AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

23 November 2020

AT 6:00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

23 November 2020

AT 6:00pm

Cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650

PO Box 20, Wagga Wagga

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 23 November 2020 at 6:00pm.

Council live streams video and audio of Council meetings. Members of the public are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

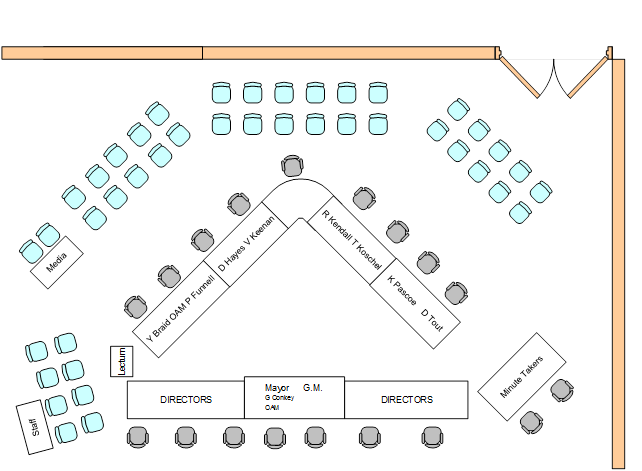

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 23 November 2020.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 23 November 2020

CLAUSE PRECIS PAGE

PRAYER 3

ACKNOWLEDGEMENT OF COUNTRY 3

APOLOGIES 3

Confirmation of Minutes

CM-1 Ordinary Council Meeting - 9 November 2020 3

DECLARATIONS OF INTEREST 3

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - COUNCIL INFORMATION 4

NOM-2 NOTICE OF MOTION - NAPPY AND MENSTRUAL PRODUCT REBATE 6

Reports from Staff

RP-1 DA20/0427 - DEMOLITION OF EXISTING DWELLING AND CONSTRUCTION OF THREE TWO-STOREY ATTACHED DWELLINGS (MULTI DWELLING HOUSING) TO BE COMMUNITY TITLE SUBDIVIDED AT LOT 9 DP 12441, 334 EDWARD STREET, WAGGA WAGGA, 2650 8

RP-2 DA20/0442 - Construction of dwelling and detached garage - Lot 63 DP 1235752 ,118 Lakehaven Drive Lake Albert 12

RP-3 ENFORCEMENT ACTION FOR DA09/0872 16

RP-4 Presentation of the 2019/20 Financial Statements 21

RP-5 CONSTITUTIONAL REFERENDUM - POPULARLY ELECTED MAYOR 23

RP-6 CODE OF CONDUCT STATISTICS 31

RP-7 Section 356 Requests for Financial Assistance 37

RP-8 LEASE OF ARTC LAND LOT 1 PLAN 1155480 42

RP-9 Financial Performance Report as at 31 October 2020 50

RP-10 POL 022 GRANTS AND SPONSORSHIP POLICY RESCISSION 83

RP-11 Completion of Private Works - Sewer Connection at Wagga Wagga Christian College 90

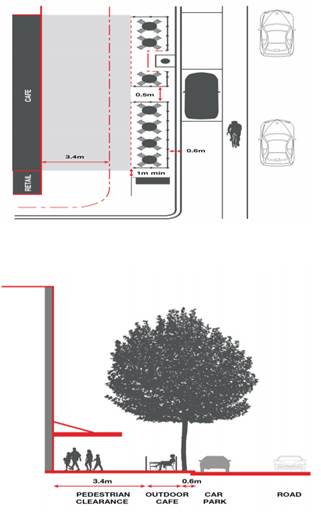

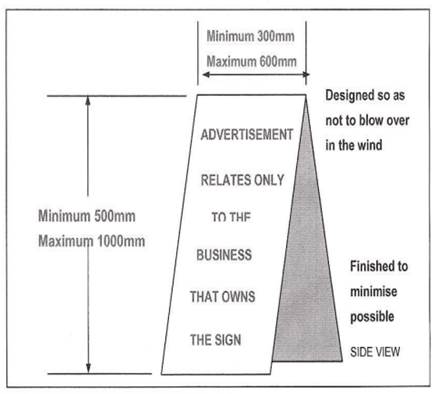

RP-12 Friday night shopping trial - footpath activity 97

RP-13 RESOLUTIONS AND NOTICES OF MOTIONS REGISTERS 126

RP-14 RESPONSE TO QUESTIONS/BUSINESS WITH NOTICE 128

Committee Minutes

M-1 RIVERINA REGIONAL LIBRARY ADVISORY COMMITTEE MEETING - 28 OCTOBER 2020 131

QUESTIONS/BUSINESS WITH NOTICE 140

Confidential Reports

CONF-1 RFQ2021-513 BULK EMULSION SUPPLY 141

CONF-2 RFT2021-04 MUSEUM REDEVELOPMENT STAGES 1 AND 2 DESIGN & CONSTRUCTION 142

CONF-3 RFT2021-08 REMOVAL AND DISPOSAL OF UNDERGROUND PETROLEUM STORAGE TANKS, AND SUPPLY AND INSTALLATION OF ABOVE-GROUND REFUELLING FACILITY 143

CONF-4 PROPOSED LEASE EXTENSION - LEISURE COMPANY DISABILITY SERVICES LTD 144

CONF-5 NOTICE OF RESCISSION - Resolution No. 20/417 145

PRAYER

CM-1 Ordinary Council Meeting - 9 November 2020

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 9 November 2020 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes Ordinary Council Meeting 9 November 2020 |

146 |

|

Report submitted to the Ordinary Meeting of Council on Monday 23 November 2020 |

NOM-1 |

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - COUNCIL INFORMATION

Author: Councillor Paul Funnell

|

Summary: |

The purpose of this Notice of Motion is to call for a report on the possibility of Council restricting the availability of confidential information to those that have been found to have breached this confidentiality. |

|

That Council receive a report by the 14 December 2020 Council Meeting that sets out the process of ability (if any) for Council to restrict the availability of confidential information to individuals found to have released confidential information in this term of Council and that is retrospective for this term of the Council. |

Report

With ongoing concerns being raised by councillors in relation to the leaking of different forms of confidential information from council workshops and meetings, associated with the inaction and flawed process of the Code of Conduct actionable process, this report explores the possibility for council to take control of the situation.

The motion is simply calling for a report on the willingness for councillors to explore the ability to actually back themselves in their own ongoing posturing that something needs to be done. An opportunity is here to actually do something themselves regarding actionable consequences rather than redirect the seriousness of the inaction on others such as the OLG and continue to, just put more motions forward at conferences.

That is not to say that those motions shouldn’t be lodged, however if councillors are serious about their claims of dismay, take charge of their own destiny.

Financial Implications

N/A

Policy and Legislation

Wagga Wagga City Council Code of Meeting Practice

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We have leaders that represent us

|

Report submitted to the Ordinary Meeting of Council on Monday 23 November 2020 |

NOM-2 |

NOM-2 NOTICE OF MOTION - NAPPY AND MENSTRUAL PRODUCT REBATE

Author: Councillor Vanessa Keenan

|

Summary: |

Save money and the environment by using reusable nappies and absorbent hygiene products. |

|

That Council:

a council recognise the impacts of disposable nappies and menstrual products on the environment and the City’s landfill

b staff provide a report to Council no later than January 2021 on potential models for a reusable nappy and menstrual product rebate system to commence in the 2021/22 financial year

|

Report

Each day there are 3.75 million disposable nappies used across Australia and New Zealand, with about one cup of crude oil used to make each nappy. Whilst cloth nappies require detergents and water to wash, they are a better alternative for the environment and provide savings for both residents and Council. Before a child is properly toilet trained, an estimated 6,000 nappies will be used and disposed of during that timeframe. Averaging the cost of a single disposable nappy at 50c, a family spends approximately $3,000 on nappies alone. When disposable nappies end up in landfill, it takes up to 300 years for them to break down. It is also estimated that an average of 150kg of sanitary products are sent to landfill during a woman’s lifetime.

Using reusable nappies and menstrual products only requires a thorough wash and they’re ready to be used again. By introducing the fortnightly FOGO system (food organics and garden organics), Council provided a platform for residents to significantly reduce the amount of waste entering landfill. Disposable nappies and absorbent menstrual products are a major contribution to household garbage waste. For many families, depositing disposable nappies in the bin for up to a fortnight is a common frustration due to potential odour issues and the amount of space taken up in the bin. Reusable cloth nappies and menstrual products are a significant upfront investment that for some residents cannot afford. Council can divert a large amount of household waste from landfill, saving Council money. Reusable products can also save households up to $1,000 a year.

A number of Councils across Australia are implementing rebate systems in recognition of the benefits of waste diversion. By offering a rebate for these costs, residents considering making the switch have an added incentive to do so. Council’s Solid Waste Reserve of over $13M provides a potential funding source for the rebate.

Financial Implications

N/A

Policy and Legislation

N/A

Link to Strategic Plan

The Environment

Objective: We create a sustainable environment for future generations

Outcome: We minimise our impact on the environment

Risk Management Issues for Council

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 23 November 2020 |

RP-1 |

RP-1 DA20/0427 - DEMOLITION OF EXISTING DWELLING AND CONSTRUCTION OF THREE TWO-STOREY ATTACHED DWELLINGS (MULTI DWELLING HOUSING) TO BE COMMUNITY TITLE SUBDIVIDED AT LOT 9 DP 12441, 334 EDWARD STREET, WAGGA WAGGA, 2650

Author: Paul O'Brien

General Manager: Peter Thompson

|

Summary: |

This report is for a development application and is presented to Council for determination. The application has been referred to Council under Section 1.11 of the Wagga Wagga Development Control Plan 2010 (DCP) as the development is for multi dwelling housing that varies numerical controls and has submissions that relate to those variations. |

|

That Council approve DA20/0427 for demolition of existing dwelling and construction of three two-storey attached dwellings (multi dwelling housing) to be community title subdivided at 334 Edward Street Wagga Wagga NSW 2650 subject to conditions outlined in the Section 4.15 Assessment Report.

|

Development Application Details

|

Applicant |

Michael Commins |

|

Owner |

G & M Commins Pty Ltd |

|

Development Cost |

$900,000 |

|

Development Description |

Demolition of existing dwelling and construction of three two-storey attached dwellings (multi dwelling housing) to be community title subdivided. |

Report

Key Issues

· Compliance with controls of the Wagga Wagga Development Control Plan 2010

· Impact on context and setting

· Neighbour submissions.

Assessment

· Under the provisions of the LEP, the subject site is within the R3 Medium Density Residential zone and is within the Health and Knowledge Precinct.

· The proposal is generally consistent with the R3 objectives because it provides for a variety of housing types to meet the housing needs of the community.

· The proposal is generally consistent with the majority of the relevant controls within the DCP.

· The proposal is generally consistent with the strategic intent of the Health and Knowledge Master Plan.

· Numerical variations have been sought in regards to the site cover provisions and street frontage requirements for multi dwelling housing in R3 zones. Justification has been provided in the attached assessment report and is considered acceptable.

· Variations have been sought to streetscape impacts. Justification has been provided in the attached assessment report and is considered acceptable.

· The application was notified and advertised and 3 submissions in objection to the development were received. The submissions related generally to impact on a neighbouring established Sugar Gum Tree, vehicle movements, traffic safety and parking and non-compliance with numerical DCP controls. The submissions have been addressed in the attached assessment report.

Having regard for the information contained in the attached Section 4.15 assessment report, it is considered that the development is acceptable for the following reasons and recommended for approval.

Reasons for Approval

1. The proposed development is consistent with the provisions of the Wagga Wagga Local Environmental Plan 2010;

2. The applicable objectives of Section 9 of the DCP are satisfied by the proposed development;

3. The proposed variations to the site cover, street frontage and impact on streetscape pursuant to Clauses 9.2.2, 9.3.2 and 9.3.3 of the DCP have been suitably justified;

4. The proposal is in the public interest as it aligns with the strategic intent of the Health and Knowledge Master Plan.

5. For the abovementioned reasons it is considered to be in the public interest to approve this development application

Site Location

The subject land is known as Lot 9 DP 12441, 334 Edward Street and is located on the southern side of the street between Cullen Road and Emblem Street.

The site measures 714.50m² and is a flat residential lot that contains a single storey detached dwelling with access off Edward Street. The site contains garden plantings that are of no value and has a sewer easement to the rear.

The locality is a mix of land uses. Immediately to the east, west and south are residential properties. To the north is the Sturt Highway (Edward Street) and an existing service station opposite the site. The wider context includes medical practitioners and the hospitals to the south and east and commercial/industrial to the west and north.

It should be noted that Council currently have an application for the demolition of the five dwellings immediately to the west of the subject site and the construction of a Health Services Facility (DA20/0476). This application will be determined by the Southern Regional Planning Panel.

The subject site is located in the Health and Knowledge precinct.

Financial Implications

The decision to refuse the application could potentially be challenged in the Land and Environment Court.

Policy

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have housing that suits our needs

Risk Management Issues for Council

Refusal of the application may result in an appeal process in the Land and Environment Court, which will have to be defended by Council. The reasons for refusal will have to be justified and withstand scrutiny and cross examination in Court.

Approval is not considered to raise risk management issues for Council as the proposed development is generally consistent with the relevant provisions of any relevant State Environmental Planning Policy, the Wagga Wagga Local Environmental Plan 2010 and the Wagga Wagga Development Control Plan 2010.

Internal / External Consultation

Pursuant to this provision of Section 1.10 of the Wagga Wagga Development Control Plan 2010, notification of the application was required. The application was notified and advertised to surrounding properties from 10/09/2020 to 24/09/2020 in accordance with the provisions of the DCP. Three public submissions were received.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

x |

|

|

|

|

|

|

|

|

|

x |

|

||||

|

Involve |

|

|

|

|

|

|

|

|

|||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

DA20-0427 - Section 4.15 Report - Provided under separate cover |

|

|

2. |

DA20-0427 - Plans - Provided under separate cover |

|

|

3. |

DA20-0427 - Statement of Environmental Effects - Provided under separate cover |

|

|

4. |

DA20-0427 - Arborist Report - Provided under separate cover |

|

|

5. |

DA20-0427 - Submissions - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 23 November 2020 |

RP-2 |

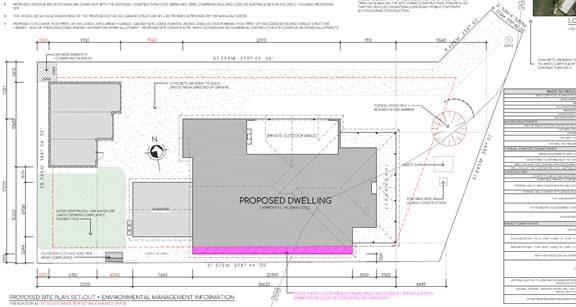

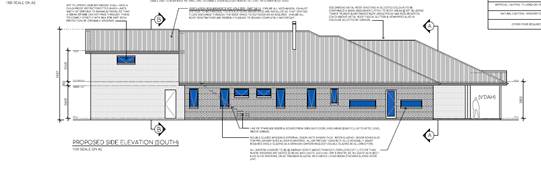

RP-2 DA20/0442 - Construction of dwelling and detached garage - Lot 63 DP 1235752 ,118 Lakehaven Drive Lake Albert

Author: Paul O'Brien

General Manager: Peter Thompson

|

Summary: |

This report is for a development application and is presented to Council for determination. The application has been referred to Council under Section 1.11 of the Wagga Wagga Development Control Plan 2010 (DCP) as the development proposes a variation to a numerical development control and a submission has been received that includes an objection that relates to the control.

The application seeks approval for a 2-storey dwelling and detached garage at 118 Lakehaven Drive Lake Albert. The applicant seeks a variation to Control 2 of Section 9.3.7 of the Wagga Wagga Development Control Plan 2010 as follows.

C2 Any point of a building must have a setback from the side boundary nearest to that point of at least:

a) If the lot is in Zone R5 a setback of 2m

The applicant proposes a 1 metre setback to the southern (side) boundary of the property.

Approval of the application is consistent with the objectives of the section 9.3.7 of the DCP and the objectives of the R5 Zone and will have negligible amenity and visual impacts on surrounding neighbourhood.

The application is recommended for approval. |

|

That Council approve DA20/0442 for construction of dwelling and detached garage at 118 Lakehaven Drive Lake Albert, Lot 63 DP 1235752 as outlined in the attached Section 4.15 report.

|

Development Application Details

|

Applicant |

Alan Brentnall & Elizabeth Brentnall |

|

Owner |

Alan Brentnall & Elizabeth Brentnall |

|

Development Cost |

$455670.00 |

|

Development Description |

Construction of dwelling and detached garage |

Report

Key Issues

· Compliance with Wagga Wagga DCP 2010.

The proposed development does not comply with the Control 2 of section9.3.7 of the DCP (9.3.7 Side and rear setbacks)

· Submission is in objection to the development: The objection relates to the proposed 1m side setback and potential visual impacts due to the reduced side setback.

Assessment

The application is for the construction of a two – storey dwelling and detached garage at 118 Lakehaven Drive Lake Albert.

The lot is 1443.00m2 in extent and located within the R5 Large Lot Residential Zone and is vacant.

The application was notified to surrounding properties and one submission has been received against the application.

The determination of the application is reported to Council as the objection is related to a numerical control being varied by greater than 10%.

The proposed development seeks variations to Control 2 of section 9.3.7 of the Wagga Wagga Development Control Plan 2010 as follows.

C2 Any point of a building must have a setback from the side boundary nearest to that point of at least:

a) If the lot is in Zone R5 a setback of 2m

The applicant proposes a 1 metre setback to the southern (side) boundary of the property (see diagram below).

Approval of the application is consistent with the objectives of the section 9.3.7 of the DCP and the objectives of the R5 Zone and will have negligible amenity and visual impacts on surrounding neighbourhood.

The application is recommended for approval.

Reasons for Approval

· The subject site is within the R5 Large Lot Residential Zone and dwellings are permissible with consent. The proposal is consistent with the objectives of the R5 Zone and objectives listed under section 9.3.7 of the DCP.

· Lots located south of the property have an adequate physical and visual separation from the proposed dwelling due to the existing easement and driveway. Approved dwelling designs for 120 and 122 Lakehaven Drive were considered as part of the assessment and no privacy or visual impacts will be anticipated.

· The reduced side setback will not compromise physical and visual separation of proposed dwelling with adjoining future dwellings for maintenance, landscaping, privacy, natural light and ventilation.

· Strict compliance with the control is considered unreasonable give these circumstances.

· Having regard to the overall assessment of the application under section 4.15 of the Act.

Site Location

The subject site is located on the southwestern side of the elbow of Lakehaven Drive approximately 130m from the intersection with Main Street Lake Albert.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have housing that suits our needs

Risk Management Issues for Council

Approval of the application may result in challenges from objector in the Land and Environment Court which will have to be defended by Council. The reasons for approval will have to be justified and withstand scrutiny and cross examination in Court.

Refusal of the application may result in challenge by the applicant in Land and Environment Court.

Internal / External Consultation

N/A

|

1. |

DA20/0442 4.15 Report - Provided under separate cover |

|

|

2. |

DA20/0442 Statement of Environmental Effects - Provided under separate cover |

|

|

3. |

DA20/0442 Plans - Provided under separate cover |

|

|

4. |

DA20/0442 118 Lakehaven Drive - Submission - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 23 November 2020 |

RP-3 |

RP-3 ENFORCEMENT ACTION FOR DA09/0872

Author: Paul O'Brien

General Manager: Peter Thompson

|

Summary: |

At the Ordinary Meeting on 14 September 2020 Council resolved to receive a further report in November 2020 confirming the outcome of the enforcement action detailed in the report to that meeting for Development Application number DA09/0872, Rocky Point Quarries. |

|

That Council receive and note the report and the steps moving forward. |

Report

Background

At the 14 September 2020 Council Meeting it was resolved:

That Council:

a note the report and the steps moving forward

b receive a further report in November 2020 confirming the outcome of the enforcement action detailed in the report

Next Steps

As detailed in the report to Council of 14 September 2020, Council has proceeded to enforcement action in relation to non-compliance with condition 5, requiring the execution of a maintenance agreement, and 21, which required the sealing of Tooyal Road, of DA09/0872 (as modified under DA09/0872.01).

A Notice of intention to issue an Order under the provisions of the Environmental Planning and Assessment Act 1979, requiring compliance with the conditions of development consent was issued.

The developer made submissions in response to that Notice. A copy of the submission is attached.

Having reviewed the submission it was determined that it was appropriate to issue the Order, with the terms modified to allow twelve months from the date of that Order, being 12 November 2020, to comply with the outstanding conditions of consent.

It is noted that the submission states that it is intended to lodge a further amendment to development consent DA09/0872 (as amended by DA09/0872.01) to allow masonry/concrete products to be recycled on the site, and that through that application it would be proposed that Tooyal Road would be sealed, at the proponents full cost, over a three year period from the date of that modified consent, should consent be forthcoming.

If a modification application is in fact made the issue can be revisited.

Financial Implications

N/A

Policy and Legislation

N/A

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

N/A

Internal / External Consultation

Further discussions and exchange of correspondence has been made with the operators of the quarry since the meeting in September.

|

1⇩. |

Rocky Point Quarries - Issue of Order Response |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 23 November 2020 |

RP-4 |

RP-4 Presentation of the 2019/20 Financial Statements

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Summary: |

Council resolved to sign the 2019/20 Financial Statements at the 26 October 2020 Council Meeting, enabling Council officers to lodge the financial statements with the Office of Local Government (OLG) prior to the 30 November 2020 due date.

Council’s external auditors, NSW Audit Office have completed their Auditor’s Report, and have provided this to Council for their information. |

|

That Council: a receive the Audited Financial Statements, together with the Auditor’s Reports on the Financial Statements for the year ended 30 June 2020 b receive a further report if any submissions are received |

Report

The Audit Reports for the 2019/20 Financial Statements have now been received and are presented in accordance with section 419(1) of the Local Government Act 1993.

Council has provided public notice that the Financial Statements and Auditor’s Reports will be presented at this meeting in accordance with section 418 of the Local Government Act 1993 and has invited public submissions on the audited financial statements, with submissions open until Monday 30 November 2020.

Financial Implications

Whilst this report and associated attachments show Council’s financial performance and position for the 2019/20 financial year, the adoption of this report by the Council has no financial implications.

Policy and Legislation

Local Government Act 1993

Sections: 419 – Presentation of council’s financial reports

420 – Submissions on financial reports and auditor’s report

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

The NSW Audit Office have provided Council with a final Management Letter which has identified six (6) issues with four (4) rated as Low and two (2) rated as Moderate. Council officers will undertake the actions that have been identified in each of the Management Responses.

Internal / External Consultation

The Council’s Community Engagement Strategy and IAP2 considers the community to be “any individual or group of individuals, organisation or political entity with an interest in the outcome of a decision….”

Council’s external auditors, NSW Audit Office have liaised with Council’s Finance division and presented the draft Financial Statements in detail to the Audit, Risk and Improvement Committee at the 8 October 2020 Committee meeting. Councillors were invited to the Committee meeting and had the opportunity to discuss any aspects of the 2019/20 financial statements with the NSW Audit Office staff prior to the 26 October 2020 Council meeting also.

The draft Financial Statements were approved for signing by Council at its 26 October 2020 Council meeting.

|

1. |

Annual Financial Statements 2019-20 - Provided under separate cover |

|

|

2. |

Report on the Conduct of the Audit - NSW Audit Office - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 23 November 2020 |

RP-5 |

RP-5 CONSTITUTIONAL REFERENDUM - POPULARLY ELECTED MAYOR

Author: Ingrid Hensley

General Manager: Peter Thompson

|

Summary: |

In September 2020 Council resolved to conduct a Constitutional Referendum for a popularly elected Mayor at the next council elections on 4 September 2021. This Report outlines the process and indicative costs involved in the community consultation process in the lead up to the elections in addition to the proposed wording of the referendum question. |

|

That Council: a note the process and costs involved in the community consultation to conduct a Constitutional Referendum for a popularly elected Mayor b note the NSW Electoral Commission have been engaged to conduct the referendum in conjunction with the 2021 NSW Local Government Elections c approve the budget variation as noted in the financial implications section of this report. c approve Option One being the following referendum wording for the 2021 Local Government Election: Wagga Wagga City Council currently has nine Councillors with the Mayor elected by the Councillors every two years. Do you approve to change this to the voters of Wagga Wagga electing a Mayor for a four-year period?

|

Report

Council, at its Ordinary Meeting on 28 September 2020, resolved:

That Council:

a following on from report RP-8 Response to Notice of Motion - Popularly Elected Mayor received at the 10 August 2020 Council Meeting, agree to conducting a constitutional referendum for a popularly elected Mayor at the next council elections scheduled for September 2021

b receive a further report with details of the process along with the relevant wording to be used to conduct the referendum

This Report is provided to address the matters raised in (b) above.

There are a number of sections under the Local Government Act 1993 (NSW) (the Act) which are relevant the election of the Mayor. The following provisions of the Act are relevant to each of these:

15 What is a constitutional referendum?

A constitutional referendum is a poll initiated by a council in order to give effect to a matter referred to in section 16.

16 What matters must be dealt with at a constitutional referendum?

A council may not do any of the following unless approval to do so has been given at a constitutional referendum:

……

(b) change the basis on which the mayor attains office (that is, by election by the councillors or by election by the electors),

…..

17 What is the effect of a constitutional referendum?

(1) The decision made at a constitutional referendum binds the council until changed by a subsequent constitutional referendum.

(2) However, such a decision does not apply to a by-election held after the constitutional referendum and before the next ordinary election.

20 When is a question at a council poll or constitutional referendum carried?

(1) The question at a council poll or constitutional referendum is carried if it is supported by a majority of the votes cast.

(2) The reference to votes in subsection (1) does not include a reference to any vote that, pursuant to the regulations, is found to be informal.

Popularly elected Mayor

The Act provides two methods by which a Mayor can be elected - by popular vote at an ordinary election or by vote amongst the councillors. Under Section 16(b) of the Act a Council must have a constitutional referendum to change the basis on which the Mayor attains office (that is, election by the councillors or by the electors).

Currently Council elects the Mayor on a bi-annual basis, from within its numbers, as provided for under section 227 of the Act.

Changing the manner in which the Mayor is elected, to a popularly elected Mayor, requires approval of the electors and which approval is sought via a referendum as provided for under sections 227-228 of the Act:

227 Who elects the mayor?

The mayor of an area is the person elected to the office of mayor by--

(a) the councillors from among their number, unless there is a decision in force under this Division which provides for the election of the mayor by the electors, or

(b) the electors, if such a decision is in force.

228 How is it decided that the mayor be elected by the electors?

(1) It may be decided at a constitutional referendum that the mayor be elected by the electors.

(2) A decision that the mayor be elected by the electors takes effect in relation to the next ordinary election after the decision is made.

Therefore, if a referendum is passed under Section 228(2) of the Act, the decision comes into effect at the next ordinary election after the decision is made, which will be in 2024.

Conducting a referendum

As stated above, Council resolved to conduct a constitutional referendum for a popularly elected Mayor at the next council election scheduled for September 2021. The process Council is implementing is in accordance with Schedule 10 of the Local Government (General) Regulation 2005 (the Regulation) under Part 3 of Chapter 4 of the Act is as follows:

(a) if a council resolves to take a constitutional referendum or council poll, the general manager is to notify the Electoral Commissioner of the resolution within 21 days after the council makes the resolution (if the Electoral Commissioner is to administer the referendum or poll),

(a1) if a constitutional referendum or council poll is to be held in conjunction with an election of councillors, the general manager must (if he or she has not already done so) notify the Electoral Commissioner of the question to be asked at the referendum or poll no later than 12 noon on the closing date for the election (if the Electoral Commissioner is to administer the referendum or poll and the election),

(b) the election manager is to publish a notice setting out the date of the referendum or poll, the question to be asked at the referendum or poll and the locations and times of polling for the referendum or poll--

(i) on the website of the council, and

(ii) in any other manner that the election manager considers necessary to bring it to the attention of members of the public in the area in which a referendum is to be taken, or the area or part of the area in which a poll is to be taken,

(b1) the election manager is to publish the notice--

(i) except as provided by subparagraph (ii)--as soon as practicable after being notified of the date of the referendum or poll, or

(ii) in the case of a referendum or poll to be held in conjunction with an election of councillors--at the same time as the election manager publishes a notice under clause 300 of this Regulation in relation to the election,

The above process includes Council providing wording for any proposed referendum for resolution. Once endorsed, this wording would be provided to the NSW Electoral Commission. In addition, an extensive media and community engagement campaign would also be undertaken raising awareness and engaging with community members in relation to the referendum, and which is considered further below.

Referendum Wording

Guidance from the Office of Local Government NSW is that it is imperative that the referendum question is carefully framed to ensure that workable decisions are achieved. All questions put at a referendum should be clear, concise, and capable of being responded to with a ‘yes’ or ‘no’ answer.

Consideration was also given to utilising as much plain language as possible, to ensure the question is able to be clearly interpreted by all electors within the community. The content of the proposed referendum question is put to Council for endorsement prior to submission to the NSW Electoral Commission and is included in the Recommendation within this Report.

Council staff have undertaken research around the wording of a referendum question for a popularly elected Mayor with the following options provided to Council for consideration and adoption of preferred wording. Option One is recommended for adoption, as reflected in the recommendation, because the voters are being asked to consider changing a current process, therefore including what that status quo is, and what the result of any change would be, is the most transparent manner in which to present this to the community.

In saying that, Option Two does present very clear and concise wording, which is desirable. However, broad awareness in the community about how Council currently elects a Mayor, and therefore what voters are being asked to change, may not be broadly understood. In other words, the objective of Option One is to show what the status quo is before voters are asked to consider a change. Although there is a broad community engagement process proposed, it is considered the question should still clearly present the question being put to voters, with the understanding that some electors may not have engaged with the community/educational campaign.

Option One

Wagga Wagga City Council currently has nine Councillors with the Mayor elected by the Councillors every two years. Do you approve to change this to the voters of Wagga Wagga electing a Mayor for a four-year period?

Option Two

Option Three

Wagga Wagga City Council currently has nine Councillors with the Mayor elected by the Councillors every two years. Do you approve of the popular election of the Mayor, by the voters of Wagga Wagga, for a four-year period?

Option Four

Wagga Wagga City Council currently has nine Councillors with the Mayor elected by the Councillors every two years. Do you approve the voters of Wagga Wagga electing the Mayor for a four-year period?

Option Five

The Mayor of the City of Wagga Wagga is currently elected biennially by the nine Councillors. Do you want to change to the direct election of the Mayor by the voters of Wagga Wagga, for a four-year term?

If the constitutional referendum is passed, the result takes effect at the next local government elections then the position of Mayor would be elected by the public commencing from the 2024 NSW Local Government Elections.

If the question is not approved, the Mayor will be elected biennially by the Councillors from the existing nine Councillors.

Community Engagement Process

In relation to a referendum, Schedule 10 of the Regulation requires that the election manager publish a notice setting out the date of the referendum, the question to be asked and the locations and times of polling on the website of the council. The election manager can also publish that notice in any other manner they consider necessary to bring it to the attention of members of the public in the area in which a referendum is to be undertaken. The election manager is NSW Electoral Commission, who have verbally advised publication will be limited to the notice on the website. Council, will however separately undertake a comprehensive community engagement process, as considered below.

Advice from the Office of Local Government NSW (Circular 19-23, 30 September 2019) is that “Council is responsible for the preparation and publicity of the required explanatory material and must ensure this material presents a balanced case both for and against any proposition to be put to a referendum.” Council staff have commenced preparing this, and councillors may wish to have further consultation/engagement in this process at a future Councillor Workshop.

The community engagement would include, but not be limited to radio, print media, social media, flyers/posters and tv news bulletins. The engagement will include images of the referendum ballot paper for the community, so there is familiarity with how that document looks, given it will be compulsory to complete as part of the voting process.

More detailed information, including costs, in relation to promoting the referendum and providing sufficient information for the community to make an informed decision is provided in the Finance section of this report.

Financial Implications

The NSW Electoral Commission has advised a Constitutional Referendum held in conjunction with the Local Government elections in 2021 would increase the cost of the elections by approximately $47,000.

The NSW Electoral Commission have advised there will be a contract variation to the current agreement, to accommodate the referendum. In correspondence from the Minister for Local Government on 17 November 2020, the Minister advised that the NSW Electoral Commissioner has been instructed to prepare for full attendance voting at the September 2021 Local Government Elections.

The Minister further advised that if COVID-19 is still impacting communities next year, the cost of holding elections in a full attendance model will increase to meet a substantial rise in the electoral staff and polling booths needed to comply with physical distancing and sanitising requirements. As a result, the Minister for Local Government has secured a $56.8 million funding package as part of the NSW Government’s 2020/21 Budget.

The Government will provide the NSW Electoral Commission with this additional funding to hold COVID-Safe elections if required, so councils will only be billed for the cost of holding elections in a normal environment.

It is proposed to fund this 2021/22 anticipated cost from the Council Election Reserve which has current capacity.

If the result of any referendum was to move to a popularly elected mayor, then further advice received is that the cost would be approximately $47,000 every four years (i.e. similar to the cost of a Referendum). This is because mayoral elections require the management of a separate set of nominations and a separate set of ballot papers and separate counts at each polling place and returning office, and then a separate distribution of preferences process. If Council was to move to a popularly elected mayor, the additional costs will be included in a future report to Council for adoption of the increased budget required.

Council has developed a proposed approach in relation to community engagement, as considered above. Costs associated with that community engagement program have been summarised into approximate amounts as set out below. These costs do not include staff time. Internal resources would need to be allocated to develop content across all media types, including drafting of scripts and other print media/promotional content, video/photography, management of media bookings and inquires and content review and management.

|

Method |

Details |

Approx. Cost |

|

Commercial Radio – 30 second slots Local Media outlets

|

Option Minimum 6-week program Approx. 150 slots including prime time |

$11,000 including GST |

|

Option Maximum 6-week program Approx. 350 slots including prime time |

$23,000 including GST |

|

|

Community Radio Announcements |

No Costs (staff time) |

|

|

Print Media |

Council News and Display Ads (referendum notice) Including Half Page Advertisements |

$2,600 |

|

Media Release / Media Opportunity |

Media release to news outlets with the intent this be picked up by commercial TV news bulletins in particular. |

No Costs (staff time) |

|

Social Media and Website |

Council’s website and social media platforms including Facebook (including sponsored posts – digital advertising) and Instagram

Council’s website will link back to the NSW Electoral Commission website, to ensure consistency and timely updating of important information |

$700 |

|

Flyers |

Option Maximum Information documentation delivered to all households in the Local Government Area |

$11,000 |

|

Option Minimum Information documentation delivered to all ratepayers in the Local Government Area through rates notices |

$6,000 |

|

|

Posters |

Various posters for public notice boards etc |

$100 |

|

|

Minimum Total (Radio Option 1 & Flyer Option 2) Maximum Total (Radio Option 2 & Flyer Option 1) |

$20,400

$37,400 |

It is proposed to fund the above community engagement up to the maximum $37,400 for the 2021 election from the Council Election Reserve and adjust future years budgets to accommodate these increased costs.

Policy and Legislation

Local Government Act 1993 (NSW)

Local Government (General) Regulation 2005

Under the Regulation, if a council resolves to take a constitutional referendum or council poll, the general manager is to notify the Electoral Commissioner of the resolution within 21 days after the council makes the resolution (if the Electoral Commissioner is to administer the referendum or poll). This was undertaken following the resolution of Council in September 2020.

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We have leaders that represent us

Risk Management Issues for Council

The advantages and disadvantages in relation to each option are to be developed. Each option has an associated level of risk in relation to the future of the Office of the Mayor with an impact on the elected body as a whole. The financial impact is also a relevant consideration, particularly if that expenditure is incurred and there is no change supported by the voters.

Internal / External Consultation

Research was undertaken with a number of NSW Councils to gather information to provide input into this report. Advice was also sought from the Office of Local Government NSW and the NSW Electoral Commission.

An extensive community engagement program will be delivered to allow the community to be involved and informed to make an informed decision at the 2021 Local Government Election.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

x |

x |

x |

x |

x |

|

|

|

|

|

|

x |

x |

x |

|

|

Involve |

|

|

x |

x |

x |

x |

x |

|

|

|

|

x |

x |

x |

|||

|

Collaborate |

|

|

x |

x |

x |

x |

x |

|

|

|

|

|

|

x |

|

x |

x |

|

Report submitted to the Ordinary Meeting of Council on Monday 23 November 2020 |

RP-6 |

RP-6 CODE OF CONDUCT STATISTICS

Author: Ingrid Hensley

General Manager: Peter Thompson

|

Summary: |

Council’s Administrative Procedures for the Code of Conduct provide that Council is to report to the Office of Local Government NSW (OLG) within three months of the end of September each year. |

|

That Council endorse the contents of this report. |

Report

In accordance with the Administrative Procedures for the Code of Conduct an annual report is required to be provided to Council. Specifically, the following provisions apply:

Part 11 Reporting statistics on code of conduct complaints about councillors and the general manager

The complaints coordinator must arrange for the following statistics to be reported to the council within 3 months of the end of September of each year:

a) the total number of code of conduct complaints made about councillors and the general manager under the code of conduct in the year to September (the reporting period)

b) the number of code of conduct complaints referred to a conduct reviewer during the reporting period

c) the number of code of conduct complaints finalised by a conduct reviewer at the preliminary assessment stage during the reporting period and the outcome of those complaints

d) the number of code of conduct complaints investigated by a conduct reviewer during the reporting period

e) without identifying particular matters, the outcome of investigations completed under these procedures during the reporting period

f) the number of matters reviewed by the Office during the reporting period and, without identifying particular matters, the outcome of the reviews, and

g) the total cost of dealing with code of conduct complaints made about councillors and the general manager during the reporting period, including staff costs.

The council is to provide the Office with a report containing the

statistics referred to in clause 11.1 within 3 months of the end of September

of each year.

Financial Implications

To date, current staff resourcing costs dealing with code of conduct complaints for the 1 September 2013 to 31 August 2020 period have been estimated at $20,000.

The costs paid during the reporting period in engaging a Conduct Reviewer from Council’s Code of Conduct Panel is $40,378.

Policy and Legislation

Code of Conduct and Administrative Procedures for the Code of Conduct.

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

1⇩. |

Code of Conduct Statistics Report - 2019-20 |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 23 November 2020 |

RP-7 |

RP-7 Section 356 Requests for Financial Assistance

Author: Craig Katsoolis

Director: Natalie Te Pohe

|

Summary: |

Council has received a number of fee waiver requests which are detailed for Council’s consideration. |

|

That Council: a in accordance with Section 356 of the Local Government Act 1993, provide financial assistance to the following: i Animal Welfare League Association (AWL) $500 (Request 1) b contact Southern Cross Austereo and respectfully advise that the $4,000 grant that Council has provided for the Wagga Christmas Spectacular for 2020 is capped, and due to Council budget constraints, no further assistance will be able to be provided by Council (Request 2) c note the remaining budget available for financial assistance requests for the 2020/21 financial year |

Report

Two (2) Section 356 financial assistance items are proposed for consideration at the 23 November 2020 Ordinary Council meeting, which are shown below. Due to Council budget constraints and previous financial assistance provided, Council staff are suggesting that one of the two financial assistance requests are approved by Council:

1. Animal Welfare League Assoc. (AWL) - $500

A member of the Executive Committee of the Animal Welfare League has written to Council requesting the waiving of room hire for their 21 November 2020 Meeting.

The writer notes:

“The inaugural meeting of Animal Welfare League Wagga Wagga branch is being held in the Council Meeting room on Sat 21 Nov at 2pm. As one of the Executive Committee members of the Wagga Wagga branch, I am requesting the fee for the room hire please be waived as AWL Wagga Wagga is a not for profit charity”.

The room hire cost for a 4-hour period at $125 per hour is estimated to be $500 total charge.

The above request aligns with Council’s Strategic Plan “Community leadership and Collaboration” – Objective: “Groups, programs and activities bring us together”

The financial assistance of $500 is proposed to be funded from unallocated funds within the General Section 356 budget allocation. The Council Meeting room can accommodate a greater number of members in a COVID-19 safe manner.

2. Southern Cross Austereo - $850

The General Manager of Southern Cross Austereo (SCA) has written to Council thanking Council for the $4,000 grant, and also requesting Council to further consider providing additional financial assistance for the Wagga Christmas Spectacular to be held on Sunday the 13 December at 6.00 pm – Civic Theatre.

The writer notes:

“I wish to thank Wagga City Council Grant’s committee for affording our organisation a $4000 grant to host The Wagga Christmas Spectacular for 2020. We are incredibly grateful that we are able to use these funds in order to provide the people of Wagga with a fantastic Christmas event that will bring much needed joy and celebration to the community.

In conjunction with The Civic Theatre and The Kapooka Army Band we have planned for the event to be held there for 200 people which will be livestreamed for the wider community on Sunday 13th December from 6pm.

I am writing to you to request assistance from Council with the costs of the event. I have attached the quote of costs from The Civic Theatre for your perusal. We are happy to invest our entire grant into ensuring the event is a great success. To support families in need in our community we would like to offer ticket packages to those enduring hardship this year. Part of these special packages we would like to be able to provide food and drinks for the evening at The Civic Theatre to save them any financial outlay which would come as additional costs to us”.

It is noted that Council at its Ordinary meeting held 24 August 2020 Officer Report RP-9 Annual Grants/Events donated $4,000 to Southern Cross Austereo to assist in the staging of this event.

The Council charges for the use of the Civic Theatre for the event are noted below:

|

Staffing Costs |

$3,511 |

|

Venue Hire - Community Rate |

$ 850 |

|

Total |

$4,361 |

It is proposed that due to Council budget constraints and taking into consideration the $4,000 financial assistance Council has previously provided, that Council respectfully advises that unfortunately no further Council assistance is able to be provided for this event.

Financial Implications

|

Section 356 Budget Summary |

|

|

Unallocated balance of S356 fee waiver financial assistance budget 2020/21 |

$13,110.46 |

|

1) Animal Welfare League |

($500.00) |

|

Subtotal Fee Waivers included in this report – proposed to be funded from the Section 356 Budget |

($500.00) |

|

Balance of Section 356 fee waiver financial assistance budget for the remainder of the 2020/21 Financial Year |

$12,610.46 |

Policy and Legislation

POL 078 – Financial Assistance Policy

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

N/A

Internal / External Consultation

Cross Directorate consultation has been undertaken as required.

|

1⇩. |

S356 Animal Welfare League - Request for Room Hire fee waiver |

|

|

2⇩. |

S356 Southern Cross Austereo - Request for donation for Wagga Christmas Spectacular |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 23 November 2020 |

RP-8 |

RP-8 LEASE OF ARTC LAND LOT 1 PLAN 1155480

Author: Ben Creighton

Director: Michael Keys

|

Summary: |

The Active Travel Plan project incorporates five major routes providing connecting links across the urban areas of Wagga Wagga. The current approved route for the Kapooka Link along Fernleigh Road, from the intersection of Tobruk Street to the intersection of Glenfield Road is along the southern side of the road and would require a new pedestrian rail level crossing to be constructed. This report proposes to change the alignment of this route through the leasing of a parcel of land from ARTC. |

|

That Council: a endorse the revised route for the Kapooka link of the Active Travel Plan b endorse entering a lease for part of Lot 1, Plan 1155480 from ARTC for a period of 10 years c authorise the affixing of Council’s Common Seal to all relevant documents as required |

Report

The Active Travel Plan project incorporates five major routes, providing connecting links to key urban sections of Wagga Wagga. The current approved route for the Kapooka Link along Fernleigh Road, from the intersection of Tobruk Street to the intersection of Glenfield Road, is along the southern side of Fernleigh Road requiring a new pedestrian rail level crossing.

Following detailed discussions with ARTC it was apparent that a new pedestrian rail level crossing, in line with NSW Staysafe committee recommendations would not be approved.

During further internal discussions on this matter an alternative proposal involving the use of vacant land on the southern side of the railway line (between Red Hill Rd and Fernleigh Rd) was identified (Attachment 1 & 2). Staff have subsequently investigated this option further.

The investigations undertaken have found that the route from Red Hill Road to Fernleigh Road would be considered a flat grade, with little impediment for construction. There is also a 2m high chain mesh fence along the full length of this route safely separating the rail line from cyclists and pedestrians.

An approach to ARTC has determined that they would be agreeable to entering into a lease arrangement for a ten-year period (Attachment 3). It is proposed at the end of the ten-year period Council would enter another 10-year lease. The service life of the shared pathway is accepted as 20 years.

Using the already submitted prices for the current ATP contract, this alternate section of the Kapooka Link route is approx. $22,500 cheaper (without including the cost for the proposed pedestrian level rail crossing) than the proposal to the west of the railway line.

Financial Implications

The cost of leasing this parcel of land commences at $720 per annum with an annual escalation of 3% per year. Council is also required to pay an administration fee of $792. The initial administration fee would be paid for out of the Active Travel project however the ongoing leasing fee will be required to be funded from a budget identified during the 2021/22 budget process.

Policy and Legislation

Active Travel Plan 2016

Wagga Wagga Integrated Transport Strategy 2040

Link to Strategic Plan

Growing Economy

Objective: We are a Regional Capital

Outcome: We have complete and accessible transport networks, building infrastructure, improving road travel reliability, ensure on-time running for public transport

Risk Management Issues for Council

The risks associated with implementing this project relate to process, cost, environmental, WHS and contractor performance. These risks are addressed as part of the Council’s project management and contractor performance management systems.

Internal / External Consultation

Extensive consultation was undertaken during the development of the Active Travel Project.

Additional localised consultation will occur with residents along the proposed route as part of the design and construction phases of the project.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

x |

x |

|

|

|

|

x |

x |

|

|

x |

|

|||

|

1⇩. |

Locality Plan |

|

|

2⇩. |

Kapooka Link - Proposed Alingment |

|

|

3⇩. |

ARTC - Letter of Offer |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 23 November 2020 |

RP-9 |

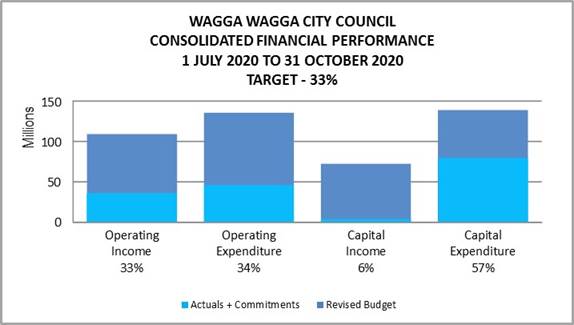

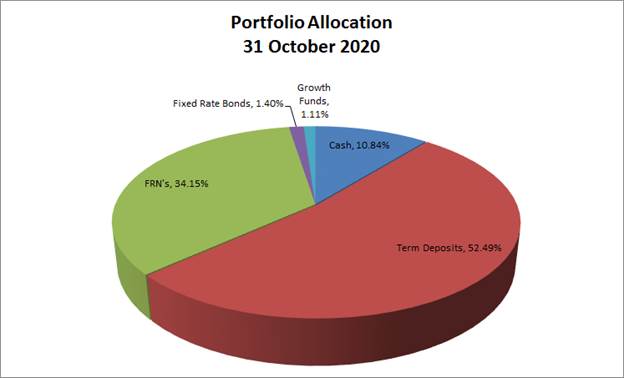

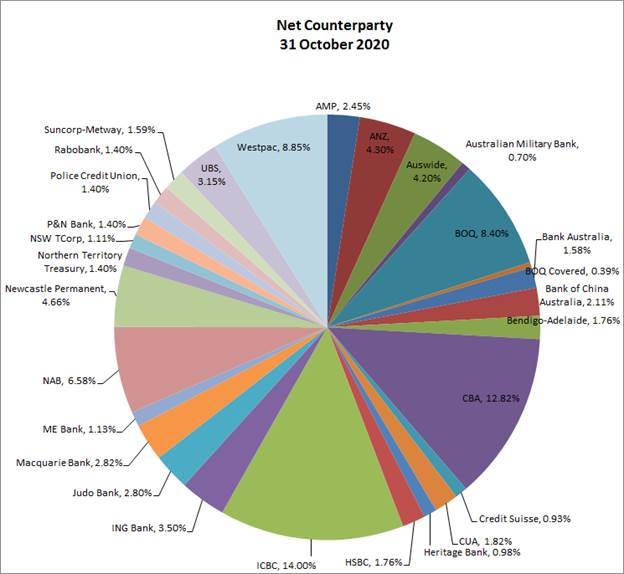

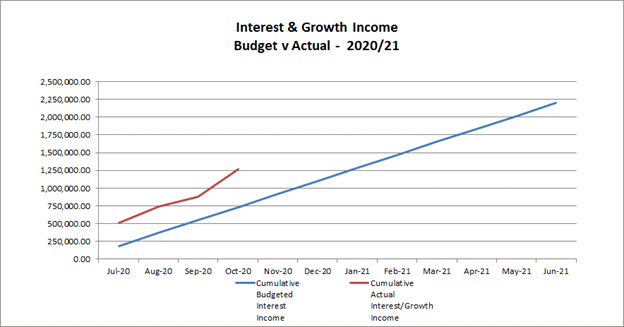

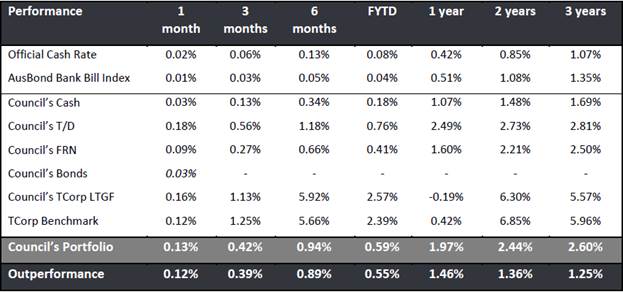

RP-9 Financial Performance Report as at 31 October 2020

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Summary: |

This report is for Council to consider information presented on the 2020/21 budget and Long Term Financial Plan, and details Council’s external investments and performance as at 31 October 2020. |

|

That Council: a approve the proposed 2020/21 budget variations for the month ended 31 October 2020 and note the proposed deficit budget position as a result of COVID-19 b note the financial information presented in the report on Council’s 2020/21 budget and the continued impact due to COVID-19 c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above d note the details of the external investments as at 31 October 2020 in accordance with section 625 of the Local Government Act 1993 |

Report

Wagga Wagga City Council (Council) continues to forecast deficit budget positions as a result of the estimated financial impact the COVID-19 pandemic is having on many businesses, with local councils not immune to the pandemic.

At this stage, Council forecasts a $4M deficit budget position for the 2020/21 budget year (as at 31 October 2020). This will be reviewed as the year progresses, with updates provided to Council as part of the monthly financial performance report.

Council has experienced a positive monthly investment performance for the month of October when compared to budget ($206,551 up on the monthly budget). This is mainly due to an increase in the principal value of Council’s Floating Rate Note portfolio.

Key Performance Indicators

OPERATING INCOME

Total operating income is 33% of approved budget. An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 77% when compared to budget.

OPERATING EXPENSES

Total operating expenditure is 34% of approved budget and is tracking slightly over budget at this stage of the financial year due to operating contract commitments that have been raised for the full year. Excluding these commitments, the expenditure to budget is 29% which is below the year to date target.

CAPITAL INCOME

Total capital income is 6% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions relating to projects. This income also includes the sale of property, plant and equipment.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 57% of approved budget (including ‘Pending Projects’). Excluding ‘Pending Projects’ budgets, the capital expenditure including commitments is 98% of approved budget which is as a result of contracts being raised for multi-year projects.

|

WAGGA WAGGA

CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2020/21 |

COMMT'S 2020/21 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|||||||

|

Rates & Annual Charges |

(72,529,470) |

0 |

(72,529,470) |

(23,961,222) |

0 |

(23,961,222) |

33% |

|

User Charges & Fees |

(22,261,420) |

0 |

(22,261,420) |

(7,247,337) |

0 |

(7,247,337) |

33% |

|

Interest & Investment Revenue |

(2,306,255) |

0 |

(2,306,255) |

(1,265,642) |

0 |

(1,265,642) |

55% |

|

Other Revenues |

(2,931,718) |

(302,515) |

(3,234,233) |

(1,332,863) |

0 |

(1,332,863) |

41% |

|

Operating Grants & Contributions |

(13,415,374) |

4,571,782 |

(8,843,591) |

(2,336,795) |

0 |

(2,336,795) |

26% |

|

Capital Grants & Contributions |

(89,541,725) |

20,431,454 |

(69,110,271) |

(3,666,536) |

0 |

(3,666,536) |

5% |

|

Total Revenue |

(202,985,962) |

24,700,721 |

(178,285,241) |

(39,810,395) |

0 |

(39,810,395) |

22% |

|

|

|||||||

|

Expenses

|

|||||||

|

Employee Benefits & On-Costs |

48,595,768 |

(448,102) |

48,147,666 |

15,542,875 |

0 |

15,542,875 |

32% |

|

Borrowing Costs |

3,452,579 |

0 |

3,452,579 |

290,908 |

0 |

290,908 |

8% |

|

Materials & Contracts |

30,860,378 |

5,446,073 |

36,306,451 |

9,183,950 |

6,263,416 |

15,447,366 |

43% |

|

Depreciation & Amortisation |

35,177,865 |

0 |

35,177,865 |

11,725,955 |

0 |

11,725,955 |

33% |

|

Other Expenses |

9,985,219 |

2,381,685 |

12,366,903 |

3,067,075 |

108,253 |

3,175,328 |

26% |

|

Total Expenses |

128,071,808 |

7,379,655 |

135,451,463 |

39,810,764 |

6,371,669 |

46,182,433 |

34% |

|

|

|||||||

|

Net Operating (Profit)/Loss |

(74,914,154) |

32,080,377 |

(42,833,777) |

369 |

6,371,669 |

6,372,038 |

|

|

|

|||||||

|

Net Operating (Profit)/Loss before Capital Grants & Contributions |

14,627,571 |

11,648,922 |

26,276,493 |

3,666,905 |

6,371,669 |

10,038,574 |

|

|

|

|||||||

|

Capital / Reserve Movements |

|||||||

|

Capital Expenditure - One Off Confirmed |

31,423,131 |

21,907,736 |

53,330,867 |

9,720,682 |

62,391,081 |

72,111,763 |

135% |

|

22,666,954 |

647,702 |

23,314,656 |

2,929,274 |

2,911,843 |

5,841,118 |

25% |

|

|

Capital Exp – Pending Projects |

102,263,183 |

(44,800,756) |

57,462,427 |

0 |

0 |

0 |

0% |

|

Loan Repayments |

4,718,119 |

0 |

4,718,119 |

1,571,706 |

0 |

1,571,706 |

33% |

|

New Loan Borrowings |

(22,723,947) |

(3,765,392) |

(26,489,338) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(2,173,514) |

(1,018,634) |

(3,192,148) |

(473,775) |

0 |

(473,775) |

15% |

|

Net Movements Reserves |

(21,740,087) |

(5,189,260) |

(26,929,347) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

114,433,839 |

(32,218,604) |

82,215,235 |

13,747,888 |

65,302,924 |

79,050,812 |

|

|

|

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED

BUDGET |

YTD ACTUAL EXCL COMMT'S 2020/21 |

COMMT'S 2020/21 |

YTD ACTUAL +

COMMT'S |

YTD % OF BUD |

|

Net Result after Depreciation |

39,519,685 |

(138,227) |

39,381,458 |

13,748,257 |

71,674,593 |

85,422,850 |

|

|

|

|||||||

|

Add back Depreciation Expense |

35,177,865 |

0 |

35,177,865 |

11,725,955 |

0 |

11,725,955 |

33% |

|

|

|||||||

|

Cash Budget (Surplus) / Deficit |

4,341,820 |

(138,227) |

4,203,593 |

2,022,302 |

71,674,593 |

73,696,895 |

|

|

Description |

Budget 2020/21 |

Budget 2021/22 |

Budget 2022/23 |

Budget 2023/24 |

Budget 2024/25 |

Budget 2025/26 |

Budget 2026/27 |

Budget 2027/28 |

Budget 2028/29 |

Budget 2029/30 |

|

Adopted Bottom Line (Surplus) / Deficit |

4,341,819 |

2,909,316 |

2,682,933 |

1,763,495 |

2,131,200 |

3,137,673 |

2,748,594 |

1,622,670 |

1,359,793 |

740,739 |

|

Prior Adopted Bottom Line Adjustments |

(138,226) |

(498,057) |

(676,339) |

(868,239) |

(1,073,591) |

(1,293,138) |

(1,527,657) |

(1,777,962) |

(2,044,912) |

(2,329,404) |

|

Revised Bottom Line (Surplus) / Deficit |

4,203,593 |

2,411,259 |

2,006,594 |

895,256 |

1,057,609 |

1,844,535 |

1,220,937 |

(155,292) |

(685,119) |

(1,588,665) |

|

RP-5 Eunony Bridge Report |

241,533 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Revised Bottom Line (Surplus) / Deficit |

4,445,126 |

2,411,259 |

2,006,594 |

895,256 |

1,057,609 |

1,844,535 |

1,220,937 |

(155,292) |

(685,119) |

(1,588,665) |

2020/21 Revised Budget Result – (Surplus) / Deficit |

$’000s |

|

Original 2020/21 Budget Result as adopted by Council Total Budget Variations approved to date RP-5 Eunony Bridge (Resolution 9th November 2020) Approved Budget Result Budget Variations for October 2020 |

$4,342K ($138K) $242K $4,446K ($482K) |

|

Proposed Revised Budget result for 31 October 2020 - (Surplus) / Deficit |

$3,964K |

The proposed Budget Variations for 31 October 2020 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact (Fav)/ Unfav |

|

1 – Community Leadership and Collaboration |

|||

|

External & Internal Loan Repayments |

$575K |

Airport Reserve ($4K) Sewer Reserve ($45K) Fit for the Future Reserve ($3K) S7.11 Reserve ($2K) Electricity Savings ($16K) LCLI Subsidy Income ($23K) |

($482K) |

|

There have been adjustments to loan repayment budgets for 2020/21 and for the future 10 years of the Long-Term Financial Plan as a result of the following changes: - Carryover of projects/programs included in the 2019/20 Delivery Program funded from external borrowings which have now been transferred to the 2020/21 Delivery Program resulting in a deferral of required loan borrowings and adjustments to loan repayments. - Adjustments to the Long-Term Financial Plan interest rate assumptions for future year internal and external loan borrowings. The budget adjustments to Council’s bottom line and reserves for the 10 years of the Long-Term Financial Plan have been included as an attachment. The General-Purpose Revenue saving of $482K for 2020/21 will be utilised to partly offset the reported deficit from the estimated financial impact from COVID-19. |

|

||

|

Sydney Office Lease |

($140K) |

Livestock Marketing Centre $140K |

Nil |

|

As resolved by Council at the 22 July 2019 Council meeting (CONF-7), Council resolved to enter into a one-year lease with two one year options with Property NSW (PNSW) for an office space in Sydney to accommodate specialist staff resources in the engineering and project management areas of Council. The one-year lease expired on 22 October 2020 and staff, through discussions with PNSW, have been able to continue utilising the current office space until a further lease agreement was enacted. The original space was shared with NSW Government, however these users are relocating. It is proposed to move the Council staff to a smaller office space within the same building in order to save costs. The new office space, whilst being a smaller footprint, will continue to meet Council’s needs for the lease period. PNSW have offered the new space for 12 months, and have waived the first three months rent. The Sydney based staff have indicated a clear preference to continue working from an office within the CBD, rather than alternative options such as working from home. The staff recruited in the Sydney office are of high quality and Council is starting to see the benefits of these appointments. For this reason, it is recommended that Council continue leasing space for at least the next 12 months. It is proposed to fund the one-year lease cost together with the estimated costs associated with moving office locations totalling $140K from the Livestock Marketing Centre, which has current capacity. |

|

||

|

4 – Our Identity and Sense of Place |

|||

|

Family Day Care Reserve |

($200K) |

Family Day Care Reserve $200K |

Nil |

|

Council’s Family Day Care operation ceased operation late in the 2019/20 financial year, with the final costs occurring early in the 2020/21 financial year. It is now appropriate to fully fund the final costs from the Reserve, which will now close the Reserve. |

|

||

|

5 – The Environment |

|||

|

Container Deposit Scheme Income |

$212K |

Solid Waste Reserve ($212K) |

Nil |

|

It is proposed to allocate a budget for the new Container Deposit Scheme (CDS) Income being received as part of Councils agreement with Kurrajong. Based on the $106K income received for the 3rd and 4th quarters of 2019/20 it is proposed to set the annual budget at $212K for 2020/21 and future years with the funds being transferred to the Solid Waste Reserve. Estimated Completion: N/A Job Consolidation: 70157 |

|

||

|

|

($482K) |

||

2020/21 Capital Works Summary

|

Approved Budget |

Proposed Movement |

Proposed Budget |

|

|

One-off |

$53,330,867 |

$0 |

$53,330,867 |

|

Recurrent |

$23,314,656 |

$0 |

$23,314,656 |

|

Pending |

$57,462,427 |

$0 |

$57,462,427 |

|

Total Capital Works |

$134,107,950 |

$0 |

$134,107,950 |

Current Restrictions

|

RESERVES SUMMARY |

|||||

|

31 OCTOBER 2020 |

|||||

|

|

CLOSING BALANCE 2019/20 |

ADOPTED RESERVE TRANSFERS 2020/21 |

BUDGET VARIATIONS APPROVED UP TO COUNCIL MEETING 26.10.2020 |

PROPOSED CHANGES for Council Resolution |

REVISED BALANCE |

|

|

|

|

|

|

|

|

Externally Restricted |

|

|

|

|

|

|

Developer Contributions - Section 7.11 |

(25,878,470) |

464,256 |

423,159 |

(1,905) |

(24,992,960) |

|

Developer Contributions - Section 7.12 |

402,380 |

(50,464) |

32,251 |

(15) |

384,152 |

|

Developer Contributions – S/Water DSP S64 |

(6,693,550) |

1,973,123 |

(448,446) |

(4) |

(5,168,877) |

|

Sewer Fund |

(25,992,570) |

582,604 |

(2,641,386) |

(44,721) |

(28,096,072) |

|

Solid Waste |

(22,421,037) |

9,163,583 |

402,407 |

(212,000) |

(13,067,047) |

|

Specific Purpose Grants |

(3,645,164) |

0 |

3,645,164 |

|

0 |

|

SRV Levee |

(4,953,842) |

(1,652,925) |

436,607 |

|

(6,170,160) |

|

Stormwater Levy |

(4,143,634) |

(200,921) |

589,036 |

|

(3,755,519) |

|

Total Externally Restricted |

(93,325,885) |

10,279,256 |

2,438,791 |

(258,645) |

(80,866,483) |

|

|

|

||||

|

Internally Restricted |

|

||||

|

Airport |

(324,921) |

(511,083) |

(110,216) |

(3,674) |

(949,894) |

|

Art Gallery |

(55,091) |

38,500 |

16,555 |

(36) |

|

|

Ashmont Community Facility |

(3,665) |

(1,500) |

0 |

(5,165) |

|

|

Bridge Replacement |

(568,093) |

236,972 |

31,121 |

(300,000) |

|

|

CBD Carparking Facilities |

(774,666) |

105,302 |

(105,302) |

(774,666) |

|

|

CCTV |

(91,109) |

18,000 |

0 |

(73,109) |

|

|

Cemetery Perpetual |

(241,401) |

(138,203) |

0 |

(379,603) |

|

|

Cemetery |