Agenda

and

Business Paper

To be held on

Monday 17

October 2022

at 6.00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

Agenda

and

Business Paper

To be held on

Monday 17

October 2022

at 6.00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

NOTICE OF MEETING

The proceedings of all Council meetings in open session, including all debate and addresses by the public, are recorded (audio visual) and livestreamed on Council’s website including for the purpose of facilitating community access to meetings and accuracy of the Minutes.

In addition to webcasting council meetings, audio recordings of confidential sessions of Ordinary Meetings of Council are also recorded, but do not form part of the webcast.

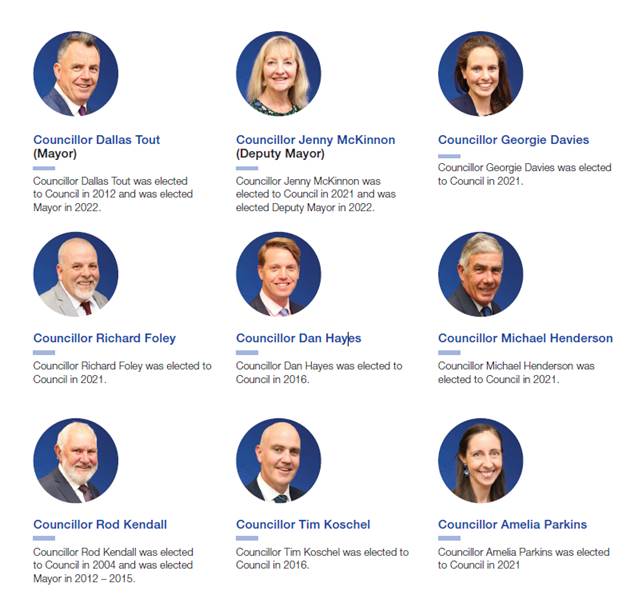

WAGGA WAGGA CITY COUNCILLORS

STATEMENT OF ETHICAL OBLIGATIONS

Councillors are reminded of their Oath or Affirmation of Office made under Section 233A of the Local Government Act 1993 and their obligation under Council’s Code of Conduct to disclose and appropriately manage Conflicts of Interest.

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

Reports submitted to the Ordinary Meeting of Council to be held on Monday 17 October 2022.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 17 October 2022

CLAUSE PRECIS PAGE

ACKNOWLEDGEMENT OF COUNTRY 3

REFLECTION 3

APOLOGIES 3

Confirmation of Minutes

CM-1 ORDINARY COUNCIL MEETING - 19 SEPTEMBER 2022 3

DECLARATIONS OF INTEREST 3

Mayoral Minutes

MM-1 MAYORAL MINUTE - ACCOUNTING TREATMENT OF RURAL FIRE SERVICE ('RED FLEET') ASSETS 4

MM-2 MAYORAL MINUTE - LATE LGNSW CONFERENCE MOTION - SUBMISSION PERIOD FOR MAJOR DEVELOPMENTS 8

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - ELECTRIC VEHICLE INFRASTRUCTURE IN THE WAGGA WAGGA LGA 10

NOM-2 NOTICE OF MOTION - POST OFFICE PEOPLES BANK 12

Councillor Report

CR-1 DELEGATE REPORT - 2022 NSW ANNUAL AUSTRALIAN LOCAL GOVERNMENT WOMEN’S ASSOCIATION (ALGWA) CONFERENCE 15

CR-2 DELEGATE REPORT - TRANSPORT AND ACCESSIBILITY MASTERCLASS 18

Reports from Staff

RP-1 PROPOSED PLANNING AGREEMENT 12 BLAKE STREET WAGGA WAGGA DA19/0125 21

RP-2 DA22/0029 - PROPOSED USE OF SITE FOR TEMPORARY EVENTS (20 PER YEAR) INCLUDING ADDITIONAL PARKING AREA AND USE OF EXISTING PERGOLA, AMENITIES BLOCK AND SHIPPING CONTAINER. LOT 1 DP 829597, 85 HILLARY STREET, NORTH WAGGA, 2650 25

RP-3 DA22/0177 - ALTERATIONS AND ADDITIONS TO INCLUDE RETAIL PREMISES, LICENCED FUNCTION CENTRE AND RESTAURANT. LOT 1 DP 631019, 187 FITZMAURICE STREET, WAGGA WAGGA, NSW, 2650. 30

RP-4 DA22/0260 - CONSTRUCTION OF 3 X 2 STOREY DWELLINGS WITH DETACHED TRIPLE GARAGE AND 4 LOT COMMUNITY TITLE SUBDIVISION - LOT 8 DP 7850, 212 EDWARD ST WAGGA WAGGA NSW 2650 35

RP-5 REQUEST TO WAIVE SECTION 64 CONTRIBUTIONS AND DEVELOPMENT APPLICATION FEES FOR DA20/0724 40

RP-6 RIVERINA JOINT ORGANISATION (RIVJO) - One Organisation Options’ Paper 45

RP-7 ANNUAL FINANCIAL STATEMENTS 2021/22 71

RP-8 FINANCIAL PERFORMANCE REPORT AS AT 30 SEPTEMBER 2022 83

RP-9 REQUESTS FOR FINANCIAL ASSISTANCE 117

RP-10 DRAFT URBAN COOLING STRATEGY 126

RP-11 ALCOHOL-FREE ZONE AND PROHIBITED AREAS 130

RP-12 AMENDMENT TO WAGGA WAGGA LOCAL GOVERNMENT AREA BUSH FIRE PRONE LAND MAP 135

RP-13 RENEWAL OF COMMUNITY, CULTURAL AND SPORTING LEASES AND LICENCES FOR 2023 143

RP-14 APPLICATIONS FOR SUBSIDY FOR WASTE DISPOSAL FOR CHARITABLE ORGANISATIONS 148

RP-15 CLOSED CIRCUIT TELEVISION (CCTV) POLICY (POL 058) 151

RP-16 ADOPTION OF COUNCIL POLICIES 158

RP-17 WRITTEN RETURNS OF INTEREST - COUNCILLORS AND DESIGNATED PERSONS 2022 167

RP-18 QUESTIONS WITH NOTICE 170

Committee Minutes

M-1 TRAFFIC COMMITTEE - 8 SEPTEMBER 2022 172

M-2 CONFIRMATION OF MINUTES AUDIT, RISK AND IMPROVEMENT COMMITTEE - 6 OCTOBER 2022 179

Confidential Reports

CONF-1 CONTAINER DEPOSIT SCHEME (CDS) - REFUND SHARING ARRANGEMENT 184

CONF-2 PROPOSED LICENCE AGREEMENT - PART SENIOR CITIZENS CENTRE, 204 TARCUTTA STREET, WAGGA WAGGA 185

Wagga Wagga City Council acknowledges the traditional custodians of the land, the Wiradjuri people, and pays respect to Elders past, present and future and extends our respect to all First Nations Peoples in Wagga Wagga.

We recognise and respect their cultural heritage, beliefs and continuing connection with the land and rivers. We also recognise the resilience, strength and pride of the Wiradjuri and First Nations communities

RELECTION

Councillors, let us in silence reflect upon our responsibilities to the community which we represent, and to all future generations and faithfully, and impartially, carry out the functions, powers, authorities and discretions vested in us, to the best of our skill and judgement.

CM-1 ORDINARY COUNCIL MEETING - 19 SEPTEMBER 2022

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 19 September 2022 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - 19 September 2022 |

186 |

|

Report submitted to the Ordinary Meeting of Council on Monday 17 October 2022 |

MM-1 |

MM-1 MAYORAL MINUTE - ACCOUNTING TREATMENT OF RURAL FIRE SERVICE ('RED FLEET') ASSETS

|

That Council: a writes to the local State Member Dr Joe McGirr MP, the Treasurer the Hon Matt Kean MP, Minister for Emergency Services and Resilience the Hon Stephanie Cook MP and the Minister for Local Government Wendy Tuckerman MP: i Expressing Council’s objection to the NSW Government’s determination on ownership of Rural Fire Service assets; ii Advising of the impact of the Government’s position on Council finances of this accounting treatment; iii Informing that Council will not carry out RFS assets stocktakes on behalf of the NSW Government and will not record RFS assets in Wagga Wagga City Council’s financial statements; iv Calling on the NSW Government to take immediate action to permanently clear up inequities and inconsistencies around the accounting treatment of Rural Fire Service (RFS) assets by acknowledging that rural firefighting equipment is vested in, under the control of and the property of the RFS; and v Amending s119 of the Rural Fires Act 1997 so that the effect is to make it clear that RFS assets are not the property of councils. b writes to the Shadow Treasurer Daniel Mookhey MLC, the Shadow Minister for Emergency Services Jihad Dib MP, the Shadow Minister for Local Government Greg Warren MP, the Greens Spokesperson for Local Government Jamie Parker MP and the leaders of the Shooters, Fishers and Farmers, Animal Justice and One Nation parties Robert Borsak MLC, Emma Hurst MLC and Mark Latham MLC: i Advising Members of Wagga Wagga City Council’s position, including providing copies of correspondence to NSW Government Ministers; and; ii Seeking Members’ commitments to support NSW Councils’ call to amend the Rural Fires Act 1997 as set out in correspondence. c writes to the Auditor General advising: i Council will not carry out RFS stocktakes on behalf of the NSW Government, and will not record RFS assets in Wagga Wagga City Council’s financial statements, noting that the State Government’s own Local Government Accounting Code of Practice and Financial Reporting provides for councils to determine whether or not they record the RFS assets as council assets, and; ii Council strongly disagrees with the modified audit opinion expressed by the Auditor General on Wagga Wagga City Council’s 30 June 2022 General Purpose Financial Statements d promotes these messages via its digital and social media channels and via its networks. e re-affirms its complete support of and commitment to local RFS brigades noting that Wagga Wagga City Council’s action is entirely directed towards the NSW Government’s nonsensical position that rather than being owned and controlled by local brigades, RFS assets are somehow controlled by councils, which councils consider to be a cynical financial sleight of hand abdicating the NSW Government’s responsibilities at the cost of local communities. f Affirms its support to Local Government NSW (LGNSW) and requests LGNSW continue advocating on Council’s behalf to get clarification once and for all from the State Government about the accounting treatment of RFS assets |

Report

I am calling on Councillors to support the local government campaign on the financial Accounting treatment of Rural Fire Service (RFS) mobile assets known as the ‘Red Fleet’.

A long-standing dispute over the accounting treatment of the Red Fleet has come to a head with the Auditor-General’s 2021 Report on Local Government on 22 June 2022. The Audit Report reemphasises the State Government determination that RFS assets are the “property” of councils and must be recorded in Council’s financial statements with Council required to therefore absorb all depreciation costs.

The Audit Office Local Government Report has reinforced the notion that RFS mobile and other fire-fighting assets can somehow be deemed to be council assets and applies more pressure on councils and the Office of Local Government (OLG) to conform with this determination, despite the fact that councils do not have effective management or control of these assets.

Councils across the State and Local Government NSW (LGNSW) refute this determination. Councils do not have any say in the acquisition, deployment or disposal of these assets. Comparable assets held by Fire & Rescue NSW (FRNSW) and the State Emergency Service (SES) are not vested anywhere other than with the organisations that purchase, use, maintain and dispose of them.

Councils and LGNSW have also raised concerns that the requirement breaches Australian Accounting Standards. The State Government’s own Local Government Accounting Code of Accounting Practice and Financial Reporting provides for councils to determine whether to record RFS assets on their books as council assets. This position has been confirmed by the Secretary of the Department of Planning and Environment in his letter to the Auditor-General dated 7 June 2022, presented in Appendix1 on page 47 of the 2021 Local Government Audit Report.

Council notes advice from LGNSW that many councils are refusing to comply with the Auditor General’s instructions. Councils remained firm for the 2020/21 financial year, resisting pressure to record RFS assets with the majority (68), choosing not to record the RFS mobile assets in accordance with the Local Government Accounting Code. This was the same number of councils as in the 2019/20 financial year.

Wagga Wagga City Council has continued to remain firm and has not recorded the RFS mobile assets in the 2021/22 financial statements, presented to Council at this same meeting. This has resulted in the NSW Audit Office issuing a Modified Audit Opinion for the 2021/22 General Purpose Financial Statements.

LGNSW is encouraging councils to continue resisting pressure from the Audit Office and make their own determinations notwithstanding overtures that ongoing non-compliance with the Auditor General’s instructions may result in future qualified financial reports.

The latest Audit Report has made further impositions on (Council) by:

· recommending Council undertakes a stocktake of RFS assets and records the value in Council’s financial statements;

· warning that if Council does not recognise the assets it will be found non-compliant and will have a high risk finding reported; and

· calling on the NSW Department of Planning and Environment (OLG) to intervene where councils do not recognise rural firefighting equipment.

The Government’s blanket determination is not only nonsensical, it is also inconsistent with the treatment of the comparable assets of other emergency service agencies such as Fire & Rescue NSW (FRNSW) and the State Emergency Service (SES). There is no rational reason for maintaining this anomaly.

LGNSW has been advocating this position on councils’ behalf and has written to the NSW Treasurer the Hon. Matt Kean MP, Minister for Emergency Services, the Hon. Steph Cooke MP, Minister for Local Government the Hon. Wendy Tuckerman MP and the Auditor-General, Ms Margaret Crawford to express the local government sector’s strong objection to the NSW Government’s determination, applied by the Auditor-General, that RFS assets are the property of councils for accounting purposes and amend the Rural Fires Act 1997.

LGNSW has advised it will continue its advocacy efforts on councils’ behalf and is asking all affected councils in NSW to consider adopting a resolution advising the Audit Office that Council will not carry out the RFS stocktakes on behalf of the NSW Government, and will not record RFS assets on Council’s financial statements.

Financial Implications

Whilst there are no financial implications with resolving this Mayoral Minute as presented, there would however be financial implications if all councils were mandated to include RFS assets in their financial statements.

Policy and Legislation

Rural Fires Act 1997 (NSW) Section 119

Link to Strategic Plan

Community leadership and collaboration

Community satisfaction with long term planning for Wagga Wagga is increasing

Objective: Wagga Wagga has strong community leadership and a shared vision for the future

Risk Management Issues for Council

N/A

Internal / External Consultation

The NSW Audit Office have held discussions with Council staff. The Audit, Risk and Improvement Committee have discussed the financial ownership of Rural Fire Service assets in detail and support Council’s position to not record these assets in Council’s financial statements.

|

Report submitted to the Ordinary Meeting of Council on Monday 17 October 2022 |

MM-2 |

MM-2 MAYORAL MINUTE - LATE LGNSW CONFERENCE MOTION - SUBMISSION PERIOD FOR MAJOR DEVELOPMENTS

|

That Council put the following motion to the Local Government NSW conference commencing 23 October 2022: ‘That LGNSW advocate to the NSW state government that the current period of 28 days during which submissions must be made on state significant development and other major development projects be extended to 90 days.’ |

Report

The recent experience of coordinating and making a submission on the Inland Rail Environmental Impact Statement (EIS) highlighted the inadequacy of the 28-period given to stakeholders to complete this process.

The proponent of a complex development has no time limit within which to prepare their document. This process often takes years, and the resulting document is massive with many technical studies of supporting data.

The notion that a person impacted by the development has 28 days to read, understand, analyse and then comment on the document is absurd. It is also worth keeping in mind that most stakeholders don’t have access to experts on their own and are about pursing all of their other day to day commitments.

The stakeholder response, or lack thereof to an EIS is often referenced and used to support an argument that the response to the EIS reflects the level of community concern.

The motion proposed is aimed to firstly highlight the common view across the state of NSW that stakeholders have an inadequate period of time to comment on complex development applications.

The second aim is to ensure that the members of LGWSW gives the representative body a clear direction to lobby the NSW government for change to give stakeholders sufficient time to comment on complex development applications.

Financial Implications

N/A

Policy and Legislation

N/A

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga has strong community leadership and a shared vision for the future

|

Report submitted to the Ordinary Meeting of Council on Monday 17 October 2022 |

NOM-1 |

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - ELECTRIC VEHICLE INFRASTRUCTURE IN THE WAGGA WAGGA LGA

Author: Councillor Jenny McKinnon

|

Summary: |

The Notice of Motion has been submitted in accordance with the Code of Meeting Practice. |

|

That Council: a requests that the General Manager write to the Chief Executive Officers’ of national fuel providers and to local independent fuel retailers to request consideration of Wagga Wagga sites for electric vehicle fast charging options; b contacts relevant local businesses to encourage uptake of NSW Government funding for destination chargers in locations such as cinemas, shopping centres, and dining locales; and c requests a report outlining partnership options with fast charging companies to provide EV fast-chargers at locations in Wagga Wagga and potentially in our villages on highway locations; and |

Report

Electric Vehicles (EV) are growing in number and are a significant aspect of the future of transport. Wagga Wagga City Council must therefore plan for electric vehicle uptake and make provision for the necessary infrastructure.

Current limitations in the number of publicly available EV chargers are impacting on EV uptake. It is not unusual to see a line-up of vehicles awaiting use of the one publicly available charger in Wagga Wagga and, as EV charging takes longer than fossil-fuel refills, such waits are a disincentive for travelers going long-distances. This situation impacts on the gains Wagga Wagga could make by having EV charging available near dining and shopping locations, thus giving travelers the opportunity to spend their money in Wagga Wagga.

Given the position of Wagga Wagga on the Sturt Highway, the city is in a prime position to service the needs of travelers from Sydney to Adelaide as well as shorter journeys in-between. Ampol Australia has announced the roll out of EV infrastructure at selected sites across its national network, and other fuel companies are likely to do the same soon. The Wagga Wagga LGA must be on the front foot in showing our interest to such companies as well as encouraging local independent operators to take advantage of this developing market.

EV owners plan their journeys around the availability of charging stations, and use a range of apps to research: where chargers are located, whether they are readily available, whether they are not maintained and regularly broken down, and where there are multiple charging stations available. By providing a location with multiple chargers available, Council can provide a real incentive for EV-owner travelers to stop for re-charging in Wagga Wagga and its surrounding villages.

While it is acknowledged that Council has already done good work in this field – by partnering early with NRMA to provide an EV charging station and by investigating grant funding options for EV infrastructure – this field is moving quickly and requires some new initiatives to keep the city of Wagga Wagga and the villages in the planning sights of EV travelers.

Financial Implications

N/A

Policy and Legislation

N/A

Link to Strategic Plan

The Environment

Objective: Wagga Wagga is sustainable, liveable, and resilient to the impacts of climate change

Support and empower our community to reach 50% reduction in emissions compared to 2005 levels by 2030 and to achieve Net Zero Emissions by 2050

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 17 October 2022 |

NOM-2 |

NOM-2 NOTICE OF MOTION - POST OFFICE PEOPLES BANK

Author: Councillor Richard Foley

|

Summary: |

In light of recent bank branch closures in the Riverina and throughout regional Australia, this Council calls on the Commonwealth Government to establish a Post Office peoples bank, guaranteed by the Commonwealth, which will ensure that basic banking services are available for all Australians. |

|

That Council: a supports the establishment of a Post Office peoples bank, guaranteed by the Commonwealth Government, which will ensure that basic banking services are available for all Australians b requests that the Mayor writes to all relevant Federal Ministers regarding this motion within seven (7) days |

Report

Throughout the past three decades banking services across regional Australia have been withdrawn from numerous regional centres and small rural communities. These ongoing bank closures have adversely disadvantaged and disproportionately affected these communities particularly aged members of these communities and small businesses.

The following are just some of the reasons why our regional communities need access to physical banking services:

1. Since the early 1980’s the number of bank branches across Australia has fallen by more than 60%. These closures have impacted more than 1500 communities across regional Australia leaving them with no access to bank branches.

2. Despite recent advances in technology with online banking many sectors of the population are still in great need of physical banking services including elderly persons, disabled persons, small business sector, local schools and charitable organisations.

3. Bank branch closures have been further exacerbated by the removal of ATM machines from these regional communities forcing many to travel to other towns to access cash and/or banking services. This is now the case for the people of nearby Junee who now do not have access to a Commonwealth Bank branch leaving citizens in Junee to travel to Wagga Wagga to access physical banking services.

4. There is an agenda to completely eliminate cash entirely from our society in order to lock the savings of Australians into the major big four banks forcing us all to transact electronically for everything. This is an attack on the financial privacy of all Australians.

5. Small businesses that cannot physically bank their cash are forced to keep it on their premises creating serious security risks likewise, elderly Australians end up keeping cash on their premises which is also risky.

The most straight forward and cost effective way to establish a Postal Bank is using the existing infrastructure of post offices. Australia Post has the biggest retail footprint of any business in Australia which is required and mandated by law to maintain services to all Australians. Post offices already have limited banking infrastructure via the provision of the Bank@Post service which is an agreement Australia Post has with the big four banks for serving their customers many of which they rejected by closing their bank branches. The big four banks can withdraw from this agreement at their whim.

Clearly none of the above is acceptable anymore to most Australians at a time when these big four banks are raking is massive record profits at the expense of regional Australian communities. Therefore, it seems logical that calling upon the Commonwealth Government to re-establish a public bank using the Australia Post infrastructure would be an ideal answer to provide face to face banking services to more Australians than any of the big four banks combined which collectively are continuing to withdraw these services from regional Australians.

I propose that this council endorses and supports the following motion:

1. The reduction and continuing closure of bank branches in our local regional communities has had detrimental effects to these communities.

2. The current existing commercial arrangement between the big four banks and Australia Post via Bank@Post does not provide surety or any real long term access to physical banking services to regional and rural Australians.

3. Wagga Wagga City Council supports the establishment by this Commonwealth Government, a Commonwealth Postal Savings Bank as a solid, reliable and secure way to ensure access to physical banking services for regional and rural Australians.

4. Upon the passing of this Notice of Motion that the Mayor of the City of Wagga Wagga writes to the appropriate Federal Ministers expressing our support as a council for the above three points. This correspondence is to be written and submitted within 7 days of the passing of this Notice of Motion by council on the 17 October 2022.

Financial Implications

N/A

Policy and Legislation

N/A

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga has strong community leadership and a shared vision for the future

Our leaders represent our community

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 17 October 2022 |

CR-1 |

CR-1 DELEGATE REPORT - 2022 NSW ANNUAL AUSTRALIAN LOCAL GOVERNMENT WOMEN’S ASSOCIATION (ALGWA) CONFERENCE

Author: Councillor Jenny McKinnon

|

That Council receive and note the report. |

Report

The 2022 NSW Annual Australian Local Government Women’s Association (ALGWA) Conference in Fairfield from Thursday 7 to Saturday 9 July 2022.

There was a late change to the conference program which deleted motions for voting, therefore nothing to report regarding motions.

Ellen Fanning (ABC journalist) was Master of Ceremony, and there were six speakers on the program:

· Dr Louise Mahler (PhD in Business and Masters in Organisational Psychology and Music), speaking on corporate leadership and the mind-body-voice connection.

· Dr Neryl East (PhD in Journalism and author of five books), speaking on leadership in ‘spotlight’ situations.

· Dr Jana Pittman (Medical Practitioner), speaking on surviving the peaks and troughs of a career in the public eye.

· Amanda Rose (Bachelor of Business, Master of Communications Management, Grad Cert Educational Leadership), speaking on confident leadership, conflict resolution, and relationship building via connection.

· Deb Wallace (retired Detective Superintendent, NSW Police) speaking on leadership in a male-dominated workforce; and

· Kiersten Fishburn (Deputy Secretary, Cities and Active Transport at Transport for NSW), speaking on her move to State Government leadership following a role as CEO of Liverpool Council.

In my view, all the speakers were excellent, providing inspiring content and then lively discussion in question time.

An important aspect of this conference is the opportunity to meet women Councillors from across NSW, and I found it to be a valuable networking experience.

This conference alternates between Sydney and country each year. Forbes is to be the host of the NSW ALGWA Conference in 2023, and in the following year the conference will return to Sydney. I was approached about the possibility of Wagga Wagga hosting this conference in 2025 and have passed this request on through the Chief Operating Officer. This would be an excellent opportunity to showcase Wagga Wagga, so I recommend that we act on this approach as soon as possible.

Financial Implications

N/A

Policy and Legislation

Code of Meeting Practice

Councillor Expenses and Facilities Policy (POL 025)

Councillor Induction and Professional Development Policy (POL 113)

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga has strong community leadership and a shared vision for the future

Our leaders represent our community

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 17 October 2022 |

CR-2 |

CR-2 DELEGATE REPORT - TRANSPORT AND ACCESSIBILITY MASTERCLASS

Author: Councillor Dan Hayes

|

That Council receive and note report |

Report

I attended the Transport and Accessibility Masterclass by Institute of Sensible Transport on Wednesday September 14th in Sydney.

The workshop was designed for Councils as “Transport consistently rates as one of the most important issues for local communities. Local councils are responsible for managing 80% of Australia’s road network. This places Council at the forefront of transport challenges and a key driver for change. Parking, congestion and safety are all common issues voiced to local government from the community. More broadly, the transport decisions made by local government have important consequences for sustainability, urban liveability, public health and productivity. This Masterclass ties these issues together and provides practical tools for Council staff and Councillors to help make informed decisions about the future of their communities”.

The topics covered

- Strategic transport planning

- Car parking and management tools

- Transport and climate change

- Electric vehicles, charging infrastructure and zero emission transport

- Disruptive transport innovation and how local government can benefit from new transport technology

- Creating a walking and cycling friendly city

- Why land use planning is critical to achieving a more sustainable transport system

Relevance to Wagga

While the masterclass focused a significant part on Major Metropolitan areas there were three main areas that were especially relevant to Wagga’s future transport discussions.

1) EV charging infrastructure: there has been a call over the years for councils to provide EV charging infrastructure at no cost. This is ratepayers subsidising the cost of EVs for those who can afford them. Having EV charging infrastructure is an important consideration for the future of Wagga, future planning needs to regards to who funds it, where it is located, who can access it. It was also highlighted that with the increasing push to prepare for the increase in EVs in our community, it is cheaper to get it right rather than do it fast.

It was also highlighted that 90% of EV charging is done at home, therefore we need to ask who publicly available charging stations are for- passing through motorists, the opportunistic motorist (was going there anyway), and the local resident who does not have access to a charger at their home. It should be noted that switching to EVs still maintains the requirement for relying on cars as the key transport tool for our city and continues the challenge with providing parking for future years.

It is acknowledged that a report is coming to council about planning for EVs.

2) Movement and place framework: This framework allows planning to consider what is the purpose of certain areas and the best transport options. Considering two variables namely movement (is the purpose for people to travel through this area eg: arterial road) and place (is the purpose for people to gather eg: civic spaces) helps identify transport planning. These options are both continuums on different axes. This framework helps us consider areas as to whether they are designed for movement of vehicles or for people and does it get this balance right?

The workshop also highlighted that traffic is a gas in the sense that it will expand or constrict based on the amount of space it is given. This raises the focus on planning to be a model of either “predict and provide” ie: provide the level of road needed future growth vs “debate and decide” ie: decide what we want transport to look like in our city. The former involves focusing predominantly on cars which creates a cycle expanding roads to cater for it and provide more and more car parking. The latter involves looking at what we want our city and neighbourhoods to look like and advocate for a range of transport modalities, which may in fact still be relying on cars. This of course then impacts on car parking which had an interesting statistic that on average 6-8 parking spaces for each car in an urban area and that on and off street parking can account for 50% of all land use, raising the question of how sustainable is this as Wagga continues to grow?

3) Active travel + Public transport: the workshop highlighted two key points in regard to active travel and public transport. Public transport needs to be accessible, take direct routes as opposed to navigating through suburbs, be reliable, and run when people need them as opposed to running when it suits the transport provider. I am doubtful that Wagga’s limited public transport system meets the above. This of course leads to low usage.

4) Regarding active travel, this links back to the notes above about Movement and Place and how we design our streets for between servicing people or cars. The requirement for people to walk or cycle instead of driving requires the following to be met- it’s safe; it’s within a feasible distance; it’s convenient; it’s an attractive trip; and they want to do it.

Financial Implications

N/A

Policy and Legislation

N/A

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga has strong community leadership and a shared vision for the future

Our leaders represent our community

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 17 October 2022 |

RP-1 |

RP-1 PROPOSED PLANNING AGREEMENT 12 BLAKE STREET WAGGA WAGGA DA19/0125

Author: Belinda Maclure

Executive: John Sidgwick

|

Summary: |

Council has received an offer to enter into a planning agreement in relation to the development of 12 Blake Street, Wagga Wagga (DA19/0125). The offer is to provide infrastructure to improve the public realm in Blake Street in lieu of paying Section 7.12 (previously Section 94A) contributions due for the development. |

|

That Council decline the offer to enter into the proposed planning agreement in relation to DA19/0125. |

Report

An offer to enter into a planning agreement with Council was received from Davtil Pty Ltd (Mr Kerry Pascoe) in relation to their development of 12 Blake Street, Wagga Wagga on 26 November 2019. The offer included the provision of public infrastructure in lieu of the Section 7.12 contributions due for the development described in DA19/0125, approved by Council resolution 19/209, determined on 24 June 2019. There have been a number of changes made to the offer. The latest offer was received on 25 March 2022.

The development described in DA19/0125 includes the demolition of an existing shed and construction of 5/6 storey mixed-use development comprising ground floor business/retail use and car parking, first floor car parking and 16 residential apartments (shop top housing) on four floors above (Notice of Determination of Development Application DA19/0125).

The proposed planning agreement includes the provision of infrastructure with the aim to improve the public realm of Blake Street in lieu of the Section 7.12 levy due in relation to the development.

The Section 7.12 levy due in relation to the development is $104,075. The cost of the infrastructure included in the proposed planning agreement is $134,000. The proposal aims to improve the public realm in Blake Street. The works proposed in the offer include:

1. Reconfiguration of street carparking from parallel to angle along both sides of the street;

2. Provision of two disabled carparking spaces on the street;

3. Installation of traffic calming devices at either end of Blake Street;

4. Removal of 11 trees from the footpath and replacement with 6 trees within the parking bays to be established along the western side of Blake Street;

5. Close off access from Blake Street to the carpark at 22 Blake Street and provide landscaping (locate an electrical substation in the carpark);

6. Upgrade of footpath along the whole of the western side of Blake Street;

7. Installation of 3 additional streetlights in the Council carpark; and

8. Installation of 4 additional streetlights in Blake Street.

The proposed planning agreement was placed on public exhibition from 9 August 2022, with submissions being accepted until 19 September 2022. Six meetings/phone calls with interested residents of Blake Street occurred during the exhibition period and Council staff visited all businesses in the street. Signs were erected in the Blake Street carpark and letters were sent to owners and residents of the wider precinct encouraging people to make a submission to Council.

Nineteen written submissions were received during this period. Six submissions received support the concept as presented and two objected it. Of the remaining submissions which highlighted support and objections to elements of the proposal, five objected to the closing of the carpark and two objected to increased traffic in Bardo Lane specifically. There was support for the angle parking, disabled parking, changes to the tree planting and the upgrade of the footpath. Two submissions suggested the infrastructure on both sides of the street should be upgraded. Three submissions suggested contributions should be paid to fund projects for the wider community.

After careful consideration of the proposal, the feedback from the community and the future vision for Blake Street and the wider city centre precinct, Council staff cannot support the closure of Blake Street entrance to the Council carpark. There are number of Council carparks in the city centre, which have rear lane and street access and the street access to these carparks is not planned to be closed in the foreseeable future. In consideration of these matters Council must take a strategic view and take into account the future land use options for the Council carpark and the need to protect these options available in the future.

Given the above, it is recommended Council declines the offer to enter into a planning agreement in relation to 12 Blake Street, Wagga Wagga (DA19/0125).

Financial Implications

The impact of this recommendation is that the Section 7.12 contributions collected for DA19/0125 will be allocated to the projects identified in the Wagga Wagga Local Infrastructure Contributions Plan 2019 – 2034.

Policy and Legislation

Environmental Planning and Assessment Act 1979 Section 7.4

Wagga Wagga Local Infrastructure Contribution Plan 2019 – 2034

Wagga Wagga City Council Developer Infrastructure Agreements Policy POL 121

Link to Strategic Plan

The Environment

Objective: Future growth and development of Wagga Wagga is planned for in a sustainable manner

Ensure sustainable urban development

Risk Management Issues for Council

There are no significant risks with this recommendation.

Internal / External Consultation

The public exhibition of the proposed planning agreement saw a Connect Wagga website created to provide information to the community. During the period signs were erected in the Council carpark encouraging people to consider the proposal and make a written submission. All businesses in the street received a visit from Council staff and were encouraged to make a submission. Six businesses made contact with Council staff after these visits to discuss the proposal in more detail and ask questions.

Letters were sent to all land holders in a wider identified area and all residents of the street.

Nineteen written submissions were received.

The following table show the community engagement strategies used during the public exhibition period.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Involve |

|

|

|

|

|

|

|

|

|||||||||

|

Collaborate |

|

X |

X |

|

X |

X |

|

X |

X |

|

|

|

|

X |

X |

X |

|

|

1⇩. |

Blake Street Proprosed Planning Agreement Submissions Summary September 2022 |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 17 October 2022 |

RP-2 |

RP-2 DA22/0029 - PROPOSED USE OF SITE FOR TEMPORARY EVENTS (20 PER YEAR) INCLUDING ADDITIONAL PARKING AREA AND USE OF EXISTING PERGOLA, AMENITIES BLOCK AND SHIPPING CONTAINER. LOT 1 DP 829597, 85 HILLARY STREET, NORTH WAGGA, 2650

Author: Paul O’Brien

General Manager: Peter Thompson

|

Summary: |

The Development Application seeks consent for the use of the site for temporary events (20 per year) including additional parking area and use of existing pergola, amenities block and shipping container at 85 Hillary Street North Wagga.

The use is permitted with consent under Clause 2.8 of the Wagga Wagga Local Environmental Plan 2010.

The application was publicly notified to adjoining and nearby property owners on two separate occasions for periods of 14 days. A total of 6 submissions were received during the first notification period and 13 during the second. Section 1.10 of the Wagga Wagga Development Control Plan 2010 requires any application that is the subject of 10 or more objections to be referred to Council for determination.

A full assessment of the application has been completed in accordance with Section 4.15 of the Environmental Planning and Assessment Act 1979 including an assessment against the relevant provisions of the Local Environmental Plan 2010 and the Development Control Plan 2010 and is provided as an attachment to this report. The assessment has considered and addressed all relevant matters raised in the submissions.

Subject to the findings of the assessment, it has been recommended that the application be refused for the reasons listed below.

|

|

It is recommended that Council refuse DA22/0029 for ‘proposed use of site for temporary events (20 per year) including additional parking area and use of existing pergola, amenities block and shipping container’ at Lot 1 DP 829597, 85 Hillary Street, North Wagga, 2650. |

Development Application Details

|

Applicant |

Camilla Rocks |

|

Owner |

Nicole Maree Lofts and Christopher Allen Lofts |

|

Development Cost |

$175,000 |

|

Development Description |

Proposed use of site for temporary events (20 per year) including additional parking area and use of existing pergola, amenities block and shipping container. |

Report

Key Issues

· Compliance with Clause 2.8 – Temporary use of Land of the Wagga Wagga Local Environmental Plan 2010.

· Impacts on surrounding residential amenity including:

o Noise

o Traffic

o Crime, safety and security impacts

o Cumulative impacts of those listed above plus odour and waste.

Assessment

· The site is zoned RU4 Primary Production Small Lots under the provisions of the WWLEP 2010.

· The temporary events would be considered a function centre by definition. Function centres are prohibited in the RU4 zone. However, under section (2) of clause 2.8 of the WWLEP 2010, a function centre can be considered on this land for a maximum period of 20 days in a 12 month period Despite any other provision of this Plan. Given the applicant has applied for 20 days the proposed use can be considered under this clause.

· The subject site contains a dwelling plus four (4) tourist and visitor accommodation cottages.

· The site is immediately surrounded by similar sized lots containing single dwellings. Wider afield there are a variety of land uses.

· The development results in adverse amenity impacts and therefore does not comply with clause 2.8(3)(b) of the WWLEP 2010.

· The structures are not temporary uses and therefore cannot be considered under clause 2.8 of the WWLEP 2010.

· The development is not in keeping with the context and setting and the site is not considered suitable for the proposed development given the impacts. The proposal is not considered to be in the public interest.

· The submissions have been addressed in the attached 4.15 report.

Having regard for the information contained in the attached Section 4.15 assessment report, it is considered that the development is not acceptable and is therefore recommended for refusal.

Reasons for Refusal

1. The development has the potential to cause adverse amenity impacts on the neighbouring properties and is therefore not considered to be in the public interest. Section 4.15(1)(e) of the Environmental Planning and Assessment Act 1979.

2. The proposed structures (pergola, amenities block and shipping container) would not be considered ‘temporary use of land’ and therefore cannot be considered under clause 2.8 of the Wagga Wagga Local Environmental Plan 2010. Section 4.15(1)(a)(i) of the Environmental Planning and Assessment Act 1979.

3. The proposal would have detrimental social and amenity effects on the land and therefore does not comply with clause 2.8(1) of the Wagga Wagga Local Environmental Plan 2010. Section 4.15(1)(a)(i) of the Environmental Planning and Assessment Act 1979.

4. The development would result in an adverse noise impact on the amenity of the neighbourhood and would therefore not comply with clause 2.8(3)(b) of the Wagga Wagga Local Environmental Plan 2010. Section 4.15(1)(a)(i) of the Environmental Planning and Assessment Act 1979.

5. The development would result in an adverse traffic impact on the amenity of the neighbourhood and would therefore not comply with clause 2.8(3)(b) of the Wagga Wagga Local Environmental Plan 2010. Section 4.15(1)(a)(i) of the Environmental Planning and Assessment Act 1979.

6. The development would result in an adverse safety and security impact on the amenity of the neighbourhood and would therefore not comply with clause 2.8(3)(b) of the Wagga Wagga Local Environmental Plan 2010. Section 4.15(1)(a)(i) of the Environmental Planning and Assessment Act 1979.

7. The cumulative impacts of noise, traffic, safety and security, odour and waste would result in an adverse impact on the amenity of the neighbourhood and would therefore not comply with clause 2.8(3)(b) of the Wagga Wagga Local Environmental Plan 2010. Section 4.15(1)(a)(i) of the Environmental Planning and Assessment Act 1979.

9. The site is not suitable for the proposed development. Environmental Plan 2010. Section 4.15(1)(c) of the Environmental Planning and Assessment Act 1979.

10. The pergola and amenity building have not appropriately addressed the safety concerns or clearance distances from the electricity infrastructure on site. Section 4.15(1)(e) of the Environmental Planning and Assessment Act 1979.

Site Location

The subject site is Lot 1 DP 829597, 85 Hillary Street, North Wagga. The land is located on the northern side of Hillary Street approximately 400m from the junction with Byrnes Road.

The site is accessed off a narrow access handle and opens up into a 2ha block to the rear. The site rises steeply from Hillary Street. As the access handle widens into the main block a shed is located immediately to the east of the driveway. The driveway continues north and services the main dwelling and four tourist and visitor accommodation villas located along the northern boundary of the site. The site contains sporadic vegetation and two transmission easements for overhead power.

The land is zoned RU4 Primary Production Small Lots. Whilst the surrounding land varies in zone from RU4 to RU1 and RU6, the immediately surrounding properties are similar small holdings with dwellings. As you move further east and south the land transitions into more traditional extensive agricultural land. Wider afield to the north is Bomen. To the west is the village of North Wagga.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: Future growth and development of Wagga Wagga is planned for in a sustainable manner

Ensure sustainable urban development

Risk Management Issues for Council

Refusal of the application may result in an appeal process in the Land and Environment Court which will have to be defended by Council. The recommended reasons for refusal have been fully justified within the attached s4.15 assessment report in accordance with the applicable legislation.

Approval of the application will result in a development that does not comply with the WWLEP 2010 and causes adverse amenity impacts on the neighbouring properties. Approval will likely result in ongoing complaints from neighbouring properties and potential enforcement action.

Internal / External Consultation

Full details of the consultation that was carried out as part of the development application assessment is contained in the attached s4.15 Report.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

x |

|

|

|

|

|

|

|

|

|

x |

|

||||

|

Involve |

|

|

|

|

|

|

|

|

|||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

DA22-0029 - Section 4.15 Assessment Report - Provided under separate cover |

|

|

2. |

DA22-0029 - Statement of Environmental Effects and Plans - Provided under separate cover |

|

|

3. |

DA22-0029 - Event Booking Request form - Provided under separate cover |

|

|

4. |

DA22-0029 - Event Management Plan - Provided under separate cover |

|

|

5. |

DA22-0029 - Redacted submission 1st notification - Provided under separate cover |

|

|

6. |

DA22-0029 - Redacted submissions 2nd notification - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 17 October 2022 |

RP-3 |

RP-3 DA22/0177 - ALTERATIONS AND ADDITIONS TO INCLUDE RETAIL PREMISES, LICENCED FUNCTION CENTRE AND RESTAURANT. LOT 1 DP 631019, 187 FITZMAURICE STREET, WAGGA WAGGA, NSW, 2650.

Author: Paul O’Brien

General Manager: Peter Thompson

|

Summary: |

The development application seeks consent for alterations and additions to the existing Knights Meats building and fitout of the additions as retail space, function centre and restaurant. The proposal includes a plan to construct part of the restaurant at first floor level over the Council footpath. The works proposed are as follows: · Extension of the ground floor to create an entrance foyer, stairs, lift, amenities, bridal room and retail tenancy · Extension of the first floor to create an entrance foyer (stairs and lift), restaurant, kitchen, function room, amenities and open deck with fireplace · Fitout of kitchen to commercial standard · Fitout of amenities · Fitout of restaurant · Fitout of function centre · Signage The application was publicly notified to adjoining and nearby property owners for a period of 14 days. A total of 5 public submissions were received during this period.

This report is presented to Council for determination. The application has been referred to Council under Section 1.11 of the Wagga Wagga Development Control Plan 2010 as the application includes a variation to a numerical control (car parking requirement) by greater than 10% and objections have been received in relation to this matter.

A full assessment of the application has been completed in accordance with Section 4.15 of the Environmental Planning and Assessment Act 1979 including an assessment against the relevant provisions of the Local Environmental Plan 2010 and the Development Control Plan 2010 and is provided as an attachment to this report.

Subject to the findings of the assessment, it has been recommended that the application be approved subject to conditions. The recommended conditions have been included in an attached assessment report.

|

|

That Council approve DA22/0177 for alterations and additions to include retail premises, licenced function centre and restaurant at Lot 1 DP 631019, 187 Fitzmaurice Street, Wagga Wagga, 2650 subject to the conditions outlined in the attached Section 4.15 Assessment Report.

|

Development Application Details

|

Applicant |

Camilla Rocks |

|

Owner |

Vibe Corp Pty Ltd |

|

Development Cost |

$1,500,000 |

|

Development Description |

Alterations and additions to include retail premises, licenced function centre and restaurant. |

Report

Key Issues

· Compliance with the car parking requirements of the Wagga Wagga Development Control Plan 2010.

· Impact on the Conservation Area and the Heritage Significance of the existing building.

· Associated amenity impacts given the proximity to residential properties.

Assessment

· Under the provisions of the Wagga Wagga Local Environmental Plan 2010 (LEP 2010), the subject site is within the B3 Commercial Core zone. The development is permissible with consent.

· The proposal is consistent with the B3 objectives and other relevant provisions of the LEP 2010.

· The impacts of the development with respect to the surrounding area have been considered in full as part of the attached 4.15 report. It is satisfied that the development will not have unreasonable impacts in relation to matters including, noise, safety and security, servicing and parking.

· The development has been assessed as being generally consistent with the objectives and controls of the Wagga Wagga Development Control Plan 2010 (DCP 2010). Where variations have been sought with respect to particular controls under the DCP 2010, appropriate justification has been provided.

· Five (5) submissions were received during the notification period. The submissions have been addressed in the attached 4.15 report and do not warrant refusal of the Development Application.

Having regard for the information contained in the attached Section 4.15 assessment report, it is considered that the development is acceptable for the following reasons and recommended for approval subject to conditions.

Reasons for Approval

· The proposed development is consistent with the provisions of the Wagga Wagga Local Environmental Plan 2010;

· The proposed development is generally consistent with the objectives and controls of the Wagga Wagga Development Control Plan 2010.

· Impacts of the proposed development are acceptable and can be managed via the recommended conditions of consent.

· The site is considered suitable for the proposed development.

· For the abovementioned reasons it is considered to be in the public interest to approve this development application.

Site Location

The site, being Lot 1 DP 631019, 187 Fitzmaurice Street Central Wagga is located on the south-eastern corner of Fitzmaurice Street and Crampton Street. The site is bound by Cadell Place along its eastern boundary.

The site measures 1435m² and is flat and void of vegetation. The building has frontage to both Crampton Street and Fitzmaurice Street.

The site is mapped as bushfire prone land and is subject to inundation in a PMF event but protected by the main city levee up to and including the 1% event plus freeboard.

The site is located in the Conservation Area.

The surrounding land uses are a mix of commercial and residential with the river to the east.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

Growing Economy

Objective: Wagga Wagga is a hub for activity

Facilitate the development of vibrant precincts

Risk Management Issues for Council

Refusal of the application may result in an appeal process in the Land and Environment Court, which will have to be defended by Council. The reasons for refusal will have to be justified and withstand scrutiny and cross examination in Court.

Approval is not considered to raise risk management issues for Council as the proposed development is generally consistent with the relevant provisions of any relevant State Environmental Planning Policy, the Wagga Wagga Local Environmental Plan 2010 and the Wagga Wagga Development Control Plan 2010.

Internal / External Consultation

Pursuant to Section 1.10 of the Wagga Wagga Development Control Plan 2010 the application was notified to surrounding properties between 19/5/22 and 2/6/22. Five (5) public submissions were received during the notification period.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

x |

|

|

|

|

|

|

|

|

|

x |

|

||||

|

Involve |

|

|

|

|

|

|

|

|

|||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

DA22-0177 - Section 4.15 assessment report - Provided under separate cover |

|

|

2. |

DA22-0177 - Plans - Provided under separate cover |

|

|

3. |

DA22-0177 - Statement of Environmental Effects - Provided under separate cover |

|

|

4. |

DA22-0177 - Supplementary Statement of Environmental Effects - Provided under separate cover |

|

|

5. |

DA22-0177 - Supplementary Information - Provided under separate cover |

|

|

6. |

DA22-0177 - Acoustic Report - Provided under separate cover |

|

|

7. |

DA22-0177 - Redacted Submissions - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 17 October 2022 |

RP-4 |

RP-4 DA22/0260 - CONSTRUCTION OF 3 X 2 STOREY DWELLINGS WITH DETACHED TRIPLE GARAGE AND 4 LOT COMMUNITY TITLE SUBDIVISION - LOT 8 DP 7850, 212 EDWARD ST WAGGA WAGGA NSW 2650

Author: Paul O’Brien

General Manager: Peter Thompson

|

Summary: |

The development application seeks consent for the construction of 3 x 2 storey dwellings with detached triple garage and 4 lot community title subdivision.

This report is presented to Council for determination. The application has been referred to Council under Section 1.11 of the Wagga Wagga Development Control Plan 2010 (DCP) as the application is for multi-dwelling housing and includes variations to more than one control.

Variations to controls are proposed in relation to the following sections of the DCP: - Section 2.2 which relates to off-street parking. - Section 9.2.2 which relates to front fence. - Section 9.3.2 which relates to total site coverage. - Section 9.3.3 which relates to minimum frontage within R3 Zone. - Section 9.4.3 which relates to privacy. - Section 9.4.4 which relates to total floor area for an outbuilding.

A full assessment of the application has been completed in accordance with Section 4.15 of the Environmental Planning and Assessment Act 1979 including an assessment against the relevant provisions of the Local Environmental Plan 2010 and the Development Control Plan 2010 and is provided as an attachment to this report.

Subject to the findings of the assessment, it has been recommended that the application be approved subject to conditions. The recommended conditions have been included in an attached assessment report.

|

|

That Council approve DA22/0260 for the construction of 3 x 2 storey dwellings with detached triple garage and 4 lot community title subdivision at 212 Edward Street, Wagga Wagga, NSW 2650 subject to the conditions outlined in the attached Section 4.15 Assessment Report.

|

Development Application Details

|

Applicant |

Matt Jenkins |

|

Owner |

Matthew Jeremy Jenkins & Mr Paul Geoffrey Keough |

|

Development Cost |

$1,140,000.00 |

|

Development Description |

Construction of 3 x 2 storey dwellings with detached triple garage and 4 lot community title subdivision |

Report

Key Issues

· Compliance with the objectives of the Wagga Wagga Local Environmental Plan 2010.

· Compliance with a number of objectives and controls of the Wagga Wagga Development Control Plan 2010.

· On-site number of car parking spaces.

Assessment

· Under the provisions of the Wagga Wagga Local Environmental Plan 2010 (LEP 2010), the subject site is within the R3 Medium Density Residential zone. The development is permissible with consent.

· The proposal is generally consistent with the R3 objectives and other relevant provisions of the LEP 2010.

· The impacts of the development with respect to the surrounding residential area has been considered in full as part of the attached 4.15 report. It is satisfied that that the development will not have unreasonable impacts in relation to matters including, solar access, privacy, streetscape and carparking.

· The development has been assessed as being generally consistent with the objectives of the Wagga Wagga Development Control Plan 2010 (DCP 2010). Where variations have been sought with respect to particular controls under the DCP 2010, appropriate justification has been provided.

· No submissions were received during the notification period.

Reasons for Approval

· The proposed development is consistent with the provisions of the Wagga Wagga Local Environmental Plan 2010;

· The proposed development is generally consistent with the objectives and controls of the Wagga Wagga Development Control Plan 2010.

· Impacts of the proposed development are acceptable and can be managed via the recommended conditions of consent.

· The site is considered suitable for the proposed development.

· For the abovementioned reasons it is considered to be in the public interest to approve this development application.

Site Location

The subject site is legally known as Lot 8 DP 7850 and is identified as 212 Edward Street, Wagga Wagga. It is located on the southern side of Edward Street (the Sturt Highway) approximately 75 metres west from its intersection with Brookong Avenue.

The subject site has an area of 758.79m² and is rectangular in shape. The site currently contains a single storey dwelling and associated outbuildings however a development application was recently approved for demolition under DA22/0129.

Vehicular access to the proposed detached triple garage is via rear lane along the southern boundary. Pedestrian access is available from both Edward Street as well as from rear lane.

The locality is generally residential in character with a mix of single storey dwellings, low to medium-density residential development and multi-dwelling housing in proximity to the subject site. The subject site is within the Health and Knowledge Precinct as identified under the Health and Knowledge Precinct Master Plan, 2019. Across Edward Street from the proposed development site are mixed land uses - i.e. residential, commercial and other health related land uses.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: Future growth and development of Wagga Wagga is planned for in a sustainable manner

Provide for a diversity of housing that meets our needs

Risk Management Issues for Council

Refusal of the application may result in an appeal process in the Land and Environment Court, which will have to be defended by Council. The reasons for refusal will have to be justified and withstand scrutiny and cross examination in Court.

Approval is not considered to raise risk management issues for Council as the proposed development is generally consistent with the relevant provisions of any relevant State Environmental Planning Policy, the Wagga Wagga Local Environmental Plan 2010 and the Wagga Wagga Development Control Plan 2010.

Internal / External Consultation

Pursuant to Section 1.10 of the Wagga Wagga Development Control Plan 2010 the application was advertised and notified to surrounding properties between 12/08/2022 and 2/09/2022. No submissions were received during the notification period.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

x |

|

|

|

|

|

|

|

|

|

x |

|

||||

|

Involve |

|

|

|

|

|

|

|

|

|||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

DA22/0260 - Section 4.15 Assessment Report - Provided under separate cover |

|

|

2. |

DA22/0260 - Plans - Provided under separate cover |

|

|

3. |

DA22/0260 - Statement of Environmental Effects - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 17 October 2022 |

RP-5 |

RP-5 REQUEST TO WAIVE SECTION 64 CONTRIBUTIONS AND DEVELOPMENT APPLICATION FEES FOR DA20/0724

Author: Belinda Maclure

Executive: John Sidgwick

|

Summary: |

A letter was received from the Opening Doors Foundation requesting Section 64 contributions and development application fees for DA20/0724, a 105-unit development at 70 Pinaroo Drive, Glenfield Park be waived.

Given the development will have an impact on Council’s sewer and stormwater network, it is recommended not to approve the request to waive Section 64 contributions. It is for this reason Council staff recommend not to support the request to waive Section 64 contributions for DA20/0724.

Development application fee income is factored into Council’s balanced budget position. Any planned income not received has a negative impact on Council’s budget and would result in the requirement to fund the reduction from another operating budget. It is for this reason that Council staff do not recommend supporting the waiver of development application fees for DA20/0724 as well as the request to waive Section 64 contributions. |

|

That Council: a refuse the request to waive Section 64 Sewer and Stormwater infrastructure contributions for DA20/0724 subject to the recommendations within the report b refuse the request to waive development application fees for DA20/0724 subject to the recommendations within the report |

A letter was received from the Opening Doors Foundation requesting Section 64 sewer and stormwater contributions and development application fees for DA20/0724 be waived.

The Opening Doors Foundation is a not-for-profit entity, established in 1951 through the generosity of Mrs E.V Roberts. Opening Doors focuses on providing affordable seniors housing and disability housing on a rental basis for Wagga Wagga and surrounding districts.

The Opening Doors Foundation consists of the following Directors:

· Scott Oehm (Chairperson)

· Dr Louis Baggio MBBS(HONS.) FAFRM (RACP)

· David Bolton

· Andrea Bradley

· John Craig

· Ronald Crouch, OAM (Vice Chairperson)

· Noelene Hogan

· Robyn Miller – Director up to 18 November 2022

· Shane McMullen is the Opening Doors Foundation’s Chief Executive Officer and Company Secretary.

DA20/0724 is for the Opening Doors development of 105 units costing $29,079,600 for financially disadvantaged seniors and people with a disability. The development meets the requirements of the State Environmental Planning Policy (SEPP 2004) – Housing for Seniors and Persons with a Disability. Therefore, the development was exempt from Section 7.11 or 7.12 contributions. However, the development will have an impact on Council’s sewer and stormwater networks, so Section 64 sewer and stormwater contributions are required.

The request seeks to waive Section 64 Sewer and Stormwater contributions levied in DA20/0724. According to the Notice of Determination for this development application, $223,416 of Section 64 Sewer contributions and $140,058 of Section 64 Stormwater contributions are required (indexed to September 2022).

The request also seeks a refund, partial refund or waiver of development application fees totaling $65,004.

Financial Implications

Section 64 Sewer and Stormwater infrastructure contributions are calculated to reflect the impact of development on the networks. The Section 64 Sewer contribution relates to the increased number of toilets and the Section 64 Stormwater relates to the area of additional hardstand and therefore stormwater run off. The Section 64 contributions are allocated to fund sewer and stormwater projects in the Development Servicing Plans.

Development application fee income is factored into Council’s balanced budget position. Any planned income not received has a negative impact on Council’s budget and would result in the requirement to fund the reduction from another operating budget.

Council staff requested the most recent financial statements of the Opening Doors Foundation in order to assess the organisations financial position and performance. These statements are attached Confidentially under Separate Cover Attachment for Councillors information.

Policy and Legislation

Wagga Wagga City Council, Development Servicing Plan Sewerage Services July 2013

Wagga Wagga City Council, Development Servicing Plan Stormwater November 2007

Wagga Wagga Local Infrastructure Contributions Plan 2019 -2034

State Environmental Planning Policy (Housing for Seniors or People with a Disability) 2004.

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

Without receiving adequate sewer and stormwater funds, there would be a funding gap to maintain and renew these vital Council assets.

Should Council waive fees there is a risk that a precedent could be set, which may lead to financial shortcomings and inability for Council to pay for citywide infrastructure projects.

Waving development application fees will put Council’s balanced budget at risk.

Internal / External Consultation

Consultation has been undertaken with Council’s Finance and Development Assessment and Building Certification sections, as well as the Executive.

|

1⇩. |

Request to waive Section 64 contributions and development application fees DA20/0724 |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 17 October 2022 |

RP-6 |

RP-6 RIVERINA JOINT ORGANISATION (RIVJO) - One Organisation Options’ Paper

Author: Peter Thompson

|

Summary: |

The separate boards of (REROC) and the Riverina Joint Organisation (RIVJO) have been considering the future of the two organisations, with a view to adopting a single organisation for collaboration in this region. The attached “One Organisation Options’ Paper” was developed for each Council to consider and adopt their preferred option. |

|

That Council adopts Option 3 as outlined in this report as the preferred method for regional collaboration in the Riverina. |

Report

Some years ago, Wagga Wagga City Council (WWCC) withdrew from the Riverina Eastern Organisation of Councils (REROC) as it received no benefit from the REROC activities, and it was an expense exceeding $50,000 each year. At or about the same time, WWCC advocated that a single joint organisation would be a better model. This view was not supported, and the other councils pursued the operation of both a ROC and a joint organisation.

WWCC joined the Canberra Joint Organisation (CRJO) as an associate member. About a year later, the NSW Government asked WWCC if it would join the Riverina Joint Organisation. WWCC agreed and WWCC was proclaimed a member of the Riverina Joint Organisation shortly thereafter.

More recently, the separate boards of (REROC) and the Riverina Joint Organisation (RIVJO) have been considering the future of the two organisations, with a view to adopting a single organisation for collaboration in this region.

The boards have met to discuss and develop options for the future of either or both the REROC and RIVJO. As a result, the attached “One Organisation Options’ Paper” was developed for each Council to consider.

The options for consideration of Councillors are listed below. The details of each option are in the attached paper:

1. REROC Stand Alone/JO Folds

2. JO Stand Alone/REROC goes into hiatus

3. REROC Stand Alone at the cost of the member councils - JO hosted by Wagga Wagga City at the cost of WWCC alone but operated on the basis of one council having one vote by all councils who are part of the JO

4. REROC Stand Alone/JO goes into hiatus

As per previous discussions with Councillors we have offered to operate the JO separately from REROC for a period of 2 years, free of charge. This is Option 3 outlined above. The JO’s activities would be the three core activities of advocacy, strategic planning and engagement with NSW State Government. After the initial 2 years, members would decide on future arrangements based on the success or otherwise of the proposed approach.

A copy of the letter of offer made by WWCC in relation to Option 3 is attached which explains the proposal in more detail.

The proposal which this Council has put forward, being Option 3, is recommended. Alternatively, and of the other three options listed above and in the attached documents are open for each Councillor to support.

The outcome sought from the meeting is for Councillors to determine by resolution which option they support.

Legal

WWCC would be responsible for compliance with Governance requirements of the JO if Option 3 is supported. Governance obligations would be shared if any one of the other three options is pursued.

Financial Implications

Council would be responsible for the operational costs of the JO if Option 3 is supported. This is expected to be around $50,000 in addition to the current commitment. This cost does not include staff time which is where the real advantage of WWCC hosting the JO is won from a cost perspective.

Policy and Legislation

NSW Local Government Act 1993

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga has strong community leadership and a shared vision for the future

Our leaders represent our community

Risk Management Issues for Council

JOs are the preferred consultation method for the NSW State Government. If WWCC does not actively participate in a JO it may miss out on the opportunity to have input into regional priorities and projects.

|

1⇩. |

Letter from the Mayor - One Organisation Discussions - Example |

|

|

2⇩. |

Moving Forward: One Organisation Options’ Paper |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 17 October 2022 |

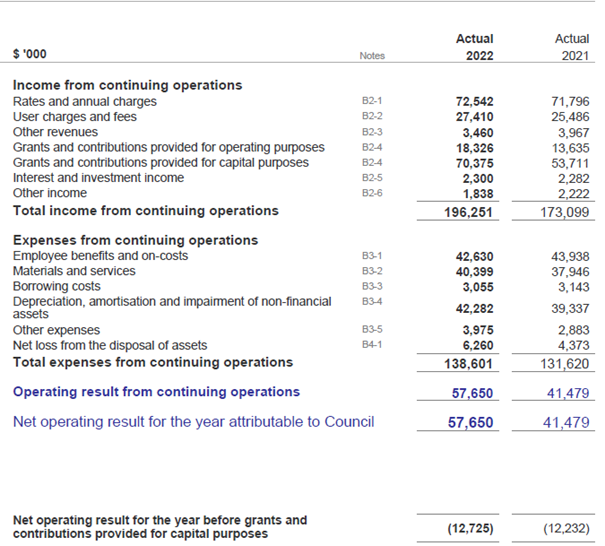

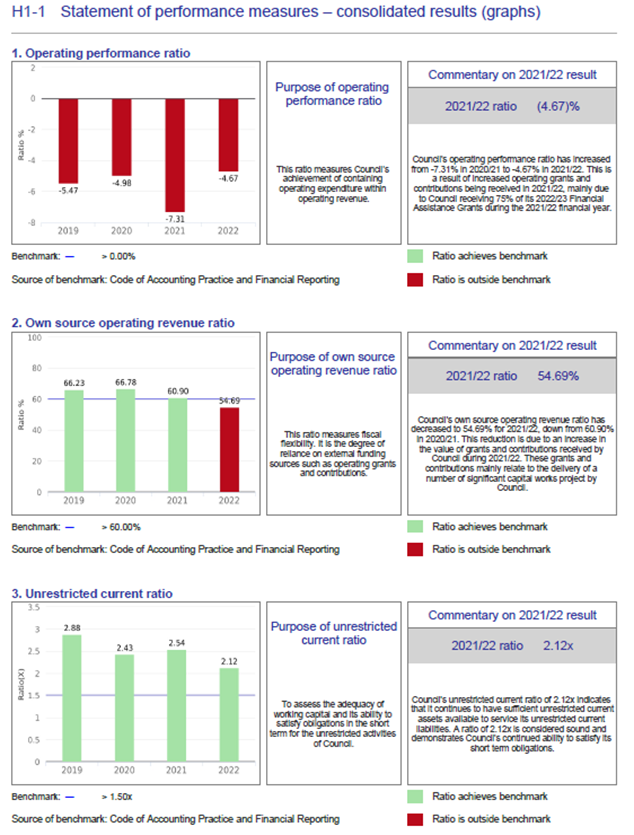

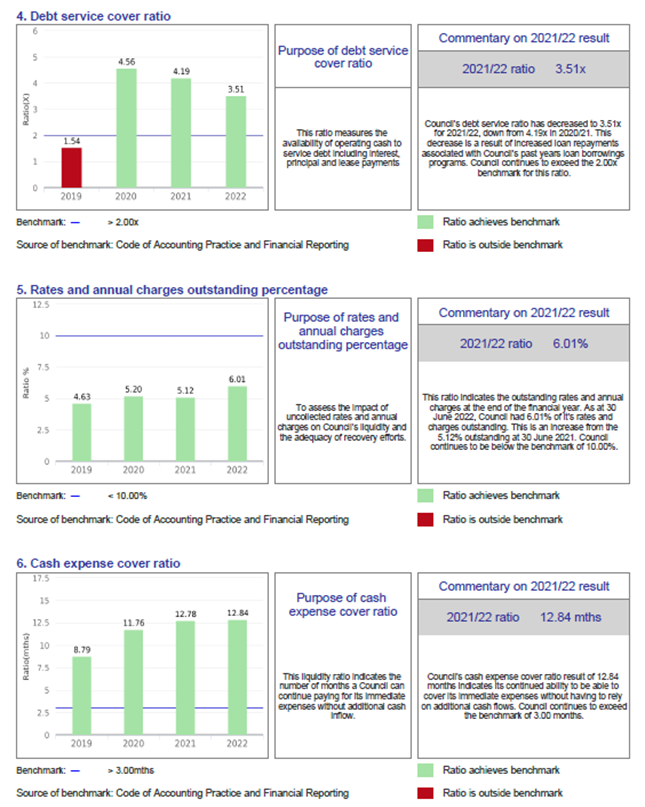

RP-7 |

RP-7 ANNUAL FINANCIAL STATEMENTS 2021/22

Author: Carolyn Rodney

|

Summary: |

The 2021/22 financial statements have been completed by Council staff and have recently been audited by the NSW Audit Office. |

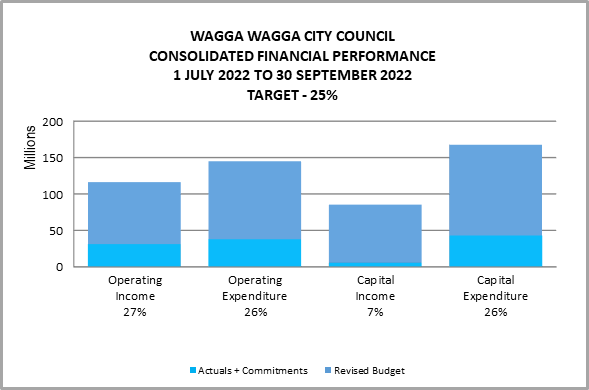

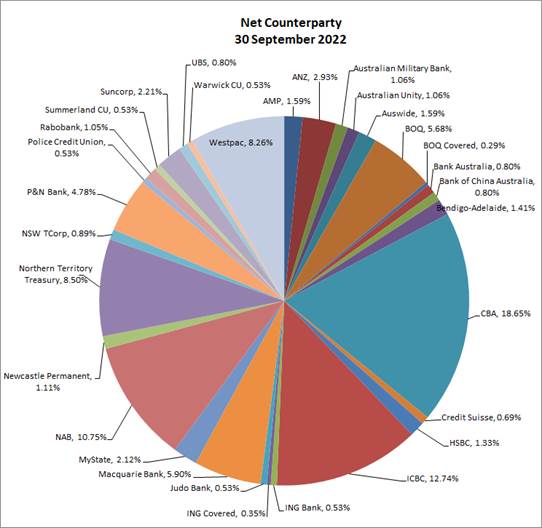

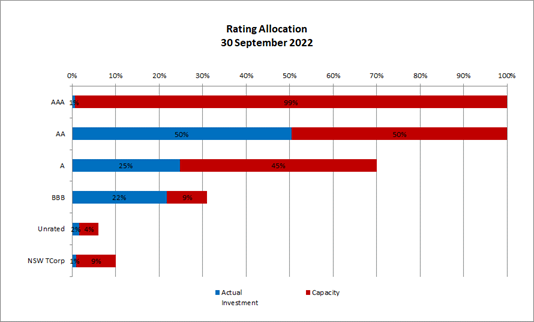

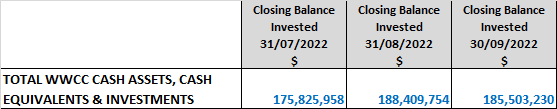

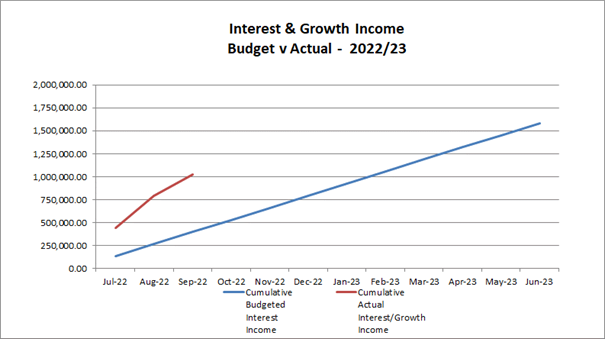

|