AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

29 June 2020

AT 6:00pm

The Council meeting will

be held remotely using

video-conferencing and livestreamed on

Council’s website

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

AGENDA AND BUSINESS PAPER

AGENDA AND BUSINESS PAPER

To be held on

Monday

29 June 2020

AT 6:00pm

The Council meeting will

be held remotely using

video-conferencing and livestreamed on

Council’s website

Phone: 1300 292 442

Fax: 02 6926 9199

Website: www.wagga.nsw.gov.au

NOTICE OF MEETING

In pursuance of the provisions of the Local Government Act, 1993 and the Regulations there under, notice is hereby given that an Ordinary Meeting of the Council of the City of Wagga Wagga will be held remotely using video-conferencing and livestreamed on Council’s website, Wagga Wagga, on Monday 29 June 2020 at 6:00pm.

Council live streams video and audio of Council meetings. Members of the public who provide a public address (via remote access) are advised that their voice and/or image may form part of the webcast.

Mr Peter Thompson

General Manager

WAGGA WAGGA CITY COUNCILLORS

|

Mayor Councillor Greg Conkey OAM |

Deputy Mayor Councillor Dallas Tout |

Councillor Yvonne Braid |

Councillor Paul Funnell |

|

Councillor Dan Hayes |

Councillor Vanessa Keenan |

Councillor Rod Kendall |

Councillor Tim Koschel |

|

Councillor Kerry Pascoe |

|

|

|

QUORUM

The quorum for a meeting of the Council is a majority of the Councillors of the Council who hold office for the time being who are eligible to vote at the meeting.

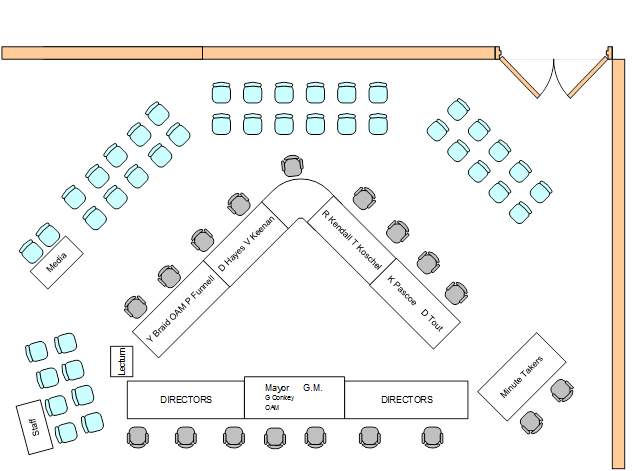

COUNCIL MEETING ROOM

Reports submitted to the Ordinary Meeting of Council to be held on Monday 29 June 2020.

Ordinary Meeting of Council AGENDA AND BUSINESS PAPER

Monday 29 June 2020

CLAUSE PRECIS PAGE

PRAYER 3

ACKNOWLEDGEMENT OF COUNTRY 3

APOLOGIES 3

Confirmation of Minutes

CM-1 Ordinary Council Meeting - 15 JUNE 2020 3

DECLARATIONS OF INTEREST 3

Reports from Staff

RP-1 Draft Planning Proposal (LEP20/0001) to introduce a new local provision clause to enable minor boundary adjustments for certain zones 4

RP-2 Draft Planning Proposal (LEP20/0003) to rezone land and remove the minimum lot size provisions for 47 and 49 Vincent Road, Lake Albert 22

RP-3 MURRAY DARLING ASSOCIATION REPRESENTATION 34

RP-4 RESPONSE TO NOTICE OF MOTION - NOTICE OF MOTIONS 36

RP-5 COUNCILLOR EXPENSES AND FACILITIES POLICY - POL 025 48

RP-6 Integrated Planning and Reporting - Adoption of Documents 119

RP-7 Financial Performance Report as at 31 May 2020 158

RP-8 Proposed New Fees and Charges for 2020/21 175

RP-9 Regional Procurement Preference Policy 178

RP-10 WIRADJURI RESERVE DOG OFF-LEASH AREA 221

RP-11 BIODIVERSITY FUNDING AGREEMENT 225

RP-12 Community Tenant Abatements 227

RP-13 PROPOSED ROAD CLOSURES WITHIN THE WAGGA WAGGA BASE HOSPITAL 231

RP-14 SOUTHERN REGIONAL PLANNING PANEL REPRESENTATION 242

RP-15 RESPONSE TO QUESTIONS/BUSINESS WITH NOTICE 244

Committee Minutes

M-1 RIVERINA REGIONAL LIBRARY ADVISORY COMMITTEE MEETING - 22 APRIL 2020 246

QUESTIONS/BUSINESS WITH NOTICE 253

Confidential Reports

CONF-1 RFT2020-05 WAGGA WAGGA MULTI-SPORT CYCLING COMPLEX 254

CONF-2 RFT2020-23 CONSTRUCTION OF WEIGHBRIDGE ROADS, BUILDING & CAR PARK 255

CONF-3 RFT2020-24 DESIGN & CONSTRUCT WEIGHBRIDGE GWMC 256

CONF-4 RFT 2020-28 BOTANIC GARDENS REDEVELOPMENT DESIGN & CONSTRUCTION WORKS 257

CONF-5 RFT2020-32 END OF TRIP FACILITIES ACTIVE TRAVEL PLAN 258

CONF-6 TEMPORARY ORGANISATION STRUCTURE 259

PRAYER

CM-1 Ordinary Council Meeting - 15 JUNE 2020

|

That the Minutes of the proceedings of the Ordinary Council Meeting held on 15 June 2020 be confirmed as a true and accurate record.

|

|

1⇩. |

Minutes - Ordinary Council Meeting - 15 June 2020 |

260 |

|

Report submitted to the Ordinary Meeting of Council on Monday 29 June 2020 |

RP-1 |

RP-1 Draft Planning Proposal (LEP20/0001) to introduce a new local provision clause to enable minor boundary adjustments for certain zones

Author: Crystal Atkinson

Director: Michael Keys

|

Summary: |

Council officers have prepared a planning proposal in response to a couple of enquires about boundary adjustments in rural zones.

The recommendation is to proceed with a planning proposal and request a Gateway Determination from NSW Department of Planning, Industry & Environment. |

|

That Council: a support planning proposal LEP20/0001 to introduce a new local provision clause in the Wagga Wagga Local Environmental Plan 2010 b submit the planning proposal to the NSW Department of Planning, Industry and Environment for Gateway Determination c receive a further report after the public exhibition period addressing any submissions made in respect of the planning proposal |

Proposal

Council officers have prepared a planning proposal to introduce a local provision clause in the Wagga Wagga Local Environmental Plan 2010 (LEP) to enable minor boundary adjustments in the rural zones and environmental management zone. The proposal also intends to protect dwelling entitlements for lots created resulting from the new local provisions.

An example of where this clause may be used is where an existing holding has been fragmented by realignment of a road. In this instance the fragmented parcel cannot be subdivided or sold off as it forms part of an original holding and is bound by the minimum lot size provisions.

This clause is commonly used in other Councils within Regional NSW and we are proposing the same clause used at Cootamundra Council. Department of Planning are supportive of this change.

Local Provision:

The local provision clause will enable boundary adjustments for rural and environmental management land. The proposed Clause 4.7 is shown below:

4.7 Boundary changes between lots in certain rural and environmental protection zones

(1) The objective of this clause is to permit the boundary between 2 or more lots to be adjusted in certain circumstances to give landowners a greater opportunity to achieve the objectives of a zone.

(2) This clause applies to land in the following zones:

(a) Zone RU1 Primary Production,

(b) Zone RU2 Rural Landscape,

(c) Zone RU4 Primary Production Small Lots,

(d) Zone E3 Environmental Management.

(3) Despite clause 4.1 (3), development consent may be granted to the subdivision of 2 or more adjoining lots that are land to which this clause applies if the subdivision will not result in:

(a) an increase in the number of lots, and

(b) an increase in the number of dwelling houses on, or dwelling houses that may be erected on, any of the lots, and

(c) any lot created by a boundary adjustment in Zone RU1 Primary Production, Zone RU2 Rural Landscape or Zone E3 Environmental Management having an area of less than 5 hectares, and

(d) any lot created by a boundary adjustment in Zone RU4 Primary Production Small Lots having an area of less than the minimum size shown on the Lot Size Map in relation to that land.

(4) Before determining a development application for the subdivision of land to which this clause applies, the consent authority must consider the following:

(a) the existing uses and approved uses of other land in the vicinity of the subdivision,

(b) whether or not the subdivision is likely to have a significant impact on land uses that are likely to be preferred and the predominant land uses in the vicinity of the development,

(c) whether or not the subdivision is likely to be incompatible with a use referred to in paragraph (a) or (b),

(d) whether or not the subdivision is likely to be incompatible with a use on land in any adjoining zone,

(e) any measures proposed by the applicant to avoid or minimise any incompatibility referred to in paragraph (c) or (d),

(f) whether or not the subdivision is appropriate having regard to the natural and physical constraints affecting the land,

(g) whether or not the subdivision is likely to have an adverse impact on the environmental values, heritage vistas or landscapes or agricultural viability of the land.

(5) This clause does not apply:

(a) in relation to the subdivision of individual lots in a strata plan or a community title scheme, or

(b) if the subdivision would create a lot that could itself be subdivided in accordance with clause 4.1.

Additional Subclause – 4.2A:

The proposal is intended to retain dwelling entitlements for lots created under the proposed boundary adjustments clause, if the dwelling entitlement existed prior to the boundary adjustment.

The proposed subclause is shown below:

Clause 4.2A:

(e) is a lot created by a boundary adjustment in accordance with clause 4.7 and upon which a dwelling house would have been permissible prior to the adjustment of the boundary.

Key considerations

1. State Environmental Planning Policy (Exempt and Complying Development Condes) 2008 (Codes SEPP)

The Codes SEPP allows subdivision of land for the purposes of realigning boundaries within the RU1, RU2, RU3, RU4, RU6, E1, E2, E3 or E4 zones where the change will not result in more than a minor change in the area of any lot and if in any other zone, not result in a change in the area of any lot by more than 10%.

For subdivisions that result in more than a minor change or more than a 10% change in area, the minimum lot size provisions of the Wagga Wagga Local Environmental Plan 2010 will prevail, and subdivisions cannot create lots below the minimum lot size.

2. Clause 4.6 Exemptions to development standards

Clause 4.6 allows for an appropriate degree of flexibility in applying certain development standards provided subdivision will not result in 2 or more lots less than the minimum lot size or one lot less than 90% of the minimum lot size.

Boundary adjustments exceeding the provisions of Clause 4.6 are prohibited.

3. Council’s vision or strategic intent

Wagga Wagga Spatial Plan 2013-204:

Through the Wagga Wagga Spatial Plan, it is acknowledged that our rural lands have provided the foundation for settlement and agriculture continues to provide significant economic return and employment. One of the key challenges identified for rural lands is ensuring productive agricultural land is protected and not unreasonably fragmented.

The proposed local provision clause will continue to protect productive agricultural land from unreasonable fragmentation by ensuring there will not be an increase in the number of lots.

Conclusion

In view of the matters considered by this assessment, the proposal is found to be reasonable and in the public interest. The matters discussed in this report are reflective of the public interest and community expectations.

The proposal has been prepared and is recommended to be supported for the following reasons:

§ The planning proposal will provide opportunities for appropriate boundary adjustments in suitable locations.

§ It complies with the provisions of Council’s endorsed strategy.

§ It meets the relevant Section 9.1 Ministerial Directions.

§ Considers the provisions of State Environmental Planning Policy (Exempt and Complying Development Codes) 2008.

Financial Implications

The planning proposal has been generated internally and therefore application fees are not required.

The local provision clause will enable development applications to be lodged seeking approval for the boundary adjustment. Applications will incur relevant application fees.

Council’s contributions plans apply and will apply to any future development consent on the land.

Policy and Legislation

Environmental Planning and Assessment Act 1979

State Environmental Planning Policy (Exempt and Complying Development Codes) 2008

Wagga Wagga Local Environmental Plan 2010

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

The planning proposal has been assessed and it is recommended it be submitted to NSW Department of Planning, Industry and Environment for a Gateway Determination. If issued, the determination will require public and agency consultation. Consultation may highlight issues not evident during the assessment.

Internal / External Consultation

Formal public consultation with agencies and the general public will occur if a Gateway Determination is received.

As the amendment will affect all rural and environmental management zoned land, direct mail out will not be undertaken.

Proposed consultation methods are indicated in the table below:

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

|

x |

|

|

x |

|

|

|

x |

x |

|

||||

|

1⇩. |

LEP20.0001 Planning Proposal |

|

|

2⇩. |

LEP20.0001 Boundary Adjustments - Assessment Report |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 29 June 2020 |

RP-2 |

RP-2 Draft Planning Proposal (LEP20/0003) to rezone land and remove the minimum lot size provisions for 47 and 49 Vincent Road, Lake Albert

Author: Crystal Atkinson

Director: Michael Keys

|

Summary: |

Council is in receipt of a planning proposal to rezone land from R5 Large Lot Residential to R1 General Residential and remove the minimum lot size for land located at 47 and 49 Vincent Road, Lake Albert.

The recommendation is to proceed with the planning proposal and request a Gateway Determination from NSW Department of Planning, Industry and Environment. |

|

That Council: a support planning proposal LEP20/0003 to amend the Wagga Wagga Local Environmental Plan 2010 b submit the planning proposal to the NSW Department of Planning, Industry and Environment for Gateway Determination c receive a further report after the public exhibition period addressing any submissions made in respect of the planning proposal |

Application details

|

Submitted planning proposal: |

Council is in receipt of a planning proposal (LEP20/0003) to rezone land located at 47 and 49 Vincent Road, Lake Albert from R5 Large Lot Residential to R1 General Residential and remove the minimum lot size provisions. |

|

Applicant |

Wayne Preston |

|

Land owners |

§ Wayne Preston - Lot 4 DP228763, 49 Vincent Road, Lake Albert § Richard & Sharon Coombe – Lot 5 DP228763, 47 Vincent Road, Lake Albert |

Proposal

Council is in receipt of a planning proposal to amend the Wagga Wagga Local Environmental Plan 2010 (WWLEP) to:

1. Rezone land from R5 Large Lot Residential to R1 General Residential

2. Remove the minimum lot size provisions

The proposed changes will be achieved by amending the land zoning and minimum lot size maps as shown below:

The aim of the planning proposal is to provide additional residential lots within an existing urban area. The proposal will create an opportunity for approximately 40-50 additional residential lots.

The application is provided under Attachment 1.

Site and Locality

The subject lots are located on the northern fringe of the Lake Albert suburb as rural lifestyle lots.

Key considerations

1. Council’s vision or strategic intent:

Wagga Wagga Spatial Plan 2013-2043

The Wagga Wagga Spatial Plan 2013-2043 identifies the subject land as ‘potential intensification’ subject to overland flow flooding and DCP density provisions being considered and managed.

The plan identifies a demand for 360 new residential lots per year and a supply of around 5,400 lots at the time of developing the plan. This demand and supply indicated a 16-year supply at 2013 and with growth tracking along these figures, we can assume supply has depleted to a 9-year supply.

The plan identifies the need to continually monitor land supply and demand to be able to respond to changing needs of the community and to ensure adequate land is available to support demand. Growth opportunities in this area will contribute to supply of residential lots within the city.

2. Infrastructure

Stormwater

There is no stormwater infrastructure available for this site to drain to. A class 9 stream adjoins the site on the eastern boundary with a 10-metre-wide easement to drain water. Using the stream would require further assessment of the impact on the flow regime of the stream and impact on downstream landowners.

The nearest pit and pipe system is located at Iris Street and north of the site on Vincent Road.

Whether extending the pit and pipe system to connect to existing infrastructure or utilising the steam along the eastern boundary, stormwater management is to be addressed to ensure adequate management. To assist in stormwater management, kerb and gutter would also be required.

Sewer

The sewer main runs along the front of the property and is a pressure main. Gravity sewer is located at Iris Street. Development will be required to extend gravity sewer to the development and dependent on the depth of the sewer main, a sewer pump station may be required.

The existing gravity sewer is nearing capacity and further investigation is required to determine the capacity and likely upgrade of sewer mains needed to accommodate anticipated additional load resulting from rezoning.

3. Flooding

The eastern part of the subject land is affected by overland flow flooding in a 100yr flood event. The land is affected by flood depths varying from 0-100mm.

Council is currently reviewing the Major Overland Flow Flood Study. The revised study will include recommended development controls for development on land affected by overland flow.

Council Infrastructure Officers have reviewed this proposal and have confirmed that there are suitable solutions for flooding, sewer and stormwater management that will enable development to proceed. Infrastructure solutions will be further assessed as part of detailed design at development application stage.

Conclusion

In view of the matters considered, the proposal is found to be reasonable and in the public interest. The infrastructure and flooding considered can be addressed once the Gateway Determination is received to identify suitable solutions.

The proposal is supported for the following reasons:

§ The planning proposal will provide opportunities to create additional residential lots that will contribute to land supply.

§ It complies with the provisions of Council’s endorsed strategy.

§ It meets the relevant S9.1 Ministerial Directions.

Financial Implications

The application was lodged during the 2019/20 financial year and attracted an application fee of $40,000 in accordance with Council’s Fees and Charges Policy.

Council’s contributions plans will apply to any future development application on the land.

Policy and Legislation

Environmental Planning and Assessment Act 1979

Wagga Wagga Local Environmental Plan 2010

Link to Strategic Plan

The Environment

Objective: We plan for the growth of the city

Outcome: We have sustainable urban development

Risk Management Issues for Council

The planning proposal has been assessed and it is recommended it be submitted to NSW Department of Planning, Industry and Environment for a Gateway Determination. If issued, the determination will require public and agency consultation. Consultation may highlight issues not evident during the assessment.

Internal / External Consultation

Formal public consultation with agencies, adjoining landowners and the general public will occur if Gateway Determination is received.

Proposed consultation methods are indicated in the table below:

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

x |

|

x |

|

|

x |

|

|

|

x |

x |

|

||||

|

1⇩. |

LEP20/0003 Vincent Road Assessment Report |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 29 June 2020 |

RP-3 |

RP-3 MURRAY DARLING ASSOCIATION REPRESENTATION

Author: Scott Gray

General Manager: Peter Thompson

|

Summary: |

The purpose of this report is to appoint a new Council representative to the Murray Darling Association. |

|

That Council appoint a new Councillor representative to the Murray Darling Association. |

Report

Councillor Paul Funnell has indicated that he would like to step aside from his role as Council’s representative on the Murray Darling Association (MDA) to provide the opportunity for another Councillor to attend.

The objectives of the MDA are to:

· advocate on behalf of Basin communities

· use local knowledge and expertise to fully understand regional issues

· act as a two-way conduit for information and discussion between our communities and governments

· encourage and facilitate debate about the things that matter for the Basin’s future

· explore options to achieve sound solutions to regional issues

· test information to ensure a sound base for those options

· be an educational resource for the Basin

Wagga Wagga is in Region 9 of the MDA, and further information regarding the region and business papers is available from:

https://www.mda.asn.au/regions/region-9.aspx

Financial Implications

There are no financial implications from this report but the 2019/20 membership fee for the association was $7,349.80.

Policy and Legislation

N/A

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We have leaders that represent us

Risk Management Issues for Council

N/A

Internal / External Consultation

Discussion regarding the appointment of a new representative took place at the 11 May 2020 and 15 June Ordinary Council Meetings. Further confirmation was received from Councillor Funnell who was in support of seeking a new representative.

|

Report submitted to the Ordinary Meeting of Council on Monday 29 June 2020 |

RP-4 |

RP-4 RESPONSE TO NOTICE OF MOTION - NOTICE OF MOTIONS

Author: Ingrid Hensley

General Manager: Peter Thompson

|

Summary: |

This Report is being presented to Council after it was resolved on 25 May 2020 that Council receive a report which outlines a process to provide Councillors and the community information on status of adopted Notice of Motions. The scope has been expanded to include all Council resolutions. |

|

That Council: a receive a monthly Report on the status of all resolutions of Council, including Notices of Motion, indicating which are completed and which are outstanding, together with a summary of action undertaken b note a future revision of the Code of Meeting Practice proposed in the next six to 12 months, that will consider provisions in relation to Notices of Motion |

Report

Council at its meeting on 25 May 2020 adopted to receive a report that:

a builds or amends its current policy for Notice of Motions and resolutions

b include a time frame for Notice of Motions and resolutions to come back to Councillors

c builds a register on Council’s website, so the community can track Notice of Motions and resolutions and update everyone when reports are due back to Council

Guidelines for Councillors to put forward Notices of Motion are currently contained in Council’s Code of Meeting Practice. The Notice of Motion must be put in a form which calls for a report to the Council and the Code of Meeting Practice does not specific a timeframe for completion of that report. Therefore, the author of the Notice of Motion can recommend a timeframe for Council to consider, and which can then form part of the resolution. There are some amendments which have been discussed in relation to the Code of Meeting Practice, so this could be incorporated for consideration in a future revision of the Code.

In relation to a register, Council currently has an internal process of compiling a resolution register for all Council resolutions, which is regularly updated and thereafter periodically distributed. This process will be expanded to provide a monthly report to Council, setting out all active and completed resolutions in addition to active and completed Notices of Motion, which would then be included on Council’s website.

Financial Implications

N/A

Policy and Legislation

Wagga Wagga City Council Code of Meeting Practice

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We are informed and involved in decision making

Outcome: Everyone in our community feels they have been heard and understood

Risk Management Issues for Council

Actions on ‘active’ resolutions often contain detail of the internal operations of council, specific to the implementation of the particular resolution. Therefore, what would be presented to Council would be a high-level summary of the status of each resolution.

Internal / External Consultation

N/A

|

1⇩. |

Sample - Active Notice of Motion Report |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 29 June 2020 |

RP-5 |

RP-5 COUNCILLOR EXPENSES AND FACILITIES POLICY - POL 025

Author: Ingrid Hensley

General Manager: Peter Thompson

|

Summary: |

Councillor expenses and facilities policies should allow for councillors to receive adequate and reasonable expenses and facilities to enable them to carry out their civic duties as elected representatives of their local communities.

Amendments have been made to the current Councillor Expenses and Facilities Policy (POL 025), requiring the endorsement of Council. |

|

That Council: a endorse the draft Councillor Expenses and Facilities Policy (POL 025), that is to be placed on public exhibition for a period of 28 days from 30 June 2020 to 27 July 2020 and invite public submissions until the 10 August 2020 on the draft Policy b receive a further report following the public exhibition and submission period: i addressing any submissions made in respect of the proposed POL 025 Councillor Expenses and Facilities Policy ii proposing adopting of the Policy unless there are any recommended amendments deemed to be substantial and requiring a further public exhibition period |

Report

Council’s current Councillor Expenses and Facilities Policy (POL 025) was adopted within the first 12 months of the term of Council, as required under the Act. Since this time, the OLG has released a better practice template policy for the purposes of s252 of the Local Government Act 1993 (NSW) (the Act). The release of that template, together with already identified opportunities for improvement to Council’s policy, in addition to correspondence from the Minister for Local Government NSW, has prompted this review. To facilitate this, a copy of that template policy is attached, together with council’s current policy and the proposed amended policy. The proposed amended policy is based on the suggested template but also includes some additional clauses from Council’s current policy.

Council currently has a lengthy policy in relation to councillor expenses and facilities and review of the template policy suggests there is the opportunity to make Council’s policy more ‘user friendly’, clear and succinct and also to clarify areas of ambiguity, uncertainty or inconsistency with the legislation.

The proposed draft removes duplication from both within the policy itself and also from the previously adopted Code of Conduct, making it a clearer ‘reference guide’ for elected members and more transparent to the community.

The draft policy has been prepared to be consistent with the Act and Local Government (General) Regulation 20095 (the Regulation) and the OLG’s template is designed to be amended to suit local needs and circumstances, which has been taken into account.

To allow community feedback on the Policy, it is recommended that the Policy be placed on public exhibition for 28 days 30 June 2020 to 27 July 2020 and invite public submissions until the 10 August 2020.

Financial Implications

The maximum amounts for each expense of facility will be set as per the adopted budget on an annual basis.

Policy and Legislation

The Local Government Act sets out the annual policy review and adoption processes that must be followed for this Policy, including the below:

· Councils must annually adopt a councillor expenses and facilities policy within the first 12 months of each term of council (s252(1))

· Councils must give public notice of the intention to adopt a policy and allow at least 28 days for public submissions (s253(1)) and consider submissions made (s253(2))

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We are accountable and transparent

Risk Management Issues for Council

Council policies are essential to ensure transparent legal, fair and consistent decision-making across the Council. They support Council in achieving its corporate objectives and provide a critical guide for staff, Councillors and other stakeholders. In the absence of effective policies there is a greater risk of inconsistency, confusion and inefficiency. The correspondence from the Minister for Local Government NSW has highlighted the need for Councillor Expenses and Facilities Policies to be compliant with the Act and Regulation.

Internal / External Consultation

The draft Councillor Expenses and Facilities Policy (POL 025), has been reviewed internally by staff and Councillors at a workshop held in December 2019 with a further consultation draft provided in May 2020. A number of different viewpoints on some of the clauses were expressed by Councillors at the Workshop, including in relation to the provision of additional facilities for the Mayor, reimbursement timeframes, the definition of appropriate refreshments and in relation to air travel. In those instances, the draft Policy includes clauses which reflect the OLG’s template policy.

During and also after the public exhibition period, the following will be undertaken to engage with the community, including as an opportunity to inform potential candidates of the support available for councillors:

· The draft policy will be placed on Council’s website during the exhibition period.

· An article in Council News, together with the required advertisements of the public exhibition period.

· Social media promotion of the policy and what expenses and facilities are available to Councillors.

· Promotion of the adopted Policy to potential candidates during local government pre-election candidate information sessions in 2021, as part of a ‘what support is provided to councillors’ session.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news story |

Council News advert |

Media releases |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

|

x |

|

|

|

|

|

|

|

x |

x |

|

|||

|

Involve |

|

|

|

|

|

|

|

|

|||||||||

|

Collaborate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1⇩. |

Draft Councillor Expenses and Facilities Policy - POL 025 |

|

|

2⇩. |

Current Payment of Expenses and Provision of Facilities to Councillors Policy - POL 025 |

|

|

3⇩. |

Councillor Expenses and Facilities Policy Suggested Template OLG NSW |

|

RP-6 Integrated Planning and Reporting - Adoption of Documents

Author: Scott Gray

Director: Peter Thompson

|

Analysis: |

This report addresses Council’s obligations in ensuring legislative compliance and meeting the requirements of the Office of Local Government in adopting and implementing the Integrated Planning and Reporting Framework. |

|

That Council, in relation to the exhibited documents: a adopt the Combined Delivery Program and Operational Plan 2020/21 inclusive of the amendments highlighted in the report b adopt the Fees and Charges for the financial year 2020/21 inclusive of the amendments highlighted in the report c approve the budget variations associated with the 2019/20 budget reset of the capital works program d adopt the Long Term Financial Plan 2021/30 inclusive of the amendments highlighted in the report and the 2019/20 budget reset of the capital works program e note that the Long Term Financial Plan 2021/30 document will be modified to the final graphic design version which will incorporate Council’s corporate design elements early in the new financial year f note that the public submissions Council receives during the public exhibition period will be discussed at a Councillor Workshop early in the new financial year, with a subsequent report to Council g sets the interest on overdue rates and charges for 2020/21, in accordance with Section 566(3) of the Local Government Act 1993: i at 0.00% per annum for the period 1 July 2020 to 31 December 2020; and ii at 7.00% per annum for the period 1 January 2021 to 30 June 2021 calculated on a daily simple interest basis. h makes and levy the following Rates and Annual Charges for 2020/21 under the relevant sections of the Local Government Act 1993: i Residential – City and Suburbs rate of 0.75359 cents in the dollar in terms of Sections 516 and 529 of the Local Government Act 1993, calculated on the land value in respect of all rateable lands situated in the centres of population defined by Council Resolution 12/176 as the City of Wagga Wagga and the Village of Forest Hill, excluding Business - City and Suburbs land, rated in accordance with the provisions of Section 518 of the Local Government Act 1993, Residential (Other) land as defined, and also Farmland, rated in accordance with the provisions of Section 515 of the Local Government Act, within such centres of population A minimum rate of $716.00 for each parcel of land as prescribed under Section 548 of the Local Government Act 1993 shall apply to this rate ii Residential – Other rate of 0.43002 cents in the dollar calculated on the land value in respect of all rateable land within the Council’s area, which, in the Council’s opinion, is land which:- (a) is not less than two (2) hectares and not more than 40 hectares in area (b) is either: (i) not zoned or otherwise designated for use under an environmental planning instrument (ii) zoned or otherwise designated for use under such an environmental planning instrument for non-urban purposes (c) does not have a significant and substantial commercial purpose or character Excludes Business - City and Suburbs land, rated in accordance with the provisions of Section 518 of the Local Government Act 1993, and also Farmland, rated in accordance with the provisions of Section 515 of the Local Government Act, within such centres of population A minimum rate of $321.00 for each parcel of land as prescribed under Section 548 of the Local Government Act 1993 shall apply to this rate. iii Residential – Villages rate of 0.50620 cents in the dollar in terms of Sections 516 and 529 of the Local Government Act 1993, calculated on the land value of all rateable land situated in the centres of population defined by Council Resolution 12/176 as the villages of San Isidore, Gumly Gumly, Tarcutta, Humula, Uranquinty, Mangoplah, Oura, Currawarna, Ladysmith, Galore, Collingullie and North Wagga excluding Business - Villages and Rural land, rated in accordance with the provisions of Section 518 of the Local Government Act 1993, Residential (Other) land as defined, and also Farmland, rated in accordance with the provisions of Section 515 of the Local Government Act, within such centres of population A minimum rate of $268.00 for each parcel of land as prescribed under section 548 of the Local Government Act 1993 shall apply to this rate. iv Business - City and Suburbs rate of 1.41030 cents in the dollar calculated on the land value of all rateable non-residential land, which cannot be classified as residential, or farmland land in the centres of population defined by Council Resolution 12/176 as the City of Wagga Wagga and the Village of Forest Hill, in terms of Sections 518 and 529 of the Local Government Act 1993 A minimum rate of $686.00 for each parcel of land as prescribed under Section 548 of the Local Government Act 1993 shall apply to this rate. v Business - Villages and Rural rate of 0.47103 cents in the dollar calculated on the land value of all rateable land in the Council’s area, in terms of Sections 518 and 529 of the Local Government Act 1993, defined by Council Resolution 12/176, excluding lands defined as Business - City and Suburbs, Residential, and Farmland A minimum rate of $113.00 for each parcel of land as prescribed under Section 548 of the Local Government Act 1993 shall apply to this rate. vi Farmland rate of 0.23455 cents in the dollar, calculated on the land value of all rateable land, which, in Council’s opinion, qualifies as farmland as defined in Section 515 of the Local Government Act 1993 A minimum rate of $309.00 for each parcel of land as prescribed under Section 548 of the Local Government Act 1993 shall apply to this rate. Special Rate - Levee Upgrade vii Residential - City and Suburbs Special Rate - Levee upgrade rate of 0.03089 cents in the dollar in terms of Sections 516 and 529 of the Local Government Act 1993, calculated on the land value in respect of all rateable lands situated in the centres of population defined by Council Resolution 12/176 as the City of Wagga Wagga and the Village of Forest Hill, excluding Business - City and Suburbs land, rated in accordance with the provisions of Section 518 of the Local Government Act 1993, Residential (Other) land as defined, and also Farmland, rated in accordance with the provisions of Section 515 of the Local Government Act 1993, within such centres of population viii Residential – Other Special Rate - Levee upgrade rate of 0.01729 cents in the dollar calculated on the land value in respect of all rateable land within the Council’s area, which, in the Council’s opinion, is land which:- (a) is not less than two (2) hectares and not more than 40 hectares in area (b) is either: (i) not zoned or otherwise designated for use under an environmental planning instrument (ii) zoned or otherwise designated for use under such an environmental planning instrument for non urban purposes (c) does not have a significant and substantial commercial purpose or character Excludes Business - City and Suburbs land, rated in accordance with the provisions of Section 518 of the Local Government Act 1993, and also Farmland, rated in accordance with the provisions of Section 515 of the Local Government Act 1993, within such centres of population ix Residential – Villages Special Rate - Levee upgrade rate of 0.02050 cents in the dollar in terms of Sections 516 and 529 of the Local Government Act 1993, calculated on the land value of all rateable lands situated in the centres of population defined by Council Resolution 12/176 as the villages of San Isidore, Gumly Gumly, Tarcutta, Humula, Uranquinty, Mangoplah, Oura, Currawarna, Ladysmith, Galore, Collingullie and North Wagga excluding Business - Villages and Rural land, rated in accordance with the provisions of Section 518 of the Local Government Act 1993, Residential (Other) land as defined, and also Farmland, rated in accordance with the provisions of Section 515 of the Local Government Act, within such centres of population x Business - City and Suburbs Special Rate - Levee upgrade rate of 0.05674 cents in the dollar calculated on the land value of all rateable non-residential land, which cannot be classified as residential, or farmland land in the centres of population defined by Council Resolution 12/176 as the City of Wagga Wagga and the Village of Forest Hill, in terms of Sections 518 and 529 of the Local Government Act 1993 xi Business - Villages and Rural Special Rate - Levee upgrade rate of 0.01909 cents in the dollar calculated on the land value of all rateable land in the Council’s area, in terms of Sections 518 and 529 of the Local Government Act 1993, defined by Council Resolution 12/176, excluding lands defined as Business - City and Suburbs, Residential, and Farmland xii Farmland - Special Rate - Levee upgrade rate of 0.00441 cents in the dollar, calculated on the land value of all rateable land, which, in Council’s opinion, qualifies as farmland as defined in Section 515 of the Local Government Act 1993 xiii Sewerage Services Annual Charge of $560.00 per dwelling unit. Multiple residence properties are charged at $560.00 per residence, for all residences, and non-strata title residential premises on a single allotment (flats/units) situated within the Council’s centres of population, capable of being connected to the sewerage service scheme except when excluded by specific council policy, such charge being made in terms of Section 501 of the Local Government Act 1993 xiv Non Residential Sewer Charges Access charge based on each and every meter connection per non-residential allotment for all non-residential premises and non-residential allotments situated within the Council’s centres of population, capable of being connected to the sewerage service scheme except when excluded by specific council policy, such charge being made in terms of Section 501 of the Local Government Act 1993. Access charge based on Meter size for 2020/21 is as follows:

Non Residential includes: (a) Non-residential strata (b) Small community property (c) land owned by the Crown, not being land held under a lease for private purposes (d) land that belongs to a religious body and is occupied and used in connection with: (i) a church or other building used or occupied for public worship (ii) a building used or occupied for the purpose of religious teaching or training (e) land that belongs to and is occupied and used in connection with a school (being a government school or non-government school within the meaning of the Education Reform Act 1990 or a school in respect of which a certificate of exemption under section 78 of that Act is in force), including: (i) a playground that belongs to and is used in connection with the school; and (ii) land that belongs to a public benevolent institution or public charity and is used or occupied by the institution or charity for the purposes of the institution or charity (f) land that belongs to a public hospital (g) land that is vested in the Minister for Health, the Health Administration Corporation or the New South Wales Health Foundation (h) land that is vested in a university, or a university college, and is used or occupied by the university or college solely for its purposes Usage charge Per kl usage charge of $2.35 per kl will apply to all Non Residential Sewer customers except excluded by specific Council Policy, such charge being made in accordance with Section 501 of the Local Government Act 1993. xv Pressure Sewer Scheme – Annual pump maintenance charge (rural residential and villages). An additional sewerage service charge of $174.00 per pump for all premises connected to the sewerage system via a pressure service for the maintenance and replacement of the pump unit as necessary xvi Domestic Waste Management Service Charge of $357.00 per service on a per occupancy basis per annum for a service rendered in the centres of population and within the scavenging areas defined as the City of Wagga Wagga and the villages of North Wagga Wagga, Gumly Gumly, Forest Hill, Kapooka, Tarcutta, Mangoplah, Oura, Ladysmith, Brucedale, Uranquinty, Bomen and Cartwrights Hill, charged in accordance with the provisions of Section 496 of the Local Government Act 1993 xvii Domestic Waste Management Service Charge Rural Residential of $357.00 per service to be applied to all properties utilising a waste collection service managed by Council, but outside Council’s defined waste collection service areas charged in accordance with the provisions of Section 496 of the Local Government Act 1993 xviii Domestic Waste Management Annual Charge of $58.00 per service to be applied to all properties utilising an upgraded general waste bin in accordance with the provisions of Section 496 of the Local Government Act 1993 xix Domestic Waste Management Annual Charge of $63.00 per service to be applied to all properties utilising an upgraded recycling bin in accordance with the provisions of Section 496 of the Local Government Act 1993 xx Domestic Waste Management Service Charge of $36.00 for each parcel of rateable undeveloped land not receiving a service within the scavenging areas of the City of Wagga Wagga and the villages of North Wagga Wagga, Gumly Gumly, Forest Hill, Kapooka, Tarcutta, Mangoplah, Oura, Ladysmith, Brucedale, Uranquinty, Bomen and Cartwrights Hill, such charge being levied in accordance with the provisions of Sections 496 of the Local Government Act 1993 xxi Domestic Waste Management Service Charge of $119.00 for each additional domestic bin, being an additional domestic bin provided over and above the three bins already provided by the service, rendered in the centres of population, and within the scavenging areas defined as the City of Wagga Wagga and the villages of North Wagga Wagga, Gumly Gumly, Forest Hill, Kapooka, Tarcutta, Mangoplah, Oura, Ladysmith, Brucedale, Uranquinty, Bomen and Cartwrights Hill, charged in accordance with the provisions of Section 496 of the Local Government Act 1993. On application, depending on individual circumstances, this fee may be waived. xxii Commercial Waste Management Service Charge of $357.00 per service per annum, for a two-bin commercial waste service rendered in the centre of population and within the scavenging areas defined as the City of Wagga Wagga and the villages of North Wagga Wagga, Gumly Gumly, Forest Hill, Kapooka, Tarcutta, Mangoplah, Oura, Ladysmith, Brucedale, Uranquinty, Bomen and Cartwrights Hill, charged in accordance with the provisions of Section 501 of the Local Government Act 1993 xxiii Commercial Waste Management Service Charge of $178.50 per service per annum, for a one-bin commercial waste service rendered in the centre of population and within the scavenging areas defined as the City of Wagga Wagga and the villages of North Wagga Wagga, Gumly Gumly, Forest Hill, Kapooka, Tarcutta, Mangoplah, Oura, Ladysmith, Brucedale, Uranquinty, Bomen and Cartwrights Hill, charged in accordance with the provisions of Section 501 of the Local Government Act 1993 xxiv Commercial Waste Management Service Charge of $119.00 for each additional commercial bin, being an additional bin provided over and above the bin/s already provided by the service, rendered in the centres of population and within the scavenging areas defined as the City of Wagga Wagga and the villages of North Wagga Wagga, Gumly Gumly, Forest Hill, Kapooka, Tarcutta, Mangoplah, Oura, Ladysmith, Brucedale, Uranquinty, Bomen and Cartwrights Hill, charged in accordance with the provisions of Section 501 of the Local Government Act 1993 xxv Commercial Waste Management Annual Charge of $65.00 per service to be applied to all commercial properties utilising an upgraded recycling bin in accordance with the provisions of Section 501 of the Local Government Act 1993 xxvi Urban Area: Scheduled Off Week Commercial Pickup Service Charge of $469.00 per bin for each commercial service with 1-2 bins onsite, charged in addition to the Commercial Waste Management Service Charge in accordance with the provisions of Section 501 of the Local Government Act 1993 xxvii Urban Area: Scheduled Off Week Commercial Pickup Service Charge of $253.00 per bin for each commercial service with 3-5 bins onsite, charged in addition to the Commercial Waste Management Service Charge in accordance with the provisions of Section 501 of the Local Government Act 1993 xxviii Urban Area: Scheduled Off Week Commercial Pickup Service Charge of $193.00 per bin for each commercial service with over 5 bins onsite, charged in addition to the Commercial Waste Management Service Charge in accordance with the provisions of Section 501 of the Local Government Act 1993 xxix Rural Areas and Villages: Scheduled Off Week Commercial Pickup Service Charge of $469.00 per bin for each commercial service onsite, charged in addition to the Commercial Waste Management Service Charge in accordance with the provisions of Section 501 of the Local Government Act 1993 xxx Multi Unit Developments (Non Strata) Domestic Waste Management Service Charge of $357.00 for each rateable property with an additional bin charge of $119.00 to apply for each additional bin charged in accordance with the provisions of Section 496 of the Local Government Act 1993. For the purposes of Council’s Fees and Charges the definition of Multi-Unit developments (Non Strata) involves the development of three or more residential units on a site at a higher density than general housing development. This reduced charge is available on application to Council, otherwise full Domestic Waste Service Charge of $357.00 applies, per occupancy. xxxi Multi Unit Developments Wheel Out Wheel In (WOWI) Services Charge of $212.00 per occupancy. For the purposes of Council’s Fees and Charges the definition of Multi-Unit developments (Non Strata) involves the development of three or more residential units, including Strata and Non Strata properties, on a site at a higher density than general housing development. On application, this service may be available to individual properties. Depending on individual circumstances, this fee may be waived. xxxii Stormwater Management Service Charges Stormwater Management Service charges will be applicable for all urban properties (i.e. residential and business) as referenced below with the following exceptions in accordance with the Division of Local Government (DLG) Stormwater Management Service Charge Guidelines dated July 2006: · Non rateable land · Crown Land · Council Owned Land · Land held under lease for private purposes granted under the Housing Act 2001 or the Aboriginal Housing Act 1998 · Vacant Land · Rural Residential or Rural Business land not located in a village, town or city · Land belonging to a charity and public benevolent institutions (a) Residential Stormwater Management Service Charge of $25.00 per residential property levied in accordance with the provisions of Section 496A of the Local Government Act 1993 (b) Residential Medium/High Density Stormwater Management Service Charge of $12.50 per occupancy: Residential Strata, Community Title, Multiple Occupancy properties (flats and units), and Retirement Village style developments. Subject to a maximum charge of $250.00 per rateable assessment levied in accordance with the provisions of Section 496A of the Local Government Act 1993 (c) Business Stormwater Management Service Charge of $25.00 per business property. Properties are charged on a basis of $25.00 per 350 square metres of land area. Subject to a maximum charge of $250.00 per rateable assessment levied in accordance with the provisions of Section 496A of the Local Government Act 1993 (d) Business Medium/High Density Stormwater Management Service Charge of $5.00 per occupancy - Business Strata and Multiple Occupancy Business properties. Subject to a maximum charge of $250.00 per rateable assessment levied in accordance with the provisions of Section 496A of the Local Government Act 1993 |

Report

The Long Term Financial Plan 2021/30 and the Combined Delivery Program and Operational Plan 2020/21 have been formulated together with consideration to the Wagga View Community Strategic Plan 2040 previously endorsed by Council as well as the Disability Inclusion Action Plan 2017/21.

These documents have been created as part of Council’s Sustainable Future Framework, based on the local government requirements for Integrated Planning and Reporting.

Amendments to Public Exhibition Documents - Long Term Financial Plan 2021/30 and Combined Delivery Program and Operational Plan 2020/21

There have been amendments made to the 2019/20 and draft 2021/30 capital works program as a result of a capital works budget reset and revised timing of projects. A separate attachment has been provided which details the reset process and the revised capital works program.

As part of this process a new methodology has been applied for monitoring and reporting on one-off capital projects allocated to the 2020/21 financial year and the voting of funds into the delivery program.

This has resulted in two new categories being applied to all 2020/21 capital projects as follows:

Pending

This is essentially a ‘holding’ category for all funded projects, and when a project progresses or priorities change, it will require a Council resolution to move the project from Pending into the ‘Confirmed’ stage.

Confirmed

This includes projects that either require further planning and require funds available to do this, are execution ready, or are already in delivery phase and form part of the delivery program.

The revised capital works program for 2020/21 based on these new categories has been split as follows:

|

2020/21 Capital |

Confirmed |

Pending |

Total |

|

One-Off Projects |

$31,423,125 |

$102,263,189 |

$133,686,314 |

|

Recurrent Program |

$22,666,954 |

- |

$22,666,954 |

|

TOTAL 2020/21 CAPITAL |

$54,090,079 |

$102,263,189 |

$156,353,268 |

As a result of the 2019/20 reset and new reported categories for 2020/21, this has also resulted in amendments to the ‘Major Projects’ section included in the Long Term Financial Plan document on Page 17 as well as an update to all of Council’s financial appendices commencing from Page 38. Changes have also been made to the appendices of the Combined Delivery Program and Operational Plan to reflect this approach.

Adjustments to the previously reported bottom line deficits for the 10 years of the Long Term Financial Plan are summarised below:

|

2020/21 |

2021/22 |

2022/23 |

2023/24 |

2024/25 |

2025/26 |

2026/27 |

2027/28 |

2028/29 |

2029/30 |

|

*(4,398,341) |

(3,126,757) |

(2,878,812) |

(1,964,735) |

(2,337,960) |

(3,350,124) |

(2,943,137) |

(1,837,930) |

(1,566,921) |

(958,653) |

|

~ (6,766) |

(6,867) |

(6,970) |

(7,075) |

(7,181) |

(7,288) |

(7,398) |

(7,509) |

(7,621) |

(7,736) |

|

^ 63,288 |

45,425 |

18,599 |

18,536 |

18,470 |

18,402 |

(5,437) |

9,172 |

(5,257) |

(955) |

|

# 0 |

178,884 |

184,251 |

189,778 |

195,471 |

201,336 |

207,376 |

213,597 |

220,005 |

226,605 |

|

(4,341,819) |

(2,909,316) |

(2,682,933) |

(1,763,495) |

(2,131,200) |

(3,137,673) |

(2,748,594) |

(1,622,670) |

(1,359,793) |

(740,739) |

*Public exhibited 10-year budgeted bottom lines - surplus/(deficits)

~Family Day Care – remove rental internal charge

^Loan repayment adjustments based on revised borrowings from Capital Works Reset

# Recently announced 2020/21 Federal grant funding for Local Roads & Community Infrastructure (LCRI) of $2.1M to be used for Kooringal Road Pavement Rehab project. This has resulted in a reduction in annual Pavement Rehab General Purpose Revenue funding each year allocated to Kooringal Road which is now no longer required.

Amendments to Public Exhibition Documents - Fees and Charges 2020/21

Interest on Overdue Rates and Charges

During the public exhibition period, Council staff received notification from the Office of Local Government regarding the setting of the maximum interest rate for Interest on Overdue Rates and Charges for the 2020/21 financial year.

In accordance with Section 566(3) of the Local Government Act 1993, the Office of Local Government has set the interest rates for overdue rates and charges at:

· 0.00% per annum for the period 1 July 2020 to 31 December 2020; and

· 7.00% per annum for the period 1 January 2021 to 30 June 2021

These changes have been included in the final document.

Oasis Swim & Survive Fees

During the public exhibition period, Council staff identified that a new 2020/21 fee for DET Swim Lessons was included at the incorrect amount. This was due to an error with the GST status of the fee.

This amendment has been included in the final document.

|

Item Number |

Fee Name |

2019/20 Adopted Fee |

2020/21 Public Exhibition Fee |

2020/21 Final Proposed Fee |

|

0237 |

DET Swim Lesson (per child, per session) |

$0.00 |

$4.09 |

$4.50 |

Sportsground Lighting Fees

During the public exhibition period, Council staff identified the requirement to amend the Lighting Fees for Council’s sportsgrounds light usage. This is due to a change in the electricity tariffs being charged by Essential Energy from January 2020, resulting in a reduction in the hourly fee to be charged to sporting clubs on 44 of the 45 fees to be amended. One (1) fee is to be increased by $0.20 per hour from the proposed fee placed on public exhibition (Item Number 0775).

These amendments have been included in the final document.

|

Item Number |

Fee Name |

2019/20 Adopted Fee |

2020/21 Public Exhibition Fee |

2020/21 Final Proposed Fee |

|

0757 |

Anderson Oval lighting fee |

$14.00 |

$15.00 |

$7.70 |

|

0758 |

Ashmont Oval lighting fee |

$6.00 |

$6.50 |

$3.70 |

|

0759 |

Bolton Park – Training lighting fee |

$28.00 |

$30.00 |

$24.00 |

|

0760 |

Bolton Park Lighting – Competition Lighting fee |

$50.00 |

$55.00 |

$47.70 |

|

0761 |

Conolly Park field 1 Competition Standard lighting fee |

$15.00 |

$16.00 |

$11.30 |

|

0762 |

Conolly Park field 1 Training Standard lighting fee |

$9.00 |

$9.50 |

$7.30 |

|

0763 |

Conolly Park field 2 lighting fee |

$11.00 |

$12.00 |

$8.30 |

|

0764 |

Conolly Park field 3 lighting fee |

$4.50 |

$4.50 |

$3.80 |

|

0765 |

Duke of Kent – Field 1 lighting fee |

$5.00 |

$5.00 |

$4.30 |

|

0766 |

Duke of Kent – Field 2 lighting fee |

$7.00 |

$7.50 |

$5.80 |

|

0767

|

Forest Hill amenities building lighting fee |

$2.50 |

$2.50 |

$2.00 |

|

0768 |

French Fields - Diamond 1 150 Lux |

$18.00 |

$19.00 |

$11.20 |

|

0770 |

Gissing Oval training goal area lighting fee |

$3.00 |

$3.00 |

$2.50 |

|

0771 |

Gissing Oval training area south per area lighting fee |

$9.50 |

$10.00 |

$6.60 |

|

0772 |

Gissing Oval training area east per area lighting fee |

$5.00 |

$5.00 |

$3.50 |

|

0773 |

Gissing Main Oval lighting fee |

$23.00 |

$25.00 |

$15.30 |

|

0774 |

Glenfield Oval lighting fee |

$9.50 |

$10.00 |

$8.00 |

|

0775 |

Harris Park - 100 Lux |

$11.00 |

$12.00 |

$12.20 |

|

0776 |

Henwood Park lower lighting fee per ground |

$8.50 |

$9.00 |

$6.20 |

|

0777 |

Henwood Park upper field lighting fee per ground |

$6.50 |

$7.00 |

$4.80 |

|

0778 |

Jubilee Park – Touch Fields lighting fee per ground (Fields 1-4) |

$7.00 |

$7.50 |

$5.50 |

|

0779 |

Jubilee Park – Fields 9, 10 and 11 lighting fee |

$14.00 |

$15.00 |

$11.50 |

|

0780 |

Jubilee Park – Touch Fields 12 & 13 (per field) |

$4.00 |

$4.00 |

$3.50 |

|

0781 |

Jubilee Park – Touch Fields 14 & 15 (West) |

$4.00 |

$4.00 |

$3.50 |

|

0782 |

Jubilee Park Synthetic Hockey Field 1 lighting fee |

$55.00 |

$60.00 |

$40.10 |

|

0783 |

Jubilee Park – Hockey Field 2 Match Lights |

$24.00 |

$26.00 |

$19.80 |

|

0784 |

Jubilee Park – Hockey Field 2 Training Lights |

$12.00 |

$13.00 |

$10.00 |

|

0785 |

Kessler Park – Main Field |

$13.00 |

$14.00 |

$9.20 |

|

0786 |

Kessler Park – Western training |

$4.50 |

$4.50 |

$3.40 |

|

0787 |

Kessler Park – Eastern training |

$4.00 |

$4.00 |

$3.20 |

|

0788 |

Lake Albert Oval lighting fee |

$15.00 |

$16.00 |

$12.40 |

|

0789 |

McDonalds Park (Exhibition Centre) training lighting |

$14.00 |

$15.00 |

$11.30 |

|

0790 |

McDonalds Park (Exhibition Centre) Competition lighting |

$27.00 |

$29.00 |

$22.50 |

|

0791 |

McPherson Oval lighting fee |

$12.00 |

$13.00 |

$10.00 |

|

0792 |

Parramore Park (Exhibition Centre) 3 Fields |

$32.00 |

$34.00 |

$26.40 |

|

0793 |

Parramore Park – West Lights |

$16.00 |

$17.00 |

$13.20 |

|

0794 |

Parramore Park – East Lights |

$16.00 |

$17.00 |

$13.20 |

|

0795 |

Rawlings Park 5 and 6 per field |

$15.00 |

$16.00 |

$8.30 |

|

0796 |

Rawlings Park 1 lighting fee training |

$15.00 |

$16.00 |

$7.30 |

|

0797 |

Rawlings Park 1 lighting fee Match |

$29.00 |

$31.00 |

$12.00 |

|

0798 |

Robertson Oval – Training lighting fee (250 lux) |

$65.00 |

$70.00 |

$55.60 |

|

0799 |

Robertson Oval – Competition lighting fee (500 lux) |

$125.00 |

$135.00 |

$111.10 |

|

0800 |

Uranquinty Oval lighting fee |

$3.00 |

$3.00 |

$1.90 |

|

0801 |

Wagga Cricket Ground cycle track lighting fee |

$17.00 |

$18.00 |

$7.90 |

|

0802 |

Wagga Cricket Ground lighting fee |

$31.00 |

$33.00 |

$19.40 |

Local Road and Community Infrastructure Program (LCRI Program)

The Australian Government committed $500 million to the Local Road and Community Infrastructure Program (LCRI Program) to support jobs, businesses and the resilience of local economies.

From 1 July 2020, councils will be able to assess funding to support delivery of priority local road and community infrastructure projects. There were two key conditions as part of the program, firstly that the project works are required to be completed by 30 June 2021, and secondly, that the projects are in addition to the pre-COVID-19 work program for 2020/21. If a project has been brought forward from a future work program it will be eligible for funding.

Wagga Wagga City Council was allocated $2,050,700. The program was discussed at Executive, and it was recommended that GPR projects would be sourced that could be brought forward from 2021/22 into 2020/21. This would assist to alleviate the significant deficit position that Council has over the next 10 years of the Long Term Financial Plan and meet the requirements of the funding program.

Upon review, there were no projects relating to community infrastructure that were GPR or shovel ready as these mainly related to projects funding from Section 7.11 Developer Contributions and therefore would not assist reducing the GPR deficit position. The Pavement Rehabilitation Program was assessed however, and Kooringal Road was identified as an opportunity that would meet the criteria and align with the recent improvements undertaken at the Exhibition Centre.

Kooringal Road has therefore been included in the draft Long Term Financial Plan. The savings to GPR are approximately $200K per annum over the 10 years as outlined below – noting that the 10 years commences from 2021/22 to 2030/31.

|

21/22 |

22/23 |

23/24 |

24/25 |

25/26 |

26/27 |

27/28 |

28/29 |

29/30 |

30/31 |

TOTAL |

|

178,884 |

184,251 |

189,778 |

195,471 |

201,336 |

207,376 |

213,597 |

220,005 |

226,605 |

233,398 |

2,050,700 |

The Kooringal Road works will result in both deep strength heavy asphalt patching along with rehabilitation of the wearing course.

The deep strength sections will be undertaken by Council’s current asphalt contractor for the $240K and $261K sections only. The rehabilitation sections, being the remaining $1,549,700 are intended to be delivered by Council staff.

Once funding is confirmed, detailed design would be completed within two months. Construction will be over four months, and well within the 12-month delivery requirement.

Financial Implications

The development of the 2021/30 Long Term Financial Plan has been challenging.

Limited revenue from rate peg along with increased expectations from the community in relation to delivering outcomes such as building new facilities while still managing a substantial asset base and the large infrastructure renewal shortfall places a significant amount of pressure on Council’s financial position. Coupled with the added significant financial impacts from the recent COVID-19 pandemic, this has placed further pressure on Council for 2020/21 and even more so into the future to remain sustainable. It is therefore imperative that Council make well-informed and considered financial decisions into the future noting that there are limited funds available for the number of programs, projects and services that Council delivers.

It is important that Council recognise the deficit position, not only as a result of COVID‑19 impacts on the 2020/21 financial year, but the already projected deficit positions from 2021/22 to 2029/30 which highlight the significant issues that Council has been facing due to the unfavourable adjustments to revenue sources (Financial Assistance Grants and Rate Pegging restrictions) in previous financial years. This has resulted in the requirement to increase the use of borrowings to fund projects, with significant loan repayments for the future 10 years of the plan.

At this stage, the likely impact on Council’s 2020/21 budget is still anticipated to be in the vicinity of the $4.4M deficit position. There are however indications that the deficit may not be as significant in some areas. As an example, the current results for car parking fines (these are dependent upon when the revenue is received from the Fines Enforcement Registry process and not when the fines are issued) show a slightly improved revenue position for 2019/20, although this may reduce in 2020/21 as a result of not issuing parking fines for several months in 2019/20. The city development areas of Council has not seen any fee waivers applied for to date. It should be noted that the Airport Reserve may not suffer as significantly as first anticipated as a result of the Federal Government’s support package for regional airlines. This package was announced after the $4.4M was predicted and results in Council still receiving the passenger service charges, albeit a much-reduced amount given the fall in passenger numbers resulting from the COVID-19 travel restrictions. The investment market has also improved more rapidly than anticipated. While this will continue to fluctuate, it is anticipated that there may be a slightly improved position for Council’s investment portfolio.

Due to the uncertainty of so many factors in relation to this unfolding pandemic, as further information comes to hand, extensive ongoing financial management will continue with regular Councillor Workshops and reports being presented to Council on an ongoing basis. These workshops and reports will include financial modelling for 2020/21 and the following years, with budgets adjusted accordingly after Council resolutions.

The 2021/30 Long Term Financial Plan is presented to Council for adoption, with a finance summary shown below:

|

2020/21 |

2021/22 |

2022/23 |

2023/24 |

2024/25 |

2025/26 |

2026/27 |

2027/28 |

2028/29 |

2029/30 |

|

(4,341,819) |

(2,909,316) |

(2,682,933) |

(1,763,495) |

(2,131,200) |

(3,137,673) |

(2,748,594) |

(1,622,670) |

(1,359,793) |

(740,739) |

10-year budgeted bottom lines - surplus/(deficits)

2020/21 Budget Snapshot:

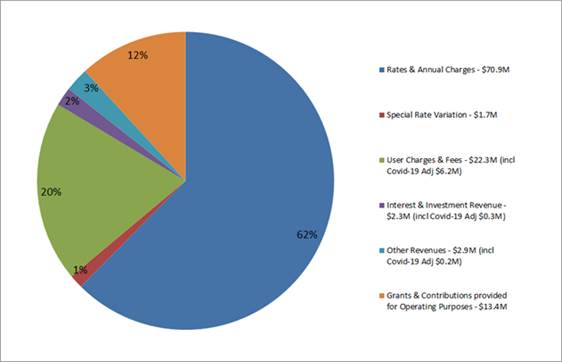

$113.5 million – total operating income budget by category

(includes COVID-19 Adjustment of $6.7M):

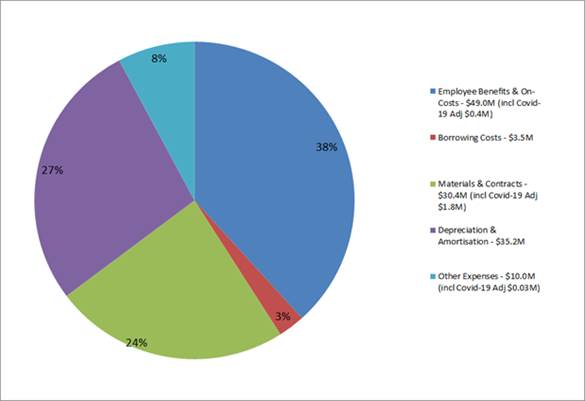

$128.1 million – total operating expenditure budget

(includes COVID-19 Adjustment of $2.3M):

Capital Works:

$22.7 million – Recurrent Capital Program

$31.4 million – New Capital Projects

$54.1 million – Total Capital works included in Delivery Program

Policy and Legislation

The documents have been created to meet Council’s Integrated Planning and Reporting requirements under the Local Government Act 1993 and Local Government Regulations 2005.

Link to Strategic Plan

Community Leadership and Collaboration

Objective: We have strong leadership

Outcome: We plan long term

Risk Management Issues for Council

A number of risk management issues were identified and have been actively managed.

A summary of these risks are as follows:

- Lack of engagement from the community

- Inability to meet everyone’s expectations

- Inability to resource and deliver on plans

With Council not receiving some budgeted revenue and forecasting a significant deficit, this places immense financial pressure on Council delivering required services to the community with the risk of not meeting the needs of the community as a whole. This may include (but is not limited to) diverting funds from previously provided Council services to other areas that may be deemed of a higher need due to COVID‑19.

The inability to meet everyone’s expectations will continue to be a challenge for Council’s future planning process.

Internal / External Consultation

The documents were placed on public exhibition for a 28 day period from 26 May 2020 to 23 June 2020. As part of the exhibition period a variety of communication methods were used, to not only promote the public exhibition period but also promote the purpose of the documents.

The deficit position of Council will require regular Councillor workshops and reports to be presented to Council on an ongoing basis. Not only will there be regular updates as part of the monthly financial performance report associated with 2020/21, but there will be a need for additional financial modelling for the following financial years in order to reign in the deficit.

|

|

|

Media |

Community Engagement |

Digital |

|||||||||||||

|

Rates notices insert |

Direct mail |

Letterbox drop |

Council news |

Media releases |

Print advertising |

TV/radio advertising |

One-on-one meetings |

Your Say website |

Community meetings |

Stakeholder workshops |

Drop-in sessions |

Surveys and feedback forms |

Social media |

Email newsletters |

Website |

Digital advertising |

|

|

TIER |

|||||||||||||||||

|

Consult |

|

|

|

x |

x |

|

|

x |

|

|

|

|

x |

|

x |

|

|

|

1⇩. |

2020/21 One-Off Capital Works Program |

|

|

2⇩. |

2020/21 Revised LTFP 10 Year Capital Works Program |

|

|

3⇩. |

2019/20 Capital Works Program Reset Process |

|

|

4. |

2021/30 Long Term Financial Plan - Provided under separate cover |

|

|

5. |

2020/21 Fees and Charges - Provided under separate cover |

|

|

6. |

2020/21 Combined Delivery Program and Operational Plan - Provided under separate cover |

|

|

Report submitted to the Ordinary Meeting of Council on Monday 29 June 2020 |

RP-7 |

RP-7 Financial Performance Report as at 31 May 2020

Author: Carolyn Rodney

Director: Natalie Te Pohe

|

Summary: |

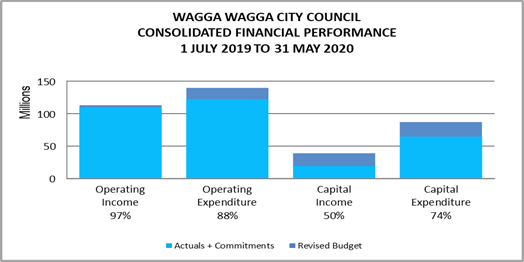

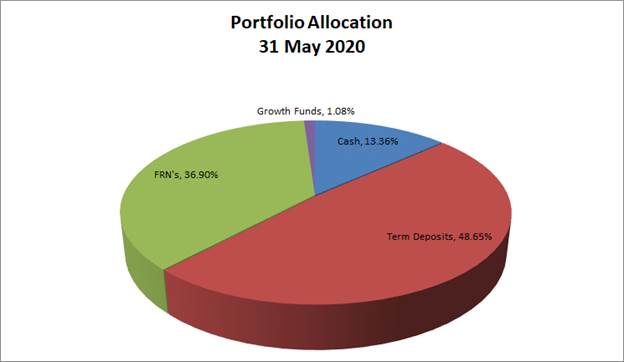

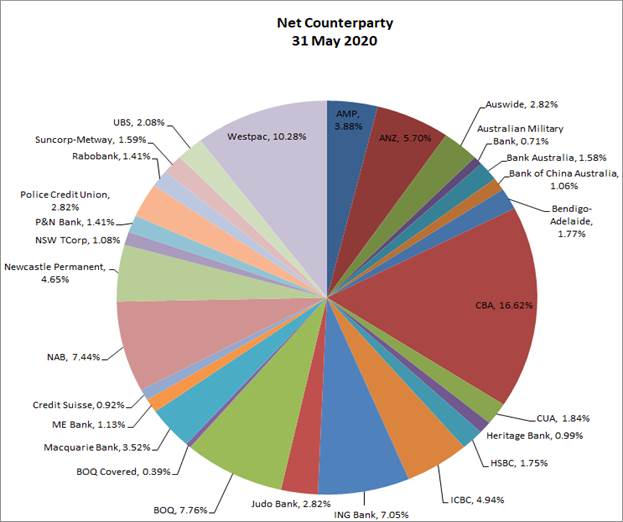

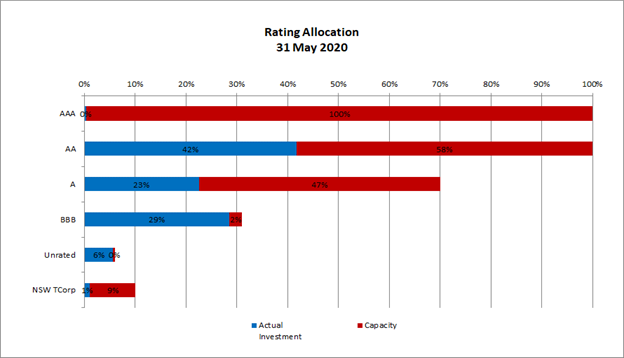

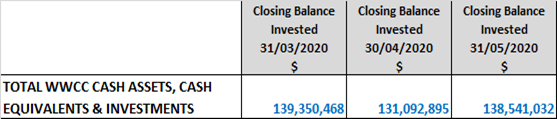

This report is for Council to consider information presented on the 2019/20 budget and Long Term Financial Plan, and details Council’s external investments and performance as at 31 May 2020. |

|

That Council: a note the financial information presented in the report on Council’s 2019/20 budget b note the updates to the Council facilities due to COVID-19 and their likely continued impact on the 2019/20 budget c note the Responsible Accounting Officer’s reports, in accordance with the Local Government (General) Regulation 2005 (Part 9 Division 3: Clause 203) that the financial position of Council is satisfactory having regard to the original estimates of income and expenditure and the recommendations made above d note the details of the external investments as at 31 May 2020 in accordance with section 625 of the Local Government Act 1993 e note the continued impact of COVID-19 on Council’s investment portfolio, as provided by Council’s independent investment advisor |

Report

Wagga Wagga City Council (Council) forecasts a deficit budget position as at 31 May 2020 as a result of the indicative financial impact reported previously from the COVID-19 pandemic on Council’s 2019/20 Budget.

At the date of writing this report, the Library, Art Gallery, Visitor Information Centre and the Oasis have all recently re-opened to the public, with limitations on the numbers of patrons at each facility, reduced services due to the public health order on gatherings (i.e.: Library Story Time and the Language Café are still offered online) and reduced opening hours at the Oasis. The Civic Theatre remains closed pending further advice from the Government, with staff currently preparing for the reopening of programming dependant on social distancing and restrictions.

Councillors and the community can access the opening hours and restrictions on all of Council’s facilities on Council’s website under the COVID-19 Restrictions tab:

https://wagga.nsw.gov.au/city-of-wagga-wagga/novel-coronavirus-covid-19/disruption-to-services or alternatively contact Council on 1300 292 442.