AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

25 May 2020

AT 6:00pm

The Council meeting will

be held remotely using

video-conferencing and livestreamed on

Council’s website

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

25 May 2020

AT 6:00pm

The Council meeting will

be held remotely using

video-conferencing and livestreamed on

Council’s website

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held remotely using video-conferencing and livestreamed on Council’s website, Wagga Wagga, on Monday 25 May 2020 at 6:00pm.

Council live streams video and audio of Council meetings. Members of the public who provide a public address (via remote access) are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

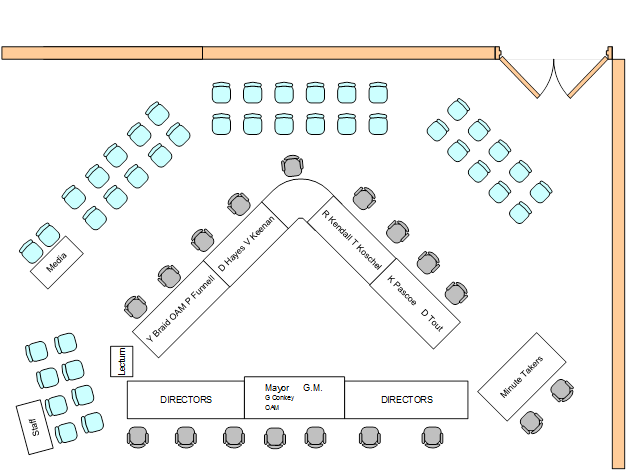

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 25 May 2020.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 25 May 2020

CLAUSE PRECIS PAGE

PRAYER 3

ACKNOWLEDGEMENT OF COUNTRY 3

APOLOGIES 3

Confirmation of Minutes

CM-1 Ordinary Council Meeting - 11 May 2020 3

DECLARATIONS OF INTEREST 3

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - EMPLOYEE EXPENSES 4

NOM-2 NOTICE OF MOTION - LOCAL GOVERNMENT ELECTIONS 7

NOM-3 NOTICE OF MOTION - NOTICE OF MOTIONS 9

NOM-4 NOTICE OF MOTION - ACCESS TO GREEN SPACES AT SCHOOLS 11

NOM-5 NOTICE OF MOTION - PEDESTRIAN CROSSING ON LAKE ALBERT ROAD 13

Reports from Staff

RP-1 DA19/0603 - ALTERATIONS AND ADDITIONS INCLUDING REAR EXTENSION AND GARAGE AT 93 BEST STREET, WAGGA WAGGA, LOT 17 SECTION 49 DP 759031 15

RP-2 RIVERINA JOINT ORGANISATION 19

RP-3 Integrated Planning and Reporting - Draft Long Term Financial Plan 2021/30 and Combined Delivery Program and Operational Plan 2020/21 22

RP-4 Indicative Financial Impact of COVID-19 on Council's 2019/20 Budget 29

RP-5 Financial Performance Report as at 30 April 2020 32

RP-6 Temporary Amendments to Council's Financial Hardship Policy - POL 102 and Debt Management Policy - POL 017 51

RP-7 DA17/0663.02 - Request for Deferral of Developer Contributions - Sewerage - 50 Edward St Wagga wagga Nsw 2650 77

RP-8 Events Strategy and Action Plan 2020-2024 84

RP-9 14 SEPTEMBER 2020 COUNCIL MEETING 161

RP-10 RESPONSE TO QUESTIONS/BUSINESS WITH NOTICE 163

Committee Minutes

M-1 TRAFFIC COMMITTEE – MEETINGS HELD 28 APRIL 2020 AND 14 MAY 2020 165

QUESTIONS/BUSINESS WITH NOTICE 176

Confidential Reports

CONF-1 2019/20 Loan Facility 177

CONF-2 RFT2020-01 RIFL HUB 2 and 3 DESIGN and CONSTRUCT 178

CONF-3 RFT2020-15 ASHMONT PUMP STATION, SEWER AND RISING MAIN 179

CONF-4 RFT2020-28 MUSEUM REDEVELOPMENT DESIGN & CONSTRUCTION 180

CONF-5 RFT2020-21 CATTLE FAN DRAFT CONSTRUCTION LMC 181

CONF-6 RFT2020-30 LIVESTOCK MARKETING CENTRE SHEEP YARD DESIGN & CONSTRUCTION 182

CONF-7 Tenant Hardship 183

CONF-8 Sewer Easment Acquisition - 112 Harris Road, Gobbagombalin - Lot 1 DP1253252 - 184

PRAYER

CM-1 Ordinary Council Meeting - 11 May 2020

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 11 May 2020 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes Ordinary Council Meeting - 11 May 2020 |

185 |

|

Report submitted to the Ordinary Meeting of Council on Monday 25 May 2020 |

NOM-1 |

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - EMPLOYEE EXPENSES

Author: Councillor Paul Funnell

|

Summary: |

The purpose of this notice of motion is to adopt a position of no increases in salaries, wages or payments for the year 2020/2021 and request support for this position through agreement and legislation. |

|

That Council: a adopt a position of no increases in salaries, wages or payments for the year 2020/2021 to Councillors, contracted senior staff and all other employees. b approach LGNSW, the Office of Local Government and the relevant unions to negotiate and establish a legal framework for this implementation c notify the Premier the Hon. Gladys Berejiklian MP, NSW Treasurer the Hon. Dominic Perrottet MP, and the Minister for Local Government the Hon. Shelley Hancock MP of this position of council |

Report

As an organisation we are looking for a methodology to offset known looming financial losses for future financial periods. Given that we find ourselves in unprecedented times due to the COVID-19 pandemic, this situation places economic pressure on every sector of the economy/community.

The recommendation is to ‘adopt a position’ and requests support for this position through agreement and legislation. We as a council cannot enforce this ourselves. However, given that we are responsible for our budget we must put forward and look at all options regarding what and how we consider to be responsible and considered actions to deliver principled and sustainable budgets in the best interests of the community that we represent.

Wagga Wagga City Council (WWCC), is not immune to these impacts and we already know that we have a looming $4.3m deficit for 2021/2022. Our current rateable income is $44.9m, this however is not inclusive of annual charges for kerbside, sewer and stormwater totalling $26m and further user fees and charges of $22.5m. These further charges must however be considered cost of doing business at a service delivery level.

Our current employee expenses for benefits and on-costs sits at a salary budget of $49.4m. Under the current arrangement this grows exponentially approximately 4.1% annually, thereby on current figures at a cost of $2M and grows exponentially annually. These figures are a high level snapshot of one section of our operational program and budget. The current situation is unsustainable even in good times let alone our current and future circumstances. Reigning in spending through this proposed position is one place to reign in an unsustainable budget. It is certainly not the low hanging fruit, we must continue to look under every rock, nook and cranny to find savings.

A salary freeze for 12 months would make a large contribution toward saving our budget whilst at the same time secures jobs and allows an opportunity to look for further options at our internal operation. To consider ‘business as usual’, rely on raising revenue, and not consider cost saving measures is just a road map to further economic, community and business hardship. We are not in control of our income; however, we are in control of our expenditure. We are looking for less than 2% of our overall annual budget to plug the shortfall, this concept finds approx. 45% of the budget shortfall and not the loss of one position.

This is not a position of, ‘everyone else is hurting so we should too’, this is a case of every other sector of the community have suffered job losses and business closures with a catastrophic destruction of our economy. Many of these situations won’t be remedied for years to come, if at all. Therefore, simply put, the rest of the community won’t be in a position to pay for increased costs for services we provide leaving us in the position that we must and need to cut expenditure and look for efficiencies.

We all, everyone in our organisation hold privileged positions that are protected and unique, we must never lose sight of that. What this report calls for is forgoing one annual automatic increase of 2.5% plus loadings, a total of 4.1%.

Personally, I believe there should be actual cuts to contracted salaries and upper levels of pay like many other institutions have had to do to save budgets and jobs. However, I do not believe the appetite is present with Councillors or Council to adopt such a position. I will therefore leave the recommendation as a one-year freeze.

As Councillors we represent the constituents of our LGA, as an organisation we are a service provider, to the community, that is ultimately funded by the community. We can no longer rely on living off grants or proposed handouts, we must be responsible for our own budget and destiny and therefore live within our means where possible.

Financial Implications

N/A

Policy and Legislation

Wagga Wagga City Council Code of Meeting Practice

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We have leaders that represent us

Risk Management Issues for Council

N/A

Internal / External Consultation

|

Report submitted to the Ordinary Meeting of Council on Monday 25 May 2020 |

NOM-2 |

NOM-2 NOTICE OF MOTION - LOCAL GOVERNMENT ELECTIONS

Author: Councillor Paul Funnell

|

Summary: |

The purpose of this notice of motion is to lobby the NSW Government to request that the local government elections be held in September 2020 as originally scheduled (or as close as possible). |

|

That Council: a write to the Minister for Local Government Minister, the Hon. Shelley Hancock MP requesting that local government elections be held in September 2020 as originally scheduled (or as close as possible) b take this motion to the Riverina Joint Organisation (RJO) and Canberra Region Joint Organisation (CRJO) seeking support in this request |

Report

At the height of the COVID-19 crisis, NSW Parliament passed legislative changes to the Local Government Act 1993 (the Act) enabling the Minister, a time-limited power to postpone Council elections.

As a result, the Minister for Local Government announced that the September 2020 local government elections will be postponed to address the risks posed by the COVID-19 virus.

It’s now time to overturn the decision and give communities an opportunity to have their democratic say in a timely fashion. The original decision appears to have turned out to be overkill and the responsible thing to now do is reverse it.

Financial Implications

N/A

Policy and Legislation

Code of Meeting Practice

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We have leaders that represent us

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 25 May 2020 |

NOM-3 |

NOM-3 NOTICE OF MOTION - NOTICE OF MOTIONS

Author: Councillor Tim Koschel

|

Summary: |

The purpose of this report is to receive a report back from Council about setting a policy in place for notice of motions from councillors. |

|

That Council: a builds or amends its current policy for Notice of Motions b include a time frame for Notice of Motions to come back to Councillors c builds a register on Council’s website, so the community can track Notice of Motions from Councillors and update everyone when reports are due back to Council |

Report

Since joining Council in 2016, I have lodged multiple Notice of Motions to Council meetings. Not one of these Notice of Motions have come back as a report to a Council meeting. Majority of these Notice of Motions were passed by all Councillors.

Notice of Motions are bought forward to Council by Councillors after correspondence from the community. The time frame in getting reports back and not getting reports back impacts Councillor relationships with the community.

Setting a policy including time frames for reports to come back and building a register for community transparency will streamline the process for both Councillors and community members. The register will also stop Councillors asking repeatedly in meetings about where their Notice of Motions are up to.

Financial Implications

N/A

Policy and Legislation

Wagga Wagga City Council Code of Meeting Practice

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We have leaders that represent us

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 25 May 2020 |

NOM-4 |

NOM-4 NOTICE OF MOTION - ACCESS TO GREEN SPACES AT SCHOOLS

Author: Councillor Dan Hayes

|

Summary: |

This Notice of Motion is being presented to Council to call for a report into working with schools and the Department of Education for improving access to green spaces. |

|

That Council receive a report on developing partnerships with schools and the Department of Education to re-open green spaces at schools that have been fenced off, in particular Kooringal High School and Mount Austin High School. |

Report

Schools are the heart of our communities, whether in villages or suburbs. It has then been unfortunate that in recent times the Department of Education has removed access to green spaces by fencing off the school ovals. Despite the Department of Education voicing their desire to work in partnerships with local councils as shown with the new Estella School, they have removed significant amounts of open play space for many in our community.

Developing options to re-open access to these open spaces will provide a benefit for the community members residing in these areas, and further connect them to the schools.

Financial Implications

N/A

Policy and Legislation

Wagga Wagga City Council Code of Meeting Practice

Link to Strategic Plan

Community Place and Identity

Objective: We have opportunities to connect with others

Outcome: We activate our community spaces to promote connectedness

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 25 May 2020 |

NOM-5 |

NOM-5 NOTICE OF MOTION - PEDESTRIAN CROSSING ON LAKE ALBERT ROAD

Author: Councillor Dan Hayes

|

Summary: |

This notice of motion is being presented to Council to call for a report into the parking pedestrian crossing on Lake Albert Road to improve its safety. |

|

That Council receives a report exploring options to improve pedestrian safety on the Lake Albert Road pedestrian crossing at Sacred Heart Primary School during hours outside of the school zone times. |

Report

Residents have raised concerns that the pedestrian crossing is dangerous outside of school zones. While different theories have been opined, it is most likely a combination of reasons, such as sight distances, the four lanes of traffic, drivers and pedestrians unsure if the crossing is operational outside of school hours and others.

There has also been a significant increase in traffic over time along the road. It is time that council re-examines the options for this crossing and make recommendations of any improvements if suitable.

Financial Implications

N/A

Policy and Legislation

N/A

Link to Strategic Plan

Safe and Healthy Community

Objective: We are safe

Outcome: We create safe spaces and places

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 25 May 2020 |

RP-1 |

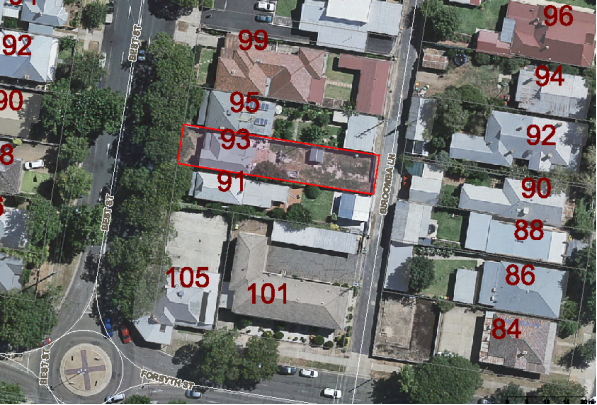

RP-1 DA19/0603 - ALTERATIONS AND ADDITIONS INCLUDING REAR EXTENSION AND GARAGE AT 93 BEST STREET, WAGGA WAGGA, LOT 17 SECTION 49 DP 759031

Author: Sam Robins

General Manager: Peter Thompson

|

Summary: |

This report is for a development application and is presented to Council for determination. The application was deferred at the Council meeting of 16 March 2020 pending the outcome of Development Control Plan (DCP) amendments. Given the timeframe involved the applicant has requested a determination of this application. The application was initially referred to Council at the request of the General Manager. |

|

That Council approve DA19/0603 for alterations and additions to the dwelling house at 93 Best Street Wagga Wagga NSW 2650, having regards to the draft amendments to the DCP, subject to conditions outlined in the attached optional conditions of consent.

|

Development Application Details

|

Applicant |

GP Bannon and CE Bannon |

|

Owner |

GP Bannon and CP Bannon |

|

Development Cost |

$475,000 |

|

Development Description |

Alterations and additions to a dwelling house including rear extension and garage. |

Report

At the Council Meeting of 16 March 2020 Council resolved the following:

That Council defer consideration of RP-2 DA19/0603 – Alterations and additions including rear extension and garage at 93 Best Street, Wagga Wagga, Lot 17 Section 49 DP 759031 pending the outcome of the amendment to the DCP as per RP-1 – Management of additions, secondary dwellings and infill development within the Heritage Conservation Area.

The draft DCP is currently on exhibition until 19 June 2020 with submissions being received until 3 July 2020 due to the current circumstances surrounding COVID-19. Given the extended time frame before the outcome of the DCP amendment (approximately 4 months before a report can be put back to Council) the applicant has requested a determination of their development application.

To assist Councillors in making their decision Council staff have undertaken an assessment of the application against the draft amendments to the DCP including the impact those amendments have on other conclusions made within the original assessment. This can be seen in the attachments.

The original assessment is attached with the following identified as key issues. No changes have been made to the original assessment.

· Compliance with the objectives of the Wagga Wagga Local Environmental Plan 2010

· Compliance with a number of objectives and controls of the Wagga Wagga Development Control Plan 2010

· Impact on the context and setting

· Impact on the public interest with regard to precedent and consistency of implementation of community endorsed documents

·

Assessment against existing DCP (Original)

This proposal had already been assessed and presented to Council having regard to the Heads of Consideration under Section 4.15(1) of the Environmental Planning and Assessment Act 1979, the provisions of Wagga Wagga Local Environmental Plan 2010 and all relevant Council DCPs, Codes and Policies.

Having regard for the information contained in the attached Section 4.15 assessment report (Attachment 1), it was considered that the development is inconsistent with a number of existing objectives and controls of the relevant plans and policies applicable to the development. The assessment also concluded that having regard to the desired future character of the Wagga Wagga Heritage Conservation Area, the impacts of the development are unacceptable with regard to the context and setting, precedent and public interest.

Assessment against draft amendments to the DCP (New)

The assessment of the application against the draft DCP amendments (Attachment 2) concluded that of the 11 reasons for refusal in the original assessment, all would be removed based on the draft amendments and subsequent reassessment of other relevant sections of the report. The conclusion is therefore that this proposal would be recommended for approval if the draft controls were adopted.

If Council chooses to make a determination based off the draft amendments to the DCP, it is recommended that Council approve the application subject to the attached optional conditions of consent.

Site Location

The site, being Lot 17 Section 49 DP 759031, 93 Best Street Central Wagga is located on the eastern side of the Street three lots north of the junction with Forsyth Street.

The site measures 505.80m² and currently contains a detached single storey dwelling with small garden shed in the rear yard.

The site is flat and free of any restrictive easements.

The locality is a residential area. Consisting in the main of single storey detached dwellings with detached outbuildings to the rear.

Financial Implications

The decision to refuse the application could potentially be challenged in the Land and Environment Court.

Policy

N/A

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

Refusal of the application may result in an appeal process in the Land and Environment Court, which will have to be defended by Council. The reasons for refusal will have to be justified and withstand scrutiny and cross examination in Court.

Internal / External Consultation

Pursuant to this provision of Section 1.10 of the Wagga Wagga Development Control Plan 2010, notification of the application was required. The application was notified to surrounding properties from 27/11/2019 to 11/12/2019 in accordance with the provisions of the DCP. No public submissions were received.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

x |

|

x |

|

|

x |

|

|

|

|

x |

|

||||

|

Involve |

|

|

|

|

|

|

|

|

|||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

DA19 0603 - 4.15 Report - Provided under separate cover |

|

|

2. |

DA19-0603 - Plans - Provided under separate cover |

|

|

3. |

DA19-0603 - Statement of Environmental Effects - Provided under separate cover |

|

|

4. |

Site Map - 93 Best St - Provided under separate cover |

|

|

5. |

DA19-0603 - Draft DCP Amendment Assessment - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 25 May 2020 |

RP-2 |

RP-2 RIVERINA JOINT ORGANISATION

Author: Peter Thompson

|

Summary: |

In November 2019 Council endorsed becoming a full member of the Riverina Joint Organisation (RivJO). RivJO and REROC recently completed a review of the operation of both entities. At the April 2020 RIVJO Board Meeting, the Board of RIVJO resolved that following the review the preferred way forward was to cease operating both entities and incorporate a Company Limited by Guarantee to perform the work currently undertaken by REROC and RivJO. |

|

That Council reaffirm its commitment to the Riverina Joint Organisation (RivJO) |

Report

Background

The REROC Board at its February 2018 meeting resolved to form the Riverina JO (RivJO) and continue the operation of REROC. Council’s preference at the time was for a stand-alone JO as per the resolution from the 26 February 2018 Ordinary Council meeting.

The RIVJO was proclaimed in May 2018 with the following member Councils:

|

Bland |

Coolamon |

Cootamundra-Gundagai |

Greater Hume |

|

Junee |

Lockhart |

Temora |

|

Wagga Wagga joined the Canberra Region JO (CRJO) as an associate member.

On 8 April 2019 Council agreed to discontinue its membership with REROC after receiving feedback from staff that indicated there was little, if any value to Council from its membership. This feedback has been validated, with no impact being realised by Council since that decision.

At the 25 November 2019 Council Meeting, Council endorsed becoming a full member of the RivJO.

Review of RivJO and REROC

In 2019 Morrison Low were engaged by RivJO and REROC to develop an independent report to review the operations of both organisations to determine the most effective and efficient way to deliver the best value to its Member Councils.

The report considered and assessed the feasibility of the following 6 structural options:

· Option 1 - two entities - REROC & RivJO

· Option 2 - RivJO - full time

· Option 3 - RivJO - part time

· Option 4 - RivJO - in-kind

· Option 5 - RivJO - delegation

· Option 6 - incorporated association and company

The outcomes of the report indicated that option 5 (RivJO delegation) and option 4 (RivJO in-kind), were the most suitable. The report also identified that an incorporated structure (option 6) might satisfy the criteria for an operating entity for the group however this would be conditional on the NSW Government recognising the incorporated entity as a partner in the same way the Government recognises Joint Organisations.

The State Government implemented Joint Organisations to improve collaboration with local government and provide better outcomes for the communities represented by the JO’s Member Councils. This is the structure implemented and encouraged by the State Government.

RivJO Board

A sub-committee was established to review the report from Morrison Low. The committee made a recommendation to the Board that the preferred way forward is the creation of a new Regional Organisation structured as a Company Limited by Guarantee. This recommendation was supported by the all the RivJO Board members, except for Wagga Wagga.

Wagga Wagga City Council advocated for the Joint Organisation as it is the vehicle which the Government has specifically established by legislation to engage with the Government in relation to regional strategy, regional planning and regional advocacy. It was respectfully submitted to the members of the RivJO Board that it is better to work with the NSW Government on regional strategy and planning using the engagement model specifically established by the Government for that purpose.

Wagga Wagga City Council also spoke against the notion of incorporating a Company Limited by Guarantee to replace the REROC incorporated association given there has been no suggestion by Government that the incorporated association is inappropriate for the operation of the group, that the Company Limited by Guarantee is more onerous in terms of Director duties and compliance and that the usual reasons for transitioning to a corporations law structure do not exist in relation to the operations of REROC or RivJO.

Conclusion

The operation of Joint Organisations across the State have been challenged by a wide range of issues including cost of operations. In 2018 Council opposed both the model which operated two entities (REROC and RivJO) and also questioned the proposed budgets which suggested that the two entities would be cheaper to operate in comparison to a single Joint Organisation.

In the fullness of time, the operation of the two entities has proven to be far more RivJO than predicted and ultimately all the Councils which joined the REROC and RivJO model have decided a single entity is a better solution.

Unfortunately, the RivJO Board have resolved that the preferable way forward is to incorporate another entity and transition the activities of both RivJO and REROC to that entity being a Company Limited by Guarantee. As noted earlier, the activities of REROC offer little or no value to Wagga and for this reason alone a move by Wagga Wagga to be a member of a Company Limited by Guarantee is not recommended.

Such a move would require the consent of the Minister for Local Government which would seem unlikely given the Government has established the legislation for Joint Organisations to perform this function.

It is recommended that Council does not endorse the resolution of the RivJO Board and that Council confirm the decision to participate as a member of RivJO.

Financial Implications

The 2019/20 membership fee is $5,000, but RIVJO are still finalising the fee for 2020/21. Council has $62,576 allocated in the 2020/21 budget for the RIVJO but it should be noted that this funding source was also identified for the Wagga Wagga Business Chamber (WWBC) contribution. Due to the timing of the WWBC decision, only $32,500 was required this financial year and the remaining amounts will be carried over to next financial year.

Policy and Legislation

Local Government Act 1993

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We plan long term

Risk Management Issues for Council

N/A

Internal / External Consultation

Discussions with various stakeholders have occurred over a long period of time. A Councillor Workshop was held on 4 May 2020.

|

Report submitted to the Ordinary Meeting of Council on Monday 25 May 2020 |

RP-3 |

RP-3 Integrated Planning and Reporting - Draft Long Term Financial Plan 2021/30 and Combined Delivery Program and Operational Plan 2020/21

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Summary: |

Council has drafted the attached Combined Delivery Program and Operational Plan 2020/21, the Draft Fees and Charges 2020/21 and the draft Long-Term Financial Plan 2021/30 for public exhibition. Council’s initial draft 2020/21 budget was balanced, but is now currently forecasting a deficit of around $4.4M.

There is a lot of uncertainty in relation to COVID-19 and the impact it will have on Council’s budget. The approach Council is currently taking is to continue to provide essential services to the community while looking for alternative revenue sources and refining the budget as more accurate information comes to hand.

Council is still committed to delivering a significant capital works program to cater for the growth of this city, with over $94 million worth of works scheduled, (noting this will be further refined during the exhibition period to take into account works in progress and carry-overs). |

|

That Council: a place the following documents on public exhibition for 28 days commencing 26 May 2020 and concluding on 23 June 2020: i draft Combined Delivery Program and Operational Plan 2020/21 ii draft Fees and Charges for the financial year 2020/21 iii draft Long-Term Financial Plan 2021/30 b invite submissions from the community in relation to these documents throughout the exhibition period c review the timing of the draft capital works program during the exhibition period d receive a further report after the public exhibition period i addressing any submissions made in respect of the draft documents ii proposing adoption of the draft Combined Delivery Program and Operational Plan 2020/21, draft Fees and Charges 2020/21 and the draft Long-Term Financial Plan 2021/30 including revised timing of capital works program e defer the review of financial assistance to community organisations which was to take effect from 2020/21 financial year f approve the continued use of the 2019/20 Fees and Charges until the 2020/21 Fees and Charges are adopted by Council, following the public exhibition period |

Report

The Long-Term Financial Plan 2021/30 and the Combined Delivery Program and Operational Plan 2020/21 have been formulated together with consideration to the Wagga View Community Strategic Plan 2040 previously endorsed by Council as well as the Disability Inclusion Action Plan 2017/21.

These documents have been created as part of Council’s Sustainable Future Framework, based on the local government requirements for Integrated Planning and reporting.

Combined Delivery Program and Operational Plan

The Draft Combined Delivery Program and Operational Plan 2020/21 has been designed to include Council’s commitment to the Wagga View Community Strategic Plan 2040 in the form of the Delivery Program and a Operational Plan inclusive of projects, programs and services to be delivered during the 2020/21 financial year.

The 2020/21 Combined Delivery Program and Operational Plan consist of:

· Clear links to ‘Wagga View” the Community Strategic Plan 2040

· Disability Inclusion Action Plan items for 2019/20

· Delivery Program items

· Operational items broken down by service areas

· Outputs of each service area

· Measures of performance

· Delivery Program four-year budget

· Delivery Program Capital Works (New Projects and Recurrent)

· A list of contributions and donations to be made by Council

In the interest of better informing the community, the Operational Plan element of the documents has been broken down by service areas displaying budgeted revenue and expenses, number of employees, details of services carried out by the area as well as relevant performance measures.

The Operational Plan has taken into consideration the potential impacts of COVID-19 with the main changes being to performance measures related to the delivery of programs and events as well as visitation and usage of Council facilities. Whilst COVID-19 has had impacts on some services, Council remains committed to maintaining service levels when the operation of facilities and delivery of programs and service are able to resume.

Fees and Charges

In accordance with Section 608 of the Local Government Act 1993, a council may charge and recover an approved fee for any service it provides.

The services for which an approved fee may be charged include the following provided under the Local Government Act or any other Act or the regulations, by the council:

· supplying a service, product or commodity

· giving information

· providing a service in connection with the exercise of the council’s regulatory functions-including receiving an application for approval, granting an approval, making an inspection and issuing a certificate

· allowing admission to any building or enclosure.

There has been a proposed freeze imposed on entry fees and membership fees at the Oasis for 2020/21.

As a result of the extension of time for Council to adopted its Combined Delivery Program and Operational Plan for 2020/21 until the end of July 2020, Council is required to continue using its previously adopted fees and charges for 2019/20 until such time as the 2020/21 Fees and Charges are adopted by Council, following the public exhibition period. As the 2019/20 fees will only be in place a month before resetting to the 2020/21 proposed amounts, the likely financial impact is minimal.

Long Term Financial Plan

The Long Term Financial Plan is an essential element of the resourcing strategy which details how the strategic aspirations of Council which are outlined in the Community Strategic Plan can be achieved in terms of time, money, assets and people.

Council’s Long Term Financial Plan is a ten-year financial planning document with an emphasis on long-term financial sustainability. Financial sustainability is one of the key issues facing local government due to several contributing factors including growing demands for community services and facilities, constrained revenue growth and ageing infrastructure.

The Long Term Financial Plan is formulated by using a number of estimates and assumptions to project the future revenue and expenditure required by Council to deliver those services and projects expected by the community. In doing so, it addresses the resources that impact on the Council’s ability to fund its services and capital works whilst remaining financially sustainable.

This iteration of the Long Term Financial Plan also provides an indication of the likely financial impact from the COVID-19 pandemic on Council’s 2020/21 financial year budget. The initial balanced budget position has now been adjusted to include a forecast deficit position as a result of these changes which are shown in Table 1.

As per resolution 18/304 Report RP-8 ‘Review of Current Financial Assistance provided to Community Organisations, Businesses, and Individuals’ presented to Council 27 August 2018, a detailed review of the current level of financial assistance provided to the community including appropriate eligibility criteria for a new financial assistance application process was to commence from 1 July 2020. Due to the impact from COVID-19, the review of the financial assistance to community organisations which was to take effect from the 2020/21 financial year will now be deferred to 2021/22.

Capital Works Program

Capital works projects and programs account for over $94 million of the planned activities for the 2020/21 financial year. There are three different categories of capital works; new, recurrent and potential. New capital projects refer to the one-off projects Council will undertake during the year. Recurrent capital projects refer to the expenditure allocated on an annual basis for capital works programs. The Potential capital projects are those that still require a resolution of Council to proceed and have therefore been excluded from the 2020/21 Delivery Program.

At the 24 February 2020 Council Meeting Councillors endorsed a Capital Works Program for 2020/21, including adjustments to the 2021/30 Long Term Financial Plan. Further meetings with project managers are currently underway to ensure that the program finally adopted for 2020/21 reflects all new and continuing projects.

Major Projects

Included in Council’s draft 2021/30 Long Term Financial Plan Capital Works Program are the following significant projects:

|

Project |

Estimated Year(s) of construction |

Estimated Total Cost |

|

Levee Bank System Upgrades |

2017/18 – 2022/23 |

$23.3M |

|

Airport Taxiways Upgrade |

2019/20 |

$5.7M |

|

Eunony Bridge Road Bridge Replacement |

2019/20 + 2020/21 |

$10.6M |

|

Active Travel Plan |

2019/20 - 2021/22 |

$13.2M |

|

Riverside – Wagga Beach Landscape Upgrade Stage 2 |

2019/20 - 2021/22 |

$7.0M |

|

Pomingalarna Multisport Cycling Complex |

2019/20 - 2021/22 |

$9.2M |

|

Farrer Road Improvements |

2018/19 + 2019/20 |

$6.5M |

|

Dunns Road Upgrade |

2020/21 |

$8.3M |

|

RIFL Stage 2 (Rail Siding) RIFL Stage 3 (Industrial Subdivision Civil Works) |

2019/20 + 2020/21 2020/21 + 2021/22 |

$14.4M $27.8M |

These works highlight Council’s commitment to getting on with the job and delivering critical infrastructure to cater for the future growth of this city.

COVID-19

Whilst Council will continue to support the community where they can with potential fee waivers and fee reductions, Council still has a financial responsibility for the long-term sustainability of the organisation. With the reduction of services and the closure of some Council businesses and facilities, this will continue to have a substantial impact on Council’s operational budgets. The estimated financial impact is detailed in Table 1.

Table 1 – Estimated Financial Impacts of COVID-19

|

Function / Facility Impacted |

2020/21 Estimated Budgeted Net Impact |

|

Investment Income |

($259,000) |

|

Airport |

($3,027,079) |

|

Development Income |

($1,070,778) |

|

Oasis Aquatic Centre |

($106,412) |

|

Car Parking Patrols |

($114,530) |

|

Parks and Sportsgrounds Fees and Charges |

($109,719) |

|

Civic Theatre |

($59,210) |

|

Other Council owned closed facilities |

($72,415) |

|

Environmental Health Fees and Charges |

($43,260) |

|

Commercial Lease income |

($52,500) |

|

Community Lease income |

($10,827) |

|

Savings in Buildings operational Costs |

$91,147 |

|

Estimated Financial Impact due to COVID-19 |

($4,834,583) |

|

Total Partial Funding Sources identified |

$436,243 |

|

Estimated Total Financial Impact due to COVID-19, considering partial funding sources identified |

($4,398,340) |

Financial Implications

The proposed adoption of the suite of IPR documents will be reported to Council 27 July 2020 after all submissions have been addressed.

It is important that Council recognise the deficit position, not only as a result of COVID‑19 impacts on the 2020/21 financial year, but the already projected deficit positions from 2021/22 to 2029/30 highlight the significant issues that Council has been facing due to the unfavourable adjustments to revenue sources (Financial Assistance Grants and Rate Pegging restrictions) in previous financial years. This has resulted in the requirement to increase the use of borrowings to fund projects, with significant loan repayments for the future 10 years of the plan.

These unprecedented times will mean that Council faces its greatest challenge in 2020/21 to remain financially sustainable and reduce the estimated proposed $4.4M deficit. Due to the uncertainty of so many factors in relation to this unfolding pandemic, as further information comes to hand, extensive ongoing financial management will continue with regular Councillor Workshops and reports being presented to Council on an ongoing basis. These workshops and reports will include financial modelling for 2020/21 and the following years, with budgets adjusted accordingly after Council resolutions.

The Long Term Financial Plan once adopted will then inform the 2020/21 budget and ongoing for 10 years.

Policy and Legislation

The documents have been created to meet Council’s Integrated Planning and Reporting requirements under the Local Government Act 1993 and Local Government Regulations 2005.

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We plan long term

Risk Management Issues for Council

A number of risk management issues were identified and have been actively managed.

A summary of these risks are as follows:

- Lack of engagement from the community

- Inability to meet everyone’s expectations

- Inability to resource and deliver on plans

With Council not receiving some budgeted revenue and forecasting a significant deficit, this places immense financial pressure on Council delivering required services to the community with the risk of not meeting the needs of the community as a whole. This may include (but is not limited to) diverting funds from previously provided Council services to other areas that may be deemed of a higher need due to COVID-19.

Internal / External Consultation

The documents will be placed on public exhibition for a 28-day period commencing from 26 May 2020 and concluding on 23 June 2020. As part of the exhibition period a variety of communication methods will be used, to not only promote the public exhibition period but also promote the purpose of the documents.

The deficit position of Council will require regular Councillor workshops and reports to be presented to Council on an ongoing basis. Not only will there be regular updates as part of the monthly financial performance report associated with 2020/21, but there will be a need for additional financial modelling for the following financial years in order to reign in the deficit.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media releases |

Print advertising |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

|

x |

x |

|

|

x |

|

|

|

|

x |

|

x |

|

|

|

Involve |

|

|

|

|

|

|

|

|

|||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

2021/30 Draft Long Term Financial Plan - Provided under separate cover |

|

|

2. |

2020/21 Draft Combined Delivery Program and Operational Plan - Provided under separate cover |

|

|

3. |

2020/21 Draft Fees and Charges - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 25 May 2020 |

RP-4 |

RP-4 Indicative Financial Impact of COVID-19 on Council's 2019/20 Budget

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Summary: |

This report provides Councillors with indicative financial impact information for Council’s 2019/20 budget. Any update to the information provided in this report will be provided to Councillors through further Council reports. |

|

That Council: a note the current indicative financial impact compiled by staff of COVID-19 on Council’s 2019/20 Budget b will be provided with further updates from staff as the 2019/20 financial year progresses c note that the estimated financial impact due to COVID-19 on the 2020/21 budget has been included in the draft Long Term Financial Plan budget d will be provided with updates on the financial impact of COVID-19 on the 2020/21 budget as part of the monthly financial performance reporting requirements |

Report

The World Health Organisation declared COVID-19 a pandemic on 11 March 2020. As the international response continues to develop, organisations are facing significant financial challenges. Local councils are not immune to these financial challenges. This report provides an indication of the likely financial impact up to 30 June 2020 on Council’s 2019/20 financial year outcome.

Council officers are also at this same meeting, proposing for Council to place on public exhibition the draft 2020/21 Long Term Financial Plan (LTFP). The proposed draft 2020/21 budget includes the estimated impacts from COVID-19 which will require extensive financial management, review and adjustments throughout the financial year. This may include (but is not limited to) diverting funds from previously provided Council services to another which is deemed a higher need due to the COVID-19 impacts.

The following table shows the indicative financial impact by fund on the 2019/20 financial year budget. These indicative figures assume that the current restrictions due to COVID-19 (as at 14 May 2020) will remain in place for the rest of this financial year (to 30 June 2020).

2019/20 Estimated Financial Impact by area due to COVID-19

|

|

Income Impact |

Expenses Impact |

Net Impact |

|

Investment Income |

($597,386) |

|

($597,386) |

|

Airport* |

($1,241,336) |

$356,446 |

($884,890) |

|

City Planning |

($530,919) |

|

($530,919) |

|

Oasis |

($453,489) |

$101,136 |

($352,353) |

|

Traffic Parking Fines |

($148,324) |

|

($148,324) |

|

Parks and Sportsground Fees and Charges |

($170,014) |

|

($170,014) |

|

Civic Theatre |

($177,163) |

$148,042 |

($29,121) |

|

Other Closed Facilities |

($75,898) |

|

($75,898) |

|

Environmental Health and Companion Animals |

($49,500) |

|

($49,500) |

|

Family Day Care*# |

($34,000) |

|

($34,000) |

|

Commercial Leases^ |

($5,235) |

|

($5,235) |

|

2019/20 Estimated Financial impact due to COVID-19 |

($3,483,264) |

$605,624 |

($2,877,640) |

* Please note that the Airport and Family Day Care areas are not General Purpose Revenue (GPR) areas, and are funded from their respective Reserves. Excluding these two areas, the Estimated Net GPR Impact due to COVID‑19 is $1,958,750

# Please note that this amount is only COVID-19 related and does not include the impact of any subsequent Council decisions

^ Please note that this amount is as per the report going to this same meeting CONF-6 ‘Tenant Hardship’

An extensive review of all of Council’s functions was undertaken to attempt to pair back some of the estimated deficit position, as shown in the below table:

|

2019/20 Estimated Financial impact due to COVID-19 |

($2,877,640) |

|

Add bank: funded from Airport Reserve |

$884,890 |

|

Add back: funded from Family Day Care Reserve |

$34,000 |

|

2019/20 Estimated COVID GPR Impact – (Deficit) |

($1,958,750) |

|

|

|

|

Finance/Manager’s Review for GPR savings for remainder of 2019/20 financial year |

$217,178 |

|

|

|

|

2019/20 Estimated GPR (Deficit) Position |

($1,741,572) |

Financial Implications

Council’s estimated financial impact due to COVID-19 for the remainder of the 2019/20 financial is $2,877,640. With Airport and Family Day Care Reserves funding their portions of the net impacts, along with Finance/Managers proposed adjustments brings the General Purpose Revenue estimated deficit to $1,741,572.

It is proposed to fund this deficit once finalised at the end of the 2019/20 financial year from Council’s unrestricted cash balance.

Policy and Legislation

Budget Policy – POL 052

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

With Council not receiving budgeted income, this places financial pressure on Council delivering required services to the community and therefore not meeting the needs of the community as a whole.

Internal / External Consultation

Council’s Finance Division have consulted with all Divisional Managers and Executive in modelling the estimated financial impact of COVID-19 on Council’s 2019/20 budget.

|

Report submitted to the Ordinary Meeting of Council on Monday 25 May 2020 |

RP-5 |

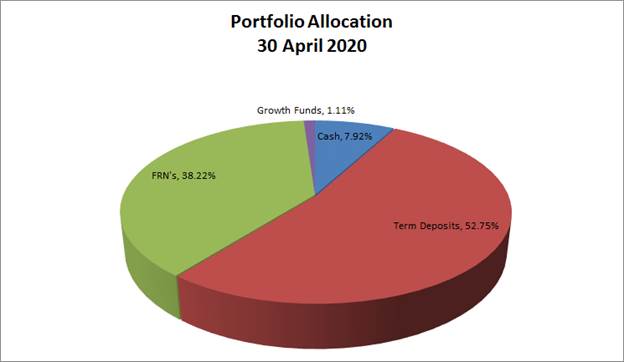

RP-5 Financial Performance Report as at 30 April 2020

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Summary: |

This report is for Council to consider and approve the proposed 2019/20 budget variations required to manage the 2019/20 budget and Long Term Financial Plan, and details Council’s external investments and performance as at 30 April 2020. |

|

That Council: a approve the proposed 2019/20 budget variations for the month ended 30 April 2020 and note the proposed deficit budget position as a result of COVID-19 with the impacts from COVID-19 to be presented in a separate report b note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above c note the details of the external investments as at 30 April 2020 in accordance with section 625 of the Local Government Act 1993 d note the impact of COVID-19 on Council’s investment portfolio, as provided by Council’s independent investment advisor |

Report

Wagga Wagga City Council (Council) forecasts a deficit budget position as at 30 April 2020. Proposed budget variations are detailed in this report for Council’s consideration and adoption.

There will be a separate report RP-4 ‘Indicative Financial Impact of COVID-19 on Council’s 2019/20 Budget’ presented to Council at this same meeting providing detailed advice on the indicative financial impact of COVID-19 on Council’s 2019/20 Budget and proposed funding.

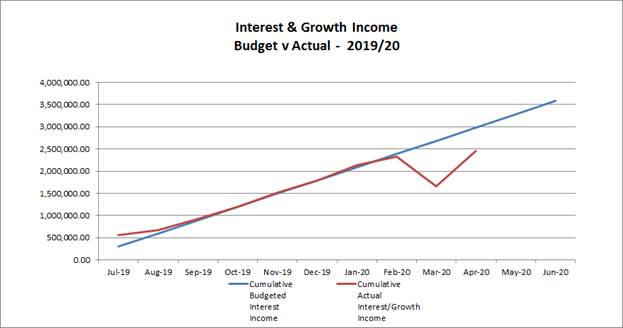

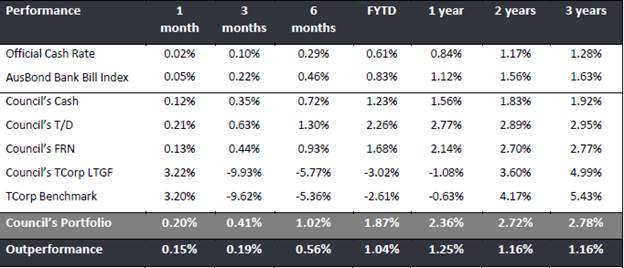

Council has experienced a positive monthly investment performance for the month of April when compared to budget ($498,650 up on the monthly budget). This is due mainly to a positive rebound from Council’s Floating Rate Note portfolio and TCorp Long Term Growth fund, as the uncertainty in financial markets continues during the COVID-19 pandemic.

Key Performance Indicators

OPERATING INCOME

Total operating income is 81% of approved budget (this percentage excludes capital grants and contributions). An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 91%. As noted earlier, the indicative financial impact of COVID-19 on Council’s 2019/20 Budget is provided in a separate report at this same meeting.

OPERATING EXPENSES

Total operating expenditure is 80% of approved budget and is tracking within budget at this stage of the financial year.

CAPITAL INCOME

Total capital income is 35% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions relating to projects. This income also includes the sale of property, plant and equipment.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 65% of approved budget (including ‘Potential Projects’). Excluding ‘Potential Projects’ budgets, the capital expenditure including commitments is 71% of approved budget.

|

WAGGA WAGGA

CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2019/20 |

COMMT'S 2019/20 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|||||||

|

Rates & Annual Charges |

(69,736,893) |

(63,636) |

(69,800,529) |

(58,286,208) |

0 |

(58,286,208) |

84% |

|

User Charges & Fees |

(28,440,057) |

232,040 |

(28,208,017) |

(22,530,920) |

0 |

(22,530,920) |

80% |

|

Interest & Investment Revenue |

(3,774,001) |

0 |

(3,774,001) |

(2,620,517) |

0 |

(2,620,517) |

69% |

|

Other Revenues |

(3,053,633) |

(230,242) |

(3,283,874) |

(3,143,408) |

0 |

(3,143,408) |

96% |

|

Operating Grants & Contributions |

(14,280,296) |

2,870,652 |

(11,409,645) |

(7,965,663) |

0 |

(7,965,663) |

70% |

|

Capital Grants & Contributions |

(56,263,733) |

20,598,248 |

(35,665,485) |

(13,032,225) |

0 |

(13,032,225) |

37% |

|

Total Revenue |

(175,548,613) |

23,407,062 |

(152,141,551) |

(107,578,940) |

0 |

(107,578,940) |

71% |

|

|

|||||||

|

Expenses

|

|||||||

|

Employee Benefits & On-Costs |

46,012,119 |

(65,334) |

45,946,285 |

38,235,880 |

56,509 |

38,292,389 |

83% |

|

Borrowing Costs |

3,587,823 |

(264,964) |

3,322,860 |

2,389,677 |

0 |

2,389,677 |

72% |

|

Materials & Contracts |

32,357,210 |

10,685,082 |

43,042,793 |

27,158,996 |

7,541,381 |

34,700,377 |

81% |

|

Depreciation & Amortisation |

34,843,073 |

0 |

34,843,073 |

29,035,894 |

0 |

29,035,894 |

83% |

|

Other Expenses |

13,015,295 |

198,762 |

13,214,057 |

7,841,506 |

136,161 |

7,977,667 |

60% |

|

Total Expenses |

129,815,520 |

10,553,547 |

140,369,067 |

104,661,954 |

7,734,051 |

112,396,004 |

80% |

|

|

|

||||||

|

Net Operating (Profit)/Loss |

(45,733,093) |

33,960,609 |

(11,772,484) |

(2,916,987) |

7,734,051 |

4,817,064 |

|

|

|

|||||||

|

Net Operating (Profit)/Loss before Capital Grants & Contributions |

10,530,640 |

13,362,361 |

23,893,001 |

10,115,238 |

7,734,051 |

17,849,289 |

|

|

|

|||||||

|

Capital / Reserve Movements |

|||||||

|

Capital Exp - Renewals |

34,034,738 |

(385,622) |

56,812,538 |

28,178,476 |

16,001,278 |

44,179,754 |

78% |

|

Capital Exp - New Projects |

42,696,132 |

(17,406,488) |

19,169,500 |

7,449,777 |

1,701,989 |

9,151,766 |

48% |

|

Capital Exp - Project Concepts |

38,364,925 |

(13,800,615) |

7,521,033 |

239,044 |

78,399 |

317,442 |

4% |

|

Loan Repayments |

3,380,744 |

(21,035) |

3,359,708 |

2,825,050 |

0 |

2,825,050 |

84% |

|

New Loan Borrowings |

(21,222,532) |

1,887,999 |

(19,334,533) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(1,502,910) |

(1,745,414) |

(3,248,324) |

(681,972) |

0 |

(681,972) |

21% |

|

Net Movements Reserves |

(15,174,931) |

(2,489,434) |

(17,664,365) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

80,576,166 |

(33,960,609) |

46,615,557 |

38,010,375 |

17,781,665 |

55,792,040 |

|

|

|

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED

BUDGET |

YTD ACTUAL EXCL COMMT'S 2019/20 |

COMMT'S 2019/20 |

YTD ACTUAL +

COMMT'S |

YTD % OF BUD |

|

Net Result after Depreciation |

34,843,073 |

0 |

34,843,073 |

35,093,388 |

25,515,716 |

60,609,104 |

|

|

|

|||||||

|

Add back Depreciation Expense |

34,843,073 |

0 |

34,843,073 |

29,035,894 |

0 |

29,035,894 |

83% |

|

|

|||||||

|

Cash Budget (Surplus)/Deficit |

0 |

0 |

0 |

6,057,494 |

25,515,716 |

31,573,210 |

|

Revised Budget Result - Surplus/(Deficit) |

$’000s |

|

Original 2019/20 Budget Result as adopted by Council Total Budget Variations approved to date Budget Variations for April 2020 Estimated 2019/20 Financial impact from COVID-19 (refer to separate report RP-4 ‘Indicative Financial Impact of COVID-19 on Council’s 2019/20 Budget’) |

$0 $0 $0

($1,742K) |

|

Proposed Revised Budget result for 30 April 2020 |

($1,742K) |

The proposed Budget Variations to 30 April 2020 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact Fav/ (Unfav) |

|

1 – Community Leadership and Collaboration |

|

||

|

Installation of Hand Sanitiser Stations |

$19K |

Workers Compensation Reserve ($19K) |

Nil |

|

Funds are required for the installation of hand sanitiser stations and wall mounted hand sanitiser dispensers for when Council re-open to the public due to COVID-19. It is proposed to fund the variation from the Workers Compensation Reserve. Estimated Completion: 30 June 2020 |

|

||

|

Gender Equity Project |

($141K) |

Department of Communities and Justices Grant $141K |

Nil |

|

Delays were experienced with the commencement of The Domestic Violence (DV) Project 2650 including the timing of recruitment of staff which meant that the grant funds for the project were not spent in the timeframes required. As a result of this, the Department of Communities and Justices and Wagga Women's Health Centre have negotiated a revised timeline and milestones to ensure program delivery is consistent with budget expenditure for the remainder of the contract. This variation has resulted in a reduction in grant income of ($141K) in 2019/20 and an increase of $72K in 2020/21. The Administration and Management Fee that is retained by Council has also been adjusted to reflect an additional charge Council is entitled to retain from these funds of $31K in 2019/20 and $26K in 2020/21 to be utilised for the ‘Enlighten for Equity’ Project. |

|

||

|

|

|||

|

Wiradjuri Walking Track |

$22K |

Crown Lands Grant ($12K) Existing Parks maintenance Budgets ($10K) |

Nil |

|

Council has been successful in securing grant funds from Crown Lands for the installation of gravel on a section of the Wiradjuri Walking Track between the river and the southern end of Gobbagombalin Bridge. These works will weatherproof a 690 metre long section of the 2 metre wide trail, requiring 300 tonne of road base compacted using a bobcat and roller. This will complete the rehabilitation of the trail between Moorong Street and the wetlands. It is proposed to fund Councils portion of the project from existing City Presentation and Parks and Recreation Maintenance budgets. Estimated Completion: 30 June 2020 |

|

||

|

4 – Community Place and Identity |

|

||

|

Library Air Conditioning & Security Access CLS 1&2 |

$22K |

Existing Library maintenance & operational budgets ($22K) |

Nil |

|

Funds are required to upgrade the Air Conditioning in the two Community Learning Space rooms in the Library and to allow external groups access to the rooms outside of library hours (but not access to the library). It is proposed to fund these works from existing Library maintenance and operational budgets. Estimated Completion: 30 June 2020 |

|

||

|

Art Gallery Display Panels |

$40K |

Workers Compensation Reserve ($40K) |

Nil |

|

The Art Gallery has 16 moveable walls that need replacing due to the manual handling risk they pose to staff and the public due to their weight and age. Moving of the existing walls is considered a hazardous manual handling task that directly stresses the body and can lead to an injury. It is a high force activity that a worker needs assistance with to complete because a greater force is required to move these walls, resulting in an increased risk of workers sustaining a Musculoskeletal Disorder (MSD). While the Art Gallery is currently closed due to COVID-19 restrictions, it is proposed to take this opportunity now and complete the works before the Art Gallery is re-opened to the general public. It is proposed to purchase display panels to eliminate this risk and fund the variation for these works from the Workers Compensation Reserve. Estimated Completion: 30 June 2020 |

|

||

|

5 – The Environment |

|

||

|

Tarcutta Truck Stop Lighting - Energy Savings Project |

$93K |

Internal Loans Reserve ($93K) |

Nil |

|

Due to a change in the availability of contractors to undertake the works, it is proposed to bring forward the Tarcutta Truck Stop Lighting Energy Savings Project and transfer it from the Potential Projects List into the Capital Works Delivery Program. The funds are currently allocated in 2020/21 ($10K) and 2021/22 ($83K) and are funded from the Internal Loans Reserve which will be repaid with the future energy savings. Estimated Completion: 30 June 2020 |

|

||

|

Stormwater Pipe Network Project |

$94K |

Stormwater Levy Reserve ($94K) |

Nil |

|

Additional funds are required to engage a contractor to clean, camera and defect assess Councils stormwater pipelines for an approximate total length of 16.4 kilometres in various locations across the Wagga local government area. This work is essential to support Council’s existing camera van to provide substantive and relevant data for the stormwater revaluation project that is being completed this financial year. It is proposed to fund the variation from the Stormwater Levy Reserve which currently has adequate funds. This will bring the total project budget to $219K. Estimated Completion: 30 June 2020 |

|

||

|

Oasis Flooring Replacement |

$42K |

Oasis Building Renewal Reserve ($42K) |

Nil |

|

It is proposed to bring forward the replacement of the Oasis Flotex Flooring (Entrance/Office and Pool Hall Carpet) that is currently budgeted for replacement in 2020/21. Due to the Oasis currently being closed, this provides a great opportunity to have the carpet replaced now and avoid major disruptions when replacing the carpet when the Oasis is reopened. The current carpet is 7 years old, in poor condition, and is proposed to be replaced with a suitable commercial grade carpet that is durable, hardwearing, stain resistant and designed for high public foot traffic usage. The funding source for the project is the Oasis Building Renewal Reserve. Estimated Completion: 30 June 2020 |

|

||

|

Eunony Bridge Road Works |

$80K |

Heavy Patching ($40K) Pavement Rehab ($40K) |

Nil |

|

Funds are required to undertake road improvements on a 150 metre section of Eunony Bridge Road. The works need to be undertaken at the same time as the bridge construction to reduce the impacts on the community due to additional roadworks. It is also more cost effective as the contractors are already onsite and it reduces the reputational risk to Council with what may be perceived as rework. It is proposed to fund the variation from existing Heavy Patching and Pavement Rehab budgets. Estimated Completion: 30 June 2020 |

|

||

|

Glenoak Reservoir Rehabilitation |

$19K |

Riverina Water County Council Contribution ($19K) |

Nil |

|

It has been requested that Council complete the rehabilitation of the area surrounding the recently completed Glenoak Reservoir with advice received from the Riverina Water County Council (RWCC) for the funding of these works. Estimated completion: 30 June 2020 |

|

||

|

SURPLUS/(DEFICIT) |

$0K |

||

Current Restrictions

|

RESERVES SUMMARY |

|||||

|

30 APRIL 2020 |

|||||

|

|

CLOSING BALANCE 2018/19 |

ADOPTED RESERVE TRANSFERS 2019/20 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 27.4.2020 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

|

|

|

|

|

|

|

Externally Restricted |

|

|

|

|

|

|

Developer Contributions - Section 7.11 |

(23,836,289) |

3,427,074 |

(5,794,902) |

|

(26,204,116) |

|

Developer Contributions - Section 7.12 |

97,487 |

(32,500) |

134,012 |

|

198,999 |

|

Developer Contributions – S/Water DSP S64 |

(6,551,347) |

2,579,329 |

(1,276,930) |

|

(5,248,947) |

|

Sewer Fund |

(31,115,819) |

155,636 |

6,550,087 |

|

(24,410,096) |

|

Solid Waste |

(21,521,767) |

2,164,970 |

(1,836,399) |

|

(21,193,196) |

|

Specific Purpose Grants |

(4,044,299) |

0 |

4,044,299 |

|

0 |

|

SRV Levee |

(3,853,286) |

(3,211) |

1,708,696 |

|

(2,147,801) |

|

Stormwater Levy |

(3,699,109) |

2,758,808 |

(2,199,103) |

93,578 |

(3,045,826) |

|

Total Externally Restricted |

(94,524,428) |

11,050,106 |

1,329,761 |

93,578 |

(82,050,983) |

|

|

|

||||

|

Internally Restricted |

|

||||

|

Airport |

(442,321) |

(522,440) |

(146) |

(964,907) |

|

|

Art Gallery |

(33,971) |

(6,865) |

0 |

(40,836) |

|

|

Ashmont Community Facility |

(7,500) |

(1,500) |

0 |

(9,000) |

|

|

Bridge Replacement |

(601,972) |

0 |

(601,972) |

||

|

CBD Carparking Facilities |

(884,968) |

110,302 |

666,796 |

(107,870) |

|

|

CCTV |

(84,476) |

18,000 |

0 |

(66,476) |

|

|

Cemetery Perpetual |

(107,717) |

(133,730) |

16,519 |

(224,928) |

|

|

Cemetery |

(448,951) |

110,164 |

(47,707) |

(386,494) |

|

|

Civic Theatre Operating |

(125,471) |

8,327 |

20,913 |

(96,231) |

|

|

Civic Theatre Technical Infrastructure |

(82,706) |

10,000 |

65,000 |

(7,706) |

|

|

Civil Projects |

(155,883) |

24,000 |

(10,133) |

(142,016) |

|

|

Community Amenities |

(76,763) |

(214,928) |

25,000 |

(266,691) |

|

|

Community Works |

(86,412) |

(32,217) |

63,020 |

|

(55,609) |

|

Council Election |

(343,408) |

(83,163) |

0 |

(426,571) |

|

|

Economic Development |

(500,000) |

(80,000) |

90,000 |

(490,000) |

|

|

Emergency Events |

(191,160) |

(50,000) |

90,420 |

|

(150,740) |

|

Employee Leave Entitlements |

(3,585,224) |

|

0 |

|

(3,585,224) |

|

Environmental Conservation |

(115,206) |

|

(42,725) |

|

(157,931) |

|

Estella Community Centre |

(230,992) |

|

0 |

|

(230,992) |

|

Family Day Care |

(245,192) |

93,442 |

0 |

|

(151,750) |

|

Fit for the Future |

(1,785,102) |

266,703 |

(3,054,537) |

|

(4,572,935) |

|

Generic Projects Saving |

(816,377) |

20,000 |

31,130 |

|

(765,248) |

|

Glenfield Community Centre |

(21,704) |

(2,000) |

0 |

|

(23,704) |

|

Grants Commission |

(5,256,259) |

|

5,256,259 |

|

0 |

|

Grassroots Cricket |

(70,992) |

|

0 |

|

(70,992) |

|

Gravel Pit Restoration |

(797,002) |

|

3,546 |

|

(793,456) |

RESERVES SUMMARY

|

|||||

|

30 APRIL 2020 |

|||||

|

|

CLOSING BALANCE 2018/19 |

ADOPTED RESERVE TRANSFERS 2019/20 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 27.4.2020 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

Gurwood Street Property |

(50,454) |

|

0 |

|

(50,454) |

|

Hampden Bridge |

(107,198) |

|

107,198 |

|

0 |

|

Information Services |

(775,938) |

(222,792) |

222,315 |

|

(776,415) |

|

Infrastructure Replacement |

(335,497) |

(30,192) |

0 |

|

(365,689) |

|

Insurance Variations |

(100,246) |

|

0 |

|

(100,246) |

|

Internal Loans |

(660,754) |

260,962 |

(1,910,123) |

93,188 |

(2,216,727) |

|

Lake Albert Improvements |

(28,338) |

(21,515) |

(158,608) |

|

(208,461) |

|

LEP Preparation |

(2,667) |

|

0 |

|

(2,667) |

|

Livestock Marketing Centre |

(3,311,635) |

972,792 |

(2,367,862) |

|

(4,706,704) |

|

Museum Acquisitions |

(39,378) |

|

0 |

|

(39,378) |

|

Oasis Building Renewal |

(320,759) |

65,000 |

28,529 |

42,420 |

(184,810) |

|

Oasis Plant |

(1,239,132) |

857,486 |

(441,652) |

|

(823,298) |

|

Office Equipment/Building Projects |

(159,030) |

|

156,530 |

|

(2,500) |

|

Parks & Recreation Projects |

(206,102) |

30,148 |

136,954 |

|

(39,000) |

|

Planning Legals |

0 |

(40,000) |

0 |

|

(40,000) |

|

Plant Replacement |

(3,550,033) |

660,253 |

1,055,919 |

|

(1,833,861) |

|

Playground Equipment Replacement |

(95,290) |

(165,727) |

0 |

|

(261,017) |

|

Project Carryovers |

(2,453,184) |

518,327 |

1,934,858 |

|

0 |

|

Public Art |

(198,922) |

30,300 |

45,594 |

|

(123,028) |

|

Robertson Oval Redevelopment |

(92,151) |

|

0 |

|

(92,151) |

|

Senior Citizens Centre |

(17,627) |

(2,000) |

0 |

|

(19,627) |

|

Sister Cities |

(46,328) |

(10,000) |

0 |

|

(56,328) |

|

Sporting Event Attraction |

(169,421) |

|

110,000 |

|

(59,421) |

|

Sporting Event Operational |

(100,000) |

|

0 |

|

(100,000) |

|

Stormwater Drainage |

(158,242) |

(100,000) |

50,000 |

|

(208,242) |

|

Strategic Real Property |

0 |

|

(395,000) |

|

(395,000) |

|

Street Lighting Replacement |

(56,549) |

|

43,288 |

|

(13,261) |

|

Subdivision Tree Planting |

(702,868) |

(20,000) |

90,000 |

|

(632,868) |

|

Sustainable Energy |

(527,244) |

389,333 |

(43,545) |

|

(181,456) |

|

Unexpended External Loans |

(431,337) |

|

36,485 |

|

(394,852) |

|

Workers Compensation |

(93,251) |

|

(133,461) |

59,000 |

(167,712) |

|

Total Internally Restricted |

(33,127,305) |

2,706,471 |

1,740,773 |

194,608 |

(28,485,454) |

|

|

|

|

|

|

|

|

Total Restricted |

(127,651,734) |

13,756,577 |

3,070,534 |

288,186 |

(110,536,437) |

|

|

|

|

|

|

|

|

Total Unrestricted |

(5,725,794) |

0 |

0 |

0 |

(5,725,794) |

|

|

|

|

|

|

|

|

Total Cash, Cash Equivalents and Investments |

(133,377,528) |

13,756,577 |

3,070,534 |

288,186 |

(116,262,231) |

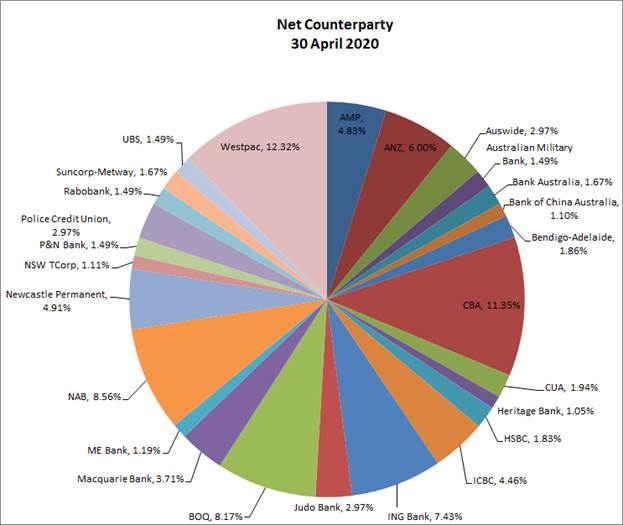

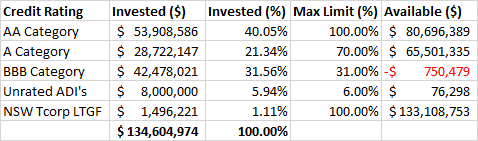

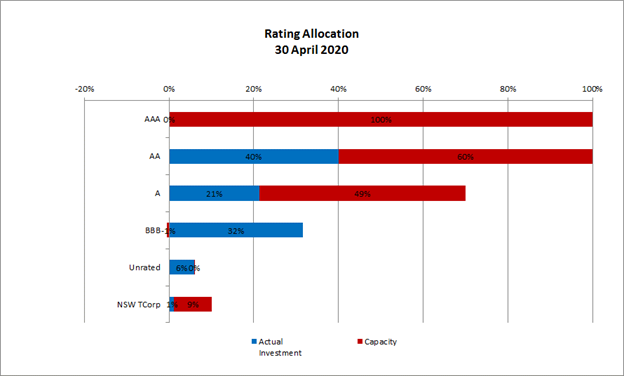

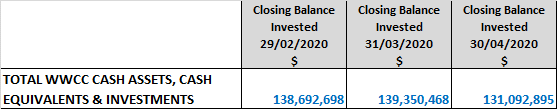

Investment Summary as at 30 April 2020

In accordance with Regulation 212 of the Local Government (General) Regulation 2005, details of Wagga Wagga City Council’s external investments are outlined below:

|

Institution |

Rating |

Closing Balance |

Closing Balance |

April |

April |

Investment |

Maturity |

Term |

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

AMP |

BBB+ |

2,000,000 |

2,000,000 |

2.10% |

1.49% |

2/12/2019 |

1/06/2020 |

6 |

|

AMP |

BBB+ |

1,000,000 |

1,000,000 |

2.00% |

0.74% |

13/11/2019 |

11/05/2020 |

6 |

|

AMP |

BBB+ |

1,000,000 |

1,000,000 |

2.10% |

0.74% |

2/12/2019 |

1/06/2020 |

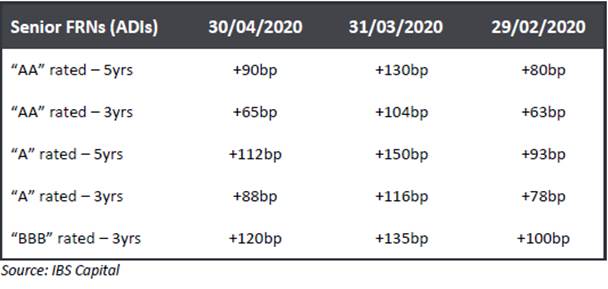

6 |