AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

27 JulY 2020

AT 6:00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

27 JulY 2020

AT 6:00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on 27 Jul 2020 at 6:00pm.

Council live streams video and audio of Council meetings. Members of the public are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

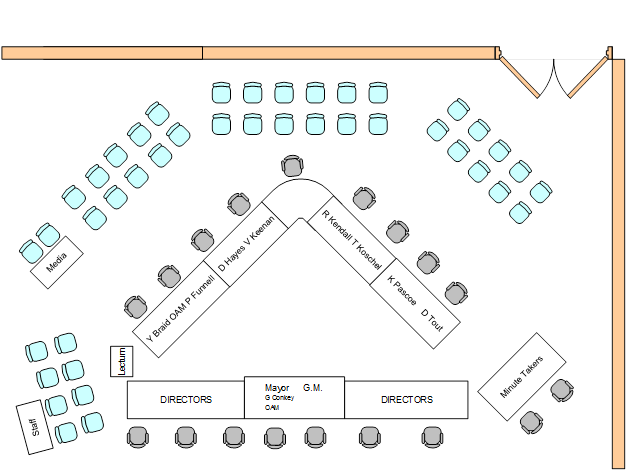

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on 27 Jul 2020.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

27 Jul 2020

CLAUSE PRECIS PAGE

PRAYER 2

ACKNOWLEDGEMENT OF COUNTRY 2

APOLOGIES 2

Confirmation of Minutes

CM-1 Ordinary Council Meeting - 13 July 2020 2

DECLARATIONS OF INTEREST 2

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - REVIEW INTO COMMITTEE MEETING TIMES 3

Reports from Staff

RP-1 RESPONSE TO NOTICE OF MOTION - ADVOCACY PLAN 5

RP-2 Planning Proposal LEP20/0005 to amend zoning and increase minimum lot size applying to lands at Cartwrights Hill and Byrnes Road 18

RP-3 INITIAL RESPONSE TO NOTICE OF MOTION - ENFORCEMENT ACTION FOR DA09/0872 38

RP-4 2019/20 Operating Budget Revotes, July 2020 Budget Variations and 30 June 2020 Investment Report 40

RP-5 NSW DEPARTMENT OF PLANNING, INDUSTRY AND ENVIRONMENT - LOW COST LOANS INITIATIVE - ROUND 3 57

RP-6 NSW PUBLIC LIBRARIES ASSOCIATION SWITCH 2020 CONFERENCE 60

RP-7 RESOLUTIONS AND NOTICES OF MOTIONS REGISTERS 62

RP-8 RESPONSE TO QUESTIONS/BUSINESS WITH NOTICE 64

QUESTIONS/BUSINESS WITH NOTICE 66

Confidential Reports

CONF-1 HOCKEY FIELD REPLACEMENT 67

PRAYER

CM-1 Ordinary Council Meeting - 13 July 2020

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 13 July 2020 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - Ordinary Council Meeting - 13 July 2020 |

68 |

EXCLUDED REPORT

A Notice of Motion was excluded on the grounds it was unlawful because it would be contrary to Clause 15.11(d) of Council’s adopted Code of Meeting Practice and Clauses 9.10-9.12 of Council’s adopted Code of Conduct.

|

Report submitted to the Ordinary Meeting of Council on Monday 27 July 2020 |

NOM-1 |

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - REVIEW INTO COMMITTEE MEETING TIMES

Author: Councillor Tim Koschel

|

Summary: |

The purpose of this notice of motion is to review the times Committee Meetings are held and how they impact participants of those meetings. |

|

That Council receives a report no later than the last meeting in September 2020 that: a reviews the time and day of all committee meetings and the impact these have on Councillors, staff and external stakeholders; and b outlines alternative options to encourage greater participation and to be more attractive to future Council candidates |

Report

In a recent report to Council, all councillors debated the importance of having the correct procedures/conditions in place to allow the time for current councillors and to entice new candidates for next election.

Having committee meetings during working hours automatically excludes the majority of the working population due to meetings being held between the hours of 9 to 5. If committee meeting times were more flexible this could encourage different candidates to run during next elections.

This would also allow Councillors who aren’t retired or self-employed more opportunity to involve themselves in further committees.

Financial Implications

N/A

Policy and Legislation

Code of Meeting Practice

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We are active community members

Outcome: We recognise we all have a role to play

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 27 July 2020 |

RP-1 |

RP-1 RESPONSE TO NOTICE OF MOTION - ADVOCACY PLAN

Author: Scott Gray

General Manager: Peter Thompson

|

Summary: |

This report is being presented to Council after a Notice of Motion was submitted by Councillor Keenan, where it was resolved that Council receive a report which outlines a draft advocacy plan that is reviewed in-line with Council’s Integrated Planning & Reporting (IPR) process.

It is envisaged that the Advocacy Plan will act as a guide to address issues that are beyond the capacity of Council and to seek additional funding for specific strategic projects as required.

The initial list has been derived through feedback and previous resolutions of Council and will be a live list to be regularly updated to align with Council’s strategic direction. |

|

That Council: a endorse the attached draft Advocacy Plan and the items contained therein b endorse the process for updating the items included in the Advocacy Plan c note that the Advocacy Plan will be listed on Council’s website and will be updated regularly to align with decisions of Council d submit a motion to the LGNSW Annual Conference expressing disappointment in the procedures and action taken by the Office of Local Government in regards to code of conduct issues |

Report

Background

The attached draft Advocacy Plan has been developed after it was resolved on 12 August 2019 that Council receive a report which outlines a draft advocacy plan that when adopted is reviewed annually in-line with Council’s Integrated Planning & Reporting (IPR) process and updated via Council resolution.

The framework of this plan is designed to allow Council and other representative groups to take advantage of advocacy opportunities as they arise. These opportunities can come with little or no warning. This plan is also the basis for prioritising strategic projects and funding bids, especially when new funding programs are announced from the Federal and State Governments.

The objectives of the plan will be to:

· Set an organisational advocacy agenda and identify priorities in a planned and strategic manner

· Identify key partners and build strong strategic relationships

· Influence key decision makers

· Secure funding for community identified priority projects

Defining and updating the list

The list of items included in the draft Advocacy Plan have been derived through feedback from staff and Councillors, and by reviewing previous resolutions of Council. The final list presented to Council has been reduced by excluding items that are already supported by other organisations such as Local Government NSW (LGNSW).

It is important to note that this is an initial list that will be updated regularly to align with the strategic direction of the city. It is proposed that the plan will be updated by resolution of Council to include items as they arise. Over the next twelve months Council will also be updating the Community Strategic Plan and this process is likely to identify new items for inclusion in the plan.

At the 13 July 2020 Council Meeting there was discussion regarding the inclusion of an item relating to the code of conduct. The following item was included in the initial draft list presented to Councillors at a workshop held on 1 June 2020. The item was submitted as a motion and was supported at last year’s LGNSW Annual Conference:

Code of Conduct Complaint Resources

Councillors throughout NSW have long expressed frustration at the time taken for Code of Conduct complaints to be handled. While a new Code of Conduct as introduced, it has little value if potential breaches are not managed quickly, efficiently, and effectively. Concerns about breaches not being reported due to little to no faith in the process due to time and costs, is concerning, but also understandable. The request is for a greater investment of resources by the State Government into managing Code of Conduct complaints to ensure they are dealt with quickly, efficiently, and effectively.

It is proposed that another motion be submitted to this year’s conference.

Format

Once the list is endorsed, staff will be developing a digital web-based version that will be regularly updated and will have links to relevant information such as reports, fact sheets etc. Some collateral material already exists on items included in the plan, and these will be available on Council’s website.

Reporting on progress

The items listed within the plan will be integrated into Council’s current performance reporting process as part of the Integrated Planning and Reporting requirements, which is conducted every six months.

Financial Implications

If the plan is endorsed, limited internal resources will be required to prepare the digital platform and collateral material.

Policy and Legislation

N/A

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

N/A

Internal / External Consultation

Discussions have been held with Executive staff, followed by a Councillor workshop on 1 June 2020. Meetings have also been held with Councillor Keenan regarding the draft plan, the items included and the layout proposed.

It is not proposed to put the plan through a formal public exhibition process, but instead promote the plan through social media and Council news stories. If feedback is received this will be presented to Councillors as part of a regular review process.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

|

x |

|

|

|

|

|

|

|

|

x |

x |

|

||

|

1⇩. |

draft Wagga Wagga City Council Advocacy Plan |

|

|

Report submitted to the Ordinary Meeting of Council on 27 July 2020 |

RP-2 |

RP-2 Planning Proposal LEP20/0005 to amend zoning and increase minimum lot size applying to lands at Cartwrights Hill and Byrnes Road

Author: Tristan Kell

Director: Michael Keys

|

Summary: |

In order to support the ongoing operation and success of the strategically important Wagga Wagga Special Activation Precinct, it is proposed to amend the provisions of the Wagga Wagga Local Environmental Plan 2010 to prevent further intensification of residential use on lands in the southern periphery of the Special Activation Precinct. |

|

That Council: a support amendment to the Wagga Wagga Local Environmental Plan 2010 as it applies to lands at Cartwrights Hill and Byrnes Rd (as reflected in Figures 1, 3 and 4): i rezone subject lands from R5 Large Lot Residential and RU4 Primary Production Small Lots to the RU6 Rural Transition. ii change the minimum lot size variously applying to the same lands from 1 Ha and 2 Ha to 200 Ha. b submit Planning Proposal LEP20/0005 to the Department of Planning and Environment for Gateway Determination. c receive a further report addressing submissions received during public exhibition and detailing the response to the conditions of the Gateway Determination.

|

Planning Proposal details

|

Intended planning proposal: |

Council is the proponent of a planning proposal (LEP20/0005) to rezone lands located at Cartwrights Hill from R5 Large Lot Residential and RU4 Primary Production Small Lots zones to RU6 Rural Transition zone. |

|

Authorised by: |

Regional Activation Directorate, Wagga Wagga City Council |

Executive Summary

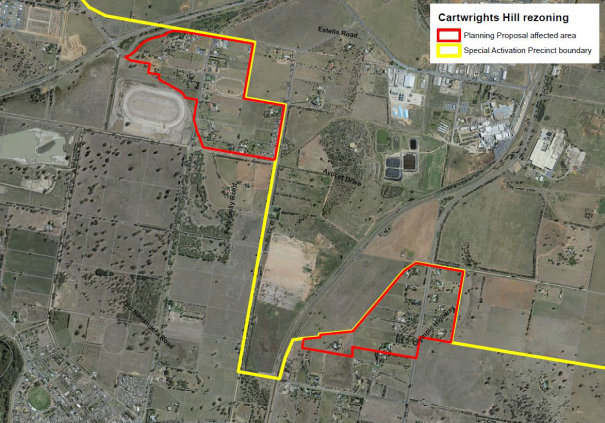

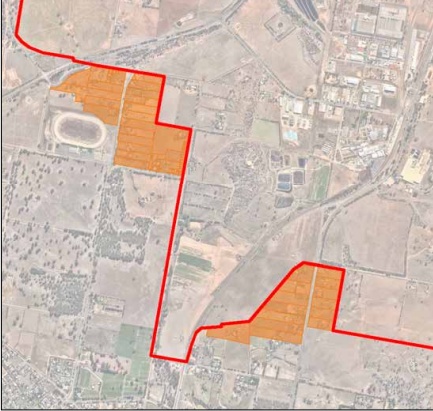

The Cartwrights Hill and Byrnes Road areas to the north of Wagga Wagga feature small clusters of residential properties. These clusters are immediately south-west and south of Bomen Industrial Precinct. The areas consist of small to medium rural lifestyle holdings, comprised of properties that range in size between <1 Ha and 20 Ha. Byrnes Rd is another cluster of rural residential holdings, which vary from 2ha to 20ha (illustrated in Figure 1).

Figure 1 – Subject land area for the Planning Proposal

These areas are predominantly rural in the landscape character. The land is relatively flat with gentle undulation and clusters of vegetation around dwellings. The homes within the area were generally constructed prior to 1980 and the area itself was established before 1950. These areas are illustrated in Figure 1. The figures also illustrate the proximity of these areas to the Wagga Wagga Special Activation Precinct (Figure 2).

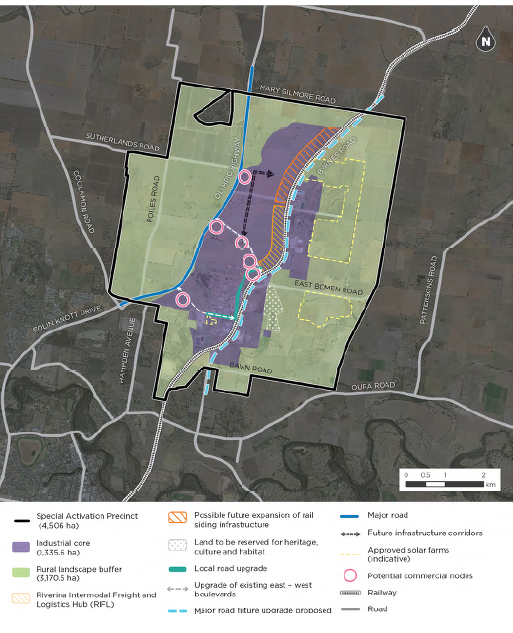

The Wagga Wagga Special Activation Precinct (seen at Figure 2), is located 8 kilometres north of the Wagga Wagga CBD at Bomen. The Special Activation Precinct (SAP) will leverage Wagga Wagga’s strategic location, its economic health and skilled workforce to establish a thriving centre for economic activity, investment and innovation. A key employment centre for the Riverina region, the Precinct will capitalise upon catalyst opportunities associated with Inland Rail. It will attract industries that specialise in agri-business or resource-related advanced manufacturing and packaging, taking advantage of close proximity and ready access to national freight and logistics networks to provide employment growth that supports the region’s economic development.

Figure 2 – Wagga Wagga Special Activation Precinct

Land use conflict occurs when sensitive receptors such as residential development are impacted by noise and odour emissions generated by industrial activity. It is proposed to mitigate future land use conflict at the periphery of the Wagga Wagga SAP by preventing further intensification of residential development within the Cartwright’s Hill or Byrnes Road areas.

Consideration must be given to the implications of future character of the Cartwrights Hill and Byrnes Road areas for development within the Wagga Wagga SAP at Bomen. Current planning controls for the Cartwrights Hill and Byrnes Road areas are not consistent with the vision and long-term strategic benefits to be obtained for Wagga Wagga and the Riverina region within the SAP, including expansion of existing industrial activities and businesses.

It is proposed to rezone these two areas to the RU6 Rural Transition zone. This would inform the strategic intent for these areas in future planning matters. In conjunction with amendments to the minimum lot size this removes the potential for intensification of residential development leading to additional land use conflict.

The ongoing operation and success of the Wagga Wagga SAP is of critical strategic importance for the City and its overall population. For this reason, the planning proposal will amend LEP provisions to prevent further intensification of residential land uses and exacerbated land use conflict in these areas. This will be achieved through:

· Preventing any additional subdivision to create additional

dwelling entitlements.

· Ensuring that development of secondary dwellings or dual occupancies will not be permissible on the subject lots.

The amendment to the LEP would maintain the rural landscape character of these small residential clusters and prevent further intensification of development in the area. This strikes a balance of allowing existing residents to remain in the area, whilst preventing further intensification of residential and rural living at these locations.

Proposed Changes to Wagga Wagga Local Environmental Plan 2010

The proposed outcome will be achieved by:

· Rezoning two separate areas, located at Cartwrights Hill and Byrnes Road respectively, that both adjoin the existing industrial area and proposed Wagga Wagga SAP. These areas will be rezoned from R5 – Large Lot Residential and RU4 – Primary Production Small Lots respectively to RU6 – Transition. Secondary dwellings are not permissible in the RU6 – Transition zone (refer to Figure 3).

· Increasing the minimum lot size within these same areas from 1ha and 2ha to 200ha (refer to figure 4).

· The Principal Development Standard that limits the erection of dwelling houses and dual occupancies on land in certain residential, rural and environmental protection zones (under clause 4.2A of the Wagga Wagga LEP 2010) would be temporally maintained for the land subject to this proposed amendment through savings and transition provisions.

Figure 3 – Existing and proposed Land Zoning Map

Figure 4 – Existing and proposed Minimum Lot Size Map

Land use permissibility changes

Although the change in zoning will restrict / prohibit new development of certain uses (such as secondary dwellings and tourist and visitor accommodation), existing development will continue to be allowed to remain, even if it is not a listed permitted use under the RU6 – Transition Land Use Table.

A list of the changes to permissibility of land uses within the R5 and RU4-zoned lands is provided below. Some notable changes include:

Current RU4 zoned land

· Extensive agriculture will become permitted without consent (currently consent is required).

· Industrial retail outlets and depots will become permitted with consent (currently prohibited).

· Dual occupancies, group homes, secondary dwellings, bed and breakfast accommodation, farm stay accommodation, cellar door premises, hardware and building supplies, markets, plant nurseries and rural supplies will become prohibited (currently permitted with consent).

Current R5 zoned land

· Extensive agriculture will become permitted without consent (currently prohibited).

· Intensive plant agriculture, animal boarding facilities, farm buildings, forestry, veterinary hospitals and depots will become permitted with consent (currently prohibited).

· Boarding houses, dual occupancies, group homes, hostels, some forms of tourist and visitor accommodation such as bed and breakfast accommodation, hardware and building supplies, rural supplies, neighbourhood shops, timber yards and vehicle sales or hire premises will become prohibited (currently permitted with consent).

Zone RU6 Transition

1 Objectives of zone

· To protect and maintain land that provides a transition between rural and other land uses of varying intensities or environmental sensitivities.

· To minimise conflict between land uses within this zone and land uses within adjoining zones.

2 Permitted without consent

Environmental protection works; Extensive agriculture; Home businesses; Home occupations; Roads

3 Permitted with consent

Dwelling houses; Home industries; Oyster aquaculture; Tank-based aquaculture; Any other development not specified in item 2 or 4

4 Prohibited

Air transport facilities; Amusement centres; Biosolids treatment facilities; Boat building and repair facilities; Boat sheds; Camping grounds; Caravan parks; Cemeteries; Charter and tourism boating facilities; Centre-based child care facilities; Commercial premises; Community facilities; Correctional centres; Crematoria; Eco-tourist facilities; Educational establishments; Entertainment facilities; Exhibition homes; Exhibition villages; Extractive industries; Freight transport facilities; Function centres; Heavy industrial storage establishments; Highway service centres; Home occupations (sex services); Industrial training facilities; Industries; Information and education facilities; Intensive livestock agriculture; Marinas; Mooring pens; Moorings; Mortuaries; Passenger transport facilities; Places of public worship; Pond-based aquaculture; Recreation facilities (indoor); Recreation facilities (major); Registered clubs; Residential accommodation; Respite day care centres; Restricted premises; Rural industries; Sewage treatment plants; Sex services premises; Storage premises; Tourist and visitor accommodation; Transport depots; Truck depots; Vehicle body repair workshops; Vehicle repair stations; Warehouse or distribution centres; Waste or resource management facilities; Water recreation structures; Wharf or boating facilities; Wholesale supplies

Key considerations

1. Strategic importance of the Wagga Wagga Special Activation Precinct

Wagga Wagga is strategically located between all major cities on the eastern seaboard of Australia, with direct rail access to Sydney, Melbourne and Brisbane to be achieved through the development of the Inland Rail project. Heavy vehicle access to those cities, and additionally Adelaide and Perth, is available through direct access to the national highway network. Air freight services departing Canberra International Airport provide daily access to Asian and Middle Eastern export markets (Figure 1).

These combined attributes define Wagga Wagga as a strategic transport hub, well positioned to provide reliable access to key domestic and international locations and networks. The Riverina Intermodal Freight and Logistics Hub (RiFL) located within the Wagga Wagga SAP is a catalyst for economic development, enabling reductions to the cost of freight, improving the reliability of freight and supporting the growth of regional enterprises.

The Bomen industrial area already hosts a range of cornerstone industries. These enterprises underpin economic activity and sustainability of the industrial area, whilst demonstrating the suitability of the area to support substantial business activity and to deliver locational benefits for enterprises positioning their operations for access to major markets. Businesses already positioned within the Special Activation Precinct include:

Teys Australia – the largest meat processing plant in NSW, providing a large proportion of meat products for all Woolworths and Aldi stores across NSW. Teys supports approximately 1,000 full time equivalent positions. Teys senior management have indicated that the expansion of the RiFL Hub would allow opportunities for additional cold storage hubs at the Wagga Wagga site. Located within the Stage 3 precinct, this would comprise an additional $120m investment and an additional 74 jobs.

Riverina Oils and Bio Energy (ROBE) - has capacity to process two-thirds of the eastern Australian canola crop. The business exports cooking oils direct to India and America. ROBE comprises a $130m investment into the agricultural sector of New South Wales and employs over 100 people. Current annual turnover is $200m and ROBE has plans in place to increase production by 100%, which would have potential to employ an additional 40 staff. In addition, ROBE advise that the company’s strategic planning considers establishing a manufacturing site for dips/mayonnaise in Bomen and relocating packaging and warehousing from Victoria to Bomen, further contributing to employment growth and value-adding activities in the industrial precinct.

Enirgi Group – the largest battery recycling company in southern hemisphere. Enirgi currently recycles 70,000 tonnes of batteries annually at its Bomen facility, employing 120 staff. RiFL Hub Stage 3 would result in Enirgi having capacity to expand upon implementation. This will enable the relocation of a processing plant from Melbourne. This will increase production and employment growth at Bomen and within southern New South Wales.

Wagga Wagga Livestock Marketing Centre (LMC) – located in Bomen, the LMC facilitates the largest sheep/lamb sales and second largest prime cattle sale figures in southern hemisphere with over $480million of stock being sold through the facility annually. The LMC employs more than 125 people.

There are approximately 40 other medium to large enterprises located within Bomen Industrial Area. Cumulatively these employ between 1,500 and, 2,000 people. These businesses are medium to heavy industries. Placement of additional sensitive receptors within close proximity has the potential to constrain their ongoing activities or future expansion.

The Wagga Wagga Special Activation Precinct will provide opportunities in southern New South Wales for industries that require uninhibited access to interstate rail. These opportunities will be further enhanced when the Inland Rail network is fully developed. Displacement of industries from Sydney as a result of this scenario has been considered. Sydney has a critical shortage of available industrial and employment lands. The Wagga Wagga SAP provides a remedy to the constraints upon industrial development and enterprises in Sydney, rather than a competitor for the viable industrial activity of that city.

The primary reason for relocation to Wagga Wagga are the advantages of a lower price of land and ready availability of larger allotments that allow heavier industrial activities. Bomen provides a lower cost of entry relative to metropolitan land prices resulting in lower input costs to businesses. As stated, there is also a limited supply of industrial and urban services land within Sydney. A large portion of the land earmarked for Potential Future Industrial/Employment in Sydney has not been zoned for industrial use to this time and the planning process to resolve this can take in excess of two years. Sydney metropolitan area has a limited supply of industrial and employment lands with access to existing rail infrastructure at this time.

The available quantity of land which has been recently released for industrial and employment purposes in Sydney does not have existing direct access to rail freight infrastructure. That land also has comparatively smaller land parcels. Having access to the M7 Motorway, this land appears to be predominantly used for logistics operations, with residential development located to its immediate north. The introduction of rail infrastructure, including the proposed Western Sydney Intermodal Freight Terminal, to these lands is subject to further investigation and development before this can be completed. By contrast, the Wagga Wagga SAP is to provide direct rail access to the existing Main Southern Line, larger allotments and relatively small amounts of residential land use in the periphery. The Wagga Wagga SAP offers a substantial supply of zoned land to facilitate further industrial and employment expansion in New South Wales at the present time.

The Wagga Wagga SAP offers other distinct advantages not easily replicated. It is ideally located for access to key agricultural lands, and combines this with excellent access to other metropolitan centres including Melbourne, Adelaide and Canberra. It is for these combined reasons that the precinct has been identified as a Special Activation Precinct in January 2019. NSW Government announced the establishment of these Special Activation Precincts as part of the 20 year economic vision for Regional NSW. The Precinct will be funded as part of the NSW Governments $4.2Billion Snowy Hydro Fund.

The above has been recognised by both the State and Federal Governments who have directed supporting funding and policy development to the land where the Wagga Wagga Special Activation Precinct is to be located.

An intensification of sensitive receptors adjacent to this land potentially limiting its functions, would be inconsistent with the strategic intent of the Wagga Wagga Special Activation Precinct and the important role it has within the broader region and would not be in the public interest.

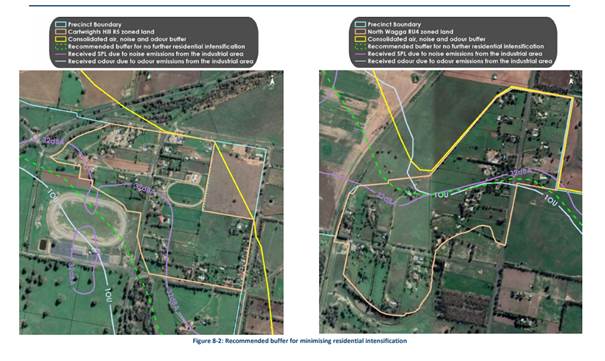

Technical studies undertaken for the Wagga Wagga Special Activation Precinct and other previous studies undertaken by Wagga Wagga City Council have identified that two areas of land adjoining the Wagga Wagga Special Activation Precinct boundary in Cartwrights Hill and North Wagga Wagga have the potential to be impacted by existing and future development in the existing Bomen Business Park / proposed Wagga Wagga Special Activation Precinct.

In order to support the ongoing operation and success of the strategically important Wagga Wagga Special Activation Precinct, it is proposed to amend the planning controls for the areas shown in to prevent further intensification of residential uses on certain sites. This will be achieved through:

· ensuring that additional residential accommodation will not be permissible on the subject lots; and

· preventing additional subdivision and additional dwellings.

The proposed amendments to the Wagga Wagga LEP 2010 for this land would maintain the rural landscape of these existing small residential clusters while preventing further intensification. This will provide a balance between allowing existing residents to remain in the area and preventing further development.

It is noted that some other areas of land surrounding the Special Activation Precinct (zoned RU1 Primary Production) are also identified as not recommended for intensification. As these areas of land comprise large lots with an existing minimum lot size of 200ha, the potential for intensification is minimal and so changes to the existing controls in these areas are not considered necessary.

2. Land use conflict

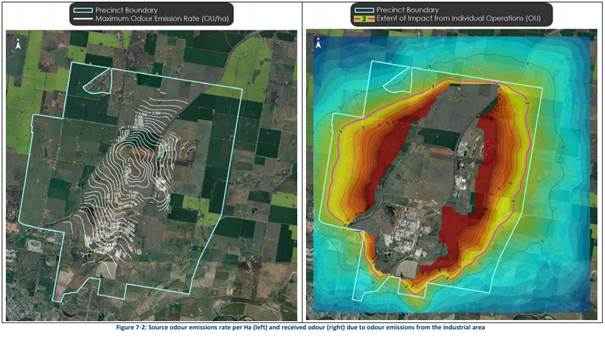

Air noise and odour technical studies undertaken by Todoroski Air Sciences in developing the Wagga Wagga Special Activation Precinct Master Plan identified a need to protect and minimise sensitive receptors in areas abutting the Wagga Wagga Special Activation Precinct boundary.

“The analysis shows a likely medium to high risk level of impact between existing industries and receptors in the Cartwrights Hill area (south and south west of the southern parts of the BIE). The impact, or land use conflict arises due to insufficient dispersion caused by the close proximity of the existing receptors to existing odorous industrial activities. This effect dominates the results, and masks the potential risk of impact that may otherwise be apparent between other sources and more distant receptors. The effect is lessened when the scale of the emissions is included in the considerations. (Todoroski Air Sciences – Noise and Odour Study 2019, p33)”

Figure 5 – Odour emissions modelling to the periphery of the Special Activation Precinct

Figure 5 illustrates that the south-western and southern portions of the study area are at highest risk of impact from air pollutant concentrations. A sensible planning outcome in response to this is to avoid placement of additional receptors within the higher-risk areas indicated in the noise and odour report.

As the population density of a location increases, the proportion of sensitive individuals in the area will also increase, in turn increasing the risks of sensitive individuals being adversely impacted by odour and noise. Due to the range in sensitivity to impacts in the population, greater residential use or intensification would be problematic if it occurs in the locations closest to the minimum required buffer area where future impacts may be near to guideline levels. In addition to the required minimum buffer area shown in Figure 8-1, it is recommended to minimise or limit further residential intensification in areas close to the required buffer area.

This is necessary to ensure that the projected impacts are not exacerbated in the future by residential creep (increased numbers of residential dwellings close to industrial sources) (Todoroski Air Sciences – Noise and Odour Study 2019, p81)” which is attached to this report.

Figure 6 – Noise and Air contours (Todoroski 2020)suggested buffers and noise and odour modelling overlaid upon lands at Cartwrights Hill and Byrnes Road areas

It is appropriate that

these are re-zoned into the Ru6 Transition Zone in order to further prevent

intensification of sensitive residential land uses that would compromise the

long-term operations of existing and future industries within the SAP.

The RU6 Transition Zone focusses on protecting and maintaining a transition between rural and other land uses in order to minimise conflicts. Dwellings remain permitted with consent, however there are restrictions on land division within these locations due to existing lot sizes. The zone also supports agriculture and environmental protection works which complements the adjacent Landscape Buffer Sub Precinct. (Jenson Plus, Bomen Special Activation Structure Plan Report p81” attached to this report.

Figure 7 – Structure Plan Special Activation Precinct (Jenson Plus, 2020)

The proposed amendments to the Wagga Wagga LEP 2010 are the most robust means of minimising land use conflicts that would result from future intensification of residential uses in the identified areas adjoining the Bomen Industrial Area. The proposed new zone objectives and permitted uses better reflect the land’s proximity to strategically important industrial land with non-replicable advantages (such as Inland Rail and the Main Southern Line) and the surrounding RU1 – Primary Production Land.

Council has received letters from NSW Government Agencies; Environmental Protection Authority, Department of Planning Industry and Environment and Regional Growth Development Corporation. All recommending that Council endorse the proposed planning proposal. These letters are attached to this report.

3. Consistency with endorsed strategic directions

Riverina Murray Regional Plan 2036

The proposed amendment to the Wagga Wagga LEP 2010 is consistent with the objectives and actions of the Riverina Murray Regional Plan 2036 (2017). In particular, the proposal supports Action 4.3 of the Plan to ‘Protect industrial land, including in the regional cities (Bomen, Nexus and Tharbogang) from potential land use conflicts arising from inappropriate and incompatible surrounding land uses’.

Continuing to develop and protect the Bomen Business Park as a designated area for specialisation in industrial activities is further supported by the following actions of the Regional Plan:

· Encourage co-location of related advanced and value-added manufacturing industries to maximise efficiency and infrastructure use, decrease supply chain costs, increase economics of scale and attract further investment.

· Encourage the sustainable development of industrial land to maximise the use of infrastructure and connectivity to the existing freight network.

· Promote specialised employment clusters and co-location of related employment generators in local plans.

· Monitor the supply and demand of employment and industrial land in regional cities to inform the planning and coordination of utility infrastructure to support new development.

Wagga Wagga Spatial Plan 2013

The Bomen Business Park features within the Wagga Wagga Spatial Plan (endorsed by the Minister for Planning) as a key area for the future development of Wagga Wagga. The Spatial Plan notes the supply of well located, competitively valued, industrial land is a key factor for local and regional prosperity. The Spatial Plan envisions that the Bomen Business Park will be “a high-quality and nationally renowned place for transport and logistics-based enterprises, well-designed and integrated with existing industry, which meets the requirements of a targeted range of businesses and supporting activities to complement and nurture a more sustainable City and Riverina Region”.

The proposed amendment to the Wagga Wagga LEP 2010 will preserve development opportunities within the Bomen Business Park to support achieving this vision and therefore aligns with the strategy.

Wagga Wagga Integrated Transport Strategy and Implementation Plan 2040

The Wagga Wagga Integrated Transport Strategy and Implementation Plan (2017) reflects the transport needs and expectations of the Wagga Wagga community, and best practice for the city. The strategies include a priority to establish Bomen as an intermodal hub connected to the Inland Rail Network.

The Inland Rail project will open up Melbourne and Brisbane ports, and the Bomen Business Park will benefit froma direct interface with this network via the Riverina Intermodal Freight and Logistics (RiFL) Hub. This will make the location of the Wagga Wagga Special Activation Precinct one of the most important freight and logistic destinations and hubs in Australia.

The Strategy emphasises capitalising upon existing and forthcoming investment and working with industry to make the best use of government investment. For this reason one of the key actions of the plan is the protection of the Bomen Business Park from inappropriate development and the prevention of land use conflict.

Significant investment into infrastructure is currently underway to support the expansion of the Bomen Business Park. The development of residential accommodation on nearby land may have a significant impact on the success of this investment and deter future investment opportunities.

State Government Strategic Investment

The Premiers 20-year vision for Regional Economic Development identified Wagga Wagga as a regional city with a population set to grow beyond 100,000. The NSW State Government has invested a significant amount in the Bomen Business Park and surrounds, including;

· Bomen Enabling Roads $35m

· Fixing Country Rail, RIFL Hub 2, $14.4m

· Growing Local Economies, RIFL Hub 3, $29.8m

· Technology Choice Area Switch $1.67m

· Special Activation Precinct $100m- $150m (Pending Business Case)

These investments rely upon land within the Wagga Wagga Special Activation Precinct reaching its potential as an enterprise area, with a range of industrial activities being allowed and existing industry being able to expand. Intensification of residential development to the south west and south of the precinct would jeopardise the success of these investments.

Federal Government Investment

Wagga Wagga City Council is currently being assessed through the Inland Rail Productivity Enhancement Program. This program is leveraging from the $10.8 Billion investment in inland rail.

The Riverina Intermodal and Freight and Logistics Hub has been identified as an opportunity to further enhance the terminal and interface with the industrial precinct to create a world class port. Additional sensitive receptors could restrict the potential of this investment.

Ministerial Directions (Section 9.1 Directions)

The Directions made by the Planning Minister under Section 9.1 of the EP&A Act 1979 must be considered when preparing and assessing a Planning Proposal. Although the Directions do not apply to the proposed amendment, they contain important considerations.

An assessment of the consistency of the proposed changes with the relevant Section 9.1 Directions has been undertaken and they have been determined to be generally consistent with the exception of Direction 3.1 Residential Zones. This Direction aims to encourage a variety and choice of housing types. The proposed amendment will reduce the permissible residential density of land, through the prohibition of secondary dwellings under the new zoning and through the proposed increase in minimum lot size, which is not aligned with this aim

The Direction states that inconsistency is permitted where it is justified by a strategy or study or it is in accordance with the relevant Regional Strategy. The proposed reduction in residential density is therefore considered to be justified in this case because:

· The proposed amendments are supported by the Wagga Wagga Special Activation Precinct technical studies, which seek to protect the operation of the strategically significant Regional Enterprise Zone, using buffer zones to manage impacts on nearby residential areas; and

· The strategic importance of the Wagga Wagga Special Activation Precinct is reinforced in the Regional Plan, as outlined in the previous section of this Discussion Paper.

4. Alternative Considerations

Alternative options for the planning proposal have been considered for both the subject land at Cartwrights Hill and at Byrnes Road.

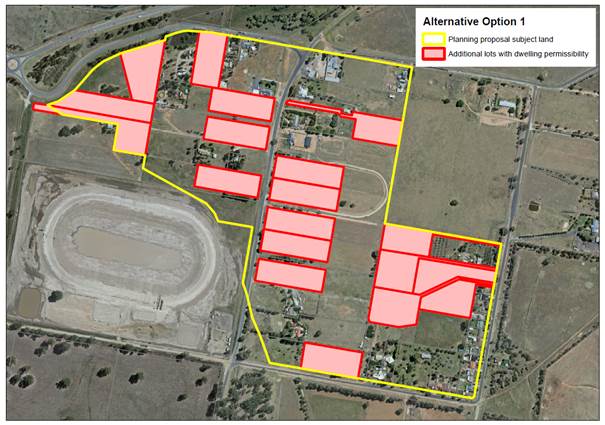

Cartwrights Hill alternative option 1

Retain current 1 Ha minimum lot size and retain current R5 Large Lot Residential zone:

· No changes to WWLEP 2010.

· Potential for up to 19 additional allotments with dwelling entitlements.

· Potential for dual occupancy development on existing dwelling lots and 19 additional lots – 70 lots total with potential for dual occupancy development.

· R5 Large Lot Residential zone objectives continue to support residential development within the subject land.

· All development applications required to address Clause 7.8 of the Wagga Wagga LEP 2010.

· Considerable opportunities remain available for new residential development and intensification, increasing potential noise and odour receptors in the area.

· Ongoing conflict between landowners, Council and Bomen Businesses, expectations due to zoning ambiguity.

Figure 8 – Potential for additional lots at Cartwrights Hill under alternative option 1

Cartwrights Hill alternative option 2

Increase to 2 Ha minimum lot size and retain current R5 Large Lot Residential zone:

· Potential for up to 3 additional allotments with dwelling entitlements.

· Potential for dual occupancy development on existing dwelling lots and 3 additional lots – 54 lots total with potential for dual occupancy development.

· R5 Large Lot Residential zone objectives would continue to support residential development within the subject land.

· All development applications required to address Clause 7.8 of the Wagga Wagga LEP 2010.

· Limited opportunities would be available for new residential allotments, but considerable opportunities would remain for intensification via dual occupancy development, increasing potential noise and odour receptors in the area.

Figure 9 – Potential for additional lots at Cartwrights Hill under alternative option 2

Cartwrights hill alternative option 3

Increase to 5 Ha minimum lot size and retain current R5 Large Lot Residential zone:

· No potential for additional allotments with dwelling entitlements.

· Potential for dual occupancy development on existing dwelling lots – 51 lots total with potential for dual occupancy development.

· R5 Large Lot Residential zone objectives would continue to support residential development within the subject land.

· All development applications required to address Clause 7.8 of the Wagga Wagga LEP 2010.

· No opportunities would be available for new residential allotments, but considerable opportunities would remain for intensification via dual occupancy development, increasing potential noise and odour receptors in the area.

Byrnes Road alternative option 1

Retain current 2 Ha minimum lot size and retain current RU4 Primary Production Small Lots zone:

· Potential for 1 additional allotment with dwelling entitlement.

· Potential for dual occupancy development on existing dwelling lots and the additional lot – 15 lots total with potential for dual occupancy development

· RU4 land use table permits dual occupancy development

· No requirement to consider noise and odour implications as per Clause 7.8, unlike Cartwrights Hill

· Only one opportunity would exist for a new residential allotment, but opportunities would remain for intensification via dual occupancy development, increasing potential noise and odour receptors.

Figure 10 – Potential for additional lots at Byrnes Road under alternative option 1

Byrnes Road alternative option 2

Increase to 5 Ha minimum lot size and retain current RU4 Primary Production Small Lots zone:

· Potential for 1 additional allotment with dwelling entitlement.

· Potential for dual occupancy development on existing dwelling lots and the additional lot – 15 lots total with potential for dual occupancy development

· RU4 land use table permits dual occupancy development

· No requirement to consider noise and odour implications as per Clause 7.8, unlike Cartwrights Hill

· Only one opportunity would exist for a new residential allotment, but opportunities would remain for intensification via dual occupancy development, increasing potential noise and odour receptors.

Figure 11 – Potential for additional lots at Byrnes Road under alternative option 2

Conclusion

The success of the Wagga Wagga Special Activation Precinct is of key strategic importance for Wagga Wagga, the Riverina-Murray Region and for southern New South Wales.

It is recommended that Council progress this planning proposal concurrently with the Special Activation Precinct to ensure that the community understands that this process is occurring due to the changes proposed within the precinct and the supporting technical information.

Alternative approaches have been considered, however will not deliver the certainty and protection that this proposal provides for future development within the SAP. Increasing sensitive receptors within close proximity to the SAP would result in unsatisfactory conditions for potential future residents and restrict the potential of business investment within the precinct.

It must be emphasised that dwellings will still be permissible. Residents will still be able to live in these areas and enjoy the rural lifestyle. Intensified residential development and tourist and visitor accommodation will be not allowed to prevent landuse conflict.

Financial Implications

This planning proposal was developed internally by Council staff in the course of their ordinary tasking in strategic planning matters. As a result, a planning proposal application fee has not accrued to Council in this instance. Development of the planning proposal has not required additional funding.

As a result of the planning proposal future development on the subject lands is likely to be limited in its scope and intensity by the effect of planning provisions. This means that demand upon public facilities and infrastructure arising from development at Cartwrights Hill would remain relatively static for the foreseeable future and Council’s requirement to fund this draw upon public infrastructure through the aforementioned levies at Cartwrights Hill would not substantially increase.

Policy and Legislation

Environmental Planning and Assessment Act 1979

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

An approval of the proposal may be subject to public scrutiny during the public consultation period.

Council can expect that the planning proposal may attract criticism from affected landowners, due to the planning proposal providing an effective continuance of constraints upon the development of lands at Cartwrights Hill.

Internal / External Consultation

No formal community consultation with regard to this amendment to the Wagga Wagga LEP 2010 has occurred to date however the issues that underly the amendment have been raised by members of the business and residential community since 2015.

Businesses within the existing Bomen Business Park have continually objected to any residential expansion proposed within Cartwrights Hill and potential investors have indicated to Council their concern in relation to additional receptors.

The last development application for residential development within Cartwrights Hill received nine objections from significant businesses in Bomen conveying their fears in relation to impediments to their operations due to additional sensitive receptors.

Residents within Cartwrights Hill have provided supporting submissions for additional residential development opportunities within the area to leverage more from their properties.

Informal consultation will commence concurrently with the exhibition of the Special Activation Precinct. This will ensure that residents are prepared for the formal exhibition process and will have a clear understanding of what is within the technical reports and the justification. Council will hold meetings with landowners with Department of Planning and Environment Staff as part of the Special Activation Precinct notification process. The Special Activation Precinct Notification period has been extended to a 56 day exhibition period.

Formal public consultation with land owners, the general public and referral agencies will occur after the Gateway Determination and in accordance with the requirements of any Gateway Determination received. It is not known when Gateway Determination will be received, however the will be a requirement for an additional 28 day exhibition period.

Proposed consultation methods are indicated in the table below.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

x |

x |

|

x |

|

|

x |

|

x |

|

|

x |

|

|||

|

Involve |

|

x |

x |

|

|

x |

|

x |

|

||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Structure Plan (SAP) - Provided under separate cover |

|

|

2. |

Noise and Odour Report (SAP) - Provided under separate cover |

|

|

3. |

NSW Planning and Environment Letter - Provided under separate cover |

|

|

4. |

EPA Letter - Provided under separate cover |

|

|

5. |

RGDC Letter - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 27 July 2020 |

RP-3 |

RP-3 INITIAL RESPONSE TO NOTICE OF MOTION - ENFORCEMENT ACTION FOR DA09/0872

Author: Peter Thompson

|

Summary: |

At the Ordinary Meeting on 14 July 2020 Council resolved that a report be provided to the 27 July 2020 Council Meeting explaining in detail the non-enforcement of conditions for Development Application number DA09/0872, Rocky Point Quarries.

This report provides an initial response to this resolution and requests a further period within which to provide the final report as it requires further detailed investigation in relation to both compliance action and also Council works and expenditure on Tooyal Road. |

|

That Council receive this report and note that a further report will be provided to Council on or before the Ordinary meeting of 24 August 2020. |

Report

Council issued a conditional consent for a proposed enlargement of the existing quarry and an increase in production for Rocky Point Quarry. The consent was issued in March 2011 and included the following condition:

5. Prior to commencement of quarrying under this consent, a formal agreement shall be made between the quarry operators and Council as to arrangements for maintenance of Tooyal Road (both pre and post seal from the quarry entrance to the intersection with Old Narrandera Road) and Old Narrandera Road (east of Tooyal Road to the Olympic Highway), including apportionment of maintenance costs and payment methods being based on traffic volumes and impacts of the traffic generated by the development. The agreement reached pursuant to this condition shall bind all future owners and shall be complied with at all times until the quarry permanently ceases operation and total rehabilitation of the site is completed.

Although this consent has been acted upon and the quarry is operational, the road sealing works have not yet been completed.

It is understood from discussions with current staff that following the issue of the consent, meetings occurred between Council staff and the developer about how the roadworks would be undertaken. The outcome of these discussions was that the developer would prepare the road base for sealing at the cost of the developer and the Council would seal the road at the cost of the Council.

This approach was executed and completed for the first 400m of the road. The next section was prepared by the developer on the same basis, however the Council funding for the sealing work did not eventuate and it was not done. No further work has been done towards sealing the road since the event.

The developer maintains the road currently at no cost to Council.

A meeting is being arranged with the developer to establish a plan for compliance with the condition at the costs of the developer. A further report will be brought to Council to detail the expenditure of Council on the works discussed in this report and the plan going forward to achieve compliance.

Financial Implications

N/A

Policy and Legislation

N/A

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 27 July 2020 |

RP-4 |

RP-4 2019/20 Operating Budget Revotes, July 2020 Budget Variations and 30 June 2020 Investment Report

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Summary: |

This report is for Council to approve the proposed 2019/20 operating budget revotes and proposed 2020/21 budget variations required to manage the 2020/21 budget and Long-Term Financial Plan.

This report is also for Council to consider its external investments and performance as at 30 June 2020. |

|

That Council: a approve the proposed 2019/20 operating budget revotes as presented in this report b approve the proposed 2020/21 budget variations for the month ended 31 July 2020 and note the proposed deficit budget position as a result of COVID-19 with the impacts from COVID-19 to be presented in a future separate report c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above d note the details of the external investments as at 30 June 2020 in accordance with section 625 of the Local Government Act 1993 |

Report

This report provides a summary of the 2019/20 operating budgets requested for carryover that have not yet commenced as at 30 June 2020.

The adoption of the recommendation will enable the revote of the funding allocation from the 2019/20 budget for operating projects that have not commenced to the 2020/21 budget.

This report does not include projects deemed works in progress as at 30 June 2020 for both operating and capital projects, noting that the unexpended funds will automatically transfer to the 2020/21 financial year without the need for a Council resolution (as per Section 211 of the Local Government (General) Regulation 2005). Council also recently adopted the 2019/20 capital works program budget reset which replaced the need for any capital budget revotes.

It is important to note that the estimated operating revote figures that are presented in this report are subject to marginally change pending the finalisation of the 2019/20 financial statements.

This report includes the proposed 2020/21 budget variations for Council’s consideration and adoption. Council is forecasting a deficit budget position as at 31 July 2021 as presented in RP-6 ‘Integrated Planning and Reporting – Adoption of Documents’ Report to Council 29 June 2020 as a result of the indicative financial impact from the COVID-19 Pandemic. The budget variations in this report include adjustments relating to COVID-19, with subsequent reports to be presented to Council in relation to the ongoing review of proposed funding and adjustments of the 2020/21 forecast deficit.

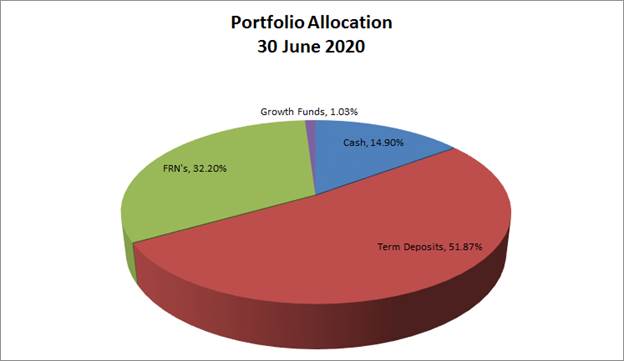

This report also includes details on the performance of Council’s investments as at 30 June 2020.

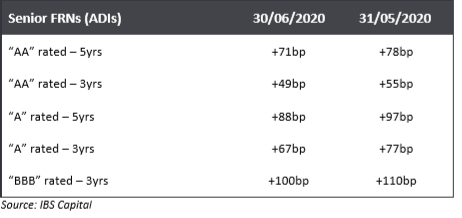

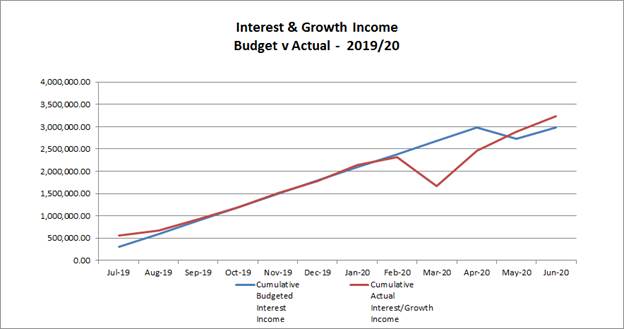

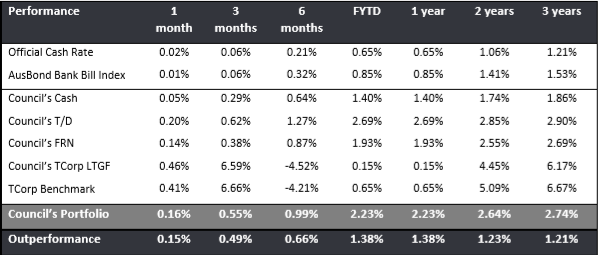

Council has experienced a positive monthly investment performance for the month of June when compared to budget ($93,101 up on the monthly budget). This is due mainly to continued positive rebound from Council’s Floating Rate Note portfolio and TCorp Long Term Growth fund.

Council’s investment portfolio continues to perform strongly in the current low interest rate environment with the portfolio returning 2.23% for the 2019/20 financial year, outperforming the AusBond Bank Bill Index by 1.38%.

The usual monthly financial report information is not included in this Council report due to the commencement of the year-end process and preparation of the financial statements for auditing. The 2019/20 Financial Statements will be presented to Council in October 2020 which will highlight and provide analysis on Council’s overall financial performance and position including the finalised financial impact of the COVID-19 pandemic for the 2019/20 financial year. Council’s Independent Auditor will present the 2019/20 Audit Report at the November 2020 Council meeting.

2019/20 Operating Budget Revotes

|

Job Description |

Revote Amount $ |

Funding |

Justification |

|

Gender Equity Management Fee |

48,033 |

GPR |

Funding to be used for Enlighten for Equity Project which is one of the key Community Engagement deliverables from the DV Project: 2650. The focus is on a whole of community approach to increase knowledge and challenge attitudes and social norms related to violence and gender inequality. |

|

Retail Strategy + Jobs Migration

|

35,000

|

GPR

|

$20K to be utilised for the Annual Grants Small Business program due to the significant number of excellent requests received. $15K is committed for consulting in regard to Riverside Stage 3. |

|

Bushfire Community Resilience & Economic Recovery Grant |

100,000 |

Grant |

Projects relating to grant funding received for the NSW Bushfire Recovery grant are still to be completed. |

|

Oasis Cogeneration Energy System |

69,000 |

Oasis Plant Reserve |

Funds are required for the ongoing services and repairs of the Cogen system. |

|

PCYC Contribution |

2,364,247 |

Borrowings |

Delays in the project have required the contribution to be carried over as per the Council resolution. |

|

Botanic Gardens Zoo Masterplan |

40,000 |

Parks & Rec Reserve + GPR |

A landscape architect will be engaged once the major works/improvements from Entwine are completed. |

|

Upgrade Trees in Baylis St - TT25 |

10,320 |

S7.11 |

New project as identified in S7.11 new plan to be completed in 20/21. |

|

Street Canopy Plantings - ROS7 |

50,000 |

S7.11 |

New project as identified in S7.11 new plan to be completed in 20/21. |

|

Integrated Planning & Reporting |

7,612 |

GPR |

Funds carried over to add to existing annual program funds to complete in 20/21. |

|

Community Survey |

31,000 |

GPR |

Community survey to be completed at the end of the Council term to align with the new election date. |

|

Road Condition Assessment |

223,870 |

GPR |

Existing funds to be carried over to add to recurrent program to enable a complete road network condition assessment. |

|

GWMC - EIS Update for Extension areas |

196,430 |

Solid Waste Reserve |

The EIS update is contingent on emerging information from the recent installation of new groundwater bores as potential new sample points. The evaluation of these groundwater bores may result in a variation requested from EPA. This together with the completed odour assessment, amalgamation of lots and new weighbridge installation will inform the required EIS. |

|

Flood Warning System FM0091 |

33,000 |

Grant + GPR |

Funds are required to be carried over to implement recommendations from the MOFFS report which is currently being finalised. |

|

MOFFS Hot Spot Mitigation |

77,872 |

Stormwater Levy Reserve |

Funds are required to be carried over to implement recommendations from the MOFFS report which is currently being finalised. |

|

|

3,286,384* |

|

|

*The estimated Revote amounts that are presented in this table are subject to change pending the finalisation of the 2019/20 financial statements.

Revised Budget Result - Surplus/(Deficit) |

$’000s |

|

Original 2020/21 Budget Result as adopted by Council Total Budget Variations approved to date Budget Variations for July 2020 Water Expense Savings $47K Salary Expense Savings $283K |

($4,342K) $0 $330K |

|

Proposed Revised Budget result for 31 July 2020 |

($4,012K) |

The proposed Budget Variations to 31 July 2020 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact Fav/ (Unfav) |

|

1 – Community Leadership and Collaboration |

|

||

|

National Art Glass Gallery Acquisitions |

$13K |

Art Gallery Reserve ($13K) |

Nil |

|

The Art Gallery is planning to acquire a piece of work by acclaimed contemporary artist Tim Silver. The work is valued at $33,000 with Council securing a discounted price of $26,400. It is proposed to fund the required $13,200 from the Art Gallery Reserve with pay back to the reserve in 2021‑2022 from the annual acquisitions budget. Estimated Completion: 30 June 2021 |

|

||

|

Water Expenses |

($61K) |

LMC Reserve $9K Airport Reserve $1K Sewer Reserve $3K |

$47K |

|

Riverina Water have frozen all increases to fees and charges for the 2020/21 financial year in a move to assist residents and businesses financially impacted by the COVID-19 pandemic. In Council's Long-Term Financial Plan (LTFP) budget process an annual increase of 5% for water expenses was factored into the budget assumptions. This saving is proposed to be utilised to partially reduce Council's COVID-19 GPR deficit and transfer funds back to relevant reserves. This has a positive impact across all 10 years of the LTFP with the future year GPR impacts included in the report attachment. |

|

||

|

($354K) |

LMC Reserve $18K Airport Reserve $5K Sewer Reserve $26K Cemetery Reserve $6K Plant Replacement Reserve $3K Solid Waste Reserve $13K |

$283K |

|

|

The Local Government State Award 2020 was recently released, and in the Award the salary increase for Local Government employees for the next 3 years has been set as 1.5% for 2020/21; 2% for 2021/22 and 2% for 2022/23. This is less than the amount allowed for in the LTFP, which was budgeted at 2.5% for future years. The result of this is a reduction in the cost of salaries for the organisation over the 10 years of the LTFP. This saving is proposed to be utilised to partially reduce Council's COVID-19 GPR deficit and transfer funds back to relevant reserves. This has a positive impact across all 10 years of the LTFP with the future year GPR impacts included in the report attachment. |

|

||

|

3 – Growing Economy |

|

||

|

Incubator Lost Lanes Project |

$20K |

Destination NSW (DNSW) Incubator Grant Funds ($20K) |

Nil |

|

Council has received $20,000 for the 2020/21 Lost Lanes festival through the Destination NSW Regional Flagship Events Program’s Incubator Event Fund. All grant monies are to be spent on marketing initiatives that encourage overnight visitation from outside the region including advertising, public relations and visitor research costs. The Lost Lanes festival was to be held in June 2020 however due to COVID-19 restrictions a virtual event was held in its place. DNSW have advised that this funding may be used for the 2021 event instead. Estimated Completion: 30 June 2021

|

|

||

|

Incubator Spring Jam Project |

$20K |

Destination NSW Incubator Grant Funds ($20K) |

Nil |

|

Council has received $20,000 for the 2020/21 Spring Jam festival through the Destination NSW Regional Flagship Events Program’s Incubator Event Fund. All grant monies are to be spent on marketing initiatives that encourage overnight visitation from outside the region including advertising, public relations and visitor research costs. The Spring Jam Festival is currently scheduled for 26 September 2020 pending Public Health Orders due to COVID-19 restrictions. Estimated Completion: 30 June 2021 |

|

||

|

5 – The Environment |

|

||

|

Fuel Tank Purchase |

$40K |

Solid Waste Reserve ($40K) |

Nil |

|

Funds are required for the purchase of a Fuel Tank that is steel-in-steel with a safe-fill capacity of 14,500 litres and a hi-flow pump for the Gregadoo Waste Management Centre (GWMC). This is required due to the existing inground tank only holding 4,000 litres which is insufficient to last the full weekly fuel delivery cycle at the GWMC. The proposed new facility will be above ground and is able to be moved to the next plant shed location when required. It is proposed to fund the variation from the Solid Waste Reserve. Estimated Completion: 30 June 2021 |

|

||

|

$4,861K |

NSW Government Fixing Local Roads Grant Income ($3,646K) Urban Asphalt Budget ($852K) Heavy Patching Budget ($363K) |

Nil |

|

|

Council has been successful in securing grant funds under the NSW Government Fixing Local Roads Program to be utilised for Lake Albert Road Stage 3. These works will involve the replacement of asphalt, concrete and line marking in two sections of Lake Albert Road, including a 762m stretch from Fay Avenue to Stanley Street and a 783m stretch from Lord Baden Powell Drive to Warrawong Street. It is proposed to fund the required $1,215K Council portion of the funding from existing Urban Asphalt and Heavy Patching budgets, with the Urban Asphalt budget already programmed for Lake Albert Road, and the Mortimer Street Rehabilitation program will be rescheduled for completion in 2021/22 when the Heavy Patching budget becomes available. Estimated Completion: 30 June 2021

|

|

||

|

Installation of Flowmeters at Major Pump Stations |

$75K |

Sewer Reserve ($75K) |

Nil |

|

Funds are required for the installation of flow meters at the inlet of our major pump stations. This will assist to identify spillage which can go unidentified, and be beneficial to determine if upgrades or degrades of pumps are required to save future maintenance and capital costs. If it is required in the future to upgrade our pump stations for future demands, inflow data will provide information to make an informed decision. Ten pump stations will be fitted with the flow meters. It is proposed to fund the works from the Sewer Reserve. Estimated Completion: 30 June 2021 |

|

||

|

Review of North Wagga Flood Mitigation Options |

$60K |

Stormwater Drainage Reserve ($60K) |

Nil |

|

Estimated Completion: 31 March 2021. |

|

||

|

SURPLUS/(DEFICIT) |

$330K |

||

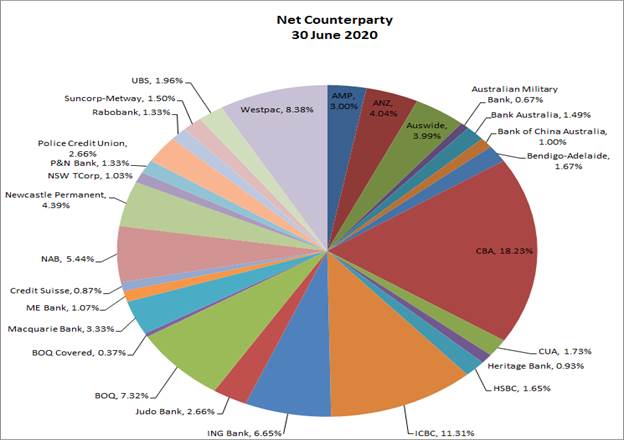

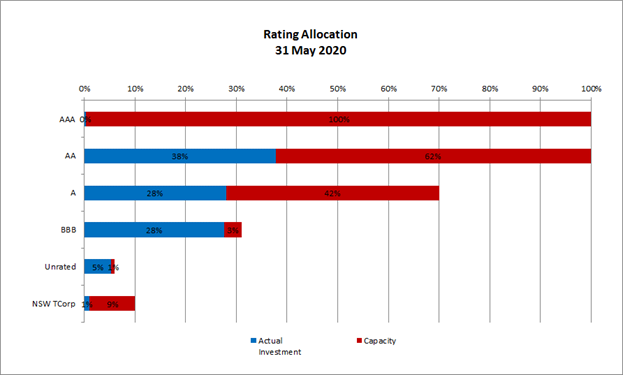

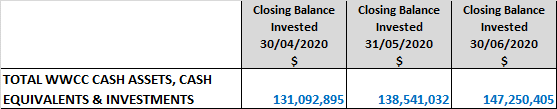

Investment Summary as at 30 June 2020

In accordance with Regulation 212 of the Local Government (General) Regulation 2005, details of Wagga Wagga City Council’s external investments are outlined below:

|

Institution |

Rating |

Closing Balance |

Closing Balance |

June |

June |

Investment |

Maturity |

Term |

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

AMP |

BBB+ |

2,000,000 |

2,000,000 |

1.80% |

1.33% |

1/06/2020 |

30/11/2020 |

6 |

|

AMP |

BBB+ |

1,000,000 |

0 |

0.00% |

0.00% |

2/12/2019 |

1/06/2020 |

6 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.67% |

0.67% |

29/08/2019 |

28/08/2020 |

12 |

|

Macquarie Bank |

A+ |

1,000,000 |

1,000,000 |

1.65% |

0.67% |

9/03/2020 |

7/09/2020 |

6 |

|

Auswide |

BBB |

0 |

2,000,000 |

1.00% |

1.33% |

30/06/2020 |

29/01/2021 |

7 |

|

Total Short Term Deposits |

|

5,000,000 |

6,000,000 |

1.49% |

3.99% |

|

|

|

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

470,217 |

96,851 |

0.25% |

0.06% |

N/A |

N/A |

N/A |

|

Rabobank |

A+ |

0 |

4 |

0.50% |

0.00% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

2,939,942 |

1,752,819 |

0.25% |

1.17% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

15,546,167 |

20,560,849 |

0.65% |

13.67% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

18,956,325 |

22,410,523 |

0.62% |

14.90% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

RaboBank |

A+ |

1,000,000 |

1,000,000 |

3.16% |

0.67% |

5/06/2017 |

6/06/2022 |

60 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.10% |

1.33% |

7/07/2017 |

7/07/2020 |

36 |

|

Rabobank |

A+ |

1,000,000 |

1,000,000 |

3.20% |

0.67% |

25/08/2016 |

25/08/2021 |

60 |

|

Westpac |

AA- |

3,000,000 |

3,000,000 |

1.20% |

2.00% |

10/03/2017 |

10/03/2022 |

60 |

|

Auswide |

BBB |

2,000,000 |

2,000,000 |

2.95% |

1.33% |

5/10/2018 |

6/10/2020 |

24 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.35% |

1.33% |

3/01/2018 |

4/01/2022 |

48 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

3.05% |

1.33% |

29/10/2018 |

29/10/2020 |

24 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

3.50% |

0.67% |

1/06/2018 |

1/06/2022 |

48 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

3.02% |

1.33% |

28/06/2018 |

28/06/2021 |

36 |

|

Westpac |

AA- |

2,000,000 |

0 |

0.00% |

0.00% |

28/06/2018 |

29/06/2020 |

24 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

2.86% |

1.33% |

16/08/2018 |

17/08/2020 |

24 |

|

BOQ |

BBB+ |

3,000,000 |

3,000,000 |

3.25% |

2.00% |

28/08/2018 |

29/08/2022 |

48 |

|

ING Bank |

A |

3,000,000 |

3,000,000 |

2.85% |

2.00% |

30/08/2018 |

14/09/2020 |

24 |

|

P&N Bank |

BBB |

1,000,000 |

1,000,000 |

3.10% |

0.67% |

16/10/2018 |

18/10/2021 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

3.05% |

1.33% |

13/11/2018 |

15/11/2021 |

36 |

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

3.07% |

0.67% |

20/11/2018 |

20/11/2020 |

24 |

|

P&N Bank |

BBB |

1,000,000 |

1,000,000 |

3.30% |

0.67% |

20/11/2018 |

21/11/2022 |

48 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

2.93% |

1.33% |

29/11/2018 |

30/11/2020 |

24 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

3.01% |

1.33% |

30/11/2018 |

30/11/2021 |

36 |

|

Bendigo-Adelaide |

BBB+ |

1,000,000 |

1,000,000 |

3.25% |

0.67% |

30/11/2018 |

30/11/2022 |

48 |

|

CUA |

BBB |

2,000,000 |

2,000,000 |

3.02% |

1.33% |

5/12/2018 |

7/12/2020 |

24 |

|

Newcastle Permanent |

BBB |

2,000,000 |

2,000,000 |

3.05% |

1.33% |

8/02/2019 |

8/02/2022 |

36 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

2.82% |

0.67% |

22/02/2019 |

22/02/2021 |

24 |

|

Newcastle Permanent |

BBB |

2,000,000 |

2,000,000 |

2.70% |

1.33% |

23/04/2019 |

26/04/2022 |

36 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

2.40% |

0.67% |

22/05/2019 |

23/05/2022 |

36 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

2.15% |

0.67% |

8/07/2019 |

10/07/2023 |

48 |

|

Judo Bank |

NR |

1,000,000 |

1,000,000 |

2.30% |

0.67% |

16/07/2019 |

16/07/2021 |

24 |

|

Auswide |

BBB |

1,000,000 |

1,000,000 |

1.95% |

0.67% |

12/08/2019 |

12/08/2022 |

36 |

|

Judo Bank |

NR |

1,000,000 |

1,000,000 |

2.15% |

0.67% |

20/08/2019 |

19/08/2021 |

24 |

|

Australian Military Bank |

BBB+ |

1,000,000 |

1,000,000 |

1.76% |

0.67% |

20/08/2019 |

20/08/2021 |

24 |

|

Institution |

Rating |

Closing Balance |

Closing Balance |

June |

June |

Investment |

Maturity |

Term |

|

Judo Bank |

NR |

1,000,000 |

1,000,000 |

1.90% |

0.67% |

10/09/2019 |

9/09/2022 |

36 |

|

Auswide |

BBB |

1,000,000 |

1,000,000 |

1.72% |

0.67% |

3/10/2019 |

4/10/2022 |

36 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

2.03% |

1.33% |

6/11/2019 |

6/11/2024 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.83% |

1.33% |

28/11/2019 |

28/11/2024 |

60 |

|

Judo Bank |

NR |

1,000,000 |

1,000,000 |

2.20% |

0.67% |

5/12/2019 |

3/12/2021 |

24 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.75% |

0.67% |

6/01/2020 |

8/01/2024 |

48 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

2.00% |

0.67% |

28/02/2020 |

28/02/2025 |

60 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

1.50% |

1.33% |

2/03/2020 |

2/03/2022 |

24 |

|

Macquarie Bank |

A+ |

2,000,000 |

2,000,000 |

1.40% |

1.33% |

9/03/2020 |

9/03/2022 |

24 |

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

2.20% |

0.67% |

1/04/2020 |

1/04/2025 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.85% |

0.67% |

29/05/2020 |

29/05/2025 |

60 |

|

ICBC |

A |

0 |

1,000,000 |

1.86% |

0.67% |

1/06/2020 |

2/06/2025 |

60 |

|

ICBC |

A |

0 |

2,000,000 |

1.75% |

1.33% |

25/06/2020 |

25/06/2025 |

60 |

|

ICBC |

A |