AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

27 April 2020

AT 6:00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

27 April 2020

AT 6:00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 27 April 2020 at 6:00pm.

Council live streams video and audio of Council meetings. Members of the public are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

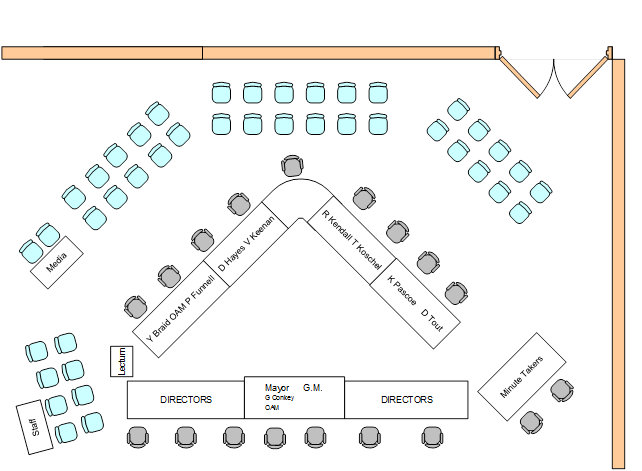

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 27 April 2020.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 27 April 2020

CLAUSE PRECIS PAGE

PRAYER 2

ACKNOWLEDGEMENT OF COUNTRY 2

APOLOGIES 2

Confirmation of Minutes

CM-1 Ordinary Council Meeting - 14 April 2020 2

DECLARATIONS OF INTEREST 2

Reports from Staff

RP-1 Financial Performance Report as at 31 March 2020 3

RP-2 Community Tenant Abatements 21

RP-3 UPDATED TERMS OF REFERENCE - Floodplain Risk Management Advisory Committee 25

Committee Minutes

M-1 FLOODPLAIN RISK MANAGEMENT ADVISORY COMMITTEE - MINUTES - February & March 2020 39

QUESTIONS/BUSINESS WITH NOTICE 52

Confidential Reports

CONF-1 Estella School and Northern Sporting Precint Update 53

CONF-2 Tenant Hardship 54

CONF-3 RFQ2020-538 ACTIVE TRAVEL PLAN CYCLE WAY CONSTRUCTION 55

CONF-4 RFT2020-27 STORMWATER, SEWER TRUNK MAINS AND DETENTION BASINS 56

PRAYER

CM-1 Ordinary Council Meeting - 14 April 2020

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 14 April 2020 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - Ordinary Council Meeting - 14 April 2020 |

57 |

|

Report submitted to the Ordinary Meeting of Council on Monday 27 April 2020 |

RP-1 |

RP-1 Financial Performance Report as at 31 March 2020

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Summary: |

This report is for Council to consider and approve the proposed 2019/20 budget variations required to manage the 2019/20 budget and Long Term Financial Plan, and details Council’s external investments and performance as at 31 March 2020. |

|

That Council: a approve the proposed 2019/20 budget variations for the month ended 31 March 2020 and note the forecasted balanced budget position presented b note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above c note the details of the external investments as at 31 March 2020 in accordance with section 625 of the Local Government Act 1993 |

Report

Wagga Wagga City Council (Council) forecasts a balanced budget position as at 31 March 2020. Proposed budget variations are detailed in this report for Council’s consideration and adoption.

Council has experienced a negative monthly investment performance for the month of March when compared to budget ($958,299 down on monthly budget). This is mainly due to negative returns from Council’s Floating Rate Note portfolio and TCorp Long Term Growth fund, resulting from the ongoing concerns of the COVID-19 pandemic.

There will be a report presented to Council at a future Council meeting providing advice on the indicative financial impact of COVID-19 on Council’s 2019/20 Budget.

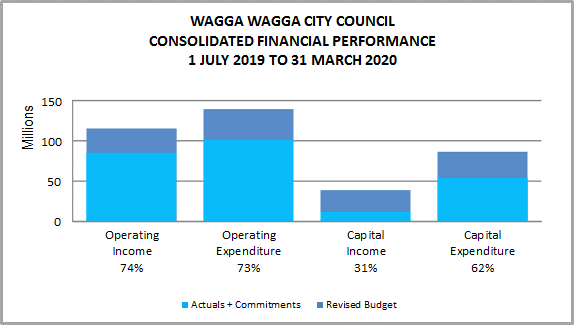

Key Performance Indicators

OPERATING INCOME

Total operating income is 74% of approved budget, which is on budget for the end of March (this percentage excludes capital grants and contributions). An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 89%. As noted earlier, the indicative financial impact of COVID-19 on Council’s 2019/20 Budget will be presented at a future Council meeting.

OPERATING EXPENSES

Total operating expenditure is 73% of approved budget and is tracking within budget at this stage of the financial year.

CAPITAL INCOME

Total capital income is 31% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions relating to projects. This income also includes the sale of property, plant and equipment.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 62% of approved budget (including ‘Potential Projects’). Excluding ‘Potential Projects’ budgets, the capital expenditure including commitments is 69% of approved budget.

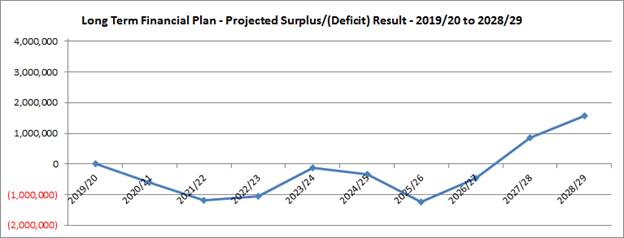

CURRENT LONG TERM FINANCIAL PLAN – PROJECTED SURPLUS/ (DEFICIT) BUDGET POSITION*

*The Long Term Financial Plan 10 year

Surplus/(Deficit) budgets as presented in this graph, are based on the current

adopted budget and does not include any forecasted adjustments as a result of

COVID-19. It also does not include any proposed adjustments for the draft

2021/30 LTFP, which will be presented to Council 27 April 2020 to go on public

exhibition in May, for adoption in June 2020.

|

WAGGA WAGGA

CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2019/20 |

COMMT'S 2019/20 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|||||||

|

Rates & Annual Charges |

(69,736,893) |

(63,636) |

(69,800,529) |

(52,325,500) |

0 |

(52,325,500) |

75% |

|

User Charges & Fees |

(28,440,057) |

(69,500) |

(28,509,557) |

(20,504,164) |

0 |

(20,504,164) |

72% |

|

Interest & Investment Revenue |

(3,774,001) |

0 |

(3,774,001) |

(1,817,883) |

0 |

(1,817,883) |

48% |

|

Other Revenues |

(3,053,633) |

(240,553) |

(3,294,186) |

(2,946,776) |

0 |

(2,946,776) |

89% |

|

Operating Grants & Contributions |

(14,280,296) |

4,365,943 |

(9,914,354) |

(7,612,744) |

0 |

(7,612,744) |

77% |

|

Capital Grants & Contributions |

(56,263,733) |

20,666,648 |

(35,597,085) |

(11,521,688) |

0 |

(11,521,688) |

32% |

|

Total Revenue |

(175,548,613) |

24,658,902 |

(150,889,711) |

(96,728,754) |

0 |

(96,728,754) |

64% |

|

|

|||||||

|

Expenses

|

|||||||

|

Employee Benefits & On-Costs |

46,012,119 |

(63,200) |

45,948,419 |

34,660,152 |

56,487 |

34,716,640 |

76% |

|

Borrowing Costs |

3,587,823 |

(264,964) |

3,322,860 |

2,195,765 |

0 |

2,195,765 |

66% |

|

Materials & Contracts |

32,357,210 |

9,561,399 |

41,919,109 |

23,792,880 |

6,718,466 |

30,511,346 |

73% |

|

Depreciation & Amortisation |

34,843,073 |

0 |

34,843,073 |

26,132,305 |

0 |

26,132,305 |

75% |

|

Other Expenses |

13,015,295 |

199,811 |

13,215,106 |

7,327,658 |

166,157 |

7,493,815 |

57% |

|

Total Expenses |

129,815,520 |

9,433,046 |

139,248,566 |

94,108,759 |

6,941,110 |

101,049,870 |

73% |

|

|

|

||||||

|

Net Operating (Profit)/Loss |

(45,733,093) |

34,091,948 |

(11,641,145) |

(2,619,995) |

6,941,110 |

4,321,115 |

|

|

|

|||||||

|

Net Operating (Profit)/Loss before Capital Grants & Contributions |

10,530,640 |

13,425,300 |

23,955,940 |

8,901,693 |

6,941,110 |

15,842,803 |

|

|

|

|||||||

|

Capital / Reserve Movements |

|||||||

|

Capital Exp - Renewals |

34,034,738 |

(615,622) |

56,582,538 |

22,649,928 |

19,708,819 |

42,358,746 |

75% |

|

Capital Exp - New Projects |

42,696,132 |

(18,670,888) |

17,905,100 |

6,791,930 |

1,938,594 |

8,730,523 |

49% |

|

Capital Exp - Project Concepts |

38,364,925 |

(12,800,615) |

8,521,033 |

232,954 |

78,649 |

311,603 |

4% |

|

Loan Repayments |

3,380,744 |

(21,035) |

3,359,708 |

2,535,558 |

0 |

2,535,558 |

75% |

|

New Loan Borrowings |

(21,222,532) |

1,887,999 |

(19,334,533) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(1,502,910) |

(1,745,414) |

(3,248,324) |

(608,072) |

0 |

(608,072) |

19% |

|

Net Movements Reserves |

(15,174,931) |

(2,126,373) |

(17,301,304) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

80,576,166 |

(34,091,948) |

46,484,218 |

31,602,298 |

21,726,061 |

53,328,359 |

|

|

|

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED

BUDGET |

YTD ACTUAL EXCL COMMT'S 2019/20 |

COMMT'S 2019/20 |

YTD ACTUAL +

COMMT'S |

YTD % OF BUD |

|

Net Result after Depreciation |

34,843,073 |

0 |

34,843,073 |

28,982,303 |

28,667,172 |

57,649,474 |

|

|

|

|||||||

|

Add back Depreciation Expense |

34,843,073 |

0 |

34,843,073 |

26,132,305 |

0 |

26,132,305 |

75% |

|

|

|||||||

|

Cash Budget (Surplus)/Deficit |

0 |

0 |

0 |

2,849,998 |

28,667,172 |

31,517,169 |

|

Revised Budget Result - Surplus/(Deficit) |

$’000s |

|

Original 2019/20 Budget Result as adopted by Council Total Budget Variations approved to date Budget Variations for March 2020 |

$0 $0 $0 |

|

Proposed Revised Budget result for 31 March 2020 |

$0 |

The proposed Budget Variations to 31 March 2020 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact Fav/ (Unfav) |

|

|

|||

|

Museum Exhibition Space Fit Out |

$144K |

State Government Grant ($68K) Existing Museum Operational Budgets ($76K) |

Nil |

|

Council has been successful in securing State Government Grant funding under the November 2019 - Arts & Culture Grant Funding program. The grant funding will enable Council to fit-out the museum exhibition space as part of the Museum of the Riverina Redevelopment through the purchase of high-quality exhibition cases. With the grant funding requiring Council to match the grant funds it is proposed to fund Council’s portion from existing Museum operational budgets. The grant funds will be paid over two payments with 90% ($68,400) to be received in 2019/20 and the remaining 10% ($7,600) to be received upon completion of the fit-out which is expected to be in 2021/22. Estimated Project Completion: November 2021 |

|

||

|

3 – Growing Economy |

|

||

|

Bushfire Community Resilience & Economic Recovery |

$100K |

Joint State and Commonwealth Government Grant ($100K) |

Nil |

|

Council has been successful in securing State and Commonwealth Government Joint Grant funding under the Bushfire Community Resilience and Economic Recovery Funds: Phase 1 program. The aim of this funding is to meet the immediate recovery needs of the communities directly affected by the recent natural disaster. |

|

||

|

Valuation of Wagga Airport Assets |

$43K |

Airport Reserve ($43K) |

Nil |

|

As part of Stage 2 of the Airport accounting review, Council has engaged a consultant to undertake a valuation of the Airport infrastructure assets. It is proposed to fund these works from the Airport Reserve. Estimated completion: 30 June 2020 |

|

||

|

5 – The Environment |

|

||

|

Pipe Network Relocation of Rising Mains |

$120K |

Sewer Reserve ($120K) |

Nil |

|

Additional funds are required for the Pipe Network Relocation of Rising Mains for Sheppard Street, Forsyth Street and Simmons Street Sewer Pump Stations due to a required change in scope of works for the project. The change in scope includes additional under bores, connections and road restorations. This will bring the total project budget to $1.16M. It is proposed to fund the variation from the Sewer Reserve. Estimated completion: 30 June 2020 |

|

||

|

Narrung Street Treatment Plant Flood Protection |

$230K |

Sewer Reserve ($200K) Existing Sewer Operational Budgets ($30K) |

Nil |

|

A Polyethylene (PE) liner is required to be installed in the Narrung Street Emergency Storage Pond to ensure sewage does not enter the groundwater and adjacent Murrumbidgee River. Previous drought conditions have made the installation of the PE liner non-urgent. The original purpose of the Emergency Storage Pond was to hold up to 20 ML of bypassed sewage during periods of high rainfall to cope with increased inflow/infiltration into the Narrung Street Sewage Treatment Plant (STP) sewerage reticulation. The Contractors operating and maintaining the STP (Downer Australia Pty Ltd) wish to replace the existing diffusers (some have failed), at their expense, with a more efficient type of diffuser which will save power costs and increase the treatment capacity of the STP. In order to complete this project, each of the Sequential Batch Reactor tanks will need to be pumped into the Emergency Storage Pond whilst the diffuser changeover occurs. This is an ideal time to install the PE Liner. $20K is allocated to the project in 2020/21 in Potential Projects. It is proposed to bring the project forward out of Potential Projects and into the Capital Works Delivery Program in 2019/20 and fund the additional works from existing Sewer Operational Budgets and the Sewer Reserve. Estimated Completion: 30 June 2020 |

|

||

|

Bomen NBN Area Switch |

$1.395M |

Infrastructure NSW Grant ($1.395M) |

Nil |

|

It is proposed to separate and bring forward into 2019/20 the Bomen NBN Area Switch from the Riverina Intermodal Freight and Logistics (RiFL) Stage 2C - Industrial Subdivision - Civil Works Project which is scheduled to commence in 2020/21 due to the availability of NBN to undertake the works earlier than originally anticipated. The works are funded from grant funds provided by Infrastructure NSW as part of the Growing Local Economies program. Estimated Completion: 30 June 2020 |

|

||

|

SURPLUS/(DEFICIT) |

$0K |

||

Current Restrictions

|

RESERVES SUMMARY |

|||||

|

31 MARCH 2020 |

|||||

|

|

CLOSING BALANCE 2018/19 |

ADOPTED RESERVE TRANSFERS 2019/20 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 30.3.2020 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

|

|

|

|

|

|

|

Externally Restricted |

|

|

|

|

|

|

Developer Contributions - Section 7.11 |

(23,836,289) |

3,427,074 |

(5,794,902) |

|

(26,204,116) |

|

Developer Contributions - Section 7.12 |

97,487 |

(32,500) |

134,012 |

|

198,999 |

|

Developer Contributions – S/Water DSP S64 |

(6,551,347) |

2,579,329 |

(1,276,930) |

|

(5,248,947) |

|

Sewer Fund |

(31,115,819) |

155,636 |

6,230,376 |

319,711 |

(24,410,096) |

|

Solid Waste |

(21,521,767) |

2,164,970 |

(1,836,399) |

|

(21,193,196) |

|

Specific Purpose Grants |

(4,044,299) |

0 |

4,044,299 |

|

0 |

|

SRV Levee |

(3,853,286) |

(3,211) |

1,708,696 |

|

(2,147,801) |

|

Stormwater Levy |

(3,699,109) |

2,758,808 |

(2,199,103) |

|

(3,139,404) |

|

Total Externally Restricted |

(94,524,428) |

11,050,106 |

1,010,050 |

319,711 |

(82,144,561) |

|

|

|

||||

|

Internally Restricted |

|

||||

|

Airport |

(442,321) |

(522,440) |

(43,496) |

43,350 |

(964,907) |

|

Art Gallery |

(33,971) |

(6,865) |

0 |

(40,836) |

|

|

Ashmont Community Facility |

(7,500) |

(1,500) |

0 |

(9,000) |

|

|

Bridge Replacement |

(601,972) |

0 |

(601,972) |

||

|

CBD Carparking Facilities |

(884,968) |

110,302 |

666,796 |

(107,870) |

|

|

CCTV |

(84,476) |

18,000 |

0 |

(66,476) |

|

|

Cemetery Perpetual |

(107,717) |

(133,730) |

16,519 |

(224,928) |

|

|

Cemetery |

(448,951) |

110,164 |

(47,707) |

(386,494) |

|

|

Civic Theatre Operating |

(125,471) |

8,327 |

20,913 |

(96,231) |

|

|

Civic Theatre Technical Infrastructure |

(82,706) |

10,000 |

65,000 |

(7,706) |

|

|

Civil Projects |

(155,883) |

24,000 |

(10,133) |

(142,016) |

|

|

Community Amenities |

(76,763) |

(214,928) |

25,000 |

(266,691) |

|

|

Community Works |

(86,412) |

(32,217) |

63,020 |

|

(55,609) |

|

Council Election |

(343,408) |

(83,163) |

0 |

(426,571) |

|

|

Economic Development |

(500,000) |

(80,000) |

90,000 |

(490,000) |

|

|

Emergency Events |

(191,160) |

(50,000) |

90,420 |

|

(150,740) |

|

Employee Leave Entitlements |

(3,585,224) |

|

0 |

|

(3,585,224) |

|

Environmental Conservation |

(115,206) |

|

(42,725) |

|

(157,931) |

|

Estella Community Centre |

(230,992) |

|

0 |

|

(230,992) |

|

Family Day Care |

(245,192) |

93,442 |

0 |

|

(151,750) |

|

Fit for the Future |

(1,785,102) |

266,703 |

(3,054,537) |

|

(4,572,935) |

|

Generic Projects Saving |

(816,377) |

20,000 |

31,130 |

|

(765,248) |

|

Glenfield Community Centre |

(21,704) |

(2,000) |

0 |

|

(23,704) |

|

Grants Commission |

(5,256,259) |

|

5,256,259 |

|

0 |

|

Grassroots Cricket |

(70,992) |

|

0 |

|

(70,992) |

|

Gravel Pit Restoration |

(797,002) |

|

3,546 |

|

(793,456) |

RESERVES SUMMARY

|

|||||

|

31 MARCH 2020 |

|||||

|

|

CLOSING BALANCE 2018/19 |

ADOPTED RESERVE TRANSFERS 2019/20 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 30.3.2020 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

Gurwood Street Property |

(50,454) |

|

0 |

|

(50,454) |

|

Hampden Bridge |

(107,198) |

|

107,198 |

|

0 |

|

Information Services |

(775,938) |

(222,792) |

222,315 |

|

(776,415) |

|

Infrastructure Replacement |

(335,497) |

(30,192) |

0 |

|

(365,689) |

|

Insurance Variations |

(100,246) |

|

0 |

|

(100,246) |

|

Internal Loans |

(660,754) |

260,962 |

(1,910,123) |

|

(2,309,915) |

|

Lake Albert Improvements |

(28,338) |

(21,515) |

(158,608) |

|

(208,461) |

|

LEP Preparation |

(2,667) |

|

0 |

|

(2,667) |

|

Livestock Marketing Centre |

(3,311,635) |

972,792 |

(2,367,862) |

|

(4,706,704) |

|

Museum Acquisitions |

(39,378) |

|

0 |

|

(39,378) |

|

Oasis Building Renewal |

(320,759) |

65,000 |

28,529 |

|

(227,230) |

|

Oasis Plant |

(1,239,132) |

857,486 |

(441,652) |

|

(823,298) |

|

Office Equipment/Building Projects |

(159,030) |

|

156,530 |

|

(2,500) |

|

Parks & Recreation Projects |

(206,102) |

30,148 |

136,954 |

|

(39,000) |

|

Planning Legals |

0 |

(40,000) |

0 |

|

(40,000) |

|

Plant Replacement |

(3,550,033) |

660,253 |

1,055,919 |

|

(1,833,861) |

|

Playground Equipment Replacement |

(95,290) |

(165,727) |

0 |

|

(261,017) |

|

Project Carryovers |

(2,453,184) |

518,327 |

1,934,858 |

|

0 |

|

Public Art |

(198,922) |

30,300 |

45,594 |

|

(123,028) |

|

Robertson Oval Redevelopment |

(92,151) |

|

0 |

|

(92,151) |

|

Senior Citizens Centre |

(17,627) |

(2,000) |

0 |

|

(19,627) |

|

Sister Cities |

(46,328) |

(10,000) |

0 |

|

(56,328) |

|

Sporting Event Attraction |

(169,421) |

|

110,000 |

|

(59,421) |

|

Sporting Event Operational |

(100,000) |

|

0 |

|

(100,000) |

|

Stormwater Drainage |

(158,242) |

(100,000) |

50,000 |

|

(208,242) |

|

Strategic Real Property |

0 |

|

(395,000) |

|

(395,000) |

|

Street Lighting Replacement |

(56,549) |

|

43,288 |

|

(13,261) |

|

Subdivision Tree Planting |

(702,868) |

(20,000) |

90,000 |

|

(632,868) |

|

Sustainable Energy |

(527,244) |

389,333 |

(43,545) |

|

(181,456) |

|

Unexpended External Loans |

(431,337) |

|

36,485 |

|

(394,852) |

|

Workers Compensation |

(93,251) |

|

(133,461) |

|

(226,712) |

|

Total Internally Restricted |

(33,127,305) |

2,706,471 |

1,697,423 |

43,350 |

(28,680,062) |

|

|

|

|

|

|

|

|

Total Restricted |

(127,651,734) |

13,756,577 |

2,707,473 |

363,061 |

(110,824,623) |

|

|

|

|

|

|

|

|

Total Unrestricted |

(5,725,794) |

0 |

0 |

0 |

(5,725,794) |

|

|

|

|

|

|

|

|

Total Cash, Cash Equivalents and Investments |

(133,377,528) |

13,756,577 |

2,707,473 |

363,061 |

(116,550,417) |

Investment Summary as at 31 March 2020

In accordance with Regulation 212 of the Local Government (General) Regulation 2005, details of Wagga Wagga City Council’s external investments are outlined below:

|

Institution |

Rating |

Closing Balance |

Closing Balance |

March |

March |

Investment |

Maturity |

Term |

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

AMP |

BBB+ |

2,000,000 |

2,000,000 |

2.10% |

1.40% |

2/12/2019 |

1/06/2020 |

6 |

|

AMP |

BBB+ |

1,000,000 |

1,000,000 |

2.00% |

0.70% |

13/11/2019 |

11/05/2020 |

6 |

|

AMP |

BBB+ |

1,000,000 |

1,000,000 |

2.10% |

0.70% |

2/12/2019 |

1/06/2020 |

6 |

|

MyState |

BBB |

1,000,000 |

1,000,000 |

2.75% |

0.70% |

1/04/2019 |

1/04/2020 |

12 |

|

NAB |

AA- |

1,000,000 |

0 |

0.00% |

0.00% |

28/08/2019 |

3/03/2020 |

6 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.67% |

0.70% |

29/08/2019 |

28/08/2020 |

12 |

|

NAB |

AA- |

2,000,000 |

0 |

0.00% |

0.00% |

30/08/2019 |

6/03/2020 |

6 |

|

Macquarie Bank |

A+ |

2,000,000 |

0 |

0.00% |

0.00% |

2/09/2019 |

2/03/2020 |

6 |

|

NAB |

AA- |

1,000,000 |

1,000,000 |

1.70% |

0.70% |

10/09/2019 |

11/05/2020 |

8 |

|

Macquarie Bank |

A+ |

0 |

1,000,000 |

1.65% |

0.70% |

9/03/2020 |

7/09/2020 |

6 |

|

Total Short Term Deposits |

|

12,000,000 |

8,000,000 |

2.01% |

5.59% |

|

|

|

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

1,308,795 |

601,301 |

0.25% |

0.42% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

2,034,934 |

2,034,801 |

0.25% |

1.42% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

14,988,976 |

17,004,874 |

1.60% |

11.89% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

18,332,705 |

19,640,976 |

1.42% |

13.73% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

RaboBank |

A+ |

1,000,000 |

1,000,000 |

3.16% |

0.70% |

5/06/2017 |

6/06/2022 |

60 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.10% |

1.40% |

7/07/2017 |

7/07/2020 |

36 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

3.20% |

0.70% |

25/08/2016 |

25/08/2021 |

60 |

|

Westpac |

AA- |

3,000,000 |

3,000,000 |

1.65% |

2.10% |

10/03/2017 |

10/03/2022 |

60 |

|

Auswide |

BBB |

2,000,000 |

2,000,000 |

2.95% |

1.40% |

5/10/2018 |

6/10/2020 |

24 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.35% |

1.40% |

3/01/2018 |

4/01/2022 |

48 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

3.05% |

1.40% |

29/10/2018 |

29/10/2020 |

24 |

|

Australian Military Bank |

BBB+ |

1,000,000 |

1,000,000 |

2.95% |

0.70% |

29/05/2018 |

29/05/2020 |

24 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

3.50% |

0.70% |

1/06/2018 |

1/06/2022 |

48 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

3.02% |

1.40% |

28/06/2018 |

28/06/2021 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

2.88% |

1.40% |

28/06/2018 |

29/06/2020 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

2.86% |

1.40% |

16/08/2018 |

17/08/2020 |

24 |

|

BOQ |

BBB+ |

3,000,000 |

3,000,000 |

3.25% |

2.10% |

28/08/2018 |

29/08/2022 |

48 |

|

ING Bank |

A |

3,000,000 |

3,000,000 |

2.85% |

2.10% |

30/08/2018 |

14/09/2020 |

24 |

|

P&N Bank |

BBB |

1,000,000 |

1,000,000 |

3.10% |

0.70% |

16/10/2018 |

18/10/2021 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

3.05% |

1.40% |

13/11/2018 |

15/11/2021 |

36 |

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

3.07% |

0.70% |

20/11/2018 |

20/11/2020 |

24 |

|

P&N Bank |

BBB |

1,000,000 |

1,000,000 |

3.30% |

0.70% |

20/11/2018 |

21/11/2022 |

48 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

2.93% |

1.40% |

29/11/2018 |

30/11/2020 |

24 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

3.01% |

1.40% |

30/11/2018 |

30/11/2021 |

36 |

|

Bendigo-Adelaide |

BBB+ |

1,000,000 |

1,000,000 |

3.25% |

0.70% |

30/11/2018 |

30/11/2022 |

48 |

|

CUA |

BBB |

2,000,000 |

2,000,000 |

3.02% |

1.40% |

5/12/2018 |

7/12/2020 |

24 |

|

Newcastle Permanent |

BBB |

2,000,000 |

2,000,000 |

3.05% |

1.40% |

8/02/2019 |

8/02/2022 |

36 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

2.82% |

0.70% |

22/02/2019 |

22/02/2021 |

24 |

|

Newcastle Permanent |

BBB |

2,000,000 |

2,000,000 |

2.70% |

1.40% |

23/04/2019 |

26/04/2022 |

36 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

2.40% |

0.70% |

22/05/2019 |

23/05/2022 |

36 |

|

Institution |

Rating |

Closing Balance |

Closing Balance |

March |

March |

Investment |

Maturity |

Term |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

2.15% |

0.70% |

8/07/2019 |

10/07/2023 |

48 |

|

Judo Bank |

NR |

1,000,000 |

1,000,000 |

2.30% |

0.70% |

16/07/2019 |

16/07/2021 |

24 |

|

Auswide |

BBB |

1,000,000 |

1,000,000 |

1.95% |

0.70% |

12/08/2019 |

12/08/2022 |

36 |

|

Judo Bank |

NR |

1,000,000 |

1,000,000 |

2.15% |

0.70% |

20/08/2019 |

19/08/2021 |

24 |

|

Australian Military Bank |

BBB+ |

1,000,000 |

1,000,000 |

1.76% |

0.70% |

20/08/2019 |

20/08/2021 |

24 |

|

Judo Bank |

NR |

1,000,000 |

1,000,000 |

1.90% |

0.70% |

10/09/2019 |

9/09/2022 |

36 |

|

Auswide |

BBB |

1,000,000 |

1,000,000 |

1.72% |

0.70% |

3/10/2019 |

4/10/2022 |

36 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

2.03% |

1.40% |

6/11/2019 |

6/11/2024 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.83% |

1.40% |

28/11/2019 |

28/11/2024 |

60 |

|

Judo Bank |

NR |

1,000,000 |

1,000,000 |

2.20% |

0.70% |

5/12/2019 |

3/12/2021 |

24 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.75% |

0.70% |

6/01/2020 |

8/01/2024 |

48 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

2.00% |

0.70% |

28/02/2020 |

28/02/2025 |

60 |

|

ING Bank |

A |

0 |

2,000,000 |

1.50% |

1.40% |

2/03/2020 |

2/03/2022 |

24 |

|

Macquarie Bank |

A+ |

0 |

2,000,000 |

1.40% |

1.40% |

9/03/2020 |

9/03/2022 |

24 |

|

Total Medium Term Deposits |

|

59,000,000 |

63,000,000 |

2.62% |

44.04% |

|

|

|

|

Floating Rate Notes - Senior Debt |

|

|

|

|

|

|

|

|

|

AMP |

BBB+ |

1,002,824 |

1,002,668 |

BBSW + 135 |

0.70% |

24/05/2016 |

24/05/2021 |

60 |

|

Suncorp-Metway |

A+ |

1,008,935 |

1,001,515 |

BBSW + 97 |

0.70% |

16/08/2017 |

16/08/2022 |

60 |

|

Bendigo-Adelaide |

BBB+ |

504,563 |

498,912 |

BBSW + 105 |

0.35% |

25/01/2018 |

25/01/2023 |

60 |

|

Newcastle Permanent |

BBB |

1,519,739 |

1,507,412 |

BBSW + 140 |

1.05% |

6/02/2018 |

6/02/2023 |

60 |

|

Westpac |

AA- |

2,021,851 |

1,991,697 |

BBSW + 83 |

1.39% |

6/03/2018 |

6/03/2023 |

60 |

|

UBS |

A+ |

2,018,940 |

2,000,138 |

BBSW + 90 |

1.40% |

8/03/2018 |

8/03/2023 |

60 |

|

Heritage Bank |

BBB+ |

1,413,439 |

1,402,747 |

BBSW + 123 |

0.98% |

29/03/2018 |

29/03/2021 |

36 |

|

ME Bank |

BBB |

1,613,270 |

1,610,084 |

BBSW + 127 |

1.13% |

17/04/2018 |

16/04/2021 |

36 |

|

ANZ |

AA- |

2,020,818 |

1,997,684 |

BBSW + 90 |

1.40% |

9/05/2018 |

9/05/2023 |

60 |

|

NAB |

AA- |

2,019,601 |

1,997,722 |

BBSW + 90 |

1.40% |

16/05/2018 |

16/05/2023 |

60 |

|

CBA |

AA- |

2,023,042 |

1,996,854 |

BBSW + 93 |

1.40% |

16/08/2018 |

16/08/2023 |

60 |

|

Bank Australia |

BBB |

754,345 |

753,953 |

BBSW + 130 |

0.53% |

30/08/2018 |

30/08/2021 |

36 |

|

CUA |

BBB |

607,647 |

602,644 |

BBSW + 125 |

0.42% |

6/09/2018 |

6/09/2021 |

36 |

|

AMP |

BBB+ |

1,505,192 |

1,495,373 |

BBSW + 108 |

1.05% |

10/09/2018 |

10/09/2021 |

36 |

|

NAB |

AA- |

2,027,483 |

1,990,559 |

BBSW + 93 |

1.39% |

26/09/2018 |

26/09/2023 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,008,076 |

1,003,012 |

BBSW + 101 |

0.70% |

19/10/2018 |

19/01/2022 |

39 |

|

CBA |

AA- |

3,061,077 |

3,015,288 |

BBSW + 113 |

2.11% |

11/01/2019 |

11/01/2024 |

60 |

|

Westpac |

AA- |

3,060,611 |

3,010,485 |

BBSW + 114 |

2.10% |

24/01/2019 |

24/04/2024 |

63 |

|

ANZ |

AA- |

2,543,143 |

2,505,504 |

BBSW + 110 |

1.75% |

8/02/2019 |

8/02/2024 |

60 |

|

NAB |

AA- |

2,027,829 |

1,998,177 |

BBSW + 104 |

1.40% |

26/02/2019 |

26/02/2024 |

60 |

|

Bank of China Australia |

A |

1,511,450 |

1,496,188 |

BBSW + 100 |

1.05% |

17/04/2019 |

17/10/2022 |

42 |

|

Westpac |

AA- |

2,520,608 |

2,473,267 |

BBSW + 88 |

1.73% |

16/05/2019 |

16/08/2024 |

63 |

|

Suncorp-Metway |

A+ |

1,252,058 |

1,231,837 |

BBSW + 78 |

0.86% |

30/07/2019 |

30/07/2024 |

60 |

|

ANZ |

AA- |

2,006,085 |

1,968,443 |

BBSW + 77 |

1.38% |

29/08/2019 |

29/08/2024 |

60 |

|

HSBC |

AA- |

2,511,111 |

2,441,988 |

BBSW + 83 |

1.71% |

27/09/2019 |

27/09/2024 |

60 |

|

Bank Australia |

BBB |

1,506,263 |

1,483,516 |

BBSW + 90 |

1.04% |

2/12/2019 |

2/12/2022 |

36 |

|

ANZ |

AA- |

1,504,711 |

1,471,869 |

BBSW + 76 |

1.03% |

16/01/2020 |

16/01/2025 |

60 |

|

NAB |

AA- |

2,006,766 |

1,962,968 |

BBSW + 77 |

1.37% |

21/01/2020 |

21/01/2025 |

60 |

|

Newcastle Permanent |

BBB |

1,104,086 |

1,084,532 |

BBSW + 112 |

0.76% |

4/02/2020 |

4/02/2025 |

60 |

|

Macquarie Bank |

A+ |

2,001,797 |

1,948,743 |

BBSW + 84 |

1.36% |

12/02/2020 |

12/02/2025 |

60 |

|

Total Floating Rate Notes - Senior Debt |

|

51,687,360 |

50,945,778 |

|

35.62% |

|

|

|

|

Institution |

Rating |

Closing Balance |

Closing Balance |

March |

March |

Investment |

Maturity |

Term |

|

Managed Funds |

|

|

|

|

|

|

|

|

|

NSW Tcorp |

NR |

1,602,227 |

1,449,575 |

-9.53% |

1.01% |

17/03/2014 |

1/03/2025 |

131 |

|

Total Managed Funds |

|

1,602,227 |

1,449,575 |

-9.53% |

1.01% |

|

|

|

|

TOTAL

CASH ASSETS, CASH |

|

142,622,293 |

143,036,329 |

|

100.00% |

|

|

|

|

LESS: RIVERINA REGIONAL LIBRARY (RRL) CASH AT BANK |

|

3,929,595 |

3,685,861 |

|

|

|

|

|

|

TOTAL

WWCC CASH ASSETS, CASH |

|

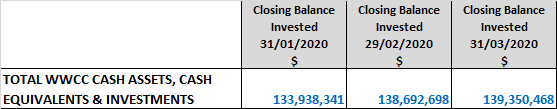

138,692,698 |

139,350,468 |

|

|

|

|

|

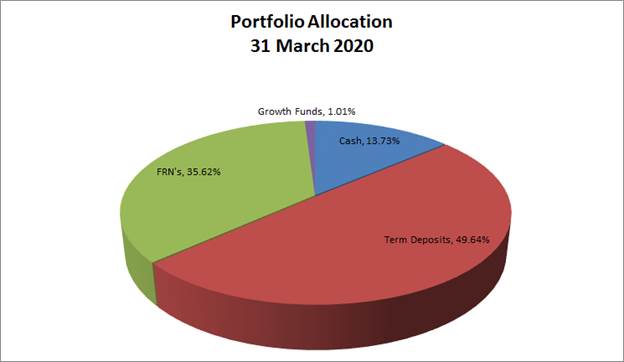

Council’s investment portfolio is dominated by Term Deposits, equating to approximately 50% of the portfolio across a broad range of counterparties. Cash equates to 14%, with Floating Rate Notes (FRNs) around 35% and growth funds around 1% of the portfolio.

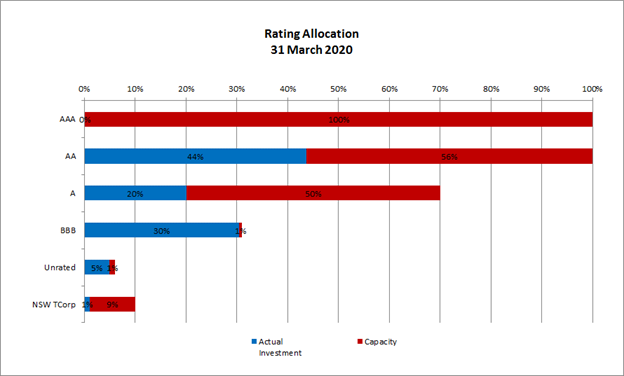

Council’s investment portfolio is well diversified in complying assets across the entire credit spectrum. It is also well diversified from a rating perspective. Credit quality is diversified and is predominately invested amongst the investment grade Authorised Deposit-Taking Institutions (ADIs) (being BBB- or higher), with a smaller allocation to unrated ADIs.

All investments are within the defined Policy limits, as outlined in the Rating Allocation chart below:

Investment Portfolio Balance

Monthly Investment Movements

Redemptions/Sales – Council redeemed/sold the following investment securities during March 2020:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

$1M |

6 months |

1.67% |

This term deposit was redeemed on maturity and funds were reinvested into a new 5-yr BoQ term deposit, purchased in late February 2020. |

|

|

NAB Term Deposit |

$2M |

6 months |

1.65% |

This term deposit was redeemed on maturity due to poor reinvestment rates. |

|

Macquarie Bank Term Deposit |

$2M |

6 months |

1.75% |

This term deposit was redeemed on maturity and funds were reinvested into a new 2-yr ING Bank term deposit (see below). |

New Investments – Council purchased the following investment securities during March 2020:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

Macquarie Bank Term Deposit |

$1M |

6 months |

1.65% |

The Macquarie Bank rate of 1.65% compared favourably to the rest of the market for this investment term. |

|

ING Bank Term Deposit |

$2M |

2 years |

1.50% |

The ING rate of 1.50% compared favourably to the rest of the market for this investment term. This term was chosen to allow Council to lock in an attractive longer-term rate, given the likelihood of further interest rate cuts. |

|

Macquarie Bank Term Deposit |

$2M |

2 years |

1.40% |

The Macquarie Bank rate of 1.40% compared favourably to the rest of the market for this investment term. This term was chosen to allow Council to lock in an attractive longer-term rate, following the first interest rate cut in March 2020. |

Rollovers – Council did not rollover any investment securities during March 2020.

Monthly Investment Performance

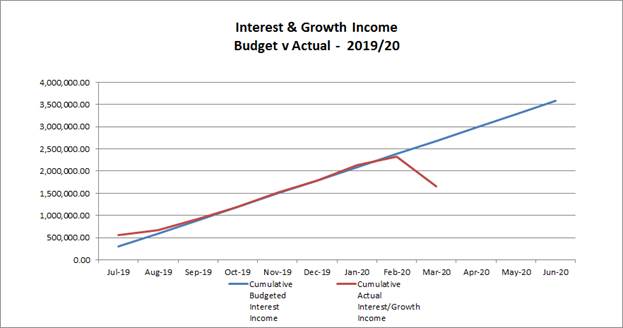

Interest/growth/capital gains/(losses) for the month totalled ($660,049), which compares unfavourably with the budget for the period of $298,250 - underperforming budget for the month by $958,299.

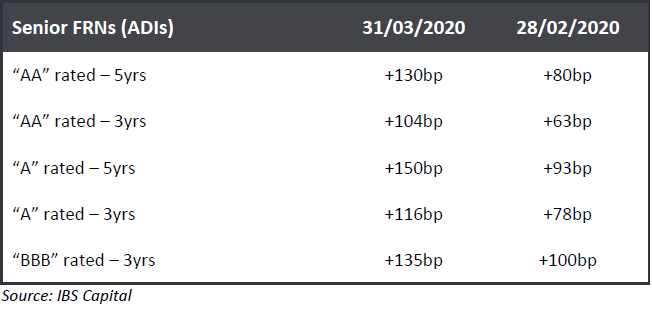

Council’s underperformance to budget for March was mainly due to a negative movement in the principal value of its Floating Rate Note (FRN) portfolio. During the month, the principal value of Council’s FRN portfolio fell by $758,917 (or -1.47%) as trading margins on these securities widened significantly – as can be seen from the below table.

It is worth noting that these investment securities are senior ranking assets and high in the bank capital structure. It is expected that, if held to maturity, these FRN’s will pay back the original face value of the investment whilst Council still receives its quarterly interest payments. Therefore, it is not expected that Council will lose any capital or interest payments from its current holdings within its FRN portfolio.

Council’s TCorp Long Term Growth fund (LTGF) also experienced a negative return, with the fund returning -9.53% (or -$152,653) for the month as both domestic and international equities suffered a strong selloff due to ongoing concerns from COVID-19. Global and domestic shares fell -13.19% and -20.65% respectively, the worst quarter performances since 1987.

As can be seen in the above graph, Council interest on investments has taken a significant hit due to the movements in Councils FRN portfolio and TCorp LTGF. It should be noted that at the time of writing this report, Council has seen a rebound in the principal value of its FRN portfolio – up approximately $209K for the first half of April 2020.

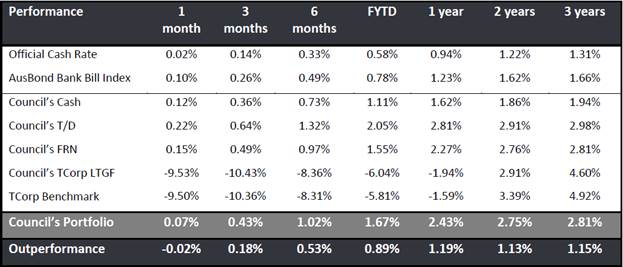

In comparison to the AusBond Bank Bill Index* (1.23%), Council’s investment portfolio returned 0.84% (annualised) for March – excluding the negative movement for Council’s FRN portfolio. Cash and At-Call accounts returned 1.44% (annualised) for this period. These funds are utilised for daily cash flow management and need to be available to meet operating and contractual payments as they fall due.

Over the past year, Councils investment portfolio has returned 2.43%, outperforming the AusBond Bank Bill index by 1.19%.

* The AusBond Bank Bill Index is the leading benchmark for the Australian fixed income market. It is interpolated from the RBA Cash rate, 1 month and 3 month Bank Bill Swap rates.

Please note that the above performance table does not take into account the negative movement from Councils FRN portfolio for the month of March due to the fact that Council does not expect to lose any of the capital value of these investments.

Council’s Independent Financial Advisor, Imperium Markets, will be presenting to Council’s Audit, Risk and Improvement Committee at its 7 May 2020 meeting where Councillors will also be invited to attend.

Report by Responsible Accounting Officer

I hereby certify that all of the above investments have been made in accordance with the provision of Section 625 of the Local Government Act 1993 and the regulations there under, and in accordance with the Investments Policy adopted by Council on 29 April 2019.

Carolyn Rodney

Responsible Accounting Officer

Policy and Legislation

Budget variations are reported in accordance with Council’s POL 052 Budget Policy.

Investments are reported in accordance with Council’s POL 075 Investment Policy.

Local Government Act 1993

Section 625 - How may councils invest?

Local Government (General) Regulation 2005

Section 212 - Reports on council investments

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

This report is a control mechanism that assists in addressing the following potential risks to Council:

· Loss of investment income or capital resulting from ongoing management of investments, especially during difficult economic times

· Failure to demonstrate to the community that its funds are being expended in an efficient and effective manner

Internal / External Consultation

All relevant areas within the Council have consulted with the Finance Division in relation to the budget variations listed in this report.

The Finance Division has consulted with relevant external parties to confirm Council’s investment portfolio balances.

|

Report submitted to the Ordinary Meeting of Council on Monday 27 April 2020 |

RP-2 |

RP-2 Community Tenant Abatements

Author: Dianne Wright

Director: Michael Keys

|

Summary: |

This report concerns a proposal to credit licence fees or rents to locally based, independent not for profit community groups affected by restrictions or closures brought about by the COVID-19 pandemic.

|

|

That Council:

a note the considerable current and future financial impact the community is facing in light of the COVID-19 pandemic b agree to provide rent reductions to the tenants identified in the attachment of this report representing one quarter of their current annual rent or licence fee c review rent reductions after 1 June 2020 on a monthly basis d in accordance with Section 356 of the Local Government Act 1993, approve in principle the financial assistance to the tenants listed in this report e give public notice of the assistance pursuant to Section 356 of the Local Government Act 1993, which is in good faith for the community f note the provisions of Section 356 of the Local Government Act 1993 legislation and acknowledge departures due to the unforeseen impacts of COVID-19 and the urgency of the situation g approve the budget variation/s as detailed in the financial implications section of the report, in the event the assistance is confirmed without further consideration by Council |

Report

The impacts of COVID-19 are affecting our community on all levels.

The activities and operations, including fund-raising events and associated actions, of community organisations are directly impacted by Government restrictions on non-essential business, social distancing measures and isolation measures. For example, local AFL and Netball clubs are not able to continue their normal activities or organise events / functions.

These groups provide a significant benefit to the wider community and region. Their ongoing survival and capacity to deliver and offer their services is largely dependant on volunteers and fundraising activities. Acknowledging this and the financial pressures that will be felt by these groups due to the restrictions of Covid 19 it is recommended that Council take a proactive approach and provide financial relief to these organisations.

Council as the landlord of a range of community sites and buildings has the opportunity to provide rent relief to community groups affected by the COVID-19.

The attached schedule identifies approximately 55 local, independent, not for profit groups who are ineligible for government funding or COVID-19 assistance packages. These tenants represent approximately 60% of Council’s community portfolio with the remainder comprising government funded education, social welfare or medical organisations and national organisations. Some have already approached Council requesting relief from the obligation to pay rent or licence fees.

It is recommended that Council agree to a rent or licence fee reduction equivalent to one quarter of the applicable annual rent or licence fee. Depending on the tenants’ anniversary this may result in a credit or refund.

A further review will be undertaken in June 2020 or in response to a direct request for assistance from a particular community group.

Financial Implications

The attachment to this report notes a $11,342.63 (GST inclusive) proposed credits/refunds across 54 sporting or cultural groups. The funding source for the credits/refunds is proposed to be the Travers Street environmental investigation (job 18924) job which is no longer required this financial year.

Policy and Legislation

Leasing & Licensing Policy 038

Local Government Act

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

Council may receive further requests for rent concessions from community groups not identified by this report. This abatement may create additional expectations from other tenants or ratepayers. These requests would be dealt with on request based on the specific circumstances. The recommendation is a proactive approach in recognition of the existing and potential impacts on these important not for profit community organisations.

Internal / External Consultation

Council has undertaken consultation with the City Strategy Division (Parks Strategic) and Council’s Community Directorate (Social Planning)

The proposal to provide financial assistance is subject to a requirement to undertake public notice in accordance with sections 356, 610 E and 610 F of the Local Government Act 1993.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

1⇩. |

Non-Profit Tenants - Rate Concession |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 27 April 2020 |

RP-3 |

RP-3 UPDATED TERMS OF REFERENCE - Floodplain Risk Management Advisory Committee

Author: Peter Ross

Director: Caroline Angel

|

Summary: |

This report seeks Council endorsement of the revised Floodplain Risk Management Advisory Committee Terms of Reference. |

|

That Council: a note this report and its update on the February Floodplain Risk Management Advisory Committee (FRMAC) b endorse the attached revised Terms of Reference for the FRMAC |

Report

At its meeting on 4 February 2020, the Floodplain Risk Management Advisory Committee (FRMAC) considered both:

a. a proposal to change the composition of community member representation on the Committee, and

b. amendments to the FRMAC Terms of Reference to align the Council’s policy and current organisation structure.

The Committee elected to retain the current composition of community member representation, namely four community members with voting rights. The Committee did not support a request to add an additional position on the Committee dedicated to a representative from North Wagga Wagga.

The Committee endorsed a recommendation to amend the Terms of Reference to ensure consistency with the Appointment of Organisation, Community and Individual Citizen Members to Council Committees Policy (POL 117), namely that the Terms of Reference ‘be amended to reflect the extended duration of the Committee for not more than six months following the Local Government Election.’

In addition to this substantive change, the Committee recommended the following additional changes to the draft Terms of Reference:

a. clause 5 Membership, point (2) to include “NSW” State Emergency Service

b. clause 5 Membership, point (2) to update NSW Office of Environment and Heritage and NSW Department of Planning to the Department of Planning, Industry and Environment

c. clause 9 Chairperson and Deputy Chairperson, point (1) to change to the ‘bi annual’ election of Mayor

Financial Implications

N/A

Policy and Legislation

Appointment of Organisation, Community and Individual Citizen Members to Council Committees Policy (POL 117)

Floodplain Risk Management Advisory Committee Terms of Reference

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We are informed and involved in decision making

Outcome: Everyone in our community feels they have been heard and understood

Risk Management Issues for Council

N/A

Internal / External Consultation

Council sought feedback on the draft TOR from the members of the FRMAC.

|

1⇩. |

Floodplain Risk Management Advisory Committee Terms of Reference February 2020 |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 27 April 2020 |

M-1 |

M-1 FLOODPLAIN RISK MANAGEMENT ADVISORY COMMITTEE - MINUTES - February & March 2020

Author: Peter Ross

Director: Caroline Angel

|

Summary: |

The Floodplain Risk Management Advisory Committee met on 4 February and 17 March 2020 |

|

That Council note the minutes of the Floodplain Risk Management Advisory Committee meetings held on 4 February and 17 March 2020. |

Report

The Floodplain Risk Management Advisory Committee met on 4 February 2020 and again, in a special meeting and workshop, on 17 March 2020. The minutes from both meetings are attached for Councillors’ reference.

Financial Implications

N/A

Policy and Legislation

N/A

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We are informed and involved in decision making

Outcome: Everyone in our community feels they have been heard and understood

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

1⇩. |

Floodplain Risk Management Advisory Committee minutes - 17 March 2020 |

|

|

2⇩. |

Floodplain Risk Management Advisory Committee minutes - 4 February 2020 |

|

Reports submitted to the Ordinary Meeting of Council to be held on Monday 27 April 2020.

|

Report submitted to the Confidential Meeting of Council on Monday 27 April 2020 |

CONF-1 |

CONF-1 Estella School and Northern Sporting Precint Update

Author: Ben Creighton

Director: Michael Keys

This report is CONFIDENTIAL in accordance with Section 10A(2) of the Local Government Act 1993, which permits the meeting to be closed to the public for business relating to the following: -

(d) (i) commercial information of a confidential nature that would, if disclosed, prejudice the commercial position of the person who supplied it.

|

Report submitted to the Confidential Meeting of Council on Monday 27 April 2020 |

CONF-2 |

Author: Dianne Wright

Director: Michael Keys

This report is CONFIDENTIAL in accordance with Section 10A(2) of the Local Government Act 1993, which permits the meeting to be closed to the public for business relating to the following: -

(b) discussion in relation to the personal hardship of a resident or ratepayer.

|

Report submitted to the Confidential Meeting of Council on Monday 27 April 2020 |

CONF-3 |

CONF-3 RFQ2020-538 ACTIVE TRAVEL PLAN CYCLE WAY CONSTRUCTION

Author: Rupesh Shah

Director: Caroline Angel

This report is CONFIDENTIAL in accordance with Section 10A(2) of the Local Government Act 1993, which permits the meeting to be closed to the public for business relating to the following: -

(d) (i) commercial information of a confidential nature that would, if disclosed, prejudice the commercial position of the person who supplied it.

|

Report submitted to the Confidential Meeting of Council on Monday 27 April 2020 |

CONF-4 |

CONF-4 RFT2020-27 STORMWATER, SEWER TRUNK MAINS AND DETENTION BASINS

Author: Peter Ross

Director: Caroline Angel

This report is CONFIDENTIAL in accordance with Section 10A(2) of the Local Government Act 1993, which permits the meeting to be closed to the public for business relating to the following: -

(d) (i) commercial information of a confidential nature that would, if disclosed, prejudice the commercial position of the person who supplied it.