AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

13 July 2020

AT 6:00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

13 July 2020

AT 6:00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 13 July 2020 at 6:00pm.

Council live streams video and audio of Council meetings. Members of the public are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

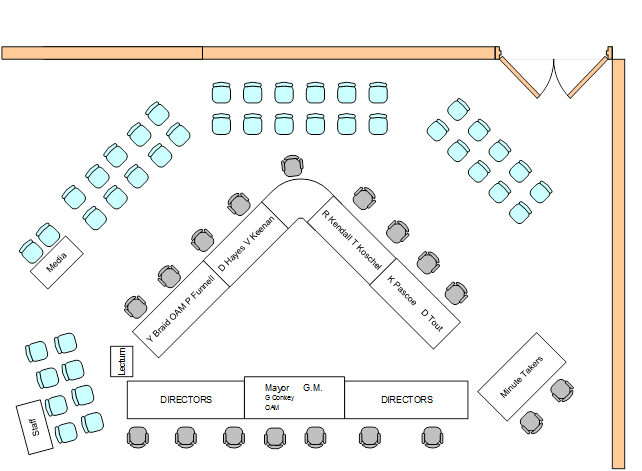

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 13 July 2020.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 13 July 2020

CLAUSE PRECIS PAGE

PRAYER 2

ACKNOWLEDGEMENT OF COUNTRY 2

APOLOGIES 2

Confirmation of Minutes

CM-1 Ordinary Council Meeting - 29 JUNE 2020 2

DECLARATIONS OF INTEREST 2

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - COUNCIL INFORMATION 3

NOM-2 NOTICE OF MOTION - ENFORCEMENT ACTION FOR DA09/0872 5

NOM-3 NOTICE OF MOTION - POPULARLY ELECTED MAYOR 7

Reports from Staff

RP-1 Councillor and Mayoral Remuneration 9

RP-2 COVID-19 Relief Package 14

RP-3 Mobile food vendor permits 26

RP-4 PROPOSED ACQUISITION OF LAND AT THE GAP FOR ROAD PURPOSES 30

RP-5 PROPOSED APPLICATION FOR CONTROL OF CROWN ROADS - OURA VILLAGE 34

RP-6 PROPOSED COMPULSORY ACQUISITION OF LAND FOR ROAD WIDENING AT FARRER ROAD 38

RP-7 RESPONSE TO QUESTIONS/BUSINESS WITH NOTICE 47

Committee Minutes

M-1 FLOODPLAIN RISK MANAGEMENT ADVISORY COMMITTEE - MINUTES - 2 June 2020 51

QUESTIONS/BUSINESS WITH NOTICE 55

Confidential Reports

CONF-1 PROPOSED RENT WAIVERS UNDER THE MANDATORY CODE OF CONDUCT FOR COMMERCIAL LEASES AFFECTED BY COVID-19 56

PRAYER

CM-1 Ordinary Council Meeting - 29 JUNE 2020

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 29 June 2020 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - Ordinary Meeting of Council - 29 June 2020 |

57 |

|

Report submitted to the Ordinary Meeting of Council on Monday 13 July 2020 |

NOM-1 |

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - COUNCIL INFORMATION

Author: Councillor Tim Koschel

|

Summary: |

The purpose of this notice of motion is to review the management of confidential information held by Councillors and staff. |

|

That Council: a receives a report no later than the last meeting in September 2020 on the leaking of confidential information from workshops and meetings that includes the following: i a review of our current policy on confidential information ii the introduction of an independent investigation into the leaking of confidential information to the media and the community from Councillors and staff b delegate authority to the General Manager to write to the Minister of Local Government expressing disappointment in the procedures and action taken by the Office of Local Government in regards to code of conduct issues |

|

|

Report

It’s becoming more and more apparent to the community and members of council that matters of confidentially are being shared widely in the community. As a Council we are trusted with confidential information and need to ensure that this trust is not broken by elected members and internal staff.

There have been notable breaches this year of information from confidential

council meetings that have shown up on social media as well as confidential

information from workshops being leaked to the media in the following days.

This type of behaviour needs to be addressed by our Mayor, General Manager and

Office of Local Government to ensure the trust of our processes to the

community.

Financial Implications

N/A

Policy and Legislation

Code of Meeting Practice

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 13 July 2020 |

NOM-2 |

NOM-2 NOTICE OF MOTION - ENFORCEMENT ACTION FOR DA09/0872

Author: Councillor Paul Funnell

|

Summary: |

The purpose of this notice of motion is to receive a report regarding the enforcement of conditions of consent for DA09/0872. |

|

That Council receive a report at the 27 July 2020 Council Meeting explaining in detail the non-enforcement of conditions for Development Application number DA09/0872, Rocky Point Quarries |

Report

The condition and situation of Tooyal Road Euberta has been an ongoing issue of consternation for residents of the area since the issuing of consent for the purposes of quarrying in the region.

The most important condition placed on the quarry and its users was the sealing of Tooyal Road. This was driven initially from a safety perspective however also from other factors.

This condition has never been met or enforced, to the point where it appears a duplicitous situation exists and Council is complicit and inconsistent in its dealings with the matter. This to the point where many in the community question the integrity of what is really going on, particularly when the applicant is a major supplier to council for services and yet doesn’t comply with approval conditions themselves, nor is instructed to comply by council.

It is due to this inconsistency and lack of explanation, despite repeated requests from multiple individuals, that has led to this request for a public enquiry and report.

Financial Implications

N/A

Policy and Legislation

Wagga Wagga City Council Code of Meeting Practice

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 13 July 2020 |

NOM-3 |

NOM-3 NOTICE OF MOTION - POPULARLY ELECTED MAYOR

Author: Councillor Paul Funnell

|

Summary: |

The purpose of this notice of motion is to receive a report regarding the processes involved in shifting to a popularly elected Mayor. |

|

That Council receive a report at the 10 August 2020 Council Meeting providing details of the processes involved in potentially shifting to a popularly elected Mayor by the people. |

Report

Members of the public have and do often question me as to why we elect our Mayor the way we do, and why other Local Government Areas have the ability to allow the people to elect their Mayor.

I have simply stated that it is the choice that we as council have made. Some accept that, however the vast majority request that we shift our position and allow the people to choose.

It is in response to that point that we receive a report to set out the process that would be involved to change our position if we so chose. This is not necessarily a position I would hold.

However, this report is simply to set out the process for a ‘popularly elected Mayor’ by the people. Simply put, can it be decided by Council and a request sent to the Minister before the next Council elections or does it have to go to a referendum, what are the costs involved, what is the process etc?

It is important to recognise that this report is not a debate over the merits or held positions of Councillors, it is purely a report to explain the options and processes available and required if so chosen, in the interests of public information and transparency.

Financial Implications

N/A

Policy and Legislation

Wagga Wagga City Council Code of Meeting Practice

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 13 July 2020 |

RP-1 |

RP-1 Councillor and Mayoral Remuneration

Author: Peter Thompson

|

Summary: |

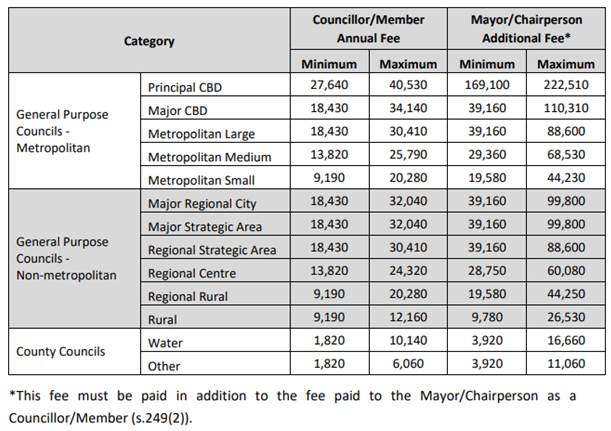

The Local Government Remuneration Tribunal (the Tribunal) recently conducted a review of the existing categorisation model for Councils and explored alternative models. As a result of that review, the Tribunal has created a new category of ‘Regional Centre’ for Non-Metropolitan councils and reclassified Wagga Wagga City Council from a Regional Rural Council to a Regional Centre.

As a result, the maximum allowance for Councillors has increased from $20,280 to $24,320 and the maximum Mayoral allowance has increased from $44,250 to $60,080. For existing categories, the Tribunal determined there would be no increase in the minimum and maximum fees payable, due to the current economic and social circumstances.

The Council has passed a resolution previously which has the effect of adopting the maximum allowance determined by the Tribunal. Given there has been change in classification the matter has been brought before Council to determine if it wishes to take a different approach to the current resolution. |

|

That Council: a determine to continue to pay the Councillors' allowance and Mayoral allowance at the maximum allowable level within the range determined by the NSW Local Government Remuneration Tribunal for the remainder of this term of the Council b approve the budget variation as detailed in the Financial Implications section of the report |

Report

Background

Section 248 of the Local Government Act 1993 (NSW) (the Act) provides that a Council must pay each Councillor an annual fee in accordance with an appropriate determination made by the Tribunal. The respective fees must not exceed the maximum amount as determined by the Tribunal.

In September 2016 Council resolved to pay the Councillors' allowance and Mayoral allowance at the maximum allowable level within the range determined annually by the Tribunal for the current term of this Council. This resolution set the allowance level for the full term of this Council, which has now been extended to September 2021.

Determination

Section 239 of the Act requires the Tribunal to determine the categories of councils and mayoral offices at least once every 3 years. The Tribunal last undertook a significant review of the categories and the allocation of councils into each of those categories in 2017. In accordance with the Act the Tribunal undertook a review of the categories and allocation of councils into each of those categories as part of the 2020 review.

The Tribunal handed down its Annual Report and Determination on 10 June 2020 and determined there will be no increase in the minimum and maximum fees applicable to each existing category, given the current economic and social circumstances.

This financial year, the Tribunal has established a new category - Regional Centre. Wagga Wagga City Council has been included in this new category. As a result of the change a new fee structure has been accordingly allocated to the new category.

Regional Centre

Councils categorised as Regional Centre will typically have a minimum residential population of 40,000.

Other features may include:

· a large city or town providing a significant proportion of the region’s housing and employment

· health services, tertiary education services and major regional airports which service the surrounding and wider regional community

· a full range of high-order services including business, office and retail uses with arts, culture, recreation and entertainment centres

· total operating revenue exceeding $100M per annum

· the highest rates of population growth in regional NSW

· significant visitor numbers to established tourism ventures and major events that attract state and national attention

· a proximity to Sydney which generates economic opportunities.

Councils in the category of Regional Centre are often considered the geographic centre of the region providing services to their immediate and wider catchment communities.

Annual Fee Range

The following table outlines each of the relevant categories and the minimum and maximum allowance for each category.

Financial Implications

Historically, Council has paid Councillors and the Mayor at the maximum amount for the category it is in and consistent with this approach Council is currently paying the maximum amount for Councillor fees in the Regional Rural Category

Payment of the maximum amount to Councillors under the new Regional Centre category will result in a total increase in expenditure of $52,190 when comparing fees for 2019/20 to 2020/21.

Council currently has $236,217 budgeted for 2020/21 and based on maximum payments, Council would be paying allowances/fees of $278,960 – which is an unbudgeted variance of $42,743.

It is proposed that the $42,743 is sourced from two areas, firstly $20,000 from the Mayoral Functions job number 12053 as a result of the reduced number of events that will be held given the COVID-19 restrictions, noting that this currently has an allocation of $40,000 for 2020/21. The remaining amount of $22,743 is proposed to be sourced from the savings in staff salaries that will be achieved as a result of the recent Award increase being 1.5% instead of the 2.5% that was initially factored into the Long-Term Financial Plan.

Policy and Legislation

Councillors don’t receive employment benefits, such as a salary and leave entitlements because they aren’t council employees. Mayors and councillors are entitled to receive an allowance while performing their duty as an elected official, in consideration of the workload, effort and skill in performing their civic role. Mayors receive a larger allowance due to their increased workload and nature of that role, as set out below.

The role of a Councillor is defined in Section 232 of the Act and is as follows:

(a) to be an active and contributing member of the governing body,

(b) to make considered and well-informed decisions as a member of the governing body,

(c) to participate in the development of the integrated planning and reporting framework,

(d) to represent the collective interests of residents, ratepayers and the local community,

(e) to facilitate communication between the local community and the governing body,

(f) to uphold and represent accurately the policies and decisions of the governing body,

(g) to make all reasonable efforts to acquire and maintain the skills necessary to perform the role of a councillor.

The role of the Mayor is defined in section 226 of the Act and is as follows:

(a) to be the leader of the council and a leader in the local community,

(b) to advance community cohesion and promote civic awareness,

(c) to be the principal member and spokesperson of the governing body, including representing the views of the council as to its local priorities,

(d) to exercise, in cases of necessity, the policy-making functions of the governing body of the council between meetings of the council,

(e) to preside at meetings of the council,

(f) to ensure that meetings of the council are conducted efficiently, effectively and in accordance with this Act,

(g) to ensure the timely development and adoption of the strategic plans, programs and policies of the council,

(h) to promote the effective and consistent implementation of the strategic plans, programs and policies of the council,

(i) to promote partnerships between the council and key stakeholders,

(j) to advise, consult with and provide strategic direction to the general manager in relation to the implementation of the strategic plans and policies of the council,

(k) in conjunction with the general manager, to ensure adequate opportunities and mechanisms for engagement between the council and the local community,

(l) to carry out the civic and ceremonial functions of the mayoral office,

(m) to represent the council on regional organisations and at intergovernmental forums at regional, State and Commonwealth level,

(n) In consultation with the councillors, to lead performance appraisals of the general manager,

(o) to exercise any other functions of the council that the council determines.

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We have leaders that represent us

Risk Management Issues for Council

No specific issues identified

Internal / External Consultation

Review of the approach undertaken by other Councils in the new Regional Centre classification took place, although at the time of that consultation a number of councils had not yet adopted the annual fee payable to councillors and the mayor. A workshop was held with Councillors to undertake consultation in relation to the re-classification of Council.

|

Report submitted to the Ordinary Meeting of Council on Monday 13 July 2020 |

RP-2 |

Author: Dominic Kennedy

Director: Michael Keys

|

Summary: |

In response to the challenges COVID-19 has incurred and will continue to have on our local community, Council has developed and is proposing a number of initiatives to mitigate the affects on the local economy.

This report presents an oversight of the initiatives that will complement the Live local. Be local. Activation Plan developed by the Business Support Group, support the development industry local businesses, community organisations and the broader community.

|

|

That Council: a note the initiatives in response to COVID-19 and increase the 2020 Small Business category funding of Council’s Annual Grants Program by $20,000 b reduce seasonal user fees by 50% for 12 months for sporting groups using Council’s facilities and 20% for Multipurpose stadium and Bolton Park stadium c provide rent and licence fee concessions for eligible community, sporting and cultural not for profit groups d implement the National Cabinet Mandatory Code of Conduct – SME Commercial Leasing during COVID-19 e place on public exhibition the three addendums to the Wagga Wagga Local Infrastructure Contributions Plan 2019 -2034, the Wagga Wagga City Council Development Servicing Plan Sewerage Services 2013 and the Wagga Wagga City Council Development Servicing Plan Stormwater 2007 and receive a further report following the public exhibition addressing any submissions made |

|

|

Report

COVID-19 has caused disruption and economic impact that is unapparelled in contemporary times. Global impacts on health, trade and production are leading Australia to our first recession in 30 years. The macro impacts have resulted in substantial decline in Gross Domestic Product and local regional economies are at risk of reduced productivity, consumption and employment availability.

The package supports Wagga Wagga through the following five elements:

1. Small Business support

2. Seasonal user fees for sporting groups

3. Commercial lease agreements - National Cabinet Mandatory Code of Conduct

4. COVID-19 Infrastructure Contributions Relief Package

5. Hardship policy for commercial tenants

Element 1 – Small Business Support

There are over 5,600 businesses in our LGA and 98% of them are considered small business (employing less than 50 staff). As the largest employment sector, small businesses are critical to maintaining a diverse workforce and career pathways for our youth. Although the sector is innovative and well suited to adapting to changing climates small businesses across the economy have been hit hard by the COVID-19 pandemic.

In response to the COVID-19 pandemic and subsequent hit to the local economy, Council brought together the Business Support group. This team of local business leaders provided feedback from the community and insights into how to support the local economy that have been integrated into a Live local. Be local. Activation Plan. The intent of this plan is for it to be a business, community and Council collaborative.

The plan has three main elements including:

1. Main Street Live – We’re bringing vibrancy back to the heart of the city! This component responds to the Notice of Motion for Main Street Events (April, 2018). A schedule of main street activities and events are scheduled for the next 12 months. We plan to catch up on all the fun we’ve missed over the last two months, so check out the event calendar on Visit Wagga and join us in the city.

2. Main Street Local – made great, in Wagga!

Our region has some incredibly talented people that create amazing artwork, make unique products, craft delicious cuisine, and provide award winning service. Eastern Riverina Arts and the business community are looking to make your main street experience even better through the Creative Spaces initiative. We’re filling empty shops with artists to not only showcase the fantastic local art, but also demonstrate the potential of a thriving main street.

3. Main Street Hub – innovation leads to growth

Innovative entrepreneurs have the potential to kick-start the local economy and solve community and industry problems quickly. Our business community is collaborating to create a hub that will help facilitate collaboration and ensure our up-and-coming business leaders have the space and support they need to make their business a reality.

In addition to these three Activation Plan elements being implemented by the broader business community, the following Council-specific initiatives are also being considered in order to encourage economic growth:

a) Small business grants applications for the 2020 Small Business category of Council’s Annual Grants Program have increased by 260% compared to 2019. This increase is due in part to the success of last years program as well as greater awareness via promotion through business and industry networks in response to COVID-19 restrictions. Currently the Program is funded in the amount of at $12,500, it is proposed to increase this funding by $20,000.

The increase will see up to an additional 10 businesses access grant funding. The Program is designed to provide seed funding to small businesses to accelerate their idea or growth opportunity.

This is a positive initiative that can support and encourage new ideas and resilience for small businesses during and following COVID-19

b) Reduction in Council fees for New Businesses in response to a Notice of Motion of deferring costs for deferring charges for new businesses (March 2020), Council Officers have considered a reduction or delay in fees associated with applications for new approvals. A review has indicated that the typical costs are not significant and we have received feedback that more assistance in streamlining the assessment process would be more helpful, such as navigating the various parts of the organisation.

c) Improved Business Support with Council

Greater support for New Business Development Proposals. Council’s Regional Activation Team is working closely with City Development to provide concierge services for some change of use activities within the CBD. Our vision is to simplify processes and guide proponents through process and Council services to enable simple applications to be easier for our customers and reduce the amount of time required to approve development. Council has been identified as a pilot program to leverage from NSW Governments Planning Acceleration Program.

d) Main Street Markets

In response to a Notice of Motion, Council Officers investigated opportunities to better leverage the Main Street for markets and events. Although there is limited local data to quantify the economic value that main street events bring to Wagga’s CBD, the Live local campaign and NSW Street Activation grant will be leveraged to deliver more Main Street events and provide greater insight into their value.

e) Main Street Activation

The Creative Spaces program that Eastern Riverina Arts is managing through a $300,000 grant allows creative industries to activate shops that are vacant through short term occupancy agreement with the intent to convert to a long-term lease.

Council is working with Eastern Riverina Arts to schedule future events/activities once the spaces are ready to occupy to generate activity to CBD of the main street. It should be noted that Council’s initial $4,000 seed investment has been recognised by the Commonwealth as an opportunity, which contributed to Eastern Riverina Arts obtaining $300,000.

Element 2 – Seasonal user fees for sporting groups

Each year approximately 11,000 people register to play sport utilising Council facilities and grounds. Income from sponsorships, fundraising activities and canteens has been significantly reduced across all clubs in 2020. These sporting clubs are integral to the vibrancy and liveability of our city, facilitating healthy lifestyles and encouraging people to be part of community.

Our sporting clubs have assisted Council deliver some of our most important recreational facilities such as Macdonald’s Park, Harris Park and Macpherson Oval, dedicating hours of time to maintenance and renewal, ensuring our reputation as a regional sporting hub and assisting with the delivery of major sporting events such as NRL Premiership Games, AFL preseason games and NSW Touch Carnival

Sportsground user fees are collected from sporting clubs and associations to help offset the ongoing maintenance costs to Council. In 2019 Council received revenue of $258,392 from sportsground user fees. Due to the impact of COVID-19 on the revenue that clubs are able to generate from sponsors, fundraising activities and canteens, it is proposed that this fee be reduced by 50% for the next 12 months. The approximate cost to Council of this proposal would be $129,196.

User groups that access the Multi-Purpose Centre and Bolton Park Stadium pay an hourly fee that incorporates all costs of using the facility, including lighting. It is proposed that these fees are reduced for the regular users by 20% for the next 12 months. The lesser percentage fee reduction is in recognition of the fact that lighting and other costs are included in the hourly rate. The approximate cost to Council of this proposal would be $27,531.

It is not proposed to reduce fees for aquatic sports using the Oasis Regional Aquatic Centre. This is due to the clubs not paying fees to use the facility as the fees are charged directly to the individual users.

Element 3 – Commercial Lease Agreements

A separate report regarding the application of the code to Council’s commercial lease portfolio is included in the confidential section of this Council meeting agenda.

Element 4 – Infrastructure Contributions COVID-19 relief package

The construction industry is the third largest employer in Wagga Wagga at 10% of the workforce and the fourth largest industry of the city, according to the Wagga Wagga Economic Snapshot 2020. At this time in particular an active construction industry producing new lots and dwellings is vital to the economy and business confidence, it shows Wagga Wagga is open for business and remains the economic hub and regional capital of New South Wales.

Development produces demand for infrastructure to support new urban areas and infill locations. The construction cost of this infrastructure is significant with $43 million to be funded by the Section 7.11 Reserve over the next five years for example. This projection assumes a 1.1% or 310 lot growth each year. If development slows this infrastructure may not be required. The construction of this infrastructure injects money into the local economy.

A relief package is being considered as local, state and national markets are facing negative outlooks for the next two years at least. The package has been developed to support and stimulate the development industry because if it declines the impacts will be felt across the city. Jobs will be lost, and people will potentially leave the city to find employment elsewhere. A significant percentage of the development industry workforce is young and skilled making them highly mobile. Economic activity will decline, and the rate base will not increase as forecast. The Package is based on the following principles:

· it must be fair in the way it is applied,

· it must not increase the burden of infrastructure contributions on future development,

· it must not impact on the long-term sustainability of the Reserves, and

· the risk of the Package must be acceptable to Council.

· Applied for development submitted since March 1, 2020 (aligning with COVID-19)

The aim of the Package is to protect the strong foundation of the development industry businesses in Wagga Wagga, while still delivering Council’s projects funded by infrastructure contributions.

NSW Planning have also released a direction that all 7.11 and 7.12contributions be deferred for development over $10m until an occupation certificate is required.

The proposed Council package has three sections, they are discussed below.

Section 1 – Defer Contributions for 12 months Secured by an Unconditional Bank Guarantee

Payment of contributions is deferred for 12 months after the date of any Construction Certificate or Subdivision Certificate issued (upon application). All contributions will be required to be secured by an unconditional bank guarantee to the value of the contributions due. This will apply to subdivisions over 5 lots and other development with a cost of over $2 million.

Section 2 – Waive Section 64 Sewer Infrastructure Contributions for Change of Use in the CBD

Any change of use to a building in the CBD will not be charged Section 64 Sewer infrastructure contributions from the date Council adopts the Addendum. This will apply until Council updates the Wagga Wagga City Council Development Servicing Plan (DSP) Sewerage Services.

Any Section 64 Sewer infrastructure contribution payments made between 1 March, 2020 and when the Addendum is adopted will be reimbursed.

This charge has been considered excessive and has prevented businesses proceeding to the development phase. Council has collected $270,000 from sewer charges in the past 6 years within the CBD. Although a change often has a minor impact on the overall network.

Section 3 – Section 64 Contributions Conditioned at Construction of Commercial and Industrial Buildings Only

The methodology is proposed in the draft DSP Stormwater 2020 Implementation Guide, where industrial and commercial subdivision is not charged the Section 64 infrastructure contributions and the charge is imposed when a building is constructed will apply to Section 64 Stormwater and Sewer infrastructure contributions from March 1 2020. This will apply until Council updates the Wagga Wagga City Council Development Servicing Plan (DSP) Sewerage Services and the Wagga Wagga City Council DSP Stormwater. If one DSP is updated first the scheme will apply to the other Section 64 contribution.

Any Section 64 Sewer or Stormwater infrastructure contribution payments made for industrial and commercial subdivision between March 1, 2020 and when the Addendum is adopted will be reimbursed.

Addendums are required to the Wagga Wagga Local Infrastructure Contributions Plan 2019 – 2034, the Wagga Wagga City Council DSP Stormwater 2007 and the Wagga Wagga City Council DSP Sewerage Services 2013 The Addendums form Attachment 1.

Element 5 – Waive interest for payment plans entered into by property owners

Financial Hardship Policy Temporary Amendments

· Report to Council 25 May 2020 proposed temporary amendments to 27 September 2020 that broadened the Policy to be applicable to all ratepayers (not only residential).

· If payment plans entered into prior to 27 September 2020, the payment period would be extended up to two (2) years.

· If the payment plans are adhered to, the interest would be waived at the end of the payment plan period (noting that it is now mandated by OLG that a 0% interest rate is in place from 1 July 2020 to 31 December 2020).

Financial Implications

The package supports Wagga Wagga through the following five elements:

1. Small Business support

2. Seasonal user fees for sporting groups

3. Commercial lease agreements - National Cabinet Mandatory Code of Conduct

4. COVID-19 Infrastructure Contributions Relief Package

5. Hardship policy for commercial tenants

|

No |

Element |

Proposed Estimated Financial Impact |

Funding Source |

|

1 |

Increase Small Business Category of the Annual Grants Program by $20K, from $12.5K to $32.5K |

$20,000 |

It is proposed for unspent funds of $20,000 in 2019/20 in the Economic Development area will be carried over to be utilised in 2020/21 for this purpose. (Job number 13193). |

|

2 |

50% reduction in Parks and Sportsground Fees and Charges and 20% for Multipurpose stadium and Bolton Park stadium for the 2020/21 financial year |

$156,727 |

Finance have factored in a $109,719 reduction in Parks and Sportsground Fees and Charges for the 2020/21 financial year budget. The remaining estimated $19,477 will be funded from within the Parks and Sportsground operating budgets. The $27,531 for the Multipurpose stadium and Bolton Park Stadium is unfunded. |

|

3 |

Commercial Lease Agreements – National Cabinet Mandatory Code of Conduct |

$129,239 |

Detailed in separate confidential report. Estimated possible loss of income at $129,239.29 over the two financial years, with $83,107.13 applicable to 2019/20 and the remaining $46,132.17 applicable to 2020/21. Adequate budget allowances have already been factored into the estimated financial impact COVID-19 will have on Council’s 2019/20 and 2020/21 budgets. |

|

4 |

Infrastructure Contributions Relief Package: |

||

|

4.1 |

Defer Contributions for 12 months Secured by an Unconditional Bank Guarantee |

* |

*The Section 7.11 and Section 7.12 infrastructure contributions will not be significantly affected by the Package, as income due will be deferred not waived. However, it will see income deferred into the 2021/22 financial year. |

|

4.2 |

Waive Section 64 Sewer Infrastructure Contributions for Change of Use in the CBD |

* |

<Section 2 of the Infrastructure Contributions Package will have an impact on the income received from Section 64 Sewer contributions. However, the Sewer reserve has a 30 June 2020 proposed closing balance of $24.8M. |

|

4.3 |

Section 64 Contributions Conditioned at Construction of Commercial and Industrial Buildings Only |

* |

>While Section 3 of the Infrastructure Contributions Package will see income from the Section 64 Sewer and Stormwater infrastructure contributions decrease, it is consistent with the new approach recommended in the draft DSP Stormwater 2020 Implementation Guide currently on public exhibition. However, the Sewer reserve has a 30 June 2020 proposed closing balance of $24.8M and the Stormwater Section 64 reserve has a 30 June 2020 proposed closing balance of $7.2M. |

|

5 |

Hardship policy for Business properties |

~ |

~With the OLG mandating 0% interest charged on overdue property rates accounts for the first 6 months of the 2020/21 financial year, the impact would be less than originally anticipated |

Policy and Legislation

- Fees & Charges

- Sportsground user agreements

- Recreation Open Space Community (ROSC) strategy

- Wagga Wagga City Council Development Servicing Plan Stormwater – November 2007

- Wagga Wagga City Council Development Servicing Plan Sewerage Services – July 2013

- Wagga Wagga Local Infrastructure Contributions Plan 2019 - 2034

Link to Strategic Plan

Growing Economy

Objective: We are a Regional Capital

Outcome: We attract and support local businesses and industry

Risk Management Issues for Council

Financial risk of lost revenue

Risk associated with region entering recession

Risk associated with lower community participation and less engaged community

Risk associated with higher unemployment within region

Risk associated with Council engagement with business community

Internal / External Consultation

Internal consultation with various Council departments included: Community Services, Parks Operations.

Council Officers have facilitated focus groups with development industry and community organisations.

|

1⇩. |

Draft Addendum |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 13 July 2020 |

RP-2 |

Draft Addendum – Wagga Wagga Local Infrastructure Contributions Plan 2019 - 2034

Deferred Payments in 2020/21 – Special Arrangements

The applicant or any person entitled to act upon a development consent containing Section 7.11 or Section 7.12 monetary contributions imposed according to this Plan may apply to modify the condition to provide for a deferred payment of the contribution, secured by an unconditional bank guarantee.

During 2020/21 approval of any request to defer Section 7.11 or Section 7.12 infrastructure contributions for subdivisions over five lots and other development with a cost of over $2 million will be granted by the Director Regional Activation.

Payment of contributions may be deferred for 12 months after the date of any Construction Certificate or Sub Division Certificate issued from 1 July 2020 until 1 July 2021.

All contributions will be required to be secured by an unconditional bank guarantee to the value of the contributions due.

Draft Addendum – Wagga Wagga City Council Development Servicing Plan - Stormwater 2007

Deferred Payments in 2020/21 – Special Arrangements

The applicant or any person entitled to act upon a development consent containing Section 64 Stormwater monetary contributions imposed according to this Plan may apply to modify the condition to provide for a deferred payment of the contribution, secured by an unconditional bank guarantee.

During 2020/21 approval of any request to defer Section 64 Stormwater infrastructure contributions for subdivisions over five lots and other development with a cost of over $2 million will be granted by the Director Regional Activation.

Payment of contributions may be deferred for 12 months after the date of any Construction Certificate or Sub Division Certificate issued from 1 July 2020 until 1 July 2021.

All contributions will be required to be secured by an unconditional bank guarantee to the value of the contributions due.

Timing of Section 64 Stormwater infrastructure contributions – Special Arrangements

Industrial and commercial subdivision will not be charged Section 64 Stormwater infrastructure contributions.

Section 64 Stormwater infrastructure contributions will be imposed when a building is constructed based on the methodology detailed in the draft Development Servicing Plan Stormwater 2020 Implementation Guide.

This method will apply until Council updates the Wagga Wagga City Council Development Servicing Plan Stormwater.

This methodology will be implemented from the date the Council adopts this Addendum. Any Section 64 Stormwater infrastructure contribution payments made for industrial and commercial subdivision between 1 July 2020 and when the Package is adopted will be reimbursed.

Draft Addendum – Wagga Wagga City Council Development Servicing Plan – Sewerage Services 2013

Deferred Payments in 2020/21 – Special Arrangements

The applicant or any person entitled to act upon a development consent containing Section 64 Sewer monetary contributions imposed according to this Plan may apply to modify the condition to provide for a deferred payment of the contribution, secured by an unconditional bank guarantee.

During 2020/21 approval of any request to defer Section 64 Sewer infrastructure contributions for subdivisions over five lots and other development with a cost of over $2 million will be granted by the Director Regional Activation.

Payment of contributions may be deferred for 12 months after the date of any Construction Certificate or Sub Division Certificate issued from 1 July 2020 until 1 July 2021.

All contributions will be required to be secured by an unconditional bank guarantee to the value of the contributions due.

Timing of Section 64 Sewer infrastructure contributions – Special Arrangements

Industrial and commercial subdivision will not be charged Section 64 Sewer infrastructure contributions.

Section 64 Sewer infrastructure contributions will be imposed when a building is constructed based on the current methodology.

This method will apply until Council updates the Wagga Wagga City Council Development Servicing Plan Sewerage Services.

This methodology will be implemented from the date the Council adopts this Addendum. Any Section 64 Sewer infrastructure contribution payments made for industrial and commercial subdivision between 1 July 2020 and when the Package is adopted will be reimbursed.

Section 64 Sewer infrastructure contributions in the Central Business District (CBD) – Special Arrangements

Any change of use to a building in the CBD will not be charged Section 64 Sewer infrastructure contributions from the date this Addendum is adopted by Council. This will apply until Council updates the Wagga Wagga City Council Development Servicing Plan Sewerage Services.

Any Section 64 Sewer infrastructure contribution payments made for developments between 1 July 2020 and when the Package is adopted will be reimbursed.

|

Report submitted to the Ordinary Meeting of Council on Monday 13 July 2020 |

RP-3 |

RP-3 Mobile food vendor permits

Author: Dominic Kennedy

Director: Michael Keys

|

Summary: |

This report provides a review of the Mobile Food Vendor (MFV) program and responds to a request regarding feasibility of increasing the number of permits. |

|

That Council: a allow an additional two permits to the current program b allow an additional three permits for new applicants where specific circumstances or product offers are made c provide a further report reviewing existing tenure, range of offerings provided and opportunities to leverage from the success of the program |

Report

1. current number of permits;

2. regulations, and;

3. if there is an opportunity to accommodate an increase in numbers or revise conditions due to COVID-19 restrictions which would allow businesses to trade in different capacities.

1. Number of permits

The Mobile Food Vendor (MFV) trial from January to May, 2019 allowed for 10 participants. Although Council staff maintain a list of approximately 100 mobile vendors that operate in the LGA for events, markets and other activities; following an Expression of Interest, we received only nine applications for the trial. All nine vendors were approved for the trial. This 10 permit limit was then continued into the permanent program due to the successful trial and information from other councils about their limits (e.g. Liverpool Council has a 20 permit limit).

These 10 MFV permits allow vendors to operate on Council owned and managed land, during the hours of 6:00 am to 10:00 pm provided they remain 200 metres from a brick & mortar food and beverage premise. Noting that the MFV permits only apply to operators on public land. Vendors unable to attain a permit have been advised of alternatives which include operating on:

· private land (with owners permission)

· RMS rest stops (with RMS permission)

· At events

· Consider collaborating with an existing vendor to operate during their off-hours under their permit.

The 2019-2020 Mobile Food Vendor (MFV) permits expire 30 June 2020. The full allotment of permits were taken up in the first year and all ten have submitted their renewal applications for 2020-2021. One additional three-month permit was issued on 1 April 2020 to the owner of the Black Swan Hotel, this was in recognition of restrictions associated with COVID-19. Conditions of this permit were that they only operate out of the Tarcutta Truck Exchange and that their permit would expire when either the Black Swan Hotel reopened, or the cafés in Tarcutta reopened – whichever happened first. This permit has expired.

Over the last 4 months, Council has received several informal requests about operating as a MFV in the LGA and information about the process for acquiring a permit. At this time, only one vendor has submitted a formal application in anticipation of acquiring a permit if one becomes available. Council has first right of refusal for the 2020-2021 permits to the incumbent vendors.

2. Regulations

Since the permits were issued in December 2019 at the conclusion of the trial, there have been no breaches of the MFV policy. However, Council has been contacted three times by brick & mortar businesses regarding breaches. In each circumstance, there was no breach, but the owner still indicated that there was a negative impact to their business. Two of the instances were related to a MFV operating too close to another business and one instance was a vendor operating within the Main Street exclusion zone. A complaint from the owner of the Little Cup Café on Kooringal Road is attached for review.

Although no official survey has been conducted, Council has also received no feedback from the vendors that the regulations are too restrictive – therefore we are not proposing operational modifications to the policy at this time.

3. Market Capacity

It’s unclear at this time if there is capacity for the market to accommodate additional mobile food vendors without jeopardising the viability of existing mobile vendors and/or brick & mortar businesses. COVID-19 pandemic has created a unique environment that some MFVs have been able to capitalise on, however we cannot predict how long these favourable conditions will continue. In order to get the data needed to make a change to the status quo, a study would need to be conducted, similar to what was undertaken for the trial.

Council staff have received anecdotal feedback from several sources regarding a significant increase in interest from the community in visiting MFVs both during the trial and since the program has become permanent. This feedback has not been received through official channels and therefore not tracked. It continues to be a positive story in the community and the program has led to the desired outcome of vendors opening up permanent shops (e.g. Lucid the Kombi operating a café in Scooter Flowers).

Summary

The MFV program is widely regarded as a successful initiative, even though it has only been running for six months and experienced significant challenges in that time. The recommended increase in permits is in response to the increasing demand for mobile food vendor offerings and an interest in expanding the variety of offerings available.

Due to the expense and challenges of establishing an MFV presence it is not recommended that this increase in the number of permits be temporary. Due to the sensitivities regarding MFVs operating in the City it is recommended that a further report be conducted that reviews; existing tenure, range of offerings provided and opportunities to leverage from the success of the program.

Financial Implications

The 2020/21 proposed fee of $365 for the mobile food vendor are included in the draft Fees & Charges which are included in this same meeting for adoption.

Policy and Legislation

Mobile Food Vendor Trading in Public Places (Parks and Reserves) – POL 062

Link to Strategic Plan

Growing Economy

Objective: We are a hub for activity

Outcome: We have vibrant precincts

Risk Management Issues for Council

· Reputational risk of negative impacts to local small businesses

· Potential for Council to miss supporting community desired services

Internal / External Consultation

Council staff have consulted with mobile food vendors participating in the program and one seeking a permit. Conversations have also been conducted with local brick & mortar business owners to get their perspective on if/how an increase in permits would impact their business.

|

Report submitted to the Ordinary Meeting of Council on Monday 13 July 2020 |

RP-4 |

RP-4 PROPOSED ACQUISITION OF LAND AT THE GAP FOR ROAD PURPOSES

Author: Dianne Wright

Director: Michael Keys

|

Summary: |

This report concerns the proposed compulsory acquisition of land to resolve encroachment of a Council road onto Crown land. |

|

That Council: a proceed with the compulsory acquisition of land from the State of New South Wales described as Lot 1 DP 1264232 for road purposes in accordance with the requirements of the Land Acquisition (Just Terms Compensation) Act 1991 b make an application to the Minister and the Governor for approval to acquire Lot 1 DP 1264232 by compulsory acquisition process under Section 177(1) of the Roads Act 1993 c pay compensation to all interest holders entitled to compensation by virtue of the compulsory acquisition on the terms set out in the Land Acquisition (Just Terms Compensation) Act 1991 d agree that all minerals are to be exempt from the acquisition of Lot 1 DP 1264232 e delegate authority to the General Manager or their delegate to execute any necessary documents on behalf of Council f authorise the affixing of Council’s common seal to all relevant documents required |

Report

Council has been approached by Crown Lands – Department of Planning Industry and Environment (Crown Lands) regarding the encroachment of The Gap Road on part of a Crown Reserve situated at The Gap Road, The Gap.

Crown Lands has requested Council acquire by compulsory acquisition the land listed in the table below:

|

Registered Owner |

Land Parcel |

Acquisition Area

|

Lot shown on Plan of Acquisition |

|

State of New South Wales |

Crown Reserve 41476 Lot 7003 DP 94516

|

4,209 square metres |

Lot 1 DP 1264232 |

The indicative compensation amount payable in relation to this land is $2,300. However, compensation will be determined by the Valuer General after gazettal of the acquisition which may result in a variation to the compensation amount.

Estimated costs associated with the land acquisition are outlined below:

|

Indicative Compensation Amount |

$2,300 |

|

Additional compensation allowance |

$700 |

|

Council’s legal fees – estimate |

$2,000 |

|

Valuation Fee – Opteon (cost already incurred) |

$1,595 |

|

Valuation Fees - VG - estimate |

$3,000 |

|

Survey fees including plan registration |

$4,427 |

|

Total Estimated |

$14,022 |

A resolution of Council in the format above is required to meet the criteria set by Office of Local Government for the compulsory acquisition of land.

Accordingly, it is recommended that Council agree to proceed with the compulsory acquisition of Lot 1 DP 1264232 for road purposes from the State of New South Wales (Crown Lands) in accordance with the requirements of the Land Acquisition (Just Terms Compensation) Act 1991.

Financial Implications

It is proposed to fund the required land acquisition and estimated associated costs totalling $14,022 from the Property Management Non-Strategic Land Acquisitions budget which has a $33,000 budget for the 2020/21 financial year.

Job Consolidation Number: 17984

Policy and Legislation

Land Acquisition (Just Terms Compensation) Act 1991

The Roads Act 1993

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

Assessment of compensation by Valuer General may exceed estimated allowance.

Internal / External Consultation

Crown Lands – Department of Planning Industry and Environment

|

1⇩. |

Location Map - The Gap Road |

|

|

2⇩. |

Survey Plan - The Gap Road |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 13 July 2020 |

RP-5 |

RP-5 PROPOSED APPLICATION FOR CONTROL OF CROWN ROADS - OURA VILLAGE

Author: Dianne Wright

Director: Michael Keys

|

Summary: |

This report recommends an application to NSW Department of Planning Industry and Environment – Crown Lands for control of Crown roads in Oura to resolve existing access issues, facilitate future development, and address risk to Council |

|

That Council apply to NSW Department of Planning Industry and Environment – Crown Lands for the transfer of Adams Street and Jarvis Street at Oura to Council as the roads authority in accordance with the Roads Act 1993. |

Report

Adams Street and Jarvis Street at Oura are unmaintained Crown roads under the administration of NSW Department of Planning Industry and Environment – Crown Lands (Crown Lands). There are 8 properties in this location where the Crown roads are the only means of access to owners of both developed (6 dwellings) and undeveloped residential parcels of land.

The roads traverse very steep topography and are currently in uneven and poor condition due to erosion. They have not been established or formed at a reasonable standard and are currently not maintained by Council or any other authority. The Crown roads require significant works to bring them up to a standard that is suitable or appropriate for access to a private property. This would typically be the equivalent of two-wheel drive all weather access.

Crown Lands is not a road construction authority and does not undertake works of this nature on Crown roads.

A number of the existing properties on Jarvis and Adams Street have been developed with private residences and other buildings. For reasons which are not clear, these were approved by Council in the knowledge that the properties were not served by a formed public road. The usual practice is that residences are not approved where there is an absence of a public road to the boundary Council has received numerous requests to upgrade the roads to ensure the properties are accessible by both private and emergency vehicles.

These requests have been refused. This refusal is difficult to justify given Council provided consent to the construction of the dwellings. This consent should have been refused if Council had no intention of providing some level of road access. Having provided consent, Council should accept the roads and commence a process where ultimately, work will be undertaken on the roads.

In order to carry out road works and facilitate future development, it is proposed to apply to Crown Lands to transfer control of Adams Street and Jarvis Street to Council so that Council becomes the Roads Authority. In this regard, both roads meet the criteria for transfer as outlined in Crown Lands Administration of Crown Roads Policy No. IND-O-250.

This would lead to Council committing to upgrading the roads to a suitable standard and accept responsibility for future maintenance. This proposal supports future residential development in Oura and recognises demand within the community for a “village lifestyle” option.

The roads also provide the route for evacuation from the village in the event of flood. It is suggested that Government support for the road construction be sought on this basis.

There are no costs associated with making application to the department for transfer of the roads. However, there will be significant costs associated with the formation of the roads and subsequently maintenance of the roads but in particular maintenance of the drainage (table drains) associated with the roads due to the topography and geology of the area.

Initial estimates for these works are $465,000. Thereafter, the cost of annual works to maintain the safety of the roads is estimated at $5,000 - $40,000 per annum. Currently, there is no proposal to upgrade the roads by sealing or undertaking any other significant works however, if the roads are transferred, Council will need to progress road plans to the conclusion of work.

Financial Implications

As described in the body of the report.

Policy and Legislation

The Roads Act 1993

Link to Strategic Plan

The Environment

Objective: Create and maintain a functional, attractive and health promoting built environment

Outcome: We improve the facilities of our places and spaces

Risk Management Issues for Council

Between 2004 and 2020 Council approved 13 development applications for various projects including a number of dwellings on Adams and Jarvis Streets at Oura.

Approving development on these sites without adequate and suitable access could be a risk issue for Council. One potential risk is emergency vehicle access in the event of an emergency at one of these properties or an accident involving a person attempting to access these properties.

This proposal recognises and seeks to manage risks to the community and Council associated with development that is reliant on and whose sole access is via these roads.

Internal / External Consultation

N/A

|

1⇩. |

Location Map - Adam & Jarvis Streets, Oura |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 13 July 2020 |

RP-6 |

RP-6 PROPOSED COMPULSORY ACQUISITION OF LAND FOR ROAD WIDENING AT FARRER ROAD

Author: Dianne Wright

Director: Michael Keys

|

Summary: |

This report concerns the proposed compulsory acquisition of land to facilitate the widening of Farrer Road. |

|

That Council: a proceed with the compulsory acquisition of the land from the State of New South Wales described as Lot 1 DP 1261450, Lot 2 DP 1261450 and Lot 6 DP 1261450 for road purposes in accordance with the requirements of the Land Acquisition (Just Terms Compensation) Act 1991 b make an application to the Minister and the Governor for approval to acquire Lot 1 DP 1261450, Lot 2 DP 1261450 and Lot 6 DP 1261450 by compulsory acquisition process under Section 177(1) of the Roads Act 1993 c pay compensation to all interest holders entitled to compensation by virtue of the compulsory acquisition on the terms set out in the Land Acquisition (Just Terms Compensation) Act 1991 d agree that all minerals are to be exempt from the acquisition of Lot 1 DP 1261450, Lot 2 DP 1261450 and Lot 6 DP 1261450 e delegate authority to the General Manager or their delegate to execute any necessary documents on behalf of Council f authorise the affixing of Council’s common seal to all relevant documents required |

Report

On 29 January 2019 (resolution 19/012, part a) Council approved a budget variation for the Farrer Road widening and reconstruction project. The project requires the acquisition of a 10- metre strip of land along the northern boundary of the existing road reserve.

It was proposed that Council enter into access licences with the landowners to facilitate the commencement of construction prior to the land being acquired.

On 11 March 2019 (resolution 19/001) Council delegated authority to the General Manager to enter into licence agreements with the relevant landowners, including The State of New South Wales as per the table below:

|

Ref in Resolution 19/066 |

Land Parcel |

Acquisition Area (m2) |

Lot shown on Plan of Acquisition |

|

A |

Lot 6 DP 1218378 (part Charles Sturt University) |

1080 |

Lot 1 DP 1261450 |

|

B |

Lot 153 DP 751407 (part Charles Sturt University) |

1428 |

Lot 2 DP 1261450 |

|

F |

Lot 2 DP 1130513 (part Travelling Stock Reserve) |

485.7 |

Lot 6 DP 1261450 |

|

TOTAL |

|

2,993.7 |

|

The above lands are administered by Crown Lands – The Department of Planning and Environment and must be acquired via compulsory acquisition.

The indicative compensation amount payable in relation to the land is $9,650 (excluding GST). However, compensation will be determined by the Valuer General after gazettal of the acquisition which may result in a variation to the compensation amount.

Estimated costs associated with the land acquisition are outlined below:

|

Compensation Amount: |

$9,650 |

|

Additional compensation allowance: |

$2,000 |

|

Council’s Legal Fees – estimate: |

$2,000 |

|

Valuation Fee – Opteon (cost already incurred): |

$1,375 |

|

Valuation Fees – Valuer General (estimate): |

$5,000 |

|

Total: |

$20,025 |

A resolution of Council in the format above is required to meet the criteria set by the Office of Local Government for the compulsory acquisition of land.

Accordingly, it is recommended that Council agree to proceed with the compulsory acquisition of Lot 1 DP 126450, Lot 2 DP 126450 and Lot 6 DP 1261450 for road purposes from the State of New South Wales (Crown Land) in accordance with the requirements of the Land Acquisition (Just Terms Compensation) Act 1991.

Financial Implications

The proposed land acquisition will be funded from within the Farrer Road project. A further report will be provided to Council over the next few months on the proposed remaining works and budget information.

Policy and Legislation

Land Acquisition (Just Terms Compensation) Act 1993

The Roads Act 1993

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

Final compensation determination may exceed budget allowance.

Internal / External Consultation

Crown Lands – Department of Planning Industry and Environment

Charles Sturt University

Local Land Services

NSW & Wagga Local Aboriginal Land Council

|

1⇩. |

Plan of Acquisition |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 13 July 2020 |

RP-7 |

RP-7 RESPONSE TO QUESTIONS/BUSINESS WITH NOTICE

Author: Scott Gray

General Manager: Peter Thompson

|

Summary: |

This report is to provide responses to Questions/Business with Notice arising from previous Ordinary Council Meetings. |

|

That Council receive and note the report. |

Report

|

Councillor R Kendall requested advice following concerns raised by residents of Bourkelands, if Council has any plans, short term or long term, to upgrade the Red Hill Road / Berembee Road intersection. |

|

At this stage, there are no plans to upgrade the Red Hill Road / Berembee Road intersection. Council staff are looking at preparing plans for duplicating Red Hill Road from Plumpton Road to Glenfield Road, for construction. Planned construction is within the next 10 years. However, if an interim solution is required for this intersection, then this may be accommodated provided it aligns with future requirements for four lanes along Red Hill Road. Council staff will monitor the performance of this intersection. |

|

Councillor T Koschel requested information on future plans for bus shelters in the Forest Hill and Brunslea Park estates. |

|

Council receives regular requests for bus shelters from the community, with an emphasis on school bus shelters. Bus service providers normally identify the need for a bus shelter at a location, based on usage. Where a shelter is constructed it is normal practice to establish a bus zone to ensure the shelter is available for its intended use. |

|

Councillor P Funnell requested information and an update on signage recently installed on entries to crown land and public reserves, including who funded the signs and what was the intent of the signage. |

|

As part of the Local Government NSW ‘Council Roadside Reserves Project’ Wagga Wagga City Council (Council) received grant funds to undertake an updated assessment of roadside vegetation extent and condition and developed the Council Roadside Vegetation Management Plan (adopted in November 2019). As a part of grant funds received project signage was developed for the purposes of educating the wider public on the importance of roadside vegetation (please see attached), and this will form part of a wider campaign. The signs are 160cm high and 60cm wide, with font sizes of 96 for the heading and size 20 for the smaller text. The signs are not intended to be read from a vehicle, rather they have been strategically placed in 12 locations where people in vehicles are known to stop. This predominantly includes formal rest stops on the Olympic and Sturt Highways, and two are located near the entrances of Travelling Stock Reserves (please see attached map of locations). |

|

Councillor K Pascoe requested an update on the condition and drainage of Kooringal Road, particularly alongside the netball courts. |

|

Staff are aware of pavement condition and drainage issues on the section of Kooringal Road near Equex. The issues will be addressed as part of the upcoming roadworks. |

Financial Implications

N/A

Policy and Legislation

Code of Meeting Practice

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We have leaders that represent us

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

1⇩. |

Roadside Vegetation Management Plan Sign |

|

|

2⇩. |

Roadside Vegetation Management Plan - Sign Location |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 13 July 2020 |

M-1 |

M-1 FLOODPLAIN RISK MANAGEMENT ADVISORY COMMITTEE - MINUTES - 2 June 2020

Author: Peter Ross

General Manager: Peter Thompson

|

Summary: |

The Floodplain Risk Management Advisory Committee met on 2 June 2020 |

|

That Council note the minutes of the Floodplain Risk Management Advisory Committee meeting held on 2 June 2020. |

Report

The Floodplain Risk Management Advisory Committee met on 2 June 2020 and the minutes from this meeting are attached for Councillors’ reference.

Financial Implications

N/A

Policy and Legislation

N/A

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We are informed and involved in decision making

Outcome: Everyone in our community feels they have been heard and understood

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

1⇩. |

Floodplain Risk Management Advisory Committee Minutes - 2 June 2020 |

|

Reports submitted to the Ordinary Meeting of Council to be held on Monday 13 July 2020.

|

Report submitted to the Confidential Meeting of Council on Monday 13 July 2020 |

CONF-1 |

CONF-1 PROPOSED RENT WAIVERS UNDER THE MANDATORY CODE OF CONDUCT FOR COMMERCIAL LEASES AFFECTED BY COVID-19

Author: Dianne Wright

Director: Michael Keys

This report is CONFIDENTIAL in accordance with Section 10A(2) of the Local Government Act 1993, which permits the meeting to be closed to the public for business relating to the following: -

(d) (ii) commercial information of a confidential nature that would, if disclosed, confer a commercial advantage on a competitor of the Council.