Agenda

and

Business Paper

To be held on

Monday 13

March 2023

at 6.00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

Agenda

and

Business Paper

To be held on

Monday 13

March 2023

at 6.00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

NOTICE OF MEETING

The proceedings of all Council meetings in open session, including all debate and addresses by the public, are recorded (audio visual) and livestreamed on Council’s website including for the purpose of facilitating community access to meetings and accuracy of the Minutes.

In addition to webcasting council meetings, audio recordings of confidential sessions of Ordinary Meetings of Council are also recorded, but do not form part of the webcast.

WAGGA WAGGA CITY COUNCILLORS

STATEMENT OF ETHICAL OBLIGATIONS

Councillors are reminded of their Oath or Affirmation of Office made under Section 233A of the Local Government Act 1993 and their obligation under Council’s Code of Conduct to disclose and appropriately manage Conflicts of Interest.

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

Reports submitted to the Ordinary Meeting of Council to be held on Monday 13 March 2023.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 13 March 2023

CLAUSE PRECIS PAGE

ACKNOWLEDGEMENT OF COUNTRY 2

REFLECTION 2

APOLOGIES 2

Confirmation of Minutes

CM-1 ORDINARY COUNCIL MEETING - 27 FEBRUARY 2023 2

DECLARATIONS OF INTEREST 2

Councillor Report

CR-1 SWITCH 2022 DELEGATE REPORT 3

CR-2 NÖRDLINGEN 2022 DELEGATE REPORT 6

Reports from Staff

RP-1 DA22/0568 - Construction of shed for use as seven depots with associated parking and landscaping at 114-116 Marah St NORTH WAGGA WAGGA NSW 2650; Lot 345 DP1124792. 9

RP-2 RESPONSE TO NOTICE OF MOTION - PROPOSED ZERO-BASED BUDGET APPROACH 15

RP-3 FINANCIAL PERFORMANCE REPORT AS AT 28 FEBRUARY 2023 21

RP-4 Review of Finance Policies 55

RP-5 2023 NATIONAL GENERAL ASSEMBLY OF LOCAL GOVERNMENT ANNUAL CONFERENCE 94

RP-6 2023 FLOODPLAIN MANAGEMENT NATIONAL CONFERENCE 99

RP-7 REVISED 2023 COUNCIL MEETING SCHEDULE 101

RP-8 QUESTIONS WITH NOTICE 103

Confidential Reports

CONF-1 RFT2023-17 PROVISION OF TRADE SERVICES 105

CONF-2 APPOINT CO-OPTED MEMBERS TO FLOODPLAIN RISK MANAGEMENT ADVISORY COMMITTEE 106

CONF-3 POSSIBLE BUSINESS OPPORTUNITY ARISING FROM THE SISTER CITY VISIT TO NORDLINGEN 107

Wagga Wagga City Council acknowledges the traditional custodians of the land, the Wiradjuri people, and pays respect to Elders past, present and future and extends our respect to all First Nations Peoples in Wagga Wagga.

We recognise and respect their cultural heritage, beliefs and continuing connection with the land and rivers. We also recognise the resilience, strength and pride of the Wiradjuri and First Nations communities

REFLECTION

Councillors, let us in silence reflect upon our responsibilities to the community which we represent, and to all future generations and faithfully, and impartially, carry out the functions, powers, authorities and discretions vested in us, to the best of our skill and judgement.

CM-1 ORDINARY COUNCIL MEETING - 27 FEBRUARY 2023

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 27 February 2023 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - OC - 27 February 2023 |

108 |

|

Report submitted to the Ordinary Meeting of Council on Monday 13 March 2023 |

CR-1 |

CR-1 SWITCH 2022 DELEGATE REPORT

Author: The Mayor, Councillor Dallas Tout

|

That Council receive and note the report. |

Report

As per the resolution from the Ordinary Meeting of Council on 7 November 2022, I attended the NSW Public Libraries Association (NSWPLA) SWITCH 2022 Conference and AGM in Albury from 8 to 11 November 2022.

As detailed in the report to Council the annual SWITCH conference is a forum in NSW for Councillors, Council Officers and Library staff to assemble for professional development. The conference provides an important opportunity for delegates to learn about contemporary practices and offers a platform for networking with colleagues and extending contacts and partnerships beyond the boundaries of the local South-West Zone of the Association.

Several Councillors and library staff from around the region attended the conference, particularly as it was held within the region. In the end the total number of registrations were 300 attendees. Staff from the Wagga Wagga library also attended.

As per the program provided at the time of approving a delegate to attend, there were a wide range of areas covered across the library space. These included updates on contemporary issues, policy and funding issues and emerging trends in the public library space. This is the feedback I continue to receive as a member of the executive of NSWPLA. The program is broads but manages to cover a variety of areas of interest to those involved in the space.

A post conference survey was undertaken online by delegates with the following feedback metrics from those who responded:

· 96% satisfied or very satisfied with ease of registration

· 94% satisfied or very satisfied with networking opportunities

· 92% satisfied or very satisfied with information obtained/presentations

· 87% are planning to implement new ideas, programs to their libraries following the conference

· 61% of delegates were from rural and regional NSW

· 35% delegates from Sydney Metro

· 4% delegates from interstate

· 100% of delegates spent some time at exhibitor stands

· 95% of delegates intend to attend SWITCH again

Cameron Morley gave a presentation on the success of the increase of public library funding that was obtained for the 2019-2022 quadrennial funding period following the successful campaign by NSWPLA, LGNSW and the State Library of NSW (State Library). A number of points of areas that funding has been used towards include:

· Days of opening increased where possible

· Increase in book votes

· $18m has been spent on infrastructure including 60 building projects, 9 mobile libraries and 2 library system replacements

· Numerous increases in expenditure on collections, furniture, IT, promotion and events

· The State Library continues to work with public libraries in relation to providing advice, as requested, as to the best value for expenditure and trends going forward

On day 2 of the conference, the State Librarian was in attendance and facilitated a video from the Minister Ben Franklin regarding the continuation of funding. During the last four years NSWPLA and the State Library had been having continuing discussions as to what would happen with the quantum of funding received for the 2019-2022 quadrennial period as this was due to expire mid-2023.

The announcement was that the level of funding was to continue. This was a very exciting announcement as it gave surety to the funding and all Councils could continue to budget for the current budget figures. In addition to that, the total of funds in the future will be indexed to population growth. This outcome confirmed that the advocacy that NSWPLA in conjunction with the State Library had been undertaking since 2020 was indeed fruitful.

At the AGM on the Friday morning of the conference I completed my third two-year term as President. My time as President was very satisfying in working as part of a team to secure major increases in funding for public libraries and then to also obtain that increase in funding ongoing and indexed. I will continue on the board of the executive as one of the two Vice Presidents.

Thank you for the opportunity to attend the conference as the elected representative for the City of Wagga Wagga. FYI the 2023 conference switches back to Sydney and will be held at the Panthers Penrith complex.

Financial Implications

The cost for attendance of one Councillor at the conference was $950 plus GST. The conference and accommodation costs were funded from the Councillors’ Conference and travelling budget which has $30,000 for the 2022/23 financial year.

Policy and Legislation

POL 025 – Councillor Expenses and Facilities Policy

POL 113 – Councillor Induction and Professional Development Policy

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga has strong community leadership and a shared vision for the future

Our leaders represent our community

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 13 March 2023 |

CR-2 |

CR-2 NÖRDLINGEN 2022 DELEGATE REPORT

Author: The Mayor, Councillor Dallas Tout

|

That Council receive and note the report. |

Report

In early September 2022 as Mayor, I led a Wagga Wagga delegation to our sister city of Nördlingen in Germany to attend the Stadtmauerfest 2022 represented the 55th anniversary of the signing of the sister city arrangement with Nördlingen.

Every three years the former Free Imperial City of Nördlingen goes back to its roots in the Middle Ages for a long weekend. During the three day “Historic City Wall Festival”, historically dressed craftsman, musicians, jugglers, and artists are involved in the festival throughout the city.

The delegation that attended consisted of:

· Dallas & Janine Tout (Mayor)

· Peter Thompson (General Manager Wagga Wagga City Council)

· Jessikah McCarthy (Miss Wagga Wagga 2022)

· Rachael Bowering (Community Princess 2022)

· Ali & Lindsay Tanner (Chair Miss Wagga Wagga Quest)

· Sally Tanner & Luke Kerlin (Sally is a previous Sister City Committee member and Young Citizen of the Year)

· Claire Lawlor (Miss Wagga Wagga Committee member)

Prior to the finalisation of the membership of the delegation, expressions of interest went to Councillors and previous members of the Sister City Committee.

Also in attendance at this festival were representatives from each of the other sister cities of Nördlingen, those being:

· Markham, Canada

· Olomouc, Czech Republic

· Riom, France

· Stollberg, Germany

As part of his welcome address at the reception to honour the sister cities Oberburgermeister David Wittner stated “We look forward to celebrating many anniversaries to come yet with our dear friends from Wagga Wagga and Olomouc. By signing the founding documents of the twinning of our cities, we all reaffirmed our will to encourage cultural, social, and economic exchanges, and we have done everything in our power to meet the defined objectives.”

The generosity and warmth of Oberburgermeister David Wittner, councillors and the community in general was quite overwhelming.

Separate to the ceremonies, church services and general festival events there were also additional items included for the delegations to attend and enjoy. This included a welcome dinner on the Friday evening in addition to a specific sister city reception on the Saturday morning. During the sister city reception gifts were interchanged between Nördlingen and Wagga Wagga.

In conjunction with a local business and Henschke primary school I also hand delivered letters written from our local primary school to primary schools in Nördlingen. I have received confirmation from senior city staff in Nördlingen that return letters from primary students in Nördlingen have been posted back to the local primary school in Wagga Wagga. A great example of the opportunities available in the cultural space in an active sister city relationship.

On the Friday morning prior to the commencement of the festival that afternoon the city organised a visit to a local company that operates internationally. Further detail is included in a confidential item in tonight’s agenda but suffice to say that economic opportunities for the city and region are a distinct possibility following on from that visit and further discussion tonight.

On the Monday afternoon after the conclusion of the festival myself and the General Manager travelled by train to Frankfurt to meet with Johanna Harvey from Austrade who is based at the Australian Consulate General offices. A general discussion was had as to concierge services that Austrade is able to offer and also what approach should be taken by Council or the State Government in pursuing potential international investment in the region.

The critical point was in relation to investors being assured as to the availability of a sufficient number of potential staff for any business they invest in. This is critical in addition to the other information in regard to liveability and other factors included in promotions done to date to entice investors. The visit was most fruitful and we now have a direct contact within the Frankfurt office.

On Monday evening we flew out to Heathrow for an early morning trip to Cambridge in the UK. Myself, The Geneal Manager and my wife drove to Cambridge in the early morning to spend until about lunchtime walking and observing the city and the feel of a fully integrated precinct that integrates the city, the University, and any number of medical and/or other facilities. The intent was to physically see how a space can work within a city where different precincts are indistinguishable from each other and work in the same space.

To view this and then apply that to what may be the future for any type of medical precinct, or more so the possibilities on and around the Charles Sturt University (CSU) campus. In my mind the vision of the northern precinct would be that if walking or moving around that space you would not be able to tell if you were in a specific area as all facilities would be indistinguishable from the other. Whether you are in a retail or community space that is either part of CSU or part of the non-CSU space. Taking a few hours to observe this firsthand was very useful.

The other added benefit was the Cambridge Park & Ride. This is a very large car park set adjacent to the freeway. There are very large car parks where vehicles are parked and then buses depart from there into the city on a very regular basis to feed commuters into a fully integrated transport system. This physically takes a large number of vehicles off the road and increased the vibrancy in the city. Variations of this could be considered in Wagga Wagga in the future. Whether that be in between South and North of the city, or in and around the SAP. Who knows, the concept is well worth investigating.

From lunch on the Tuesday on, myself and the General Manager then went on private leave at our own expense. The costs incurred for the trip were economy return airfares only for myself and the General Manager, two night’s accommodation, taxi fares in Frankfurt and train tickets from Nördlingen to Frankfurt.

As in the past this visit allowed the City of Wagga to continue to further the goodwill and understanding developed over 55 years in our sister city relationship. Over those years the visits have been mutual and are relevant to this day in building relationships both cultural and economic.

The visit to the local business with international clients was only facilitated due to the relationship the Lord Mayor David Wittner with that business and the relationship we have with Nördlingen flowing from five decades of a close sister city relationship. Details of which are in the confidential item tonight.

Thank you to the Council for the support in resolving that the trip and visit be undertaken.

Financial Implications

The total travel costs for the Nordlingen 2022 Delegate visit were $11,909. The main costs were the international airfares, which due to the travel market at the time with the COVID-19 pandemic, were more expensive than originally anticipated.

The visit was funded from the Sister Cities budget allocation.

Job 17868: Sister Cities

Policy and Legislation

N/A

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga has strong community leadership and a shared vision for the future

Our leaders represent our community

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 13 March 2023 |

RP-1 |

RP-1 DA22/0568 - Construction of shed for use as seven depots with associated parking and landscaping at 114-116 Marah St NORTH WAGGA WAGGA NSW 2650; Lot 345 DP1124792.

Author: Paul O’Brien

General Manager: Peter Thompson

|

Summary: |

The Development Application seeks consent for the construction of a shed to be used as seven individual depots.

Depots are permitted with consent under the Wagga Wagga Local Environmental Plan 2010 in the RU5 Village zone.

The application was publicly advertised and notified to adjoining and nearby property owners for a period of 14 days. A total of 28 submissions and one online petition of 203 signatures were received in objection to the development.

Section 1.10 of the Wagga Wagga Development Control Plan 2010 requires any application that is the subject of 10 or more objections to be referred to Council for determination.

A full assessment of the application has been completed in accordance with Section 4.15 of the Environmental Planning and Assessment Act 1979 and is provided as an attachment to this report. The assessment has considered and addressed all relevant matters raised in the submissions.

Subject to the findings of the assessment, it has been recommended that the application be approved subject to conditions. The recommended conditions have been included in the attached assessment report. |

|

That Council approve DA22/0568 for Construction of shed for use as seven depots with associated parking and landscaping at 114-116 Marah Street, North Wagga Wagga subject to the conditions outlined in the Section 4.15 Assessment Report. |

Development Application Details

|

Applicant |

Mr Robert Gordon Moore |

|

Owner |

Mr Robert Gordon Moore |

|

Development Cost |

$989,200.00 |

|

Development Description |

Construction of shed for use as seven depots with associated parking and landscaping. |

Report

Key Issues

· Permissibility of development and objectives of the RU5 zone.

· Character of the village of North Wagga

· Flooding and stormwater impacts

· Streetscape impacts

· Residential amenity

Assessment

· The site is zoned RU5 Village under the provisions of the WWLEP 2010. Depots are permitted with consent in the RU5 zone.

· The development complies with the controls of the WWLEP 2010 and the WWDCP 2010.

· The site and surrounding area are subject to flooding and mapped as being within the flood planning area for North Wagga Wagga. The attached s4.15 assessment report considers the relevant flood considerations for the type of development which are satisfied.

· Increased stormwater run-off from the development is to be piped to the opposite side of Marah Street where there is a wider table drain and greater capacity for the water to naturally disperse.

· The site is within the village zone and the village contains a variety of land uses including industrial, educational, commercial and residential. The site is at the edge of the village zoned area with rural zoned land on the opposite side of Marah Street. The proposed depots are suitable within the existing site context.

· There is a diverse streetscape within this part of North Wagga that includes farm buildings, depots, residences and vacant land. Accordingly, the proposal will not detract from a consistent pattern of development and is not considered to the streetscape. Landscaping within the front setback area will soften the development to the street.

· New access, manoeuvring areas and parking have been provided to support the development in accordance with requirements. Marah Street provides a direct link to Hampden Avenue with easy access to the wider road network.

· The impacts of the development upon residential amenity have been considered as part of the attached s4.15 report and deemed to be acceptable.

· Twenty-eight submissions and an online petition were received in objection to the development. Generally, the submissions related to the scale of the development and its suitability within a village zone. The submissions have been addressed further in detail under section (d) of the attached s4.15 report.

· Appropriate conditions of consent are included to manage and mitigate the impacts of development. Subject to compliance with the conditions there are no anticipated impacts that would warrant refusal of the development application.

Reasons for Approval

1. The proposed development is consistent with the provisions of the Wagga Wagga Local Environmental Plan 2010.

2. The proposed development is generally consistent with the objectives and controls of the Wagga Wagga Development Control Plan 2010.

3. Impacts of the proposed development are acceptable and can be managed via the recommended conditions of consent.

4. The site is considered suitable for the proposed development.

Site Location

The property is located on the western side of Marah Street approximately 65 metres to the west of the junction with Arthur Street and extends to 3109sq.m in size. The site is generally flat and vacant with minimal vegetation to the southern boundary. There is a laneway to the rear of the site.

Land on the other (northern) side of Marah Street is rural zoned land in use for grazing predominantly, there are a number of farm buildings of various sizes on the site opposite. The adjoining site to the west is vacant land with sheds at the rear and to the south on the opposite side of Marah Lane there are residential properties some of which are two storeys in height. The land adjoining to the east has development consent for a similar development to that proposed. The proposal is for four separate sheds to be used as 3 x depots and 1 x industrial premises. This development is under construction and not yet complete.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: Future growth and development of Wagga Wagga is planned for in a sustainable manner

Ensure sustainable urban development

Risk Management Issues for Council

Refusal of the application may result in an appeal process in the Land and Environment Court which will have to be defended by Council. The reasons for refusal will have to be justified and withstand scrutiny and cross examination in Court.

Approval of the application is not considered to raise risk management issues for Council as the proposed development is generally consistent with LEP and DCP controls. Submissions raised in objection to the development have been addressed in the attached s4.15 assessment report.

Internal / External Consultation

Full details of the consultation that was carried out as part of the development application assessment is contained in the attached s4.15 Report.

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Connect.Wagga |

Email newsletter |

Social media |

Website |

|

|

Inform |

|

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

x |

|

Consult |

|

|

x |

|

|

|

|

|

|

|

x |

|||||

|

Involve |

|

|

|

|

|

|

|

|

||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other methods (please list specific details below) |

||||

|

|

|

|

|

|

|

1. |

DA22/0568 - s4.15 Assessment Report - Provided under separate cover |

|

|

2. |

DA22/0568 - Plans - Provided under separate cover |

|

|

3. |

DA22/0568 - Statement of Environmental Effects - Provided under separate cover |

|

|

4. |

DA22/0568 - Redacted Submissions - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 13 March 2023 |

RP-2 |

RP-2 RESPONSE TO NOTICE OF MOTION - PROPOSED ZERO-BASED BUDGET APPROACH

Author: Carolyn Rodney

|

Summary: |

This report is in response to the 12 December 2022 Council meeting Notice of Motion requesting to receive a report on the options surrounding a zero-based budget approach for Council. |

|

That Council: a note the listed benefits and outlined drawbacks to council and the community of a zero-based budget approach b note the estimated costs and timing to undertake a zero-based budget c note the potential funding options/grants to undertake a zero-based budget d discuss the proposed Zero-Based Budgeting Program outlined in this report |

Report

At the 12 December 2022 Council Meeting it was resolved:

That Council receive a report by the end of March 2023 on undergoing a zero-based budget that includes but not limited to:

a costs and timing to undertake a zero based budget including an option for an independent consultant

b benefits to council and the community of a zero-based budget

c funding options/grants to undertake the project

Current Budgeting Process at Wagga Wagga City Council

Wagga Wagga City Council (Council) have an adopted 10-year Long Term Financial Plan (LTFP), and under the Integrated Planning & Reporting (IP&R) framework, the LTFP is required to be updated and adopted on an annual basis.

Council’s LTFP process involves the following:

· Updates to assumptions for utilities costs and current tariff rates

· Updates for estimated interest rates for interest income for Council’s investment portfolio and adopted future loan borrowings

· Updates to the labour budget from the Organisational Structure

· Updates to Rates & Annual Charges based on the rate peg announcement

· Proposed Amendments to budget line items during monthly detailed reviews undertaken with Council’s Finance staff and Divisional Managers

· Review of the current and future year Capital program, with amendments made throughout the year and reported to Council in order for the program to remain current and up to date.

Budget workshops are held with Executive and Councillors during the third quarter of each financial year (January-March) to discuss the overall budget, and any suggested amendments.

Under the IP&R framework staff are also required to report to council on a quarterly basis how the council is tracking to budget during a financial year – the Quarterly Budget Review Statement (QBRS). Council however undertakes a more detailed review and reporting process, and reports to Council monthly via the Financial Performance Report. This practice has been in place for many years and is seen advantageous for both staff and Councillors to maintain a more up to date rolling 10 year Long Term Financial Plan.

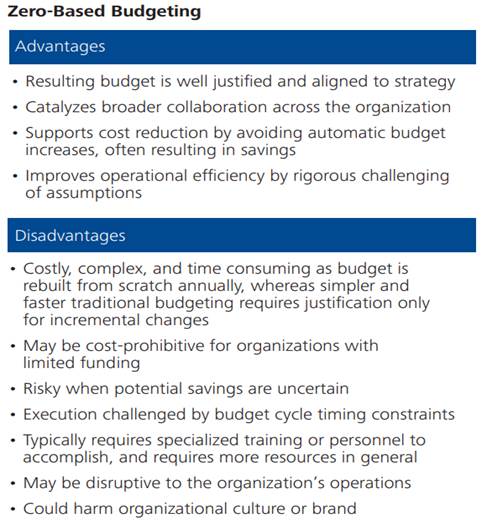

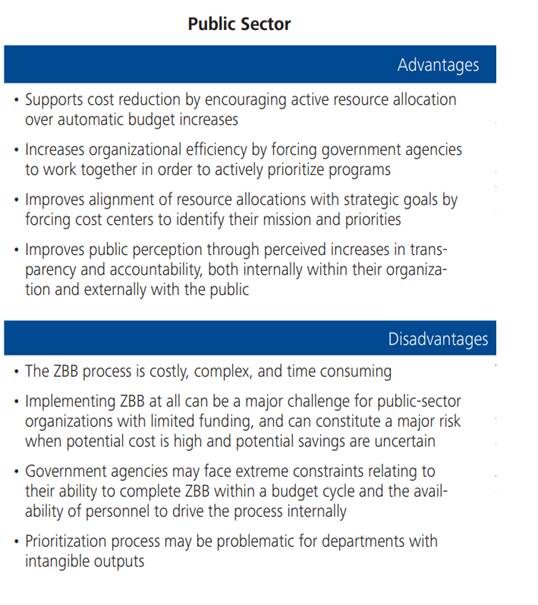

Zero-Based Budgeting

Zero-based budgeting (ZBB) is a budgeting process that allocates funding based on program efficiency and necessity, rather than budget history. As opposed to traditional budgeting, no item is automatically included in the next financial year budget. Justification of each budget line item is required in order to receive a funding allocation.

The Deloitte company, summarise the advantages and disadvantages of ZBB in their 2015 paper titled “Zero-Based Budgeting: Zero or Hero?”, shown below for Councillors information:

Deloitte also go further in describing the advantages and disadvantages of ZBB in the public sector:

*Source: https://www2.deloitte.com/content/dam/Deloitte/us/Documents/risk/us-risk-zbb.pdf

As noted earlier in this report, Finance staff in consultation with Divisional managers review line by line each budget item every month. Whilst time consuming, this is seen advantageous for Divisional Managers and Finance Staff to be able to manage and monitor budgets.

Recent Detailed Service reviews undertaken, inclusive of a Zero-based budgeting process

Over the past few years, Council has undertaken detailed service reviews of three (3) Council functional areas. These reviews all included a zero-based budgeting process to inform Councillors on potential service delivery options/continue undertaking the service:

1. Auspiced Family Day Care Service Review

By Council resolution after considering the service review and financial position report this service was ceased on 30 June 2020.

2. City Library Service Review

By Council resolution after considering the service options and financial report this service moved to a Standalone Service and new staff structure, which commenced 1 July 2022.

3. Auspiced Sector Support Review

By Council resolution after considering service and financial funding report this service will end 30 June 2023. The Sector Support functions will be covered by other Commonwealth funded services.

To ensure continuous improvement, business excellence and service efficiency, Council staff will continue to review functional service areas and report back to Councillors. Council staff are proposing to work with Councillors on a prioritised list of functional areas to be reviewed. Further detail provided in the Proposed Program section towards the end of this report.

Estimated Costs and timing to undertake a zero-based budget including an option for an independent consultant

Local Government Organisations are diverse organisations, with Wagga Wagga City Council responsible for over 80 functions (cost centres) across 20 diverse Divisional areas. Given this, any zero-based budgeting process will require a considerable amount of time and dedicated resourcing.

The potential benefits/advantages to council and the community of implementing a zero-based budget is noted earlier in this report in Deloitte’s summary. In reviewing the advantages, a review of the potential disadvantages also needs to be considered, with most notable being costly and time consuming.

Recent cost centre reviews undertaken have used a combination of both internal staff time, and specialised consultants. A complete service review of functional areas are time consuming tasks, and inclusive of both staff time and consultant charges, can be in the hundreds of thousands of dollars.

Given this, and given the 80 plus functions Council undertakes, Council staff are proposing to undertake a rolling program of zero-based budgeting reviews, with at least three (3) functional areas undertaken annually. It is proposed for the first annual program to include the following areas, with further consultation with Councillors on the selected areas to be included in future reviews:

Proposed Zero-Based Budgeting Program

|

Functional Area |

Status |

Notes |

|

Oasis Swimming Centre |

Commenced

|

Initial SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis has been completed. Currently undertaking Zero-based budgeting process. |

|

Development Assessment |

Not yet commenced |

To commence in 4th quarter 2022/23 (April-June). |

|

Governance and Risk |

Not yet commenced |

To commence in 1st quarter 2023/24 (July-September). |

The first workshop with Councillors on the Oasis is in the process of being scheduled. These workshops on budgeting will continue on a rolling program throughout the years, as opposed to only the two (2) budget workshops held in February and March each year.

Funding options/grants to undertake the project

Council officers review grant eligibility criteria when grants are announced, to determine if it is appropriate to submit an application. Grants to undertake service reviews have previously not been forthcoming, however Council officers will continue to review and assess grants as they are announced.

In the interim, Council officers are suggesting a hybrid method for detailed reviews – a combination of Council officers and engaging consultants where and when required. As indicated above when reviewing what previous reviews undertaken by external consultants have cost, an annual consultant budget allocation for Zero-based budgeting reviews of $50K would be deemed appropriate. Depending on what functional area has been selected, some years may require more funding for specialised consultants, with other yearly programs conducted in-house with existing staff resources.

Financial Implications

Council officers will include a proposed $50K budget line item in the 2023/24 budget process for Councillors further consideration.

Policy and Legislation

Budget Policy – POL 052

Link to Strategic Plan

Community leadership and collaboration

Community satisfaction with long term planning for Wagga Wagga is increasing

Objective: Wagga Wagga has strong community leadership and a shared vision for the future

Risk Management Issues for Council

N/A

Internal / External Consultation

As noted earlier in this report, Council staff will be undertaking workshops with Councillors.

|

Report submitted to the Ordinary Meeting of Council on Monday 13 March 2023 |

RP-3 |

RP-3 FINANCIAL PERFORMANCE REPORT AS AT 28 FEBRUARY 2023

Author: Carolyn Rodney

|

Summary: |

This report is for Council to consider information presented on the 2022/23 budget and Long-Term Financial Plan, and details Council’s external investments and performance as at 28 February 2023. |

|

That Council: a approve the proposed 2022/23 budget variations for the month ended 28 February 2023 and note the balanced budget position as presented in this report b approve the proposed budget variations to the 2022/23 Long Term Financial Plan Capital Works Program including future year timing adjustments c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2021 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above d note the details of the external investments as of 28 February 2023 in accordance with section 625 of the Local Government Act 1993 e approve the transfer of Additional Special Variation (ASV) funds to a separate reserve to fund future year bottom line deficits as per Resolution 22/122 f accept the grant funding offers as presented in this report |

Wagga Wagga City Council (Council) forecasts a balanced budget position as of 28 February 2023.

The balanced budget position excludes the Wagga Wagga Airport estimated deficit result for the financial year – as previously reported to Council, any Airport deficit result will be sanctioned, and funded in the interim by General Purpose Revenue (via the Internal Loans Reserve). The deficit results will be accounted for as a liability in the Airport’s end of financial year statements and paid back to General Purpose Revenue (Internal Loans Reserve) by the Airport in future financial years.

Proposed budget variations including adjustments to the capital works program are detailed in this report for Council’s consideration and adoption.

Council has experienced a positive monthly investment performance for the month of February when compared to budget ($359,508 up on the monthly budget). This is mainly due to better than budgeted returns on Council’s investment portfolio, as a result of the ongoing movement in the interest rate environment, as well as a positive movement in Councils Floating Rate note portfolio for the month.

Key Performance Indicators

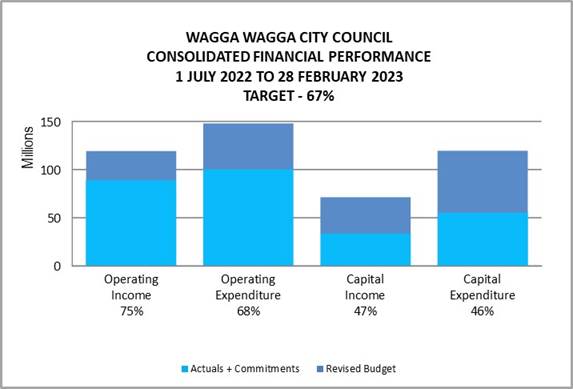

OPERATING INCOME

Total operating income is 75% of approved budget and is trending above budget for the month of February 2023. This is due to increased revenue from Interest on Investments. An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 96% when compared to budget.

OPERATING EXPENSES

Total operating expenditure is 68% of approved budget so it is tracking slightly over budget at this stage of the financial year. This is due to the commitment for multi-year software licences.

CAPITAL INCOME

Total capital income is 47% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions in relation to expenditure incurred on the projects. This income also includes the sale of property, plant and equipment.

CAPITAL EXPENDITURE

Total capital

expenditure including commitments is 46% of approved budget with some purchase

orders being raised for the full contract amounts for multi-year projects.

Excluding commitments, the total expenditure is 22% when compared to the

approved budget.

|

WAGGA WAGGA CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2022/23 |

COMMT'S 2022/23 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|

||||||

|

Rates & Annual Charges |

(75,524,168) |

0 |

(75,524,168) |

(50,571,074) |

0 |

(50,571,074) |

67% |

|

User Charges & Fees |

(27,844,136) |

(626,935) |

(28,471,071) |

(19,112,143) |

0 |

(19,112,143) |

67% |

|

Other Revenues |

(2,769,503) |

(202,000) |

(2,971,503) |

(2,028,664) |

0 |

(2,028,664) |

68% |

|

Grants & Contributions provided for Operating Purposes |

(13,524,889) |

4,645,395 |

(8,879,493) |

(12,432,720) |

0 |

(12,432,720) |

140% |

|

Grants & Contributions provided for Capital Purposes |

(36,295,253) |

(30,106,685) |

(66,401,938) |

(29,377,488) |

0 |

(29,377,488) |

44% |

|

Interest & Investment Revenue |

(1,828,128) |

0 |

(1,828,128) |

(3,712,025) |

0 |

(3,712,025) |

203% |

|

Other Income |

(1,406,222) |

(54,000) |

(1,460,222) |

(1,014,521) |

0 |

(1,014,521) |

69% |

|

Total Revenue |

(159,192,300) |

(26,344,225) |

(185,536,524) |

(118,248,635) |

0 |

(118,248,635) |

64% |

|

|

|||||||

|

Expenses |

|||||||

|

Employee Benefits & On-Costs |

51,315,412 |

741,605 |

52,057,018 |

31,077,473 |

0 |

31,077,473 |

60% |

|

Borrowing Costs |

3,268,989 |

0 |

3,268,989 |

1,555,913 |

0 |

1,555,913 |

48% |

|

Materials & Services |

36,542,674 |

8,886,865 |

45,429,539 |

27,605,606 |

7,487,234 |

35,092,840 |

77% |

|

Depreciation & Amortisation |

43,196,051 |

0 |

43,196,051 |

28,797,368 |

0 |

28,797,368 |

67% |

|

Other Expenses |

1,866,271 |

2,023,345 |

3,889,616 |

3,591,387 |

15,511 |

3,606,898 |

93% |

|

Total Expenses |

136,189,398 |

11,651,815 |

147,841,213 |

92,627,746 |

7,502,745 |

100,130,491 |

68% |

|

|

|||||||

|

Net Operating (Profit)/Loss |

(23,002,902) |

(14,692,409) |

(37,695,311) |

(25,620,889) |

7,502,745 |

(18,118,144) |

|

|

|

|||||||

|

Net Operating Result Before Capital (Profit)/Loss |

13,292,351 |

15,414,276 |

28,706,627 |

3,756,599 |

7,502,745 |

11,259,345 |

|

|

|

|||||||

|

Cap/Reserve Movements |

|||||||

|

Capital Expenditure - One Off Confirmed |

13,638,521 |

67,934,079 |

81,572,600 |

17,279,240 |

24,892,818 |

42,172,058 |

52% |

|

Capital Expenditure - Recurrent* |

18,890,352 |

8,238,710 |

27,129,062 |

4,991,816 |

3,655,453 |

8,647,269 |

32% |

|

Capital Expenditure - Pending Projects |

59,770,944 |

(56,508,230) |

3,262,713 |

2,970 |

0 |

2,970 |

0% |

|

Loan Repayments |

7,571,681 |

0 |

7,571,681 |

4,381,121 |

0 |

4,381,121 |

58% |

|

New Loan Borrowings |

(17,458,537) |

11,279,368 |

(6,179,168) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(880,181) |

(4,037,359) |

(4,917,540) |

(4,314,901) |

0 |

(4,314,901) |

88% |

|

Net Movements Reserves |

(15,333,827) |

(12,214,158) |

(27,547,985) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

66,198,954 |

14,692,409 |

80,891,363 |

22,340,245 |

28,548,271 |

50,888,516 |

|

|

|

|||||||

|

Net Result after Depreciation |

43,196,052 |

0 |

43,196,052 |

(3,280,644) |

36,051,016 |

32,770,372 |

|

|

|

|||||||

|

Add back Depreciation Expense |

43,196,051 |

0 |

43,196,051 |

28,797,368 |

0 |

28,797,368 |

67% |

|

|

|||||||

|

Cash Budget (Surplus)/Deficit |

0 |

0 |

0 |

(32,078,011) |

36,051,016 |

3,973,005 |

|

Years 2-10 Long Term Financial Plan (Surplus) /Deficit

|

Description |

Budget 2023/24 |

Budget 2024/25 |

Budget 2025/26 |

Budget 2026/27 |

Budget 2027/28 |

Budget 2028/29 |

Budget 2029/30 |

Budget 2030/31 |

Budget 2031/32 |

|

Adopted Bottom Line (Surplus) / Deficit |

1,163,681 |

1,205,672 |

4,377,581 |

4,833,506 |

2,199,382 |

1,967,334 |

1,257,474 |

1,234,053 |

418,437 |

|

Adopted Bottom Line Adjustments |

26,080 |

27,297 |

40,051 |

41,342 |

42,673 |

44,042 |

45,454 |

46,907 |

93,404 |

|

Revised Bottom Line (Surplus) / Deficit |

1,189,761 |

1,232,969 |

4,417,632 |

4,874,848 |

2,242,055 |

2,011,376 |

1,302,928 |

1,280,960 |

511,841 |

2022/23 Revised Budget Result – (Surplus) / Deficit |

$’000s |

|

Original 2022/23 Budget Result as adopted by Council Total Budget Variations approved to date Budget Variations for February 2023 |

$0K $0K $0K |

|

Proposed Revised Budget result for 28 February 2023 - (Surplus) / Deficit |

$0K |

The proposed Operating and Capital Budget Variations for 28 February 2023 which affect the current 2022/23 financial year are listed below.

|

Budget Variation |

Amount |

Funding Source |

Net Impact (Fav)/ Unfav |

|

|

2 – Safe and Healthy Community |

|

|||

|

Apex Park Playground Climbing Net Replacement |

$45K |

Parks & Recreation Reserve ($45K) |

|

|

|

Funds are required for the replacement of the large climbing net on the Apex Park playground equipment. The current climbing net has reached the end of its useful life earlier than expected due to the significant usage the playground experiences. It is proposed to fund the replacement from the Parks & Recreation Reserve which has current capacity. Estimated Completion: 30 June 2023 Job Consolidation: 22203 |

|

|||

|

3 – Growing Economy |

||||

|

Airport Business Case Development |

$199K |

Regional NSW ($199K) |

Nil |

|

|

Council has been successful in securing Regional NSW grant funds under the RNSW – Business Case and Strategy Development Fund for the development of a business case for upgrades to the Wagga Wagga Airport. The Wagga Wagga Airport is a critical gateway to the Riverina and delivers significant economic and social benefits to the region and is highly constrained in terms of capacity and safety. The business case will provide Council and The NSW Government with the data and information required to support improvements and opportunities at the Airport to ensure it meets the communities needs and supports the growth of the region. To be scheduled $199K in 2022/23 and $50K in 2023/24. Estimated Completion: 30 September 2023 Job Consolidation: 47329 |

|

|||

|

5 – The Environment |

||||

|

Local Road Repair Program Funding |

$4,211K |

Transport for NSW ($4,211K) |

Nil |

|

|

Council has been successful in securing Transport for NSW grant funds under the Regional and Local Roads Repair Program. The grant funds will be directed towards corrective maintenance works and repair of potholes on regional and local roads within the Local Government Area (LGA) and in accordance with Council’s Integrated Planning and Reporting Plans. Estimated Completion: 29 February 2024 Job Consolidation: 22202 |

|

|||

|

Level 2 Bridge Inspections |

$135K |

Bridge Replacement Reserve ($60K) Asset Assessment for Revaluations ($75K) |

Nil |

|

|

Additional funds are required for Council staff to engage a consultant to undertake a Level 2 inspection of all vehicle, rail and pedestrian bridges throughout the Local Government Area (LGA). A Level 2 inspection is required to be undertaken every 5 years, with the results of these inspections to be used to inform Council’s asset revaluation for Bridges, to be undertaken in 2022/23, as well as identify any future capital works to be undertaken. There is an existing Bridge Inspection Program budget of $35K, with additional funds required of $135K to be funded from Asset Assessment and the Bridge Replacement Reserve. Estimated Completion: 30 June 2023 Job Consolidation: 12637 |

|

|||

|

Gissing Oval – Renew Community Amenities |

$151K |

NSW Government Office of Sport ($100K) Internal Loans Reserve/GPR ($51K) |

|

|

|

Council has been successful in securing NSW State Government grant funds under the Female Friendly Community Sport Facilities and Lighting Upgrades Grant Program. The refurbishment of the existing amenities and the construction of two female friendly change rooms will increase the capacity to host competitions and training at Gissing Oval. The current amenities are quite old and run down and there are only two change rooms that are not female friendly. It is proposed to bring forward Councils contribution from General Purpose Revenue (GPR) allocated in 2025/26 and 2026/27 and transferred to the Internal Loans Reserve. The project is proposed to be allocated $151K in 2022/23 and $605K in 2023/24. Estimated Completion: 31 December 2024 Job Consolidation: 17749 |

|

|||

|

|

$0K |

|||

The following 2022/23 and future year projects have been reviewed by Council’s Project Management Team and delivery timelines rescheduled. There has been no change to the total budgets for these projects.

|

Job No. |

Project Title* |

2022/23 Current Confirmed |

2022/23 Proposed Confirmed |

2023/24 Proposed Confirmed |

2025/26 Proposed Pending |

2026/27 Proposed Pending |

2028/29 Proposed Pending |

|

50221 |

Narrung St Treatment Plant Flood Protection Infrastructure |

499,591 |

587 |

499,004 |

0 |

0 |

0 |

*The current year project budgets have been reviewed and at this stage no future year increases have been factored in due to the restrictions on the project funding source. For future year project budget adjustments, once these projects are scoped in the year of commencement, adjustments/increases will be factored in and reported to Council at that time.

2022/23 Capital Works Summary

|

Approved Budget |

Proposed Movement |

Proposed Budget |

|

|

One-off |

$81,572,600 |

($302,677) |

$81,269,923 |

|

Recurrent |

$27,129,061 |

$0 |

$27,129,061 |

|

Pending |

$3,262,713 |

$0 |

$3,262,713 |

|

Total Capital Works |

$111,964,374 |

($302,677) |

$111,661,697 |

Current Restrictions

|

RESERVES SUMMARY |

|||||

|

28 FEBRUARY 2023 |

|||||

|

|

CLOSING BALANCE 2021/22 |

ADOPTED RESERVE TRANSFERS 2022/23 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 27.2.2023 |

PROPOSED CHANGES for Council Resolution* |

BALANCE AS AT 28 FEBRUARY 2023 |

|

|

|

|

|

|

|

|

Externally Restricted |

|

|

|

|

|

|

Developer Contributions - Section 7.11 |

(31,045,478) |

7,213,679 |

(7,421,600) |

|

(31,253,399) |

|

Developer Contributions - Section 7.12 |

(278,187) |

(28,179) |

0 |

|

(306,366) |

|

Developer Contributions - Stormwater Section 64 |

(7,112,864) |

(786,229) |

281,476 |

|

(7,617,617) |

|

Sewer Fund |

(32,439,399) |

673,962 |

2,726,899 |

|

(29,038,538) |

|

Solid Waste |

(24,880,735) |

7,737,392 |

(3,486,453) |

|

(20,629,796) |

|

Specific Purpose Unexpended Grants & Contributions |

(4,195,951) |

|

4,195,951 |

|

0 |

|

SRV Levee Reserve |

(6,357,282) |

0 |

57,520 |

|

(6,299,762) |

|

Stormwater Levy |

(5,150,281) |

35,773 |

610,957 |

|

(4,503,551) |

|

Total Externally Restricted |

(111,460,179) |

14,846,399 |

(3,035,249) |

0 |

(99,649,029) |

|

|

|

|

|||

|

Internally Restricted |

|

|

|||

|

Airport |

0 |

0 |

0 |

|

0 |

|

Art Gallery |

(3,804) |

0 |

0 |

|

(3,804) |

|

Bridge Replacement |

(296,805) |

0 |

0 |

60,000 |

(236,805) |

|

Buildings |

(1,088,635) |

(23,658) |

258,460 |

|

(853,832) |

|

CCTV |

(100,843) |

30,633 |

30,000 |

|

(40,211) |

|

Cemetery |

(882,761) |

(226,784) |

46,123 |

|

(1,063,421) |

|

Civic Theatre |

(44,048) |

0 |

43,922 |

|

(127) |

|

Civil Infrastructure |

(9,317,219) |

1,598,454 |

(326,175) |

|

(8,044,940) |

|

Community Works |

(159,648) |

140,317 |

12,555 |

|

(6,776) |

|

Council Election |

(235,385) |

(112,845) |

49,085 |

|

(299,146) |

|

Economic Development |

(419,160) |

60,000 |

349,832 |

|

(9,328) |

|

Emergency Events Reserve |

(639,548) |

(120,142) |

(275,120) |

|

(1,034,810) |

|

Employee Leave Entitlements Gen Fund |

(3,453,655) |

0 |

0 |

|

(3,453,655) |

|

Environmental Conservation |

(116,578) |

41,578 |

0 |

|

(75,000) |

|

Event Attraction |

(491,893) |

0 |

210,249 |

|

(281,644) |

|

Financial Assistance Grants in Advance |

(8,536,837) |

0 |

8,536,837 |

|

0 |

|

Grant Co-Funding |

(500,000) |

0 |

0 |

|

(500,000) |

|

Gravel Pit Restoration |

(816,897) |

3,333 |

0 |

|

(813,564) |

|

Information Services |

(1,835,475) |

(507,158) |

179,643 |

|

(2,162,990) |

|

Insurance Variations |

(50,000) |

0 |

0 |

|

(50,000) |

|

Internal Loans |

(3,649,517) |

(201,545) |

(395,037) |

51,327 |

(4,194,772) |

|

Lake Albert Improvements |

(105,839) |

(21,366) |

0 |

|

(127,205) |

|

Library |

0 |

(171,724) |

0 |

|

(171,724) |

|

Livestock Marketing Centre |

(6,032,463) |

685,981 |

2,177,470 |

|

(3,169,012) |

|

|

CLOSING BALANCE 2021/22 |

ADOPTED RESERVE TRANSFERS 2022/23 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 27.2.2023 |

PROPOSED CHANGES for Council Resolution* |

BALANCE AS AT 28 FEBRUARY 2023 |

|

Museum Acquisitions |

(39,378) |

10,000 |

15,000 |

|

(14,378) |

|

Net Zero Emissions |

(394,001) |

0 |

321,212 |

|

(72,790) |

|

Oasis Reserve |

(1,085,465) |

(63,900) |

428,554 |

|

(720,810) |

|

Parks & Recreation Projects |

(1,356,795) |

(33,906) |

661,822 |

45,000 |

(683,879) |

|

Parks Water |

0 |

(180,000) |

0 |

|

(180,000) |

|

Planning Legals |

(100,000) |

0 |

0 |

|

(100,000) |

|

Plant Replacement |

(4,335,819) |

(723,537) |

2,658,372 |

|

(2,400,984) |

|

Project Carryovers |

(3,098,056) |

0 |

3,098,056 |

|

0 |

|

Public Art |

(211,155) |

106,595 |

34,893 |

|

(69,667) |

|

Sister Cities |

(50,000) |

10,000 |

7,000 |

|

(33,000) |

|

Stormwater Drainage |

(158,178) |

0 |

48,000 |

|

(110,178) |

|

Strategic Real Property |

(766,176) |

0 |

(1,611,857) |

|

(2,378,032) |

|

Subdivision Tree Planting |

(368,640) |

20,000 |

0 |

|

(348,640) |

|

Unexpended External Loans |

(3,143,977) |

74,744 |

2,909,068 |

|

(160,165) |

|

Workers Compensation |

(211,112) |

|

50,963 |

|

(160,149) |

|

Total Internally Restricted |

(54,095,762) |

395,070 |

19,518,926 |

156,327 |

(34,025,439) |

|

|

|

|

|

|

|

|

Total Restricted |

(165,555,941) |

15,241,469 |

16,483,677 |

156,327 |

(133,674,468) |

|

|

|

|

|

|

|

|

Total Unrestricted |

(11,494,000) |

0 |

0 |

0 |

(11,494,000) |

|

|

|

|

|

|

|

|

Total Cash, Cash Equivalents, and Investments |

(177,049,941) |

15,241,469 |

16,483,677 |

156,327 |

(145,168,468) |

Investment Summary as at 28 February 2023

In accordance with Regulation 212 of the Local Government (General) Regulation 2021, details of Wagga Wagga City Council’s external investments are outlined below.

|

Institution |

Rating |

Closing

Balance |

Closing

Balance |

February |

February |

Investment |

Maturity |

Term |

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

259,854 |

234,127 |

3.35% |

0.11% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

4,261,375 |

13,630,982 |

3.35% |

6.49% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

17,045,069 |

17,092,310 |

3.40% |

8.14% |

N/A |

N/A |

N/A |

|

Macquarie Bank |

A+ |

9,189,371 |

9,211,708 |

3.20% |

4.39% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

30,755,669 |

40,169,127 |

3.34% |

19.14% |

|

|

|

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

CBA |

AA- |

2,000,000 |

2,000,000 |

2.22% |

0.95% |

20/04/2022 |

20/04/2023 |

12 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

3.68% |

0.95% |

8/06/2022 |

8/06/2023 |

12 |

|

AMP |

BBB |

1,000,000 |

1,000,000 |

4.70% |

0.48% |

15/11/2022 |

15/11/2023 |

12 |

|

AMP |

BBB |

2,000,000 |

2,000,000 |

4.55% |

0.95% |

30/11/2022 |

30/11/2023 |

12 |

|

CBA |

AA- |

1,000,000 |

1,000,000 |

4.69% |

0.48% |

30/01/2023 |

30/01/2024 |

12 |

|

Total Short Term Deposits |

|

8,000,000 |

8,000,000 |

3.79% |

3.81% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

1.20% |

0.95% |

4/01/2022 |

4/01/2024 |

24 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

3.78% |

0.48% |

1/06/2022 |

3/06/2024 |

24 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.32% |

0.95% |

28/06/2021 |

29/06/2026 |

60 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.80% |

0.95% |

15/11/2021 |

17/11/2025 |

48 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

2.15% |

0.48% |

8/07/2019 |

10/07/2023 |

48 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

2.03% |

0.95% |

6/11/2019 |

6/11/2024 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.83% |

0.95% |

28/11/2019 |

28/11/2024 |

60 |

|

Judo Bank |

BBB- |

1,000,000 |

1,000,000 |

1.30% |

0.48% |

3/12/2021 |

4/12/2023 |

24 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.75% |

0.48% |

6/01/2020 |

8/01/2024 |

48 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

2.00% |

0.48% |

28/02/2020 |

28/02/2025 |

60 |

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

2.20% |

0.48% |

1/04/2020 |

1/04/2025 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.85% |

0.48% |

29/05/2020 |

29/05/2025 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.86% |

0.48% |

1/06/2020 |

2/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.75% |

0.95% |

25/06/2020 |

25/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.75% |

0.95% |

25/06/2020 |

25/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.60% |

0.95% |

29/06/2020 |

28/06/2024 |

48 |

|

ICBC |

A |

3,000,000 |

3,000,000 |

5.07% |

1.43% |

30/06/2022 |

30/06/2027 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.42% |

0.95% |

7/07/2020 |

8/07/2024 |

48 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.50% |

0.95% |

17/08/2020 |

18/08/2025 |

60 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

1.25% |

0.48% |

7/09/2020 |

8/09/2025 |

60 |

|

BoQ |

BBB+ |

2,000,000 |

2,000,000 |

1.25% |

0.95% |

14/09/2020 |

15/09/2025 |

60 |

|

NAB |

AA- |

1,000,000 |

1,000,000 |

0.60% |

0.48% |

14/09/2021 |

14/09/2023 |

24 |

|

AMP |

BBB |

1,000,000 |

1,000,000 |

3.30% |

0.48% |

25/05/2022 |

27/11/2023 |

18 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.20% |

0.48% |

7/12/2020 |

8/12/2025 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

0.95% |

0.95% |

29/01/2021 |

29/01/2026 |

60 |

|

NAB |

AA- |

1,000,000 |

1,000,000 |

1.08% |

0.48% |

22/02/2021 |

20/02/2026 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

1.25% |

0.95% |

3/03/2021 |

2/03/2026 |

60 |

|

Summerland CU |

NR |

1,000,000 |

1,000,000 |

0.75% |

0.48% |

29/04/2021 |

28/04/2023 |

24 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

1.40% |

0.95% |

21/06/2021 |

19/06/2026 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

0.65% |

0.95% |

25/06/2021 |

26/06/2023 |

24 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.32% |

0.95% |

25/06/2021 |

25/06/2026 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.32% |

0.48% |

25/08/2021 |

25/08/2026 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

0.65% |

0.95% |

31/08/2021 |

31/08/2023 |

24 |

|

AMP |

BBB |

2,000,000 |

2,000,000 |

1.00% |

0.95% |

18/10/2021 |

17/10/2024 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.56% |

0.95% |

30/11/2021 |

29/11/2024 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

2.00% |

0.95% |

8/02/2022 |

10/02/2025 |

36 |

|

P&N Bank |

BBB |

2,000,000 |

2,000,000 |

2.40% |

0.95% |

9/03/2022 |

10/03/2025 |

36 |

|

P&N Bank |

BBB |

2,000,000 |

2,000,000 |

2.00% |

0.95% |

10/03/2022 |

11/03/2024 |

24 |

|

MyState |

BBB |

2,000,000 |

2,000,000 |

2.20% |

0.95% |

2/03/2022 |

3/03/2025 |

36 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

3.28% |

0.95% |

26/04/2022 |

26/04/2024 |

24 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

3.78% |

0.95% |

4/05/2022 |

6/05/2024 |

24 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

3.99% |

0.95% |

4/05/2022 |

5/05/2025 |

36 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

3.76% |

0.48% |

23/05/2022 |

23/05/2024 |

24 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

3.95% |

0.95% |

6/06/2022 |

6/06/2024 |

24 |

|

Australian Unity |

BBB+ |

2,000,000 |

2,000,000 |

4.15% |

0.95% |

8/06/2022 |

11/06/2024 |

24 |

|

Suncorp |

A+ |

2,000,000 |

2,000,000 |

4.40% |

0.95% |

22/06/2022 |

14/12/2023 |

18 |

|

MyState |

BBB |

2,000,000 |

2,000,000 |

4.45% |

0.95% |

29/06/2022 |

28/06/2024 |

24 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

4.50% |

0.48% |

7/07/2022 |

7/07/2025 |

36 |

|

CBA |

AA- |

1,000,000 |

1,000,000 |

4.25% |

0.48% |

12/08/2022 |

12/08/2025 |

36 |

|

P&N Bank |

BBB |

3,000,000 |

3,000,000 |

4.55% |

1.43% |

29/08/2022 |

29/08/2025 |

36 |

|

Australian Military Bank |

BBB+ |

2,000,000 |

2,000,000 |

4.55% |

0.95% |

2/09/2022 |

2/09/2025 |

36 |

|

P&N Bank |

BBB |

1,000,000 |

1,000,000 |

4.40% |

0.48% |

9/09/2022 |

9/09/2025 |

36 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

4.70% |

0.48% |

4/10/2022 |

4/10/2024 |

24 |

|

AMP |

BBB |

2,000,000 |

2,000,000 |

4.95% |

0.95% |

21/10/2022 |

21/10/2024 |

24 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

5.20% |

0.95% |

21/10/2022 |

21/10/2025 |

36 |

|

AMP |

BBB |

1,000,000 |

1,000,000 |

4.75% |

0.48% |

15/11/2022 |

14/11/2024 |

24 |

|

AMP |

BBB |

1,000,000 |

1,000,000 |

4.80% |

0.48% |

21/11/2022 |

20/11/2025 |

36 |

|

P&N Bank |

BBB |

2,000,000 |

2,000,000 |

4.75% |

0.95% |

16/12/2022 |

16/12/2024 |

24 |

|

Police Credit Union |

NR |

0 |

2,000,000 |

5.04% |

0.95% |

15/02/2023 |

17/02/2025 |

24 |

|

Total Medium Term Deposits |

|

96,000,000 |

98,000,000 |

2.66% |

46.69% |

|

|

|

|

Floating Rate Notes - Senior Debt |

|

|

|

|

|

|

|

|

|

Westpac |

AA- |

2,531,442 |

2,516,059 |

BBSW + 88 |

1.20% |

16/05/2019 |

16/08/2024 |

63 |

|

Suncorp |

A+ |

1,251,052 |

1,255,167 |

BBSW + 78 |

0.60% |

30/07/2019 |

30/07/2024 |

60 |

|

ANZ |

AA- |

2,018,754 |

2,006,922 |

BBSW + 77 |

0.96% |

29/08/2019 |

29/08/2024 |

60 |

|

HSBC |

AA- |

2,510,130 |

2,520,170 |

BBSW + 83 |

1.20% |

27/09/2019 |

27/09/2024 |

60 |

|

ANZ |

AA- |

1,506,063 |

1,512,354 |

BBSW + 76 |

0.72% |

16/01/2020 |

16/01/2025 |

60 |

|

NAB |

AA- |

2,004,679 |

2,014,975 |

BBSW + 77 |

0.96% |

21/01/2020 |

21/01/2025 |

60 |

|

Newcastle Permanent |

BBB |

1,110,027 |

1,102,538 |

BBSW + 112 |

0.53% |

4/02/2020 |

4/02/2025 |

60 |

|

Macquarie Bank |

A+ |

2,014,778 |

2,004,690 |

BBSW + 84 |

0.96% |

12/02/2020 |

12/02/2025 |

60 |

|

BOQ Covered |

AAA |

556,936 |

554,217 |

BBSW + 107 |

0.26% |

14/05/2020 |

14/05/2025 |

60 |

|

Credit Suisse |

A+ |

1,303,850 |

1,296,290 |

BBSW + 115 |

0.62% |

26/05/2020 |

26/05/2023 |

36 |

|

UBS |

A+ |

1,497,295 |

1,504,781 |

BBSW + 87 |

0.72% |

30/07/2020 |

30/07/2025 |

60 |

|

Bank of China Australia |

A |

1,498,379 |

1,503,206 |

BBSW + 78 |

0.72% |

27/10/2020 |

27/10/2023 |

36 |

|

CBA |

AA- |

1,983,760 |

1,997,213 |

BBSW + 70 |

0.95% |

14/01/2022 |

14/01/2027 |

60 |

|

Rabobank |

A+ |

1,980,814 |

1,991,851 |

BBSW + 73 |

0.95% |

27/01/2022 |

27/01/2027 |

60 |

|

Newcastle Permanent |

BBB |

985,446 |

982,288 |

BBSW + 100 |

0.47% |

10/02/2022 |

10/02/2027 |

60 |

|

NAB |

AA- |

2,396,019 |

2,384,935 |

BBSW + 72 |

1.14% |

25/02/2022 |

25/02/2027 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,657,965 |

1,666,009 |

BBSW + 98 |

0.79% |

17/03/2022 |

17/03/2025 |

36 |

|

ANZ |

AA- |

2,016,232 |

2,007,903 |

BBSW + 97 |

0.96% |

12/05/2022 |

12/05/2027 |

60 |

|

NAB |

AA- |

1,719,405 |

1,709,387 |

BBSW + 90 |

0.81% |

30/05/2022 |

30/05/2025 |

36 |

|

Suncorp |

A+ |

908,512 |

903,817 |

BBSW + 93 |

0.43% |

22/08/2022 |

22/08/2025 |

36 |

|

ANZ |

AA- |

2,547,979 |

2,534,565 |

BBSW + 120 |

1.21% |

4/11/2022 |

4/11/2027 |

60 |

|

NAB |

AA- |

2,543,180 |

2,527,623 |

BBSW + 120 |

1.20% |

25/11/2022 |

25/11/2027 |

60 |

|

Suncorp |

A+ |

1,114,086 |

1,121,284 |

BBSW + 125 |

0.53% |

14/12/2022 |

14/12/2027 |

60 |

|

CBA |

AA- |

2,010,977 |

2,028,699 |

BBSW + 115 |

0.97% |

13/01/2023 |

13/01/2028 |

60 |

|

Bank Australia |

BBB |

0 |

1,906,397 |

BBSW + 155 |

0.91% |

22/02/2023 |

22/02/2027 |

48 |

|

Total Floating Rate Notes - Senior Debt |

|

41,667,759 |

43,553,340 |

|

20.75% |

|

|

|

|

Fixed Rate Bonds |

|

|

|

|

|

|

|

|

|

ING Covered |

AAA |

669,597 |

659,377 |

1.10% |

0.31% |

19/08/2021 |

19/08/2026 |

60 |

|

Northern Territory Treasury |

AA- |

3,000,000 |

3,000,000 |

1.00% |

1.43% |

24/08/2021 |

16/12/2024 |

40 |

|

Northern Territory Treasury |

AA- |

3,000,000 |

3,000,000 |

1.50% |

1.43% |

24/08/2021 |

15/12/2026 |

64 |

|

BoQ |

BBB+ |

1,733,944 |

1,717,805 |

2.10% |

0.82% |

27/10/2021 |

27/10/2026 |

60 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.50% |

0.95% |

6/08/2021 |

15/12/2026 |

64 |

|

Northern Territory Treasury |

AA- |

1,000,000 |

1,000,000 |

1.50% |

0.48% |

14/07/2021 |

15/12/2026 |

65 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.30% |

0.95% |

29/04/2021 |

15/06/2026 |

61 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.00% |

0.95% |

30/11/2020 |

15/12/2025 |

60 |

|

Northern Territory Treasury |

AA- |

1,000,000 |

1,000,000 |

1.00% |

0.48% |

20/11/2020 |

15/12/2025 |

61 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.00% |

0.95% |

21/10/2020 |

15/12/2025 |

62 |

|

Total Fixed Rate Bonds |

|

18,403,541 |

18,377,182 |

1.30% |

8.76% |

|

|

|

|

Managed Funds |

|

|

|

|

|

|

|

|

|

NSW Tcorp |

NR |

1,804,898 |

1,789,798 |

-0.84% |

0.85% |

17/03/2014 |

1/02/2028 |

166 |

|

Total Managed Funds |

|

1,804,898 |

1,789,798 |

-0.84% |

0.85% |

|

|

|

|

TOTAL CASH ASSETS, CASH |

|

196,631,867 |

209,889,446 |

|

100.00% |

|

|

|

|

LESS: RIVERINA REGIONAL LIBRARY (RRL) CASH AT BANK |

|

2,713,323 |

2,460,514 |

|

|

|

|

|

|

TOTAL WWCC CASH ASSETS, CASH |

|

193,918,545 |

207,428,932 |

|

|

|

|

|

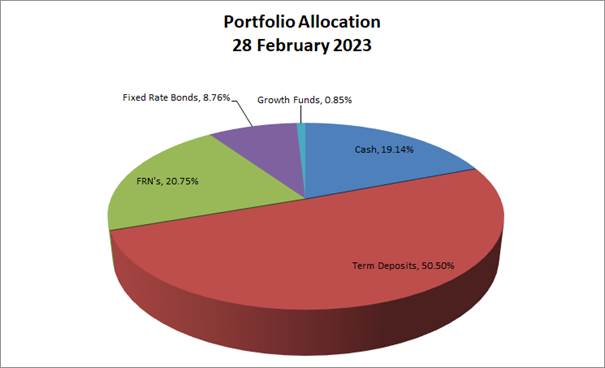

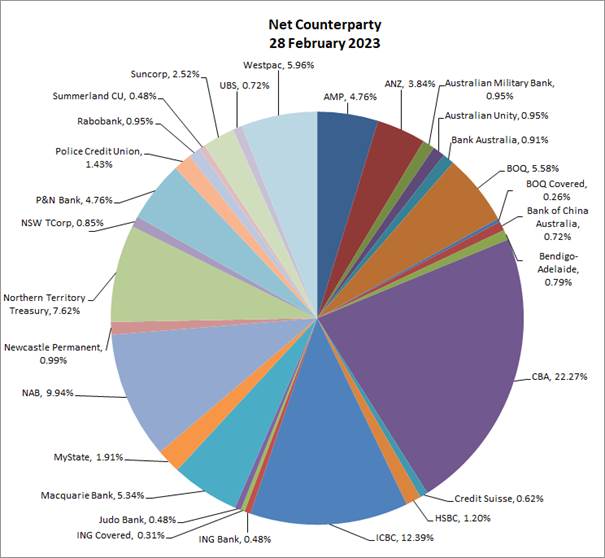

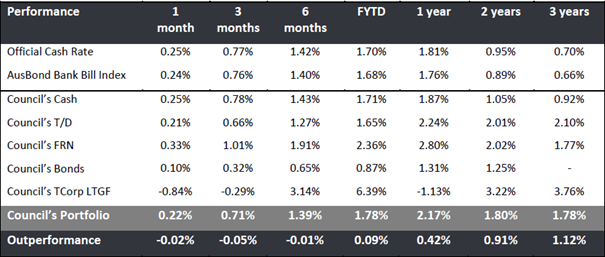

Council’s investment portfolio is dominated by Term Deposits, equating to approximately 50% of the portfolio across a broad range of counterparties. Cash equates to 19%, with Floating Rate Notes (FRNs) around 21%, fixed rate bonds around 9% and growth funds around 1% of the portfolio.

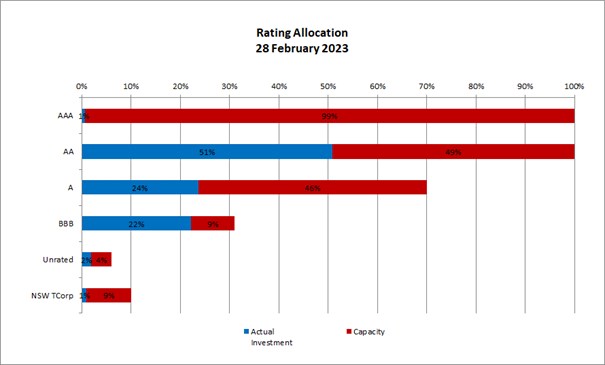

Council’s investment portfolio is well diversified in complying assets across the entire credit spectrum. It is also well diversified from a rating perspective. Credit quality is diversified and is predominately invested amongst the investment grade Authorised Deposit-Taking Institutions (ADIs) (being BBB- or higher), with a smaller allocation to unrated ADIs.

All investments are within the defined Policy limits, as outlined in the Rating Allocation chart below:

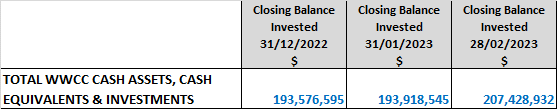

Investment Portfolio Balance

Council’s investment portfolio balance has increased significantly over the past month, up from $193.92M to $207.43M. This is reflective of the 2022/23 third quarter rates instalments being due at end of February 2023.

Monthly Investment Movements

Redemptions/Sales – Council did not redeem or sell any investment securities during February 2023.

New Investments – Council purchased the following investment securities during February 2023:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

Police Credit Union (Unrated) Term Deposit |

$2M |

2 years |

5.04% |

The Police Credit Union rate of 5.04% compared favourably to the rest of the market for this term. The next best rate for this term was 4.92%. |

|

Bank Australia (BBB) Floating Rate Note |

$1.9M |

4 years |

BBSW + 155bps |

Council’s independent Investment Advisor advised this Floating Rate Note represented fair value with a potential grossed-up value of +175bps after 3 years. |

Rollovers – Council did not rollover any investment securities during February 2023.

Monthly Investment Performance

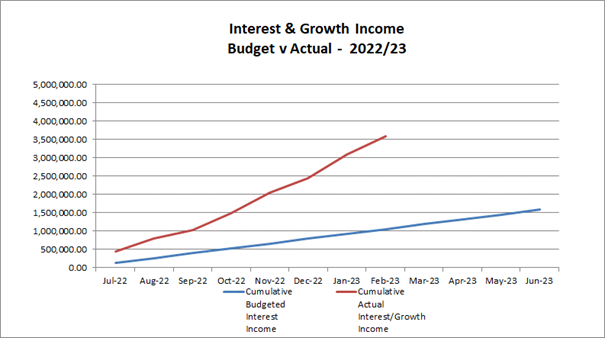

Interest/growth/capital gains/(losses) for the month totalled $491,459, which compares favourably with the budget for the period of $131,951 - outperforming budget for the month by $359,508.

Council’s outperformance to budget for February is mainly due to better than budgeted returns on Councils investment portfolio. This is a result of the ongoing movements in the cash rate made by the Reserve Bank of Australia, with the latest increase in early February 2023 bringing the cash rate to 3.35% from a record low of 0.10% in April 2022.