AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

17 December 2018

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

17 December 2018

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 17 December 2018 at 6.00pm.

Council live streams video and audio of Council meetings. Members of the public are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

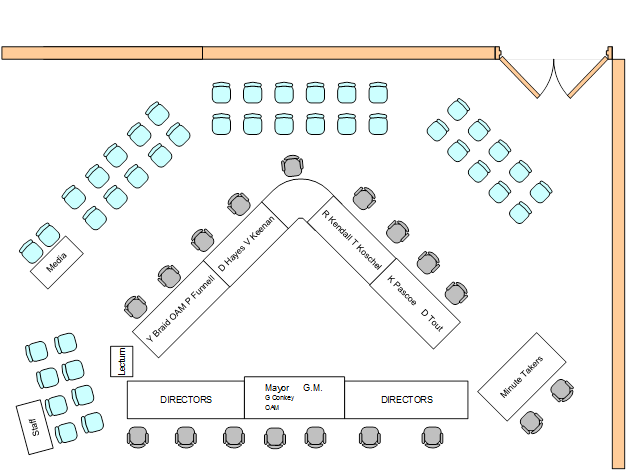

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 17 December 2018.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 17 December 2018

CLAUSE PRECIS PAGE

PRAYER 3

ACKNOWLEDGEMENT OF COUNTRY 3

APOLOGIES 3

CONFIRMATIONS OF MINUTES

CM-1 ORDINARY COUNCIL MEETING - 26 NOVEMBER 2018 3

DECLARATIONS OF INTEREST 3

Mayoral Minutes

MM-1 Mayoral Minute - High Speed Rail Network Access 4

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - Wagga App 7

Reports from Staff

RP-1 Financial Performance Report as at 30 November 2018 9

RP-2 ORGANISATION STRUCTURE 29

RP-3 PARKING FINE CONCESSIONS 34

RP-4 SALE OF LAND FOR UNPAID RATES - RESULTS OF PUBLIC AUCTION 44

RP-5 Sewer and Stormwater Infrastructure in Gobbagombalin 48

RP-6 LICENCE AGREEMENT FOR ELECTRIC VEHICLE CHARGING STATION 52

RP-7 BOLTON PARK MASTER PLAN 65

RP-8 PETITION - DOG OFF-LEASH AREA 72

RP-9 Petition - Church Street Parking Time Limits 78

RP-10 The Riverina Anglican College Sewer Connection 80

RP-11 Evocities extension of MOU 85

RP-12 POL 017 - DEBT MANAGEMENT POLICY 99

RP-13 RFQ2017/529 - Densely Graded Asphalt Supply & Lay 112

RP-14 Proposed application for appointment as Crown Land Managers 116

RP-15 RECISSION - MURRUMBIDGEE MUSIC MUSTER EVENT 2019 120

RP-16 RFT2018-27 PRINT MEDIA COUNCIL NOTICES (COUNCIL NEWS) 122

RP-17 Response to Questions/Business with Notice 126

Committee Minutes

M-1 TRAFFIC COMMITTEE MEETING - 8 NOVEMBER 2018 131

QUESTIONS/BUSINESS WITH NOTICE 142

Confidential Reports

CONF-1 PROPOSED COMPULSORY ACQUISITION OF EASEMENTS FOR PUBLIC ACCESS AND RIGHT OF ACCESS IN DP1246382 WITHIN LOT 272 DP 757249 AT NARRUNG STREET, WAGGA 143

CONF-2 New Positions for Gregadoo Waste Management Centre and Livestock Marketing Centre 144

CONF-3 Regional Growth Environment and Tourism Fund 145

CONF-4 PROPOSED LICENCE AGREEMENT - OASIS CAFE 146

CONF-5 RFT2019-02 OASIS RETILING REMEDIAL BUILDING WORKS NEGOTIATIONS 147

CONF-6 RFT2019-14 GREEN WASTE PROCESSING 148

CONF-7 RFT2019-16 CRUSHING OF CONCRETE GWMC 149

CONF-8 RFT2019-18 ADULT ACCESSIBLE CHANGE ROOM STAGE 2 150

PRAYER

Confirmation of Minutes

CM-1 ORDINARY COUNCIL MEETING - 26 NOVEMBER 2018

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 26 November 2018 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - Ordinary Council Meeting - 26 November 2018 |

151 |

Report submitted to the Ordinary Meeting of Council on Monday 17 December 2018. MM-1

MM-1 Mayoral Minute - High Speed Rail Network Access

|

Summary: |

The Premier of NSW Gladys Berejiklian announced $4.6m to investigate the delivery of a high-speed rail network for NSW. The northern route would service the Central Coast and Newcastle; the southern route would service Wollongong and Nowra; the western route would service Lithgow, Bathurst and Parkes; and the south western route would service Goulbourn and Canberra. |

|

That Council authorise the General Manager and Mayor to: a write to the Premier and Deputy Premier expressing concern in relation to the announcement of a high speed rail network that does not correlate with the Future Transport Strategy, Federal Strategy and recent Victorian Strategy b write to the Deputy Prime Minister to ensure that any high-speed rail activity is consistent with a national strategy c write directly to Professor McNaughton to consider the existing corridor between Sydney and Melbourne as a priority |

Report

On 4 December 2018, the Premier of NSW Gladys Berejiklian announced a high speed rail commitment, which included $4.6 million dollars in planning from the Snowy Hydro fund. A British expert, Professor Andrew McNaughton is to consider a northern route from Sydney to Newcastle, a western route to service Lithgow, Bathurst and Parkes; a southern route to service Wollongong and Nowra and a south western route to service Goulbourn and Canberra.

High speed rail would travel at speeds more than 250km per hour with the intention to make regional cities more accessible to Sydney. The advice from Professor McNaughton will identify existing corridors, while undertaking long term visionary planning.

In March 2018, Transport for NSW in conjunction with RMS released the Future Transport Strategy. This strategy had a focus on the role of transport in delivering movement and place outcomes that support the character of the places and communities we want for the future. The plan also identified key corridors to support the growth of Regional Cities.

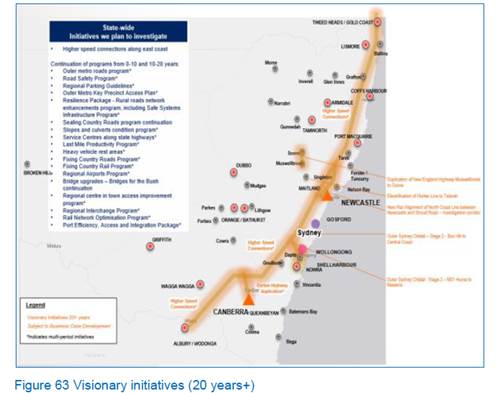

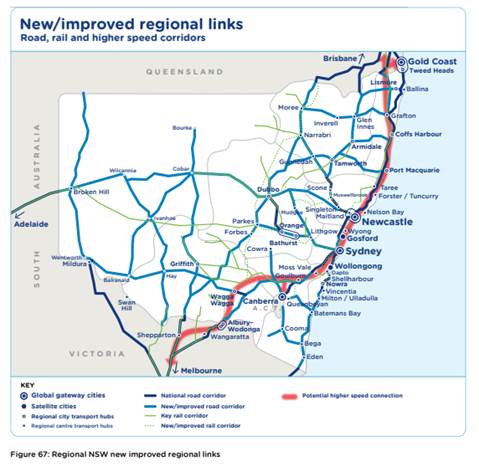

Wagga Wagga was included within the Adopted Future Transport Strategy 2056. The endorsed plan is to have a high speed connection between Sydney and Melbourne, while the Draft Plan initially excluded Wagga Wagga (Figure 1). Council wrote to the Minister for Transport and prepared a comprehensive submission to justify its inclusion, illustrated in Figure 2.

Figure 1, Draft Future Transport High Speed Connections

Figure 2, Final Future Transport Plan High Speed Connections

To not incorporate Wagga Wagga and Albury in the initial planning for high speed rail study is imprudent for the following reasons:

· This is counter to the premier’s 20-year Economic vision of supporting Albury and Wagga Wagga, regional cities southwest of Sydney to grow to 100,000.

· It is inconsistent with the 2056 Future Strategy, developed by Transport for NSW in consultation with regional and metropolitan stakeholders.

· Melbourne to Sydney are in the top five most travelled air routes in the world.

· Victoria and NSW undertaking a regional rail network in isolation, which counters cross-border collaboration.

· It is inconsistent with the Federal Governments’ high speed rail network, which incorporates Wagga Wagga and Albury-Wodonga as hubs on the network.

Financial Implications

N/A

Policy and Legislation

N/A

Link to Strategic Plan

Growing Economy

Objective: We are a Regional Capital

Outcome: We have complete and accessible transport networks, building infrastructure, improving road travel reliability, ensure on-time running for public transport

Risk Management Issues for Council

Wagga Wagga is the largest regional city in NSW, located halfway between Melbourne and Sydney; not including Wagga Wagga on the high speed regional network would restrict the long term potential of the city.

Internal / External Consultation

N/A

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - Wagga App

Author: Councillor Tim Koschel

|

Summary: |

This Notice of Motion is being presented to Council to call for a report on options of developing an app or web based application that provides a single point of reference for residents and visitors to the city. |

|

That council staff bring forward a report on options to develop a native app or web based application that collates key information about Wagga Wagga that can be used by residents and visitors of the city. |

Report

The purpose of this notice of motion is for Council to consider options for developing a native app or web based application that provides a single reference point for residents and visitors to use. Cairns City Council have a great app that can be referenced as an example (see attached pictures). The proposed application would be a one stop shop for all things Wagga. This will have a great impact on people who live and visit or city.

Functions available within the app could include:

· what’s happening this week in Wagga (might be able to sell advertising space)

· things to do in Wagga major attractions

· online service functions e.g. customer requests, complaints, rates

· council news

· feedback

· waste management education and training on new kerbside bin system

· notifications/reminders e.g. bin night, council works

Financial Implications

N/A

Policy and Legislation

Wagga Wagga City Council Code of Meeting Practice

Link to Strategic Plan

Growing Economy

Objective: We are a Regional Capital

Outcome: We are enabled by technology

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

Report submitted to the Ordinary Meeting of Council on Monday 17 December 2018. RP-1

RP-1 Financial Performance Report as at 30 November 2018

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Summary: |

This report is for Council to consider and approve the proposed 2018/19 budget variations required to manage the 2018/19 budget and Long Term Financial Plan, and details Council’s external investments and performance as at 30 November 2018. |

|

That Council: a approve the proposed 2018/19 budget variations for the month ended 30 November 2018 and note the balanced budget position as presented in this report b provide financial assistance of the following amounts in accordance with Section 356 of the Local Government Act 1993: i) Oz Fish Wagga Chapter $ 80.20 ii) The Compassionate Friends NSW $ 175.00 iii) NSW Rural Fire Service $ 105.00 iv) Australian Army Band Kapooka $1,750.81 (funded as detailed in the report) c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above d note details of the external investments as at 30 November 2018 in accordance with section 625 of the Local Government Act 1993 |

Report

Wagga Wagga City Council (Council) forecasts a balanced budget position as at 30 November 2018. Proposed budget variations are detailed in this report for Council’s consideration and adoption.

Council has experienced a negative monthly investment performance for the month of November, when compared to budget. This is mainly due to a negative movement for Councils Floating Rate Note (FRN) portfolio during November.

Key Performance Indicators

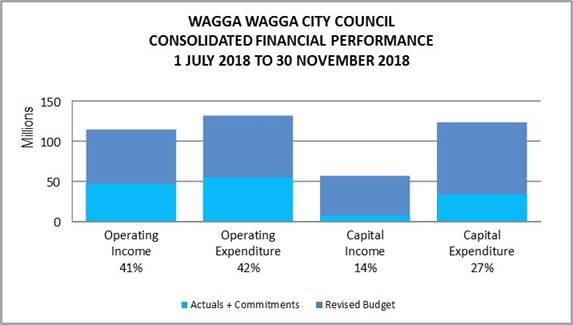

OPERATING INCOME

Total operating income is 41% of approved budget, which is tracking on budget for the end of November (this percentage excludes capital grants and contributions). An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 73%.

OPERATING EXPENSES

Total operating expenditure is 42% of approved budget and is tracking on budget for the full financial year.

CAPITAL INCOME

Total capital income is 14% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions relating to projects. This income also includes the sale of property, plant and equipment.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 27% of approved budget.

|

WAGGA WAGGA

CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2018/19 |

COMMT'S 2018/19 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|||||||

|

Rates & Annual Charges |

(65,998,971) |

0 |

(65,998,971) |

(28,237,717) |

0 |

(28,237,717) |

43% |

|

User Charges & Fees |

(26,844,544) |

150,317 |

(26,694,227) |

(10,401,341) |

0 |

(10,401,341) |

39% |

|

Interest & Investment Revenue |

(2,917,452) |

(205,000) |

(3,122,452) |

(1,602,560) |

0 |

(1,602,560) |

51% |

|

Other Revenues |

(2,983,104) |

(333,552) |

(3,316,656) |

(1,749,592) |

0 |

(1,749,592) |

53% |

|

Operating Grants & Contributions |

(13,894,989) |

(1,533,569) |

(15,428,557) |

(4,658,331) |

0 |

(4,658,331) |

30% |

|

Capital Grants & Contributions |

(36,517,290) |

(16,722,608) |

(53,239,899) |

(7,410,842) |

0 |

(7,410,842) |

14% |

|

Total Revenue |

(149,156,350) |

(18,644,412) |

(167,800,762) |

(54,060,383) |

0 |

(54,060,383) |

32% |

|

|

|||||||

|

Expenses

|

|||||||

|

Employee Benefits & On-Costs |

44,786,608 |

87,445 |

44,874,053 |

17,864,971 |

10,580 |

17,875,551 |

40% |

|

Borrowing Costs |

3,752,580 |

(121,277) |

3,631,304 |

886,120 |

0 |

886,120 |

24% |

|

Materials & Contracts |

32,384,231 |

5,901,808 |

38,286,039 |

13,163,661 |

3,438,746 |

16,602,407 |

43% |

|

Depreciation & Amortisation |

35,418,997 |

0 |

35,418,997 |

14,757,915 |

0 |

14,757,915 |

42% |

|

Other Expenses |

12,125,204 |

(2,478,954) |

9,646,250 |

4,891,186 |

84,482 |

4,975,667 |

52% |

|

Total Expenses |

128,467,621 |

3,389,022 |

131,856,643 |

51,563,853 |

3,533,808 |

55,097,660 |

42% |

|

|

|

||||||

|

Net Operating (Profit)/Loss |

(20,688,729) |

(15,255,390) |

(35,944,119) |

(2,496,530) |

3,533,808 |

1,037,277 |

|

|

|

|||||||

|

Net Operating (Profit)/Loss before Capital Grants & Contributions |

15,828,561 |

1,467,219 |

17,295,780 |

4,914,312 |

3,533,808 |

8,448,119 |

|

|

|

|||||||

|

Capital / Reserve Movements |

|||||||

|

Capital Exp - Renewals |

33,260,752 |

13,373,398 |

46,634,150 |

5,889,726 |

17,054,669 |

22,944,395 |

49% |

|

Capital Exp - New Projects |

31,336,485 |

17,374,328 |

50,000,415 |

5,782,784 |

3,667,254 |

9,450,037 |

19% |

|

Capital Exp - Project Concepts |

25,044,335 |

145,641 |

23,900,375 |

27,648 |

84,079 |

111,727 |

0% |

|

Loan Repayments |

3,129,777 |

(225,924) |

2,903,853 |

1,304,074 |

0 |

1,304,074 |

45% |

|

New Loan Borrowings |

(6,108,672) |

1,755,867 |

(4,352,805) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(952,795) |

(2,701,703) |

(3,654,498) |

(353,509) |

0 |

(353,509) |

10% |

|

Net Movements Reserves |

(29,602,157) |

(14,466,217) |

(44,068,374) |

0 |

5,200 |

5,200 |

0% |

|

Total Cap/Res Movements |

56,107,727 |

15,255,390 |

71,363,116 |

12,650,723 |

20,811,201 |

33,461,925 |

|

|

|

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED

BUDGET |

YTD ACTUAL EXCL COMMT'S 2018/19 |

COMMT'S 2018/19 |

YTD ACTUAL +

COMMT'S |

YTD % OF BUD |

|

Net Result after Depreciation |

35,418,997 |

0 |

88,658,896 |

17,565,035 |

24,345,009 |

34,499,202 |

|

|

|

|||||||

|

Add back Depreciation Expense |

35,418,997 |

0 |

35,418,997 |

14,757,915 |

0 |

14,757,915 |

42% |

|

|

|||||||

|

Cash Budget (Surplus)/Deficit |

0 |

0 |

53,239,899 |

2,807,120 |

24,345,009 |

19,741,287 |

|

Revised Budget Result - Surplus/(Deficit) |

$’000s |

|

Original 2018/19 Budget Result as adopted by Council Total Budget Variations approved to date Budget variations for November 2018 |

$0 $0 $0 |

|

Proposed revised budget result for 30 November 2018 |

$0 |

The proposed Budget Variations to 30 November 2018 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact Fav/ (Unfav) |

||||

|

2 – Safe and Healthy Community |

|||||||

|

Ladysmith Asphalt Bike Track & Access Paths |

$21K |

NSW State Government Grant ($21K) |

Nil |

||||

|

Council has been successful in securing grant funding under the Community Building Partnership Program for the construction of an asphalt seal bike track and access paths at Ladysmith Sports Ground. The program requires 50:50 funding with Councils contribution proposed to be funded from existing recreation facilities renewal budgets in 2019/20, to bring the total project budget to $42K. In-kind contributions will be provided by the Ladysmith Community. Estimated Completion Date: March 2020 |

|

||||||

|

4 – Community Place and Identity |

|||||||

|

Future Library Plan Project |

($17K) |

NSW State Library Grant $17K |

Nil |

||||

|

Council have been advised that the 2018/19 NSW State Public Library Grant Subsidy Funding will be $17K lower than budgeted. The total subsidy expected was $53K and will now be $36K. These funds will be utilised for the library plan project to review the Library’s footprint and future growth needs, of which has been supported by the state library for these funds. |

|

||||||

|

5 – The Environment |

|||||||

|

Road Reserves Activities Officer |

$33K |

Sewer Reserve ($10K) Infrastructure Planning Salary Savings ($23K) |

Nil |

||||

|

Funds are required for a Road Reserves Activities Officer (30% Sewer & 70% GPR funded) as there is currently a temporary arrangement in place which is taking another employee away from their core duties. If approved this position is expected to be recruited and filled in February 2019. It is proposed to fund the GPR portion for 2018/19 from salary savings within the Technical and Strategy Division with future years to be included in the 2019/20 LTFP budget process. |

|

||||||

|

SURPLUS/(DEFICIT) |

Nil |

||||||

Current Restrictions

|

RESERVES SUMMARY |

|||||

|

30 NOVEMBER 2018 |

|||||

|

|

CLOSING BALANCE 2017/18 |

ADOPTED RESERVE TRANSFERS 2018/19 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 26.11.18 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

|

|

|

|

|

|

|

Externally Restricted |

|

|

|

|

|

|

Developer Contributions - Sect 7.11 |

(19,959,750) |

7,405,683 |

2,050,333 |

|

(10,503,733) |

|

Developer Contributions - Sect 7.12 |

(465,272) |

358,500 |

112,629 |

|

5,857 |

|

Developer Contributions – S/Water DSP S64 |

(5,478,298) |

500,000 |

96,347 |

|

(4,881,951) |

|

Sewer Fund |

(26,204,212) |

4,267,364 |

2,638,508 |

10,000 |

(19,288,341) |

|

Solid Waste |

(20,184,154) |

9,600,364 |

1,155,611 |

|

(9,428,179) |

|

Specific Purpose Grants |

(3,519,384) |

0 |

3,519,384 |

|

0 |

|

SRV Levee |

(2,847,382) |

1,807,667 |

892,802 |

|

(146,914) |

|

Stormwater Levy |

(3,167,296) |

162,032 |

102,841 |

|

(2,902,423) |

|

Total Externally Restricted |

(81,825,747) |

24,101,610 |

10,568,454 |

10,000 |

(47,145,683) |

|

|

|

||||

|

Internally Restricted |

|

||||

|

Airport |

(63,685) |

(158,452) |

(330,776) |

(552,913) |

|

|

Art Gallery |

(49,209) |

13,262 |

0 |

(35,947) |

|

|

Ashmont Community Facility |

(6,000) |

(1,500) |

0 |

(7,500) |

|

|

Bridge Replacement |

(201,972) |

(100,000) |

0 |

(301,972) |

|

|

CBD Carparking Facilities |

(863,695) |

160,302 |

50,801 |

(652,592) |

|

|

CCTV |

(74,476) |

(10,000) |

0 |

(84,476) |

|

|

Cemetery Perpetual |

(65,479) |

(129,379) |

51,958 |

(142,900) |

|

|

Cemetery |

(452,507) |

420 |

139,581 |

(312,506) |

|

|

Civic Theatre Operating |

0 |

(55,000) |

55,000 |

0 |

|

|

Civic Theatre Technical Infrastructure |

(92,585) |

(50,000) |

4,911 |

(137,675) |

|

|

Civil Projects |

(155,883) |

0 |

0 |

(155,883) |

|

|

Community Amenities |

(76,763) |

0 |

0 |

(76,763) |

|

|

Community Works |

(61,888) |

(59,720) |

0 |

|

(121,608) |

|

Council Election |

(255,952) |

(76,333) |

44,045 |

(288,240) |

|

|

Emergency Events |

(220,160) |

0 |

29,000 |

(191,160) |

|

|

Employee Leave Entitlements |

(3,322,780) |

0 |

0 |

|

(3,322,780) |

|

Environmental Conservation |

(131,351) |

20,295 |

0 |

|

(111,056) |

|

Estella Community Centre |

(230,992) |

178,519 |

0 |

|

(52,473) |

|

Event Attraction Reserve |

0 |

0 |

(4,421) |

|

(4,421) |

|

Family Day Care |

(320,364) |

75,366 |

(1,556) |

|

(246,555) |

|

Fit for the Future |

(5,340,222) |

4,444,014 |

661,863 |

|

(234,345) |

|

Generic Projects Saving |

(1,056,917) |

150,000 |

115,306 |

|

(791,611) |

|

Glenfield Community Centre |

(19,704) |

(2,000) |

0 |

|

(21,704) |

|

Grants Commission |

(5,199,163) |

0 |

0 |

|

(5,199,163) |

|

Grassroots Cricket |

(70,992) |

0 |

0 |

|

(70,992) |

|

Gravel Pit Restoration |

(767,509) |

0 |

0 |

|

(767,509) |

RESERVES SUMMARY

|

|||||

|

30 NOVEMBER 2018 |

|||||

|

|

CLOSING BALANCE 2017/18 |

ADOPTED RESERVE TRANSFERS 2018/19 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 26.11.18 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

Gurwood Street Property |

(50,454) |

0 |

0 |

|

(50,454) |

|

Information Services |

(369,113) |

77,858 |

285,000 |

|

(6,256) |

|

Infrastructure Replacement |

(193,634) |

(68,109) |

15,000 |

|

(246,743) |

|

Insurance Variations |

(28,644) |

0 |

(71,603) |

|

(100,246) |

|

Internal Loans |

(518,505) |

(631,470) |

680,054 |

|

(469,921) |

|

Lake Albert Improvements |

(62,349) |

(21,563) |

64,054 |

|

(19,858) |

|

LEP Preparation |

(3,895) |

0 |

1,350 |

|

(2,545) |

|

Livestock Marketing Centre |

(5,724,767) |

(1,146,762) |

1,098,260 |

|

(5,773,270) |

|

Museum Acquisitions |

(39,378) |

0 |

0 |

|

(39,378) |

|

Oasis Building Renewal |

(209,851) |

(85,379) |

0 |

|

(295,230) |

|

Oasis Plant |

(1,140,543) |

390,000 |

100,000 |

|

(650,543) |

|

Parks & Recreation Projects |

(79,648) |

49,500 |

0 |

|

(30,148) |

|

Pedestrian River Crossing |

(10,775) |

|

10,775 |

|

0 |

|

Plant Replacement |

(3,935,062) |

253,958 |

1,043,434 |

|

(2,637,671) |

|

Playground Equipment Replacement |

(164,784) |

69,494 |

0 |

|

(95,290) |

|

Project Carryovers |

(2,006,338) |

402,808 |

1,585,155 |

|

(18,376) |

|

Public Art |

(208,754) |

30,300 |

64,997 |

|

(113,457) |

|

Robertson Oval Redevelopment |

(92,151) |

0 |

0 |

|

(92,151) |

|

Senior Citizens Centre |

(15,627) |

(2,000) |

0 |

|

(17,627) |

|

Sister Cities |

(36,328) |

(10,000) |

0 |

|

(46,328) |

|

Stormwater Drainage |

(180,242) |

0 |

22,000 |

|

(158,242) |

|

Strategic Real Property |

(475,000) |

401,305 |

(395,655) |

|

(469,350) |

|

Street Lighting Replacement |

(74,755) |

0 |

18,206 |

|

(56,549) |

|

Subdivision Tree Planting |

(582,108) |

40,000 |

0 |

|

(542,108) |

|

Sustainable Energy |

(588,983) |

95,000 |

259,414 |

|

(234,569) |

|

Traffic Committee |

(21,930) |

0 |

20,138 |

|

(1,792) |

|

Unexpended External Loans |

(841,521) |

0 |

841,521 |

|

0 |

|

Workers Compensation |

(40,000) |

0 |

(53,251) |

|

(93,251) |

|

Total Internally Restricted |

(36,795,390) |

4,244,732 |

6,404,558 |

0 |

(26,146,100) |

|

|

|

|

|

|

|

|

Total Restricted |

(118,621,137) |

28,346,342 |

16,973,012 |

10,000 |

(73,291,783) |

Section 356 Financial Assistance Requests

Four Section 356 financial assistance requests have been received for consideration at the 17 December 2018 Ordinary Council meeting.

It should be noted that in the last 12 months no grants or Section 356 contributions have been provided to any of the four groups who have requested financial assistance in this current report.

Details of the current financial assistance requests are shown below:

· Oz Fish Wagga Chapter $80.20

The Oz Fish Wagga Chapter conducted a clean-up event at the Eunony Reserve on Sunday 25 November 2018. Approximately 1.5 tonnes of general rubbish was collected by the Fishing group (see Facebook link of event attached).

https://www.facebook.com/ozfishwagga/videos/vb.2107176822836959/349390352274791/?type=2&theater

The Oz Fish Wagga Chapter is seeking Council’s consideration to the waiving of the Gregadoo Waste Management waste fees paid by the volunteers on the clean-up day of $80.20. Council’s Solid Waste Service Business Unit can accommodate the cost of waiving the above collection fees for the Volunteer Group.

The above request aligns with Council’s Strategic Plan “Environment” – Outcome: We create a sustainable environment for future generations “.

· The Compassionate Friends NSW $175.00

The Wagga Chapter of the Compassionate Friends NSW has written to Council (Attachment No 1) seeking financial assistance for their Candle Lighting day an event to honour lost children. The group held a candle lighting event on the 10 December 2017 at Collins Park that had Council hire fees of $85.

The Wagga group is seeking to establish their Candle Lighting day as an annual event and are holding a candle lighting event on Sunday 9 December 2018 at Collins Park. The fees for 2018/19 are $90.

In total, the group is seeking financial assistance of $175 for their 2017/18 and 2018/19 Candle Lighting events.

The above request aligns with Council’s Strategic Plan “Safe and Healthy Community – Outcome: We have access to health and support services that cater for all our needs.

· NSW Rural Fire Service $105.00

The NSW Rural Fire Service has written to Council (Attachment No 2) requesting Council’s consideration to the waiver of the fees of $105 (Council Charge Item 0680 Section 138 Permit – Application Fee) for the consent for work on a Road Reserve (Public Reserve Illeura Road Bourkelands – Permit Number ROC18/0110 ) .

The NSW Rural Fire Service wish to place a Variable Message Sign (VMS) mounted on a registered trailer at the Illeura Road Bourkelands location to deliver community safety messages.

The NSW Rural Fire Service has requested that any future Council Section 138 Permits for the placement of their Variable Message Sign on Council Road Reserves be at no charge.

It is proposed when updating the Draft 2019/20 Council Fees and Charges that a new charge item Section 138 – Application Fee (NSW Rural Fire Service – Variable Message Sign) – Nil charge, be established to facilitate the use of the above community safety communication equipment.

The above request aligns with Council’s Strategic Plan “Safe and Healthy Community – Outcome: We are safe”.

· The Australian Army Band Kapooka $1,750.81

The Australian Army Band Kapooka have offered to stage a community Christmas music event at the Victory Memorial Gardens on the Saturday the 15 December 2018 (commencing at 7.30pm and closing at approximately 9.00 pm).

Councils’ proposed contribution would assist with the costs of the venue hire $90 (Victory Memorial Gardens), Traffic Management costs (Closure of Morrow Street (from Baylis to the Esplanade) $600 plus $240 Road Closure advertising i.e. total financial assistance - $930.

The above costs are proposed to be funded from the Major Events Budget which has a current available budget of $73,445 i.e. remaining budget if this allocation is approved would be $72,515.

It is further proposed that Council absorb the costs for the provision of additional general waste/recycling bins $294 and portable toilets $526.81 required for the event, which is proposed to be funded from Council’s Waste Services Business Unit and Sewer Business Unit which have the capacity to absorb this cost.Thus the total funding from Council for the Australian Army Band Kapooka Christmas community

event would be $1,750.81.

The above request aligns with Council’s Strategic Plan “Community Place and Identity – Outcome: Groups, programs and activities bring us together “.

The Section 356 financial assistance budget for the 2018/19 financial year is $50,255.50, of which $41,689 is already committed in the adopted Delivery and Operational Plan 2018/19.

A balance of $2,359.00 is currently available for additional fee waiver requests received for the reminder of the year following financial assistance approved at the 26 November 2018 Council meeting.

|

Unallocated balance of S356 fee waiver financial assistance budget 2018/19 |

$2,359.00 |

|

The Compassionate Friends NSW |

($175.00) |

|

NSW Rural Fire Service |

($105.00) |

|

Total Section 356 Financial Assistance Requests 17 December 2018 Council Meeting |

($280.00) |

|

Balance of Section 356 fee waiver financial assistance budget for the remainder of the 2018/19 Financial Year |

$2,079.00 |

Note the Australian Army Band Kapooka financial assistance as noted above is proposed to be funded from the Major Events Budget for $930; the Solid Waste Business Unit for $294; and Sewer Business Unit for $526.81 (total funding for the music event $1,750.81).The Oz Fish Wagga Chapter financial assistance is proposed to be funded from the Solid Waste Business Unit for $80.20.

Investment Summary as at 30 November 2018

In accordance with Regulation 212 of the Local Government (General) Regulation 2005, details of Wagga Wagga City Council’s external investments are outlined below:

|

Institution |

Rating |

Closing Balance |

Closing Balance |

November |

November |

Investment |

Maturity |

Term |

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

AMP |

A |

2,000,000 |

2,000,000 |

2.95% |

1.38% |

1/06/2018 |

31/05/2019 |

12 |

|

AMP |

A |

1,000,000 |

1,000,000 |

2.95% |

0.69% |

5/06/2018 |

2/01/2019 |

7 |

|

Auswide |

BBB- |

2,000,000 |

2,000,000 |

2.70% |

1.38% |

5/12/2017 |

5/12/2018 |

12 |

|

AMP |

A |

2,000,000 |

0 |

0.00% |

0.00% |

17/05/2018 |

13/11/2018 |

6 |

|

AMP |

A |

1,000,000 |

1,000,000 |

2.95% |

0.69% |

17/05/2018 |

17/05/2019 |

12 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

2.86% |

1.38% |

28/05/2018 |

28/05/2019 |

12 |

|

AMP |

A |

2,000,000 |

2,000,000 |

2.95% |

1.38% |

29/05/2018 |

24/01/2019 |

8 |

|

Westpac |

AA- |

1,000,000 |

1,000,000 |

2.80% |

0.69% |

28/06/2018 |

28/06/2019 |

12 |

|

Australian Military Bank |

NR |

1,000,000 |

1,000,000 |

3.01% |

0.69% |

16/07/2018 |

16/07/2019 |

12 |

|

Suncorp-Metway |

A+ |

2,000,000 |

0 |

0.00% |

0.00% |

31/08/2018 |

30/11/2018 |

3 |

|

Bankwest |

AA- |

2,000,000 |

2,000,000 |

2.76% |

1.38% |

31/08/2018 |

23/04/2019 |

8 |

|

NAB |

AA- |

1,000,000 |

1,000,000 |

2.65% |

0.69% |

7/09/2018 |

7/12/2018 |

3 |

|

Australian Military Bank |

NR |

1,000,000 |

1,000,000 |

2.86% |

0.69% |

7/09/2018 |

8/07/2019 |

10 |

|

Total Short Term Deposits |

|

20,000,000 |

16,000,000 |

2.85% |

11.03% |

|

|

|

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

1,001,924 |

2,444,058 |

1.50% |

1.68% |

N/A |

N/A |

N/A |

|

NAB |

AA- |

12,745,357 |

13,768,719 |

2.19% |

9.49% |

N/A |

N/A |

N/A |

|

AMP |

A |

347 |

0 |

2.30% |

0.00% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

13,747,628 |

16,212,777 |

2.09% |

11.18% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

RaboBank |

A+ |

1,000,000 |

1,000,000 |

3.16% |

0.69% |

5/06/2017 |

6/06/2022 |

60 |

|

ING Bank |

A |

3,000,000 |

3,000,000 |

2.75% |

2.07% |

24/08/2017 |

26/08/2019 |

24 |

|

ME Bank |

BBB |

2,000,000 |

2,000,000 |

4.28% |

1.38% |

2/09/2014 |

2/09/2019 |

60 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

4.10% |

0.69% |

5/12/2014 |

5/12/2019 |

60 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.10% |

1.38% |

7/07/2017 |

7/07/2020 |

36 |

|

Institution |

Rating |

Closing Balance |

Closing Balance |

November |

November |

Investment |

Maturity |

Term |

|

AMP |

A |

2,000,000 |

2,000,000 |

3.00% |

1.38% |

2/08/2018 |

3/02/2020 |

18 |

|

Newcastle Permanent |

BBB |

1,000,000 |

1,000,000 |

3.00% |

0.69% |

12/08/2016 |

12/08/2019 |

36 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

3.20% |

0.69% |

25/08/2016 |

25/08/2021 |

60 |

|

Newcastle Permanent |

BBB |

1,000,000 |

1,000,000 |

3.00% |

0.69% |

31/08/2016 |

30/08/2019 |

36 |

|

Newcastle Permanent |

BBB |

2,000,000 |

2,000,000 |

3.00% |

1.38% |

10/02/2017 |

11/02/2019 |

24 |

|

Westpac |

AA- |

3,000,000 |

3,000,000 |

3.10% |

2.07% |

10/03/2017 |

10/03/2022 |

60 |

|

Auswide |

BBB- |

2,000,000 |

2,000,000 |

2.95% |

1.38% |

5/10/2018 |

6/10/2020 |

24 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

2.92% |

0.69% |

16/10/2017 |

16/10/2019 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

2.92% |

1.38% |

6/11/2017 |

6/11/2019 |

24 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.35% |

1.38% |

3/01/2018 |

4/01/2022 |

48 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

2.80% |

0.69% |

5/01/2018 |

6/01/2020 |

24 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

3.05% |

1.38% |

29/10/2018 |

29/10/2020 |

24 |

|

Australian Military Bank |

NR |

1,000,000 |

1,000,000 |

2.95% |

0.69% |

29/05/2018 |

29/05/2020 |

24 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

3.50% |

0.69% |

1/06/2018 |

1/06/2022 |

48 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

3.02% |

1.38% |

28/06/2018 |

28/06/2021 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

2.88% |

1.38% |

28/06/2018 |

29/06/2020 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

2.86% |

1.38% |

16/08/2018 |

17/08/2020 |

24 |

|

BOQ |

BBB+ |

3,000,000 |

3,000,000 |

3.25% |

2.07% |

28/08/2018 |

29/08/2022 |

48 |

|

ING Bank |

A |

3,000,000 |

3,000,000 |

2.85% |

2.07% |

30/08/2018 |

14/09/2020 |

24 |

|

P&N Bank |

BBB |

1,000,000 |

1,000,000 |

3.10% |

0.69% |

16/10/2018 |

18/10/2021 |

36 |

|

Westpac |

AA- |

0 |

2,000,000 |

3.05% |

1.38% |

13/11/2018 |

15/11/2021 |

36 |

|

Police Credit Union |

NR |

0 |

1,000,000 |

3.07% |

0.69% |

20/11/2018 |

20/11/2020 |

24 |

|

P&N Bank |

BBB |

0 |

1,000,000 |

3.30% |

0.69% |

20/11/2018 |

21/11/2022 |

48 |

|

ING Bank |

A |

0 |

2,000,000 |

2.93% |

1.38% |

29/11/2018 |

30/11/2020 |

24 |

|

NAB |

AA- |

0 |

2,000,000 |

3.01% |

1.38% |

30/11/2018 |

30/11/2021 |

36 |

|

Bendigo-Adelaide |

BBB+ |

0 |

1,000,000 |

3.25% |

0.69% |

30/11/2018 |

30/11/2022 |

48 |

|

Total Medium Term Deposits |

|

44,000,000 |

53,000,000 |

3.09% |

36.53% |

|

|

|

|

Floating Rate Notes - Senior Debt |

|

|

|

|

|

|

|

|

|

BOQ |

BBB+ |

2,014,400 |

2,016,400 |

BBSW + 110 |

1.39% |

5/08/2014 |

24/06/2019 |

58 |

|

Bendigo-Adelaide |

BBB+ |

1,011,267 |

1,005,595 |

BBSW + 110 |

0.69% |

18/08/2015 |

18/08/2020 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,011,267 |

1,005,595 |

BBSW + 110 |

0.69% |

28/09/2015 |

18/08/2020 |

59 |

|

Suncorp-Metway |

A+ |

1,012,377 |

1,013,863 |

BBSW + 125 |

0.70% |

20/10/2015 |

20/10/2020 |

60 |

|

Rabobank |

A+ |

2,047,672 |

2,032,486 |

BBSW + 150 |

1.40% |

4/03/2016 |

4/03/2021 |

60 |

|

Newcastle Permanent |

BBB |

1,006,577 |

1,008,944 |

BBSW + 160 |

0.70% |

22/03/2016 |

22/03/2019 |

36 |

|

CUA |

BBB |

2,012,294 |

2,016,868 |

BBSW + 160 |

1.39% |

1/04/2016 |

1/04/2019 |

36 |

|

ANZ |

AA- |

1,014,407 |

1,015,193 |

BBSW + 118 |

0.70% |

7/04/2016 |

7/04/2021 |

60 |

|

Suncorp-Metway |

A+ |

1,017,076 |

1,018,503 |

BBSW + 138 |

0.70% |

21/04/2016 |

12/04/2021 |

60 |

|

AMP |

A |

1,014,427 |

1,007,254 |

BBSW + 135 |

0.69% |

24/05/2016 |

24/05/2021 |

60 |

|

Westpac |

AA- |

1,016,926 |

1,009,414 |

BBSW + 117 |

0.70% |

3/06/2016 |

3/06/2021 |

60 |

|

CBA |

AA- |

1,015,117 |

1,015,283 |

BBSW + 121 |

0.70% |

12/07/2016 |

12/07/2021 |

60 |

|

ANZ |

AA- |

2,035,952 |

2,020,728 |

BBSW + 113 |

1.39% |

16/08/2016 |

16/08/2021 |

60 |

|

BOQ |

BBB+ |

1,509,566 |

1,511,631 |

BBSW + 117 |

1.04% |

26/10/2016 |

26/10/2020 |

48 |

|

NAB |

AA- |

1,009,807 |

1,010,344 |

BBSW + 105 |

0.70% |

21/10/2016 |

21/10/2021 |

60 |

|

Teachers Mutual |

BBB |

1,505,427 |

1,508,708 |

BBSW + 140 |

1.04% |

28/10/2016 |

28/10/2019 |

36 |

|

Bendigo-Adelaide |

BBB+ |

1,010,597 |

1,004,965 |

BBSW + 110 |

0.69% |

21/11/2016 |

21/02/2020 |

39 |

|

Westpac |

AA- |

1,010,757 |

1,010,524 |

BBSW + 111 |

0.70% |

7/02/2017 |

7/02/2022 |

60 |

|

ANZ |

AA- |

1,012,257 |

1,004,885 |

BBSW + 100 |

0.69% |

7/03/2017 |

7/03/2022 |

60 |

|

CUA |

BBB |

755,840 |

757,623 |

BBSW + 130 |

0.52% |

20/03/2017 |

20/03/2020 |

36 |

|

Heritage Bank |

BBB+ |

601,925 |

603,315 |

BBSW + 130 |

0.42% |

4/05/2017 |

4/05/2020 |

36 |

|

Institution |

Rating |

Closing Balance |

Closing Balance |

November |

November |

Investment |

Maturity |

Term |

|

Teachers Mutual |

BBB |

1,008,347 |

1,010,494 |

BBSW + 142 |

0.70% |

29/06/2017 |

29/06/2020 |

36 |

|

NAB |

AA- |

3,017,811 |

3,017,955 |

BBSW + 90 |

2.08% |

5/07/2017 |

5/07/2022 |

60 |

|

Suncorp-Metway |

A+ |

1,010,367 |

1,002,605 |

BBSW + 97 |

0.69% |

16/08/2017 |

16/08/2022 |

60 |

|

Westpac |

AA- |

2,000,796 |

1,999,392 |

BBSW + 81 |

1.38% |

30/10/2017 |

27/10/2022 |

60 |

|

ME Bank |

BBB |

1,501,692 |

1,505,048 |

BBSW + 125 |

1.04% |

9/11/2017 |

9/11/2020 |

36 |

|

NAB |

AA- |

2,009,894 |

1,993,872 |

BBSW + 80 |

1.37% |

10/11/2017 |

10/02/2023 |

63 |

|

ANZ |

AA- |

1,499,232 |

1,496,814 |

BBSW + 77 |

1.03% |

18/01/2018 |

18/01/2023 |

60 |

|

Bendigo-Adelaide |

BBB+ |

499,599 |

499,488 |

BBSW + 105 |

0.34% |

25/01/2018 |

25/01/2023 |

60 |

|

Newcastle Permanent |

BBB |

1,496,127 |

1,496,859 |

BBSW + 140 |

1.03% |

6/02/2018 |

6/02/2023 |

60 |

|

Westpac |

AA- |

2,007,814 |

1,991,052 |

BBSW + 83 |

1.37% |

6/03/2018 |

6/03/2023 |

60 |

|

UBS |

A+ |

2,011,394 |

1,998,432 |

BBSW + 90 |

1.38% |

8/03/2018 |

8/03/2023 |

60 |

|

Heritage Bank |

BBB+ |

1,405,498 |

1,408,687 |

BBSW + 123 |

0.97% |

29/03/2018 |

29/03/2021 |

36 |

|

ME Bank |

BBB |

1,603,453 |

1,606,760 |

BBSW + 127 |

1.11% |

17/04/2018 |

16/04/2021 |

36 |

|

ANZ |

AA- |

2,002,656 |

1,998,512 |

BBSW + 93 |

1.38% |

9/05/2018 |

9/05/2023 |

60 |

|

NAB |

AA- |

2,015,174 |

1,997,392 |

BBSW + 90 |

1.38% |

16/05/2018 |

16/05/2023 |

60 |

|

CBA |

AA- |

2,015,454 |

1,997,152 |

BBSW + 93 |

1.38% |

16/08/2018 |

16/08/2023 |

60 |

|

Bank Australia |

BBB |

755,458 |

751,383 |

BBSW + 130 |

0.52% |

30/08/2018 |

30/08/2021 |

36 |

|

CUA |

BBB |

603,145 |

604,596 |

BBSW + 125 |

0.42% |

6/09/2018 |

6/09/2021 |

36 |

|

AMP |

A |

1,505,277 |

1,496,499 |

BBSW + 108 |

1.03% |

10/09/2018 |

10/09/2021 |

36 |

|

NAB |

AA- |

2,008,954 |

2,003,470 |

BBSW + 93 |

1.38% |

26/09/2018 |

26/09/2023 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,002,115 |

1,003,127 |

BBSW + 101 |

0.69% |

19/10/2018 |

19/01/2022 |

39 |

|

Total Floating Rate Notes - Senior Debt |

|

58,626,191 |

58,477,709 |

|

40.31% |

|

|

|

|

Managed Funds |

|

|

|

|

|

|

|

|

|

NSW Tcorp |

NR |

1,402,531 |

1,387,903 |

-1.04% |

0.96% |

17/03/2014 |

1/11/2023 |

115 |

|

Total Managed Funds |

|

1,402,531 |

1,387,903 |

-1.04% |

0.96% |

|

|

|

|

TOTAL

CASH ASSETS, CASH |

|

137,776,350 |

145,078,389 |

|

100.00% |

|

|

|

|

LESS: RIVERINA REGIONAL LIBRARY (RRL) CASH AT BANK |

|

4,436,102 |

4,235,919 |

|

|

|

|

|

|

TOTAL

WWCC CASH ASSETS, CASH |

|

133,340,248 |

140,842,469 |

|

|

|

|

|

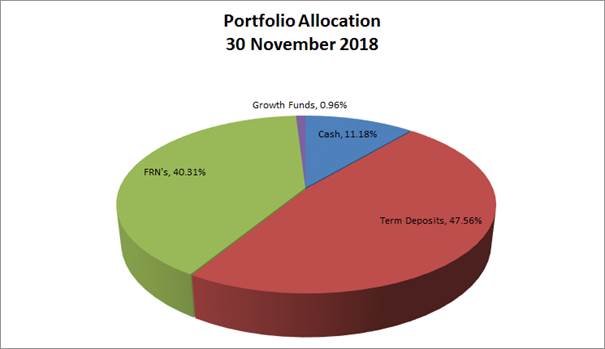

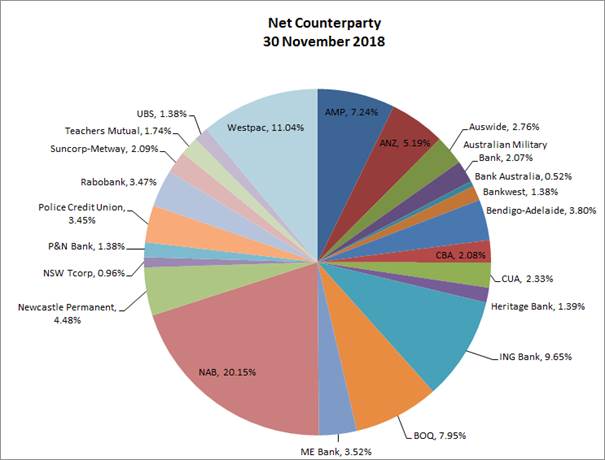

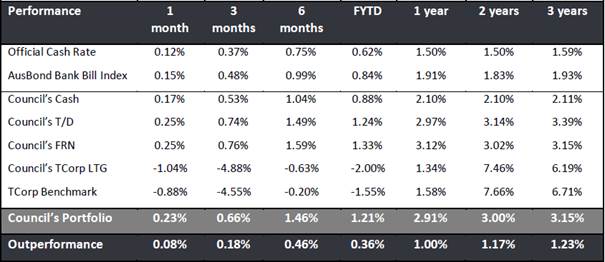

Council’s investment portfolio is now dominated by Term Deposits, equating to approximately 48% of the portfolio across a broad range of counterparties. Cash equates to 11% of the portfolio with Floating Rate Notes (FRNs) around 40% and growth funds around 1% of the portfolio.

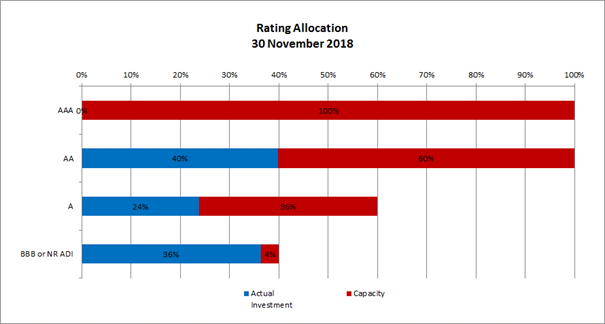

Council’s investment portfolio is well diversified in complying assets across the entire credit spectrum. It is also well diversified from a rating perspective. Credit quality is diversified and is predominately invested amongst the investment grade Authorised Deposit-Taking Institutions (ADIs) (being BBB- or higher), with a smaller allocation to unrated ADIs.

All investments are within the defined Policy limits, as outlined in the Rating Allocation chart below:

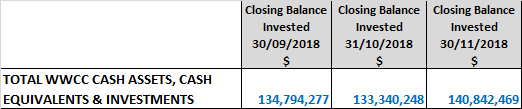

Investment Portfolio Balance

Council’s investment portfolio balance has increased from the previous month’s balance, up from $133.3M to $140.8M. This is reflective of the 2nd quarter rates instalments being due on 30 November.

MONTHLY INVESTMENT MOVEMENTS

Redemptions/Sales – Council redeemed the following investment security during November 2018:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

AMP Bank Term Deposit |

$2M |

6 months |

2.95% |

This term deposit was redeemed on maturity and funds were reinvested in a 3‑year term deposit with Westpac Bank (see below). |

|

Suncorp Bank Term Deposit |

$2M |

3 months |

2.65% |

This term deposit was redeemed on maturity and funds were reinvested in a 3‑year term deposit with NAB (see below). |

New Investments – Council purchased the following investment security during November 2018:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

Westpac Bank Term Deposit |

$2M |

3 years |

3.05% |

The Westpac Bank rate of 3.05% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

|

Police Credit Union Term Deposit |

$1M |

2 years |

3.07% |

The PCU rate of 3.07% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

|

P&N Bank Term Deposit |

$1M |

4 years |

3.30% |

The P&N Bank rate of 3.30% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

|

ING Bank Term Deposit |

$2M |

2 years |

2.93% |

The ING Bank rate of 2.93% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

|

NAB Term Deposit |

$2M |

3 years |

3.01% |

The NAB rate of 3.01% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

|

Bendigo-Adelaide Bank Term Deposit |

$1M |

4 years |

3.25% |

The Bendigo-Adelaide Bank rate of 3.25% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

Rollovers – Council did not rollover any investment securities during November 2018.

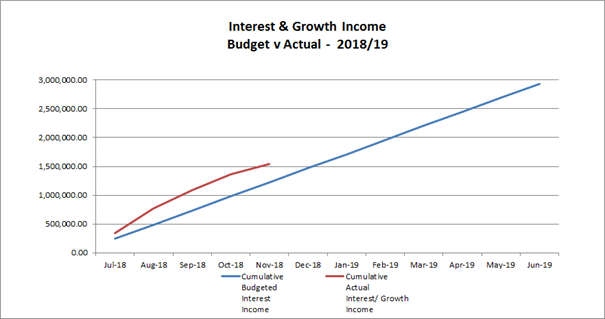

MONTHLY PERFORMANCE

Interest/growth/capital gains for the month totalled $179,774, which compares unfavourably with the budget for the period of $244,709, underperforming budget for the month of November by $64,935. This is mainly due to a negative movement for Councils Floating Rate Note (FRN) portfolio during November.

It should be noted that a majority of Councils FRNs continue to trade at a premium. The capital market value of these investments will fluctuate from month to month and Council continues to receive the coupon payments and the face value of the investment security when sold or at maturity.

Council’s T-Corp Long Term Growth Fund also detracted from the overall performance for the month of November following losses suffered in domestic and international markets. Even though the fund was down 1.04% for the month of November, the fund has returned 8.38% per annum since the original investment in March 2014. Overall, the Growth Fund remains Council’s best performing asset over 1-3 years by a considerable margin.

It is important to note Council’s investment portfolio balance is tracking well above what was originally predicted. This is mainly due to the timing of some of the major projects that are either not yet commenced or not as advanced as originally predicted. It is anticipated that over the 2018/19 financial year the portfolio balance will reduce in line with the completion of major projects. This will result in Councils investment portfolio continuing to maintain a higher balance until these projects commence or advance further.

The longer-dated deposits in the portfolio, particularly those locked in above 4% yields, have previously anchored Council’s portfolio performance. It should be noted that the portfolio now only includes two investments yielding above 4% and Council will inevitably see a fall in investment income over the coming months compared with previous periods. Council staff and Council’s Independent Financial Advisor will continue to identify opportunities to lock in higher yielding investments as they become available.

In comparison to the AusBond Bank Bill Index* (1.91%), Council’s investment portfolio returned 2.76% (annualised) for November. Cash and At-Call accounts returned 2.09% (annualised) for this period. These funds are utilised for daily cash flow management and need to be available to meet operating and contractual payments as they fall due.

* The AusBond Bank Bill Index is the leading benchmark for the Australian fixed income market. It is interpolated from the RBA Cash rate, 1 month and 3 month Bank Bill Swap rates.

Report by Responsible Accounting Officer

I hereby certify that all of the above investments have been made in accordance with the provision of Section 625 of the Local Government Act 1993 and the regulations there under, and in accordance with the Investments Policy adopted by Council on 26 February 2018.

Carolyn Rodney

Responsible Accounting Officer

Policy and Legislation

Budget variations are reported in accordance with Council’s POL 052 Budget Policy.

Investments are reported in accordance with Council’s POL 075 Investment Policy.

Local Government Act 1993

Section 625 - How may councils invest?

Local Government (General) Regulation 2005

Section 212 - Reports on council investments

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

This report is a control mechanism that assists in addressing the following potential risks to Council:

· Loss of investment income or capital resulting from ongoing management of investments, especially during difficult economic times

· Failure to demonstrate to the community that its funds are being expended in an efficient and effective manner

Internal / External Consultation

Council’s Community Engagement Strategy and IAP2 considers the community to be “any individual or group of individuals, organisation or political entity with an interest in the outcome of a decision….”

All relevant areas within the Council have consulted with the Finance Division in regards to the budget variations listed in this report.

The Finance Division has consulted with relevant external parties to confirm Council’s investment portfolio balances.

|

1⇩. |

Section 356 Financial Assistance request - The Compassionate Friends NSW |

|

|

2⇩. |

Section 356 Financial Assistance request - NSW Rural Fire Service |

|

Report submitted to the Ordinary Meeting of Council on Monday 17 December 2018. RP-2

General Manager: Peter Thompson

|

Summary: |

The city of Wagga Wagga is the regional capital of the Riverina with an urban population in excess of 65,000 people and servicing a catchment of over 185,000 people.

The city is ideally located between Sydney and Melbourne (450kms each way) and is only two and a half hours drive from Canberra. Wagga Wagga is an important economic hub for the state of NSW and is the ninth fastest growing inland city in Australia.

The population is expected to exceed 80,000 people by 2040, however we must plan for a city that could grow to beyond 100,000 people with the NSW State Government working towards achieving this target.

To assist in achieving these growth targets it is proposed that Council establish a new Regional Activation Directorate with a focus on developing and implementing economic opportunities and growth initiatives that will establish Wagga Wagga as a future focused, thriving, and recognised regional hub. |

|

That Council: a receive and note this report b adopt the Organisation Structure as outlined in this report, noting the inclusion of the Regional Activation Directorate c approve the budget variation as detailed in the Financial Implications section of the report |

Report

Background

In 2016 Wagga Wagga City Council undertook a major organisational restructure. One of the major implications of this restructure was the removal of the Commercial and Economic Development Directorate (CEDD). The Director role was removed from the structure and the remainder of the functions of the CEDD were re-distributed across the remaining directorates.

Since the 2016 restructure, the organisation has not had a dedicated economic development area. These skills, expertise and business acumen are required in the organisation to attract industry and commercial investment to the city.

Drivers for Change

Wagga Wagga is the regional capital of the Riverina with an urban population in excess of 65,000 people, servicing a catchment of over 185,000 people. The city is ideally located between Sydney and Melbourne (450kms each way) and is only two and a half hours drive from the National Capital Canberra. Wagga Wagga is an important economic hub for the state of NSW and is the ninth fastest growing inland city in Australia. The city is well connected with excellent air, rail and road links and is an important agricultural, industrial, health, education, military, and transport hub.

In August 2018 the Premier announced investment into a new rail siding at Bomen saying that it will create “more jobs and more investment for Wagga”. The next stages of the RiFL Hub including the development of the 60-hectare industrial estate adjacent will be critical to the success of the entire 10-year project to transform Bomen and leverage off the investment already made by the Federal Government, NSW Government, Council and the private sector. The industrial estate will be uniquely attractive for manufacturing, distribution and logistics businesses who can gain efficiencies by being so close to the RIFL and the inland rail route which will link Wagga Wagga with the Ports of Brisbane and Melbourne.

The Department of Planning and Environment (DPE) is currently conducting a review on potential locations for Special Activity Areas (SAA) across the state, and Bomen is currently under strong consideration. SAA’s are intended to streamline and expedite development processes to support regional industrial development in NSW. If Bomen is announced as a SAA, interest in investing in the region is likely to increase due to anticipated reductions in red tape.

The economic outlook for Asia and the Pacific remains strong, and the region continues to be the most dynamic of the global economy. Growth in Asia is forecast at 5.6 percent in 2018 and 2019, while inflation is projected to be subdued. Strong and broad-based global growth and trade, reinforced by the US fiscal stimulus, are expected to support Asia’s exports and investment. There are opportunities for Wagga Wagga engage with businesses from the Asia Pacific region to invest in the city.

Wagga Wagga is also well placed to benefit from decentralisation policies for Sydney, Melbourne and Canberra. Decentralisation can act as an effective catalyst for regional growth in population and employment. By planning for growth, Wagga Wagga has significant potential to be an effective location for decentralisation. Additional contributors to growth will be the revitalisation of the CBD as a central place for retail and business activity and the establishment of a health precinct for health related services.

Proposed Structure

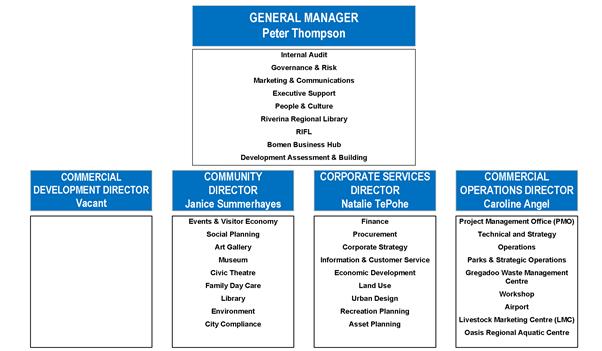

Diagram 1 below outlines the current organisational structure and the high level functions within each of the Directorates.

It is important to note that the organisation has been operating without the Commercial Development Directorate and a Director for approximately 18 months. In the absence of the Commercial Development Directorate, the Development Assessment and Building functions have been reporting directly to the General Manager and Council Businesses have been reporting to the Director Commercial Operations.

Diagram 1: Current Organisational Structure

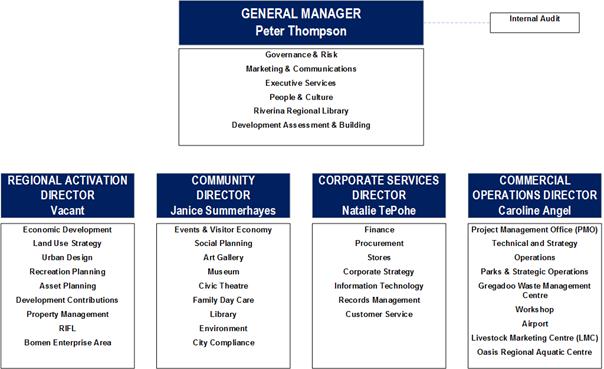

Under the proposed structure as per Diagram 2 below, it is recommended that that the Development Assessment and Building functions continue to report to the General Manager, with Council Businesses continuing to report to the Director Commercial Operations. As a result, the Commercial Development Directorate will be removed from the structure and the funding for the Director role will be transferred to the new Regional Activation Director position. A permanent solution for management oversight of Council businesses will be included for discussion as part of 2019/20 budget process.

It is proposed that the City Strategy Division and the Property Management Section be transitioned from the Finance Directorate to new Regional Activation Directorate. The Finance Directorate will also change its name back to the Corporate Services Directorate to more broadly reflect the traditional functions of the area.

Diagram 2: New Organisational Structure

Financial Implications

At this stage there will be no further financial implications for this change. It is recommended that the Regional Activation Director position (Senior Staff Contract) be funded by the Commercial Development Director position which has been vacant since June 2017.

Policy and Legislation

N/A

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We have leaders that represent us

Risk Management Issues for Council

There is a risk that Wagga Wagga falls behind without the appropriate resources developing economic strategies and encouraging investment in the city.

Internal / External Consultation

Discussions have been held with Councillors at the General Manager’s Performance Review Committee meetings, with one of the agreed annual priorities for 18/19 being the establishment of an Economic Development Directorate.

Report submitted to the Ordinary Meeting of Council on Monday 17 December 2018. RP-3

Author: Mark Gardiner

Director: Janice Summerhayes

|

Summary: |

Councils in NSW have an opportunity to reduce level 2 parking fines from $112 down to $80 and have been notified by the Hon Dominic Perrottet MP Treasurer and Minister for Industrial Relations, to resolve on a position to opt in as part of the process by 1 January 2019. |

|

That Council: a receive and note the report b make a determination from the options outlined in the report |

Report

Council has received correspondence (attached) from the Hon Dominic Perrottet MP, Treasurer and Minister for Industrial Relations, regarding the opportunity for Councils to reduce the parking fine amounts within their Local Government Area.

The State Government sets the value of parking fines within NSW and have announced a new framework to allow Councils to reduce the value of 52 level 2 parking fines from $112 down to $80.

Councils wishing to opt in to reduce the value of the parking fines have an opportunity to do so prior to 1 January 2019, with the lower fines becoming effective from 1 March 2019. A list of Councils who opt in will be made public after 1 January 2019. There is also an opportunity to opt in at a later date.

The fines proposed to be reduced represent approximately 45% of the revenue from total parking fines issued over the past 12 months. The proposed reduction from $112 to $80 represents a 28% decrease in the value of those fines, which will impact on the current and future budgets if Council opts in prior to 1 January 2019. This equates approximately to:

· A reduction of $19,000 - $21,000 for the period 1 March – 30 June 2019

· A reduction of $85,000 - $95,000 for financial year 2019/2020 and ongoing

It is recommended that Council select one of the options outlined below.

Option 1:

That Council:

a receive and note the report

b opt in to reducing parking fines as outlined in the report, commencing from the 1 March 2019

c notify the Hon Dominic Perrottet MP, Treasurer and Minister for Industrial Relations of Councils decision

d endorse the budget variations outlined in the report

Option 2:

That Council:

a receive and note the report

b opt in to reducing parking fines as outlined in the report, commencing from the 1 September 2019

c notify the Hon Dominic Perrottet MP, Treasurer and Minister for Industrial Relations of Councils decision

d endorse the budget variations outlined in the report

Option 3:

That Council:

a receive and note the report

b not opt in to reducing parking fines as outlined in the report

c notify the Hon Dominic Perrottet MP, Treasurer and Minister for Industrial Relations of Councils decision

Financial Implications

The fines proposed to be reduced represent approximately 45% of the revenue from total parking fines issued. The proposed reduction from $112 to $80 represents a 28% decrease in the value of those fines, which will impact on the current and future budgets if Council opts in prior to 1 January 2019. This equates approximately to:

· A reduction of $19K - $21K for the period 1 March 2019 – 30 June 2019

· A reduction of $85K - $95K for 2019/20 and ongoing in the LTFP

It is expected that Council’s 2018/19 interest on investment income will exceed the current $2.9M income budget. Council staff will be submitting a further report to the 29 January 2019 Council meeting, reforecasting the expected interest income for the remaining six (6) months of the 2018/19 financial year.

If Option 1 is resolved, it is proposed to fund this estimated reduction in income of $19K - $21K in 2018/19 from this additional interest on investments income.

The estimated $85K - $95K reduction in income from 2019/20 and ongoing for the 10 years of the LTFP will be funded as part of the 2019/20 LTFP budget process.

Policy and Legislation

Road Transport (General) Amendment (Parking Fine Flexibility and Grace Period) Regulation 2018

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We have leaders that represent us

Risk Management Issues for Council

N/A

Internal / External Consultation

Internal consultation has included the Executive Team and Finance section.

|

1⇩. |

Correspondence from the Hon Dominic Perrottet MP Treasure and Minister for Industrial Relations |

|

RP-4 SALE OF LAND FOR UNPAID RATES - RESULTS OF PUBLIC AUCTION

Author: Craig Katsoolis

Director: Natalie Te Pohe

|

Summary: |

A Sale of Land for Unpaid Rates Auction was held on 17 November 2018 in the Council Chambers. This report details the result of the above public auction and recommends the write off of outstanding rates and charges on properties sold pursuant to the requirements of the NSW Local Government Act 1993 and associated Regulations. |

|

That Council: a note the results of the Sale of Land for Unpaid Rates Auction held 17 November 2018 b pursuant to the Local Government (General) Regulation 2005 – Regs 131 (3) and 4(b), write off rates and charges of $31,224.12 as detailed in the table below:

|

||||||||||||||||||||||||

Report

Council at its Ordinary meeting held the 12 June 2018 resolved in respect of RP-4 Sale of Land for Unpaid rates as follows:

That Council:

a continue to discuss and negotiate with property holders whose outstanding rates are greater than five years in an effort to arrange an acceptable payment plan

b if an acceptable payment plan with ratepayers is not able to be achieved, or is not adhered to, then pursuant to Section 713 of the Local Government Act 1993, sell the land and properties detailed in this report to recover unpaid rates, annual charges, interest and extra charges

c authorise the General Manager or their delegate, to set the reserve price for properties put to public auction or sold after public auction

d authorise the affixing of the Council Seal to the transfer documents in order to effect the transfer of ownership for properties sold by Council at or after the public auction for unpaid rates and charges

e receive a further report following the public auction, outlining the outcomes of each property sale

Six properties (under seven lots) were submitted for the Sale of Land for Unpaid Rates Public Auction held on the 17 November 2018. Details of the results of the public auction are outlined in the table below:

|

No |

Property |

Owner |

Rates and Charges Balance as at 17 November 2018 including accrued interest |

Public Auction Sale Price |

Net write off |

Pro Rata – Rates Payable by New Owner for 2018/19 from 17/11/2018 |

|

1 & 2 |

Lot 1 & 2 DP 193746 - 797 Livingstone Gully Rd BIG SPRINGS NSW 2650 |

Yarran Park Pty Ltd & GCB Pty Limited |

$14,795.06 |

$5,000.00 |

9,609.87 |

$185.19 |

|

3 |

Lot 1 DP317480 3012 Westbrook Rd OBERNE CREEK NSW 2650 |

Astley George Pearce, LaurenceAugustus Wilkinson & Edmund Macleod Curr

|

$8,794.18 |

$3,000.00 |

$5,634.51 |

$159.67 |

|

No |

Property |

Owner |

Rates and Charges Balance as at 17 November 2018 including accrued interest |

Public Auction Sale Price |

Net write off |

Pro Rata – Rates Payable by New Owner for 2018/19 from 17/11/2018 |

|

4 |

Lot 2 DP 178044 1187 Mates Gully Rd TARCUTTA NSW 2652 |

Alfred James Turner |

$8,766.06 |

$1,000.00 |

$7,606.21 |

$159.85 |

5 |

Lot 1 & Lot 2 DP 433411 1215 Humula Rd TARCUTTA NSW 2652 |

Philip Craig |

$9,033.16 |

$500.00 |

$8,373.53 |

$159.63 |

|

6 |

Lot 1 DP665045 1580 Downfall Rd HUMULA NSW 2652 |

Arthur Fredrick Hooper |

$8,764.75 |

Passed in. To be put to sale via Private Treaty |

N/A |

N/A |

|

7 |

19 Humula Eight Mile Rd HUMULA NSW 2652 |

Perpetual Trustee Co Ltd |

$7,962.78 |

Passed in. To be put to sale via Private Treaty |

N/A |

N/A |

|

TOTAL |

$58,115.99 |

$9,500.00 |

$31,224.12 |

$664.34 |

||

As noted in RP-4 Sale of Land for unpaid Rates report presented to the 12 June 2018 Council meeting:

“A sale of land for unpaid rates is considered the last remaining avenue available to Council to recover these outstanding amounts. The proceeds received from the sale of properties will reduce Council’s rates outstanding percentage (the percentage of rates outstanding versus the total rates collectible), which was 5.10% at 30 June 2017 (5.91% at 30 June 2016).

All proceeds of sale are paid to the Council and in accordance with Section 718 of the Local Government Act 1993 are to be discharged in the following order:

a) Reimbursement of all Council expenses associated with the sale, then:

b) Discharge of any rate or charge in respect of the land due to the Council, or any other rating authority, and any debt in respect of the land (being a debt which the Council has notice) due to the Crown.

Should insufficient funds be recovered to satisfy all rates, charges and debts, then a pro-rata of funds to debts occurs with all debts then deemed satisfied, which is ultimately writing off the outstanding balance.

Surplus funds (if any) are held within Council’s Trust Fund (separate bank account) pending discharge to persons having interest in the properties. Where no claim is forthcoming, the balance of sale proceeds is remitted to the State Government in accordance with the Unclaimed Moneys Act.”

The public auction by Council of the above properties provided an opportunity to resolve the above land title issues, and going forward Council will now receive rates for the above properties sold at public auction.

A further report will be presented to Council when the remaining two unsold properties are sold by Council - by private treaty pursuant to Section 716 of the NSW Local Government Act 1993.

Financial Implications

Pursuant to Section 718 and Section 719 of the NSW Local Government Act 1993, as the outstanding rates and charges on the sold properties are greater than the sale proceeds, the balance is to be written off. The total write off for the 5 property lots is $31,224.12.

Funding Source:

It is expected that Council’s 2018/19 interest on investment income will exceed the current $2.9M income budget. Council staff will be submitting a further report to the 29 January 2019 Council meeting, reforecasting the expected interest income for the remaining six (6) months of the 2018/19 financial year.

Policy and Legislation

NSW Local Government Act 1993, sections 718, 719

Debt Management Policy

Local Government (General) Regulation 2005 – Reg 131

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We are informed and involved in decision making

Outcome: Everyone in our community feels they have been heard and understood

Risk Management Issues for Council

N/A

Internal / External Consultation

The 2017/18 Sale of Land for Unpaid rates process was advertised via a sales campaign in the Daily Advertiser and on the appointed real estate’s website. Along with the public notices, each of the adjoining owners of the properties that were put to public auction on 17 November 2018 were contacted by phone and in writing regarding the 2018 Sale of Land for Unpaid Rates Auction.

Report submitted to the Ordinary Meeting of Council on Monday 17 December 2018. RP-5

RP-5 Sewer and Stormwater Infrastructure in Gobbagombalin

Author: Belinda Maclure