AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday 27 May 2019

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday 27 May 2019

AT 6.00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

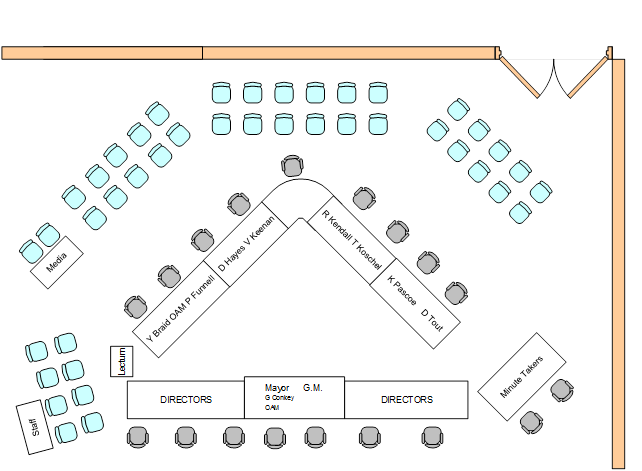

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 27 May 2019 at 6.00pm.

Council live streams video and audio of Council meetings. Members of the public are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 27 May 2019.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 27 May 2019

CLAUSE PRECIS PAGE

PRAYER 3

ACKNOWLEDGEMENT OF COUNTRY 3

APOLOGIES 3

CONFIRMATIONS OF MINUTES 3

CM-1 ORDINARY COUNCIL MEETING - 13 MAY 2019

DECLARATIONS OF INTEREST 3

Motions Of Which Due Notice Has Been Given

NOM-1 Notice of Motion - Flood Modelling Software 4

Reports from Staff

RP-1 Planning Proposal to amend the Wagga Wagga Local Environmental Plan 2010 - Gumly Gumly 6

RP-2 Draft Planning Proposal LEP18/0012 - adjustment of zone boundaries at Lot 1 DP 605970 and increase to minimum lot size control to Part Lot 1 DP 605970 on Holbrook Road 18

RP-3 Indexing and Application of Contribution Rates of the City of Wagga Wagga Section 94 Contributions Plan 2006 - 2019 and the City of Wagga Wagga S94A Levy Contributions Plan 2006 41

RP-4 ROAD CLOSURE - COUNCIL ROAD WITHIN LOT 2 DP 631591, BORAMBOLA 58

RP-5 PROPOSED LICENCE TO TARCUTTA MENSHED - 8 BENT STREET, TARCUTTA 62

RP-6 Financial Performance Report as at 30 April 2019 65

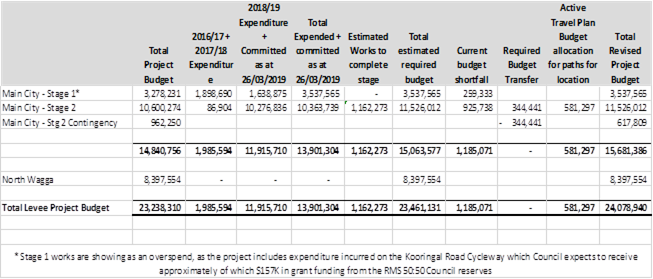

RP-7 Wagga Wagga Main City Levee Bank - Project Update 88

RP-8 Response to Questions/Business with Notice 93

Committee Minutes

M-1 Airport Advisory Committee Meeting - 1 May 2019 95

QUESTIONS/BUSINESS WITH NOTICE 101

Confidential Reports

CONF-1 2018/19 Loan Facility 102

CONF-2 ASHMONT RISING MAIN - PROPOSED ACCESS LICENCE AND ACQUISITION FOR EASEMENT 103

CONF-3 RFQ2019-535 Supply of One Water Truck 104

CONF-4 PROPOSED ACQUISTION OF LAND 105

CONF-5 PROPOSED EXPANSION OF SUB-LEASE AREA - ENCORE AVIATION PTY LTD 106

CONF-6 Wagga Wagga Airport Review 107

PRAYER

Confirmation of Minutes

CM-1 ORDINARY COUNCIL MEETING - 13 MAY 2019

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 13 May 2019 be confirmed as a true and accurate record.

|

|

1⇩. |

Council Meeting Minutes - 13 May 2019 |

108 |

|

Report submitted to the Ordinary Meeting of Council on Monday 27 May 2019 |

NOM-1 |

Motions Of Which Due Notice Has Been Given

NOM-1 Notice of Motion - Flood Modelling Software

Author: Councillor Vanessa Keenan

|

Summary: |

This Motion calls for detail on what capacity can be achieved if Council were to invest further in optimising its use of the waterRIDE program for the benefits of engineers, planners and the community. |

|

That a report be presented to the next Ordinary Meeting of Council outlining the capacity and current use of Council’s waterRIDE flood modelling software with an identified budget for potentially increasing Council’s use of the program through the consideration of a permanent dedicated resource with high level training, software upgrades or increased licences as part of the discussion for the 2019/20 budget. |

Report

Council’s waterRide software has significant capabilities that are currently not fully utilised by Council. To fully maximise Council’s usage it would be necessary to have a dedicated staff resource to support engineering and planning staff to enable intricate analysis of flooding issues.

At present the software is primarily used by staff for the automatic production of flood certificates. There are significant benefits from increasing Council’s knowledge and usage of the software including:

· Integration of data with GIS information such as floor heights, depth over evacuation routes, how long until low points on an evacuation route are reached etc.

· Impacts of road design in floodplains or flood paths

· Visual illustration of flooding issues for the community

· The capacity to forecast the impacts of imminent rains events on a catchment to provide staff with a clearer understanding of what preparations are needed in the lead up to anticipated increased river heights and heavy rainfall.

Financial Implications

N/A

Policy and Legislation

Wagga Wagga City Council Code of Meeting Practice.

Link to Strategic Plan

The Environment

Objective: We create a sustainable environment for future generations

Outcome: We demonstrate sustainable practices

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 27 May 2019 |

RP-1 |

RP-1 Planning Proposal to amend the Wagga Wagga Local Environmental Plan 2010 - Gumly Gumly

Author: Crystal Golden

Director: Natalie Te Pohe

|

Summary: |

Consider submissions received and the results of a completed cumulative flood impact study for the proposal.

Propose two revised planning proposals and submit to NSW Department of Planning and Environment for revised Gateway Determination to enable further public consultation. |

|

That Council: a note the submissions and results of the cumulative flood impact study b support the revision of two planning proposals for Gumly Gumly to amend the Wagga Wagga Local Environmental Plan 2010 c revise and submit the two planning proposals to the Department of Planning and Environment for Gateway Determination d prepare an amendment to the Wagga Wagga Development Control Plan 2010 to be exhibited alongside the planning proposal, addressing development concerns outlined in the report e receive a further report after receiving the revised Gateway Determinations from the Department of Planning and Environment, and the subsequent public exhibition period: i addressing any submissions made in respect of the planning proposals ii proposing adoption of the planning proposals unless there are any recommended amendments deemed to be substantial and requiring a further public exhibition period |

Application Details

|

Submitted Proposal: |

Amendment to the Wagga Wagga Local Environmental Plan 2010 to rezone land and remove the minimum lot size. |

|

Applicant: |

RPS Australia East Pty Ltd (Refer to in Attachment 4) |

|

Land Owners: |

Various land owners provided under confidential cover |

Report

The Proposa

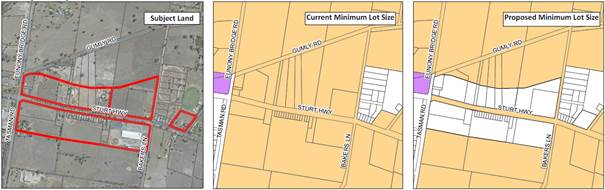

· 3870 Sturt Highway, Gumly Gumly – Gateway Determination received 2 November 2011

· Gumly Gumly Precinct – Gateway Determination received 9 July 2013

The original proposal areas are shown in the map below:

In 2012, Council was in receipt of an application to amend the Wagga Wagga Local Environmental Plan 2010 (WWLEP) for 3870 Sturt Highway, Gumly Gumly. The application resulted in a planning proposal being submitted to the NSW Department of Planning and Environment (DPE) for Gateway Determination. Gateway Determination was received in 2013 enabling the proposal to proceed subject to conditions.

To support the application for 3870 Sturt Highway, Gumly Gumly, a precinct was identified and submitted to DPE and received Gateway Determination to proceed subject to conditions.

The proposals intended to rezone the identified land from RU1 Primary Production, RE1 Public Recreation and B1 Neighbourhood Centre to B6 Enterprise Corridor and remove the minimum lot size of 200ha.

Formal public consultation has occurred in accordance with the Gateway Determination with the general public and state agencies for 3870 Sturt Highway, Gumly Gumly Planning Proposal. No formal consultation has occurred for the Gumly Gumly Precinct Planning Proposal.

During the consultation period for the 3870 Sturt Highway, Gumly Gumly Planning Proposal, 9 submissions were received and are outlined below under “Internal / External Consultation” with a response. As Council is proposing to revise the planning proposal, further consultation with agencies, submitters and affected land owners will be undertaken. No formal public consultation has been undertaken for the precinct proposal.

As a result of the submissions received and the results of the cumulative flood impact study, it is proposed to amend the planning proposal and submit to DPE for a revised Gateway Determination.

The revised amendments intend to achieve the following:

§ Rezone lots or part lots from RU1 Primary Production to B6 Enterprise Corridor and remove the 200ha minimum lot size.

§ Rezone lots from RE1 Public Recreation to B6 Enterprise Corridor.

§ Rezone one lot from B1 Neighbourhood Centre to B6 Enterprise Corridor.

§ Rezone part of a lot from RU1 Primary Production to E2 Environmental Conservation.

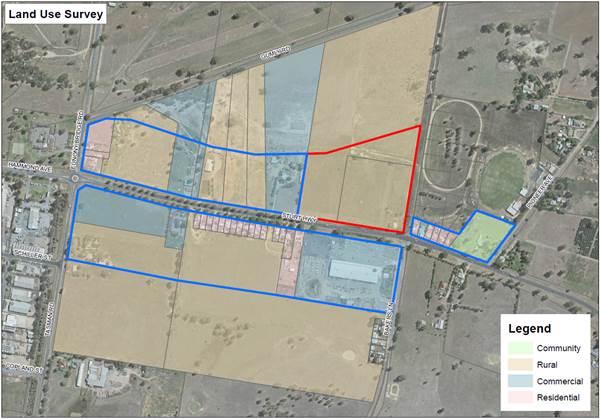

The revised amendments are show in the maps below:

Site and location

The subject sites are located on the Sturt Highway, east of the city. The proposed rezoning is a direct extension of the existing eastern employment precinct.

The site currently contains a mix of rural, commercial, community and residential land uses, as shown in the map below:

Key Considerations

Council staff assessment has considered the following:

1. B6 Enterprise Corridor zone and competition with the central business district:

The objectives of the B6 Enterprise Corridor zone are to:

§ Promote businesses along main roads and to encourage a mix of compatible uses.

§ To provide a range of employment uses (including business, office, retail and light industrial uses).

§ To maintain the economic strength of centres by limiting retailing activity.

§ To maintain the effective operation and function of main roads and limit opportunities for additional access to and from the Sturt Highway.

§ To enable a mix of business and warehouse uses, and specialised retail premises that require a large floor area, in locations that are close to, and support the viability of centres.

§ To facilitate the development of large-scale business premises that do not detract from the core commercial functions of the Wagga Wagga central business district.

§ To protect the primacy of the Wagga Wagga central business district.

§ To facilitate a mix of uses along the Sturt Highway that services the need of the travelling public.

Other zones were considered for this area, and the B6 Enterprise Corridor is considered the most appropriate zoning and will protect the central business district and function of the Sturt Highway.

The B6 Enterprise Corridor zone will provide opportunities for a clear entrance to be established for the city and is an extension of an existing B6 Enterprise Corridor west of the precinct.

2. Loss of agricultural land

The land is not currently used for prime agricultural purposes, nor is it likely to be used for prime agricultural purposes in the future. The majority of the sites are currently being used for residential and commercial purposes.

The proposal to rezone RU1 Primary Production land will not result in the loss of prime agricultural land. The land is identified as Class 2. The NSW Office of Environment and Heritage “The land and soil capability assessment scheme” identifies that Class 2 is very high capability land with slight limitation that can be managed by readily available, easily implemented management practices. The land is capable of most land uses and land management practices, including intensive cropping with cultivation. Whilst the land has a Class 2 categorisation, the existing use of the land and potential for land use conflicts, limits the areas ability to be used for prime agricultural purposes.

3. Flooding

The site is subject to riverine flooding as identified in Council’s Floodplain Risk Management Plan and Study. As part of the Gateway Determination conditions, staff have consulted with the Office of Environment and Heritage on flooding matters. As a result of this consultation, a cumulative flood impact assessment (attached) for the site has been undertaken alongside the review of the Floodplain Risk Management Plan and Study.

The purpose of the cumulative flood impact study was to assess the cumulative impacts of land raising and building development within the precinct to ensure the proposed zoning will not have significant impacts on flooding upstream or downstream of the precinct.

The assessment originally included five scenarios and a revised preferred scenario was also modelled. In each scenario, the rezoned land was filled to the final 5% annual exceedance probability (AEP) level plus 500mm freeboard, in accordance with the current policy for land in the adjacent eastern employment precinct.

The original assessment identified that scenario 4 was the preferred scenario as it resulted in little or no flood impacts. The scenario avoids areas identified as floodway, a key recommendation of the Floodplain Development Manual and the NSW Government’s Flood Prone Land Policy. The original Scenario 4 was determined by the low and no hazard areas identified in the 2014 Flood Model adopted by Council. The revised scenario 4 was developed for the final assessment which refined scenario 4 based on hydraulic categorisation (floodway) defined in the Wagga Wagga Revised Murrumbidgee River Flood Risk Management Study, resulting in the southern rezoning area being extended further towards the southern floodway.

The final assessment assumed that each vacant lot that is currently zoned for development is filled to the 5% AEP level plus 500mm freeboard. This ensured an accurate assessment of the cumulative impacts of the Gumly Gumly rezoning.

Whilst the revised scenario 4 enables greater opportunities for the site and avoids floodway hydraulic categorisation in accordance with the Floodplain Development Manual, the scenario results in greater increases in flood levels on adjoining areas. For these reasons the planning proposal is recommended to proceed with the original scenario 4 zoning configuration.

The current Wagga Wagga Development Control Plan 2010 (DCP) applies a range of controls to ensure development is compatible with the existing flood risk. Currently, flood risk on the proposed rezoning site would most appropriately be managed by complying with the controls currently set for Gumly Gumly and in particular low impact commercial development. These controls are consistent with the Flood Risk Management Study and its review of the current Development Control Plan.

To support this planning proposal, Council is currently undertaking an amendment to the DCP to ensure the existing flood controls are updated in line with the recommendations of the Revised Wagga Wagga Floodplain Risk Management Study and Plan (2018). This will also ensure the flood controls apply to the subject land.

Full flooding details are included in the planning proposal.

4. Vegetation

A patch of River Red Gum has been identified within the area of the broader precinct and has been recommended for protection by the Office of Environment and Heritage. As part of the planning proposal, an E2 Environmental Conservation zone is proposed to protect the threatened species.

5. Maintaining effective operation and function of the Sturt Highway

The Roads and Maritime Services (RMS) have indicated that the number of access points to the Sturt Highway are to be minimised and the use of local roads should be encouraged. Council supports this and will ensure that the DCP provides controls that ensure the area is developed in consultation with RMS to ensure access points are minimised.

Conclusion

An assessment has been undertaken (Attached) and has determined that the planning proposal is supported for the following reasons:

§ It will facilitate development that is consistent with the Wagga Wagga 2018 Flood Risk Management Plan and Study and NSW Flood Plain Development Manual.

§ The proposal is consistent with Council’s adopted strategies.

§ It is consistent with the relevant S117 Ministerial Directions.

Financial Implications

The planning proposal for 3870 Sturt Highway, Gumly Gumly is the result of an application to amend the Wagga Wagga Local Environmental Plan 2010. The application was lodged in 2011 and attracted an application fee of $5,000 during the 2011/2012 financial year. The planning proposal for the precinct was generated internally and did not attract any application fees.

Policy and Legislation

Environmental Planning and Assessment Act 1979.

Wagga Wagga Local Environmental Plan 2010.

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

An approval of the proposal may be subject to public scrutiny during the public consultation process and may put additional pressure on Council to consider the increase in the height of building provisions throughout the local government area.

Internal / External Consultation

The most recent Councillor Workshop was held on 6 May 2019 to discuss the planning proposals.

Formal public consultation and Agency consultation has been undertaken in accordance with the Gateway Conditions. As this report is recommending a revised planning proposal be submitted for a revised Gateway Determination, additional formal consultation will occur after the revised Gateway Determination is received.

Standard internal referrals were undertaken with the original planning proposals. The planning proposals have now been altered as a result of submissions received and the completed flood study. As Gateway Determinations have been received for these proposals, no further internal consultation is proposed.

Submissions received during public consultation are summarised in the table below:

|

Submitter |

Comment |

Response |

|

Office of Environment and Heritage (OEH) Submissions dated § 6/3/2013 § 10/11/2014 § 2/12/2014

|

§ Does not support the proposal due to a number of outstanding issues relating to flood modelling and cumulative impacts of development on the Gumly Gumly Floodplain. § The planning proposal should be deferred until the issue with the revised ‘Rating Curve’ is resolved and remodelling is completed to better understand the flooding issues and impacts at the proposed rezoning site. |

Agreed. The planning proposal has been delayed significantly to address the flooding concerns. The Gumly Gumly cumulative flood assessment was delayed pending the finalisation of the Wagga Wagga 2018 Revised Flood Risk Management Plan and Study to ensure correct modelling of the impacts. It is believed that this now addresses the original concerns raised. OEH have been involved in finalising the Gumly Assessment. |

|

§ Does not oppose the planning proposal, however, recommends rezoning a patch of River Red Gum identified on Lot 2 DP 829057 to E3 Environmental Management. |

Noted – the rezoning is included in the precinct planning proposal. |

|

|

§ Notes that the proposal will have no effect on the conservation of areas, objects or places of indigenous heritage significance, but has concerns with subsequent development resulting from the rezoning if objects are present. § Requests that a detailed cultural heritage assessment be undertaken with consideration to soil type and the potential for the land to have been used by Aboriginal people. Should an assessment not be carried out prior to rezoning, it will need to be completed as part of ‘due diligence’ required as part of a development application. |

It is considered that the development application stage is appropriate for detailed cultural heritage assessment and ‘due diligence’. |

|

|

Catchment Management Authority Murrumbidgee (CMA) Dated 27/2/2013 |

§ CMA has a statutory role in the assessment of proposals that may involve the clearing / removal of native vegetation under the Native Vegetation Act 2003. The proposal will remove CMA from the statutory role. § Recommends Council investigate potential protection requirements with OEH. § Recommend council consider mechanisms, such as tree preservation orders that would protect significant habitat native trees from future developments. |

Agreed. Since the original planning proposal, new biodiversity legislation has been introduced providing greater protection and changed approval processes. It is considered that the new legislation is adequate enough to provide protection during subsequent development of the site.

|

|

Local Land Services (LLS) Dated 17/10/2014 |

§ No significant issues. § Any clearing of native vegetation should be avoided and / or minimised wherever possible. § Consider rehabilitating the landscape through revegetation activities utilising endemic species that will also ensure minimal impact on soil erosion and water quality. § Consider any threatened communities and threatened species habitat. |

Agree. The new biodiversity legislation has been introduced and will address clearing. Revegetation can be addressed as part of development application assessment. OEH have indicated a patch of River Red Gum to be rezoned and this is included in the precinct planning proposal. |

|

Roads and Maritime Services (RMS) Dated 30/10/2014 |

§ RMS has a policy to minimise the number of vehicular access points to the Sturt Highway and/or encourage the use of local road for access. § RMS promotes the strategic approach to rezoning and subdivision of the site to provide for connectivity within the various stages of subdivision of land and integration of access provision for the development of adjoining sites and minimise the need for access directly to the Classified Road network. § Council needs to consider the short and long term options for the road network and consider the location of a gateway treatment to Wagga Wagga, the importance of Bakers Lane and whether access to the subject site from the Sturt Highway is the be provided via a 4 way intersection at Bakers Lane or new intersection offset from the current intersection of Bakers Lane with the Sturt Highway |

Agreed. Council will consider the access options and include within the DCP in consultation with RMS. |

|

Resident Dated 20/1/2013 |

§ Need to address localised flooding caused by existing developments. § There are no drainage systems for the site. Additional drainage needs to be installed. § The houses north of the Sturt Highway is odd to be included and suggests the owners wouldn’t agree with the rezoning. § Understands Council’s wants to beautify the approach to Wagga Wagga, but does not believe this will occur with the amount of rubbish around. § Agree that development is good for the city but it must not be at the expense of existing and established rate payer. |

Council notes the concerns regarding flooding impacts and this has been considered as part of the cumulative flood impact assessment. In terms of existing developments, this relates to current development application approvals and not this planning proposal. Any future development applications will be subject to the relevant development controls. Further consultation will be undertaken. |

|

Progress Association Dated 8/2/2013 |

§ The rezoning will introduce industry in the corridor and impact on the traffic conditions and safety of residents that live within the precinct. § Concerns are raised about the flood impacts on residents living within the area. § Questions whether rates will be increased if the property is not being used for commercial purposes. § How will the land use conflicts be managed with new industries and existing residences? |

The traffic concerns are noted and further work will be undertaken with RMS to ensure the DCP contains appropriate provisions. The flooding impacts have been addressed as part of the cumulative flood impact study. Residents will have the ability to request that the rate change be deferred. Land use conflicts will be addressed through the development application process. |

|

Habitat Planning (Submission to 3870 Sturt Highway proposal) Dated 14/11/2014 |

§ There are inconsistencies with the mapping and land descriptions of the exhibited material. § Seeks Council’s support to rezone the broader precinct to the north. § The detailed flood model provision completed in March 2014 provides the analysis of flooding in Gumly Gumly that can be used to determine developable land and the request for the rezoning to extend to the precinct. |

|

Proposed consultation methods are indicated in the table below:

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

x |

|

x |

|

|

|

|

|

|

|

x |

|

||||

|

1. |

Land Owners Details This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: personnel matters concerning particular individuals. - Provided under separate cover |

|

|

2⇨. |

Gumly Gumly Cumulative Flood Impact Study - Provided under separate cover |

|

|

3⇨. |

Assessment Report - Gumly Gumly Planning Proposal - Provided under separate cover |

|

|

4⇩. |

Applicant Details |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 27 May 2019 |

RP-1 |

|

RPS Australia East Pty Ltd (forms part of the RPS Group) |

|

|

Registered Office: Fortitude Valley, QLD, 4006 |

|

|

Australia / Asia Pacific Segment Leadership Team |

|

|

Ross Thompson |

CEO – Australia Asia Pacific |

|

Ben Perry |

Executive General Manager – Project Management |

|

Meegan Sullivan |

Executive Director – Strategic Development |

|

Michael Owens |

Executive General Manager – Project Management |

|

Nick van Bronswijk |

Executive General Manager – Project Approvals and Communications |

|

Robert Fields |

Executive General Manager – Advisory Services |

|

Rob Salisbury |

Executive General Manager – Environment and Water |

|

Susan Farr |

Executive General Manager – Planning and Development |

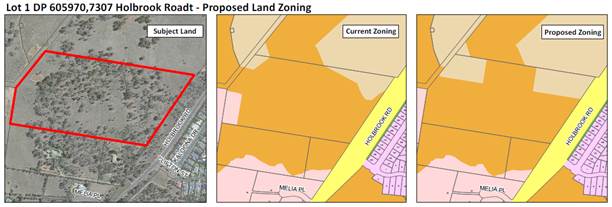

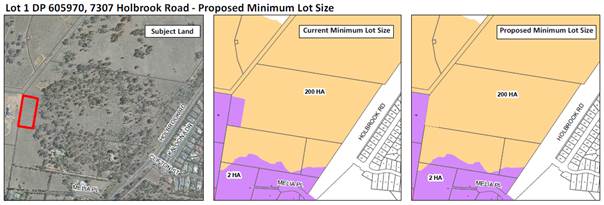

RP-2 Draft Planning Proposal LEP18/0012 - adjustment of zone boundaries at Lot 1 DP 605970 and increase to minimum lot size control to Part Lot 1 DP 605970 on Holbrook Road

Author: Adam Wood

Director: Natalie Te Pohe

|

Summary: |

The planning proposal is to adjust land use zone boundaries at Lot 1 DP 605970 and to increase the minimum lot size requirement to part of Lot 1 DP 605970. The proposal originated from the land owner, Susan Forster and was submitted by Kim Kennedy and Associates. The recommendation is to proceed with the planning proposal and to request Gateway Determination from the NSW Department of Planning and Environment.

|

|

That Council: a support the planning proposal LEP18/0012 prepared to amend the Wagga Wagga Local Environmental Plan 2010 b submit a planning proposal to the Department of Planning and Environment for Gateway Determination c receive a further report after the public exhibition period; i addressing any submissions made in respect of the planning proposal ii proposing adoption of the planning proposal unless there are any recommended amendment deemed to be substantial and requiring a further public exhibition period |

Application Details

|

Submitted Proposal: |

Amendment to the Wagga Wagga Local Environmental Plan 2010 to change the zone boundaries between the R5 – Large Lot Residential Zone, RU1 – Primary Production Zone and E2 – Environmental Conservation Zone at Lot 1 DP 605970 and to increase minimum lot size provisions applicable to Part Lot 1 DP 605970 from 2 hectares to 200 hectares. |

|

Land Owner: |

Susan Forster |

|

Applicant: |

Kim Kennedy and Associates |

Report

Council is in receipt of the planning proposal LEP18/0012 to adjust land zoning boundaries and rationalise minimum lot size provisions applying to Lot 1 DP 605970 (7307 Holbrook Road, Lloyd). The planning proposal seeks to amend the zone boundaries between RU1 – Primary Production and E2 – Environmental Conservation. An area of R5 – Large Lot Residential zone is proposed to be rezoned to RU1 – Primary Production zone.

The proposed changes are illustrated below.

The proposal also seeks to apply a 200 hectare minimum lot size across Lot 1 605970. An area of a 2 hectare minimum lot size will be removed in order to achieve this outcome.

Site and location

The subject land is located to the southern extent of Lloyd immediately west of Holbrook Road and the southern portion of Bourkelands. It is approximately 200m south of the extent of the Lloyd Urban Release Area. It contains significant environmental assets including Box-Gum Woodland.

The subject land is currently within and adjoining multiple land use zones. E2 – Environmental Conservation Zone covers the majority of the subject land and continues immediately north and west. RU1 – Primary Production zone exists in the north-east and north-west and continues into adjoining lands in these directions and to the south. A small area of R5 – Large Lot Residential Zone exists to the south-west and continues into adjoining lands.

Key considerations

The officer’s assessment report (attached) has taken into account various considerations relevant to the subject lands. These include:

1. Future vision for the area

The subject land is at the southern extent of the suburb of Lloyd. The southern portions of Lloyd are to be developed contingent upon the success of preceding parts of the Lloyd subdivision in managing salinity issues. The stage of the suburban development of Lloyd that affects the subject land is to be one of the latest stages of development if pursued.

At this stage of strategic work, it can be identified that the environmental corridors to the southern parts of Wagga Wagga will be retained and planning proposals should uphold this direction.

A large part of the subject land is within the E2 – Environmental Conservation zone. Having this zone enables the Biodiversity Certification of the Wagga Wagga Local Environmental Plan 2010. The E2 - Environmental Conservation zone must therefore remain in effect into the future to retain the biodiversity certification of the WWLEP.

The planning proposal is a minor adjustment which enables effective use of non-environmental lands with the continuation of the adjacent E2 – Environmental Conservation zone over and connecting environmentally-significant lands. The planning proposal will do this in a manner which provides sufficient space to allow for a sound development outcome, including the use of the existing dwelling entitlement, which upholds zone objectives. It does not represent a significant strategic shift in the use of the subject lands.

The absence of any development would result in the rural zoned lands failing to uphold any of the zone objectives. Underutilisation is not a desirable outcome for rural lands in the area and not ideal for the upkeep of neighbouring environmental lands.

2. Protecting environmental assets and upholding biodiversity certification of the Wagga Wagga Local Environmental Plan 2010

The subject land is of importance to the city from an environmental perspective. Important environmental assets including Box-Gum Woodland exist over much of the subject land. Box-Gum Woodland is an Endangered Ecological Community listed under the Threatened Species Conservation Act 1995. It provides habitat for a number of threatened species.

The subject land also provides a linkage between tracts of environmental land. This provides continuity of habitat across the landscape. These reasons mean the subject land is within the E2 – Environmental Conservation zone. Retaining this zoning is integral to the ongoing biodiversity certification of the Wagga Wagga Local Environmental Plan 2010.

The planning proposal realigns the boundary between lands in the E2 – Environmental Conservation and RU1 – Primary Production zones in the northern portion of the subject land. Slightly more of this land shall be zoned RU1 – Primary Production as a result. Another area in the south-west of the subject land is to be rezoned from R5 – Large Lot Residential to E2 – Environmental Conservation. As a result, the proportion of the subject land zoned E2 – Environmental Conservation is to be only slightly reduced relative to the present arrangement and this configuration is supported by NSW Office of Environment and Heritage (OEH).

3. Removal of R5 – Large Lot Residential zone and consistent minimum lot size across the subject land.

The south-western corner of the subject land features an area of approximately 8000m2 which is currently zoned R5 – Large Lot Residential and has a minimum lot size of 2 hectares (20000m2).

This area does not have realistic prospects of fulfilling R5 – Large Lot Residential zone objectives, lacking both the scale and good location for access required. The minimum lot size of 2 hectares does not relate to any future development opportunity under this zone as this 8000m2 area is smaller than this lot size.

A superior outcome for the subject land is to focus upon small scale rural-based land uses in the northern portion of the lot within the RU1 – Primary Production zone and allow the balance of the subject land to be protected for environmental assets in the E2 – Environmental Conservation zone.

4. Existing provision of infrastructure to the subject land

Infrastructure servicing to the subject land is minimal at this time. The limited infrastructure provision to the subject land suggests that only a modest level of development should be planned for at this time. The planning proposal only enhances the ability to use the existing dwelling entitlement, with no further development potential requiring additional infrastructure to be enabled.

Financial Implications

In accordance with Council’s 2018/19 Fees and Charges, a Minor LEP Amendment (minor complexity) attracts total application fees of $7,500. The proponent has paid this fee. There are no requirements to amend the DCP therefore the $2,000 fee for such action is not required to be paid in this instance.

Policy and Legislation

Environmental Planning and Assessment Act 1979.

Wagga Wagga Local Environmental Plan 2010.

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

An approval of the proposal may be subject to public scrutiny during the formal public consultation process and may put additional pressure on Council to consider changes to zoning and minimum lot size requirements throughout the local government area.

Refusal of the application may result in an appeal process. The applicant has the ability to appeal Council’s decision by submitting the planning proposal to the Department of Planning and Environment through a pre-Gateway review process. The reasons for refusal will have to be justified and withstand scrutiny and cross examination.

Internal / External Consultation

Formal consultation with general public and referral agencies will occur after the Gateway Determination.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

|

ü |

|

|

|

|

|

|

|

ü |

|

||||

|

Involve |

|

|

|

|

|

|

|

|

|||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1⇩. |

LEP18/0012 - Planning Proposal as submitted |

|

|

2⇩. |

LEP18/0012 - Council Assessment Report |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 27 May 2019 |

RP-3 |

RP-3 Indexing and Application of Contribution Rates of the City of Wagga Wagga Section 94 Contributions Plan 2006 - 2019 and the City of Wagga Wagga S94A Levy Contributions Plan 2006

Author: Belinda Maclure

Director: Natalie Te Pohe

|

Summary: |

It is proposed to amend the Wagga Wagga Section 94 Contributions Plan 2006 – 2019 Plan and the City of Wagga Wagga S94A Levy Contributions Plan 2006 to change the indexing for inflation from a quarterly basis to annually.

The proposed change to annual indexing is to simplify the administration of the developer contribution plans and align them with the Wagga Wagga Local Infrastructure Contributions Plan 2019 – 2034.

The Local Infrastructure Contributions Plan was adopted by Council on 8 April 2019 and is effective from 1 July 2019. Development applications, complying development certificates and planning proposals determined before 1 July 2019 and any subsequent modifications to these will be required to pay the contributions included in the City of Wagga Wagga Section 94 Contributions Plan 2006 – 2019 Plan or the City of Wagga Wagga S94A Levy Contributions Plan 2006.

These contributions can be paid up to five years from the determination date. Currently the Section 94 Plan and the S94A Levy Contributions Plan index the contributions rates quarterly. It is recommended the indexation is changed to annually to align with the process included in the new Local Infrastructure Contributions Plan.

To ensure indexation reflects the true cost to Council of providing infrastructure to the community, Council staff are lobbying the IPART to change the requirement to use the Consumer Price Index (All Groups Index) for Sydney as published by the Australian Bureau of Statistics in contributions plans. |

|

That Council: a authorise the General Manager or their delegate to make amendments to the City of Wagga Wagga Section 94 Contributions Plan 2006 – 2019 and the City of Wagga Wagga S94A Levy Contributions Plan 2006, which will change the indexation of contributions payable from quarterly to annually effective from 1 July 2019 b note that for clarity, an additional amendment will be made to the City of Wagga Wagga Section 94 Contributions Plan 2006 – 2019 to ensure that all development applications, complying development certificates and planning proposals determined before 1 July 2019, and any subsequent amendments of these will be required to pay the contributions under this Plan c note that Council staff are lobbying IPART to make the appropriate changes in legislation and the Guidelines to allow utilisation of the Local Government Cost Index within contribution plans in preference to the requirement to use the Consumer Price Index (All Groups Index) for Sydney as published by the Australian Bureau of Statistics |

Report

The Wagga Wagga Local Infrastructure Contributions Plan 2019 – 2034 was adopted by Council at its Ordinary Meeting held on 8 April 2019. The new Contributions Plan applies to a development application or application for a complying development certificate submitted but not yet determined on the date on which the Plan took effect, being 1 July 2019 (Wagga Wagga Local Infrastructure Contributions Plan 2019 – 2034, clause 4.2). All development applications, planning proposals or application for complying development certificates determined before 1 July 2019, and any subsequent modifications to these will be charged under the City of Wagga Wagga Section 94 Contributions Plan 2006 – 2019.

Clause 2.11 of the City of Wagga Wagga Section 94 Contributions Plan 2006 – 2019 explains the contribution rates in the Plan will be indexed quarterly to reflect changes in the Consumer Price Index.

The City of Wagga Wagga S94A Levy Contributions Plan 2006, clause 11 states the cost of carrying out development will be indexed quarterly to reflect variations in the Consumer Price Index All Group Index Number for Sydney.

As a result of the recommendation in the Final Internal Audit Report (CA2018 – 1) into development contributions, the process for indexing contributions was reviewed during the development of the Local Infrastructure Contributions Plan. The Plan states Section 7.11 contributions will be indexed in accordance with annual movements in the March quarter Consumer Price Index (All Groups Index) for Sydney as published by the Australian Bureau of Statistics. Similarly, the cost of carrying out development subject to a Section 7.12 levy, is to be indexed between the date consent is granted and the date on which the contribution is paid in accordance with the annual movement in the March quarter Consumer Price Index (All Groups Index) for Sydney as published by the Australian Bureau of Statistics (Wagga Wagga Local infrastructure Contributions Plan, clause 3.2).

Development contributions will still be paid under the City of Wagga Wagga S94A Levy Contributions Plan 2006 and the City of Wagga Wagga Section 94 Contributions Plan 2006 – 2019 for up to the next five years. Given this and the new indexation process included the newly adopted Contributions Plan 2019 – 2034, it is recommended that Council endorse a change to the S94A Levy Contributions Plan 2006 and the Section 94 Contributions Plan 2006 – 2019, which has the effect of indexing both Section 7.11 and Section 7.12 on an annual basis. This approach ensures the process of indexation is the same across all three Plans, therefore reducing the administration cost associated with this process and ensuring consistency. This will see the contribution rates updated to reflect the June 2019 Consumer Price Index, then remain unchanged to 1 July 2020, where they will be altered to reflect the annual increase in the March quarter Consumer Price Index movements.

The developer contributions for the coming financial year if annually indexed based on the respective March Consumer Price Index would allow the following year’s rates to be included in the adopted Fees and Charges, providing clearer and more timely information to the development industry on the applicable developer contributions rates. It is therefore proposed, that if Council support the recommendations in the report, to modify the 2019/20 Fees and Charges document that is currently on exhibition to incorporate the rates applicable.

Financial Implications

The changes proposed to the timing of the indexation process are not expected to have any significant financial implications on the Section 7.11 Contributions Reserve or the Section 7.12 Levy Reserve.

There are financial implications for Council however if the rate of indexation does not reflect the true cost of providing the infrastructure required to the community. It is for this reason why a briefing paper was sent to the LGNSW Board to recommend updating the 2016 Developer Charges Guidelines for Water Supply, Sewerage and Stormwater and modify Section 251 of the Environmental Planning and Assessment Regulation 2000 to ensure reference is made to the Local Government Cost Index in preference to the Consumer Price Index (All Groups Index) for Sydney as published by the Australian Bureau of Statistics. The briefing is attached to this report along with the submission that was provided to IPART who are in the process of undertaking a review of contributions indexation. Both the briefing and submission to IPART was provided to Councillors via the Councillor Bulletin on 17 May 2019.

The Local Government Cost Index is designed to measure how much the price of a fixed ‘basket’ of inputs acquired by Councils in a given period changes compared with the price of the same inputs in the base period. It is also the index that is used as a base for IPART to establish the rate peg.

IPART set the 2019/20 rate peg for Councils at 2.7% being the increase of the Local Government Cost Index to June 2018 of 2.7%, and setting the productivity factor to 0%. In comparison, the Consumer Price Index (All Groups Index) for Sydney for the June Quarter 2017 to June Quarter 2018 was only 2.1%.

Policy and Legislation

Environmental Planning and Assessment Act 1979, Section 7.11, 7.12 and 7.18

Environmental Planning and Assessment Regulation 2000, Part 4, Division 4, Clause 32

Environmental Planning and Assessment Regulation 2000, Part 4, Division 3, Clause 31

City of Wagga Wagga Section 94 Contributions Plan 2006 – 2019

City of Wagga Wagga S94A Levy Contributions Plan 2006

Wagga Wagga Local Infrastructure Contributions Plan 2019 - 2034

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

There are no significant risks with changing the indexation from quarterly to annually.

Internal / External Consultation

No consultation is required, however a public notice will be placed in Council News to ensure transparency of the proposed amendment.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

|

x |

|

|

|

|

|

|

|

|

|||||

|

Involve |

|

|

|

|

|

|

|

|

|||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1⇩. |

LGNSW Board Briefing Paper |

|

|

2⇩. |

Submission to IPART |

|

|

3⇩. |

IPART Discussion Paper |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 27 May 2019 |

RP-4 |

RP-4 ROAD CLOSURE - COUNCIL ROAD WITHIN LOT 2 DP 631591, BORAMBOLA

Author: Dianne Wright

Director: Natalie Te Pohe

|

Summary: |

This report proposes the closure of an unformed and unmaintained Council public road. |

|

That Council: a note that the Crown Land Legislation Amendment Act 2017 has changed the process for closure of Council public roads b propose the closure of the unnamed, unformed and unmaintained road within Lot 2 DP 631591 at Borambola c provide public notice of the proposal as per the Roads Act 1993 (as amended by the Crown Land Legislation Amendment Act 2017, schedule 3) d delegate authority to the General Manager or their delegate to execute any necessary documents on behalf of Council |

Report

By Resolution 15/339.17 on 23 November 2015, Council resolved as follows:

That Council consent to Lidodale Pty Ltd (ACN 002 801 256) making a road closure application to NSW Department of Primary Industries – Lands in connection with the Council public road within Lot 2 DP 631591 at Borambola.

After the date of the resolution, and prior to Lidodale applying for legal closure of the road, the NSW Department of Industry – Lands & Water (Crown Lands) instigated a moratorium on acceptance of new road closure applications.

This was due to the pending activation of new legislation that would transfer authority for all Council public road closures from Crown Lands to Councils. This legislation was activated from 1 July 2018 and comprised amendments to the Roads Act 1993 introduced by the Crown Land Legislation Amendment Act 2017.

Under the amended legislation Council can propose the closure of Council public roads under s38A of Roads Act 1993 if:

(a) the road is not reasonably required as a road for public use (whether for present or future needs), and

(b) the road is not required to provide continuity for an existing road network, and

(c) if the road provides a means of vehicular access to particular land, another public road provides lawful and reasonably practicable vehicular access to that land.

The road proposed for closure is un-named, unformed, unmaintained and does not form part of Council’s current or future road network. Further, consultation with Council’s Infrastructure Services Directorate (as it was known at the time) confirmed that Council has no requirement for the road.

While the legislation changes do not necessarily require a new resolution of Council, the former resolution only requested consent to lodging of an application with Crown Lands to close the road. For transparency, this resolution notes that Council is formally proposing the road closure.

All costs in relation to the road closure being application fees, survey fees, registration costs and advertising costs will be borne by Lidodale Pty Ltd.

Being an unformed road the road parcel will vest in the Crown upon closure. Lidodale Pty Ltd will then be required to acquire the land from the Crown at current market value.

Financial Implications

Council will receive income of $1,650.00 (including GST) from the Permanent Road Closure application fee, which will be receipted to the Property Management Cost Centre.

Policy and Legislation

Roads Act 1993

Crown Land Legislation Amendment Act 2017

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

N/A

Internal / External Consultation

The proposal to close the road within Lot 2 DP 631591 must be publicly notified and can only proceed if objections received are satisfactorily resolved. Public notification will comprise advertising in the local newspaper, and direct notification of authorities and neighbouring land owners as indicated below.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

l |

|

l |

|

|

|

|

|

|

|

|

|||||

|

1⇩. |

Location Map - Public Road within Lot 2 DP 631591 |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 27 May 2019 |

RP-5 |

RP-5 PROPOSED LICENCE TO TARCUTTA MENSHED - 8 BENT STREET, TARCUTTA

Author: Dianne Wright

Director: Natalie Te Pohe

|

Summary: |

This report concerns the granting of a licence for occupation of a Council building at Tarcutta following an Expression of Interest process. |

|

That Council: a enter into a licence agreement with Tarcutta Men’s Shed Incorporated upon the following terms i Location – former Tarcutta RFS shed at 8 Bent Street, Tarcutta (Lot 136 DP 757255) ii Period - one (1) year commencing 1 July 2019 iii Licence fee – in accordance with Council’s minimum community licence fee adopted for the 2019/2020 financial year b undertake public notice advertising of the intention to grant a licence under in accordance with s47A and s47 of the Local Government Act 1993 c authorise lodgement of a development application for change of use to community purposes d delegate authority to the General Manager or their delegate to execute any necessary documents on behalf of the Council e authorise the affixing of Council’s common seal to all relevant documents as required f delegate authority to the General Manager, or their delegate to renew the licence for a further period of one (1) year on 1 July 2020 at the discretion of Council |

Report

Council resolved on 11 March 2019 by way of resolution of Council 19/036 to conduct an Expression of Interest for licensing of the former Tarcutta RFS shed by registered community groups. The property is situated at 8 Bent Street, Tarcutta on Crown Land managed by Council as the Crown Land Manager.

Subsequently, an Expression of Interest process was advertised with submissions closing on 26th April 2019. One (1) submission was received for the licensing of the facility from the Tarcutta Men’s Sheds Incorporated (ABN 19 932 273 072).

The Tarcutta Men’s Shed presently boast a membership of twenty (20) from Tarcutta and surrounding areas. Membership is open to women as well as men and regular activities are conducted on Monday, Tuesday and Wednesday mornings for a number of hours. Hours are extended for particular projects, and members may access the facility outside of regular hours in the company of one other member.

Public notice advertising of the intention to grant the licence is required under the provisions of the Local Government Act 1993 pertaining to community land. As per the provisions of the Crown Land Management Act 2016, Council as Crown Land Manager now manages Crown Reserves as though they were community land. Should the public notice result in any unresolved objections from the community a further report will be submitted to Council for consideration.

During the same period a development application for change of use will be lodged for assessment with Council’s Development Services division. Costs associated with this development application are estimated at $285 and will be funded from the Property Management cost centre.

The format of the proposed licence differs from Council’s usual community group licence due to limitations imposed by Crown Land reforms as explained by the following excerpt from the report to Council dated 11 March 2019.

Introduction of the Crown Lands Management Act 2016 (on 1 July 2018) restricts Council’s leasing and licensing options for this property prior to adoption of a Plan of Management (POM).

Transitional arrangements limit tenure opportunities to short-term licences of one year in duration. Short-term licences may be granted for prescribed purposes set out in Part 4, Clause 31 of the Crown Land Management Regulation 2018. Such purposes include community, education, training, meetings, organised recreational activities, and functions. Consecutive short-term licences can be granted during the period before a POM is adopted.

In accordance with the above, it is recommended that Council delegate authority to the General Manager or their delegate to renew the licence for a further term of one (1) year upon the same conditions subject to satisfactory performance of the licensee.

Financial Implications

Projected licence fee income of $650 will be received in the Property Management cost centre for the 2019/20 financial year. As mentioned earlier in the report, development application lodgement costs of $285 are proposed to be funded from within the Property Management cost centre.

Policy and Legislation

038 Leasing & Licensing

Local Government Act 1993

Crown Land Management Act 2016

Link to Strategic Plan

Community Place and Identity

Objective: We have opportunities to connect with others

Outcome: We activate our community spaces to promote connectedness

Risk Management Issues for Council

No specific risks identified

Internal / External Consultation

Public notice advertising of intention to grant licence in accordance with the requirements of s47 and s47A of the Local Government Act 1993.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

x |

x |

x |

|

|

|

|

|

|

|

|

|||||

Report submitted to the Ordinary Meeting of Council on Monday 27 May 2019. RP-6

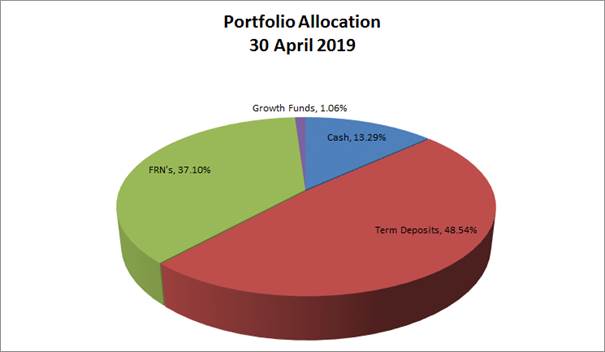

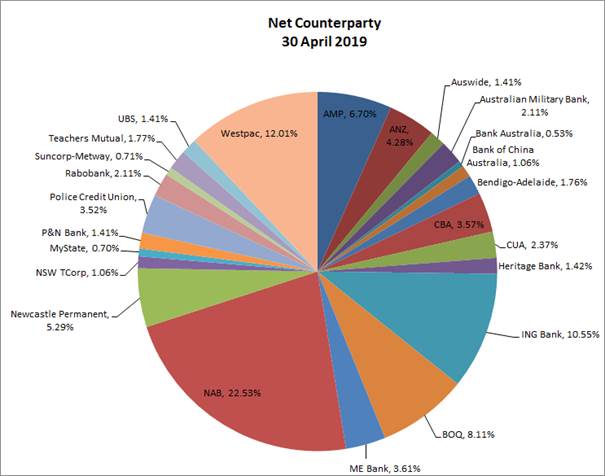

RP-6 Financial Performance Report as at 30 April 2019

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Summary: |

This report is for Council to consider and approve the proposed 2018/19 budget variations required to manage the 2018/19 budget and Long Term Financial Plan, and details Council’s external investments and performance as at 30 April 2019. |

|

That Council: a approve the proposed 2018/19 budget variations for the month ended 30 April 2019 and note the balanced budget position as presented in this report b provide $300 financial assistance to the South Wagga Anglican Church in accordance with Section 356 of the Local Government Act 1993 c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above d note details of the external investments as at 30 April 2019 in accordance with section 625 of the Local Government Act 1993 |

Report

Wagga Wagga City Council (Council) forecasts a balanced budget position as at 30 April 2019. Proposed budget variations are detailed in this report for Council’s consideration and adoption.

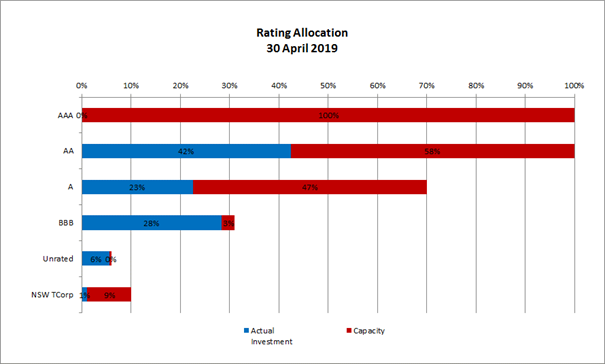

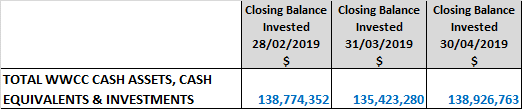

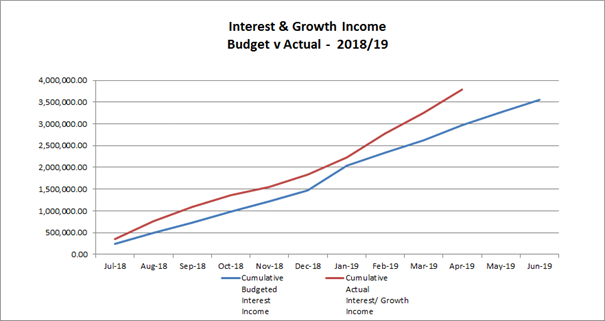

Council has experienced a positive monthly investment performance for the month of April, when compared to budget. This is mainly due to a higher than anticipated portfolio balance and strong performance of Councils Managed Fund and Floating Rate Notes.

Key Performance Indicators

OPERATING INCOME

Total operating income is 83% of approved budget, which is tracking on budget for the end of April (this percentage excludes capital grants and contributions). An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 93%.

OPERATING EXPENSES

Total operating expenditure is 79% of approved budget and is tracking close to the budget for the full financial year.

CAPITAL INCOME

Total capital income is 66% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions relating to projects. This income also includes the sale of property, plant and equipment.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 90% of approved budget.

|

WAGGA WAGGA

CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2018/19 |

COMMT'S 2018/19 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|||||||

|

Rates & Annual Charges |

(66,609,093) |

0 |

(66,609,093) |

(55,858,770) |

0 |

(55,858,770) |

84% |

|

User Charges & Fees |

(26,844,544) |

361,404 |

(26,483,140) |

(21,411,184) |

0 |

(21,411,184) |

81% |

|

Interest & Investment Revenue |

(2,917,452) |

(822,999) |

(3,740,451) |

(3,930,388) |

0 |

(3,930,388) |

105% |

|

Other Revenues |

(2,983,104) |

(332,402) |

(3,315,506) |

(2,998,293) |

0 |

(2,998,293) |

90% |

|

Operating Grants & Contributions |

(13,284,867) |

3,418,922 |

(9,865,944) |

(7,470,090) |

0 |

(7,470,090) |

76% |

|

Capital Grants & Contributions |

(36,517,290) |

15,661,543 |

(20,855,747) |

(15,376,780) |

0 |

(15,376,780) |

74% |

|

Total Revenue |

(149,156,350) |

18,286,468 |

(130,869,882) |

(107,045,506) |

0 |

(107,045,506) |

82% |

|

|

|||||||

|

Expenses

|

|||||||

|

Employee Benefits & On-Costs |

44,786,608 |

332,201 |

45,118,809 |

35,110,923 |

24,863 |

35,135,787 |

78% |

|

Borrowing Costs |

3,752,580 |

(121,277) |

3,631,304 |

2,689,953 |

0 |

2,689,953 |

74% |

|

Materials & Contracts |

32,384,231 |

5,985,700 |

38,369,931 |

25,323,765 |

3,806,943 |

29,130,709 |

76% |

|

Depreciation & Amortisation |

35,418,997 |

0 |

35,418,997 |

29,515,831 |

0 |

29,515,831 |

83% |

|

Other Expenses |

12,125,204 |

(2,355,984) |

9,769,220 |

8,161,699 |

104,672 |

8,266,371 |

85% |

|

Total Expenses |

128,467,621 |

3,840,640 |

132,308,261 |

100,802,171 |

3,936,478 |

104,738,650 |

79% |

|

|

|

||||||

|

Net Operating (Profit)/Loss |

(20,688,729) |

22,127,109 |

1,438,379 |

(6,243,335) |

3,936,478 |

(2,306,856) |

|

|

|

|||||||

|

Net Operating (Profit)/Loss before Capital Grants & Contributions |

15,828,561 |

6,465,566 |

22,294,127 |

9,133,445 |

3,936,478 |

13,069,923 |

|

|

|

|||||||

|

Capital / Reserve Movements |

|||||||

|

Capital Exp - Renewals |

33,460,752 |

(1,871,979) |

32,008,997 |

17,041,441 |

14,383,389 |

31,424,830 |

98% |

|

Capital Exp - New Projects |

32,626,087 |

(16,375,304) |

15,168,118 |

9,708,047 |

2,636,699 |

12,344,746 |

81% |

|

Capital Exp - Project Concepts |

23,554,733 |

(22,538,606) |

1,678,568 |

378,566 |

176,619 |

555,185 |

33% |

|

Loan Repayments |

3,129,777 |

(225,924) |

2,903,853 |

2,419,878 |

0 |

2,419,878 |

83% |

|

New Loan Borrowings |

(6,108,672) |

1,503,878 |

(4,604,793) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(952,795) |

(2,701,703) |

(3,654,498) |

(731,540) |

(72,250) |

(803,790) |

22% |

|

Net Movements Reserves |

(29,602,157) |

20,082,530 |

(9,519,626) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

56,107,727 |

(22,127,109) |

33,980,618 |

28,816,392 |

17,124,457 |

45,940,848 |

|

|

|

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED

BUDGET |

YTD ACTUAL EXCL COMMT'S 2018/19 |

COMMT'S 2018/19 |

YTD ACTUAL +

COMMT'S |

YTD % OF BUD |

|

Net Result after Depreciation |

35,418,997 |

0 |

35,418,997 |

22,573,057 |

21,060,935 |

43,633,992 |

|

|

|

|||||||

|

Add back Depreciation Expense |

35,418,997 |

0 |

35,418,997 |

29,515,831 |

0 |

29,515,831 |

83% |

|

|

|||||||

|

Cash Budget (Surplus)/Deficit |

0 |

0 |

0 |

(6,942,774) |

21,060,935 |

14,118,162 |

|

Revised Budget Result - Surplus/(Deficit) |

$’000s |

|

Original 2018/19 Budget Result as adopted by Council Total Budget Variations approved to date Budget variations for April 2019 |

$0 $0 $0 |

|

Proposed revised budget result for 30 April 2019 |

$0 |

The proposed Budget Variations to 30 April 2019 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact Fav/ (Unfav) |

||||

|

1 – Community Leadership and Collaboration |

|||||||

|

Section 7.11 Income Section 64 Stormwater Income Section 64 DSP Sewer Income |

$1,600K

$330K

$55K |

Section 7.11 Reserve ($1,600K) Section 64 Stormwater Reserve ($330K) Section 64 Sewer Reserve ($55K) |

Nil |

||||

|

Strong subdivision activity has continued in the second half of 2018/19 with subdivisions completed in the northern suburbs of Gobbagombalin, Boorooma and Estella and the southern suburb of Lloyd. This has resulted in additional income for Section 7.11 and Section 64. This income is to be transferred to the relevant Reserve as the funds have already been committed to future projects as identified in Councils Long Term Financial Plan. |

|

||||||

|

2 – Safe and Healthy Community |

|||||||

|

Fire Trail Maintenance |

$124K |

Rural Fire Service Grant Income ($124K) |

Nil |

||||

|

Council has been successful in securing grant funding in Round 3 of the Rural Fire Services 2018/19 Bush Fire Mitigation and Resilience Program. The grant relates to fire trail maintenance on the Warrawong, Museum and Garden Trails. Completion Date: July 2019 |

|

||||||

|

3 – Growing Economy |

|||||||

|

Spring Jam Festival |

$20K |

Destination NSW Grant ($20K) |

Nil |

||||

|

Council has received $20K for the 2019 Spring Jam Festival through the Destination NSW Regional Flagship Events Program’s Incubator Event Fund. All grant monies are to be spent on marketing initiatives that encourage overnight visitation from outside the region. The Spring Jam Festival will be held on 28 September 2019. These additional grant funds will bring the total Spring Jam 2019 budget up to $60K. |

|

||||||

|

Livestock Marketing Centre - Install New Fan Draft for Receivals |

Nil |

Transfer project from Potential Projects to Delivery Program |

Nil |

||||

|

It is proposed to transfer the Livestock Marketing Centre (LMC) Install New Fan Draft for Receivals project out of the Potential Projects List and into the Capital Works Delivery Program for 2018/19 and 2019/20 as the project has progressed at a faster rate than expected. The total allocated project budget is $45K and is funded from the LMC Reserve. |

|

||||||

|

5 – The Environment |

|||||||

|

Planning Fee Income |

($331K) |

Salary Savings $291K Planning Legals $40K |

Nil |

||||

|

Based on the current financial year’s development activity for the Local Government Area, the income received to date for development applications, construction certificates and Section 168 Plumbing Certificates is lower than the anticipated budget. The planning income budgets have been increased annually over several financial years and are now too high based on this current activity. In addition to this, the increased use of private certifiers for building approvals and inspections have also impacted on the total income to be received for the financial year. This variation is proposed to be funded from salary vacancies in the department and savings in budgeted legal expenses. |

|

||||||

|

Lord Baden Powell Drive Redevelopment Concept Design |

$10K |

Museum Maintenance Savings ($10K) |

Nil |

||||

|

Funds are required for a concept design for the road redevelopment of Lord Baden Powell Drive. This redevelopment is required due to 20 safety issues being identified during a recent road safety audit in relation to the Museum of the Riverina Redevelopment project and the Entwine project. It is Council’s intention to produce a concept design that addresses the issues raised, produce a cost estimate for the proposed works and seek funding (internal and/or external) to complete the required road upgrades. It is proposed to fund this $10K variation from existing Museum Maintenance Savings. |

|

||||||

|

|

Nil |

||||||

Current Restrictions

|

RESERVES SUMMARY |

|||||

|

30 APRIL 2019 |

|||||

|

|

CLOSING BALANCE 2017/18 |

ADOPTED RESERVE TRANSFERS 2018/19 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 29.04.19 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

|

|

|

|

|

|

|

Externally Restricted |

|

|

|

|

|

|

Developer Contributions - Sect 7.11 |

(19,959,750) |

7,405,683 |

(8,650,301) |

(1,600,000) |

(22,804,367) |

|

Developer Contributions - Sect 7.12 |

(465,272) |

358,500 |

112,629 |

|

5,857 |

|

Developer Contributions – S/Water DSP S64 |

(5,478,298) |

500,000 |

(823,831) |

(330,000) |

(6,132,128) |

|

Sewer Fund |

(26,204,212) |

4,267,364 |

(5,789,888) |

(55,000) |

(27,781,736) |

|

Solid Waste |

(20,184,154) |

9,600,364 |

(8,733,353) |

|

(19,317,142) |

|

Specific Purpose Grants |

(3,519,384) |

0 |

3,519,384 |

|

0 |

|

SRV Levee |

(2,847,382) |

1,807,667 |

(798,197) |

|

(1,837,912) |

|

Stormwater Levy |

(3,167,296) |

162,032 |

(97,159) |

|

(3,102,423) |

|

Total Externally Restricted |

(81,825,747) |

24,101,610 |

(21,260,716) |

(1,985,000) |

(80,969,852) |

|

|

|

||||

|

Internally Restricted |

|

||||

|

Airport |

(63,685) |

(158,452) |

(25,598) |

(247,735) |

|

|

Art Gallery |

(49,209) |

13,262 |

0 |

(35,947) |

|

|

Ashmont Community Facility |

(6,000) |

(1,500) |

0 |

(7,500) |

|

|

Bridge Replacement |

(201,972) |

(100,000) |

0 |

(301,972) |

|

|

CBD Carparking Facilities |

(863,695) |

160,302 |

(59,501) |

(762,894) |

|

|

CCTV |

(74,476) |

(10,000) |

0 |

(84,476) |

|

|

Cemetery Perpetual |

(65,479) |

(129,379) |

103,758 |

(91,100) |

|

|

Cemetery |

(452,507) |

420 |

79,947 |

(372,141) |

|

|

Civic Theatre Operating |

0 |

(55,000) |

24,485 |

(30,515) |

|

|

Civic Theatre Technical Infrastructure |

(92,585) |

(50,000) |

63,711 |

(78,875) |

|

|

Civil Projects |

(155,883) |

0 |

0 |

(155,883) |

|

|

Community Amenities |

(76,763) |

0 |

0 |

(76,763) |

|

|

Community Works |

(61,888) |

(59,720) |

17,000 |

|

(104,608) |

|

Council Election |

(255,952) |

(76,333) |

44,045 |

(288,240) |

|

|

Emergency Events |

(220,160) |

0 |

29,000 |

(191,160) |

|

|

Employee Leave Entitlements |

(3,322,780) |

0 |

0 |

|

(3,322,780) |

|

Environmental Conservation |

(131,351) |

20,295 |

0 |

|

(111,056) |

|

Estella Community Centre |

(230,992) |

178,519 |

(178,519) |

|

(230,992) |

|

Event Attraction Reserve |

0 |

0 |

(4,421) |

|

(4,421) |

|

Family Day Care |

(320,364) |

75,366 |

(1,556) |

|

(246,555) |

|

Fit for the Future |

(5,340,222) |

4,444,014 |

(3,651,328) |

|

(4,547,536) |

|

Generic Projects Saving |

(1,056,917) |

150,000 |

122,306 |

|

(784,611) |

|

Glenfield Community Centre |

(19,704) |

(2,000) |

0 |

|

(21,704) |

|

Grants Commission |

(5,199,163) |

0 |

5,199,163 |

|

0 |

|

Grassroots Cricket |

(70,992) |

0 |

0 |

|

(70,992) |

|

Gravel Pit Restoration |

(767,509) |

0 |

0 |

|

(767,509) |

RESERVES SUMMARY

|

|||||

|

30 APRIL 2019 |

|||||

|

|

CLOSING BALANCE 2017/18 |

ADOPTED RESERVE TRANSFERS 2018/19 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 29.04.19 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

Gurwood Street Property |

(50,454) |

0 |

0 |

|

(50,454) |

|

Information Services |

(369,113) |

77,858 |

73,406 |

|

(217,850) |

|

Infrastructure Replacement |

(193,634) |

(68,109) |

(62,934) |

|

(324,677) |

|

Insurance Variations |

(28,644) |

0 |

(71,603) |

|

(100,246) |

|

Internal Loans |

(518,505) |

(631,470) |

(680,576) |

|

(1,830,551) |

|

Lake Albert Improvements |

(62,349) |

(21,563) |

64,054 |

|

(19,858) |

|

LEP Preparation |

(3,895) |

0 |

1,350 |

|

(2,545) |

|

Livestock Marketing Centre |

(5,724,767) |

(1,146,762) |

902,475 |

|

(5,969,055) |

|

Museum Acquisitions |

(39,378) |

0 |

0 |

|

(39,378) |

|

Oasis Building Renewal |

(209,851) |

(85,379) |

3,000 |

|

(292,230) |

|

Oasis Plant |

(1,140,543) |

390,000 |

(481,652) |

|

(1,232,195) |

|

Parks & Recreation Projects |

(79,648) |

49,500 |

0 |

|

(30,148) |

|

Pedestrian River Crossing |

(10,775) |

0 |

10,775 |

|

0 |

|

Plant Replacement |

(3,935,062) |

253,958 |

1,093,434 |

|

(2,587,671) |

|

Playground Equipment Replacement |

(164,784) |

69,494 |

0 |

|

(95,290) |