Agenda

and

Business Paper

To be held on

Tuesday

10 June 2025

at 6:00 PM

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

Agenda

and

Business Paper

To be held on

Tuesday

10 June 2025

at 6:00 PM

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

NOTICE OF MEETING

The proceedings of all Council meetings in open session, including all debate and addresses by the public, are recorded (audio visual) and livestreamed on Council’s website including for the purpose of facilitating community access to meetings and accuracy of the Minutes.

In addition to webcasting council meetings, audio recordings of confidential sessions of Ordinary Meetings of Council are also recorded, but do not form part of the webcast.

WAGGA WAGGA CITY COUNCILLORS

STATEMENT OF ETHICAL OBLIGATIONS

Councillors are reminded of their Oath or Affirmation of Office made under Section 233A of the Local Government Act 1993 and their obligation under Council’s Code of Conduct to disclose and appropriately manage Conflicts of Interest.

QUORUM

The quorum for a meeting of the Council, is a majority of the Councillors of the Council, who hold office for the time being, who are eligible to vote at the meeting.

Reports submitted to the Ordinary Meeting of Council to be held on Tuesday 10 June 2025.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Tuesday 10 June 2025

CLAUSE PRECIS PAGE

ACKNOWLEDGEMENT OF COUNTRY 2

REFLECTION 2

APOLOGIES 2

Confirmation of Minutes

CM-1 CONFIRMATION OF MINUTES - ORDINARY COUNCIL MEETING - 26 MAY 2025 2

DECLARATIONS OF INTEREST 2

Reports from Staff

RP-1 WAGGA WAGGA BUSINESS CHAMBER MEMORANDUM OF UNDERSTANDING (MOU) – 2025-2029 3

RP-2 2025/26 GET NSW ACTIVE PROGRAM WAGGA WAGGA ACTIVE TRAVEL - PLUMPTON ROAD LINK 29

RP-3 RENEWAL OF COMMUNITY, CULTURAL AND SPORTING LEASES AND LICENCES FOR THE 2025-2026 FINANCIAL YEAR 32

RP-4 Section 3.22 Amendment to Wagga Wagga Local Environmental Plan 2010 – Rezoning of additional land in the Livingstone State Conservation Area. 37

RP-5 RESPONSE TO NOTICE OF MOTION - LINE MARKING 49

RP-6 REQUESTS FOR FINANCIAL ASSISTANCE - SECTION 356 57

RP-7 QUESTIONS WITH NOTICE 65

Committee Minutes

M-1 CONFIRMATION OF MINUTES AUDIT, RISK AND IMPROVEMENT COMMITTEE – 21 may 2025 70

Confidential Reports

CONF-1 REQUEST TO REMOVE PROPERTY DEALINGS - COUSINS ROAD, BOMEN (LOT 18 DP 1295212) 83

CONF-2 RFT CT2025076 CATTLE DELIVERY SERVICES LMC 84

CONF-3 RFQ CT2025074 ROAD REHABILITATION WORKS AT GWMC 85

CONF-4 RFT CT2025069 DATA MIGRATION SERVICES 86

Wagga Wagga City Council acknowledges the traditional custodians of the land, the Wiradjuri people, and pays respect to Elders past, present and future and extends our respect to all First Nations Peoples in Wagga Wagga.

We recognise and respect their cultural heritage, beliefs and continuing connection with the land and rivers. We also recognise the resilience, strength and pride of the Wiradjuri and First Nations communities

REFLECTION

Councillors, let us in silence reflect upon our responsibilities to the community which we represent, and to all future generations and faithfully, and impartially, carry out the functions, powers, authorities and discretions vested in us, to the best of our skill and judgement.

CM-1 CONFIRMATION OF MINUTES - ORDINARY COUNCIL MEETING - 6 MAY 2025

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 26 May 2025 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - 26 May 2025 Ordinary Council Meeting |

87 |

|

Report submitted to the Ordinary Meeting of Council on Tuesday 10 June 2025 |

RP-1 |

Reports from Staff

RP-1 WAGGA WAGGA BUSINESS CHAMBER MEMORANDUM OF UNDERSTANDING (MOU) – 2025-2029

Author: Sue Hanrahan

Executive: Fiona Piltz

|

Summary: |

Council has provided funding support to the Wagga Wagga Business Chamber (Business Chamber) over the past three years by way of a Memorandum of Understanding (MOU). The MOU ends on 30 June 2025. The Business Chamber is seeking further funding for 4 years, from 30 June 2025 to 30 June 2029.

The Business Chamber has effectively met its undertakings under the MOU. Accordingly, considering the Chamber’s beneficial role in supporting and fostering business activity in our City, it is recommended that Council support renewal of the MOU on suitable terms. |

That Council:

a endorse the attached draft Memorandum of Understanding (MOU) – 2025 to 2029 between Wagga Wagga City Council and the Wagga Wagga Business Chamber

b delegate authority to the Mayor to sign the MOU on behalf of Council

Report

Background

Council initially entered into a Memorandum of Understanding (MOU) with the Wagga Wagga Business Chamber in 2019 to support local business development and engagement. This agreement was subsequently extended in June 2022 for a further three years, providing $68,250 per year (incl. GST). Throughout both terms, the Business Chamber has delivered strongly against the MOU objectives, particularly in the areas of business engagement, advocacy, and economic development.

The 2022-2025 MOU had six objectives:

1. promote, lobby and advocate for the Wagga Wagga business sector broadly at the regional, state and federal levels;

2. jointly seek, promote and advocate for major funding (from all levels of government) and projects within the LGA;

3. engage the local business sector in revitalising the commercial and industrial areas of the Wagga Wagga region through increased commercial activity;

4. advocate for the creation of new businesses in the LGA, the relocation of existing businesses to the LGA and the attraction of government services to the LGA;

5. build the economic development capacity of the Chamber through increased funding and membership;

6. Demonstrate a commitment to inclusion and accessibility.

Funding provided by Council has assisted the Business Chamber to participate actively in initiatives hosted by Council such as the Business Round Table as well as the reactivation of the Central Activity District Committee (CAD), which works to activate the CBD. It has also allowed the Business Chamber to enhance business opportunities and partner with businesses to improve the visitor and community experience.

Overall, the Business Chamber has met the expectations set out in the MOU, including

undertaking specific activities such as events and promotions. The Business Chamber has also conducted business engagement and questionnaires on behalf of Council when requested.

The Business Chamber has prepared a detailed performance report (attached) outlining its activities and achievements under the 2022–2025 MOU. This report demonstrates how the Chamber has delivered on its obligations over the past three years.

Renewal of MOU

An internal review by staff has indicated that Council could not provide the same support, representation and resources to the Wagga Wagga business community without a substantial increase in resources and associated expenditure.

The Chamber has proposed a longer-term MOU to provide long-term certainty and align with Council’s Community Strategic Plan. Following an internal review, it is proposed that Council enter a four-year agreement which would allow sufficient time for projects to develop, mature, and deliver measurable outcomes.

This length of term will ensure funding continuity can be managed over a longer term, while also retaining Council’s option to withdraw from the MOU in the unlikely event there is a deterioration in performance. Quarterly reviews will also continue to allow important two-way feedback and will ensure the partnership remains strong throughout the four-year period.

Why a Four-Year Term?

· Aligns with strategic priorities and allows time for long-term initiatives to take effect.

· Enables continuity and stability in planning and delivery, particularly in the recruitment and retention of staff

· Includes quarterly reviews to monitor performance and retain Council oversight.

Proposed Increased Annual Funding (incl. GST)

The Business Chamber is proposing a base funding of $68,000 plus GST per year ($74,800 including GST) with a 2.5% increase per year.

Due to the ongoing increasing costs of the Business Chamber as a result of inflation, and to support the growing scope and impact of their initiatives, they are requesting an increase in funding is to allow them to continue to support new and existing businesses.

Without an increase in funding, the Business Chamber would be unable to operate in the same capacity without needing to increase the cost to members. A significant increase in the membership cost will likely make being a member of the Business Chamber no longer a viable or affordable option for a number of smaller businesses in our region.

Business Chamber’s Rationale for Increased Funding

· Rising operational costs (inflation, staffing) threaten service sustainability.

· Without additional support, increased membership fees may reduce accessibility.

· Enhanced funding ensures the Business Chamber can continue delivering value to the broader business community and Council.

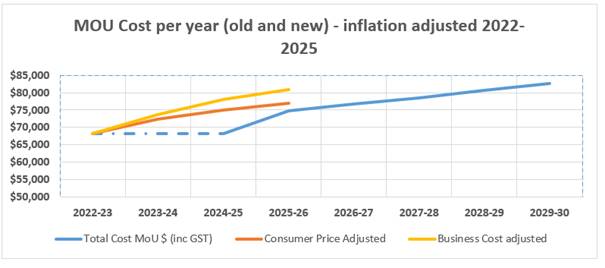

Internal analysis indicates that the proposed 9.6% increase from the end of the previous MOU to the start of the new one represents good value for money. Under the previous agreement, three annual flat payments of $68,250 (inclusive of GST) were made. If consumer price index (CPI) increases had been applied to those annual payments (see graph below), the starting payment for the proposed new agreement would fall between $76,896 and $80,867.

Following a Councillor workshop, two additional KPIs relating to membership growth and alignment with strategic plans have been included to guide the new MOU.

A strong and effective Business Chamber provides a mix of advocacy and direct services to the Wagga Wagga business community. The proposed funding would continue to foster a positive relationship between Council and business community and allow the Business Chamber to continue to build an inclusive, innovative and collaborative business environment.

Financial Implications

The duration of this MOU is for four (4) years from 01 July 2025 to 30 June 2029, subject to:

• the development of an agreed Business Chamber Strategic Plan in year one.

• the provision a yearly status report detailing how it is progressing with the actions in the Chambers key performance indicator schedule

The Agreement will be reviewed formally by Council during April 2028 prior to the end of the current term of Council. Subject to a satisfactory review against the key performance indicators an additional one years’ funding will be provided to allow the Chamber to put forward a new proposal to the newly formed Council.

Currently there is $59,000 (GST exclusive) budgeted annually for the 10 years of the LTFP.

The year 1 increase of $9,000 is proposed to be funded from the Economic Development Reserve. The year 2 – 4 increases ($11K - $14K annually) are proposed to be included as a part of the 2026/27 budget process and incorporated into the base budget funded from GPR.

Funding Summary (GST incl) (GST excl)

Year One (July 2025 - June 2026) $74,800.00 $68,000.00

WWBC Strategic Plan to be accepted

Year Two (July 2026 - June 2027) $76,670.00 $69,700.00

Year Three (July 2027 - June 2028) $78,586.75 $71,442.50

Review April 2028

Year Four (July 2028 - June 2029) $80,551.42 $73,228.56

Policy and Legislation

Community Strategic Plan 2050

Link to Strategic Plan

Growing

A growing business sector

Support existing businesses to grow, expand and remain viable through activation, innovation and collaboration.

Risk Management Issues for Council

If funding is not provided to the Business Chamber, there is a risk that the effectiveness of its advocacy and service delivery to the Wagga Wagga business community will be reduced. This may weaken the positive relationship between Council and the business community and hinder the Business Chamber’s ability to foster an inclusive, innovative, and collaborative business environment.

Internal / External Consultation

Internal and external consultation has been undertaken, including a Councillor workshop held on 5 May 2025, where the Business Chamber presented their proposal.

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Have your Say |

Email newsletter |

Social media |

Website |

|

|

Inform |

|

|

|

|

|

|

|

T |

|

T |

|

|

|

|

|

|

|

Consult |

|

|

|

|

|

T |

|

T |

|

|

|

|||||

|

Involve |

|

|

|

|

T |

T |

|

|

||||||||

|

Collaborate |

|

|

|

|

|

|

|

T |

|

T |

|

|

|

|

|

|

|

Other methods (please list specific details below) |

|

|

|

1⇩. |

Wagga Business Chamber Performance Report |

|

|

2⇩. |

Memorandum of Understanding - Wagga Business Chamber 2025 |

|

|

Report submitted to the Ordinary Meeting of Council on Tuesday 10 June 2025 |

RP-2 |

RP-2 2025/26 GET NSW ACTIVE PROGRAM WAGGA WAGGA ACTIVE TRAVEL - PLUMPTON ROAD LINK

Author: Jacqueline Collins

Executive: Fiona Piltz

|

Summary: |

Wagga Wagga City Council has been successful in securing $4,892,415 in funding through the NSW Government Transport for NSW Get NSW Active 2025-26 program to allow for the construction of the Plumpton Road Active Travel link. |

That Council:

a authorise the General Manager or their delegate to enter into an agreement with Transport for NSW for $4,892,415 in funding through the Get NSW Active 2025-26 program for the construction of the Plumpton Road Active Travel Pathway

b approve the budget variations as detailed in the financial implications section of this report

c authorise the affixing of Council’s Common Seal to all relevant documents as required

Report

The Get NSW Active program is a State Government initiative aimed at promoting active transportation by investing in infrastructure projects that encourage walking and cycling.

In late 2024 staff made application to this program seeking funding to reconstruct and extend the Plumpton Road active travel path as it was seen as critical infrastructure to support the future Southern Growth Area. In May 2025 staff received notification that the application had been successful and $4,892,415 had been offered for the project.

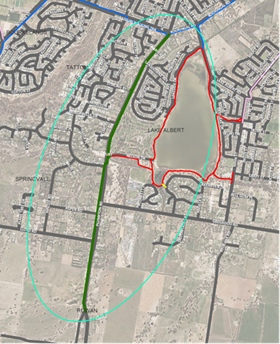

The proposed concrete path will be approximately 4,600m long and 3m wide. It will connect the Southern Growth Area into the existing Active Travel network starting at Rowan Rd and ending at Kooringal Red Hill Road intersection. The proposed project also includes multiple road crossings at Stirling Boulevarde, Brindabella Drive, Springvale Drive and Lloyd Road and a pedestrian bridge at Crooked Creek.

To avoid conflicts between the Plumpton Road North and South duplication projects, this project will be delivered concurrently by the Plumpton Road project team and incorporated into the overall Plumpton Road project.

Financial Implications

The $4,892,415 in funding through the NSW Government Transport for NSW Get NSW Active 2025-26 program will fully fund the Plumpton Road Active Travel Pathway project. There is no financial contribution required by Council. Once constructed, required maintenance of this active travel section will be incorporated into future Long Term Financial Plan budgets.

The project budget will be split evenly between the 2025/26 and 2026/27 financial years.

Policy and Legislation

Community Strategic Plan 2040

Recreation, Open Space and Community Strategy 2040

Wagga Wagga Community Net Zero Emissions 2050 Roadmap

Corporate Net Zero 2040 Strategy

Wagga Wagga Integrated Transport Strategy.

Link to Strategic Plan

Growing

Enabling infrastructure

Deliver critical regional transport facilities.

Risk Management Issues for Council

The risks associated with implementing this project relate to process, cost, environmental, WHS and contractor performance. These risks are addressed as part of the Council’s project management and contractor performance management systems.

Internal / External Consultation

Internal Consultation has been undertaken with the Major Projects and City Growth and Regional Assets Teams.

External consultation has been undertaken with Transport for NSW.

Ongoing resident and business consultations are being undertaken by the Plumpton Road project team.

|

Report submitted to the Ordinary Meeting of Council on Tuesday 10 June 2025 |

RP-3 |

RP-3 RENEWAL OF COMMUNITY, CULTURAL AND SPORTING LEASES AND LICENCES FOR THE 2025-2026 FINANCIAL YEAR

Author: Matthew Dombrovski

Executive: Fiona Piltz

|

Summary: |

This report provides an update on the renewal of lease and licence agreements with sporting, cultural and community associations who occupy Council land and/or buildings which are due to expire during the 2025-2026 financial year |

That Council:

a delegate authority to the General Manager or their delegate to negotiate and execute renewal of the community, cultural or sporting association lease and licence agreements as detailed in the body of this report

b authorise the affixing of Council’s common seal to all relevant documents as required

Report

Council has a portfolio of approximately 75 community, cultural and sporting association lease and licence agreements. These agreements regulate the occupation of Council owned and controlled land and building assets, and generally include the following conditions:

|

STANDARD CONDITIONS |

|

|

Agreement duration |

Up to five years. |

|

Fees |

Rent and other occupation fees as per the Council’s Fees and Charges as at the date of commencement. (Currently the Council’s minimum community rent is $840 per annum including GST and will be reviewed as of 1 July 2025.) |

|

Fee increases |

Rent and other occupation fees reviewed annually on the anniversary of commencement in accordance with Council’s adopted Fees and Charges. |

|

Public Liability Insurance |

No less than $20 million with Wagga Wagga City Council listed as an interested party. |

|

Occupation Costs |

Tenant to meet costs associated with occupation of the premises, including but not limited to water, gas, electricity, fire safety, sewer and waste disposal. |

|

Maintenance Responsibilities |

Tenant to be responsible for routine upkeep, servicing of equipment and day-to-day maintenance. The Council is responsible for works of a structural nature only (where Council owned buildings are occupied). |

|

Preparation Fees |

As per the Council’s adopted Revenue and Pricing Policy current as at the date of commencement of the renewed agreement (currently the licence preparation fee is $295 including GST). Where Council needs to instruct external solicitors to prepare agreements (generally only lease agreements), legal fees incurred are reimbursed by the tenant on a 100% cost recovery basis. |

During the 2025/26 financial year, the agreements listed below will expire. Renewal is recommended upon similar terms and conditions to the current agreements. Each of the tenants identified below have generally complied with their obligations under the current licence agreement and as such Council officers recommend renewing the licence agreement.

The agreements relate to Crown Land managed by Council, operational and community land as set out in the following tables:

|

COMMUNITY LAND |

|||

|

Note: Under Section 47A of the Local Government Act 1993 Council is required to give public notice of a proposal to lease or licence of land classified as community land. If objecting submissions are received in relation to any proposed agreement, a further report will be submitted to Council for consideration. |

|||

|

Organisation |

Property Address |

Permitted Use |

Expiry Date |

|

Wagga Wagga Bridge Club Inc |

Belling Park Hall (old Scout Hall), 7 Bolton Street, Wagga. Part Lot 1 Sec 80 DP 759031 |

Bridge Clubhouse |

30 Sep 2025 |

|

Wagga Wagga Community Media Inc. (2AAAFM) LAND |

Public Reserve, Wandoo Place, Willans Hill (South). Part Lot 23 DP 1062973 |

Telecommunications tower |

31 Jul 2025 |

|

CROWN LAND |

|||

|

Note: All agreements over Crown Land require review by Council’s Native Title Manager in accordance with section 8.3 of the Crown Land Management Act 2016 (taking effect from 1 July 2018). Under the aforementioned legislation, Council manages Crown Land as community land under the Local Government Act 1993 and is required to give public notice of a proposal to lease or licence of land. If objecting submissions are received in relation to any proposed agreement, a further report will be submitted to Council for consideration. |

|||

|

Organisation |

Property Address |

Permitted Use |

Expiry Date |

|

Wagga Wagga Polocrosse Club Incorporated |

1541 Old Narrandera Road, Euberta. Lot 218 DP 750863 |

Clubhouse for polocrosse activities including equestrian activities, polo training and competitions |

28 Feb 2026 |

|

Wagga Wagga Society of Model Engineers Inc. (Miniature Railway at Botanic Gardens) |

Reserve 1440, Willans Hill, Model Railway, Botanic Gardens, Wagga Wagga. Lot 18 DP 1177748 |

Clubhouse for model engine railway and associated uses |

31 Dec 2025 |

|

OPERATIONAL LAND |

|||

|

Organisation |

Property Address |

Permitted Use |

Expiry Date |

|

Uranquinty Neighbourhood Centre Management Committee |

Uranquinty Neighbourhood Centre, 80 Connorton Street, Uranquinty. Part Lot 2 DP 590564 and Crown Lot 218 DP 43136 (Reserve 93924) |

Community centre, meetings and associated activities |

31 Jan 2026

|

|

Visual Dreaming Pty Ltd ACN: 629 219 085

|

Part 204 Tarcutta Street, Wagga Wagga. Part Lot 1 & Part Lot 2 DP 1035833 |

Community cultural programs and associated activities |

31 Oct 2025 |

Financial Implications

The above tables represent a renewal of existing arrangements. Accordingly, there will be no further change to Council’s Long Term Financial Plan. Lease and licence fees will continue to be reviewed in accordance with the annual review of endorsed Fees and Charges.

The rent received is included in the Council’s annual operating income budget. In respect of the Crown Land lease, the net proceeds of dedicated or reserved Crown land must be applied for permitted purposes pursuant to section 3.16 of the Crown Land Management Act 2016 (ie: improving, managing and/or preparing plans of management for Crown land.)

Policy and Legislation

Local Government Act 1993

Crown Land Management Act 2016

Acquisition, Disposal and Management of Land Policy POL 038

Link to Strategic Plan

Safe and Healthy Community

Objective: Our community embraces healthier lifestyle choices and practices

Promote access and participation for all sections of the community to a full range of sports and recreational activities

Risk Management Issues for Council

Council has a responsibility to appropriately deal with and manage its real property assets. In the event that external factors arise that prevent the renewal of a lease / licence (such as a decision by a user group to hand back the existing arrangement or registration of an Aboriginal Land Claim or Native Title Claim) a further report will be provided to Council outlining options for the future use of the site.

Internal / External Consultation

Internal consultation has been undertaken with Council’s Regional Activation, Operations and Community directorates.

Public notification of proposed agreements concerning Council community land and Crown Land managed under the Local Government Act 1993 is required as outlined below. Direct consultation with Native Title Interests and Aboriginal Land Claimants may also be required in the case of Crown Land.

|

|

|

Traditional Media |

Community Engagement |

Digital |

||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media release |

Media opportunity |

TV/radio advertising |

One-on-one meeting(s) |

Community meeting(s) |

Stakeholder workshop(s) |

Drop-in session(s) |

Survey/feedback form(s) |

Have your Say |

Email newsletter |

Social media |

Website |

|

|

Inform |

|

x |

|

x |

|

|

|

|

|

|

|

|

|

|

|

|

|

Consult |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Involve |

|

|

|

|

|

|

|

|

||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other methods (please list specific details below) |

|

|

|

Report submitted to the Ordinary Meeting of Council on Tuesday 10 June 2025 |

RP-4 |

RP-4 Section 3.22 Amendment to Wagga Wagga Local Environmental Plan 2010 – Rezoning of additional land in the Livingstone State Conservation Area.

Author: Matthew Yeomans

Executive: Fiona Hamilton

|

Summary: |

Council was notified on 7 April 2025 that additional land was reserved under the National Parks & Wildlife Act 1974 (NPW Act) within the Wagga Wagga Local Government Area. The land is currently zoned ‘RU1 Primary Production’. Land reserved under the NPW Act is typically zoned ‘C1 – National Parks and Nature Reserves’.

The section 3.22 amendment seeks to amend the zoning to ensure consistency and application of zoning for gazetted National Parks and nature reserves. |

That Council delegate authority to the General Manager or their delegate to lodge a section 3.22 request to amend the Wagga Wagga Local Environmental Plan 2010 to rezone Lot 62, DP754544 from RU1 Primary Production to C1 National Parks and Nature Reserves under Section 3.22 and 3.36(2) of the Environmental Planning and Assessment Act 1979.

Report

|

Landholder |

Minister Administering The National Parks And Wildlife Act 1974 |

|

Address & Legal Description |

Livingstone State Forrest Rd BURRANDANA NSW 2650 Lot 62 in DP754544 |

Background

Council was notified on 7 April 2025 that additional land was reserved under the National Parks & Wildlife Act 1974 in relation to the Livingstone State Conservation Area (Attachment 1). The subject land (Lot 62 in DP754544) is currently zoned ‘RU1 Primary Production’. Land reserved under the NPW Act is typically zoned ‘C1 - National Parks and Nature Reserves’ under the relevant Local Environmental Plan.

This report seeks authorisation from Council to lodge an application under a section 3.22 to undertake an expedited amendment to the Wagga Wagga Local Environmental

Plan 2010.

An existing zoning and context map are provided below.

|

|

|

|

Figure 1 – Subject property (existing zoning RU1 – Primary Production) |

Figure 2 – Context map |

What are the proposed planning controls?

The amendment proposes to rezone the land ‘C1 – National Parks and Nature Reserves’ under the Wagga Wagga Local Environmental Plan 2010.

The objectives of the C1 zone are to:

• To enable the management and appropriate use of land that is reserved under the National Parks and Wildlife Act 1974 or that is acquired under Part 11 of that Act.

• To enable uses authorised under the National Parks and Wildlife Act 1974.

• To identify land that is to be reserved under the National Parks and Wildlife Act 1974 and to protect the environmental significance of that land.

Only uses authorised under the National Parks & Wildlife Act 1974 are permitted without consent. All other uses are prohibited.

What steps need to be taken?

Council staff have liaised with the Department of Planning, Housing and Infrastructure (DPHI) to determine the most appropriate pathway forward to address this issue. DPHI advised Council a section 3.22 is an appropriate pathway to rezone the land in this instance.

What is a section 3.22 expedited amendment?

Planning and Assessment Act 1979. An extract of section 3.22 of the Act is provided below.

3.22 Expedited amendments of environmental planning instruments

(cf previous s 73A)

(1) An amending environmental planning instrument may be made under this Part without compliance with the provisions of this Act relating to the conditions precedent to the making of the instrument if the instrument, if made, would amend or repeal a provision of a principal instrument in order to do any one or more of the following—

(a) correct an obvious error in the principal instrument consisting of a misdescription, the inconsistent numbering of provisions, a wrong cross-reference, a spelling error, a grammatical mistake, the insertion of obviously missing words, the removal of obviously unnecessary words or a formatting error,

(b) address matters in the principal instrument that are of a consequential, transitional, machinery or other minor nature,

(c) deal with matters that the Minister considers do not warrant compliance with the conditions precedent for the making of the instrument because they will not have any significant adverse impact on the environment or adjoining land,

(c1) deal with matters the NSW Reconstruction Authority considers necessary to give effect to the NSW Reconstruction Authority Act 2022.

(2) A reference in this section to an amendment of an instrument includes a reference to the amendment or replacement of a map adopted by an instrument.

(2A) For the purposes of subsection (1)(c1), the Minister may direct that the NSW Reconstruction Authority is—

(a) the planning proposal authority for this Part, or

(b) a local plan-making authority for section 3.31.

(2B) For subsection (2A), the Minister’s direction may provide that the NSW Reconstruction Authority must exercise the functions of a planning proposal authority or local plan-making authority—

(a) for a particular period or for particular stages of development, or

(b) only in relation to certain matters.

Council staff anticipate this section 3.22 amendment would be undertaken pursuant to section 3.22(1)(b), as the proposed change is of a transitional nature.

Financial Implications

N/A

Policy and Legislation

Environmental Planning and Assessment Act 1979

National Parks & Wildlife Act 1974

Wagga Wagga Local Environmental Plan 2010

Link to Strategic Plan

The Environment

Objective: Our natural areas are protected and enhanced

Preserve and improve our natural assets

Risk Management Issues for Council

If this report is not adopted the land will remain zoned RU1 – Primary Production. This is considered low risk as the land is owned by the State Government; however it is not considered to be efficient land use planning.

Internal / External Consultation

A section 3.22 amendment is not subject to public exhibition, as it is of an inconsequential, transitional or minor nature.

|

1⇩. |

Attachment 1 - Notification of Gazettal |

|

|

2⇩. |

Attachment 2 - Planning Circular PS21-014 (Minor amendments to local environmental plans using section 3.22) |

|

|

Report submitted to the Ordinary Meeting of Council on Tuesday 10 June 2025 |

RP-5 |

RP-5 RESPONSE TO NOTICE OF MOTION - LINE MARKING

Author: Zachary Wilson

Executive: Carolyn Rodney

|

Summary: |

This report is presented to Council in response to NOM-2 Sealed Road Line Marking adopted at the 20 January 2025 Ordinary Council meeting. |

That Council receives and notes the report.

Report

At the Ordinary Council meeting of the 20 January 2025, Council resolved:

That Council receives a report on the introduction of line marking as an asset prior to the making of the 2025/26 budget, which includes but is not limited to:

a recognising sealed road line marking as an asset

b introducing line marking as a discrete component of the Transport Asset Management Plan

c asset data such as agreed asset life, asset condition and other asset attributes

d the creation of a discrete line item in Councils budget to address "end of useful life" line marking renewal

Background

Wagga Wagga City Council is responsible for operating, maintaining and renewing a road network of 2,320 kilometres (valued at $951.36M), consisting of 1,280kms of sealed roads and 1,040kms of unsealed roads stretching across a Council area of 4,824 square kilometres. In response to previous Questions with Notice, Council staff have outlined the following with regard to line marking:

· Council does not currently track line marking as it is renewed

· Council has an annual budget of $75K which is used for line marking roads following renewal

· Council does not have a renewal plan for line marking

· Council’s draft Transport Asset Management Plan does not separately identify line marking

The below includes recent questions with notice and Council officer responses to provide further context:

11 November 2024 Ordinary Council Meeting

|

Councillor Tanner

What is the annual budget for road linemarking and the estimated useful life attribute to line marking? What was the linear amount of linemarking renewed in km's in FY23/24 and what is planned for FY25, and does council plan the renewal based on useful life? |

|

For the 2024/25 financial year, Council has introduced a new $75K annual budget for linemarking, funded from general purpose revenue. This budget is planned to be used for linemarking renewed road assets that are reconstructed and/or resealed as part of Councils 2024/25 roads program. Council has also identified $64K in linemarking budget for Regional Roads, funded from the Regional Roads block grant, which will be used to renew linemarking on Councils regional roads network. In addition to the above two funding sources, Council also has an annual ongoing budget, $56K for 2024/25, which is used for Council staff to perform line maintenance as required.

Council does not currently track the quantity of linemarking renewed each financial year. Council did spend in excess of $400K on linemarking throughout the 2023/24 financial year.

Council does not have a specific estimated useful life that it applies to linemarking as it generally depends on the location and product type. Based on this, the life of linemarking can range from anywhere from 12 months to 5 years. Council does not have a renewal plan for linemarking. |

25 November 2024 Ordinary Council Meeting

|

Councillor Tanner

Will there be a line marking renewal plan soon or will Council continue to spend money without knowing where it should be spent? |

|

There is no plan to develop a line marking renewal plan in the immediate future. Council has a $75K annual budget that will be used to line mark newly reconstructed/renewed road works following completion. |

26 May 2025 Ordinary Council Meeting

|

Councillor L Tanner

Will line marking be included in the draft Asset Management plan? |

|

The draft Transport Asset Management Plan does not recognise or capture line marking as a discrete asset. The outstanding Notice of Motion (NOM) on line marking reported at the 20 January 2025 Council meeting has been delayed due to staff workloads and the NOM response will provide further information on this. |

Introduction

In determining whether Council should or should not recognise line marking as an asset, staff have considered the following:

· Australian Accounting Standards

· Local Government Code of Accounting Practice and Financial Reporting (Code)

· Benchmarking other council practices

· Council resourcing constraints

Accounting Standards and Office of Local Government Code

Each year, Council is required to prepare its Annual Financial Statements which includes accounting for Council’s Infrastructure, Property, Plant and Equipment (IPPE). These financial statements are required to be prepared and audited under Section 413 of the Local Government Act 1993 and must be prepared in accordance with the Local Government Act, Australian Accounting Standards and the Office of Local Government’s Local Government Code of Accounting Practice and Financial Reporting.

Australian Accounting Standards (AASB) provide guidance and direction on the application of the International Financial Reporting Standards (IFRS) in the local reporting environment. Specifically, AASB 116 Property, Plant and Equipment outlines the criteria for Council to recognise an item of Infrastructure, Property, Plant or Equipment as an asset of Council.

Paragraph 7 of AASB 116 Property, Plant and Equipment outlines the following criteria for the recognition of an asset:

7 The cost of an item of property, plant and equipment shall be recognised as an asset if, and only if:

(a) it is probable that future economic benefits associated with the item will flow to the entity; and

(b) the cost of the item can be measured reliably.

Although AASB 116 does not provide a specific definition of future economic benefits, the AASB Conceptual Framework defines future economic benefits as “the future economic benefit embodied in an asset is the potential to contribute, directly or indirectly, to the flow of cash and cash equivalents to the entity”. For local government, this can be defined as the potential to contribute, directly or indirectly, to the delivery of services that meet the needs of the community and at a level of service that is deemed to be acceptable to the community.

The second item of the recognition criteria is the reliable measure of cost. This element of the criteria doesn’t just consider the cost of the activity but also the other financial elements involved in the recognition of items of IPPE. In order to meet this element of the recognition criteria, financial inputs such as, but not limited to, unit of measure, useful life, estimated remaining life, modern equivalent replacement cost must be known for each individual asset. Additionally, in line with AASB 13 Fair Value Measurement, in order for an entity to reliably measure the fair value of an asset it must be able to identify and account for each separable element and component.

In addition to the recognition criteria within AASB 116 Property, Plant and Equipment, Council staff must also consider the application of materiality. The AASB Conceptual Framework provides guidance on materiality and the need for consideration to be given to the costs and benefits of recognition. Additionally, AASB 101 Presentation of Financial Statements mandates that materiality must be considered in the preparation of financial reports and whether omitting, misstating or obscuring it could reasonably be expected to influence decisions that primary users of financial statements make on the basis of those financial statements.

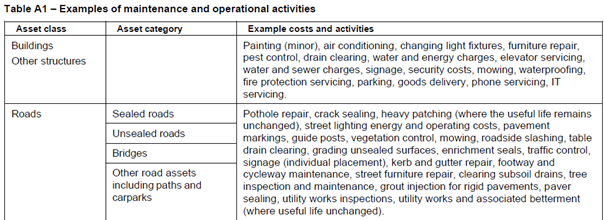

The Office of Local Government (OLG) provides support and advice to councils through the Local Government Code of Accounting Practice and Financial Reporting (Code). The Code prescribes the forms of financial statements required to be prepared and submitted by Council. The Code is updated each year, in consultation with industry experts and council representatives across NSW and provides guidance on interpreting and applying accounting standards and provides examples of this application. As Councillors would be aware, Council is required to provide a Report on Infrastructure Assets at 30 June each year – as part of it’s Annual Financial Statements. In collating this, Council staff rely on guidance provided under the Code to determine the distinction between maintenance, operational, renewal and rehabilitation activities for Council assets. Within the Code, pavement markings, otherwise known as line marking, is defined as being a maintenance and operational activity relating to the Roads asset class. The below extract is provided from the 2024-25 update of the Code.

Benchmarking

In reviewing Council’s position on the recognition of line marking as an asset, staff contacted a number of similar regional councils regarding their current asset recognition practices for sealed road line marking. These councils were selected as they are members of a similar OLG Group and Classification rating to Wagga Wagga City Council – the below six (6) councils are all classified as Regional Town/City by the OLG. The below table outlines the council, their road network length and their position on recognising line marking as an asset.

|

Council |

OLG Group^ |

Road Length (km)^ |

Line marking as an asset? |

|

Albury |

4 |

606.9 |

No |

|

Bathurst Regional |

4 |

1,370.3 |

No |

|

Eurobodalla |

4 |

1,023.7 |

No |

|

Queanbeyan-Palerang Regional |

4 |

1,730.3 |

No |

|

Tamworth Regional |

4 |

3,241.4 |

No |

|

Tweed Shire |

5 |

1,247.4 |

No |

^This information was collated from the OLG Time Series data for 2023/24.

In discussing current practices with these councils, it was identified that none of these councils recognise line marking as a separate asset with a majority of these councils currently accounting for line marking as part of the surface (wearing surface) component and/or as an operational expense.

Council staff also consulted with an accounting and asset valuation industry member, who advised that they were not aware of a council that has recorded line marking as a separate asset. Advice received from this industry member was that the cost of line marking is normally minor and immaterial in nature and therefore is incorporated into the cost of the surface component.

Resourcing Constraints

Currently Council does not capture line marking data within its spatial or asset management systems. Capturing, assessing and maintaining line marking data in both spatial and asset management systems is time consuming and would require an additional, dedicated resource within Council. If line marking was to be recognised as an individual asset, Council staff would be required to capture and maintain a separate asset for each time a line marking type changes – as required under Australian Accounting Standards. As Council staff already maintain in excess of 100,000 asset records in its asset management system, if Council was to recognise line marking it is expected that this number will increase significantly.

Asset Attribute Data

As detailed in earlier responses to Questions with Notice, Council does not currently track the quantity of line marking renewed each year. In reviewing the different types of line marking, Council staff, in consultation with contractors, have identified an extensive list of the different line marking types and associated sub types.

The following table provides this listing.

|

Type |

Sub Type |

|

Longitudinal |

Barrier Lines - Double Two Way |

|

Barrier Lines - Single |

|

|

Barrier Lines – Double One Way |

|

|

Continuity Line |

|

|

Dividing Line |

|

|

Clearway Line |

|

|

Dragon's Teeth |

|

|

Edge Line (PCH Edge Line for painted islands) |

|

|

No Stopping |

|

|

Lane Line Broken |

|

|

Lane Line Unbroken |

|

|

Turn Line |

|

|

Zig Zag |

|

|

Bicycle Lane Line |

|

|

Bicycle Lane Line Continuity Line |

|

|

Transverse |

Stop Line |

|

Give Way Line |

|

|

Piano Keys |

|

|

Pavement Marking |

Bike Marking |

|

Sharrow (Bike with Arrow) |

|

|

Directional Arrow |

|

|

Directional Arrow – Bike Lane |

|

|

Keep Clear |

|

|

Pedestrian Crossing |

|

|

Pedestrian Crossing - Zebra |

|

|

Speed Marking |

|

|

Parking Area |

Side On |

|

Perpendicular |

|

|

Parking restriction |

As Council does not currently recognise line marking as an asset either financially or spatially, Council does not have an agreed estimated useful life that it applies to line marking as it generally depends on the location, traffic usage, surface type and product type. Based on this, the life of line marking can range from anywhere from 12 months to 5 years. Determining the appropriate useful life of line marking would require consideration of all the above factors. As Council has not previously tracked line marking, age data is unable to be used to help determine useful life.

Line marking Budget

Council currently has a recurrent operating budget line of $75,000, which is used for line marking renewed roads following completion of works. The draft Transport AMP identifies that Council currently has 70% of the required maintenance costs for sealed roads funded within the draft 2025-26 Long Term Financial Plan – with an identified maintenance funding shortfall of $2.89M per annum. If Council resolves to create an additional budget to fund the renewal of line marking, this will require Council staff to identify a plan and potential costs for this. This will require Council to direct resources to undertake this capture, planning and proposal.

Draft Transport Asset Management Plan

The draft Transport Asset Management Plan (AMP) has been developed utilising the best practice NAMS+ templates provided by IPWEA. Utilising these templates allows Council to present its Asset Management Plans in line with best practice standards and allows alignment with the International Infrastructure Management Manual and the ISO 55000, 55001 and 31000 series of standards. The draft Transport AMP currently includes assets that are recognised as Infrastructure assets in Council’s Annual Financial Statements – which includes Council’s 1,240km sealed road network.

As Council doesn’t currently recognise line marking as an asset, Council’s draft Transport AMP does not identify these as a discrete asset within the AMP. The draft Transport AMP includes calculations of the required and actual funding for renewal and maintenance activities for each asset class and although line marking is not separately identified in the AMP, it is considered within the forecast $25.55M in renewal funding required for the next 10-year period for the reinstatement of existing line marking as a result of renewal or rehabilitation works.

The draft Transport AMP includes an Improvement Plan, which identifies short, medium and long-term improvements that can be made for Transport asset information – to help assist better future informed decision making. Within this plan, Council staff have specifically identified a short-term task to develop a list of maintenance activities and associated costs for each transport asset class. This will include identifying the maintenance activity, frequency and associated cost for each activity – with renewal of line marking to be considered as part of this improvement.

Once this has been developed, Council staff will update the Transport AMP with the new forecast maintenance costings for each transport asset class.

Financial Implications

It is staff recommendation that Council continues to recognise expenditure on unplanned line marking renewal as an operational expense, and reinstatement of existing line marking as a result of renewal or rehabilitation works will be recognised against the surface (wearing surface) component of the relevant sealed road asset.

If Council was to resolve to recognise sealed road line marking as an asset, this would cost Council an additional $130,000 per annum to capture, assess and maintain line marking within its spatial and asset management systems. This would require a new, dedicated full time equivalent position to perform these duties on an ongoing basis. In addition to this, Council staff would also be required to purchase additional asset data capture equipment, which is expected to cost around $12,500 upfront with an annual ongoing licence fee of $2,000 per annum.

If Council was to resolve to create an additional budget line to address the renewal of line marking (in addition to the current operating budget for line marking of $75,000 per annum), this is currently unfunded.

The above two options of resourcing and adding an additional budget line to address renewal of line marking are both currently unfunded in Council’s Long Term Financial Plan and if Council was to resolve with either of the above, funding would be required to be sourced from within the current road’s maintenance and/or renewal budgets. This would result in reduced funding available to undertake roads maintenance and/or road renewal.

Policy and Legislation

POL 001 – Asset Management Policy

Wagga Wagga Code of Meeting Practice

Australian Accounting Standard Pronouncements (AASB)

Local Government Code of Accounting Practice and Financial Reporting

Link to Strategic Plan

Safe and Healthy Community

Objective: Our community feel safe

Monitor and enforce public safety

Risk Management Issues for Council

If Council was to resolve to recognise sealed road line markings as an asset, Council staff would be required to provide a detailed accounting position paper to Council’s external auditors, the NSW Audit Office, for review and approval before recognition can occur. This would also require Council staff identifying any potential changes in accounting estimates that would require remeasurement and restatement of prior financial statements.

Internal / External Consultation

Council staff have consulted with other regional councils regarding asset recognition practices for sealed road line marking, as well as discussing this matter with accounting and asset management industry members.

|

Report submitted to the Ordinary Meeting of Council on Tuesday 10 June 2025 |

RP-6 |

RP-6 REQUESTS FOR FINANCIAL ASSISTANCE - SECTION 356

Author: Carolyn Rodney

|

Summary: |

Council has received two (2) fee waiver requests for Council’s consideration. |

That Council:

a in accordance with Section 356 of the Local Government Act 1993, provide financial assistance to:

i Riverina Racing Pigeon Federation for this calendar year for $400, noting that this financial fee waiver is not ongoing, and future annual licence fees will be required to be paid in full

ii Lilier Lodge Cancer Centre for $80.60

b note the proposed budget available for financial assistance requests for the remainder of the 2024/25 financial year

Report

Two (2) Section 356 financial assistance request is proposed for consideration at this Ordinary Council meeting:

1. Riverina Racing Pigeon Federation – Request for partial waiver of Annual Licence Fee - $400.00

William Boydell, on behalf of the Riverina Racing Pigeon Federation in the attached letter requests:

Dear Stephanie

I'm writing to you in reference to the Annual Licence fee for the above named clubs shed which is used as our clubs 'Club House'.

Once again we are seeking a reduction in the yearly rental, as a very small not for proffit club and little opportunity to raise funds the $916.16 fee is beyond our financial means.

Our membership is mostly retired members and some of them are pensioners all of whom find the age old sport of pigeon racing one that keeps them very interested and active and thus in a better state of mental health.

We as a club realise and respect the need for Council to raise rent for the upkeep of these buildings and as such we are not asking for free rental but we would ask if a reduction to a cost the same as last year ($400) is possible.

We have actively engaged in trying to increase our membership this past year and we are hopeful of extra membership which will give the club extra opportunity to raise extra finances.

Looking forward to, hopefully a favorable response in the near future.

Sincere regards

Yours sincerely

W G Boydell

President/Secretary

RRPF-Wagga Wagga Branch

The above request aligns with Council’s Strategic Plan “Community Place and Identity” – Objective: Our community feel welcome, included and connected”

Riverina Racing Pigeon Federation have not received any financial assistance this financial year. The group received a similar fee waiver for last year’s 2023/24 annual community licence fee. Given the community licence fee is set at a subsidised rate already, it is appropriate that in future years the full community rate is charged and payable.

2. Lilier Lodge Cancer Centre - $80.60

Richard Moffart, Manager of Lilier Lodge in the attached email writes:

Dear Mr Thompson,

Lilier Lodge is a 21 room not for profit facility providing accommodation and support to regional people traveling to Wagga Wagga for their cancer treatments. We are owned by Can Assist and Cancer Council.

This Sunday 18th May we are having a working bee in the garden and we will have a bit of green waste to take to Gregado Waste Management Centre. Is council in a position to waive the fee associated on this one occasion? I am guessing there will be 2 ute loads.

A fee waiver to our local charity would be greatly appreciated and keep our limited funds support our cancer patients.

Looking forward to your reply.

Kind Regards,

Richard Moffatt

Manager Lilier Lodge

The above request aligns with Council’s Strategic Plan “Community Place and Identity” – Objective: Our community feel welcome, included and connected”

Lilier Lodge have not received any financial assistance from Council this financial year. Staff have advised Lilier Lodge to submit an annual application for waste disposal at the Gregadoo Waste Management Centre, which they have now submitted for the 2025/26 financial year, and will be included in a future report to Council.

Financial Implications

|

Budget Summary (rounded to the nearest dollar where applicable) |

|

|

Total Section 356 Contributions, Grants and Donations 2024/25 Budget allocation |

$2,190,329 |

|

Total of Section 356 Contributions, Grants and Donations budget allocations approved during 2024/25 Operational Plan adoption* |

($2,156,731) |

|

Total of fee waivers approved to date this financial year |

($2,418) |

|

Revised Balance of Section 356 budget available for requests received during the 2024/25 financial year |

$31,180 |

|

1) Riverina Racing Pigeon Federation |

($400) |

|

2) Lilier Lodge – $80.60 funded from the Solid Waste budget |

- |

|

Subtotal Fee Waivers included in this report proposed to be funded from the Section 356 Budget |

($400) |

|

Proposed Balance of Section 356 fee waiver financial assistance budget for the remainder of the 2024/25 Financial Year |

$30,780 |

Policy and Legislation

POL 078 – Financial Assistance Policy

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga City Council leads through engaged civic governance and is recognised and distinguished by its ethical decision-making, efficient management, innovation and quality customer service

Ensure transparency and accountability

Risk Management Issues for Council

N/A

Internal / External Consultation

Cross Directorate consultation has been undertaken as required.

|

1⇩. |

Financial Assistance Request - Section 356 - Riverina Racing Pigeon Federation |

|

|

2⇩. |

Financial Assistance Request - Section 356 - Lilier Lodge |

|

|

Report submitted to the Ordinary Meeting of Council on Tuesday 10 June 2025 |

RP-7 |

RP-7 QUESTIONS WITH NOTICE

Author: Scott Gray

|

Summary: |

This report is to respond to questions with notice raised by Councillors in accordance with Council’s Code of Meeting Practice. |

|

That Council receive and note the report. |

Report

The following questions with notice were received prior to the meeting, in accordance with the Code of Meeting Practice.

|

Councillor J McKinnon

In relation to the delivery of a roundabout at the intersection of Gregadoo Road and Plunkett Drive, could Councillors be provided with information regarding the communication undertaken with local residents, the rationale for the roundabout, including any traffic modelling completed and Council’s response to concerns raised about resident engagement and consultation. |

|

The roundabout at Gregadoo Road and Plunkett Drive forms part of the broader Gregadoo Road Corridor Strategy, developed in response to ongoing growth in Wagga Wagga’s southern suburbs. The Strategy was formally endorsed by Council at its Ordinary Meeting on 24 February 2025, and the intersection upgrade was incorporated into an amendment to the Wagga Wagga Local Infrastructure Contributions Plan (LICP) 2019–2034 (Ref: TT7).

The roundabout was originally planned for the Gregadoo/Plumpton Road intersection. However, following analysis and Councillor workshops held in May 2021 and November 2024, the roundabout was relocated to the Gregadoo/Plunkett Drive intersection to better address traffic congestion and safety concerns associated with school peak periods on Plunkett Drive.

Traffic analysis undertaken by Council’s Traffic Engineer considered existing and projected traffic volumes, particularly from the Southern Growth Area. The modelling concluded that duplication of Gregadoo Road was not required, but that intersection upgrades were critical for improving traffic flow and safety.

The relocation of the roundabout to Plunkett Drive was based on: · Poor levels of service and queuing during AM and PM peak periods due to school traffic; · Lack of significant traffic volumes or generators at the originally proposed Gregadoo/Plumpton Road location; · The potential for the Plumpton Road intersection to be funded and delivered through a separate Voluntary Planning Agreement associated with a new development application.

Accordingly, the LICP was amended to redirect $1.685 million in funding from the Plumpton intersection to the Plunkett Drive roundabout.

Community consultation to date for this project has occurred through both targeted engagement with affected landowners and a public exhibition process for the amended Contributions Plan. Direct consultation has been with landowners impacted by land acquisition requirements near the proposed roundabout.

The amendment to the LICP was made available through Council’s “Have Your Say” platform in accordance with legislative requirements. Two public submissions were received from nearby residents during this exhibition. Follow-up conversations with both submitters were conducted by the Project Manager to address concerns and clarify project rationale.

A dedicated Communications and Engagement Strategy has been developed to ensure that residents receive clear and distinct updates regarding the Gregadoo Road works, separate from the nearby Plumpton Road Upgrade project. |

|

Can Council be provided with the footpath condition assessment methodology used for the 2022–2026 period, as well as the methodology applied in 2023, to enable the Council and the community to understand the difference. |

|

In 2018 a visual condition assessment of the entire footpath network was undertaken by internal Council staff. The footpath condition for each segment was determined after the consideration of a number of factors such as cracking, trip hazards, inadequate surface levels, previous defect repairs and age. The assessed footpath condition score was then entered into Council's asset management system, as at 30 June 2018, and over the course of the next 3 years the asset condition was incrementally recalculated by the system based on the asset specific degradation profile that was set. This recalculated condition score, as at 30 June 2021, formed the basis for the condition information included in the 2022–2026 Transport Asset Management Plan.

In 2023 Council engaged an independent Contractor to undertake a network wide condition assessment of the footpath network. The assessment involved the Contractor travelling on all footpaths and shared paths capturing detailed video imagery of the network at 20m intervals. This video was then viewed and assessed against a number of factors including defects such as cracking, chipping or spalling, distortion, inadequate surface grip and age to determine the condition score of each 20m segment. The condition score of each 20m segment was then able to be used to calculate the average condition of each footpath segment in the network. The use of this methodology is consistent with the IPWEA NAMS Footpath Best Practice guidelines.

Council has allocated a budget in each of the revaluation years for Transport asset classes, within its Long Term Financial Plan, to have an independent external condition assessment and network validation undertaken. This will assist in applying a more consistent approach to calculating asset condition scores and renewal backlog figures, and also help Council staff to analyse the movement in condition of assets over a number of years. |

|

Councillor L Tanner

In relation to the predictive modelling software used to forecast the degradation of Council’s sealed road network, has this software been applied to any other asset categories? If not, can it be applied to other asset categories, and if not suitable, what is the reasoning behind this? |

|

Currently the predictive modelling has recently been used for multiple asset classes such as: · Sealed Roads · Kerbs · Footpaths/Shared Paths

Staff are yet to undertake predictive modelling on asset classes such as Carparks, Culverts, Unsealed Roads, Recreational Assets, Buildings, Sewer and Stormwater - however these will be done in conjunction with the revaluation cycle for Infrastructure Property Plant & Equipment assets. Predictive modelling for the remaining asset classes are scheduled as below:

· Carparks, Culverts and Unsealed Roads asset class modelling to be undertaken and Asset Management Plans updated following the presentation of the Financial Statements to Council in November 2025. · Stormwater asset class modelling to be undertaken and Asset Management Plans updated following the presentation of the Financial Statements to Council in November 2025. · Recreational and Buildings asset class modelling to be undertaken and Asset Management Plans updated following the presentation of the Financial Statements to Council in November 2026. · Sewerage asset class modelling to be undertaken and Asset Management Plans updated following the presentation of the Financial Statements to Council in November 2027. |

|

Councillor R Foley

Has Council been provided an indication of timing by Housing NSW for the Tolland Renewal project? |

|

Council has received a Part 5 Application for Stage 1A for the development. Homes NSW anticipate work to commence in this calendar year. |

|

Councillor R Foley

When will the traffic plan for the Inland Rail project be available for the public to view in particular Edmondson Street Bridge. |

|

Inland Rail and their delivery contractor Martinus Rail have developed a draft Construction Traffic, Transport & Access Mitigations Report (CTTMAR) that is the traffic plan for when the Edmondson Street Bridge is closed. The plan is currently being reviewed by Inland Rail & Martinus following feedback/comments from Council Officers and Transport for NSW. This plan is required to be approved by the Department of Planning, Housing & Infrastructure before works can commence on the Edmondson Street Bridge. Inland Rail and Martinus Rail will inform the community of the mitigation measures that are proposed and will be implemented to minimise the traffic impacts on the Wagga road network before the Edmondson Street Bridge closure takes place. |

|

Councillor R Foley

When is the Marshalls Creek Bridge project due to commence? |

|

Information on the Marshalls Creek Bridge replacement can be found on Transport for NSW’s Projects webpage under Current Projects and searching for ‘Marshalls Creek Bridge Replacement’.

The link is https://www.transport.nsw.gov.au/projects/current-projects/marshalls-creek-bridge-replacement

The last update on the website was in February 2025 which indicated the award of the construction contract is expected to be this month with the start of construction scheduled for August 2025 and be on-going for the next 2 years. |

|

Councillor A Parkins

Can Council investigate the parking restrictions displayed on the disabled parking sign at the northern end of Gurwood Street, as they appear to be more restrictive than the general parking signage in the area? |

|

If a designated accessible space has a time limit, permit holders can still park there, but for the signposted time limit only. In areas with normal parking restrictions, mobility permit holders can typically park for longer than the general time limit.

All designated disability parking bays are signposted without specified timeframes or days. This ensures that these spaces remain exclusively available to vehicles displaying a valid disability permit at all times, regardless of the day or hour. Should these signs include specific timeframes or days (similar to standard parking signage) for example, "2P mobility only - 8am to 6pm," then non-permit holders can legally park in that space outside of the designated mobility hours, limiting access for those who genuinely require them. While disability symbols are also painted on the roadway, these markings alone do not provide legal enforcement rather it is against the specified displayed signage.

Furthermore, the existing disability parking signage aligns with common practice across local government areas. Implementing a time limit within disability bays facilitates vehicle turnover, thereby providing other permit holders with the opportunity to access parking spaces in close proximity to their destinations. Alternatively, consideration could be given to extending the current 2P time limit to allow permit holders additional time to return to their vehicles. This proposal would need to be formally submitted to the Traffic Management Committee for review and consideration. |

Financial Implications

N/A

Policy and Legislation

Code of Meeting Practice

Link to Strategic Plan

Regional Leadership

Good governance

Provide professional, innovative, accessible and efficient services.

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Tuesday 10 June 2025 |

M-1 |

Committee Minutes

M-1 CONFIRMATION OF MINUTES AUDIT, RISK AND IMPROVEMENT COMMITTEE – 21 May 2025

Author: Melinda Conolly

General Manager: Peter Thompson

|

Summary: |

The Audit, Risk and Improvement Committee (ARIC) is an advisory committee of Council. This Report seeks that Council endorse the recommendations made by the Committee at the meeting on 21 May 2025.

Those recommendations relate to the role of the Committee in providing independent assurance and assistance to Council on financial reporting, risk management, internal controls, governance, and internal and external audit and accountability responsibilities. |

|

That Council endorse the recommendations contained in the minutes of the Audit, Risk and Improvement Committee Meeting held on 21 May 2025. |

Report

The minutes of the Audit, Risk and Improvement Committee Meeting held on 21 May 2025 are presented to Council for adoption. The Chairperson Report is provided below providing a summary of the meeting.

The Audit Risk and Improvement Committee met on 21 May 2025. This was the first formal meeting after welcoming new independent members Michael Jones and Liz Jeremy, and Councillor Lindsay Tanner to the Committee.

The Committee received an update on emerging risks and areas of concern from the General Manager. The Committee note Council’s concerns regarding the ongoing issues surrounding the lease of the Wagga Wagga Airport and were informed of recent advocacy efforts in relation to the Inland Rail project and the impacts this will have on Wagga City. The Committee encourages Council to continue the ongoing advocacy efforts with the State Government in relation to the Inland Rail project.

The Committee were pleased to hear of ongoing improvements being implemented across Council. This included:

· an overview on the strategies Council has implemented to mitigate the concerning psychosocial risks in the workplace

· recruitment of a dedicated cyber security resource and the work being conducted by Council to align Council’s ICT systems with the NSW Cyber Security Guidelines

· an update on Council’s ICT environment, and the strategies in place to manage this important resource, minimise the impact of any disruption and enhance security

· updates in relation to Council’s project management and capital works program, including the development of a new reporting format.

The Committee received a presentation from Council’s investment advisor – Arlo Advisory, who noted WWCC investments continue to perform well in the current market, are compliant with current requirements, are adequately diversified and being managed to support future financial sustainability and cash flow requirements.

Following the formal meeting of the ARIC, the members held a strategic planning meeting with the Chief Audit Executive with the aim of establishing a strategic plan for the term of this current ARIC. The Committee noted that Council is currently undertaking a large body of work in relation to its risk management framework and is updating the key enterprise risks facing Council. The Committee considered there are key strategic risks Council will be required to manage and will continue to request updates from Council Officers in relation to the strategies Council has implemented to manage and mitigate these risks.

The Committee agreed the work of the ARIC over the next four years will be focused on providing guidance and advice to Council in these key risk areas, as well as notifying Council of emerging risks that may impact Council. The Committee will maintain a focus on supporting Council on its improvement pathways.

Carolyn Rosetta-Walsh

Independent Chairperson

Audit Risk and Improvement Committee

Wagga Wagga City Council

Financial Implications

Council has granted certain authorities to the Audit, Risk and Improvement Committee within the scope of its role and responsibilities, as defined within its Charter. As an advisory committee to Council, the Audit, Risk and Improvement Committee has no authority to action items that may have a budget and/or resource implication outside of this authority unless Council resolves to adopt the recommendations.

Policy and Legislation

Audit, Risk and Improvement Committee Charter

Link to Strategic Plan

Community leadership and collaboration

Objective: Wagga Wagga City Council leads through engaged civic governance and is recognised and distinguished by its ethical decision-making, efficient management, innovation and quality customer service

Ensure transparency and accountability

Risk Management Issues for Council

The Committee considered matters relating to their role in providing independent assurance and assistance to Council on risk management, as outlined in the attached Minutes and which included consideration of Council’s Corporate Strategic Risk Register.

Internal / External Consultation

ARIC Chairperson and Committee members

|

1⇩. |

Minutes - Audit, Risk and Improvement Committee - 21 May 2025 |

|

|

Report submitted to the Confidential Meeting of Council on Tuesday 10 June 2025 |

CONF-1 |

Confidential Reports

CONF-1 REQUEST TO REMOVE PROPERTY DEALINGS - COUSINS ROAD, BOMEN (LOT 18 DP 1295212)

Author: Matthew Dombrovski

Executive: Fiona Piltz

This report is CONFIDENTIAL in accordance with Section 10A(2) of the Local Government Act 1993, which permits the meeting to be closed to the public for business relating to the following: -

(d) (i) commercial information of a confidential nature that would, if disclosed, prejudice the commercial position of the person who supplied it; and

(d) (ii) commercial information of a confidential nature that would, if disclosed, confer a commercial advantage on a competitor of the Council.

|

Report submitted to the Confidential Meeting of Council on Tuesday 10 June 2025 |

CONF-2 |

CONF-2 RFT CT2025076 CATTLE DELIVERY SERVICES LMC

Author: Diljinder Uppal

Executive: Fiona Piltz

This report is CONFIDENTIAL in accordance with Section 10A(2) of the Local Government Act 1993, which permits the meeting to be closed to the public for business relating to the following: -

(d) (i) commercial information of a confidential nature that would, if disclosed, prejudice the commercial position of the person who supplied it.

|

Report submitted to the Confidential Meeting of Council on Tuesday 10 June 2025 |

CONF-3 |

CONF-3 RFQ CT2025074 ROAD REHABILITATION WORKS AT GWMC

Author: Dipu Kuriakose

Executive: Fiona Piltz

This report is CONFIDENTIAL in accordance with Section 10A(2) of the Local Government Act 1993, which permits the meeting to be closed to the public for business relating to the following: -

(d) (i) commercial information of a confidential nature that would, if disclosed, prejudice the commercial position of the person who supplied it.

|

Report submitted to the Confidential Meeting of Council on Tuesday 10 June 2025 |

CONF-4 |

CONF-4 RFT CT2025069 DATA MIGRATION SERVICES

Author: Reece Hamblin

Executive: Scott Gray

This report is CONFIDENTIAL in accordance with Section 10A(2) of the Local Government Act 1993, which permits the meeting to be closed to the public for business relating to the following: -

(d) (i) commercial information of a confidential nature that would, if disclosed, prejudice the commercial position of the person who supplied it.