Agenda

and

Business Paper

To be held on

Monday 22

May 2023

at 6.00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

Agenda

and

Business Paper

To be held on

Monday 22

May 2023

at 6.00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

NOTICE OF MEETING

The proceedings of all Council meetings in open session, including all debate and addresses by the public, are recorded (audio visual) and livestreamed on Council’s website including for the purpose of facilitating community access to meetings and accuracy of the Minutes.

In addition to webcasting council meetings, audio recordings of confidential sessions of Ordinary Meetings of Council are also recorded, but do not form part of the webcast.

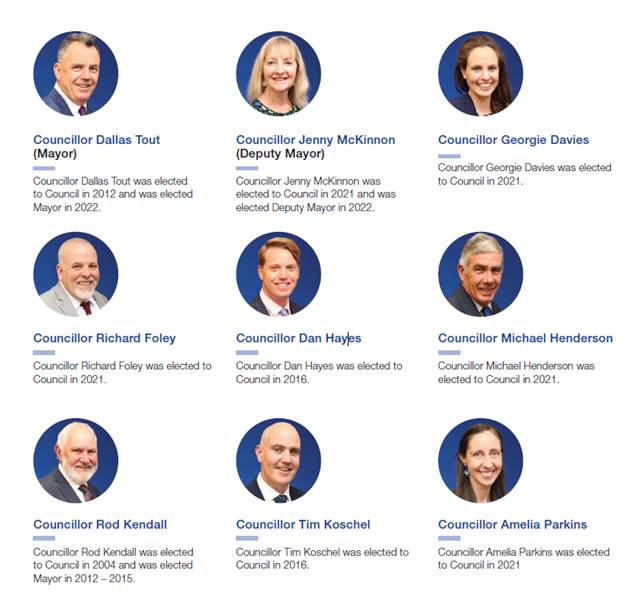

WAGGA WAGGA CITY COUNCILLORS

STATEMENT OF ETHICAL OBLIGATIONS

Councillors are reminded of their Oath or Affirmation of Office made under Section 233A of the Local Government Act 1993 and their obligation under Council’s Code of Conduct to disclose and appropriately manage Conflicts of Interest.

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

Reports submitted to the Ordinary Meeting of Council to be held on Monday 22 May 2023.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 22 May 2023

CLAUSE PRECIS PAGE

ACKNOWLEDGEMENT OF COUNTRY 2

REFLECTION 2

APOLOGIES 2

Confirmation of Minutes

CM-1 ORDINARY COUNCIL MEETING - 8 MAY 2023 2

DECLARATIONS OF INTEREST 2

Reports from Staff

RP-1 RESPONSE TO NOTICE OF MOTION - ENGAGEMENT WITH BUILDING AND CONSTRUCTION INDUSTRY 3

RP-2 LICENCE RENEWAL TO WAGGA HISTORIC ENGINE CLUB INC - PART LOT 14 DP 1177748 6

RP-3 APPLICATIONS FOR SUBSIDY FOR WASTE DISPOSAL FOR CHARITABLE ORGANISATIONS 11

RP-4 FINANCIAL PERFORMANCE REPORT AS AT 30 APRIL 2023 14

RP-5 REVIEW OF FINANCE POLICIES - PROPOSED ADOPTION 47

RP-6 NSW LIBRARIES ASSOCIATION (NSWPLA) SWITCH 2023 CONFERENCE AND ANNUAL GENERAL MEETING 86

RP-7 DRAFT ELECTRIC VEHICLE CHARGING INFRASTRUCTURE ON PUBLIC LAND POLICY (POL 054) 88

RP-8 RESOLUTIONS AND NOTICES OF MOTIONS REGISTERS 99

RP-9 QUESTIONS WITH NOTICE 101

Committee Minutes

M-1 FLOODPLAIN RISK MANAGEMENT ADVISORY COMMITTEE - 27 APRIL 2023 103

Confidential Reports

CONF-1 2022/23 Loan Facility 110

CONF-2 PROPOSED LICENCE OF AIRPORT LAND TO THE BUREAU OF METEOROLOGY - PART LOT 6 DP 846849 111

Wagga Wagga City Council acknowledges the traditional custodians of the land, the Wiradjuri people, and pays respect to Elders past, present and future and extends our respect to all First Nations Peoples in Wagga Wagga.

We recognise and respect their cultural heritage, beliefs and continuing connection with the land and rivers. We also recognise the resilience, strength and pride of the Wiradjuri and First Nations communities

REFLECTION

Councillors, let us in silence reflect upon our responsibilities to the community which we represent, and to all future generations and faithfully, and impartially, carry out the functions, powers, authorities and discretions vested in us, to the best of our skill and judgement.

CM-1 ORDINARY COUNCIL MEETING - 8 MAY 2023

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 8 May 2023 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - 8 May 2023 Ordinary Council Meeting |

112 |

|

Report submitted to the Ordinary Meeting of Council on Monday 22 May 2023 |

RP-1 |

RP-1 RESPONSE TO NOTICE OF MOTION - ENGAGEMENT WITH BUILDING AND CONSTRUCTION INDUSTRY

Author: John Sidgwick

|

Summary: |

The purpose of this report is to respond to the Notice of Motion report as requested by Councillor Richard Foley.

The report identifies the current strategies and processes in place to engage with the building and constructions industry. |

|

That Council note the information provided in the report. |

Report

At the Ordinary Council Meeting of 14 February 2023, Councillors made the following resolution:

That Council receive a report that considers the following in relation to engagement with the building and construction industry:

a audit of current engagement activities with industry stakeholders, including face to face, digital communications, newsletters etc

b consider the option of coordinating quarterly breakfast forums available for all industry stakeholders along the following lines:

i key planning staff to be present at these forums to brief the attendees with any relevant information and to answer any industry relevant questions posed by attendees

ii provide opportunities for all attendees to speak and address the forum for no longer than 5 minutes.

iii the forum is to act as an informal consultative entry point and significant interface between Council and these key building and construction sectors

iv affordable housing to be a regular topic of discussion with open participation and discussion of ideas to be encouraged with Industry in assisting Council in evaluating affordable housing development strategies for Wagga Wagga which has an ongoing crisis in affordable housing.

c any other engagement opportunities that staff may be considering that is not referenced in this report

Current engagement activities

Council officers currently engage with the building and construction industry through the following channels:

· Quarterly building and construction breakfast forum;

· Face to face meetings with a number of peak industry bodies including the HIA;

· Hosting of a variety of industry related forums including the monthly meetings of the Business Round Table, Committee for Wagga, the Business Chamber, Business NSW and the RDA;

· Attendance at business forums such as quarterly HIA forums and monthly Business Chamber functions

· Bi annual meetings with state agencies

· Circulation of the Development & Building Newsletter

Quarterly Breakfast Forums

Council officers arranged a breakfast seminar to approximately 50 members of the local building and construction industry. The General Manager, Director of Regional Activation and Manager Development Assessment and Building Certification presented on current challenges facing the housing sector and the outcomes of the Strategic Initiatives report of December 2022. Officers also provided details and proposed timings for several key strategic project, including the Wagga Housing Strategy, the CBD Masterplan and the Northern Growth Area.

Officers provided an opportunity for attendees to ask questions and Graham Walker of Walker Development addressed the group regarding current challenges with biodiversity.

At the request of attendees officers have arranged a further Breakfast forum to be held in the Council Chamber on the 23 May 2023. An invitation has been extended to all councillors for this forum. At the forum, officers will provide an update on progress with the strategies identified at the Forum in March.

These forums will continue on a quarterly basis and will be an opportunity to hear from industry on issues as well as providing a forum for Council to engage with representatives on key strategies and major amendments to planning documents.

Other engagement opportunities

Officers recently hosted a Future Growth workshop for a number of state agencies to provide a briefing on the future growth of the city and strategies that council was developing to plan for this level of growth. The forum provided an opportunity for agency stakeholders to understand key locations for future residential development and for the group to better understand current infrastructure capacity and upgraded needed to service this future growth.

Officers will continue to utilise similar forums to engage with relevant staff from state government around key projects such as the Northern Growth Area, Housing Strategy and CBD Masterplan.

Financial Implications

The costs to provide building and construction breakfast forums will be incorporate within the Regional Activation budget.

Policy and Legislation

There are no legislative implications of this NOM.

Link to Strategic Plan

Community leadership and collaboration

Objective: Our community is informed and actively engaged in decision making and problem-solving to shape the future of Wagga Wagga

Ensure our community feels heard and understood

Risk Management Issues for Council

A more structured and consistent approach to engagement with the building and construction sector is considered to represent an opportunity to better manage the exchange of information and feedback from the building industry.

Internal / External Consultation

Council staff will continue to undertake engagement with the building and construction industry, developing engagement strategies for major strategic pieces of work to ensure that council engages with relevant stakeholders during the preparation of major strategies.

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Connect.Wagga |

Email newsletter |

Social media |

Website |

|

|

Inform |

|

|

|

|

|

|

|

* |

* |

* |

|

* |

|

* |

|

|

|

Consult |

|

|

|

|

|

* |

|

* |

|

|

|

|||||

|

Involve |

|

|

|

|

|

|

|

|

||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other methods (please list specific details below) |

||||

|

N/A |

|

|

|

|

|

Report submitted to the Ordinary Meeting of Council on Monday 22 May 2023 |

RP-2 |

RP-2 LICENCE RENEWAL TO WAGGA HISTORIC ENGINE CLUB INC - PART LOT 14 DP 1177748

Author: Matthew Dombrovski

Executive: John Sidgwick

|

Summary: |

Following public exhibition, Council staff have received an objection to the licence renewal of Wagga Historic Engine Club Inc over Crown Reserve 1440, Willans Hill part lot 14 DP 1177748. This report seeks endorsement from Council to proceed with the renewal of the Licence Agreement. |

|

That Council: a acknowledge that one submission has been received following the public consultation period b endorse proceeding with the renewal of the Licence Agreement as outlined in the body of this report. c authorise the affixing of Council’s common seal to all relevant documents as required |

Report

Council resolved on the 31 January 2022 (resolution 22/030) to renew the existing licence agreement with Wagga Historic Engine Club Inc (WHEC) over Crown Reserve 1440, Willans Hill (being part Lot 14 DP 1177748) for a period of five years.

In accordance with its obligations pursuant to the Local Government Act 1993, Council undertook a public exhibition process of the proposed licence of Crown Land to the WHEC. During the public exhibition period, Council staff received one submission. The submission raised three concerns in relation to the licenced premises, including a formal objection to the fire trail being enclosed within the licenced area. The other two concerns were observations of issues associated with the existing Licence Agreement. A copy of the submission received (with contact details redacted) is attached as Annexure A.

Objection raised

Sections 47 & 47A of the Local Government Act 1993 provides details of the processes which need to be considered when dealing with the grant of a lease or licence over community land. In particular, Clause 47 (4) sets out that before granting a lease or licence, Council must consider all submissions duly made to it.

The formal objection contained in the submission relates to the fire trail being located within the enclosed licenced area. The submission states that as a result of the lands being contained within the fenced area, the public are required to walk/ride around the WHEC perimeter fence and down a ‘badly constructed foot track’ to re-join the fire trail. The submission claims that the WHEC fence has restricted easy foot and bicycle access to the fire trail.

Attached as Annexure B is an aerial map which shows the current licenced area, walking track and emergency vehicle access to the fire trail.

History with the Fence:

A number of years ago, WHEC approached Council requesting to install a perimeter fence to increase the security of the clubs’ assets and enable them to have outdoor displays.

Council resolved a number of matters relating to the WHEC at its April 2015 meeting. Part (e) of that resolution (15/101) concerned the dual use (bike and walking) track that currently runs through the area licensed to WHEC:

e defer consideration of the track location until the June 2015 Policy and Strategy Committee Meeting pending further negotiations between council staff and relevant stakeholders to ascertain the best outcome for the Wagga Historic Engine Club Inc and track users

On 15 June 2015 a Policy and Strategy Committee Meeting was held to respond to part (e) of Council Resolution 15/101 (April 2015). Outlined in the report was the stakeholder engagement conducted by Council on the possible options for the realignment of the dual track and any concerns identified. The stakeholder engagement conducted by Council included ten clubs representing cycling, running and walking (including kennel clubs) to identify the needs to the users of the track. No opposition was proposed to the realigning of the track, and the only factors identified as requiring further consideration included aspects such as signage on the track.

Council therefore resolved in June 2015 (Resolution No. 15/177) to construct a perimeter fence around the Wagga Historic Engine Club licenced area and realign the dual purpose track so that it followed the alignment of the perimeter fence.

On the basis that Council has previously endorsed the construction of the fence pursuant to Resolution No. 15/177, it is recommended that Council acknowledge the submission, but undertake no further action to change the position.

Other concerns identified in submission

The submission also identified two areas of concern with the licensee’s maintenance and use of the site.

Firstly, the submitting party identified the weeds which are currently growing on the land. Council have addressed this concern with the licensee who have formally responded advising they do control the noxious weeds and mowing of the grass around the premises, however, have had difficulty maintaining the weeds due to the wet season we have experienced. Council’s Property Officers intend to continue inspections of the area to ensure this has been addressed by the licensee.

Secondly it was identified that a large amount of dirt had been ‘dumped’ on the site to enlarge the proposed display area. Council staff have conducted internal consultations on this matter, have confirmed that a development application in relation to the fill on the site (DA No. 18/0425) was lodged by the licensee.

Recommendation

It is recommended that Council acknowledge the submission made, but on the basis the historic information provided above and noting previous Council Resolutions, that Council endorse proceeding with the renewal of the Licence Agreement.

Financial Implications

No additional financial implications. Council will receive rental income commencing at $765 on the renewal of the Licence, reviewed annually in accordance with Council’s Fees and Charges.

Policy and Legislation

Local Government Act 1993

Crown Land Management Act 2016

Acquisition, Disposal and Management of Land Policy POL 038

Link to Strategic Plan

Community leadership and collaboration

Objective: Our community is informed and actively engaged in decision making and problem-solving to shape the future of Wagga Wagga

Communicate with our community

Risk Management Issues for Council

Council has a responsibility to adequately manage its property assets. This includes, in cases where the property is Crown Land, managing the assets in accordance with obligations set out in the Crown Land Management Act 2016 and Local Government Act 1993.

The review of submissions including formal objection is a requirement of the Local Government Act 1993, and failure to do so would leave Council in breach of its legislative requirements.

Internal / External Consultation

Internal consultation has been undertaken within Council’s Regional Activation Directorate.

A public exhibition has been consulted in relation to the grant of the proposed Licence which attracted one submission.

|

1⇩. |

Annexure A |

|

|

2⇩. |

Annexure B |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 22 May 2023 |

RP-3 |

RP-3 APPLICATIONS FOR SUBSIDY FOR WASTE DISPOSAL FOR CHARITABLE ORGANISATIONS

Author: Greg Ewings

Executive: John Sidgwick

|

Summary: |

This report has been prepared for applications submitted to Council by local charitable organisations, community groups and individuals seeking relief from fees for the disposal of waste at Council’s Gregadoo Waste Management Centre (GWMC) for the 2022/23 financial year, on the basis that they are providing a benefit to the community. |

|

That Council endorse the Annual 2022/23 Waste Disposal Subsidy for the total amount of $1,000.00 for Wagga Menshed. |

Report

Council’s Financial Assistance Policy (POL 093), along with the Delivery Program and Operational Plan incorporate the specific program of waiving of Gregadoo Waste Management Centre Fee and provides the $10,300 budget allocation for 2022/23.

As part of this program, individuals, registered not-for-profit, non-government registered charities or community groups located in the Wagga Wagga Local Government Area can apply for a waiver or subsidised waste disposal fees. There are two types of waivers or subsidised waste disposal fees that may be applied for:

1. An annual waiver or reduction to a maximum value of $1,000, or

2. A waiver or fee reduction for a single, specific project up to a maximum value of $250. This may be for advertised events such as Clean-Up Australia Day or the Adopt-A-Road Program.

An advertisement was placed in regional newspapers and on Council’s website during April and May 2022 inviting applications for subsidised waste disposal fees. The Wagga Menshed application was received 6 March 2023 after the advertised closing date of 31 May 2022.

The following table lists the amount of the subsidy requested:

|

No. |

Name of Applicant |

Requested Subsidy $ |

|

1 |

Wagga Menshed |

$1,000.00 |

|

|

Total |

$1,000.00 |

The Wagga Menshed organisation is well known to Council for providing valuable charitable and social services that benefit the community of Wagga Wagga.

It is recommended to approve this application and given that there are over 150 registered charities listed in the Wagga Wagga Local Government Area, it is proposed that the remaining budget amount of $2,000.00 be retained to fund any further applications for subsidised fees that may be received during the 2022/23 financial year

Financial Implications

An allowance of $10,300.00 for subsidised waste disposal has been made in the Solid Waste budget for 2022/23, funded from the Solid Waste Reserve. The approval of this report will leave $2,000.00 for Council to consider any further applications received for the remainder of the financial year as set out below.

|

2022/23 Subsidy Budget |

$10,300.00 |

|

Applications previously approved: × 18 July 2022 Council meeting × 8 August 2022 Council meeting × 5 September 2022 Council meeting × 17 October 2022 Council meeting |

($5,050.00) ($ 250.00) ($1,000.00) ($1,000.00) |

|

Total applications approved to date |

($7,300.00) |

|

2022/23 Subsidy Budget remaining |

$ 3,000.00 |

|

Recommendations for subsidy included in this report: |

|

|

1) Wagga Menshed |

($1,000.00) |

|

Proposed Budget available for remainder of this financial year |

$ 2,000.00 |

Policy and Legislation

Section 356 of the Local Government Act 1993

Subsidy for Waste Disposal by Charitable Organisations & Community Groups Policy - POL 093.

Link to Strategic Plan

The Environment

Objective: We create a sustainable environment for future generations

Outcome: We are proactive with our waste management

Risk Management Issues for Council

No risk management issues were identified in respect to the provision of subsidised waste disposal fees provided they are applied as per the Policy.

Internal / External Consultation

Internal consultation with the relevant sections within Council will be undertaken to ensure the operators of the landfill and finance staff are advised of the subsidy to ensure it is applied correctly and monitored appropriately.

The applicant will be advised of the resolution of Council regarding their application for subsidised disposal fees, how the subsidy will be applied and the conditions of entry into the landfill.

|

Report submitted to the Ordinary Meeting of Council on Monday 22 May 2023 |

RP-4 |

RP-4 FINANCIAL PERFORMANCE REPORT AS AT 30 APRIL 2023

Author: Carolyn Rodney

|

Summary: |

This report is for Council to consider information presented on the 2022/23 budget and Long-Term Financial Plan, and details Council’s external investments and performance as at 30 April 2023. |

|

That Council: a approve the proposed 2022/23 budget variations for the month ended 30 April 2023 and note the balanced budget position as presented in this report b approve the proposed budget variations to the 2022/23 Long Term Financial Plan Capital Works Program including new projects and timing adjustments c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2021 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above d note the details of the external investments as of 30 April 2023 in accordance with section 625 of the Local Government Act 1993 e accept the grant funding offers as presented in this report |

Wagga Wagga City Council (Council) forecasts a balanced budget position as of 30 April 2023.

The balanced budget position excludes the Wagga Wagga Airport estimated deficit result for the financial year – as previously reported to Council, any Airport deficit result will be sanctioned, and funded in the interim by General Purpose Revenue (via the Internal Loans Reserve). The deficit results will be accounted for as a liability in the Airport’s end of financial year statements and paid back to General Purpose Revenue (Internal Loans Reserve) by the Airport in future financial years.

Proposed budget variations including adjustments to the capital works program are detailed in this report for Council’s consideration and adoption.

Council has experienced a positive monthly investment performance for the month of April when compared to budget ($267,131 up on the revised monthly budget). This is mainly due to better than budgeted returns on Council’s investment portfolio, as a result of the ongoing movement in the interest rate environment, as well as a positive movement in Councils Floating Rate note portfolio and NSW T-Corp Managed Fund for the month.

Key Performance Indicators

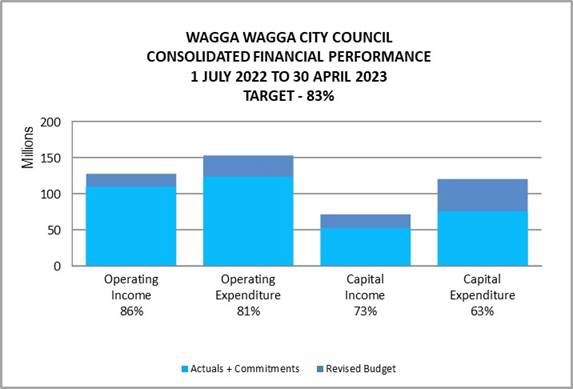

OPERATING INCOME

Total operating income is 86% of approved budget and is trending above budget for the month of April 2023. This is due to increased revenue from Interest on Investments, with more detail included in the Interest on Investments section of the report below.

An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 96% when compared to budget.

OPERATING EXPENSES

Total operating expenditure is 81% of approved budget which is slightly under budget for the end of April.

CAPITAL INCOME

Total capital income is 73% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions in relation to expenditure incurred on the projects. This income also includes the sale of property (including the recent sale of Bomen land) as well as plant and equipment.

CAPITAL EXPENDITURE

Total capital

expenditure including commitments is 63% of approved budget with some purchase

orders being raised for the full contract amounts for multi-year projects.

Excluding commitments, the total expenditure is 32% when compared to the

approved budget.

|

WAGGA WAGGA CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2022/23 |

COMMT'S 2022/23 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|

||||||

|

Rates & Annual Charges |

(75,524,168) |

(630,214) |

(76,154,382) |

(63,316,127) |

0 |

(63,316,127) |

83% |

|

User Charges & Fees |

(27,844,136) |

(626,935) |

(28,471,071) |

(24,447,387) |

0 |

(24,447,387) |

86% |

|

Other Revenues |

(2,769,503) |

(202,000) |

(2,971,503) |

(2,436,165) |

0 |

(2,436,165) |

82% |

|

Grants & Contributions provided for Operating Purposes |

(13,524,889) |

(264,927) |

(13,789,815) |

(13,239,075) |

0 |

(13,239,075) |

96% |

|

Grants & Contributions provided for Capital Purposes |

(36,295,253) |

(30,238,241) |

(66,533,494) |

(36,462,610) |

0 |

(36,462,610) |

55% |

|

Interest & Investment Revenue |

(1,828,128) |

(2,870,966) |

(4,699,094) |

(4,954,385) |

0 |

(4,954,385) |

105% |

|

Other Income |

(1,406,222) |

(54,000) |

(1,460,222) |

(1,249,077) |

0 |

(1,249,077) |

86% |

|

Total Revenue |

(159,192,300) |

(34,887,283) |

(194,079,583) |

(146,104,824) |

0 |

(146,104,824) |

75% |

|

|

|||||||

|

Expenses |

|||||||

|

Employee Benefits & On-Costs |

51,315,412 |

876,605 |

52,192,018 |

38,242,826 |

0 |

38,242,826 |

73% |

|

Borrowing Costs |

3,268,989 |

0 |

3,268,989 |

2,294,051 |

0 |

2,294,051 |

70% |

|

Materials & Services |

36,542,674 |

13,738,280 |

50,280,954 |

33,670,490 |

9,257,018 |

42,927,509 |

85% |

|

Depreciation & Amortisation |

43,196,051 |

0 |

43,196,051 |

35,996,709 |

0 |

35,996,709 |

83% |

|

Other Expenses |

1,866,271 |

2,078,121 |

3,944,392 |

3,945,890 |

15,511 |

3,961,401 |

100% |

|

Total Expenses |

136,189,398 |

16,693,006 |

152,882,404 |

114,149,967 |

9,272,530 |

123,422,497 |

81% |

|

|

|||||||

|

Net Operating (Profit)/Loss |

(23,002,902) |

(18,194,277) |

(41,197,179) |

(31,954,857) |

9,272,530 |

(22,682,328) |

|

|

|

|||||||

|

Net Operating Result Before Capital (Profit)/Loss |

13,292,351 |

12,043,964 |

25,336,315 |

4,507,752 |

9,272,530 |

13,780,282 |

|

|

|

|||||||

|

Cap/Reserve Movements |

|||||||

|

Capital Expenditure - One Off Confirmed |

13,638,521 |

68,605,896 |

82,244,417 |

24,369,859 |

28,240,624 |

52,610,483 |

64% |

|

Capital Expenditure - Recurrent |

18,890,352 |

8,390,036 |

27,280,388 |

8,705,783 |

8,925,383 |

17,631,166 |

65% |

|

Capital Expenditure - Pending Projects |

59,770,944 |

(56,508,231) |

3,262,713 |

20,653 |

0 |

20,653 |

0% |

|

Loan Repayments |

7,571,681 |

0 |

7,571,681 |

5,476,401 |

0 |

5,476,401 |

72% |

|

New Loan Borrowings |

(17,458,537) |

14,259,162 |

(3,199,375) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(880,181) |

(4,037,359) |

(4,917,540) |

(15,944,090) |

0 |

(15,944,090) |

324% |

|

Net Movements Reserves |

(15,333,827) |

(12,515,227) |

(27,849,054) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

66,198,954 |

18,194,277 |

84,393,231 |

22,628,607 |

37,166,006 |

59,794,613 |

|

|

|

|||||||

|

Net Result after Depreciation |

43,196,052 |

(0) |

43,196,052 |

(9,326,251) |

46,438,536 |

37,112,286 |

|

|

|

|||||||

|

Add back Depreciation Expense |

43,196,051 |

0 |

43,196,051 |

35,996,709 |

0 |

35,996,709 |

83% |

|

|

|||||||

|

Cash Budget (Surplus)/Deficit |

0 |

0 |

0 |

(45,322,960) |

46,438,536 |

1,115,576 |

|

Years 2-10 Long Term Financial Plan (Surplus) /Deficit*

|

Description |

Budget 2023/24 |

Budget 2024/25 |

Budget 2025/26 |

Budget 2026/27 |

Budget 2027/28 |

Budget 2028/29 |

Budget 2029/30 |

Budget 2030/31 |

Budget 2031/32 |

|

Adopted Bottom Line (Surplus) / Deficit |

1,163,681 |

1,205,672 |

4,377,581 |

4,833,506 |

2,199,382 |

1,967,334 |

1,257,474 |

1,234,053 |

418,437 |

|

Adopted Bottom Line Adjustments |

26,080 |

27,297 |

40,051 |

41,342 |

42,673 |

44,042 |

45,454 |

46,907 |

93,404 |

|

Revised Bottom Line (Surplus) / Deficit |

1,189,761 |

1,232,969 |

4,417,632 |

4,874,848 |

2,242,055 |

2,011,376 |

1,302,928 |

1,280,960 |

511,841 |

* This table does not include any proposed adjustments to the draft 2023/24 LTFP budget

2022/23 Revised Budget Result – (Surplus) / Deficit |

$’000s |

|

Original 2022/23 Budget Result as adopted by Council Total Budget Variations approved to date Budget Variations for April 2023 |

$0K $0K $0K |

|

Proposed Revised Budget result for 30 April 2023 - (Surplus) / Deficit |

$0K |

The proposed Operating and Capital Budget Variations for 30 April 2023 which affect the current 2022/23 financial year are listed below.

|

Budget Variation |

Amount |

Funding Source |

Net Impact (Fav)/ Unfav |

|

|

4 – Community Place and Identity |

||||

|

Museum Of the Riverina – Roof repairs |

$40K |

Buildings Reserve ($40K) |

Nil |

|

|

Funds are required for the replacement of the box gutter on the original Collections Store building that is currently leaking. The required works include the replacement of the box gutter, flashing, installation of leaf protection and cladding over the existing window with corrugated iron. It is proposed to fund the budget variation from the Buildings Reserve which has sufficient funds for these works. Estimated Completion: 30 June 2023 Job Consolidation: 22355 |

|

|||

|

5 – The Environment |

||||

|

Alan Turner Depot Office Works |

$20K |

Sewer Reserve ($20K) |

Nil |

|

|

Funds are required for construction works to be undertaken at the Alan Turner Depot to construct a new office space for the Manager of Sewer and Stormwater. The works include the construction of three walls, installation of internal doors and associated electrical and data works. It is proposed to fund the works from the Sewer Reserve. Estimated Completion: 30 June 2023 Job Consolidation: 50427 |

|

|||

|

Local Road Repair Program Funding |

$227K |

Transport for NSW ($227K) |

Nil |

|

|

Council has been successful in securing grant funding from Transport for NSW of $227K under the Regional Road Repair Program for the rehabilitation of Bourke Street between Fernleigh Road and Urana Street. The estimated project budget is $880K with the remaining required funding of $653K allocated from the Regional and Local Roads Repair Program of $4.2M previously reported to Council. Estimated Completion: 30 June 2023 Job: 22368 |

|

|||

|

|

$0K |

|||

2022/23 Capital Works Summary

|

Approved Budget |

Proposed Movement |

Proposed Budget |

|

|

One-off |

$82,244,417 |

$60,000 |

$82,304,417 |

|

Recurrent |

$27,280,388 |

$0 |

$27,280,388 |

|

Pending |

$3,262,713 |

$0 |

$3,262,713 |

|

Total Capital Works |

$112,787,518 |

$60,000 |

$112,847,518 |

Current Restrictions

|

RESERVES SUMMARY |

|||||

|

30 APRIL 2023 |

|||||

|

|

CLOSING BALANCE 2021/22 |

ADOPTED RESERVE TRANSFERS 2022/23 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 26.4.2023 |

PROPOSED CHANGES for Council Resolution* |

BALANCE AS AT 30 APRIL 2023 |

|

|

|

|

|

|

|

|

Externally Restricted |

|

|

|

|

|

|

Developer Contributions - Section 7.11 |

(31,045,478) |

7,213,679 |

(5,882,677) |

|

(29,714,476) |

|

Developer Contributions - Section 7.12 |

(278,187) |

(28,179) |

0 |

|

(306,366) |

|

Developer Contributions - Stormwater Section 64 |

(7,112,864) |

(786,229) |

281,476 |

|

(7,617,617) |

|

Sewer Fund |

(32,439,399) |

673,962 |

1,842,861 |

20,000 |

(29,902,576) |

|

Solid Waste |

(24,880,735) |

7,737,392 |

(3,521,382) |

|

(20,664,725) |

|

Specific Purpose Unexpended Grants & Contributions |

(4,195,951) |

0 |

4,195,951 |

|

0 |

|

SRV Levee Reserve |

(6,357,282) |

0 |

57,520 |

|

(6,299,762) |

|

Stormwater Levy |

(5,150,281) |

35,773 |

650,957 |

|

(4,463,551) |

|

Total Externally Restricted |

(111,460,179) |

14,846,399 |

(2,375,293) |

20,000 |

(98,969,073) |

|

|

|

|

|

|

|

|

Internally Restricted |

|

|

|||

|

Additional Special Variation (ASV) |

0 |

0 |

(630,214) |

|

(630,214) |

|

Airport |

0 |

0 |

0 |

|

0 |

|

Art Gallery |

(3,804) |

0 |

0 |

|

(3,804) |

|

Bridge Replacement |

(296,805) |

0 |

60,000 |

|

(236,805) |

|

Buildings |

(1,088,635) |

(23,658) |

258,460 |

40,000 |

(813,832) |

|

CCTV |

(100,843) |

30,633 |

30,000 |

|

(40,211) |

|

Cemetery |

(882,761) |

(226,784) |

46,123 |

|

(1,063,421) |

|

Civic Theatre |

(44,048) |

0 |

43,922 |

|

(127) |

|

Civil Infrastructure |

(9,317,219) |

1,598,454 |

(211,175) |

|

(7,929,940) |

|

Community Works |

(159,648) |

140,317 |

12,555 |

|

(6,776) |

|

Council Election |

(235,385) |

(112,845) |

49,085 |

|

(299,146) |

|

Economic Development |

(419,160) |

60,000 |

349,832 |

|

(9,328) |

|

Emergency Events Reserve |

(639,548) |

(120,142) |

(275,120) |

|

(1,034,810) |

|

Employee Leave Entitlements Gen Fund |

(3,453,655) |

0 |

0 |

|

(3,453,655) |

|

Environmental Conservation |

(116,578) |

41,578 |

0 |

|

(75,000) |

|

Event Attraction |

(491,893) |

0 |

210,249 |

|

(281,644) |

|

Financial Assistance Grants in Advance |

(8,536,837) |

0 |

8,536,837 |

|

0 |

|

Grant Co-Funding |

(500,000) |

0 |

0 |

|

(500,000) |

|

Gravel Pit Restoration |

(816,897) |

3,333 |

0 |

|

(813,564) |

|

Information Services |

(1,835,475) |

(507,158) |

179,643 |

|

(2,162,990) |

|

Insurance Variations |

(50,000) |

0 |

0 |

|

(50,000) |

|

Internal Loans |

(3,649,517) |

(201,545) |

(343,710) |

|

(4,194,772) |

|

Lake Albert Improvements |

(105,839) |

(21,366) |

0 |

|

(127,205) |

|

Library |

0 |

(171,724) |

0 |

|

(171,724) |

|

Livestock Marketing Centre |

(6,032,463) |

685,981 |

2,177,470 |

|

(3,169,012) |

|

|

CLOSING BALANCE 2021/22 |

ADOPTED RESERVE TRANSFERS 2022/23 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 26.4.2023 |

PROPOSED CHANGES for Council Resolution* |

BALANCE AS AT 30 APRIL 2023 |

|

Museum Acquisitions |

(39,378) |

10,000 |

15,000 |

|

(14,378) |

|

Net Zero Emissions |

(394,001) |

0 |

321,212 |

|

(72,790) |

|

Oasis Reserve |

(1,085,465) |

(63,900) |

428,554 |

|

(720,810) |

|

Parks & Recreation Projects |

(1,356,795) |

(33,906) |

706,822 |

|

(683,879) |

|

Parks Water |

0 |

(180,000) |

0 |

|

(180,000) |

|

Planning Legals |

(100,000) |

0 |

0 |

|

(100,000) |

|

Plant Replacement |

(4,335,819) |

(723,537) |

2,658,372 |

|

(2,400,984) |

|

Project Carryovers |

(3,098,056) |

0 |

3,098,056 |

|

0 |

|

Public Art |

(211,155) |

106,595 |

34,893 |

|

(69,667) |

|

Sister Cities |

(50,000) |

10,000 |

7,000 |

|

(33,000) |

|

Stormwater Drainage |

(158,178) |

0 |

48,000 |

|

(110,178) |

|

Strategic Real Property |

(766,176) |

0 |

(1,611,857) |

|

(2,378,032) |

|

Subdivision Tree Planting |

(368,640) |

20,000 |

0 |

|

(348,640) |

|

Unexpended External Loans |

(3,143,977) |

74,744 |

2,909,068 |

|

(160,165) |

|

Workers Compensation |

(211,112) |

|

50,963 |

|

(160,149) |

|

Total Internally Restricted |

(54,095,762) |

395,070 |

19,160,039 |

40,000 |

(34,500,653) |

|

|

|

|

|

|

|

|

Total Restricted |

(165,555,941) |

15,241,469 |

16,784,746 |

20,000 |

(133,469,726) |

|

|

|

|

|

|

|

|

Total Unrestricted |

(11,494,000) |

0 |

0 |

0 |

(11,494,000) |

|

|

|

|

|

|

|

|

Total Cash, Cash Equivalents, and Investments |

(177,049,941) |

15,241,469 |

16,784,746 |

60,000 |

(145,963,726) |

Investment Summary as at 30 April 2023

In accordance with Regulation 212 of the Local Government (General) Regulation 2021, details of Wagga Wagga City Council’s external investments are outlined below.

|

Institution |

Rating |

Closing

Balance |

Closing

Balance |

April |

April |

Investment |

Maturity |

Term |

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

155,168 |

263,158 |

3.60% |

0.13% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

11,907,655 |

6,745,088 |

3.60% |

3.21% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

17,136,071 |

17,188,371 |

3.65% |

8.17% |

N/A |

N/A |

N/A |

|

Macquarie Bank |

A+ |

9,237,462 |

9,261,634 |

3.40% |

4.40% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

38,436,355 |

33,458,251 |

3.57% |

15.90% |

|

|

|

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

CBA |

AA- |

2,000,000 |

0 |

0.00% |

0.00% |

20/04/2022 |

20/04/2023 |

12 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

3.68% |

0.95% |

8/06/2022 |

8/06/2023 |

12 |

|

AMP |

BBB |

1,000,000 |

1,000,000 |

4.70% |

0.48% |

15/11/2022 |

15/11/2023 |

12 |

|

AMP |

BBB |

2,000,000 |

2,000,000 |

4.55% |

0.95% |

30/11/2022 |

30/11/2023 |

12 |

|

CBA |

AA- |

1,000,000 |

1,000,000 |

4.69% |

0.48% |

30/01/2023 |

30/01/2024 |

12 |

|

Total Short Term Deposits |

|

8,000,000 |

6,000,000 |

4.31% |

2.85% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

1.20% |

0.95% |

4/01/2022 |

4/01/2024 |

24 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

3.78% |

0.48% |

1/06/2022 |

3/06/2024 |

24 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.32% |

0.95% |

28/06/2021 |

29/06/2026 |

60 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.80% |

0.95% |

15/11/2021 |

17/11/2025 |

48 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

2.15% |

0.48% |

8/07/2019 |

10/07/2023 |

48 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

2.03% |

0.95% |

6/11/2019 |

6/11/2024 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.83% |

0.95% |

28/11/2019 |

28/11/2024 |

60 |

|

Judo Bank |

BBB- |

1,000,000 |

1,000,000 |

1.30% |

0.48% |

3/12/2021 |

4/12/2023 |

24 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.75% |

0.48% |

6/01/2020 |

8/01/2024 |

48 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

2.00% |

0.48% |

28/02/2020 |

28/02/2025 |

60 |

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

2.20% |

0.48% |

1/04/2020 |

1/04/2025 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.85% |

0.48% |

29/05/2020 |

29/05/2025 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.86% |

0.48% |

1/06/2020 |

2/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.75% |

0.95% |

25/06/2020 |

25/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.75% |

0.95% |

25/06/2020 |

25/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.60% |

0.95% |

29/06/2020 |

28/06/2024 |

48 |

|

ICBC |

A |

3,000,000 |

3,000,000 |

5.07% |

1.43% |

30/06/2022 |

30/06/2027 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.42% |

0.95% |

7/07/2020 |

8/07/2024 |

48 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.50% |

0.95% |

17/08/2020 |

18/08/2025 |

60 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

1.25% |

0.48% |

7/09/2020 |

8/09/2025 |

60 |

|

BoQ |

BBB+ |

2,000,000 |

2,000,000 |

1.25% |

0.95% |

14/09/2020 |

15/09/2025 |

60 |

|

NAB |

AA- |

1,000,000 |

1,000,000 |

0.60% |

0.48% |

14/09/2021 |

14/09/2023 |

24 |

|

AMP |

BBB |

1,000,000 |

1,000,000 |

3.30% |

0.48% |

25/05/2022 |

27/11/2023 |

18 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.20% |

0.48% |

7/12/2020 |

8/12/2025 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

0.95% |

0.95% |

29/01/2021 |

29/01/2026 |

60 |

|

NAB |

AA- |

1,000,000 |

1,000,000 |

1.08% |

0.48% |

22/02/2021 |

20/02/2026 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

1.25% |

0.95% |

3/03/2021 |

2/03/2026 |

60 |

|

Summerland CU |

NR |

1,000,000 |

0 |

0.00% |

0.00% |

29/04/2021 |

28/04/2023 |

24 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

1.40% |

0.95% |

21/06/2021 |

19/06/2026 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

0.65% |

0.95% |

25/06/2021 |

26/06/2023 |

24 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.32% |

0.95% |

25/06/2021 |

25/06/2026 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.32% |

0.48% |

25/08/2021 |

25/08/2026 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

0.65% |

0.95% |

31/08/2021 |

31/08/2023 |

24 |

|

AMP |

BBB |

2,000,000 |

2,000,000 |

1.00% |

0.95% |

18/10/2021 |

17/10/2024 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.56% |

0.95% |

30/11/2021 |

29/11/2024 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

2.00% |

0.95% |

8/02/2022 |

10/02/2025 |

36 |

|

P&N Bank |

BBB |

2,000,000 |

2,000,000 |

2.40% |

0.95% |

9/03/2022 |

10/03/2025 |

36 |

|

P&N Bank |

BBB |

2,000,000 |

2,000,000 |

2.00% |

0.95% |

10/03/2022 |

11/03/2024 |

24 |

|

MyState |

BBB |

2,000,000 |

2,000,000 |

2.20% |

0.95% |

2/03/2022 |

3/03/2025 |

36 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

3.28% |

0.95% |

26/04/2022 |

26/04/2024 |

24 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

3.78% |

0.95% |

4/05/2022 |

6/05/2024 |

24 |

|

CBA |

AA- |

2,000,000 |

2,000,000 |

3.99% |

0.95% |

4/05/2022 |

5/05/2025 |

36 |

|

ING Bank |

A |

1,000,000 |

1,000,000 |

3.76% |

0.48% |

23/05/2022 |

23/05/2024 |

24 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

3.95% |

0.95% |

6/06/2022 |

6/06/2024 |

24 |

|

Australian Unity |

BBB+ |

2,000,000 |

2,000,000 |

4.15% |

0.95% |

8/06/2022 |

11/06/2024 |

24 |

|

Suncorp |

A+ |

2,000,000 |

2,000,000 |

4.40% |

0.95% |

22/06/2022 |

14/12/2023 |

18 |

|

MyState |

BBB |

2,000,000 |

2,000,000 |

4.45% |

0.95% |

29/06/2022 |

28/06/2024 |

24 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

4.50% |

0.48% |

7/07/2022 |

7/07/2025 |

36 |

|

CBA |

AA- |

1,000,000 |

1,000,000 |

4.25% |

0.48% |

12/08/2022 |

12/08/2025 |

36 |

|

P&N Bank |

BBB |

3,000,000 |

3,000,000 |

4.55% |

1.43% |

29/08/2022 |

29/08/2025 |

36 |

|

Australian Military Bank |

BBB+ |

2,000,000 |

2,000,000 |

4.55% |

0.95% |

2/09/2022 |

2/09/2025 |

36 |

|

P&N Bank |

BBB |

1,000,000 |

1,000,000 |

4.40% |

0.48% |

9/09/2022 |

9/09/2025 |

36 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

4.70% |

0.48% |

4/10/2022 |

4/10/2024 |

24 |

|

AMP |

BBB |

2,000,000 |

2,000,000 |

4.95% |

0.95% |

21/10/2022 |

21/10/2024 |

24 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

5.20% |

0.95% |

21/10/2022 |

21/10/2025 |

36 |

|

AMP |

BBB |

1,000,000 |

1,000,000 |

4.75% |

0.48% |

15/11/2022 |

14/11/2024 |

24 |

|

AMP |

BBB |

1,000,000 |

1,000,000 |

4.80% |

0.48% |

21/11/2022 |

20/11/2025 |

36 |

|

P&N Bank |

BBB |

2,000,000 |

2,000,000 |

4.75% |

0.95% |

16/12/2022 |

16/12/2024 |

24 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

5.04% |

0.95% |

15/02/2023 |

17/02/2025 |

24 |

|

Police Credit Union |

NR |

2,000,000 |

2,000,000 |

4.94% |

0.95% |

14/03/2023 |

14/03/2025 |

24 |

|

P&N Bank |

BBB |

2,000,000 |

2,000,000 |

5.00% |

0.95% |

14/03/2023 |

15/03/2027 |

48 |

|

Hume Bank |

BBB+ |

2,000,000 |

2,000,000 |

4.75% |

0.95% |

31/03/2023 |

31/03/2025 |

24 |

|

Auswide |

BBB |

0 |

2,000,000 |

4.95% |

0.95% |

13/04/2023 |

13/04/2026 |

36 |

|

P&N Bank |

BBB |

0 |

2,000,000 |

5.20% |

0.95% |

20/04/2023 |

20/04/2027 |

48 |

|

Total Medium Term Deposits |

|

104,000,000 |

107,000,000 |

2.90% |

50.86% |

|

|

|

|

Floating Rate Notes - Senior Debt |

|

|

|

|

|

|

|

|

|

Westpac |

AA- |

2,522,863 |

2,532,478 |

BBSW + 88 |

1.20% |

16/05/2019 |

16/08/2024 |

63 |

|

Suncorp |

A+ |

1,258,965 |

1,250,911 |

BBSW + 78 |

0.59% |

30/07/2019 |

30/07/2024 |

60 |

|

ANZ |

AA- |

2,012,563 |

2,020,654 |

BBSW + 77 |

0.96% |

29/08/2019 |

29/08/2024 |

60 |

|

HSBC |

AA- |

2,502,928 |

2,513,316 |

BBSW + 83 |

1.19% |

27/09/2019 |

27/09/2024 |

60 |

|

ANZ |

AA- |

1,516,810 |

1,507,574 |

BBSW + 76 |

0.72% |

16/01/2020 |

16/01/2025 |

60 |

|

NAB |

AA- |

2,020,565 |

2,009,447 |

BBSW + 77 |

0.96% |

21/01/2020 |

21/01/2025 |

60 |

|

Newcastle Permanent |

BBB |

1,104,663 |

1,109,007 |

BBSW + 112 |

0.53% |

4/02/2020 |

4/02/2025 |

60 |

|

Macquarie Bank |

A+ |

2,010,277 |

2,018,439 |

BBSW + 84 |

0.96% |

12/02/2020 |

12/02/2025 |

60 |

|

BOQ Covered |

AAA |

555,832 |

557,842 |

BBSW + 107 |

0.27% |

14/05/2020 |

14/05/2025 |

60 |

|

Credit Suisse |

A+ |

1,299,421 |

1,308,316 |

BBSW + 115 |

0.62% |

26/05/2020 |

26/05/2023 |

36 |

|

UBS |

A+ |

1,503,186 |

1,493,719 |

BBSW + 87 |

0.71% |

30/07/2020 |

30/07/2025 |

60 |

|

Bank of China Australia |

A |

1,508,140 |

1,498,294 |

BBSW + 78 |

0.71% |

27/10/2020 |

27/10/2023 |

36 |

|

CBA |

AA- |

2,002,620 |

1,995,086 |

BBSW + 70 |

0.95% |

14/01/2022 |

14/01/2027 |

60 |

|

Rabobank |

A+ |

1,996,958 |

1,987,481 |

BBSW + 73 |

0.94% |

27/01/2022 |

27/01/2027 |

60 |

|

Newcastle Permanent |

BBB |

982,112 |

987,394 |

BBSW + 100 |

0.47% |

10/02/2022 |

10/02/2027 |

60 |

|

NAB |

AA- |

2,391,482 |

2,404,758 |

BBSW + 72 |

1.14% |

25/02/2022 |

25/02/2027 |

60 |

|

Bendigo-Adelaide |

BBB+ |

1,653,256 |

1,659,844 |

BBSW + 98 |

0.79% |

17/03/2022 |

17/03/2025 |

36 |

|

ANZ |

AA- |

2,013,960 |

2,027,459 |

BBSW + 97 |

0.96% |

12/05/2022 |

12/05/2027 |

60 |

|

NAB |

AA- |

1,714,749 |

1,722,881 |

BBSW + 90 |

0.82% |

30/05/2022 |

30/05/2025 |

36 |

|

Suncorp |

A+ |

905,329 |

908,732 |

BBSW + 93 |

0.43% |

22/08/2022 |

22/08/2025 |

36 |

|

ANZ |

AA- |

2,542,756 |

2,559,690 |

BBSW + 120 |

1.22% |

4/11/2022 |

4/11/2027 |

60 |

|

NAB |

AA- |

2,536,425 |

2,551,938 |

BBSW + 120 |

1.21% |

25/11/2022 |

25/11/2027 |

60 |

|

Suncorp |

A+ |

1,110,388 |

1,114,807 |

BBSW + 125 |

0.53% |

14/12/2022 |

14/12/2027 |

60 |

|

CBA |

AA- |

2,033,676 |

2,024,896 |

BBSW + 115 |

0.96% |

13/01/2023 |

13/01/2028 |

60 |

|

Bank Australia |

BBB |

1,908,806 |

1,921,728 |

BBSW + 155 |

0.91% |

22/02/2023 |

22/02/2027 |

48 |

|

Total Floating Rate Notes - Senior Debt |

|

43,608,729 |

43,686,692 |

|

20.76% |

|

|

|

|

Fixed Rate Bonds |

|

|

|

|

|

|

|

|

|

ING Covered |

AAA |

673,574 |

677,430 |

1.10% |

0.32% |

19/08/2021 |

19/08/2026 |

60 |

|

Northern Territory Treasury |

AA- |

3,000,000 |

3,000,000 |

1.00% |

1.43% |

24/08/2021 |

16/12/2024 |

40 |

|

Northern Territory Treasury |

AA- |

3,000,000 |

3,000,000 |

1.50% |

1.43% |

24/08/2021 |

15/12/2026 |

64 |

|

BoQ |

BBB+ |

1,754,235 |

1,741,714 |

2.10% |

0.83% |

27/10/2021 |

27/10/2026 |

60 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.50% |

0.95% |

6/08/2021 |

15/12/2026 |

64 |

|

Northern Territory Treasury |

AA- |

1,000,000 |

1,000,000 |

1.50% |

0.48% |

14/07/2021 |

15/12/2026 |

65 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.30% |

0.95% |

29/04/2021 |

15/06/2026 |

61 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.00% |

0.95% |

30/11/2020 |

15/12/2025 |

60 |

|

Northern Territory Treasury |

AA- |

1,000,000 |

1,000,000 |

1.00% |

0.48% |

20/11/2020 |

15/12/2025 |

61 |

|

Northern Territory Treasury |

AA- |

2,000,000 |

2,000,000 |

1.00% |

0.95% |

21/10/2020 |

15/12/2025 |

62 |

|

Total Fixed Rate Bonds |

|

18,427,809 |

18,419,144 |

1.30% |

8.75% |

|

|

|

|

Managed Funds |

|

|

|

|

|

|

|

|

|

NSW Tcorp |

NR |

1,815,443 |

1,837,304 |

1.20% |

0.87% |

17/03/2014 |

1/04/2028 |

168 |

|

Total Managed Funds |

|

1,815,443 |

1,837,304 |

1.20% |

0.87% |

|

|

|

|

TOTAL CASH ASSETS, CASH |

|

214,288,336 |

210,401,391 |

|

100.00% |

|

|

|

|

LESS: RIVERINA REGIONAL LIBRARY (RRL) CASH AT BANK |

|

2,451,399 |

2,476,324 |

|

|

|

|

|

|

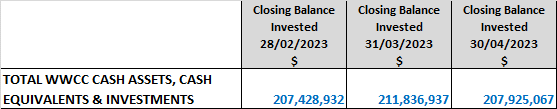

TOTAL WWCC CASH ASSETS, CASH |

|

211,836,937 |

207,925,067 |

|

|

|

|

|

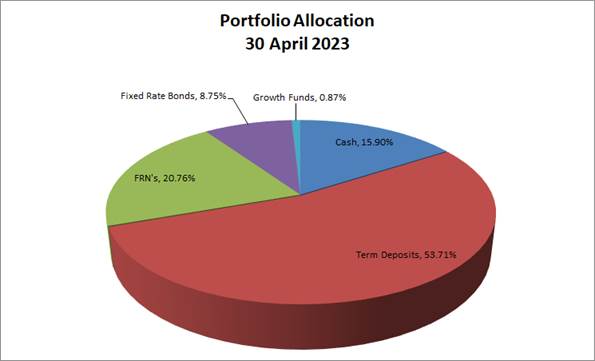

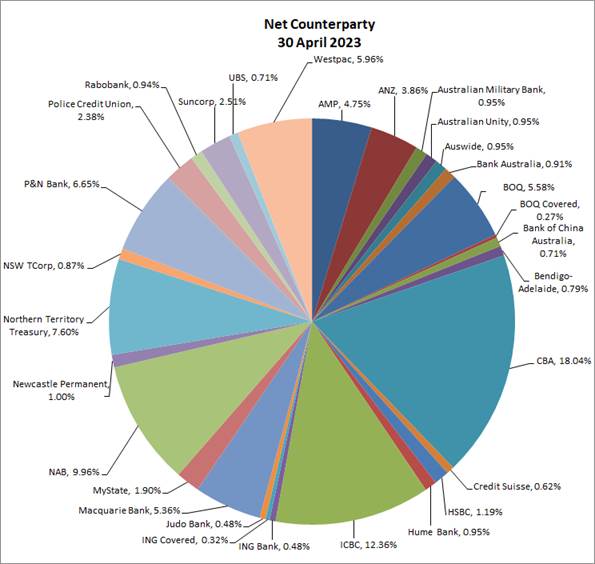

Council’s investment portfolio is dominated by Term Deposits, equating to approximately 54% of the portfolio across a broad range of counterparties. Cash equates to 16%, with Floating Rate Notes (FRNs) around 20%, fixed rate bonds around 9% and growth funds around 1% of the portfolio.

Council’s investment portfolio is well diversified in complying assets across the entire credit spectrum. It is also well diversified from a rating perspective. Credit quality is diversified and is predominately invested amongst the investment grade Authorised Deposit-Taking Institutions (ADIs) (being BBB- or higher), with a smaller allocation to unrated ADIs.

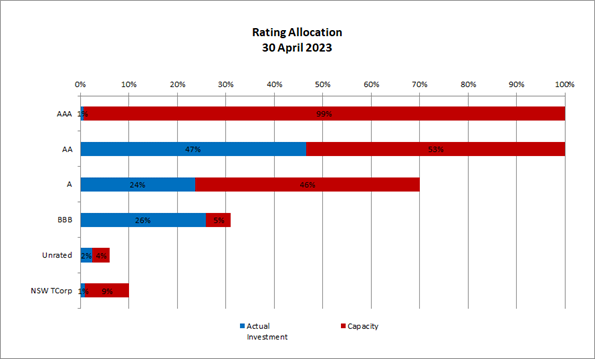

All investments are within the defined Policy limits, as outlined in the Rating Allocation chart below:

Investment Portfolio Balance

Council’s investment portfolio balance has decreased over the past month, down from $211.84M to $207.93M.

Monthly Investment Movements

Redemptions/Sales – Council redeemed the following investment securities during April 2023:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

CBA (AA-) Term Deposit |

$2M |

12 months |

2.22% |

This term deposit was redeemed on maturity and funds were reinvested in a new 4-year P&N Bank term deposit (see below). |

|

Summerland Credit Union (Unrated) Term Deposit |

$1M |

2 years |

0.75% |

This term deposit was redeemed on maturity due to poor reinvestment rates being offered. |

New Investments – Council purchased the following investment securities during April 2023:

|

Institution and Type |

Amount |

Investment Term |

Interest Rate |

Comments |

|

Auswide Bank (BBB) Term Deposit |

$2M |

3 years |

4.95% |

The Auswide Bank rate of 4.95% compared favourably to the rest of the market for this term. The next best rate for this term was 4.65%. |

|

P&N Bank (BBB) Term Deposit |

$2M |

4 years |

5.20% |

The P&N Bank rate of 5.20% compared favourably to the rest of the market for this term. The next best rate for this term was 4.80%. |

Rollovers – Council did not rollover any investment securities during April 2023.

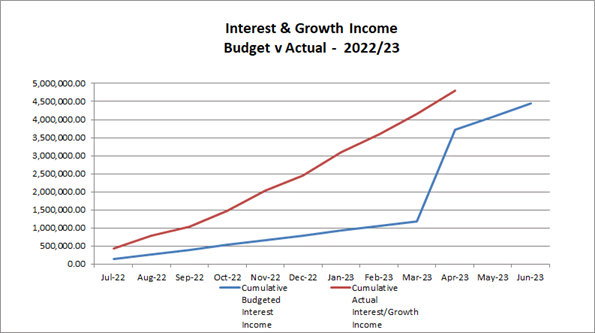

Monthly Investment Performance

Interest/growth/capital gains/(losses) for the month totalled $638,329, which compares favourably with the revised budget for the period of $371,198 - outperforming budget for the month by $267,131.

Council’s outperformance to budget for April is mainly due to better than budgeted returns on Councils investment portfolio. This is a result of the ongoing movements in the cash rate made by the Reserve Bank of Australia, with the latest increase in early May 2023 bringing the cash rate to 3.85% from a record low of 0.10% in April 2022. Council’s Floating Rate Note portfolio also experience a positive movement during the month of April, with the principal value of this portfolio increasing by $59,262 (or +0.14%).

Council experienced a positive return on its NSW T-Corp Managed Fund for the month of April, with the fund returning +1.20% (or $21,861) as international (+1.62%) and domestic (+1.85%) shares gained over the month.

Over the past year, Council’s investment portfolio has returned 2.53%, outperforming the AusBond Bank Bill index by 0.16%.

* The AusBond Bank Bill Index is the leading benchmark for the Australian fixed income market. It is interpolated from the RBA Cash rate, 1 month and 3-month Bank Bill Swap rates.

Report by Responsible Accounting Officer

I hereby certify that all of the above investments have been made in accordance with the provision of Section 625 of the Local Government Act 1993 and the regulations there under, and in accordance with the Investment Policy adopted by Council on 21 November 2022.

Carolyn Rodney

Responsible Accounting Officer

Policy and Legislation

Budget variations are reported in accordance with Council’s POL 052 Budget Policy.

Investments are reported in accordance with Council’s POL 075 Investment Policy.

Local Government Act 1993

Section 625 - How may councils invest?

Local Government (General) Regulation 2021

Section 212 - Reports on council investments

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

This report is a control mechanism that assists in addressing the following potential risks to Council:

· Loss of investment income or capital resulting from ongoing management of investments, especially during difficult economic times

· Failure to demonstrate to the community that its funds are being expended in an efficient and effective manner

Internal / External Consultation

All relevant areas within Council have consulted with the Finance Division in relation to the budget variations listed in this report.

The Finance Division has consulted with relevant external parties to confirm Council’s investment portfolio balances.

|

1⇩. |

Capital Works Program 2022/23 to 2032/33 |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 22 May 2023 |

RP-5 |

RP-5 REVIEW OF FINANCE POLICIES - PROPOSED ADOPTION

Author: Carolyn Rodney

|

Summary: |

Council’s policies have a review period with the three Finance Policies noted in this report due to be reviewed and any amendments to be approved by Council. The Community Organisations Management Policy, Financial Assistance Policy and the Financial Hardship Policy are now presented to Council for endorsement, following public exhibition. |

|

That Council: a note that there were no public submissions received during the public exhibition period for the POL 010 - Community Organisations Management Policy and the POL 078 - Financial Assistance Policy, b note the one public submission received for the POL 102 – Financial Hardship – Payment Arrangements and Waiving of Interest Policy c adopt the following revised policies: i POL 010 - Community Organisations Management Policy ii POL 078 - Financial Assistance Policy iii POL 102 - Financial Hardship – Payment Arrangements and Waiving of Interest Policy |

Report

Council, at its 13 March 2023 Council meeting, resolved to place the draft Loans to Community Organisations Management Policy (POL 010), Financial Assistance Policy (POL 078) and the Financial Hardship Policy (POL 102) on public exhibition for a period of 28 days from 17 March 2023 to 14 April 2023 and invited public submissions until 28 April 2023.

During the public exhibition and submission period, no public submissions were received for the Community Organisations Management Policy and the Financial Assistance Policy, with one public submission received for the Financial Hardship - Payment Arrangements and Waiving of Interest Policy, which was a short submission consisting of a comment that “the current environment to make payments is hard.”

It is now recommended that Council adopt the Loans to Community Organisations Management Policy (POL 010), Financial Assistance Policy (POL 078) and the Financial Hardship Policy (POL 102) as exhibited.

Financial Implications

As outlined in the Report

Policy and Legislation

Loans to Community Organisations Management Policy (POL 010)

Financial Assistance Policy (POL 078)

Financial Hardship - Payment Arrangements and Waiving of Interest Policy (POL 102)

Link to Strategic Plan

Community leadership and collaboration

Objective: Our community is informed and actively engaged in decision making and problem-solving to shape the future of Wagga Wagga

Communicate with our community

Risk Management Issues for Council

Council policies are essential to ensure transparent legal, fair and consistent decision-making across the Council. They support Council in achieving its corporate objectives and provide a critical guide for staff, Councillors and other stakeholders in decision-making. In the absence of effective policies there is a greater risk of inconsistency, confusion and inefficiency.

Internal / External Consultation

Consultation has been held internally across Council with relevant parties.

Given the financial and public transparent nature of these draft policies, the Audit, Risk and Improvement Committee (ARIC), reviewed and endorsed the draft policies as attached at their meeting on 23 February 2023.

The draft policies were placed on public exhibition for 28 days from 17 March 2023 to 14 April 2023 and open for public submissions until 28 April 2023 through media and community engagement mechanisms as outlined below.

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Connect.Wagga |

Email newsletter |

Social media |

Website |

|

|

Inform |

|

|

|

x |

|

|

|

|

|

|

|

|

x |

|

|

x |

|

Consult |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Involve |

|

|

|

|

|

|

|

|

||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1⇩. |

Draft Loans to Community Organisations Management Policy (POL 010) |

|

|

2⇩. |

Draft Financial Assistance Policy (POL 078) |

|

|

3⇩. |

Draft Financial Hardship Policy (POL 102) |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 22 May 2023 |

RP-6 |

RP-6 NSW LIBRARIES ASSOCIATION (NSWPLA) SWITCH 2023 CONFERENCE AND ANNUAL GENERAL MEETING

Author: Madeleine Scully

Executive: Janice Summerhayes

|

Summary: |

Endorse representation and appointment one Councillor to attend the NSW Public Libraries Association (NSWPLA) SWITCH 2022 Conference being held in Penrith 14 - 17 November 2023. |

|

That Council: a be represented at the NSW Public Libraries Association (NSWPLA) SWITCH 2022 Conference and Annual General Meeting, to be held in Penrith on 14-17 November 2023 b appoints one Councillor as Council’s delegate to attend the conference |

Report

Switch 2023 will be held at the Western Sydney Conference Centre in Penrith NSW. The conference theme in 2023 is Equality, Inclusion, Diversity. On Tuesday 14 November 2023 there will be an evening Welcome Reception. Traditionally the Welcome Reception marks the opening of the Conference, and it will include the announcement of the successful nominations for the 2023 Scholarships and Awards program. This will be followed by the SWITCH 2023 Conference program on Wednesday and Thursday. The NSWPLA Annual General Meeting will be held on the morning of Friday 17 November 2023.

The annual SWITCH conference is a forum in NSW for Councillors, Council Officers and Library staff to assemble for professional development. The conference provides an important opportunity for delegates to learn about contemporary practices and offers a platform for networking with colleagues and extending contacts and partnerships beyond the boundaries of the local South-West Zone of the Association.

The NSWPLA Annual General Meeting will be held during the conference and provides an important platform for discussions surrounding the lobbying and advocacy work of the Association. These matters are particularly relevant to the role of councillors in the work of NSWPLA.

Financial Implications

The cost for attendance of one Councillor at the conference is $825 plus GST (early bird rate). The conference and accommodation costs will be funded from the Councillors’ Conference and travelling budget which has $30,000 for the 2023/24 financial year, with nil expenditure committed to date for the 2023/245 financial year.

Policy and Legislation

POL-025 – Payment of Expenses and Provision of Facilities to Councillors.

Link to Strategic Plan

Community leadership and collaboration

Objective: Our community is informed and actively engaged in decision making and problem-solving to shape the future of Wagga Wagga

Ensure our community feels heard and understood

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 22 May 2023 |

RP-7 |

RP-7 DRAFT ELECTRIC VEHICLE CHARGING INFRASTRUCTURE ON PUBLIC LAND POLICY (POL 054)

Author: Carly Hood

Executive: Janice Summerhayes

|

Summary: |

This report provides a draft ‘Electric Vehicle Charging on Public Land’ Policy (the Policy) for endorsement to be placed on public exhibition. |

|

That Council: a endorse the draft ‘Electric Vehicle Charging Infrastructure on Public Land’ Policy (POL 054) to be placed on public exhibition for a period of 28 days from 27 May 2023 to 24 June 2023 and invite public submissions until 8 July 2023 on the draft policies b receive a further report following the public exhibition and submission period: i addressing any submissions made with respect to the proposed ‘Electric Vehicle Charging Infrastructure on Public Land’ Policy ii proposing adoption of the Policy unless there are any recommended amendments deemed to be substantial and requiring a further public exhibition period |

Report

At its ordinary meeting on 7 November 2022 Council resolved to:

a note the information provided in the report

b prepare an EV charging on public land policy as detailed in the report

c endorse participation in the NSW Destination EV Charging Grants

d approve the budget variation/s as detailed in the Financial Implications section of the report

Background

Demand for electric vehicles (EVs) in Australia has grown, with the EV market share increasing by 65% in 2022 to 3.4% of new light vehicle car sales (EV Council, 2022). In 25 years, it is highly likely that virtually all new passenger vehicles sold in Australia will be electric vehicles, with many global car manufacturers committing to exiting the Internal Combustion Engine market.

There are numerous businesses that have established commercial models where they provide and fund EV infrastructure and cover their costs by charging vehicle users. This provides an opportunity to increase the required infrastructure that is funded by EV users, as well as State and Commonwealth grants, rather than by ratepayers generally. Council strongly encourages the uptake of chargers on private land through private investment, however the scope of this Policy relates specifically to publicly available EV charging infrastructure on Council owned and controlled land (including Crown Land).

Given the complex and dynamic space of transport electrification, an overview of the various government initiatives is provided below for additional background and context.

Federal Government actions on vehicle uptake

The Federal Government has the most influence in driving an increase in the supply of electric vehicles. The National Electric Vehicle Strategy has seen the introduction of an electric car discount, which includes removal of import duty taxes for EVs. Additionally, this policy includes the removal of the Fringe Benefit Tax for fleet vehicles. A more modern national fuel efficiency standard would also be a powerful driver in EV adoption.

NSW Government actions on vehicle uptake

As part of the NSW Electric Vehicle Strategy the Government is providing rebates of $3000 for the first 25,000 EVs sold in NSW (for under $68,750). These rebates are designed to encourage EV uptake and are targeted to the cars more people can afford.

The NSW Government has also removed stamp duty from EVs under $78,000 (purchased after 1 September 2021) and from all other EVs and plug-in hybrids from 1 July 2027 or when EVs make up at least 30% of new car sales, at which time a road user charge will also be introduced.

Federal Government actions on grid infrastructure