Agenda

and

Business Paper

To be held on

Monday 16

December 2024

at 6.00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

Agenda

and

Business Paper

To be held on

Monday 16

December 2024

at 6.00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

NOTICE OF MEETING

The proceedings of all Council meetings in open session, including all debate and addresses by the public, are recorded (audio visual) and livestreamed on Council’s website including for the purpose of facilitating community access to meetings and accuracy of the Minutes.

In addition to webcasting council meetings, audio recordings of confidential sessions of Ordinary Meetings of Council are also recorded, but do not form part of the webcast.

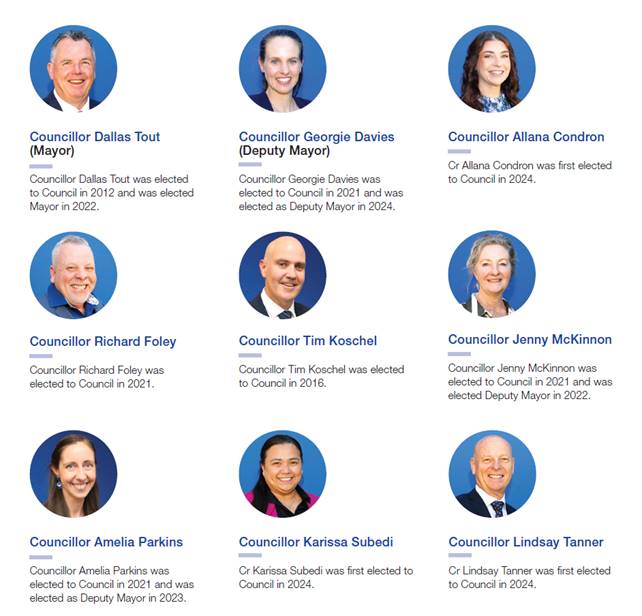

WAGGA WAGGA CITY COUNCILLORS

STATEMENT OF ETHICAL OBLIGATIONS

Councillors are reminded of their Oath or Affirmation of Office made under Section 233A of the Local Government Act 1993 and their obligation under Council’s Code of Conduct to disclose and appropriately manage Conflicts of Interest.

QUORUM

The quorum for a meeting of the Council, is a majority of the Councillors of the Council, who hold office for the time being, who are eligible to vote at the meeting.

Reports submitted to the Ordinary Meeting of Council to be held on Monday 16 December 2024.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 16 December 2024

CLAUSE PRECIS PAGE

ACKNOWLEDGEMENT OF COUNTRY 3

REFLECTION 3

APOLOGIES 3

Confirmation of Minutes

CM-1 ORDINARY COUNCIL MEETING - 25 NOVEMBER 2024 3

DECLARATIONS OF INTEREST 3

Mayoral Minutes

MM-1 MAYORAL MINUTE - TOLLAND RENEWAL PROJECT - COMPULSARY ACQUISITION 4

MM-2 MAYORAL MINUTE - WAGGA AIRPORT 8

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE

OF MOTION - INVESTIGATING REGULATION OF FACIAL

RECOGNITION & CONSUMER PROFILING TECHNOLOGIES 10

Councillor Report

CR-1 DELEGATE REPORT - LGNSW CONFERENCE 2024 12

Reports from Staff

RP-1 Amendment to the Wagga Wagga Local Infrastructure Contributions Plan and 12 Blake Street, Wagga Wagga DA19/0125 Works in Kind Agreement 14

RP-2 ONE-OFF CAPITAL WORKS PROGRAM RESET 73

RP-3 JIM ELPHICK TENNIS CENTRE AND WAGGA WORKOUT FEES AND CHARGES 86

RP-4 FINANCIAL PERFORMANCE REPORT AS AT 30 NOVEMBER 2024 101

RP-5 PROPOSED MEMORANDUM OF UNDERSTANDING BETWEEN COUNCIL AND THE WAGGA WAGGA SHOW SOCIETY 119

RP-6 QUESTIONS WITH NOTICE 131

Committee Minutes

M-1 LOCAL TRAFFIC COMMITTEE MINUTES - 14 NOVEMBER 2024 135

M-2 FLOODPLAIN RISK MANAGEMENT ADVISORY COMMITTEE - 7 NOVEMBER 2024 143

Confidential Mayoral Minutes

MM-CONF-1 MAYORAL MINUTE - electricity supply infrastructure ON PUBLIC land 154

Confidential Reports

CONF-1 2024/25 PAVEMENT IN-SITU STABILISATION AND ASPHALT WEARING COURSE PROGRAM 155

CONF-2 RFT CT2025023 KILLICK'S BRIDGE REPLACEMENT DESIGN & CONSTRUCT 156

CONF-3 PROPOSED LEASE FROM AUSTRALIAN RAIL TRACK CORPORATION - URANQUINTY REST STOP 157

CONF-4 TECHNOLOGYONE ENTERPRISE RESOURCE PLANNING (ERP) SOFTWARE SOLUTION – DIRECT NEGOTIATIONS 158

Wagga Wagga City Council acknowledges the traditional custodians of the land, the Wiradjuri people, and pays respect to Elders past, present and future and extends our respect to all First Nations Peoples in Wagga Wagga.

We recognise and respect their cultural heritage, beliefs and continuing connection with the land and rivers. We also recognise the resilience, strength and pride of the Wiradjuri and First Nations communities

REFLECTION

Councillors, let us in silence reflect upon our responsibilities to the community which we represent, and to all future generations and faithfully, and impartially, carry out the functions, powers, authorities and discretions vested in us, to the best of our skill and judgement.

CM-1 ORDINARY COUNCIL MEETING - 25 NOVEMBER 2024

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 25 November 2024 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - Ordinary Council Meeting - 25 November 2024. |

159 |

|

Report submitted to the Ordinary Meeting of Council on Monday 16 December 2024 |

MM-1 |

Mayoral Minute

MM-1 MAYORAL MINUTE - TOLLAND RENEWAL PROJECT - COMPULSARY ACQUISITION

|

Summary: |

Since the last update to Council on 27 May 2024, Council staff have continued to collaborate with Homes NSW and the Department of Planning, Housing and Infrastructure (DPHI) to progress the Tolland Renewal Project. Since May, the Concept Masterplan has been adopted, the State Assessed Planning Proposal (SAPP) has been gazetted by DPHI, and the Development Control Plan (DCP) is under consideration by Council’s Development Assessment team.

This Council report provides an update on the acquisition of Council land by Homes NSW that will unlock key parts of the Tolland Estate for renewal. Homes NSW is seeking Council to enter into a section 29 agreement under the Land Acquisition (Just Terms Compensation) Act 1991 with Council and Homes NSW agreeing to all terms of the proposed acquisition, to enact the acquisition of land.

Council has obtained legal advice that Council can legally take part in the section 29 agreement process, addressing previous Council concerns regarding its obligations under the Local Government Act 1993. A decision is sought from Council to enter into the section 29 process to enable the formal process around the acquisition of land to occur. |

That Council:

a agree to enter into an agreement with Homes NSW under section 29 of the Land Acquisition (Just Terms Compensation) Act 1991 (the Just Terms Act) to compulsorily acquire Council land within the Tolland Estate

b delegate to the General Manager or their delegate the signing of relevant documentation under section 29 of the Land Acquisition (Just Terms Compensation) Act 1991 (the Just Terms Act) for Homes NSW to compulsorily acquire Council land within the Tolland Estate

Report

The General Manager has requested that this report be presented as a Mayoral Minute due to the time between now and the next Council Meeting.

Background

The original Tolland Estate was developed and built between the 1970s and 1990s. It comprises a large number of properties owned by Homes NSW (formerly the NSW Land and Housing Corporation and Aboriginal Housing Office), as well as private dwellings, parcels of vacant land, a community centre, Red Hill Public School, OneSchool Global NSW – Wagga Wagga, and Wagga Wagga Brethren Church.

Over time, there have been growing concerns regarding the social housing stock located in Tolland – it is no longer fit-for-purpose and has significant maintenance issues for Homes NSW. The Tolland Renewal Project seeks to deliver a mix of new social, affordable and private housing fit for the needs of residents, improved green spaces such as parks and outdoor communal areas, increased road connectivity and pathways, and increased recognition of Tolland’s First Nations history.

The amount of private, social and affordable housing dwellings to be delivered in the project is identified in Table 1 below.

|

Type of Housing |

Number of dwellings |

|

Private housing |

270 private lots and 22 private dwellings in Tolland |

|

Social housing and Affordable housing |

200 dwellings in Tolland |

|

84 social dwellings in Wagga LGA |

|

|

Net increase in social and affordable dwellings |

65 additional dwellings in Wagga LGA |

Tolland Renewal Project elements

The Tolland Renewal Project is a complex, multi-faceted project, with multiple planning and non-planning elements required to deliver the desired outcomes. The separate, but interrelated, elements of the Tolland Estate Renewal are:

· The Concept Masterplan

· Development controls

· The Planning Agreement

· Acquisition of Council-owned land

· The Planning Proposal

As part of the proposal, Homes NSW has proposed to enter into a ‘land swap’ arrangement with Council. This would include Council transferring to Homes NSW (free of charge) some of its community land, including open space and dedicated road parcels on the basis that Homes NSW will dedicate an equivalent area of embellished open space back to Council as part of the renewal process.

Homes NSW has advised that in order to facilitate the proposed acquisitions they would like to use section 29 of the Land Acquisition (Just Terms Compensation) Act 1991 (the Just Terms Act) as the basis of an acquisition from Council. Section 29(4) of the Just Terms Act provides that if both parties agree to all terms of the proposed acquisition, the requirements under Division 1 Pre-acquisition procedures and Part 3 Compensation for acquisition of land do not apply to the acquisition process . Homes NSW is seeking to utilise this provision because, if the owner of the land has agreed to all relevant matters concerning the compulsory acquisition (including the compensation to be paid, if any), Homes NSW would not have to comply with certain aspects of the Just Terms Act (such as statutory timeframes).

Council staff have previously raised concern that entering into a Section 29 agreement with Homes NSW for the acquisition of community land would breach Council’s obligations under the Local Government Act 1993, as it would effectively dispose of the land.

Council sought independent legal advice from both Lindsay Taylor Lawyers and Malcolm Craig KC in relation to this issue and was advised that consenting (‘agreement’) to Homes NSW’s exercise of its compulsory acquisition powers would not be considered a disposal for the purposes of the Local Government Act 1993. This means Council can enter into a Section 29 agreement with Homes NSW for the compulsory acquisition of land.

On the basis of this legal advice and recognising the social and community significance of the Tolland Renewal Project in delivering a range of social and market housing, it is recommended that Council agree to enter into a section 29 agreement with Homes NSW.

Financial Implications

Policy and Legislation

Wagga Wagga Local

Strategic Planning Statement

Developer Infrastructure Agreements Policy (POL121)

Wagga Wagga Local Infrastructure Contributions Plan 2019 – 2034

Environmental Planning and Assessment Act 1979 (particularly Section 7.4)

Land Acquisition (Just Terms Compensation) Act 1991

Local Government Act 1993

Link to Strategic Plan

The Environment

Objective: Future growth and development of Wagga Wagga is planned for in a sustainable manner

Provide for a diversity of housing that meets our needs

Risk Management Issues for Council

Council officers have previously raised concerns over the proposed use of a Section 29 agreement to facilitate Homes NSW’s compulsory acquisition of Council-owned land. The use of compulsory acquisition powers means that the community will not

have had an opportunity to be consulted on the fact that all open space and some of the road parcels within the Tolland Renewal Area will be acquired, as would have been required if Homes NSW lodged a reclassification planning proposal.

It is noted that since 2022, Homes NSW has consulted extensively with the Tolland community in relation to the draft masterplan and rezoning process, distributing over 3,100 letters, newsletter and other supporting materials to owners, tenants and residents. In addition, 9 drop-in sessions were held at the Tolland Community Centre between December 2022 and February 2024. A copy of the Homes NSW Community Engagement Report is provided at Attachment 2. However, this consultation did not specifically advise that Homes NSW would be acquiring all community land and some roads from Council.

If members of the community raised objection to the acquisition, Council has agreed to the acquisition, and therefore has actively participated in that process. It is Council, not Homes NSW, who bears any legal liability if there are allegations of breaching the Local Government Act 1993.

|

Report submitted to the Ordinary Meeting of Council on Monday 16 December 2024 |

MM-2 |

MM-2 MAYORAL MINUTE - WAGGA AIRPORT

|

Summary: |

With the Federal election coming it is critical that we seek a commitment from the Member for Riverina, the Hon. Michael McCormack MP and other candidates regarding the Wagga Airport terminal and lease. |

That Council:

a write to the Member for Riverina, the Hon. Michael McCormack MP, and request that if the coalition government is elected in 2025, they will;

i honour the commitment made at the 2022 Federal Election to fund a new Wagga Airport to at least the sum of the commitment made in 2022, and

ii ensure that the Wagga Airport is not privatised and that a 50 + 49 year lease is granted to Wagga Wagga City Council at a nominal rental

b write to all other candidates in the upcoming election seeking their commitment for the Airport Terminal and lease

Report

During the Federal election in 2022, the Member for Riverina, the Hon. Michael McCormack MP pledged $20 million to revamp the Wagga Wagga Airport if the coalition was returned to Government.

Michael McCormack was re-elected but the coalition Government was not.

Although the Federal election date is not yet announced it will be in the first 6 months of next year. As a community we are no further advanced in relation to upgrading our Airport terminal which is owned by the Federal Government.

Mr McCormack has not yet made any election commitments and the purpose of this Mayoral Minute is to ensure that he, and the coalition, have plenty of notice to recommit to their 2022 promise of renewing the Wagga Airport.

Since the election, Council was advised that the lease of the Airport would be advertised in a public expression of interest process with a view to privatising the Airport. This process has been halted pending discussion between Council and Defence. These discussions are positive however there is not yet any commitment to the renewal of the lease.

For these reasons Council should write to Mr McCormack and all other candidates in the upcoming election seeking a commitment regarding the Airport terminal and lease.

Financial Implications

N/A

Policy and Legislation

Wagga Wagga City Council Code of Meeting Practice

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga has strong community leadership and a shared vision for the future

Plan long term for the future of Wagga Wagga

|

Report submitted to the Ordinary Meeting of Council on Monday 16 December 2024 |

NOM-1 |

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - INVESTIGATING

REGULATION OF FACIAL

RECOGNITION & CONSUMER PROFILING TECHNOLOGIES

Author: Councillor Richard Foley

|

Summary: |

This Notice of Motion is for Council to acknowledge the privacy and ethical concerns raised by community members surrounding the use of facial recognition and consumer profiling technologies. |

That Council:

a acknowledges privacy, ethical and wider community concerns surrounding the use of facial recognition and consumer profiling technologies (FRT and CPT) in commercial public spaces

b receives a report within six months that explores how Council can respond to these challenges within its existing powers (if any), including but not limited to the development of policy frameworks and/or implementation of conditions on developments

c advocates to State and Federal Governments for stronger consumer protections, including transparency and opt-out provisions for FRT and CPT, by requesting the Mayor write to our local members and the relevant State and Federal Ministers in relation to this matter

Report

Facial recognition technology (FRT) and consumer profiling technology (CPT) are becoming increasingly prevalent in commercial spaces. However, their use raises significant privacy, ethical, and transparency concerns. These technologies collect and analyse personal data, often without clear consent or public understanding, which can undermine trust and create perceptions of intrusive surveillance.

While Wagga Wagga City Council’s jurisdiction over privacy laws is limited, the Council has a responsibility to protect the welfare of its community and promote transparent and ethical business practices. A comprehensive report is required to explore how the Council can respond to these challenges within its existing powers, including the development of policy frameworks and implementation of conditions on developments.

Additionally, the Council can advocate for stronger protections at the state and federal levels, such as mandatory opt-out mechanisms and stricter consumer safeguards, recognising that these technologies are primarily regulated by higher levels of government.

By taking these steps, Wagga Wagga City Council can lead by example, addressing community concerns while fostering a culture of accountability and trust in how emerging technologies are used. This approach balances the need for innovation with the protection of fundamental rights, ensuring that the community’s privacy and values are upheld.

Financial Implications

There are financial implications within this report.

Policy and Legislation

Wagga Wagga Code of Meeting Practice

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga has strong community leadership and a shared vision for the future

Our leaders represent our community

|

Report submitted to the Ordinary Meeting of Council on Monday 16 December 2024 |

CR-1 |

Councillor Report

CR-1 DELEGATE REPORT - LGNSW CONFERENCE 2024

Author: Councillor Allana Condron and Jenny MCKinnon and the Mayor Councillor Dallas Tout

That Council receive and note the report.

Report

The purpose of the 2024 LGNSW Conference was to provide opportunity for councillors to come together to share ideas and debate issues that shape the way LGNSW is governed and advocates on behalf of the local government sector. Those who were voting delegates in attendance played a key role in voting on motions that have been put forward by other Councils across NSW.

The full agenda can be found on the website.

There were several motions of interest for councillors in attendance, those of which included motions such as the proposed Model Code of Conduct. The vast variety of motions put forth at the conference also provided for insight into the priorities, and in particular, concerns of other neighbouring councils, as well as councils operating in metropolitan areas.

The conference provided great benefit in not only connecting councillors to other councillors and government professionals, creating support networks across the NSW Local Government sector, but also a great opportunity for in particular new councillors to understand the roles and responsibilities of council and councillors as a whole, and where best to seek support whilst undertaking their duties of office this term.

On the Friday prior to the conference the Premier announced the creation of the Housing Development Authority. This was announced with no prior discussions or consultations and of even more concern no consultation with the peak body Local Government NSW.

The creation of this authority was of such concern to all Councils due to the lack of any detail at all that an existing board motion was amended to reflect the opinion of Councils. The wording being “That LGNSW and Councils across the state condemn the NSW Governments 15 November 2024 announcement that I will bypass councils and communities with a new spot-rezoning and state approval pathway, which will deliver windfall gains for developers while removing safeguards that protect communities from inappropriate development.”

This motion was moved by Wagga Wagga council. The agreement in the conference was such that there was no opposition and it was passed unanimously by all Councils in attendance.

Financial Implications

N/A

Policy and Legislation

Code of Conduct 2022

Councillor Expenses and Facilities Policy POL 025

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga has strong community leadership and a shared vision for the future

Our leaders represent our community

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 16 December 2024 |

RP-1 |

Reports from Staff

RP-1 Amendment to the Wagga Wagga Local Infrastructure Contributions Plan and 12 Blake Street, Wagga Wagga DA19/0125 Works in Kind Agreement

Author: Belinda Maclure

Executive: Fiona Piltz

|

Summary: |

Council has been working for an extended period with the developer at 12 Blake Street regarding the provision of infrastructure to improve the public realm in Blake Street in lieu of providing the section 7.12 contributions due for the development associated with DA19/0125.

Following the Council Meeting of 6 November 2023, Council staff drafted an amendment to the Wagga Wagga Local Infrastructure Contributions Plan 2019-2034 and drafted a Works in Kind Agreement for the provision of infrastructure to improve the public realm in Blake Street. These documents have recently been placed on public exhibition, with one submission received.

It is recommended that Council enters into a Works in Kind Agreement with Davtil Pty Ltd in relation to their development at 12 Blake Street, Wagga Wagga and adopts the Addendum to the Wagga Wagga Blake Street.

The Section 7.12 contributions collected in relation to DA19/0125 will be allocated to the delivery of the infrastructure described in the Addendum and Deed as attached to this report. |

That Council:

a notes that one submission was received during the latest public exhibition period of the draft Deed Developer Works for 12 Blake Street, Wagga Wagga

b notes that no submissions were received relating to the draft Addendum to the Wagga Wagga Local Infrastructure Plan 2019 – 2034

c authorises the General Manager or their delegate to execute the Deed Developer Works for 12 Blake Street, Wagga Wagga and any other relevant documents on behalf of Council relating to Lot 13 DP 1211352 and associated with DA19/0125

d authorises the affixing of the Wagga Wagga City Council common seal to all relevant documents as required.

e authorises the General Manager or their delegate to pay the Section 7.12 contributions for DA19/0125 to the infrastructure projects identified in the Deed Developer Works 12 Blake Street, Wagga Wagga

f resolves to adjust the Section 7.12 budget in the Long-Term Financial Plan to include the allocation of $104,075 to the delivery of infrastructure as described in the Deed Developer Works 12 Blake Street, Wagga Wagga

g adopts the Addendum to the Wagga Wagga Local Infrastructure Contributions Plan 2019 – 2034 Additional Blake Street Projects for Section 7.12

Report

At the Ordinary Council Meeting of Monday 6 November 2023 Council resolved to (among other items):

d authorise the General Manager or their delegate to draft the amendment to the Local Infrastructure Contributions Plan (LICP) as outlined in the body of this report

e authorise the General Manager or their delegate to draft a Works In Kind Agreement (WIKA) as outlined in the body of this report

f authorise the General Manager or their delegate to place both the draft Works In Kind Agreement (WIKA) and the draft amendment to the Local Infrastructure Contributions Plan (LICP) on public exhibition for a period of 28 days and invite public submissions

g receive a further report following the exhibition and submission period addressing any submission made in respect of the draft documents

In August 2024 the developer amended one part of their offer in relation to trees. The original plan was to remove 11 existing trees on the western side of Blake Street and install 11 Chinese Elms within the road reserve. After further investigation this was deemed unsuitable by the developer due to the potential damage this would cause to the surrounding infrastructure. The amended plan is to still remove 11 of the existing trees on the western side of Blake Street (already approved) and install 27 Crepe Myrtles that will be fully irrigated. Accordingly, the draft Works in Kind Agreement and the following proposed changes to the Local Infrastructure Contributions Plan were placed on public exhibition:

1. Reconfiguration of the existing on-street car parking between Morgan and Forsyth Streets from parallel parking to angle parking

2. Reconfiguration of existing road design including the installation of new traffic calming devices at either end of Blake Street

3. Establishment of new line marking and signage including the designation of disabled car parking spaces

4. Removal of existing street trees and replacement of crepe myrtles

5. Replacement and upgrade to 2.5-metre-wide footpaths on the western side of Blake Street

6. Landscaping and installation of three lights in the Blake Street Council carpark.

One submission was received during this public exhibition period. The submission objected to the removal of the existing street trees and their replacement with crepe myrtles. The objector was of the opinion that 25 existing street trees were being removed, however only 11 are identified for removal. Council staff have worked with the developer over a period of time and considered a number of options in relation to the street trees. Council staff support the replacement of the existing street trees with crepe myrtles as per the plans recently exhibited. This is based on the poor health of the existing street trees on the western side Blake Street, the damage caused to the footpath and kerb and gutter infrastructure in the street from the existing street trees and that the proposal will see the street trees located on the roadside verge.

The changes are detailed in the Addendum to the Local Infrastructure Contributions Plan and the draft Deed Developer Works for 12 Blake Street Wagga Wagga which are attached as Attachments 1 and 2 to this report.

The mixed use development comprises of ground floor commercial space, carparking and residential units on the floors above. The development will increase housing density within the central business district and provides diversity of housing options with its shop top residential units. Increased density and diversity of housing options in the city are highly desirable outcomes. The development will revitalise Blake Street through commercial activity and providing infill housing in an area which will promote a lifestyle where people can walk to all the services the central business district has to offer.

Below are some images to assist with visualising the proposal.

Picture 1: Blake Street Artistic Impression

Picture 2: Blake Street (western side

currently)

Picture 3: Blake Street (western side

currently)

Picture 4: Blake Street (western side

currently)

Picture 5: Tarcutta Street

Financial Implications

The Work in Kind Agreement will see $171,900 worth of public infrastructure delivered in Blake Street (in 2024 dollars).

As $104,075 of Section 7.12 contributions were paid on 16 June 2021, the developer is required to provide Council with a developer works security totalling $67,825.

At the completion of all the works listed in the Deed Council will return the developer works security and pay the developer $104,075 for the works. The resulting change to the Section 7.12 budget in the Long Term Financial Plan to include the allocation of $104,075 to the delivery of infrastructure as described in the Deed Developer Works 12 Blake Street, Wagga Wagga will be made after the Council meeting.

The result will be the developer will provide $67,825 (in 2024 dollars) worth of infrastructure in Blake Street over and above the Section 7.12 contributions required in DA19/0125.

Link to Strategic Plan

Community leadership and collaboration

Objective: Our community is informed and actively engaged in decision making and problem-solving to shape the future of Wagga Wagga

Communicate with our community

Risk Management Issues for Council

The Deed Developer Works 12 Blake Street Wagga Wagga is designed to manage the risks associated with the delivery of the infrastructure in the Works in Kind Agreement.

As Section 7.12 contributions have been paid and a developer works security is required, there is no risk Council will not collect the contributions required as a result of the development.

Internal / External Consultation

The proposed Works in Kind Agreement for 12 Blake Street has been placed on public exhibition twice and the changes to the Local Infrastructure Contributions Plan and Work in Kind Agreement has been placed on public exhibition once.

The projects included in the Works in Kind Agreement have also been placed on public exhibition twice prior to the recent public exhibition periods.

|

1⇩. |

Draft Deed WIKA Blake Street DA19-0125 as at October 2024 |

|

|

2⇩. |

Draft Blake Street Amendment Oct 2024 |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 16 December 2024 |

RP-2 |

RP-2 ONE-OFF CAPITAL WORKS PROGRAM RESET

Author: Scott Gray

|

Summary: |

The purpose of the report is to reset the One-Off Capital Works program for the remainder of the 2024/25 financial year so it better aligns with allocated resources and delivery timeframes. |

That Council:

a receive and note the contents of the report

b adopt the attached revised One-Off Capital Works Program

c note that further review and refinement of the program will occur over the next 6 months

d receive a further report early in 2025 with a more detailed status update on projects identified for delivery/progress in 2024/25

e approve the budget variation/s as detailed in the Financial Implications section of the report

Report

At the Council Meeting on 24 June 2024, Councillors approved an Operational Plan allocating over $57 million for One-Off Capital Works projects. This allocation excluded carry-overs from 2022/23 and, due to the timing of announcements, did not account for major projects such as the Lake Albert Pipeline, Plumpton Road, and the Northern Growth Sewer.

The following is a summary of the budgets allocated for the 2024/25 One-Off Capital Works Program, along with the actual expenditure and commitments recorded as of 31 October 2024.

|

Directorate |

Budget (Confirmed) |

Budget (Pending) |

Budget (Total) |

Actuals/ Commit |

|

Community |

$906,378 |

$0 |

$906,378 |

$36,345 |

|

Econ, Business & Workforce |

$43,588,226 |

$14,081,738 |

$57,669,964 |

$17,290,886 |

|

Governance |

$69,440,048 |

$1,000,000 |

$70,440,048 |

$3,851,510 |

|

Infrastructure |

$42,133,486 |

$16,660,156 |

$58,793,641 |

$2,073,758 |

|

Total |

$156,068,137 |

$31,741,894 |

$187,810,030 |

$23,252,499 |

A review of the 10 Year One-Off Capital Works Program has been undertaken with project sponsors, project managers and Directors. It is important to note that this is the initial stage of the review, with a focus on the next 1-2 years.

Further reviews will be undertaken to ensure the whole program reflects the expectations of Councillors and the community and has the appropriate budget amounts allocated.

A pragmatic approach was taken to the review with the aim to increase the accuracy of the program across the 4-year Council term. Some of the outcomes from the review include requests to:

· remove projects on the basis they were completed through normal operations or in prior years

· move projects outside the 4-year Delivery plan if they are unfunded, relying on grant funding, awaiting review pending the redevelopment of master plans or awaiting review pending review of demand / requirement

· revise project timing

A copy of the revised 10 Year One Off Capital Works Program is attached (Attachment 1).

A status report on the whole Capital Works Program (including recurrent) will be prepared at the end of December and will be presented to Council in the first quarter of 2025. These reports will be provided to Councillors on a regular basis through the Councillor SharePoint site and through Council reports as part of the Operational Performance Reporting process.

Financial Implications

Below is a summary of the revised projects and the budgets allocated for the remainder of the 2024/25 financial year.

|

Job No. |

Project |

Budget |

|

Community |

||

|

18792 |

Public Art - River Life |

$135,763 |

|

23074 |

Art Gallery Cabinetry Work |

$111,600 |

|

23962 |

Permit Plug Pilot Program |

$400,000 |

|

24277 |

Community Centres Safety Upgrades |

$45,615 |

|

Economy, Business and Workforce |

||

|

15293 |

Sportsgrounds Lighting Program - McPherson Oval (Nth Wagga) |

$35,995 |

|

17749 |

Community Amenities - Gissing Oval |

$200,000 |

|

18638 |

Lake Albert - Raising Water Level |

$125,027 |

|

18812 |

Active Travel Plan - Stage 1 - TT26 |

$2,624,258 |

|

19648 |

Gobbagombalin Nth (Harris Road) Park Embellishment - ROS2 |

$194,228 |

|

19661 |

Lloyd Establish 3 Local Parks - ROS5 + LA4 (Deakin Ave) + LA5 (Barton Ave) + LA6 (Central Lloyd) - Land Acquisitions |

$50,000 |

|

19664 |

Jubilee Park - Athletics Park Upgrade - ROS10 |

$3,109,572 |

|

19668 |

Harris Road to Open Space - ROS13 |

$44,132 |

|

21089 |

Jim Elphick Tennis Centre - ROS15 |

$6,947,141 |

|

21777 |

Wiradjuri Walking Track Upgrade |

$35,574 |

|

21789 |

Tarcutta Recreation Reserve Infrastructure Upgrade |

$68,208 |

|

21931 |

Active Travel Plan - Stage 3 (Various) |

$457,554 |

|

22157 |

Stronger Country Communities Fund Round 5 Grant |

$731,876 |

|

22317 |

Lake Albert Pipeline |

$449,378 |

|

22379 |

Local Government Recovery Grant |

$696,051 |

|

23088 |

Victory Memorial Gardens Shade Sails |

$22,000 |

|

23935 |

Active Travel Plan - Stage 3 - Kooringal Road Link |

$500,000 |

|

24286 |

Workout Wagga Gym Purchase |

$175,000 |

|

28119 |

Oasis - Filter Sand for All Pools |

$72,887 |

|

28145 |

Oasis - Water Features Project |

$199,236 |

|

28162 |

Oasis - Energy Savings Project (Mechanical Air Ventilation System Upgrade) |

$231,770 |

|

28173 |

Oasis - Disable/ Mixed Access Equipment / Steps - Wheel Chairs - Hoist & Extras |

$76,673 |

|

45096 |

LMC - New circulating road (partial) |

$699,309 |

|

45128 |

LMC - Sheep & Goat Electronic (EiD) System Feasibility Study |

$987,623 |

|

45131 |

LMC - Cattle Delivery Yard Rehabilitation |

$22,823 |

|

45133 |

LMC - Realign Sheep and Cattle Draft Ramps |

$3,067,917 |

|

45134 |

LMC - Asbestos Removal |

$71,480 |

|

45135 |

LMC - Main Building Amenities |

$33,150 |

|

45136 |

LMC - Main Building Sills |

$34,810 |

|

70101 |

GWMC - Road Rehabilitation |

$491,782 |

|

70164 |

GWMC - Construction of a new Waste Cell |

$500,000 |

|

70168 |

GWMC Plant Shed |

$100,000 |

|

70178 |

GWMC - Construction of a new Monocell |

$500,000 |

|

70195 |

GWMC - Cell Extension |

$1,261,664 |

|

Governance / Major Projects |

||

|

17866 |

Levee System Upgrade - North Wagga (1 in 20) |

$500,000 |

|

21903 |

RIFL Stage 1A Subdivision Works |

$1,321,048 |

|

23126 |

Southern Growth Area - Plumpton Road North |

$1,992,030 |

|

23127 |

Southern Growth Area - Plumpton Road South |

$1,973,623 |

|

50447 |

Northern Growth Area - Sewer Upgrades |

$773,089 |

|

Infrastructure |

||

|

12922 |

Glenfield Road Corridor Works - TT1 |

121,787 |

|

17742 |

Stormwater - Murray St Project |

159,956 |

|

18738 |

Glenfield Road Drain Remediation |

79,807 |

|

19546 |

Botanic Gardens Zoo - Stage 2 CCTV |

9,890 |

|

19604 |

Gregadoo Road Corridor Works - TT7 |

250,000 |

|

19627 |

Red Hill Rd/Dalman Parkway Intersection Treatment - TT27 |

137,457 |

|

21273 |

Lawn Cemetery Master Plan Stage 2A Works - New burial area, outdoor chapel and water feature |

50,207 |

|

21348 |

Dobney Avenue & Pearson Street Pavement Rehabilitation |

618,941 |

|

21855 |

Incarnie Crescent Stormwater Augmentation |

421,559 |

|

21902 |

Murray St/ Brookong Ave Intersection Works - Hospital Upgrade |

75,800 |

|

22138 |

Alan Turner Depot Washbay Waste/Oil Separator & Pit |

130,466 |

|

22226 |

Civic Theatre - Balcony Retiling & Waterproofing |

165,000 |

|

22322 |

Improved Pedestrian Access in Turvey Park |

34,787 |

|

22324 |

Local Road Repair Program Funding Phase 2 |

2,791,133 |

|

22490 |

RFS Mangoplah Station Additional Bay & Amenities |

94,667 |

|

22491 |

RFS Humula Station Capital Works |

50,000 |

|

22694 |

Local Roads Community Infrastructure Round 4 |

1,547,609 |

|

22825 |

Bus Shelter Installations (CPTIGS - Fernleigh Rd x 2, Fay Ave) |

34,368 |

|

23084 |

Destination Electric Vehicle (EV) Charger Installation Round 2 |

6,826 |

|

23103 |

Chapel Refurbishment |

154,664 |

|

23934 |

Bus Shelter Installation (CPTIGS - 48 Chaston St) |

20,000 |

|

24256 |

Pomingalarna Shed Construction |

235,000 |

|

24266 |

Ivan Jack Drive Bridge Structural Rectification |

623,039 |

|

50199 |

Sewer - Elizabeth Avenue Forest Hill SPS22 - New Assets |

52,014 |

|

50221 |

Sewer - Narrung St Treatment Plant Flood Protection Infrastructure |

464,132 |

|

50224 |

Sewer Ashmont SPS (Lloyd to Ashmont Gravity Main Upgrade) |

24,980 |

|

50245 |

Sewer - Olympic Highway - SPS13 New Assets |

21,037 |

|

50418 |

Southern Growth Area Sewer Augmentation |

1,165,853 |

|

50441 |

Sewer Telemetry Hardware Upgrades |

1,000,000 |

|

|

Total |

$42,610,865 |

The following table represents the movement of project budgets allocated across the 10 year program.

|

Year |

Current Budget Allocated |

Revised Budget Allocated |

|

2024/25 |

$187,810,030 |

$42,610,865 |

|

2025/26 |

$71,356,362 |

$97,407,802 |

|

2026/27 |

$43,057,329 |

$105,928,896 |

|

2027/28 |

$48,734,469 |

$8,139,020 |

|

2028/29 |

$15,258,879 |

$16,593,436 |

|

2029/30 |

$15,063,915 |

$62,491,089 |

|

2030/31 |

$7,265,304 |

$32,453,765 |

|

2031/32 |

$861,142 |

$14,265,391 |

|

2032/33 |

$8,585,460 |

$10,220,554 |

|

2033/34 |

$5,333,184 |

$5,333,184 |

|

To be reviewed/removed |

7,882,073 |

|

Policy and Legislation

NSW Local Government Act 1993

Link to Strategic Plan

Community leadership and collaboration

Objective: Our community is informed and actively engaged in decision making and problem-solving to shape the future of Wagga Wagga

Communicate with our community

Risk Management Issues for Council

If the capital works program is not reset to something more realistic there will be a community expectation that can’t be met.

Internal / External Consultation

Significant Internal engagement has been undertaken to prepare this initial revised 10 year capital works program. In addition, consultation is occurring in relation to Council’s project management methodology, systems and reporting.

A Councillor workshop was held on 9 December 2024.

|

1⇩. |

One-Off Capital Works Program 2024/25 to 2033/34 - Reset as at 16 December 2024 |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 16 December 2024 |

RP-3 |

RP-3 JIM ELPHICK TENNIS CENTRE AND WAGGA WORKOUT FEES AND CHARGES

Author: Marc Geppert

Executive: Fiona Piltz

|

Summary: |

This report proposes to adopt the publicly exhibited fees and charges for the Jim Elphick Tennis Centre and Wagga Workout Gym for the 2024/25 financial year with one amendment as noted in this report. |

That Council:

a note that there were 8 submissions received during the public exhibition period

|

Jim Elphick Tennis Centre |

|||

|

Fee Name |

Year 24/25 |

||

|

Fee (excl GST) |

GST |

Total Fee (Inc GST) |

|

|

Casual Hire |

|||

|

ITF Court Hire (per hour, inc lights if applicable) |

$18.18 |

$1.82 |

$20.00 |

|

Community Court Hire (per hour, inc lights if applicable) |

$13.64 |

$1.36 |

$15.00 |

|

Multi Purpose Court Hire (per hour, inc lights if applicable) |

$22.73 |

$2.27 |

$25.00 |

|

Tournament Rate Court Hire (per hour, per court) |

$9.09 |

$0.91 |

$10.00 |

|

School Court Hire (Community Court, per hour) |

$9.09 |

$0.91 |

$10.00 |

|

Adult Programming and Competitions |

|||

|

Social/Competitions (per 10 week competition or school term) |

$109.09 |

$10.91 |

$120.00 |

|

Pro-Am Matchplay - 1 Pro, 3 players (per player per one hour session) |

$22.73 |

$2.27 |

$25.00 |

|

Adult competitions (Singles, Doubles, mixed doubles per 10 week competition or school term) |

$122.73 |

$12.27 |

$135.00 |

|

Adult Private coaching per half hour |

$36.36 |

$3.64 |

$40.00 |

|

Adult Private coaching per hour |

$68.18 |

$6.82 |

$75.00 |

|

Junior Programming and Competitions |

- |

- |

|

|

Junior competition fee per match |

$8.18 |

$0.82 |

$9.00 |

|

Hot Shots Blue |

$90.91 |

$9.09 |

$100.00 |

|

Hot Shots Red |

$90.91 |

$9.09 |

$100.00 |

|

Red Squad |

$163.64 |

$16.36 |

$180.00 |

|

Hot Shots Orange |

$90.91 |

$9.09 |

$100.00 |

|

Orange Squad |

$163.64 |

$16.36 |

$180.00 |

|

Hot Shots Green |

$100.00 |

$10.00 |

$110.00 |

|

Green Squad |

$163.64 |

$16.36 |

$180.00 |

|

Hot Shots Yellow |

$100.00 |

$10.00 |

$110.00 |

|

Yellow Squad |

$163.64 |

$16.36 |

$180.00 |

|

Group Coaching (per hour) |

$10.91 |

$1.09 |

$12.00 |

|

Private Coaching (per half hour) |

$36.36 |

$3.64 |

$40.00 |

|

Private Coaching (per hour) |

$68.18 |

$6.82 |

$75.00 |

|

Tennis School Holiday Program (per 4 hour clinic) |

$45.45 |

$4.55 |

$50.00 |

|

Sporting Schools Play Program (per child, per week) |

$9.00 |

$0.90 |

$9.90 |

|

Room Hire/Events |

|||

|

Jim Elphick Meeting room (per hour) |

$32.73 |

$3.27 |

$36.00 |

|

Jim Elphick Function room (per hour inc kitchen/bar) |

$63.64 |

$6.36 |

$70.00 |

|

Event staff member per hour |

$63.64 |

$ 6.36 |

$70.00 |

|

Miscellaneous Hire |

- |

- |

|

|

Ball Machine (per hour) |

$32.73 |

$3.27 |

$36.00 |

|

Re-stringing (per racquet, not inc strings) |

$32.73 |

$3.27 |

$36.00 |

|

Racquet Hire |

$4.55 |

$0.45 |

$5.00 |

|

Wagga Workout |

|||

|

Fee Name |

Year 24/25 |

||

|

Fee (Excl GST) |

GST |

Total Fee (Inc GST) |

|

|

Individual Membership |

|||

|

12 month membership |

$545.45 |

$54.55 |

$600.00 |

|

12 month direct debit weekly |

$14.55 |

$1.45 |

$16.00 |

|

12 month membership - Concession/Student |

$454.55 |

$45.45 |

$500.00 |

|

12 month membership - Family (inc 2 adults, 2 children under 18) |

$909.09 |

$90.91 |

$1,000.00 |

|

12 month membership - Family Direct Debit (per week) |

$22.73 |

$ 2.27 |

$25.00 |

|

No contract membership - direct debit weekly (cancel anytime) |

$16.36 |

$1.64 |

$18.00 |

|

No contract membership - joining fee |

$90.91 |

$9.09 |

$100.00 |

|

6 month membership |

$409.09 |

$40.91 |

$450.00 |

|

6 month membership - Concession/Student |

$363.64 |

$36.36 |

$400.00 |

|

6 month membership - family (inc 2 adults, 2 children under 18) |

$681.82 |

$68.18 |

$750.00 |

|

3 month membership |

$318.18 |

$31.82 |

$350.00 |

|

3 month membership - Concession/Student |

$272.73 |

$27.27 |

$300.00 |

|

3 month membership - Family (2 adults, 2 children under 18) |

$545.45 |

$54.55 |

$600.00 |

|

1 month membership |

$159.09 |

$15.91 |

$175.00 |

|

1 month membership - Concession/Student |

$136.36 |

$13.64 |

$150.00 |

|

14 day membership |

$104.55 |

$10.45 |

$115.00 |

|

7 day membership |

$68.18 |

$6.82 |

$75.00 |

|

12 month Gym/Swim Membership |

$931.82 |

$93.18 |

$1,025.00 |

|

6 month Gym/Swim Membership |

$727.27 |

$72.73 |

$800.00 |

|

3 month Gym/Swim Membership |

$563.64 |

$56.36 |

$620.00 |

|

24 Hour access tag (one off fee) |

$36.36 |

$3.64 |

$40.00 |

|

24 hour access tag replacement |

$9.09 |

$0.91 |

$10.00 |

|

Casual Visitation |

- |

- |

|

|

Single visit |

$15.45 |

$1.55 |

$17.00 |

|

Single visit - concession/student |

$10.91 |

$1.09 |

$12.00 |

|

Sauna only |

$10.91 |

$1.09 |

$12.00 |

|

Student school group fee (per student - applies to groups only) |

$7.27 |

$0.73 |

$8.00 |

|

Sporting group fee (per player, applies to groups only) |

$7.27 |

$0.73 |

$8.00 |

|

10 visit pass |

$136.36 |

$13.64 |

$150.00 |

|

10 visit pass - Concession/Student |

$100.00 |

$10.00 |

$110.00 |

|

20 visit pass |

$200.00 |

$20.00 |

$220.00 |

|

20 visit pass - Concession/Student |

$163.64 |

$16.36 |

$180.00 |

|

Miscellaneous Hire |

- |

- |

|

|

Towel hire |

$2.73 |

$0.27 |

$3.00 |

|

Health Assessment/Fitness testing |

$50.00 |

$5.00 |

$55.00 |

|

Workout Group Fitness room hire inc equipment (per hour) |

$36.36 |

$3.64 |

$40.00 |

Report

At the Ordinary Meeting of Council, held 28 October 2024 Council resolved:

That Council:

a authorise the General Manager or their delegate to enter into a contract for the purchase of the business known as ‘Wagga Workout’ on the conditions outlined in this report

b endorse the Council management model for the Jim Elphick Tennis Centre

c place the following fees and charges on public exhibition for period of 28 days from 30 October 2024 to 27 November 2024

|

Jim Elphick Tennis Centre |

|||

|

Fee Name |

Year 24/25 |

||

|

Fee (excl GST) |

GST |

Total Fee (Inc GST) |

|

|

Casual Hire |

|||

|

$22.73 |

$2.27 |

$25.00 |

|

|

Community Court Hire (per hour, inc lights if applicable) |

$13.64 |

$1.36 |

$15.00 |

|

Multi Purpose Court Hire (per hour, inc lights if applicable) |

$22.73 |

$2.27 |

$25.00 |

|

Tournament Rate Court Hire (per hour, per court) |

$9.09 |

$0.91 |

$10.00 |

|

School Court Hire (Community Court, per hour) |

$9.09 |

$0.91 |

$10.00 |

|

Adult Programming and Competitions |

|||

|

Social/Competitions (per 10 week competition or school term) |

$109.09 |

$10.91 |

$120.00 |

|

Pro-Am Matchplay - 1 Pro, 3 players (per player per one hour session) |

$22.73 |

$2.27 |

$25.00 |

|

Adult competitions (Singles, Doubles, mixed doubles per 10 week competition or school term) |

$122.73 |

$12.27 |

$135.00 |

|

Adult Private coaching per half hour |

$36.36 |

$3.64 |

$40.00 |

|

Adult Private coaching per hour |

$68.18 |

$6.82 |

$75.00 |

|

Junior Programming and Competitions |

- |

- |

|

|

Junior competition fee per match |

$8.18 |

$0.82 |

$9.00 |

|

Hot Shots Blue |

$90.91 |

$9.09 |

$100.00 |

|

Hot Shots Red |

$90.91 |

$9.09 |

$100.00 |

|

Red Squad |

$163.64 |

$16.36 |

$180.00 |

|

Hot Shots Orange |

$90.91 |

$9.09 |

$100.00 |

|

Orange Squad |

$163.64 |

$16.36 |

$180.00 |

|

Hot Shots Green |

$100.00 |

$10.00 |

$110.00 |

|

Green Squad |

$163.64 |

$16.36 |

$180.00 |

|

Hot Shots Yellow |

$100.00 |

$10.00 |

$110.00 |

|

Yellow Squad |

$163.64 |

$16.36 |

$180.00 |

|

Group Coaching (per hour) |

$10.91 |

$1.09 |

$12.00 |

|

Private Coaching (per half hour) |

$36.36 |

$3.64 |

$40.00 |

|

Private Coaching (per hour) |

$68.18 |

$6.82 |

$75.00 |

|

Tennis School Holiday Program (per 4 hour clinic) |

$45.45 |

$4.55 |

$50.00 |

|

Sporting Schools Play Program (per child, per week) |

$9.00 |

$0.90 |

$9.90 |

|

Room Hire/Events |

|||

|

Jim Elphick Meeting room (per hour) |

$32.73 |

$3.27 |

$36.00 |

|

Jim Elphick Function room (per hour inc kitchen/bar) |

$63.64 |

$6.36 |

$70.00 |

|

Event staff member per hour |

$63.64 |

$ 6.36 |

$70.00 |

|

Miscellaneous Hire |

- |

- |

|

|

Ball Machine (per hour) |

$32.73 |

$3.27 |

$36.00 |

|

Re-stringing (per racquet, not inc strings) |

$32.73 |

$3.27 |

$36.00 |

|

Racquet Hire |

$4.55 |

$0.45 |

$5.00 |

|

Wagga Workout |

|||

|

Fee Name |

Year 24/25 |

||

|

Fee (Excl GST) |

GST |

Total Fee (Inc GST) |

|

|

Individual Membership |

|||

|

12 month membership |

$545.45 |

$54.55 |

$600.00 |

|

12 month direct debit weekly |

$14.55 |

$1.45 |

$16.00 |

|

12 month membership - Concession/Student |

$454.55 |

$45.45 |

$500.00 |

|

12 month membership - Family (inc 2 adults, 2 children under 18) |

$909.09 |

$90.91 |

$1,000.00 |

|

12 month membership - Family Direct Debit (per week) |

$22.73 |

$ 2.27 |

$25.00 |

|

No contract membership - direct debit weekly (cancel anytime) |

$16.36 |

$1.64 |

$18.00 |

|

No contract membership - joining fee |

$90.91 |

$9.09 |

$100.00 |

|

6 month membership |

$409.09 |

$40.91 |

$450.00 |

|

6 month membership - Concession/Student |

$363.64 |

$36.36 |

$400.00 |

|

6 month membership - family (inc 2 adults, 2 children under 18) |

$681.82 |

$68.18 |

$750.00 |

|

3 month membership |

$318.18 |

$31.82 |

$350.00 |

|

3 month membership - Concession/Student |

$272.73 |

$27.27 |

$300.00 |

|

3 month membership - Family (2 adults, 2 children under 18) |

$545.45 |

$54.55 |

$600.00 |

|

1 month membership |

$159.09 |

$15.91 |

$175.00 |

|

1 month membership - Concession/Student |

$136.36 |

$13.64 |

$150.00 |

|

14 day membership |

$104.55 |

$10.45 |

$115.00 |

|

7 day membership |

$68.18 |

$6.82 |

$75.00 |

|

12 month Gym/Swim Membership |

$931.82 |

$93.18 |

$1,025.00 |

|

6 month Gym/Swim Membership |

$727.27 |

$72.73 |

$800.00 |

|

3 month Gym/Swim Membership |

$563.64 |

$56.36 |

$620.00 |

|

24 Hour access tag (one off fee) |

$36.36 |

$3.64 |

$40.00 |

|

24 hour access tag replacement |

$9.09 |

$0.91 |

$10.00 |

|

Casual Visitation |

- |

- |

|

|

Single visit |

$15.45 |

$1.55 |

$17.00 |

|

Single visit - concession/student |

$10.91 |

$1.09 |

$12.00 |

|

Sauna only |

$10.91 |

$1.09 |

$12.00 |

|

Student school group fee (per student - applies to groups only) |

$7.27 |

$0.73 |

$8.00 |

|

Sporting group fee (per player, applies to groups only) |

$7.27 |

$0.73 |

$8.00 |

|

10 visit pass |

$136.36 |

$13.64 |

$150.00 |

|

10 visit pass - Concession/Student |

$100.00 |

$10.00 |

$110.00 |

|

20 visit pass |

$200.00 |

$20.00 |

$220.00 |

|

20 visit pass - Concession/Student |

$163.64 |

$16.36 |

$180.00 |

|

Miscellaneous Hire |

- |

- |

|

|

Towel hire |

$2.73 |

$0.27 |

$3.00 |

|

Health Assessment/Fitness testing |

$50.00 |

$5.00 |

$55.00 |

|

Workout Group Fitness room hire inc equipment (per hour) |

$36.36 |

$3.64 |

$40.00 |

d authorise the affixing of Council’s common seal as required

e approve the budget variation/s as detailed in the Financial Implications section of the report relating to the 2024/25 financial year

f include the proposed budget amendments to the future financial years during the 2025/26 Long Term Financial Plan budget process as detailed in the financial implications section of the report

Following the resolution the fees and charges were placed on public exhibition for 28 days. 8 online submissions were received along with a separate direct email from the South Wagga Tennis Club to the Manager Oasis.

|

Submission |

Staff Comment |

|

The fee structure for the Jim Elphick Tennis Centre proposed by WWCC seems to be fair and reasonable with some concerns.

2. Lighting- To hire a court should be less if you do

not need lights.

3. Court Surfaces -there is a significant cost

difference in hiring an ITF court as opposed to Community court hire.

Difference of $5 rather than $10 would be more equitable. |

1. A report on a suite of individual and combined facility membership options will be presented to the 20 January 2025 Council Meeting with the view to placing the options and associated fees on public exhibition.

2. A standardised pricing structure has been established to reduce the complexity of the venue fees and charges. This was established in consideration of the highly efficient LED lights that have been installed during the project.

3.It is proposed to reduce the ITF charge by $5 to $20 inc GST and establish a $5 gap between the ITF and Community Courts. |

|

Submission made via email 27/11/2024 due to the character limit. (Attachment 1) |

The Oasis Manager met with the South Wagga Tennis Club on the 3 December and had wide ranging discussions on venue operations, staffing, tournaments, competitions etc.

Feedback on the fees and charges included that the fees were too cheap for court hire compared to SWTC. The current pricing has been developed in consideration of the venue being operated in a cost-effective manner while also providing facilities that are affordable for use by the community.

Membership Options will be considered within the report to the 20 January 2025 Council Meeting. |

|

The gym and pool membership fees are way too expensive particularly for people on low incomes and older people. |

There are current concession options for both the Oasis and Workout Gym. Both the pool and gym are below market rates when comparing with other similar facilities and other councils.

Membership Options will be considered within the report to the 20 January 2025 Council Meeting. |

|

I think it

would be good to broaden the terms of the family membership for the gym. Very

few people that attend Workout have kids under 18 that attend the gym. It

would be useful for quite a few that have dependent university/other

students/children over 18 living at the same address to be included as a

family. |

This will be considered within the Membership Options report to the 20 January 2025 Council Meeting. |

|

I currently participate in the over 50 exercise class at the Oasis. Can not see any reference to it in the price schedule. is it to continues? and at what cost pls? |

Yes, this is continuing with no change |

|

I’d like to know if existing contracts with a set membership fee with Workout will be honoured and remain intact for the period of membership. |

Yes, memberships are being honoured unchanged |

|

This is very

exciting news!! |

This will be considered within the Membership Options report to the 20 January 2025 Council Meeting. |

|

I believe the

gym and pool costs are prohibitively for low-income earners and people on

Centrelink benefits. |

There are current concession options for both the Oasis and Workout Gym. Both the pool and gym are below market rates when comparing with other similar facilities and other councils.

Memberships will be considered within the Membership Options report to the 20 January 2025 Council Meeting. |

Staff have considered the feedback received and are proposing one change to the exhibited fees being the ITF Court Hire. It is proposed that this fee be amended to:

|

Fee Name |

Year 24/25 |

||

|

Fee (excl GST) |

GST |

Total Fee (Inc GST) |

|

|

Casual Hire |

|||

|

ITF Court Hire (per hour, inc lights if applicable) |

$18.18 |

$1.82 |

$20.00 |

The reason for this change is that it is recognised that the gap between community courts and ITF courts was on the larger end of the scale, and it is anticipated that the revised change will lead to additional usage of the ITF courts.

Financial Implications

These facilities fees and charges have been factored into Council’s amended operating income budget for the 2024/25 Long Term Financial Plan.

Policy and Legislation

Local Government Act 1993

Chapter 15, Part 10, Division 1:

· Section 608 Council fees for services

Chapter 15, Part 10, Division 2:

· Section 610B Fees to be determined in accordance with pricing methodologies

Chapter 15, Part 10, Division 3:

· Section 610D How does a council determine the amount of a fee for service?

· Section 610F Public notice of fees

Local Government (General) Regulation 2021

Regulation 201 Annual statement of council’s revenue policy

Link to Strategic Plan

Safe and Healthy Community

Objective: Our community embraces healthier lifestyle choices and practices

Promote access and participation for all sections of the community to a full range of sports and recreational activities

Risk Management Issues for Council

Without adequate revenue to cover the costs of operating the recreational facilities they may not remain financially sustainable into the future.

Internal / External Consultation

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Have your Say |

Email newsletter |

Social media |

Website |

|

|

Inform |

|

|

|

X |

|

|

|

|

|

|

|

|

X |

|

X |

X |

In addition to this an email (Attachment 2) was sent to local tennis stakeholders informing them of the 28 October resolution and inviting them to make a submission on the fees and charges.

The Oasis Manager also attended the committee meeting of the South Wagga Tennis Club on 3 December to respond to questions and discuss the sport of tennis more broadly.

During the public exhibition period 193 visitors to the Hay Your Say page during the exhibition period.

|

1⇩. |

Email received from South Wagga Tennis |

|

|

2⇩. |

Correspondence to tennis stakeholders |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 16 December 2024 |

RP-4 |

RP-4 FINANCIAL PERFORMANCE REPORT AS AT 30 NOVEMBER 2024

Author: Carolyn Rodney

|

Summary: |

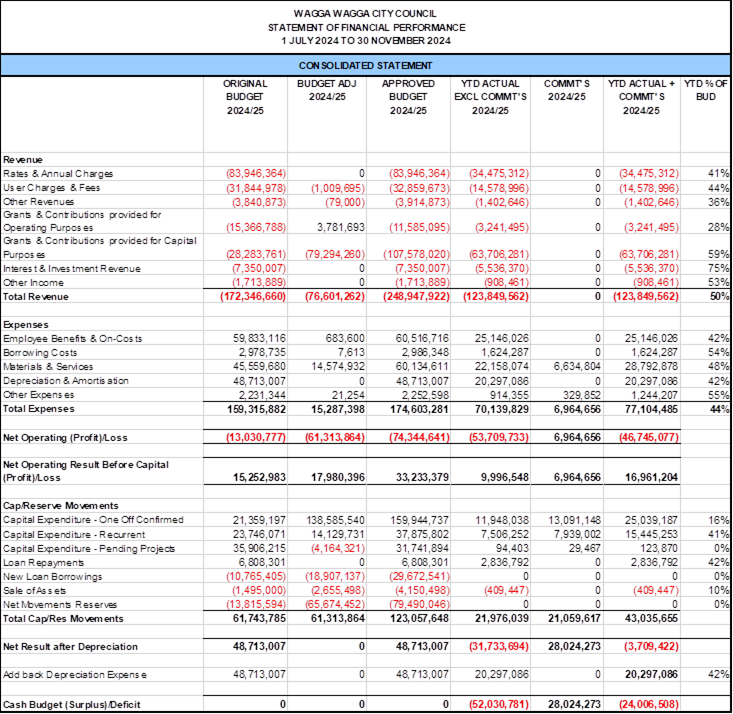

This report is for Council to consider information presented on the 2024/25 budget and Long-Term Financial Plan, and details Council’s external investments and performance as at 30 November 2024. |

That Council:

a approve the proposed 2024/25 budget variations for the month ended 30 November 2024 and note the balanced budget position as presented in this report

b approve the proposed budget variations to the 2024/25 Long Term Financial Plan Capital Works Program including new projects and timing adjustments

c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2021 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above

d note the details of the external investments as at 30 November 2024 in accordance with section 625 of the Local Government Act 1993

Report

Wagga Wagga City Council (Council) forecasts a balanced budget position as of 30 November 2024.

Proposed budget variations including adjustments to the capital works program are detailed in this report for Council’s consideration and adoption.

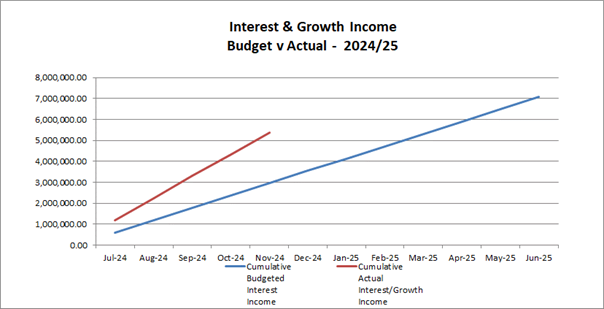

Council has experienced a positive monthly investment performance for the month of November when compared to budget ($469,301 up on the monthly budget). This is mainly due to better than budgeted returns on Council’s investment portfolio as a result of the recent interest rate movements, as well as a higher than anticipated investment portfolio balance.

Key Performance Indicators

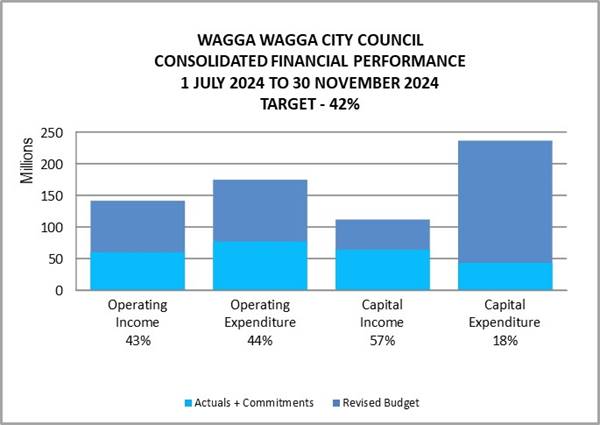

OPERATING INCOME

Total operating income is 43% of approved budget and is tracking close to budget for the month of November 2024. An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 76% when compared to budget.

OPERATING EXPENSES

Total operating expenditure is 44% of approved budget and is tracking slightly over budget at this stage of the financial year. This is due to the payment of annual one-off expenses such as rates and insurances.

CAPITAL INCOME

Total capital income is 57% of approved budget, which is mainly attributed to the Accelerated Infrastructure Fund (AIF) grant funding that has been received. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions in relation to expenditure incurred on the projects.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 18% of approved budget including pending projects. Excluding commitments, the total expenditure is 9% when compared to the approved budget. The capital project budgets are currently being reviewed and will be reported back to Council to accurately reflect the capital works program.

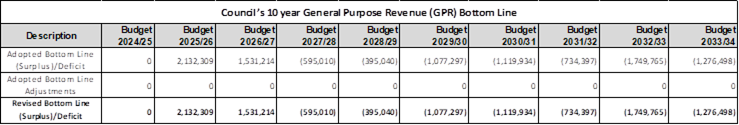

2024/25 Revised Budget Result – (Surplus) / Deficit |

$’000s |

|

Original 2024/25 Budget Result as adopted by Council Total Budget Variations approved to date Budget Variations for November 2024 |

$0K $0K $0K |

|

Proposed Revised Budget result for 30 November 2024 - (Surplus) / Deficit |

$0K |

The proposed Operating and Capital Budget Variations for 30 November 2024 which affect the current 2024/25 financial year are listed below.

|

Budget Variation |

Amount |

Funding Source |

Net Impact (Fav)/ Unfav |

|

|

5 – Growing Economy |

|

|||

|

Administration Building – New Lunch Room |

$90K |

Administration Building Maintenance ($30K) Buildings Reserve ($30K) WHS Incentive Income ($30K) |

Nil |

|

|

The recent changes to the Local Government State Award emphasise the right to disconnect, ensuring that staff can take meaningful breaks free from the pressures of their work environment. The Council Civic Centre does not have (and has not for several years) a designated, suitable lunchroom, which has resulted in many staff having to eat their lunch at their desks - blurring the boundaries between work and rest. This not only undermines the intent of the Award but also impacts on productivity and morale. The WHS Act places a duty on employers to address psychosocial hazards, including the risks associated with an inability to take proper breaks. The Local Government State Award changes and WHS requirements make it clear that the provision of adequate facilities is not optional—it is a legal and ethical obligation. Failing to provide such facilities could expose the organisation to compliance risks, including grievances, increased turnover, or breaches of the Award. The works will be undertaken in a currently unused space on level 1, where Council previously operated the Family Day Care function. Works include removal of internal walls, plumbing, electrical, flooring, painting, kitchen cabinetry, and appliances. Estimated Completion: 30 June 2025 Job Number: 24367 |

|

|||

|

Narrung Street Treatment Ponds Flood Protection Plant |

$230K |

Sewer Reserve ($230K) |

Nil |

|

|

The Narrung Street Treatment Ponds Effluent Liner project costs have risen over the past three years due to inflation of the price of materials, labour, and other essential resources required including project management overheads. As a result, an additional budget variation of $230K is needed to successfully complete this project and will be funded from the Sewer Reserve. This variation will bring the total project budget to $694K. Estimated Completion: 30 June 2025 Job Number: 50221 |

|

|||

2024/25 Capital Works Summary

As a result of the above variations $320,000 will be moved into the Confirmed budget for 2024/25. These figures will be reflected next month after Council adopt the reset as per RP-1.

Current Restrictions

|

RESERVES SUMMARY |

|||||

|

30 NOVEMBER 2024 |

|||||

|

|

CLOSING BALANCE 2023/24 |

ADOPTED RESERVE TRANSFERS 2024/25 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 25.11.2024 |

PROPOSED CHANGES for Council Resolution* |

BALANCE AS AT 30 NOVEMBER 2024 |

|

|

|

|

|

|

|

|

Externally Restricted |

|

|

|

|

|

|

Developer Contributions - Section 7.11 |

(35,346,092) |

3,828,593 |

6,107,271 |

|

(25,410,229) |

|

Developer Contributions - Section 7.12 |

(849,883) |

(28,096) |

0 |

|

(877,979) |

|

Developer Contributions - Stormwater Section 64 |

(8,765,571) |

131,291 |

110,565 |

|

(8,523,715) |

|

Sewer Fund |

(52,652,543) |

(276,425) |

10,992,699 |

230,000 |

(41,706,268) |

|

Solid Waste |

(31,897,464) |

2,924,014 |

7,513,181 |

|

(21,460,270) |

|

Specific Purpose Unexpended Grants & Contributions |

(58,467,746) |

0 |

58,467,746 |

|

0 |

|

SRV Levee Reserve |

(6,230,711) |

0 |

0 |

|

(6,230,711) |

|

Stormwater Levy |

(5,505,698) |

2,772,743 |

719,289 |

|

(2,013,667) |

|

Total Externally Restricted |

(199,715,707) |

9,352,119 |

83,910,749 |

230,000 |

(106,222,838) |

|

|

|

|

|

|

|

|

Internally Restricted |

|

|

|||

|

Additional Special Variation (ASV) |

(934,841) |

934,841 |

0 |

|

0 |

|

Airport |

0 |

0 |

0 |

|

0 |

|

Art Gallery |

(15,398) |

(6,000) |

0 |

|

(21,398) |

|

Bridge Replacement |

(277,544) |

0 |

277,544 |

|

0 |

|

Buildings |

(3,386,635) |

77,514 |

122,179 |

30,000 |

(3,156,943) |

|

CCTV |

(34,995) |

0 |

0 |

|

(34,995) |

|

Cemetery |

(1,378,480) |

(204,757) |

129,870 |

|

(1,453,366) |

|

Civic Theatre |

(95,013) |

(21,237) |

30,000 |

|

(86,250) |

|

Civil Infrastructure |

(11,521,350) |

696,586 |

5,200,493 |

|

(5,624,271) |

|

Council Election |

(427,970) |

372,507 |

0 |

|

(55,463) |

|

Economic Development |

(361,938) |

18,358 |

291,936 |

|

(51,645) |

|

Emergency Events Reserve |

(252,702) |

(109,381) |

0 |

|

(362,084) |

|

Employee Leave Entitlements Gen Fund |

(3,607,285) |

0 |

0 |

|

(3,607,285) |

|

Environmental Conservation |

(116,578) |

0 |

0 |

|

(116,578) |

|

Event Attraction |

(962,294) |

91,784 |

601,625 |

|

(268,885) |

|

Financial Assistance Grants in Advance |

(10,947,037) |

0 |

10,947,037 |

|

0 |

|

Grant Co-Funding |

(500,000) |

180,000 |

140,000 |

|

(180,000) |

|

Gravel Pit Restoration |

(790,095) |

3,333 |

222,825 |

|

(563,936) |

|

Information Services |

(2,387,681) |

1,037,601 |

290,000 |

|

(1,060,080) |

|

Insurance Variations |

(50,000) |

0 |

0 |

|

(50,000) |

|

Internal Loans |

(7,841,730) |

(149,108) |

748,574 |

|

(7,242,264) |

|

Lake Albert Improvements |

(741,740) |

(21,261) |

707,783 |

|

(55,218) |

|

Library |

(400,985) |

(237,430) |

0 |

|

(638,415) |

|

Livestock Marketing Centre |

(8,324,132) |

1,013,875 |

5,056,146 |

|

(2,254,111) |

|

Museum Acquisitions |

(48,476) |

4,378 |

0 |

|

(44,099) |

|

|

CLOSING BALANCE 2023/24 |

ADOPTED RESERVE TRANSFERS 2024/25 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 25.11.2024 |

PROPOSED CHANGES for Council Resolution* |

BALANCE AS AT 30 NOVEMBER 2024 |

|

Net Zero Emissions |

(262,207) |

(80,157) |

119,788 |

|

(222,576) |

|

Oasis Reserve |

(1,201,931) |

476,905 |

403,704 |

|

(321,321) |

|

Parks & Recreation Projects |

(2,520,071) |

21,556 |

728,274 |

|

(1,770,241) |

|

Parks Water |

(180,000) |

20,593 |

0 |

|

(159,407) |

|

Planning Legals |

(61,747) |

(20,000) |

0 |

|

(81,747) |

|

Plant Replacement |

(6,383,440) |

227,092 |

2,777,129 |

|

(3,379,218) |

|

Project Carryovers |

(8,548,629) |

0 |

8,548,629 |

|

0 |

|

Public Art |

(225,215) |

0 |

186,495 |

|

(38,720) |

|

Service Reviews |

(100,000) |

0 |

0 |

|

(100,000) |

|

Sister Cities |

(30,590) |

0 |

0 |

|

(30,590) |

|

Stormwater Drainage |

(110,178) |

0 |

0 |

|

(110,178) |

|

Strategic Real Property |

(1,949,243) |

50,000 |

(2,127,600) |

|

(4,026,843) |

|

Subdivision Tree Planting |

(516,648) |

20,000 |

0 |

|

(496,648) |

|

Unexpended External Loans |

(602,525) |

68,176 |

406,176 |

|

(128,172) |

|

Visitors Economy |

(33,394) |

(24,792) |

0 |

|

(58,186) |

|

Workers Compensation |

(155,010) |

22,500 |

0 |

|

(132,510) |

|

Total Internally Restricted |

(78,285,726) |

4,463,475 |

35,808,607 |

30,000 |

(37,983,644) |

|

|

|

|

|

|

|

|

Total Restricted |

(278,001,433) |

13,815,594 |

119,719,357 |

260,000 |

(144,206,482) |

|

|

|

|

|

|

|

|

Total Unrestricted |

(11,426,000) |

0 |

0 |

0 |

(11,426,000) |

|

|

|

|

|

|

|

|

Total Cash, Cash Equivalents, and Investments |

(289,427,433) |

13,815,594 |

119,719,357 |

260,000 |

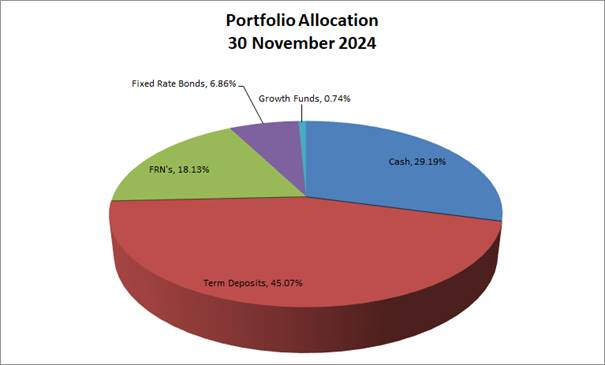

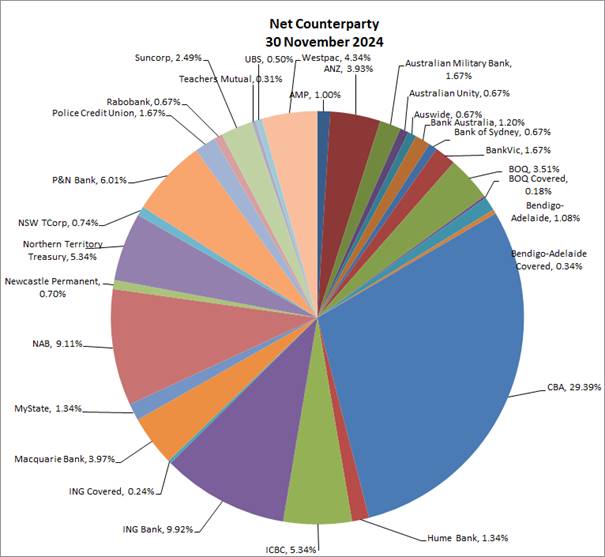

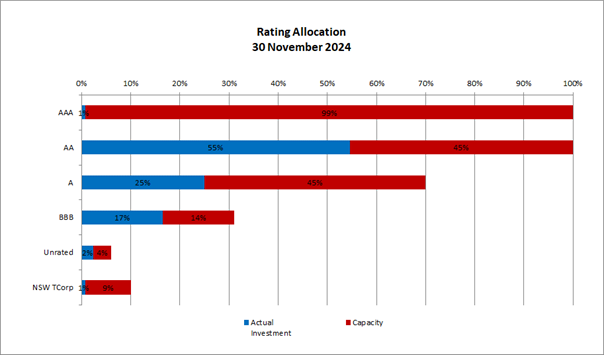

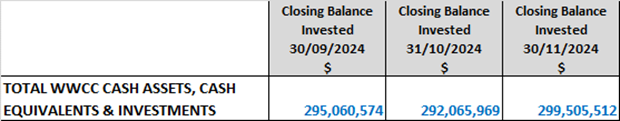

(155,632,482) |