Agenda

and

Business Paper

To be held on

Monday 29

November 2021

at 6.00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

Agenda

and

Business Paper

To be held on

Monday 29

November 2021

at 6.00pm

Civic Centre cnr Baylis and Morrow Streets,

Wagga Wagga NSW 2650 (PO Box 20)

P 1300 292 442

P council@wagga.nsw.gov.au

wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held in the Council Chamber, Civic Centre, Corner Baylis and Morrow Streets, Wagga Wagga, on Monday 29 November 2021 at 6.00pm.

Council live streams video and audio of Council meetings. Members of the public are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

|

|

|

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

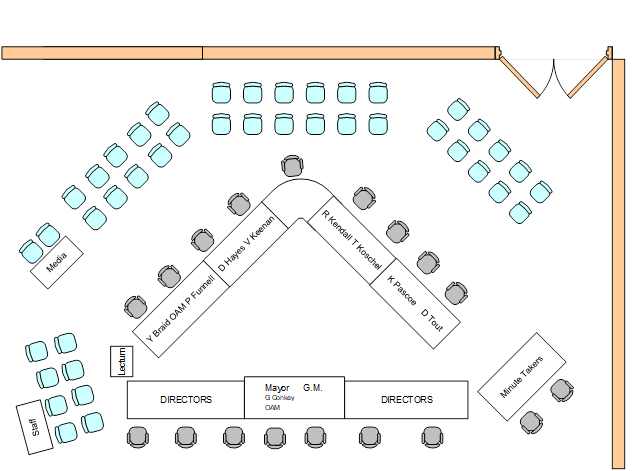

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 29 November 2021.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 29 November 2021

CLAUSE PRECIS PAGE

PRAYER 3

ACKNOWLEDGEMENT OF COUNTRY 3

APOLOGIES 3

Confirmation of Minutes

CM-1 Ordinary Council Meeting - 8 November 2021 3

DECLARATIONS OF INTEREST 3

Reports from Staff

RP-1 Standard Instrument Local Environmental Plan - Flood Planning Clauses 5

RP-2 EUNONY VALLEY GREENING FUNDS 19

RP-3 COVID-19 Fast Track Events Sponsorship 21

RP-4 LAKE ALBERT - SPECIAL PURPOSE ACCESS LICENCE UPDATE 31

RP-5 Presentation of the 2020/21 Financial Statements 34

RP-6 POL 075 - Investment Policy 36

RP-7 Proposed New Fees and Charges for 2021/22 50

RP-8 FINANCIAL PERFORMANCE REPORT AS AT 31 OCTOBER 2021 53

RP-9 SECTION 356 REQUESTS FOR FINANCIAL ASSISTANCE 93

RP-10 POL 083 - Child Safe Policy 99

RP-11 INTEGRATED PLANNING AND REPORTING (IP&R) - END OF TERM REPORT 112

RP-12 GREGADOO WASTE MANAGEMENT CENTRE - DRAFT ACCESS FEE 114

RP-13 CODE OF CONDUCT STATISTICS 117

RP-14 RESOLUTIONS AND NOTICES OF MOTIONS REGISTERS 122

RP-15 RESPONSE TO QUESTIONS/BUSINESS WITH NOTICE 124

Committee Minutes

M-1 Local Traffic Committee - 11 November 2021 - Minutes 126

M-2 RIVERINA REGIONAL LIBRARY ADVISORY COMMITTEE - MINUTES - 4 NOVEMBER 2021 133

QUESTIONS/BUSINESS WITH NOTICE 141

Confidential Reports

CONF-1 Proposed Airport Subleases - Light Aircraft Precinct Hangar Sites 9-10 142

PRAYER

Almighty God,

Help protect our Mayor, elected Councillors and staff.

Help Councillors to govern with justice, integrity, and respect for equality, to preserve rights and liberties, to be guided by wisdom when making decisions and settling priorities, and not least of all to preserve harmony.

Amen.

Wagga Wagga City Council acknowledges the traditional custodians of the land, the Wiradjuri people, and pays respect to Elders past, present and future and extends our respect to all First Nations Peoples in Wagga Wagga.

We recognise and respect their cultural heritage, beliefs and continuing connection with the land and rivers. We also recognise the resilience, strength and pride of the Wiradjuri and First Nations communities

CM-1 Ordinary Council Meeting - 8 November 2021

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 8 November 2021 be confirmed as a true and accurate record.

|

|

1⇩. |

Mintues - 8 November 2021 |

143 |

|

Report submitted to the Ordinary Meeting of Council on Monday 29 November 2021 |

RP-1 |

RP-1 Standard Instrument Local Environmental Plan - Flood Planning Clauses

Author: Crystal Atkinson

Director: Michael Keys

|

Summary: |

The NSW Government is currently integrating measures included in its Flood Planning Package into the NSW state planning system. This includes the introduction of new clauses into the Standard Instrument Local Environmental Plan. The new clauses include one mandatory Clause 5.21 that is now included in all Local Environmental Plans, alongside a further Clause 5.22 for optional future inclusion within LEPs in early 2022.

The mandatory Clause 5.21 Flood Planning includes provisions to guide development assessment within the Flood Planning Area, having replaced the former Clause 7.2 Flood planning in the Wagga Wagga LEP.

The optional Clause 5.22 Special Flood Considerations provides flexibility for sensitive uses within the Probable Maximum Flood (PMF) area which covers most of the city and already contains sensitive uses. Incorporating the optional clause within the Wagga Wagga Local Environmental Plan 2010 is consistent with Council’s adopted Floodplain Risk Management Plan and Study 2018.

To enable continued participation in the implementation of optional Clause 5.22, it is recommended that Council resolve to confirm its ongoing interest in incorporating the optional Clause 5.22 into the Wagga Wagga Local Environmental Plan 2010.

|

|

That Council: a note the reforms being made to the Standard Instrument Local Environmental Plan in respect of flood planning b note the compulsory integration of Clause 5.21 Flood planning into the Wagga Wagga Local Environmental Plan 2010, as in force at the date of this resolution c note the option to also integrate Clause 5.22 Special flood considerations into the Wagga Wagga Local Environmental Plan 2010 d notify the NSW Department of Planning, Industry and Environment of Council’s continued interest to ‘opt-in’ to adoption of Clause 5.22 Special flood considerations within the Wagga Wagga Local Environmental Plan 2010 e note and endorse the ongoing leadership of the NSW Department of Planning, Industry and Environment in the amendment process, including delivery of future engagement and consultation processes in respect of Clause 5.22 |

Overview

In December 2020 the NSW Government made changes to housing-related policies. These changes included amendments to the Standard Instrument Local Environmental Plan 2006, which were applied to all LEPs including the Wagga Wagga Local Environmental Plan.

A component of the package is to introduce two new clauses to the Standard Instrument LEP 2006. These clauses are attached to this report.

Clause 5.21 is a compulsory clause which will feature within the Wagga Wagga LEP 2010 upon the introduction of the new provisions to the Standard Instrument LEP.

Previous practice in Wagga Wagga LEP flood planning

Until 2021, land use planning for flood affected areas of Wagga Wagga had been governed by Clause 7.2 Flood planning of the Wagga Wagga Local Environmental Plan.

The former Clause 7.2 Flood planning included provisions applying to development at or below the flood planning level. The clause defined this as the 1:100 flood level (average recurrent interval or ‘ARI’) plus 0.5 metres freeboard.

The provisions required that:

(3) Development consent must not be granted to development on land to which this clause applies unless the consent authority is satisfied that the development–

(a) is compatible with the flood hazard of the land, and

(b) will not significantly adversely affect flood behaviour resulting in detrimental increase in the potential flood affectation of other development or properties, and

(c) incorporates appropriate measures to manage risk to life from flood, and

(d) will not significantly adversely affect the environment or cause avoidable erosion, siltation, destruction of riparian vegetation or a reduction in the stability of river banks or watercourses, and

(e) is not likely to result in unsustainable social and economic costs to the community as a consequence of flooding

As a result of the upgrade of the Wagga Wagga levee, the key regional sites and infrastructure of the Wagga Wagga CBD and Wagga Wagga Health and Knowledge Precinct, as well as other parts of Central Wagga Wagga, are now located outside the 1:100 ARI.

This outcome provides a considerable degree of protection to these key locations and functions of the city, to the benefit of the local and regional population. As a further consequence, this also removed the former Clause 7.2 from the consideration applied to various development applications in Central Wagga Wagga.

Notwithstanding this, these locations within the city are still liable to be affected by a larger flood event of a scale up to and including the Probable Maximum Flood event. It remains prudent that key developments and infrastructure within the central area of the city receive targeted consideration of the mitigated flood risk.

The former Clause 7.2 Flood planning was made obsolete through the inclusion of the new Standard Instrument LEP Clause 5.21 Flood planning as detailed in the following section.

Compulsory LEP flood planning changes

Now installed within all Local Environmental Plans is Clause 5.21 Flood planning. This clause governs how Council must assess development applications that occur on lands within the Flood Planning Area. In Wagga Wagga’s circumstance, this is land that sits outside the protection of the Wagga Wagga CBD levee, within the area to be impacted by a 1:100 flood event. The change to the Wagga Wagga Local Environmental Plan 2010 was made on 14 July 2021.

Clause 5.21 Flood planning makes the following requirements in relation to development within the Flood Planning Area:

(2) Development consent must not be granted to development on land the consent authority considers to be within the flood planning area unless the consent authority is satisfied the development—

a) is compatible with the flood function and behaviour on the land, and

b) will not adversely affect flood behaviour in a way that results in detrimental increases in the potential flood affectation of other development or properties, and

c) will not adversely affect the safe occupation and efficient evacuation of people or exceed the capacity of existing evacuation routes for the surrounding area in the event of a flood, and

d) incorporates appropriate measures to manage risk to life in the event of a flood, and

f) will not adversely affect the environment or cause avoidable erosion, siltation, destruction of riparian vegetation or a reduction in the stability of river banks or watercourses.

(3) In deciding whether to grant development consent on land to which this clause applies, the consent authority must consider the following matters—

(a) the impact of the development on projected changes to flood behaviour as a result of climate change,

(b) the intended design and scale of buildings resulting from the development,

(c) whether the development incorporates measures to minimise the risk to life and ensure the safe evacuation of people in the event of a flood,

(d) the potential to modify, relocate or remove buildings resulting from development if the surrounding area is impacted by flooding or coastal erosion.

These provisions provide Council with continued ability to ensure that only suitable development occurs within the Flood Planning Area and to give due consideration to the form that those acceptable developments take.

Optional LEP flood planning changes

In addition to Clause 5.21 Flood Planning described in the section above, the implementation of new flood planning for NSW includes the opportunity for Council to include optional Clause 5.22 Special Flood Considerations within the LEP.

The optional clause provides flood risk considerations for certain types of developments that have a higher risk to life warranting the consideration of the impacts of rarer flood events outside the Flood Planning Area and up to the Probable Maximum Flood (PMF). In Wagga Wagga, the Probable Maximum Flood (PMF) area now includes the Wagga Wagga CBD and Health and Knowledge Precinct, which both now benefit from levee protection up to a 1:100 flooding event and currently contain sensitive uses.

As detailed by Clause 5.22:

(2) This clause applies to–

(a) for sensitive and hazardous development–land between the flood planning area and the probable maximum flood, and

(b) for development that is not sensitive and hazardous development–land the consent authority considered to be land that, in the event of a flood, may–

(i) cause a particular risk to life, and

(ii) require the evacuation of people or other safety considerations.

The land uses eligible to be listed as sensitive and hazardous development are:

(a) boarding houses,

(b) caravan parks,

(c) correctional centres,

(d) early education and care facilities,

(e) eco-tourist facilities,

(f) educational establishments,

(g) emergency services facilities,

(h) group homes,

(i) hazardous industries,

(j) hazardous storage establishments,

(k) hospitals,

(l) hostels,

(m) information and education facilities,

(n) respite day care centres,

(o) seniors housing,

(p) sewerage systems,

(q) tourist and visitor accommodation,

(r) water supply systems.

Within this subset of land uses are development types that are of key significance to the city and to its regional standing. As such, several of these land uses are of key relevance to the strategic planning intent for the Wagga Wagga CBD and Wagga Wagga Health and Knowledge Precinct, as directed by the Wagga Wagga Local Strategic Planning Statement. It is prudent that Council should ensure these types of development achieve suitable levels of flood preparedness and resilience for the risk level posed by a probable maximum flood event

Within this subset of land uses are also development types which are significant for their propensity to have large numbers of people on site at any given time and in the case of some of these land uses for those people on site to be comprised in large part of vulnerable members of the population.

The installation of the CBD levee has provided considerable mitigation of flood risk to the Wagga Wagga CBD and Health and Knowledge Precinct. However, noting the extent of the probable maximum flood that could affect these precincts, and in view of the factors described above, it remains prudent and not unreasonable that Council’s bounds of consideration for these development types continues to include some consideration of the flood preparedness, resilience and responsiveness of these particular development proposals, and that the Wagga Wagga Local Environmental Plan 2010 continues to give consideration these circumstances.

Inclusion of optional Clause 5.22 within the Wagga Wagga Local Environmental Plan 2010 would accomplish this end. The matters for consideration that optional Clause 5.22 provide Council are as detailed below:

(3) Development consent must not be granted to development on land to which this clause applies unless the consent authority is satisfied that the development–

(a) will not affect the safe occupation and efficient evacuation of people in the event of a flood, and

(b) incorporates appropriate measures to manage risk to life in the event of a flood, and

(c) will not adversely affect the environment in the event of a flood.

Council is not required to specify which land uses it wishes to specify as sensitive and hazardous development to receive this consideration at this stage of the process. This will be determined subject to the forthcoming engagement and consultation activities to be conducted by NSW Department of Planning, Industry and Environment.

A resolution of Council’s continued interest in adopting optional Clause 5.22 into the Wagga Wagga Local Environmental Plan 2010 is all that is required for Council’s continued involvement in this process at this time. This report recommends inclusion of Clause 5.22 as a prudent measure, pending NSW DPIE’s consultation activities informing Council’s ultimate considerations on this matter.

Future DCP flood planning alignment

Amendments to flood planning considerations within the Wagga Wagga LEP foreshadow a requirement for modernisation of flood planning provisions provided within the Wagga Wagga DCP.

At present the Wagga Wagga Development Control Plan contains provisions which are no longer representative of the contemporary state of flood planning for Wagga Wagga.

In the period since current DCP flood planning provisions have been installed, flood mitigation within the Wagga Wagga urban environment has advanced considerably. The CBD levee has now been installed, providing protection to noted key areas and sites within the city centre. This is consistent with the overarching strategic direction for the city embedded within the Wagga Wagga Local Strategic Planning Statement.

Further, the Wagga Wagga Local Environmental Plan 2010 has changed to include the matters of consideration for flood planning detailed at Clause 5.21 and may yet include other matters as detailed at Clause 5.22, pending Council’s adoption. Excerpts including these matters have been provided in earlier sections of this report.

The role of the Development Control Plan is to provide specific guidance in the evaluation and approval of development proposals, such that the overarching directions of the Local Environmental Plan are upheld.

A revised set of DCP provisions for flood planning would then provide consideration of:

· the contemporary flood planning context, including the addition of additional flood mitigation in Wagga Wagga, more recent calculation/modelling of the extent of likely flood impacts and any changes in contemporary design practice for flood affected sites, and;

· how development proposals might best seek to address or demonstrate adherence to the matters for consideration within Clause 5.21(2) and (3) and optional Clause 5.22 (3) (subject to the specific form and inclusions adopted by Council in future).

Financial Implications

The amendments made to Local Environmental Plans to date have been conducted by the NSW Department of Planning, Industry and Environment.

This will also be the case for any further amendments to Local Environmental Plans in relation to this matter. Forthcoming engagement activities associated with the optional LEP clauses are to be implemented by the NSW Department of Planning, Industry and Environment. No financial implication has been identified at this time in relation to this process for Council.

Future work to contemporise the flood planning provisions of the Wagga Wagga Development Control Plan to achieve alignment with the strategic planning intent for the city and with new LEP provisions will require resourcing. Amendment to the DCP is within the ordinary work tasking of the Strategic Planning business section. It is yet to be determined whether work to develop the underlying technical basis for those new provisions in the DCP will require establishment of a separate funding stream.

It is anticipated that this work would build upon previous investigation on this topic and will most likely be fulfilled via the ordinary funding pool available for strategic planning work. Notwithstanding this, further consideration on this matter may expose a requirement for further specialist investigation, which may require a funding allocation.

Policy and Legislation

Environmental Planning and Assessment Act 1979

Standard Instrument Local Environmental Plan 2006

NSW Floodplain Development Manual 2005

Wagga Wagga Local Environmental Plan 2010

Wagga Wagga Development Control Plan 2010

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

Council’s adopted strategic direction for the city, the Wagga Wagga Local Strategic Planning Statement, places emphasis upon key sites and areas to provide the foundation for the economic development and growth of the city into the future.

The Wagga Wagga CBD is one of six key sites nominated by the Local Strategic Planning Statement to underpin the economic growth and resilience of the city. This area is a significant site for commerce, service delivery and cultural events for the entire city as well as the population of the broader Riverina region. This role necessarily implies an ability to develop a wide variety of key services to serve the needs of the community. The Health and Knowledge Precinct is another of the six key sites which similarly underpins service provision to the city and region.

Both locations are within the modelled area of the Probable Maximum Flood event. As a result, the new LEP provisions, both compulsory and optional, are advantageous for the alignment of the Wagga Wagga Local Environmental Plan with the strategic direction of the city. The optional Clause 5.22 Special flood considerations particularly will afford Council the latitude to ensure development of key installations can occur in Central Wagga Wagga with due consideration to flood risk within the area potentially affected by the Probable Maximum Flood event. Considerable investment has been directed toward the advancement and protection of these key sites for the city and region, not only in relation to flooding concerns but the overall development trajectory of these areas in view of their regional significance.

Council’s approach to flood risk management and planning should seek to ensure that these areas are able to fulfil their strategic role for the city and region, making good upon investment directed toward their protection and advancement to date. Planning activity should ensure alignment between the implementation of flood planning measures at the individual site scale and the overarching direction of land use planning for the local government area. The implementation of new LEP flood planning provisions is an incremental step towards this objective and is aligned with Council’s continuing direction to reduce the impact of flood hazard upon key areas of the city. This further mitigates the risk that flooding poses to the city’s ability to sustain key municipal and regionally significant sites in the Wagga Wagga CBD, in line with strategic planning directions.

Internal / External Consultation

Engagement associated with the Flood Planning Package has been and will continue to be conducted by the NSW Department of Planning, Industry and Environment.

Internal consultation has been undertaken on the impacts of opting in for the optional clause with benefits identified as providing flexibility while managing risks associated with sensitive uses within the probably maximum flood area.

|

1⇩. |

Former WWLEP Clause 7.2 Flood planning |

|

|

2⇩. |

New WWLEP Clause 5.21 Flood planning |

|

|

3⇩. |

Optional SILEP Clause 5.22 Special flood considerations |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 29 November 2021 |

RP-2 |

RP-2 EUNONY VALLEY GREENING FUNDS

Author: Mark Gardiner

Director: Janice Summerhayes

|

Summary: |

Spark Renewables in partnership with Westpac have established the Eunony Valley Greening Fund (EVGF). The EVGF is a community fund of $100,000 made available to support landholders in the eligible area to deliver native tree planting projects that will help address the impact of climate change and promote biodiversity.

Eunony Valley residents were invited to make application for funding between 17 August and 27 September 2021. This report provides details of the successful applications for funding under the EVGF.

|

|

That Council approve the successful applications for the Eunony Valley Greening program as detailed in the report totalling $98,464.55. |

Report

Spark Infrastructure in partnership with Westpac have established a community fund in which one million dollars ($1,000,000) is invested into the local community over the first ten years of operation of the solar farm. As part of the community fund Spark Infrastructure entered into a funding partnership agreement with Council, where they will provide Council $350,000 to undertake revegetation programs to enhance biodiversity in the proximity of the Bomen precinct.

This includes a revegetation program for Eunony Valley residents through a Eunony Valley Greening Fund (EVGF). The EVGF is a community fund of $100,000 made available to support landholders in the eligible area to deliver native tree planting projects that will help address the impact of climate change and promote biodiversity. The proposed planting projects will also enhance visual amenity by providing screening of the Bomen Solar Farm.

Eunony Valley residents within 4km of the Bomen Solar Farm were invited to make application for funding between 17 August and 27 September 2021. Eight (8) applications involving 10 properties were received and have been assessed internally by staff against the programs criteria, with all applications meeting the eligibility for funding. The projects will provide significant environmental benefits to the Eunony Valley residents with the proposed projects delivering approximately 13,000 native plants in Winter 2022. The following table outlines the successful applications received:

|

Applicant |

Funding requested (Exclusive GST) |

|

Tony Dunn and Michele Fromholtz |

$33,727.27 |

|

Sheila & Craig Buntin |

$5,863.64 |

|

Carol and Graeme Obst |

$8,663.64 |

|

John and Norma Gray |

$13,090.91 |

|

Helen and Henry Hicks |

$5,046.36 |

|

Graham White |

$7,381.82 |

|

Brett Tindal |

$5,136.36 |

|

Bill Schulz and Marie Suthern / Ruth Jude / Anthony and Cathie O'Kane |

$19,554.55 |

|

Total |

$98,464.55 |

Financial Implications

Spark Infrastructure in partnership with Westpac have provided $100,000 to Council for eligible projects under the Eunony Valley Greening Fund (EVGF). This will fund the requests of $98,464.55 outlined in the report.

The remaining $1,545.45 will be used by Council for further plantings at Bomen, which has been confirmed with Spark Infrastructure.

Policy and Legislation

Biodiversity Strategy: Maldhangilanha 2020-2030

POL 078 – Financial Assistance Policy

Link to Strategic Plan

The Environment

Objective: We create a sustainable environment for future generations

Outcome: We demonstrate sustainable practices

Risk Management Issues for Council

Internal / External Consultation

Eunony Valley residents within 4km of the Bomen Solar Farm were invited to make application for funding between 17 August and 27 September 2021. External consultation has been undertaken with representatives of Spark Infrastructure.

|

Report submitted to the Ordinary Meeting of Council on Monday 29 November 2021 |

RP-3 |

RP-3 COVID-19 Fast Track Events Sponsorship

Author: Fiona Hamilton

Director: Janice Summerhayes

|

Summary: |

Council is in receipt of four applications for the second round of the COVID-19 Fast Track Event Sponsorship Program. This funding is available to support events held from 1 January to 31 December 2022. Council endorsed the second round of the COVID-19 Fast Track Events Sponsorship program at the 8 November 2021 Ordinary Meeting.

The applications detailed in this report are for the Southern District Racing Association’s Country Championships Day, Bidgee Theatre Production’s Mamma Mia, the 2022 Stone the Crows Festival and the 2022 Wagga Wagga Mardi Gras.

|

|

That Council: a authorise the General Manager or their delegate to enter into an agreement to support: i. Murrumbidgee Turf Club for the hosting of the Southern District Racing Association’s. ii. Three Crows Pty Ltd in hosting the 2022 Stone the Crows Festival iii. HC Events in the hosting of the 2022 Wagga Mardi Gras iv. Bidgee Theatre Productions staging of Mamma Mia! The Musical

b approve the budget variation/s as detailed in the Financial Implications section of the report |

|

|

Report

Council is in receipt of four applications for the COVID-19 Fast Track Event Sponsorship Program for events held from 1 January to 30 December 2022.

These applications have been assessed by the Major Events Advisory Panel In line with the COVID-19 Fast Track Events Sponsorship guidelines.

The applications received and recommended sponsorship funding amounts are summarised as follows:

|

|

Organisation Name |

Event Name |

Amount Requested |

Funding Recommended |

|

1 |

Murrumbidgee Turf Club Ltd |

Southern District Racing Association’s Country Championship |

$12,500 |

$12,500 subject to March date change OR $7,500 if on 19/2/2022 |

|

2 |

Three Crows Pty Ltd |

2022 Stone the Crows Festival |

$19,504 |

$16,000 |

|

3 |

HC Events Pty Ltd |

2022Wagga Wagga Mardi Gras Festival |

$20,000 |

$15,000 |

|

4 |

Bidgee Theatre Productions |

Mamma Mia! The Musical |

$20,000 |

$10,000 |

Events Details:

Southern District Racing Association’s Country Championships

The Murrumbidgee Turf Club (MTC) is seeking $12,500 in funding through the COVID-19 Fast Track Event Sponsorship Program to support the delivery of the Southern District Race Association’s (SDRA) Country Championships to be held on Saturday 19 February 2022 in Wagga Wagga.

Event details are as follows:

· Name: SDRA Country Championships

· Date: Saturday 19 February 2022 or 5 March 2022 (TBC)

· Expected attendance: 2,800

· Visitors (from outside of LGA): 20%

· Program:

o Major regional race day attracting state-wide trainers and owners

o Event precinct for under 30’s years with award winning and local DJ’s

o Kids entertainment

· Duration: one day

· Venue: Murrumbidgee Turf Club

· Total event cost: $96,000

· Forecast income: $96,000

The funding requested will be utilised to support the MTC with the provision of entertainment, marketing and COVID-19 event delivery compliance.

This event was held in Wagga Wagga 19 February 2021 and the MTC are working to secure this event beyond 2022 for future years in Wagga Wagga. The applicant had initially proposed the event take place on 19 February 2022 which is the same weekend as the NSW Junior Touch Southern Conference. The event organiser has proposed a new date, 5 March 2022 to Racing NSW and is awaiting approval in the near future.

If successful with this funding application, the MTC will acknowledge Council as a premier partner with Council’s logo included on all promotional material and digital platforms.

The Panel has assessed this application against the COVID-19 Fast Track Events Sponsorship Guidelines and recommends this festival be funded $12,500 if this event does not clash with the NSW Junior Touch Southern Conference event for the following reasons:

· The event appeals to a broad demographic and includes programming targeting at both youth and families in addition to the entertainment provided to traditional racegoers.

· The event provides benefit to both the community and local business, particularly in relation to the ancillary services the event goers are likely to access for example Hairdressers, fashion boutiques and hospitality venues.

· The broadcasting and media coverage of this event will ensure national exposure for the City.

· The MTC has demonstrated the capability to deliver an event of this nature, particularly during COVID-19 restrictions.

· The MTC has provided detailed budgets and venue management plans to support the application.

· The event aligns to the major tourism event category defined in the Events Strategy and Action Plan 2020-24 focused on attracting significant attendee numbers, economic benefit and the generation of national media exposure.

· The event will generate visitor spend of $127,120 and create an economic impact of $159,829 for our City (source: economy.id), in addition to the national media exposure generated through this event.

· The sponsorship represents an investment of $4.16 per attendee, representing good value for investment.

In the case of Racing NSW not supporting the proposed date change to 5 March 2022, the Panel recommend supporting the event to a lesser amount of $7,500. Securing this event in 2022 will assist in building the case for the longer-term hosting of this event through Racing NSW, however a reduced sponsorship is proposed if the date of this event remains on the 19 February 2022. This is because the out of region marketing costs would be reduced as accommodation is already at 98% occupancy due to the confirmed 2022 touch football event already occurring on this date. Meaning this event organiser would not need to advertise outside the region as the City would be unable to host additional overnight visitors.

Stone the Crows Festival

The Stone the Crows Festival is a week-long festival designed for the over 50’s years demographic who have an interest in Recreational Vehicle (RV) touring. The Festival which is held at the Australian Clay Target Association grounds, started 10 years ago and now attracts approximately 1500 visitors each Easter to the City. The participants stay seven nights and are reported to spend an additional nine nights in the Riverina pre or post the Festival.

Event details are as follows:

· Name: Stone the Crows Festival

· Date: 14 to 21 April 2022

· Expected attendance: 1300 per night over 7 days

· Visitors (from outside of LGA): 90%

· Program:

o Daily activities including workshops, games and markets

· Duration: 7 days

· Venue: Australian Clay Target Association

· Total event cost: $121,786

· Forecast income: $145,797

The funding requested will be used to support additional costs incurred to ensure COVID-19 compliance, including the contracting of professional cleaners ($12,000 over the Easter holiday period) and a larger marquee to accommodate social distancing regulations ($6,992). The event is forecast to make a profit of $24,011 which will go towards covering the losses incurred in 2019/20 with the cancellation of the 2020 event due to COVID-19 restrictions, with any remaining amount to be invested into the 2023 event.

Council have supported this event in the past through a Tourism Grant of $8,500 in 2018 and also through the provision of in-kind support over the lifetime of the event which has included event promotions, marquee hire and event logistics support.

If successful in this funding application, the event organiser will acknowledge Council through the inclusion of Council’s logo on all promotional material and digital platforms.

The Panel has assessed this application against the COVID-19 Fast Track Events Sponsorship Guidelines and recommends this festival be funded $16,000 for the following reasons:

· The event is multi day with 90% of attendees coming from outside our region generating a significant economic return to the City.

· The event takes place over Easter which has traditionally been a low season for both events and tourism.

· The event provides benefit to local business, particularly in relation to the equipment hire, printing, food supply and accommodation operators.

· The event organiser has provided detailed budgets and has indicated a strategy for targeting a younger cohort of over 50’s are encouraged to participate in this event to ensure viability of this event going forward

· The event aligns to the major tourism event category defined in the Events Strategy and Action Plan 2020-24 with overnight visitation in excess of three nights, shoulder season and significant economic benefit.

· The event will generate visitor spend of between $679,140 with the total impact on the economy of $853,889 (source: economy.id).

· The sponsorship represents an investment of $11.42, this is offset by the fact the participants are staying 7 nights in our City.

The application scored highly against the visitation criteria outlined in the guidelines however, the assessment panel determined that in terms of event innovation or adaptation that is more than the staging of the previous event and programming, the application did not establish a case for the full amount of $20,000 requested. For this reason, the Panel have recommended the amount of $16,000 is granted to the organiser.

Mardi Gras

In March 2019 the inaugural Wagga Wagga Mardi Gras Festival was held with the aim of raising the visibility of the lesbian, gay, bisexual, transgender, queer and intersex communities in the Riverina. Wagga Wagga City Council sponsored the event to the amount of $15,000 with the event organiser reporting estimates of 10,000 attendees participating at the Mardi Gras parade.

In 2020 Council sponsored the second Wagga Wagga Mardi Gras Festival to the amount of $20,000. Due to circumstances outside the reasonable control of HC Events Pty Ltd the Mardi Gras event was cancelled the day before the event was due to be held with the onset of COVID-19 pandemic. With this cancellation Council acknowledged that there had been a financial impact on this event organiser, and substantial costs already incurred, for this reason Council honoured the full sponsorship payments totalling $20,000 even though the event did not proceed.

The 2021 Mardi Gras event was not held due to the COVID-19 pandemic.

Event details for 2022 are as follows:

· Date: 11 – 13 March 2022

· Expected Attendance: 2,000 – 3,000 people

· Visitors (from outside of LGA): 15%

· Venue: Baylis Street and Victory Memorial Gardens

· Program:

o Friday 11 March – Que Bar drag show

o Saturday 12 March

§ 4pm - Baylis Street parade

§ 5pm – 10pm Victory Memorial Gardens celebration with DJ, information stalls, licensed bar area

§ 10pm – late Que Bar after party

· Duration: 1.5 days

· Total event cost: $68,385

· Forecast income: $76,500

The event organiser is working with local businesses to secure sponsorship for the festival and has confirmed that these sponsorship requests are in negotiation and currently embargoed. The event is forecasted to make a profit of $8,115 in 2022 with funds being reinvested into the 2023 event.

The applicant is seeking $20,000 in funding for the 2022 event to enable the event organiser to secure tv and radio advertising and out of region social media advertising, which is identified as $15,000 in the event budget.

The Panel assessed this application against the COVID-19 Fast Track Sponsorship Guidelines and recommended the festival be funded $15,000 for the following reasons:

· The event aligns to the City of Wagga Wagga’s vision to be a connected and inclusive community, creating long term legacy for the community

· The event aligns to the major tourism event category defined in the Events Strategy and Action Plan 2020-24 attracting significant attendee numbers, economic benefit and generation of national media exposure.

· The event will generate visitor spend of between $153,225 with the total impact on the economy of $192,651 (source: economy.id).

· The sponsorship represents an investment of $5 per attendee representing good value for investment

The application scored highly against the community benefit criteria, however the assessment panel noted that the Mardi Gras event budget for marketing and advertising is $15,000 and in terms of innovation or adaptation in the current climate the application did not establish a full case for the amount of $20,000 requested. For this reason, the Panel have recommended the amount of $15,000 be approved for this event.

Mamma Mia Stage Production

Bidgee Theatre Productions is seeking $20,000 in funding to support the production of “Mamma Mia! The Musical”, a theatre production being held at the Civic Theatre from 11 – 26 February 2022.

Event details are as follows:

· Name: Mamma Mia! The Musical

· Date: 11 – 26 February 2022

· Expected attendance: 1500+

· Visitors (from outside of LGA): 25-30% (from Griffith, Leeton and Tumut), predominantly day trippers

· Program:

o Opening night performance 11 February 2022

o Matinee and evening performances 12 – 26 February 2022

· Duration: 15 days

· Venue: Wagga Wagga Civic Theatre

· Total event cost: $148,123.35

· Forecast income: $197,856.

The funding requested will be utilised to offset the venue hire fee and staffing costs required over the 15 days at the Wagga Wagga Civic Theatre of $44,919.50. The venue hire is $13,050 which is calculated at the reduced ‘community rate’ of $850 per day.

If successful, Bidgee Theatre Productions will acknowledge Council as a major sponsor on all promotional material and program information. Naming rights are not available.

The Panel has assessed the application against the COVID-19 Fast Track Events Sponsorship Guidelines criteria and recommends the production be funded to the amount of $10,000 for the following reasons:

· The event provides benefit to both the community and local business through the creative industries sector.

· The event aligns to the Community Event category defined in the Events Strategy and Action Plan 2020-24 attracting local attendance and day trips, while building capability within the community.

· The event will generate visitor spend of $68,250 with the total impact on the economy of $85,811 (source: economy.id).

· The sponsorship represents an investment of $6.60 per attendee representing good value for investment

This project addresses some of the criteria for the funding by the employment of local creatives as well as local procurement and hire of equipment and services. However, the assessment panel noted in terms of value for money and innovation this project was unable to establish a case for the full amount of $20K requested and noted there will be a profit realised for staging the event.

Financial Implications

|

2021/22 Major Events Sponsorship budget |

$100,000 |

|

Less previously approved Council sponsorship: |

|

|

Sporting Academy Games 2022 |

($20,000) |

|

Scott Howie - Interesting (auspiced by Eastern Riverina Arts), carry over from 2020/21 |

($3,000) |

|

Wagga Wagga Road Runners - Wagga Trail Marathon – rolled over from 2020/21 to 2021/22 |

$7,918 |

|

2021/22 Major Events Sponsorship current budget available |

$84,918 |

|

· Murrumbidgee Turf Club’s Southern District Racing Association’s Country Championship |

($12,500) |

|

· Three Crow’s Pty Ltd 2022 Stone the Crows Festival |

($16,000) |

|

· HC Events 2022 Mardi Gras Festival |

($15,000) |

|

· Bidgee Theatre Productions Mamma Mia! |

($10,000) |

|

· Total Major Events Sponsorship funding recommended |

($53,500) |

|

Proposed 2021/22 COVID-19 Fast Track Events Sponsorship budget available for remainder of this financial year |

$31,418 |

Job consolidation number: 15308

Policy and Legislation

POL087 – Major Events, Festivals and Films Sponsorship

Link to Strategic Plan

Growing Economy

Objective: We are a hub for activity

Outcome: We have vibrant precincts

Risk Management Issues for Council

Risk management will be addressed as part of any future sponsorship agreement, with terms and conditions ensuring events are managed in a COVID-19 safe framework based on the current Public Health Order in place at the time. A staged payment schedule based on event planning and delivery milestones will also be implemented to mitigate against non-delivery of event.

Internal / External Consultation

Staff have consulted with local event organisers to support the planning and delivery of events in the 2022 annual events schedule in line with the timelines detailed in the NSW Roadmap to Recovery.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Involve |

|

|

|

X |

|

X |

|

|

|

X |

X |

X |

X |

||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Mamma Mia! The Musical Application This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, reveal a trade secret. - Provided under separate cover |

|

|

2. |

Mamma Mia! The Musical Budget This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, reveal a trade secret. - Provided under separate cover |

|

|

3. |

Mamma Mia! The Musical Event Runsheet This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, reveal a trade secret. - Provided under separate cover |

|

|

4. |

SDRA Country Championships heat @ MTC Wagga Application This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, reveal a trade secret. - Provided under separate cover |

|

|

5. |

SDRA Country Championships heat @ MTC Wagga Budget This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, reveal a trade secret. - Provided under separate cover |

|

|

6. |

SDRA Country Championships heat @ MTC Wagga Event Management Plan This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, reveal a trade secret. - Provided under separate cover |

|

|

7. |

Stone the Crows Festival Application This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, reveal a trade secret. - Provided under separate cover |

|

|

8. |

Stone the Crows Festival Budget This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, reveal a trade secret. - Provided under separate cover |

|

|

9. |

Stone the Crows Festival Infrastructure Covid Expenses This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, reveal a trade secret. - Provided under separate cover |

|

|

10. |

Stone the Crows Festival Risk Management This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, reveal a trade secret. - Provided under separate cover |

|

|

11. |

Wagga Wagga Mardi Gras Festival Application This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, reveal a trade secret. - Provided under separate cover |

|

|

12. |

Wagga Wagga Mardi Gras Festival Budget This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, reveal a trade secret. - Provided under separate cover |

|

|

13. |

Wagga Wagga Mardi Gras Festival Covid Safety Plan This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, reveal a trade secret. - Provided under separate cover |

|

|

14. |

Wagga Wagga Mardi Gras Festival Event Management Plan This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, reveal a trade secret. - Provided under separate cover |

|

|

15. |

COVID-19 Fast Track Event Sponsorship Guidelines Round Two This matter is considered to be confidential under Section 10A(2) of the Local Government Act 1993, as it deals with: commercial information of a confidential nature that would, if disclosed, reveal a trade secret. - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 29 November 2021 |

RP-4 |

RP-4 LAKE ALBERT - SPECIAL PURPOSE ACCESS LICENCE UPDATE

Author: Peter Thompson

|

Summary: |

The purpose of this report is to provide Council with an update on the agreement reached with the NSW State Government for the grant of a Special Purpose Access Licence to provide water to Lake Albert. |

|

That Council receive and note the report. |

Report

As Council is aware, we reached agreement with the NSW State Government earlier this year on the grant of a Special Purpose Access Licence (the Access Licence) to provide water to Lake Albert. This agreement is recorded in the terms of a Memorandum of Understanding executed earlier this year by Minister Melinda Pavey and the Mayor and General Manager of Wagga Wagga City Council.

Following this meeting, Council has been working on how to convey water from the river to Lake Albert when the Access Licence is available. We have met with Riverina Water who have been supportive, and we are continuing to meet with them to complete the design of a route. At this point in time we anticipate that we will use the recently decommissioned rising main from the Hammond Avenue Pump station to the Kooringal treatment works as part of the solution. This will save the cost of constructing a new pipeline in this area and make the construction task cheaper and quicker.

In September we wrote to the Minister and advised where we were up to in relation to the things we had to do under the agreement and confirmed that we hoped to be in a position to pump water to Lake Albert in April next year.

The Minister wrote her reply on 20 October 2021 and a copy is attached for your reference. The NSW Government are progressing what they said they would do in the agreement with the Minister currently awaiting the draft legislation from Parliamentary Counsel. Once this is finalised the change to the regulation will be made to record the Wagga Wagga Lake Albert Special Purpose Access Licence in the regulations which is an essential step before the licence can be issued.

Unfortunately, our application for Commonwealth Government funding to assist in constructing the pipeline under Building Better Regions Funds was unsuccessful. We do not currently have any grant applications submitted and will continue to look for funding. Even without the support of the Commonwealth Government or NSW State Government in relation to costs, we will be able to build the pipeline and embrace the solution to the previously ongoing low water events at Lake Albert. It would, of course, be preferable for the other levels of Government to contribute to the cost and in doing so, support our community.

Financial Implications

N/A

Policy and Legislation

N/A

Link to Strategic Plan

Safe and Healthy Community

Objective: We promote a healthy lifestyle

Outcome: Recreation is a part of everyday life

Risk Management Issues for Council

· Lack of grant funding for the capital cost of the pipeline

· Council requires the regulation change to formalise the Special Access Licence

Internal / External Consultation

Council has continued to consult closely with Riverina Water County Council on the construction of the pipeline and the State Government on the progress of providing the Special Purpose Access Licence

|

1⇩. |

Correspondence from Hon Melinda Pavey MP - Special Purpose Access Licence - Lake Albert |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 29 November 2021 |

RP-5 |

RP-5 Presentation of the 2020/21 Financial Statements

Author: Zachary Wilson

Executive: Carolyn Rodney

|

Summary: |

Council resolved to sign the 2020/21 Financial Statements at the 25 October 2021 Council Meeting, enabling Council officers to lodge the financial statements with the Office of Local Government (OLG) prior to the 31 October 2021 due date.

Council’s external auditors, NSW Audit Office have completed their Auditor’s Report, and have provided this to Council for their information. |

|

That Council: a receive the Audited Financial Statements, together with the Auditor’s Reports on the Financial Statements for the year ended 30 June 2021 b receive a further report if any public submissions are received |

Report

The Audit Reports for the 2020/21 Financial Statements have now been received and are presented in accordance with section 419(1) of the Local Government Act 1993.

Council has provided public notice that the Financial Statements and Auditor’s Reports will be presented at this meeting in accordance with section 418 of the Local Government Act 1993 and has invited public submissions on the audited financial statements, with submissions open until Monday 6 December 2021.

Financial Implications

Whilst this report and associated attachments show Council’s financial performance and position for the 2020/21 financial year, the adoption of this report by the Council has no financial implications.

Policy and Legislation

Local Government Act 1993

Sections: 419 – Presentation of council’s financial reports

420 – Submissions on financial reports and auditor’s report

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

The NSW Audit Office have provided Council with a final Management Letter which has identified three (3) issues with one (1) rated as High and two (2) rated as Moderate. Council officers will undertake the actions that have been identified in each of the Management Responses.

Internal / External Consultation

The Council’s Community Engagement Strategy and IAP2 considers the community to be “any individual or group of individuals, organisation or political entity with an interest in the outcome of a decision….”

Council’s external auditors, NSW Audit Office have liaised with Council’s Finance division and presented the draft Financial Statements in detail to the Audit, Risk and Improvement Committee at the 7 October 2021 Committee meeting. Councillors were invited to the Committee meeting and had the opportunity to discuss any aspects of the 2020/21 financial statements with the NSW Audit Office staff prior to the 25 October 2021 Council meeting.

The draft Financial Statements were approved for signing by Council at its 25 October 2021 Council meeting.

|

1. |

2020/21 Annual Financial Statements - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 29 November 2021 |

RP-6 |

RP-6 POL 075 - Investment Policy

Author: Zachary Wilson

Executive: Carolyn Rodney

|

Summary: |

Council’s Investment Policy (POL 075) is required to be reviewed annually with any amendments approved by Council. A review has been undertaken and only minor amendments are proposed to the current Policy. This Policy is presented to Council for endorsement, following public exhibition. |

|

That Council: a note that there were no public submissions received during the exhibition period for POL 075 – Investment Policy b adopt the draft POL 075 – Investment Policy |

Report

Council’s Investment Policy provides a framework for Council officers who have been delegated by the General Manager to invest Council funds. The Policy ensures that adequate controls are in place to ensure Council’s investments are managed appropriately, in order to maximise the return to Council in accordance with the risk appetite of Council.

Council, at its 13 September 2021 Council meeting, resolved to place the draft Investment Policy on public exhibition for a period of 28 days from 14 September 2021 to 12 October 2021 and invite public submissions until 26 October 2021.

During the submission period, no public submission were received.

It is recommended that Council adopt the Policy as exhibited.

Financial Implications

The content of the Investment Policy determines what types of investments and terms are allowable and its content outlines the framework Council officers are able to work within in making investment decisions. The role of Council officers responsible for managing Council’s investment portfolio is to maximise investment revenue earned, whilst adhering to the Investment Policy.

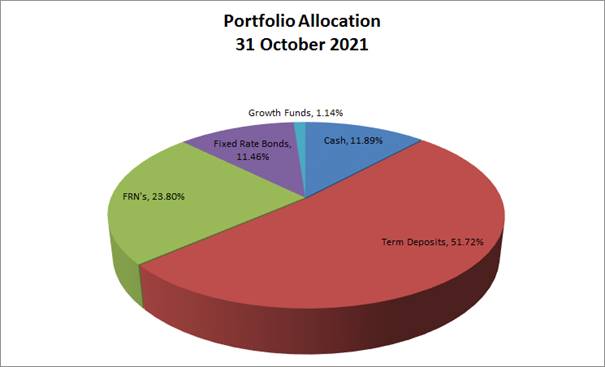

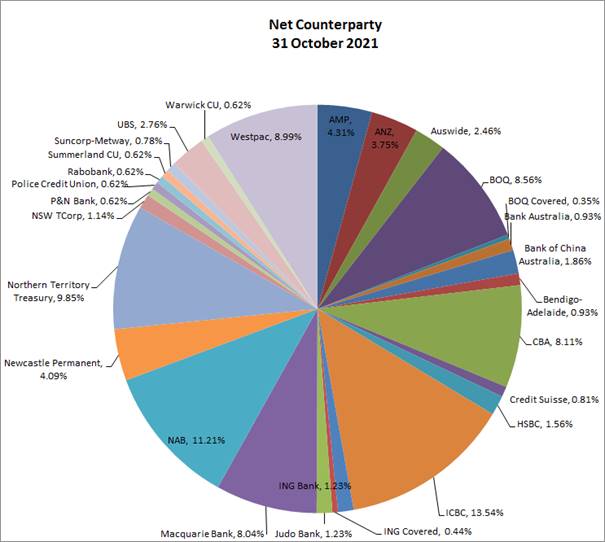

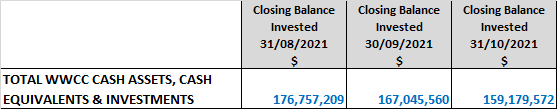

Council’s portfolio balance was $177M at 31 October 2021 with budgeted investment income for the 2021/22 financial year of $1.8M.

Policy and Legislation

Investment Policy – POL 075

Local Government Act 1993 – Section 625

Local Government (General) Regulation 2005 – Section 212

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

The Investment Policy attempts to mitigate the potential loss of investment income or capital resulting from ongoing management of investments, especially during difficult economic times.

As required by the Local Government Regulation 2005, Council officers report monthly to Council on the investment portfolio performance and position.

Internal / External Consultation

Council’s independent investment advisor, Imperium Markets, has reviewed the policy and has provided adjustments where necessary.

Council officers have also reported the reviewed Policy to the Audit, Risk and Improvement Committee, at its 19 August 2021 meeting.

Following endorsement by Council at its 13 September 2021 Council meeting, the draft policy was placed on public exhibition for a period of 28 days from 14 September 2021 to 12 October 2021 with public submissions received until 26 October 2021.

|

1⇩. |

POL 075 - Investment Policy |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 29 November 2021 |

RP-7 |

RP-7 Proposed New Fees and Charges for 2021/22

Author: Zachary Wilson

Executive: Carolyn Rodney

|

Summary: |

This report proposes to add a number of new lighting fees for 2021/22 for the Wagga Wagga Multi Sports Cycling Complex, which will be available for use early in the new year. |

|

That Council: a place the following new fees and charges on public exhibition for a period from 30 November 2021 to 7 January 2021:

b invite public submissions on the proposed new fees and charges until 7 January 2021. c receives a further report following the public exhibition period: i addressing any submission made in respect of the proposed new fees ii proposing adoption of the new fees and charges unless there are any recommended amendments that will require a further public exhibition period |

Report

The Wagga Wagga Multi Sports Cycling Complex will be available for use by cycling clubs early in the new year. As there are currently no lighting fees included in Councils adopted 2021/22 fees and charges for this new venue, this report proposes to include four (4) new fees for the lighting systems that will be available for use at this facility.

For Councillors information, the charge rate for the facility is accounted for within the current sportsgrounds user fees, casual hire and event rates included in Council’s adopted 2021/22 Fees and Charges.

Council staff have undertaken a review of the proposed lighting charges for this facility for 2021/22, with the proposed lighting fees comprising a maintenance component and an electricity usage component.

As the proposed fees are new fees and charges to be raised for 2021/22, it is recommended for these fees to be placed on public exhibition for a period of 28 days, from 30 November 2021 to 28 December 2021, to allow for public submissions to be received.

Following the public exhibition period, a further report will be provided addressing any submissions received.

These lighting fees will be factored into Council’s annual operating income budget during the compilation of the 2022/23 Long Term Financial Plan.

Policy and Legislation

Local Government Act 1993

Chapter 15, Part 10, Division 1:

· Section 608 Council fees for services

Chapter 15, Part 10, Division 2:

· Section 610B Fees to be determined in accordance with pricing methodologies

Chapter 15, Part 10, Division 3:

· Section 610D How does a council determine the amount of a fee for service?

· Section 610F Public notice of fees

Local Government (General) Regulation 2005

Regulation 201 Annual statement of council’s revenue policy

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

The charging of these fees will assist in recouping the lighting costs, therefore reducing the impact on Council’s financial position.

Internal / External Consultation

The proposed new fees and charges will be publicly exhibited through Council News and on Councils website, seeking public submissions. Council staff will also be notifying the relevant clubs who will are proposed users of these lighting areas.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

x |

|

x |

|

|

|

|

|

|

|

x |

|

||||

|

Involve |

|

|

|

|

|

|

|

|

|||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Report submitted to the Ordinary Meeting of Council on Monday 29 November 2021 |

RP-8 |

RP-8 FINANCIAL PERFORMANCE REPORT AS AT 31 OCTOBER 2021

Author: Carolyn Rodney

General Manager: Peter Thompson

|

Summary: |

This report is for Council to consider information presented on the 2021/22 budget and Long-Term Financial Plan, and details Council’s external investments and performance as at 31 October 2021. |

|

That Council: a approve the proposed 2021/22 budget variations for the month ended 31 October 2021 and note the balanced budget position as presented in this report b approve the proposed budget variations to the 2021/22 Long Term Financial Plan Capital Works Program including future year timing adjustments c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above d note the details of the external investments as at 31 October 2021 in accordance with section 625 of the Local Government Act 1993 |

Wagga Wagga City Council (Council) forecasts a balanced budget position as at 31 October 2021. The balanced budget position excludes the Wagga Wagga Airport estimated deficit result for the financial year, as any Airport deficit result will be sanctioned, and funded in the interim by General Purpose Revenue (via the Internal Loans Reserve). The deficit results will be accounted for as a liability in the Airport’s end of financial year statements and paid back to General Purpose Revenue (Internal Loans Reserve) by the Airport in future financial years.

Proposed budget variations including adjustments to the capital works program are detailed in this report for Council’s consideration and adoption.

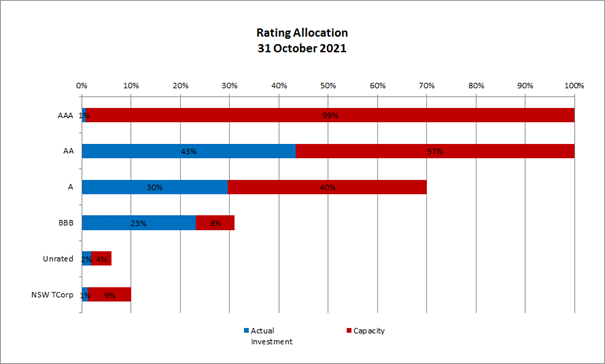

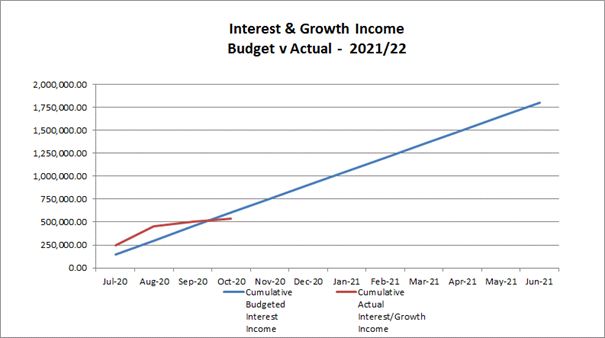

Council has experienced a negative monthly investment performance for the month of October when compared to budget ($116,530 down on the monthly budget). This is mainly due to a negative movement in the principal value of Councils Floating rate note portfolio.

Key Performance Indicators

OPERATING INCOME

Total operating income is 33% of approved budget and is trending on budget for the month of October 2021. An adjustment has been made to reflect the levy of rates that occurred at the start of the financial year. Excluding this adjustment, operating income received is 76% when compared to budget.

OPERATING EXPENSES

Total operating expenditure is 33% of approved budget so it is tracking on budget at this stage of the financial year. Excluding commitments, the total expenditure is 30% when compared to the approved budget.

CAPITAL INCOME

Total capital income is 15% of approved budget. It is important to note that the actual income from capital is influenced by the timing of the receipt of capital grants and contributions relating to projects. This income also includes the sale of property, plant and equipment.

CAPITAL EXPENDITURE

Total capital expenditure including commitments is 41% of approved budget (including pending projects) which is as a result of purchase orders being raised for the full contract amounts for multi-year projects. Excluding commitments, the total expenditure is 14% when compared to the approved budget.

|

WAGGA WAGGA CITY COUNCIL |

|||||||

|

CONSOLIDATED STATEMENT |

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2021/22 |

COMMT'S 2021/22 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Revenue |

|||||||

|

Rates & Annual Charges |

(73,169,576) |

0 |

(73,169,576) |

(24,208,338) |

0 |

(24,208,338) |

33% |

|

User Charges & Fees |

(25,225,528) |

(128,906) |

(25,353,204) |

(8,719,080) |

0 |

(8,719,080) |

34% |

|

Interest & Investment Revenue |

(2,014,844) |

0 |

(2,014,844) |

(592,227) |

0 |

(592,227) |

29% |

|

Other Revenues |

(3,436,033) |

(362,622) |

(3,799,885) |

(1,366,803) |

0 |

(1,366,803) |

36% |

|

Operating Grants & Contributions |

(12,902,235) |

3,936,103 |

(8,966,132) |

(3,015,089) |

0 |

(3,015,089) |

34% |

|

Capital Grants & Contributions |

(82,436,148) |

(13,733,015) |

(96,169,163) |

(14,141,220) |

0 |

(14,141,220) |

15% |

|

Total Revenue |

(199,184,362) |

(10,288,441) |

(209,472,803) |

(52,042,757) |

0 |

(52,042,757) |

25% |

|

|

|||||||

|

Expenses

|

|||||||

|

Employee Benefits & On-Costs |

49,289,314 |

(3,533) |

49,285,782 |

15,049,755 |

0 |

15,049,755 |

31% |

|

Borrowing Costs |

3,211,705 |

0 |

3,211,705 |

600,811 |

0 |

600,811 |

19% |

|

Materials & Services |

35,727,106 |

6,716,008 |

42,443,113 |

12,039,416 |

3,987,682 |

16,027,098 |

38% |

|

Depreciation & Amortisation |

39,287,050 |

0 |

39,287,050 |

13,095,683 |

0 |

13,095,683 |

33% |

|

Other Expenses |

3,708,040 |

2,419,477 |

6,127,517 |

1,592,416 |

2,534 |

1,594,951 |

26% |

|

Total Expenses |

131,223,215 |

9,131,952 |

140,355,168 |

42,378,082 |

3,990,216 |

46,368,299 |

33% |

|

|

|||||||

|

Net Operating (Profit)/Loss |

(67,961,147) |

(1,156,489) |

(69,117,636) |

(9,664,675) |

3,990,216 |

(5,674,458) |

|

|

|

|||||||

|

Net Operating (Profit)/Loss before Capital Grants & Contributions |

14,475,001 |

12,576,526 |

27,051,527 |

4,476,546 |

3,990,216 |

8,466,762 |

|

|

|

|||||||

|

Capital / Reserve Movements |

|||||||

|

Capital Expenditure - One Off Confirmed |

67,205,986 |

34,548,954 |

101,754,939 |

19,792,523 |

41,463,769 |

61,256,292 |

60% |

|

18,487,675 |

1,027,759 |

19,515,433 |

2,170,621 |

2,552,818 |

4,723,439 |

24% |

|

|

51,844,544 |

(14,029,039) |

37,815,505 |

0 |

0 |

0 |

0% |

|

|

Loan Repayments |

8,236,502 |

0 |

8,236,502 |

1,912,167 |

0 |

1,912,167 |

23% |

|

New Loan Borrowings |

(17,678,518) |

(3,755,828) |

(21,434,346) |

0 |

0 |

0 |

0% |

|

Sale of Assets |

(804,819) |

(2,066,159) |

(2,870,978) |

(784,314) |

0 |

(784,314) |

27% |

|

Net Movements Reserves |

(20,043,173) |

(14,569,197) |

(34,612,370) |

0 |

0 |

0 |

0% |

|

Total Cap/Res Movements |

107,248,197 |

1,156,489 |

108,404,686 |

23,090,997 |

44,016,587 |

67,107,584 |

|

|

|

|||||||

|

|

ORIGINAL |

BUDGET ADJ |

APPROVED BUDGET |

YTD ACTUAL EXCL COMMT'S 2021/22 |

COMMT'S 2021/22 |

YTD ACTUAL + COMMT'S |

YTD % OF BUD |

|

Net Result after Depreciation |

39,287,050 |

0 |

39,287,050 |

13,426,322 |

48,006,803 |

61,433,126 |

|

|

|

|||||||

|

Add back Depreciation Expense |

39,287,050 |

0 |

39,287,050 |

13,095,683 |

0 |

13,095,683 |

33% |

|

|

|||||||

|

Cash Budget (Surplus) / Deficit |

0 |

0 |

0 |

330,639 |

48,006,803 |

48,337,442 |

|

Long Term Financial Plan (Surplus) /Deficit

|

Description |

Budget 2021/22 |

Budget 2022/23 |

Budget 2023/24 |

Budget 2024/25 |

Budget 2025/26 |

Budget 2026/27 |

Budget 2027/28 |

Budget 2028/29 |

Budget 2029/30 |

Budget 2030/31 |

|

Adopted Bottom Line (Surplus) / Deficit |

0 |

860,298 |

1,751,328 |

2,469,233 |

3,928,332 |

3,831,470 |

3,259,284 |

3,494,780 |

3,511,108 |

3,930,045 |

|

Prior Adopted Bottom Line Adjustments |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

Revised Bottom Line (Surplus) / Deficit |

0 |

860,298 |

1,751,328 |

2,469,233 |

3,928,332 |

3,831,470 |

3,259,284 |

3,494,780 |

3,511,108 |

3,930,045 |

Categories for budget adjustments in this month’s finance report:

This month’s Budget adjustments are categorised as follows:

1. Operating Budget Variations which affect the current 2021/22 financial year

2. 2021/22 Capital Project budgets timing adjustments

3. Future Year Capital Project budgets timing adjustments

4. 2021/22 and Future Year Capital Projects completed, or deemed no longer required

2021/22 Revised Budget Result – (Surplus) / Deficit |

$’000s |

|

Original 2021/22 Budget Result as adopted by Council Total Budget Variations approved to date |

$0K $0K $0K |

|

Proposed Revised Budget result for 31 October 2021 - (Surplus) / Deficit |

$0K |

1. The proposed Operating Budget Variations for 31 October 2021 which affect the current 2021/22 financial year are listed below:

|

Budget Variation |

Amount |

Funding Source |

Net Impact (Fav)/ Unfav |

|

|

1 – Community Leadership and Collaboration |

||||

|

Chain of Responsibility Program & Training |

$60K |

Workers Compensation Reserve ($60K) |

Nil |

|

|

The Workers Compensation Reserve balance consists of funds received from Council’s workers compensation insurer to be spent on initiatives that improve safety at Council. It is proposed to transfer $60,000 from this reserve to the Work Health & Safety budget to fund Chain of Responsibility Program and Training, initiatives to be run under Council’s Health & Wellbeing strategy and to support Council’s Alcohol and Other Drugs testing regime. Estimated Completion: 30 June 2022 Job Consolidation: 13836 |

|

|||

|

External & Internal Loan Repayments |

$461K |

S7.11 Reserve ($157K) Electricity Savings ($3K) LCLI Subsidy Income ($7K) Civil Infrastructure Reserve ($296K) |

Nil |

|

|

There are required adjustments to loan repayment budgets for 2021/22 and for the future 10 years of the Long-Term Financial Plan as a result of the following changes: - Carryover of projects/programs included in the 2020/21 Delivery Program and reviewed timing of the 10 years Capital Works Program budgets that are funded from external borrowings has resulted in adjustments to timing of required loan borrowings and loan repayments. - Adjustments to the Long-Term Financial Plan interest rate assumptions for future year internal and external loan borrowings and Low Cost Loans Initiative (LCLI) subsidy income. The budget adjustments to Council’s bottom line and reserves for the 10 years of the Long-Term Financial Plan have been included as an attachment. The General-Purpose Revenue saving of $296K for 2021/22 will be transferred to the Civil Infrastructure Reserve. |

|

|||

|

State Government Financial Assistance Grants |

($209K) |

Emergency Events Reserve $75K Unsealed Roads Maintenance $84K |

$50K |

|

|