AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

25 March 2019

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

25 March 2019

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 25 March 2019 at 6.00pm.

Council live streams video and audio of Council meetings. Members of the public are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

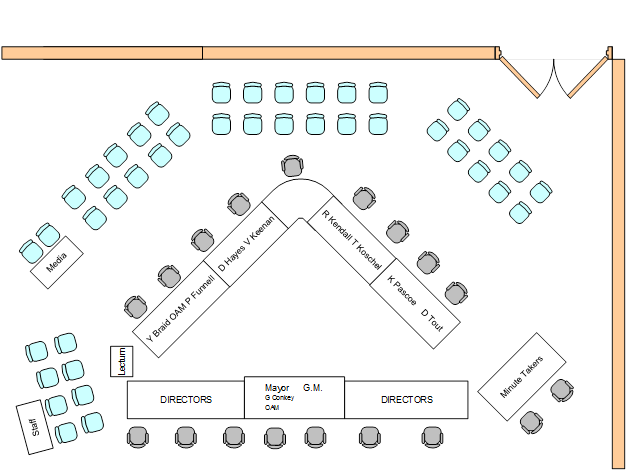

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 25 March 2019.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 25 March 2019

CLAUSE PRECIS PAGE

PRAYER 2

ACKNOWLEDGEMENT OF COUNTRY 2

APOLOGIES 2

CONFIRMATIONS OF MINUTES

CM-1 ORDINARY COUNCIL MEETING - 11 MARCH 2019 2

DECLARATIONS OF INTEREST 2

Reports from Staff

RP-1 RIVERINA MEDICAL SPECIALIST RECRUITMENT & RETENTION COMMITTEE 3

RP-2 Medical Scholarship Funding Request 14

RP-3 Payroll tax changes to encourage business growth and support employment of mature aged workers 22

RP-4 Financial Performance Report as at 28 February 2019 30

RP-5 NSW Department of Planning & Environment - Low Cost Loans Initiative 50

RP-6 CROWN RESERVE MANAGEMENT 71

RP-7 WAGGA WAGGA CITY COUNCIL CRIME PREVENTION WORKING GROUP 73

RP-8 AFM Statewide Mutual Risk Management Scholarship 2018 88

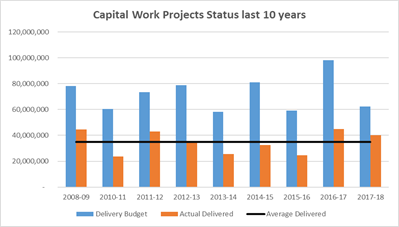

RP-9 RESETTING OF CAPITAL WORKS PROGRAM FOR 2018/19 AND PROPOSED CAPITAL WORKS PROGRAM FOR 2019/20 92

RP-10 Response to Questions/Business with Notice 103

QUESTIONS/BUSINESS WITH NOTICE 106

Confidential Reports

CONF-1 Loan Facility - Refinancing of Existing Loans 107

CONF-2 RFT2019-27 NATURAL GAS SUPPLY TO OASIS REGIONAL AQUATIC CENTRE 108

CONF-3 Major Events, Festivals and Films Sponsorship 109

CONF-4 BOTANIC GARDENS RESTAURANT AND CAFE - EXPRESSION OF INTEREST 110

Confirmation of Minutes

CM-1 Ordinary Council Meeting - 11 March 2019

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 11 March 2019 be confirmed as a true and accurate record.

|

|

1⇩. |

Confirmation of Minutes Ordinary Council Meeting - 11 March 2019 |

111 |

RP-1 RIVERINA MEDICAL SPECIALIST RECRUITMENT & RETENTION COMMITTEE

Author: Dominic Kennedy

Director: Natalie Te Pohe

|

Summary: |

To consider the continuation of Council’s commitment to support the Riverina Medical Specialist Recruitment Committee. |

|

That Council: a provide $10,000 (exclusive of GST) per annum to the Riverina Medical Specialist Recruitment and Retention Committee for three years from 2019/20 to 2021/22 b authorise the General Manager or their delegate to liaise with the Riverina Medical Specialist Recruitment and Retention Committee to update the existing Heads of Agreement c review the commitment prior to the 2022/23 financial year |

Report

Wagga Wagga City Council has been approached by the Riverina Medical Specialist and Recruitment and Retention Committee to continue its commitment to provide $10,000 (exclusive of GST) annually until the end of the 2021/22 financial year.

The Committee commenced meeting in December 2003 and originally comprised representatives of the Area Health Service, Calvary Hospital, Regional Imaging Riverina and a local physician. The Committee then expanded to include the Riverina Division of General Practice and Primary Health and the Wagga Wagga Commercial Response Unit with selected specialists attending Committee meetings as appropriate.

The Committee has further evolved to assist in the recruitment of medical specialists across the region and is now known as the Riverina Medical Specialist Recruitment and Retention Committee. The Committee’s primary focus is to recruit quality, locally resident medical specialists in Wagga Wagga and the region, for the benefit of the whole community.

This is a collaborative partnership with Committee representatives including:

· Regional Imaging Riverina (RIR)

· Calvary Riverina Hospital (CRH)

· Wagga Wagga City Council (WWCC)

· Clinicians

· Murrumbidgee Local Health District (MLHD)

· Murrumbidgee Primary Health Network (MPHN)

· University of New South Wales Rural Clinical School (UNSW)

· University of Notre Dame Australia Rural Clinical School (UNDA)

Core principles of the collaboration as outlined in the 2016-2019 Heads of Agreement include the following:

· Quality medical specialist care is available locally, able to meet community needs, improve services and provide continuity of care

· Collaborative discussion on medical specialist recruitment, retention and training, including a commitment to shared planning of the medical specialist workforce

· Sustainability of the collaboration, with clear identification of how resources and governance can sustain it in the long term

Since 2004 a total of 166 medical specialists (including 91 resident and 75 visiting/locum medical specialists) have been recruited or supported in their move to, or work in, Wagga Wagga. 40 of those 166 specialists have commenced working in Wagga Wagga during the current Heads of Agreement period, including 18 since the last report to Wagga Wagga City Council in July 2017.

The most critical workforce successes for the community have been in facilitating significant expansion and ongoing sustainability of General Physicians in the region, the establishment of private Psychiatry services and maintaining adequate numbers of Obstetricians and Gynaecologists. Attachment 1 provides further details in relation to the outcomes achieved.

Health related services are the biggest driver in the regional economy and is a critical service for the broader region. The Committee has provided a key conduit for Council whilst developing the Health Precinct Master Plan, ensuring that the project addresses key issues and engages with the right people.

Council has been a financial contributor to the Committee since the 2008/09 financial year. There was a Memorandum of Understanding established between the two parties prior to that in 2006 and a further Heads of Agreement established in 2011 that was later revised in 2016. The Committee employs a full-time Manager of Specialist Recruitment and the operating costs (including the full-time Manager salary) are shared between Regional Imaging Riverina, Calvary Riverina Hospital and the contribution from Council.

While the Committee has achieved positive outcomes to date, there is still more to be undertaken, particularly with the intended growth of the city. The financial support from Wagga Wagga City Council is an important contribution and also assists in promoting the city and region at wide ranging medical specialist forums across Australia and in New Zealand.

Financial Implications

Council has been providing support to the Riverina Medical Specialist Recruitment Committee since the 2008/09 financial year - $5,000 for the first two years, and $10,000 per year for the remaining 9 years, bringing the total contribution to date up to $100,000.

This report is recommending for Council to continue to support the Committee for the 2019/20, 2020/21 and 2021/22 financial years. An annual $10,000 (excluding GST) contribution budget is currently included within Council’s Long Term Financial Plan, therefore there would be no budget implications if the contribution were to continue.

Policy and Legislation

N/A

Link to Strategic Plan

Growing Economy

Objective: We have employment opportunities

Outcome: We have career opportunities

Risk Management Issues for Council

N/A

Internal / External Consultation

Regular engagement occurs between Council and the Committee.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Involve |

|

|

|

|

|

|

x |

|

|||||||||

|

Collaborate |

|

|

|

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

1⇩. |

Committee Report - 23 January 2019 |

|

|

2⇩. |

Heads of Agreement 2016-2019 |

|

RP-2 Medical Scholarship Funding Request

Author: Dominic Kennedy

Director: Natalie Te Pohe

|

Summary: |

To consider sponsoring medical students from a select list of medical schools who will in exchange spend two weeks on rural placement in country NSW. |

|

That Council does not contribute to the Bush Bursary/CWA scholarship program. |

Report

Wagga Wagga City Council is being presented with the opportunity to sponsor students as part of the Bush Bursary/Country Women’s Association Scholarship Program.

Operating for the past 22 years, Bush Bursaries are sponsored by various rural and remote Councils of NSW. This is to assist with costs associated with NSW/ACT medical student studies and the scholarships are a partnership between the NSW Rural Doctors Network and the NSW Country Women’s Association (CWA).

In return, students spend two weeks on a rural placement in country NSW during their university holidays. Applicants must be Australian or New Zealand citizens or Australian permanent residents; and be enrolled in first year medicine at the University of Sydney, University of Wollongong, Australian National University or the University of Notre Dame, second year medicine at the University of Newcastle, University of New England or University of Western Sydney, or third year medicine at the University of NSW.

The aims of the scholarships are to:

· Provide students with the opportunity to experience living in a rural community and gain knowledge of a rural lifestyle, health care and medical practice.

· Increase the number of graduates who join the rural and remote medical workforces or who will provide rural/remote locum services and or outreach throughout their careers.

The sponsoring Council’s role is:

· Payment of $3,000

· Nomination of placement coordinator from within the host Shire Council or associated organisation

· Organisation of placement for sponsored Bush Bursary student, including liaising with local medical practitioners and community groups, accommodation and social aspects of the two-week placement.

· Liaise with NSW Rural Doctor Network and sponsored Bush Bursary student regarding placement arrangements.

The Rural Doctors Network’s Role is:

· Advertising and promotion of the scheme to eligible students

· Recruitment and selection of the recipients

· Administration of funds from sponsoring shire councils

· Matching recipients to sponsoring shire council

· On-going support and information or recipients throughout the year

The recommendation to not contribute to the scholarship program is based upon several factors, including the evaluation prepared by the NSW Rural Doctors Network in 2012 (Attachment 2). It is also based on the financial contribution that Council has made to the Riverina Medical Specialist Recruitment and Retention Committee since 2008/09. This Committee is achieving positive outcomes and the proposal for continued funding provision is the subject of another Council report.

The attached paper summarises this evaluation and indicates that early exposure through the two-week placement did demonstrate some benefits and understanding for rural medicine, however, they were unable to detail or substantiate a later link to return employment. It is worth noting that Goulburn Milwaree Council, who had provided financial assistance for 16 years, also discontinued its direct financial contribution to the program at their Council meeting on 15 August 2017 for this reason also.

There was also a key recommendation made within the report that suggested that more opportunities be provided for specialist training in rural and regional areas, and the contribution to the abovementioned Committee is reflective of this.

Financial Implications

There are no financial implications if Council resolve as per the recommended resolution. If Council does resolve to support the Bush Bursary/CWA scholarship program, the $3,000 funding will be sourced from within the Economic Development area.

Policy and Legislation

N/A

Link to Strategic Plan

Growing Economy

Objective: We have employment opportunities

Outcome: We have career opportunities

Risk Management Issues for Council

N/A

Internal / External Consultation

Internal discussions have been had between the Community and Corporate Services Directorates.

Attachments:

|

1⇩. |

Letter from Rural Doctors Network Requesting Council Participation in Scholarship |

|

|

2⇨. |

Evaluation of Rural Doctor's Network Scholarship 2012 - Provided under separate cover |

|

RP-3 Payroll tax changes to encourage business growth and support employment of mature aged workers

Author: Dominic Kennedy

Director: Natalie Te Pohe

|

Summary: |

For Council to consider actively lobbying the NSW government and opposition to reduce payroll tax rates for regional areas as it is a major disincentive for business development, jobs growth and it negatively impacts on the local economy. |

|

That Council authorise the Mayor and General Manager to: a actively lobby the NSW government and the opposition to review existing payroll tax legislation to ensure the state, and especially the regions, are an attractive place for business to locate and thrive, and include the following key recommendations: i to reduce payroll taxes for businesses operating in regional areas to encourage relocation from congested cities to be in line with Victorian rates ii to remove payroll taxes for blue-collar workers above the age of 55 iii write to the NSW Treasurer, Minister for Regional NSW and local member after the State Election in relation to the aforementioned. |

Report

Labour is typically a business’s largest expense and a closely monitored budget line item – on average it can account for 60% of overall operating costs. Council staff receive feedback from local businesses on a regular basis about the impact that the addition of payroll taxes to their labour expenses has on their growth. When compared to Victoria and Queensland, NSW has the highest payroll tax rate – detailed in the table below. The discrepancy in rates between states and the heavy cost to businesses make payroll taxes a critical factor when it comes to choosing where to locate a business and a disincentive to hire more staff, or increase wages.

Treasurer, Tim Pallas, announced in 2017 that the Victorian government would cut the payroll tax rate for businesses that have a workforce made up of at least 85% “regional employees”. This means these qualifying businesses pay a payroll tax rate of 2.425%, down from 4.85%. This is compared to the current NSW tax rate of 5.45% for any business with annual payroll expenses greater than $850,000.

|

State |

Min Annual Threshold |

Tax Rate |

|

NSW |

$850,000 (will escalate to $1m by 2021) |

5.45% |

|

QLD |

$1,000,000 |

4.75% |

|

SA |

$1,500,000 |

4.95% |

|

ACT |

$2,000,000 |

6.85% |

|

VIC |

$650,000 |

4.85% |

|

WA |

$850,000 |

5.50% |

|

TAS |

$1,250,000 |

4.0% to 6.1% |

|

NT |

$1,500,000 |

5.50% |

It may be years before we see the full impact that the payroll tax change will have on business relocations to Victoria, but it is already having an immediate positive influence on existing Victorian businesses. Data reveals regional Victoria’s unemployment rate is lower than all other states in the nation – dropping 0.3 percentage points in the December 2018 quarter. Victoria’s regional unemployment rate fell by 2.1 percentage points, with nearly 58,000 people finding work – more than 80 per cent of these jobs were fulltime.

Wagga Wagga City Council staff recently received email correspondence from a local business owner regarding the direct impact that NSW payroll taxes are having on their business. With 17 fulltime employees, it means a $28,000 per year hit to their bottom line. They would like to see payroll taxes reduced so they can grow their business and hire more employees (note: this local business owner would like to remain anonymous because they don’t want their employees knowing they’re concerned about labour costs).

The business owner also requested to remove, or reduce payroll tax for blue-collar workers that are over 55 years old. Mature aged employees are considered high-risk by business owners, which could be contributing to the continued rise in the long-term, mature-aged unemployment rate (Refer to Attachment 2 – Australian Human Rights Commission Report from 2016). An example of this risk was noted by this local business owner:

· 40% (8 employees) of their workforce are 55 years of age or more

· 85% of the work is highly physical and manual delivery based

· The company has received two workers compensation claims in the last 24 months – both employees were over 55 years old

The following motion was submitted by Council at last year's annual Local Government NSW conference, but it wasn't debated because it was either an existing LGNSW policy; supported by Conference resolutions from recent years; and/or the subject of recent or ongoing representations by LGNSW:

|

Motion |

Motion Background |

|

That LGNSW lobbies the NSW State Government to Advocate for a reduction in payroll tax for businesses in regional NSW to be comparable to the rate offered to regional Victorian employers (2.425 per cent). |

The NSW State Government recently announced that the payroll tax threshold would be progressively lifted to $1 million by 2022. While this is welcomed and means that some businesses will no longer pay payroll tax, those businesses sitting above the threshold will still need to meet all of the complex payroll tax obligations. The Victorian State Government offers a lower payroll tax rate of 2.425 per cent for regional employers, which is half the metropolitan rate. It is requested that the NSW State Government consider a similar rate for regional NSW to help regional businesses grow, and encourage more businesses to establish themselves and create jobs in regional NSW. |

As the payroll tax rate has not been adjusted to date, it is further recommended that Council now actively lobby the NSW state government and opposition, for payroll taxes to be reduced in regional areas to encourage regional growth and employment. Preliminary changes could be to reduce NSW rates to at least be in line with Victoria and then work towards more forward thinking policies that incentivise businesses to hire or retain our most experienced employees.

Financial Implications

There are no financial implications if Council resolve to lobby the NSW government for a reduction on the rate of payroll tax for regional NSW. It should be noted that councils, county councils or local government businesses are generally exempt from paying payroll tax, however there are certain types of functions that are not exempt. For Wagga Wagga City Council the functions that are not exempt include the sewerage and cemetery functions. For the 2017/18 financial year, Council paid $98K in payroll tax.

Policy and Legislation

Payroll Tax Act 2007

Link to Strategic Plan

Growing Economy

Objective: We have employment opportunities

Outcome: We have career opportunities

Risk Management Issues for Council

N/A

Internal / External Consultation

Correspondence was received from a local business owner.

|

1⇩. |

State Payroll Tax Comparison |

|

|

2⇨. |

National Inquiry into Employment Discrimination Against Older Australians and Australians with Disability - 2016 - Provided under separate cover |

|

|

3⇩. |

Regional Victoria Unemployment Announcement |

|

|

4⇩. |

Victoria Payroll Tax Announcement |

|

Report submitted to the Ordinary Meeting of Council on Monday 25 March 2019. RP-4

RP-4 Financial Performance Report as at 28 February 2019

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Summary: |

This report is for Council to consider and approve the proposed 2018/19 budget variations required to manage the 2018/19 budget and Long Term Financial Plan, and details Council’s external investments and performance as at 28 February 2019. |

|

That Council: a approve the proposed 2018/19 budget variations for the month ended 28 February 2019 and note the balanced budget position as presented in this report b provide financial assistance of the following amounts in accordance with Section 356 of the Local Government Act 1993: 1) Climate Action Wagga Group $150.00 2) 4th Dimension Art Practice $25.00 c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above d note details of the external investments as at 28 February 2019 in accordance with section 625 of the Local Government Act 1993 |

Report

Wagga Wagga City Council (Council) forecasts a balanced budget position as at 28 February 2019. Proposed budget variations are detailed in this report for Council’s consideration and adoption.

Council has experienced a positive monthly investment performance for the month of February, when compared to budget. This is mainly due to a higher than anticipated portfolio balance and strong performance of Councils Managed Fund and Floating Rate Notes.

Key Performance Indicators

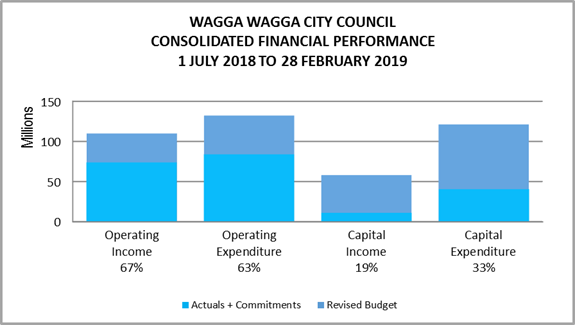

OPERATING INCOME

Total operating income is 67% of approved budget, which is tracking on budget for the end of February (this percentage excludes capital grants and contributions). An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 87%.

OPERATING EXPENSES

Total operating expenditure is 63% of approved budget and is tracking close to the budget for the full financial year.

CAPITAL INCOME

Total capital income is 19% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions relating to projects. This income also includes the sale of property, plant and equipment.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 33% of approved budget.

A workshop has been conducted with Councillors and PMO staff regarding the delivery of the 2018/19 and 2019/20 capital works program with this revised capital works program and timing of projects to be reported to 25 March 2019 Council meeting.

|

WAGGA WAGGA

CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2018/19 |

COMMT'S 2018/19 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|||||||

|

Rates & Annual Charges |

(66,609,093) |

0 |

(66,609,093) |

(44,990,533) |

0 |

(44,990,533) |

68% |

|

User Charges & Fees |

(26,844,544) |

361,404 |

(26,483,140) |

(16,643,756) |

0 |

(16,643,756) |

63% |

|

Interest & Investment Revenue |

(2,917,452) |

(764,199) |

(3,681,651) |

(2,888,192) |

0 |

(2,888,192) |

78% |

|

Other Revenues |

(2,983,104) |

(332,402) |

(3,315,506) |

(2,507,552) |

0 |

(2,507,552) |

76% |

|

Operating Grants & Contributions |

(13,284,867) |

3,485,840 |

(9,799,026) |

(6,794,021) |

0 |

(6,794,021) |

69% |

|

Capital Grants & Contributions |

(36,517,290) |

(17,894,522) |

(54,411,813) |

(10,634,944) |

0 |

(10,634,944) |

20% |

|

Total Revenue |

(149,156,350) |

(15,143,879) |

(164,300,229) |

(84,458,998) |

0 |

(84,458,998) |

51% |

|

|

|||||||

|

Expenses

|

|||||||

|

Employee Benefits & On-Costs |

44,786,608 |

333,470 |

45,120,078 |

27,199,949 |

14,475 |

27,214,423 |

60% |

|

Borrowing Costs |

3,752,580 |

(121,277) |

3,631,304 |

1,820,227 |

0 |

1,820,227 |

50% |

|

Materials & Contracts |

32,384,231 |

6,042,064 |

38,426,295 |

20,698,456 |

3,602,048 |

24,300,504 |

63% |

|

Depreciation & Amortisation |

35,418,997 |

0 |

35,418,997 |

23,612,664 |

0 |

23,612,664 |

67% |

|

Other Expenses |

12,125,204 |

(2,439,984) |

9,685,220 |

6,886,709 |

84,932 |

6,971,641 |

72% |

|

Total Expenses |

128,467,621 |

3,814,273 |

132,281,894 |

80,218,005 |

3,701,455 |

83,919,460 |

63% |

|

|

|

||||||

|

Net Operating (Profit)/Loss |

(20,688,729) |

(11,329,606) |

(32,018,335) |

(4,240,992) |

3,701,455 |

(539,537) |

|

|

|

|||||||

|

Net Operating (Profit)/Loss before Capital Grants & Contributions |

15,828,561 |

6,564,917 |

22,393,478 |

6,393,952 |

3,701,455 |

10,095,407 |

|

|

|

|||||||

|

Capital / Reserve Movements |

|||||||

|

Capital Exp - Renewals |

33,460,752 |

12,217,901 |

53,298,653 |

12,946,871 |

14,641,176 |

27,588,046 |

52% |

|

Capital Exp - New Projects |

32,626,087 |

18,484,686 |

51,110,772 |

8,810,351 |

2,117,733 |

10,928,084 |

21% |

|

Capital Exp - Project Concepts |

23,554,733 |

(2,114,214) |

13,820,519 |

55,897 |

35,318 |

91,215 |

1% |

|

Loan Repayments |

3,129,777 |

(225,924) |

2,903,853 |

1,935,902 |

0 |

1,935,902 |

67% |

|

New Loan Borrowings |

(6,108,672) |

1,755,867 |

(4,352,805) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(952,795) |

(2,701,703) |

(3,654,498) |

(530,151) |

0 |

(530,151) |

15% |

|

Net Movements Reserves |

(29,602,157) |

(16,087,006) |

(45,689,162) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

56,107,727 |

11,329,606 |

67,437,332 |

23,218,870 |

16,794,227 |

40,013,097 |

|

|

|

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED

BUDGET |

YTD ACTUAL EXCL COMMT'S 2018/19 |

COMMT'S 2018/19 |

YTD ACTUAL +

COMMT'S |

YTD % OF BUD |

|

Net Result after Depreciation |

35,418,997 |

0 |

35,418,997 |

18,977,877 |

20,495,682 |

39,473,559 |

|

|

|

|||||||

|

Add back Depreciation Expense |

35,418,997 |

0 |

35,418,997 |

23,612,664 |

0 |

23,612,664 |

67% |

|

|

|||||||

|

Cash Budget (Surplus)/Deficit |

0 |

0 |

0 |

(4,634,787) |

20,495,682 |

15,860,895 |

|

Revised Budget Result - Surplus/(Deficit) |

$’000s |

|

Original 2018/19 Budget Result as adopted by Council Total Budget Variations approved to date Budget variations for February 2019 |

$0 $0 $0 |

|

Proposed revised budget result for 28 February 2019 |

$0 |

The proposed Budget Variations to 28 February 2019 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact Fav/ (Unfav) |

||

|

1 – Community Leadership and Collaboration |

|||||

|

Corporate Management Performance System |

$60K |

IT Corporate Hardware Purchases ($60K) |

Nil |

||

|

Council has consolidated the reporting requirements from across the organisation and is looking to replace the current corporate reporting system with a corporate management system that will allow more flexibility with the way Council currently reports on the delivery program and operating plan to the community. It is proposed to fund the management system purchase from savings within the existing IT Corporate Hardware purchases budget. |

|

||||

|

Accounts Payable Scanning System |

$105K |

IT Corporate Hardware Purchases ($105K) |

Nil |

||

|

Council was advised in late 2018 that the Accounts Payable Scanning System is no longer supported by the current provider. In reviewing the options available to Council, an upgrade of the current system under a new provider is required. The upgrade of the scanning system is assisting in the move to a paperless environment in Accounts Payable. This not only has environmental benefits and will allow for a more streamlined process across Council, but will ensure that the increasing volume of work in Accounts Payable is maintained within the current staffing levels. It is proposed to fund the upgrade of the scanning system from savings within the existing IT Corporate Hardware purchases budget. |

|

||||

|

2 – Safe and Healthy Community |

|||||

|

Lawn Cemetery Irrigation/ Pump Upgrade |

$117K |

Cemetery Reserve ($39K) Cemetery Perpetual Reserve ($52K) Cemetery Maintenance Budgets ($26K) |

Nil |

||

|

Funds are required due to

unforeseen expenditure on the Lawn Cemetery Irrigation/Pump Upgrade project.

This expenditure included access roads and underlay preparation for turf.

These works were a necessity to ensure successful establishment of the turf

and serviceability of the section during inclement weather. It is proposed to

fund the variation from the Cemetery Reserves and various Cemetery operating

maintenance lines. This brings the total project budget to $271K. |

|

||||

|

3 – Growing Economy |

|||||

|

LMC Water |

$125K |

LMC Reserve ($125K) |

Nil |

||

|

A new digital water meter was installed at the LMC by Riverina Water in January 2018 which has resulted in a substantial increase in actual water usage recorded and therefore payable. For Council’s information, the average annual water usage billed for the LMC was $29K (from 2012/13 to 2016/17). Since the new meter has been installed, it is anticipated that the annual water usage will be in the vicinity of $180K. It is proposed to increase the budget in line with these updated water billing charges and fund the variation from the LMC Reserve. |

|

||||

|

Incubator Lost Lanes Project |

$20K |

Destination NSW Incubator Grant Funds ($20K) |

Nil |

||

|

Council has been successful in securing grant funding through the Destination NSW Regional Flagship Events Program’s Incubator Event Fund. The grant funds are for Councils Lost Lanes Festival to be held in June 2019 and is to be used for marketing initiatives that encourage overnight visitation from outside the region. Estimated Completion: August 2019

|

|

||||

|

4 – Community Place and Identity |

|||||

|

The Hall Committee Program |

$12K |

Create NSW ($12K) |

Nil |

||

|

Council has been successful in securing Create NSW grant funding for the Civic Theatres ‘The Hall Committee’ program. The Civic Theatre developed the new play with playwright Damian Callinan and the local community. This grant allows the theatre to take the finished play back to the local community halls (Oura, Uranquinty, Ladysmith, Downside, Ganmain and Cootamundra) that helped create the work. It is a grant specifically for touring professional work to country halls in New South Wales. Estimated Completion: September 2019 |

|

||||

|

|

Nil |

||||

Current Restrictions

|

RESERVES SUMMARY |

|||||

|

28 FEBRUARY 2019 |

|||||

|

|

CLOSING BALANCE 2017/18 |

ADOPTED RESERVE TRANSFERS 2018/19 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 25.02.19 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

|

|

|

|

|

|

|

Externally Restricted |

|

|

|

|

|

|

Developer Contributions - Sect 7.11 |

(19,959,750) |

7,405,683 |

(280,151) |

|

(12,834,217) |

|

Developer Contributions - Sect 7.12 |

(465,272) |

358,500 |

112,629 |

|

5,857 |

|

Developer Contributions – S/Water DSP S64 |

(5,478,298) |

500,000 |

(233,653) |

|

(5,211,951) |

|

Sewer Fund |

(26,204,212) |

4,267,364 |

2,926,010 |

|

(19,010,838) |

|

Solid Waste |

(20,184,154) |

9,600,364 |

1,157,808 |

|

(9,425,981) |

|

Specific Purpose Grants |

(3,519,384) |

0 |

3,519,384 |

|

0 |

|

SRV Levee |

(2,847,382) |

1,807,667 |

970,802 |

|

(68,914) |

|

Stormwater Levy |

(3,167,296) |

162,032 |

(97,159) |

|

(3,102,423) |

|

Total Externally Restricted |

(81,825,747) |

24,101,610 |

8,075,670 |

0 |

(49,648,466) |

|

|

|

||||

|

Internally Restricted |

|

||||

|

Airport |

(63,685) |

(158,452) |

(119,689) |

(341,826) |

|

|

Art Gallery |

(49,209) |

13,262 |

0 |

(35,947) |

|

|

Ashmont Community Facility |

(6,000) |

(1,500) |

0 |

(7,500) |

|

|

Bridge Replacement |

(201,972) |

(100,000) |

0 |

(301,972) |

|

|

CBD Carparking Facilities |

(863,695) |

160,302 |

50,801 |

(652,592) |

|

|

CCTV |

(74,476) |

(10,000) |

0 |

(84,476) |

|

|

Cemetery Perpetual |

(65,479) |

(129,379) |

51,958 |

51,800 |

(91,100) |

|

Cemetery |

(452,507) |

420 |

139,581 |

39,000 |

(273,506) |

|

Civic Theatre Operating |

0 |

(55,000) |

32,812 |

(22,188) |

|

|

Civic Theatre Technical Infrastructure |

(92,585) |

(50,000) |

63,711 |

(78,875) |

|

|

Civil Projects |

(155,883) |

0 |

0 |

(155,883) |

|

|

Community Amenities |

(76,763) |

0 |

0 |

(76,763) |

|

|

Community Works |

(61,888) |

(59,720) |

0 |

|

(121,608) |

|

Council Election |

(255,952) |

(76,333) |

44,045 |

(288,240) |

|

|

Emergency Events |

(220,160) |

0 |

29,000 |

(191,160) |

|

|

Employee Leave Entitlements |

(3,322,780) |

0 |

0 |

|

(3,322,780) |

|

Environmental Conservation |

(131,351) |

20,295 |

0 |

|

(111,056) |

|

Estella Community Centre |

(230,992) |

178,519 |

0 |

|

(52,473) |

|

Event Attraction Reserve |

0 |

0 |

(18,470) |

|

(18,470) |

|

Family Day Care |

(320,364) |

75,366 |

(1,556) |

|

(246,555) |

|

Fit for the Future |

(5,340,222) |

4,444,014 |

(558,342) |

|

(1,454,550) |

|

Generic Projects Saving |

(1,056,917) |

150,000 |

115,306 |

|

(791,611) |

|

Glenfield Community Centre |

(19,704) |

(2,000) |

0 |

|

(21,704) |

|

Grants Commission |

(5,199,163) |

0 |

5,199,163 |

|

0 |

|

Grassroots Cricket |

(70,992) |

0 |

0 |

|

(70,992) |

|

Gravel Pit Restoration |

(767,509) |

0 |

0 |

|

(767,509) |

RESERVES SUMMARY

|

|||||

|

28 FEBRUARY 2019 |

|||||

|

|

CLOSING BALANCE 2017/18 |

ADOPTED RESERVE TRANSFERS 2018/19 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 25.02.19 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

Gurwood Street Property |

(50,454) |

0 |

0 |

|

(50,454) |

|

Information Services |

(369,113) |

77,858 |

285,000 |

|

(6,256) |

|

Infrastructure Replacement |

(193,634) |

(68,109) |

(62,934) |

|

(324,677) |

|

Insurance Variations |

(28,644) |

0 |

(71,603) |

|

(100,246) |

|

Internal Loans |

(518,505) |

(631,470) |

543,498 |

|

(606,477) |

|

Lake Albert Improvements |

(62,349) |

(21,563) |

64,054 |

|

(19,858) |

|

LEP Preparation |

(3,895) |

0 |

1,350 |

|

(2,545) |

|

Livestock Marketing Centre |

(5,724,767) |

(1,146,762) |

1,165,260 |

125,000 |

(5,581,270) |

|

Museum Acquisitions |

(39,378) |

0 |

0 |

|

(39,378) |

|

Oasis Building Renewal |

(209,851) |

(85,379) |

3,000 |

|

(292,230) |

|

Oasis Plant |

(1,140,543) |

390,000 |

100,000 |

|

(650,543) |

|

Parks & Recreation Projects |

(79,648) |

49,500 |

0 |

|

(30,148) |

|

Pedestrian River Crossing |

(10,775) |

0 |

10,775 |

|

0 |

|

Plant Replacement |

(3,935,062) |

253,958 |

1,043,434 |

|

(2,637,671) |

|

Playground Equipment Replacement |

(164,784) |

69,494 |

0 |

|

(95,290) |

|

Project Carryovers |

(2,006,338) |

402,808 |

1,585,155 |

|

(18,376) |

|

Public Art |

(208,754) |

30,300 |

64,997 |

|

(113,457) |

|

Robertson Oval Redevelopment |

(92,151) |

0 |

0 |

|

(92,151) |

|

Senior Citizens Centre |

(15,627) |

(2,000) |

0 |

|

(17,627) |

|

Sister Cities |

(36,328) |

(10,000) |

0 |

|

(46,328) |

|

Stormwater Drainage |

(180,242) |

0 |

22,000 |

|

(158,242) |

|

Strategic Real Property |

(475,000) |

401,305 |

(395,655) |

|

(469,350) |

|

Street Lighting Replacement |

(74,755) |

0 |

18,206 |

|

(56,549) |

|

Subdivision Tree Planting |

(582,108) |

40,000 |

0 |

|

(542,108) |

|

Sustainable Energy |

(588,983) |

95,000 |

259,414 |

|

(234,569) |

|

Traffic Committee |

(21,930) |

0 |

20,138 |

|

(1,792) |

|

Unexpended External Loans |

(841,521) |

0 |

841,521 |

|

0 |

|

Workers Compensation |

(40,000) |

0 |

(53,251) |

|

(93,251) |

|

Total Internally Restricted |

(36,795,390) |

4,244,732 |

10,472,676 |

215,800 |

(21,862,182) |

|

|

|

|

|

|

|

|

Total Restricted |

(118,621,137) |

28,346,342 |

18,548,346 |

215,800 |

(71,510,648) |

Section 356 Financial Assistance Requests

Two Section 356 financial assistance requests have been received for consideration at the 25 March 2019 Ordinary Council meeting.

Details of the current financial assistance requests are shown below:

· Climate Action Wagga Group – March 9 Amphitheatre Event $150

The Climate Action Wagga group is seeking Council’s consideration for financial assistance by the waiving of the hire fees for the amphitheatre for a community event held on Saturday 9 March 2019 to stage talks about Climate Change. Refer to Attachment 1 for details.

The above request aligns with Council’s Strategic Plan “The Environment” – Outcome: We create a sustainable environment for future generations.

Council has not provided any financial assistance to the above group in the last 12 months.

· 4th Dimension Art Practice – Art Workshop April 6 Glenfield Community Centre $25

Sheree Ridley of the 4th Dimension Art Practice Wagga has written (Attachment 2) to seek Council’s consideration for financial assistance by the waiving of the Glenfield Community Centre hire fees to stage an art workshop for marginalised people.

The attached request notes:

“I have applied to run an art workshop at the Glenfield Community Centre Saturday the 6 April aimed at using art to promote mental and emotional wellbeing.

The above request aligns with Council’s Strategic Plan “Safe and Healthy Community – Outcome: We promote participation across a variety of sports and recreation”.

Council has not provided any financial assistance to the above person in the last 12 months.

Budget

The Section 356 financial assistance budget for the 2018/19 financial year is $50,256, of which $41,689 is already committed in the adopted 2018/19 Delivery and Operational Plan.

From the $8,567 that was initially remaining, a balance of $4,920 (includes the additional budget vote of $3,346 approved at the 29 January 2019 Council Meeting Council Officers Report RP5) is currently available.

If the proposed financial assistance of $175 included in this report is approved, would leave $4,745 available for the remainder of this financial year.

|

Unallocated balance of S356 fee waiver financial assistance budget 2018/19 |

$4,920 |

|

Climate Action Wagga Group – Rally Event 9 March 2019 |

($150) |

|

4th Dimension Art Practice |

($25) |

|

Total Section 356 Financial Assistance Requests

- 25 March 2019 Council Meeting |

($175) |

|

Balance of Section 356 fee waiver financial assistance budget for the remainder of the 2018/19 Financial Year |

$4,745 |

Investment Summary as at 28 February 2019

In accordance with Regulation 212 of the Local Government (General) Regulation 2005, details of Wagga Wagga City Council’s external investments are outlined below:

|

Institution |

Rating |

Closing Balance |

Closing Balance |

February |

February |

Investment |

Maturity |

Term |

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

AMP |

A |

2,000,000 |

2,000,000 |

2.95% |

1.40% |

1/06/2018 |

31/05/2019 |

12 |

|

AMP |

A |

1,000,000 |

1,000,000 |

2.95% |

0.70% |

17/05/2018 |

17/05/2019 |

12 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

2.86% |

1.40% |

28/05/2018 |

28/05/2019 |

12 |

|

Westpac |

AA- |

1,000,000 |

1,000,000 |

2.80% |

0.70% |

28/06/2018 |

28/06/2019 |

12 |

|

Australian Military Bank |

NR |

1,000,000 |

1,000,000 |

3.01% |

0.70% |

16/07/2018 |

16/07/2019 |

12 |

|

Bankwest |

AA- |

2,000,000 |

2,000,000 |

2.76% |

1.40% |

31/08/2018 |

23/04/2019 |

8 |

|

Australian Military Bank |

NR |

1,000,000 |

1,000,000 |

2.86% |

0.70% |

7/09/2018 |

8/07/2019 |

10 |

|

Total Short Term Deposits |

|

10,000,000 |

10,000,000 |

2.88% |

7.02% |

|

|

|

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

875,062 |

2,133,724 |

1.50% |

1.50% |

N/A |

N/A |

N/A |

|

NAB |

AA- |

13,314,496 |

15,837,974 |

2.19% |

11.12% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

14,189,558 |

17,971,698 |

2.11% |

12.62% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

RaboBank |

A+ |

1,000,000 |

1,000,000 |

3.16% |

0.70% |

5/06/2017 |

6/06/2022 |

60 |

|

ING Bank |

A |

3,000,000 |

3,000,000 |

2.75% |

2.11% |

24/08/2017 |

26/08/2019 |

24 |

|

ME Bank |

BBB |

2,000,000 |

2,000,000 |

4.28% |

1.40% |

2/09/2014 |

2/09/2019 |

60 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

4.10% |

0.70% |

5/12/2014 |

5/12/2019 |

60 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.10% |

1.40% |

7/07/2017 |

7/07/2020 |

36 |

|

AMP |

A |

2,000,000 |

2,000,000 |

3.00% |

1.40% |

2/08/2018 |

3/02/2020 |

18 |

|

Newcastle Permanent |

BBB |

1,000,000 |

1,000,000 |

3.00% |

0.70% |

12/08/2016 |

12/08/2019 |

36 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

3.20% |

0.70% |

25/08/2016 |

25/08/2021 |

60 |

|

Newcastle Permanent |

BBB |

1,000,000 |

1,000,000 |

3.00% |

0.70% |

31/08/2016 |

30/08/2019 |

36 |

|

Newcastle Permanent |

BBB |

2,000,000 |

0 |

0.00% |

0.00% |

10/02/2017 |

11/02/2019 |

24 |

|

Westpac |

AA- |

3,000,000 |

3,000,000 |

3.10% |

2.11% |

10/03/2017 |

10/03/2022 |

60 |

|

Auswide |

BBB- |

2,000,000 |

2,000,000 |

2.95% |

1.40% |

5/10/2018 |

6/10/2020 |

24 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

2.92% |

0.70% |

16/10/2017 |

16/10/2019 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

2.92% |

1.40% |

6/11/2017 |

6/11/2019 |

24 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.35% |

1.40% |

3/01/2018 |

4/01/2022 |

48 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

2.80% |

0.70% |

5/01/2018 |

6/01/2020 |

24 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

3.05% |

1.40% |

29/10/2018 |

29/10/2020 |

24 |

|

Australian Military Bank |

NR |

1,000,000 |

1,000,000 |

2.95% |

0.70% |

29/05/2018 |

29/05/2020 |

24 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

3.50% |

0.70% |

1/06/2018 |

1/06/2022 |

48 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

3.02% |

1.40% |

28/06/2018 |

28/06/2021 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

2.88% |

1.40% |

28/06/2018 |

29/06/2020 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

2.86% |

1.40% |

16/08/2018 |

17/08/2020 |

24 |

|

BOQ |

BBB+ |

3,000,000 |

3,000,000 |

3.25% |

2.11% |

28/08/2018 |

29/08/2022 |

48 |

|

ING Bank |

A |

3,000,000 |

3,000,000 |

2.85% |

2.11% |

30/08/2018 |

14/09/2020 |

24 |

|

P&N Bank |

BBB |

1,000,000 |

1,000,000 |

3.10% |

0.70% |

16/10/2018 |

18/10/2021 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

3.05% |

1.40% |

13/11/2018 |

15/11/2021 |

36 |

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

3.07% |

0.70% |

20/11/2018 |

20/11/2020 |

24 |

|

P&N Bank |

BBB |

1,000,000 |

1,000,000 |

3.30% |

0.70% |

20/11/2018 |

21/11/2022 |

48 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

2.93% |

1.40% |

29/11/2018 |

30/11/2020 |

24 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

3.01% |

1.40% |

30/11/2018 |

30/11/2021 |

36 |

|

Bendigo-Adelaide |

BBB+ |

1,000,000 |

1,000,000 |

3.25% |

0.70% |

30/11/2018 |

30/11/2022 |

48 |

|

CUA |

BBB |

2,000,000 |

2,000,000 |

3.02% |

1.40% |

5/12/2018 |

7/12/2020 |

24 |

|

Newcastle Permanent |

BBB |

0 |

2,000,000 |

3.05% |

1.40% |

8/02/2019 |

8/02/2022 |

36 |

|

ING Bank |

A |

0 |

1,000,000 |

2.82% |

0.70% |

22/02/2019 |

22/02/2021 |

24 |

|

Total Medium Term Deposits |

|

55,000,000 |

56,000,000 |

3.09% |

39.32% |

|

|

|

|

Floating Rate Notes - Senior Debt |

|

|

|

|

|

|

|

|

|

BOQ |

BBB+ |

2,012,400 |

2,015,000 |

BBSW + 110 |

1.41% |

5/08/2014 |

24/06/2019 |

58 |

|

Bendigo-Adelaide |

BBB+ |

1,010,384 |

1,006,565 |

BBSW + 110 |

0.71% |

18/08/2015 |

18/08/2020 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,010,384 |

1,006,565 |

BBSW + 110 |

0.71% |

28/09/2015 |

18/08/2020 |

59 |

|

Newcastle Permanent |

BBB |

1,005,075 |

1,007,494 |

BBSW + 160 |

0.71% |

22/03/2016 |

22/03/2019 |

36 |

|

CUA |

BBB |

2,008,970 |

2,013,748 |

BBSW + 160 |

1.41% |

1/04/2016 |

1/04/2019 |

36 |

|

Suncorp-Metway |

A+ |

1,014,473 |

0 |

0.00% |

0.00% |

21/04/2016 |

12/04/2021 |

60 |

|

AMP |

A |

1,012,184 |

1,007,024 |

BBSW + 135 |

0.71% |

24/05/2016 |

24/05/2021 |

60 |

|

ANZ |

AA- |

2,029,486 |

0 |

0.00% |

0.00% |

16/08/2016 |

16/08/2021 |

60 |

|

BOQ |

BBB+ |

1,507,433 |

1,513,131 |

BBSW + 117 |

1.06% |

26/10/2016 |

26/10/2020 |

48 |

|

NAB |

AA- |

1,006,994 |

0 |

0.00% |

0.00% |

21/10/2016 |

21/10/2021 |

60 |

|

Teachers Mutual |

BBB |

1,503,893 |

1,508,693 |

BBSW + 140 |

1.06% |

28/10/2016 |

28/10/2019 |

36 |

|

Westpac |

AA- |

1,006,944 |

0 |

0.00% |

0.00% |

7/02/2017 |

7/02/2022 |

60 |

|

ANZ |

AA- |

1,008,554 |

1,007,574 |

BBSW + 100 |

0.71% |

7/03/2017 |

7/03/2022 |

60 |

|

CUA |

BBB |

755,508 |

758,043 |

BBSW + 130 |

0.53% |

20/03/2017 |

20/03/2020 |

36 |

|

Heritage Bank |

BBB+ |

601,665 |

603,699 |

BBSW + 130 |

0.42% |

4/05/2017 |

4/05/2020 |

36 |

|

Teachers Mutual |

BBB |

1,007,164 |

1,010,614 |

BBSW + 142 |

0.71% |

29/06/2017 |

29/06/2020 |

36 |

|

NAB |

AA- |

3,006,675 |

3,026,952 |

BBSW + 90 |

2.13% |

5/07/2017 |

5/07/2022 |

60 |

|

Suncorp-Metway |

A+ |

1,006,395 |

1,003,225 |

BBSW + 97 |

0.70% |

16/08/2017 |

16/08/2022 |

60 |

|

Westpac |

AA- |

1,992,432 |

2,006,990 |

BBSW + 81 |

1.41% |

30/10/2017 |

27/10/2022 |

60 |

|

ME Bank |

BBB |

1,500,939 |

1,506,893 |

BBSW + 125 |

1.06% |

9/11/2017 |

9/11/2020 |

36 |

|

NAB |

AA- |

1,986,214 |

1,999,172 |

BBSW + 80 |

1.40% |

10/11/2017 |

10/02/2023 |

63 |

|

ANZ |

AA- |

1,491,879 |

1,502,273 |

BBSW + 77 |

1.05% |

18/01/2018 |

18/01/2023 |

60 |

|

Bendigo-Adelaide |

BBB+ |

497,728 |

500,948 |

BBSW + 105 |

0.35% |

25/01/2018 |

25/01/2023 |

60 |

|

Newcastle Permanent |

BBB |

1,490,831 |

1,503,743 |

BBSW + 140 |

1.06% |

6/02/2018 |

6/02/2023 |

60 |

|

Westpac |

AA- |

1,998,732 |

1,997,132 |

BBSW + 83 |

1.40% |

6/03/2018 |

6/03/2023 |

60 |

|

UBS |

A+ |

2,001,410 |

1,993,432 |

BBSW + 90 |

1.40% |

8/03/2018 |

8/03/2023 |

60 |

|

Heritage Bank |

BBB+ |

1,405,103 |

1,410,072 |

BBSW + 123 |

0.99% |

29/03/2018 |

29/03/2021 |

36 |

|

ME Bank |

BBB |

1,602,440 |

1,608,728 |

BBSW + 127 |

1.13% |

17/04/2018 |

16/04/2021 |

36 |

|

ANZ |

AA- |

1,991,072 |

2,004,170 |

BBSW + 93 |

1.41% |

9/05/2018 |

9/05/2023 |

60 |

|

NAB |

AA- |

2,004,130 |

2,002,510 |

BBSW + 90 |

1.41% |

16/05/2018 |

16/05/2023 |

60 |

|

CBA |

AA- |

2,004,670 |

2,003,810 |

BBSW + 93 |

1.41% |

16/08/2018 |

16/08/2023 |

60 |

|

Bank Australia |

BBB |

755,868 |

752,981 |

BBSW + 130 |

0.53% |

30/08/2018 |

30/08/2021 |

36 |

|

CUA |

BBB |

602,735 |

600,952 |

BBSW + 125 |

0.42% |

6/09/2018 |

6/09/2021 |

36 |

|

AMP |

A |

1,503,668 |

1,497,864 |

BBSW + 108 |

1.05% |

10/09/2018 |

10/09/2021 |

36 |

|

NAB |

AA- |

1,997,912 |

2,009,710 |

BBSW + 93 |

1.41% |

26/09/2018 |

26/09/2023 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,000,058 |

1,005,315 |

BBSW + 101 |

0.71% |

19/10/2018 |

19/01/2022 |

39 |

|

CBA |

AA- |

3,013,185 |

3,034,722 |

BBSW + 113 |

2.13% |

11/01/2019 |

11/01/2024 |

60 |

|

Westpac |

AA- |

3,009,585 |

3,030,672 |

BBSW + 114 |

2.13% |

24/01/2019 |

24/04/2024 |

63 |

|

ANZ |

AA- |

0 |

2,519,010 |

BBSW + 110 |

1.77% |

8/02/2019 |

8/02/2024 |

60 |

|

NAB |

AA- |

0 |

2,006,630 |

BBSW + 104 |

1.41% |

26/02/2019 |

26/02/2024 |

60 |

|

Total Floating Rate Notes - Senior Debt |

|

57,365,170 |

56,986,054 |

|

40.01% |

|

|

|

|

Managed Funds |

|

|

|

|

|

|

|

|

|

NSW Tcorp |

NR |

1,412,214 |

1,463,864 |

3.66% |

1.03% |

17/03/2014 |

1/02/2024 |

118 |

|

Total Managed Funds |

|

1,412,214 |

1,463,864 |

3.66% |

1.03% |

|

|

|

|

TOTAL

CASH ASSETS, CASH |

|

137,966,943 |

142,421,616 |

|

100.00% |

|

|

|

|

LESS: RIVERINA REGIONAL LIBRARY (RRL) CASH AT BANK |

|

3,858,352 |

3,647,264 |

|

|

|

|

|

|

TOTAL

WWCC CASH ASSETS, CASH |

|

134,108,590 |

138,774,352 |

|

|

|

|

|

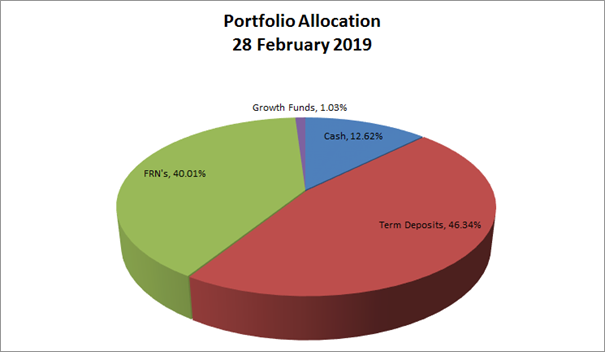

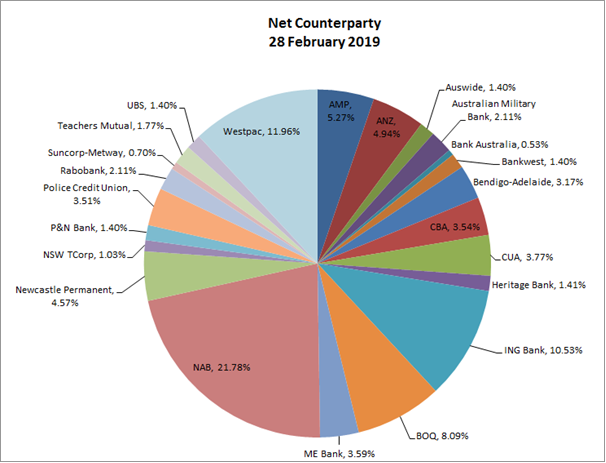

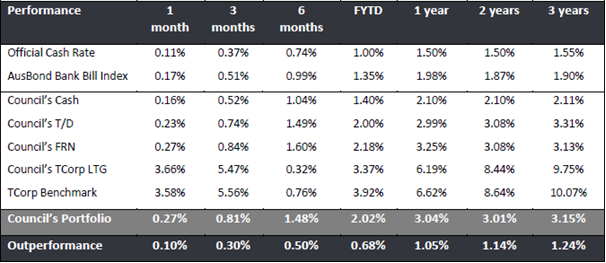

Council’s investment portfolio is dominated by Term Deposits, equating to approximately 46% of the portfolio across a broad range of counterparties. Cash equates to 13%, with Floating Rate Notes (FRNs) around 40% and growth funds around 1% of the portfolio.

Council’s investment portfolio is well diversified in complying assets across the entire credit spectrum. It is also well diversified from a rating perspective. Credit quality is diversified and is predominately invested amongst the investment grade Authorised Deposit-Taking Institutions (ADIs) (being BBB- or higher), with a smaller allocation to unrated ADIs.

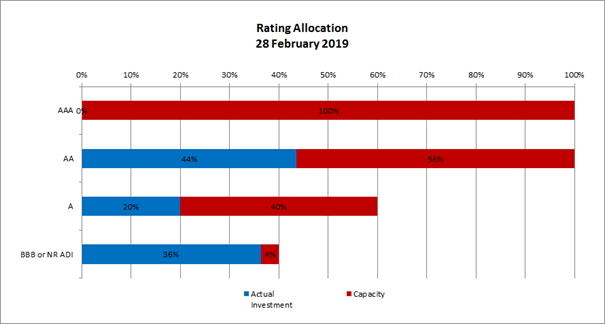

All investments are within the defined Policy limits, as outlined in the Rating Allocation chart below:

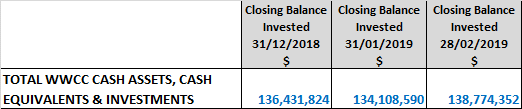

Investment Portfolio Balance

Council’s investment portfolio balance has increased from the previous month’s balance, up from $134.1M to $138.8M. This is reflective of the third quarter rates instalment being due at the end of February.

MONTHLY INVESTMENT MOVEMENTS

Redemptions/Sales – Council redeemed the following investment securities during February 2019:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

Newcastle Permanent Term Deposit |

$2M |

2 years |

3.00% |

This term deposit was redeemed on maturity and funds were reinvested in a new 3 year term deposit with Newcastle Permanent (see below). |

|

Suncorp Floating Rate Note |

$1M |

5 years |

BBSW + 138 |

This floating rate note was sold prior to maturity and funds were reinvested in the new 5 year ANZ FRN (see below). Council recognised a capital gain of $12,090. |

|

ANZ Floating Rate Note |

$2M |

5 years |

BBSW + 113 |

This floating rate note was sold prior to maturity and funds were reinvested in the new 5 year ANZ FRN (see below). Council recognised a capital gain of $15,300. |

|

NAB Floating Rate Note |

$1M |

5 years |

BBSW + 105 |

This floating rate note was sold prior to maturity and funds were reinvested in the new 5 year NAB FRN (see below). Council recognised a capital gain of $8,410. |

|

Westpac Floating Rate Note |

$1M |

5 years |

BBSW + 111 |

This floating rate note was sold prior to maturity and funds were reinvested in the new 5 year NAB FRN (see below). Council recognised a capital gain of $10,320. |

New Investments – Council purchased the following investment securities during February 2019:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

Newcastle Permanent Term Deposit |

$2M |

3 years |

3.05% |

The Newcastle Permanent rate of 3.05% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

|

ING Bank Term Deposit |

$1M |

2 years |

2.82% |

The ING rate of 2.82% compared favourably to the rest of the market for this investment term. This term was chosen to fill a maturity gap within Council’s investment portfolio. |

|

ANZ Floating Rate Note |

$2.5M |

5 years |

BBSW + 110 |

Council’s independent Financial Advisor advised this Floating Rate Note represented good value with a major bank. |

|

NAB Floating Rate Note |

$2M |

5 years |

BBSW + 104 |

Council’s independent Financial Advisor advised this Floating Rate Note represented good value with a major bank. |

Rollovers – Council did not rollover any investment securities during February 2019.

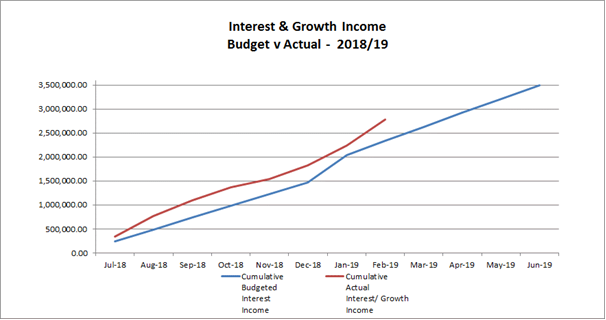

MONTHLY PERFORMANCE

Interest/growth/capital gains for the month totalled $548,164, which compares favourably with the budget for the period of $291,629, outperforming budget for the month by $256,535.

Council’s T-Corp Long Term Growth Fund contributed to the overall performance for the month of February, as domestic and international markets started the year strongly. The fund was up 3.66% for the month of February and has returned 9.36% per annum since the original investment in March 2014. Overall, the Growth Fund remains Council’s best performing asset over 3 years by a considerable margin.

It is important to note Council’s investment portfolio balance is tracking well above what was originally predicted. This is mainly due to the timing of some of the major projects that are either not yet commenced or not as advanced as originally predicted. Further analysis of the capital works program and revised timing of projects is currently underway and is planned to be reported to Council separately. This will result in Councils investment portfolio continuing to maintain a higher balance until these projects commence or advance further.

The longer-dated deposits in the portfolio, particularly those locked in above 3.50%, have previously anchored Council’s portfolio performance. It should be noted that the portfolio now only includes two (2) investments yielding above 3.50%. Council staff and Council’s Independent Financial Advisor will continue to identify opportunities to lock in higher yielding investments as they become available.

In comparison to the AusBond Bank Bill Index* (1.98%), Council’s investment portfolio returned 3.24% (annualised) for February. Cash and At-Call accounts returned 2.11% (annualised) for this period. These funds are utilised for daily cash flow management and need to be available to meet operating and contractual payments as they fall due.

Council’s Independent Financial Advisor, Imperium Markets, outlined that with regards to its total investment portfolio, Wagga Wagga City Council remains one of the best performing local government entities in the country. Representatives from Imperium Markets will be presenting to Council’s Audit, Risk and Improvement Committee at its 9 May 2019 meeting where Councillors will also be invited to attend.

*

The AusBond Bank Bill Index is the leading benchmark for the Australian fixed

income market. It is interpolated from the RBA Cash rate, 1 month and 3 month

Bank Bill Swap rates.

Report by Responsible Accounting Officer

I hereby certify that all of the above investments have been made in accordance with the provision of Section 625 of the Local Government Act 1993 and the regulations there under, and in accordance with the Investments Policy adopted by Council on 26 February 2018.

Carolyn Rodney

Responsible Accounting Officer

Policy and Legislation

Budget variations are reported in accordance with Council’s POL 052 Budget Policy.

Investments are reported in accordance with Council’s POL 075 Investment Policy.

Local Government Act 1993

Section 625 - How may councils invest?

Local Government (General) Regulation 2005

Section 212 - Reports on council investments

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

This report is a control mechanism that assists in addressing the following potential risks to Council:

· Loss of investment income or capital resulting from ongoing management of investments, especially during difficult economic times

· Failure to demonstrate to the community that its funds are being expended in an efficient and effective manner

Internal / External Consultation

Council’s Community Engagement Strategy and IAP2 considers the community to be “any individual or group of individuals, organisation or political entity with an interest in the outcome of a decision….”

All relevant areas within the Council have consulted with the Finance Division in regards to the budget variations listed in this report.

The Finance Division has consulted with relevant external parties to confirm Council’s investment portfolio balances.

Attachments:

|

1⇩. |

Section 356 Financial Assistance Request - Climate Action Wagga Group |

|

|

2⇩. |

Section 356 Financial Assistance Request - 4th Dimension Art Practice |

|

Report submitted to the Ordinary Meeting of Council on Monday 25 March 2019. RP-5

RP-5 NSW Department of Planning & Environment - Low Cost Loans Initiative

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Analysis: |

Council resolved in June 2018 to apply for the Low Cost Loans Initiative (LCLI) that was announced by NSW Planning & Environment. Council has been advised that it was successful in its application that provides a 50% interest subsidy on projects that met the criteria under the program.

This report is resolving to adjust the funding sources to reflect the projects now being funded from loan borrowings, with debt servicing repayments to be made from the original funding sources. |

|

That Council: a note the update on the Low Cost Loans Initiative (LCLI) announced by NSW Environment & Planning b note the delay in progressing with some projects proposed under the LCLI program c adjust the timing of the projects in Council’s Long Term Financial Plan as per the suggested timing documented in this report d approve the change in funding source to Loan Borrowings for the projects identified in the report e note that a variation to the funding agreement may be required, subject to the timing of the loan drawdowns and the interest rates provided at the time of the loan applications f approve the interest subsidy being returned to the appropriate funding sources upon receipt |

Report

NSW Planning & Environment announced the $500 million Low Cost Loans Initiative (LCLI) in late April 2018. As mentioned in the attached guidelines:

The key aim of the LCLI is to enable new housing supply. The essential elements are:

· the NSW Government will refund 50% of the costs of council’s interest payments on loans for eligible infrastructure

· the council is responsible for repaying the loan which is funded by TCorp, or another financial institution or the council’s choice, on their standard terms and prudential requirements

Loans taken out must be for a minimum of $1 million and have a fixed interest rate.

The duration of loans subsidised under the LCLI must be no longer than 10 years. Councils showing that planned infrastructure will be substantially completed by 30 June 2021 will be preferred for LCLI support.

During the 2018/19 Budget process, numerous infrastructure works were identified that would effectively exhaust the Contributions Reserve and the Fit for the Future Reserve in particular, within a relatively short timeframe. While additional contributions will be received and assist in supplementing the cash reserves over this time, there is the risk of depleting these funds at the expense of additional infrastructure requirements. In order to assist with the Council’s cashflow for the large infrastructure program that is associated with growth across the city, it was determined that the LCLI would be a beneficial source of income that could then be repaid over 10 years, resulting in cash being available for future growth and infrastructure requirements.

A report was subsequently presented to Council in June 2018 whereby Council resolved:

That Council:

a endorse the General Manager or their delegate to submit an application to the Low Cost Loans Initiative (LCLI) program, for the projects listed in this report

b approve the inclusion of the Potential Projects outlined in this report to be included in Council’s Delivery Program

c note that a subsequent report will be provided to Council once a determination has been made by NSW Planning & Environment which will outline any budget variations required

On 8 October 2018, Council was notified (Attachment 1) that the application had been successful. Officers had numerous discussions with the Department of Planning who advised that a funding agreement would be drafted by the Office of Local Government, however as this was a new process, the agreement may take some time.

On 21 January 2019, Council officers were subsequently advised of a slight change in the process, in that Council is required to seek the borrowings from TCorp (who were represented on the initial assessment panel) who will then provide Council with the drawdown schedule. The drawdown schedule will then be incorporated into the funding agreement for signing.

The delay in the announcement and Council’s significant delivery program has resulted in an impact on the timing of the works program that was incorporated into the original application. The revised project timing is based upon the Resetting of Capital Works Programme for 2018/19 and proposed Capital Works Programme report presented to this meeting. The revised timing is also shown below in Table 1:

Table 1: Projects originally included in Council’s LCLI application and now proposed to be in the revised application, due to project reset

|

Project – linked to enabling new housing supply |

Total Project Budget – submitted in LCLI application |

Revised LCLI Project Budget (due to expenditure and or reset) |

Current LTFP Funding Source comments |

Current year(s) for completion, as listed in Reset Report (25 March 2019 Council meeting) |

|

NORTHERN GROWTH |

||||

|

Estella - Neighbourhood Open Space Works - Walking Path (Job No. 15172) |

$31,816 |

$31,816 |

Section 94 |

2018/19 |

|

Sewer - Pump Station - SPS 08 Boorooma - Increase Pump Capacity (Job No 50195) |

$76,689 |

$76,409 |

Sewer Reserve |

Deferred to 2020/21 |

|

Northern Sporting Precinct - Sports grounds and play equipment* (Job No. 18796) |

$6,579,000 |

$6,579,000 |

S94 Plan $5,979,000 (New Plan still to be adopted) + GPR $199,643 + S94 (Old Plan) $121,838 + Estella Community Centre Reserve $178,519 + Borrowings $100,000 |

2019/20 - $5,000,000

2020/21 - $1,579,000 |

|

Old Narrandera Road - Second Carriageway for 600m (Job No. 15088) |

$827,428 |

$0 |

Project removed in Budget Reset report |

|

|

Old Narrandera Road/Olympic Highway Roundabout (Job No. 15089 – Now referred to as Intersection, not Roundabout) |

$667,886 |

$672,055 |

2018/19 - S94 $94,169 + 2020/21 - S94A $100,000 + S94 $477,886 |

2018/19 – Design $94,169

2020/21 – Construct $577,886 |

|

Pine Gully Road Roundabout (Job No. 18797)

|

$1,500,000 |

$1,500,000 |

Section 94 |

2019/20 – Design $25,000

2020/21 - Construct $1,475,000 |

|

Pine Gully Road - Bike Track (Job No. 15090) |

$126,510 |

$126,510 |

Section 94 |

2018/19 – Design $30,000

2020/21 – Construct $96,510 |

|

Pine Gully Road/Old Narrandera Road - Intersection Upgrade (Job No 15118)* |

$1,057,439 |

$1,071,462 |

Section 94 |

2018/19 – Design $25,000

2019/20 – Construct $1,046,462 |

|

Harris Road/Pine Gully Road - Dual Lane Roundabout (Job No. 15086)* |

$1,201,000 |

$1,204,951 |

Section 94 |

2018/19 – Design $75,000

2019/20 – Construct $1,129,951 |

|

Farrer Road Improvements (Job No. 15084) |

$6,120,000 |

$6,158,856 |

Fit for the Future Reserve $4,392,066 + S94 $1,658,856 + Infrastructure Reserve $107,934 |

2018/19 - $1,700,000

2019/20 - $4,458,856 |

|

TOTAL NORTHERN GROWTH |

$18,187,768 |

$17,421,059

|

|

|

|

Project – linked to enabling new housing supply |

Total Project Budget – submitted in LCLI application |

Revised LCLI Project Budget (due to expenditure and or reset) |

Current LTFP Funding Source comments |

Current year(s) for completion, as listed in Reset Report (25 March 2019 Council meeting) |

|

LLOYD GROWTH |

||||

|

Sewer - Pump Station - SPS23 Ashmont - New Assets - New pump station and rising main (Job No. 50250) |

$2,093,413 |

$2,098,112 |

Sewer Reserve |

2018/19 – Design $191,286

2019/20 – Construct $1,906,826 |

|

Red Hill Road and Hudson Drive – Intersection improvements* (Job No. 13680) |

$101,164 |

$95,665 |

Section 94 |

2018/19 – Design $4,501

2019/20 – Construct $91,164 |

|

TOTAL LLOYD GROWTH |

$2,194,577 |

$2,193,777 |

|

|

|

CITY WIDE GROWTH |

||||

|

Exhibition Centre - Kooringal Road Exit (Job No. 17727)* |

$1,775,157 |

$1,775,157 |

Loan Borrowings |

2018/19 – Design $50,000

2019/20 – Construct $1,725,157 |

|

Sewer - Pump Station - SPS39 Copland Street - New Assets - New pump station (Job No. 50258) |

$414,910 |

$0 |

Sewer Reserve