Agenda

and

Business Paper

To be held on

Monday 28

April 2025

at 6:00 PM

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

Agenda

and

Business Paper

To be held on

Monday 28

April 2025

at 6:00 PM

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

NOTICE OF MEETING

The proceedings of all Council meetings in open session, including all debate and addresses by the public, are recorded (audio visual) and livestreamed on Council’s website including for the purpose of facilitating community access to meetings and accuracy of the Minutes.

In addition to webcasting council meetings, audio recordings of confidential sessions of Ordinary Meetings of Council are also recorded, but do not form part of the webcast.

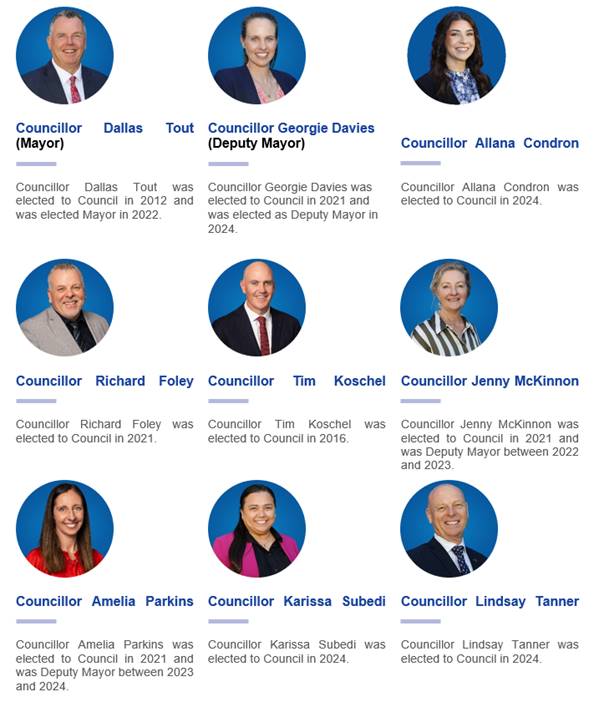

WAGGA WAGGA CITY COUNCILLORS

STATEMENT OF ETHICAL OBLIGATIONS

Councillors are reminded of their Oath or Affirmation of Office made under Section 233A of the Local Government Act 1993 and their obligation under Council’s Code of Conduct to disclose and appropriately manage Conflicts of Interest.

QUORUM

The quorum for a meeting of the Council, is a majority of the Councillors of the Council, who hold office for the time being, who are eligible to vote at the meeting.

Reports submitted to the Ordinary Meeting of Council to be held on Monday 28 April 2025.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 28 April 2025

CLAUSE PRECIS PAGE

ACKNOWLEDGEMENT OF COUNTRY 3

REFLECTION 3

APOLOGIES 3

Confirmation of Minutes

CM-1 ORDINARY COUNCIL MEETING - 7 APRIL 2025 3

DECLARATIONS OF INTEREST 3

Reports from Staff

RP-1 DEVELOPMENT APPLICATION DA24/0548 - ALTERATIONS AND ADDITIONS TO EXISTING MCDONALD'S, DEMOLITION AND SIGNAGE - 92-94 FAY AVENUE AND 269 LAKE ALBERT ROAD, KOORINGAL 4

RP-2 Community Strategic Plan - Wagga Wagga 2050 11

RP-3 ACCEPTANCE OF FUNDING - SALUTING THEIR SERVICE COMMERATIVE GRANTS PROGRAM 19

RP-4 2023/24 REGIONAL DROUGHT RESILIENCE PLANNING PROGRAM - ROUND 2 34

RP-5 2025/26 Airport Fees and Charges 41

RP-6 REQUEST FOR FINANCIAL ASSISTANCE - SECTION 356 46

RP-7 FINANCIAL PERFORMANCE REPORT AS AT 31 MARCH 2025 51

RP-8 QUESTIONS WITH NOTICE 87

Committee Minutes

M-1 LOCAL TRAFFIC COMMIITTEE MEETING - CONFIRMATION OF MINUTES - 20 MARCH 2025 91

Confidential Reports

CONF-1 Gregadoo Waste Management Centre 101

CONF-2 Memorandum of Understanding - Homes NSW 102

CONF-3 RFT CT2025047 - SUPPLY ONE (1) HEAVY TRI-AXLE PNEUMATIC DRY BULK TANKER 103

CONF-4 CT2025072 ASPHALT WORKS PACKAGE 2 104

CONF-5 RFT CT2025058 GWMC Plant Shed Design and Construct 105

CONF-6 RFT CT2025070 LAKE ALBERT WATER SPORTS AND EVENTS PRECINCT FORESHORE REMEDIATION D&C 106

Wagga Wagga City Council acknowledges the traditional custodians of the land, the Wiradjuri people, and pays respect to Elders past, present and future and extends our respect to all First Nations Peoples in Wagga Wagga.

We recognise and respect their cultural heritage, beliefs and continuing connection with the land and rivers. We also recognise the resilience, strength and pride of the Wiradjuri and First Nations communities

REFLECTION

Councillors, let us in silence reflect upon our responsibilities to the community which we represent, and to all future generations and faithfully, and impartially, carry out the functions, powers, authorities and discretions vested in us, to the best of our skill and judgement.

CM-1 ORDINARY COUNCIL MEETING - 7 APRIL 2025

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 7 April 2025 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - Ordinary Council Meeting - 7 April 2025 |

107 |

|

Report submitted to the Ordinary Meeting of Council on Monday 28 April 2025 |

RP-1 |

Reports from Staff

RP-1 DEVELOPMENT APPLICATION DA24/0548 - ALTERATIONS AND ADDITIONS TO EXISTING MCDONALD'S, DEMOLITION AND SIGNAGE - 92-94 FAY AVENUE AND 269 LAKE ALBERT ROAD, KOORINGAL

Author: Steven Cook

General Manager: Peter Thompson

|

Summary: |

The report is for a development application and is presented to Council for determination.

The proposed development seeks consent for alterations and additions to the existing Kooringal McDonald’s, including demolition and signage.

The maximum building height for the site under the Wagga Wagga Local Environmental Plan 2010 is 10 metres. The Development Application proposes to replace the existing 12-metre-high pylon sign on the site fronting Lake Albert Road with a new pylon sign of the same height. The Development Application therefore requires an application to vary the development standard under clause 4.6 of the WWLEP 2010.

The Department of Planning, Housing and Infrastructure document “Guide to Varying Development Standards” states that variations greater than 10% should be determined by the elected Council. As the maximum building height is 10 metres and the replacement pylon sign is 12 metres, the variation is 20%.

The 4.6 variation is the sole reason the application is required to be presented to Council for determination.

The application also proposes a number of variations to the Wagga Wagga Development Control Plan in relation to parking and signage.

The application was advertised for a period of 7 days from the 12 to 19 February 2025. No public submissions were received.

A full assessment of the Development Application and justification for the variations is contained within the attached Section 4.15 Assessment Report. |

That Council approve DA24/0548 for alterations and additions to existing McDonald’s, demolition and signage at 92-94 Fay Avenue and 269 Lake Albert Road, Kooringal NSW 2650 (Lot 1 DP 1046386 and Lot 12 DP 1195177) subject to the conditions outlined in the Section 4.15 Assessment Report.

Development Application Details

|

Applicant |

SLR Consulting Australia Pty Ltd on behalf of McDonald’s Australia Limited |

|

Owners |

McDonald’s Australia Limited Directors: Craig Aaron Cawood, Antoni Norris Martinez, and Bradley John McMullen

Rydal Serpan Pty Ltd Director: Patrick Pearce |

|

Development Cost |

$2,320,780 |

|

Development Description |

Alterations and Additions to Existing McDonald's, Demolition and Signage |

Report

Key Issues

· Variation to Clause 4.3 of the Wagga Wagga Local Environmental Plan 2010 – Height of Buildings.

· Variation to Control C1 of Section 2.2 of the Wagga Wagga Development Control Plan (WWDCP) 2010 in relation to car parking.

· Variation to various controls of Section 2.4 of the WWDCP 2010 in relation to signage.

Site Location

The development is proposed across two sites. The bulk of the development, being the alterations and additions to the existing Kooringal McDonalds store, is proposed on 92-94 Fay Avenue (Lot 12 DP 1195177). The Development Application also proposes the replacement of the existing pylon sign that fronts Lake Albert Road and is situated on the adjacent block that contains the Kooringal Mall, known as 269 Lake Albert Road (Lot 1 DP 1046386).

The site is zoned E1 Local Centre and is within the Kooringal Mall precinct. The shopping centre site, in turn, is surrounded by residential uses.

Assessment

The Development Application seeks consent for:

· Partial demolition, and alterations and additions to the existing Kooringal McDonalds, primarily within the existing footprint of the store and outdoor terrace area.

· New building signage.

· Minor alterations to the layout of the carpark spaces to ensure compliance with relevant Australian Standards for accessible parking (without any loss of car parking spaces).

· Replacement of the existing 12-metre-high pylon sign to Lake Albert Road, with a new 12-metre-high pylon sign.

WWLEP 2010 4.6 Variation

The sole reason this application is required to be presented to Council for determination is because the replacement pylon sign exceeds the maximum building height set out under Clause 4.3 of the WWLEP 2010. While the replacement sign will retain the 12-metre height of the existing sign, the maximum building height for the site set by the WWLEP 2010 is 10 metres.

As a consequence, the Development Application requires a variation under 4.6 of the WWLEP 2010, which allows Council to approve development that does not meet certain development standards in the LEP if the variation is well-justified. The Department of Planning, Housing and Infrastructure document “Guide to Varying Development Standards” states that variations greater than 10% should be determined by the elected Council. As the maximum building height is 10 metres, and the replacement pylon sign is 12 metres, the variation is 20%.

As required under Clause 35B of the Environmental Planning and Assessment Regulation 2021, the applicant has submitted a formal request to vary Clause 4.3 to permit a new replacement 12-metre-high pylon sign on the site.

Under the WWLEP 2010, the consent authority must be satisfied that the request demonstrates why “compliance with the development standard is unreasonable or unnecessary in the circumstances”, and that “there are sufficient environmental planning grounds to justify the contravention of the development standard”.

The applicant has demonstrated this by showing that the development is consistent with the objectives of Clause 4.3 and does not result in significant adverse environmental impacts. The sign is a replacement sign that remains generally consistent with the sign it replaces. Therefore, it will not result in any additional amenity impacts, does not alter the overall built form and scale of the development and will not result in visual bulk or sunlight and privacy impacts.

The development otherwise complies with the WWLEP 2010.

Remaining Assessment

· The development is otherwise consistent with the WWLEP 2010, and relevant State Environmental Planning Policies (SEPPs), including SEPP (Industry and Employment) 2021.

· Variations are proposed under the WWDCP 2010. No submissions have been raised in relation to the variations and these are assessed as acceptable. The variations include:

o Variation to Control C1 of Section 2.2 of the WWDCP 2010 in relation to car parking. This variation arises because car parking is calculated off gross floor area (GFA), or the number of seats, whichever generates the greater demand. Under the Development Application, the GFA of the premises increases. GFA, by definition, does not include the outdoor terrace or playground area of the existing store. Enclosure of the playground and a section of the terrace accounts for the overwhelming majority of the increase in GFA. It is also noted that the overall dining area as a result of the development actually decreases. Given the terrace is already used for dining, the playground function is unchanged, and the overall size of the dining area decreases, it is assessed that there will be no increase in parking demand, and the variation is logical and reasonable.

o Variation to Controls C1, C38 and C39 of Section 2.4 of the WWDCP 2010 are proposed. These controls all relate to the pylon sign being replaced. The controls require signage to relate to the lawful use of the land, or relate to the maximum panel area size or height of pylon signs. These variations are justified on the basis that the sign is replacing a similar sign, of similar scale, approved by Council over 20 years ago, and that strict application of the panel area control has, in practice, proven to be unreasonably restrictive, and variation of it has been consistently supported where well-justified and appropriate.

o Variations to Controls C8, C13, C14, C16 and C28 of Section 2.4 of the WWDCP 2010. These controls all relate to the proposed signage on the McDonalds building, and control matters such as the illumination of signs, underside clearance of signs, and the maximum number of signs. All variations are not considered significant and are typical of Development Applications involving signage. The overall volume, type and illumination of the signage on the building is not substantial and is assessed as not resulting in unacceptable impacts.

· The development is assessed as otherwise complying with the WWDCP 2010 and as not resulting in unreasonable impacts. The site is considered suitable for the proposed development, no public submissions were received, and overall the development is considered to be in the public interest.

A complete assessment of the Development Application under Section 4.15 of the Environmental Planning and Assessment Act 1979 is provided under separate cover. Having regard to the information contained in the attached Section 4.15 assessment report, it is considered that the development is acceptable for the following reasons and recommended for approval.

Reasons for Approval

1. The 4.6 variation has been adequately justified and the development otherwise complies with the WWLEP 2010.

2. The development generally complies with the WWDCP 2010. Where variations are proposed to the WWDCP 2010, they are not significant and are considered acceptable.

3. The site is suitable for the proposed development.

4. The development does not result in unreasonable impacts.

5. No public submissions were received.

6. The development is in the public interest.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: Future growth and development of Wagga Wagga is planned for in a sustainable manner

Ensure sustainable urban development

Risk Management Issues for Council

Approval of the application is not considered to raise risk management issues for Council as the proposed development is generally consistent with LEP and DCP controls and the proposed variations, including the 4.6 variation to the LEP, have been fully assessed and justified.

Internal / External Consultation

Full details of the consultation that was carried out as part of the development application assessment is contained in the attached s4.15 Report.

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Have your Say |

Email newsletter |

Social media |

Website |

|

|

Inform |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consult |

|

x |

|

|

|

|

|

|

|

|

x |

|||||

|

Involve |

|

|

|

|

|

|

|

|

||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other methods (please list specific details below) |

|

N/A |

|

1. |

DA24/0548 - Section 4.15 Assessment Report - Provided under separate cover |

|

|

2. |

DA24/0548 - Plans - Provided under separate cover |

|

|

3. |

DA24/0548 - Statement of Environmental Effects (Excluding Plan Set and 4.6 Variation Request) - Provided under separate cover |

|

|

4. |

DA24/0548 - Section 4.6 Variation Request - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 28 April 2025 |

RP-2 |

RP-2 Community Strategic Plan - Wagga Wagga 2050

Author: Christine Priest

General Manager: Peter Thompson

|

Summary: |

The Community Strategic Plan – Wagga Wagga 2050 is the highest-level plan that Council will prepare and informs all other planning documents at Council. The draft plan was placed on public exhibition from 12 February to 28 March 2025 and is now ready for adoption. |

That Council:

a receive and note the feedback received during the public exhibition period

b adopt the draft Community Strategic Plan – Wagga Wagga 2050

Report

Background

The draft Community Strategic Plan (CSP), Wagga Wagga 2050 has been developed through strong collaboration and engagement with the community.

The CSP is the highest-level plan for Council. The purpose of the CSP is to identify the community’s main priorities and aspirations for the future and to plan strategies to achieving these goals (Integrated Planning & Reporting Guidelines. September 2021. p12)

The draft plan was considered by Council on Monday 10 February 2025 and placed on public exhibition from Wednesday 12 February 2025 until Friday 28 March 2025.

Over 2,500 submissions were received as part of the 12-month long community engagement conducted as part of the process to inform the development of the community strategic plan.

During the public exhibition period Council visited several locations and promoted engagement opportunities to ensure a successful public exhibition of the draft plan. Feedback received during this period was reviewed and where possible has been incorporated into the final document.

This report explores the feedback received during the public exhibition period and highlights the updates made to the draft Community Strategic Plan – Wagga Wagga 2050 following the public exhibition.

Public Exhibition

Whilst the plan was on public exhibition the community were provided an opportunity to have further dialogue with Council and provide a formal submission.

The opportunities to engage with Council included face-to-face sessions, pop up stalls, on-line engagement through ‘Have your say’, group presentations and individual meetings.

Public Exhibition engagement numbers

|

No |

Feedback medium |

|

23 |

Postcards |

|

17 |

On-line submissions |

|

2 |

Presentations to groups |

|

2 |

Individual meetings |

|

8 |

Business Chamber meeting |

|

25,973 |

combined social media reach paid and organic |

|

396 |

council news online article views |

|

5488 |

Electronic direct mail (EDM) subscribers |

|

270 |

Discussions at pop up stalls |

Promotion whilst the plan was on public exhibition

The public exhibition of the plan was promoted in a number of ways which included:

- Direct communication with local villages to arrange either suitable times to visit or distribution of information,

- Letter box drops,

- Postcards to request feedback

- An animation was developed to promote the plan being on public exhibition and encourage people to make a submission,

- Posters to be located at various sites promoting the engagement,

- Online adverts,

- Council news articles,

- Promotion of Councils ‘Have your say’ page to encourage feedback on the plan.

Engagement sessions

The face-to-face scheduled engagements were conducted as follows:

1. Business round table meeting: Wednesday 5 February 4pm-5pm.

2. Wheelchair AFL Bolton Park Stadium near Oasis: Wednesday 12 February 6pm-7.30pm.

3. Kooringal Mall: Thursday 13 February 4pm-6pm.

4. Lake Village Shopping Centre: Saturday 15 February 8am-10am.

5. Willans Hill Miniature Railway Rides: Sunday 16 February 10am-11am.

6. Oasis Aquatic Centre: Tuesday 18 February 3.30pm-5.30pm.

7. Humula Sports Club: Wednesday 19 February 5.30pm-6.30pm.

8. Southcity Shopping Centre: Thursday 20 February 4pm-6pm.

9. First Nations Engagement: Tuesday 25 February 10am-12pm.

10. Uranquinty (outside café): Saturday 22 February 8am-10am.

11. Estella Shopping Centre: Monday 24 February 3pm-5pm.

12. Mangoplah Pub: Wednesday 26 February 5.30pm-6.30pm.

13. Turvey Park Shopping Centre: Thursday 27 February 4pm-6pm.

14. Northshore Café (North Wagga): Friday 28 February 10am-11am.

15. Oura Hall (Progress Association Community Night): Friday 28 February 5.30pm-6.30pm.

16. Tarcutta Park (BBQ): Tuesday 4 March 5.30pm-7pm.

17. Currawarna Community Centre (BBQ): Thursday 6 March 5.30pm-7pm.

18. Galore: Galore have again requested engagement via email.

19. Collingullie: letterbox drop, and social media as discussed with progress association representative.

20. Ladysmith engagement: date and time to be confirmed.

Summary of Feedback

Feedback received during the engagement period included comments around the following areas:

- The need for improved public transport,

- Infrastructure and expanding this to refer to water infrastructure,

- Ensure focus on roads and maintenance of our existing assets,

- Some specific requests and feedback around roads and infrastructure,

- Specific requests for infrastructure and services required at villages

- Importance of protecting our agricultural land,

- Climate change – multiple submissions, with a request for more focus and action from Council,

- Question around our population limit,

- Importance of our promoting a healthy community and specific suggested inclusions,

- Importance of the Airport and regional airlines,

- Need for more music venues,

- Request to establish a special entertainment precinct,

- Importance of emergency services north of the Murrumbidgee River,

- Desire for a water park, playgrounds and recreational areas,

- Request for a National Park along with Murrumbidgee River,

- Councils’ role in relation to regional leadership and suggested memberships of regional organisations,

- Suggestions around the need for specific numerical figures on the measures rather than just the term ‘increase’.

There were several detailed submissions received that will relate to further plans at Council and this information will be used to help inform some of these plans and strategies. These included submissions from Murrumbidgee Local Health District, Eastern Riverina Arts, Committee 4 Wagga.

In addition, Council met with the board of the Wagga Wagga Business Chamber and went through the plan in detail and discussed potential collaborations for the future.

Council presented to the Business Round Table on the plan and this group includes delegates from education, health, government and business organisations in Wagga Wagga. Council also met with local Wiradjuri Elders along with residents from local communities and villages.

There was some positive feedback received in relation to the engagement process with the following comment being received from a resident from a local village - “Thank you for making our small community feel included and remembered”.

In addition, further internal feedback on the draft plan was provided during the public exhibition plan to ensure the plan flowed well from through to our other levels of plans at Council and to deliver a high level of integration with our planning.

Support for the vision and strategic focus areas

At the sessions conducted the several people expressed that they were supportive of the vision and strategic focus areas vision. Wagga Wagga: a Vibrant, Growing and Sustainable Regional City.

Amendments

Following submissions received, some minor amendments to the document have been made. These minor amendments are detailed below:

- Updates to photos included to represent each village following engagement at the villages.

- Slight refinement of some of the language used in the objectives to allow these to flow better and take on board specific feedback from stakeholders.

- Consolidating a few strategies together to make these clearer and ensure that they can be effectively reported as they flow through to the Delivery Program and Operational Plan.

- Some of the examples included in the plan have been removed to make the strategy more general and to not limit the thinking around what this strategy could cover.

- Updating the roles of some of the strategies and the partners who will help deliver the strategies based on feedback from the community and stakeholders, for example “A healthy community” to reflect feedback received.

- The addition of some partners who have identified themselves for inclusion in the plan.

Some of the specific updates include:

A minor change to the descriptor of the “vibrant” focus area as shown below.

|

Vibrant

|

Wagga Wagga is a vibrant place to live, work and visit. We foster a

thriving cultural, social, and recreational |

|

Growing

|

Wagga Wagga is a progressive regional city with a strong economic future for our local government area and wider region. Wagga Wagga is the Southern Regional Capital of NSW. |

|

Sustainable

|

We plan for future generations with a focus on sustainability. We protect the environment and embrace best practice as we move towards net zero emissions for the Community and Council. |

|

Regional Leader |

Wagga Wagga is a regional leader. We lead by example and set the standard for innovation, collaboration and resilience driving progress. Our approach is underpinned by good governance and planning. |

Addition of new items:

Where a gap in a strategy was identified further details were added. These items are listed below:

|

Strategic focus area |

Objective |

Strategy

|

|

Growing |

Enabling infrastructure |

5.2 Partner with water and energy suppliers to facilitate the delivery of key infrastructure. |

|

Growing |

Agriculture and agribusiness |

8.2 Protect high quality agricultural land. |

There was some feedback around Climate change. Council has updated the table on page S03 to reflect that Council will both ‘Partner’ and ‘Deliver’ the strategies in this section.

Updates to the homelessness strategy have been made to make Councils role clearer and clearly shows Councils role as a partner for one strategy and as an advocate for the other strategy.

The suggestion around more numerical figures rather than just generic terms like ‘increase’ is a sound one and it is suggested that this element of the plan will be further refined and expanded in future revisions.

Changes that have not been accommodated from the submissions received were for specific projects, services or programs requested to be added to the plan. As this document is a high-level strategic document, strategies have been focused on providing direction rather than operational outcomes. This further detail will be included in the next level of plans being the Delivery Program and Operational Plan.

Financial Implications

This project was delivered within budget.

Policy and Legislation

OLG Integrated Planning and Reporting Framework Guidelines

Local Government Act 1993 – section 402

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga has strong community leadership and a shared vision for the future

Plan long term for the future of Wagga Wagga

Risk Management Issues for Council

Significant community engagement has been undertaken and informed the development of the community strategic plan. Not endorsing this document would have a negative impact on the perception of the community members who were involved in its development and may impact Council’s ability to meet legislative timelines.

Internal / External Consultation

There was significant community engagement as part of the development of the plan and then there was active engagement throughout the public exhibition period.

The engagement was structured to move through 4 key stages:

|

The engagement campaign for Wagga Wagga 2050, had the call to action to ‘Help shape our future’ which was highly visible and effective within the community. Through the engagement process Council reached approximately 100,000 people in terms of informing them of the process and intent of the CSP.

Council heard from approximately 2,500 members of our community who actively put forward a submission to help inform the draft CSP.

A summary of the engagement is detailed within the draft Community Strategic Plan Wagga Wagga 2050.

Information on the engagement is also available at haveyoursay.wagga.nsw.gov.au.

The engagement methods that were used were varied and extensive as shown in the matrix below.

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Have your Say |

Email newsletter |

Social media |

Website |

|

|

Inform |

|

x |

x |

x |

|

|

|

x |

x |

x |

x |

|

x |

x |

x |

x |

|

Consult |

|

|

|

|

|

x |

x |

x |

x |

|

x |

|

||||

|

Involve |

|

|

|

|

x |

x |

x |

|

|

x |

||||||

|

Collaborate |

|

|

|

|

|

|

|

x |

x |

x |

|

|

x |

|

|

|

|

Other methods (please list specific details below) |

|

N/A |

|

1. |

Community Strategic Plan - Wagga Wagga 2050 - Provided under separate cover |

|

|

2. |

Community Strategic Plan redacted submissions - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 28 April 2025 |

RP-3 |

RP-3 ACCEPTANCE OF FUNDING - SALUTING THEIR SERVICE COMMERATIVE GRANTS PROGRAM

Author: Jacqueline Collins

Executive: Fiona Piltz

|

Summary: |

Wagga Wagga City Council has been successful in securing $147,425 in funding through the Federal Government Office of Veterans Affairs Saluting Their Service Commemorative Grants Program 2024-25 to complete remediation of the Wagga Wagga Honour Roll and Eternal Flame Memorial at the Victory Memorial Gardens. |

That Council:

a authorise the General Manager or their delegate to negotiate to enter into a funding agreement with the Office of Veterans’ Affairs for $147,425 of grant funding for the remediation of the Wagga Wagga Honour Roll and Eternal Flame Memorial

b note the additional assessment quotations for the cost and time to appoint a specialist consultant and complete a detailed asset condition audit and future conservation plan.

c commence the project as soon as possible to allow completion by Remembrance Day being 11 November 2025

d authorise the affixing of Council’s Common Seal to all relevant documents as required

Report

As reported to council on 7 April 2025, discussions between the Mayor, the Wagga RSL sub-Branch and Council Staff during late 2024 identified the need for remediation work to be undertaken on the honour roll walls and eternal flame. During subsequent inspections it was identified after undertaking the required due diligence that the existing structure was being impacted by moisture penetration of the wall causing bubbling and breakage of the render. Following consultation with experienced building and construction contractors, Council’s Heritage advisor and the Wagga Wagga RSL sub-Branch, a grant application was made for funding to the Federal Government’s Saluting their Service program to allow remediation works to be undertaken.

The Office of Veterans Affairs has since offered Wagga Wagga City Council $147,425 of funding to complete this project. The Saluting Their Service Commemorative Grants Program is part of the Australian Government’s commitment to promoting awareness of the experiences of those who have served and to preserving and promoting information about Australia’s wartime heritage

Attachment 1- Letter of Offer

This funding will allow the removal of the existing render, water and salt proofing of the structure, removal of pavers, installation of sub soil drainage, the moving of an existing garden bed and adjacent sprinklers, the installation of new pavement and remediation and water proofing of the eternal flame. The estimated cost of completing these works is $147,425.

It is proposed that these works will commence shortly after Anzac Day (25 April 2025) and be completed prior to Remembrance Day (11 November 2025).

The Office of Veterans Affairs provided the funding deed on the 8 of April 2025 to be executed by 12.00am 29 April 2025. Staff have requested an extension to Friday 2 May 2025 to allow for this report to be submitted. This extension has been granted by the Transitions Team at the Community Grants Hub administering this funding opportunity. The funding deed will be required to be executed post tonight’s Council Meeting if it is resolved to accept the funding by Friday 2 May 2025.

The acceptance of this funding was debated at the 7 April 2025 Ordinary meeting of Council where it was resolved:

That Council defer the matter to the next Ordinary Council Meeting and bring back a report after discussion with the funding body and the Wagga Wagga RSL sub-Branch.

This deferral was made to allow staff the time to provide additional information to Council on:

· the cost and time to appoint a specialist consultant and complete a detailed asset condition audit and future conservation plan prior to accepting the grant funding or commencing the repair works

· the impact the delay would have on the grant funding and if there is a risk of it being forfeited

· the impact of the delay would have on the RSL sub-Branch and the veteran communities

This report is provided in response to the resolution and requests for additional information.

The cost and time required by a consultant to complete the requested reports has been provided by David Scobie Architects, Council’s appointed Heritage Advisor.

1. A full asset condition assessment of the Memorial, honour roles and Eternal Flame - $18,000 excl. GST.

Two weeks to complete

2. Detailed Conservation/Works Plan to ensure the assets longevity for generations into the future to be compiled in collaboration with Julian Bickersteth of International Conservation Services Pty Ltd - $19,000 excl. GST (estimate)

Eight weeks to complete

3. Additional reporting extended to all the VMG Memorials - $14,500 excl. GST

Four weeks to complete

This cost was requested due to the RSL sub-Branch stating that if Council were to do it for one memorial, the reporting should be done for all.

The fees above exclude travel and accommodation unless the project were to be commissioned as part of the usual Heritage Advisor duties.

Office of Veteran Affairs have been contacted to provide advice and contact details for qualified specialist consultants. A reply was received on 9 April 2025 notifying council that a reply is being prepared. At the time of drafting this report, the reply has not been received.

The impact on the grant funding if the delay extends beyond 2 May 2025, would be that Council would be required to submit a further request for approval from the Department of Veterans’ Affairs (DVA) as they are the Policy owner of the Saluting Their Service Commemorative Grants (STSCG) Program.

Wagga Wagga RSL sub-Branch were consulted and the President, Mr Rodney Cooper met with Council on 8 April. Wagga Wagga RSL sub-Branch have provided a letter to support the remediation project at the Victory Memorial Gardens.

Attachment 2 – Saluting Their Service WW RSL sub-Branch - Letter of Support

As was noted during the debate at the 7 April Council Meeting a detailed process was undertaken in partnership with the RSL sub-Branch over 6 months to develop the scope of works for this project following the initial approach by the RSL sub-Branch.

If the project and acceptance of funding is delayed, the impact of the delay would necessitate the project to be completed post Remembrance Day, 11 November 2025, to ensure works will not disrupt commemorative events that would impact on the RSL sub-Branch and the veteran communities.

The proposed scope of works was referred to Council’s Heritage Advisor Mr David Scobie for review as part of the due diligence undertaken for any project within or in close proximity to a heritage area.

This report did not extend to a detailed asset condition audit or future conservation plan debated on the night but did highlight the need for the works and suitability of the proposed scope from a heritage perspective.

In response to the debate on the night, staff sought further clarification from Mr Scobie on the assessment undertaken and suitability of the works. His response received on 14 April 2025 stated.

1. Confirmation of qualifications

2. Confirmation of initial investigation consideration undertaken regarding heritage aspects of the works to be completed

3. Confirmation that the preliminary work for the proposed scope of work considered the conservation and heritage aspects and that the proposed works are considered appropriate for the longevity of the Honour Wall and Eternal Flame.

Attachment 3 – Heritage Advisor APRIL2025VMGWM Project

Given the advice of Veterans Affairs as the funding body, the ongoing support for the project to be completed from the Wagga RSL sub-Branch, the due diligence undertaken by staff in respect to heritage and the need for the repairs to be made it is recommended that these works commence as soon as possible to allow for completion prior to Remembrance Day being 11 November 2025.

The proposed works are estimated to cost $147,425. It is proposed that Council accept the offer of $147,425 in funding to complete the works.

Staff have compiled quotes for the additional assessments as shown below:

Additional Assessments requested and quotes by David Scobie Architects

$18,000 - A full asset condition assessment

$19,000 - Detailed Conservation/Works Plan

$14,500 - Additional reporting extended to all the VMG Memorials

$51,500 -Total exclusive GST

Given the assessments undertaken to date, for the purposes of this accepting this grant and completing the works to the Wagga Wagga Honour Roll and Eternal Flame Memorial at the Victory Memorial Gardens, staff do not recommend undertaking these additional assessments.

If Councillors would prefer to undertake these additional assessments more broadly the $51,500 could potentially be funded from the Parks & Recreation Reserve which currently has capacity.

Policy and Legislation

Local Government Act

Link to Strategic Plan

Community Place and Identity

Objective: Our community are proud of where we live and our identity

Value our heritage

Risk Management Issues for Council

The risks associated with implementing this project relate to process, cost, environmental, WHS and contractor performance. These risks are addressed as part of the Council’s project management and performance management systems.

Internal / External Consultation

Meetings and external consultations have occurred with the:

· RSL sub-Branch

· Federal Government Office of Veterans Affairs Saluting Their Service Commemorative Grants Program 2024-25 administered by the Community Grants Hub.

· Council’s Heritage Advisor

Internal consultation has occurred with:

· Council’s Executive,

· Economy, Business and Workforce Directorate,

· Strategic Recreation, Parks Operations, Governance, and Property divisions.

|

1⇩. |

Letter of Offer Office of Veterans Affairs |

|

|

2⇩. |

Saluting Their Service WW RSL sub-Branch - Letter of Support |

|

|

3⇩. |

Heritage Advisor APRIL2025VMGWM Project |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 28 April 2025 |

RP-4 |

RP-4 2023/24 REGIONAL DROUGHT RESILIENCE PLANNING PROGRAM - ROUND 2

Author: Sue Hanrahan

Executive: Fiona Piltz

|

Summary: |

This report proposes Council adopt the Regional Drought Resilience Plan in its final form. Once adopted by both Wagga Wagga City Council (WWCC) and Lockhart Shire Council, the plan will be submitted to the Minister for Regional NSW, and the Federal Minister for Agriculture, Fisheries and Forestry for endorsement and public release. |

That Council:

a notes the completion of the public exhibition and consultation period for the draft Regional Drought Resilience Plan

b endorses the final Regional Drought Resilience Plan as presented in its final form

c authorises submission of the adopted plan to the Department of Regional NSW and the Federal Minister for Agriculture, Fisheries and Forestry for endorsement and public release

Report

In September 2023 staff submitted a grant funding application through the Regional Drought Resilience Planning Programme - Round 2. Regional Drought Resilience Planning grants are co funded by the NSW Government and the Australian Government’s Future Drought Fund. The funding was provided to selected regions in NSW to allow the development and implementation of Regional Drought Resilience Plans and assist in the mitigation of future drought risks.

The Regional Drought Resilience Planning Program is being delivered as part of the Future Ready Regions Strategy. The program is designed to enable consortia of local governments and their communities to better prepare for, respond to and recover from drought.

These plans are not intended to replace or be in competition with other existing drought resilience programs which focus on, farm preparedness, water and feed for stock during drought or economic assistance for communities, families and individuals impacted by drought. Instead, they are funded to strengthen resilience and develop adaptive capacity among the residents and businesses of the Wagga Wagga City and Lockhart Shire region to support their community, environment, and economic resilience during drought.

Funding was made available in Round 2 to selected eligible NSW councils working as a consortium to develop their own Regional Drought Resilience Plans. WWCC was required to submit an application as a consortium with Lockhart Shire Council.

· Regional Drought Resilience Plan development: $200,000

· Regional Drought Resilience Plan implementation (conditional): $250,000

During discussions with Regional NSW, it was identified the final plan would play an important role in future drought-related funding opportunities. Councils have been nominated into consortia based on previously identified Functional Economic Region (FER) boundaries.

The first phase of the program focused on developing a Regional Drought Resilience Plan, which was developed following resident and stakeholder engagement. The two documents that were developed included an 82-page public facing plan along with a more detailed 100-page technical document which have been on public exhibition to enable broader community input before a final document is developed and proposed for adoption.

The development of the plan was based on research along with stakeholder and community consultation. In August 2024, four public drop-in sessions were held across the two Local Government Areas (LGAs), followed by a four-week online community survey in September/October 2024 which received 79 submissions.

Key stakeholders involved in the process included:

· Farmers and businesses

· Social support service providers

· Education and training providers

· Local health and social services providers

· Representatives from the manufacturing, transport, and construction sectors

· State and Federal government agencies

· Southern NSW Drought resilience Adoption and Innovation Hub (CSU)

· Rural Financial Counselling Services

The draft Regional Drought Resilience Plan has also been independently reviewed by CSIRO via the Department of Primary Industries and Regional Development (DPIRD) with feedback incorporated into this version of the plan.

The Regional Drought Resilience Plans must receive approval from DPIRD, the Minister for Regional NSW, and the Federal Minister for Agriculture, Fisheries and Forestry once adopted by Councils. Once approved the additional $250,000 in funding becomes available to implement actions from the plan.

During the public exhibition period, which ran from 25 February to 25 March 2025, Council undertook a range of engagement activities to promote awareness and invite feedback on the draft Regional Drought Resilience Plan (RDRP). This included social media posts, news stories in print and online, listings in Council’s "Have Your Say" and EDM channels, and direct stakeholder communication. Targeted outreach was conducted to key stakeholders such as NSW Farmers, CSU Drought Hub, RFCS, and various business and community organisations.

Community consultation sessions were held in Tarcutta, Currawarna, and the Livestock Marketing Centre, with positive feedback on the development of a community-focused drought plan. While participation varied, key themes raised included the value of having a coordinated response plan, recognition of previously gathered input, and the ongoing difficulty in engaging all stakeholders’ areas. As shown in attached public exhibition responses and letters of support.

The draft plan has now been finalised and is ready for adoption. It will guide the implementation of targeted projects under Phase 2 of the program, focusing on initiatives that strengthen resilience across economic, social, and environmental dimensions.

It is now proposed to adopt the RDRP and to submit the RDRP for approval from DPIRD, the Minister for Regional NSW, and the Federal Minister for Agriculture, Fisheries and Forestry for formal endorsement and public release.

Financial Implications

The application was successful, securing $450,000 in funding over two years, with WWCC as the project lead. This funding was accepted at the 29 January 2024 Ordinary Meeting of council and consisted of:

· Regional Drought Resilience Plan development: $200,000

· Regional Drought Resilience Plan implementation (conditional): $250,000

WWCC and Lockhart Shire Council engaged a qualified consultant AEC Consultancy to assist with the development of a comprehensive Regional Drought Resilience Plan at a cost of $147,924 (GST exclusive).

Current actual and committed expenditure is $148,227.

Once adopted the remaining plan development funds of $51,773 will be combined with the $250,000 implementation funds to allow implementation of the identified projects and activities.

Job Consolidation Number – 23036: Regional Drought Resilience Planning Programme

Policy and Legislation

Community and Strategy and Implementation Plan 2040

Regional Economic Development Strategies – 2023 Update

Link to Strategic Plan

The Environment

Objective: Wagga Wagga is sustainable, liveable, and resilient to the impacts of climate change

Adapt to our changing climate

Risk Management Issues for Council

If WWCC does not adopt the RDRP and submit it to the Department of Primary Industries and Regional Development (DPIRD) for endorsement, several key risks arise. Most significantly, the project may fail to meet Milestone Four of the funding deed, which requires the adopted plan to be submitted for clearance to the Department of Regional NSW and the Federal Minister for Agriculture, Fisheries and Forestry for formal endorsement and public release.

Endorsement is necessary to enable implementation of the actions identified in the plan. Delays in adoption could jeopardise future funding and the credibility of the initiative. Lockhart Shire Council, a key partner, has expressed its expectation that the plan will be adopted and intends to submit a funding application for the implementation of its immediate identified actions.

The available funding closes at the end of November 2025, and any delays may result in missed funding opportunities, particularly given the Federal government caretaker period, which may impact the Federal department’s ability to provide timely endorsement. Failure to proceed may also damage inter-council relationships, delay the rollout of key resilience initiatives, and undermine Wagga Wagga City Council’s leadership role within the consortium.

Internal / External Consultation

The stakeholder engagement outcomes are incorporated within the Regional Drought Resilience Plan document.

In August 2024, four public drop-in sessions were held across the two Local Government Areas (LGAs), followed by a four-week online community survey in September/October 2024 which received 79 submissions.

External consultation has also occurred with NSW State Government Agencies, the Southern NSW Drought resilience Adoption and Innovation Hub (CSU) and CSIRO.

The RDRP has completed its formal 28-day public exhibition and consultation period. This followed an extensive engagement process with key stakeholders and community members, aimed at ensuring a collaborative and inclusive planning process. In collaboration with Lockhart Shire Council community consultation sessions were held in Tarcutta, Currawarna, Livestock Marketing Centre, Lockhart, and The Rock, complemented by written submissions, letters of support and feedback from various stakeholders.

Lockhart Shire’s public exhibition process also received positive responses from elected representatives and the community, affirming the consortium’s collective direction and commitment. Lockhart Shire Councillors have expressed their strong support for the plan and have confirmed their intent to adopt when the RDRP is presented to Lockhart Shire Council at their next ordinary meeting on 28 April 2025.

Wagga Wagga Consultation

|

Activity |

Details |

|

Council Endorsement |

Council endorsed 100-page technical document & public facing document for public exhibition 24 Feb 2025. |

|

Public Exhibition |

Draft Documents on Public Exhibition – Wagga Wagga City Council & Lockhart Shire Council from 25th Feb to 25th Mar (28 days). |

|

Social Media |

Social media post on 27 February (Facebook and Instagram). |

|

Council News Story |

Council News story online and in print (DA) on 1 March. |

|

Have Your Say |

Listed in the Have Your Say section of the Council Newsprint version on 8 March. |

|

Council News EDM |

Listed in the Council News EDM on 1 March, 8 March, and 15 March. |

|

Key Stakeholder Notification |

6 March 2025 – 4 April 2025 – Contacted - President of NSW Farmers, CSU Drought Hub, RFCS, DAF, WWCC Governance. Riverina Water, Wagga Business Chamber, Women in Business, Riverina Cooperative & Committee 4 Wagga. |

|

Targeted Stakeholder Notification |

6 March 2025 – Emailed all attendees of previous consultation workshops with the draft documents on public exhibition requesting review of documents. |

|

Community Consultation – Tarcutta |

Held on 4 March 2025 – Spoke to several attendees with considerable feedback from two attendees who were involved in the initial consultation of the plan. A review of the draft RDRP noted positive feedback of the inclusion of the feedback from the original stakeholder meetings. Concerns were raised by the stakeholders of the limited attendance and input by other stakeholders during consultation: |

|

Community Consultation - Currawarna |

Held on 6 March 2025, conversation with all attendees with positive feedback to having a Community Drought Plan in place. |

|

Community Consultation - Livestock Marketing Centre |

Held on Monday 14 April, spoke to community, feedback was limited. |

|

NSW Farmers Consultation |

Contacted NSW Farmers Federation President of Riverina Chapter via email and phone to offer additional presentation on several occasions, without acceptance. |

|

Feedback Received |

One Submission and four emails were received during the public exhibition period. |

|

Letters of Support |

Received from Riverina Water & Committee for Wagga. |

Lockhart Shire Consultation

|

Activity |

Detail |

|

Community Consultation |

Held two drop-in sessions at The Rock and Lockhart (8th & 9th March 2025) |

|

Online Survey |

Conducted over two months (September - October 2024) with 79 respondents. Promoted to stakeholders, community groups, and businesses for feedback. |

|

Social Media Promotion |

Survey promoted on Facebook on 9th September and 25th October 2024 with a reach of 660 people. |

|

Council Endorsement |

Lockhart Shire Council endorsed the draft public-facing document for public exhibition on 17th February 2025. |

|

Public Exhibition |

Draft document was placed on public exhibition from 25th February – 25th March 2025 (28 days). |

|

Feedback Received |

No feedback or submissions were received during the public exhibition period. |

|

Promotion Channels |

Promoted via: |

|

Targeted Stakeholder Engagement |

Tourism and Economic Development Steering Committee (15 members including 3 Councillors) were emailed for feedback. |

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Have your Say |

Email newsletter |

Social media |

Website |

|

|

Inform |

|

|

|

x |

x |

x |

|

x |

x |

|

|

x |

x |

x |

x |

x |

|

Consult |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Involve |

|

|

|

|

|

|

|

|

||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other methods (please list specific details below) |

|

N/A |

|

1. |

Wagga and Lockhart Regional Drought Resilience Plan - Provided under separate cover |

|

|

2. |

RDRP Wagga Lockhart - Public Facing Document - Provided under separate cover |

|

|

3. |

RDRP public exhibition submission responses - redacted - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 28 April 2025 |

RP-5 |

RP-5 2025/26 Airport Fees and Charges

Author: Carolyn Rodney

|

Summary: |

The proposed Airport fees and charges for the 2025/26 financial year have been on public exhibition for a period of 28 days, from 12 March 2025 to 8 April 2025. This report outlines public submissions received and proposes adoption of those fees and charges. |

That Council:

a note that there were seven (7) public submissions received during the exhibition period for the 2025/26 Airport fees and charges

b adopt the Airport Fees and Charges for the 2025/26 financial year, to commence from 1 July 2025

c commence the new Passenger Service Charges from 1 August 2025

Report

Council, at its meeting of 10 March 2025, resolved:

That Council:

a place the draft 2025/26 Airport Fees and Charges on public exhibition for a period of 28 days from 12 March 2025 to 8 April 2025 and invite public submissions during this period

b receive a further report following the exhibition and submission period:

i addressing any submissions made in respect of the draft 2025/26 Airport Fees and Charges

ii proposing adoption of the 2025/26 Airport Fees and Charges unless there are any recommended amendments deemed to be substantial and requiring a further public exhibition period

iii proposing that the new Passenger Services Charges rates commence from 1 August 2025

The proposed Airport fees and charges for the 2025/26 financial year were placed on public exhibition from 12 March 2025 until 8 March 2025 and Council invited public submissions during this period. Seven (7) public submissions were received during this period.

Airport User Notification

In order for airport users to be provided with adequate notice of the change in fees and charges for the 2025/26 financial year, a three (3) month notification period is required for Airlines to enact this change – in particular for the Passenger Service Charges.

On adoption of the proposed fees and charges, Council staff will commence the notification process to airport users. Based on the required notification period, it is proposed to commence the increased Passenger Service Charges from 1 August 2025.

These adopted fees and charges will subsequently be incorporated into Councils Operational Plan for consideration and adoption by Council in its entirety in June 2025.

Financial Implications

As a result of the COVID-19 pandemic, the financial position of the Wagga Airport has declined significantly over the past few financial years. This impact, along with the freezing of the passenger service charge from 2018/19 to 2022/23 inclusive, has resulted in the Airport reserve being reduced to a $0 balance as at 30 June 2024.

For the Airport business to return to surplus and to fund any future capital spend at the Airport, the proposed yearly minimum increase in fees and charges is required.

Policy and Legislation

Local Government Act 1993, Sections 610F

Integrated Planning and Reporting Guidelines

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga City Council leads through engaged civic governance and is recognised and distinguished by its ethical decision-making, efficient management, innovation and quality customer service

Ensure transparency and accountability

Risk Management Issues for Council

Without adequate revenue to cover the costs of operating the Wagga Wagga Airport, the Airport will not be financially sustainable into the future and will not meet the expectations of the community.

Internal / External Consultation

The draft 2025/26 Airport fees and charges were placed on public exhibition for a period of 28 days, from 12 March 2025 until 8 March 2025 with seven (7) public submissions being received. The submissions received are attached and below is a summary, along with response from staff.

|

Submitter |

Submission Summary |

Officers Response |

|

|

FC-1 |

Craig Bromley |

Suggests that any increase above CPI is required due to poor budget control, or unfunded improvements. |

Some Airport costs increase at a rate higher than CPI. Until a decision on the Airport lease is determined, recent works undertaken at the Airport have been minor and required for the Airport to remain open and operational. |

|

FC-2 |

Brendon Agpasa |

Mentions passenger services charges and thresholds at other airports. |

The passenger service charges and thresholds at the Wagga Airport are negotiated between the Wagga Airport and the Wagga airport passenger carriers. |

|

FC-3 |

Geoff Breust – Wagga City Aero Club |

Disagrees with the increases in private/recreational airport fees above inflation rate, but no increase in car parking rates.

Disagrees with the Annual Landing Permit for Private Aircraft being restricted to resident aircraft hangered at the Wagga Airport.

|

The Resident Private Aircraft – Annual Landing Permit is proposed to increase from $204.37 to $214.59 per tonne, a 5% increase.

The landing charges fixed wing aircraft proposed to increase from $16.84 to $18.19 per tonne; landing charges rotary wing aircraft proposed to increase from $8.43 to $9.11 per tonne – both a 8% increase.

Some Airport costs increase at a rate higher than CPI, and it is due to this reason that some fees are increased at a rate higher than CPI, while others are not.

It is also important to note that for the 2021/22 financial year, no increase to landing charges was applied, however CPI was 6.14%.

It is proposed for the Airport carpark rates to remain the same as previous years. The overhead cost increases related to the carpark on a comparison percentage basis are far less than the overhead costs of operating the airport.

Whilst there is no direct increase to the carpark rates, other rates have been increased - passengers experience increases with the passenger head tax charge, charged through the airlines.

It is important to note that the adjacent valet service currently charge $8.50 per day, compared to the Airport carpark rate of $13.60 per day.

The Annual Landing Permits for Private Aircraft are restricted to resident aircraft hangered at the Wagga Airport. All other aircraft that do not lease a hangar are to pay per landing.

Having a hangar lease provides leaseholders with the ability to opt in to an annual landing charge rate. Those that do not have a hangar lease pay per landing. A review of other regional airport fees and charges have found similar fee structures: Albury – “annual permit for locally based operators”; Orange – “Local private aircraft”; Dubbo – “Local Wellington Aerodrome Tenant”. |

|

FC-4 |

Geoff Breust |

As above |

As above |

|

FC-5 |

Brayden Kettle – World Fuel Services (Australia) Ptu Ltd

|

Concerns with the landing fee increases above CPI, and the restriction on Annual Landing Permits to aircraft hangered in Wagga. |

As above |

|

FC-6 |

Bob Chalton |

Requests the landing fee increases are reduced to a level commensurate with CPI, and for other Airport users to be charged to fund the shortfall. Requests reversal of the decision to restrict the Annual Landing Fees to resident aircraft. |

As above |

|

FC-7 |

Andrew Irvine |

Notes that there is no consideration for a 50% discount on landing charges for non-resident private aircraft on weekends.

Notes that there is no parking fees for aircraft, if there was, it is suggested that more of the dormant aircrafts would be moved on, making way for more visiting aircraft. |

The airport fee structure does not allow for a 50% discount on landing charges for non-resident private aircraft on weekends. The costs of operating the airport do not decrease on a weekend (staff and contractor penalty rates increase on a weekend), therefore it is not appropriate for the fee to be discounted.

Regarding the potential introduction of overnight parking fees for all aircraft (as is the case at most airports), this is currently in the process of being reviewed and will be discussed with Councillors during the 2025/26 financial year. |

Direct correspondence will be provided to the Airport users outlining Council’s decision.

|

Report submitted to the Ordinary Meeting of Council on Monday 28 April 2025 |

RP-6 |

RP-6 REQUEST FOR FINANCIAL ASSISTANCE - SECTION 356

Author: Carolyn Rodney

|

Summary: |

Council has received one (1) fee waiver request for Council’s consideration. |

That Council:

a in accordance with Section 356 of the Local Government Act 1993, provide financial assistance to the Palliative Care Enhancement Council for this calendar year for $895

b note that due to the date of the event, this financial assistance will be funded from the 2025/26 Section 356 general budget allocation

Report

One (1) Section 356 financial assistance request is proposed for consideration at this Ordinary Council meeting:

Palliative Care Enhancement Council

Request from Founder and Chairperson of the Palliative Care Enhancement Council, Kay E Hull AO as below in part and as attached.

I write this email on behalf of the Palliative Care Enhancement Council seeking WWCC consideration of a fee waiver for the use of the Civic Theatre to present a Free Community Information Evening designed to provide better understanding of the Palliative Care journey after a life limiting diagnosis.

It is my experience that those who have received a diagnosis of an end of life illness have great difficulty in accessing information and support in relation to all options available in palliative care. This was borne out when with little advertising other than a few posters up and word of mouth, the theatre was full at our information evening at the civic theatre in 2019 and again in 2023.

In this world of passwords and identifications it is also imperative that the accountancy, legal, banking, advance directives etc are understood by all who are part of an end of life diagnosis.

Most think that one has to be at the very end of life stage before being able to access support services which is so far from reality. The information evening will give attendees the understanding that accessing early palliative care results in living a life not dying a life after the diagnosis, reinforcing their engaging with all palliative care services should not be feared.

It is our belief one must have worlds best practice in palliative options that provide dignity and respect not only for the person diagnosed but all loved ones who are also on the journey, our system should ensure all those involved in the passing of a loved one have no regrets on the compassion and respect given during their care….

I do hope the Councillors are able to see the value of the request and will determine to waive the hire fee I look forward to the WWCC response.

The Palliative Care Enhancement Council have not received any other financial assistance from Council this 2024/25 financial year.

Financial Implications

As noted in the resolution, this request will be funded from the 2025/26 Section 356 general allocation funds.

Policy and Legislation

POL 078 – Financial Assistance Policy

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga City Council leads through engaged civic governance and is recognised and distinguished by its ethical decision-making, efficient management, innovation and quality customer service

Ensure transparency and accountability

Risk Management Issues for Council

N/A

Internal / External Consultation

Cross Directorate consultation has been undertaken as required.

|

1⇩. |

Request for waiver of Civic Theatre fees - Palliative Care Enhancement Council |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 28 April 2025 |

RP-7 |

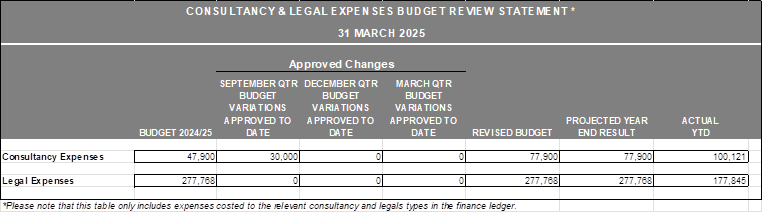

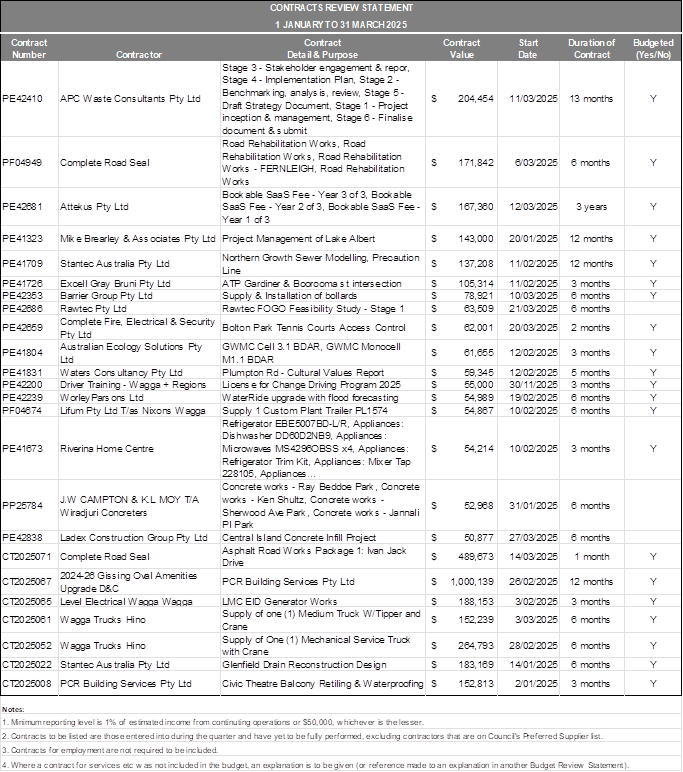

RP-7 FINANCIAL PERFORMANCE REPORT AS AT 31 MARCH 2025

Author: Carolyn Rodney

|

Summary: |

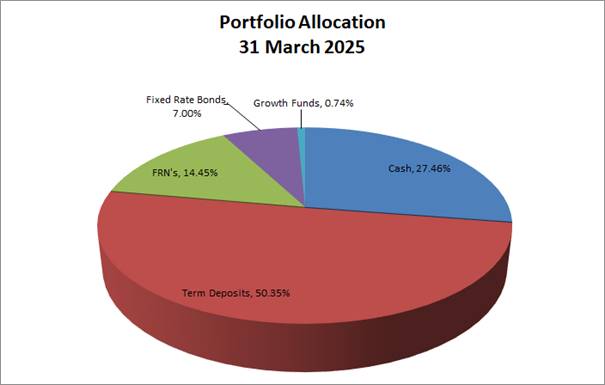

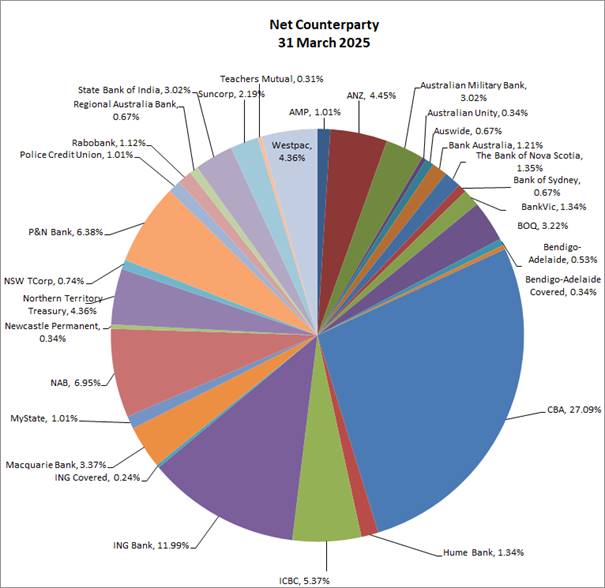

This report is for Council to consider information presented on the 2024/25 budget and Long-Term Financial Plan, and details Council’s external investments and performance as at 31 March 2025. |

That Council:

a approve the proposed 2024/25 budget variations for the month ended 31 March 2025 and note the balanced budget position as presented in this report

b approve the proposed budget variations to the 2024/25 Long Term Financial Plan Capital Works Program including new projects and timing adjustments

c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2021 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above

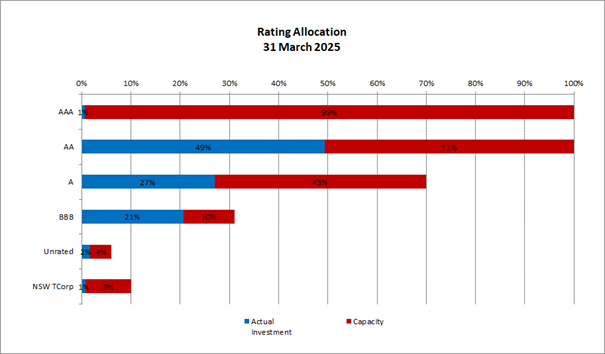

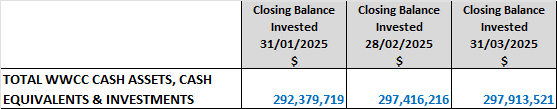

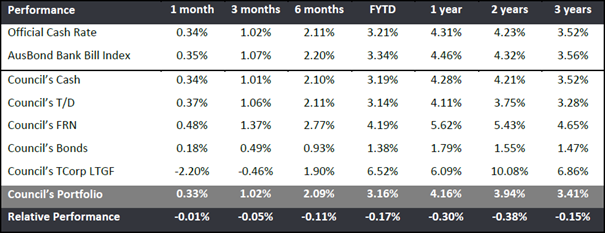

d note the details of the external investments as at 31 March 2025 in accordance with section 625 of the Local Government Act 1993

e accept the grant funding offers as presented in this report

f withdraw the projects listed in this report from the Low Cost Loans Initiative Scheme

Report

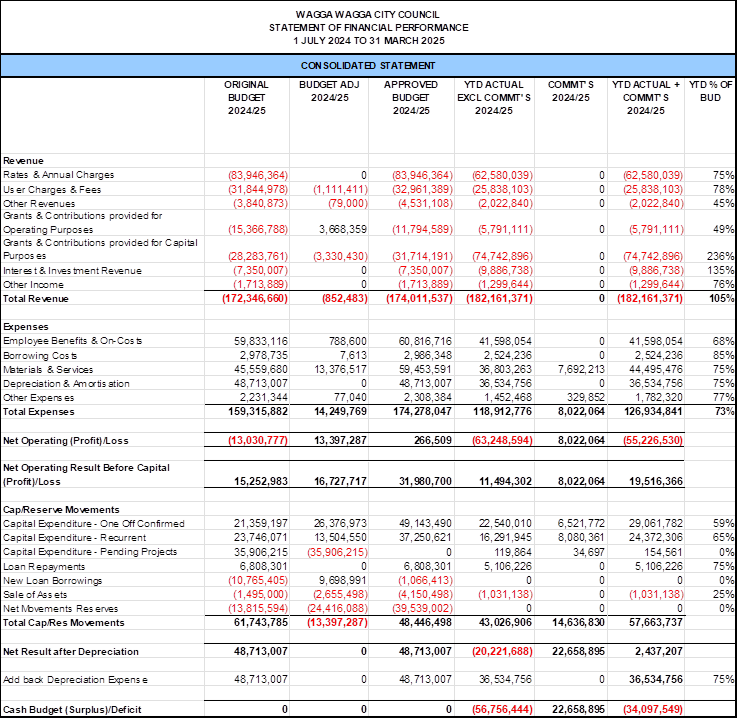

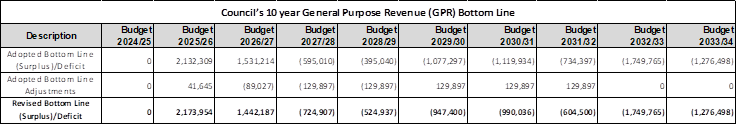

Wagga Wagga City Council (Council) forecasts a balanced budget position as of 31 March 2025.

Proposed budget variations including adjustments to the capital works program are detailed in this report for Council’s consideration and adoption.

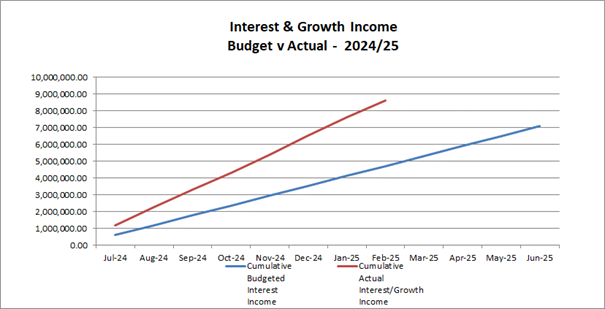

Council has experienced a positive monthly investment performance for the month of March when compared to budget ($385,275 up on the monthly budget). This is mainly due to better than budgeted returns on Council’s investment portfolio, as well as a higher than anticipated investment portfolio balance – which is partly due to Council receiving upfront payment of $48.5M in funding under the Accelerated Infrastructure Fund in June 2024.

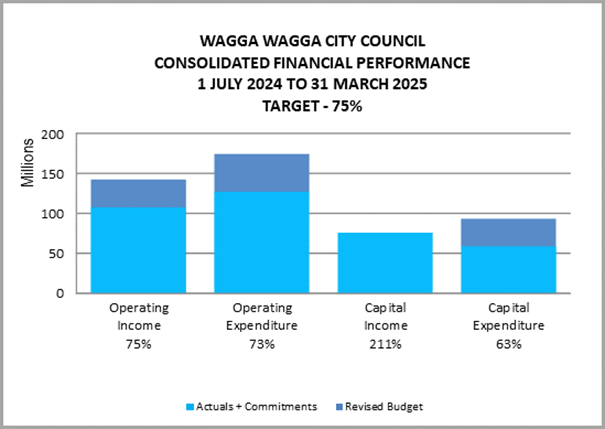

Key Performance Indicators

OPERATING INCOME

Total operating income is 75% of approved budget and is tracking on budget for the month of March 2025. An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 90% when compared to budget.

OPERATING EXPENSES

Total operating expenditure is 73% of approved budget and is tracking close to budget at this stage of the financial year.

CAPITAL INCOME

Total capital income is 211% of approved budget, which is mainly attributed to the Accelerated Infrastructure Fund (AIF) grant funding that has been received. If this up-front grant funding is not fully spent in this financial year, the income will be reduced and carried over to next financial year for completion of the project.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 63% of approved budget. Excluding commitments, the total expenditure is 47% when compared to the approved budget.

*This table does not include any proposed draft 2025/26 LTFP budget adjustments.

2024/25 Revised Budget Result – (Surplus) / Deficit |

$’000s |

|

Original 2024/25 Budget Result as adopted by Council Total Budget Variations approved to date Budget Variations for March 2025 |

$0K $0K $0K |

|

Proposed Revised Budget result for 31 March 2025 - (Surplus) / Deficit |

$0K |

The proposed Operating and Capital Budget Variations for 31 March 2025 which affect the current 2024/25 financial year are listed below.

|

Budget Variation |

Amount |

Funding Source |

Net Impact (Fav)/ Unfav |

|

|

1 – Community Leadership and Collaboration |

|

|||

|

Alan Turner Depot Stores Upgrade |

$220K |

Plant Replacement Reserve ($220K) |

Nil |

|

|

In the 2023/24 financial year, a Garaging Cost component was introduced as part of the new methodology for internal plant cost recovery. This updated approach aims to support capital improvements at the Alan Turner Depot. With the ongoing growth in Council staff numbers, the Depot has reached full capacity in terms of available workspace, posing risks to both operational efficiency and daily functionality. To address this, Council has identified an area within the Depot suitable for the development of an additional fourteen (14) workstations, aimed at improving seating ergonomics and accommodating increased staff. A funding request of $220,000 (excluding GST) is being made, to be drawn from the Garaging Fund generated through internal plant cost recovery, within the Plant Reserve. Estimated Completion: 30 June 2025 Job Number: 24461 |

|

|||

|

2 – Safe and Healthy Community |

|

|||

|

Equex Filter Replacement |

$50K |

Operational Savings from Parks & Recreation Division ($50K) |

Nil |

|

|

Funds are required to replace the filtration system at the Equex Centre which is currently 23 years old. Most systems are replaced between 15 and 20 years. The filtration system is critical for the upkeep of the irrigation and turf surfaces at the Equex Centre. It is proposed to fund the works from operational savings within the Parks Division otherwise if these savings are not able to be achieved at the end of the financial year, it is proposed to fund the works from the Parks & Recreation Reserve. Estimated Completion: 30 June 2025 Job Number: 24456 |

|

|||

|

4 – Community Place and Identity |

|

|||

|

Fusion Stronger Together Grant |

$126K |

Multicultural NSW ($126K) |

Nil |

|

|

Council has been successful in securing one-off grant funding for the FUSION BOTANICAL 2025 festival through the Multicultural NSW 2024/25 Stronger Together Local Council Major Festival Grant program. This one-off $125,500 grant will enable our City’s flagship multicultural festival to deliver new elements to the festival offering this year for residents and visitors to the City. This includes scheduling national music acts, improving temporary safety infrastructure and accessibility, track matting and way-finding signage, along with an upgrade in professional sound and lighting, accessible marketing and communications in multiple languages, and the provision of an Auslan interpreter on the main stage. FUSION BOTANICAL 2025 festival aligns with and advances Multicultural NSW priorities, particularly in the areas of community resilience, sector capability, settlement, and fostering a shared sense of value. Estimated Completion: 31 October 2025 Job Number: 24455 |

|

|||

|

5 – The Environment |

|

|||

|

Community Education

CDS Refund Sharing Income

Domestic & Commercial Garbage Gate Charges

|

$99K

$330K

($429K)

|

|

Nil |

|

|

Changes in FOGO have necessitated the need for an increase in expenditure to support education campaigns for our community. It is also proposed that Council signs up to Halve Waste, which is an education program that supplies engagement programs and educational initiatives for Local Government, reducing duplication of efforts and supporting key messages across LGA’s. To reduce contamination in our FOGO and recycling, combined with a focus on reducing waste to landfill we need to ensure that we have appropriate education programs in place. The Container Deposit Scheme (CDS) income is lower than originally anticipated due to a change in the way the amount is calculated with the new contract. It is proposed to reduce this budget to align with forecasted income. It is also proposed to amend these budgets for the 10 years of the LTFP. In 2024/25, these 2 variations are proposed to be funded from increased gate charges income and from 2025/26 and ongoing a combination of increased fees and the Solid Waste Reserve where required. Job Numbers: 70157, 70172, 78210 & 78220 |

|

|||

|

Bus Shelter Installations |

$40K |

Transport for NSW Grant Funding ($40K) |

Nil |

|

|

Council has been successful in securing Transport for NSW grant funding under the Country Passenger Transport Infrastructure Grants Scheme (CPTIGS) for the installation of two bus shelters within the LGA. The shelters will be installed at 2 Rainbow Drive (Estella Shopping Centre) and Estella Road (Estella Public School). Estimated Completion: 30 June 2025 Job Number: 24463 |

|

|||

2024/25 Capital Works Summary

|

Approved Budget |

Proposed Movement |

Proposed Budget |

|

|

One-off |

$49,143,490 |

$310,000 |

$49,453,490 |

|

Recurrent |

$37,250,621 |

$0 |

$37,250,621 |

|

Pending |

$0 |

$0 |

$0 |

|

Total Capital Works |

$86,394,111 |

$310,000 |

$86,704,111 |

Low Cost Loans Initiative

The Low Cost Loans Iniative (LCLI) assists councils with the cost of new infrastructure by funding 50% of the interest paid on borrowings related to this infrastructure. Council successfully applied over recent years for a number of projects to be funded initially through the State Government’s LCLI Scheme. The intent was to bring forward the delivery of infrastructure that enables new house supply.

Due to a review of Councils projects and timeframes, a number of projects were not able to commence at the original planned start date. It is now appropriate to formally remove these projects from the LCLI scheme, and revert to their original funding sources, which now have adequate balances to fund the projects.

Round 1:

· 18796: Northern Sporting Precinct – Sportsgrounds and play equipment

· 15086: Harris (Estella) Road/Pine Gully Road - Dual Lane Roundabout (Stage 3)

· 18797: Pine Gully Road (Cootamundra Drive) Roundabout (Stage 2)