Agenda

and

Business Paper

To be held on

Monday 27

September 2021

at 6:00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

Agenda

and

Business Paper

To be held on

Monday 27

September 2021

at 6:00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 27 September 2021 at 6:00pm.

Council live streams video and audio of Council meetings. Members of the public are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

|

|

|

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

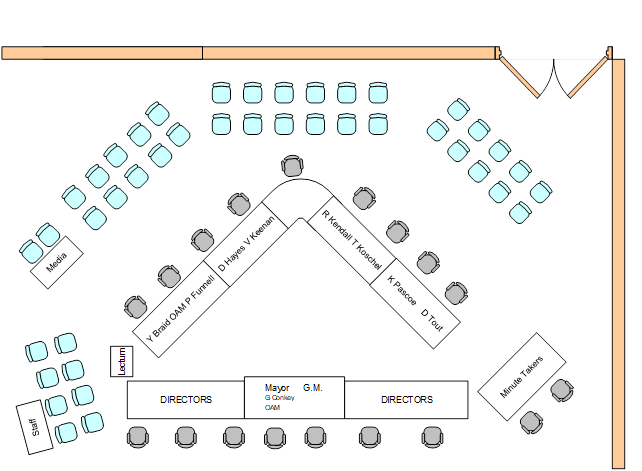

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 27 September 2021.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 27 September 2021

CLAUSE PRECIS PAGE

PRAYER 3

ACKNOWLEDGEMENT OF COUNTRY 3

APOLOGIES 3

Confirmation of Minutes

CM-1 Ordinary Council Meeting - 13 September 2021 3

DECLARATIONS OF INTEREST 4

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - AIRPORT STRATEGIC PLANNING 5

Reports from Staff

RP-1 Peer Review of Wagga Wagga Floodplain Risk Management Study & Plan - Preliminary report 7

RP-2 Planning Proposal (LEP18/0012) to amend Wagga Wagga Local Environmental Plan 2010 land zoning and minimum lot size for land located at Lot 1 DP 605970, Holbrook Road, Lloyd 12

RP-3 Planning Proposal (LEP20/0008) to amend Wagga Wagga Local Environmental Plan 2010 to include artisan food and drink industry within certain rural and commercial zones 20

RP-4 FINANCIAL PERFORMANCE REPORT AS AT 31 AUGUST 2021 27

RP-5 Kooringal Road Pavement Rehabilitation 59

RP-6 DOG OFF-LEASH AREA 62

RP-7 RESOLUTIONS AND NOTICES OF MOTIONS REGISTERS 65

RP-8 RESPONSE TO QUESTIONS/BUSINESS WITH NOTICE 67

Committee Minutes

M-1 FLOODPLAIN RISK MANAGEMENT ADVISORY COMMITTEE MINUTES EXTRAORDINARY MEETING 2 SEPTEMBER 2021 69

QUESTIONS/BUSINESS WITH NOTICE 73

Confidential Mayoral Minute

MM-CONF-1 General Managers Performance Review - 1 July 2020 - 30 June 2021 74

Confidential Reports

CONF-1 RFT2022-02 BULK SUPPLY OF CO2 TO THE OASIS REGIONAL AQUATIC CENTRE 75

CONF-2 RFT2022-01 SWIMWEAR SUPPLY TO THE OASIS 76

CONF-3 WAGGA WAGGA CITY COUNCIL GRAZING LICENCES - EXPRESSIONS OF INTEREST (BURILDA STREET AND OXLEY BRIDGE ROAD) 77

CONF-4 Proposed Acquisition of Land for Road Widening - Part 29 - 31 Gregadoo Road, Lake Albert 78

CONF-5 Proposed Acquisition of Land for Active Travel Plan - Part 319 Bakers Lane, Gumly Gumly 79

PRAYER

Almighty God,

Help protect our Mayor, elected Councillors and staff.

Help Councillors to govern with justice, integrity, and respect for equality, to preserve rights and liberties, to be guided by wisdom when making decisions and settling priorities, and not least of all to preserve harmony.

Amen.

Wagga Wagga City Council acknowledges the traditional custodians of the land, the Wiradjuri people, and pays respect to Elders past, present and future and extends our respect to all First Nations Peoples in Wagga Wagga.

We recognise and respect their cultural heritage, beliefs and continuing connection with the land and rivers. We also recognise the resilience, strength and pride of the Wiradjuri and First Nations communities

CM-1 Ordinary Council Meeting - 13 September 2021

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 13 September 2021 be confirmed as a true and accurate record. |

|

1⇩. |

Minutes - Ordinary Council Meeting - 13 September 2021 |

80 |

DECLARATIONS OF INTEREST

|

Report submitted to the Ordinary Meeting of Council on Monday 27 September 2021 |

NOM-1 |

Motions Of Which Due Notice Has Been Given

NOM-1 NOTICE OF MOTION - AIRPORT STRATEGIC PLANNING

Author: Councillor Dan Hayes

|

Summary: |

This Notice of Motion is presented to Council by Councillor Dan Hayes, in accordance with Council’s Code of Meeting Practice. |

|

That Council receive a report outlining: a process to develop a strategic plan for the airport for the betterment of our region b key areas for inclusion in the Strategic Plan such as tourism, business development, trade, and healthcare c investment and commercialisation options for the airport precinct d referral of the draft strategy to the Airport Advisory committee to enable that committee to provide comment to Council |

Report

Significant focus has been on the airport lease arrangement and the challenges it presents. Recently these challenges were highlighted to the Australian Senate Rural and Regional Affairs and Transport References Committee review into ‘The future of Australia’s aviation sector, in the context of COVID-19 and conditions post pandemic’.

Representatives from Wagga Wagga City Council were invited to participate in the hearing which included General Manager, Peter Thompson, Manager Council Businesses, Daryl Woods, Councillor Rod Kendall, and Councillor Dan Hayes.

This committee highlighted the need for Wagga Wagga City Council to look beyond the current lease agreement and to the future of the airport.

The airport has a significant role in Wagga’s current and future plans and growth therefore the next step for Wagga Wagga City Council is to develop a Strategic Plan for the airport. Regardless of the outcome of the lease agreement negotiations, including the option of Wagga Wagga City Council no longer being the lessee, developing a plan for the role of the airport in our region’s future is necessary.

Financial Implications

N/A

Policy and Legislation

Code of Meeting Practice

Link to Strategic Plan

Growing Economy

Objective: We are a Regional Capital

Outcome: We have complete and accessible transport networks, building infrastructure, improving road travel reliability, ensure on-time running for public transport

Risk Management Issues for Council

N/A

Internal / External Consultation

N/A

|

Report submitted to the Ordinary Meeting of Council on Monday 27 September 2021 |

RP-1 |

RP-1 Peer Review of Wagga Wagga Floodplain Risk Management Study & Plan - Preliminary report

General Manager: Peter Thompson

|

Summary: |

The purpose of this report is to provide Council with a copy of the Preliminary Report of the Peer Review of the Wagga Wagga Floodplain Risk Management Study & Plan and to establish the next steps to allow BMT to answer the primary question from the Peer Review, “to determine if there is cause to reasonably conclude that a flood protection levee greater than a 5% AEP level of protection should be considered in the feasibility study”. |

|

That Council: a receive and note the Preliminary Report of the Peer Review of the Wagga Wagga Floodplain Risk Management Study & Plan b receive and note the initial response from WMAwater Pty Ltd (WMA) and request that they formally respond to the Preliminary Report c officers facilitate communication between WMA and BMT that allows BMT to answer the primary question from the Peer Review, to determine if there is cause to reasonably conclude that a flood protection levee greater than a 5% AEP level of protection should be considered in the feasibility study d officers if necessary, request Department of Planning, Industry and Environment (Environment, Energy and Science) to review the BMT Peer Review and the WMA response and provide Council with a way forward with regard to this matter |

Report

The Wagga Wagga Floodplain Risk Management Study Plan (FRMSP) was adopted in March 2018 after several years of preparation. It replaced the study of 2009. The review and updating of the floodplain risk management study and plan is routine under the NSW Flood Prone Land Policy and is usually triggered by the availability of better data and methodology which improves the quality of the study and plan or a significant flood event. This was the case with the FRMSP.

One of the areas of Wagga which is greatly impacted by flooding is North Wagga. The settlement of North Wagga is situated in the floodway of the Murrumbidgee River. This fact means that there are many factors to consider in relation to assessing risk associated with the flood event itself and the best approach to mitigating the impact of flood events.

While the community was consulted in the preparation of the FRMSP study adopted in 2018, there were calls from the North Wagga community that their views had not been given due weight in the recommendations which were made in the FRMSP and plan. Ultimately there were three options which were recommended for further investigation and feasibility assessment. One was voluntary house purchase, the second was house raising (or a combination of both). The other was increasing the height of the levee around North Wagga to protect it from a 5% AEP event (which is often referred to as a 1 in 20-year flood event).

The next step in the process of delivering flood mitigation works to North Wagga was to undertake a feasibility study into the three recommended options. Tenders were called and a contract was issued to the Centre for International Economics to undertake this work.

As noted above, during the preparation of the FRMSP from 2015 to 2018 there was public commentary from the North Wagga community that their views had not been properly taken into account in the study and were not reflected by the three options which were adopted for further investigation. The view expressed by the representatives of the North Wagga community that a levee which protected the village from a flood event greater than a 5% AEP (ie 1 in 20) should be considered. It was said that this should be a 1% AEP (1 in 100 year) event but there was also acknowledgement that something less than this would be acceptable whereas 5% AEP (1 in 20) and voluntary house raising and house purchase was not acceptable.

Council, with the Floodplain Risk Management Advisory Committee (FRMAC), wrote to the Minister requesting that funding be provided to undertake a feasibility study for a levee which provided greater protection to what was recommended in the FRMSP. The Minister responded that he would not fund such a feasibility study as it was not endorsed by the current FRMSP. He suggested that Wagga might like to undertake a brief review of the study and he would reconsider the question.

Again, with the endorsement of Council and the FRMAC, a Peer review of the current FRMSP was pursued. The representatives of the North Wagga community which form the North Wagga subcommittee on the FRMAC participated in reaching the way forward and also participated directly in the preparation of the scope of work for the Peer review. The Council, the FRMAC and the representatives of North Wagga reached agreement on the scope of works and ultimately the same groups also endorsed a successful tenderer which was BMT.

The feasibility study for the first three options commenced at about this time and communication with the North Wagga community was commenced by the Consultant. The North Wagga Residents Association objected to this process continuing given the Peer Review process was underway. Council agreed to suspend work on the options for flood mitigation in North Wagga which had been approved for further investigation and this suspension remains in place pending and outcome to the Peer review process.

BMT consulted with a range of stakeholders and the extent of this consultation was left to the discretion of BMT. It should be remembered that the Peer Review is not intended to redo the flood study. Its aim is to test the process followed and the outcomes reached in the FRMSP and plan. While Council did not dictate the stakeholders which were consulted by BMT we did ensure that the North Wagga Residents Association had direct input and consultation with BMT.

BMT have now issued their report which should be regarded as a Preliminary Report. The reason for this is that BMT reached the point in their assessment that they needed a range of issues to be addressed before they could answer the key question in their scope of work which was: (5) Determine if this is a cause to reasonably conclude that a flood protection levee greater than a 5% AEP level of protection should be considered in the feasibility study.

The Preliminary Report issued by BMT identifies several key issues which BMT state should be addressed to enable them to answer this question. Their report is detailed, thoughtful and a represents a thorough review of the work undertaken in preparing the FRMSP. When considered by the FRMAC it was agreed by all in attendance, including the representatives of North Wagga, that it was a robust and genuinely independent professional review. This, in itself, represents a significant step in achieving genuine engagement with the North Wagga community in relation to this issue.

As Council will see from the minutes of the FRMAC, the recommendation from that committee was that WMA be asked to review the Preliminary Report and provide their input into the issues which are raised in that report and to address corrective actions where they are required. BMT was asked what time be required for WMA to complete this task and a period of 3 months was suggested.

WMA was provided with the Preliminary Report and requested to undertake their review of the report and address corrective actions where required. They were also given the opportunity to provide a short initial response which could be reviewed by Councillors at the workshop on 20 September and which could be incorporated in the business papers which support this report. WMA provided this initial response on 16 September 2021 which is attached.

It is noted that BMT and WMA have not yet consulted directly with each other in relation to the matter. With the BMT Preliminary Report and the WMA initial response now to hand it is apparent that there might be considerable benefit achieved by coordinating a shared session between BMT and WMA to identify where there might be relatively straightforward answers to issues identified in the BMT Preliminary Report. Such a session might also narrow down issues which might influence a different outcome to the FRMSP and hence be essential to BMT completing their scope of work and answering the key question in that scope.

From the initial response from WMA there might also be a need to clarify which policy or analysis approaches are accepted under the NSW Government’s Flood Prone Land Policy as there appears to be some divergence between jurisdictions which is not identified in the BMT Preliminary Report. The Department of Planning, Infrastructure and Environment should be able to assist in further clarifying this issue should the need arise.

The recommendation to Council aims to identify a way forward which progresses the matter as quickly as possible. The key question remains: (5) Determine if this is a cause to reasonably conclude that a flood protection levee greater than a 5% AEP level of protection should be considered in the feasibility study. This question is yet to be answered. It would be wrong to conclude at this time that BMT Preliminary Report identifies that the options adopted for flood mitigation in North Wagga will change. Indeed one of the issues raised by BMT is that the proposal to increase the levee height to a 5% AEP event (1 in 20) scored a negative result in the multi criteria assessment and it is not clear why this option was supported.

The explanation for this outcome was that the 1 in 20 levee was supported by the FRMC and Council because it was felt that this level of increased protection should be considered as an outcome to the study, notwithstanding the negative score in the multi criteria assessment, given that North Wagga had been to considered to have this level of protection under previous standards. The previous Council resolution was to provide a 1 in 100 levee to the main city and a 1 in 20 levee to North Wagga. The point here is that the answer to the key question remains unresolved and we need to get that answer as soon as we can so the flood mitigation work in North Wagga can recommence.

Financial Implications

|

Total Project Budget |

Expended + Committed as at 22 September 2021 |

Budget Remaining/ (overspend) |

|

|

Flood Mitigation Option Feasibility Study for North Wagga & Floodplain Residents FM-0071 - (19555) |

$234,000 |

$229,504 |

$4,496 |

The initial grant for the North Wagga Flood Mitigation Investigation was $234,000. The initial quote provided by the successful consultant was $175,586.

Council were initially going to fund the Peer Review from existing budgets, however with the quote for the North Wagga Flood Mitigation Investigation coming in under budget a request was made to DPIE to utilise this unspent money to finance the Peer Review. This request was approved by DPIE and the Peer Review has been funded from within the original grant from DPIE.

At this point in time, Council has expended $22,293.39 on the Peer Review.

Policy and Legislation

N/A

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We plan long term

Internal / External Consultation

BMT consulted with a range of stakeholders and the extent of this consultation was left to the discretion of BMT (this is outlined in the Preliminary Report).

The Preliminary Report was presented to the FRMAC meeting held on 2 September 2021. As Council will see from the minutes of the FRMAC, the recommendation from that committee was that WMA be asked to review the Preliminary Report and provide their input into the issues which are raised in that report and to address corrective actions where they are required.

A Councillor Workshop was held on 20 September 2021.

|

1. |

Peer Review of Wagga Wagga Floodplain Risk Management Study & Plan - Preliminary report - Provided under separate cover |

|

|

2. |

WMAwater Pty Ltd Initial Response to the Peer Review of Wagga Wagga Floodplain Risk Management Study & Plan - Preliminary report - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 27 September 2021 |

RP-2 |

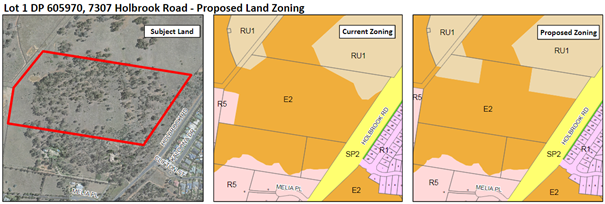

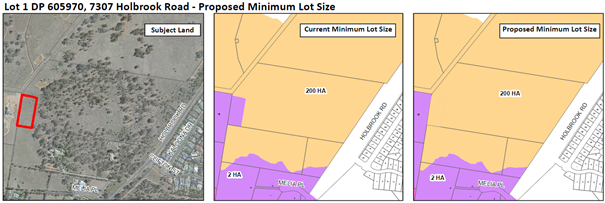

RP-2 Planning Proposal (LEP18/0012) to amend Wagga Wagga Local Environmental Plan 2010 land zoning and minimum lot size for land located at Lot 1 DP 605970, Holbrook Road, Lloyd

Author: Crystal Atkinson

Director: Michael Keys

|

Summary: |

At the Ordinary Meeting of Council on 27 May 2019, Council resolved to support a planning proposal and seek Gateway Determination from NSW Department of Planning, Industry and Environment.

The planning proposal sought to amend land zoning and minimum lot size provisions for land located on Holbrook Road, Lloyd.

Council received a Gateway Determination from the NSW Department of Planning, Industry and Environment on 5 August 2019 to proceed with the above-mentioned planning proposal subject to public exhibition and agency consultation.

The planning proposal was placed on public exhibition from 16 January to 14 February 2020 (inclusive). The reason for delay between the exhibition and reporting to Council is detailed within the report.

The purpose of the report is to provide feedback on the public consultation and submissions received. The report also requests adoption and gazettal of the amendment to the Wagga Wagga Local Environmental Plan 2010. |

|

That Council: a note the results of the exhibition period for planning proposal LEP18/0012 b adopt planning proposal LEP18/0012 (as exhibited) to amend the Wagga Wagga Local Environmental Plan 2010 c request the NSW Department of Planning, Industry and Environment to prepare the amending instrument d gazette the plan and notify NSW Department of Planning, Industry and Environment of the decision |

|

Submitted Proposal: |

Amendment to

Wagga Wagga Local Environmental Plan 2010 to change the zone boundaries between

the R5 – Large Lot Residential Zone, RU1 – Primary Production

Zone and E2 – Environmental Conservation Zone at Lot 1 DP 605970 and to

increase the minimum lot size provisions applicable to Part Lot 1 DP 605970

from

|

|

Applicant: |

Kim Kennedy and Associates |

|

Landowner: |

Susan Forster |

Proposal

Council is in receipt of an application to amend the Wagga Wagga Local Environmental Plan 2010 (LEP) to:

1. Rezone part of the lot from R5 Large Lot Residential to E2 Environmental Conservation

2. Adjust the RU1 Primary Production and E2 Environmental Conservation zone boundaries

3. Amend the minimum lot size from 2 hectares to 200 hectares for part of the lot

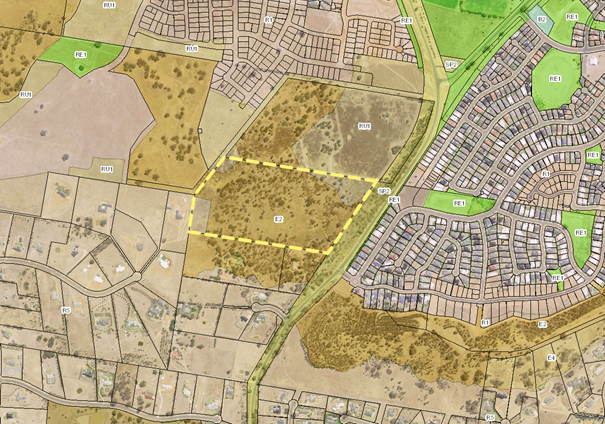

The purpose of the rezoning is to continue protection of environmental land and provide space for the use of the existing dwelling entitlement. The proposed changes will be achieved by amending the land zoning and minimum lot size maps as illustrated in Figure 1 and 2.

Figure 1: Proposed amendments to the Land Zoning map

Figure 2: Proposed amendments to the Minimum Lot Size map

Site and Locality

The subject land is located on the southern extent of Lloyd immediately west of Holbrook Road and the southern portion of Bourkelands. It is approximately 200m south of the Lloyd Urban Release Area. It contains significant environmental assets including Box-Gum Woodland.

The subject land is currently within and adjoining multiple land use zones. E2 – Environmental Conservation Zone covers most of the subject land and continues immediately north and west. RU1 – Primary Production zone exists in the north-east and north-west and continues into adjoining lands in these directions and to the south. A small area of R5 Large Lot Residential Zone exists to the south-west and continues into adjoining lands shown in figure 2.

Figure 3: Subject land area for the planning proposal

Public Exhibition and Agency Consultation

The planning proposal and accompanying exhibition material were placed on public exhibition from 16 January 2020 to 14 February 2020 (inclusive) and agency referrals were provided to NSW Department of Planning, Industry and Environment Biodiversity Conservation Division (BCD) and Rural Fire Service (RFS) as per Gateway Condition no. 2. See full details below under Internal / External Consultation.

A key concern that resulted in delays to processing the planning proposal was raised by BCD in their submission was the need to assess the full impacts on biodiversity through a Biodiversity Development Assessment Report (BDAR) on the basis that clearing for RU1 Primary Production Land is subject to approvals through Local Land Services and not Council. The advice was to prepare a BDAR based on clearing of the rural land for the purposes of potential rezoning and residential development. This is based on concerns that clearing of primary production land may enable rezoning for residential purposes in the future after clearing has occurred causing serious and irreversible impacts. This is a risk with rezoning land from an environmental to a rural zone, however, the vegetation status on the site has recently been elevated to critical species and is further protected from clearing. It is noted that illegal clearing is also a risk in these circumstances for this site and other sites across the local government area.

To avoid further delays, further consideration was given to the request for a BDAR for potential future development and it is considered excessive at this stage when the proposal intends to only use the existing dwelling entitlement and does not propose any additional development. The development of one dwelling on the site would be able to occur whilst avoiding impacts to biodiversity values on site. If the land is subject to a further planning proposal to rezone land for residential purposes, a BDAR would be required along with other relevant studies and reports to assess the impacts.

Financial Implications

Policy and Legislation

Environmental Planning and Assessment Act 1979

Biodiversity Conservation Act 2016

Wagga Wagga Local Environmental Plan 2010

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

The proposal was subject to consultation where no objections were received from the public. The response from NSW Department of Planning, Industry and Environment Biodiversity Conservation Division raised concerns with the protection of biodiversity on the site and there is a risk that vegetation could be cleared illegally. This risk exists for this site and other sites across the local government area and would exist for this site even if the planning proposal wasn’t to proceed. The recent upgrade in vegetation status on the site provides further protection from clearing.

Following consideration of the matters raised in this submission and the outcomes sought by the planning proposal, it is recommended that further environmental assessment can be more appropriately addressed if more intensive development outcomes are sought on-site rather than delaying the proposal further.

By implementing the recommendations of the amendment to the Wagga Wagga Local Environmental 2010, the proposal strikes a balance of allowing the rezoning and minimum lot size changes to occur in the interim, whilst preventing more intensive development outcomes from occurring without the need to further investigate these impacts.

Internal / External Consultation

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

x |

|

x |

|

|

|

|

|

|

|

x |

|

||||

The planning proposal and accompanying exhibition material were made available for viewing by the public on Council’s website and at Council’s Customer Service Counter in the Civic Centre.

The period during which Council would accept submissions was between 16 January 2020 and 28 February 2020.

No submissions were received during this public notification period.

Notwithstanding, a condition of the Gateway Determination required Council to consult with the Department of Planning, Industry and Environment’s Environment, Energy and Science Group (Biodiversity Conservation Division) and the NSW Rural Fire Service. Council was required to give these government agencies at least 21 days to comment on the proposal.

Consultation was undertaken with both government agencies prior to public exhibition and a response was received from these agencies (Attachment 4). It is noted that the Biodiversity Conservation Division provided a subsequent submission post public exhibition, however this response was largely consistent with their original submission.

A summary of the submissions and a Council officer response is provided below.

|

NSW Rural Fire Service |

|

|

Submission |

Officer Response |

|

§ The NSW RFS has no objection to the planning proposal provided that the future occupation of the site for residential purposes has regard to the current version of Planning for Bushfire Protection. |

Any proposed future development of the site will require consideration of, and compliance with, the NSW Rural Fire Service document titled: Planning for Bushfire Protection Guidelines 2019.

|

|

Biodiversity Conservation Division, Department of Planning, Industry and Environment |

|

|

Submission |

Officer Response |

|

§ The proposal increases the likelihood of harm to threatened species. It is requested that consideration of the potential impacts of the proposal be undertaken at the planning proposal stage.

§ Recommend that Council require the proponent to either: o Demonstrate that anticipated clearing as a result of the proposal does not exceed the Biodiversity Offset Scheme Entry Threshold (BOSET), or o Apply Stage 1 of the Biodiversity Assessment Method (BAM) to all development that is anticipated as a result of the proposal which involves the clearing of native vegetation, including Asset Protection Zones.

§ Council has a duty to apply Part 7 of the Biodiversity Conservation Act 2016 to any subsequent development application on the subject land.

§ Recommend that Council consider how the development anticipated as a result of the proposal might impact recharge to the saline water table in Lloyd.

§ The Biodiversity Conservation Division previously provided conditional support for the proposal based on the following: o The bulk of the woodland is maintained. o Asset Protection Zones (APZs) are limited to the RU1 zoned land. o The landholder enters into a Planning Agreement and commits to the long-term protection of the E2 zoned land and implementation of the Lloyd Conservation Management Plan.

We do not consider that the planning proposal has demonstrated how these conditions of support have been met.

§ The existing E2 Environmental Conservation boundary was critical to the decision to confer Biodiversity Certification on the Wagga Wagga Local Environmental Plan 2010.

Any proposal that reduces the biodiversity values of environmental zoned land will be contrary to this agreement any may compromise the improvement and maintenance of biodiversity values.

§ Recommend Council demonstrate due diligence in accordance with ‘Due Diligence Code of Practice for the Protection of Aboriginal Objects in NSW’.

|

Council officers have considered the likely environmental impacts resulting from the proposed change in zoning and minimum lot size requirements sought by the planning proposal.

In summary, the planning proposal will not create any additional development opportunities above and beyond those already available to the land and will therefore not create any additional environmental impacts.

More specifically, the planning proposal seeks to back-zone a portion of the site from R5 Large Lot Residential to E2 Environmental Conservation and remove the 2 hectare minimum lot size that applies to this portion of the land and replace it with a 200 hectare minimum lot size.

Whilst it is acknowledged that the planning proposal seeks to adjust the boundaries between the E2 Environmental Conservation and RU1 Primary Production Zones, a 200 hectare minimum lot size applies to both these zones, which therefore prevents any additional development opportunities.

See below for further details.

As outlined above, the planning proposal does not seek to increase the development opportunities available to the land. The existing dwelling entitlement could be utilised whilst avoiding clearing.

The planning proposal does not propose any clearing of native vegetation and requests to undertake more detailed environmental assessments at the planning proposal stage is considered pre-emptive for a proposal that enables a single dwelling.

Noted and agreed.

Any subsequent development of the land will be subject to further biodiversity assessment including consideration of the BOSET and BAM requirements as outlined above.

As outlined above, the planning proposal does not increase the development opportunities available to the land and will therefore not increase any impacts on the saline water table of Lloyd.

The impacts on recharge to the saline water table in Lloyd would be significant if the planning proposal was proposing a rezoning for residential purposes. If rezoning for residential purposes was proposed, the recommendations of the Lloyd Salinity Study would require salinity assessment prior to rezoning stages 3 and 4 of the Lloyd estate (which includes the subject land) to residential to demonstrate that recharge from urban development (at 75% development) has been successfully controlled.

As this proposal is not for residential development, the salinity reassessment is not required.

As outlined above, the planning proposal does not propose the removal of any vegetation, rather an adjustment to zoning and minimum lot size controls that apply to the land.

There is sufficient land area available for asset protection zones for a dwelling to be located on rural zoned land.

Requests for the proponent to enter into a Planning Agreement with Council for environmental protection purposes, whilst acknowledged are not considered necessary in this instance.

The legal effect of any zoning and minimum lot size changes as sought is not altered by or contingent upon other land management arrangements such as a Planning Agreement being in place.

As outlined above, until such time as the development outcomes on site are known, the requirement to enter into a Planning Agreement is not considered necessary in the interim.

As outlined above, the planning proposal does not seek to increase the development opportunities available to the land.

A conservation management plan exists for Lloyd that implements the recommendations of the former Biodiversity Certification. This order is still current despite the certification having now lapsed.

Further consideration of matters regarding Aboriginal cultural heritage will be undertaken as part of any further rezoning of the site for urban purposes, or application for development in accordance with the Due Diligence Code of Practice for the Protection of Aboriginal Objects in NSW.

|

|

1. |

LEP18/0012 - Planning Proposal and Addendum - Provided under separate cover |

|

|

2. |

LEP18/0012 - Report and Minutes - 27 May 2019 - Provided under separate cover |

|

|

3. |

LEP18/0012 - Gateway Determination - Provided under separate cover |

|

|

4. |

LEP18/0012 - Submissions - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 27 September 2021 |

RP-3 |

RP-3 Planning Proposal (LEP20/0008) to amend Wagga Wagga Local Environmental Plan 2010 to include artisan food and drink industry within certain rural and commercial zones

Author: Crystal Atkinson

Director: Michael Keys

|

Summary: |

At the Ordinary Meeting of Council on 8 March 2021, Council resolved to support a planning proposal and seek Gateway Determination from NSW Department of Planning, Industry and Environment.

The planning proposal sought to include artisan food and drink industries as a permitted land use within certain rural and commercial zones.

Council received Gateway Determination from NSW Department of Planning, Industry and Environment on 27 April 2021 to proceed with the above-mentioned planning proposal subject to public exhibition and agency consultation.

The planning proposal was placed on public exhibition from 19 July 2021 to 28 August 2021 (inclusive).

The purpose of the report is to provide feedback on the public consultation and submissions received. The report also requests adoption and gazettal of the amendment to the Wagga Wagga Local Environmental Plan 2010. |

|

That Council: a note the results of the exhibition period for planning proposal LEP20/0008 b adopt planning proposal LEP20/0008 (as exhibited) to amend the Wagga Wagga Local Environmental Plan 2010 c request NSW Parliamentary Council to prepare the amending instrument as per instrument amendment requirements d gazette the plan and notify NSW Department of Planning, Industry and Environment of the decision |

Planning Proposal Details

|

Submitted Proposal: |

Amendment to Wagga Wagga Local Environmental Plan 2010 to include artisan food and drink industries as an additional permitted use within Schedule 1 of the Wagga Wagga Local Environmental Plan 2010 as it relates to 611 Sturt Highway, Borambola (part Attachment 1). |

|

Applicant: |

Monette O’Leary |

|

Landowner: |

Monette and Noel O’Leary and John Jelly |

Proposal

Council is in receipt of a planning proposal to amend the Wagga Wagga Local Environmental Plan 2010 (LEP) to include artisan food and drink industries as an additional permitted use in Schedule 1 of the LEP as it relates to the subject land.

The purpose of the planning proposal is to allow the landowners to build a small café and retail outlet on-site, which will support the existing and proposed future agricultural operation of the property and allow for the direct sale of goods and products produced on-site (‘farm gate’).

Artisan food and drink industries were not a defined land use term at the time the LEP was gazetted in 2010. Consequently, artisan food and drink industries are currently prohibited within a range of land use zones across Wagga Wagga except for the RU5 village, B6 Business Park, IN1 General Industrial and IN2 Light Industrial zones where they are permitted with consent either under the higher order definition of ‘light industry’ or as ‘any other development not specified in item 2 or 4’ being development that is permitted without consent or is prohibited.

Following review of the planning proposal and the strategic merit and wider economic and tourism benefits that would result from such an activity, an addendum to the planning proposal (part Attachment 1) was prepared to seek to include artisan food and drink industries as a permitted land use with the following rural and commercial zones:

§ RU1 Primary Production zone

§ RU2 Rural Landscape zone

§ RU4 Primary Production Small Lot zone

§ B3 Commercial Core zone

§ B4 Mixed Use zone

By proposing to include the land use as ‘permitted with consent’ in the above zones, the original application to include the use as an ‘additional permitted use’ for the subject site is not required.

The addendum and planning proposal were endorsed by Council at the 26 April 2021 Council meeting (Attachment 2).

Gateway Determination

The NSW Department of Planning, Industry and Environment issued a Gateway Determination for the planning proposal subject to public exhibition and consultation with NSW Rural Fire Service. A copy of the Gateway Determination is provided as Attachment 3.

Public Exhibition and Agency Consultation

The planning proposal and accompanying exhibition materials were placed on public exhibition from 19 July 2021 to 28 August 2021 (inclusive). Six (6) public submissions were received along with a referral response from NSW Rural Fire Service. Full details of the submissions received, and council officer response is provided below under Internal / External Consultation.

Financial Implications

In accordance with Council’s 2019/20 Fees and Charges, the application attracted an application fee of $16,000.00. The proponent has paid these fees.

Policy and Legislation

Environmental Planning and Assessment Act 1979

Wagga Wagga Local Environmental Plan 2010

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

The planning proposal was subject to consultation where public submissions were received in support of the planning proposal. The consultation shows a level of support from the community.

Internal / External Consultation

The planning proposal was placed on public exhibition from 19 July 2021 to 28 August 2021 (inclusive) with engagement as per the table below:

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

|

x |

x |

x |

|

|

x |

|

|

|

|

x |

x |

|

|

The planning proposal and accompanying material were made available for viewing by the public on Council’s website and at Council’s Customer Service Counter in the Civic Centre.

The period during which Council would accept submissions was between 19 July 2021 and 28 August 2021.

A total of seven (7) submissions were received with six (6) from the community and one (1) Agency submission (provided as Attachment 4). A summary of the submissions and a Council officer response is provided below:

|

No. |

Submission |

Officer Response |

|

1 |

The NSW RFS raises no objection to the proposal subject to a requirement that future development for the land-use, on bushfire prone land, complies with Planning for Bush Fire Protection 2019. |

Any proposed future development of the site will require consideration of, and compliance with, the NSW Rural Fire Service document titled: Planning for Bushfire Protection Guidelines 2019. |

|

2 |

This is a fabulous opportunity for our area. We have seen this in La Trobe Shire in Victoria and the produce and revenue generated is outstanding. |

Noted |

|

3 |

I fully support changes that will allow a broadening of artisanal food and drink industries in Wagga area. Wagga is a food bowl region, and a focus on artisanal food and drink will be a boon for tourism and will give local growers access to a broader income base. Locals and travellers seek food and drink experiences that connect them with growers and with local culture, so this type of development will be a great asset for Wagga. |

Noted |

|

4 |

This is such a great thing to do and will really put Wagga and the Riverina on the culinary map. Thank you for all the wonderful work you do to keep us going. |

Noted |

|

5

5

|

Commend Wagga Wagga City Council on the decision to review local planning laws related to Artisan Food and Drink on a wider scale, rather than making a single recommendation for the initial applicant.

The proposed amendments have the potential to make a significant impact on visitation to Wagga and surrounds, to provide diversified small business opportunities, and subsequently improve the city’s economy.

Agritourism is a major theme in the Destination Management Plan for the Riverina Murray region. The Riverina region has appeal to travellers more than other tourism regions within NSW during COVID, with domestic visitors now looking for new experiences within the country while international boarders are closed.

The Riverina is known for its agriculture and is uniquely positioned to attract visitors looking for agritourism experiences once restrictions ease. The ability for Wagga to make the most of this growth by providing opportunities for rural landowners to develop small scale agribusiness offerings should not be underestimated. One thing we would like to question is the limitations that come with the definition of ‘food & drink’ under this proposal. There are a range of small scale on-farm businesses that we believe should be considered for potential inclusion, with potential for farm-gate or retail areas and delivery of small workshops and tours. For example, beauty products made from goat’s milk produced on a small-scale goat farm

We would also like to draw your attention to the recent review by NSW State Government related to small scale agri-business, including farm gate businesses, on-farm events, and farm stay guest accommodation. Has this been considered as part of this review?

Overall, strongly supportive of this proposal, and if passed, would intent to provide this as a case study for other local councils throughout the Riverina Murray region.

|

Noted

Noted

Noted

Further work is being done by State Government to introduce and improve provisions relating to Agri-tourism. As these emerge Council will be looking to implement these changes.

Council has been engaged with NSW Government on the draft provisions for Agri-tourism and will continue to review as this work progresses to implement changes.

Noted |

|

6 |

Support and comment the WWCC proposing amendments to the LEP to allow Artisan Food and Drink Industries to be permitted in various zones across our local government area, including certain rural and commercial zones. I believe this will open up an additional income for local business, employ additional staff to operate these facilities and further enhance our offering to visitors to the region. |

Noted |

|

7

7 |

Support the proposed amendment to include Artisan Food and Drink Industries as permitted with consent in specific zones.

I produce fruit, vegetables and flowers that I sell to several Wagga restaurants and a florist and while I do not intend to establish an on-farm outlet for my produce, Council’s intention to make it easier to produce, promote and serve local food and drinks at the point of production will encourage others to avail themselves to the opportunity to set up enterprises that will benefit our community.

Support the proposal on the following grounds:

§ Facilitating the establishment of Artisan Food and Drink businesses creates a more complex economic and social ecosystem within the region, which in turn builds diversity and resilience in our community. § Reduces cost of development applications for developments that come within the definition of Artisan Food and Drink Industries, which is very important as many businesses taking advantage of the opportunity will be small family businesses that may have limited capital to establish their enterprise. § Increases the economic viability of small holdings through additional income streams. § Prevents the need for owners of small, non-viable farming operations having to sell to new owners who may amalgamate land into larger holdings and apply industrial scale agricultural practices that can have negative environmental and social impacts. § Increases the viability and complexity in Wagga’s economic and social infrastructure § Increases employment opportunities, both in the development and operational phases of these businesses. § Creates new activities for both locals and visitors to enjoy including the potential development of tourist trails when there is sufficient density of such businesses. § Helps the Riverina develop a reputation for agri tourism by providing diverse visitor experiences leading to longer stays and additional expenditure in the city. § May enhance local biodiversity, for example, through the development of a micro distillery producing native botanicals to flavour the spirits it produces.

|

Noted

Noted

Noted

|

Attachments

|

1. |

LEP20/0008 - Addendum and Planning Proposal - Provided under separate cover |

|

|

2. |

LEP20/0008 - Report and Minutes - 8 March 2021 - Provided under separate cover |

|

|

3. |

LEP20/0008 - Gateway Determination - Provided under separate cover |

|

|

4. |

LEP20/0008 - Submissions - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 27 September 2021 |

RP-4 |

RP-4 FINANCIAL PERFORMANCE REPORT AS AT 31 AUGUST 2021

Author: Carolyn Rodney

General Manager: Peter Thomspon

|

Summary: |

This report is for Council to consider information presented on the 2021/22 budget and Long-Term Financial Plan, and details Council’s external investments and performance as at 31 August 2021. |

|

That Council: a approve the proposed 2021/22 budget variations for the month ended 31 August 2021 and note the balanced budget position as presented in this report b approve the proposed budget variations to future financial years of the Long-Term Financial Plan c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above d note the amendment to the 2021/22 Fees and Charges document as presented in this report e note the details of the external investments as at 31 August 2021 in accordance with section 625 of the Local Government Act 1993 |

|

|

Wagga Wagga City Council (Council) forecasts a balanced budget position as at 31 August 2021. The balanced budget position excludes the Wagga Wagga Airport estimated deficit result for the financial year, as any Airport deficit result will be sanctioned, and funded in the interim by General Purpose Revenue (via the Internal Loans Reserve). The deficit results will be accounted for as a liability in the Airport’s end of financial year statements, and paid back to General Purpose Revenue (Internal Loans Reserve) by the Airport in future financial years.

Proposed budget variations are detailed in this report for Council’s consideration and adoption.

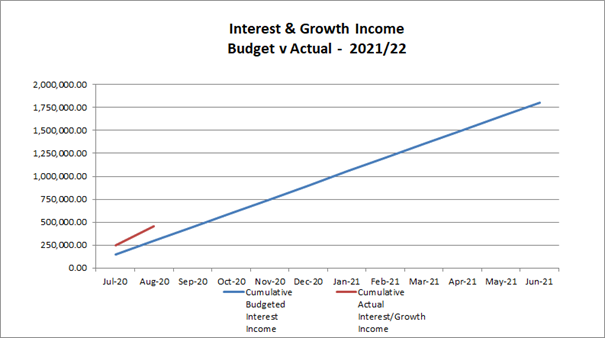

Council has experienced a positive monthly investment performance for the month of August when compared to budget ($60,931 up on the monthly budget). This is mainly due to a strong return for the month for Councils TCorp managed fund.

Key Performance Indicators

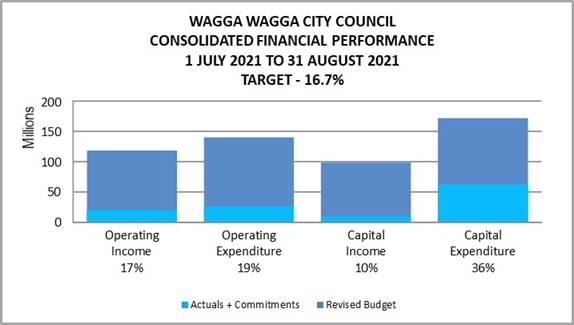

OPERATING INCOME

Total operating income is 17% of approved budget and is trending on budget for the month of August 2021. An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 68% when compared to budget.

OPERATING EXPENSES

Total operating expenditure is 19% of approved budget so it is tracking slightly over budget at this stage of the financial year. This relates to some commitments that have been raised for the full financial year, so excluding commitments the total expenditure is 16% when compared to the approved budget.

CAPITAL INCOME

Total capital income is 10% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions relating to projects. This income also includes the sale of property, plant and equipment.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 36% of approved budget (including pending projects) which is as a result of purchase orders being raised for the full contract amounts for multi-year projects. Excluding commitments, the total expenditure is 2% when compared to the approved budget.

|

WAGGA WAGGA CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2021/22 |

COMMT'S 2021/22 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|||||||

|

Rates & Annual Charges |

(73,169,576) |

0 |

(73,169,576) |

(12,006,565) |

0 |

(12,006,565) |

16% |

|

User Charges & Fees |

(25,225,528) |

(222,906) |

(25,447,204) |

(4,403,915) |

0 |

(4,403,915) |

17% |

|

Interest & Investment Revenue |

(2,014,844) |

0 |

(2,014,844) |

(475,073) |

0 |

(475,073) |

24% |

|

Other Revenues |

(3,436,033) |

(299,363) |

(3,736,625) |

(552,671) |

0 |

(552,671) |

15% |

|

Operating Grants & Contributions |

(12,902,235) |

(1,087,760) |

(13,989,995) |

(2,843,590) |

0 |

(2,843,590) |

20% |

|

Capital Grants & Contributions |

(82,436,148) |

(13,139,733) |

(95,575,881) |

(9,281,724) |

0 |

(9,281,724) |

10% |

|

Total Revenue |

(199,184,362) |

(14,749,762) |

(213,934,125) |

(29,563,539) |

0 |

(29,563,539) |

14% |

|

|

|||||||

|

Expenses

|

|||||||

|

Employee Benefits & On-Costs |

49,289,314 |

2,467 |

49,291,782 |

8,185,275 |

0 |

8,185,275 |

17% |

|

Borrowing Costs |

3,211,705 |

0 |

3,211,705 |

(105,261) |

0 |

(105,261) |

-3% |

|

Materials & Services |

35,727,106 |

6,318,526 |

42,045,631 |

5,938,740 |

4,179,734 |

10,118,474 |

24% |

|

Depreciation & Amortisation |

39,287,050 |

0 |

39,287,050 |

6,547,842 |

0 |

6,547,842 |

17% |

|

Other Expenses |

3,708,040 |

2,437,752 |

6,145,792 |

1,155,945 |

2,534 |

1,158,479 |

19% |

|

Total Expenses |

131,223,215 |

8,758,745 |

139,981,960 |

21,722,541 |

4,182,268 |

25,904,809 |

19% |

|

|

|||||||

|

Net Operating (Profit)/Loss |

(67,961,147) |

(5,991,018) |

(73,952,164) |

(7,840,999) |

4,182,268 |

(3,658,730) |

|

|

|

|||||||

|

Net Operating (Profit)/Loss before Capital Grants & Contributions |

14,475,001 |

7,148,715 |

21,623,716 |

1,440,726 |

4,182,268 |

5,622,994 |

|

|

|

|||||||

|

Capital / Reserve Movements |

|||||||

|

Capital Expenditure - One Off Confirmed |

67,205,986 |

25,072,090 |

92,278,075 |

2,189,252 |

55,261,109 |

57,450,361 |

62% |

|

18,487,675 |

1,002,864 |

19,490,539 |

841,908 |

2,699,362 |

3,541,270 |

18% |

|

|

51,844,544 |

(145,815) |

51,698,729 |

215 |

1,116 |

1,331 |

0% |

|

|

Loan Repayments |

8,236,502 |

0 |

8,236,502 |

956,084 |

0 |

956,084 |

12% |

|

New Loan Borrowings |

(17,678,518) |

(3,750,362) |

(21,428,880) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(804,819) |

(2,106,159) |

(2,910,978) |

(294,691) |

0 |

(294,691) |

10% |

|

Net Movements Reserves |

(20,043,173) |

(14,081,600) |

(34,124,772) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

107,248,197 |

5,991,018 |

113,239,215 |

3,692,768 |

57,961,587 |

61,654,354 |

|

|

|

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2021/22 |

COMMT'S 2021/22 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Net Result after Depreciation |

39,287,050 |

0 |

39,287,050 |

(4,148,231) |

62,143,855 |

57,995,624 |

|

|

|

|||||||

|

Add back Depreciation Expense |

39,287,050 |

0 |

39,287,050 |

6,547,842 |

0 |

6,547,842 |

17% |

|

|

|||||||

|

Cash Budget (Surplus) / Deficit |

0 |

0 |

0 |

(10,696,073) |

62,143,855 |

51,447,782 |

|

|

Description |

Budget 2021/22 |

Budget 2022/23 |

Budget 2023/24 |

Budget 2024/25 |

Budget 2025/26 |

Budget 2026/27 |

Budget 2027/28 |

Budget 2028/29 |

Budget 2029/30 |

Budget 2030/31 |

|

Adopted Bottom Line (Surplus) / Deficit |

0 |

860,298 |

1,751,328 |

2,469,233 |

3,928,332 |

3,831,470 |

3,259,284 |

3,494,780 |

3,511,108 |

3,930,045 |

|

Prior Adopted Bottom Line Adjustments |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Revised Bottom Line (Surplus) / Deficit |

0 |

860,298 |

1,751,328 |

2,469,233 |

3,928,332 |

3,831,470 |

3,259,284 |

3,494,780 |

3,511,108 |

3,930,045 |

2021/22 Revised Budget Result – (Surplus) / Deficit |

$’000s |

|

Original 2021/22 Budget Result as adopted by Council Total Budget Variations approved to date |

$0K $0K $0K |

|

Proposed Revised Budget result for 31 August 2021 - (Surplus) / Deficit |

$0K |

The proposed Budget Variations for 31 August 2021 are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact (Fav)/ Unfav |

|

|

Library Capital Works Stage 1 – State Library Infrastructure Grant Library Priority Funding |

$55K

$4K |

NSW State Public Library Funding ($59K) |

Nil |

|

|

Estimated Completion: 30 June 2022 Job Consolidations: 12283 & 21446 |

|

|||

|

5 – The Environment |

||||

|

Holbrook Road Pavement Rehab |

$633K |

RMS Regional Roads Repair Grant funding ($316K) RMS Supplementary Block Grant funding ($199K) Pavement Rehab Program – unallocated RMS Block Grant funding ($117K) |

Nil |

|

|

Each year Council submits an application to Roads and Maritime Services (RMS) for Regional Roads 'Repair Program' Grant funding which is eligible for regional roads only. Annual budgets are allocated in 'Pending Projects' for Supplementary Block Funding and Repair funding with no set location identified in the Long Term Financial Plan, until the funding for the specified location is approved. This year Council submitted an application for Holbrook Road Pavement Rehabilitation and have been successful in obtaining funding of $316K. The total project is proposed to cost $633K with Council contributing the remaining funds from RMS Supplementary Block Grant of $199K and unallocated RMS Block Grant funding on the Pavement Rehab Program of $117K. Estimated Completion: 30 June 2022 Job Number: 18129 |

|

|||

|

|

$0K |

|||

The Pending Projects list is a list of adopted Capital Works projects which have not been included in the 2021/22 Delivery Program for the following reason(s):

- Capacity and resourcing constraints

- Project description and scope not fully defined

- External funding to be determined

|

Capital Works Project |

Prior Years |

2021/22 Budget |

Future Years |

Total Project Budget |

Comments |

|

Dunns Road – Roads and Traffic Facilities Upgrade Job Consolidation:13684 |

$419,798 |

$7,884,558 |

$0 |

$8,304,356 |

Currently $0 delivery and $7,884,558 pending. Proposed $3,942,279 delivery and $3,942,279 pending. |

|

Oasis Energy Saving Projects Job Consolidation: 28162 |

$112,110 |

$1,446,738 |

$231,770 |

$1,790,618 |

Currently $0 delivery and $1,446,738 pending. Proposed $50,000 delivery and $1,396,738 pending. |

|

GWMC Construct New Cells Job Consolidation: 70041 |

$2,270,937 |

$7,723,826 |

$8,952,942 |

$18,947,705 |

Currently $79,529 delivery and $7,644,297 pending. Proposed $429,529 delivery, $1,490,471 pending and $5,803,826 2022/23. |

|

Glenfield Road Corridor Works Job Consolidation: 12922 |

$22,027 |

$408,942 |

$18,754,226 |

$19,185,195 |

Currently $0 delivery and $408,942 pending. Proposed $75,000 delivery and $333,942 pending. |

|

Pine Gully Road Corridor Works Job Consolidation: 19601 |

$422,045 |

$659,453 |

$6,079,092 |

$7,160,590 |

Currently $0 delivery and $659,453 pending. Proposed $75,000 delivery and $584,453 pending. |

|

Gregadoo Road Corridor Works Job Consolidation: 19604 |

$282,619 |

$2,165,241 |

$2,248,715 |

$4,696,575 |

Currently $5,466 delivery and $2,159,775 pending. Proposed $170,000 delivery and $1,995,241 pending. |

|

Gas Capture Network Expansion & Evaporator Job Consolidation: 70135 |

$362,226 |

$1,837,993 |

$983,430 |

$3,183,649 |

Currently $0 delivery and $1,837,993 pending. Proposed $50,000 delivery and $1,787,993 pending. |

2021/22 Capital Works Summary

|

Approved Budget |

Proposed Movement |

Proposed Budget |

|

|

One-off |

$92,278,074 |

$4,762,201 |

$97,040,275 |

|

Recurrent |

$19,490,539 |

$459,894 |

$19,950,433 |

|

Pending |

$51,698,729 |

($11,109,639) |

$40,589,090 |

|

Total Capital Works |

$163,467,342 |

($5,887,544) |

$157,579,798 |

Current Restrictions

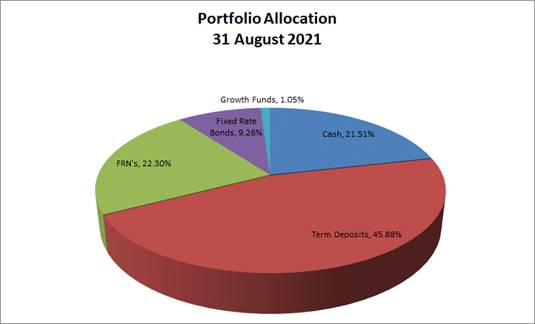

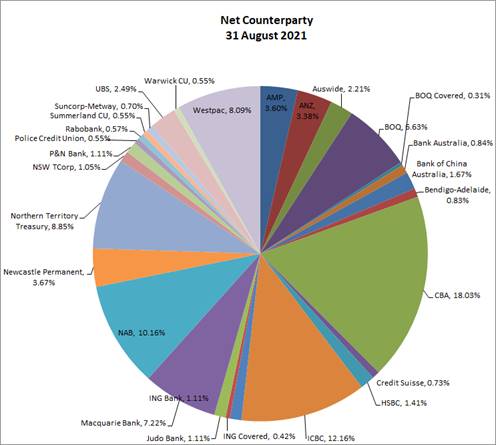

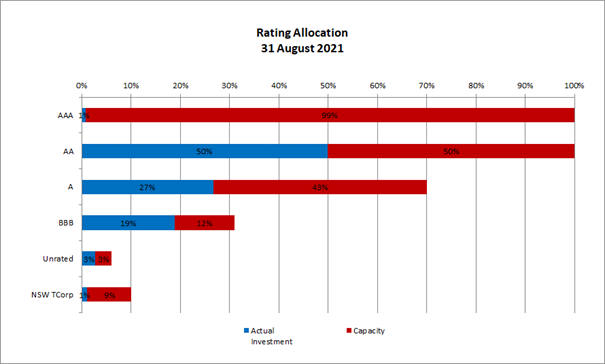

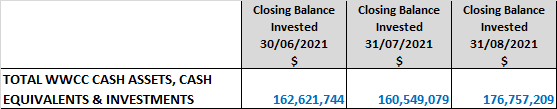

Investment Summary as at 31 August 2021

In accordance with Regulation 212 of the Local Government (General) Regulation 2005, details of Wagga Wagga City Council’s external investments are outlined below.

|

Institution |

Rating |

Closing

Balance |

Closing

Balance |

August |

August |

Investment |

Maturity |

Term |

|

Short Term Deposits |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

1,000,000 |

1,000,000 |

0.75% |

0.55% |

14/09/2020 |

14/09/2021 |

12 |

|

Total Short Term Deposits |

|

1,000,000 |

1,000,000 |

0.75% |

0.55% |

|

|

|

|

At Call Accounts |

|

|

|

|

|

|

|

|

|

NAB |

AA- |

422,248 |

301,258 |

0.10% |

0.17% |

N/A |

N/A |

N/A |

|

Rabobank |

A+ |

31,774 |

31,774 |

0.01% |

0.02% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

6,284,815 |

2,929,668 |

0.10% |

1.62% |

N/A |

N/A |

N/A |

|

CBA |

AA- |

15,116,982 |

26,618,863 |

0.15% |

14.72% |

N/A |

N/A |

N/A |

|

Macquarie Bank |

A+ |

9,023,300 |

9,026,366 |

0.40% |

4.99% |

N/A |

N/A |

N/A |

|

Total At Call Accounts |

|

30,879,119 |

38,907,928 |

0.20% |

21.51% |

|

|

|

|

Medium Term Deposits |

|

|

|

|

|

|

|

|

|

RaboBank |

A+ |

1,000,000 |

1,000,000 |

3.16% |

0.55% |

5/06/2017 |

6/06/2022 |

60 |

|

AMP |

BBB |

2,000,000 |

2,000,000 |

0.95% |

1.11% |

30/11/2020 |

30/05/2022 |

18 |

|

Rabobank |

A+ |

1,000,000 |

0 |

0.00% |

0.00% |

25/08/2016 |

25/08/2021 |

60 |

|

Westpac |

AA- |

3,000,000 |

3,000,000 |

1.13% |

1.66% |

10/03/2017 |

10/03/2022 |

60 |

|

Auswide |

BBB |

2,000,000 |

2,000,000 |

0.85% |

1.11% |

6/10/2020 |

6/10/2022 |

24 |

|

BOQ |

BBB+ |

2,000,000 |

2,000,000 |

3.35% |

1.11% |

3/01/2018 |

4/01/2022 |

48 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

3.50% |

0.55% |

1/06/2018 |

1/06/2022 |

48 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.32% |

1.11% |

28/06/2021 |

29/06/2026 |

60 |

|

BOQ |

BBB+ |

3,000,000 |

3,000,000 |

3.25% |

1.66% |

28/08/2018 |

29/08/2022 |

48 |

|

P&N Bank |

BBB |

1,000,000 |

1,000,000 |

3.10% |

0.55% |

16/10/2018 |

18/10/2021 |

36 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

3.05% |

1.11% |

13/11/2018 |

15/11/2021 |

36 |

|

P&N Bank |

BBB |

1,000,000 |

1,000,000 |

3.30% |

0.55% |

20/11/2018 |

21/11/2022 |

48 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

3.01% |

1.11% |

30/11/2018 |

30/11/2021 |

36 |

|

Bendigo-Adelaide |

BBB+ |

1,000,000 |

1,000,000 |

3.25% |

0.55% |

30/11/2018 |

30/11/2022 |

48 |

|

Newcastle Permanent |

BBB |

2,000,000 |

2,000,000 |

3.05% |

1.11% |

8/02/2019 |

8/02/2022 |

36 |

|

Newcastle Permanent |

BBB |

2,000,000 |

2,000,000 |

2.70% |

1.11% |

23/04/2019 |

26/04/2022 |

36 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

2.40% |

0.55% |

22/05/2019 |

23/05/2022 |

36 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

2.15% |

0.55% |

8/07/2019 |

10/07/2023 |

48 |

|

Auswide |

BBB |

1,000,000 |

1,000,000 |

1.95% |

0.55% |

12/08/2019 |

12/08/2022 |

36 |

|

Judo Bank |

NR |

1,000,000 |

0 |

0.00% |

0.00% |

20/08/2019 |

19/08/2021 |

24 |

|

Australian Military Bank |

BBB+ |

1,000,000 |

0 |

0.00% |

0.00% |

20/08/2019 |

20/08/2021 |

24 |

|

Judo Bank |

NR |

1,000,000 |

1,000,000 |

1.90% |

0.55% |

10/09/2019 |

9/09/2022 |

36 |

|

Auswide |

BBB |

1,000,000 |

1,000,000 |

1.72% |

0.55% |

3/10/2019 |

4/10/2022 |

36 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

2.03% |

1.11% |

6/11/2019 |

6/11/2024 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.83% |

1.11% |

28/11/2019 |

28/11/2024 |

60 |

|

Judo Bank |

NR |

1,000,000 |

1,000,000 |

2.20% |

0.55% |

5/12/2019 |

3/12/2021 |

24 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.75% |

0.55% |

6/01/2020 |

8/01/2024 |

48 |

|

BOQ |

BBB+ |

1,000,000 |

1,000,000 |

2.00% |

0.55% |

28/02/2020 |

28/02/2025 |

60 |

|

ING Bank |

A |

2,000,000 |

2,000,000 |

1.50% |

1.11% |

2/03/2020 |

2/03/2022 |

24 |

|

Macquarie Bank |

A+ |

2,000,000 |

2,000,000 |

1.40% |

1.11% |

9/03/2020 |

9/03/2022 |

24 |

|

Police Credit Union |

NR |

1,000,000 |

1,000,000 |

2.20% |

0.55% |

1/04/2020 |

1/04/2025 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.85% |

0.55% |

29/05/2020 |

29/05/2025 |

60 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.86% |

0.55% |

1/06/2020 |

2/06/2025 |

60 |

|

Institution |

Rating |

Closing

Balance |

Closing

Balance |

August |

August |

Investment |

Maturity |

Term |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.75% |

1.11% |

25/06/2020 |

25/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.75% |

1.11% |

25/06/2020 |

25/06/2025 |

60 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.60% |

1.11% |

29/06/2020 |

28/06/2024 |

48 |

|

ICBC |

A |

3,000,000 |

3,000,000 |

1.25% |

1.66% |

30/06/2020 |

30/06/2022 |

24 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.42% |

1.11% |

7/07/2020 |

8/07/2024 |

48 |

|

ICBC |

A |

2,000,000 |

2,000,000 |

1.50% |

1.11% |

17/08/2020 |

18/08/2025 |

60 |

|

BoQ |

BBB+ |

1,000,000 |

1,000,000 |

1.25% |

0.55% |

7/09/2020 |

8/09/2025 |

60 |

|

BoQ |

BBB+ |

2,000,000 |

2,000,000 |

1.25% |

1.11% |

14/09/2020 |

15/09/2025 |

60 |

|

AMP |

BBB |

1,000,000 |

1,000,000 |

0.95% |

0.55% |

26/11/2020 |

25/05/2022 |

18 |

|

AMP |

BBB |

2,000,000 |

2,000,000 |

0.95% |

1.11% |

7/12/2020 |

6/06/2022 |

18 |

|

ICBC |

A |

1,000,000 |

1,000,000 |

1.20% |

0.55% |

7/12/2020 |

8/12/2025 |

60 |

|

Warwick CU |

NR |

1,000,000 |

1,000,000 |

0.75% |

0.55% |

29/01/2021 |

30/01/2023 |

24 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

0.95% |

1.11% |

29/01/2021 |

29/01/2026 |

60 |

|

NAB |

AA- |

1,000,000 |

1,000,000 |

1.08% |

0.55% |

22/02/2021 |

20/02/2026 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

1.25% |

1.11% |

3/03/2021 |

2/03/2026 |

60 |

|

Summerland CU |

NR |

1,000,000 |

1,000,000 |

0.75% |

0.55% |

29/04/2021 |

28/04/2023 |

24 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

1.40% |

1.11% |

21/06/2021 |

19/06/2026 |

60 |

|

NAB |

AA- |

2,000,000 |

2,000,000 |

0.65% |

1.11% |

25/06/2021 |

26/06/2023 |

24 |

|

Westpac |

AA- |

2,000,000 |

2,000,000 |

1.32% |

1.11% |

25/06/2021 |

25/06/2026 |

60 |

|

ICBC |

A |

0 |

1,000,000 |

1.32% |

0.55% |

25/08/2021 |

25/08/2026 |

60 |

|

NAB |

AA- |

0 |

2,000,000 |

0.65% |

1.11% |

31/08/2021 |

31/08/2023 |

24 |

|

Total Medium Term Deposits |

|

82,000,000 |

82,000,000 |

1.77% |

45.33% |

|

|

|

|

Floating Rate Notes - Senior Debt |

|

|

|

|

|

|

|

|

|

Bendigo-Adelaide |

BBB+ |

506,298 |

506,662 |

BBSW + 105 |

0.28% |

25/01/2018 |

25/01/2023 |

60 |

|

Newcastle Permanent |

BBB |

1,526,324 |

1,522,619 |

BBSW + 140 |

0.84% |

6/02/2018 |

6/02/2023 |

60 |

|

UBS |

A+ |

2,025,165 |

2,026,348 |

BBSW + 90 |

1.12% |

8/03/2018 |

8/03/2023 |

60 |

|

Bank Australia |

BBB |

752,292 |

0 |

0.00% |

0.00% |

30/08/2018 |

30/08/2021 |

36 |

|

AMP |

BBB |

1,502,947 |

1,503,913 |

BBSW + 108 |

0.83% |

10/09/2018 |

10/09/2021 |

36 |

|

CBA |

AA- |

3,072,729 |

3,074,379 |

BBSW + 113 |

1.70% |

11/01/2019 |

11/01/2024 |

60 |

|

Westpac |

AA- |

3,078,854 |

3,079,878 |

BBSW + 114 |

1.70% |

24/01/2019 |

24/04/2024 |

63 |

|

ANZ |

AA- |

2,565,435 |

2,558,482 |

BBSW + 110 |

1.41% |

8/02/2019 |

8/02/2024 |

60 |

|

NAB |

AA- |

2,048,433 |

2,043,690 |

BBSW + 104 |

1.13% |

26/02/2019 |

26/02/2024 |

60 |

|

Bank of China Australia |

A |

1,514,351 |

1,515,504 |

BBSW + 100 |

0.84% |

17/04/2019 |

17/10/2022 |

42 |

|

Westpac |

AA- |

2,556,863 |

2,552,109 |

BBSW + 88 |

1.41% |

16/05/2019 |

16/08/2024 |

63 |

|

Suncorp-Metway |

A+ |

1,266,775 |

1,267,381 |

BBSW + 78 |

0.70% |

30/07/2019 |

30/07/2024 |

60 |

|

ANZ |

AA- |

2,038,228 |

2,034,946 |

BBSW + 77 |

1.12% |

29/08/2019 |

29/08/2024 |

60 |

|

HSBC |

AA- |

2,539,600 |

2,542,376 |

BBSW + 83 |

1.41% |

27/09/2019 |

27/09/2024 |

60 |

|

Bank Australia |

BBB |

1,512,705 |

1,514,653 |

BBSW + 90 |

0.84% |

2/12/2019 |

2/12/2022 |

36 |

|

ANZ |

AA- |

1,526,295 |

1,526,952 |

BBSW + 76 |

0.84% |

16/01/2020 |

16/01/2025 |

60 |

|

NAB |

AA- |

2,035,618 |

2,037,845 |

BBSW + 77 |

1.13% |

21/01/2020 |

21/01/2025 |

60 |

|

Newcastle Permanent |

BBB |

1,125,544 |

1,124,571 |

BBSW + 112 |

0.62% |

4/02/2020 |

4/02/2025 |

60 |

|

Macquarie Bank |

A+ |

2,030,429 |

2,029,270 |

BBSW + 84 |

1.12% |

12/02/2020 |

12/02/2025 |

60 |

|

BOQ Covered |

AAA |

564,881 |

564,242 |

BBSW + 107 |

0.31% |

14/05/2020 |

14/05/2025 |

60 |

|

UBS |

A+ |

953,072 |

950,759 |

BBSW + 105 |

0.53% |

21/05/2020 |

21/11/2022 |

30 |

|

Credit Suisse |

A+ |

1,324,751 |

1,320,392 |

BBSW + 115 |

0.73% |

26/05/2020 |

26/05/2023 |

36 |

|

UBS |

A+ |

1,526,041 |

1,528,137 |

BBSW + 87 |

0.84% |

30/07/2020 |

30/07/2025 |

60 |

|

Bank of China Australia |

A |

1,512,893 |

1,513,642 |

BBSW + 78 |

0.84% |

27/10/2020 |

27/10/2023 |

36 |

|

Total Floating Rate Notes - Senior Debt |

|

41,106,522 |

40,338,750 |

|

22.30% |

|

|

|

|

Institution |

Rating |

Closing

Balance |

Closing

Balance |

August |

August |

Investment |

Maturity |

Term |

|

Fixed Rate Bonds |

|

|

|

|

|

|

|

|

|

ING Covered |

AAA |

0 |

752,029 |

1.10% |

0.42% |

19/08/2021 |

19/08/2026 |

60 |

|

Northern Territory Treasury |

AA- |

0 |

3,000,000 |

1.00% |

1.66% |

24/08/2021 |

16/12/2024 |

40 |

|

Northern Territory Treasury |

AA- |

0 |

3,000,000 |

1.50% |

1.66% |

24/08/2021 |

15/12/2026 |

64 |

|

Northern Territory Treasury |

AA- |

0 |

2,000,000 |

1.50% |

1.11% |

6/08/2021 |

15/12/2026 |

64 |

|

Northern Territory Treasury |

AA- |

1,000,000 |

1,000,000 |

1.50% |