Agenda

and

Business Paper

To be held on

Monday 24

March 2025

at 6:00 PM

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

Agenda

and

Business Paper

To be held on

Monday 24

March 2025

at 6:00 PM

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

NOTICE OF MEETING

The proceedings of all Council meetings in open session, including all debate and addresses by the public, are recorded (audio visual) and livestreamed on Council’s website including for the purpose of facilitating community access to meetings and accuracy of the Minutes.

In addition to webcasting council meetings, audio recordings of confidential sessions of Ordinary Meetings of Council are also recorded, but do not form part of the webcast.

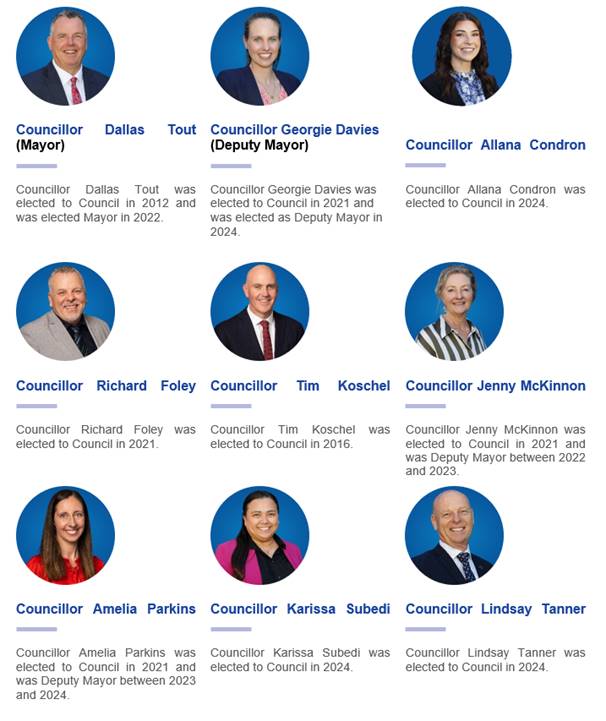

WAGGA WAGGA CITY COUNCILLORS

STATEMENT OF ETHICAL OBLIGATIONS

Councillors are reminded of their Oath or Affirmation of Office made under Section 233A of the Local Government Act 1993 and their obligation under Council’s Code of Conduct to disclose and appropriately manage Conflicts of Interest.

QUORUM

The quorum for a meeting of the Council, is a majority of the Councillors of the Council, who hold office for the time being, who are eligible to vote at the meeting.

Reports submitted to the Ordinary Meeting of Council to be held on Monday 24 March 2025.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 24 March 2025

CLAUSE PRECIS PAGE

ACKNOWLEDGEMENT OF COUNTRY 2

REFLECTION 2

APOLOGIES 2

Confirmation of Minutes

CM-1 CONFIRMATION OF ORDINARY COUNCIL MEETING MINUTES - 10 MARCH 2025 2

DECLARATIONS OF INTEREST 2

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION – ADDRESSING ILLEGAL & DANGEROUS MOTORCYCLE ACTIVITY IN WAGGA WAGGA 3

Reports from Staff

RP-1 LEP24/0003 - Planning Proposal - Southern Growth Area Zone 1 6

RP-2 PETITION - RETICULATED GAS IN NEW SUBDIVISIONS 30

RP-3 FINANCIAL PERFORMANCE REPORT AS AT 28 FEBRUARY 2025 32

RP-4 WAGGA WAGGA DESTINATION MANAGEMENT PLAN 2025-2034 65

RP-5 COMMUNITY ENERGY UPGRADES FUND (CEUF) – OASIS REGIONAL AQUATIC CENTRE 152

RP-6 QUESTIONS WITH NOTICE 155

Confidential Reports

CONF-1 REQUEST FOR RENTAL CREDIT - EASTERN RIVERINA ARTS 159

CONF-2 EXPRESSION OF INTEREST - CAFE/CANTEEN SITES 160

CONF-3 ADDITIONAL REQUEST FOR LICENCE OF COUNCIL LAND TO FACILITATE MARSHALLS CREEK BRIDGE UPGRADE 161

CONF-4 RFT CT2025025 ACTIVE TRAVEL PLAN STATE 1 - FOREST HILL LINK CONSTRUCTION 162

CONF-5 DEED OF AGREEMENT - ROAD FUNDING 163

Wagga Wagga City Council acknowledges the traditional custodians of the land, the Wiradjuri people, and pays respect to Elders past, present and future and extends our respect to all First Nations Peoples in Wagga Wagga.

We recognise and respect their cultural heritage, beliefs and continuing connection with the land and rivers. We also recognise the resilience, strength and pride of the Wiradjuri and First Nations communities

REFLECTION

Councillors, let us in silence reflect upon our responsibilities to the community which we represent, and to all future generations and faithfully, and impartially, carry out the functions, powers, authorities and discretions vested in us, to the best of our skill and judgement.

CM-1 CONFIRMATION OF ORDINARY COUNCIL MEETING MINUTES - 10 MARCH 2025

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 10 March 2025 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - Council Meeting - 10 March 2025 |

164 |

DECLARATIONS OF INTEREST

|

Report submitted to the Ordinary Meeting of Council on Monday 24 March 2025 |

NOM-1 |

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION – ADDRESSING ILLEGAL & DANGEROUS MOTORCYCLE ACTIVITY IN WAGGA WAGGA

Author: Councillor Richard Foley

|

Summary: |

This motion seeks to combat illegal motorcycle activity in Wagga Wagga through enforcement, physical deterrents, legislative measures, and funding opportunities to enhance public safety. Councillors and the Executive team are scheduled to meet with the Local Police in April to be briefed on local crime trends and issues, however I believe this is a critical issue that needs to start progressing now. |

That Council:

a acknowledges the growing community concern regarding the reckless and unlawful operation of unregistered motorcycles within the Wagga Wagga local government area, particularly in public spaces such as laneways, parks, causeways, stormwater drains, and pedestrian areas

b writes to NSW Police, the Local Area Command, and relevant road safety authorities to explore increased enforcement measures, including:

i targeted police operations to identify and apprehend offenders

ii public awareness campaigns to educate residents on reporting incidents, promoting safer streets, and increasing the use of Crime Stoppers for anonymous reporting

iii investigating the use of CCTV surveillance and license plate recognition technology to support enforcement and identify repeat offenders

c receive a further report within six (6) months, that:

i investigates and reports on the feasibility and implementation of physical deterrents, including but not limited to:

· the installation of barrier systems, fencing, gates, bollards, speed humps, and other access control measures in high-risk areas to prevent motorcycles from unlawfully entering public spaces

· reviewing local road infrastructure and public space designs to minimise access points for illegal riders while ensuring accessibility for pedestrians and emergency services

· conducting site assessments of identified hotspots and providing recommendations for urgent intervention

ii explores legislative and enforcement mechanisms available to Council under the Local Government Act 1993 (NSW), Roads Act 1993 (NSW), and Protection of the Environment Operations Act 1997 (NSW), including but not limited to:

· Council’s power to regulate public spaces and enforce local orders prohibiting unauthorised vehicle use in parks and public land

· provisions for traffic control measures, including restricting access to certain roadways and laneways

· enabling Council to issue penalty notices for excessive noise and environmental nuisance caused by illegal motorcycle activity

· the ability to introduce local orders restricting access to specific areas known for illegal motorcycle activity

iii explores funding opportunities at both the state and federal government level to finance infrastructure solutions and enhanced enforcement measures, including but not limited to:

· the NSW Safer Cities Program

· the Federal Black Spot Program (if safety concerns on roads are identified)

· the Local Government Road Safety Program (administered by Transport for NSW)

· Crime Prevention & Community Safety Grants applicable to reducing antisocial behaviour

· potential funding under Community Infrastructure or Public Safety Initiatives from NSW and Commonwealth sources

Report

The growing issue of unregistered and reckless motorcyclists within the Wagga Wagga LGA is causing serious safety concerns. These riders frequently travel at excessive speeds, ride against traffic, and unlawfully enter public spaces such as parks, pedestrian walkways, and stormwater drains. Their dangerous behaviour not only puts lives at risk but also disrupts community amenity and liveability.

Residents and businesses have repeatedly raised concerns about the public safety threats posed by these riders, the persistent noise disturbances at all hours, and the perceived lack of enforcement to curb this escalating issue. While NSW Police play a primary role in law enforcement, Council has a responsibility to manage public spaces effectively and support enforcement efforts through proactive measures.

A comprehensive approach is needed to address this issue. This includes the introduction of physical deterrents such as barriers, fencing, gates, and speed humps to restrict access to high-risk areas. Additionally, enhanced monitoring through CCTV surveillance and number plate recognition technology can assist law enforcement in identifying offenders.

Council must also explore legislative tools under the Local Government Act 1993 (NSW), Roads Act 1993 (NSW), and Protection of the Environment Operations Act 1997 (NSW) to introduce enforceable restrictions and penalties against offenders. Further, seeking funding from state and federal programs, such as the NSW Safer Cities Program and the Federal Black Spot Program, will ensure that necessary infrastructure and enforcement measures can be implemented without imposing financial strain on ratepayers.

This motion proposes a multi-faceted strategy that integrates enforcement, infrastructure improvements, legislative action, and public engagement to deter illegal motorcycle activity and enhance public safety across the Wagga Wagga LGA.

Financial Implications

N/A

Policy and Legislation

Code of Meeting Practice

Code of Conduct

Local Government Act 1993

Roads Act 1993

Protection of the Environment Operations Act 1997

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga has strong community leadership and a shared vision for the future

Our leaders represent our community

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 24 March 2025 |

RP-1 |

Reports from Staff

RP-1 LEP24/0003 - Planning Proposal - Southern Growth Area Zone 1

Author: Matthew Yeomans

Executive: John Sidgwick

|

Summary: |

Council is in receipt of a proponent-led planning proposal to rezone land in Zone 1 of the Southern Growth Area (SGA).

The proposal seeks to establish a new community consisting of circa 2,900 dwellings that will be supported by enabling infrastructure and services.

This assessment recommends and confirms that the draft Planning Proposal has strategic merit and site-specific merit. The high-level objectives and intended outcomes are supported.

Whilst there are outstanding documentation requirements, these matters are appropriate to manage, update and complete during the Gateway Determination process.

This report recommends that Council support the proposal in-principle, subject to the changes outlined in this report, and direct staff to lodge the draft Planning Proposal with the Department of Planning, Housing and Infrastructure (DPHI) requesting Gateway Determination. In lodging the draft Planning Proposal to DPHI, staff will request the remaining matters be conditioned on any favourable Gateway Determination and ensure completion prior to formal public exhibition of the proposal. |

That Council:

a endorse Planning Proposal LEP24/0003, subject to the contents of this report.

b write to the Department of Planning, Housing and Infrastructure (DPHI) requesting a gateway determination under s3.34 of the Environmental Planning & Assessment Act 1979 (EP&A Act).

c request that the Department of Planning, Housing and Infrastructure (DPHI) include a condition in the Gateway Determination requiring the outstanding matters listed in this report be resolved prior to exhibition of the draft Planning Proposal as outlined in the recommendation made in Section 11 of the Planning Proposal Assessment Report.

d on receipt of a Gateway Determination under section 3.34 of the Environmental Planning & Assessment Act 1979, Council enact all the requirements of the Gateway Determination and requirements of Schedule 1, clause 4 of the Environmental Planning & Assessment Act 1979

e delegate authority to the General Manager or their delegate of all functions under section 3.36 of the Environmental Planning and Assessment Act 1979 to make the local environmental plan and put into effect the Planning Proposal.

f delegate authority to the General Manager or their delegate to make any variations to the planning proposal, to correct any drafting errors or anomalies to ensure consistency with the Gateway Determination or to address any other matter that may arise during the amendment process.

g receive a further report on the outcome of the public exhibition of the Planning Proposal.

h require the proponent to update the draft Planning Proposal to demonstrate consistency with the Wagga Wagga Recreation, Open Space and Community (ROSC) 2040 Strategy.

i provide in principle support for the development of a contributions plan that addresses the infrastructure required for the Southern Growth Area (SGA) Zone 1 and that Council staff subsequently report this matter to Council with the intent that the planning proposal and draft contribution plan are placed on public exhibition at the same time.

j seek approval from Department of Planning, Housing and Infrastructure (DPHI) to identify Zone 1 of the Southern Growth Area (SGA) as an Urban Release Area with an infrastructure contribution cap of $30,000.

Planning Proposal Application Details

|

Applicant: |

Cameron Beames (Rowan Village Pty Ltd) On behalf of: · Rowan Village Pty Ltd (Devcore Property Group Pty Ltd) · Sunnyside Ventures Pty Ltd |

|

Director: |

Daniel McMillan |

|

Subject land: |

Street Address: · 7066 Holbrook Road, Rowan NSW 2650, · 456 Plumpton Road, Rowan, NSW 2650 · 474 Plumpton Road, Rowan, NSW 2650 · 16 Lloyd Road, Springvale, NSW 2650 Legal Description: Lot 18 DP1054800, Lot 24, 26, 43, 65 and 66 DP757246, Lot 23 DP1063399, Lot 1 and 2 DP1171894, Lot 23 DP757246, Lot 25 DP757246, Lot 1 DP870056 |

|

Landowners |

Refer to confidential attachment 1 |

Report

The subject planning proposal seeks to amend the Wagga Wagga Local Environmental Plan 2010 (LEP) to:

· Rezone the subject land from RU1 Primary Production zoned land and R5 Large Lot Residential to the following mix of land use zones:

o R1 – General Residential

o R3 – Medium Density Residential

o R5 – Large Lot Residential

o RE1 – Public Recreation

o E1 – Local Centre

o SP2 – Infrastructure (School)

· Remove the minimum lot size of 200 hectares and 2 hectares.

· Apply a minimum lot size of 2,000m2 for the proposed R5 Large Lot Residential zone.

· Amend the ‘Urban Release Area Map’ to include the subject land.

· Amend Clause 5.1 to identify the land to be zoned SP2 and the relevant acquisition authority.

· Amend the ‘Land Reservation Acquisition Map’ to identify the school site.

· Introduce a new local provision to Part 7 (new draft clause 7.14).

· Introduce a new ‘clause application map’ to identify the land to which the clause will apply.

· Introduce a new local provision to Part 7 (new draft clause 7.15)

· Introduce a ‘Dwelling Density Map’ to identify the relevant densities to apply to the subject land.

· Introduce an additional permitted use on a designated part of the site for the purpose of ‘Caravan parks’ to facilitate the development of a manufactured home estate (MHE).

· Introduce an ‘Additional Permitted Uses’ Map to identify the location of the proposed additional permitted use.

The planning proposal is supported by a draft development control plan (DCP) prepared by the proponent. The draft DCP is currently under assessment and will be implemented under a separate process to the planning proposal outlined above.

The planning proposal is also supported by an addendum to clarify certain provisions that require further information or justification for certain aspects of the proponent’s draft Planning Proposal.

2. Context

In May 2023 the then Department of Planning and Environment refused the gateway determination for Sunnyside (LEP21/0001) stating that the proposal should not proceed. Further information regarding the refusal was provided Councillors in a briefing on 4 November 2024.

Subsequently the Rowan Planning Proposal (LEP22/0001) was placed on hold while Council met with the DPHI to understand the required approach for a successful planning proposal Gateway Determination. Council, the Department and the proponents for both Rowan and Sunnyside have continued to collaborate to establish a pathway to approval.

In June 2023, Council and the Department developed a four-step process to facilitate success of a subsequent planning proposal.

This included the following:

1. Strategic planning rationale

2. Precinct wide infrastructure requirements

3. Combined planning proposal

4. Fresh planning proposal

In order to respond to 1). Council prepared a SGA Context Paper. This context paper provided a detailed analysis of the strategic merit for the proposal, including the changing context for housing in Wagga, the projected growth for housing in 2041 and the supportive planning to achieve this. This was reported to the Ordinary Council Meeting of 13 May 2024. 2). is covered in off in further detail in the body to this report. Lastly, the lodgement of a fresh planning proposal in January 2024 incorporating the combined land of Sunnyside Ventures Pty Ltd and DevCore satisfies 3). and 4).

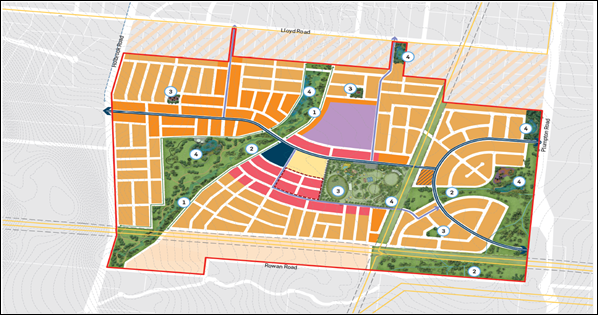

In January 2024 Council received a planning proposal that sought to rezone approximately 350ha of RU1 rural production zoned land and R5 large lot residential zoned land into a variety of R1, R3 and R5 zoned land, supported by RE1 public recreation, E1 local centre and SP2 infrastructure zoned land (the subject of this report). The proposal seeks to deliver an integrated community consisting of approximately 2,900 dwellings, 34ha of open space (including a district park and 4 local parks), active travel network, a local centre, community centre and land for a school. These components are set out within an indicative masterplan for the development (see Figure 1 below).

Figure 1 – Zone 1 Southern Growth Area Indicative Masterplan

The proposal follows an extended period of discussion between Council staff and the proponents (Rowan Village and Sunnyside Ventures) to identify the infrastructure required to service the development. Council staff briefed Councillors on the background to this complex matter in November 2024 and February 2025.

Since lodgement, Council staff have focused attention on key components of the proposal, including the mix of residential dwelling density and diversity across the site, the provision and location of formal and informal open space (including a new district park), details around the proposed seniors housing (Manufactured Homes Estate - MHE), school site and local centre and the proposed planning agreement. A significant package of information updating the planning proposal was lodged with Council in January 2025, responding to feedback provided by Council staff.

On 29 May 2024 the Minister for Planning and Public Spaces announced a further investment of $137.9M under the Accelerated Infrastructure Fund (Tranche 3). Council received and accepted a funding offer of $70.79 million of grant funding in June 2024.

The funding is designed to provide critical infrastructure to support sewer upgrades in the Northern Growth Area and the duplication of Plumpton Road North and Plumpton Road South to support the delivery of new homes. The funding for the upgrades of Plumpton Road North and Plumpton Road South is intrinsically linked to the delivery of housing in the south of the city and emphasises the State government’s financial commitment to delivering housing in Wagga Wagga.

Extensive negotiations have been held with the proponents around the detail to be included within a potential planning agreement, with several offers being received over recent months. Whilst these negotiations have resolved the majority of issues in relation to a potential planning agreement, three core matters remain between the parties:

1. The timing for a signed planning agreement;

2. Contributions payable for dwellings developed within the MHE and medium density development and;

3. The timing of upgrades to Holbrook Road.

Given the ongoing uncertainty regarding the collection of contributions and the potential financial exposure to Council, staff recommend a standard approach to contributions through the use of a contributions plan to identify the infrastructure requirements to service Zone 1 of the SGA.

3. Legislative framework

LEPs provide the local statutory framework that guides development and land use decisions throughout NSW. They do this through zoning and development standards, which provide a framework for the way land can be developed and used.

Amendments to LEPs are generally undertaken through the preparation and assessment of planning proposals. A planning proposal is the document that sets out the justification and supporting information to allow an LEP to be made.

Planning proposals are considered and assessed through a process under Division 3.4 of the Environmental Planning & Assessment Act 1979. The process is supported by the Local Environmental Plan Making Guideline (DPE, August 2023).

The planning proposal describes how amendments to an LEP ‘give effect’ to strategic and site-specific planning outcomes. It is therefore the first step in making the statutory link with strategic plans and amending an LEP.

Where the planning proposal has been initiated by a proponent, council is to review and assess the planning proposal and decide whether to support and submit it to the Department for a Gateway determination.

Section 3.33 sets out matters in relation to the explanation and justification for a proposed instrument (the planning proposal).

(2) The planning proposal is to include the following:

(a) a statement of the objectives or intended outcomes of the proposed instrument,

(b) an explanation of the provisions that are to be included in the proposed instrument,

(c) the justification for those objectives, outcomes and provisions and the process for their implementation (including whether the proposed instrument will give effect to the local strategic planning statement of the council of the area and will comply with relevant directions under section 9.1),

(d) if maps are to be adopted by the proposed instrument, such as maps for proposed land use zones; heritage areas; flood prone land—a version of the maps containing sufficient detail to indicate the substantive effect of the proposed instrument,

(e) details of the community consultation that is to be undertaken before consideration is given to the making of the proposed instrument.

4. Consistency with strategic planning framework

The draft planning proposal has been assessed against the following strategies and plans (in accordance with the LEP Making Guideline).

· Riverina Murray Regional Plan 2041

· Wagga Wagga Local Strategic Planning Statement

· Wagga Wagga Community Strategic Plan

· Wagga Wagga Integrated Transport Strategy

· Wagga Wagga Recreation, Open Space and Community Strategy

· Southern Growth Area Context Paper

· Wagga Wagga Transport Plan (TfNSW)

The draft planning proposal has been assessed against the relevant State Environmental Planning Policies and Ministerial Directions issued under s9.1 of the EP&A Act.

The draft planning proposal has considered environmental, social and economic impacts as well as local, state and commonwealth infrastructure requirements and interests.

The draft planning proposal has considered a range of technical reports and has considered internal and external referral comments from a range of stakeholders.

The assessment has confirmed that there are some inconsistencies; these are justified or can be considered consistent with the resolution of the outstanding technical reports updates that are required to be resolved prior to exhibition of the draft Planning Proposal (discussed in section 0 of this report).

Overall, the draft Planning Proposal is considered to meet the requirements of s3.33(2) of the EP&A Act and the LEP Making Guidelines with respect to determining consistency with the strategic planning framework that applies to this proposal.

5. Infrastructure delivery & funding (contributions)

In areas such as SGA Zone 1, Council collects contributions from developers to ensure new development is supported by the required local infrastructure. Open space, community facilities, active travel and roads infrastructure for example are usually funded under Section 7.11 of the EP&A Act, with contributions collected by Council under a contributions plan.

Sewer and stormwater contributions to fund infrastructure required to support the development are levied under Section 64 of the Local Government Act 1993 and these contributions are detailed in the Development Servicing Plans (DSP).

In May 2023 the Department refused the gateway determination for the original Sunnyside Planning Proposal (LEP21/0001). The refusal outlined a number of reasons why the proposal was not supported, including that the planning proposal did not demonstrate strategic merit with respect to ensuring feasibility of providing infrastructure and services and the identification of staging of development and infrastructure upgrades in the SGA. Further discussions with the Department highlighted the need to deliver precinct wide infrastructure that could be secured, funded and delivered appropriately.

In response to this advice, Council staff and the proponents have identified a list of community facilities, roads, open space, and active travel infrastructure required to support Zone 1 of the SGA to be included in a proposed planning agreement. This includes estimated costs and trigger points in the development for the delivery of this infrastructure and formed the basis of a proposed planning agreement.

Section 7.11 contributions collected under a contributions plan are capped in approved greenfield areas (such as the SGA) to $30,000, unless the contributions plan is approved by the Independent Pricing and Regulatory Tribunal (IPART). By comparison, planning agreements are a voluntary agreement between the parties to provide or fund infrastructure which would usually be in a contributions plan but are not subject to the Section 7.11 contributions cap. They are however, subject to the requirements of Section 7.4 of the EP&A Act.

Section 64 sewer and stormwater contributions have not been included in the proposed planning agreement (if it was to go ahead).

As discussed in Section 2 above, the proponents have made several offers to enter a planning agreement to fund the local infrastructure required to support Zone 1 of the SGA, which would usually be included in a Section 7.11 contributions plan. The most recent offer to enter into a planning agreement for SGA Zone 1 includes developer works and cash contributions which are valued at approximately $38,000 per lot (in 2024/25 dollars, based on lot yield of 2,678[1]).

Attachment 2 includes a table which details the list of infrastructure agreed between the proponent and Council staff required to support SGA Zone 1 and form the basis of the current offer to enter into a planning agreement.

Whilst these negotiations have resolved the majority of issues in relation to a potential planning agreement, three core matters remain between the parties: the timing of a signed planning agreement; contributions payable for dwellings developed within the MHE and medium density development and; the timing of upgrades to Holbrook Road.

These concerns are heightened by the fact that no agreement has been reached with the proponents on the delivery triggers for infrastructure, which could result in later staged infrastructure, such as the planned upgrades to the District Park or Holbrook Road, not being delivered by the proposal. Additionally, the proponents have not agreed to enter into bank guarantees for this infrastructure, potentially leaving council with a significant financial exposure in the event that the proponents do not deliver the required infrastructure to service the SGA.

In the absence of an approved planning agreement Council must develop a contributions plan for the SGA Zone 1 to facilitate the collection of Section 7.11 contributions for the principal subdivision.

Council staff are currently preparing scenarios for a draft contributions plan, which will form the basis of an addendum to the Wagga Wagga Local Infrastructure Contributions Plan. A further report will be presented to Council on this matter prior to the public exhibition of the planning proposal.

6. Key matters

6.1. Zoning

The draft planning proposal proposes to achieve the following zoning across the Zone 1 of the SGA. The proposed zoning map below shows a range of zoning, including commercial, residential (large lot, general and medium density), open space and special purposes (future education).

Figure 2 – Proposed land zoning Source: Urbis

The zoning will be supported by the masterplan shown in Figure 1 above. The proposal will also see a minimum lot size of 2,000m2 applied to the R5 (Large Lot Residential) land.

The draft planning proposal will introduce new local clauses to the LEP to ensure appropriate densities are achieved in key locations and implement the vision of the masterplan across Zone 1.

The draft planning proposal will also introduce administrative changes relating to acquisition authorities, and designating Zone 1 as an ‘urban release area’.

The draft planning proposal seeks an additional permitted use, however for the reasons outlined in this report and the assessment report, this is not supported.

6.2. Density, diversity, distribution

Council and the proponents have sought to agree how 2,900 dwellings will be accommodated within Zone 1 of the SGA. Council staff have focused on the density of residential development to be achieved, how diversity of residential outcomes can be delivered and how these outcomes can be spatially planned across the site.

Whilst the planning proposal seeks the rezoning of land to deliver circa 2,900 dwellings, the proponent has recently indicated that while it is their commercial interest to maximise development outcomes in Zone 1, they cannot commit to the delivery of 2,900 dwellings in Zone 1 and will instead seek to deliver a minimum of 2,515 lots. It is anticipated that some of these lots will be subdivided for medium density, which will increase the overall dwelling yield above this figure.

The yield needs to be as accurate as possible as this is the basis on which Council staff will model the contributions income against costs. The documentation received from the developer mentions 2,900 dwellings, however the most recent offer to enter into a planning agreement references 2,678 lots (which is greater than the minimum lot yield mentioned above).

To ensure the rezoning will deliver 2,900 dwellings, Council staff have investigated a range of mechanisms including a review of potential minimum lot sizes, maximum lot sizes and minimum dwelling yield requirements to secure appropriate outcomes.

A minimum dwelling yield mechanism has been agreed with the proponent as the best mechanism to deliver the desired housing outcomes, however the actual dwelling density calculation remains in contention.

The proponent has put forward three ‘tiers’ of dwelling density, which align with the proposed zoning of R1 – General Residential and R3 – Medium Density Residential. The R3 zone is further split into an ‘inner area’ (dark pink) and ‘outer area’ (light pink). The distribution is agreed. The table below provides a summary of the proposed density rates and the associated yield, noting that Council staff are proposing higher density figures in the R3 zone.

Table 1 – Proposed Densities and yield (lots)

|

Zoning |

Proponent proposed density |

Proponent min. yield |

Council proposed density |

Council min. yield |

|

R3 – Medium Density (inner) |

18 dw/ha |

346 |

28 dw/ha |

518 |

|

R3 – Medium Density (outer) |

12 dw/ha |

454 |

22 dw/ha |

833 |

|

R1 – General Residential |

10 dw/ha |

1,434 |

10 dw/ha |

1,434 |

|

R5 – Large Lot Residential |

N/A |

51 |

N/A |

51 |

|

Seniors Living |

N/A |

230 |

N/A |

230 |

|

Total |

|

2,515 |

|

3,066 |

Figure 3 – Density areas (including the proponent densities)

This will also be supported by the introduction of a dwelling cap (‘restricted density yield’) on the number of dwellings to be delivered to align with current infrastructure capacity. Further detail regarding the infrastructure capacity has been outlined in this report and the assessment report (Attachment 3)

6.3. Addendum

The draft planning proposal is supported by an addendum, which has been prepared by Council staff.

The addendum was prepared to address the identified gaps in the proponent’s planning proposal and enable additional provisions (such as the restricted dwelling yield).

6.4. Local clause provisions

The draft Planning Proposal seeks to introduce two site-specific additional local provisions:

1. A local provision that enables the delivery of a minimum ‘net dwellings per hectare’, and

2. A local provision that requires that development in Zone 1 is generally in accordance with the ‘Design Principles’ in Appendix A – Urban Design Report (i.e. providing it statutory weight)

Council staff and the proponent have previously discussed the elements that would make up the local clause, however the updated draft Planning Proposal received in January 2025 did not reflect these discussions. Accordingly, staff will include these additional considerations within the addendum.

The second local provision above will also include:

· Objectives to support the intent of the proposed local clause and guide future assessment of development applications in Zone 1.

· Administrative matters to enable appropriate implementation.

· Controls to ensure that development within Zone 1 is consistent with the masterplan and guidelines outlined in the Urban Design Report.

· Provisions which require a detailed masterplan to be prepared for the future commercial zoned land (discussed further below).

The full provisions are outlined in the addendum prepared by Council staff to ensure the entire intent of the clause is realised. The addendum is provided in Attachment 4

6.5. Infrastructure capacity & servicing

As part of the referral process, constraints have been identified regarding sewer and water capacity requirements to service future development in SGA Zone 1.

The developer will require ongoing discussions with Council’s City Engineering department and Riverina Water to agree on a proposed approach to delivering the capacity required to service Zone 1 of the SGA.

Sewer

Currently the Kooringal STP will require a short-term solution to manage peak average dry weather flows (ADWF), but in the long term require upgrades to the entire plant (already identified within Council’s Long Term Financial Plan) to 7ML/day ADWF capacity.

Council’s City Engineering department has advised, at the time of writing, that there is capacity to accommodate the sewage from 440 lots at the Kooringal Sewer Treatment Plant (STP). Budget is proposed in the 2025/26 Council budget to undertake a feasibility study for the temporary storage of wastewater in tanks to create additional capacity for an additional 500-750 dwellings in Zone 1 in advance of a planned upgrade to the Kooringal STP.

The proponent prepared an Infrastructure and Servicing Delivery Plan (ISDP) to inform their planning agreement offer. The ISDP identified that the developer would deliver the lead in sewer infrastructure to the Kooringal STP and that suitable upgrades would be required to the Kooringal STP.

To sustainably manage the capacity constraints mechanisms are in place to ensure that development cannot proceed unless adequate arrangements have been put in place.

Water

Riverina Water has advised that the SGA is serviceable and that they can currently service the first 422 dwellings without any infrastructure upgrades. However additional infrastructure, including a new rising main, storage reservoir and trunk main will be required to service the balance of Zone 1. At the time of writing, Riverina Water has engaged a third-party consultant (Public Works) to undertake a review and update of their hydraulic model and incorporate the additional information relating to the SGA and broader LGA. This review is understood to have a preliminary draft delivered by March 2025.

The update to the model will also detail any upgrades required to existing infrastructure, as well as detailing any new infrastructure requirements. Whilst the updated hydraulic model remains under review, any future servicing capacity and infrastructure requirements beyond Year 1 are not yet known. This includes the cost for any works beyond Year 1 of the development.

Riverina Water has also advised:

· Indicative estimates note that additional capacity to service beyond Year 1 of the SGA growth would be available in approx. 3-5 years from confirmation of the planning approval.

· Timeframes are proposed to be refined once the infrastructure requirements are known and prioritised within existing capital works programs.

· Infrastructure delivery will be dependent on scope, planning requirements such as land acquisition, design and construction.

· Once the hydraulic modelling is complete and a full list of infrastructure requirements is known, Riverina Water will be able to provide more detailed information on the scope of works, the costs involved (both to Riverina Water and the developers) and the timeframe for delivery.”

To sustainably manage the capacity constraints mechanisms are in place to ensure that development cannot proceed unless adequate arrangements have been put in place.

Proposed solution

A dwelling cap (‘restricted dwelling yield’) is recommended to protect the sustainable delivery of infrastructure whilst planning for long term capacity and infrastructure delivery across the precinct. The ‘cap’ would be introduced as part of the dwelling densities clause and would subsequently be removed once infrastructure planning for water and sewer delivery is complete. This would require a future LEP amendment, to remove the cap at an appropriate time.

The current Wagga Wagga Local Environmental Plan provides existing protection for Urban Release Areas under Clause 6.2 which states:

“Development consent must not be granted for development on land in an urban release area unless the Council is satisfied that any public utility infrastructure that is essential for the proposed development is available or that adequate arrangements have been made to make that infrastructure available when required.”

This clause cannot be varied under clause 4.6 of the LEP. This clause aims to ensure that land within an urban release area can accommodate future development and the infrastructure needs arising from increased density. This means government authorities are not burdened by the cost of infrastructure associated with development and avoids the potential for cost-shifting.

The draft Planning Proposal is supported by a broad range of detailed technical reports. The draft Planning Proposal and supporting documentation were referred as part of the assessment process to both internal and external stakeholders.

The outcomes of this referral process identified a range of technical gaps with several of the reports, with these matters raised with the proponent through detailed further information requests.

As part of the assessment of the planning proposal staff have considered the issues raised and have concluded that the outstanding matters should not prevent the planning proposal from being lodged with DPHI for assessment. Council staff consider these issues can be resolved during the gateway process prior to exhibition of the draft Planning Proposal.

The information that remains outstanding is summarised below; the outstanding matters requested to be conditioned as part of a Gateway Determination is outlined in Section 9 of this report.

Detailed assessment of the technical reports is outlined in the relevant sections of the assessment report in Section C and D. A high level overview is provided in the table below.

Table 2 – Outstanding matters

|

Outstanding matter |

Assessment |

|

Biodiversity (draft BDAR’s) |

Acceptable for assessment (consistent with written advice received from DPHI). Outstanding matters are to be dealt with during the gateway process prior to exhibition. |

|

Flooding |

Information lodged was acceptable for assessment. Outstanding matters identified by City Engineering are to be resolved through the preparation of the Development Control Plan |

|

Strategic Bushfire Study |

Acceptable for assessment. Outstanding matters are to be dealt with during the gateway process prior to exhibition. |

|

Agricultural land values |

Outstanding matters are to be dealt with during the gateway process prior to exhibition. |

|

Cultural Heritage |

Acceptable for assessment. Outstanding matters are to be dealt with during the gateway process prior to exhibition. |

|

Contamination |

Acceptable for assessment. Outstanding matters are to be dealt with during the gateway process prior to exhibition. |

|

Roads & Traffic |

The proponent will be required to undertake additional trip origin destination modelling so that the provision of infrastructure can adequately address the impacts of development on Plumpton Road and Holbrook Road |

6.7. Additional permitted use

A comprehensive update to the draft Planning Proposal report was received on 21 January 2025 that included a formal request to consider an additional permitted use within the subject site.

The updated report seeks (amongst other matters) to ‘Introduce an additional permitted use on a designated part of the site for ‘Caravan parks’ to facilitate the development of a manufactured home estate’.

The draft Planning Proposal specifically seeks:

The provisions would seek to enable manufactured home estates (through ‘caravan parks’) within certain parts of the R3 zone.

The proposed wording of the additional local provision is provided below:

Schedule 1 Additional permitted Uses

7.XX Use of certain land in the Southern Growth Area – Zone 1

(1) This clause applies to land mapped as ‘X’ on the Clause Application Map

(2) Development for the purpose of a ‘Caravan Parks’ is permitted with consent in ‘Area 1’ development will be only for the purposes of a manufactured home estate

Note: For the purposes of Clause (7.XX), a Caravan Park means a development application for the purposes of a Manufactured Home Estate

The assessment confirms that the additional permitted use is not supported for the following reasons (a fuller description of these matters is outlined in the Planning Proposal Assessment report).

· The application has not had detailed consideration of Ministerial Direction 6.2(2)(b) which requires an assessment of the principles listed in clause 125 State Environmental Planning Policy (Housing) 2021.

· The proposal advises that the MHE does not require subdivision, therefore the principal subdivision of the land will create a larger englobo lot.

· Council should not consider an additional permitted use where a legal planning pathway[2] (that is already permitted with consent) is already available under the proposed residential zoning. Introducing an additional provision would be unnecessary and redundant.

· The introduction of the additional permitted use for ‘caravan parks’ presents a potential risk of unintended consequences[3]. Specifically, it opens the door for developments that may not align with the proponent’s intentions for a Residential Land Lease Community (LLC) or Manufactured Home Estate.

· The planning proposal contradicts itself as it asserts that individual development consent would not be required for each dwelling within the MHE, which is characteristic of the Residential Land Lease Community model. However, the proposed wording within the draft Planning Proposal also suggests that, despite the MHE being defined under the Local Government Act 1993, the development would be characterised as a standard residential development application requiring consent for each dwelling's construction.

· This discrepancy introduces confusion about the application process and whether the proposed development aligns with the operational framework of MHEs. A standard residential DA process for each dwelling contradicts the typical approach of MHEs, where individual consents are not usually required.

· Incorporating the matters raised above this creates significant legal complexities and implications with each planning pathway that need to be managed in conjunction with the Development Assessment team. Introducing further legal complexity through an additional permitted use is not recommended. This can include matters such as the characterisation of the land use, interaction of the EP&A Act and LG Act, contributions levies, and post consent approvals pathways.

Accordingly, the introduction of an additional permitted use is not recommended or supported.

Further information regarding the additional permitted use can be found in the Section 5.6 of the assessment report.

6.8. Open space provision and distribution

The Recreation, Open Space and Community Strategy 2040 (ROSC), sets the standards for the provision of open space in Wagga Wagga. A draft Planning Proposal must be supported by a Recreation and Open Space Plan for the development which considers; parks (passive recreation areas), sporting and recreation facilities (active recreation areas) and lineal parks (corridors).

The proposed open space requirement has been met by virtue of the quantum of open space being provided. However, the distribution of this open space does not meet the ROSC requirements. The proposal outlines that four (4) local parks will be provided but these are undersized (LP1 - 0.61ha, LP2 - 0.5ha and LP3 - 0.46ha).

Council must ensure delivery of open space that is consistent with the ROSC and the recommendations of this report reflect this position.

6.9. School infrastructure

Ongoing discussions with the Department of Education have indicated that the land allocation of 3ha is sufficient area for consideration of a primary school. Further detailed analysis is required by the Department to determine whether a high school is required, the future land should this be required has been identified as ‘Investigation Area for Educational Facilities – subject to further review’. Council staff expect that further engagement with the Department will occur as part of the Gateway Determination process.

7. DCP update

A draft site-specific development control plan (draft DCP) has been prepared in support of the Planning Proposal and considers the requirements set out in Clause 6.3(3) of the Wagga Wagga Local Environmental Plan 2010.

The draft DCP provides high level site-specific development controls for the future development in Zone 1. It is intended to be included within Part E (Site specific controls) of the Wagga Wagga Development Control Plan 2010.

The assessment of a draft DCP is a separate process and does not preclude the ability for the draft Planning Proposal to proceed.

Multiple iterations of the draft DCP are likely to be required throughout the Planning Proposal process. The draft DCP will be reported to Council at a separate point in time.

8. Outcome of assessment and recommendations

This report recommends and confirms that the draft Planning Proposal has strategic merit and site-specific merit. The high-level objectives and intended outcomes are supported.

Whilst it is recognised there are outstanding documentation requirements, this assessment report confirms that these matters are appropriate to manage, update and complete during the Gateway Determination process.

This report recommends that Council support the proposal in-principle and direct staff to lodge the draft Planning Proposal with the DPHI requesting Gateway Determination.

It is recommended that the draft Planning Proposal consider and address the following outstanding matters on receipt of the Gateway Determination and prior to exhibition of the proposal. These matters will be requested to be included as part of the conditions of the Gateway Determination issued by DPHI or pursued by Council in alignment with the Gateway Determination conditions.

1. Biodiversity

1.1. Update the draft BDAR’s for Sunnyside and Rowan to clearly identify how the proposed development adopts the Avoid, Minimise and Offset regime.

1.2. Ensure the draft BDAR’s are consistent with the advice issued by Biodiversity, Conservation and Science Group of the Department of Climate Change, Energy, the Environment and Water (DCCEEW) and echoed by Wagga Wagga City Council.

1.3. The refusal of Sunnyside LEP21/0001 identified the fact that the Biodiversity Conservation Act & Regulation establishes that Council must assess biodiversity values and likely impacts (direct, indirect and prescribed) that include all anticipated development and ancillary works off site. This includes any road upgrades and other utilities or infrastructure that is required to facilitate any future development.

This also includes:

- Likely impacts to proposed retained vegetation and scattered paddock trees;

- Likely impacts on connectivity on and beyond the site, and;

- Cumulative impacts on the same Threatened Species or Endangered Ecological Communities from other projects such as the reduced minimum lot size of land on Gregadoo Road, the Gregadoo Solar farm, the Energy Connect East project and the Dunns Road upgrade.

1.4. The legislation also establishes the primacy of the ‘avoidance hierarchy’. The draft BDAR’s lack sufficient evidence for Council to establish that the avoidance hierarchy has been robustly applied and justified, particularly when there is an SAII entity impacted. Updated reports must address this matter.

1.5. The SGA design should retain enough habitat, so that future development could involve minimal obligation for Biodiversity Offsets, which would represent a positive outcome for Council’s Biodiversity objectives, and also for the Proponents time and costs in meeting this obligation.

This could be achieved through considering the addition of measures like:

· Avoiding all of the moderate condition PCT277 located to the west of the riparian corridor;

· Zoning the higher value environmental areas as C2 Environmental Conservation rather than RE1 Recreation;

· Incorporating appropriate buffer distances between zones to avoid future land use conflict that may result in removal or significant decline.

· Incorporating as much of the lower condition PCT277 into planned open space areas as possible;

· Incorporating as many of the scattered paddock trees into planned open space areas as possible;

· Creating an east-west corridor to allow threatened species movement.

1.6. Council acknowledges that some elements of impact assessment are commonly left until DA stage. However, Council is seeking to establish the key principles around the protection of native vegetation such as the PCT 277 and scattered trees to ensure their incorporation within the design and avoid delays at the development consent stage.

1.7. Council do not support the location of formal sporting facilities within the area identified for moderate value PCT277. The areas for protection need to incorporate an appropriate buffer distance from residential or commercial uses to ensure their ongoing viability and environmental value.

2. Strategic Bushfire Study

2.1. Submit an updated Strategic Bushfire Study (Rowan Village) that assesses the current structure plan layout.

3. Agricultural land values

3.1. An agricultural lands assessment and land use conflict risk assessment (LUCRA) must be prepared to consider the impact of the planning proposals objectives with respect to the agricultural production value of the rural land sought to be rezoned.

3.2. The report must consider the following:

3.2.1. Correspondence from the Department of Primary Industries dated 12/2/2024 (provided under a separate comment).

3.2.2. The potential detrimental impact to agricultural production and/or supply chain threshold of the LGA and/or undermine future opportunities for agribusiness and/or agritourism close to the Wagga Wagga urban area.

3.2.3. The report is to be prepared with regard to any applicable Department of Primary Industries guideline. Liaison with DPI to confirm the correct or applicable guidelines is recommended.

3.2.4. The report must have regard to all objectives, strategies or actions relating to agricultural land protection that is included in the Murray Riverina Regional Plan and Wagga Wagga Local Strategic Planning Statement

3.2.5. Must give consideration and response to Direction 9.1 – Rural Zones and Direction 9.2 – Rural Lands under s9.1 of the EP&A Act.

3.2.6. Any other matter Council or the Department of Primary Industries deems required through subsequent discussions relating to the preparation of this report.

4. Cultural Heritage

4.1. Undertake a second archaeological survey for the Rowan site on a day with good site and weather conditions to achieve ground surface visibility equal or greater than 50%. If additional sites of significance are found and are likely to be impacted, the proposal is to be redesigned, if required, to avoid impacts. The ACHA report is to be amended accordingly.

4.2. Overlay all identified archaeological sites and sites of cultural value of both sites on top of the concept plan to clearly demonstrate that the Planning Proposal avoids and protects Aboriginal sites of significance. Update the ACHA, Urban Design and Structure Plan reports accordingly to clearly identify the sites that are protected using an avoidance and mitigate hierarchy.

4.3. Amend the ACHA report for the Sunnyside site to clearly identify the sites that will be protected and provide details for avoidance of impacts in relation to the culturally modified trees.

4.4. Retain mature trees within the site even if they are not culturally significant.

4.5. Ensure that all recommendations contained in the two ACHA reports and the CVA report are implemented throughout the various approvals and development stages for the Site.

4.6. Update draft ACHA reports to confirm that appropriate investigations were undertaken on Lot 1, DP870056 which is the subject of this draft Planning Proposal.

4.7. Update the draft ACHA report to include Lot 1 and Lot 2, DP1171894 and confirm these areas were investigated as part of the report.

5. Contamination

5.1. Both contamination reports must have regard to Council policy - POL 030 (Contaminated Land Management). Both reports are to be updated to ensure consideration and consistency with Council policy (including certification requirements).

5.2. The Preliminary Environmental Assessment Report requires the following amendments:

5.2.1. The submitted report is a hybrid document that includes a desktop analysis and limited sampling. This is inconsistent with the prescribed requirements for a Preliminary Site Investigation therefore creating inconsistencies with the documentation.

5.2.2. The report contains inconsistent data of soil sample depth, update in accordance with the NEPC

5.2.3. Additional assessment is required for the recreational category to include consideration of the Health Investigation Levels not just Ecological Investigation Levels.

5.3. Submit a Detailed Site Investigation for the entirety of Zone 1 which is prepared in accordance with the relevant guidelines and legislation. The Detailed Site Investigation must take into consideration the recommendations of both the Preliminary Environmental Assessment Report (Sunnyside) and Preliminary Site Investigation (Rowan Village). The proposed zoning plan shows the entirety of the site will be developed either through residential or recreational zoning, therefore it is requested that a DSI is completed before rezoning, to ensure the correct zoning of the potential contaminated land and minimising the risk of finding potential contaminates after rezoning has taken place.

6. Roads & Traffic

6.1. Require provision of trip origin destination model to ensure that the future provision of infrastructure can adequately address the impacts of development on Plumpton Road and Holbrook Road.

7. Recreation & Open Space

7.1. That Council require the proponent to update the draft Planning Proposal to demonstrate consistency with the Wagga Wagga Recreation, Open Space and Community (ROSC) Strategy.

8. Updates to Planning Proposal

8.1. The introduction of an additional permitted use is not recommended or supported.

8.2. That prior to any exhibition, the draft Planning Proposal is updated to remove reference to provisions regarding the additional permitted use (APU) as a result of the recommendation of this report.

Links to the Attachments

|

1. |

|

|

|

2. |

|

|

|

3. |

|

|

|

4. |

|

|

|

5. |

|

|

|

6. |

|

|

|

7. |

|

|

|

8. |

|

|

|

9. |

|

|

|

10. |

|

|

|

11. |

LEP24.0003 - PSI - Preliminary Environmental Assessment Report |

|

|

12. |

LEP24.0003 - PSI - Preliminary Site Investigation - Rowan Village |

|

|

13. |

LEP24.0003 - Residential and Retail Market Demand Assessment |

|

|

14. |

LEP24.0003 - Site and Precinct Stormwater Management Strategy Review |

|

|

15. |

LEP24.0003 - Social Infrastructure and Open Space Assessment |

|

|

16. |

|

|

|

17. |

|

|

|

18. |

|

|

|

19. |

|

|

|

20. |

|

|

|

21. |

|

Financial Implications

· Infrastructure contributions are essential to fund the local infrastructure required to support the development. These can be collected under contribution plans (including development servicing plans for sewer and stormwater) or under planning agreements.

· Section 64 sewer and stormwater contributions for SGA Zone 1 will be collected based on the current rates of the adjacent areas as identified in the development servicing plans. In 2024/25 dollars this will see approximately $13 million Section 64 Sewer and approximately $12 million Section 64 Stormwater contributions collected (based on a lot yield of 2,678) to fund local sewer and stormwater infrastructure. These figures will be indexed annually on 1 July in accordance with the DSP.

· Given the proposed planning agreement negotiations have ceased, Section 7.11 contributions for SGA Zone 1 for the principal subdivision is proposed to be collected under an addendum to the current LICP.

· The proponent has previously offered to enter into a Planning Agreement, for the amount of $101,646,210 (or $37,956 per lot) to be provided by a combination of works in kind and cash contributions. As Council has been unable to resolve three core matters within the Planning Agreement, it is recommended that Council develop a contributions plan for Zone 1 of the SGA. This will provide council with the certainty of section 7.11 contributions to a value of $80,340,000 (or $30,000 per lot). Applying a contribution plan will lead to a shortfall of infrastructure funding of $21,306,210, with Council to seek alternative forms of funding for this shortfall.

Policy and Legislation

Environmental Planning & Assessment Act 1979

Environmental Planning & Assessment Regulation 2021

Local Government Act 1993

Biodiversity Conservation Act 2016

Contaminated Lands Management Policy POL030

Developer Infrastructure Agreements Policy POL121

Link to Strategic Plan

The Environment

Objective: Future growth and development of Wagga Wagga is planned for in a sustainable manner

Ensure sustainable urban development

Risk Management Issues for Council

· In the instance that a favorable gateway determination is received, it will require public and agency consultation. Consultation may highlight issues not evident during the assessment.

· Refusal of the subject planning proposal may result in the proponent seeking a rezoning review. This process allows a proponent to request an independent planning panel evaluate and recommend to the Minister whether a proposal should progress to Gateway determination. Council staff have worked extensively to enhance the outcomes proposed by this development. These enhancements could be lost if the matter was reviewed by an independent panel.

· With respect to water and sewer capacity, there is a low risk that approving the rezoning may result in future subdivision/development stages being placed on hold when capacity (dwelling cap) is reached. As explained in this report, Council have existing planning controls in place to ensure that development is not approved without adequate arrangements being in place for infrastructure delivery. Additional controls are also proposed.

· There are several risks associated with introducing additional permitted uses

o Once a use is added to Schedule 1, it may be difficult to remove or restrict it later.

o There are potential for legal risks whereby a future development application for a Land Lease Community is not ‘characterised’ as a ‘manufactured home estate’ (MHE) and the additional permitted use is unnecessary. There are outstanding concerns that early indications around the proposed built form are a typical housing construction method (i.e. slab on ground) rather than moveable dwellings/transportable dwellings. This may result in undesired inconsistencies or legal challenge.

o Aligning infrastructure provision and development contributions to reflect the demand created by any future development of this kind.

o It may bypass the future zoning framework and weaken the integrity of the LEP’s strategic intent.

· A planning agreement is a ‘voluntary’ agreement between the proponent and Council. As such, it can offer to undertake works or pay cash contributions which are higher than can be incorporated in an LICP. While the proposed planning agreement for SGA Zone 1 does not include any Section 7.11 contributions towards the citywide projects listed in the LICP, it does include infrastructure which services an area wider than SGA Zone 1 (Zones 2-4 of the SGA). By comparison, in an LICP only infrastructure with a ‘nexus’ to Zone 1 of the SGA can be included in the infrastructure list for the area. This leaves the potential for a significant shortfall in funding of infrastructure required to support the development of the SGA Zone 1, with alternative funding sources required to meet this shortfall. The extent of any shortfall, along with alternative funding sources, will be presented to council as part of a future Council report. To increase the Section 7.11 contributions cap to $30,000 for SGA Zone 1, the area must be identified and approved as a greenfield area by DPHI.

· To charge Section 7.11 contributions over the cap, contributions plans must be approved by IPART. This would require a review of the costings in the whole LICP.

· It is expected the Section 64 sewer and stormwater contributions for SGA Zone 1 will change when the development servicing plans for the local government area are updated.

· An addendum to the LICP is proposed to collect contributions for the further subdivision of lots in the SGA Zone 1 and for any medium density development. With the proposed planning agreement not proceeding at this point in time, the contributions plan now needs to be developed to be applied to the principal subdivision.

Internal / External Consultation

Internal and external consultation was undertaken following lodgement of the draft Planning Proposal in February and March 2024. External referral responses are included at Attachment 5. Internal and external responses are summarised and discussed in the section 9 of the planning proposal assessment report.

Subject to a favourable gateway determination being issued by the DPHI and the relevant conditions being met, the planning proposal will be placed on public exhibition in accordance with Clause 4, Schedule 1 of the Environmental Planning & Assessment Act 1979.

The planning proposal will also need to be referred to public authorities who are specified on the Gateway Determination issued by DPHI.

Extensive consultation with internal stakeholders across Council has occurred over a substantial length of time to establish the local infrastructure list required to support the development and the estimated costings. Council staff have also been working with the developers and their consultants during the last twelve months to progress the proposed planning agreement.

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Have your Say |

Email newsletter |

Social media |

Website |

|

|

Consult |

|

x |

|

x |

|

|

|

|

|

x |

|

x |

|

|||

|

Other methods (please list specific details below) |

|

Staff are currently preparing a detailed engagement strategy that will support the Planning Proposal and amendments to the Local Infrastructure Contributions Plan. This will identify how Council will specifically engage with the community and relevant stakeholders regarding the SGA (Zone 1). |

|

1. |

Land Owners Information This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: personnel matters concerning particular individuals. - Provided under separate cover |

|

|

2. |

Proposed Planning Agreement - Infrastructure list and costings This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, confer a commercial advantage on a competitor of the Council. - Provided under separate cover |

|

|

3. |

LEP24.0003 - Planning Proposal Assessment Report - Final - Provided under separate cover |

|

|

4. |

SGA Zone 1 - Planning Proposal Addendum - Final - Provided under separate cover |

|

|

5. |

External Referral Responses - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 24 March 2025 |

RP-2 |

RP-2 PETITION - RETICULATED GAS IN NEW SUBDIVISIONS

Author: John Sidgwick

|

Summary: |

The purpose of this report is to receive and note the petition before receiving a further report at a later date to address the specific request. |

That Council:

a receive and note the petition received on 6 March 2025 requesting that Council consider allowing new residential subdivisions to proceed without reticulated gas

b receive a further report in response to the petition within three months

Report

Council received a petition on 6 March 2025 from William Adlong containing 198 signatures. The petition has been submitted to Council in accordance with Council’s Petitions Management Policy.

The petition was initiated on 24 January 2025 with a closing date of 3 March 2025, and requests that Council that Council allow new subdivisions to proceed without reticulated gas. Below is an extract from the petition with the specific wording:

We request that Wagga Wagga City Council allow new residential subdivisions the option to proceed without reticulated gas. This will reduce the price of land, the new home package, and the cost of livening pressures on new home owners. The resulting benefits include:

· lower capital costs for developers;

· reduced connection fees and other operational costs for householders;

· reduced incidence of asthma and respiratory disease from indoor air pollution;

· alignment with the NSW Net Zero Plan.

As per Council’s policy, only the substance of the petition and the number of signatories are provided in the business paper, however the full petition will be available for viewing by Councillors.

Financial Implications

N/A

Policy and Legislation

Petition Management Policy (POL 086)

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga has strong community leadership and a shared vision for the future

Plan long term for the future of Wagga Wagga

Risk Management Issues for Council

Council policies are essential to ensure transparent legal, fair and consistent decision making across the Council. They support Council in achieving its corporate objectives and provide a critical guide for staff, councillors and other stakeholders. In the absence of effective policies there is a greater risk of inconsistency, confusion and inefficiency and can lead to non-compliance with the requirements of legislation and regulations.

Internal / External Consultation

Only minimal internal consultation has occurred at this stage. Further discussions with relevant stakeholders will take place before providing a response back to Council.

|

Report submitted to the Ordinary Meeting of Council on Monday 24 March 2025 |

RP-3 |

RP-3 FINANCIAL PERFORMANCE REPORT AS AT 28 FEBRUARY 2025

Author: Carolyn Rodney

|

Summary: |

This report is for Council to consider information presented on the 2024/25 budget and Long-Term Financial Plan, and details Council’s external investments and performance as at 28 February 2025. |

That Council:

a approve the proposed 2024/25 budget variations for the month ended 28 February 2025 and note the balanced budget position as presented in this report

b approve the proposed budget variations to the 2024/25 Long Term Financial Plan Capital Works Program including new projects and timing adjustments

c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2021 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above

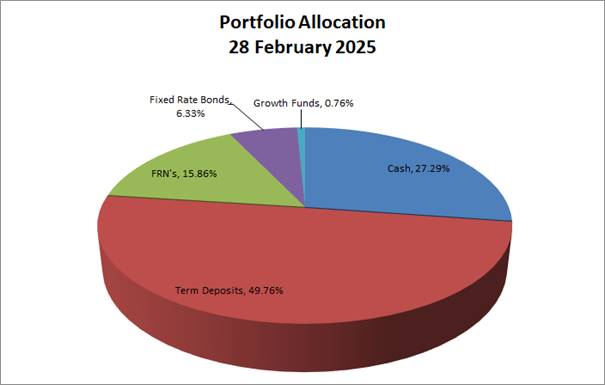

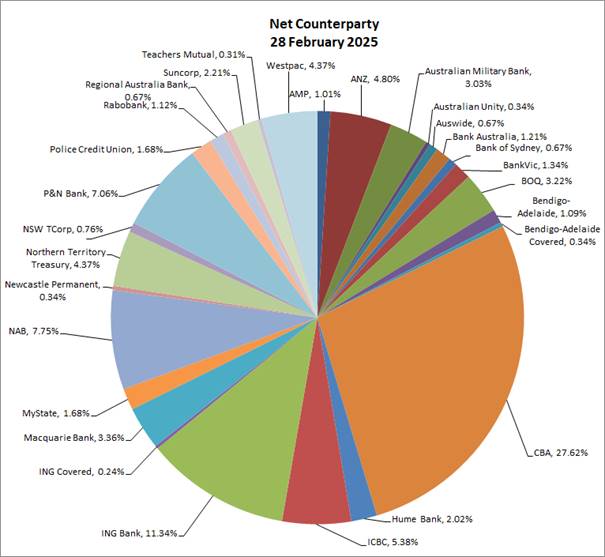

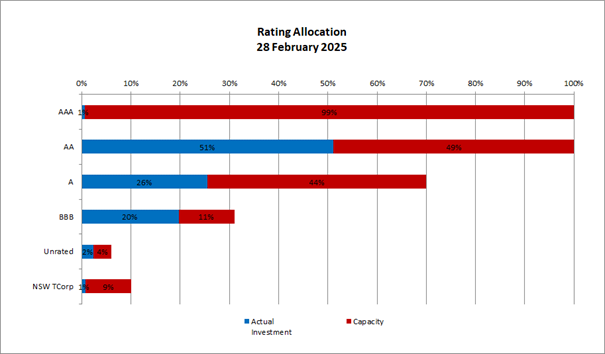

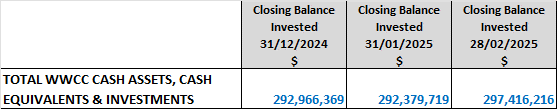

d note the details of the external investments as at 28 February 2025 in accordance with section 625 of the Local Government Act 1993

e accept the grant funding offers as presented in this report

Report

Wagga Wagga City Council (Council) forecasts a balanced budget position as of 28 February 2025.

Proposed budget variations including adjustments to the capital works program are detailed in this report for Council’s consideration and adoption.

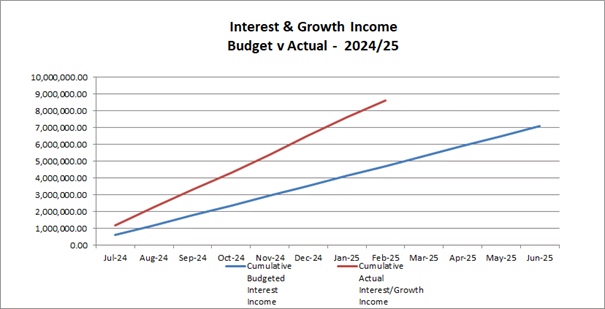

Council has experienced a positive monthly investment performance for the month of February when compared to budget ($431,412 up on the monthly budget). This is mainly due to better than budgeted returns on Council’s investment portfolio, as well as a higher than anticipated investment portfolio balance – which is partly due to Council receiving upfront payment of $48.5M in funding under the Accelerated Infrastructure Fund in June 2024.

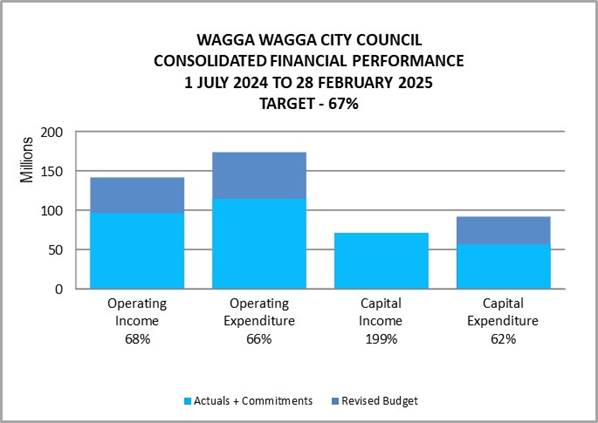

Key Performance Indicators

OPERATING INCOME

Total operating income is 68% of approved budget and is tracking close to budget for the month of February 2025. An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 87% when compared to budget.

OPERATING EXPENSES

Total operating expenditure is 66% of approved budget and is tracking on budget at this stage of the financial year.

CAPITAL INCOME

Total capital income is 199% of approved budget, which is mainly attributed to the Accelerated Infrastructure Fund (AIF) grant funding that has been received. If this up-front grant funding is not fully spent in this financial year, the income will be reduced and carried over to next financial year for completion of the project.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 62% of approved budget. Excluding commitments, the total expenditure is 42% when compared to the approved budget. The capital project budgets have since being reviewed and will be included in the next monthly finance report to accurately reflect the revised timing of the capital works program.

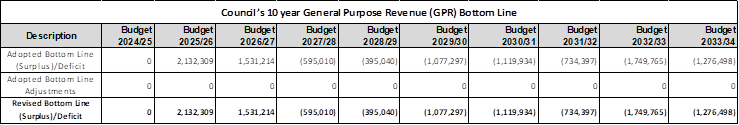

*This table does not include any proposed draft 2025/26 LTFP budget adjustments.

2024/25 Revised Budget Result – (Surplus) / Deficit |

$’000s |

|

Original 2024/25 Budget Result as adopted by Council Total Budget Variations approved to date Budget Variations for February 2025 |

$0K $0K $0K |

|

Proposed Revised Budget result for 28 February 2025 - (Surplus) / Deficit |

$0K |

The proposed Operating and Capital Budget Variations for 28 February 2025 which affect the current 2024/25 financial year are listed below.

|

Budget Variation |

Amount |

Funding Source |

Net Impact (Fav)/ Unfav |

|

|

4 – Community Place and Identity |

|

|||

|

Resilient Response – Flood Equipment & Volunteer Training Project |

$96K |

NSW State Reconstruction Authority Grant ($96K) |

Nil |

|

|

Council has been successful in securing $96,160 in funding from the NSW Government’s Reconstruction Authority’s Supporting Spontaneous Volunteers Program. These funds will be used for the delivery of First Aid, Emergency Preparedness and Flood Response Training along with the purchase of flood equipment that will be allocated to Uranquinty, Oura and North Wagga volunteer response groups. Estimated Completion: 31 December 2025 Job Number: 24331 |

|

|||

|

5 – The Environment |

|

|||

|

Currawarna Community Centre Roof Replacement |

$50K |

Buildings Reserve ($50K) |

Nil |

|

|

Funds are required for the replacement the roof at the Currawarna Community Centre. Works were being undertaken to remove the asbestos ceiling at the Community Centre when it was revealed that the roof structure was in poor condition. Works are required as soon as possible to reduce the time that the Currawarna Community Centre will be out of service. It is proposed to fund the works from the Buildings Reserve. Estimated Completion: 30 June 2025 Job Number: 24439 |

|

|||

|

Sewer Treatment Works Plant Shed Construction – Narrung Street |

$100K |

Sewer Reserve ($100K) |

Nil |

|

|

Funds are required for the construction of a new Plant Shed at the Narrung Street Sewer Treatment Works. The existing shed is not fit for purpose. The new shed will allow for sufficient room to safely carry out testing, repairs and rebuilding of equipment, an electrical testing bench, the cleaning of equipment, emergency shower/eye wash station, sufficient ventilation for welding, improved lighting and adequate room for the storage of parts and equipment. It is proposed to fund the variation from the Sewer Reserve. Estimated Completion: 30 June 2025 Job Number: 50444 |

|

|||

The following projects have been presented to Councillors as part of the 2025/26 LTFP Councillor Budget Workshop process and are now being included below for adoption and inclusion in the 10 year Capital Works Program:

|

Project Title |

2025/26 |

2026/27 |

2027/28 |

2028/29 |

2029/30 |

2030/31 |

|

Top Dressing Machine Purchase |

|

80,000 |

|

|

|

|

|

Historic Council Chambers (HCC) Buildings Upgrade |

123,146 |

|

|

|

|

|

|

Civic Centre Safety Lights |

151,925 |

|

|

|

|

|

|

Airport - Runway Lighting Upgrade (increase to budget) |

|

|

|

|

|

3,642,000 |

|

LMC Hardstand |

2,250,000 |

|

|

|

|

|

|

Glass Gallery Toilet |

|

137,099 |

|

|

|

|

|

Lighting Community Campaigns |

41,645 |

40,870 |

|

|

|

|

|

Orchestra Pit Upgrade |

|

277,898 |

|

|

|

|

|

TOTAL |

2,566,716 |

535,867 |

0 |

0 |

0 |

3,642,000 |

2024/25 Capital Works Summary

|

Approved Budget |

Proposed Movement |

Proposed Budget |

|

|

One-off |

$47,736,170 |

$150,000 |

$47,886,170 |

|

Recurrent |

$37,250,621 |

$0 |

$37,250,621 |

|

Pending |

$0 |