Agenda

and

Business Paper

To be held on

Monday 28

June 2021

at 6.00pm

Civic Centre cnr

Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

Agenda

and

Business Paper

To be held on

Monday 28

June 2021

at 6.00pm

Civic Centre cnr

Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 28 June 2021 at 6.00pm.

Council live streams video and audio of Council meetings. Members of the public are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

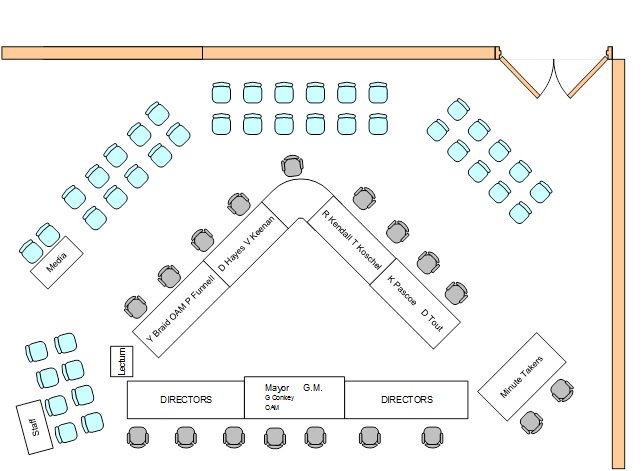

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 28 June 2021.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 28 June 2021

CLAUSE PRECIS PAGE

PRAYER 3

ACKNOWLEDGEMENT OF COUNTRY 3

APOLOGIES 3

Confirmation of Minutes

CM-1 Ordinary Council Meeting - 15 June 2021 3

DECLARATIONS OF INTEREST 3

Reports from Staff

RP-1 Review of Determination of Development Consent DA19/0575 for alterations and additions to an existing dwelling including double garage with attached workshop, 33 Best Street, Wagga Wagga 4

RP-2 DA21/0086 - 15 LOT SUBDIVISION - RIVERINA INTERMODAL FREIGHT AND LOGISTICS (RIFL) HUB 18

RP-3 Standard Instrument Local Environmental Plan - Secondary dwellings in rural zones 23

RP-4 CROWN LAND LICENCE - Lot 7323 DP 1157383, Lot 4&5 DP 248694 27

RP-5 PROPOSED COMMUNITY LICENCE AGREEMENT WITH BIDGEE DRAGONS WAGGA WAGGA INCOPORATED OVER PART LOT 1 IN DEPOSITED PLAN 1260459 AT NELSON DRIVE, LAKE ALBERT 29

RP-6 Petition - request to reseal Biroomba Lane between Edward Street and Morgan Street 33

RP-7 SALE OF LAND FOR UNPAID RATES 40

RP-8 FINANCIAL PERFORMANCE REPORT AS AT 31 MAY 2021 46

RP-9 SECTION 356 REQUESTS FOR FINANCIAL ASSISTANCE 97

RP-10 Integrated Planning and Reporting - Adoption of Documents 100

RP-11 RESOLUTIONS AND NOTICES OF MOTIONS REGISTERS 140

RP-12 RESPONSE TO QUESTIONS/BUSINESS WITH NOTICE 142

QUESTIONS/BUSINESS WITH NOTICE 144

Confidential Reports

CONF-1 RFT2021-15 TREE MAINTENANCE SERVICES 145

CONF-2 Narrung Street, BISTF and Kooringal Sewer Treatment Plants Operation - Negotiation of Extension of DBO Contract No. 12/2007 146

CONF-3 PROPOSED SALE OF COUNCIL PROPERTY - 34 JOHNSTON STREET, WAGGA WAGGA 147

CONF-4 EXPRESSIONS OF INTEREST - COMMERCIAL TENANCIES IN THE BOLTON PARK PRECINCT AND THE WIRADJURI GOLF CENTRE 148

PRAYER

CM-1 Ordinary Council Meeting - 15 June 2021

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 15 June 2021 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - Ordinary Council Meeting - 15 June 2021 |

149 |

|

Report submitted to the Ordinary Meeting of Council on Monday 28 June 2021 |

RP-1 |

RP-1 Review of Determination of Development Consent DA19/0575 for alterations and additions to an existing dwelling including double garage with attached workshop, 33 Best Street, Wagga Wagga

Author: Paul O’Brien

General Manager: Peter Thompson

|

Summary: |

The applicant has applied for a review of the determination of Development Consent DA19/0575 under Division 8.2 of the Environmental Planning and Assessment Act 1979. The application seeks a review of the decision to impose a condition of consent denying approval for the proposed garage/workshop fronting the rear laneway within the heritage conservation area.

This review has considered the proposed garage/workshop with regard to the current heritage provisions within Section 3.3.2 of the Wagga Wagga Development Control Plan 2010 (DCP 2010) and concludes that the original consent should be upheld. This report also contains an assessment based on the proposed amendments to these provisions, under draft Amendment No. 16, which has recently been placed on hold by Council, which concludes that the garage would be acceptable had this amendment been adopted.

Whilst the LSPS and the resulting draft DCP amendment is a matter for consideration under the public interest, the question of weighting that should be applied within the decision making process must be considered when compared to the current provisions of the DCP 2010.

The removal of the prescriptive standards for dimensions of the garage allows consideration of the size of the building on merits in line with the key outcomes identified in the LSPS and Draft DCP amendment. It is satisfied, through the application, that the proposed building will not have a detrimental impact within the conservation area with respect to the underlying objective of the controls to:

Minimise visual intrusion from garages and carports, and require structures to be located behind the building line.

The proposed garage is assessed as being compliant with relevant draft DCP controls under Section 3.3.2. Should Council propose to approve the development for the proposed garage/workshop fronting the rear laneway within the heritage conservation area an alternative recommendation and set of conditions is attached. |

|

That Council, following the Review of Determination under Division 8.2 of the Environmental Planning & Assessment Act 1979, uphold its original determination to approve DA18/0395 subject to conditions, including the retention of Condition C.23 as follows:

The proposed garage and attached workshop is not approved under this consent.

|

Development Application Details

|

Applicant |

Peter and Gail Kimpton |

|

Owner |

Gail Kimpton |

|

Development Cost |

$335,000 |

|

Development Description |

Additions to an existing dwelling including double garage with attached workshop |

Report

Key Issues

· Consent has been granted for alterations and additions to the dwelling, however a condition of the consent denies approval for the proposed garage/workshop building.

· Application lodged under Division 8.2 of the Environmental Planning and Assessment Act 1979 to review Councils determination of DA19/0575, specifically the decision to impose a condition denying consent for the proposed garage/workshop.

· Non-compliance of the garage/workshop building with the provisions of Section 3.3.2 of the Wagga Wagga Development Control Plan 2010 (DCP 2010) relating to garages in the heritage conservation area.

· Draft amendment to Section 3 of the DCP 2010 (Amendment No.16) and Council’s recent resolution to take no further action on this amendment and hold any further amendments to the DCP in relation to Heritage provisions.

· Weighting to be applied to the draft Amendment No. 16 with respect to the review of determination.

Assessment

Approval, subject to conditions, was granted for the proposed alterations and additions to the dwelling however the approval did not consent to the proposed double garage and workshop. The decision not to approve the garage/workshop was confirmed via the inclusion of a condition of consent (Condition C.23) as follows:

C.23 The proposed garage and attached workshop is not approved under this consent.

An application has now been lodged under Division 8.2 of the Environmental Planning and Assessment Act 1979 to review the decision to impose Condition C.23 denying consent for the proposed garage/workshop.

The applicant has elected to seek the review based on the original submitted plans and design for the garage/workshop building (i.e. no amendments have been made to the building as originally proposed). The applicant has provided written correspondence with their application supporting their proposition that Council should approve the garage/workshop building.

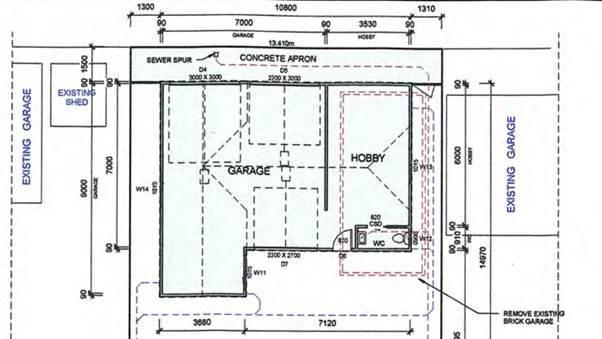

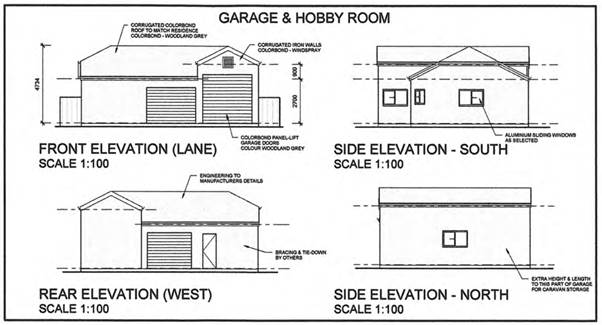

Extracts from the submitted plans detailing the proposed building and its key elements and dimensions are provided below for reference.

Notification Requirements for Reviews under Section 82

The original application (including the proposed garage/workshop) was notified to adjoining neighbours in accordance with the provisions of the DCP 2010. No submissions were received.

For Reviews of Determination, the DCP 2010 states that:

As a minimum, Section 82A applications to review a previously determined development application will require re-notification to those people who may have previously made submissions to the original application.

As no submissions were made, it was determined that re-notification was not necessary.

Original Assessment

The determination was supported by an assessment of the garage/workshop building under the relevant provisions of the Wagga Wagga Development Control Plan 2010, specifically Section 3.3.2 dealing with alterations and additions (including garages and carports) within the residential precinct of the heritage conservation area. The following is an overview of the officer’s assessment of the proposal:

The proposal also makes provision for a double garage with a hobby room to be accessed Biroomba Lane. The garage and hobby room will be constructed of Colourbond. C4 requires double garages to be a maximum of 6 metres wide and 7.5 metres long with the walls 2.4 metres high rising to an apex of 3.9 metres. The proposed garage is in two sections with one bay being a total of 9 metres in length whilst the other bay and hobby room are a total of 7 metres in length. The walls are a minimum of 2.7 metres high and rising to 3.5 metres. The structure is 4.7 metres in height. As such a variation is sought. Written justification was provided by the applicant at the time of lodgement. The justification states “that rear lanes consist of a mix of everything from small rusty sheds to full width brick garages and two storey structures with secondary dwellings”. Questions were raised over the legitimacy of two storey secondary dwellings in regards to the objectives of the Conservation Area and that in allowing two storey structures indicates that the rear lanes are of no importance. An argument was made “that harsh restrictions are not serving any great purpose and that the current theme is no theme at all which at the end of the day does it really matter”. The applicant did state that lifestyles have changed dramatically since these houses were built and that the garage is needed to provide secure storage for the occupant’s possessions. A list of photos demonstrating the non-compliant structures within the laneway were also provided.

Variations are considered in terms of impact, nature and magnitude of the departure, the degree of compliance with other controls and objectives, whether the particular control is unreasonable or unnecessary, whether non-compliance will prejudice the objectives of the zone and the aims of the DCP and any matters of consideration with Section 4.15 of the Environmental Planning and Assessment Act 1979.

Whilst the above justification does raise some valid points in regards to secondary dwellings and character of the laneway. The DCP is a community adopted document that controls development within the Local Government Area. The current DCP was adopted in 2010 with specific controls for the Conservation Area to address concerns raised over the built form within the Heritage Conservation Area. To use other structures within the laneway especially those built prior to the adoption of current controls would not be conducive to what the community identified as an acceptable built form within the Conservation Area. Councils consistent practice post 2010 has been to accept small variations to double garages and allowing open skillion roof carports and workshops that have been articulated from the primary form of the double garage. The subject development offers no articulation to the laneway side as such it would be inconsistent with Council’s current practice to support such a variation and would result in the controls no longer being of any relevance. In addition, as stated previously the applicant did receive advice from Council’s Heritage Advisor. The advisor was given plans for the garage that were 11m x 8m, the Advisor did note that this would not be supported. The submitted plans have been shown to the Heritage Advisor for further comment, the Advisor did not support the revised plans. The proposed garage and workshop is therefore not supported.

As identified, the assessment concluded that the variation sort with respect to the numerical controls under Section 3.3.2 were unreasonable and unjustified having regard to the objectives of this section of the DCP 2010. The assessment recommended that the garage/workshop building not be approved and that this restriction be imposed via a recommended condition of consent. This recommendation was adopted in the notice of determination issued.

Review of Assessment

The following table provides a summary of the applicable controls under Section 3.3.2 of the DCP 2010. As identified in the original assessment and confirmed in the table below, the development as proposed fails to meet all or the numerical controls that govern the scale of the garage under Control C4.

|

Assessment under current controls for garages - Section 3.3.2 (DCP 2010) |

|||

|

DCP Control |

DCP Requirement |

Proposed |

Complies |

|

C1 |

Where possible, car access should be from a rear lane.

|

Rear lane access proposed |

Yes |

|

C2 |

Where no rear lane access is available locate the garage or carport behind the building line, or preferably to the rear of the property.

Alterations that require removal of original features on a front elevation or require demolition of significant building fabric to enable car access will not be supported.

|

N/A – rear lane access available

No demolition or removal of significant fabric proposed. |

Yes

Yes |

|

C3 |

Materials are to be compatible with the materials of the main building. Any detailing is to be subservient to the detailing or decorative features of the main building.

|

Materials will not be inconsistent. Main dwelling contains no significant detailing or decorative features. |

Yes |

|

C4 |

Max size of garages:

Single garage – 3000mm wide x 7500mm long, 2400mm walls, 27 degree roof pitch rising to an apex 3400mm high. Garage roller door 2600mm wide.

Double garage – · 6000mm wide · 7500mm long · 2400mm walls · 27 degree roof pitch · rising to apex 3900mm high · Two roller doors 2600mm wide in 3 equal wall bays

Roof pitch 27 degrees (quarter pitch) or steeper to match the roof pitch of the house. Roof pitches can be broken with a 10 to 12.5 degree pitch verandah skillion.

|

N/A

· 10800mm wide · 9000mm long · 3600mm walls · 270 · 4734mm apex · Two doors 3000mm wide each

270

|

N/A

No No No Yes No No

Yes

|

|

C5 |

Specifications:

Walls can be in Custom Orb corrugated metal, weatherboards, fibre cement sheet or face brick

Galvanised corrugated metal roof preferred rather than Zincalume.

Roll barge and roll top.

Gutters are to be quad or ogee profile and galvanised.

|

Corrugated metal walls

Corrugated metal roof (Colorbond)

Unspecified

Unspecified |

Yes

Yes

To be conditioned To be conditioned

|

|

C6 |

Doors may be tilt doors of a simple design and neutral colour. Roller doors may be considered on merit.

|

2 x roller doors |

Roller doors non-compliant with C4

|

The numerical controls under C4 are specified to support the attainment of the objective of this part of the DCP 2010 which is to minimise the visual intrusion of garages and to establish parameters for the proportion and detailing of garages. Given that the variations to these parameters are significant and are beyond any minor variations that Council has previously supported in relation to other similar proposals, it is satisfied that the conclusion and recommendation provided in the original assessment is sound.

Proposed Amendments to Section 3 of DCP 2010

Council is in the process of considering a draft amendment to provisions of Section 3 of DCP 2010 (Amendment No. 16) relating to heritage conservation. The intent of the draft DCP Amendment is to better direct development outcomes in line with Council’s identified strategic needs as detailed in the Wagga Wagga Local Strategic Planning Statement (LSPS).

The LSPS identifies the need for housing diversity and infill development in Central Wagga Wagga which includes significant identified attributes of the Conservation Area. Heritage streetscapes and character features are to remain intact and predominantly at the frontage of properties throughout the Conservation Area. The draft amendment to the DCP would allow well-designed extensions, secondary dwellings and other outbuildings and amenities, up to two storeys, recessed to the rear of heritage dwellings.

The key outcomes of the amendment include:

· a framework for buildings and property to be updated to meet contemporary living expectations:

· an appropriate standard of design quality and presentation in the Conservation Area

· provide and incentivise reinvestment into heritage properties and their upkeep

· retain significant character dwellings and streetscape features to property frontages; and

· provide further variety in living options that are not typical of other segments and locations within the local housing market.

In line with these outcomes, the amendment seeks to provide opportunity for further development to the rear of conservation area properties including development fronting affected laneways. Specific amendments are proposed to the controls relating to garages within the conservation area contained at Section 3.3.2. The following image provides a summary of the changes proposed in the amendment for Section 3.3.2. The primary intent of the amendments is to remove the prescriptive standards for dimensions of the garage and to allow consideration of the size of the building on merits in line with the key outcomes identified above.

|

Proposed amendments to Section 3.3.2 of DCP 2010 |

|

Controls

C2 Where lanes exist with vehicular access to the rear of the property; driveways, crossings and garages are not to be provided on the primary street frontage. C3 Where no rear lane access is available locate the garage or carport behind the building line, or preferably to the rear of the property. Alterations that require removal of original features on a front elevation or require demolition of significant building fabric to enable car access will not be supported. C4 Materials are to be compatible with the materials of the main building. Any detailing is to be subservient to the detailing or decorative features of the main building.

C7

C8 The scale or size of the carport, garage or shed should not dominate the main house. C9 Where metal is used in buildings and fences, corrugated profile is preferred. Contemporary ribbed profiles are inappropriate (Trimdek, etc.). Other profiles may be appropriate subject to heritage advice. Galvanised or monochrome matt finishes are preferred finishes. C10 Contemporary downpipe and guttering profiles (when not part of modern design), PVC products, contrast coloured & decorated garage doors are inappropriate. Timber frame windows and tilt panel garage doors are preferred.

|

The proposed amendment to Section 3 (including the amendments identified above) was considered by Council at its meeting of 26 April 2021. Council resolved to

a note the outcomes of the public exhibition of draft DCP Amendment No.16

and

take no further action on this amendment and hold any further amendments to the DCP in relation to Heritage provisions, pending completion of a review as part of the CBD Master Plan

Whilst Council has elected to defer its consideration of any amendments to the heritage provisions of the DCP, the intended outcomes of the amendment remain a strategic direction under the adopted LSPS. The strategic direction of the LSPS is a matter of public interest and for this reason should be given consideration with regard to the review of the subject determination.

The following is an assessment of the proposed development in regard to the key outcomes of the draft DCP amendment and also in regard to the proposed amendments to the controls for garages under Section 3.3.2.

|

Assessment against key outcomes of the draft DCP amendment |

|

|

Outcome |

Comment |

|

a framework for buildings and property to be updated to meet contemporary living expectations

|

The development is consistent with pattern of development occurring within the residential section of the conservation area which is reflective of the desire for larger garaging and storage opportunities. Landowners are seeking secure parking/storage and larger floorspace to provide flexibility in use including other activities such as workshops, studio spaces and storage of recreational items and equipment.

|

|

an appropriate standard of design quality and presentation in the Conservation Area

|

Proposed colours, materials and profiles are acceptable and consistent with those represented throughout the adjoining laneway and other laneways within the conservation area.

|

|

provide and incentivise reinvestment into heritage properties and their upkeep

|

Improved development opportunities to the rear of the property will promote investment in the renovation and upkeep of the primary building (the dwelling) on the site and the ongoing preservation of the primary streetscape. This is reflective of the overall development proposed under this application which includes substantial improvements to the existing dwelling and its presentation to Best Street. |

|

retain significant character dwellings and streetscape features to property frontages

|

The existing dwelling is not a contributory building within the Best Street streetscape and contains no significant detailing or decorative features. Despite this, the development proposes renovation to the dwelling which will improve its streetscape appeal including new fencing and landscaping.

|

|

provide further variety in living options that are not typical of other segments and locations within the local housing market.

|

The development does not propose an alternate living option, however will maintain an the existing single detached dwelling. |

|

Conclusion:

The development is consistent with the strategic direction offered by the LSPS and the key outcomes of the supporting draft DCP amendment.

|

|

|

Assessment against proposed amendments to controls for garages - Section 3.3.2 (DCP 2010) |

|||

|

DCP Control |

Proposed DCP Requirement |

Proposed |

Complies |

|

C… |

Where lanes exist…garages are not to be provided on the primary street frontage

|

Garage proposed on laneway |

Yes |

|

C… |

Where no rear lane access is available locate the garage or carport behind the building line, or preferably to the rear of the property.

Alterations that require removal of original features on a front elevation or require demolition of significant building fabric to enable car access will not be supported.

|

N/A – rear lane access available

No demolition or removal of significant fabric proposed. |

Yes

Yes |

|

C… |

Materials are to be compatible with the materials of the main building. Any detailing is to be subservient to the detailing or decorative features of the main building.

|

Materials will not be inconsistent. Main dwelling contains no significant detailing or decorative features.

|

Yes |

|

C… |

The scale or size of the… garage… shall not dominate the main house at the front elevation.

|

The garage will not be visible from Best Street. |

Yes |

|

C… |

Where metal is used in building and fences, corrugated profile is preferred… Galvanised or monochrome finishes are preferred…

|

Monochrome corrugated metal sheeting proposed for roof and walls. |

Yes |

|

C… |

Contemporary downpipes and gutter profiles…, PVC products, contrast coloured and decorated garage doors, are inappropriate.

Timber framed windows and tilt panel garage doors are proposed. |

Unspecified

Aluminium windows proposed. |

Profiles to be conditioned

Windows not visible externally to site

Roller doors satisfactory

|

|

Conclusion:

The removal of the prescriptive standards for dimensions of the garage allow consideration of the size of the building on merits in line with the key outcomes identified above. It is satisfied that the proposed building will not have a detrimental impact within the conservation area with respect to the underlying objective of the controls to:

Minimise visual intrusion from garages and carports, and require structures to be located behind the building line.

The proposed garage is compliant with relevant draft DCP controls under Section 3.3.2.

|

|||

Whilst the LSPS and the resulting draft DCP amendment is a matter for consideration under the public interest, the question of weighting that should be applied within the decision making process must be considered when compared to the current provisions of the DCP 2010.

The fact that the Council has made a clear and recent decision to defer the amendment to Section 3 of the DCP 2010 clarifies that it has in no way endorsed these proposed amendments and that minimal weight should be given to their application. The current provisions of Section 3.3.2 relating to garages remain the primary position of the Council with respect to the assessment of development proposed within the Conservation Area. As identified earlier in this report the variations to these controls are significant and are beyond any minor variations that Council has previously supported in relation to other similar proposals.

Having regard to the current provisions of the DCP 2010 and the status of the proposed amendment, it is satisfied that the conclusion and recommendation provided in the original assessment is sound.

Recommendation

That the Wagga Wagga City Council, following the Review of Determination under Division 8.2 of the Environmental Planning & Assessment Act 1979, uphold its original determination to approve DA18/0395 subject to conditions, including the retention of Condition C.23 as follows:

The proposed garage and attached workshop is not approved under this consent.

Reasons for Decision

1. The proposed development (garage/workshop) is not consistent with the controls of Section 3.3.2 of the Wagga Wagga Development Control Plan 2010.

2. The variations sort with respect to the numerical controls under Section 3.3.2 are unreasonable and unjustified having regard to the objectives of this section of the Wagga Wagga Development Control Plan 2010.

3. Whilst the development is compliant with amendments proposed to Section 3.3.2 of the Wagga Wagga Development Control Plan 2010 (draft Amendment No. 16), the draft amendments do not hold sufficient weight to justify a departure from the current provisions of the DCP 2010 and an alternate determination of the application.

Site Location

The subject site is legally known as Lot 1 DP916119 located at 33 Best Street, Wagga Wagga. The subject site is within the Heritage Conservation Area, on the eastern side of Best Street, approximately 85 metres from the intersection of Best and Morgan Streets.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

A decision to uphold the original determination of the application (DA19/0575) is not considered to raise risk management issues for Council as the original decision is generally consistent with LEP and DCP controls.

Internal / External Consultation

Notification is not required for this review under the provisions of the Wagga wagga Development Control Plan 2010. See discussion in relation to ‘Notification Requirements for Reviews under Section 82’ within the assessment section of this report above.

|

1. |

Redacted Plans - DA19/0575 - Provided under separate cover |

|

|

2. |

Supporting documentation for review of DA19/0575 - Provided under separate cover |

|

|

3. |

Original 4.15 Assessment Report for DA19/0575 - Provided under separate cover |

|

|

4. |

original notice of Determination of DA19/0575 - Provided under separate cover |

|

|

5. |

Alternate resolution and amended conditions subject to change in determination for DA19/0575 - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 28 June 2021 |

RP-2 |

RP-2 DA21/0086 - 15 LOT SUBDIVISION - RIVERINA INTERMODAL FREIGHT AND LOGISTICS (RIFL) HUB

Author: Paul O’Brien

General Manager: Peter Thompson

|

Summary: |

The report is for a Development Application and is presented to Council for determination. The Application has been referred to Council for public interest reasons, as Council is both the landowner/proponent and Consent Authority.

The vast majority of the works at the Riverina Intermodal Freight and Logistics (RIFL) Hub, including the associated industrial subdivision, are being carried out as ‘development without consent’, under State Environmental Planning Policy (Infrastructure) 2007, which permits public authorities, such as Council, to carry out a range of works without development consent.

This Development Application is for the balance of the works not able to be carried out as ‘development without consent’, being a 15 lot Torrens Title subdivision, the dedication of two reserves, the construction of a public road to service the development, and individual service connections to each lot.

A full assessment of the Development Application is contained within the attached Section 4.15 Assessment Report carried out by Council staff. An independent third-party peer review of the Assessment Report was commissioned and is also attached. The peer review concurred with the Assessment Report carried out by staff and supported the recommended conditions of consent.

|

|

That Council approve DA21/0086 for a 15 Lot Subdivision at the Riverina Intermodal Freight and Logistics Hub, 177 Merino Drive and Dampier Street, Bomen, subject to the conditions outlined in the Section 4.15 Assessment Report. |

Development Application Details

|

Applicant |

Wagga Wagga City Council |

|

Owner |

Wagga Wagga City Council |

|

Development Cost |

$4,150,000 |

|

Development Description |

15 Lot Subdivision |

Report

Key Issues

Council is both the landowner/proponent and Consent Authority for this Development Application.

Submissions were received from a range of public authorities.

Site Location

The site is located on the western side of the Main Southern Railway, south of Trahairs Road. The majority of the land also lies north-east of Merino Drive, however a small part of the development site is located to the east of Dorset Dr and south-west of Merino Drive.

Assessment

The Development Application is for a 15 Lot Torrens Title industrial subdivision associated with the Riverina Freight and Logistics (RIFL) Hub. Also proposed is the dedication of two reserves. Works proposed are the construction of a road to service development and individual service connections to each lot. The proposed lots range in size from approximately 2.5 hectares to 28 hectares.

All other works associated with the Development Application are being carried out as ‘development without consent’, under State Environmental Planning Policy (Infrastructure) 2007, which permits public authorities, such as Council, to carry out a range of works without development consent. The impacts of these works considered under Part 5 of the Environmental Planning and Assessment Act 1979 via a Review of Environmental Factors (REF). These works include:

· Construction of the RIFL access road,

· Enabling subdivision works including bulk earthworks,

· Vegetation removal,

· Trunk service provision,

· Stormwater drainage,

· Relocation of 132kV power lines,

· A 5.8km master siding, and

· Construction of the RIFL Intermodal Terminal.

The site is located within an area that has been investigated to form the Wagga Wagga Special Activation Precinct (SAP). The SAP recognises the strategic importance of the Bomen area, with its strong transport linkages and proximity to major infrastructure. A range of technical documents have been prepared and a Master Plan endorsed. The SAP would permit a range of uses to be carried out as Complying Development within the area, subject to compliance with relevant planning documents, including a Master Plan and Delivery Plan. For the land to be within the SAP, State Environmental Planning Policy (Activation Precincts) 2020 would need to be amended to include the land associated with the proposed SAP. Amendments to this effect have been published, but are not proposed to take force until 31 December 2021.

No significant issues of concern were identified in the assessment of the Development Application. Submissions were received from a number of public authorities, being APA Gas, Essential Energy, Riverina Water, Riverina Local Land Services, the NSW Department of Planning, Industry and Environment, and Regional Growth NSW Development Corporation. Key points from these submissions are as follows:

NSW Department of Planning Industry and Environment

DPIE determined that the development is consistent with the proposed Master Plan for the precinct and the SEPP Amendment.

Regional Growth NSW Development Corporation.

RGDC requested that conditions of consent requiring the provision of a shared pathway and the provision of landscaping (including street trees) within the development be imposed.

Riverina Local Land Services

Advised that they had no objection to the development, “providing safe and adequate access and freedom of stock movement is maintained for livestock coming to and exiting from the Bomen Saleyards complex.”

The matters raised by these submissions are addressed in detail in the attached Section 4.15 Assessment Report.

As Council is both the proponent/landowner and the Consent Authority, an independent third-party peer review of the Assessment Report prepared by staff was commissioned and is attached. The peer review concurred with the Assessment Report carried out by staff and supported the recommended conditions of consent.

Reasons for Approval

1. The proposed development is generally consistent with the provisions of the Wagga Wagga Local Environmental Plan 2010, the Wagga Wagga Development Control Plan 2010, and relevant State Environmental Planning Policies.

2. Impacts of the proposed development are considered acceptable.

3. Matters raised in submissions have been considered, and where appropriate, conditions of consent have been recommended.

4. The site is suitable for the proposed development, and the development is considered to be in the public interest.

Financial Implications

N/A

Policy

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

Approval of the application is not considered to raise risk management issues for Council as the proposed development is generally consistent with LEP and DCP controls.

Internal / External Consultation

Full details of the consultation that was carried out as part of the development application assessment is contained in the attached s4.15 Report.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

x |

|

x |

|

|

|

|

|

|

|

x |

|

||||

|

Involve |

|

|

|

|

|

|

|

|

|||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

DA21/0086 - Section 4.15 Assessment Report - Provided under separate cover |

|

|

2. |

DA21/0086 - Peer Review Report - Provided under separate cover |

|

|

3. |

DA21/0086 - Plans - Provided under separate cover |

|

|

4. |

DA21/0086 - Statement of Environmental Effects - Provided under separate cover |

|

|

5. |

DA21/0086 - Submission from Public Authorities - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 28 June 2021 |

RP-3 |

RP-3 Standard Instrument Local Environmental Plan - Secondary dwellings in rural zones

Author: Adam Wood

Director: Michael Keys

|

Summary: |

The NSW Government implemented changes to provisions in all LEPs concerning secondary dwellings in December 2020. This meant that provisions for secondary dwellings no longer applied in rural zones.

Department of Planning, Industry and Environment has now revised the provisions and Council’s can elect to opt-in to LEP provisions which re-establish controls for secondary dwellings in rural zones. This would be implemented by the Department without the need for a planning proposal to be conducted by Council. It is recommended that Council take the opportunity offered by the Department. |

|

That Council: a note the reforms made and being made to the Standard Instrument Local Environmental Plan in respect to secondary dwellings. b include optional Clause 5.5 of the Standard Instrument LEP in the Wagga Wagga LEP and notify the NSW Department of Planning, Industry and Environment of Council’s decision to ‘opt-in’. c specify development standards within Clause 5.5 of the Wagga Wagga Local Environmental Plan that continue the effect of Council’s development standards for secondary dwellings in rural zones prior to December 2020. |

Report

In December 2020 the NSW Government made changes to housing-related policies. These changes included amendments to the Standard Instrument Local Environmental Plan 2006, which were applied to all LEPs including the Wagga Wagga Local Environmental Plan.

This change updated the wording of Clause 5.4(9) of LEPs which relates to secondary dwellings. As a result, Clause 5.4(9) only applied to secondary dwellings on land other than in a rural zone. Before the change in December, Clause 5.4(9) included secondary dwellings in all locations in the Local Government Area, including rural zones. Clause 5.4(9) had applied a 60 square metre or 33%-of-principal-dwelling size limit since July 2011.

Wagga Wagga LEP Clause 5.4(9) prior to December 2020:

(9) Secondary dwellings If development for the purposes of a secondary dwelling is permitted under this Plan, the total floor area of the dwelling (excluding any area used for parking) must not exceed whichever of the following is the greater:

(a) 60 square metres,

(b) 33% of the total floor area of the principal dwelling.

Wagga Wagga LEP Clause 5.4(9) at present:

(9) Secondary dwellings on land other than land in a rural zone If development for the purposes of a secondary dwelling is permitted under this Plan on land other than land in a rural zone, the total floor area of the dwelling, excluding any area used for parking, must not exceed whichever of the following is the greater—

(a) 60 square metres,

(b) 33% of the total floor area of the principal dwelling.

The NSW Government amendments also introduced a new optional provision, Clause 5.5 of the Standard Instrument LEP 2006. If incorporated into the Wagga Wagga LEP, Clause 5.5 provides Council with the discretion to set a maximum size for secondary dwellings in a rural zone as well as set the maximum distance a secondary dwelling in a rural zone can be located from the principal dwelling on the property.

Standard Instrument LEP base version of Clause 5.5:

5.5 Controls relating to secondary dwellings on land in a rural zone [optional]

If development for the purposes of a secondary dwelling is permitted under this Plan on land in a rural zone—

(a) the total floor area of the dwelling, excluding any area used for parking, must not exceed whichever of the following is the greater—

(i) [insert number] square metres,

(ii) [insert number]% of the total floor area of the principal dwelling, and

(b) the distance between the secondary dwelling and the principal dwelling must not exceed [insert number] metres.

Direction—

This clause may also be adopted without paragraph (a) or without paragraph (b).

At present the Wagga Wagga LEP does not feature a version of Clause 5.5. This means that LEP controls relating to the size of secondary dwellings do not apply to secondary dwellings in rural zones.

The NSW Department of Planning, Industry and Environment is currently providing Councils with the opportunity to ‘opt-in’ to Clause 5.5 of the Standard Instrument LEP and to amend Council’s LEP without the requirement for Council to conduct a planning proposal. If Council elects to opt-in, it can specify the development standard to apply within the clause. It is proposed that Council would elect to adopt the same standards that applied to rural dwellings prior to December 2020. This would mean that Council specifies a maximum floor area but would not choose to incorporate any control governing the distance that a secondary dwelling can be located from the primary dwelling.

Suggested version of Clause 5.5 for implementation in the Wagga Wagga LEP:

5.5 Controls relating to secondary dwellings on land in a rural zone

If development for the purposes of a secondary dwelling is permitted under this Plan on land in a rural zone—

(a) the total floor area of the dwelling, excluding any area used for parking, must not exceed whichever of the following is the greater—

(i) 60 square metres,

(ii) 33% of the total floor area of the principal dwelling,

Financial Implications

The amendment process is to be implemented by the Department of Planning, Industry and Environment. No significant financial implications have been identified in relation to this matter.

Policy and Legislation

Environmental Planning and Assessment Act 1979

Standard Instrument Local Environmental Plan 2006

Wagga Wagga Local Environmental Plan 2010

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have housing that suits our needs

Risk Management Issues for Council

With the Department’s changes implemented December 2020, the Wagga Wagga LEP does not contain development standards for secondary dwellings in rural zones. This presents greater risk relative to the previous situation, whereby secondary dwelling permissibility in rural zones could now be utilised to seek approval for development proposals that are not in keeping with Council’s intent or anticipated outcome for this kind of development, or aligned with what has been the accepted practice for this type of development in the Wagga Wagga Local Government Area for the past decade.

The standard LEP clause reflects Council’s previous position and re-establishes consistency with other zones in the Wagga LEP 2010.

Internal / External Consultation

The new Standard Instrument LEP clause is consistent with previous consultation and ongoing operation in Wagga Wagga LGA. There is no further requirement for engagement activities on Council’s part as the Department is administering these changes to LEPs.

|

Report submitted to the Ordinary Meeting of Council on Monday 28 June 2021 |

RP-4 |

RP-4 CROWN LAND LICENCE - Lot 7323 DP 1157383, Lot 4&5 DP 248694

Author: Ben Creighton

Director: Michael Keys

|

Summary: |

Council is required to enter into a Crown Land Licence to facilitate electrical transmission works associated with the Pomingalarna Multi-Sport Cycling Complex. |

|

That Council: a endorse entering a Crown Land Licence for part of Lot 7323 DP1157383, Lot 4&5 DP 248694 b authorise the affixing of Council’s Common Seal to all relevant documents as required |

Report

At the Ordinary Meeting of Council held 10 August 2020 it was resolved:

That Council:

a proceed with the compulsory acquisition of the land described as Lots 1 & 3 DP1260671 and Lot 5 DP 248694 for public road in accordance with the provisions of the Land Acquisition (Just Terms Compensation) Act 1991

b make application to the Minister and the Governor for approval to acquire Lots 1 & 3 DP1260671 and Lot 5 DP 248694 by compulsory process for public road under section 177 of the Roads Act 1993

c pay compensation to all interest holders entitled to compensation by virtue of the compulsory acquisition on the terms set out in the Land Acquisition (Just Terms Compensation) Act 1991

d agree that all minerals are exempt from the acquisition of Lots as Lots 1 & 3 DP1260671 and Lot 5 DP 248694

e delegate authority to the General Manager or their delegate to take each further step necessary to obtain approval from the Minister, the Governor or any public authority as may be necessary, and take all actions as may be necessary, to give notices and otherwise carry out the acquisition by means of compulsory acquisition

f following receipt of the Governors approval, give effect to the acquisition by publication of an Acquisition Notice in the NSW Government Gazette and such other publication as may be required by law

g approve the budget variation as detailed in the Financial Implications section of the report

In response to this resolution Staff have commenced the compulsory acquisition process however no timeline has been provided for the finalisation of this acquisition and previous similar acquisitions have taken in excess of 12 months.

As a component of the Pomingalarna Multi-Sport Cycling Complex project, Council’s contractor is required to construct new electrical transmission lines into the facility. These works require landowners’ consent and the establishment of electrical easements.

Given staff are still undertaking the acquisition process, Council is required to enter into a licence agreement with the Crown to facilitate these works. Staff have undertaken discussions with Crown Lands and have now received an offer of a Crown Land licence to allow the required works to be undertaken.

Financial Implications

The cost of the licence will be $512 annually and subject to CPI Increases. This licence will be funded from the Pomingalarna Multi-Sport Cycling Complex project budget. Once Council’s acquisition of the land is complete this licence will be terminated.

Policy and Legislation

Roads Act 1993

Land Acquisition (Just Terms Compensation) Act 1991

Crown Land Management Act 2016

Link to Strategic Plan

Growing Economy

Objective: There is growing investment in our Community

Outcome: There is government investment to develop our community

Risk Management Issues for Council

The risks associated with implementing this project relate to process, cost, environmental, WHS and contractor performance. These risks are addressed as part of the Council’s project management and contractor performance management systems.

Internal / External Consultation

Council’s City Strategy Division

Council’s Commercial Operations Directorate (Project Management Office)

NSW Department of Industry – Crown Lands

|

Report submitted to the Ordinary Meeting of Council on Monday 28 June 2021 |

RP-5 |

RP-5 PROPOSED COMMUNITY LICENCE AGREEMENT WITH BIDGEE DRAGONS WAGGA WAGGA INCOPORATED OVER PART LOT 1 IN DEPOSITED PLAN 1260459 AT NELSON DRIVE, LAKE ALBERT

Author: David Bolton

Director: Michael Keys

|

Summary: |

This report provides for the variation of existing resolution to enter into a licence agreement with Bidgee Dragons Wagga Wagga Incorporated following boundary adjustment of lands. |

|

That Council: a delegate authority to the General Manager, or their delegate to negotiate and enter into a community licence agreement with Bidgee Dragons Incorporated of part Lot 1 in DP 1260459 at Nelson Drive, Lake Albert within the parameters outlined in the body of this report b authorise the General Manager, or their delegate to complete and execute any necessary documents on behalf of the Council c authorise the affixing of Council’s common seal to all relevant documents as required |

Report

This report provides for the variation of existing resolution to enter into a licence agreement with Bidgee Dragons Wagga Wagga Incorporated following subdivision and boundary adjustment of lands.

Council resolved in April 2018 (Resolution 18/120) as follows: -

That Council:

a. Enter into a licence agreement with NSW Department of Industry – Crown Lands for the purpose of enabling construction of a boatshed on land at Lot 185 DP 757246 and Lot 7003 DP 1049748 at Lake Albert.

b. Apply to Department of Primary Industries – Crown Lands and Water Divisions for appointment as Trust managers for a portion of Lot 185 DP 757246.

c. Upon appointment as trustees enter into a Crown Lands Crown Reserve community licence agreement with Bidgee Dragons Incorporated for the use and occupation of the boatshed upon the following terms:-

i. Property – part Lot 185 DP 757246 and part Lot 7003 DP 1049748 at Lake Albert

ii. Duration – 5 years

iii. Licence Fee – in accordance with Council’s minimum community licensing fee as per the adopted Revenue and Pricing Policy in force at the time of the agreement commencement.

d. Delegate authority to the General Manager or their delegate to execute any necessary documents, under seal if required.

e. Approve the budget variation/s as detailed in the budget section of the report.

It was a condition of the Licence Agreement entered into with Crown Lands by Wagga Wagga City Council referred to in Paragraph a. of Resolution 18/120 that the boundaries of the reserve managed by Wagga Wagga City Council be amended to accommodate the boat shed. The boundary adjustment has been completed, resulting in the creation of two new titles – the reserve managed by Scouts Australia (which has been reduced), and the reserve managed by Wagga Wagga City Council as Crown Land Manager (which incorporates the additional area for the boat shed.)

The boatshed has now been constructed, and Council wishes to formalise the occupation of the boatshed by Bidgee Dragons Incorporated by entering into a formal community licence agreement in accordance with Paragraph c. of Resolution 18/120. A copy of the new location plan is now attached.

Given the change in the title particulars of the affected lands, it is recommended that Council provide a further resolution delegating authority to the General Manager, or their delegate to enter into a Community Licence Agreement with Bidgee Dragons Incorporated reflecting the amended title particulars.

Financial Implications

Rent and occupation fees will be charged as per Council’s adopted Revenue and Pricing Policy as at the date of the Agreement (currently the Council’s minimum community rent for the 2020/21 financial year is $690 per annum including GST). The total rent received is included in Council’s annual operating income budget.

Policy and Legislation

Leasing and Licensing Policy 038

Crown Land Management Act 2016

Local Government Act 1993

Link to Strategic Plan

Safe and Healthy Community

Objective: We promote a healthy lifestyle

Outcome: We promote participation across a variety of sports and recreation

Risk Management Issues for Council

N/A

Internal / External Consultation

Public notification of proposed agreement concerning Council community land and Crown Land managed under the Local government Act 1993 is required as outlined below. Direct consultation with Native Title Interests and Aboriginal Land Claimants may also be required in the case of Crown Land.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

x |

|

x |

|

|

|

|

|

|

|

|

|||||

|

1⇩. |

Location Plan |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 28 June 2021 |

RP-6 |

RP-6 Petition - request to reseal Biroomba Lane between Edward Street and Morgan Street

Author: Warren Faulkner

|

Summary: |

Council received a petition on 8 May 2021 from 28 signatories residing on Best Street and Peter Street located between Edward Street and Morgan Street, Wagga Wagga requesting that a high priority be given to resurfacing the rear laneway that services these properties. |

|

That Council: a receive and note the petition b note the action in the 2021 Operational Plan to develop a laneway upgrade program for Central Wagga Wagga c include the renewal of the wearing course on Biroomba Lane between Edward Street and Morgan Street in the 2021/22 resealing program d request staff advise the petition contact person of Council’s determination in accordance with Council’s Petition Policy (POL 086) |

Report

Background

A petition was received by Council on 8 May 2021 requesting that Council assign a high priority to carrying out the necessary pavement repairs and then resurfacing to the section of Biroomba Lane between Morgan Street and Edward Street (the Sturt Highway). The petition is provided as part of the attachments.

The petition was submitted by Mr Colin Noye who is the contact person for the petition. In accordance with the Petitions Management Policy POL086, a letter acknowledging the receipt of the petition was sent to Mr Noye. A copy of the letter is provided as part of the attachments.

Comment

Biroomba Lane runs in a north/south direction between Edward Street and Sheppard Street as a rear lane to properties fronting Peter and Best Streets in central Wagga Wagga. The lane is bitumen sealed for its entire length and is broken into four blocks because it intersects Morgan, Forsyth and Tompson Streets. Three of the four blocks are kerb and guttered on the eastern side with the formation of the laneway being one-way cross fall to the gutter where the kerb and guttering exists. There is minimal underground (minor) stormwater infrastructure in the lane as part of the kerb and guttering. Each block of the laneway contains a 150 diameter sewer reticulation pipe that services each property on either side of it as well as a 300 diameter sewer main that conveys sewerage from the north-east area of Turvey Park to the Sewer Pump Station in Sheppard Street. Overhead electricity also runs along the street with streetlights intermittently provided on the poles.

The pavement in the block that the petition is concerning is in fair to good condition, the wearing course (bitumen seal) is in fair condition and the kerb and guttering as well as the sewer reticulation is in good condition.

Hence, because the laneway is kerb and guttered and sealed with underground infrastructure in good condition, it is timely that some minor patching works is undertaken and the wearing course renewed by resurfacing to prevent the laneway from slipping into major rehabilitation works and costing considerably more to provide a satisfactory level of service. It is estimated that the cost to resurface the lane between the Sturt Highway and Morgan Street, including some minor patching is $11,000. It is therefore recommended that this section of Biroomba Lane be included in the 2021/22 resurfacing program.

However, it should be noted that a significant issue leading to the deteriorating condition of the road pavement in the laneway is the number of sheds on the western side of the lane that discharge rainwater from their roof directly onto and across the pavement to the kerb and gutter on the eastern side of the lane. This excess water is accelerating the deterioration of the wearing course and pavement because of the more intense soaking of the road due to a lack of underground stormwater infrastructure in the lane to take the nuisance flows away, a problem which is not uncommon with all the rear laneways in central Wagga Wagga.

To achieve a full appreciation of the condition of central Wagga Wagga’s laneways and the infrastructure deficiencies in them, an action item in the 2021/22 Delivery Plan and Operational Plan is to develop a Wagga Wagga Central laneway upgrade program for Council to deliberate on and determine priorities for improvements.

Financial Implications

There are no additional financial implications to undertake the resurfacing as described as the works are minor in nature and can be incorporated into the 2021/22 resurfacing allocation.

Policy and Legislation

Petitions Management Policy (POL 086)

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

There are no significant risk issues for Council in adopting the recommendation.

Internal / External Consultation

Internal consultation has occurred with the respective asset Supervisors and Team Leaders to reach consensus on the recommendation.

|

1⇩. |

Petition Cover Letter |

|

|

2⇩. |

Council Acknowledgment Letter |

|

Report submitted to the Ordinary Meeting of Council on Monday 28 June 2021. RP-7

RP-7 SALE OF LAND FOR UNPAID RATES

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Analysis: |

In accordance with Section 713(2) of the Local Government Act 1993, Councils have the ability to sell properties with outstanding rates and charges balances in excess of five (5) years. This report lists all properties whose rates are in excess of five (5) years, with the properties categorised into either “potential sale”, “uneconomical to sell at this time” or “arrangements/other”. |

|

That Council: a continue to discuss and negotiate with property holders whose outstanding rates are greater than five (5) years with the aim to arrange an acceptable payment plan b if an acceptable payment plan with that ratepayers is not able to be achieved, or is not adhered to, then pursuant to Section 713 of the Local Government Act 1993, authorise the General Manager or their delegate to sell the land and properties detailed in this report to recover unpaid rates, annual charges, interest and extra charges c authorise the General Manager or their delegate, to set the reserve price for properties put to public auction or sold after public auction d authorise the affixing of the Council Seal to the transfer documents in order to effect the transfer of ownership for properties sold by Council at or after the public auction for unpaid rates and charges e receive a further report following the public auction, outlining the outcomes of each property sale |

Report

Council raises in excess of $70 million in rates and annual charges each financial year. The below table illustrates the rates and charges raised, the amount outstanding and the percentage outstanding at financial year end.

*2019/20 Benchmark:

Less than 5% Metro Council; Less than 10% Regional & Rural Councils.

Benchmark Source: Code of Accounting Practice

As can be seen from the above table, Council has been proactive in managing debt levels using a variety of debt recovery methods. The success of Council’s debt recovery methods has resulted in Council sitting well below the benchmark for a regional Council – 5.20% outstanding as at 30 June 2020 as compared to the target of less than 10% outstanding. There was an increase in outstanding amounts from 30 June 2019 to 30 June 2020 due to the COVID-19 pandemic, and the restrictions imposed relating to debt recovery action. Council staff are continuing to be proactive and are working with property holders – setting up payment arrangements where available.

As a last resort, and in accordance with Section 713(2) of the Local Government Act 1993, Councils have the ability to sell properties with outstanding rates balances in excess of five years:

713 Sale of land for unpaid rates and charges

(2) A council may, in accordance with this Division:

(a) sell any land (including vacant land) on which any rate or charge has remained unpaid for more than 5 years from the date on which it became payable

Council last undertook a sale of land for unpaid rates process in November 2018. Management were planning to conduct the sale of land process each year, however in 2019 the review determined that it would be uneconomical to proceed with the process, and due to the COVID-19 pandemic in 2020 and the restrictions imposed on debt recovery, this was delayed to the 2021 year. Table 1 below sets out the sale of land process timeline.

Table 1: The sale of land process

|

Step |

Task |

Timeframe |

|

1 |

Identification of properties whose rates accounts are outstanding for greater than 5 years |

April 2021 |

|

2 |

Send final letters out to properties who have been categorised as “likely sales”, along with letters to adjoining owners for properties where owners are uncontactable. |

April/May 2021 |

|

3 |

Obtain Council resolution for approval to list properties for sale under a Council Public Notice |

28 June 2021 |

|

4 |

Public Notice – Local Newspaper and Gazette (Section 715) |

July 2021 |

|

5 |

General Manager certifies properties have greater than 5 years rates owing |

October 2021 (at the latest, the day before public auction) |

|

6 |

Public Auction to be held (being not more than 6 months and not less than 3 months from the publication in a newspaper of the advertisement and a convenient place for the sale – Section 715(1A)) |

30 October 2021 – Council Chambers (3+ months from public notice) |

Table 2 below summarises the number of properties and value of rates outstanding, separated into categories with rates overdue more than 5 years.

Table 2: Categorisation of properties with rates outstanding greater than 5 years (See Confidential Attachment A provided under separate cover for individual property details):

|

Number of properties |

Total Amount Owing As at 08/06/2021 $ |

|

|

Proposed - Sale of Properties |

||

|

General comment - The properties are all vacant blocks refer attached summary |

3 |

$11,083.68 |

|

Total – Proposed Sale of Properties |

3 |

$11,083.68 |

|

|

|

|

|

Uneconomical to sell at this time |

|

|

|

Small value rate arrears |

1 |

$1,603.26 |

|

Total – Uneconomical to sell |

1 |

$1,603.26 |

|

|

|

|

|

Arrangements/Other |

|

|

|

Contact made to discuss increasing regular rates payments |

2 |

$27,987.77 |

|

Payment arrangements negotiated. Officers will continue to monitor |

4 |

$32,719.07 |

|

Negotiations with potential buyers after last sale of land auction continuing to be undertaken |

4 |

$52,669.47 |

|

Total – Arrangements/Other |

10 |

$113,376.31 |

|

Total Properties Rates outstanding greater than 5 years as at 08/06/2021

|

14 |

$126,063.25 |

# Officers will continue to monitor the four (4) payment arrangements agreed to over the coming months. If any of the agreed payments are not received, properties will be added back into the sale of land process in next years’ annual process.

Prior to the public auction, Council Officers have, and will continue to work with the property owners (who make contact with Council) with the objective of either full payment of the outstanding account, or putting in place a satisfactory arrangement, which is allowable under Section 715 of the Local Government Act 1993:

715 Notice of proposal to sell land

(2) If, before the time fixed for the sale:

(a) all rates and charges payable (including overdue rates and charges) are paid to the council, or

(b) an arrangement satisfactory to the council for payment of all such rates and charges is entered into by the rateable person,

the council must not proceed with the sale.

Financial Implications

Council officers have undertaken all available recovery action methods for the outstanding debts. A sale of land for unpaid rates process is considered the last remaining avenue available to Council to recover these outstanding amounts. The proceeds received from the sale of properties will reduce Council’s rates outstanding percentage and assist to ensure that Council’s cashflow is sustainable.

All proceeds of sale are paid to the Council and in accordance with Section 718 of the Local Government Act 1993 are to be discharged in the following order:

718 Application of purchase money

The Council must apply any purchase money received by it on the sale of land for unpaid rates and charges in or towards payment of the following purposes and in the following order:

(a) firstly, the expenses of the council incurred in connection with the sale,

(b) secondly, any rate or charge in respect of the land due to the council, or any other rating authority, and any debt in respect of the land (being a debt of which the council has notice) due to the Crown as a consequence of the sale on an equal footing.

Should insufficient funds be recovered to satisfy all rates, charges and debts, then a pro-rata of funds to debts occurs with all debts then deemed satisfied, which is ultimately writing off the outstanding balance.

Surplus funds (if any) are held within Council’s Trust Fund (separate bank account) pending discharge to persons having interest in the properties. Where no claim is forthcoming, the balance of sale proceeds is remitted to the State Government in accordance with the Unclaimed Money Act 1995.

Policy and Legislation

Council Policy: POL 017 - Debt Management Policy

Local Government Act 1993

Unclaimed Money Act 1995

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

The proposed sale of properties for outstanding rates is a contentious issue, with the potential for negative local media reports. Council officers have documented all correspondence between the Council and the property owner and as highlighted earlier, the selling of property is the last resort. It is noted the properties proposed to be sold in this report consist of vacant parcels of land and include laneways of which the neighbouring property owners have been advised of the potential sale of the adjoining property for unpaid rates.

Internal / External Consultation

The Finance division have discussed the proposed sale of properties with Management.

Before selling land under Section 715 of the Local Government Act, the council must:

715 Notice of proposal to sell land

(1) Before selling land under this Division, the council must:

(a) fix a convenient time (being not more than 6 months and not less than 3 months from the publication in a newspaper of the advertisement referred to in paragraph (b)) and a convenient place for the sale, and

(b) give notice of the proposed sale by means of an advertisement published in the Gazette and in at least one newspaper, and

(c) take reasonable steps to ascertain the identity of any person who has an interest in the land, and

(d) take reasonable steps to notify each such person (and the Crown, if the land concerned is owned by the Crown) of the council's intention to sell the land under this Division.

|

|

|

|

Media |

Community Engagement |

Digital |

||||||||||||||

|

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media releases |

Print advertising |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

||

|

|

TIER |

||||||||||||||||||

|

Consult |

|

|

|

|

X |

|

X |

|

|

|

|

|

|

|

X |

|

|||

|

Involve |

|

|

|

|

|

|

|

|

|

||||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Properties with rates outstanding greater than 5 years This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: discussion in relation to the personal hardship of a resident or ratepayer. - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 28 June 2021 |

RP-8 |

RP-8 FINANCIAL PERFORMANCE REPORT AS AT 31 MAY 2021

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Summary: |

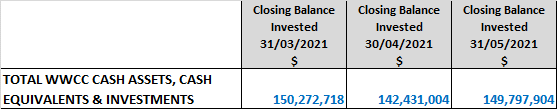

This report is for Council to consider information presented on the 2020/21 budget and Long-Term Financial Plan, and details Council’s external investments and performance as at 31 May 2021. This report also discusses the Councillor and Mayoral additional fee for the 2021/22 financial year period. |

|

That Council: a approve the proposed 2020/21 budget variations for the month ended 31 May 2021 and note the continued forecast deficit budget position as a result of the COVID‑19 pandemic b approve the proposed budget variations to future financial years of the Long-Term Financial Plan c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above d note the details of the external investments as at 31 May 2021 in accordance with section 625 of the Local Government Act 1993 e adopt to receive the maximum allowance under the Regional Rural category (as per Minute number 20/253) for the 2021/22 financial year being: i $20,690 for Councillors; and ii $45,140 additional fee for the Mayor f receive a subsequent report after the 4 September 2021 election to determine the rate to be paid to Councillors for the new elected term g accept the funding offer of $29,000 from Transport for NSW for the Active Travel to School Program which attempts to understand the barriers that may prevent active travel by students and initiatives that could promote higher active travels in the Wagga Wagga community i authorise the General Manager or their delegate to enter into a Funding Deed with Transport for NSW for the Active Travel to School Program ii authorise the affixing of Council’s Common Seal to all relevant documents as required h accept the funding offer of $90,000 from Transport for NSW for the Coolamon Road Fatal Crash Response – Houlaghans Bridge Works i authorise the General Manager or their delegate to enter into a Funding Deed with Transport for NSW for the Coolamon Road Fatal Crash Response – Houlaghans Bridge Works ii authorise the affixing of Council’s Common Seal to all relevant documents as required |

Report

Wagga Wagga City Council (Council) continues to forecast deficit budget positions as a result of the estimated financial impact the COVID-19 pandemic is having on many businesses, with local councils not immune to the pandemic.

At this stage, Council forecasts a $479K deficit budget position for the 2020/21 budget year (as at 31 May 2021).

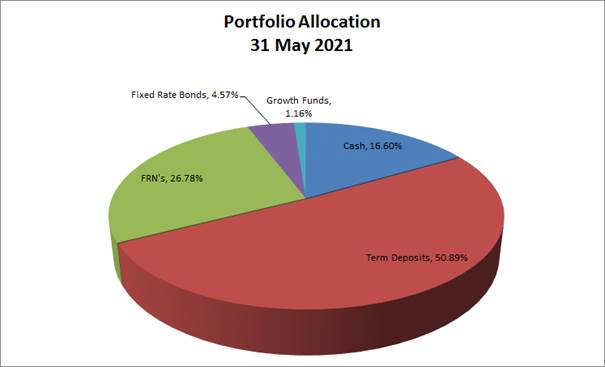

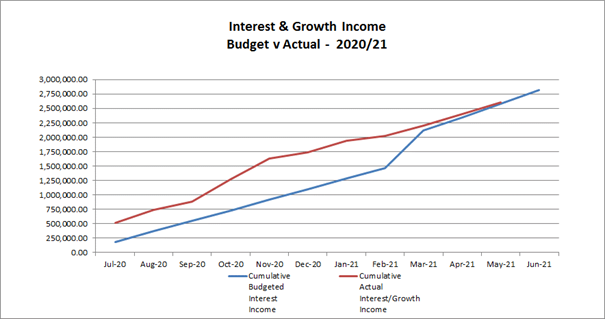

Council has experienced a negative monthly investment performance for the month of May when compared to budget ($30,289 down on the monthly budget). This is mainly due to a smaller than anticipated increase in the principal value of Council’s Floating Rate Note portfolio at 31 May 2021.

Councillor Remuneration for the 2021/22 financial year

The attached Local Government Remuneration Tribunal Annual Report and Determination dated 23 April 2021 is provided for Councillors information. Similar to last year’s report, Wagga Wagga has been allocated to the Regional Centre category, however it is understood that the intent of the 12 July 2020 Council resolution (as per below) was to continue paying the current term of Councillors the maximum available in the Regional Rural category:

That Council:

a confirm the reclassification by the Local Government Remuneration tribunal of Wagga Wagga City Council from the Regional Rural category to the new Regional Centre category

b confirm that the reclassification was not as a result of a submission by Wagga Wagga City Council but was actioned by the Tribunal separately

c confirm that due to budget constraints and the current adopted budget deficit for 2020/21 that the full maximum allowance under the tribunal ruling not be adopted

d as representatives of the community agree to adopt for the 2020/21 year the maximum Regional Rural category that Councillors have received to date during this term for both councillor fee and mayoral additional fee the 20/21 fee being:

i. $20280 for Councillors, and

ii. $44250 additional fee for the Mayor

e acknowledge that the action in (d) will represent a saving of $52,190 in total when compared to what the amount would be if the maximum allowances in the Regional Centre category be adopted

The proposed resolution in this report will enable payments to be made to Councillors until a subsequent report is resolved by Council - planned to be reported to the 27 September 2021 Council meeting. If it is resolved to pay a different amount for the newly elected Council for the remainder of the 2021/22 financial year (12 September 2021 to 30 June 2022) any budget adjustments will be covered off in this subsequent report.

Key Performance Indicators

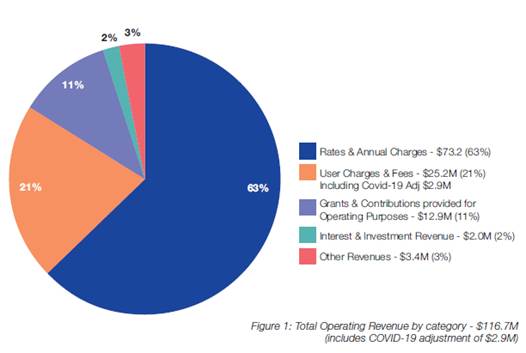

OPERATING INCOME

Total operating income is 93% of approved budget so is trending on budget for the month of May 2021. An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 98% when compared to budget.

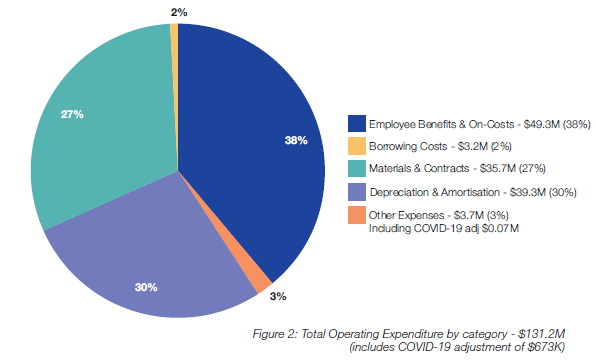

OPERATING EXPENSES

Total operating expenditure is 86% of approved budget so it is tracking under budget at this stage of the financial year.

CAPITAL INCOME