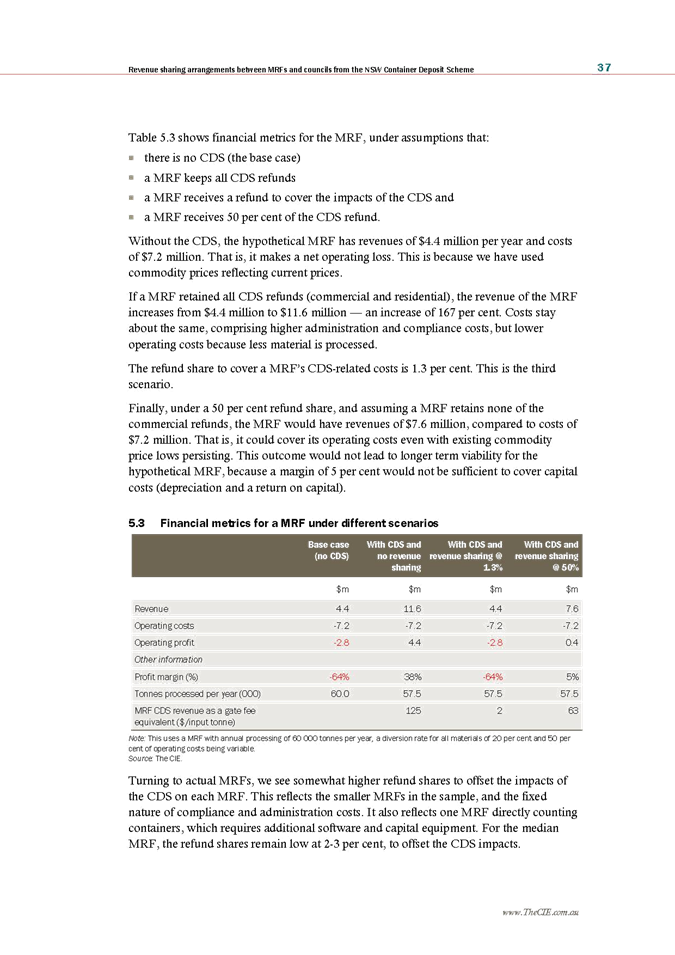

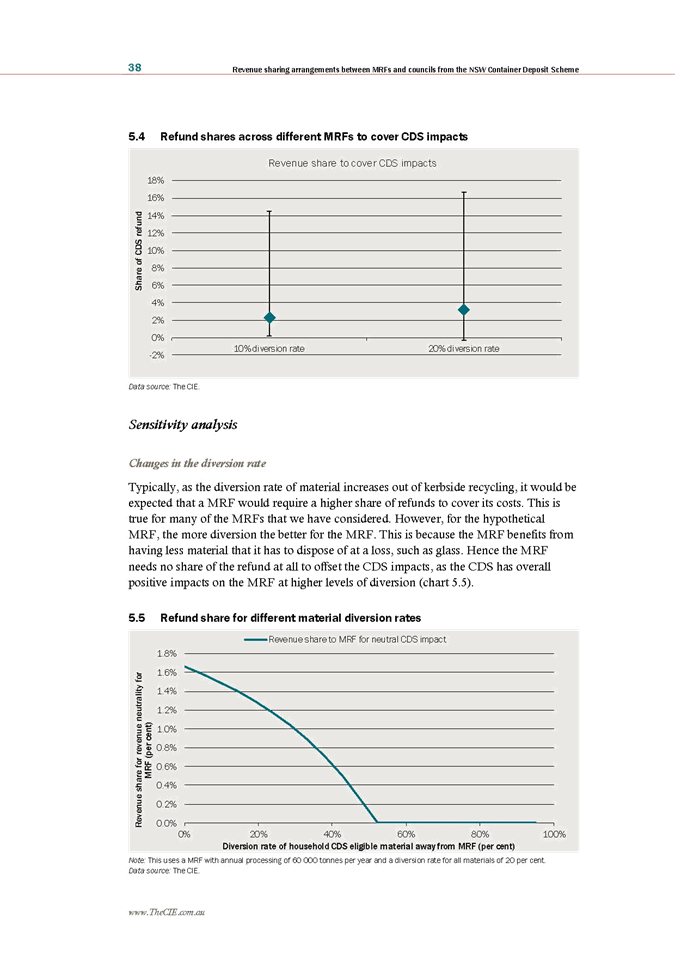

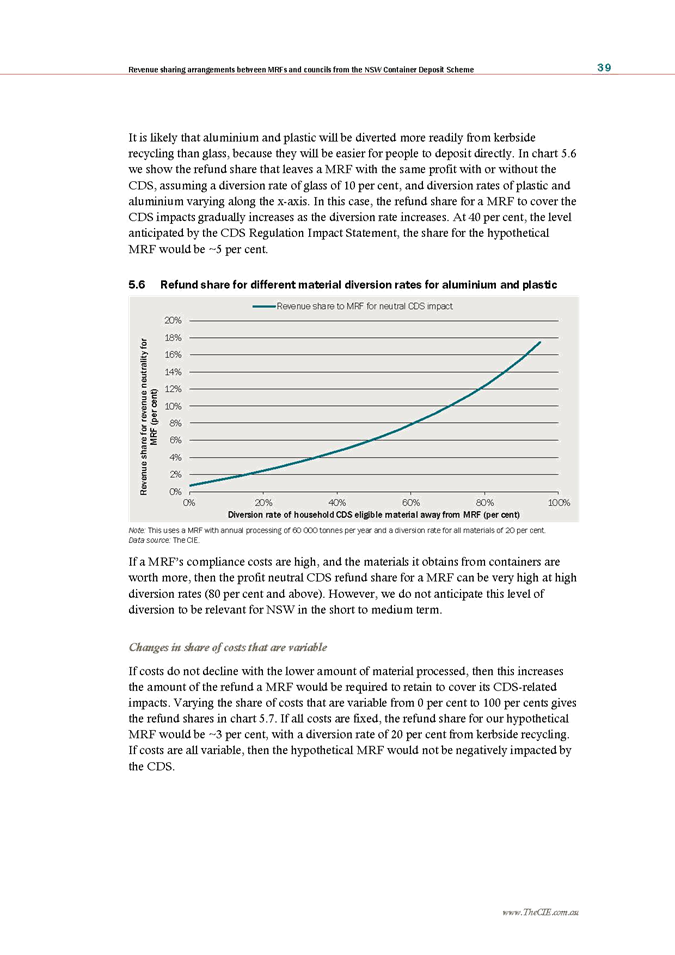

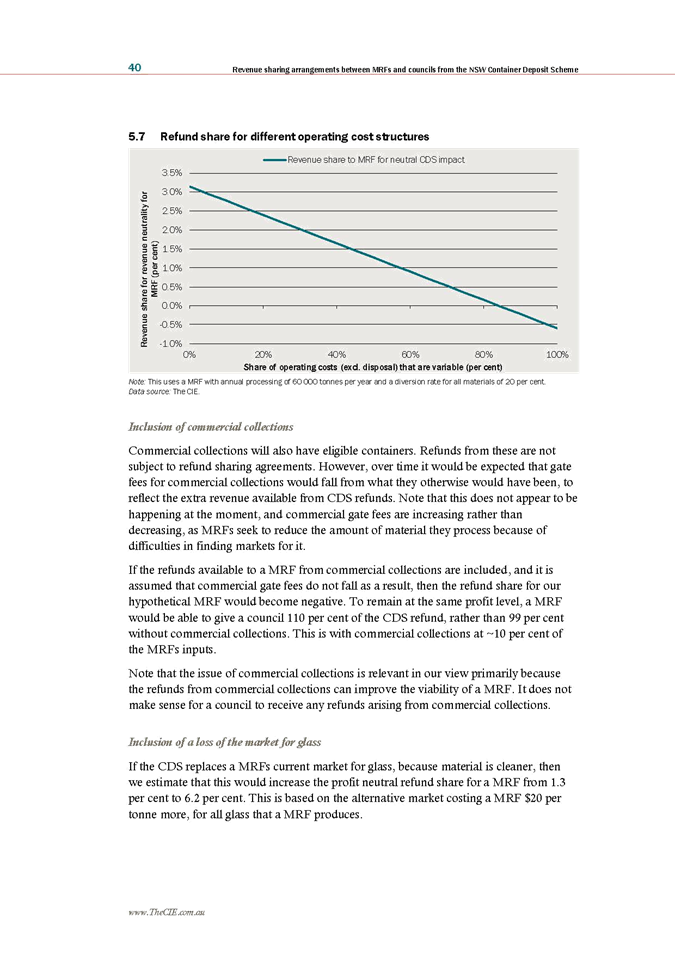

Key findings from the study found:

· A

high proportion of eligible household containers in NSW are anticipated to

still be processed through kerbside recycling. This is a potentially

significant revenue stream for councils and MRFs.

· The

direct cost of CDS compliance on MRFs is very low (around 5% of CDS kerbside

revenue).

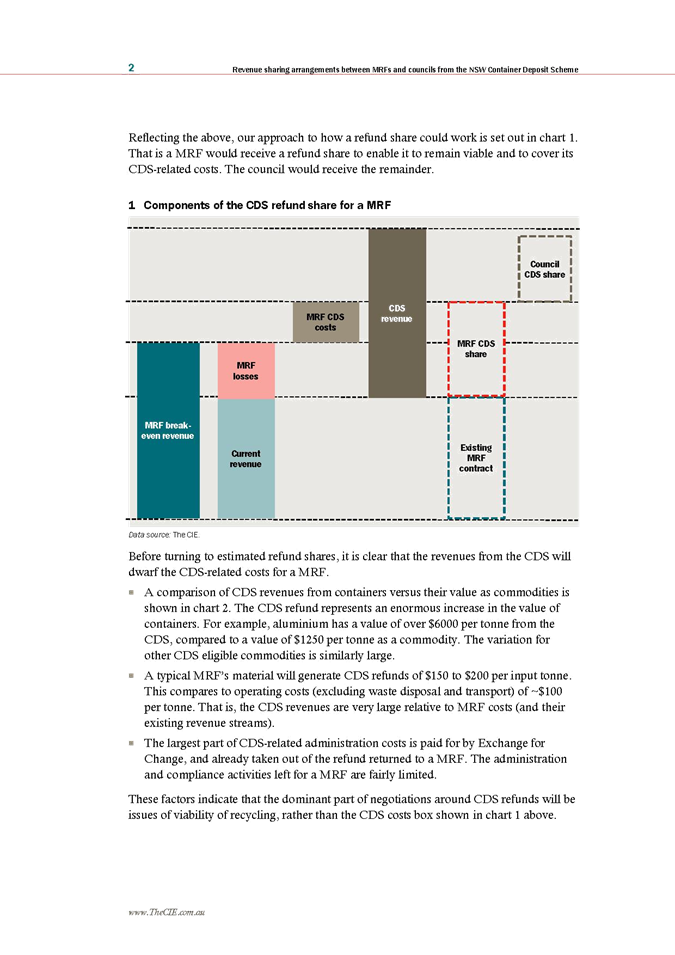

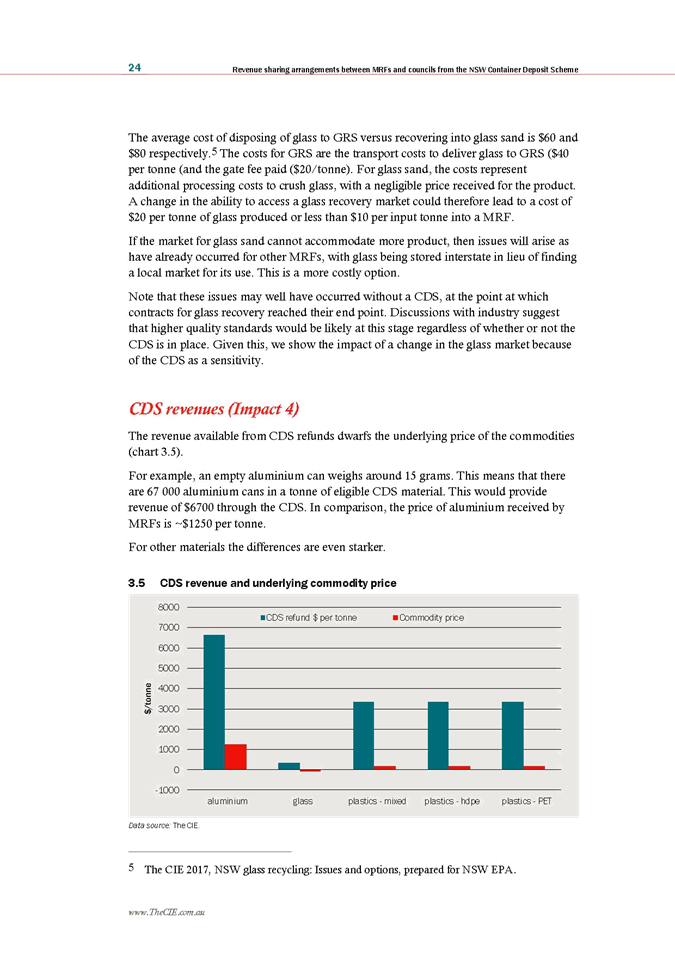

· Eligible

containers are worth more from the CDS than their current commodity value.

· It

is estimated that the additional revenue stream from eligible containers

through kerbside recycling could be worth around $100 million per annum for

councils and MRFs across NSW. In terms of the revenue per input tonne, it is

estimated that the number of eligible containers per tonne of inputs into the

MRF will be at least 1500 to 2000, implying an available refund of $150 to $200

per input tonne.

· A

proportion of CDS revenue may assist councils in their negotiations with MRFs

to address broader MRF and recycling viability issues, instead of higher gate

fees.

During discussions with officers from the Office of Local Government

(OLG) on 25 July 2018 in relation to the refund sharing matter, Council

officers were advised that to date, many of the MRFs were attempting to

incorporate both the impacts of the China Sword Policy and the introduction of

the refund sharing arrangements into a combined variation to gate fees. OLG

strongly recommended to keep both matters separate, as they were not interrelated,

and the impacts of the China Sword Policy varies quite significantly. This is

also highlighted in the final report commissioned by the Government.

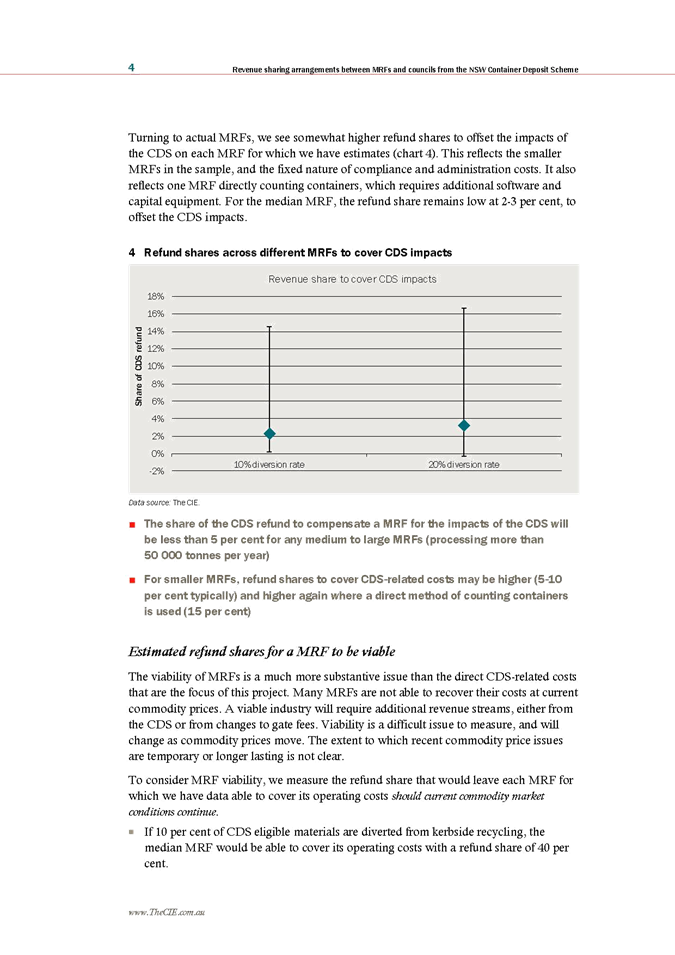

Council officers advised that the two matters were being managed

separately, with advice then received that the refund sharing arrangement

should be in the vicinity of 5% MRF / 95% Council; however if there was

more hand sorting undertaken by the MRF then Council should receive no less

than an 85% share.

Council were also advised that the EPA had provided funding to

establish model clauses for refund sharing agreements that were to be shared

across all councils once developed. The NSROC and SSROC who were leading this

process, engaged Maddocks Law Firm to prepare draft documents, which were then

provided to Council on 11 September, subsequent to initial discussions with

representatives from Kurrajong on 5 September.

Negotiations

with Kurrajong

Details of the negotiations have been outlined confidentially in

Attachment 2

Estimated Value to the Community

The waste that the community provides for kerbside collection can

generate revenue for Council, which can effectively be returned to the

community on the basis that it is utilised in providing domestic waste

management services in accordance with Section 504 of the Local Government Act

1993. Further details of the estimates are contained in the confidential

Attachment 2 however, officers have determined that Council could potentially

receive up to $500K per annum in this regard.

Kurrajong is an important support organisation with their vision being

“for people with disability to lead a life of their choice. Together, we

can change lives”. The organisation was first formed in 1957 and they

offer support and services for people with disability in the Riverina and

Murray regions. Kurrajong is a registered National Disability Insurance Scheme

(NDIS) provider with service provision including core support (help in everyday

life); capital support (for equipment and modifications to homes); and for

capacity building support (to help learn new skills). Therefore, any refund

revenue received by Kurrajong would be reinvested into their organisation that

will provide a good community outcome.

It is acknowledged that other Councils in the region have accepted a

50/50 refund sharing arrangement retrospective to 1 December 2017 for a

12-month period. While Council anticipates that, with better data over time,

the community will be entitled to a share which exceeds 50%, agreement on a

50/50 split now enables both parties to move forward. It will also allow both

Kurrajong and Council to undertake the necessary audits required to have a more

informed position when split is revisited next year.

If Council agree to a 50/50 Refund Sharing Arrangement with Kurrajong

for an initial 12-month period retrospectively applied to 1 December 2017, it

is anticipated that the Scheme could generate at least an additional $500K per

annum for Council and therefore the community as a whole. This will be

dependent however, upon the continued receipt of containers through the Scheme.

It is understood that other community organisations and schools have been

discussing the potential establishment of their own reverse vending machine

utilising the Return and Earn Scheme, which would effectively reduce the refund

earning potential. At this stage, the Long Term Financial Plan has not

incorporated any revenue from the Scheme, however any revenue received is

required to be incorporated in the Solid Waste Reserve and is externally restricted.

It is anticipated that any future audits or associated programs related to the

Scheme would be funded from this Reserve.

Local Government Act 1993, Section 504.

Waste Avoidance and Resource Recovery (Container Deposit Scheme)

Regulation 2017

The Environment

Objective:

We create a sustainable environment for future generations

Outcome:

We minimise our impact on the environment

Risk Management Issues for

Council

If community groups or schools establish further reverse vending

machines across Wagga, it would reduce the revenue stream that can then be

passed onto the community.

Internal / External

Consultation

Consultation has occurred between officers of the Procurement and

Gregadoo Waste Management areas of Council, in conjunction with the General

Manager and Kurrajong representatives.

Consultation has also occurred with the Interim Executive Officer of

the Riverina and Murray Joint Organisation, Regional Waste Management

Coordinator of the Northern Sydney Regional Organisation of Councils,

Environment Protection Authority and the Office of Local Government.

|

1⇩.

|

Report from NSW

Office of Local Government - "Revenue sharing arrangements between MRFs

and councils from the NSW Container Deposit Scheme

|

|

|

2.

|

Overview of

Negotiations and Estimated Value

This matter is

considered to be confidential under Section 10A(2) of the Local Government

Act 1993, as it deals with: information that would, if disclosed, confer a

commercial advantage on a person with whom the Council is conducting (or

proposes to conduct) business.

|

|

|

3.

|

Correspondence

from Kurrajong - 22 October 2018

This matter is

considered to be confidential under Section 10A(2) of the Local Government

Act 1993, as it deals with: information that would, if disclosed, confer a

commercial advantage on a person with whom the Council is conducting (or

proposes to conduct) business.

|

|

|

4.

|

Correspondence

from Kurrajong - 28 November 2018

This matter is

considered to be confidential under Section 10A(2) of the Local Government

Act 1993, as it deals with: information that would, if disclosed, confer a

commercial advantage on a person with whom the Council is conducting (or

proposes to conduct) business.

|

|

|

5.

|

Proposed Refund

Sharing Arrangement

This matter is

considered to be confidential under Section 10A(2) of the Local Government

Act 1993, as it deals with: information that would, if disclosed, confer a

commercial advantage on a person with whom the Council is conducting (or

proposes to conduct) business.

|

|

AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER