Agenda

and

Business Paper

To be held on

Monday 27

February 2023

at 6.00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

Agenda

and

Business Paper

To be held on

Monday 27

February 2023

at 6.00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

NOTICE OF MEETING

The proceedings of all Council meetings in open session, including all debate and addresses by the public, are recorded (audio visual) and livestreamed on Council’s website including for the purpose of facilitating community access to meetings and accuracy of the Minutes.

In addition to webcasting council meetings, audio recordings of confidential sessions of Ordinary Meetings of Council are also recorded, but do not form part of the webcast.

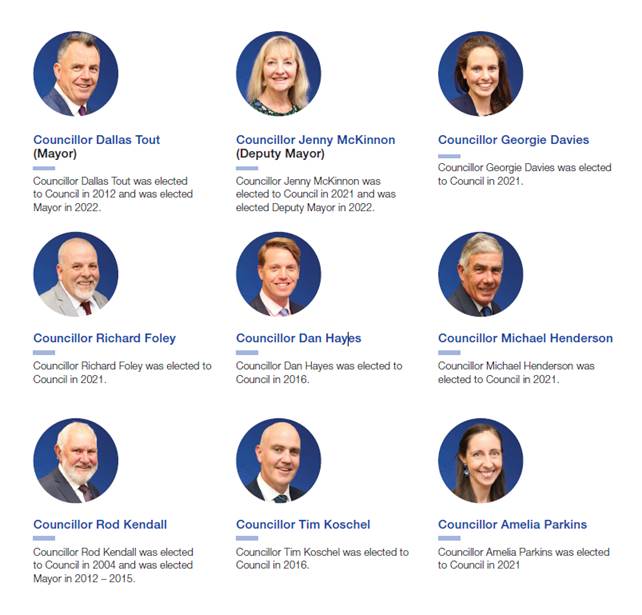

WAGGA WAGGA CITY COUNCILLORS

STATEMENT OF ETHICAL OBLIGATIONS

Councillors are reminded of their Oath or Affirmation of Office made under Section 233A of the Local Government Act 1993 and their obligation under Council’s Code of Conduct to disclose and appropriately manage Conflicts of Interest.

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

Reports submitted to the Ordinary Meeting of Council to be held on Monday 27 February 2023.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 27 February 2023

CLAUSE PRECIS PAGE

ACKNOWLEDGEMENT OF COUNTRY 2

REFLECTION 2

APOLOGIES 2

Confirmation of Minutes

CM-1 ORDINARY COUNCIL MEETING - 13 FEBRUARY 2023 2

DECLARATIONS OF INTEREST 2

Reports from Staff

RP-1 DA22/0346 - Service Station, 232-236 Hammond Avenue, East Wagga Wagga 3

RP-2 PROPOSED PLANNING AGREEMENT 12 BLAKE STREET, WAGGA WAGGA 9

RP-3 REQUEST FOR FINANCIAL ASSISTANCE - SECTION 356 22

RP-4 NSW STRONGER COUNTRY COMMUNITIES ROUND 5 SUCCESSFUL FUNDING 29

RP-5 FINANCIAL PERFORMANCE REPORT AS AT 31 JANUARY 2023 32

RP-6 Revaluation of Property Land Values for Rating Purposes - Base Date 01/07/2022 65

RP-7 RESOLUTIONS AND NOTICES OF MOTIONS REGISTERS 75

RP-8 QUESTIONS WITH NOTICE 77

Committee Minutes

M-1 LOCAL TRAFFIC COMMITTEE MEETING - 1 DECEMBER 2022 79

Confidential Reports

CONF-1 RIFL AGENCY REPORT 90

Wagga Wagga City Council acknowledges the traditional custodians of the land, the Wiradjuri people, and pays respect to Elders past, present and future and extends our respect to all First Nations Peoples in Wagga Wagga.

We recognise and respect their cultural heritage, beliefs and continuing connection with the land and rivers. We also recognise the resilience, strength and pride of the Wiradjuri and First Nations communities

RELECTION

Councillors, let us in silence reflect upon our responsibilities to the community which we represent, and to all future generations and faithfully, and impartially, carry out the functions, powers, authorities and discretions vested in us, to the best of our skill and judgement.

CM-1 ORDINARY COUNCIL MEETING - 13 FEBRUARY 2023

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 13 February 2023 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - 13 February 2023 |

91 |

|

Report submitted to the Ordinary Meeting of Council on Monday 27 February 2023 |

RP-1 |

RP-1 DA22/0346 - Service Station, 232-236 Hammond Avenue, East Wagga Wagga

Author: Paul O’Brien

General Manager: Peter Thompson

|

Summary: |

The report is for a Development Application and is presented to Council for determination.

In accordance with the provisions of POL 046 ‘Processing Development Applications Lodged by Councillors, Staff and Individuals of Which a Conflict of Interest May Arise, or on Council Owned Land Policy’ the Development Application is required to be referred to Council for determination. A director of the company that is the owner of the land on which this application is made is a current Councillor. In addition, a different director of the landowning company is a relative of a current Councillor.

The proposed development includes: · Construction of: o A service station including sales/convenience store building, o A freestanding car canopy with 8 fuel dispensers, o A freestanding truck canopy with 9 fuel dispensers, · Installation of an underground tank farm. · Signage, including a 10.15m high pylon sign. · Two lot boundary adjustment. · Road works in Hammond Ave to facilitate left-in, left-out access only to the site. · 24-hour operation. · Removal of 6 trees on site.

Three formal public submissions were received across the two public exhibition periods carried out for the development.

The merits assessment of the proposal has determined that the development is generally consistent with the Wagga Wagga Local Environmental Plan 2010, relevant State Environmental Planning Policies, and the Wagga Wagga Development Control Plan 2010, that the impacts of the development are acceptable, and that subject to conditions, the development is acceptable in this location. Recommended conditions include a limit on the proposed pylon sign height to a maximum 8m.

A full assessment of the Development Application is contained within the attached Section 4.15 Assessment Report. |

|

That Council approve DA22/0346 subject to the conditions outlined in the Section 4.15 Assessment Report.

|

Development Application Details

|

Applicant |

MMJ Town Planning |

|

Owner |

Wollundry Investments Pty Ltd |

|

Directors |

Rodney Kendall Richard Pottie John Tyrrell Allen Thompson Robert Davies Christopher Chamberlain |

|

Development Cost |

$1,800,000 |

|

Development Description |

Service Station and Two Lot Subdivision (Boundary Adjustment) |

Report

Key Issues

· Traffic and access

· Height of proposed pylon sign

· Submissions

· Tree protection

Site Location

The site, being Lots 31 and 32 DP 874819, 232-236 Hammond Avenue, East Wagga Wagga, is located on the southern side of Hammond Avenue, approximately 200m west of Blaxland Road.

The site is approximately 3.36ha and is elevated from Hammond Avenue, through apparent historical filling, but is relatively flat itself. The site contains some vegetation, including a large Eucalyptus tree at the front of the site.

The locality is generally industrial / large floor area commercial in nature, with surrounding land uses including an iron foundry and an electrical contractor. Opposite the site to the north is rural land.

Assessment

· The site is zoned B6 Enterprise Corridor under the provisions of the WWLEP 2010.

· Service stations are permitted with consent in the B6 zone.

· The development complies with the controls of the WWLEP 2010.

· The development generally complies with relevant State Environmental Planning Policies, however, it has been assessed that the proposed pylon sign, at 10.15m, is inconsistent with the matters for consideration under SEPP (Industry and Employment) 2021 for signage. If reduced to 8m it is considered that the pylon sign would be consistent.

· The development generally complies with the controls of the WWDCP 2010, however a number of non-compliances are proposed. These include:

o C1 of Section 2.2 in relation to minimum number of parking spaces.

o C13 of Section 2.4 in relation to the number of fascia business identification signs.

o C14 of Section 2.4 in relation to the protrusion of fascia business identification signs above awnings.

o C15 of Section 2.4 in relation to the illumination of fascia signs.

o C39 of Section 2.4 in relation to the maximum panel area for pylon signs.

o C40 of Section 2.4 in relation to the maximum height for pylon signs.

o C1 of Section 10.6 in relation to the need for masterplans for sites greater than 1ha in size.

o C2 of Section 10.6 in relation to front setbacks in the B6 zone.

· It is recommended that these variations be supported, apart from C40 of Section 2.4 in relation to the maximum height for pylon signs in business zones. The maximum height permitted is 8m and the proposed pylon sign is 10.15m. It is considered that the proposed variation would result in unreasonable impacts on the streetscape, and is inconsistent with the objectives of the control.

· An 8m height limit has been consistently applied by Council along Hammond Avenue under the WWDCP 2010, and any variation is considered to be out of character with the area. Any signage greater than 8m along the corridor predates 2010 and are pole signs with significantly less panel area than the monolith style sign proposed, thus resulting in far fewer impacts.

· A condition has been recommended limiting the pylon sign height to 8m.

· Six trees are proposed to be removed from the site. Conditions of consent have been recommended to protect a significant tree on adjoining land to the west, and the avenue of London Plane Trees on the northern side of the highway opposite the site.

· The site is identified as being within the Flood Planning Area for both riverine flooding and overland flooding.

· During a 1% Annual Exceedance Probability (AEP) riverine flood event (i.e. a 1 in 100 year flood event) the front of the site where the service station is proposed is modelled to be inundated to a depth of approximately 0.05-0.72m. The rear of the site ranges between 0.09m-0.48m.

· In a 5% AEP flood event (i.e. a 1 in 20 year flood event) the site is not flooded, apart from two very small areas adjacent to the highway. In these areas flooding is minor, between 0.05m-0.07m.

· The development proposes a finished floor level for the shop building well above the 5% AEP level plus 500mm, which is Council’s standard for commercial and industrial development.

· The site has been previously filled (prior to 1997). This filling has therefore been incorporated into Council’s flood modelling. The proposed development requires some earthworks for levelling but essentially maintains the current height of the site.

· The development proposes left-in and left-out access and was referred to Transport for NSW, as per the requirements of SEPP (Transport and Infrastructure) 2021. TfNSW raised no objection to the development, subject to the imposition of a number of conditions.

· The development was advertised and notified to adjoining owners twice. Initially the application was placed on public exhibition from 1/11/22-15/11/22. This period was extended for 14 days to 29/11/22 due to flooding in the vicinity of the site. The application was renotified from 5/1/23 to 19/1/23 due to amendments to the plans.

· Three formal public submissions were received over the two periods, as well as one additional submission that was identified as not being a formal submission.

· Matters raised in submissions include:

o Stormwater impacts

o Impacts on access to existing properties

o Fencing

· Matters raised in submissions have been considered in full and have been addressed via conditions of consent where appropriate. It is noted that full access is maintained to adjoining properties and that this is reinforced by conditions.

Having regard for the information contained in the attached Section 4.15 assessment report, it is considered that the development is acceptable for the following reasons and recommended for approval.

Reasons for Approval

1. The proposed development is consistent with the provisions of the Wagga Wagga Local Environmental Plan 2010.

2. The proposed development is consistent with the controls and matters for consideration in relevant State Environmental Planning Policies, apart from the 10.15m pylon sign. In the case of the pylon sign, conditions have been recommended to ensure compliance.

3. The proposed development is generally consistent with the objectives and controls of the Wagga Wagga Development Control Plan 2010 and apart from the 10.15m pylon sign, where a variation is proposed, the variation is reasonable. In the case of the pylon sign, conditions have been recommended to ensure compliance and to manage impacts.

4. Impacts of the proposed development are acceptable and can be managed via the recommended conditions of consent.

5. Submissions have been considered and addressed and the development is considered to be in the public interest.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010

State Environmental Planning Policy (Transport and Infrastructure) 2021

State Environmental Planning Policy (Industry and Employment) 2021

State Environmental Planning Policy (Resilience and Hazards) 2021

Wagga Wagga Development Control Plan 2021

Link to Strategic Plan

The Environment

Objective: Future growth and development of Wagga Wagga is planned for in a sustainable manner

Ensure sustainable urban development

Risk Management Issues for Council

Refusal of the application may result in an appeal process to the Land and Environment Court which will have to be defended by Council. The reasons for refusal will have to be justified and withstand scrutiny and cross examination in Court.

Approval of the application is not considered to raise risk management issues for Council as the proposed development is generally consistent with LEP and DCP controls and the proposed variations, where supported, have been fully assessed and justified.

Internal / External Consultation

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Connect.Wagga |

Email newsletter |

Social media |

Website |

|

|

Inform |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consult |

|

x |

|

|

|

|

|

|

|

|

x |

|||||

|

Involve |

|

|

|

|

|

|

|

|

||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other methods (please list specific details below) |

||||

|

|

|

|

|

|

|

1. |

DA22/0346 - Section 4.15 Assessment Report - Provided under separate cover |

|

|

2. |

DA22/0346 - Plans - Provided under separate cover |

|

|

3. |

DA22/0346 - Statement of Environmental Effects - Provided under separate cover |

|

|

4. |

DA22/0346 - Redacted Submissions - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 27 February 2023 |

RP-2 |

RP-2 PROPOSED PLANNING AGREEMENT 12 BLAKE STREET, WAGGA WAGGA

Author: Belinda Maclure

Executive: John Sidgwick

|

Summary: |

In March 2022 Council received an offer to enter into a planning agreement in relation to the development of 12 Blake Street, Wagga Wagga (DA19/0125). The offer is to provide infrastructure to improve the public realm in Blake Street in lieu of paying Section 7.12 (previously Section 94A) contributions due for the development. The offer was placed on public exhibition and after consideration of the feedback declined by Council. An updated offer was received in October 2022. The changes were considered material and therefore the updated offer to enter into a planning agreement was placed on public exhibition from 17 December 2022 until 10 February 2023. After consideration of the five written submissions received, it is recommended Council enter into a planning agreement with Davtil Pty Ltd in relation to their development at 12 Blake Street, Wagga Wagga. |

|

That Council: a note the written submissions received during the public exhibition period for the draft 12 Blake Street proposed planning agreement associated with DA19/0125 b authorise the General Manager or their delegate to develop and execute a Planning Agreement for 12 Blake Street including the Explanatory Note and any other relevant documents on behalf of Council relating to Lot 13 DP 1211352 and associated with DA19/0125 c authorise the affixing of the Wagga Wagga City Council common seal to all relevant documents as required d authorise the General Manager or their delegate to refund the Section 7.12 contributions paid for DA19/0125 |

Report

After careful consideration of the nineteen written submissions received, Council resolved at the 17 October 2022 meeting to decline the offer to enter into a planning agreement as it did not support closing access to the Council carpark from Blake Street (Officers Report RP-1, Minute Number 22/341).

Following this decision, the developer, Davtil Pty Ltd, updated the offer to enter into a planning agreement with Council responding to the feedback received. The latest offer (dated 2nd December 2022) includes the provision of public infrastructure in lieu of the Section 7.12 contributions due for the development described in DA19/0125, approved by Council resolution 19/209, determined on 24 June 2019. The letter of offer and civil plans are attached to this report. Please note plan 22WW006-C04 includes details of the new underground electricity reticulation, which is not part of the proposed planning agreement.

The latest offer includes the following public infrastructure:

· reconfiguration of the existing on-street car parking between Morgan and Forsyth Streets from parallel parking to angle parking,

· reconfiguration of existing road design including the installation of new traffic calming devices at either end of Blake Street,

· establishment of new line marking and signage including the designation of disabled car parking spaces,

· removal of eleven existing trees and replacement with eleven “Chinese Elms”,

· replacement and upgrade to 2.5 metre wide footpaths on the western side of Blake Street,

· landscaping Council carpark, including locating an electrical sub-station on an 25m2 easement, and

· installation of three lights in Blake Street Council carpark.

Given there was a material change to the updated proposal, Council resolved to place the proposed planning agreement for 12 Blake Street on back public exhibition at its Ordinary Meeting on 12 December 2022 (Resolution Number 22/419). The latest proposal was placed on public exhibition from 17 December 2022 until 10 February 2023.

Five written submissions were received. All submissions were in support of the development. Two submissions called for the existing driveway entrance to 23 Blake Street to remain open and supported the rest of the proposal. Council staff support this request and have advised the developer accordingly. The developer has agreed to not close the existing driveway access to 23 Blake Street as part of the proposed planning agreement.

Financial Implications

The Section 7.12 contributions due for this development ($104,075) have been paid by the applicant on 16 June 2021. If Council approve this planning proposal, this will subsequently approve the refund of the $104,075 currently paid in Section 7.12 contributions.

The Local Infrastructure Contributions Plan 2019 - 2034 details the projects funded by the Section 7.12 levies (page 34). The project list includes $500,000 per year for the debt servicing costs of the Bomen Enabling roads – stage 1 project and $20,000 per year towards village recreational projects from the Recreation, Open Space and Community Strategy and Implementation Plan 2040.

The Section 7.12 Reserve balance as included in Wagga Wagga City Council’s Annual Financial Statements for the year ended 30 June 2022 was a $276,000 surplus position. This is a positive result from the ($464,000) deficit position as at 30 June 2021 and is a result of larger than anticipated income received during the 2021/22 financial year.

It is important to note that the current 2022/23 Long Term Financial Plan is still estimating the Section 7.12 Reserve balance being in a deficit position for the next 10 years based on anticipated annual contributions to be received.

As noted previously in this report, if Council approve this planning proposal, this will result in a refund of contributions received of $104,075 and will affect the closing balance of the Section 7.12 Reserve for the 2022/23 financial year.

The total value of the infrastructure to be provided in the proposed planning agreement as at December 2022 is $171,900. This includes the cost of the easement required within the council car park to accommodate the proposed sub-station which has been valued at $19,588.

Policy and Legislation

Environmental Planning and Assessment Act 1979 Section 7.4

Wagga Wagga Local Infrastructure Contribution Plan 2019 – 2034

Wagga Wagga City Council Developer Infrastructure Agreements Policy POL 121

Link to Strategic Plan

The Environment

Objective: Future growth and development of Wagga Wagga is planned for in a sustainable manner

Ensure sustainable urban development

Risk Management Issues for Council

There is a risk the community will perceive an agreement with a developer as unfair and benefiting the developer and not the community. Council is required to ensure all developers are treated fairly and consistently when dealing with Council and works to ensure transparency of all agreements between developers and Council.

It is important developers propose to provide suitable infrastructure through a planning agreement. Proposed planning agreements need to include developer-provided infrastructure which aligns with Council’s strategic plans.

As noted in the Financial Implications section of this report, if Council approve this planning proposal, this will face further pressure on this Reserve, and will increase the timeframe this Reserve will be in a deficit position.

Internal / External Consultation

The public exhibition of the proposed planning agreement in August/September saw a Connect Wagga website created to provide information to the community. During the first public exhibition period in August and September 2022, signs were erected in the Council carpark encouraging people to consider the proposal and make a written submission.

In September 2022, all businesses in the street received a visit from Council staff and were encouraged to make a submission. Six businesses made contact with Council staff after these visits to discuss the proposal in more detail and ask questions. Letters were sent to all land holders in a wider identified area and all residents of the street. Nineteen written submissions were received.

During the latest public exhibition, the Connect Wagga website was updated to include the latest information. Residents and businesses within the precinct received a letter updating them of the changes and an industry email was circulated. All the businesses in Blake Street received a visit from Council staff at the end of January 2023 and were encouraged to make a written submission. Verbal feedback during these visits was very supportive of the updated proposed planning agreement. Two businesses contacted Council staff after the visits. Five written submissions were received during the public exhibition period. These are summarised below.

|

Submission |

Summary |

|

1 |

The proposal sees to improve the utilisation of public land by improving parking. It makes sense and is a benefit to the city and the surrounding properties. The proposal should be supported. |

|

2 |

Supports proposal |

|

3 |

Supports proposal. But note that access to existing driveways must be maintained if required by the owners. |

|

4 |

Supports proposal. But note that access to existing driveways must be maintained if required by the owners. |

|

5 |

Supports proposal |

The following table shows the community engagement strategies used during the public exhibition periods.

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Connect.Wagga |

Email newsletter |

Social media |

Website |

|

|

Inform |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consult |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Involve |

|

|

|

|

|

|

|

|

||||||||

|

Collaborate |

|

x |

x |

|

x |

|

x |

|

x |

x |

|

|

x |

x |

x |

x |

|

Other methods (please list specific details below) |

||||

|

|

|

|

|

|

|

1⇩. |

Blake Street Proposed Planning Agreement December 2022 |

|

|

2⇩. |

Blake Sreet Planning Agreement Civil Plans |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 27 February 2023 |

RP-3 |

RP-3 REQUEST FOR FINANCIAL ASSISTANCE - SECTION 356

Author: Carolyn Rodney

|

Summary: |

Council has received two (2) fee waiver requests which are detailed for Council’s consideration. |

|

That Council: a In accordance with Section 356 of the Local Government Act 1993, provide financial assistance to the following organisations: i Department of Planning and Environment for $6,619 ii Cricket NSW Baggy Blues Charity Cricket Match for $626.00 b note the proposed budget available for financial assistance requests for the remainder of the 2022/23 financial year |

Report

Two (2) financial assistance requests are proposed for consideration at this Ordinary Council meeting. Details of the requests are shown below:

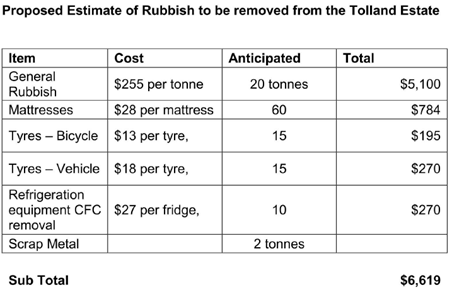

1. Department of Planning and Environment: Tolland Clean Up - $6,619

Craig Smith – Delivery Director, Southern NSW – NSW Land & Housing Corporation in the attached letter requests:

Tolland Estate Clean Up - Request for Assistance

As you are aware, the Department of Communities and Justice (DCJ), Housing Murrumbidgee, led a community clean up in Kooringal Estate late last year. The day exceeded all expectations with the following amount of rubbish removed from the estate:

· 17 tonnes of rubbish

· 49 mattresses

· 1.6 tonne of scrap metal

· 20 tyres

Many residents that live in social housing estates have limited means to access waste removal options, with events like this greatly appreciated by the community and this was echoed throughout the day. I would like to acknowledge the vital importance of the Wagga Wagga City Council in making these days a success and for their ongoing support and commitment to the community. Without the Council’s support, these days would not be the success that they are.

The DCJ Housing Murrumbidgee Team are planning to hold another Community Clean-up Day on Thursday 9 March in the Tolland Estate. Similar, to the Kooringal Clean-up day, we will providing large skip bins placed around the estate and a BBQ throughout the day. In conducting this clean-up day we are, again, seeking Council’s support for the following:

· Council to waive the tip fees (see estimate below) and leave the tip open to allow drivers to empty skips. Council to allow two trucks and a ‘bobcat’ with four workers to assist the community with bulky items. Please note, as estimate of truck hire and staff costs is $3,000, to be payable by LAHC.

· The clean-up works are to be scheduled for Thursday 9 March from 10:00am as well as the following morning, Friday 10 March, to collect any additional rubbish that may have been left from the previous day.

· LAHC to contribute $25,000 to the Tolland clean-up.

Based on the success of the previous rubbish removal from Kooringal and an increased volume of rubbish anticipated in the Tolland Estate the estimate for the rubbish removal is set out in the table below. This is an expected increase of approximately 20% above the rubbish removed from Kooringal.

The areas of the Tolland Estate proposed for the clean-up comprises the following streets:

Awaba Ave; Quabara Pl; Nyrang St; Martin St; O’Connor St; Pike St; Anne St; Bruce St; Raye St; Edghill Pl; Kenny Pl; Flynn Pl; Oliver Pl; Brooks Cir; Davies Pl; Bingham Pl; Melba Pl; Jordan Pl; Boyd Pl; Dennis Cres; French Pl; Toy Pl; Tarra Pl; Lalor Pl; and Rogers Pl.

The Local Tenancy team at DCJ has completed a few clean-up days over the past couple of years, with the most recent one in Kooringal in November at a cost of $15,400. This clean-up proposed for the Tolland Estate is estimated to cost LAHC $25,000.

Would you please review this request and advise if Council will support LAHC and DCJ with this event, through tip activities and on-site resources.

The above request aligns with Council’s Strategic Plan “The Environment” – Objective: We are proactive with our waste management”

Council has provided similar assistance to the Department in the last 12 months via community clean-up days at Ashmont and Kooringal.

2. Cricket NSW Baggy Blues Charity Cricket Match - $626.00

Luke Olsen, Area Manager – Southern & Western NSW in the attached email requests:

Dear Peter,

I’m writing on behalf of the Cricket NSW Baggy Blues. The Baggy Blues are a group of past NSW cricketers who travel the state promoting the game as well as mental health awareness. They are bringing a match to Wagga Wagga this season and would like Councils support.

I am hoping that Wagga Wagga City Council could consider waiving the costs associated with holding a match at Robertson Oval (curating fees, light charges etc).

The Baggy Blues match is currently scheduled to be held at Robertson Oval on Thursday 16th March 2023 from 3pm-10.30pm. The associated charges for the use of Robertson Oval are ground hire fees of $115.00 and Sportsground lighting fees of $511.00, totalling $626.00.

The above request aligns with Council’s Strategic Plan “Community Place and Identity” – Objective: Our community feel welcome, included and connected”

Council has not provided any assistance to Cricket NSW in the last 12 months.

Financial Implications

|

Section 356 Budget Summary |

|

|

2022/23 Opening Budget* |

$43,528.00 |

|

Total of fee waivers approved to date |

($13,870.03) |

|

Revised Balance of Section 356 fee waiver financial assistance |

$29,927.97 |

|

1) Department of Planning and Environment: Tolland Clean Up - $6,619 (funded from Solid Waste Cost Centre)* |

- |

|

2) Cricket NSW Baggy Blues Charity Cricket Match |

($626.00) |

|

Subtotal Fee Waivers included in this report proposed to be funded from the Section 356 Budget |

($626.00) |

|

Proposed Balance of Section 356 fee waiver financial assistance budget for the remainder of the 2022/23 Financial Year |

$29,301.97 |

*It is proposed that Council support the Tolland Clean up event by contributing the above assistance estimated at $6,619. It is proposed for this support to be funded from Council’s Solid Waste Management Operations budget which can absorb the total cost estimate of $6,619 (Job Number 70138). All other costs associated with this request will be met by the Department of Communities and Justice.

Policy and Legislation

POL 078 – Financial Assistance Policy

Link to Strategic Plan

The Environment

Objective: Our built environment is functional, attractive and health promoting

Create an attractive city

Risk Management Issues for Council

N/A

Internal / External Consultation

Cross Directorate consultation has been undertaken as required.

|

1⇩. |

Request for Fee Waiver - Department of Planning and Environment: Tolland Clean Up |

|

|

2⇩. |

Request for Fee Waiver - Cricket NSW Baggy Blues |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 27 February 2023 |

RP-4 |

RP-4 NSW STRONGER COUNTRY COMMUNITIES ROUND 5 SUCCESSFUL FUNDING

Author: Carolyn Rodney

|

Summary: |

Council has been successful in receiving grant funding under the NSW Government’s (Department of Regional NSW) Stronger Country Communities Fund (SCCF) Round 5 funding. |

|

That Council: a accept the funding offer of $1,571,466 from Department of Regional NSW for the Stronger Country Communities Fund (SCCF) Round 5 Funding b approve the budget variation/s as detailed in the Financial Implications section of the report |

Report

Council has been successful in receiving grant funding under the NSW Government’s (Department of Regional NSW) Stronger Country Communities Fund (SCCF) Round 5 funding.

This funding aims to boost the wellbeing of communities in regional areas by providing new or upgraded social and sporting infrastructure, or community programs that have strong local support. The funding will be utilised for the following projects/programs:

|

Project |

Funding |

|

Bill Jacob Athletics Centre Lighting Upgrade - Design and installation of sports ground lighting at the Bill Jacobs Athletics Centre to allow night training and competition. This project will be completed concurrently with the track renewal project. |

$587,967 SCCF 5

Council Contribution $0

|

|

Festival of W - Delivery of a 16-day festival inclusive of the installation of an ice-skating rink, a large-scale light and sound show along with immersive art installations, live music and pop up food and beverage experiences located in the Civic Centre cultural precinct from 1 July to 16 July 2023. |

$300,000 SCCF-5

Council Contribution $184,485 (previous years ticketing income received*) |

|

Stadium Upgrades (Equex Centre + Bolton Park) - Installation of new scoreboards and shot clocks at Bolton Park and portable retractable seating at the MPS.

|

$429,209 SCCF-5

Council Contribution $0 |

|

Shade Sails over Playgrounds in Wagga - Installation of Shade Sails at Webb Park Playground, Pomingalarna Playground and Lingiari Park Playground |

$112,841 SCCF-5

Council Contribution $0 |

|

Pomingalarna Cultural Garden Stage 1 - Commencement of the construction of a cultural garden at the Pomingalarna Multi-sport Cycling Complex that recognises the significance of the site to the Wiradjuri Community.

|

$141,450 SCCF-5

Council Contribution $0 |

Financial Implications

The total estimated cost to implement all funded projects is $1,755,951 with $1,571,466 to be funded from the Stronger Country Community Fund Round 5.

|

Project |

Grant Funding |

Council Contribution (currently budgeted in LTFP) |

Other |

Total Project Budget |

Project Timing |

|

Bill Jacob Athletics Centre Lighting Upgrade

|

$587,967 |

$0 |

$0 |

$587,967 |

2023/24

|

|

Festival of W at Victory Memorial Gardens

|

$300,000 |

$184,485* |

$0 |

$484,485 |

July 2023 |

|

Stadium Upgrades (Equex Centre + Bolton Park)

|

$429,209 |

$0 |

$0 |

$429,209 |

2022/23 |

|

Shade Sails over Playgrounds in Wagga

|

$112,841 |

$0 |

$0 |

$112,841 |

2022/23 |

|

Pomingalarna Cultural Garden Stage 1

|

$141,450 |

$0 |

$0 |

$141,450 |

2022/23 |

|

|

$1,571,467 |

$184,485 |

$0 |

$1,755,952 |

|

*The $184,485 Council contribution relates to previous two years ticketing income received that has been restricted in an internal reserve, to use as seed funding for future events. It is planned for ticketing income for this event be treated the same.

Policy and Legislation

Recreation and Open Space and Community Strategy and Implementation Plans 2040

Wagga Wagga Playground Strategy

Wagga Wagga Event Strategy

Link to Strategic Plan

Safe and Healthy Community

Objective: Our community embraces healthier lifestyle choices and practices

Promote access and participation for all sections of the community to a full range of sports and recreational activities

Risk Management Issues for Council

The risks associated with implementing these projects relate to process, cost, environmental, WHS and contractor performance. These risks are addressed as part of Council’s project management and contractor performance management systems.

Internal / External Consultation

Projects were initially identified from the recommendations of adopted Council Strategies. Internal consultation was undertaken prior to the submission of the applications.

Additional internal and external consultation will be undertaken during the planning phase of each of the projects.

|

Report submitted to the Ordinary Meeting of Council on Monday 27 February 2023 |

RP-5 |

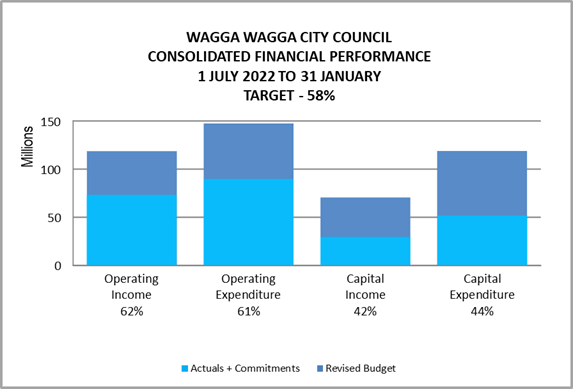

RP-5 FINANCIAL PERFORMANCE REPORT AS AT 31 JANUARY 2023

Author: Carolyn Rodney

|

Summary: |

This report is for Council to consider information presented on the 2022/23 budget and Long-Term Financial Plan, and details Council’s external investments and performance as at 31 January 2023. |

|

That Council: a approve the proposed 2022/23 budget variations for the month ended 31 January 2023 and note the balanced budget position as presented in this report b approve the proposed budget variations to the 2022/23 Long Term Financial Plan Capital Works Program including future year timing adjustments c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2021 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above d note the details of the external investments as of 31 January 2023 in accordance with section 625 of the Local Government Act 1993 e accept the grant funding offers as presented in this report |

Wagga Wagga City Council (Council) forecasts a balanced budget position as of 31 January 2023.

The balanced budget position excludes the Wagga Wagga Airport estimated deficit result for the financial year – as previously reported to Council, any Airport deficit result will be sanctioned, and funded in the interim by General Purpose Revenue (via the Internal Loans Reserve). The deficit results will be accounted for as a liability in the Airport’s end of financial year statements and paid back to General Purpose Revenue (Internal Loans Reserve) by the Airport in future financial years.

Proposed budget variations including adjustments to the capital works program are detailed in this report for Council’s consideration and adoption.

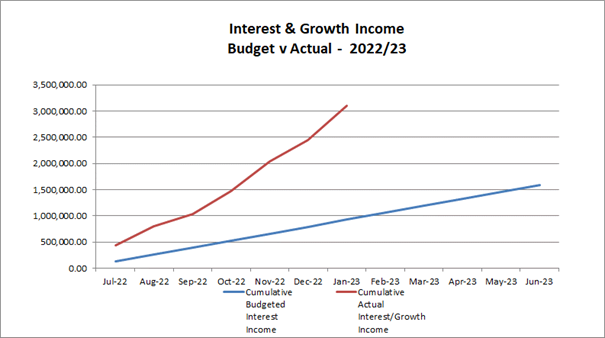

Council has experienced a positive monthly investment performance for the month of January when compared to budget ($511,579 up on the monthly budget). This is mainly due to better than budgeted returns on Council’s investment portfolio, as a result of the ongoing movement in the interest rate environment, as well as a positive return on Councils T-Corp Managed fund for the month.

Key Performance Indicators

OPERATING INCOME

Total operating income is 62% of approved budget and is trending above budget for the month of January 2023. This is due to increased revenue from Interest on Investments. An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 88% when compared to budget.

OPERATING EXPENSES

Total operating expenditure is 61% of approved budget so it is tracking over budget at this stage of the financial year. This is due to the commitment for multi-year software licences.

CAPITAL INCOME

Total capital income is 42% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions in relation to expenditure incurred on the projects. This income also includes the sale of property, plant and equipment.

CAPITAL EXPENDITURE

Total capital

expenditure including commitments is 44% of approved budget with some purchase

orders being raised for the full contract amounts for multi-year projects.

Excluding commitments, the total expenditure is 17% when compared to the

approved budget.

|

WAGGA WAGGA CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2022/23 |

COMMT'S 2022/23 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|

||||||

|

Rates & Annual Charges |

(75,524,168) |

0 |

(75,524,168) |

(44,301,332) |

0 |

(44,301,332) |

59% |

|

User Charges & Fees |

(27,844,136) |

(442,450) |

(28,286,586) |

(17,133,422) |

0 |

(17,133,422) |

61% |

|

Other Revenues |

(2,769,503) |

(202,000) |

(2,971,503) |

(1,814,169) |

0 |

(1,814,169) |

61% |

|

Grants & Contributions provided for Operating Purposes |

(13,524,889) |

4,975,395 |

(8,549,493) |

(5,883,836) |

0 |

(5,883,836) |

69% |

|

Grants & Contributions provided for Capital Purposes |

(36,295,253) |

(29,348,185) |

(65,643,438) |

(25,495,029) |

0 |

(25,495,029) |

39% |

|

Interest & Investment Revenue |

(1,828,128) |

0 |

(1,828,128) |

(3,207,972) |

0 |

(3,207,972) |

175% |

|

Other Income |

(1,406,222) |

(54,000) |

(1,460,222) |

(913,904) |

0 |

(913,904) |

63% |

|

Total Revenue |

(159,192,300) |

(25,071,240) |

(184,263,539) |

(98,749,662) |

0 |

(98,749,662) |

54% |

|

|

|||||||

|

Expenses |

|||||||

|

Employee Benefits & On-Costs |

51,315,412 |

445,000 |

51,760,412 |

27,443,378 |

0 |

27,443,378 |

53% |

|

Borrowing Costs |

3,268,989 |

0 |

3,268,989 |

1,475,356 |

0 |

1,475,356 |

45% |

|

Materials & Services |

36,542,674 |

8,618,985 |

45,161,659 |

24,773,468 |

7,252,184 |

32,025,653 |

71% |

|

Depreciation & Amortisation |

43,196,051 |

0 |

43,196,051 |

25,197,697 |

0 |

25,197,697 |

58% |

|

Other Expenses |

1,866,271 |

2,078,121 |

3,944,392 |

3,566,329 |

31,023 |

3,597,352 |

91% |

|

Total Expenses |

136,189,398 |

11,142,106 |

147,331,504 |

82,456,227 |

7,283,207 |

89,739,434 |

61% |

|

|

|||||||

|

Net Operating (Profit)/Loss |

(23,002,902) |

(13,929,133) |

(36,932,035) |

(16,293,435) |

7,283,207 |

(9,010,228) |

|

|

|

|||||||

|

Net Operating Result Before Capital (Profit)/Loss |

13,292,351 |

15,419,052 |

28,711,403 |

9,201,594 |

7,283,207 |

16,484,801 |

|

|

|

|||||||

|

Cap/Reserve Movements |

|||||||

|

Capital Expenditure - One Off Confirmed |

13,638,521 |

67,163,079 |

80,801,600 |

11,460,775 |

28,630,073 |

40,090,848 |

50% |

|

Capital Expenditure - Recurrent* |

18,890,352 |

8,238,710 |

27,129,062 |

4,307,254 |

3,598,176 |

7,905,431 |

29% |

|

Capital Expenditure - Pending Projects |

59,770,944 |

(56,508,230) |

3,262,713 |

1,936 |

0 |

1,936 |

0% |

|

Loan Repayments |

7,571,681 |

0 |

7,571,681 |

3,833,480 |

0 |

3,833,480 |

51% |

|

New Loan Borrowings |

(17,458,537) |

11,279,368 |

(6,179,168) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(880,181) |

(4,037,359) |

(4,917,540) |

(4,212,051) |

0 |

(4,212,051) |

86% |

|

Net Movements Reserves |

(15,333,827) |

(12,206,434) |

(27,540,261) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

66,198,954 |

13,929,133 |

80,128,087 |

15,391,395 |

32,228,249 |

47,619,645 |

|

|

|

|||||||

|

Net Result after Depreciation |

43,196,052 |

0 |

43,196,052 |

(902,040) |

39,511,456 |

38,609,417 |

|

|

|

|||||||

|

Add back Depreciation Expense |

43,196,051 |

0 |

43,196,051 |

25,197,697 |

0 |

25,197,697 |

58% |

|

|

|||||||

|

Cash Budget (Surplus)/Deficit |

0 |

0 |

0 |

(26,099,736) |

39,511,456 |

13,411,720 |

|

Years 2-10 Long Term Financial Plan (Surplus) /Deficit

|

Description |

Budget 2023/24 |

Budget 2024/25 |

Budget 2025/26 |

Budget 2026/27 |

Budget 2027/28 |

Budget 2028/29 |

Budget 2029/30 |

Budget 2030/31 |

Budget 2031/32 |

|

Adopted Bottom Line (Surplus) / Deficit |

1,163,681 |

1,205,672 |

4,377,581 |

4,833,506 |

2,199,382 |

1,967,334 |

1,257,474 |

1,234,053 |

418,437 |

|

Adopted Bottom Line Adjustments |

26,080 |

27,297 |

40,051 |

41,342 |

42,673 |

44,042 |

45,454 |

46,907 |

93,404 |

|

Revised Bottom Line (Surplus) / Deficit |

1,189,761 |

1,232,969 |

4,417,632 |

4,874,848 |

2,242,055 |

2,011,376 |

1,302,928 |

1,280,960 |

511,841 |

2022/23 Revised Budget Result – (Surplus) / Deficit |

$’000s |

|

Original 2022/23 Budget Result as adopted by Council Total Budget Variations approved to date Budget Variations for January 2023 |

$0K $0K $0K |

|

Proposed Revised Budget result for 31 January 2023 - (Surplus) / Deficit |

$0K |

The proposed Operating and Capital Budget Variations for 31 January 2023 which affect the current 2022/23 financial year are listed below.

|

Budget Variation |

Amount |

Funding Source |

Net Impact (Fav)/ Unfav |

|

|

1 – Community Leadership and Collaboration |

||||

|

Stores – Bar Coding System & Shelving |

$13K |

Plant Replacement Reserve ($13K) |

Nil |

|

|

Funds are required for the supply of equipment for the bar coding of all stores stocked items and also all minor plant and equipment. This will provide efficiencies with record keeping for all minor plant and equipment. It is proposed to schedule the project with $12.5K in 2022/23 for the Stores Racking/Shelving and $37.5K in 2024/25 for the Bar Coding System, with the budget variation funded from the Plant Replacement Reserve. Estimated Completion: 30 June 2025 Job Consolidation: 20799

|

|

|||

|

4 – Community Place and Identity |

||||

|

Learn English and Play LEAP Program |

$30K |

Scanlon Foundation ($30K) |

Nil |

|

|

The Wagga Wagga City Library (WWCL) has been granted funds through the Scanlon Foundation to support the Library’s LEAP (Learn English and Play) program. The program will support Culturally and Linguistically Diverse (CALD) parents, guardians and their pre-school children to practice their conversational English skills while participating in play-based activities. The program will be delivered in identified suburbs across Wagga Wagga during 2023, commencing in February in Ashmont. Estimated Completion: 31 December 2023 Job Consolidation: 22173 |

|

|||

|

5 – The Environment |

||||

|

Section 7.11 Developer Contribution Plan Review |

$50K |

Section 7.11 Reserve ($50K) |

Nil |

|

|

Funds are required to engage a Quantity Surveyor to review the cost estimates for the major and complex projects that are still to be completed in the Contributions Plan. Following the completion of these works by the Quantity Surveyor funds are also required for the update of the Wagga Wagga Local Infrastructure Contributions Plan 2019-2034. The plan was adopted by Council in April 2019 and it is best practice to review the plan every 5 years. It is proposed to bring forward funds of $100K allocated in 2024/25, plus an additional $15K (both funded from the S7.11 Reserve). The funds are to be allocated for the Quantity Surveyor ($50K) in 2022/23 and the Contributions Plan Update ($65K) in 2023/24. Estimated Completion: 30 June 2024 Job Consolidation:14235 |

|

|||

|

Keajura Road – Fixing Local Roads Program |

$75K |

NSW State Government ($75K) |

Nil |

|

|

Council has been successful in securing Fixing Local Roads grant funding from the NSW State Government for the upgrade and sealing of the existing 2.7km of unsealed pavement on Keajura Road, Tarcutta. It is proposed to fund Council’s required contribution of $333K from Roads to Recovery Pavement Rehabilitation grant funds in 2023/24 and schedule the project with $75K in 2022/23 for design and $1,590K for construction in 2023/24. Estimated Completion: 30 June 2024 Job Consolidation: 22193 |

|

|||

|

|

$0K |

|||

The following future year projects have been reviewed by Council’s Project Management Team and delivery timelines rescheduled. There has been no change to the total budgets for these projects.

|

Job No. |

Project Title* |

2023/24 Current Pending |

2023/24 Proposed Pending |

2024/25 Current Pending |

2024/25 Proposed Pending |

2025/26 Proposed Pending |

2026/27 Proposed Pending |

2028/29 Proposed Pending |

|

19647 |

Estella New Local Park Embellishment |

2,727,675 |

1,363,838 |

0 |

1,363,837 |

0 |

0 |

0 |

|

18796 |

Northern Sporting Precinct |

5,258,854 |

2,629,427 |

0 |

2,629,427 |

0 |

0 |

0 |

|

19667 |

Rawlings Park North - Construct a synthetic soccer facility |

3,877,112 |

700,000 |

0 |

3,177,112 |

0 |

0 |

0 |

|

19627 |

Red Hill Rd/Dalman Parkway Intersection Treatment |

1,750,443 |

0 |

0 |

0 |

0 |

0 |

1,750,443 |

|

45096 |

LMC - New circulating road (partial) |

2,086,693 |

1,043,347 |

0 |

1,043,346 |

0 |

0 |

0 |

|

70147 |

GWMC – Domestic Precinct |

5,608,790 |

150,000 |

1,200,000 |

150,000 |

3,254,395 |

3,254,395 |

0 |

*The current year project budgets have been reviewed and at this stage no future year increases have been factored in due to the restrictions on the project funding source. For future year project budget adjustments, once these projects are scoped in the year of commencement, adjustments/increases will be factored in and reported to Council at that time.

2022/23 Capital Works Summary

|

Approved Budget |

Proposed Movement |

Proposed Budget |

|

|

One-off |

$80,801,600 |

$87,500 |

$80,889,100 |

|

Recurrent |

$27,129,061 |

$0 |

$27,129,061 |

|

Pending |

$3,262,713 |

$0 |

$3,262,713 |

|

Total Capital Works |

$111,193,374 |

$87,500 |

$111,280,874 |

Current Restrictions

|

RESERVES SUMMARY |

|||||

|

31 JANUARY 2023 |

|||||

|

|

CLOSING BALANCE 2021/22 |

ADOPTED RESERVE TRANSFERS 2022/23 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 30.1.2023 |

PROPOSED CHANGES for Council Resolution* |

BALANCE AS AT 31 JANUARY 2023 |

|

|

|

|

|

|

|

|

Externally Restricted |

|

|

|

|

|

|

Developer Contributions - Section 7.11 |

(31,045,478) |

7,213,679 |

(7,471,600) |

50,000 |

(31,253,399) |

|

Developer Contributions - Section 7.12 |

(278,187) |

(28,179) |

0 |

|

(306,366) |

|

Developer Contributions - Stormwater Section 64 |

(7,112,864) |

(786,229) |

281,476 |

|

(7,617,617) |

|

Sewer Fund |

(32,439,399) |

673,962 |

2,726,899 |

|

(29,038,538) |

|

Solid Waste |

(24,880,735) |

7,737,392 |

(3,486,453) |

|

(20,629,796) |

|

Specific Purpose Unexpended Grants & Contributions |

(4,195,951) |

|

4,195,951 |

|

0 |

|

SRV Levee Reserve |

(6,357,282) |

0 |

57,520 |

|

(6,299,762) |

|

Stormwater Levy |

(5,150,281) |

35,773 |

610,957 |

|

(4,503,551) |

|

Total Externally Restricted |

(111,460,179) |

14,846,399 |

(3,085,249) |

50,000 |

(99,649,029) |

|

|

|

|

|||

|

Internally Restricted |

|

|

|||

|

Airport |

0 |

0 |

0 |

|

0 |

|

Art Gallery |

(3,804) |

0 |

0 |

|

(3,804) |

|

Bridge Replacement |

(296,805) |

0 |

0 |

|

(296,805) |

|

Buildings |

(1,088,635) |

(23,658) |

258,460 |

|

(853,832) |

|

CCTV |

(100,843) |

30,633 |

30,000 |

|

(40,211) |

|

Cemetery |

(882,761) |

(226,784) |

46,123 |

|

(1,063,421) |

|

Civic Theatre |

(44,048) |

0 |

43,922 |

|

(127) |

|

Civil Infrastructure |

(9,317,219) |

1,598,454 |

(326,175) |

|

(8,044,940) |

|

Community Works |

(159,648) |

140,317 |

12,555 |

|

(6,776) |

|

Council Election |

(235,385) |

(112,845) |

49,085 |

|

(299,146) |

|

Economic Development |

(419,160) |

60,000 |

349,832 |

|

(9,328) |

|

Emergency Events Reserve |

(639,548) |

(120,142) |

(275,120) |

|

(1,034,810) |

|

Employee Leave Entitlements Gen Fund |

(3,453,655) |

0 |

0 |

|

(3,453,655) |

|

Environmental Conservation |

(116,578) |

41,578 |

0 |

|

(75,000) |

|

Event Attraction |

(491,893) |

0 |

210,249 |

|

(281,644) |

|

Financial Assistance Grants in Advance |

(8,536,837) |

0 |

8,536,837 |

|

0 |

|

Grant Co-Funding |

(500,000) |

0 |

0 |

|

(500,000) |

|

Gravel Pit Restoration |

(816,897) |

3,333 |

0 |

|

(813,564) |

|

Information Services |

(1,835,475) |

(507,158) |

179,643 |

|

(2,162,990) |

|

Insurance Variations |

(50,000) |

0 |

0 |

|

(50,000) |

|

Internal Loans |

(3,649,517) |

(201,545) |

(395,037) |

|

(4,246,099) |

|

Lake Albert Improvements |

(105,839) |

(21,366) |

0 |

|

(127,205) |

|

Library |

0 |

(171,724) |

0 |

|

(171,724) |

|

Livestock Marketing Centre |

(6,032,463) |

685,981 |

2,177,470 |

|

(3,169,012) |

|

|

CLOSING BALANCE 2021/22 |

ADOPTED RESERVE TRANSFERS 2022/23 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 30.1.2023 |

PROPOSED CHANGES for Council Resolution* |

BALANCE AS AT 31 JANUARY 2023 |

|

Museum Acquisitions |

(39,378) |

10,000 |

15,000 |

|

(14,378) |

|

Net Zero Emissions |

(394,001) |

0 |

321,212 |

|

(72,790) |

|

Oasis Reserve |

(1,085,465) |

(63,900) |

428,554 |

|

(720,810) |

|

Parks & Recreation Projects |

(1,356,795) |

(33,906) |

661,822 |

|

(728,879) |

|

Parks Water |

0 |

(180,000) |

0 |

|

(180,000) |

|

Planning Legals |

(100,000) |

0 |

0 |

|

(100,000) |

|

Plant Replacement |

(4,335,819) |

(723,537) |

2,645,872 |

12,500 |

(2,400,984) |

|

Project Carryovers |

(3,098,056) |

0 |

3,098,056 |

|

0 |

|

Public Art |

(211,155) |

106,595 |

34,893 |

|

(69,667) |

|

Sister Cities |

(50,000) |

10,000 |

7,000 |

|

(33,000) |

|

Stormwater Drainage |

(158,178) |

0 |

48,000 |

|

(110,178) |

|

Strategic Real Property |

(766,176) |

0 |

(1,611,857) |

|

(2,378,032) |

|

Subdivision Tree Planting |

(368,640) |

20,000 |

0 |

|

(348,640) |

|

Unexpended External Loans |

(3,143,977) |

74,744 |

2,909,068 |

|

(160,165) |

|

Workers Compensation |

(211,112) |

|

50,963 |

|

(160,149) |

|

Total Internally Restricted |

(54,095,762) |

395,070 |

19,506,426 |

12,500 |

(34,181,795) |

|

|

|

|

|

|

|

|

Total Restricted |

(165,555,941) |

15,241,469 |

16,421,177 |

62,500 |

(133,830,795) |

|

|

|

|

|

|

|

|

Total Unrestricted |

(11,494,000) |

0 |

0 |

0 |

(11,494,000) |

|

|

|

|

|

|

|

|

Total Cash, Cash Equivalents, and Investments |

(177,049,941) |

15,241,469 |

16,421,177 |

62,500 |

(145,324,795) |

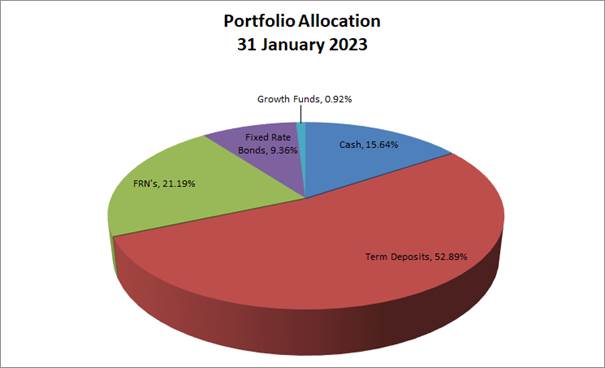

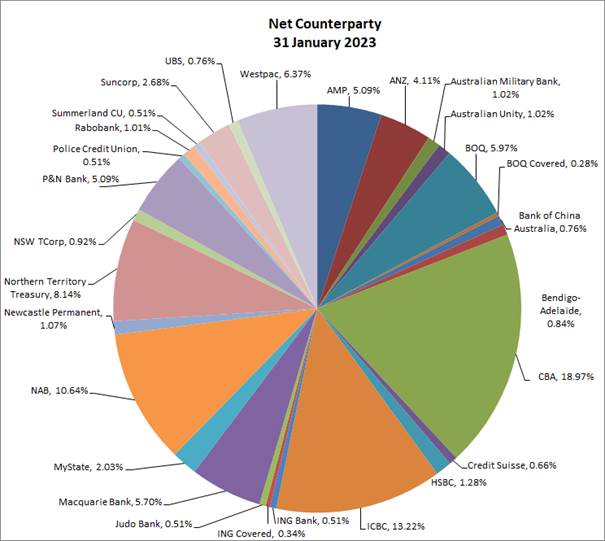

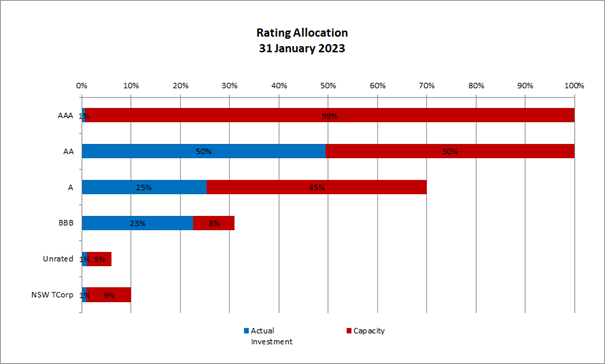

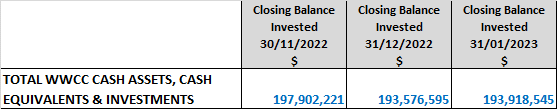

Investment Summary as at 31 January 2023

In accordance with Regulation 212 of the Local Government (General) Regulation 2021, details of Wagga Wagga City Council’s external investments are outlined below.

|

Institution |

Rating |

Closing

Balance |

Closing

Balance |

January |

January |

Investment |

Maturity |

Term |

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

168,396 |

259,854 |

3.10% |

0.13% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

5,311,262 |

4,261,375 |

3.10% |

2.17% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

17,997,658 |

17,045,069 |

3.15% |

8.67% |

N/A |

N/A |

N/A |

|

Macquarie Bank |

A+ |

9,164,114 |

9,189,371 |

3.10% |

4.67% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

32,641,431 |

30,755,669 |

3.13% |

15.64% |

|

|

|

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

CBA |

AA- |

2,000,000 |

2,000,000 |

2.22% |

1.02% |

20/04/2022 |

20/04/2023 |

12 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

3.68% |

1.02% |

8/06/2022 |

8/06/2023 |

12 |

|

AMP |

BBB |

1,000,000 |

1,000,000 |

4.70% |

0.51% |

15/11/2022 |

15/11/2023 |

12 |

|

AMP |

BBB |

2,000,000 |

2,000,000 |

4.55% |

1.02% |

30/11/2022 |

30/11/2023 |

12 |

|

CBA |

AA- |

0 |

1,000,000 |

4.69% |

0.51% |

30/01/2023 |

30/01/2024 |

12 |

|

Total Short Term Deposits |

|

7,000,000 |

8,000,000 |

3.79% |

4.07% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

1.20% |

1.02% |

4/01/2022 |

4/01/2024 |

24 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

3.78% |

0.51% |

1/06/2022 |

3/06/2024 |

24 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.32% |

1.02% |

28/06/2021 |

29/06/2026 |

60 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.80% |

1.02% |

15/11/2021 |

17/11/2025 |

48 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

2.15% |

0.51% |

8/07/2019 |

10/07/2023 |

48 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

2.03% |

1.02% |

6/11/2019 |

6/11/2024 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.83% |

1.02% |

28/11/2019 |

28/11/2024 |

60 |

|

Judo Bank |

BBB- |

1,000,000 |

1,000,000 |

1.30% |

0.51% |

3/12/2021 |

4/12/2023 |

24 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.75% |

0.51% |

6/01/2020 |

8/01/2024 |

48 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

2.00% |

0.51% |

28/02/2020 |

28/02/2025 |

60 |

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

2.20% |

0.51% |

1/04/2020 |

1/04/2025 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.85% |

0.51% |

29/05/2020 |

29/05/2025 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.86% |

0.51% |

1/06/2020 |

2/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.75% |

1.02% |

25/06/2020 |

25/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.75% |

1.02% |

25/06/2020 |

25/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.60% |

1.02% |

29/06/2020 |

28/06/2024 |

48 |

|

ICBC |

A |

3,000,000 |

3,000,000 |

5.07% |

1.53% |

30/06/2022 |

30/06/2027 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.42% |

1.02% |

7/07/2020 |

8/07/2024 |

48 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.50% |

1.02% |

17/08/2020 |

18/08/2025 |

60 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

1.25% |

0.51% |

7/09/2020 |

8/09/2025 |

60 |

|

BoQ |

BBB+ |

2,000,000 |

2,000,000 |

1.25% |

1.02% |

14/09/2020 |

15/09/2025 |

60 |

|

NAB |

AA- |

1,000,000 |

1,000,000 |

0.60% |

0.51% |

14/09/2021 |

14/09/2023 |

24 |

|

AMP |

BBB |

1,000,000 |

1,000,000 |

3.30% |

0.51% |

25/05/2022 |

27/11/2023 |

18 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.20% |

0.51% |

7/12/2020 |

8/12/2025 |

60 |

|

Warwick CU |

NR |

1,000,000 |

0 |

0.00% |

0.00% |

29/01/2021 |

30/01/2023 |

24 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

0.95% |

1.02% |

29/01/2021 |

29/01/2026 |

60 |

|

NAB |

AA- |

1,000,000 |

1,000,000 |

1.08% |

0.51% |

22/02/2021 |

20/02/2026 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

1.25% |

1.02% |

3/03/2021 |

2/03/2026 |

60 |

|

Summerland CU |

NR |

1,000,000 |

1,000,000 |

0.75% |

0.51% |

29/04/2021 |

28/04/2023 |

24 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

1.40% |

1.02% |

21/06/2021 |

19/06/2026 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

0.65% |

1.02% |

25/06/2021 |

26/06/2023 |

24 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.32% |

1.02% |

25/06/2021 |

25/06/2026 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.32% |

0.51% |

25/08/2021 |

25/08/2026 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

0.65% |

1.02% |

31/08/2021 |

31/08/2023 |

24 |

|

AMP |

BBB |

2,000,000 |

2,000,000 |

1.00% |

1.02% |

18/10/2021 |

17/10/2024 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.56% |

1.02% |

30/11/2021 |

29/11/2024 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

2.00% |

1.02% |

8/02/2022 |

10/02/2025 |

36 |

|

P&N Bank |

BBB |

2,000,000 |

2,000,000 |

2.40% |

1.02% |

9/03/2022 |

10/03/2025 |

36 |

|

P&N Bank |

BBB |

2,000,000 |

2,000,000 |

2.00% |

1.02% |

10/03/2022 |

11/03/2024 |

24 |

|

MyState |

BBB |

2,000,000 |

2,000,000 |

2.20% |

1.02% |

2/03/2022 |

3/03/2025 |

36 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

3.28% |

1.02% |

26/04/2022 |

26/04/2024 |

24 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

3.78% |

1.02% |

4/05/2022 |

6/05/2024 |

24 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

3.99% |

1.02% |

4/05/2022 |

5/05/2025 |

36 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

3.76% |

0.51% |

23/05/2022 |

23/05/2024 |

24 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

3.95% |

1.02% |

6/06/2022 |

6/06/2024 |

24 |

|

Australian Unity |

BBB+ |

2,000,000 |

2,000,000 |

4.15% |

1.02% |

8/06/2022 |

11/06/2024 |

24 |

|

Suncorp |

A+ |

2,000,000 |

2,000,000 |

4.40% |

1.02% |

22/06/2022 |

14/12/2023 |

18 |

|

MyState |

BBB |

2,000,000 |

2,000,000 |

4.45% |

1.02% |

29/06/2022 |

28/06/2024 |

24 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

4.50% |

0.51% |

7/07/2022 |

7/07/2025 |

36 |

|

CBA |

AA- |

1,000,000 |

1,000,000 |

4.25% |

0.51% |

12/08/2022 |

12/08/2025 |

36 |

|

P&N Bank |

BBB |

3,000,000 |

3,000,000 |

4.55% |

1.53% |

29/08/2022 |

29/08/2025 |

36 |

|

Australian Military Bank |

BBB+ |

2,000,000 |

2,000,000 |

4.55% |

1.02% |

2/09/2022 |

2/09/2025 |

36 |

|

P&N Bank |

BBB |

1,000,000 |

1,000,000 |

4.40% |

0.51% |

9/09/2022 |

9/09/2025 |

36 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

4.70% |

0.51% |

4/10/2022 |

4/10/2024 |

24 |

|

AMP |

BBB |

2,000,000 |

2,000,000 |

4.95% |

1.02% |

21/10/2022 |

21/10/2024 |

24 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

5.20% |

1.02% |

21/10/2022 |

21/10/2025 |

36 |

|

AMP |

BBB |

1,000,000 |

1,000,000 |

4.75% |

0.51% |

15/11/2022 |

14/11/2024 |

24 |

|

AMP |

BBB |

1,000,000 |

1,000,000 |

4.80% |

0.51% |

21/11/2022 |

20/11/2025 |

36 |

|

P&N Bank |

BBB |

2,000,000 |

2,000,000 |

4.75% |

1.02% |

16/12/2022 |

16/12/2024 |

24 |

|

Total Medium Term Deposits |

|

97,000,000 |

96,000,000 |

2.61% |

48.82% |

|

|

|

|

Floating Rate Notes - Senior Debt |

|

|

|

|

|

|

|

|

|

Westpac |

AA- |

2,520,970 |

2,531,442 |

BBSW + 88 |

1.29% |

16/05/2019 |

16/08/2024 |

63 |

|

Suncorp |

A+ |

1,257,925 |

1,251,052 |

BBSW + 78 |

0.64% |

30/07/2019 |

30/07/2024 |

60 |

|

ANZ |

AA- |

2,009,999 |

2,018,754 |

BBSW + 77 |

1.03% |

29/08/2019 |

29/08/2024 |

60 |

|

HSBC |

AA- |

2,499,702 |

2,510,130 |

BBSW + 83 |

1.28% |

27/09/2019 |

27/09/2024 |

60 |

|

ANZ |

AA- |

1,513,031 |

1,506,063 |

BBSW + 76 |

0.77% |

16/01/2020 |

16/01/2025 |

60 |

|

NAB |

AA- |

2,016,784 |

2,004,679 |

BBSW + 77 |

1.02% |

21/01/2020 |

21/01/2025 |

60 |

|

Newcastle Permanent |

BBB |

1,104,393 |

1,110,027 |

BBSW + 112 |

0.56% |

4/02/2020 |

4/02/2025 |

60 |

|

Macquarie Bank |

A+ |

2,006,127 |

2,014,778 |

BBSW + 84 |

1.02% |

12/02/2020 |

12/02/2025 |

60 |

|

BOQ Covered |

AAA |

554,614 |

556,936 |

BBSW + 107 |

0.28% |

14/05/2020 |

14/05/2025 |

60 |

|

Credit Suisse |

A+ |

1,296,858 |

1,303,850 |

BBSW + 115 |

0.66% |

26/05/2020 |

26/05/2023 |

36 |

|

UBS |

A+ |

1,504,665 |

1,497,295 |

BBSW + 87 |

0.76% |

30/07/2020 |

30/07/2025 |

60 |

|

Bank of China Australia |

A |

1,505,698 |

1,498,379 |

BBSW + 78 |

0.76% |

27/10/2020 |

27/10/2023 |

36 |

|

CBA |

AA- |

1,994,254 |

1,983,760 |

BBSW + 70 |

1.01% |

14/01/2022 |

14/01/2027 |

60 |

|

Rabobank |

A+ |

1,990,707 |

1,980,814 |

BBSW + 73 |

1.01% |

27/01/2022 |

27/01/2027 |

60 |

|

Newcastle Permanent |

BBB |

979,483 |

985,446 |

BBSW + 100 |

0.50% |

10/02/2022 |

10/02/2027 |

60 |

|

NAB |

AA- |

2,383,343 |

2,396,019 |

BBSW + 72 |

1.22% |

25/02/2022 |

25/02/2027 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,650,894 |

1,657,965 |

BBSW + 98 |

0.84% |

17/03/2022 |

17/03/2025 |

36 |

|

ANZ |

AA- |

2,008,927 |

2,016,232 |

BBSW + 97 |

1.03% |

12/05/2022 |

12/05/2027 |

60 |

|

NAB |

AA- |

1,711,195 |

1,719,405 |

BBSW + 90 |

0.87% |

30/05/2022 |

30/05/2025 |

36 |

|

Suncorp |

A+ |

904,609 |

908,512 |

BBSW + 93 |

0.46% |

22/08/2022 |

22/08/2025 |

36 |

|

ANZ |

AA- |

2,537,889 |

2,547,979 |

BBSW + 120 |

1.30% |

4/11/2022 |

4/11/2027 |

60 |

|

NAB |

AA- |

2,530,202 |

2,543,180 |

BBSW + 120 |

1.29% |

25/11/2022 |

25/11/2027 |

60 |

|

Suncorp |

A+ |

1,106,366 |

1,114,086 |

BBSW + 125 |

0.57% |

14/12/2022 |

14/12/2027 |

60 |

|

CBA |

AA- |

0 |

2,010,977 |

BBSW + 115 |

1.02% |

13/01/2023 |

13/01/2028 |

60 |

|

Total Floating Rate Notes - Senior Debt |

|

39,588,636 |

41,667,759 |

|

21.19% |

|

|

|

|

Fixed Rate Bonds |

|

|

|

|

|

|

|

|

|

ING Covered |

AAA |

657,555 |

669,597 |

1.10% |

0.34% |

19/08/2021 |

19/08/2026 |

60 |

|

Northern Territory Treasury |

AA- |

3,000,000 |

3,000,000 |

1.00% |

1.53% |

24/08/2021 |

16/12/2024 |

40 |

|

Northern Territory Treasury |

AA- |

3,000,000 |

3,000,000 |

1.50% |

1.53% |

24/08/2021 |

15/12/2026 |

64 |

|

BoQ |

BBB+ |

1,692,716 |

1,733,944 |

2.10% |

0.88% |

27/10/2021 |

27/10/2026 |

60 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.50% |

1.02% |

6/08/2021 |

15/12/2026 |

64 |

|

Northern Territory Treasury |

AA- |

1,000,000 |

1,000,000 |

1.50% |

0.51% |

14/07/2021 |

15/12/2026 |

65 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.30% |

1.02% |

29/04/2021 |

15/06/2026 |

61 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.00% |

1.02% |

30/11/2020 |

15/12/2025 |

60 |

|

Northern Territory Treasury |

AA- |

1,000,000 |

1,000,000 |

1.00% |

0.51% |

20/11/2020 |

15/12/2025 |

61 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.00% |

1.02% |

21/10/2020 |

15/12/2025 |

62 |

|

Total Fixed Rate Bonds |

|

18,350,271 |

18,403,541 |

1.30% |

9.36% |

|